Gennaro Cuofano's Blog, page 151

June 27, 2021

Customer Journey In A Nutshell

The customer journey – sometimes called the buyer or user journey – tells the customer experience with a business, brand, product, or service. A customer journey is an alternative approach to other linear models like the sales funnel which hypothesize that most customers follow the same path.

Understanding the customer journeyDescribing a customer journey may seem simple if we only consider the transaction between the buyer and the seller.

In truth, the customer journey is much more complex and multifaceted. It begins when a consumer first becomes aware of a brand and extends well beyond the final purchase into loyalty programs and brand advocacy. Whatever the industry, customer journeys must reflect a deep understanding of the end-user. How does the user behave and feel as they travel through the sales process? Are there impediments to user or business success?

The customer journey is measured by touch-points, or consumer interactions with a brand. How a business manages marketing, point-of-sale, and customer support touch-points will dictate whether it can attract and then retain buyers.

It’s important to note that touchpoints should be tailored to a specific buyer persona. They must also be treated as single, independent entities while still making logical sense as part of a journey from start to finish.

Mapping a customer journeyCreating a compelling customer journey means adopting the perspective of the customer.

How is this accomplished?

Conduct analytical research – use website and other analytics data to identify where the ideal customer hangs out and how much time they spend interacting with a brand.Conduct anecdotal research – it is not possible to get inside someone else’s head, but social media can yield vital clues regarding how an individual feels or thinks when interacting with a brand. Pay particular attention to reviews, as many only feel compelled to leave feedback when they have strong negative or positive feelings. If this information is unavailable, consider asking the target audience directly by conducting surveys.Identify customer touch-points – how does the customer interact with the brand via newsletters, advertising, websites, or after-sales support? Identify the obstacles and then associate each touch-point with a goal that overcomes them to facilitate a seamless customer experience.Create a graphic – include both analytical and anecdotal research data to display the customer journey in a spreadsheet or similar. Highlight areas where customer frustration or dissatisfaction causes them to end their journey and purchase elsewhere, but also make a note of areas where the customer is happy. To help visualize the customer’s state of mind, some find it helpful to use emojis.Benefits of customer journey mappingSome businesses may have a superficial understanding of the obstacles their customers face and how to overcome them.

However, the biggest rewards are had by going deeper to break down the customer journey into smaller parts and then restructure each touch-point.

Here are some of the benefits of doing so:

Refocus the company with an inbound perspective – instead of the business trying to attract buyers through outbound channels, it attracts customers by creating valuable and tailored content and experiences. Inbound marketing is more efficient and cost-effective than the alternative which is more of a scattergun approach.Proactive customer service – knowing where the customer is both delighted and frustrated allows a customer service strategy to be planned in advance. As a result, the business becomes more nimble and can selectively market to maximize brand value and equity.Improved customer retention – it stands to reason that a satisfied buyer with fewer pain points is more likely to become a loyal and devoted fan. Customer satisfaction is crucial, as a single bad experience from customers might lead them to switch. Customer journey mapping also allows the business to identify the common behavioral patterns associated with customer churn, and plan accordingly.Customer journey as an alternative to sales funnels The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.

The sales funnel is a model used in marketing to represent an ideal, potential journey that potential customers go through before becoming actual customers. As a representation, it is also often an approximation, that helps marketing and sales teams structure their processes at scale, thus building repeatable sales and marketing tactics to convert customers.A customer journey is a great addition to other more linear tools like the sales funnel, as it enables you to have a deeper understanding of how customers get to know your brand. Therefore, removing assumptions about how customers interact with your brand. This is critical as it helps to act with fewer assumptions and drive more effective branding campaigns.

Key takeaways:The customer journey tells the story of a consumer’s experience from the first interaction with a brand to a point well beyond their last purchase.For the business, crafting a compelling customer journey means taking the perspective of the customer. It must conduct analytical and anecdotal research to identify pain points, thoughts, and feelings that influence behavior. Then, it must visually represent the journey to identify obstacles and areas for improvement.The customer journey helps an organization adopt an inbound marketing strategy with a focus on proactive customer service. This mindset creates satisfied customers who are more likely to be retained.Related Concepts

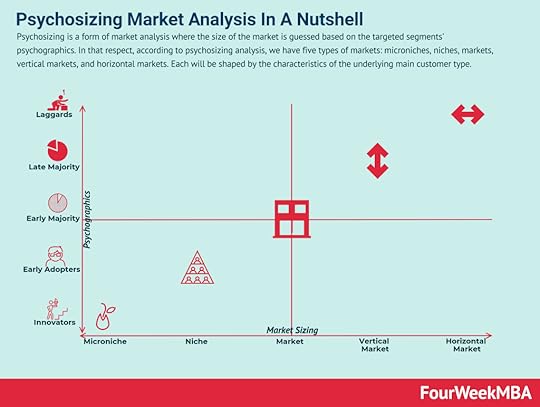

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.  Customer experience maps are visual representations of every encounter a customer has with a brand. On a customer experience map, interactions called touchpoints visually denote each interaction that a business has with its consumers. Typically, these include every interaction from the first contact to marketing, branding, sales, and customer support.

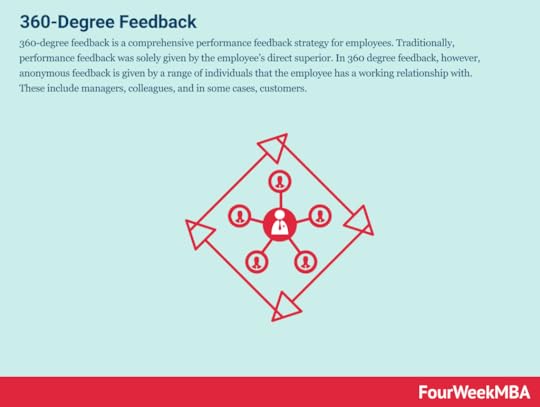

Customer experience maps are visual representations of every encounter a customer has with a brand. On a customer experience map, interactions called touchpoints visually denote each interaction that a business has with its consumers. Typically, these include every interaction from the first contact to marketing, branding, sales, and customer support. 360-degree feedback is a comprehensive performance feedback strategy for employees. Traditionally, performance feedback was solely given by the employee’s direct superior. In 360 degree feedback, however, anonymous feedback is given by a range of individuals that the employee has a working relationship with. These include managers, colleagues, and in some cases, customers.

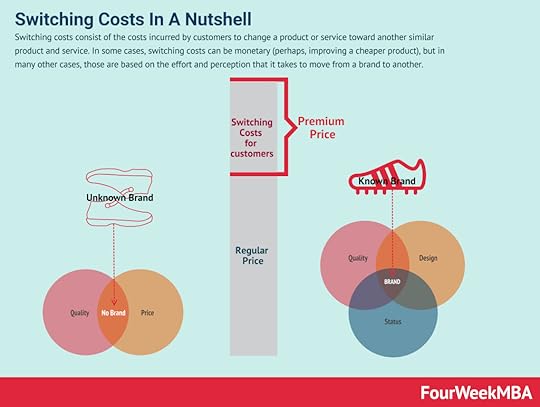

360-degree feedback is a comprehensive performance feedback strategy for employees. Traditionally, performance feedback was solely given by the employee’s direct superior. In 360 degree feedback, however, anonymous feedback is given by a range of individuals that the employee has a working relationship with. These include managers, colleagues, and in some cases, customers. Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another.

Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another. Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups.

Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups. Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Customer Journey In A Nutshell appeared first on FourWeekMBA.

PFOF: Payment For Order Flow

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.

How does the payment for order floe work?In an interview to Bernie Madoff back on May 2000, asked why his firm was “paying brokerages to ship trades your way” Madoff explained:

It’s a relatively small part, maybe 20 percent, of our business today. Payment for order flow was only an issue as it related to best execution. Does inducing someone to send an order to you present a problem as far as getting the right price goes? Quite honestly that depends on the firm. You’re all fiduciaries. As long as you operate in the proper fiduciary capacity, and you’re dealing with a reputable firm, it wasn’t a problem.

At the question “Will payment for order flow ever disappear?” Madoff replied:

The Robinhood SagaNo. I think it will get lower and lower as the spreads get lower and lower with decimals. No one tells a firm how they can advertise. If I want to hire salesmen to generate order flow, no one is going to object. I don’t have them. So if I want to use Fidelity’s salesmen and pay part of my trading profits in the form of a rebate, why shouldn’t I be allowed to do it? It was characterized as this bribe and kickback and something sinister, which was very easy to do. But if your girlfriend goes to buy stockings at a supermarket, the racks that display those stockings are usually paid for by the company that manufactured the stockings. Order flow is an issue that attracted a lot of attention but is grossly overrated.

Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, earn interest from customer cash and stocks, and rebates from market makers and trading venues.

Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, earn interest from customer cash and stocks, and rebates from market makers and trading venues.The payment for order flow issue got a major interest in 2021, as meme investors targeted various stocks, and some of them were backed by hedge funds, which were squeezed out.

Robinhood stopped trading these stocks, and the suspect from some was that the platform was acting in favor of these players instead of its retail investors. And some claimed this might be due to the fact Robinhood earns money also through payments for order flow.

Indeed, brokerage firms like Robinhood pass along their customers’ trades to other market makers are compensated on top of the spread between the bid and ask price with a fee for each trade as a “market maker fee” (the largest market maker for options in the US is called Citadel Securities – owned by Citadel LLC, which during the short squeeze from Redditors bailed out the hedge fund Melvin Capital).

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns. Understanding The Issue

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns. Understanding The Issue The CEO of Robinhood highlighted that the main issue with payment for order flow was the limitation posed by Rule 612:

In general, the Rule prohibits market participants from displaying, ranking, or accepting quotations, orders, or indications of interest in any NMS stock priced in an increment smaller than $0.01 if the quotation, order, or indication of interest is priced equal to or greater than $1.00 per share.

As Robinhood’s CEO highlighted:

Back in 2005, when Rule 612 was adopted, the consensus was that price increments of $0.0001 were economically insignificant. Supporters of the rule argued that sophisticated investors may use these smaller increments to step ahead of retail investors by trivial amounts. Some also argued that technology hadn’t advanced enough to properly handle an enormous increase in on-exchange quoting.

Read Also: Robinhood Business Model, Reddit Business Model, Twitter Business Model, Dogecoin.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post PFOF: Payment For Order Flow appeared first on FourWeekMBA.

June 17, 2021

Meme Stocks: Meme Investing Demystified

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.

Meme Investing: An Origin StoryIt was the beginning of 2021 when a group of private investors through a Reddit community called WallStreetBets turned against multi-billion dollar hedge funds who were short-selling (betting on the downside) a few brick and mortar stocks.

The symbol of this “digital revolution” started with GameStop. As the community-driven trade was unraveling traditional investing wasn’t looking at it with a good eye.

In a few words, starting from the WallStreetBets board, private investors all agreed to buy GameStop on what they later called a “diamond hand” (those private investors were ready to hold their position even though that meant losing all the money).

They started from GameStop, which was rumored to be shorted by large hedge funds taking advantage of how the pandemic affected the business.

In a few days, some of these hedge funds, who until now were the market makers, had to close their own positions, burning billions of dollars of their portfolio.

As the trade further unraveled and the loss for these hedge funds widened, platforms like Robinhood restricted trades on the GameStop stocks, claiming liquidity issues, from there meme investing also helped expose conflict of interests existing in the business models of some of the stock brokerage firms.

How do stockbrokers make their money?This situation opened up discussions on whether platforms like Robinhood – making money on fees coming from these same Wall Street institutions – to sell the retail investors trades are legitimate, what’s known as “payment for order flow.”

*A quick side note on how payments for order flow or “PFOF” work: apps like Robinhood, or other stock brokerage firms make money by selling trades of their customers. In short, a market is made when ask and bid offers are fulfilled. Indeed that is what provides liquidity to the market. Therefore brokerage firms that like Robinhood pass along their customers’ trades to other market makers are compensated on top of the spread between the bid and ask price with a fee for each trade as a “market maker fee” (the largest market maker for options in the US is called Citadel Securities – owned by Citadel LLC, which during the short squeeze from Redditors bailed out the hedge fund Melvin Capital).

Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, it earns interests from customer cash and stocks, and rebates from market makers and trading venues.

Robinhood is an app that helps to invest in stocks, ETFs, options, and cryptocurrencies, all commission-free. Robinhood earns money by offering: Robinhood Gold, a margin trading service, which starts at $6 a month, it earns interests from customer cash and stocks, and rebates from market makers and trading venues.So to recap, Redditors took over Game Stop by making its price shoot over $400 per share, thus “squeezing” hedge funds like Melvin Capital, who had massive short bets on the company (thus creating a lack of liquidity as those short-sales determined millions of losses for the hedge fund).

In turn, one of the primary platform used by those Redditors, Robinhood (which claimed mission is “to democratize finance”) restricted the trades on Game Stop, de facto making it harder for those retail investors to squeeze further hedge funds involved in the trade. At the same time, Robinhood claimed liquidity issues as the reason for restricting these trades.

Redditors also questioned Robinhood’s mission to democratize investing. When faced with the dilemma, Robinhood favored market makers rather than retail investors.

Thus, while we can believe that the high volatility created a difficult situation for Robinhood to handle, we can also leave it open here whether it still makes sense for a company that stands on democratizing investing, to have among its largest clients a market maker, which can retaliate the platform against retail investors in these scenarios.

Therefore, even though this is a legal practice, is it still legitimate?

Reddit and Twitter became the media of meme investingWhile it fits a narrative to give the birth of the meme investing phenomenon to a single event, this “digital revolution” has been building up for decades, and even though the web has become much more centralized starting in the 2010s, the crowd’s potential is still a built-in feature of the Internet.

The pandemic has just amplified something that started over two decades ago for better or worse. At the same time, many talks about speculations, bubbles, and excess (no doubt we’ll remember this period also for some of these things).

Indeed, already months before through the Reddit group was pushing for a rise of Game Stop as a digital revolt against hedge funds.

How did this phenomenon develop?

While traditional investing moves along the lines of traditional media (be it TV, Radio or also online publications with a top-down approach), meme investing instead has developed as a result of “user-generated” investment strategies. Its platforms to communicate have been Reddit and Twitter:

Reddit is a social news and discussion website that also rates web content. The platform was created in 2005 after founders Alexis Ohanian and Steve Huffman met venture capitalist Paul Graham and pitched the company as the “front page of the internet.” Reddit makes money primarily via advertising. It also offers premium membership plans.

Reddit is a social news and discussion website that also rates web content. The platform was created in 2005 after founders Alexis Ohanian and Steve Huffman met venture capitalist Paul Graham and pitched the company as the “front page of the internet.” Reddit makes money primarily via advertising. It also offers premium membership plans.The most incredible thing about Reddit is that it managed to be a popular platform for user-generated content for a decade. And indeed, those who have tried to build user-generated platforms over the years know how a feat that is.

As angel investor Paul Graham has highlighted “The biggest source of stress for me at YC was running HN.”

In short, among the ventures, he had built over the years. Hacker News which was the social news website launched in 2007, by startup incubator Y Combinator turned out to be the most difficult product.

On the other hand, Twitter has been renamed by many as “Crypto Twitter” as in 2020 going forward it became the primary platform for those interested in crypto investing. Crypto investing would become unbeknownst to many the next major platform for meme investing, with the rise of Doge.

Dogecoin’s conception was in 2013 as a satire on the flourishing altcoin sector. No one expected that the small community built around a coin inscribed with the famous Shiba Inu “doge” meme would grow as it did. Presently, eight years later, the satirical comment of a coin has and is still pumping in value, aggressively thriving in the ever-competitive altcoin world. And things only got even more interesting, when Elon Musk started to tweet with more and more frequency about that.

Dogecoin’s conception was in 2013 as a satire on the flourishing altcoin sector. No one expected that the small community built around a coin inscribed with the famous Shiba Inu “doge” meme would grow as it did. Presently, eight years later, the satirical comment of a coin has and is still pumping in value, aggressively thriving in the ever-competitive altcoin world. And things only got even more interesting, when Elon Musk started to tweet with more and more frequency about that. To understand how this was unexpected, also smart people like venture capitalist Fred Wilson highlighted:

I remember when a friend of mine told me five or six years ago that he had bought some Dogecoin. I thought “what is he doing?” and dismissed it as something silly and or crazy.

How did that happen? In part, through the PR stunts of Elon Musk, also renamed the “King of Doge.”

Elon Musk Tweet

Elon Musk TweetWhat made things even more interesting is that something started as a joke became sort of serious.

In fact, as a quick timeline:

Elon Musk had announced that Tesla would start accepting payments in Bitcoin, and at the same time to enable that, back in February 2021, it had bought $1.5 billion worth of Bitcoins. Over the months, Elon Musk had tweeted more and more frequently about Bitcoin first; then, he started to tweet about crypto meme coins (Dogecoin), gathering more and more interest around the coin that was born as a joke. By May 2021, Elon Musk suddenly came out with a statement announcing that Tesla would not accept Bitcoin payments anymore due to the high coal energy consumption due to the Bitcoin mining process. That opened Pandora’s box that also showed the fanaticism around the Bitcoin community. At the same time, Elon Musk announced that he would be working with the Doge developer’s community instead of making the former meme coin a potential medium to purchase Tesla in the future.As the debate got heated, though, some fundamental points came up about the evolution of Bitcoin’s blockchain.And as the discussion around the inefficiency and electric consumption of Bitcoin, Elon Musk turned to Doge even more:

This proved to be an incredible meme machine that turned a joke into a over $50 billion market cap protocol at its peak!

Understanding meme stocks Source: reddit.com/r/MemeEconomy/comments/93v...

Source: reddit.com/r/MemeEconomy/comments/93v...Giving a precise definition of a meme stock is difficult. But in general, a meme stock has seen an increase in volume because of social media hype and not superior company performance. Or at least an investment opportunity that a crowd of people across the various social communities find appealing for some reason.

Indeed in the case of GameStop, various reasons drove the hype. First, from a brand that has been iconic for many years, hit further by the pandemic. To the fact, that was easier to take over as shorter in liquidity. And the fact yet that given the many short-selling bets placed on the order, a quick uptake would have liquidated those short bets, thus driving a further increase of the price.

In the case of Dogecoin instead, the primary reasons behind the meme take over stood in entertainment, speculation, a new “asset class,” and a life-changing opportunity for many young people to become rich quickly.

Fuelled by hype, and while in a highly liquid market, these stocks become overvalued in a short period of time and experience rapid share price appreciation. They also tend to depreciate just as quickly as the hype dies down and investors look for the next opportunity. Since the share price is not based on company fundamentals, meme stocks are highly volatile.

Meme stocks are becoming increasingly relevant because of the rising popularity of retail investing. For one, services like Robinhood have made it very easy for the average investor to purchase securities in general. Significant stimulus money in the wake of the COVID-19 pandemic has also been invested in the stock market as retail players seek to maximize their returns.

As we saw, most meme stocks are born on social media sites such as Twitter and Reddit.

To describe how a meme stock is formed, consider the following steps which echo a similar mechanism for the uptake of a new product or technology by consumers.

Early adopter phaseInitially, a small number of investors believe a particular stock is undervalued and purchase it in large quantities.

As a result, the share price gradually begins to increase.

Middle phaseThe increase in volume is noticed by observant investors who buy in and cause the share price to appreciate more significantly. Through the virality of social media, more and more investors join the party, so to speak.

FOMO phaseIn the FOMO phase, the stock becomes a meme stock as it gains traction across multiple social media channels or forums. Less savvy investors purchase shares in the meme stock for no other reason than a fear of missing out on potential gains.

Profit-taking phaseAt some point, the early adopters sell part or all of their holding and take profit.

This sets off a chain reaction causing more investors to sell and lock in profits as the share price begins to decrease.

New buyers in the profit-taking phase become bag holders. In other words, they are left holding shares in the now worthless stock and will incur large losses once they sell.

Examples of meme stocksHere are some of the more notable meme stocks in recent times:

GameStop (GME) – when Reddit investors noted that GameStop was heavily shorted by hedge funds, they began mass purchasing the stock causing the price to increase by hundreds of dollars in a matter of days.AMC Entertainment (AMC) – after the GameStop short squeeze died down, investors turned their attention toward a similarly shorted stock in AMC. The share price peaked at $63.97, representing a 570% increase in value.BlackBerry (BB) – Canadian enterprise and security software company BlackBerry was also targeted. Before the meme stocks boom, the share price was around $9 – but this more than tripled to a 52-week high of $28.77 in January 2021.Will meme investing become an accepted investment style?As Fred Wilson from AVC has noted:

Memes are fun and memes are also something to come together around. Speculating on the popularity of memes and their staying power is no different than any other form of speculation.

But more than that, and this is where my head has been going on this topic, the market caps of these memes are also economically powerful. If the board and management teams of the companies with meme stocks choose to issue more shares at these prices, they can raise a lot of capital to transform these companies. Similar opportunities could exist with meme tokens. AMC recently did this with their “meme stock.”

I’ve decided that I am going to stop ignoring and dismissing meme investing and start trying to understand it better. I think it is not something that is going away anytime soon and may turn into something even more interesting.

avc.com/2021/06/meme-investing

So while meme investing might have become popular in recent times, thanks also to the speculative bubbles formed in the market, there are some fundamentals reasons to believe this phenomenon might survive, and some aspects that make it worth analyzing:

Retail investors now have platforms that can be used to generate short-term buzz, thus acting as a sort of “liquidity pumps” toward assets that might be, for some reason, undervalued by main players on Wall Street. Meme investing might actually help some companies turn around beyond what Wall Street thinks of them and give them a chance. So as a form of crowd-investing where capital can be allocated to restructure an organization. Meme investing can also be used to involve younger generations in the decision-making process that determines the future of organizations that will lead the economic establishment.At the same time, meme investing can be deceiving and leave unprepared retail investors holding the “bag,” thus never recovering their losses. Meme investing also raised the question of whether the current pay-for-order flow model is still legitimate. Key takeaways:Meme stocks are any which experience rapid share price appreciation because of social media hype and not company fundamentals.Meme stock formation follows a similar pattern to the uptake of a new product or technology by consumers. Generally speaking, there are four phases: early adopter phase, middle phase, FOMO phase, and profit-taking phase.Popular examples of meme stocks include GameStop, AMC Entertainment, and BlackBerry. In all three examples, retail investors identified high short interest by hedge funds.Read Also: Robinhood Business Model, Reddit Business Model, Twitter Business Model, Dogecoin.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Meme Stocks: Meme Investing Demystified appeared first on FourWeekMBA.

June 16, 2021

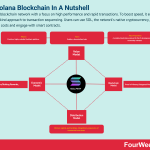

The Solana Blockchain In A Nutshell

Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.

What is Solana?Scalability is one of the most difficult aspects of blockchain technology to overcome. As these networks expand, they frequently encounter transaction speed and confirmation time constraints. Solana attempts to address these issues while maintaining security and decentralization.

The Solana blockchain, founded in 2017 by Anatoly Yakovenko of Solana Labs, uses a novel verification method. Scalability and speed difficulties plague Bitcoin, Ethereum, and a slew of other projects. However, the Solana blockchain can overcome this and handle thousands of transactions per second thanks to Proof-of-History (PoH) technology.

Value Model of SolanaSolana is a third-generation, Proof-of-Stake blockchain. It has developed Proof-of-History, a novel method of establishing a trustless system for identifying the timing of a transaction.

For cryptocurrencies, keeping track of transaction sequence is critical. Solana’s Proof-of-History strategy understands this and employs a unique technique to overcome the scalability and speed challenges that hamper its competitors.

Proof of HistoryThe SHA256 hash algorithm hashes all Solana events and transactions. This function takes an input and generates a one-of-a-kind output that is nearly impossible to predict. Solana takes a transaction’s output and feeds it into the next hash. The hashed output now includes the sequence of the transactions.

This hashing technique results in a long, uninterrupted chain of hashed transactions. This feature creates a clear, verifiable order of transactions that a validator adds to a block without using a traditional timestamp. Validators can simply verify how much time has elapsed because hashing takes a given amount of time to finish.

Validators process and send less information in each block by arranging transactions in a chain of hashes. Moreover, the time it takes to confirm a new block gets considerably reduced when a hashed representation of the most recent state of transactions gets used.

Blockchain ModelThe Solana team has developed eight fundamental technical elements to assist the blockchain in matching a centralized system’s capabilities. The most famous is perhaps Proof-of-History, but there are others as well:

Archivers: Distributed ledger storageCloudbreak: Horizontally-Scaled Accounts DatabaseGulf Stream: Mempool-less transaction forwarding protocolPipelining: a Transaction Processing Unit for validation optimizationSealevel: Parallel smart contracts run-timeTower BFT: a PoH-optimized version of Practical Byzantine Fault ToleranceTurbine: a block propagation protocolThese elements combine to provide a high-performance network with block speeds of 400 milliseconds and thousands of transactions per second. For the sake of reference, Bitcoin’s block time is about 10 minutes, and Ethereum’s is about 15 seconds.

SOL token holders can participate in the blockchain’s PoS consensus method by staking their tokens. Users can stake their tokens with validators who perform and execute network transactions if they have a suitable crypto wallet.

Those who have staked savings into Solana share some of the rewards with a successful validator. This incentive system encourages validators and delegators to act in the best interests of the network.

Notably, Solana has roughly 900 validators as of May 2021, making it a relatively decentralized network.

Distribution ModelThe Solana blockchain project was very successful in drawing interests from prominent venture capital firms, which will play a key role in enabling its distribution network. In addition, partnerships, and integrations will help to consolidate its distribution. While the expansion of its commercial use cases will help it scale it further.

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot, Dfinity, NEO, Algorand, EOS, IOTA.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Solana Blockchain In A Nutshell appeared first on FourWeekMBA.

IOTA Token: Enabling IOT Via Blockchain

IOTA integrates Winternitz Signatures that ensure its resilience to the next generation of computing. Furthermore, IOTA has given enough focus to developing its network called The Tangle. IOTA claims that with the Tangle, users can rest assured that the exchange of data and value is immutable; thus, the information they will be getting is trustworthy — untampered and undamaged.

In the present landscape of cryptocurrency, it is not enough to develop systems that can keep up with existing ones; instead, develop ones that can withstand the test of time.

What is IOTA?To its core, IOTA is a distributed ledger created to record and facilitate the exchange of data and value between machines and the devices in the Internet of Things (IoT) ecosystem. IOTA allows transactions within its network using its native cryptocurrency called MIOTA. Among its many innovations, IOTA prides itself on the same network on which it runs, called The Tangle. IOTA will provide faster transaction times as they claim that The Tangle is relatively quicker and more efficient than the traditional blockchains employed in most cryptocurrencies.

To further extend IOTA’s utility between connected devices, the IOTA Foundation, the non-profit organization behind the ledger that the world has come to know, has inked accords with some of the biggest companies like Bosch and Volkswagen, to name a few.

Value ModelIOTA’s value proposition has been a roller coaster ride. Presently, it has not yet fully recovered from the downfall from its 2017 peak. However, by late 2020, IOTA’s market capitalization has increasingly demonstrated signs of improvement. From a market capitalization amounting to $446 million at the beginning of 2020, IOTA has reached approximately $900 million as of Dec. 19, 2020. Although IOTA did not have it easy, a gain of over 100% is still what it is — a gain.

From there, IOTA, like most other cryptocurrencies, will face more bumpy roads. However, with continued and renewed partnerships and collaborations with established corporations, and an intense focus on the increasingly growing Internet of Things (IoT), IOTA is well on its way to greater heights.

Blockchain ModelAs established, IOTA does not employ the typical blockchain structure that most cryptocurrencies run on and use. IOTA sets itself apart by developing its platform that incorporates a Directed Acyclic Graphs (DAG) called The Tangle.

For the network’s transactions to be valid, each node in a DAG Tangle must approve two preceding transactions at the other node. The integration of this mathematical system consequently results in two things. First, the need for “miners” to validate transactions is eliminated, thereby preventing the happenstance of bottleneck congestion when transaction numbers are high. Second, the network’s growth and speed become directly proportional to the number of active users, thereby allowing transactions to be through within minutes.

Furthermore, IOTA features zero-fee transactions among its users. IOTA also prides itself on high scalability, solving long-standing scaling problems such as network delays and block congestions.

As IOTA establishes its resilience to the next generation of computing, it should simplify and streamline transactions and mundane processes that involve objects with sensors, like vending machines.

Distribution ModelIOTA is among the cryptocurrencies that hold the greatest promise in building a better world moving forward. Although it has gone through some bumpy roads in the past, trust that it can thrive and successfully traverse the rough roads ahead. With continuous support from some of the biggest brands in the world, IOTA is now building a comprehensive platform for developers to build more reliable supply chains, enable mobility and smart cities.

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot, Dfinity, NEO, Algorand, EOS.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post IOTA Token: Enabling IOT Via Blockchain appeared first on FourWeekMBA.

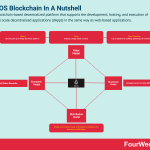

The EOS Blockchain In A Nutshell

EOS is a blockchain-based decentralized platform that supports the development, hosting, and execution of commercial-scale decentralized applications (dApps) in the same way as web-based applications.

What is EOS?In a sea of decentralized applications, EOS prides itself as among the most powerful. EOS is a blockchain-based decentralized platform that supports the development, hosting, and execution of commercial-scale decentralized applications (dApps) in the same way as web-based applications.

Although EOS takes no official nor final form, among its most prized features is its containment of all the necessary core functionality that allows businesses and individuals to develop blockchain-based applications without compromising the following:

Security of access and authentication.Permissions.Data Hosting.Usage Management.Communication Linking dApps and the Internet.In September 2017, the Block.one company created the EOS.IO blockchain and its native cryptocurrency that the world has known as the EOS. In four years, the EOS.IO blockchain platform, which features smart contract capabilities, has now more than 100 dApps and thousands of active users daily.

With its decentralized blockchain platform, EOS allows software developers to create decentralized applications, or dApps, on its platform itself. Although there are existing blockchains that offer the same features, EOS is a standout. It provides better platform scalability that can process a million transactions per second, all for free.

EOS shares similar dApp development capabilities as Ethereum. However, with EOS, transaction confirmations are carried out using a different type of dedicated consensus system — a remarkable distinction separates the two.

Through a voting mechanism called delegated-proof-of-stake, or DPos, the EOS ecosystem can select who will be producing dApps on the block. Users must keep tokens on the system for three days without selling them to vote. Although users run the risk of losing their money if the price of tokens drops during that period, the chance to vote may override this risk.

Unlike most other cryptocurrencies, EOS tokens have no supply limits. The delegated-proof-of-stake mechanism capitalizes on inflation annually capped at 5% to fund transactions and compensate block users.

Value ModelAs established, EOS is a decentralized blockchain that allows software developers to create on-chain applications. As such, EOS aims to support smart contracts and processes and deliver faster transaction times without any impending costs.

Staying ahead of its league, EOS seeks to provide novel ideas and solutions such as cloud storage, user authentication, and server hosting, and ultimately, to function as an operating system. When achieved, EOS can simplify the development of various dApps on its blockchain. Developers who plan on using the EOS blockchain and any of its resources must be EOS token holders. Although seemingly contradicting their drive to provide free services, holding EOS tokens does not necessarily mean paying to use EOS; rather, users only need some coins to access it.

As previously described, similarities can be attributed to both EOS and Ethereum in that they are both capable of hosting dApps built on smart contracts. However, EOS takes the lead to process approximately a million transactions per second, whereas Ethereum can only do merely 15 transactions per second, a remarkable difference between the two. Although this is the case, the EOS market value will always be tied to Ethereum’s because EOS added scalability attributes to the extra layer it has put on top of Ethereum.

Distribution ModelWith the claim to be a highly configurable blockchain platform, it’s critical for its distribution to build up to become the go-to place for developers to build any sort of decentralized application. It’s critical to remark that in some cases it’s hard to predict which use cases might take off – in the long run – on a platform. Therefore, in the short term, there might be a few use cases the platform embraces to make distribution take-off (see current commercial use cases below).

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot, Dfinity, NEO, Algorand.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The EOS Blockchain In A Nutshell appeared first on FourWeekMBA.

Algorand Blockchain In A Nutshell

Algorand’s technology features a set of high-performing Layer-1 blockchains that ensures security, scalability, complete transaction finality, built-in privacy, Co-Chains, and smart contracts that are indispensable in the advancement towards a Future-FI world.

What is Algorand?Algorand, with its native currency, ALGO, is a public cryptocurrency blockchain and protocol. This cryptocurrency’s design is to bring about decentralization, scalability, and security among all participants. Algorand employs a permissionless proof-of-stake protocol. Thus, all ALGO holders are automatically qualified and eligible to participate in the full protocol functionalities, such as participating in decision making by proposing and voting on blocks, depending on the proportion to their stake, that is, how much ALGO they possess.

Value ModelAlgorand exercises a core philosophy that circles the principle of “democratic” user participation. With this in mind, Algorand aims to advance its upgraded Proof-of-Stake and self-validating transactions. This protocol is contrary to the mining-based, Proof-of-Work design that Bitcoin and other existing cryptocurrencies employ.

The Algorand project has set specific goals contingent on the implementation and execution of its concept and technologies:

Algorand is promoted as an open-door platform, meaning anyone can join without seeking approval from an officially appointed gatekeeper authority. With the openness that Algorand champions, its developers hope to cultivate a healthy exchange of ideas among various user profiles.

Algorand operates on the same principle as open-source software, housing a whole range of actors from small business owners, individual investors, and even large corporations, and having access to a permissionless blockchain.

Furthermore, distinct from a blockchain with permissions that may hinder the users’ innovation potential, Algorand allows its users to freely offer new market applications regarding ownership records that are publicly accessible on the blockchain. This permission should help Algorand build wholly innovative markets that do not just imitate their real-world counterparts but bring something new to the table.

Blockchain ModelBuilding a “Borderless” EconomyFirstly, Algorand’s economic innovation lies in creating a blockchain that offers genuine appreciation and value to advancing the building of a “borderless” economy.

Algorand aims to make the bridge that links companies and organizations to relatively untapped markets. With Algorand’s technology featuring a decentralized, secure, scalable, and distributed ledger, this is made feasible. However, this would remain a vision and would count for nothing if the blockchain platform on which Algorand rests cannot perform adequately to keep abreast with this type of economy’s demands. Moreover, the Algorand blockchain provides immediate transaction finality, thereby eliminating the risk of forking or uncertainty based on its unique consensus algorithm.

Once implemented, each new block remains on the chain indefinitely, ensuring that all transactions on this blockchain are final. Upon the launch of the Algorand MainNet, the network reported a processing rate of 1,000 transactions per second, not far behind the performance level of mainstream payment networks such as VISA, which is reportedly able to handle an estimate of 1,700 transactions per second.

Recognizing Ownership Rights Over AssetsSecondly, at the core of Algorand’s Pure Proof-of-Stake protocol operation is recognizing one’s ownership rights over assets. This focus on ownership rights should make Algorand more readily acceptable in its planned financial industry implementation. Its Pure Proof-of-Stake is a unique consensus algorithm developed by Silvio Micali to succeed in this venture.

This Pure PoS also accounts for a significantly decreased demand for computing power as it can settle transactions within just a few seconds. Thus, the system can reach a consensus without necessitating the presence of a central authority. Plus, it has a tolerance for malicious users, as long as the bulk of the stakes are under honest users’ care.

Moreover, each user can read every block and has the opportunity to write a transaction in a future block. As established earlier, users can impact selecting a new block depending on the size of their stake in the system, that is, by the number of ALGO tokens they possess. Based on random selection principles, users are selected, allowed to propose blocks, and vote on block proposals, discreetly. No matter random, the likelihood of being chosen is still proportional to the user’s stake volume.

Distribution ModelAs the project proves viable over time its distribution will highly depend on the use cases built by developers joining the blockchain platform (as smart contracts in specific industries are the key value proposition to the Algorand project) To sustain its development bya core team the more it will attract now investors that are willing to sustain that the more it will become viable over time. Thus in this phase it’s critical for Algorand to keep its core development team aligned, while involving a developer’s community and investors.

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot, Dfinity, NEO.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Algorand Blockchain In A Nutshell appeared first on FourWeekMBA.

NEO Coin: The Chinese Ethereum NEO Blockchain In A Nutshell

Formerly known as AntShares, NEO was launched in 2014 and changed its name in June 2017. Da Hongfei and Erik Zhan introduced NEO as a blockchain-based platform that supports its cryptocurrency. At the same time, NEO allows its users to diversify their digital assets and develop smart contracts.

What’s NEO?NEO is the next generation smart economy platform that earned its monumental rise fairly recently. Also known as the Chinese Ethereum.

Formerly known as AntShares, NEO was launched in 2014 and changed its name in June 2017. Da Hongfei and Erik Zhan introduced NEO as a blockchain-based platform that supports its cryptocurrency. At the same time, NEO allows its users to diversify their digital assets and develop smart contracts.

The blockchain-based platform aims to streamline the management of digital assets through automation. Users can create smart contracts that promote a distributed network-based smart economy system.

Value ModelThe value proposition of NEO focuses on establishing a smart economy. The plans to achieve this involve the merging of digital assets, digital identity, and smart contracts. NEO gets written through complex computer languages, which means developers can make the value proposition possible on the blockchain-based platform.

Additionally, NEO has made it possible to convert its cryptocurrency to other coins, including Bitcoin, Ethereum, and Litecoin. The only challenge that users may face is having to convert NEO to Fiat.

Blockchain ModelTo know more about the famed blockchain-based platform, here are some of its significant features that make up the NEO ecosystem and its applications:

Delegated Byzantine Fault Tolerance (DBFT) AlgorithmInstead of a conventional proof of work mechanism, the DBFT algorithm is a consensus mechanism that resists the issues with Byzantine General while maintaining consensus even though nodes that bring malicious intentions appear.

NeoXThe NeoX system will allow users to execute and operate across multiple Blockchains.

NEO ContractNEO Contract is another mechanism used to produce smart contracts seamlessly. It promotes scalability allowing users to integrate the tool in pre-existing codebases such as C#, VB.Net, F#, Java, and Kotlin.

NeoFSNeoFS is another feature of the NEO platform allowing users to obtain decentralized storage that resembles a peer-to-peer Dropbox.

NeoQSNeoQS is a lattice-based cryptographic mechanism that generates problems that quantum computers cannot solve while maintaining quantum-proof.

Distribution ModelThe distribution model is highly dependent on the progress over the development of the new protocol by the core team. Just like a release of a beta version of a software here, enabling more and more developers to start to test the ability of the new network is critical.

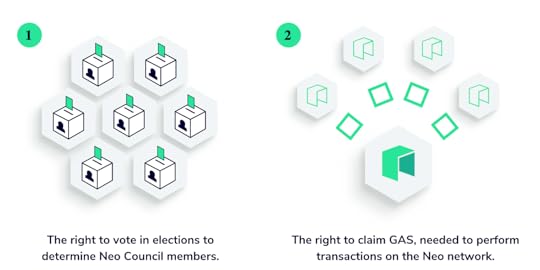

Economic Model & Commercial ApplicationsWith a total circulation of 100 million tokens as highlighted on NEO those have two key features:

Image Source: neo.org/neogas#tokens

Image Source: neo.org/neogas#tokensOn the one hand, NEO holders can participate in the voting for the Neo Committee (made of members and consensus nodes to run the network).

On the other hand, similarly to Ethereum, the network charges for fees called GAS, which work as a disincentive to process less useful transactions on top of NEO. However, just like Ethereum 2.0 will burn GAS fees to prevent miners from acting against the interests of the network. So NEO does burn the system fees, while instead, it redistributes the network fees, as economic incentives/disincentives to make the network run.

Below an explanation of how this mechanism work:

Image Source: neo.org/neogas#tokens

Image Source: neo.org/neogas#tokensIn short, every new block 5 GAS is generated, as there are operations and storage of tokens and smart contracts. Network fees are distributed accordingly to create positive incentives. A 10% split goes to NEO holders, a 80% goes to successful voters and a 10% goes to the members of the Neo Council (composed of 21 candidates responsible for “maintaining the health and liveliness of the Neo network”).

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot, Dfinity.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post NEO Coin: The Chinese Ethereum NEO Blockchain In A Nutshell appeared first on FourWeekMBA.

Dfinity Coin: Building Up A Super Computer

Dfinity is developing a decentralized computer cloud that is both stable and cost-effective. When successful, Dfinity will be housed in a wide-scale network of computers worldwide, powering the next wave of mega-apps, such as decentralized versions of Uber, eBay, and Facebook.

Value ModelIt is no new news that blockchain has a scalability problem. For many applications, primarily real-time gaming, users need much faster transaction speeds. Notably, in 2017, the remarkable success of one gaming app, CryptoKitties, resulted in a rapid shoot-up of fees that slowed all transactions on its network host, Ethereum. With that, properties in the Ethereum blockchain race to solve such scaling issues, with Dfinity being the dominating one.

Ethereum currently dominates the cryptocurrency industry. Thus, Dfinity seeks to overcome Ethereum’s scaling issues without compromising its degree of decentralization, for which another competitor, EOS, has been chastised.

Dfinity also claims to be able to complete transactions in under five seconds. For the sake of contrast, Bitcoin can take up to an hour, and Ethereum can take up to six minutes, an incredible feat if Dfinity does hold its claims.

Dfinity achieves consensus by using a variant of the proof-of-stake algorithm. Specifically, Dfinity employs weverything in computing, like any other theory, should be scrutinized. Given Dfinity’s nature, it appears that there is a group of crypto enthusiasts willing to experiment with this new method.

This enthusiasm gets hyped up further as Dfinity also receives a strong vote of confidence from Coinbase, the leading crypto exchange platform in the United States. Coinbase declared that Dfinity’s governance and utility token, ICP, would be immediately open to deposit on Coinbase Pro, with trading to follow once liquidity conditions reach consensus.

Blockchain ModelAs highlighted in its White Paper “DFINITY is a decentralized network design whose protocols generate a reliable “virtual blockchain computer” running on top of a peer-to-peer network upon which software can be installed and can operate in the tamperproof mode of smart contracts.”

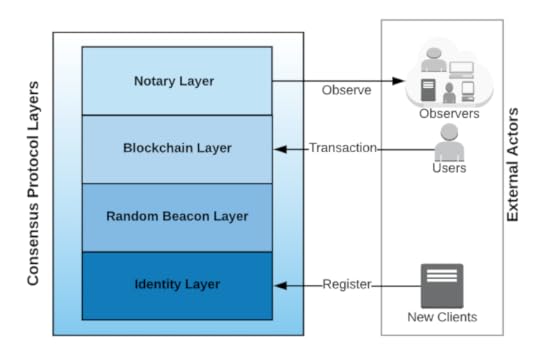

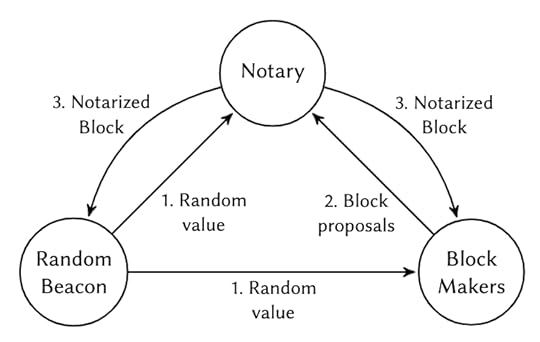

The goal of this network is to enable fast computations, and scalability. Its consensus mechanism is comprised of four layers:

Image Source: DFINITY White Paper

Identity layer (providing a registry of all clients). Random Beacon layer (providing the source of randomness (VRF) for all higher layers including applications (smart contracts). Blockchain layer (building a blockchain via the Probabilistic Slot Protocol driven by the random beacon). Notarization layer (providing fast finality guarantees to clients and external observers).In the network clients fulfill three key roles: participate in the decentralized random beacon, participate in the decentralized notary, and propose blocks. Various phases within the protocol comprise notarization, and finalization. Consensus is achieved when the various players come together to enable these phases.

Image Source: DFINITY White Paper

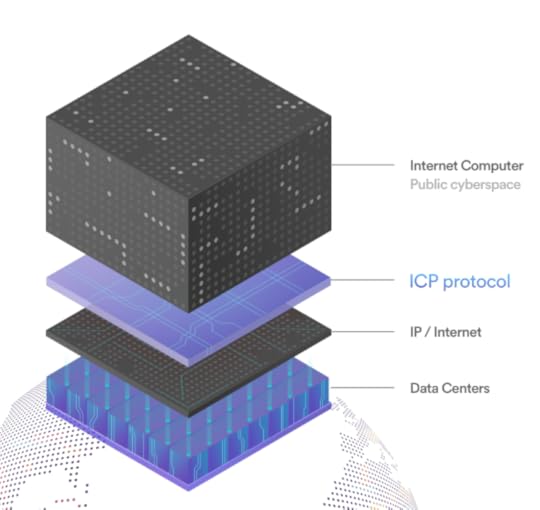

The whole point is to build a protocol that would enable further the development of the web as an additional layer on top of it, to create a sort of “public syberspace.”

Image Source: dfinity.org/deck

This Internet Computer would enable smart contracts, called “canisters” in the contest of DFINITY. In that respect, this Internet Computer would hold various foundational elements, for this blockchain-based web (like tokenized internet services, pan-industry platforms, DeFi and smart contracts, enterprise systems and websites).

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Dfinity Coin: Building Up A Super Computer appeared first on FourWeekMBA.

The Cardano Blockchain In A Nutshell

Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation.

Cardano in a NutshellCardano is now one of the most sizeable cryptocurrencies in terms of market cap. Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation. The team behind Cardano intends to build a blockchain platform that can process more transactions at a lower cost. Furthermore, the developers integrated the distributed ledger technology and the smart contract infrastructure into Cardano’s protocol to protect its users’ data.

Cardano came into the cryptocurrency world in 2015.

Founded by Charles Hoskinson, which as we saw was among the Ethereum’s core development team (even though he stayed for just a few months), he then departed (or perhaps was ousted) from the project to start after a few years Cardano. According to the book “Out of The Ether” Charles Hoskinson wasn’t exactly the kind of person you want to have in a team and that you might want to trust. According to that account, eventually the disagreement and fight with Gavin Wood (Vitalik Buterin’s right wing man who later built Polkadot and Kusama) that finally had Charles Hoskinson (beyond various accounts of him acting strangely) kicked out.

As later on Charles Hoskinson explained his behaviors in the initial development team, as a “philosophical disagreements about how things ought to be run” and he further highlighted “first there was a fundamental disagreement about business strategy and execution vision and I felt a for-profit model with VC money to build the protocol made a lot more sense than the other.”

Another dimension was instead interpersonal, as Charles Hoskinson explained “we have for six months been living like hippies you know in the switzerland house and he – referring to Vitalik Buterin – was traveling around the world and communication was very siloed and paranoia and fear started building up and there’s like three books now written about this and those books you know they paint a portrait that there was a bunch of very brilliant people that got two doses of brains and half a dose of social skills myself included and when you put them into a high stress hippie-like situation it breeds a lot of conspiracy theories and fear and these types of things and frankly there was just too many founders so at some point you have to consolidate and there was really two different paths that vitalik could choose he was sitting in the middle he could pick the business side which is what i was advocating.”

Going back to the protocol, Cardano is a two-layer platform, allowing the system to become more flexible and more easily maintained. Sidechains enable the communication between these two layers, namely:

The Settlement Layer got employed in September 2017. This layer is a ledger to transfer value.The Computation Layer gives its users the option to execute smart contracts — digital legal agreements that experts project to be the foundation of future commerce and business.It is also interesting to note that Cardano has its Proof-of-Stake algorithm called Ouroboros. Ouroboros supports nodes throughout the network to reach a consensus. The level of security displayed by Ouroboros likens it to that of Bitcoin’s blockchain. The security of which has never gotten compromised.

However, different from Cardano’s Proof-of-Stake algorithm, Bitcoin utilizes an energy-hungry Proof-of-Work protocol.

Value ModelAs stated in its origins 2017 essay:

Cardano is a project that began in 2015 as an effort to change the way cryptocurrencies are designed and developed. The overall focus beyond a particular set of innovations is to provide a more balanced and sustainable ecosystem that better accounts for the needs of its users as well as other systems seeking integration.

As established, Cardano is a project that launched in 2015 to modify the way cryptocurrency designs get developed. Like many open-source projects, Cardano began without a comprehensive framework nor an authoritative white paper. Instead, Cardano became an experimental project as it embraced multiple design principles and different engineering best practices, thereby providing leeway for exploration. These principles and practices are the following:

The framework separated accounting and Computation into different layers.Core components are implemented in a highly modular functional code.Small groups of academics and developers participated in peer-reviewed research.Interdisciplinary teams were consulted, including InfoSec experts.Rapid iteration between white papers, implementation, and new research findings to adjust and correct issues that arise during the review.Built with the capability to upgrade post-deployed systems without compromising the network.Cardano developed a decentralized funding mechanism for future work.Developed with foresight such that cryptocurrencies can work on mobile devices without compromising the security of user experience.Designed to bring stakeholders closer to the operations and maintenance of their cryptocurrency.Recognizes the necessity of accounting for multiple assets on the same ledger.Transactions were abstracted to include optional metadata to better conform to legacy systems’ needs.Embraced features that make sense to learn from nearly 1,000 altcoins.Using a dedicated foundation to lock down the final protocol design, it adopted a standards-driven process inspired by the Internet Engineering Task Force.The platform explored social elements of commerce.Reach a consensus allowing regulators to interact with transactions without compromising some core principles inherited from Bitcoin.Coming from these unstructured ideas, the team behind Cardano began exploring cryptocurrency literature and building a toolset of abstractions. From this research arose IOHK’s extensive library of papers, several survey results including a recent scripting language overview and an Ontology of Smart Contracts, and the Scorex project’s birth. Furthermore, this research brought about an appreciation of the unusual and sometimes counterproductive growth of the cryptocurrency industry.

Blockchain ModelCardano uses Ouroboros, which as it claims is “is the first provably secure proof-of-stake protocol, and the first blockchain protocol to be based on peer-reviewed research.”

As Cardano claims “Ouroboros solves the greatest challenge faced by existing blockchains: the need for more and more energy to achieve consensus.”

In short, as this is a proof of stake protocol (the same kind to which Ethereum 2.0 is moving toward) Cardano claims that with Ouroboros, Cardano “is able to securely, sustainably, and ethically scale.” Indeed, Ouroboros (its name come from an ancient symbol depicting a serpent or dragon eating its own tail) as a proof-of-stake protocol it distributes control based on stake pools. At each stake pool a “slot leader” is assigned. More precisely Ouroboros divides chains into “epochs” which are subdivided into time slots. A slot leader gets elected and she/he will be responsible for adding a block to the chain.

Get The Full Analysis In Blockchain Business Models

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin, TRON Blockchain, Chainlink, ETHO Coin, Uniswap, Polkadot.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Cardano Blockchain In A Nutshell appeared first on FourWeekMBA.