Gennaro Cuofano's Blog, page 142

November 3, 2021

Why Did Segway Fail? What Happened To Segway

The Segway is a two-wheeled, self-balancing personal transporter invented by Dean Kamen and launched in 2001 as the Segway PT.

The transporter arrived on the scene with much fanfare, with consumers curious and eager to ride a device that looked like it belonged in a sci-fi movie. Upon its release, Kamen believed “the Segway HT will do for walking, what the calculator did for pad and pencil. Get there quicker. You’ll go further.” This, he hoped, would also help the two-wheeled transporter revolutionize the way cities were laid out and how people moved through them.

Just six years later, the PT had achieved only 1% of its sales target. Kamen hoped to sell half a million units per year, but after six years had sold a mere 30,000. The company was later acquired by Ninebot, Inc., with the Chinese robotics start-up announcing it would discontinue production in June 2020.

What went wrong?

Consumer novelty and safety regulationsSteve Jobs famously warned Kamen the Segway’s image could be ruined by a single rider falling off and hurting themselves.

In 2003, press photographers captured President George W. Bush dismounting from his Segway during a family vacation. Piers Morgan, a notable British journalist, also had a fall in 2007 and broke three ribs in the process.

In June 2010, Segway company owner James Heselden died after riding his Segway off a cliff and into a river.

It’s important to note that the Segway was not an inherently dangerous form of transportation. Instead, many who were accustomed to driving cars were simply unaware of the safety gear required to operate a two-wheeled vehicle. Most barely wore a helmet, let alone the protective gear commonly seen on motorcycle riders, for example.

Eventually, transport authorities did step in and enforce certain rules for Segway use.

Poor pricing strategySegway RTs were initially priced at $5,000, a hefty price to pay to avoid walking and equivalent to buying a reliable used car.

Some suggest the company should have offered the Segway on a pay-per-use basis. However, this would have been difficult since smartphones and smartphone apps had yet to achieve critical mass.

ImpracticalityTo some extent, the Segway was impractical. It was small enough to fit inside an elevator, but its 100-pound bulk made it impractical for buildings with stairs.

It also occupied a somewhat awkward gap in the personal transportation market. With most cities designed for pedestrians and large vehicles but nothing in between, there was no infrastructure to support the Segway as a form of mass transportation.

In many countries, it was banned from sidewalks and roads because authorities didn’t know how to classify it.

Early adopters were also called fat and lazy and felt they should have been walking instead. Many consumers considered the Segway to be a device that invited mockery, which no doubt impacted sales and public perception.

Poor market researchLike many products that promise to revolutionize the world, the company ended up releasing an invention and not an innovation.

The RT was kept a secret until launch and there was little if any consideration given to user feedback and testing.

History will also show that the inventors failed to identify a viable target market. This point is related to impracticality and Segway’s failure to identify a compelling reason for a consumer to shell out $5,000.

CompetitionIn 2017, electric scooter companies such as Bird and Lime effectively sealed the fate of the Segway.

The scooters, which are controlled by an app, are a much cheaper (and somewhat safer) form of personal transportation in cities.

Read The Business Failure Book

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Why Did Segway Fail? What Happened To Segway appeared first on FourWeekMBA.

What Happened To Google Glass? How Google Glass Set The Stage For The AR Revolution

Google Glass is a brand of smart glasses with an optical, head-mounted display. Google developed the glasses with the intent to produce a ubiquitous computer allowing the wearer to communicate with the internet via voice commands.

Prototype Google Glass smart glasses were launched in April 2013 for the princely sum of $1,500. Almost immediately, they attracted criticism from consumers who had concerns over their privacy, safety, and cost.

Just two years later, Google announced it would be ceasing production of the consumer version of the glasses. The company then pivoted to the business sector and launched Glass Enterprise Edition for certain workplaces such as factories and surgeries.

Why did the consumer version fail so spectacularly? Read on to find out.

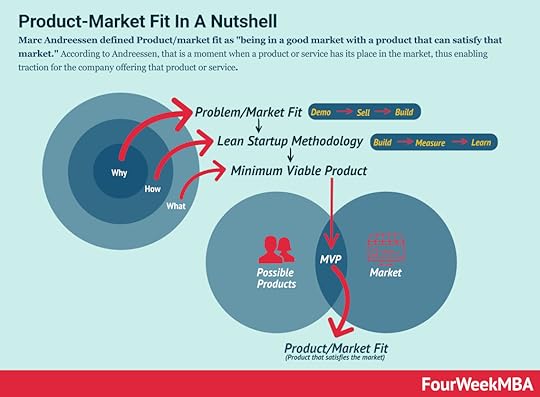

Product-market fit Marc Andreessen defined Product/market fit as “being in a good market with a product that can satisfy that market.” According to Andreessen, that is a moment when a product or service has its place in the market, thus enabling traction for the company offering that product or service.

Marc Andreessen defined Product/market fit as “being in a good market with a product that can satisfy that market.” According to Andreessen, that is a moment when a product or service has its place in the market, thus enabling traction for the company offering that product or service.Google Glass failed as a product because its inventors neglected to do the proper research on its potential users and the market more generally. Instead of developing a product that would solve user problems, they believed the glasses would sell on hype and revolutionary technology alone.

Poor product development was exposed by the early adopters who could not identify any meaningful benefits to wearing the glasses. What’s more, the glasses were not technologically advanced enough to warrant regular use and Google had not determined whether they were comfortable to wear for long periods.

CompetitionGoogle had lofty ambitions to augment reality with a touchpad, camera, and LCD or LED display. In truth, however, all the company did was supplement reality.

Ultimately, the sunglasses had a limited battery life of between three to five hours. They were also competing with smart televisions, watches, and speakers that had faster processors, larger capacities, and better cameras.

Stigma and negative publicityGoogle Glass attracted significant criticism after it was discovered wearers could film others covertly.

Some bars and restaurants banned wearers from entry, with the term “Glasshole” coined around the same time. Google then released a statement instructing users to respect the privacy of others and not be creepy or rude, but the damage had been done.

The timing of the negative publicity was also unfortunate since there was also rising distrust around the power of big tech companies at the time.

CostEven the prototype version of the glasses retailed for $1,500 – equivalent to the price of a well-equipped desktop computer.

The high cost of the glasses was exacerbated by the fact that they didn’t perform any function especially well. As a result, those who could afford them were content purchasing a more affordable smartphone without the associated stigma of owning it.

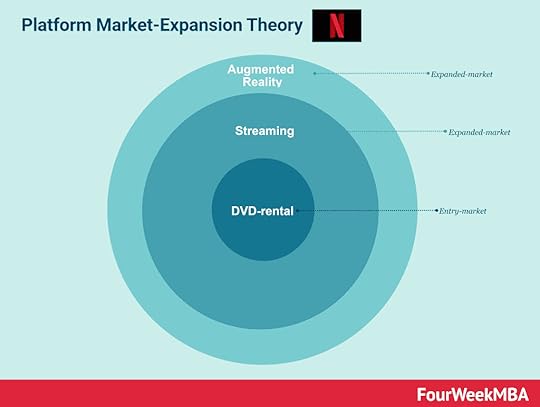

TimingWhile as a company you can innovate, and create new markets. Oftentimes, technologies proceed with the development of complementary innovations. At the time, AR might have been too early to be accepted, given the strong transition from desktop to mobile. In that phase though, mobile won.

Setting the stage for the AR revolutionAugmented reality and virtual reality are taking the center stage, in what has been defined as “Metaverse.”

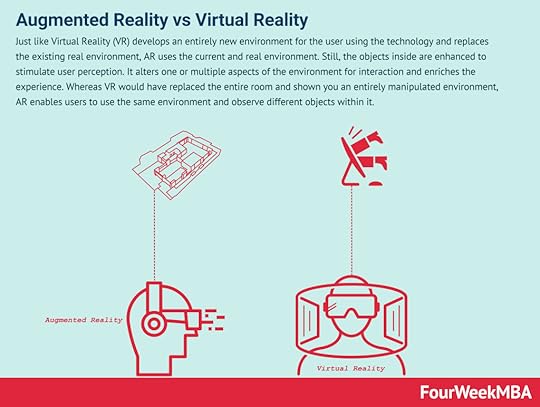

Just like Virtual Reality (VR) develops an entirely new environment for the user using the technology and replaces the existing real environment, AR uses the current and real environment. Still, the objects inside are enhanced to stimulate user perception. It alters one or multiple aspects of the environment for interaction and enriches the experience. Whereas VR would have replaced the entire room and shown you an entirely manipulated environment, AR enables users to use the same environment and observe different objects within it.

Just like Virtual Reality (VR) develops an entirely new environment for the user using the technology and replaces the existing real environment, AR uses the current and real environment. Still, the objects inside are enhanced to stimulate user perception. It alters one or multiple aspects of the environment for interaction and enriches the experience. Whereas VR would have replaced the entire room and shown you an entirely manipulated environment, AR enables users to use the same environment and observe different objects within it.Today these technologies and products might become the next frontier. As companies like Apple dominated the mobile industry. Who’ll be able to tame the next wave will also ride a very large market.

Read The Business Failure Book

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Happened To Google Glass? How Google Glass Set The Stage For The AR Revolution appeared first on FourWeekMBA.

What Happened To Digg? How Digg Failure Brought To Reddit’s Success

Digg is an American news aggregator website founded by Jay Adelson and Kevin Rose in 2004.

Digg was once an extremely successful social platform that disrupted the news industry with a curated front page of popular and shareable web content. Users could vote such content up or down, which Digg called digging and burying respectively.

The platform reached peak popularity between 2006 and 2010, with the site attracting close to 200 million unique visits per year. Independent websites mentioned on the Digg homepage frequently crashed due to the sudden influx of traffic, a phenomenon called the “Digg effect”.

In 2012, however, after a total of 350 million upvotes, the site announced it would be acquired by technology investment company Betaworks. The purchase price of $500,000 was a fraction of the $160 million Digg was thought to be worth during its heyday.

Let’s take a look at how Digg fell from grace.

The emergence of competitorsThe Digg button, which allowed users to submit a site to Digg, suddenly had competition. The Facebook Like button was launched in April 2010 and could be found on 350,000 sites just five months later.

Around the same time, Digg had to deal with the rapid emergence of social news site Reddit and to a lesser extent, Twitter.

The impact of this extra competition was exacerbated by a Google Algorithm update that same year, which made Digg links less valuable in search result rankings.

User experience issuesFaced with increased competition and declining traffic, Digg decided to act with a now-infamous site redesign in August 2010.

The new design was widely criticized by users because it removed many popular features, including the ability to bury posts, save favorites, post videos, and sort by subcategory. What’s more, the platform became buggy, and users were frustrated that they couldn’t communicate with other users directly. Perhaps most damaging of all, the updates were implemented without any regard to user feedback.

This alienated Digg’s user base and caused mass migration to Reddit in particular, which maintained user trust by remaining consistent throughout.

Platform abuseDigg’s reputation as a democratic news service where everyone could submit links and vote quickly devolved into an oligarchy of power users.

Each of these power users had a disproportionate influence on votes because of their large and devoted following. Whenever they submitted a link to Digg, their followers would game the system by populating the front page with their content.

Investor pressure to make Digg profitable also resulted in the essence of the platform being abused. The platform removed popular features to copy the business model of more profitable websites. Decision-makers also changed the ranking algorithm when the site was redesigned so that corporate-sponsored articles were published on the home page.

Sale and relaunchDigg was sold in three separate parts during July 2012. The Digg Brand, website, and technology were sold to Betaworks, while 15 staff transferred to The Washington Post. Professional network LinkedIn also purchased multiple patents for approximately $4 million.

Betaworks relaunched Digg in 2012 with many of its original features reinstated. However, the platform never recovered as competitors such as Reddit took most of the market share.

Six years later, Digg was acquired by advertising company BuySellAds.com for an undisclosed amount.

How Digg failure set the stage fro Reddit’s successAs Digg failed, Reddit took off. The platform has become among the most popular social network of our times, thanks to the ability to have subcommunities create their own digital environments so that users could freely express themselves.

Reddit is a social news and discussion website that also rates web content. The platform was created in 2005 after founders Alexis Ohanian and Steve Huffman met venture capitalist Paul Graham and pitched the company as the “front page of the internet.” Reddit makes money primarily via advertising. It also offers premium membership plans.

Reddit is a social news and discussion website that also rates web content. The platform was created in 2005 after founders Alexis Ohanian and Steve Huffman met venture capitalist Paul Graham and pitched the company as the “front page of the internet.” Reddit makes money primarily via advertising. It also offers premium membership plans.  Some people find marketing on Reddit very outdated and obsolete, yet where Facebook and Instagram are today’s traditional marketing channels, Reddit has the nature of being unconventional amongst them. Reddit can be a great viral channel to cheaply amplify your brand and fill the top of the funnel.

Some people find marketing on Reddit very outdated and obsolete, yet where Facebook and Instagram are today’s traditional marketing channels, Reddit has the nature of being unconventional amongst them. Reddit can be a great viral channel to cheaply amplify your brand and fill the top of the funnel.Read The Business Failure Book

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Happened To Digg? How Digg Failure Brought To Reddit’s Success appeared first on FourWeekMBA.

What is Web3? Web3 In A Nutshell

Web3 describes a version of the internet where data will be interconnected in a decentralized way. Web3 is an umbrella that comprises various fields like semantic web, AR/VR, AI at scale, blockchain technologies, and decentralization. The core idea of Web3 moves along the lines of enabling decentralized ownership on the web.

Understanding Web3

To better understand Web3, it may be helpful to first describe a little internet history.

The evolution of the internet is often separated into three distinct stages: Web 1.0, Web 2.0, and Web 3.0.

Web 1.0 was the first iteration of the internet, with most users consuming content on websites that contained information in the form of text and images. These sites were served from a static file system and featured low levels of interactivity. Many call Web 1.0 the read-only web.

Web 2.0 is, for the most part, the internet in its current state. This iteration is social and interactive and there are more users creating content as opposed to simply consuming it. Web 2.0 gave rise to several sites that were more interactive and built upon user-generated content. Here, content is siloed, centralized, and run by corporations such as Google, Amazon, Facebook, and Airbnb. Web 2.0 is often referred to as the read-write web.

The Web 3.0 era is now beginning to emerge and is a key component in solving many of the problems associated with a centralized Web 2.0. Instead of the internet being controlled by a few organizations, Web 3.0 favors privacy, transparency, data ownership, and digital identity solutions. This functionality is underpinned by decentralized networks, blockchain technology, and a tokenized economy.

What are the core characteristics of Web3?Though the shift from Web 1.0 is Web 2.0 is relatively simple to define, the shift from Web 2.0 to Web 3.0 is less clear.

To provide clarity on Web 3.0, consider the following specific innovations and practices that define it:

Semantic web – Web 3.0 improves web technologies to generate, share, and connect content through search and analysis based on an ability to understand the meaning of words. This differs from Web 2.0, which relies on an understanding of keywords and numbers.Artificial intelligence – Web 3.0 is also able to decrypt natural language and understand intention in much the same way humans do. What’s more, it can recognize real information from fake information. This results in faster, relevant, reliable, and more intelligent results which meet user needs.3D Graphics – the third generation of the internet also integrates 3D and VR technologies to blur the line between the physical and digital world. Examples include museum guides, geospatial applications, computer games, and eCommerce product guides.Connectivity – information within Web 3.0 is more connected via semantic metadata, enabling the user experience to be enhanced by leveraging all available information.Ubiquity – in the Web 3.0 era, the internet is accessible to everyone, everywhere, all of the time. At some future point, internet connectivity will no longer be restricted to Web 2.0 devices such as computers and smartphones. Internet of Things (IoT) will facilitate the creation of novel types of connected devices.Web3, decentralization, and Blockchain[image error]A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.The desire for decentralization started to grow after users on centralized networks began to fear for the privacy of their personal data. At more or less the same time, the popularity of Blockchain and cryptocurrency also began gathering momentum.

As a result, Blockchain in the Web 3.0 era incorporates the five characteristics mentioned in the previous section on a decentralized, peer-to-peer network. Using Blockchain technology and its immutable encrypted data, the need for centralized corporate operators is made redundant.

The Ethereum platform is currently the Blockchain platform most closely resembling the characteristics of Web 3.0.

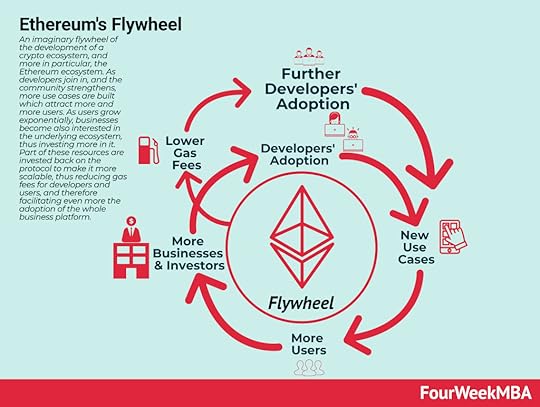

An imaginary flywheel of the development of a crypto ecosystem, and more in particular, the Ethereum ecosystem. As developers join in, and the community strengthens, more use cases are built which attract more and more users. As users grow exponentially, businesses become also interested in the underlying ecosystem, thus investing more in it. Part of these resources are invested back on the protocol to make it more scalable, thus reducing gas fees for developers and users, and therefore facilitating even more the adoption of the whole business platform. Key takeaways:Web3 is a version of the internet where data will be interconnected in a decentralized way. It emerged in response to the limitations of a centralized Web 2.0, where a few large corporations control the internet. Web3 is perhaps best described by the specific innovations and practices that define it. These five characteristics include semantic web, artificial intelligence, 3D graphics, connectivity, and ubiquity.Web3 and Blockchain incorporate the five characteristics of a decentralized, peer-to-peer network with immutable and encrypted data. Ethereum is arguably the Blockchain platform embodying most aspects of Web3.

Blockchain Business Models Book

An imaginary flywheel of the development of a crypto ecosystem, and more in particular, the Ethereum ecosystem. As developers join in, and the community strengthens, more use cases are built which attract more and more users. As users grow exponentially, businesses become also interested in the underlying ecosystem, thus investing more in it. Part of these resources are invested back on the protocol to make it more scalable, thus reducing gas fees for developers and users, and therefore facilitating even more the adoption of the whole business platform. Key takeaways:Web3 is a version of the internet where data will be interconnected in a decentralized way. It emerged in response to the limitations of a centralized Web 2.0, where a few large corporations control the internet. Web3 is perhaps best described by the specific innovations and practices that define it. These five characteristics include semantic web, artificial intelligence, 3D graphics, connectivity, and ubiquity.Web3 and Blockchain incorporate the five characteristics of a decentralized, peer-to-peer network with immutable and encrypted data. Ethereum is arguably the Blockchain platform embodying most aspects of Web3.

Blockchain Business Models Book

Read Next: Dissecting Blockchain Business Models, Blockchain Flywheel: Inside Ethereum’s Distribution Flywheel.

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post What is Web3? Web3 In A Nutshell appeared first on FourWeekMBA.

Developing A Business Strategy With The Strategy Lever Framework

Developing a successful business strategy is about finding the proper niche, where to launch an initial version of your product to create a feedback loop and improve fast while making sure not to run out of money. And from there create options to scale to adjacent niches.

Business strategies make sense only in hindsightI have a business mantra that goes along these lines:

Business strategies take years to roll out. Yet when they do, they are obvious only in hindsight.

For the entrepreneurs who roll them out, that is all but a linear process. Rolling out these business strategies is a painful process, which requires a lot of faith in your own gut instinct, and it’s all about sweat, persistence, execution, and stubbornness.

And it all starts by balancing out the short and long term.

Balancing short term survival with long-term (at times) grandiose visionAs Jeff Bezos explained many times over, many decisions seemingly do not make sense in the short term. They do with a long-term perspective. Therefore, as an entrepreneur, it’s critical to balance short and long term.

From here let me give you some examples of how short term and long term are two different creatures, and yet they feed each other:

Profit is different from liquidity: when you run a business, that might seem obvious. But as you see it making the first profits, you might still struggle with profitability. As perhaps your clients’ payment cycles are long or your suppliers’ payment cycles are short. Or both. In other words, getting to profitability is great, but if you don’t have liquidity to invest back into the business, to create options to scale, not much useful for the long run.Being right in the long-term does not guarantee survival: while we all love to be right. If you don’t manage to survive the short-term, that won’t be much needed. Regrets will hunt you down, as you see others successfully executing on your same idea, but with more ability to balance the short term survival to the long-term vision, which leads to the next point. You might have a grandiose vision, but you need reality checks: we all like to think of ourselves as changing the world. For how noble this thought might seem, this also can easily lead to failure. When building up a business, execution takes up most of the effort. Thus, without built-in reality checks (is the product feasable? do people want it? is it adding value to the right people?), it’s easy to fall into the business cimitery.So how to minimize the risk of a bad execution? Let’s build some premises before we can lay down the whole framework.

Action plan: can you hold it in your head? If not, throw it awayBack in 2006, as Tesla was trying to pull off its first model, the Roadster, one thing was clear. The grandiose business plan who had been drafted a few years earlier by Tesla’s co-founders (Elon Musk would become CEO only in 2008) proved quite wrong.

That’s not because the people who drafted it were not smart. On the opposite, they were so smart to be able to put together a complex scenario analysis and have it drafted as a business plan. Yet when execution came, the costs and timing to produce the electric sport’s car were, by far, quite off. This also led to a final internal fight, where the initial co-founders (Martin Eberhard and Marc Tarpenning) were ousted.

In the meantime, in 2006, Musk had drafted a master plan that looked like the following:

Source: Elon Mush Tweet

Source: Elon Mush TweetThis action plan, which was written down but could have been held in mind represented the key steps, took Tesla over fifteen years to roll out! And I’m sure Elon Musk might have rehearsed it over and over, through the years.

The niche is the reality checkFrom a market launch perspective, how do you balance short and long term?

The answer is the niche. Or a subsegment of the market that will enable you to kick off a feedback loop to improve the business quickly. In fact, a “market” is too big to even understand whether your product is making a difference.

I know this might sound trivial. Yet, there is a critical reason why the market niche you pick is so important:

This serves as the center stage to present your product. It helps narrow down the scope of the business, thus make it much much simpler to execute. But most importantly, when you start something new, the most valuable thing to have – to progress fast – is to kick off a feedback loop. When you target too wide market, there is no feedback loop in place. Why? Because the environment you target is so complex, that to understand wheter you’re doing something right or wrong is impossible. That is why a much smaller market segment, is way more simple to tackle. A niche, the smaller it is, the easier to target, to track the progress of your business and trigger “learning feedback loops”.This last point is extremely important to stress. In fact, we can argue that the most valuable asset for our business over time, is a continued “learning feedback loop” where the market is able to tell us what we’re doing wrong, and how we can improve. In a niche market, the audience is small enough to give us this feedback. When the audience is too large and spared, it’s very hard to make any conclusion at all.

Complex systems are fractalsBenoit Mandelbrot who coined the term “fractal” made fractal geometry an incredible tool to describe the real world. A fractal is a sort of pattern that repeats itself at various scales. A great example of that is the cauliflower, a cruciferous vegetable with a very interesting shape. In fact, if you zoom in, you find the same pattern and shape repeated over and over.

I took this picture for you at the local supermarket. This, in particular, is a Roman cauliflower, and as you can see, if you zoom over and over again, you will find a self-repeating pattern. The same shape over and over at various scales. As a sort of Russian Matryoshka doll.

In short, complex systems in the real world are very very irregular. They do look similar at various scales (a neighborhood is made of blocks, a city is made of neighborhoods, a country is made of cities). Yet when things scale up and down, the dynamics change. This is what a complex system means. It’s not about the shape itself, but the size and scale which determine the dynamics of the system.

Why is this important to us, here? A few implications:

Smaller scale is easier to handle, as complex dynamics kick in exponentially at wider scale (you don’t control large, complex systems) Complex systems are mostly perturbated. Therefore, the more you take on a larger market the more you expose yourseful to unknown risks, volatility and therefore chances to fail. A bigger opportunity, but not a reversible one. It’s true there is a much bigger opportunity in a larger market, but there is a point in which you cannot reverse your position. As you get exposed to the largest chunk of the market, you can’t go back. Why? you have structured your whole company to survive in that market, and if that market suddenly changes, srhinks or it’s taken over by another market, the company might collapse.These are all things you need to be aware of when creating options to scale.

Create options to scaleAs you take over a niche, at that point you have options to scale. It’s worth highlighting that scaling to a certain extent can be a great way to grow your business. Yet, as you scale, once a critical mass is reached, everything will change. The wider the market, the less control you will have on it, and the more fragile your business might become.

From here it makes sense to adopt a transitional business model framework.

Transform the business at each stage (Transitional Business Modeling)As we’ll see later on, a transitional business model is a “temporary business model” that is executed to tackle various stages of growth. The premise that matters here is that as you move from a transition to the next, your whole business model changes, and this, in turn, might require a completely different business midnset.

Inside the Strategy Lever FrameworkThe strategy lever framework is a five-step tool to go from niche, to option to scale. This exercise can be done as a thought experiment, so that you can pretty much hold it in your mind, without having to write down dozens of pages of a business plan.

The whole logic behind the framework is that of unlocking options to grow further, by conquering adjacent niches.

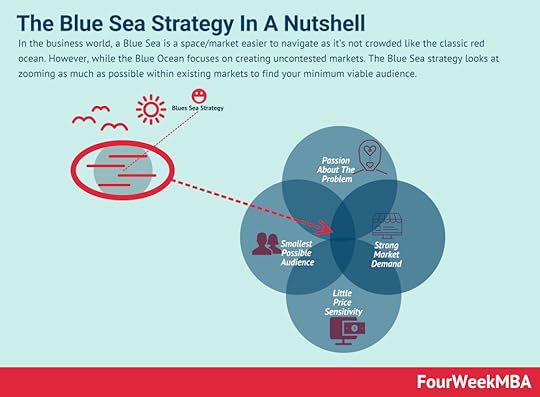

Start with a Blue Sea StrategyWhat I defined as a “Blue Sea Strategy” moves in the opposite direction than a “Blue Ocean Strategy.”

Where in the Blue Ocean strategy the trade-off between value and cost is removed, by offering much more value at lower cost, thus creating a new uncontested (potentially huge) market.

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.In a Blue Sea Strategy, we start from the opposite premise. Even if you’re launching an innovative product. You want to start from a very small niche of the market and charge a premium.

Why? First, as you’re building the initial version of the product, that might turn out to cost way more than you imagined. Second, by targeting a very small segment of the market you are adding value where existing (large) players can’t. Third, the niche will give you feedback and will work as the foundation to move to adjacent niches.

As you move to these niches, the new uncontested market will build bottom-up, and organically.

Read: Blue Sea Strategy.

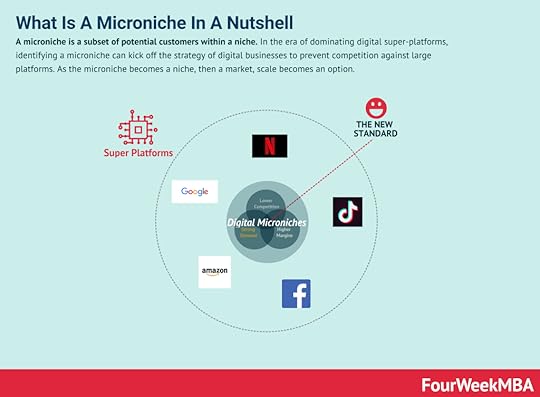

Niche down (From Niches to Microniches)Thus the first question is about identifying a niche where your product might be successful.

If you target a microniche, things get even better.

A microniche is a subset of potential customers within a niche. In the era of dominating digital super-platforms, identifying a microniche can kick off the strategy of digital businesses to prevent competition against large platforms. As the microniche becomes a niche, then a market, scale becomes an option.

A microniche is a subset of potential customers within a niche. In the era of dominating digital super-platforms, identifying a microniche can kick off the strategy of digital businesses to prevent competition against large platforms. As the microniche becomes a niche, then a market, scale becomes an option.Read: Niche, Microniche.

Identify a Minimum Viable AudienceFrom there you got to identify a Minimum Viable Audience.

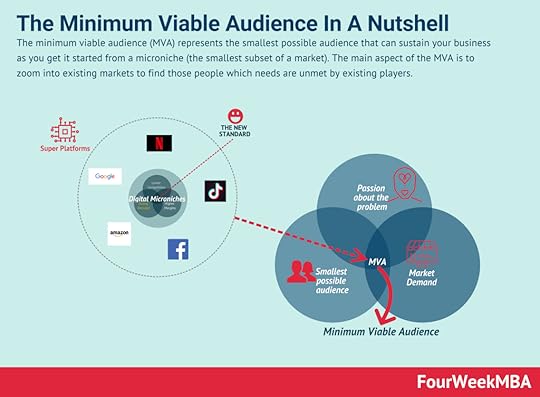

The minimum viable audience (MVA) represents the smallest possible audience that can sustain your business as you get it started from a microniche (the smallest subset of a market). The main aspect of the MVA is to zoom into existing markets to find those people which needs are unmet by existing players.

The minimum viable audience (MVA) represents the smallest possible audience that can sustain your business as you get it started from a microniche (the smallest subset of a market). The main aspect of the MVA is to zoom into existing markets to find those people which needs are unmet by existing players.Read: Minimum Viable Audience.

Move to adjacent nichesWhen Jeff Bezos started Amazon, started Amazon, as he did market research, he found various categories that worked well to prove the business concept. As Jeff Bezos pointed out back in 1997, “there are more items in the book category than any other category by far,” with over three million different books worldwide at the time. Only Music was number two.

Thus, as Amazon became the most successful online bookstore, it then moved to music.

Amazon of the early years, therefore, used this rollout where it moved to adjacent niches, where the know-how developed, made sense, and can be used to scale them faster.

Unlock scaleThis connects to the business scaling process, highlighted next.

Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale.

Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale. Read: Business Scaling.

Main Free Guides:

Business ModelsBusiness StrategyMarketing StrategyBusiness Model InnovationPlatform Business ModelsNetwork Effects In A NutshellDigital Business ModelsThe post Developing A Business Strategy With The Strategy Lever Framework appeared first on FourWeekMBA.

November 1, 2021

Amazon Third-Party Sales vs. First-Party Sales

Since the late 1990s Amazon started to enable third-party stores to sell on the platform. This strategy enabled Amazon to improve the variety, reduce prices and further expand into more categories.

As Jeff Wilke, CEO, Amazon Worldwide Consumer highlighted:

Amazon’s mission is to be Earth’s most customer-centric company. Among the customers we’re focused on are small businesses and entrepreneurs. As we work to help them grow their businesses, we are making big investments: in our delivery network, data centers, AI research, robotics. Since 2011, we’ve invested tens of billions to help SMBs succeed working with Amazon. Amazon is inspired by the type of courage and inventiveness that makes entrepreneurs tick. And our customers benefit from the products, books, videos and skills they produce. We salute the millions of entrepreneurs, creators, and developers around the world whose impressive efforts are summarized in this report.

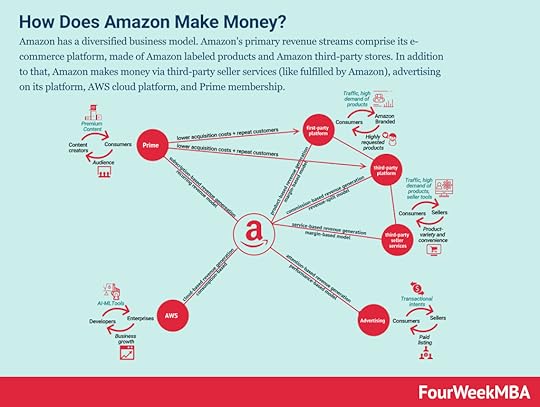

Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership. All you have to know about Amazon:

Amazon Business ModelHistory of AmazonRegret Minimization FrameworkSuccessful Types Of Business Models What Is Business Model Innovation And Why It MattersWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A NutshellThe post Amazon Third-Party Sales vs. First-Party Sales appeared first on FourWeekMBA.

Website Flipping: A Comprehensive Guide

Website flipping is a business activity where existing web properties are purchased to scale them further up. Similar to real estate flipping, where a physical property is bought to resold at a premium after having repurposed it for the market. Website flipping, therefore, enables to scale existing web properties, thus generating a profit by scaling them up further.

Why it makes sense to buy existing websites?All things considered, it’s a pretty great time to be an entrepreneur. The concept of the self-made millionaire used to be something of a joke, with those singled out as success stories generally coming from wealthy backgrounds or having benefited from great fortune in some other sense — today, though there’s still some fortune required, it’s relatively minimal.

In fact, let’s run through the basic things you need to pursue your entrepreneurial ambitions (aside from food and water, naturally): a computer, a smartphone, and internet access. You could work solely through a smartphone in a pinch, and use Starbucks Wi-Fi if necessary. So there’s no reason why one person with a decent smartphone couldn’t hit it big.

Throughout the rich digital world, there are numerous options for the aspiring entrepreneur (you can read about a decent selection of them here), but in this piece, we’re going to look at one in particular: website flipping.

Much akin to a cross between stock trading and real-estate investment, website flipping provides the convenience of the former with the reassuring reliability of the latter. Instead of buying and selling conventional assets, you buy and sell entire websites, sprucing them up and moving them along at a profit.

So if you’re interested in giving it a try, how should you go about it? Where should you shop, and how should you choose the websites to buy? Let’s go through it all.

Where can you buy or sell a website?While of course, you can independently arrange the purchase or sale of a website (as we’ll see understanding the deal flow, and how the private market works, beyond marketplaces is critical). We’re going to list a few market places, as it’s generally easiest to get started from there. However, over time, it’s best developing your own sense of business, by either developing a private network that informs you when good deals are out there.

Or, perhaps identifying opportunities through market research, and contacting directly potential sellers.

Let’s see some options out there.

Empire FlippersDespite the name, Empire Flipping isn’t about flipping empires — just websites. All sellers are vetted to ensure that their stores have stable and verified histories, and their sites are initially listed by average monthly profit to give you an idea of possible performance. You don’t need to speak to buyers or sellers directly, because the site staff will handle it for you, and each buyer must first make a deposit to demonstrate commitment. There’s even a valuation tool if you want to get an idea of what your site may be worth.

FlippaAs the marketplace with the most awareness in the field of website flipping, Flippa is an extremely popular choice, and for a good reason. The selection is strong, website sales hit around $5m each month, and you can even dip your toe into the app world since that’s also an option. And with a success fee of between 12 and 15 percent, it’s often cheaper than Empire Flippers (with a set fee of 15 percent).

Exchange MarketplaceA relatively-new contender, Exchange Marketplace has some notable characteristics that set it apart from the other marketplaces. Two in particular: it only accepts or offers stores running on Shopify, and it doesn’t charge any fees. Because it’s a Shopify project, the profit comes from keeping people on the Shopify platform. No further charge required. Something useful about Exchange is that it allows the narrowing of the selection by type or even location (e.g., profitable Nevada businesses for sale) — it might not seem significant where a store is supposedly based, but it is, particularly given the impending changes to state-determined sales tax regulations.

eBayYes, it’s true — you can buy or sell a website through eBay. Should you, though? Well, if you’ve ruled out the three previous options for whatever reason, it might be worth a look before you start checking out more niche marketplaces. That’s because eBay might be full of spam but that’s really because it’s full of everything. Given its broad inventory, it certainly warrants a glance before you rule it out entirely.

If none of these marketplaces seems a good fit for your needs, it’s best to consult entrepreneurs who operate in your preferred niche. Where do they buy/sell sites? Look for relevant subreddits, Facebook groups, and Twitter conversations — make some online connections and start asking questions. You’ll find that people will be happy to help.

What makes a website worth buying?Whichever marketplace you ultimately decide to use, the hardest part is choosing a website to buy. You want something that already works well enough can be updated somewhat to drive up the sales and is likely to hold its value (at least for a little while). Let’s look at some examples of how you can get this wrong:

If you buy a website that hasn’t been set up correctly, then you’ll need to fix it before you even think about making other alterations. Once you reach that point, you might as well have built a new site from scratch and saved the purchase money.If you buy a website that is already optimized, you won’t have much room to improve it — and if you can’t make improvements, you can’t sell it on for a healthy profit.If you buy a website that’s focussed on a fad or something seasonal, its value is likely to diminish over time (or by the month) regardless of what you do. Think about how much money there was in fidget spinners when they first hit the market, and how profitable they are today — still performing, but not even close to that massive level.If you’ve selected one of the top marketplaces we looked at (the first three, really), then you can trust in the accuracy of the financial information provided for a listing — but interpreting it is up to you. You may be familiar with the warning of “past performance is not a guarantee of future success,” as some version of it will crop up for any trading advice service, and it certainly applies here.

It isn’t enough simply to know that a website has been successful before. If you don’t know how that success was achieved, you might struggle to replicate it. Sometimes people sell websites because they just want to move on to pastures new, but sometimes they’re fortunate enough to luck into some early success and try to exploit that success to pass their sites off as being more stable as they really are.

Ideally, each site you buy should offer each of the following:

An up-to-date platform. There’s the aforementioned Shopify, or WooCommerce (on WordPress), or BigCommerce, or Magento, or… well, there are numerous viable options. It just isn’t a good idea to buy a site that runs on old software, because you might have issues updating.Historic transparency. Can you see what the revenue has been for at least the last year (or the entire lifetime of the site, whichever is shorter)? And has the seller commented on why they’re selling? Do you believe their explanation?Evergreen relevance. Cosmetics will sell at any time of year, but Halloween masks won’t. Unless you plan on waiting for 12 months, it isn’t too sensible to buy a Halloween store at the beginning of November.A thriving industry. You don’t want to grab a website that operates in a niche that’s losing ground, because the value is inevitably going to decline. Pick something solid.No operational demands. Turnkey sites that use dropshipping for any product sales might have low-profit margins, but they’re easy to keep running. Getting something with an actual inventory would likely end up being more trouble than it was worth.If you can pick up a suitable site, you’ll have a great foundation upon which to build. What comes after that is up to you. You can focus on driving some sales to improve the record and raise the value, or you can adjust the style and product range to make it a more well-rounded site for whichever person ends up buying it from you.

Become an acquisition entrepreneur Acquisition Entrepreneurship (AE) starts by buying an existing business instead of starting one from scratch. Therefore, an acquisition entrepreneur masters the process of acquiring existing businesses to shorten the path to success. In short, the acquisition entrepreneur thinks like an investor in the process of buying an existing business and acts as a CEO once the deal has been closed and he needs to run the company to bring it to the next level.

Acquisition Entrepreneurship (AE) starts by buying an existing business instead of starting one from scratch. Therefore, an acquisition entrepreneur masters the process of acquiring existing businesses to shorten the path to success. In short, the acquisition entrepreneur thinks like an investor in the process of buying an existing business and acts as a CEO once the deal has been closed and he needs to run the company to bring it to the next level.When I interviewed Walker Deibel, an entrepreneur, investor, advisor and the author of the book “Buy Then Build” he told me that to be a successful acquisition entrepreneur you needed to avoid these pitfalls:

Lack of urgency: As he explained “the number one reason in my view, why that never ends up working out is because they don’t work with a sense of urgency. They believe that everyone who is selling, they know something destructive to the business and they’re trying to unload it really quickly.”Accusatory mindset: and he also emphasized “nine times out of ten (businesses on sale are not getting unloaded). Usually, someone who has built something ofvaluethey eventually want to sell it. And so a lot of times you get the first question from a first-time buyer, and that’s “Well, why are they selling?” And it’s this sort of accusatory question.”Walker Deibel explained:

The truth is that if you’re an entrepreneur and you start abusiness, and you start this thing from scratch. It’s hard, its hard work and then the second year if you’re one of the lucky ones, yourbusinessgrows, whatever, 200% over the year before.

The next year it grows another 200% the following year it grows 100%. The year after that it grows 50%, the year after that it grows like 20%, and you’re like “I don’t even know what to do with this anymore.”

Right? It sort of “I’ve done with it all that I can.” And I’ve run my course and not only that, but I’m an entrepreneur.

So, I need to kind of move on and do my next thing, and it’s a great opportunity for an acquisition entrepreneur to come in. Presumably, use a bit of leverage to get an outstandingROIon it.

Jump in, take over, and create thebusinessthat they want intending to take thatbusinessto the next level — all the while getting theROI of the equity build up as well. So,number one is that they put way too much weight on the reason for selling.

One thing, of course, is to make sure you do your homework and due diligence:

You need to understand the due diligencemodel; you need to understand why it’s working. You need to figure out if this is the right fit for you, but be patient.The negatives will turn up because there is an appropriate time, and that’s immediately following the letter of intent.

Once done that, these are the primary steps:

Create a sense of urgency. Pitch the seller. Go after a great opportunityDevelop a growth mindset.Do not start from the marketplaces. The R Cubed Acquisition Model Thras.io follows an acquisition entrepreneurship template, by surfing the Amazon third-party ecosystem. The company acquires Amazon sellers’ businesses and it scales them up. It follows a fast acquisition template to offer an exit to Amazon sellers. Thras.io also follows a multi-brand and multi-product strategy, focused on consumer-brands.

Thras.io follows an acquisition entrepreneurship template, by surfing the Amazon third-party ecosystem. The company acquires Amazon sellers’ businesses and it scales them up. It follows a fast acquisition template to offer an exit to Amazon sellers. Thras.io also follows a multi-brand and multi-product strategy, focused on consumer-brands.Another option to become good at acquiring businesses is to leverage on the Thras.io R Cubed model.

This is well suited for those that want to buy FBAs (third-party stores on top of Amazon), and as Thras.io explains it’s based on a few key steps:

As Ken Kubec from the Thras.io team highlighted, the company starts with a broad research approach, and it starts narrowing it down to what they call the R Cubed (Reviews, Rating and Rank).

And from there, they start asking questions with a drill down approach, starting from the reviews:

Do they have reviews that should establish them as a leadership position?

If so, it goes a level down and look at product/rating:

Do they have their rating, the product quality to back up and sustain their position?

And lastly, about ranking:

...and then rank: are they ranking organically on high keyword volume?

Thras.io looks at what they call “simple everyday hard-good objects.”

The buying process is primarily focused on businesses which revenues span from 1-30 million dollars, and that are private labels.

Thras.io also looks for Amazon businesses with a lower amount of SKUs (fewer products but more sales). Indeed, for Thras.io the most valuable businesses are those that hit over a million in sales with the fewer SKUs.

Do you need other ideas to make money? Below a list of ideas with low cost and high profit we found for you:

Become a bloggerBecome an online instructorBecome a professional photographerBecome a ghostwriterBecome a Chatbots makerBecome an affiliate marketerBecome a career coach, resume writer or LinkedIn profile writer Become a business development contractorBecome an infopreneur Become an SEO consultantBecome a contractor headhunterResources for your business:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkHandpicked popular case studies from the site:

The Power of Google Business Model in a NutshellHow Does Google Make Money? It’s Not Just Advertising!How Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedHow Does Spotify Make Money? Spotify Business Model In A NutshellThe Trillion Dollar Company: Apple Business Model In A NutshellDuckDuckGo: The [Former] Solopreneur That Is Beating Google at Its GameThe post Website Flipping: A Comprehensive Guide appeared first on FourWeekMBA.

Regret Minimization Framework In A Nutshell

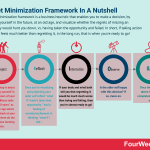

A regret minimization framework is a business heuristic that enables you to make a decision, by projecting yourself in the future, at an old age, and visualize whether the regrets of missing an opportunity would hunt you down, vs. having taken the opportunity and failed. In short, if taking action and failing feels much better than regretting it, in the long run, that is when you’re ready to go!

The Regret Minimization Framework Explained By Jeff BezosThe regret minimization framework has been made popular by Jeff Bezos. Indeed, in many interviews over the years he has highlighted over and over again, how this framework helped him make a decision (that of leaving Wall Street) which, with hindsight was an incredibly successful one.

How did he get to the decision? In a “60 Minutes” interview, from 1997, Jeff Bezos explained:

I want to have lived my life in such a way that when I’m 80 years old I’ve minimized the number of regrets that I have

Thus, when the journalist highlighted, that was not a “Carpe Diem” moment (a moment driven by instinct, rather than reason) Jeff Bezos stressed out:

I don’t go in for Carpe Diem, I go in for regret minimization framework!

As Jeff Bezos further explained in another interview, as he recounted the whole story:

I went to my boss and said to him you know I’m going to go do this crazy thing and I’m going to start this this company selling books online and this is something that I’d already been talking to him about in a sort of more general context.

And he continued:

But then he said “let’s go on a walk” and we went on a two-hour walk in Central Park in New York City. And the conclusion of that was this he said “you know this actually sounds like a really good idea to me but it sounds like it would be a better idea for somebody who didn’t already have a good job.”

Thus, Jeff Bezos’ boss tried to persuade him. Yet, as Bezos recounted:

And he convinced me to think about it for 48 hours before making a final decision. And so I went away and and and was trying to find the right framework in which to make that kind of big decision. And you know I already talked to my wife about this and she was very supportive. And said “look you know you can count me in 100% whatever you want to do.”

However, as Bezos pointed out this was not the “implicit deal” they had as they got together:

True she had married this kind of you know, fairly stable guy in a stable career path. And now he wanted to go do this crazy thing but she was 100% supportive. So it really was a decision that I had to make for myself.

In that process the idea came:

And the framework I found which made the decision incredibly easy was what I called – which only a nerd would call – a regret minimization framework. So I wanted to project myself forward to age 80 and say okay now I’m looking back on my life I want to have minimized the number of regrets I have.

How did he know?

And you know what I knew that when I was 80 I was not going to regret having tried this. I was not going to regret having wanted trying to participate in this thing called the Internet. That I thought was going to be a really big deal.

I knew that if I failed I wouldn’t regret that. But I knew the one thing I might regret is not ever having tried and I knew that that would hunted me every day. And so when I thought about it that way, it was an incredibly easy decision. And I think that’s a very good. It’s if you can project yourself out to age 80 and think what will I think.

At that time it gets you away from some of the daily pieces of confusion. I left this Wall Street firm in the middle of the year when you do that you walk away from your annual bonus. And that’s the kind of thing then the short-term can confuse you, but if you think about the long-term then you can really make good life decisions that you won’t regret later.

This short vs. long-term decision-making model would actually become the basis for the whole of Amazon’s philosophy. In fact, as the company listed back in 1997, within its shareholders’ letter, in a paragraph entitled “It’s All About the Long Term” Jeff Bezos explained:

We believe that a fundamental measure of our success will be the shareholder value we create over the long

term. This value will be a direct result of our ability to extend and solidify our current market leadership position. The stronger our market leadership, the more powerful our economic model. Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital.

Our decisions have consistently reflected this focus. We first measure ourselves in terms of the metrics most

indicative of our market leadership: customer and revenue growth, the degree to which our customers continue to purchase from us on a repeat basis, and the strength of our brand. We have invested and will continue to invest aggressively to expand and leverage our customer base, brand, and infrastructure as we move to establish an enduring franchise.

To be sure, after almost 25 years, in 2021, as Jeff Bezos passed the baton to Andy Jassy, as the company’s CEO, he highlighted in October 2021:

We’ve always said that when confronted with the choice between optimizing for short-term profits versus what’s best for customers over the long term, we will choose the latter—and you can see that during every phase of this pandemic.

Let’s break down the regret minimization framework so that you can use it too!

Breaking down the Regret Minimization FrameworkLet’s now break down the main thinking phases, through which a decision can be made within the regret minimization framework. We can do that through five steps, which we summarized as “PRIOR” from the Latin “precede” as the framework that precedes the final decision.

ProjectThe first step is about projecting yourself in the final years of your life. Jeff Bezos talks about “80 years” as this is the age where you think back at your life, and where all the regrets come hunting you.

ReflectOnce you’re visualizing and projecting your older self. Start reflecting “what if I hadn’t taken that opportunity.” You will notice two feelings: that of regret for not having taken it, and a feeling of anxiety/excitement in thinking “what if I fail.”

At this stage, the “what if I fail” is the short-term consequence, balanced out with “how much would I regret.”

While Jeff Bezos recounts this framework as “rational” in reality, you got to feel what’s right at that moment. Thus, internalize.

InternalizeIf your body and mind both tell you that regretting it would be much much worse than trying and failing, then you’re almost ready to go!

ObserveIs the older self happy with this decision? If so, move on.

ReactOnce the process above has been completed you got to act!

All you have to know about Amazon:

Amazon Business ModelSuccessful Types Of Business Models What Is Business Model Innovation And Why It MattersWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A NutshellThe post Regret Minimization Framework In A Nutshell appeared first on FourWeekMBA.

October 31, 2021

Amazon Revenues: How Amazon Revenue Model Evolved Over The Year

Amazon’s revenue model starts from its online stores, and it moves along other segments, such as third-party seller services (where Amazon takes care of fulfillment for third-party sellers on the platform), Amazon Prime, and Amazon subscriptions.

All you have to know about Amazon:

Amazon Business ModelSuccessful Types Of Business Models What Is Business Model Innovation And Why It MattersWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A NutshellThe post Amazon Revenues: How Amazon Revenue Model Evolved Over The Year appeared first on FourWeekMBA.

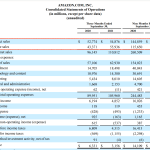

Amazon Q3 2021 Financial Snapshot

Amazon reported net sales of over $332 billion in the first nine months of 2021. Distributed across product sales (over $170 billion) and services (over $162 billion). Reporting over $19 billion in net income in the same period. The fastest growing segment was the advertising business, with a 50% year over year growth (at over $8 billion in Q3), followed by AWS, and subscription services (Prime). Online stores grew by 3% at over $49 billion, and third party seller services also grew by 19% year over year at over $24 billion.

Amazon reported net sales of over $332 billion in the first nine months of 2021. Distributed across product sales (over $170 billion) and services (over $162 billion). Reporting over $19 billion in net income in the same period. The fastest growing segment was the advertising business, with a 50% year over year growth (at over $8 billion in Q3), followed by AWS, and subscription services (Prime). Online stores grew by 3% at over $49 billion, and third party seller services also grew by 19% year over year at over $24 billion. Amazon’s CEO, Andy Jassy highlighted:

We’ve always said that when confronted with the choice between optimizing for short-term profits versus what’s best for

customers over the long term, we will choose the latter—and you can see that during every phase of this pandemic

He also highlighted:

In the first several months of COVID-19, Amazonians played an essential role to help people secure the requisite PPE, food, and other in-demand items needed, and we worked closely with businesses and governments to leverage AWS to maintain business continuity as they responded to the pandemic. Customers have appreciated this commitment, which is part of what’s driving this past quarter’s AWS growth acceleration to 39% year over year; but, it’s also driven extraordinary investments across our businesses to satisfy customer needs—just one example is that we’ve nearly doubled the size of our fulfillment network since the pandemic began. In the fourth quarter, we expect to incur several billion dollars of additional costs in our Consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues and increased freight and shipping costs—all while doing whatever it takes to minimize the impact on customers and selling partners this holiday season. It’ll be expensive for us in the short term, but it’s the right prioritization for our customers and partners.

All you have to know about Amazon:

Successful Types Of Business Models What Is Business Model Innovation And Why It MattersWhat Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive GrowthAmazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”What Is Cash Conversion Cycle? Amazon Cash Machine Business Model ExplainedWhy Is AWS so Important for Amazon Future Business Growth?Amazon Flywheel: Amazon Virtuous Cycle In A NutshellAmazon Value Proposition In A NutshellWhy Amazon Is Doubling Down On AWSThe Economics Of The Amazon Seller Business In A NutshellHow Much Is Amazon Advertising Business Worth?What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model ExplainedJeff Bezos Teaches You When Judgment Is Better Than Math And DataAlibaba vs. Amazon Compared in a Single InfographicAmazon Mission Statement and Vision Statement In A NutshellThe post Amazon Q3 2021 Financial Snapshot appeared first on FourWeekMBA.