Gennaro Cuofano's Blog, page 144

September 3, 2021

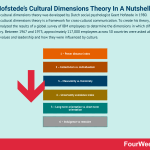

What is Hofstede’s Cultural Dimensions Theory? The Hofstede’s Cultural Dimensions Theory In A Nutshell

Hofstede’s cultural dimensions theory was developed by Dutch social psychologist Geert Hofstede in 1980. Hofstede’s cultural dimensions theory is a framework for cross-cultural communication. To create his theory, Hofstede analyzed the results of a global survey of IBM employees to determine the dimensions in which different cultures vary. Between 1967 and 1973, approximately 117,000 employees across 50 countries were asked about workplace values and leadership and how they were influenced by culture.

Understanding Hofstede’s cultural dimensions theoryAs a result of his work, Hofstede’s discovered four cultural dimensions that help explain why cultural practices in business and non-business settings differ. A further two dimensions were later added, with the sixth dimension added as recently as 2010.

The six dimensions of Hofstede’s theoryHofstede identified six dimensions that influence culture. Before we explain them below, it’s important to note that each dimension exists on a continuum from low to high. As a result, some practitioners choose to rate each on a scale of 1 to 100.

1 – Power distance indexThe power distance index considers the extent to which power and inequality are tolerated by followers.

Countries with a high power distance index embrace hierarchy and encourage bureaucracy. Culture is defined by the acceptance of power differences and the respect of rank and authority. Many Latin American, Asian, and African countries display this culture.Countries with a low power distance index are egalitarian. They favor flat organizational structures with decentralized decision-making. They also tend to distribute power more evenly and adopt participative management styles. Examples of egalitarian countries include Israel, Denmark, and Ireland.2 – Collectivism vs. individualismThis dimension considers the degree to which societies are integrated into groups. It also considers the perceived obligation or dependence on groups.

Collectivist countries place more importance on the goals and well-being of a group, with individuals sacrificing their own needs and desires. Many countries with a high power distance index display collectivist tendencies. Individualist countries place more importance on achieving personal goals, with culture defined by a loose social framework where individuals take care of themselves and their immediate family.3 – Masculinity vs. femininityThe masculinity vs. femininity dimension encompasses societal preferences regarding achievement, sexual attitudes, gender roles, and behavior.

Masculine countries such as Japan and Australia view power as important. Ambition, achievement, power, and assertiveness are preferred, with men and women occupying separate but complementary roles in society. Feminine countries such as Sweden and Norway view nurturing as important. Gender roles are more fluid and flexible and there is an emphasis on service and quality of life.4 – Uncertainty avoidance indexThe uncertainty avoidance index evaluates how much uncertainty and ambiguity a country tolerates. Specifically, how does the country handle unknown or unexpected events?

A high uncertainty avoidance index country is uncomfortable with uncertainty. Countries like Japan, Mexico, Germany, and Poland tend to favor formal rules, procedures, and standards. Deviation from these accepted practices is considered undesirable, if not illegal in some cases. A low uncertainty avoidance index country is comfortable with uncertainty. Citizens of countries such as China, Jamaica, and the United Kingdom are more comfortable in unstructured scenarios. They value creativity, autonomy, and the freedom to task risks.5 – Long-term orientation vs. short-term orientationThe fifth dimension describes how cultures are oriented toward space and time. How do different countries overcome real or potential challenges?

Countries with a long-term orientation emphasize traditions and customs to overcome challenges and see change as a negative. This is best exemplified in many East Asian societies that value thrift, persistence, humility, planning, and the delaying of gratification to secure a better future.Countries with short-term orientation are more accepting of change because they see it as inevitable. They tend to focus on short-term gains and immediate gratification at the expense of a future payoff.6 – Indulgence vs restraintIn the final dimension, Hofstede analyzed how different cultures acknowledge the natural human need to satisfy impulses or desires.

Indulgent countries have societies that encourage individuals to enjoy life and have fun. As a result, they see leisure as a virtue and pleasure as theirs for the taking.Restrained countries have societies that suppress or regulate the gratification of desires through social norms. The fulfillment of individual obligations is equated with life purpose and some may feel guilt or shame for engaging in activities they consider frivolous.Key takeaways:Hofstede’s cultural dimensions theory is a framework for cross-cultural communication. The theory is based on a global study into how workplace values and leadership are influenced by culture.Hofstede’s cultural dimensions theory was initially based on four cultural dimensions that explain why cultural practices vary in business and non-business settings. A further two dimensions were added, with the final dimension added as recently as 2010.Hofstede’s cultural dimensions theory suggests each dimension exists on a continuum of low to high. In other words, each country exhibits varying degrees of multiple traits: power, inequality, masculinity, femininity, uncertainty avoidance, social integration, and openness to change.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What is Hofstede’s Cultural Dimensions Theory? The Hofstede’s Cultural Dimensions Theory In A Nutshell appeared first on FourWeekMBA.

What is the helical model of communication? The helical model of communication in a nutshell

The helical model of communication is a framework inspired by the three-dimensional spring-like curve of a helix. It argues communication is cyclical, continuous, non-repetitive, accumulative, and influenced by time and experience.

Understanding the helical model of communicationThe helical model of communication was first proposed by Frank Dance in 1967 to offer a more detailed look at the communication process. Dance equated the functioning of his model with a helix or spiraling curve shaped like a spring that moves upward and downward.

To better explain the helical aspect of the model, Dance argued that an individual begins communicating from the day they are born by crying for whatever they need. This is a simple and very rudimentary form of communication. As they grow older, the child progresses to more complex forms of communication which are also cumulative. When they graduate from single words to complete sentences, they are building on what they already know to communicate more effectively.

This process is represented by a helix, with progressively larger circles providing a visual metaphor for the evolution of communication from birth to the present moment. It’s also important to note that communication moves backward in the metaphorical sense. The child who learns to speak in complete sentences is drawing on memories and impressions from an earlier period in their life. This process of looking backward also shapes behavior. For example, a teenager may alter their communication style to avoid swearing after being reprimanded by someone in the past.

The key ideas of the Helical model of communicationHere are some of the key ideas of Dance’s model:

Communication occurs cyclically without ever perfectly repeating itself. When an individual receives information from someone, they will use it to communicate more effectively next time.The model accounts for the dimension of time in communication to suggest how an individual improves. Instead of communication being a two-dimensional process, it is in fact a three-dimensional process. Complex communication grows from simple origins. Although we touched on this concept in the introduction, the cumulative way communication evolves is worth reiterating. Two strangers may meet each other and initially exchange names and occupations to start the communication process. Over time, however, they learn to communicate through more complex channels such as body language, moods, gestures, or mannerisms.Limitations of the Helical model of communicationThe helical model of communication does possess some limitations.

For one, it is somewhat ambiguous. While similar frameworks such as the Osgood-Schramm and Lasswell models detail clear steps in communication, Dance’s model does not detail the processes that occur within the cycle. This makes the Helical model difficult to validate. What’s more, there is debate as to whether the helix represents an evolving ability to communicate or the progression of learning through the act of communicating itself.

The Helical model also assumes communication to be a continuous and constant process. In reality, however, life is punctuated by meaningless or unproductive periods where the individual does not learn from their past or adopt more complex forms of communicating. That is, communication is not always associated with growth.

Key takeaways:The helical model of communication argues communication is cyclical, continuous, non-repetitive, accumulative, and influenced by time and experienceThe helical model of communication suggests the evolution of communication in an individual starts the day they are born. As they grow older, they develop progressively more complex communication through experience and feedback.The helical model of communication has some limitations. For one, its abstract nature means it is difficult to validate. The model also assumes communication to be a constantly evolving process. Unfortunately, this notion contradicts the realities of life.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What is the helical model of communication? The helical model of communication in a nutshell appeared first on FourWeekMBA.

What is The Great Man Theory? The Great Man Theory In A Nutshell

The great man theory arose during the 19th century thanks in part to historian Thomas Carlyle. The great man theory argues that great leaders are born and not made because they possess certain inherited traits.

Understanding the great man theoryCarlyle suggested world history was nothing more than a collection of biographies belonging to powerful men – or heroes as he called them. These men included Alexander the Great, Napoleon Bonaparte, Abraham Lincoln, and Julius Caesar, among others. Importantly, Carlyle believed these individuals were born with natural abilities and talents that made them effective leaders.

Early research into successful leadership appeared to support the theory. At the time, many leaders were aristocrats who attained their status through birthright alone. Individuals with less social status tended to receive fewer opportunities, which reinforced the idea that leadership was inherent and innate.

The great man theory is also based on the assumption that great leaders can arise when the need for leadership is great. Essentially, the theory implies that individuals with power deserve to lead because of their unique set of inherited traits.

The six archetypes of the great man theoryCarlyle developed six archetypes of heroes according to their role in shaping history:

The divine hero – or any leader perceived to be a God. Carlyle frequented mentioned figures in Greek and Norse mythology such as Odin, Thor, and Zeus.The prophet hero – or leaders considered to be an envoy or messenger for God. Jesus and Moses are the most obvious examples.The poet hero – or heroes that transcend time, such as thinkers, warriors, politicians, and philosophers. Carlyle saw William Shakespeare as the archetypal poet hero.The priest hero – these are heroes seen as revolutionaries that change the status quo, such as Scottish theologian John Knox and German professor, author, and composer Martin Luther.The king hero – or commanders of loyal men who bring order to the world, such as Napoleon Bonaparte and Oliver Cromwell. The man of letters hero – these inspiring leaders describe what man is capable of achieving using sincerity, genius, and originality. Examples included writer Samuel Johnson and philosopher Jean-Jacques Rousseau.Opposition to the great man theoryIn his work entitled The Study of Sociology, sociologist Herbert Spencer argued leaders were the product of the society in which they lived. Specifically, he suggested that “the genesis of a great man depends on the long series of complex influences which has produced the race in which he appears, and the social state into which that race has slowly grown.”

Critics of the great man theory also posit that simply possessing great leadership qualities does not guarantee great leadership. If leadership was an inherent trait, then every person who possessed it should eventually find themselves in a position of power. Today, common sense says that an individual needs ambition and drive to realize their full potential.

Modern leadership research has also challenged Carlyle’s original theory. While he believed that masculine traits were a good determinant of success, feminine traits have also been proven to be important. Furthermore, leadership is now seen as more of a science that can be learned and nurtured.

Key takeaways:The great man theory argues that great leaders are born and not made because they possess certain inherited traits.The great man theory was developed by historian Thomas Carlyle, who argued history was a collection of the biographies of powerful men. He called these men heroes and created six archetypes to categorize the leaders of his day.The great man theory has been debunked by modern research. For one, an individual with leadership qualities will not become a leader without ambition. Furthermore, leadership is now considered a science that can be learned with a blend of masculine and feminine traits.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What is The Great Man Theory? The Great Man Theory In A Nutshell appeared first on FourWeekMBA.

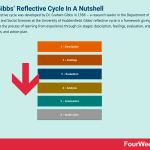

What is Gibbs’ Reflective Cycle? The Gibbs’ Reflective Cycle In A Nutshell

Gibbs’ reflective cycle was developed by Dr. Graham Gibbs in 1988 – a research leader in the Department of Behavioral and Social Sciences at the University of Huddersfield. Gibbs’ reflective cycle is a framework giving structure to the process of learning from experience through six stages: description, feelings, evaluation, analysis, conclusions, and action plan.

Understanding Gibbs’ reflective cycleIn his work entitled Learning by Doing, A Guide to Teaching and Learning Methods, Gibbs noted that it was “not sufficient simply to have an experience in order to learn. Without reflecting upon this experience it may quickly be forgotten, or its learning potential lost. It is from the feelings and thoughts emerging from this reflection that generalisations or concepts can be generated and it is generalisations that allow new situations to be tackled effectively.”

Fundamentally, Gibbs’ reflective cycle supports experiential learning through a structured debriefing process. The nature of the framework as a cycle means it can be used for continuous improvement of repeated experiences, enabling the practitioner to learn and plan based on things that went well and others that did not. With that in mind, the cycle can also be used to reflect on singular, standalone experiences unlikely to be repeated.

The six stages of Gibbs’ reflective cycleEach of the six stages of Gibbs’ model encourages the individual to reflect on their experiences through questions.

Following is a look at each stage and some of the questions that may result.

1 – DescriptionIn the first stage, the individual has an opportunity to describe the situation in detail. It’s important to remain objective – feelings, thoughts, emotions, and inferences can be described later.

Some helpful questions include:

What happened?Who was present?When and where did it happen?What were the actions of the people involved?What was the outcome?2 – FeelingsNow is the time to explore feelings or thoughts associated with the event:

What were you feeling before, during, and after the event?What do you believe other people were thinking or feeling?What do you think about the situation now that some time has passed?3 – EvaluationEvaluation means determining the positive and negative aspects of the event – regardless of whether you consider the event to be one or the other. Again, objectivity is key.

Some pointers include:

What was good and bad about the experience?What did you contribute to the situation? Did your actions have a positive or negative impact? Repeat the question to consider the contributions of others.4 – AnalysisDuring the analysis stage, you have a chance to understand what happened using theory and context. This step should comprise the bulk of your reflection and should take into account any insights gleaned from the previous steps.

Why did things go well or go badly?How does your experience compare to academic literature, if applicable?Could you have responded differently?Are there theories or models that can help you understand what happened?Are there factors likely to have contributed to a better outcome?5 – ConclusionsIn the fifth stage, conclude what happened by summarising key findings and reflecting on changes that could improve future outcomes.

This step should be a natural and intuitive response to the previous steps. It may incorporate questions such as:

What did the situation teach you? You can be rather general or more specific.How might the situation have been more positive for all concerned?What skills or competencies are required to handle the situation more effectively?6 – Action planLastly, an action plan is crafted to detail how you will respond differently to a similar situation in the future. The plan is important in making sure good intentions are backed by action.

To get you in the right of mind, consider these questions:

What would you do differently when faced with a similar situation? How would your new skills or knowledge be applied?How can you make sure you act differently when faced with a similar situation in the future?How and when will you develop the required skills?Key takeaways:Gibbs’ reflective cycle is a framework giving structure to the process of learning from experience. The framework was developed by Dr. Graham Gibbs in 1988.The cyclical nature of Gibbs’ reflective cycle is best suited to fostering continuous improvement of repeated experiences. However, it can also be used to reflect on standalone experiences.Gibbs’ reflective cycle is based on six stages: description, feelings, evaluation, analysis, conclusion, and action plan. Each stage encourages self-reflection through the posing of multiple questions.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What is Gibbs’ Reflective Cycle? The Gibbs’ Reflective Cycle In A Nutshell appeared first on FourWeekMBA.

What Is Impression Management? Impression Management In A Nutshell

Impression management as a term was first coined by Canadian-American social psychologist Erving Goffman, a pioneer in the study of everyday human behavior and social interaction. Impression management is a process used by individuals and businesses to try to control the impressions other people form of them.

Understanding impression managementImpression management can simply be defined as self-presentation, or how an individual tries to control the impression others form of them. In his book The Presentation of Self in Everyday Life, Goffman theorized that self-presentation:

Sets the tone and direction of social interaction.Plays an important part in defining an individual’s role in the social order, andFacilitates the performance of rule-governed behavior.There is also a second aspect to the way impressions are managed. This occurs when third parties control the impression businesses, celebrities, countries, and politicians make on the general public.

Regardless of the context, impression management is a form of social manipulation that presents something as true even if it is not.

Examples of impression management during social interactionHere is a look at some typical behaviors used in impression management during social interaction:

Intimidation – or any aggressive tactic used to force others into submission.Gossiping and lying – both are used in combination to avoid or influence a specific outcome, situation, or person.Flattery – a common form of impression management where the individual flatters someone with the hope the other person will like them more. Clothing – most people dress to be seen a certain way, whether that be friendly, respectable, professional, authoritative, sexy, or trendy. Boasting – in the vast majority of cases, boasting is an excessive form of self-promotion designed to positively influence others. However, it can also have the opposite effect.Conformity – where an individual agrees with the opinion of their counterpart to gain approval.Impression management in businessImpression management in business is seen in the presentation of merchandise through advertising and marketing. Here, every business endeavors to present its products and services well by highlighting certain features over others.

With that said, impression management is vital for businesses selling products that are unhealthy, dangerous, or controversial for whatever reason. For example, a company selling chocolate bars would not market its products as causing tooth decay. Instead, it may focus on the delicious taste and the experience of sharing chocolate with friends and family.

Online businessesFor online businesses, impression management involves:

Monitoring reviews and ratings – often the first and most important interaction between the consumer and business. Crafting content that paints the company in a positive light – particularly if reputational harm has occurred. Removing defamatory search results – this includes negative or malicious reviews, but many businesses also suffer from content that is spammy, sexually explicit, derogatory, or violates copyright and identify theft laws.Key takeaways:Impression management is a process used by individuals and businesses to try to control the impressions other people form of them. The term was first coined by social psychologist Erving Goffman.Impression management during social interaction is facilitated by boasting, gossiping, lying, flattery, conformity, and choice of clothing.Impression management is an important part of the marketing of products and services – particularly if there is potential for negative consumer opinion. Businesses must also monitor their online presence to ensure their reputation is not threatened by malicious actors.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What Is Impression Management? Impression Management In A Nutshell appeared first on FourWeekMBA.

What Is The Heckscher-Ohlin model? The Heckscher-Ohlin Model In A Nutshell

The Heckscher-Ohlin model is named after Swedish economists Bertil Ohlin and Eli Filip Heckscher. Ohlin, who developed the model while a student of Heckscher, won the Nobel Prize for Economics in 1977. The Heckscher-Ohlin model is an economic theory suggesting countries only export what they can produce efficiently and in sufficient quantity.

Understanding the Heckscher-Ohlin modelIn general terms, the Heckscher-Ohlin model is a theory of international trade suggesting nations with relatively plentiful capital and relatively scarce labor will tend to export capital-intensive products and import labor-intensive products. Conversely, a nation where labor is relatively plentiful and capital relatively scarce will tend to export labor-intensive products and import capital-intensive products.

Wealthy nations have access to more capital, which means workers are assisted by equipment and technology. As a result, the cost of producing labor-intensive goods tends to be higher than in poorer, less advanced countries with plentiful labor and lower wages. By the same token, goods requiring more capital and less labor tend to be cheaper in wealthy countries because the cost of paying employees is reduced.

This leads to a situation where a wealthy nation can produce capital-intensive goods more cheaply than a poorer country. These goods are then exported to the poorer nation to pay for the import of labor-intensive goods in return. In theory, this should be a mutually beneficial arrangement for both parties.

The two assumptions of the Heckscher-Ohlin modelThe model makes two major assumptions that are worth mentioning.

Firstly, it assumes each country in a trade arrangement will differ according to the factors of production it has available. For example, one country may have a large and uneducated population with an abundance of labor and land but relatively less access to capital. The other country may have access to capital and be technologically advanced, but have less access to land and a smaller workforce.

Secondly, Heckscher and Ohlin assumed that different countries have the same preferences for one good over another. With preferences being equal, it is the relative cost of production (and not the relative demand) that drives how much of a good is produced and consumed before being traded.

Using these assumptions, model posits that countries with an abundance of land, labor, or capital will have a comparative market advantage for the goods produced over other countries.

As an example, relatively wealthy Saudi Arabia holds 17% of the world’s known petroleum resources. The country is the largest exporter in the world because petroleum is a capital-intensive resource that is easy to extract – which reduces labor costs. In other words, Saudi Arabia has an advantage over competing nations because it can export petroleum more efficiently and in greater quantities.

Criticisms of the Heckscher-Ohlin modelDespite the model appearing plausible on paper, it frequently differs from actual patterns of dynamic international trade.

The Heckscher-Ohlin model:

Does not account for rent-seeking – this occurs when a government is lobbied by a group or body to protect its interests through tax breaks, extra duties, or bans on imported products. This may result in a wealthy nation exporting labor-intensive products and importing capital-intensive products, instead of the more economically viable reverse.Assumes all workers are employed – in other words, the model does not account for the prevalence of unpaid work in poorer countries which reduces labor costs.Assumes that production is equal – rather unrealistically, Heckscher and Ohlin suggest every nation has the same level of production technology. This ignores the major discrepancies in technological innovation and design between some countries.Ignores trade between two wealthy countries – the model implies that trade will not occur between two capital-intensive nations, despite obvious evidence to the contrary. Indeed, a significant proportion of world trade occurs between the United States and the countries of Western Europe. In this case, comparative advantage is driven by transport costs, economies of scale, and cost or price differences.Ignores factor mobility – both capital and labor can move between countries, which the model does not consider. Capital moves from advanced countries to those with petroleum, mineral, or plantation resources, among other things. Similarly, the large-scale movement of labor from third-world countries to much richer countries is well documented. In the resource-rich nation of the United Arab Emirates, there are thought to be 8 million foreign temporary contract workers from poor nations such as India, Bangladesh, Nepal, Sri Lanka, and Pakistan.Key takeaways:The Heckscher-Ohlin model is an economic theory suggesting countries only export what they can produce efficiently and in sufficient quantity. It was developed by Swedish economists Bertil Ohlin and Eli Filip HeckscherThe Heckscher-Ohlin model assumes international trade is mutually beneficial to both parties. It also assumes that the relative cost of production is the key driver of how much of a good is produced and consumed.The Heckscher-Ohlin model has several limitations. It does not account for workers in poor nations who are not employed, which reduces total labor costs. Nor does it account for trade between two wealthy nations or the high mobility of capital and labor across international borders.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What Is The Heckscher-Ohlin model? The Heckscher-Ohlin Model In A Nutshell appeared first on FourWeekMBA.

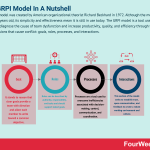

What Is The GRPI Model? The GRPI Model In A Nutshell

The GRPI model was created by American organizational theorist Richard Beckhard in 1972. Although the model is almost 50 years old, its simplicity and effectiveness mean it is still in use today. The GRPI model is a tool used by leaders to diagnose the cause of team dysfunction and increase productivity, quality, and efficiency through four key dimensions that cause conflict: goals, roles, processes, and interactions.

Understanding the GRPI modelFundamentally, the GRPI model highlights the various interrelated aspects that contribute to team functioning and success. These include goal identification, role clarification, responsibilities, processes, and interpersonal relationships. When a project team understands the interrelatedness of team function and team dysfunction, it can better pinpoint the source of conflict to maximize project efficiency and output.

The model can be used for any dysfunctional team where the leader is forced to review different aspects of team operation. For maximum impact, however, it should be utilized during the process of assembling a team and planning the work. Alternatively, the GRPI model can be deployed at the first stage of the DMAIC process or as part of the Six Sigma change acceleration process (CAP) toolkit.

The four dimensions that characterize a teamGRPI is an acronym of four key dimensions that cause conflict: goals, roles, processes, and interactions.

Research conducted by management consultant Noel Tichy in 2002 highlighted how conflict cascaded across each dimension according to the 80:20 rule. Tichy also found that ambiguity at one level impacted lower levels, while problems at lower levels were often symptomatic of problems higher up.

For example, unclear goals cause conflict and uncertainty to arise regarding individual roles. Conversely, poor interpersonal relationships may be a symptom of improperly defined roles and responsibilities.

To understand the context of Tichy’s findings, let’s take a look at each dimension below:

Goals (80% of team conflict is attributed to unclear goals) – thus, it stands to reason that clear goals provide a team with direction and allow each member to unite toward a common objective. Without a clear, shared, and agreed-upon goal, team development is a waste of time. As always, the goal should be specific, measurable, achievable, relevant, and time-sensitive.Roles (16% of team conflict is due to unclear roles) – roles can be described by authority, responsibility, and tasks and should support stated goals. Each member of the team should understand, accept, and agree to their assigned roles or responsibilities. It is also important team members cooperate to achieve goals and are accountable for their actions, individually and collectively.Processes (3.2% of team conflict is due to unclear processes) – in theory, processes are a tool used to overcome inefficiencies associated with decision-making, control, communication, and coordination. The team must formulate processes that are repeatable and predictable in terms of output quality while allowing for sufficient operational flexibility. In the GRPI model, processes help teams deal with conflict by stimulating the actions necessary for conflict resolution.Interactions (0.8% of team conflict is due to poor interpersonal relationships) – this section of the model seeks to establish trust, open communication, and feedback to create a robust working environment and culture. These standards, like goals and roles, must be guided by rules or a specific format understood and agreed to by all. However, interpersonal relationships can be improved very simply by listening carefully, smiling, asking for advice, honoring promises, and apologizing where necessary.Key takeaways:The GRPI model is a tool used by leaders to diagnose the cause of team dysfunction and increase productivity, quality, and efficiency. It was developed by organizational theorist Richard Beckhard in 1972.The GRPI model describes the various interrelated aspects that contribute to team dysfunction and by extension, team dysfunction. The framework has since been applied to the DMAIC process and Six Sigma change acceleration process toolkit.The GRPI model is characterized by four key dimensions that cause conflict: goals, roles, processes, and interactions. Research by Noel Tichy suggests 80% of all team conflict is caused by poorly defined goals which then impact the other three dimensions.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What Is The GRPI Model? The GRPI Model In A Nutshell appeared first on FourWeekMBA.

July 27, 2021

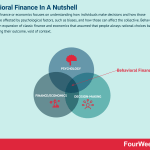

What is Behavioral Finance? The Behavioral Finance Guide For Beginners

Behavioral finance or economics focuses on understanding how individuals make decisions and how those decisions are affected by psychological factors, such as biases, and how those can affect the collective. Behavioral finance is an expansion of classic finance and economics that assumed that people always rational choices based on optimizing their outcome, void of context.

The Flaws of Standard Finance and the Rise of The “Behavioral Crew”In the first half of the twenty century, a group of economists believed that markets overall worked efficiently. In other words, we could assume by looking at the price of the assets exchanged through the stock exchanges that those prices were fairly valued.

This leads to the development of investment strategies, mainly based on the Modern Portfolio Theory (MPT), of which Harry Markowitz, of the University of Chicago, was the prophet. In short, the MPT developed a financial toolbox that presumingly would give the investor the maximum return, based on the assumed risk the investor undertook.

This led to the overconfident use of standard deviation and Beta, to assess the expected return of a certain stock. Although this method is flawed, it is still used by many financial institutions and professionals.

Economists slowly understood that in order to create a valid framework for investing a new approach was needed. Indeed, the understanding of the “psychology of the masses” was already known at the beginning of the twenty century (see Selden’s 1912 book “Psychology Of The Stock Market“).

On the other hand, this understanding was not packaged into the financial decision framework, because the “Chicago crew” was still too powerful. But the severe crises that happened in the last decades convinced economists and practitioners that the “new science” (behavioral finance) could not be ignored.

The “Behavioral Investor”The rise of the efficient market theory survived throughout the twenty-century. On the other hand, recent studies have confirmed the importance of understanding the “psychological and sociological framework” before picking up stocks.

Therefore, the modern investor has to have a foundation in psychology and sociology as well. Why? For two main reasons:

First, as Shefrin stated: “One investor’s mistakes can become another investor’s profits.” in other words, creating a financial model that incorporates the new discoveries of behavioral finance would more credibly fit reality.Second, one of the major causes of troubles in finance is due to overconfidence. The most striking aspect is that overconfidence affects academics and practitioners, more than the average guy.Make Inaction Your Ally – the Overconfidence ParadoxFinance is one of those fields, in which experience and knowledge may create more harm than good. And the paradox is that hundreds of millions of individuals rely on the ability of fund managers to safeguard their savings.

What are the main behaviors we have to safeguard ourselves from?

As the say goes, “who dares wins.” No doubt that this “say” may work in some fields, such as entrepreneurship. On the other hand, when it comes to financing and investing it is important to take two variables into accounts: the opportunity cost and the transactional costs.

In other words, before buying and selling any stock, it is important to understand that when our money is tied to a financial instrument, we cannot invest it in an alternative one. In economics, this is called opportunity cost.

In addition, modern technologies allow us to buy and sell with a high frequency. This creates the illusion of low if not irrelevant transactional costs. But this is only an illusion. Why? For instance, in a study about how men and women invested, men resulted in more overconfident. Therefore, they traded with more frequency. The sudden increase in transactional costs, due to the impulse of men to act, slowly eroded the returns of those investors.

Surprisingly enough, transactional costs reduced men’s investment return by about 2.5%, compared to 1.72% for women. This may seem a small percentage but it is actually a 45% increase in transactional costs, which compounded for a few years, makes a huge difference. One way to avoid this is to set-up a long-term plan and make sure to stick with it.

Switch off Your Narrative MachineMr. Average has bought Popular Inc. stocks, based on the article he recently read in the Wall Street Journal. The article argued how the company that now produced the coolest socks in the world, was an amazing investment, due to their new acquisition. It all made sense in Mr. Average’s mind.

On the other hand, after a few days, the stock declined considerably. Did Mr. Average sell? Of course, he didn’t. In fact, he felt relieved when the news confirmed this only was a temporary adjustment. Unfortunately, it was not.

Yet even after losing more than half of the invested capital, Mr. Average still believed his investment was sound, and eventually, he would have profited. Why? He forgot to switch off his narrative machine.

In fact, modern psychologists argue that our conscious brain often intervenes after the fact. In short, if we are swept by our emotions, the unconscious mind decides for us. The conscious mind only intrudes to generate an ex-post narrative, which gives us the illusion that everything is under control. But this is only an illusion! Behavioral finance calls this phenomenon, “cognitive financial dissonance.”

Probability Neglect – Careful to the Sure GainProbably due to our biological heritage, we love sure things. Mr. Hominidus, while hunting in the Savannah, when given the chance to have a sure prey he could not resist the temptation. Why resist?

It was crucial for him to survive. Unfortunately, what worked in Savannah, does not work nowadays. In a complex world, in which rhythm is imposed by the probabilistic laws, Mr. Hominidus (which is us) makes a lot of bad decisions. In behavioral finance, this is called Prospect Theory.

Its assumptions are diametrically opposed to that of efficient market theory. In fact, prospect theory holds that “under the condition of uncertainty individuals act irrationally.” In other words, they neglect probabilistic laws altogether, which makes them very bad decision-makers.

How to Get out from the SavannahAs we saw many of our human features, evolved when we still lived in the Savannah. Now cultures and societies evolve at such a fast pace, that we are not able to keep up with them. How can we become better investors? Victor Ricciardi and Helen K. Simon give us some advice:

“The best way for investors to control their “mental mistakes” is to focus On a specific investment strategy over the long-term. Investors should keep detailed records outlining such matters as why a specific stock was purchased for their portfolio. Also, investors should decide upon specific criteria for making an investment decision to buy, sell or hold.”

To read the entire paper click here.

The limits of Behavioral Finance And EconomicsWhile Behavioral Finance might represent an improvement of classical finance and economics, in reality, it showed already its many drawbacks. Indeed, the foundation of behavioral finance is built on the premise that:

Individuals are more often than not biased.By understanding individual biases it’s possible to predict/tweak collective behaviors. That same complex models are relevant in the same way to predict the behaviors of individual/masses.Those are just some of the flawed premises of behavioral finance.

Indeed, as explained in bounded rationality, heuristics, and biases, which in many cases psychologists call biases, are context-based decision-making tricks. In addition, individual behaviors when scaled become something else, which cannot be explained from the individual but it becomes a creature of its own (to say the psychology of the individual is something completely different from that of the masses and confusing the two is extremely dangerous).

Lastly, behavioral finance has given the rise of the school of thought, that of the “nudgers” that believe that by understanding individual biases they can tweak the whole collective.

This whole discipline, therefore, just as classic economics is flawed, and as an entrepreneur and business person you want to be skeptical of that.

Connected Business Concepts As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty. The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not. The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist.

The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist. The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty. The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased.

The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased. The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post What is Behavioral Finance? The Behavioral Finance Guide For Beginners appeared first on FourWeekMBA.

Personal SWOT Analysis In A Nutshell

The SWOT analysis is commonly used as a strategic planning tool in business. However, it is also well suited for personal use in addressing a specific goal or problem. A personal SWOT analysis helps individuals identify their strengths, weaknesses, opportunities, and threats.

Understanding a personal SWOT analysisIndeed, individuals can adapt the SWOT analysis to:

Assist in personal development and career progression. Prepare for job interviews.Successfully transition from one industry to another.Conducting a personal SWOT analysisWhen conducting a personal SWOT analysis, the information must be as unbiased as possible. For example, some individuals may overstate their strengths while understating their weaknesses.

Wherever possible, consult friends or colleagues for their opinions. While their opinions can also be biased, this can be counteracted by interviewing as many people as possible and identifying common themes. Independent market research can also be incorporated to further strengthen the integrity of the analysis.

Then, create a SWOT diagram with four boxes. Each box represents:

Strengths – what skill set do you bring to the table? Consider your qualifications, experience, achievements, personal skills, and any industry contacts or leads. Weaknesses – what are your professional bad habits or shortcomings? Do you struggle with public speaking or do you tend to call in sick often? What skills or qualifications are lacking or have expired? In identifying weaknesses, be honest and thorough. Each weakness represents an avenue for potential growth.Opportunities – who are the movers and shakers in your industry and how can you position yourself in front of them? What trends can you foresee? Will these trends create job vacancies?Threats – what are the obstacles you are currently facing? How is your role or broader industry changing? Could automation or increased competition affect your job security? Threats also take the form of ambitious or vocal colleagues who have the potential to outcompete you for promotions.Determining personal SWOT analysis outcomesIn evaluating the results, there are two popular methods.

The first is matching, where two categories are matched to outline a course of action. Strengths matched with opportunities show you where to seize the moment and be aggressive. Conversely, weaknesses matched with threats identifies vulnerabilities that you should avoid or work on proactively.

The second method involves turning negatives into positives. How can weaknesses be turned into strengths, or threats into opportunities? For example, an extroverted individual who accepts an entry-level position with little human interaction may initially see extroversion as a weakness. However, they identify a sales position within the same company and work aggressively toward being hired for a role where extroversion is a strength.

Key takeawaysA personal SWOT analysis identifies areas of growth through the personal reflection of strengths, weaknesses, opportunities, and threats.A personal SWOT analysis relies on unbiased information to be effective. Independent market research and the opinions of friends and colleagues can help offset personal biases.Personal SWOT analysis results can be evaluated by matching two categories to determine where efforts should be directed. Negative attributes can also be turned into positive attributes by considering context and future planning.Connected Business FrameworksPorter’s Five Forces Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forces.BCG Matrix

Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forces.BCG Matrix

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Balanced Scorecard

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Balanced Scorecard

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Blue Ocean Strategy

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Blue Ocean Strategy

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Scenario Planning

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Scenario Planning

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.Ansoff Matrix

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.Ansoff Matrix You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Comparable Analysis Framework

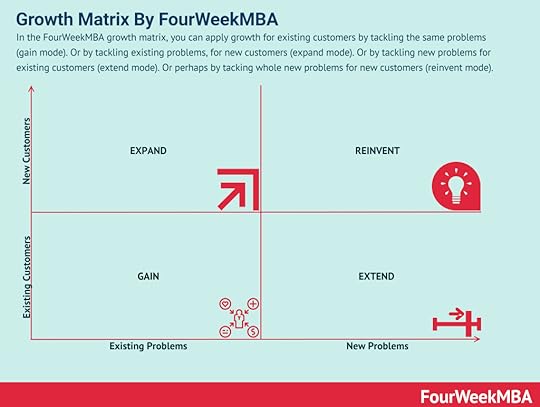

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Comparable Analysis Framework A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.Growth Matrix

A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.Growth Matrix In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Revenue Streams Matrix

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Revenue Streams Matrix In the FourWeekMBA Revenue Streams Matrix, revenue streams are classified according to the kind of interactions the business has with its key customers. The first dimension is the “Frequency” of interaction with the key customer. As the second dimension, there is the “Ownership” of the interaction with the key customer.

In the FourWeekMBA Revenue Streams Matrix, revenue streams are classified according to the kind of interactions the business has with its key customers. The first dimension is the “Frequency” of interaction with the key customer. As the second dimension, there is the “Ownership” of the interaction with the key customer.Read Next: SWOT Analysis.

Main Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDistribution ChannelsMarketing StrategyPlatform Business ModelsNetwork EffectsMain Case Studies:

Amazon Business ModelApple Mission StatementNike Mission Statement Amazon Mission StatementApple DistributionThe post Personal SWOT Analysis In A Nutshell appeared first on FourWeekMBA.

Vertical Market: What Is A Vertical Market And Why It Matters In Business

A vertical or vertical market usually refers to a business that services a specific niche or group of people in a market. In short, a vertical market is smaller by definition, and it serves a group of customers/products that can be identified as part of the same group. A search engine like Google is a horizontal player, while a travel engine like Airbnb is a vertical player.

Horizontal vs. Vertical Markets Horizontal integration refers to the process of increasing market shares or expanding by integrating at the same level of the supply chain, and within the same industry. Vertical integration happens when a company takes control of more parts of the supply chain, thus covering more parts of it.

Horizontal integration refers to the process of increasing market shares or expanding by integrating at the same level of the supply chain, and within the same industry. Vertical integration happens when a company takes control of more parts of the supply chain, thus covering more parts of it.To understand the concept of vertical market, we can look at the concept of vertical integration and horizontal integration. In a vertically integrated strategy, a company gets closer and closer to the final customer, or perhaps it gets more control over the product manufacturing.

Take the case of Luxottica and how it integrated vertically in the eyewear industry. Luxottica didn’t expand to cover other verticals (for instance, by moving from eyeglasses to footwear) instead it moved vertically by controlling more and more of the manufacturing and distribution process.

On the other hand, think of the case of Alphabet that controls Google. While the company still operates the leading search engine, the search market by definition has grown to cover many verticals (publishing, travel, e-commerce, and many many other small niche markets). This makes Google, in part a horizontal player, therefore, able to cover various niches.

Connected Business Concepts Backward chaining, also called backward integration, describes a process where a company expands to fulfill roles previously held by other businesses further up the supply chain. It is a form of vertical integration where a company owns or controls its suppliers, distributors, or retail locations.

Backward chaining, also called backward integration, describes a process where a company expands to fulfill roles previously held by other businesses further up the supply chain. It is a form of vertical integration where a company owns or controls its suppliers, distributors, or retail locations.

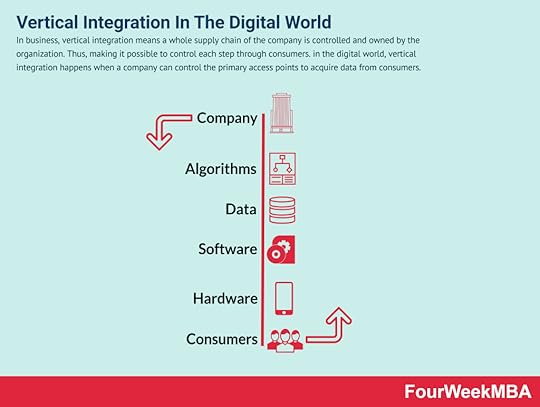

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through consumers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through consumers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers. An AI supply chain starts with the sourcing of data, which is produced by consumers. As this data gets stored on hardware, it goes through a first refinement process via software. Then it’s further refined, and repackaged by algorithms, and stored in data centers, which work as the fulfillment centers.

An AI supply chain starts with the sourcing of data, which is produced by consumers. As this data gets stored on hardware, it goes through a first refinement process via software. Then it’s further refined, and repackaged by algorithms, and stored in data centers, which work as the fulfillment centers.  An AI supply chain starts with the sourcing of data, which is produced by consumers. As this data gets stored on hardware, it goes through a first refinement process via software. Then it’s further refined, and repackaged by algorithms, and stored in data centers, which work as the fulfillment centers.

An AI supply chain starts with the sourcing of data, which is produced by consumers. As this data gets stored on hardware, it goes through a first refinement process via software. Then it’s further refined, and repackaged by algorithms, and stored in data centers, which work as the fulfillment centers. Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelThe post Vertical Market: What Is A Vertical Market And Why It Matters In Business appeared first on FourWeekMBA.