Gennaro Cuofano's Blog, page 153

May 30, 2021

IBM Competitors

International Business Machines Corporation (IBM) is an American multinational technology company. It was founded in New York as the Computing-Tabulating-Recording Company in 1911 by Charles Ranlett Flint. IBM is a diverse company with a similarly diverse portfolio of products and services. It produces and sells hardware, middleware, and software. It also offers hosting and consultancy services in nanotechnology and mainframe computers. What’s more, IBM has a strong culture in research and development, filing the most U.S. patents of any business for the past 28 years.

Started in 1911 as Computing-Tabulating-Recording Company (CTR), called then International Business Machines by 1924. IBM primarily makes money by five segments (cognitive solutions, global business services, technology services, and cloud platforms, systems, and global financing) with also innovative products such as IBM Watson and IBM Blockchain.Cloud computing

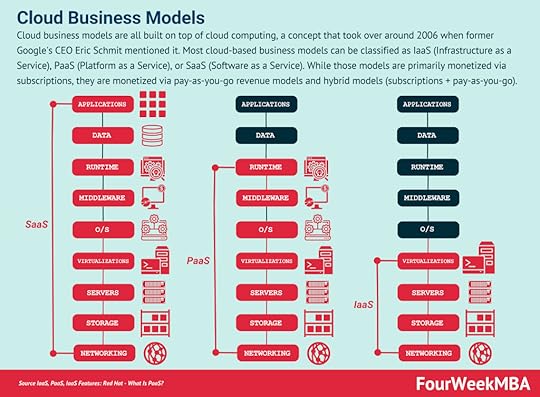

Started in 1911 as Computing-Tabulating-Recording Company (CTR), called then International Business Machines by 1924. IBM primarily makes money by five segments (cognitive solutions, global business services, technology services, and cloud platforms, systems, and global financing) with also innovative products such as IBM Watson and IBM Blockchain.Cloud computing Cloud business models are all built on top of cloud computing, a concept that took over around 2006 when former Google’s CEO Eric Schmit mentioned it. Most cloud-based business models can be classified as IaaS (Infrastructure as a Service), PaaS (Platform as a Service), or SaaS (Software as a Service). While those models are primarily monetized via subscriptions, they are monetized via pay-as-you-go revenue models and hybrid models (subscriptions + pay-as-you-go).

Cloud business models are all built on top of cloud computing, a concept that took over around 2006 when former Google’s CEO Eric Schmit mentioned it. Most cloud-based business models can be classified as IaaS (Infrastructure as a Service), PaaS (Platform as a Service), or SaaS (Software as a Service). While those models are primarily monetized via subscriptions, they are monetized via pay-as-you-go revenue models and hybrid models (subscriptions + pay-as-you-go).In cloud computing, IBM combines platform as a service (PaaS) with infrastructure as a service (Iaas). The service, named IBM Cloud, scales and supports the development of small organizations and large enterprise businesses alike.

PaaS stands for the platform as a service. Together with other “as-a-service” models, this model’s basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. The PaaS model is a form of evolved cloud computing. The provider, together with virtualization, storage, network, and servers, provides middleware and runtime to the user/customer, which only handles data and applications.

PaaS stands for the platform as a service. Together with other “as-a-service” models, this model’s basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. The PaaS model is a form of evolved cloud computing. The provider, together with virtualization, storage, network, and servers, provides middleware and runtime to the user/customer, which only handles data and applications.In cloud computing, the main IBM competitors include AWS, Microsoft Azure, and Google.

Consultancy servicesThe majority of IBM’s revenue comes from the services industry. Some of the main competitors in this industry include:

Tata Consultancy Services (TCS) – an Indian IT solutions company founded in 1968. TCS has a focus on helping clients from a range of industries meet their objectives by leading them through technological transformation. This is achieved through a portfolio of integrated solutions, consulting, and outsourcing.Accenture – an Irish consultancy, strategy, and digital transformation company founded in 1989. Accenture helps organizations prepare for the future via digitization in many industries, including media, capital markets, oil, transportation, and public health.Infosys – another Indian company providing business consultancy and IT services with a core focus on manufacturing and insurance. Infosys products include management consulting, artificial intelligence and global banking platforms, and digital marketing.Hewlett Packard Enterprise (HPE) – founded in 2015 as part of the Hewlett-Packard company, Hewlett Packard Enterprise is a business-focused organization in servers, storage, networking, consulting, support, and financial services. After just six years in operation, HPE revenue reached $6.8 billion in Q1 2021.Software and hardwareWithin the software industry, IBM sells software products in API management, enterprise identity mapping, security, digital experience, DevOps, Internet of Things (IoT) solutions, and planning analytics.

DevOps refers to a series of practices performed to perform automated software development processes. It is a conjugation of the term “development” and “operations” to emphasize how functions integrate across IT teams. DevOps strategies promote seamless building, testing, and deployment of products. It aims to bridge a gap between development and operations teams to streamline the development altogether.

DevOps refers to a series of practices performed to perform automated software development processes. It is a conjugation of the term “development” and “operations” to emphasize how functions integrate across IT teams. DevOps strategies promote seamless building, testing, and deployment of products. It aims to bridge a gap between development and operations teams to streamline the development altogether.These products place the company in direct competition with many large players, including Adobe, Symantec, Microsoft, and Amazon.

In terms of computer hardware manufacturing, IBM is up against Hewlett Packard, Oracle, and Dell.

Global financingIBM Global Financing (IGF) was founded in 1981 as an organization composed of sellers, accountants, analysts, and business credit and pricing specialists. More succinctly, IGF helps clients design, build, and run businesses with IBM expertise and infrastructure.

Today, it is the largest IT financier in the world with more than $36 billion in assets. Some of the major competitors in global financing have been acquired by IBM over the years, including PricewaterhouseCoopers Consulting, Bluewolf, and Promontory Financial Group.

Key takeaways:IBM is a large and extremely diverse American multinational technology company. With a diverse product and service portfolio, many of the most significant IBM competitors can be found in the services industry. These include Hewlett Packard Enterprise, Tata Consultancy Services, and Accenture.IBM is also up against giants such as Adobe, Microsoft, and Amazon in software production. In hardware, competition is provided by Hewlett Packard, Oracle, and Dell. However, the company enjoys relative dominance in global financing after acquiring several major competitors.You Might Want To Read Also: How Does IBM Make Money, Microsoft Subsidiaries, Google Subsidiaries, Amazon Subsidiaries, Warren Buffett Companies, Bill Gates Companies, Jeff Bezos Companies, Proptech Companies, Fintech Companies.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post IBM Competitors appeared first on FourWeekMBA.

Uber Competitors

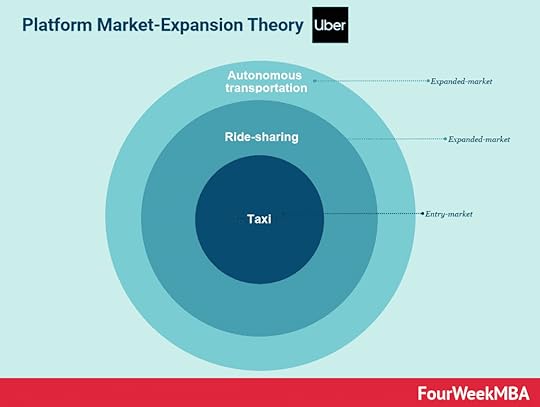

Uber is an American technology company known for ride-sharing, food and package delivery, freight transportation, and bicycle and scooter rentals.

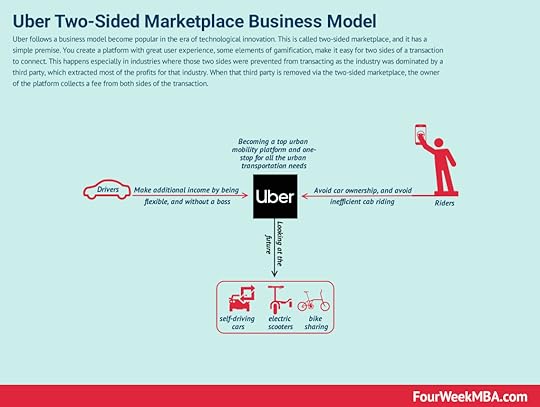

Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings.

Uber is a is two-sided marketplace, a platform business model that connects drivers and riders, with an interface that has elements of gamification, that makes it easy for two sides to connect and transact. Uber makes money by collecting fees from the platform’s gross bookings. Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time.Lyft

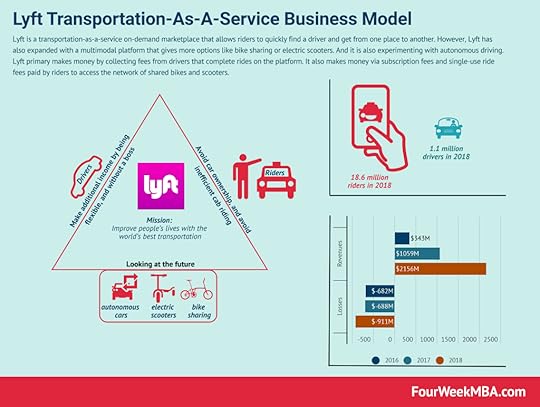

Uber Eats is a three-sided marketplace connecting a driver, a restaurant owner and a customer with Uber Eats platform at the center. The three-sided marketplace moves around three players: Restaurants pay commission on the orders to Uber Eats; Customers pay the small delivery charges, and at times, cancellation fee; Drivers earn through making reliable deliveries on time.Lyft Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform.

Lyft is a transportation-as-a-service marketplace allowing riders to find a driver for a ride. Lyft has also expanded with a multimodal platform that gives more options like bike-sharing or electric scooters. Lyft primary makes money by collecting fees from drivers that complete rides on the platform.Lyft was founded by Logan Green and John Zimmer in 2012, operating in 656 cities across the United States and Canada. The service is also available in a select number of cities within the Asian market, including Malaysia, Thailand, Indonesia, and Singapore.

Lyft is the second-largest ridesharing company in North America after Uber.

In addition to traditional ride-sharing and food delivery services, Lyft is also working on developing a network of autonomous vehicles with General Motors.

CurbCurb was founded in 2014, formerly known as RideCharge in 2007 and Taxi Magic in 2009.

Importantly, Curb is an app-based service connecting consumers with professional, insured, and fully licensed taxi or chauffeur drivers. This makes it a rather unique Uber competitor as its business model is not seen as detrimental to the taxi industry.

Curb users can search for and book rides instantly, but the company also targets travelers by allowing rides to be scheduled up to 24 hours in advance.

DiDiDiDi is a Chinese ride-hailing service born from the merger of China’s two largest taxi firms.

With over 600 million users and tens of millions of drivers, Didi is often referred to as the Uber of China. In addition to ride-sharing and delivery services, Didi offers automobile sales, leasing, financing, and maintenance. The company also offers fleet operation services and electric vehicle charging points.

DiDi was voted the most valuable start-up in 2017 and is the only company in China to see investment from the big three Chinese firms in Tencent, Baidu, and Alibaba. With successful expansion into other areas of Asia, Oceania, and South America, DiDi is a serious threat to Uber’s supremacy.

CabifyCabify is a Spanish ridesharing company founded in 2011 by Juan de Antonio.

Today, the company has a significant presence in major Spanish and Portuguese-speaking countries, including Spain, Mexico, Chile, Colombia, Peru, Panama, Brazil, Portugal, Ecuador, and Argentina.

Cabify gives consumers the option to select luxury or non-luxury vehicles. The company also offers larger vehicles for groups of up to 6 people.

Cabify operates several ancillary services, including:

Cabify Express – an instant delivery service using moto-taxis.Cabify Taxi – connecting users with local taxi services.Cabify Bike – a bicycle transportation service for bike riders.OlaIf Didi is the Uber of China, then Ola is the Uber of India.

Founded in Bangalore in 2010, Ola extended into New Zealand and Australia in 2018 and the United Kingdom the following year.

Ola offers different levels of ride-sharing comfort, ranging from economy rides to luxury travel. The company also has a strong focus on electric vehicles and is developing infrastructure to allow commercial EVs to operate at scale.

Unfortunately, Ola has not been immune to many of the issues facing the ride-share industry. The company has been criticized for a lack of transparent employee payments and for causing congestion in major cities.

Key takeaways:Uber is an American technology company that has enjoyed first-mover status in ride-sharing and food delivery among other industries. However, the success of its business model and negative publicity has not gone unnoticed by competitors and the general public.Uber’s main competitor in North America is Lyft with a 30% market share. Chinese company DiDi and Indian company Ola are also competitors with large user bases and access to significant investment funding.Curb is also a worthy Uber competitor because it works with licensed and insured taxi drivers and chauffeurs.Read Next: How Does Uber Make Money, Uber’s Flywheel: Liquidity Network Effects, How Does Uber Eats Make Money, Uber SWOT Analysis, Uber And Lyft Business Models, Last-Mile Delivery: The Anti-Network Effects And Why It’s Such A Hard Problem.

You Might Want To Read Also: History Of Starbucks, Starbucks Organizational Structure, SWOT Analysis Of Starbucks, Starbucks Chain Business Model, Starbucks Mission Statement and Vision Statement, History Of McDonald’s, McDonald’s Heavy Franchised Business Model, Microsoft Subsidiaries, Google Subsidiaries, Amazon Subsidiaries, Warren Buffett Companies, Bill Gates Companies, Jeff Bezos Companies, Proptech Companies, Fintech Companies.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Uber Competitors appeared first on FourWeekMBA.

Starbucks Competitors

Starbucks is a multinational coffee chain headquartered in Seattle, Washington. It was founded by Jerry Baldwin, Zev Siegl, and Gordon Bowker in 1971. From a single and very humble bean roasting store in Pike Place Market, the company is now a global giant operating almost 33,000 stores around the world. This large global footprint obviously increases the competition for Starbucks in many different markets. The coffee industry itself is also highly competitive, with established players including McDonald’s and Dunkin’ Donuts.

Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model. McDonald’s

Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model. McDonald’sMcDonald’s may not be the first brand people associate with good coffee, but the company has made significant progress in the quality of its product offering through the McCafé chain.

The first such store opened in Australia in 1993, with more than 15,000 McDonald’s restaurants now serving hot and cold coffee-related beverages with premium beans. In terms of the number of stores opened, McDonald’s is the primary Starbucks competitor. Its competitiveness is further strengthened because the company can leverage its existing restaurant infrastructure to serve coffee.

In 2014, McDonald’s also started selling a range of coffee pods to compete with similar Starbucks products.

McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017.

McDonald’s is a heavy-franchised business model. In 2018, of McDonald’s total restaurants, 93% were franchised. The long-term goal of the company is to transition toward 95% of franchised restaurants. The company’s operating income in 2018 was $8.8 billion compared to $9.55 in operating income for 2017. Dunkin’ Donuts

Dunkin’ DonutsDunkin’ Donuts is an American multinational coffee and doughnut company founded in 1950 by William Rosenberg. The company operates in almost 13,000 locations across 42 countries.

Although the company moved away from marketing itself as a coffee chain in the 90s, it introduced a specialty coffee line a decade later. Dunkin’ Donuts then launched its “American Runs on Dunkin'” advertising campaign, promoting itself as an All-American brand for the average consumer.

In addition to coffee and donuts, the chain also sells sandwiches, frozen beverages, bagels, and tea.

Costa CoffeeCosta Coffee is a major European competitor of Starbucks, with over 2,000 stores in the United Kingdom alone. Furthermore, the company operates over 6,000 Costa Express vending machine facilities.

Realizing its potential in non-North American markets, The Coca-Cola Company acquired Costa Coffee in 2019 for £3.9 billion. Ultimately, this gave the beverage giant a strong foothold in coffee and related products across parts of Europe, Africa, Asia Pacific, and the Middle East.

Tim HortonsIn terms of value for money, not many coffee chain companies can compete with the Canadian brand Tim Hortons. Starbucks is no exception.

Tim Hortons was founded in 1964 by former professional ice hockey player Tim Horton together with Jim Charade. The chain is a Canadian institution, with almost 5,000 quick-service restaurants in 14 countries.

The company offers a range of products, including muffins, cookies, pastries, bagels, and Greek yogurt with mixed berries. It also sells products under the Tims at Home banner, encompassing everyday essentials such as instant tea and coffee, hot chocolate, soup, and granola bars.

Key takeaways:Starbucks is a multinational coffee chain operating over 33,000 stores worldwide. Competitive pressures are a direct result of the company’s global reach and also the nature of the industry it operates in.Starbucks faces strong competition from McDonald’s, a company with a similarly large network of global franchises. Using existing infrastructure, many of these franchises sell premium coffee products through a McCafé store.Dunkin’ Donuts and Tim Hortons are also significant Starbucks competitors in the North American market. In Europe and elsewhere, Costa Coffee is leveraging the power of parent company Coca-Cola to establish a strong presence.Read Also: History Of Starbucks, Starbucks Organizational Structure, SWOT Analysis Of Starbucks, Starbucks Chain Business Model, Starbucks Mission Statement and Vision Statement, History Of McDonald’s, McDonald’s Heavy Franchised Business Model, Microsoft Subsidiaries, Google Subsidiaries, Amazon Subsidiaries, Warren Buffett Companies, Bill Gates Companies, Jeff Bezos Companies, Proptech Companies, Fintech Companies.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Starbucks Competitors appeared first on FourWeekMBA.

Boeing Competitors

Boeing is best known for designing and manufacturing commercial aircraft, but the company also produces helicopters, rockets, satellites, spacecraft, missiles, and telecommunications infrastructure. Founded in 1916 by William Boeing in Seattle, Washington, the company is one of the largest aerospace manufacturers and defense contractors in the world.

AirbusAirbus and Boeing have a rivalry stretching back decades, with both dominating the commercial aviation industry at various times.

Airbus is a French manufacturer of commercial aircraft and is one of the largest patent holders in the world with over 370 registered trademarks. Like Boeing, Airbus also designs and manufactures military aerospace products but with a particular focus on turbine helicopters.

In 2019, Airbus delivered 863 jets to clients, overtaking Boeing to become the world’s largest aircraft manufacturer for the first time since 2011.

EmbraerEmbraer is a Brazilian aerospace conglomerate producing aircraft for commercial, military, agricultural, and executive purposes. Founded in 1959 by Ozires Silva, the company is the third-largest producer of civilian aircraft behind Boeing and Airbus.

In 2018, Boeing announced a joint venture with Embraer which would result in the company owning 80% of the Embraer commercial aviation division. However, this venture was terminated two years later as Boeing dealt with the financial fallout of the COVID-19 pandemic and the 737 Max problems.

Northrup GrummanNorthrup Grumman is an American weapons manufacturer and military technology provider. Revenue for the 2020 financial year was $33.841 billion, with 75% of that coming from defense contracts.

With a history of developing technically superior military aircraft, Boeing faces stiff competition from the company. It successfully developed the B-2 Spirit, the world’s only know stealth bomber. Northrup Grumman is also in the process of developing rocket boosters for NASA and an orbiting telescope observatory.

Lockheed MartinLockheed Martin is an American aerospace, defense, security, and advanced technology company.

The company is the world’s largest defense contractor, with a significant proportion of revenue coming from U.S. government contracts. These contracts involve combat and transport aircraft, missile defense systems, fire control systems, energy management solutions, and manned and unmanned ground vehicles.

The company is also a contractor for NASA, where it develops reusable command modules and space surveillance systems.

SpaceX – SpaceX is a space transportation service and manufacturer of space rockets and other transport vehicles. It was founded by Elon Musk in 2002. – SpaceX makes money by charging both governmental and commercial customers to send goods into space. These goods include ISS supplies and infrastructure, but also people and satellites for various purposes. – SpaceX is also in the process of creating its Starlink network, designed to give every citizen access to fast and affordable internet.

– SpaceX is a space transportation service and manufacturer of space rockets and other transport vehicles. It was founded by Elon Musk in 2002. – SpaceX makes money by charging both governmental and commercial customers to send goods into space. These goods include ISS supplies and infrastructure, but also people and satellites for various purposes. – SpaceX is also in the process of creating its Starlink network, designed to give every citizen access to fast and affordable internet.SpaceX was founded by billionaire entrepreneur Elon Musk in 2002. The company designs and manufacturers space rockets, launch vehicles, engines, spacecraft, and communications satellites.

Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, eventually turned into a mass manufacturing electric car maker.

Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, eventually turned into a mass manufacturing electric car maker. With a focus on space exploration and design, SpaceX is in direct competition with Boeing’s Defense, Space, and Security division. Both companies have been actively competing against each other for NASA contracts for over a decade.

While Boeing has enjoyed a long working history with NASA, SpaceX has recently developed an edge because of its culture, speed, and flexibility to offer a better price. As more credence is given to space exploration in the future, Boeing will need to adopt similar characteristics to remain a major player.

Key takeawaysBoeing was founded in 1916 by William Boeing. In addition to designing and manufacturing commercial aircraft, Boeing also sells rockets, satellites, military aircraft, and telecommunications infrastructure.Boeing’s main competitor is arguably Airbus, which recently took the mantle as the world’s largest manufacturer of commercial aircraft. Embraer is also a major player that Boeing tried to acquire before becoming plagued by financial difficulties.Northrup Grumman and Lockheed Martin are the major Boeing competitors in terms of military aircraft and equipment. In Space exploration, SpaceX is threatening to disrupt Boeing’s long-term relationship with NASA.Read Also: How Does SpaceX Make Money, Microsoft Subsidiaries, Google Subsidiaries, Amazon Subsidiaries, Warren Buffett Companies, Bill Gates Companies, Jeff Bezos Companies, Proptech Companies, Fintech Companies.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Boeing Competitors appeared first on FourWeekMBA.

May 28, 2021

Blockchain, Web 3.0, And The Decentralized Internet

In February 2009, about twenty years from the first version of the Hypertext project, Tim Berners-Lee stood on a TED stage in Long Beach, California. As he opened the speech he remarked how 20 years had passed since the inception of the project that would lead to the web, and yet for 18 months that project, back in 1989 stood on a desk at the CERN, without anyone doing anything about it. Until Tim Berners-Lee volunteered to do it as a side project!

In that time span, Tim Berners-Lee had laid the foundation for HTML, and the idea of URLs that stood behind HTTP. As he remarked in 2009, he felt compelled to take that side project, as he worked in a large research lab and felt extremely frustrated by the fragmentation that existed at the time. There was no single protocol or framework that could connect all the various programs and make them talk. That is how the web was conceived, as a massive document that connected all other documents via hyperlinks. And yet by 2009, Tim Berners-Lee highlighted another frustration, that of connecting data. Up until that point, therefore, the web connected text and documents but failed to connect data.

Tim Berners-Lee explained that concept with these words: “so I want us now to think about not just two pieces of data being connected, or six like he did, but I want to think about a world where everybody has put data on the web and so virtually everything you can imagine is on the web and then calling that linked data.”

This would give the rise to the Semantic Web, which has already become a reality. Indeed, if we look at Google itself a good chunk of queries that it serves to users are served from its Knowledge Graph, a massive database made (as of 2020) of more than 500 billion facts about five billion entities (an entity is anything that exists on the web, it can be a person, a place, an event and so forth).

It’s important to understand that, because now Google (with the Knowledge Graph), Facebook (with the Social Graph) and all the other tech giants, in a form, have already converted their “databases” as the Graphs. Yet while these companies put together massive amounts of data about anything on the web, their algorithms are still siloed, walled and managed as “proprietary data.”

Thus, while these semantic technologies did turn into advanced features for users at scale (think of how voice assistants can give answers to millions of questions) they do not talk to each other, and they might never talk to each other (why would Google, now Alphabet cooperate with Amazon? Or vice versa, when perhaps they are fighting against each other for the market of voice search? – which might also be relevant for the future digital marketing landscape).

This is also where the Blockchain ecosystem becomes interesting. As the data sits on the Blockchain protocols, this is usually open and accessible. In this sense, the Web 3.0, as also intended by Ethereum’s co-founder Gavin Wilson would make sense:

“Web 3.0 is an inclusive set of protocols to provide building blocks for application makers. These building blocks take the place of traditional web technologies like HTTP, AJAX, and MySQL, but present a whole new way of creating applications. These technologies give the user strong and verifiable guarantees about the information they are receiving, what information they are giving away, and what they are paying and what they are receiving in return. By empowering users to act for themselves within low-barrier markets, we can ensure censorship and monopolization have fewer places to hide. Consider Web 3.0 to be an executable Magna Carta — ‘the foundation of the freedom of the individual against the arbitrary authority of the despot.’”

The most significant creature from Web 2.0 has been the Platform Business Model, which promise stood in building up peer-to-peer networks where finally two or more parties could interact, or transact without the middleman. However, the platform business model of Web 2.0 also became a master in centralization.

Indeed, where the ecosystem was built in the form of marketplace (think of the Apple Store as a classic example) the company in charge of that remained the primary decision-maker, in determining the whole governance.

In short, the main argument of Web 3.0 is that once a business ecosystem is created, as a result of the investments made by a corporation, the governance model should be redefined. There shouldn’t be a single entity in charge to move a business ecosystem forward, with the logic of extracting revenues from the ecosystem.

Rather a decentralized/distributed entity (made of many organizations and users) that will determine the protocol rules and how it will evolve.

In short, Web 3.0 is looking into disintermediating the digital platforms that have become the protagonists of our daily lives.

Read Also: Platform Business Models, Super Gatekeepers.

Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Blockchain, Web 3.0, And The Decentralized Internet appeared first on FourWeekMBA.

May 27, 2021

Why Did Amazon Buy MGM?

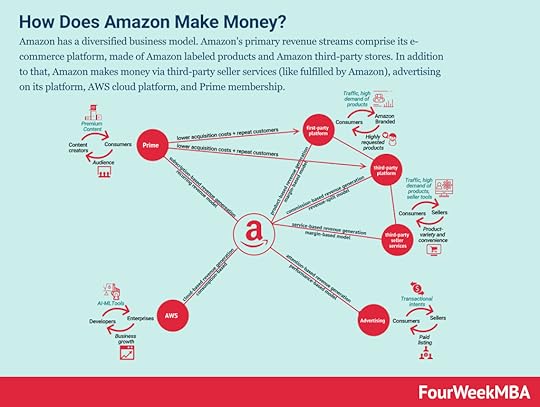

When we look under the hood of the Amazon business model we find out a web of sub-business models, which in part are all tied together, in a massive platform/business ecosystem.

Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership. More broadly we can break down the Amazon business model within two major business platforms, one for consumers and another for enterprises/B2B:

Amazon e-Commerce Consumer Business Platform: The e-commerce platform is also the consumer-facing part of the business. This comprises all the business lines that go from the e-commerce platform (which is made up of first-party products – the labels that Amazon owns – and the third-party products – those that are not owned by Amazon but might still be fulfilled by it). On top of that, Amazon’s whole fulfillment capability comprises all the seller services that help the e-commerce platform guarantee a wide range of low-priced products. Amazon’s advertising platform also sits there, challenging the Google-Facebook duopoly. And on top of all, Amazon Prime helps the e-commerce platform foster its repeat customer through free, fast, and quality-proof delivery. Amazon AWS Business Enterprise/B2B Business Platform: On the other side, the Amazon AWS platform is the enterprise-side of the company, dealing mostly with large enterprises and small and medium businesses; AWS powers up a good chunk of the web. Initially developed to enable Amazon to transition into a platform (to host third-party stores), it eventually became a business for its own sake. It definitely helped power up the streaming service Amazon offers (AWS also powers up Netflix – see the concept of coopetition).Let’s get back to Prime, and how this fits the overall Amazon business model, and how MGM might fit in the overall picture.

When Jeff Bezos – at the Vox’s Code Conference back in 2016 – said, “when we win a Golden Globe, it helps us sell more shoes,” that well exemplifies the strategy that Amazon Prime has been following. Integrated into the whole Amazon Business Model. This single statement might not make sense at first, yet it thoroughly explains the current battle to keep millions of credit cards linked to their subscriptions, be it Amazon, Netflix, Apple, or YouTube.

In addition to that, while Prime has taken life for its own sake (who knows whether in the coming decades we’ll know Amazon primarily as an entertainment company) as of now it is highly integrated into the overall Amazon business model. Indeed, one of the greatest hurdles for e-commerce to scale up is to be convenient, fast, and guarantee the item sold doesn’t get lost in the last mile delivery.

Amazon Prime solves most of these problems. As the subscribers, part of the program get a free, fast delivery, where the quality of the ordered item is usually in line with its promise (in most cases, Amazon Prime subscriptions are tied to the fulfilled by Amazon, in short, the items that Amazon has in its inventories and for which it can guarantee higher standards of shipping and delivery).

Tech companies, Silicon Valley-style, have learned a great lesson in the past decade. Indeed, to become a real giant, one that would stick to the test of time, a company’s brand needs to become a cultural phenomenon.

When Romans built up their empire, they did innovate from the engineering standpoint (scaled engineering feats like aqueducts and roads that crossed entire countries were what made a global empire possible). Still, they built upon the Pagan and Greek culture, using that as a lever to build a roman-centered empire covering most of the known (at the time) western (and in part eastern) world.

Now Amazon is doing the same. While innovating from a modern engineering standpoint. It is also leveraging on what Hollywood has done in the last century. But what does MGM bring to the table for Amazon?

As explained in its financial statements “MGM is a leading entertainment company focused on the production and global distribution of film and television content across all platforms.”

Historically MGM generated revenues by distributing its content through traditional media, like TV, Cinema, and theaters. However, as a company with a long history (it was born in 1934), it also generated revenues by licensing its content and the hits it had produced over the years.

Indeed, as the company highlighted in its financials:

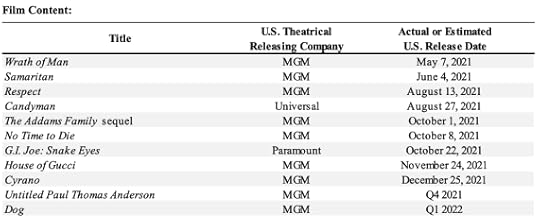

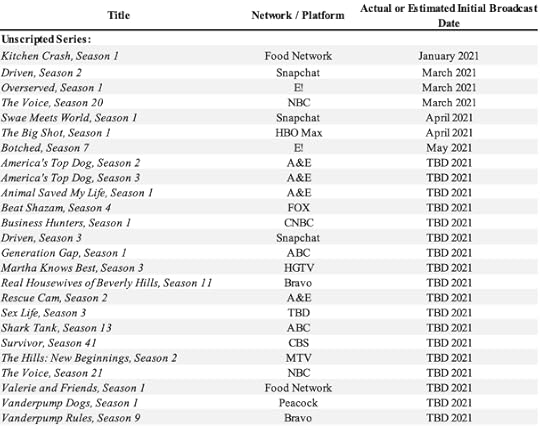

We control one of the world’s deepest libraries of premium film and television content. Our film content library includes approximately 4,000 titles, including the James Bond, The Hobbit, Rocky/Creed, RoboCop and Pink Panther franchises, as well as The Silence of the Lambs, The Magnificent Seven, Four Weddings and a Funeral and many other highly recognizable titles. Our film content library also includes rights to films that have received more than 180 Academy Awards, including 12 Best Picture Awards. Our television content library includes approximately 17,000 episodes of programming, including Stargate SG-1, which was one of the longest running science fiction series in U.S. television history, Stargate Atlantis, Stargate Universe, Vikings, Fargo, The Handmaid’s Tale, Get Shorty, Condor, Clarice, Fame, American Gladiators, Teen Wolf and In the Heat of the Night, as well as our rights to or income from prominent unscripted shows including The Voice, Survivor, Shark Tank, Live Rescue, Eco-Challenge, Are You Smarter Than a 5th Grader, Beat Shazam, The Real Housewives of Beverly Hills, The Hills, and other titles.

This alone will enrich the Amazon Prime library and it might be used as a library that Amazon can have exclusive on its streaming platform.

As MGM got negatively affected by the pandemic, its content library still represents among the most compelling ones:

Above, you can see all the main content formats (from the MGM financials) that the company has built for traditional media like TV and theaters.

Part of the MGM business model also was skewed toward digita licensing to platforms like Amazon Prime Video, Hulu and Netflix.

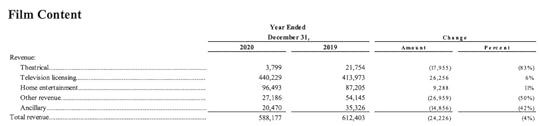

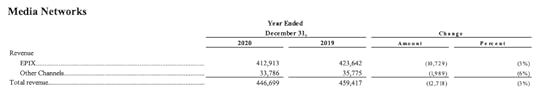

The MGM revenues are made of three main channels: Film Content, Television Content, and Media Networks.

The MGM revenues are made of three main channels: Film Content, Television Content, and Media Networks. Within the film content television licensing is the primary revenue stream, where Theatrical revenue had been almost zeroed out by the pandemic.

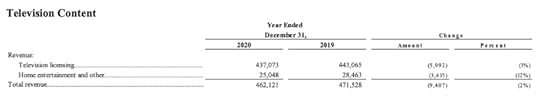

Within the film content television licensing is the primary revenue stream, where Theatrical revenue had been almost zeroed out by the pandemic. In television content, the licensing also comprises the content passed to SVOD (streaming platforms).

In television content, the licensing also comprises the content passed to SVOD (streaming platforms). Here the main driver of revenues is the fully-owned subsidiary, EPIX, which is a cable network. Key takeawaysAmazon Prime – a company in its own sake – is also a key ingredient to the overall consumer-facing e-commerce platform. It serves to foster the Amazon repeat customer to guarantee speed, convenience, and quality. Over the years, Amazon learned, more Amazon subscribers also meant more e-commerce customers and more repeat transactions; from there, the streaming service became a key part of the overall Amazon business strategy. MGM, an iconic entertainment company, will bring to the table a vast library of content that can be licensed exclusively for Amazon Prime (thus revamping Prime and giving a blow to Netflix) while also giving access to traditional media like Television and Cinema.

Here the main driver of revenues is the fully-owned subsidiary, EPIX, which is a cable network. Key takeawaysAmazon Prime – a company in its own sake – is also a key ingredient to the overall consumer-facing e-commerce platform. It serves to foster the Amazon repeat customer to guarantee speed, convenience, and quality. Over the years, Amazon learned, more Amazon subscribers also meant more e-commerce customers and more repeat transactions; from there, the streaming service became a key part of the overall Amazon business strategy. MGM, an iconic entertainment company, will bring to the table a vast library of content that can be licensed exclusively for Amazon Prime (thus revamping Prime and giving a blow to Netflix) while also giving access to traditional media like Television and Cinema. Is Amazon finally mastering the Hollywood playbook in Silicon Valley style?

All you have to know about Amazon:

How Amazon Makes MoneyAmazon SubsidiariesAmazon CompetitorsJeff Bezos Companies: What Companies Does Jeff Bezos Own?Successful Types Of Business Models What Is Business Model Innovation And Why It MattersWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A NutshellThe post Why Did Amazon Buy MGM? appeared first on FourWeekMBA.

May 26, 2021

The Monero Blockchain In A Nutshell

Monero is one of the cryptocurrencies recognized for its privacy-oriented features. When it initially launched in April 2014, Monero was called BitMonero with the symbol XMR which translates to Esperanto.

Value ModelMonero is known for being one of the most secure, private, and untraceable cryptocurrencies. As a fork of Bytecoin, it operates through the Cryptonote protocol using Ring Signatures. It also takes advantage of the Proof of Work mechanism called CryptoNight to issue new coins. In this way, people who are planning on mining Monero can enjoy a secured network that validates their transactions. Users can use the public and hidden Monero ledger to transact confidentially. In other words, you cannot trace transactions in terms of the name of the sender, the amount sent, and its destination.

Since its launch, Monero built a community based upon the following value propositions:

SecurityAs one of the signatures of Monero, the cryptocurrency can ensure that users would not have to worry about any sort of risk when transacting. All transactions are untraceable to eliminate the risk of error or unprecedented attack.

PrivacyTo establish a fully private network, Monero protects its users in a court of law and even in the extreme cases of the death penalty.

DecentralizationThe cryptocurrency is devoted to its community, offering the maximum amount of decentralization.

Blockchain ModelMonero means ‘money’ in the language Esperanto, and it uses “RandomX, an ASIC-resistant and CPU-friendly POW algorithm created by Monero community members, designed to make the use of mining-specific hardware unfeasible. Monero previously used CryptoNight and variations of this algorithm.”

Monero obfuscates transactions at the protocol level using ring signatures, ring confidential transactions (RCT), and stealth addresses to shield either senders and receivers from knowing anything about the marketing. Simultaneously, these features can also enable transactions to be validated by a third party if necessary. One of the most significant applications of Monero is the protocol that highlights privacy at a maximum capacity. Through Ring Signatures, you cannot trace transactions in terms of the sender’s name, the amount sent, and its destination. Ron Rivest, Adi Shamir, and Yael Tauman introduced the feature at a 2001 Cryptography conference in Queensland, Australia. You cannot detect transactions released from the Monero wallet because of stealth addresses. Stealth addresses protect both the sender and receiver while allowing selective observation of transactions through a public/private view key construct in addition to normal private/public keys.

In terms of mining, Monero will keep its mining going, in two main emissions (emission 1 = ~18.132 million coins by the end of May 2022; and emission 2 = 0.6 XMR per 2-minute block, kicks in once main emission is done, translates to <1% inflation decreasing over time – also called Tail Emission).

This means that Monero block rewards will never drop to zero, but they will be fixed as the tail emission kicks in. This is the way of Monero to guarantee the security of the network. Indeed, as a PoW network, if miners would stop mining (due to lack of incentives and profits in doing so) this might destabilize the whole network (here we can notice how each protocol deals differently in terms of consensus, and also how within the most known consensus algorithms – like PoW and PoS – the philosophies behind each protocol change).

Beyond Ring Signatures, some other technologies used by Monero to enhance privacy are:

RingCTStealth AddressesTransactions over Tor/I2PDandelion++Distribution ModelIn order to enable distribution and continuous growth of the network the Monero protocol moves along two lines: on the one hand, sponsors and developers to improve the code base. And on the other hand, merchants and service providers leveraging Monero to offer a privacy-focused solution to their users/customers.

On the sponsorship side, indeed, Monero partners up with various labs and sponsors to improve its code base. On the marchant and services side Monero partnered up and has been integrated among Exchanges, Block Explorers, Payment Gateways, Web Hosting, tools and services to expand the network and community.

In addition, when it comes to the developers’ community, beyond the core team, Monero also maintains a set of workgroups tackling various projects on the protocol. The community can also submit ideas, or get involved in the protocol development via the Community Crowdfunding System (CCS).

Get The Full Analysis Of Monero In Blockchain Business Models

Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Monero Blockchain In A Nutshell appeared first on FourWeekMBA.

The Stellar Blockchain In A Nutshell

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!

Stellar Blockchain In A NutshellIn essence, Stellar is a distributed, blockchain-based ledger and database that enables cross-asset transfers of value, including payments and other tokenized assets on its blockchain. The Stellar network runs using its native digital asset or token called Lumens or XLM.

Stellar.org oversees the entire Stellar network. It is responsible for monitoring Stellar, the payment network, such as Horizon API and Stellar Core, and its cryptocurrency, Lumens (XLM). Although Stellar assumes a competitive stance against other cryptocurrencies on varying facets, it is mostly in direct competition with Ethereum and Ripple. More specifically, Stellar competes with Ethereum for ICOs. Furthermore, its competition with Ripple stems from the fact that they both are digital partners for banks and related institutions.

Lumens’ relatively lower price attributes to its high supply in the current market landscape, rather than undervalue. While Lumens (XLM) is behind the value of both cryptocurrencies in market capitalization, it is a cryptocurrency to watch.

Value ModelThe inception of Stellar came as an effort to offer a faster, more reliable, and significantly cheaper method of cross-asset transfers. The Stellar cryptocurrency employs a technology that allows users to move and exchange digital assets without running the risk of losing money spent on commissions, staying true to its core.

As established, Stellar is a close competition of Ripple in that they are both a cross-border payment and transfer system.

Thus, Stellar significantly reduces transaction time and costs by implementing a blockchain solution that connects financial institutions, thereby optimizing the overall state of the global financial system. Stellar focuses on developing economies to address the needs of the people who are still beyond the reach of existing banking services, particularly in bank loans and remittances. The Stellar network does not charge its users. Instead, it secures its initial funding from the payments startup Stripe and donations from various organizations such as Google.org, FastForward, and BlackRock to bring this goal to fruition. Particularly, Stellar sustains its operational costs by setting aside 5% of Stellar Lumens and tax-deductible public donations from different institutions and organizations.

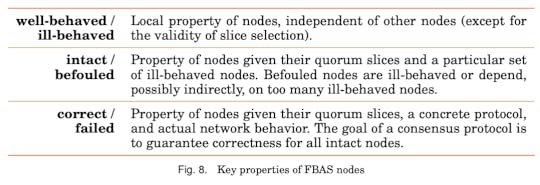

Blockchain ModelAs highlighted on Stellar, “The Stellar Consensus Protocol (SCP) provides a way to reach consensus without relying on a closed system to accurately record financial transactions.” Indeed, in the same paper Stellar introduces a “federated Byzantine agreement (FBA). FBA achieves robustness through quorum slices—individual trust decisions made by each node that together determine system-level quorums. Slices bind the system together much the way individual networks’ peering and transit decisions now unify the Internet.”

As further, highlighted “in FBA, each participant knows of others it considers important. It waits for the vast majority of those others to agree on any transaction before considering the transaction settled. In turn, those important participants do not agree to the transaction until the participants they consider important agree as well, and so on. Eventually, enough of the network accepts a transaction that it becomes infeasible for an attacker to roll it back. Only then do any participants consider the transaction settled. FBA’s consensus can ensure the integrity of a financial network. Its decentralized control can spur organic growth.”

To understand the difference between the protocol proposed by Stellar and the traditional consensus mechanisms (like proof of work and proof of stake) the Stellar Consensus Protocol (SCP) is a construction of FBA, to enable decentralized control, flexible trust and security.

Indeed, the Stellar’s protocol is built upon what might be considered the weaknesses of both proof of work and proof of stake. In the proof of work, as we saw in the case of Bitcoin, is very intensive in terms of energy consumption and it can be prone to 51% attacks. Whereas, instead, in proof of stake (where the consensus is built according to the provided collaterals) this might be prompt to “nothing at stake” attacks, where participants in the network, can “rewrite history” (perhaps through hard-forking) thus only taking into account the history where the attackers had stakes in the protocol and therefore taking control of it (as we’ll see this is the case of what happened with Steem and its blockchain, forked by community as Justin Sun was trying to “take that over” only with capital).

Stellar instead built upon the Byzantine agreement consensus, where participants can still reach an agreement even where there are conflicts among participants. Here as Stellar points out in its White Paper “trust is decoupled from resource ownership” from here the variation which turned into the Stellar Consensus Protocol (SCP).

The key elements of federated Byzantine agreement nodes, as per the Stellar White Paper, determine how consensus is achieved (Image Source: stellar.org/papers/stellar-consensus-...)

Get The Full Analysis Of Ripple In Blockchain Business Models

Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Stellar Blockchain In A Nutshell appeared first on FourWeekMBA.

The Ripple Blockchain And Its Blockchain-Based Business Model

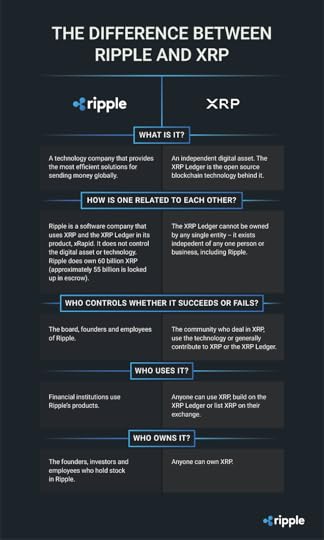

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.

Value Proposition of RippleRipple’s creation was an effort to allow faster and more cost-efficient transfers between its users, something reflective of its core: open-source, decentralized, peer-to-peer protocol and blockchain technology.

Aside from being a digital payment protocol, Ripple also has its native cryptocurrency that you can use on its platform — a digital asset called XRP. Thus, while still looking at the “money problem” Ripple has been trying to institutionalize the crypto market, by leveraging partnerships with banks and more traditional credit institutions.

Source: ripple.com

Source: ripple.comMore precisely, Ripple’s vision is “to enable the world to move value like information moves today—the Internet of Value” with a mission of enabling people “to send money globally using the power of blockchain technology.”

Ripple is trying to implement this vision through its payments network, RippleNet, which includes over 300 financial institutions.

Blockchain ModelRipple is an open-source, decentralized, peer-to-peer platform that facilitates smooth and seamless financial transfers in any form: USD, Yen, Litecoin, or Bitcoin. Ripple is foremostly known for its digital payment protocol than its native cryptocurrency, the XRP.

Opting for Ripple as a mode of money transfer requires trust among the parties involved. Ripple uses a medium called Gateway to strengthen this trust and its entailing security, which links the trust chain between the parties participating in a transaction. More specifically, Gateway acts as the credit intermediary that initiates the transmission and reception of the currencies to public addresses over the Ripple network. Anyone, whether a private individual or a business, can register and open a Gateway. Furthermore, Gateway authorizes registrants to assume intermediary roles as the middlemen for exchanging currencies, ensuring liquidity, and transferring payments on the network.

Thus it’s important to distinguish Ripple (the tech company also managing the RippleNet) and XRP (which is the underlying digital asset independent of Ripple, and its XRP, an open-source technology.

Image Credit: ripple.com/insights/difference-ripple...

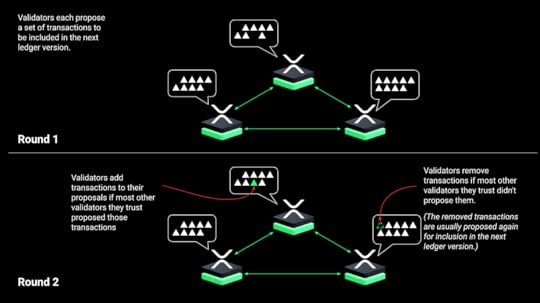

Image Credit: ripple.com/insights/difference-ripple...In addition, the way Ripple’s network achieves consensus is slightly different from Bitcoin. As highlighted in xrpl.org:

“The core principle behind the XRP Ledger’s consensus mechanism is that a little trust goes a long way. Each participant in the network chooses a set of validators, servers specifically configured to participate actively in consensus, run by different parties who are expected to behave honestly most of the time. More importantly, the set of chosen validators should not be likely to collude with one another to break the rules in the exact same way. This list is sometimes called a Unique Node List, or UNL.”

Image Source: xrpl.org

Image Source: xrpl.orgAs highlighted in the same “It’s OK if a small proportion of validators don’t work properly all the time. As long as fewer than 20% of trusted validators are faulty, consensus can continue unimpeded; and confirming an invalid transaction would require over 80% of trusted validators to collude. If more than 20% but less than 80% of trusted validators are faulty, the network stops making progress.”

This type of consensus is known as XRP Ledger Consensus Protocol.

Get The Full Analysis Of Ripple In Blockchain Business Models

Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Ripple Blockchain And Its Blockchain-Based Business Model appeared first on FourWeekMBA.

May 25, 2021

How Does Spotify Pay Artists?

Founded in Sweden in 2006, Spotify has risen to become one of the world’s largest music streaming service providers. The platform can now boast 356 million active users, with approximately 44% of those being paid subscribers. The company has a mission to unlock the potential of human creativity and allow billions of listeners to enjoy and be inspired by music. Spotify plans to fulfill this mission by paying 1 million artists enough money to live off their creative work through royalties based on stream shares.

RoyaltiesMusicians and related professionals on the Spotify platform earn two different types of royalties:

Recording royalties – this is money owed to rights holders for tracks streamed on Spotify that is paid through the licensor delivering the music. In most cases, the licensor is a record label or distributor.Publishing royalties – these royalties describe money paid to a songwriter or owner of a composition. Publishing royalties are issued to publishers, collecting societies, and mechanical agencies based on usage territory.It’s important to note that rightsholders receive royalties whenever a qualifying song is played on Spotify. The song does not need to be played as part of a premium user subscription.

How are artists and songwriters paid?Spotify revenue generation depends on:

Users signing up to Spotify Premium and paying a monthly subscription fee.Brands paying to advertise to users on the free version.The company says that approximately 66% of the revenue from these two sources is paid to music rights holders. In 2020, this equated to over $5 billion.

Taking 2020 as an example, the $5 billion royalty pool is then divided amongst rights holders based on their respective streamshare.

Streamshare is calculated by:

Determining the total number of streams each rights holder receives, and then: Dividing that number by the total number of streams in the applicable market. Spotify markets are typically represented by countries or geographic regions.In terms of the royalty pool itself, the share each market receives depends on the total revenue it earns from advertising and premium user subscriptions.

It should also be pointed that royalty pool fund distribution is not based on each musician’s streamshare alone. In other words, musicians do not earn a fixed dollar amount per stream because Spotify Premium subscribers do not pay to listen to music on a per-stream basis.

Funds are usually distributed to eligible artists once per month. In some cases, they may be distributed to record labels and distributors first and then shared with musicians as per contractual agreements.

Key takeaways:Spotify pays artists through a combination of premium subscription and advertising revenue.Musicians and related professionals earn two different types of royalties on the platform. Recording royalties are paid to record labels and distributors while publishing royalties are paid directly to the songwriter or owner of a composition.Spotify claims to pass on two-thirds of all its revenue to musicians. In 2020, this amounted to over $5 billion. Musicians are not paid on a per-stream basis because premium users pay a flat subscription fee for access to ad-free content.Read Also: How Does Spotify Make Money, Spotify Model, Who Owns Spotify, How Does Twitch Make Money, How Does SoundCloud Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Spotify Pay Artists? appeared first on FourWeekMBA.