Gennaro Cuofano's Blog, page 145

July 24, 2021

Thinking Models

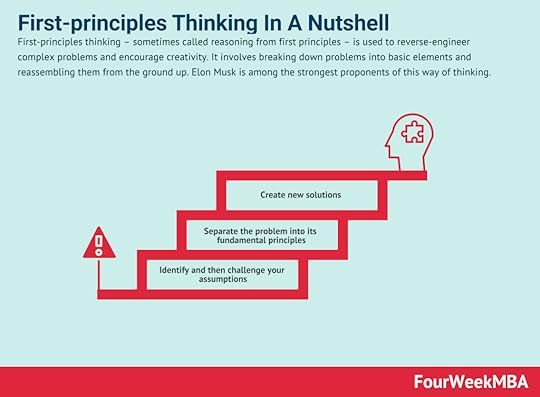

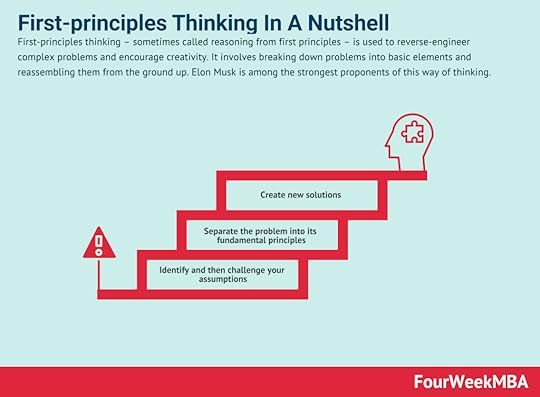

First-principles thinking – sometimes called reasoning from first principles – is used to reverse-engineer complex problems and encourage creativity. It involves breaking down problems into basic elements and reassembling them from the ground up. Elon Musk is among the strongest proponents of this way of thinking.

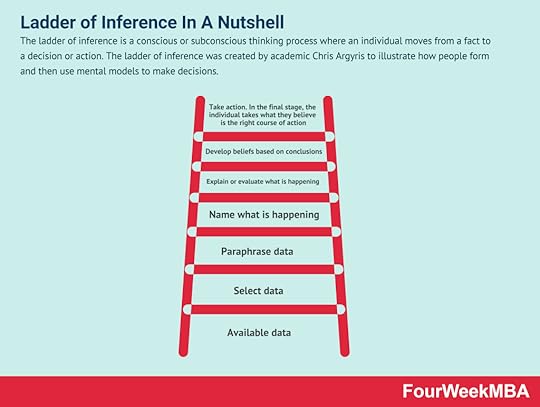

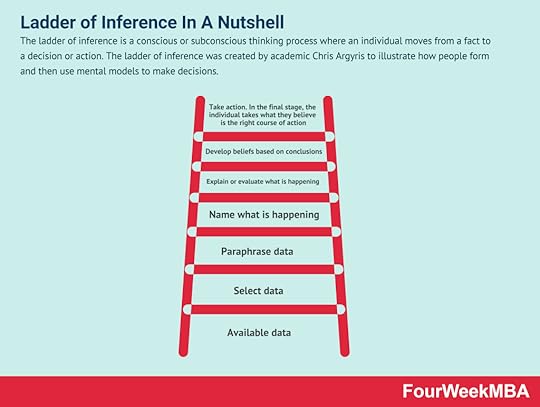

First-principles thinking – sometimes called reasoning from first principles – is used to reverse-engineer complex problems and encourage creativity. It involves breaking down problems into basic elements and reassembling them from the ground up. Elon Musk is among the strongest proponents of this way of thinking.  The ladder of inference is a conscious or subconscious thinking process where an individual moves from a fact to a decision or action. The ladder of inference was created by academic Chris Argyris to illustrate how people form and then use mental models to make decisions.

The ladder of inference is a conscious or subconscious thinking process where an individual moves from a fact to a decision or action. The ladder of inference was created by academic Chris Argyris to illustrate how people form and then use mental models to make decisions. The Six Thinking Hats model was created by psychologist Edward de Bono in 1986, who noted that personality type was a key driver of how people approached problem-solving. For example, optimists view situations differently from pessimists. Analytical individuals may generate ideas that a more emotional person would not, and vice versa.

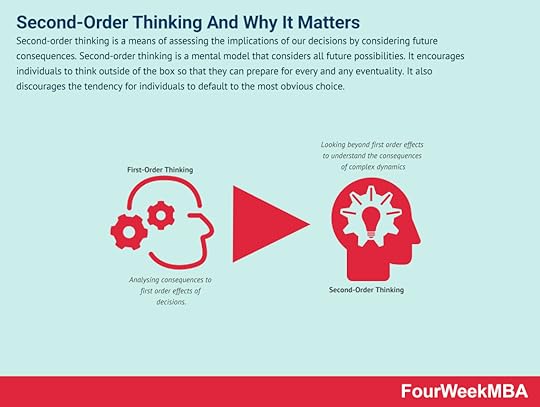

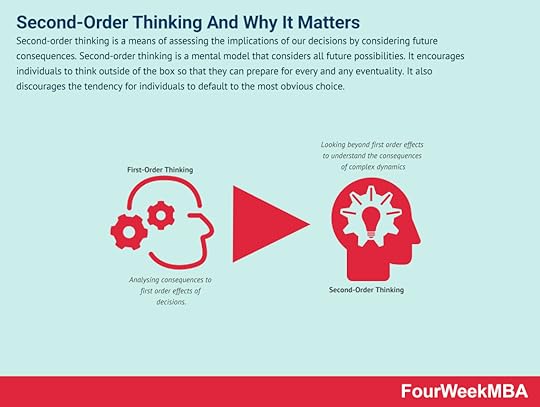

The Six Thinking Hats model was created by psychologist Edward de Bono in 1986, who noted that personality type was a key driver of how people approached problem-solving. For example, optimists view situations differently from pessimists. Analytical individuals may generate ideas that a more emotional person would not, and vice versa. Second-order thinking is a means of assessing the implications of our decisions by considering future consequences. Second-order thinking is a mental model that considers all future possibilities. It encourages individuals to think outside of the box so that they can prepare for every and eventuality. It also discourages the tendency for individuals to default to the most obvious choice.

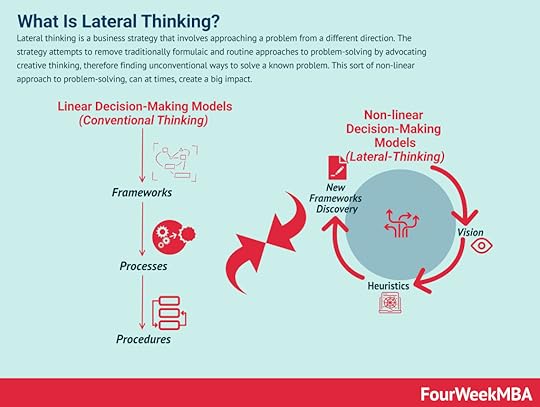

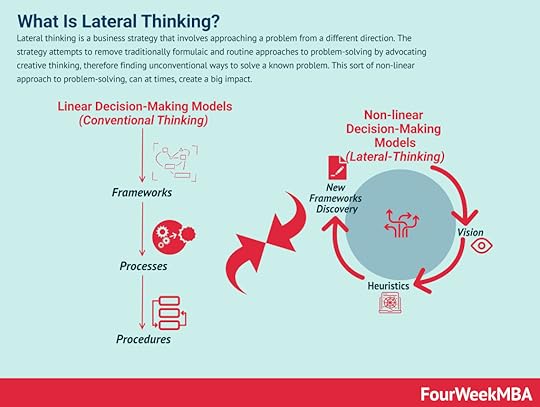

Second-order thinking is a means of assessing the implications of our decisions by considering future consequences. Second-order thinking is a mental model that considers all future possibilities. It encourages individuals to think outside of the box so that they can prepare for every and eventuality. It also discourages the tendency for individuals to default to the most obvious choice. Lateral thinking is a business strategy that involves approaching a problem from a different direction. The strategy attempts to remove traditionally formulaic and routine approaches to problem-solving by advocating creative thinking, therefore finding unconventional ways to solve a known problem. This sort of non-linear approach to problem-solving, can at times, create a big impact.

Lateral thinking is a business strategy that involves approaching a problem from a different direction. The strategy attempts to remove traditionally formulaic and routine approaches to problem-solving by advocating creative thinking, therefore finding unconventional ways to solve a known problem. This sort of non-linear approach to problem-solving, can at times, create a big impact. Moonshot thinking is an approach to innovation, and it can be applied to business or any other discipline where you target at least 10X goals. That shifts the mindset, and it empowers a team of people to look for unconventional solutions, thus starting from first principles, by leveraging on fast-paced experimentation.

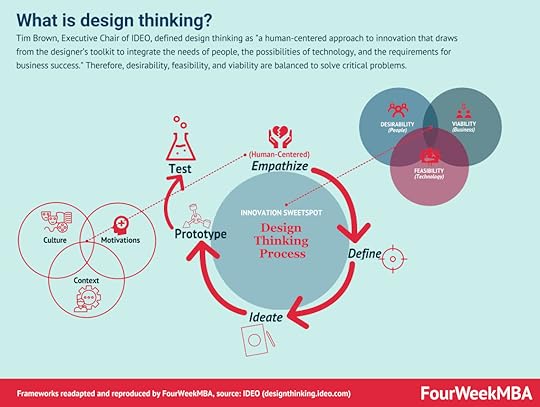

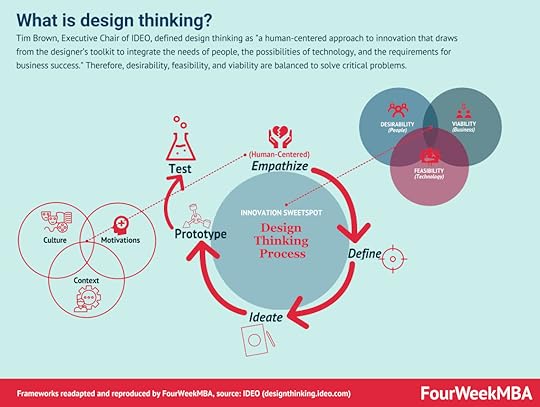

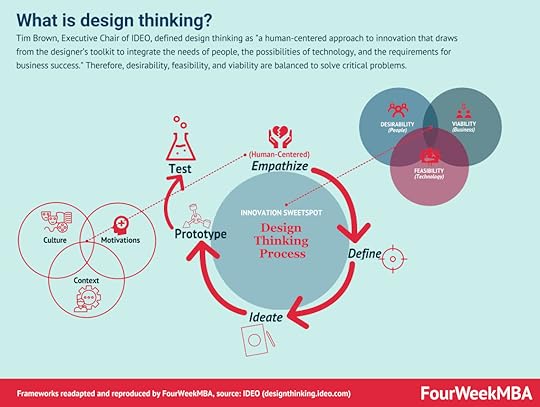

Moonshot thinking is an approach to innovation, and it can be applied to business or any other discipline where you target at least 10X goals. That shifts the mindset, and it empowers a team of people to look for unconventional solutions, thus starting from first principles, by leveraging on fast-paced experimentation. Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.

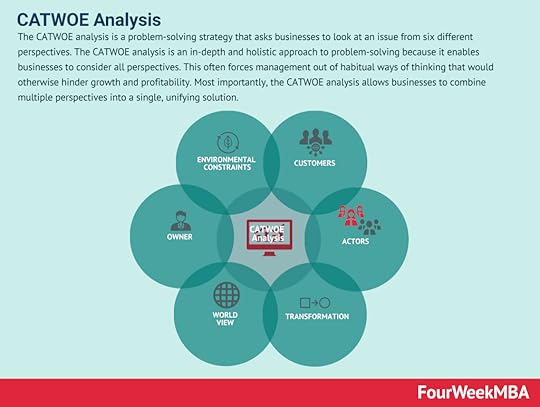

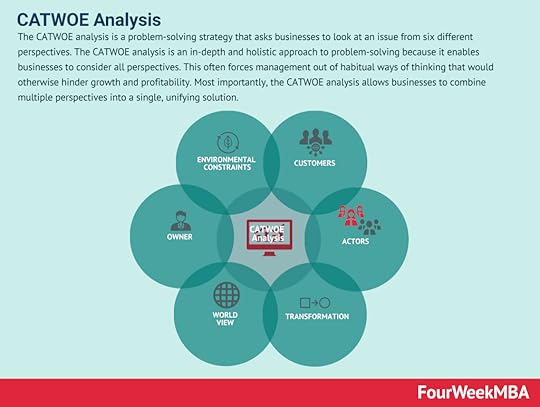

Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.  The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.

The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Thinking Models appeared first on FourWeekMBA.

July 23, 2021

Ladder Of Abstraction In A Nutshell

The ladder of abstraction was created by American linguist S.I. Hayakawa in his book Language in Thought and Action. The ladder of abstraction is a mental model that describes varying levels of abstraction and concreteness as one moves up or down a hypothetical ladder.

Understanding the ladder of abstractionIn the book, Hayakawa describes the way that people think or communicate in varying degrees of abstraction. Intangible abstract concepts occupy the top rung of a hypothetical ladder, while tangible concrete particulars occupy the bottom rung. In the middle rungs exist forms of communication with characteristics of each.

The Linnaean system of classification is one example. The red fox (Vulpes vulpes) occupies the bottom rung of the ladder as a concrete, tangible species of animal. The top rung is occupied by the abstract, intangible Kingdom Animalia. Middle rungs are occupied by the remaining hierarchical taxa, including genus, family, order, class, and phylum. As one moves up the ladder, there is a decreasing level of concreteness and an increasing level of abstractness.

Implications for effective communicationAttaining the right level of abstraction is essential to establishing context and becoming an effective communicator.

Audiences need both concrete details and abstract concepts, so communicators should spend time on the middle rungs for balance and rhythm. In general, however, the communicator should never linger in one place for too long.

Lingering at either extreme of the ladder is called dead-level abstracting and commonly occurs in one of two scenarios:

Stuck at the bottom of the ladder (concrete-centric) – where a project manager presents detailed and specific budget data without explaining its broader implications.Stuck at the top of the ladder (abstract-centric) – where a politician proposes generic legislative reform without clarifying how the reform will affect ordinary citizens.Moving along the ladder of abstractionIn the previous section, we established that effective communication relied on freedom of movement along the ladder.

Here is how that might be accomplished.

To move down the ladder:

Support theories or abstractions with tangible, real-world case studies, photographs, or data.Use sensory language that the other party can taste, smell, hear, touch, or see.Tell stories or anecdotes with emotion or some other form of human connection.Conversely, to move up the ladder:

Explain patterns or relationships. How do certain ideas connect in a broader context? For less certain relationships, it is appropriate to make inferences through logical reasoning.Show trends through appropriate chart usage instead of focusing on small subsets of data.Sympathize with shared ideals or values such as justice, freedom, environmentalism, and transparency. Here, it is helpful to know the audience and what resonates with them most.Key takeawaysThe ladder of abstraction describes the varying levels of abstraction and concreteness present in communication.In a conversation, free movement on the ladder of abstraction is important in establishing appropriate context. A lack of context results when the communicator lingers on subjects or concepts at either end. That is, the communication is either too abstract or too concrete.Moving down the ladder of abstraction is as simple as supporting abstract concepts with relatable case studies or data. Communicating broader trends or relationships and understanding the audience’s values help an individual move up the ladder.Connected Business Frameworks First-principles thinking – sometimes called reasoning from first principles – is used to reverse-engineer complex problems and encourage creativity. It involves breaking down problems into basic elements and reassembling them from the ground up. Elon Musk is among the strongest proponents of this way of thinking.

First-principles thinking – sometimes called reasoning from first principles – is used to reverse-engineer complex problems and encourage creativity. It involves breaking down problems into basic elements and reassembling them from the ground up. Elon Musk is among the strongest proponents of this way of thinking.  The ladder of inference is a conscious or subconscious thinking process where an individual moves from a fact to a decision or action. The ladder of inference was created by academic Chris Argyris to illustrate how people form and then use mental models to make decisions.

The ladder of inference is a conscious or subconscious thinking process where an individual moves from a fact to a decision or action. The ladder of inference was created by academic Chris Argyris to illustrate how people form and then use mental models to make decisions. The Six Thinking Hats model was created by psychologist Edward de Bono in 1986, who noted that personality type was a key driver of how people approached problem-solving. For example, optimists view situations differently from pessimists. Analytical individuals may generate ideas that a more emotional person would not, and vice versa.

The Six Thinking Hats model was created by psychologist Edward de Bono in 1986, who noted that personality type was a key driver of how people approached problem-solving. For example, optimists view situations differently from pessimists. Analytical individuals may generate ideas that a more emotional person would not, and vice versa. Second-order thinking is a means of assessing the implications of our decisions by considering future consequences. Second-order thinking is a mental model that considers all future possibilities. It encourages individuals to think outside of the box so that they can prepare for every and eventuality. It also discourages the tendency for individuals to default to the most obvious choice.

Second-order thinking is a means of assessing the implications of our decisions by considering future consequences. Second-order thinking is a mental model that considers all future possibilities. It encourages individuals to think outside of the box so that they can prepare for every and eventuality. It also discourages the tendency for individuals to default to the most obvious choice. Lateral thinking is a business strategy that involves approaching a problem from a different direction. The strategy attempts to remove traditionally formulaic and routine approaches to problem-solving by advocating creative thinking, therefore finding unconventional ways to solve a known problem. This sort of non-linear approach to problem-solving, can at times, create a big impact.

Lateral thinking is a business strategy that involves approaching a problem from a different direction. The strategy attempts to remove traditionally formulaic and routine approaches to problem-solving by advocating creative thinking, therefore finding unconventional ways to solve a known problem. This sort of non-linear approach to problem-solving, can at times, create a big impact. Moonshot thinking is an approach to innovation, and it can be applied to business or any other discipline where you target at least 10X goals. That shifts the mindset, and it empowers a team of people to look for unconventional solutions, thus starting from first principles, by leveraging on fast-paced experimentation.

Moonshot thinking is an approach to innovation, and it can be applied to business or any other discipline where you target at least 10X goals. That shifts the mindset, and it empowers a team of people to look for unconventional solutions, thus starting from first principles, by leveraging on fast-paced experimentation. Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.

Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.  The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.

The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.Main Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Ladder Of Abstraction In A Nutshell appeared first on FourWeekMBA.

SCAMPER Method In A Nutshell

Eighteen years later, it was adapted by psychologist Bob Eberle in his book SCAMPER: Games for Imagination Development. The SCAMPER method was first described by advertising executive Alex Osborne in 1953. The SCAMPER method is a form of creative thinking or problem solving based on evaluating ideas or groups of ideas.

Understanding the SCAMPER methodThe SCAMPER method is a simple way to stimulate creative thinking through the brainstorming of ideas. It is based on the philosophy that new ideas are simply modifications or combinations of existing ideas.

To generate new ideas during the product development process, businesses must ask seven different types of questions.

The seven questions of the SCAMPER methodThe seven questions – which comprise the acronym SCAMPER – can be tackled in any order that the project team sees fit. There is no emphasis on following a sequential process.

Team leaders should also consider a wide range of creative ideas, no matter how ridiculous they initially sound.

Here is a look at each of the seven question categories:

Substitute – what parts of a product or service can be substituted with something else? Are there better alternatives that will not affect the broader project? Are there substitutes and simpler and most cost-effective to produce? Team members can also be swapped out for someone with a different perspective. In the early days of McDonald’s, glass and porcelain table implements were replaced with paper and plastic to avoid dishwashing. Combine – how can two or more parts of a product, problem, or process be combined to produce something innovative? How can certain expertise be combined?Adapt – could products or services be adapted or tweaked to improve performance? How can the product or service be made more user-friendly or attractive?Modify – what can be emphasized (or de-emphasized) in a product or problem? Are there certain components or features that could be accentuated in line with consumer demand? Indeed, which components are superfluous and should be omitted? Here, the focus should always be on creating value.Put to another use – how can a product or service be repurposed? Could it be better utilized by a different target audience? Might the consumer use a product in a way that was not intended? In 1974, McDonald’s opened the first Ronald McDonald House charity to assist children and their families dealing with cancer.Eliminate – can the product or service be simplified through the elimination of one or more aspects? Can it be made smaller, more efficient, or easier to assemble? Elimination is crucial in refining a product to the point where only the primary function remains. For example, McDonald’s chose to eliminate table service to save money on wait staff and simplify its process.Reverse/rearrange – what happens if a process is run backward? Can the pace or order of the schedule be modified? Can components be rearranged more efficiently?Key takeawaysThe SCAMPER method is a simple means of generating ideas to develop new products or improve existing products through brainstorming.The SCAMPER method is an acronym of seven question categories. Each category can be analyzed when or as a business sees fit. There is no requirement to run through the list sequentially.The SCAMPER method is a holistic approach to lateral thinking. It helps businesses consider all perspectives and make decisions most likely to encourage creativity and innovation.Connected Business Frameworks The Fishbone Diagram is a diagram-based technique used in brainstorming to identify potential causes for a problem, thus it is a visual representation of cause and effect. The problem or effect serves as the head of the fish. Possible causes of the problem are listed on the individual “bones” of the fish. This encourages problem-solving teams to consider a wide range of alternatives.

The Fishbone Diagram is a diagram-based technique used in brainstorming to identify potential causes for a problem, thus it is a visual representation of cause and effect. The problem or effect serves as the head of the fish. Possible causes of the problem are listed on the individual “bones” of the fish. This encourages problem-solving teams to consider a wide range of alternatives. Round-robin brainstorming is a collective and iterative approach to brainstorming. Brainstorming is an effective way of generating fresh ideas for an organization. Round-robin brainstorming is a balanced approach, employing an iterative, circular process that builds on the previous contribution of each participant.

Round-robin brainstorming is a collective and iterative approach to brainstorming. Brainstorming is an effective way of generating fresh ideas for an organization. Round-robin brainstorming is a balanced approach, employing an iterative, circular process that builds on the previous contribution of each participant.  Starbursting is a structured brainstorming technique with a focus on question generation. Starbursting is a structured form of brainstorming allowing product teams to cover all bases during the ideation process. It utilizes a series of questions to systematically work through various aspects of product development, forcing teams to evaluate ideas based on viability.

Starbursting is a structured brainstorming technique with a focus on question generation. Starbursting is a structured form of brainstorming allowing product teams to cover all bases during the ideation process. It utilizes a series of questions to systematically work through various aspects of product development, forcing teams to evaluate ideas based on viability. Impact mapping is a product development technique based on user design, mind mapping, and outcome-driven planning. Impact mapping is an agile technique intended to help teams connect individual product features that can impact the user behaviors while connecting to the key, guiding metrics for the business.

Impact mapping is a product development technique based on user design, mind mapping, and outcome-driven planning. Impact mapping is an agile technique intended to help teams connect individual product features that can impact the user behaviors while connecting to the key, guiding metrics for the business. The reframing matrix was first described by author Michael Morgan in his book Creating Workforce Innovation: Turning Individual Creativity into Organizational Innovation. A reframing matrix allows businesses to creatively assess problems from a variety of perspectives.

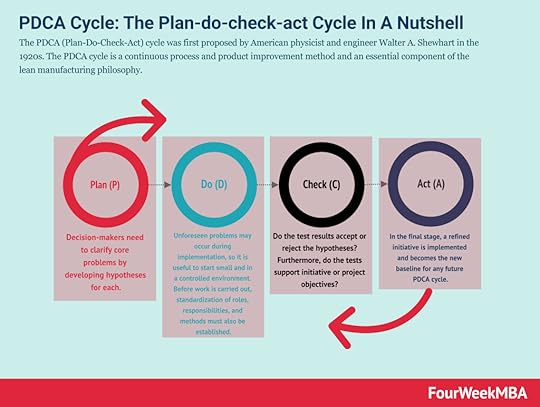

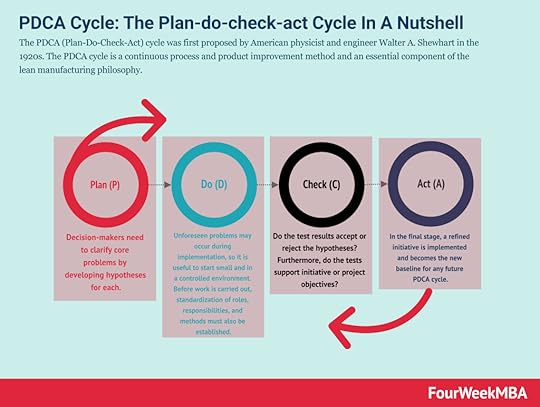

The reframing matrix was first described by author Michael Morgan in his book Creating Workforce Innovation: Turning Individual Creativity into Organizational Innovation. A reframing matrix allows businesses to creatively assess problems from a variety of perspectives. The PDCA (Plan-Do-Check-Act) cycle was first proposed by American physicist and engineer Walter A. Shewhart in the 1920s. The PDCA cycle is a continuous process and product improvement method and an essential component of the lean manufacturing philosophy.

The PDCA (Plan-Do-Check-Act) cycle was first proposed by American physicist and engineer Walter A. Shewhart in the 1920s. The PDCA cycle is a continuous process and product improvement method and an essential component of the lean manufacturing philosophy.  An after-action review (AAR) is a structured process of reflecting on the work of a group by identifying strengths, weaknesses, and areas for improvement. After action reviews were first utilized by the United States Army on combat missions. Since then, modern companies such as British Petroleum, Motorola, and General Electric have all become proponents. AARs are also used to identify gaps in public health emergency preparedness systems. After Hurricane Katrina in 2005, a searching review of the emergency response led to new methods of communicating during natural disasters.

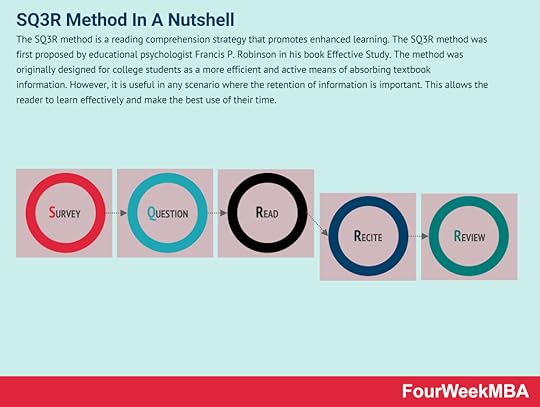

An after-action review (AAR) is a structured process of reflecting on the work of a group by identifying strengths, weaknesses, and areas for improvement. After action reviews were first utilized by the United States Army on combat missions. Since then, modern companies such as British Petroleum, Motorola, and General Electric have all become proponents. AARs are also used to identify gaps in public health emergency preparedness systems. After Hurricane Katrina in 2005, a searching review of the emergency response led to new methods of communicating during natural disasters. The SQ3R method is a reading comprehension strategy that promotes enhanced learning. The SQ3R method was first proposed by educational psychologist Francis P. Robinson in his book Effective Study. The method was originally designed for college students as a more efficient and active means of absorbing textbook information. However, it is useful in any scenario where the retention of information is important. This allows the reader to learn effectively and make the best use of their time.

The SQ3R method is a reading comprehension strategy that promotes enhanced learning. The SQ3R method was first proposed by educational psychologist Francis P. Robinson in his book Effective Study. The method was originally designed for college students as a more efficient and active means of absorbing textbook information. However, it is useful in any scenario where the retention of information is important. This allows the reader to learn effectively and make the best use of their time. The HEART framework is a methodology that aims to align the focus of the product team with the customer experience. The HEART framework was initially described in a research article entitled Measuring the User Experience on a Large Scale: User-Centered Metrics for Web Applications.

The HEART framework is a methodology that aims to align the focus of the product team with the customer experience. The HEART framework was initially described in a research article entitled Measuring the User Experience on a Large Scale: User-Centered Metrics for Web Applications.Main Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDistribution ChannelsMarketing StrategyPlatform Business ModelsNetwork EffectsMain Case Studies:

Amazon Business ModelApple Mission StatementNike Mission Statement Amazon Mission StatementApple DistributionThe post SCAMPER Method In A Nutshell appeared first on FourWeekMBA.

OODA Loop And Why It Matters In Business

The OODA loop was popularized by U.S. Air Force fighter pilot Colonel John Boyd to describe maneuver warfare during the Korean War. The OODA loop is a four-step approach to decision making where strategies must be adjusted quickly. Those four steps comprise observe, orient, decide, and act.

Understanding the OODA loopBoyd noted that USAF pilots flying F-86 fighter jets were able to consistently down the Korean Mig-15 by a factor of 10 to 1. This was even though the Mig-15 was a technically superior aircraft, with better acceleration and higher climb rates.

However, the F-86 had two distinct advantages. Thanks to a hydraulic control system, it could transition from one maneuver to another in rapid succession. The canopy of the F-86 was also more expansive, allowing pilots to better observe and react more quickly in combat. Ultimately, the F-86 was the more agile of the two jets.

In the context of the OODA loop, agility is represented as a series of decision-making cycles. Businesses can use these cycles to solve specific problems quickly, thereby remaining competitive.

In the next section, we will look at the cycle in more detail.

Decision-making cycles of the OODA loopIn its simplest form, the OODA loop has four stages.

Stage 1 – ObserveWhat are the internal and external drivers of change? Where are the inflection points in trends?

Decision-makers must observe changes at the micro or macro level to determine whether a response is required. Drivers might include ever-increasing internet speeds or the continued replacement of jobs with technology and automation.

Stage 2 – OrientIs the business aligned with the observations made? Scenario planning is useful in ensuring that strategic plans are meeting expectations or challenging expectations.

This is the most important step because it determines how a business will position itself to take advantage of its observations. It’s also the step most vulnerable to bias, which has five main influences:

Cultural traditions.An ability to analyze and synthesize.Genetic heritage.New information.Previous experience.As a rule, each decision made in the orienting process must be based on evidence. Businesses must also understand the perspective of a competitor by using the five influences above. This, to some extent, can predict how a competitor will behave.

Stage 3 – DecideWhat is the most appropriate course of action?

Here, taking no action is sometimes the best choice. Indeed, businesses should avoid acting for the sake of it.

Since the OODA loop advocates quick decision making in fluid environments, businesses often cycle between Stage 1 and Stage 3 as more information becomes available.

Stage 4 – ActOnce a decision is made it is important to act quickly and implement it. The results of decision implementation are then fed back into the observation stage and their impact re-assessed.

Note also that the OODA loop is not a cyclical process but a series of iterative adjustments.

Businesses should also remember that it favors quick decision making to remain competitive. For some decisions where the cost of failure is high, a more considered approach is required.

For example, a relatively minor change in customer refund policy can be made quickly and adapted if required. But a significant product refresh has a higher cost of failure and as a result, would likely reduce competitiveness if not implemented properly.

Key takeawaysThe OODA loop is a quick, effective, and proactive decision-making process that allows businesses to remain competitive.The OODA loop is based on four stages that help decision-makers identify key drivers of change, identify unbiased solutions, and then implement the best course of action quickly.Despite its name, the OODA loop decision-making process is less of a loop and more a series of iterative and interactive adjustments. Businesses should also be careful not to rush important decisions where the cost of failure is high.Connected Business Frameworks The PDCA (Plan-Do-Check-Act) cycle was first proposed by American physicist and engineer Walter A. Shewhart in the 1920s. The PDCA cycle is a continuous process and product improvement method and an essential component of the lean manufacturing philosophy.

The PDCA (Plan-Do-Check-Act) cycle was first proposed by American physicist and engineer Walter A. Shewhart in the 1920s. The PDCA cycle is a continuous process and product improvement method and an essential component of the lean manufacturing philosophy.  Agile Modeling (AM) is a methodology for modeling and documenting software-based systems. Agile Modeling is critical to the rapid and continuous delivery of software. It is a collection of values, principles, and practices that guide effective, lightweight software modeling.

Agile Modeling (AM) is a methodology for modeling and documenting software-based systems. Agile Modeling is critical to the rapid and continuous delivery of software. It is a collection of values, principles, and practices that guide effective, lightweight software modeling. Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.

Tim Brown, Executive Chair of IDEO, defined design thinking as “a human-centered approach to innovation that draws from the designer’s toolkit to integrate the needs of people, the possibilities of technology, and the requirements for business success.” Therefore, desirability, feasibility, and viability are balanced to solve critical problems.  The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

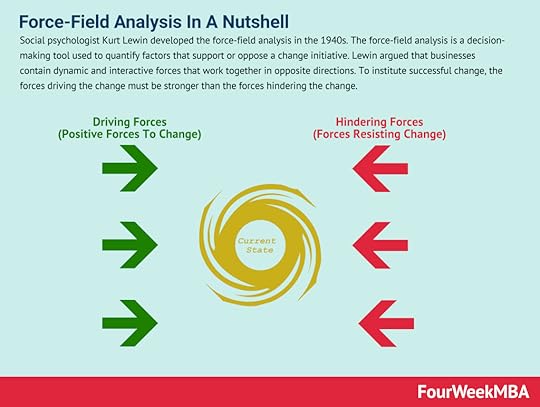

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. Social psychologist Kurt Lewin developed the force-field analysis in the 1940s. The force-field analysis is a decision-making tool used to quantify factors that support or oppose a change initiative. Lewin argued that businesses contain dynamic and interactive forces that work together in opposite directions. To institute successful change, the forces driving the change must be stronger than the forces hindering the change.

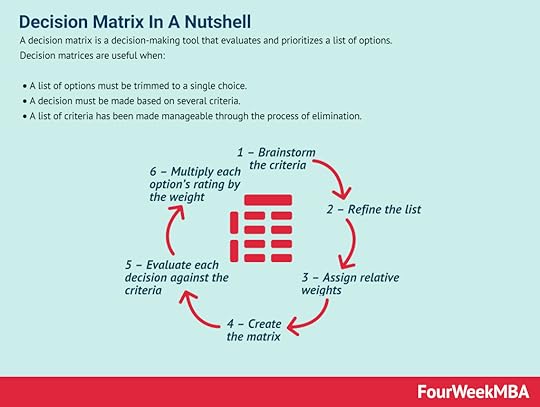

Social psychologist Kurt Lewin developed the force-field analysis in the 1940s. The force-field analysis is a decision-making tool used to quantify factors that support or oppose a change initiative. Lewin argued that businesses contain dynamic and interactive forces that work together in opposite directions. To institute successful change, the forces driving the change must be stronger than the forces hindering the change. A decision matrix is a decision-making tool that evaluates and prioritizes a list of options. Decision matrices are useful when: A list of options must be trimmed to a single choice. A decision must be made based on several criteria. A list of criteria has been made manageable through the process of elimination.

A decision matrix is a decision-making tool that evaluates and prioritizes a list of options. Decision matrices are useful when: A list of options must be trimmed to a single choice. A decision must be made based on several criteria. A list of criteria has been made manageable through the process of elimination. The Pareto Analysis is a statistical analysis used in business decision-making that identifies a certain number of input factors that have the greatest impact on income. It is based on the similarly named Pareto Principle, which states that 80% of the effect of something can be attributed to just 20% of the drivers.

The Pareto Analysis is a statistical analysis used in business decision-making that identifies a certain number of input factors that have the greatest impact on income. It is based on the similarly named Pareto Principle, which states that 80% of the effect of something can be attributed to just 20% of the drivers. Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision-making by avoiding two pitfalls: underprediction, and overprediction.

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision-making by avoiding two pitfalls: underprediction, and overprediction.Main Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDistribution ChannelsMarketing StrategyPlatform Business ModelsNetwork EffectsMain Case Studies:

Amazon Business ModelApple Mission StatementNike Mission Statement Amazon Mission StatementApple DistributionThe post OODA Loop And Why It Matters In Business appeared first on FourWeekMBA.

July 21, 2021

Consumer-to-manufacturer (C2M) Business Model

Consumer-to-manufacturer (C2M) is a model connecting manufacturers with consumers. The model removes logistics, inventory, sales, distribution, and other intermediaries enabling consumers to buy higher quality products at lower prices. C2M is useful in any scenario where the manufacturer can react to proven, consolidated, consumer-driven niche demand.

Understanding consumer-to-manufacturerConsumer-to-manufacturer is a disruptive form of consumer-driven demand-shaping, combining elements of social selling and tech-enabled consumer aggregation. In recent years, C2M has enjoyed a resurgence in interest thanks to advances in technology.

Interactions between the consumer and manufacturer are nothing new. Manufacturers collect consumer data to better gauge trends and develop ideas for innovative products. Indeed, smaller manufacturers already undertake direct-to-consumer selling on farm-to-table platforms and eCommerce sites such as Taobao and Douyin.

However, a key characteristic of C2M lies in the initiator of demand. Rather than fulfilling one order at a time, manufacturers receive real-time feedback on demand for specific and customized products. Feedback and product demand are wholly community-driven, allowing the business to passively source important metrics regarding consumer preferences, location, or behavior. Importantly, the manufacturer does not produce an item unless it has been ordered by a consumer first.

Fundamentally speaking, the C2M strategy involves consumers collectively approaching the manufacturer with what they should produce. The strategy differs from traditional methods where the manufacturer approaches consumers with what it could produce.

Where is C2M most suited?C2M is useful in any scenario where the manufacturer can react to proven, consolidated, consumer-driven niche demand.

Note that C2M will not be able to compete in marketplaces where common products are easily sourced. Here, product demand is more predictable and is already being met by manufacturers.

Instead, consumer-to-manufacturer should be employed to analyze niche demand infrastructure within specific verticals such as insurance. In this context, demand is more difficult to detect. It typically occurs in industries with high production costs for high-value or high-importance items.

Real-world examples of customer-to-manufacturerThe Customer-to-manufacture strategy has seen great success in China with several apps helping Chinese enterprises respond to consumer demand.

In 2018, the Chinese eCommerce platform Pinduoduo (PDD) launched its “1,000 New Brand Initiative” giving small and medium manufacturers access to huge buyer traffic.

Consumers use Pinduoduo to buy full-price items or get a discount if they invite others to participate in a group purchase. In most cases, the discounted order is shipped once a certain number of purchases has been met.

Manufacturing company Jiaweishi used C2M to redesign the appearance of its robotic vacuum cleaners and give them a less randomised cleaning route. As a new brand, it also live-streamed the manufacturing process to allay consumer concerns over product quality.

Cookware company Sanhe also used C2M to great effect. Although one of Europe’s biggest cookware manufacturers, PDD helped the company identify strong domestic demand for its pots made with the same quality and craftsmanship as export models. This demand was backed by consumer data on product functionality, material, and color. Sanhe also received valuable data on the age, gender, and spending power of its Chinese market.

Key takeaways:Consumer-to-manufacturer allows consumers to purchase directly from the manufacturer. With most third parties omitted, consumers get access to higher quality products at lower prices.Consumer-to-manufacturer is less effective in general product marketplaces where demand has been met by established players. Instead, it is more useful in industries with hidden demand and higher product pricing or production costs.Consumer-to-manufacturer has been popularised in China by eCommerce apps such as Pinduoduo. The company behind the app uses technology-driven insights to help Chinese enterprise produce products based on consumer demand and preferences.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Consumer-to-manufacturer (C2M) Business Model appeared first on FourWeekMBA.

The Patagonia Business Model In A Nutshell

Patagonia is an American clothing retailer founded by climbing enthusiast Yvon Chouinard in 1973 who saw initial success by selling reusable climbing pitons and Scottish rugby shirts. Over time Patagonia also became a fashionable brand also for its focus on slow fashion. Indeed, the company sells high-priced clothing items built to last which it will repair for free.Background

Patagonia is an American clothing retailer founded by climbing enthusiast Yvon Chouinard in 1973 who saw initial success by selling reusable climbing pitons and Scottish rugby shirts. Over time Patagonia also became a fashionable brand also for its focus on slow fashion. Indeed, the company sells high-priced clothing items built to last which it will repair for free.BackgroundPatagonia, Inc. is an American clothing company selling primarily outdoor clothing and associated equipment.

Based in California, the company was founded by climbing enthusiast Yvon Chouinard in 1973. Chouinard began rock climbing in 1953 as a 14-year-old member of the Southern California Falconry Club. His passion was instilled in him by the leaders of the club who taught him how to rappel down cliffs to view falcon nests.

As he grew older, he met members of the Sierra Club who would regularly meet in Yosemite. Chouinard was also an environmentalist who wanted to climb without leaving his equipment embedded in the rock face. He figured that a reusable piton was the answer, but no such product existed on the market. So he decided to design and then produce one himself, using an old coal-fired forge salvaged from a junkyard.

The reusable pitons were a hit in the climbing community, so Chouinard began selling them under the company name Chouinard Equipment. By 1970, Chouinard had become the largest supplier of climbing hardware in the United States.

Patagonia then began selling rugby shirts, bivouac sacks, gloves, hats, and mittens after Chouinard returned from a climbing trip to Scotland. The first store opened in 1973 in Ventura, California as the company shifted to developing innovative activewear made from synthetic fibers with an environmental slant. Further expansion of the product line saw Patagonia branch into sleeping bags, camping gear, surfwear, athletic equipment, and backpacks.

Today, Patagonia has annual revenue of approximately $1 billion with more than 50 stores globally.

Patagonia revenue generationPatagonia makes money by manufacturing and selling clothing to consumers for a profit.

However, the company is unique among its peers. It enjoys high brand equity but encourages people not to buy its clothing despite remaining a for-profit organization.

Patagonia promotes anti-consumerism, fair trade, charity, and environmental stewardship and actively embodies its values to build trust with consumers.

Let’s take a look at how these values help the company make money.

Highly durable clothingPatagonia sells high-quality, long-lasting clothing to consumers. While profit margins on individual items are higher, the company does not subscribe to the planned obsolescence strategy used by many clothes retailers today.

To further its environmental values, Patagonia also holds regular Worn Wear events across the US where customers receive free help repairing old clothing. Alternatively, shoppers can pick an item from a selection of pre-worn clothing and fix it themselves. These events solidify the connection between Patagonia and its target audience. It also assures customers that their warranties will be honored.

Advertising and marketingThrough its advertising campaigns, Patagonia believes that less is more. In other words, it actively encourages consumers to buy less clothing.

The Patagonia Common Threads Initiative advocates sustainability and anti-consumerism, with a message on the company website stating that “We design and sell things made to last and be useful. But we ask our customers not to buy from us what you don’t need or can’t really use. Everything we make – everything anyone makes – costs the planet more than it gives back.”

Patagonia is also famous for its “Don’t Buy This Jacket” campaign as a way to push back against sales such as Black Friday and encourage consumers to be more thoughtful about their purchases.

B-Corp certificationPatagonia became a Benefit Corp (B-Corp) almost as soon as it was possible to do so in California.

A B-Corp is a socially and/or environmentally responsible company that can write associated values into their articles of incorporation. In more general terms, Patagonia is accountable for metrics beyond just profit and loss.

To that end, Patagonia donates 1% of total revenue to charities promoting conservation and sustainability. It also makes the manufacturing and distribution footprints of its operations freely available online.

This certification increases operating costs and certainly reduces revenue, but embodying these values helps Patagonia resonate with a target audience who then become more motivated to purchase Patagonia products.

Key takeaways:Patagonia is an American clothing retailer with an emphasis on activewear and associated equipment. It was founded in 1973 by Yvon Chouinard who saw initial success by selling reusable climbing pitons and Scottish rugby shirts.Patagonia makes money by selling clothing items for a profit. But in reality, its revenue generation strategy is far more nuanced. The company sells high-priced clothing items built to last which it will repair for free.Patagonia promotes anti-consumerism by encouraging consumers to purchase thoughtfully during sales events such as Black Friday. As a B-Corporation, it also donates to charity and is transparent about its impact on the environment. Demonstrating the change it wants to see in the world further strengthens Patagonia’s brand image and equity. Consumers with similar values then become proud to wear and promote the Patagonia brand.Read Next: ASOS, SHEIN, Zara, Fast Fashion, Ultra-Fast Fashion, Real-Time Retail, Slow Fashion.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Patagonia Business Model In A Nutshell appeared first on FourWeekMBA.

July 20, 2021

25 Incredible Stories Of Business Failures

On September 15, 2008, the company filed for Chapter 11 bankruptcy proceedings following an exodus of clients, share price depreciation, and devaluation of assets. With $613 billion in debt, it was the largest such filing in United States history and is generally accepted to have precipitated the Global Financial Crisis (GFC).

American ApparelThe company filed for bankruptcy in October 2015 and then again in November 2016. Almost 2,500 employees were terminated in January 2017 as the company began shutting its factories and over 100 stores worldwide.

Toy “R” UsThe company filed for bankruptcy in September 2017 after almost 70 years in operation, with stores closing in the United States, United Kingdom, and Australia the following year. Stores in Canada, Europe, and Asia were also sold to third parties. While many casual observers may attribute the failure of Toys “R” Us to competitors such as Amazon, several causes contributed to its failure.

RadioShackFounded in 1921 by brothers Theodore and Milton Deutschmann. RadioShack was an industry leader in the tech world of the late 1970s and early 1980s. The company failed to capitalize on the PC and portable device revolutions that followed. This forced bankruptcy proceedings in 2015 where the RadioShack brand was sold off to various entities around the world.

Forever 21Forever 21 is a North American fast fashion retailer founded by the husband and wife team Do Won Chang and Jin Sook Chang in 1984, making $700,000 in revenue during its first year and by becoming a global player with over $4 billion in revenues and across 480 locations in the US alone by 2015. Only four years later, a 32% drop in global sales forced Forever 21 to file for bankruptcy. Several factors, such as too aggressive expansion, lack of proper online commerce strategy and lack of focus might have contributed.

GawkerIn June 2016, Gawker announced a bankruptcy filing related to a lawsuit instigated by retired professional wrestler Hulk Hogan. Two months later, Gawker Media announced its flagship blog would cease operations. After publishing a video of Hulk Hogan having sex with his best friend’s wife without permission set the company on a path to bankruptcy. Hogan sued in a Florida court and as a result, Gawker was forced to pay out $140 million in damages. Hogan lawsuit was founded in secret by billionaire Peter Thiel.

EnronThe so-called “Enron scandal” describes a series of events resulting in one of the largest bankruptcy filings in United States history. The scandal consisted of a mixture of bad culture, aggressive sales incentives, and serious accounting manipulations, resulting in one of the greatest American scandals of history.

CompaqCompaq was an American information technology company founded by Rod Canion, Jim Harris, and Bill Murto with just $3000 in 1982. Compaq rose to prominence in the 1990s as the largest supplier of PC systems after becoming the first company to clone an IBM PC legally and successfully. The company was acquired by Hewlett Packard in 2002 for $24.2 billion. Compaq products were rebranded as part of a new range of lower-end HP computers and the Compaq brand was discontinued in 2013.

KodakKodak is an American analog photography company founded in 1892 by George Eastman and Henry A. Strong. By the 2010s as the photography market had been flipped upside down by the rise of smartphones and digital photography, Kodak didn’t manage to adapt to this new market, thus losing its market leadership.

AltavistaAltaVista was a search engine created in 1995 by a group of researchers attempting to make finding files on a public network easier. Despite its obvious power, AltaVista fell into disuse like many similar (but arguably inferior) services including Infoseek, AOL Search, Excite, and Ask Jeeves. The advent of Google as market leader helped make AltaVista much less relevant, thus making it fall in disuse among consumers.

PalmPalm, Inc. was an American manufacturer of personal digital assistants (PDAs) and other electronics. founded in 1992 by Jeff Hawkins, its popularity tended to be restricted to early adopters. Despite the company revolutionizing mobile computing, it no longer exists today. Palm’s demise was caused by poor decision-making, squandered resources, and misplaced effort. The company got stuck in the “chasm.”

FriendsterFriendster was a social networking service founded by Jonathan Abrams in 2002. Early versions of Friendster functioned in much the same way as eventual successor Facebook. As the social media market consolidated, by 2009, Friendster was purchased by Malaysian company MOL Global. That same year, MOL Global sold 18 Friendster patents to Facebook. Friendster remained relatively popular in southeast Asia for a few more years until it was shut down in 2015.

StumbleUponFounded in 2001, StumbleUpon was a discovery and advertisement engine pushing content recommendations to users in the form of “stumbles”. As the competition started to increase as more businesses tried to emulate its success. Many users were lost to rivals such as Pinterest, Reddit, and Digg after the StumbleUpon algorithm started to become outdated and made the site unresponsive. To remain financially viable, StumbleUpon terminated 30% of its workforce in 2013. The company failed to achieve further funding while other companies like Pinterest became tech unicorns.

QuibiQuibi was an American short-form streaming platform for mobile devices, founded in 2018 by Jeffrey Katzenberg and targeted a younger demographic by delivering content in 10-minute episodes called “quick bites”. Once the coronavirus pandemic took hold, the audience Quibi was targeting was forced to stay at home and as a result, consumed content through more traditional channels. Just eight months after launch, Quibi shut down in December 2020.

BlockbusterBlockbuster was an American home movie and video game rental service founded in 1985 by David Cook. By the 1990s the company reached its peak, with thousands of stores in the US. And yet by the 2000s Less than a decade later, Blockbuster filed for bankruptcy with almost $1 billion in debt. Today, a single store remains in Bend, Oregon. Many attribute the failure of Blockbuster to Netflix, however, the failure was a lack of adaptation of its business model to the rising of streaming as a service.

NapsterNapster was a pioneering peer-to-peer music sharing service founded by Shawn Fanning, John Fanning, and Sean Parker in 1999. The platform reached peak popularity in February 2001 with over 80 million users sharing cassette tapes, vinyl records, rare albums, bootleg recordings, and the latest hits in mp3 form. After a protracted court battle, the court ruled in favor of the RIAA which forced Napster to shut down its network late in 2001. This represented a great lesson for later players, like Apple, who took advantage of it to build a successful platform like iTunes.

NetscapeNetscape – or Netscape Communications Corporation – was a computer services company best known for its web browser. The company was founded in 1994 by Marc Andreessen and James H. Clark as one of the first and most important start-ups on the internet. The Netscape Navigator web browser was released in 1995 and it became the browser of choice for the users of the time. By November 1998, it had been acquired by AOL which tried unsuccessfully to revive the popularity of the web browser. Ten years later, Netscape was shut down entirely.

ChachaChaCha was a human-guided search engine founded in 2006. The platform provided a valuable service at a time when traditional search engine algorithms were unreliable and less developed.When algorithms did become sufficiently developed, they provided answers to questions for free and much more rapidly than ChaCha could. The ChaCha business model was also unscalable, with employees overworked as the company tried to stay ahead of innovation.ChaCha’s demise was also compounded by the smartphone, which provided another avenue for consumers to find information. A belated attempt to restructure and cut costs followed, but the company could not service its debt past 2016.MapQuestMapQuest is an American web mapping service and was the first route-finding service to be launched online in 1996. Despite the first-mover advantage and the acquisition by market leader AOL, MapQuest was sold off for an undisclosed sum in 2007.MapQuest faced intense competitive pressure from Google and its large and consistent investment in Google Maps. For whatever reason, AOL was not willing to devote the same amount of time and money to developing MapQuest.MapQuest’s list of static driving directions paled in comparison to a smartphone with global positioning technology. Both Google Maps and Apple Maps were also factory installed on smartphones, increasing their uptake.Sports Authority Sports Authority was an American sports retailer founded by a group of venture capitalists and founding executives in 1987. Increasingly burdened by debt, the company filed for bankruptcy in 2016.Sports Authority experienced intense competition from big-box retailers and eCommerce giants. Its tired stores and high prices could not compete with online shopping.Sports Authority also could not identify and then capitalize on trends. This was due to a combination of poor corporate leadership and insufficient investment capital.WeWorkWeWork is a commercial real estate company providing shared workspaces for tech start-ups and other enterprise services. It was founded by Adam Neumann and Miguel McKelvey in 2010. WeWork’s business model was built on complex arrangements between the company and its landlords. There were also several conflicts of interest between Neumann and WeWork which provided the impetus for the failed IPO and significant devaluation that would follow.

ConcordeConcorde was a supersonic passenger airliner jointly developed and manufactured by Sud Aviation and the British Aircraft Corporation (BAC). After more than three decades in the sky, the entire fleet was retired in 2003.Concorde was not a commercially viable aircraft. The presence of a sonic boom limited its routes to those occurring over the open ocean. It was also heavy on fuel which made Air France and British Airways vulnerable to price hikes.Concorde’s fate was sealed by a fatal crash in 2000 and the September 11 terrorist attacks the following year. A collapse in the first-class market and consumer avoidance of air travel exposed the aircraft’s lack of commercial viability.XeroxXerox is an American corporation selling print and digital document products in 160 countries around the world. The company was founded in 1906 by Joseph C. Wilson and Chester Carlson. Xerox was visited by Steve Jobs in 1979 who gained access to PARC in exchange for Xerox receiving shares in Apple. He then purchased the rights to a Xerox GUI and used it to produce the Apple Macintosh. Xerox myopic focus on its photocopier business, an organization skewed toward sales and marketing, and that might have lost the focus on product slowly lost its market leadership.

CommodoreCommodore was an American manufacturer of home computers and electronics. The company, which was founded by Jack Tramiel and Manfred Kapp, was a major player during the burgeoning PC market of the 70s, 80s, and early 90s. Commodore failed to keep pace with advancements in personal computing, which opened the door for IBM and Apple. This lack of innovation was no doubt caused by the appointment of a CEO who cut research and development funds to almost nothing.

Circuit CityCircuit City is an American consumer electronics retailer originally founded by Samuel S. Wurtzel in 1949. The company filed for bankruptcy in 2009 after being an industry leader for decades. Circuit City suffered from complacent management who also made poor decisions. Many Circuit City stores were outdated and in poor locations. Stores were also staffed with salespeople pushing high-margin products at a time when consumers were moving toward cheap, low-margin products.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post 25 Incredible Stories Of Business Failures appeared first on FourWeekMBA.

July 16, 2021

What happened to ChaCha?

ChaCha was a human-guided search engine founded by Brad Bostic and Scott A. Jones.

When ChaCha was launched in 2006, Facebook was in its infancy and Google was just beginning to assert itself as the dominant search engine.

However, ChaCha offered something different. The search engine gave its uses the ability to interact with a real person who would then manually search the internet on their behalf. This was a useful service in 2006 because search engine algorithms were far less adept at serving up relevant results.

At its peak, 55,000 employees were answering nearly 600,000 questions a day on the platform. But after one decade in operation, ChaCha ceased operations in December 2016.

Let’s take a look at the series of events that crippled this once popular service.

Search engine evolution and advertisingAs search engines became better at delivering accurate search results, there was less need for users to hire others to find information for them.

When Google released its Panda algorithm update in 2011, ChaCha and similar sites such as Ask.com were relegated to the second or third page of search results. Voice-activated services such as Siri also contributed to the problem through increased competition.

As the ChaCha business model became increasingly obsolete, users became accustomed to finding their information through a simple Google search. Google returned results instantaneously, a benefit ChaCha could never replicate.

Advertising revenue fell as advertisers migrated to a search-engine-based pay-per-click (PPC) model.

Scaling and culture problemsFrom a financial point of view, the ChaCha business model was difficult to scale. The company did expand into the United Kingdom in 2011 but shut down operations after just eight months.

Subjective topics such as politics and religion were difficult to answer efficiently. What’s more, ChaCha employees with expertise on these sorts of topics were not paid enough to make their time worthwhile.

This created a poor company culture where employees became frustrated at the long working hours. Frustration also grew as the company consistently pivoted to stay ahead of innovation and fluctuating consumer preferences. Disgruntled employees would later note that the company never progressed beyond the start-up phase.

Smartphone innovationChaCha was also disadvantaged by the introduction of smartphones with internet functionality.

The consumer shift from ChaCha’s SMS-based answer service to internet search was as rapid as it was devastating.

Restructuring and shutdownWith little advertising revenue to service operations, ChaCha moved from a physical office to a virtual office in the middle of 2015 with a core skeleton crew of around a dozen employees.

Assets were also sold off in a final attempt to meet debt obligations, but the company was ultimately shut down after failing to secure a buyer.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to ChaCha? appeared first on FourWeekMBA.

What happened to MapQuest?

MapQuest is an American web mapping service and was the first such commercial service of its kind.

The history of MapQuest predates mass uptake of the internet by decades, with its origins traced back to the founding of Cartographic Services in 1967. The company initially generated roadmaps for driving enthusiasts and then reimagined itself for the digital age, launching the first online route-finding service in February 1996.

In 1999, the company went public and was acquired in an all-stock deal by AOL for $1.1 billion the following year. MapQuest then became an important addition to AOL’s increasingly dominant search and advertising portfolio.

In October 2019, the service was sold by corporate parent Verizon to System1 in a deal not material enough for Verizon to bother filing paperwork.

So what happened to this once pioneering service? Read on to find out.

Google acquisitionThe beginning of MapQuest’s decline can be traced back to the Google acquisition of a little-known Australian navigation company called Where 2 Technologies.

The acquisition would later become the foundation for Google Maps, released in 2005. Google took the idea of a route-finding service with driving directions and expanded it to include a searchable database of locations. Google Maps was also more interactive than MapQuest because users could drag their cursor over the map to change locations.

What’s more, Google invested heavily in its map service to consistently evolve and develop the service. This was in stark contrast to AOL, which made modest, occasional investments in MapQuest with no apparent future strategy.

By 2007, MapQuest usage declined further after Google removed links to competing mapping sites in its search results. Two years later, Google Maps surpassed MapQuest as the most popular mapping site.

Smartphone usageWhen smartphones became freely available, the portable technology was a perfect fit for those who needed directions on the go. This was enabled after companies began rolling out GPS technology on smartphones in 2004. Once reserved for government and military use, GPS gave citizens access to a wealth of positioning data we now take for granted.

MapQuest, with its static list of driving directions, became inferior almost overnight. Both Google Maps and then Apple Maps were factory installed on smartphones, whereas MapQuest users had to manually download the app.

Furthermore, MapQuest could not match the far more sophisticated offering from Google that warned drivers of construction, road closures, and later traffic congestion.

AOL’s lackluster interest in joining the GPS revolution then sealed MapQuest’s demise.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to MapQuest? appeared first on FourWeekMBA.

What happened to Sports Authority?

Sports Authority was an American sports retailer originally founded by Nathan Gart in 1928.

Gart opened the first store, called Gart Brothers, with $50 in fishing rod samples. Sports Authority as most people know it was founded in 1987 by a syndicate of venture capital groups and several founding executives.

At its peak, the company was the largest sporting goods store in the United States with over 460 stores and 14,000 employees.

In March 2016, Sports Authority filed for Chapter 11 bankruptcy protection with debts topping $1 billion. Proceedings were then converted to Chapter 7 some months later, with Dick’s Sporting Goods acquiring the company’s brand name and intellectual property.

Let’s discuss some of the key factors behind the demise of Sports Authority below.

Competition and brand differentiationSports Authority suffered intense competition from Dick’s Sporting Goods, Walmart, Target, and Amazon, with the latter taking market share away from many big-box retailers.

Competition from omnichannel merchants and individual brands such as Nike was also high. This made it exceedingly difficult for the underdeveloped Sports Authority brand to stand out.

eCommerce presenceAlthough not alone, Sports Authority failed to capitalize on the growing eCommerce movement.

The company was unable to compensate for its lack of online presence with hundreds of physical stores in dire need of a refresh. Customers also complained of high store prices with the company not honoring coupons for popular brands.

As a result, consumers went online to competitors with greater product range, price transparency, and convenience.

Failure to recognize trendsThe company also failed to identify and capitalize on trends.

One example was the so-called “athleisure” trend of casual wear inspired by workout clothing.

Competitors such as Lululemon and Under Armour quickly gained market share, with Dick’s Sporting Goods and Nike joining later. Each company offered a blueprint for success that Sports Authority was not interested in replicating.

Lack of innovative thinkingIn an interview about the downfall of Sports Authority, brand and strategy consultant Lee Peterson was critical of the lack of vision at the corporate level. “Any time you see a company move slowly on trends, it’s usually a lack of leadership, which creates bureaucracy, [which] creates stagnation. I know Sports Authority opened some ‘new look’ stores with interesting names, but when you went inside, there was actually nothing new.”

The lack of forward-thinking limited the company’s ability to identify trends and develop a strong and recognizable brand.

DebtAnother factor that hindered the flexibility of the company was debt.

Through a series of mergers and acquisitions, Sports Authority took on a mountain of debt that it would struggle to repay. In 2006, the company was sold to Leonard Green & Partners. Typical of such a deal, the private equity firm then placed the debt it had incurred in making the purchase back on Sports Authority.

In March 2016, it failed to make a $20 million debt repayment and then declared bankruptcy two months later.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Sports Authority? appeared first on FourWeekMBA.