Gennaro Cuofano's Blog, page 148

July 7, 2021

Fast Fashion vs Slow fashion

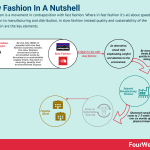

Both movements took off in the mid 1980s but they took opposite direction. Where fast fashion with players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles, slow fashion focused on sourcing sustainability, quality and sustainability of the supply chain as the key elements.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs. Slow fashion is a movement in contraposition with fast fashion. Where in fast fashion it’s all about speed from design to manufacturing and distribution, in slow fashion instead quality and sustainability of the supply chain are the key elements.

Slow fashion is a movement in contraposition with fast fashion. Where in fast fashion it’s all about speed from design to manufacturing and distribution, in slow fashion instead quality and sustainability of the supply chain are the key elements. Read Next: SHEIN, ASOS, Zara, Slow Fashion, Fast Fashion, Ultra-Fast Fashion, Real-Time Retail.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Fast Fashion vs Slow fashion appeared first on FourWeekMBA.

The Slow Fashion Business Model In A Nutshell

Slow fashion is a movement in contraposition with fast fashion. Where in fast fashion it’s all about speed from design to manufacturing and distribution, in slow fashion instead quality and sustainability of the supply chain are the key elements.

A quick timeline of how Slow Fashion came to beBy the 2000s a company who had been building up its supply chain for decades had become the mammoth of fashion. That company was Zara. Zara epitomized the fast fashion industry, as its business model sat on top of a few key principles (like fast following, low price, and variety) and a core objective: speed.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs.By fast following fashion trends, shortening the manufacturing cycle, and by setting up a just-in-time logistics serving its flagship stores, Zara became a behemoth:

Zara is a brand part of the retail empire Inditex. Zara business model, with over €18 billion in sales in 2018 (comprising Zara Home), and an integrated retail format with quick sales cycles. Zara follows an integrated retail format where customers are free to move from physical to digital experience.

Zara is a brand part of the retail empire Inditex. Zara business model, with over €18 billion in sales in 2018 (comprising Zara Home), and an integrated retail format with quick sales cycles. Zara follows an integrated retail format where customers are free to move from physical to digital experience.As the 2010s came, a new trend started to shape the fashion industry. That was the social commerce trend. As in countries like UK, the penetration of e-commerce was high, some UK players, like ASOS led the way in this transformation, from fast fashion to ultra-fast fashion:

The Ultra Fashion business model is an evolution of fast fashion with a strong online twist. Indeed, where the fast-fashion retailer invests massively in logistics, warehousing, its costs are still skewed toward operating physical retail stores. While the ultra-fast fashion retailer mainly moves its operations online, thus focusing its cost centers toward logistics, warehousing, and a mobile-based digital presence.

The Ultra Fashion business model is an evolution of fast fashion with a strong online twist. Indeed, where the fast-fashion retailer invests massively in logistics, warehousing, its costs are still skewed toward operating physical retail stores. While the ultra-fast fashion retailer mainly moves its operations online, thus focusing its cost centers toward logistics, warehousing, and a mobile-based digital presence. The ultra-fast fashion business model was epitomized by ASOS, among others and it further prioritized on speed, and efficiency of the supply chain, with a strong online twist. In short, no more flagship stores to operate. The money that other fast fashion players like Zara were spending to operate these stores, were instead used by ultra-fast fashion players to run their online operations and further optimize manufacturing and logistics to serve a global audience:

ASOS is a British online fashion retailer founded in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Deborah Thorpe. As an online fashion retailer, ASOS makes money by purchasing clothes from wholesalers and then selling them for a profit. This includes the sale of private label or own-brand products. ASOS further expanded on the fast fashion business model to create an ultra-fast fashion model driven by short sales cycles and online mobile e-commerce as main drivers.

ASOS is a British online fashion retailer founded in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Deborah Thorpe. As an online fashion retailer, ASOS makes money by purchasing clothes from wholesalers and then selling them for a profit. This includes the sale of private label or own-brand products. ASOS further expanded on the fast fashion business model to create an ultra-fast fashion model driven by short sales cycles and online mobile e-commerce as main drivers.From there another, further evolution, this time headed by China, came with real-time retail, a further “improvement” from the ultra-fashion business model, where timing from idea/fashion meme to distribution got shortened further:

Real-time retail involves the instantaneous collection, analysis, and distribution of data to give consumers an integrated and personalized shopping experience. This represents a strong new trend, as a further evolution of fast fashion first (who turned the design into manufacturing in a few weeks), ultra-fast fashion later (which further shortened the cycle of design-manufacturing). Real-time retail turns fashion trends into clothes collection in a few days cycle or a maximum of one week.

Real-time retail involves the instantaneous collection, analysis, and distribution of data to give consumers an integrated and personalized shopping experience. This represents a strong new trend, as a further evolution of fast fashion first (who turned the design into manufacturing in a few weeks), ultra-fast fashion later (which further shortened the cycle of design-manufacturing). Real-time retail turns fashion trends into clothes collection in a few days cycle or a maximum of one week.Among the players that most mastered this business model, SHEIN led the way:

SHEIN is an international B2C fast fashion eCommerce platform founded in 2008 by Chris Xu. The company improved on the ultra-fast fashion model by leveraging real-time retail, which quickly turned fashion trends in clothes’ collections through its strong digital presence and successful branding campaigns.

SHEIN is an international B2C fast fashion eCommerce platform founded in 2008 by Chris Xu. The company improved on the ultra-fast fashion model by leveraging real-time retail, which quickly turned fashion trends in clothes’ collections through its strong digital presence and successful branding campaigns. In parallel, with the fast fashion business models from the 1990s to the 2020s, an opposite movement has been developed.

A player that highly emphasized on the slow fashion movement is Patagonia, which as it highlighted on its Sustainable Apparel Coalition:

An apparel industry that produces no unnecessary environmental harm and has a positive impact on the people and communities associated with its activities.

The Slow Movement evolved in parallel with the fast fashion movement, as an alternative business practice. Indeed, as explained on Patagonia website:

Since 1985, Patagonia has pledged 1% of sales to the preservation and restoration of the natural environment. We’ve awarded over $140 million in cash and in-kind donations to domestic and international grassroots environmental groups making a difference in their local communities. In 2002, founder of Patagonia, Yvon Chouinard, and Craig Mathews, owner of Blue Ribbon Flies, created a non-profit corporation to encourage other businesses to do the same.

How does this translate into practice in terms of supply chain? As Patagonia highlights:

The purpose of Patagonia’s Supply Chain Environmental Responsibility Program is to measure and reduce the environmental impacts of manufacturing Patagonia products and materials. We implement our program at supplier facilities all over the world and cover a broad range of impact areas, including environmental management systems, chemicals, water use, water emissions, energy use, greenhouse gases, other air emissions and waste.

The attempt to build a more sustainable supply chain moves along a few key areas, what Patagonia calls a “4-Fold Approach to Supply Chain Decisions” which as the company highlighted:

This process includes screening potential new suppliers for the ability to meet our (1) sourcing, (2) quality, (3) social and (4) environmental standards.

To execute on this, Patagonia built a Social and Environmental Responsibility team (SER) to make sure these practices are implemented.

Read Next: SHEIN, ASOS, Zara, Fast Fashion, Ultra-Fast Fashion, Real-Time Retail.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Slow Fashion Business Model In A Nutshell appeared first on FourWeekMBA.

July 6, 2021

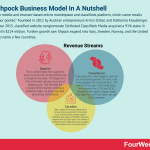

How Does Shpock Make Money? The Shpock Business Model In A Nutshell

Shpock is a mobile and browser-based online marketplace and classifieds platform, which name recalls “shop in your pocket.” Founded in 2012 by Austrian entrepreneurs Armin Strbac and Katharina Klausberger. In September 2015, classified website conglomerate Schibsted Classifieds Media acquired a 91% stake in Shpock worth $214 million. Further growth saw Shpock expand into Italy, Sweden, Norway, and the United Kingdom to name a few countries.

BackgroundShpock is a mobile and browser-based online marketplace and classifieds platform. The name of the platform is a portmanteau of the phrase “shop in your pocket”.

Shpock was founded in 2012 by Austrian entrepreneurs Armin Strbac and Katharina Klausberger. After graduating from a prestigious Austrian business school, the two founders went their separate ways for a few years. Strbac continued studying to earn his doctorate in entrepreneurship, while Klausberger spent almost six years working for a consultancy firm.

Fuelled by a desire to create something of their own, the pair reconnected in 2010 and participated in a start-up event. There, they wrote a business plan for a website called finderly – a site helping consumers find the best electronic products using a community-based recommendations tool.

Two years later, they held a workshop designed to flesh out a new app that would support the website. During the workshop, they heard consumer complaints about the cumbersome nature of listing products for sale online. This was particularly true for eBay Kleinanzeigen – a classified app dominating the German-speaking market forcing users to spend around thirty minutes uploading the required information.

Shpock was launched to the same market in 2012 and had amassed over 100,000 downloads in just three months. Nine months later, this figure had grown to 1.2 million downloads. Funding was then secured to completely redesign the app and enhance the user experience.

In September 2015, classified website conglomerate Schibsted Classifieds Media acquired a 91% stake in Shpock worth $214 million. Further growth saw Shpock expand into Italy, Sweden, Norway, and the United Kingdom to name a few countries.

Shpock revenue generationShpock has a revenue generation model typical of many online marketplaces.

Following is a look at some of the core components.

AdvertisingShpock offers advertising to sellers which it claims allows them to take advantage of “a young, curious and mobile-first user base, who love exploring new things – everyday. People who browse on Shpock are truly in a shopping mood and are particularly valuable to advertisers.”

Sellers have a lot of flexibility with Shpock advertising. They can choose from a variety of ad placement positions and types. They can also target buyers based on location, interest, gender, age, and search terms.

Shpock earns money through advertising on a per-impression basis. When a buyer sees an advert, the company takes money from the monthly advertising budget of the advertiser.

Premium membershipPremium members get access to several perks, including:

Shpock Super Boost – allowing sellers to choose two items per month to appear at the top of product listings.Unlimited Photo Credits – allowing sellers to list products with ten accompanying photos instead of five.Ad-free – lastly, an ad-free experience on both mobile and web.After a one-week free trial, membership prices depend on geographic region.

Shpock+ ShopsShpock+ Shops is a service helping businesses sell their products to users on a commercial basis – either directly or through a shop.

Features include customizable storefronts, unlimited product listings, branding, customizable price points, and related product suggestions.

Prices range from €19 to €99 based on the level of functionality desired for a yearly-based subscription. A similar service, Shpock+ Motors, is available for the automotive industry.

Prices are available on request.

Key takeaways:Shpock is an online marketplace and classifieds platform created by entrepreneurs Armin Strbac and Katharina Klausberger. Both saw a need to improve the inefficient process of listing products for sale online.Shpock makes money through advertising by charging sellers on a per-impression basis. It also offers sellers a premium membership to enhance their listings.Shpock also offers solutions to commercial sellers who need to sell unlimited products through a storefront. The company charges an annual subscription fee based on the level of functionality desired.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Shpock Make Money? The Shpock Business Model In A Nutshell appeared first on FourWeekMBA.

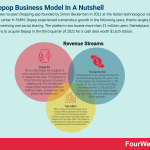

How Does Depop Make Money? The Depop Business Model In A Nutshell

Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion.

BackgroundDepop is a peer-to-peer shopping app.

The platform was founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM.

Depop was initially a social network where readers of People In Groove (PIG) – which Beckerman founded in 1998 – could buy items from creatives featured in the magazine.

With a background in technology and entrepreneurship, Beckerman quickly realized that print media would be superseded by digital media at some point in the near future. His magazine already had a website, but it did not have a shop enabling users to purchase items they saw advertised.

As a result, Beckerman envisioned an app serving as a mobile marketplace where readers could see what their friends and the people they were inspired by were purchasing and selling.

After presenting his concept to H-FARM, he received €1 million in seed funding to bring the vision to life. A soft launch occurred in late 2012 on iOS and Depop was made available to the general public eight months later. Additional funding facilitated the development of an Android app and expansion with offices established in Manchester, New York City, Los Angeles, and Sydney.

Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users.

Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion.

Depop revenue generationAs an online marketplace, Depop makes money by charging a couple of different fees.

Let’s explore these fees in more detail.

Depop feeThe so-called Depop fee is applied to every successful sale on the platform and is charged to the seller.

The Depop fee is 10% of the total sale price inclusive of shipping costs. This fee helps the company offset expenses relating to employee wages, up-keep costs, and general app maintenance.

Depop claims users can offset the transaction fee by simply raising their prices. It should also be noted that there are no listing fees and products can be listed on the platform indefinitely.

Transaction feeA transaction fee is also charged to cover the cost of facilitating payment.

For users in the United Kingdom, the transaction fee is 2.9% plus £0.30. For users in the United States, the transaction fee is 2.9% plus $0.30.

Transactions fees apply to Depop, Google Pay, Apple Pay, credit card, debit card, and PayPal payments.

Top sellersWith a simple fee structure, Depop has to increase revenue generation by increasing users.

To that end, the company rewards individuals who achieve consistently high sales volumes with Top Seller status. This involves a verified blue tick, a dedicated account manager, and exclusive access to a private forum.

Social signalsDepop is somewhat unique among online fashion retailers in that it offers a social component. Sellers can build a following, like and share content, and engage directly with their audience.

This encourages sellers to placate their followers by only offering high-quality, legitimate products. Depop as a platform also benefits from the legitimacy these social signals create.

Key takeaways:Depop is a peer-to-peer marketplace for the buying and selling of fashion items. It was founded in 2012 by Simon Beckerman who recognized that print media would be replaced by digital media and eCommerce.Depop makes money by charging a so-called Depop fee to sellers. The company also charges a transaction fee for facilitating payments.With a simple fee structure, increasing Depop revenue generation means increasing the number of users on the platform. This is encouraged by giving top sellers access to a range of perks and incorporating social signals to increase legitimacy and product quality.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Depop Make Money? The Depop Business Model In A Nutshell appeared first on FourWeekMBA.

July 5, 2021

What happened to Netscape?

Netscape – or Netscape Communications Corporation – was a computer services company best known for its web browser. The company was founded in 1994 by Marc Andreessen and James H. Clark as one of the first and most important start-ups on the internet. The Netscape Navigator web browser was released in 1995 and it became the browser of choice for the users of the time. By November 1998, it had been acquired by AOL which tried unsuccessfully to revive the popularity of the web browser. Ten years later, Netscape was shut down entirely.

BackgroundNetscape – or Netscape Communications Corporation – was a computer services company best known for its web browser.

The company was founded in 1994 by Marc Andreessen and James H. Clark as one of the first and most important start-ups on the internet. The Netscape Navigator web browser was released in 1995 and with virtually zero competition, became the browser of choice for the users of the time.

Andreesen and Clark were true visionaries of their time, understanding the significant role web browsers would play in a free and accessible internet. A Netscape IPO followed in August 1995, enabling the company to reach a market cap of $2.9 billion on its first day of trading.

Despite a promising start, Netscape would quickly fade into obscurity. By November 1998, it had been acquired by AOL which tried unsuccessfully to revive the popularity of the web browser. Ten years later, Netscape was shut down entirely.

So what happened to Netscape? Keep reading to find out!

Browser warsWhile Netscape enjoyed first-mover advantage for a short while, Microsoft was working in the background to develop a browser of its own.

Around the time of the Netscape IPO, Microsoft released Windows 95 with an optional feature called Internet Explorer 1.0. The two companies would engage in the so-called “browser wars” during 1995 and 1996 – but Microsoft eventually closed the gap with their release of Internet Explorer 3.0.

To differentiate itself, Netscape released the Communicator 4.0 bundle in late 1996. This bundle was an early form of sales and management-driven bloatware featuring a Usenet client, web editor, email app, and address book.

Unfortunately, Communicator 4.0 uptake was low.

Bundling, bugs, and product creepInternet Explorer 4.0 was released in 1997. Microsoft began to assert its dominance at this point because its browser was bundled with every copy of Windows – itself bundled with the purchase of most personal computers.

Given the boom in sales of PCs in the late 90s, Internet Explorer became the most popular browser by default.

Around the same time, Netscape was increasingly plagued with bugs caused by an outdated browser core and was also criticized for feature creep.

Netscape Communicator 5.0 was then promised in January 1998. But after a delay of more than three years, consumer trust in the company was almost non-existent.

What else caused the downfall of Netscape?Microsoft ultimately gained the upper hand through distribution and bundling, but this was not the only contributing factor to the demise of Netscape.

Here are a few more reasons:

Poor product strategy – after Netscape 4.0, developers decided to rewrite the code from scratch causing them to miss the release date for Netscape 5.0. Netscape 6.0 was eventually launched in November 2000 but was plagued with problems after owner AOL forced a release before it was ready. By that stage, Netscape had become irrelevant in the industry.Poor product planning – Netscape developers continually added new features to Navigator in the web browser arms race. The codebase then became difficult to manage, leading to quality control problems and buggy experiences for consumers.Feature bloat – the obsession with adding new features also resulted in the company losing its focus and direction. Instead of doubling down on its highly successful web browser, Netscape essentially became an enterprise and server software company with eCommerce applications.Key takeaways:Netscape was a computer services company founded by Marc Andreessen and James H. Clark. It was the first company to introduce a free and accessible web browser for general internet use.Netscape enjoyed first-mover advantage for a time, but became engaged in a war with Microsoft who was quietly developing its own browser in the background. Microsoft ultimately won because Internet Explorer was bundled with sales of Windows and home computers.Netscape also contributed to its downfall with poor product strategy and planning. An obsession with adding new features caused the company to deviate from its core offering and suffer from extensive development-related delays.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Netscape? appeared first on FourWeekMBA.

What happened to Napster?

Napster was a pioneering peer-to-peer music sharing service founded by Shawn Fanning, John Fanning, and Sean Parker in 1999. The platform reached peak popularity in February 2001 with over 80 million users sharing cassette tapes, vinyl records, rare albums, bootleg recordings, and the latest hits in mp3 form. After a protracted court battle, the court ruled in favor of the RIAA which forced Napster to shut down its network late in 2001. This represented a great lesson for later players, like Apple, who took advantage of it to build a successful platform like iTunes.

BackgroundNapster was a pioneering peer-to-peer music sharing service founded by Shawn Fanning, John Fanning, and Sean Parker in 1999.

Although similar services already existed, Napster combined an intuitive software application with a core focus on music files. For the first time, a full history of recorded music was available online to everyone instantly.

The platform reached peak popularity in February 2001 with over 80 million users sharing cassette tapes, vinyl records, rare albums, bootleg recordings, and the latest hits in mp3 form.

However, it wasn’t long before Napster caught the attention of music artists and the recording industry for copyright infringement. Not only were songs shared for free, in some cases they were being shared before their official release date.

Let’s take a look at the events that precipitated the eventual demise of Napster.

Metallica and Dr. Dre litigationUpon learning that their music was being freely distributed by Napster, Metallica and Dr. Dre were two of the first artists to launch legal action against the company.

Metallica co-founder Lars Ulrich famously delivered thirteen boxes of documents to Napster headquarters with a list of 335,000 users suspected of sharing music without permission. The band took Napster to court for distributing an alternative mix of the song I Disappear – which had never been formally released.

Charges laid against the company included copyright infringement, racketeering, and unlawful use of digital audio interface devices.

Recording Industry Association of America litigationJust months after Napster reached 80 million users, the Recording Industry Association of America (RIAA) sued the company for facilitating the illegal transfer of copyrighted music.

After a protracted court battle, the court ruled in favor of the RIAA which forced Napster to shut down its network late in 2001.

Monetization plans and legal costsDuring these court proceedings, Napster hatched a somewhat belated plan to monetize its service. The company sought to establish 2% of its user base as paying customers with the remainder on a freemium model.

While this model would later be adopted by companies such as Spotify, rolling legal action against Napster hindered its ability to grow and quickly depleted its resources. The company agreed to pay damages in the tens of millions of dollars to artists in September 2001 in addition to mounting legal fees.

In May 2002, the company could not pay its staff and filed for bankruptcy the following month.

Through a series of acquisitions, Napster is now owned by streaming company Rhapsody International. Rhapsody has managed to build Napster into a viable company, but the Napster brand is remains a shadow of its former self.

Key takeaways:Napster was a peer-to-peer music-sharing software application. It was the first such platform to provide free access to the full history of recorded music online.Napster quickly attracted the attention of music artists, with Metallica instigating court proceedings against the company for copyright infringement and the distribution of unreleased music.Napster was forced to shut down after the Recording Industry Association of America won a court injunction. Mounting legal fees and compensation costs led to the company filing for bankruptcy in 2002.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Napster? appeared first on FourWeekMBA.

What happened to Blockbuster?

Blockbuster was an American home movie and video game rental service founded in 1985 by David Cook. By the 1990s the company reached its peak, with thousand of stores in the US. And yet by the 2000s Less than a decade later, Blockbuster filed for bankruptcy with almost $1 billion in debt. Today, a single store remains in Bend, Oregon. Many attribute the failure of Blockbuster to Netflix, however, the failure was a lack of adaptation of its business model to the rising of streaming as a service.

BackgroundBlockbuster was an American home movie and video game rental service founded in 1985 by David Cook.

The rise and fall of Blockbuster has been well documented in popular culture. At one point in the late 1990s, the company owned over 9,000 stores in the United States alone and employed 84,000 people globally.

Less than a decade later, Blockbuster filed for bankruptcy with almost $1 billion in debt. Today, a single store remains in Bend, Oregon.

How did it come to this? We’ll discuss some of the main reasons below.

Over-reliance on late feesDuring its peak, Blockbuster earned around $800 million annually from late fees alone.

This reliance on late fees, though profitable initially, would cause the company to lose significant market share to Netflix. At the time, Netflix was a fledgling company offering a mail-order movie rental service that did not charge late fees.

It took Blockbuster more than five years to offer a similar service and even longer to cut late fees. During these years, Netflix built an unassailable competitive advantage.

Failure to acquire NetflixThen Blockbuster CEO John Antioco is famous for passing on an opportunity to buy Netflix for $50 million in early 2000.

This decision was compounded by Blockbuster’s decision to develop a video-on-demand streaming service with Enron. The partnership ultimately failed, with Enron doing most of the work of building and testing the service and going bankrupt soon after.

Blockbuster, on the other hand, remained myopically focused on its lucrative video store franchise and was generally disinterested in the technology. It was an opportunity missed.

Failure to adaptA failure to adapt to innovation and changing consumer preferences have been the cause of many business demises over the years.

Blockbuster was no different. Company annual reports show it was well aware of the rising popularity of streaming services and other threats. Despite this knowledge, it continued to open new stores and experiment with a variety of new services.

These included Blockbuster total access – a mail-order rental service similar to that offered by Netflix. But it was more expensive and less convenient than the Netflix offering.

They also offered a subscription service called Blockbuster movie paths which was also unsuccessful. Without late fees, there was no incentive for consumers to return movies on time.

Ultimately, Blockbuster filed for bankruptcy because they underestimated how quickly their core business became irrelevant. The somewhat scattergun approach to maintaining some semblance of relevancy was a case of too little too late.

Key takeaways:Blockbuster was an American movie and video game rental chain. The company went from industry leader to filing for bankruptcy with $1 billion in debt in less than a decade.Blockbuster relied on late fees to drive a high proportion of revenue. This strategy proved uncompetitive after Netflix offered fee-free movie rentals by mail. Blockbuster lost significant market share to Netflix in the ensuing years and experienced a decline in profit after abolishing late fees in an attempt to remain competitive.Blockbuster’s demise is mostly due to an inability to innovate. Although passing on the offer to purchase Netflix is noteworthy, the company failed because of a myopic focus on its outdated rental franchise model.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Blockbuster? appeared first on FourWeekMBA.

What happened to Quibi?

Quibi was an American short-form streaming platform for mobile devices, founded in 2018 by Jeffrey Katzenberg and targeted a younger demographic by delivering content in 10-minute episodes called “quick bites”. Once the coronavirus pandemic took hold, the audience Quibi was targeting was forced to stay at home and as a result, consumed content through more traditional channels. Just eight months after launch, Quibi shut down in December 2020.

BackgroundQuibi was an American short-form streaming platform for mobile devices.

It was founded in 2018 by Jeffrey Katzenberg and targeted a younger demographic by delivering content in 10-minute episodes called “quick bites”.

While Katzenberg managed to raise $2 billion and secure Hollywood talent to produce content, the platform was built on the premise that people would watch streaming content on the go.

Once the coronavirus pandemic took hold, the audience Quibi was targeting was forced to stay at home and as a result, consumed content through more traditional channels. Just eight months after launch, Quibi shut down in December 2020.

History will show that Quibi’s launch in April 2020 coincided with a world in lockdown, but there are many other reasons for its demise.

Poor quality contentFor a streaming service to remain viable, it needs to host high-quality content.

Quibi was notorious for offering mediocre content studios and networks had been trying to sell for years. While many can recall several of their favorite Amazon or Netflix productions, the same cannot be said for Quibi. Granted, it did score ten Emmy nominations for short-form content. But it was routinely up against content from free platforms such as YouTube.

The lack of decent viewing was particularly troublesome when one considers the billions of dollars invested in Hollywood talent and projects from top production studios.

Lack of adaptabilityQuibi was intended for viewing on smartphones, but executives were reluctant to consider alternatives even as the world changed around them.

Stuck at home, consumers watched content on their televisions. Support for Apple AirPlay and Google Chromecast was eventually added, but it disabled Quibi’s Turnstyle technology – a feature that gave the company its sole point of difference.

What’s more, support for Roku and Fire TV was famously added just one day before Katzenberg announced the end of Quibi.

Lack of social sharingEven if Quibi-produced content was worth sharing, users had no way to share clips or screenshots from television shows or films.

This lack of functionality showed that Quibi executives failed to recognize the changing landscape of home entertainment. Content must be interactive and able to be shared across social media networks.

PricingQuibi charged $5 per month for its low-quality content or $8 per month for an ad-free experience.

Free content on platforms such as YouTube and TikTok represented far better value for money, so it’s not difficult to see how Quibi struggled to attract users.

There was also significant competition from established players at similar price points. If nothing else, this highlighted the extremely poor price to quality ratio of Quibi content.

Improper and inadequate marketingQuibi executives also failed to properly market the platform. An expensive Super Bowl ad failed to tell consumers what was being offered and was run several months before the platform was ready to be launched.

For whatever reason, Quibi was also never advertised on similar platforms such as Instagram, TikTok, and Facebook. Many consumers were simply unaware of its existence.

Key takeaways:Quibi was an American short-form streaming service for smartphones. Unfortunate timing with the onset of the COVID-19 pandemic is at least partly responsible for the failure of the platform.Despite billions being invested in securing high-end talent and production studios, Quibi content was generally poor quality. In any case, there was no way for consumers to share or engage with the content they did enjoy.Quibi was not helped by its pricing strategy and the presence of established competitors offering more for less. It was also improperly and inadequately marketed.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Quibi? appeared first on FourWeekMBA.

What happened to StumbleUpon?

Founded in 2001, StumbleUpon was a discovery and advertisement engine pushing content recommendations to users in the form of “stumbles”. As competition started to increase as more businesses tried to emulate its success. Many users were lost to rivals such as Pinterest, Reddit, and Digg after the StumbleUpon algorithm started to become outdated and made the site unresponsive. To remain financially viable, StumbleUpon terminated 30% of its workforce in 2013. The company failed to achieve further funding while other companies like Pinterest became tech unicorns.

BackgroundStumbleUpon was a discovery and advertisement engine pushing content recommendations to users in the form of “stumbles”. In some ways, StumbleUpon was a social network because content recommendations were based on pages liked by a user’s friends and family.

The platform was founded at the University of Calgary in 2001 by eventual Uber co-founder Garrett Camp together with Geoff Smith, Justin LaFrance, and Eric Boyd. After attracting more than half a million users, the company caught the attention of Silicon Valley and received a substantial amount of angel investor and seed funding.

In 2011, StumbleUpon reached 25 billion stumbles and was adding to this figure by an incredible 1 billion stumbles per month. The following year, StumbleUpon eclipsed 25 million registered users.

Just six years later after 16 years online, the service was shut down. Let’s take a look at how and why this happened.

Competition and monetizationStumbleUpon was popular during the early years before the concept of like buttons and newsfeeds became mainstream. In fact, the platform was so popular it once accounted for half of all social media traffic in the United States.

Inevitably, competition started to increase as more businesses tried to emulate its success. Many users were lost to rivals such as Pinterest, Reddit, and Digg after the StumbleUpon algorithm started to become outdated and made the site unresponsive.

Pinterest in particular was a major threat because it had developed the ability to incorporate paid advertisements and sponsored content into its offering. With a less developed monetization strategy, StumbleUpon was reliant on investment funding to keep the lights on.

eBay acquisition and buy-backNoticing its popularity, eBay acquired StumbleUpon for $75 million in 2007. However, the partnership between a giant online marketplace and a social network proved to be unsuccessful.

Camp, Smith, and several other investors then bought back the company in 2009 for a reported $29 million. Two years adrift under eBay had left the platform uncompetitive, so Camp instituted a major redesign and launched an app for all major devices.

The company enjoyed a period of success with advertisers flocking to the platform, but many complained the redesign had been made to look exactly like main competitor Pinterest.

To remain financially viable, StumbleUpon terminated 30% of its workforce in 2013. The company failed to achieve further funding while Pinterest became a tech unicorn.

Garrett Camp then re-acquired the majority share of the company in 2015 after its financial problems worsened.

Changing consumer preferencesPerhaps the clearest explanation for the end of StumbleUpon is changing consumer preferences.

StumbleUpon was one of the pioneers of helping people waste time on the internet. But at some point, users decided to spend their idle time scrolling news feeds on Facebook, Twitter, and Instagram.

Indeed, social media feeds curate the vast internet in a way that bouncing randomly between sites on StumbleUpon never could. These thoughts were echoed by Camp when discussing the shutdown of StumbleUpon and transition to similar site Mix.com, “The number of platforms to share or host content has increased significantly, yet we still need better tools to help us filter through the exploding amount of content on the web, and find signal within the noise. And we’ve learned from SU that while simplicity and serendipity is important, so is enabling contextual curation.”

Key takeaways:StumbleUpon was an early social network founded by Garrett Camp, Geoff Smith, Justin LaFrance, and Eric Boyd. At one point, the platform was responsible for half of all social media traffic in the United States.StumbleUpon suffered intense competition from the likes of Pinterest, Digg, and Reddit – both in terms of site functionality and monetization strategy. After a failed partnership with eBay, Camp bought back the company and instituted a major redesign to limited success. The StumbleUpon user experience became outdated as consumers preferred to waste time scrolling through news feeds. Upon this realization, Camp shut down the service in 2018 to focus on a more modern iteration called Mix.comRead Next: Pinterest Business Model, Reddit Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to StumbleUpon? appeared first on FourWeekMBA.

What happened to Friendster?

Friendster was a social networking service founded by Jonathan Abrams in 2002. Early versions of Friendster functioned in much the same way as eventual successor Facebook. As the social media market consolidated, by 2009, Friendster was purchased by Malaysian company MOL Global. That same year, MOL Global sold 18 Friendster patents to Facebook. Friendster remained relatively popular in southeast Asia for a few more years until it was shut down in 2015.

BackgroundFriendster was a social networking service founded by Jonathan Abrams in 2002.

It went live in 2003 and secured three million users in the first three months. Launched before the likes of Myspace and Facebook, Friendster was one of the earliest social media networks to gain mass appeal. It was particularly popular in Asia where it boasted around 115 million registered users at its peak in 2011.

Friendster was successful because it was more than a simple social networking site. It provided opportunities for its users to make new friends and stay in touch with old ones. Users could also discover new events, brands, and hobbies in addition to sharing content. Early versions of Friendster functioned in much the same way as eventual successor Facebook.

This begs the question: why did Friendster close in 2015 while Facebook continues to be a social media juggernaut? In truth, it was due to a combination of reasons.

A change of directionNear the peak of its popularity, Friendster made the fateful decision to transition from a social networking site into a gaming site.

They did this without consulting their current users, who lost the content they had placed on Friendster during the shift. As a result, many became disenfranchised and began deserting the platform to competitors such as Facebook.

The gaming platform itself was well regarded and functional. But it appealed to a smaller section of Friendster’s original user base. The company also missed a massive opportunity to profit from the rise of social media by deviating from its core offering at the worst possible time.

What’s more, the gaming platform was enjoyable for users but only up to a certain point. Sites such as Facebook incorporated news feeds into their social networks which continuously served fresh content to users. This was a crucial addition that separated Facebook from Friendster and other such sites.

A lack of new featuresDespite the lack of a news feed, it might be surprising to learn that Friendster had slated one for development. The company also had plans to launch a college edition and develop a social graph.

These plans never materialized because of constant tech issues and a lack of investor interest. Had these features been implemented, Friendster may have become the Facebook of today.

Venture capital fundingFriendster turned down a lucrative acquisition offer from Google worth $30 million in 2003. It also received similar offers from AOL and Yahoo.

Instead, Abrams chose to fund the growth of the company through venture capitalists. This populated the company board of directors with individuals who channeled funds into low-impact initiatives and not technology-focused development.

Tech issues and patent salesFriendster gradually fell by the wayside as it continued to lose market share to Facebook.

Inadequate investment of company funds meant the user experience was poor and neglected, with pages routinely slow to load or not loading at all. Friendster also had difficulty in managing the new subscribers it did manage to obtain.

In 2009, Friendster was purchased by Malaysian company MOL Global. That same year, MOL Global sold 18 Friendster patents to Facebook.

Friendster remained relatively popular in southeast Asia for a few more years until it was shut down in 2015.

Key takeaways:Friendster was a social networking site that then transitioned to a gaming platform. Ultimately, Friendster failed to capitalize on its early success as one of the first social media platforms to experience mass uptake. When Friendster became a gaming platform, it failed to notify its user base. This set in motion the migration of users to Facebook which would continue for some years.Friendster’s decision to raise funds via venture capital funding populated its board with investors who were not interested in technology or innovation. The company was acquired by MOL Global in 2009 who then sold its patents to Facebook soon after.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Friendster? appeared first on FourWeekMBA.