Gennaro Cuofano's Blog, page 138

December 2, 2021

What Was The Dot-com bubble? The Dot-com Bubble And Why It Matters To Understand The Evolution Of Tech Business Models

The dot-com bubble describes a rapid rise in technology stock equity valuations during the bull market of the late 1990s. The stock market bubble was caused by rampant speculation of internet-related companies. In part, this was caused by the easily available liquidity in the markets combined with the rise of Internet companies. After the dot-com bubbles, the survived Internet companies learned how to master a leaner playbook.

Understanding the dot-com bubbleThe origins of the dot-com bubble can be traced back as early as 1993 when the first web browsers gave users access to the World Wide Web. Four years later, the percentage of households owning a computer in the United States increased from 15% to 35%. This heralded the beginning of the Information Age, where computer ownership for ordinary citizens transitioned from a luxury to a necessity.

Around the same time, the United States federal government introduced the Taxpayer Relief Act of 1997 to lower marginal capital gains tax. In combination with a decline in interest rates and increased availability of capital, the measure caused individuals to make speculative investments in any dot-com company. Venture capital was readily raised and investment banks encouraged further speculation in technology companies because they benefitted enormously from their IPOs.

Speculation caused share prices to rapidly increase as investors overlooked traditional metrics such as price-to-earnings ratio, debt/equity ratio, and amount of free cash flow. Indeed, the NASDAQ composite index rose 400% between 1995 and 2000 with an unsustainable price-to-earnings ratio of 200.

At the height of the dot-com bubble, instances of private investors quitting their day jobs to trade on the financial market were common. What’s more, it was perfectly feasible for a dot-com company to raise a substantial amount of money through an IPO – even if it had not realized a profit or, in some cases, earned any operating revenue. Many of the employees of these companies became instant paper millionaires in the process.

The bursting of the dot-com bubbleIn an attempt to rein in equity prices, the government raised interest rates three times in 1999 and a further two times in 2000. Following its lead, Wall Street analysts began advising their clients to reduce their exposure in internet stocks because it was no longer undervalued.

The NASDAQ peaked on March 10, 2000, at 5,048. This represented a near doubling of its value over the previous year.

Inevitably, capital began to become scarce as valuations reached astronomical levels. Companies such as Dell and Cisco placed large sell orders on their stocks near the peak, which caused panic selling among investors.

Companies that had held an IPO based on questionable business models or without solid financials quickly burned through their cash and declared bankruptcy.

In October 2002, the NASDAQ had slid to 1,114 – representing a decline of 80%. It would not recapture its previous highs until March 2015.

Though exact figures are difficult to ascertain, it is estimated around 4,800 of the enterprises launched during the boom disappeared, with trillions of dollars in wealth being lost almost overnight.

Key takeaways:The dot-com bubble describes a rapid rise in technology stock equity valuations during the bull market of the late 1990s. The stock market bubble was caused by rampant speculation of internet-related companies.At the height of the dot-com bubble, instances of private investors quitting their day jobs to trade on the financial market were common. Thousands of companies held profitable IPOs despite earning no profit or even revenue in some cases.The dot-com bubble began to burst after interest rates were raised five times between 1999 and 2000. Wall Street analysts, perhaps seeing the writing on the wall, advised investors to lower their exposure to dot-com stocks. The NASDAQ peaked in March 2000 and had lost 80% of its value by October 2002.From the burst of the dot-com bubble a few key companies not only survived but thrived, below some examples:

History of AmazonHistory of Google Amazon Business Model Google Business ModelNetflix Business ModelMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Was The Dot-com bubble? The Dot-com Bubble And Why It Matters To Understand The Evolution Of Tech Business Models appeared first on FourWeekMBA.

What Was The Stock Market Crash Of 1929? The Stock Market Crash Of 1929 In A Nutshell

The Stock Market Crash of 1929 was a major American stock market crash in October 1929 that precipitated the beginning of the Great Depression. Various causes stood behind the financial collapse of 1929, some of which attributed to speculation, government mismanagement, and oversupply.

Understanding the Stock Market Crash of 1929Before the Stock Market Crash of 1929, the United States had enjoyed a period of economic and social growth in a period known as the “Roaring Twenties”.

Stock prices soared during this time as the United States underwent rapid expansion. When President Herbert Hoover was inaugurated in January 1929, millions of American citizens poured their liquid assets into securities. Many invested their life savings, while others sold bonds and mortgaged their homes to invest billions in the stock market.

The Dow Jones Industrial Average (DJIA) reached a peak of 381 in September 1929, with prices starting to decline in early October. Speculation continued, however, with investors ignoring warnings about an imminent collapse by borrowing more money to invest in shares.

After recently witnessing massive losses on the British stock market, Chancellor of the Exchequer Philip Snowden described America’s predicament as “a perfect orgy of speculation.”

Black ThursdayThe crash began on October 24, 1929, when the market opened 11% lower than it had closed the previous day.

Losses were initially modest as institutions stepped in with bids above the market to quell investor panic and protect their wealthy clientele. As a result, most stocks had bounced back by the end of the day with the DJIA closing only 6.8 points down.

Black MondayOn the following Monday, October 28, many investors exited the market after facing margin calls.

The Dow suffered a record loss of 38.33 points, or 12.82%.

Black TuesdayThe next day, some 16 million shares were traded on the New York Stock Exchange as investors suffered losses in the billions of dollars.

The Dow lost another 12% and closed at 198, representing a drop of 183 points in less than two months. Companies including General Electric, American Telephone and Telegraph, DuPont, and United States Steel also suffered heavy losses. Most smaller organizations were forced to declare bankruptcy.

The DJIA continued to slide until the summer of 1932 when it closed at a record low of 41.22. The index would not recapture its pre-crash value until November 1954.

What caused the Stock Market Crash of 1929?As with most disasters, there was no single cause of the 1929 crash.

Nevertheless, here are a few of the major contributing factors:

Complacency – during the 1920s, American companies exported goods to Europe which was still rebuilding after the First World War. Unemployment was also low and the rise of the automobile was creating new jobs where there were none previously. Investors became complacent by assuming the new status quo would last forever. Stock speculating became a national pastime with many new investors entering the market with little understanding of how it worked. Margin calls – many of these new investors were buying stocks on margin. In this scenario, the buyer of the asset pays a percentage of the asset’s value and borrows the rest from a bank or broker. This arrangement meant investors were extremely vulnerable to share price decreases, losing money on their original investment and owing money to the entities who had granted them loans. Government mismanagement – the United States Federal Reserve is tasked with the role of creating a safe and stable financial system. When the country was experiencing rapid growth, they kept interest rates low and only raised them when the crash hit. Today, these actions are considered to be the opposite of good economic management. Oversupply – while there was a period of growth in the 1920s, many companies were selling their goods at a loss because of oversupply. Unfortunately, the share price of such companies did not accurately reflect their financials or indeed broader market conditions. U.S. Congress eventually passed the United States Tariff Act of 1930 to increase domestic demand for goods by increasing import tariffs. However, this move backfired as other countries retaliated by imposing import tariffs on U.S. products.Key takeaways:The Stock Market Crash of 1929 was a major American stock market crash in October 1929 that precipitated the beginning of the Great Depression.Black Friday, Black Monday, and Black Tuesday are terms used to describe the calamitous fall of the Dow Jones Industrial Average over three days. The index would slide further in the following years and would not recapture its pre-crash value until November 1954.The Stock Market Crash of 1929 was caused by complacency during the economic prosperity of the 1920s with many new investors buying stocks on margin. Government mismanagement and company share prices that did not reflect their true value were also contributing factors.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Was The Stock Market Crash Of 1929? The Stock Market Crash Of 1929 In A Nutshell appeared first on FourWeekMBA.

What Is The South Sea Bubble? The South Sea Bubble And The Rise Of Financial Bubbles

The South Sea Bubble describes the financial collapse of the South Sea Company in 1720, which was formed to supply slaves to Spanish America and reduce Britain’s national debt. The story behind the South Sea Bubble is somewhat complicated. However, it begins with the formation of the South Sea Company in 1711 by Robert Harvey.

Understanding the South Sea BubbleHarvey created the company with the intention to partner with the government and reduce the English national debt. He also wanted to make money for investors by underwriting the national debt in exchange for interest in return.

When the War of the Spanish Succession ended in 1713, the Treaty of Utrecht was signed. As part of the negotiations, Britain secured the rights to supply slaves to Spanish America. The deal was deemed a coup for the country because there were huge profits to be made by trading South American nations that were rich in silver and gold.

Investor excitementTo reduce its national debt, the government sold a contract to the South Sea Company worth £9,500,000. In return for taking on a substantial percentage of Britain’s national debt, the company gained monopoly access to the lucrative west coast of the Americas in 1720.

Once the deal was signed, excitement grew dramatically. Investors saw the potential for the South Sea Company to collect interest on the loan in addition to profiting from its gold, silver, and slave interests.

To some extent, positive market sentiment was also reinforced by the actions of the government. South Sea Company ships received convoy protection from the Royal Navy and even the King himself made a sizeable investment in the company. With backing from the seemingly robust British state, shareholder confidence was high.

The bursting of the South Sea BubbleBy the summer of 1720, South Sea Company shares became dangerously overvalued.

Nevertheless, some investors continued to purchase shares hoping to sell out in time as waves of more naïve investors entered the market. In the short term, this pushed the share price from a mere £100 in 1719 to £1,050 by August 1720.

Unfortunately, the lucrative trade profits spruiked by management never materialized. Instead, the South Sea Company operated more like a bank and less like a shipping business. It lent money to investors which maintained demand for company stock and artificially inflated its price. In what some suggest was an early Ponzi scheme, money from the issuance of new shares was used to award dividends to more substantial investors.

By December 1720, the share price had fallen back to £124.

AftermathOnce the South Sea Bubble burst, many investors suffered financial ruin.

The disaster was particularly damaging for wealthy investors who had invested large sums of money. One of these was Sir Isaac Newton, who claimed to have said that he could “calculate the motions of the heavenly bodies, but not the madness of people.”

Several directors of the South Sea Company were impeached and had their estates confiscated. Later, it was found the company had gifted political figures company stock in exchange for their support. Chancellor of the Exchequer John Aislabe was famously imprisoned in the Tower of London for his involvement.

While the South Sea Bubble did prompt calls for tighter controls of unregulated markets, Georgian society carried on as usual. The South Sea Company continued operating for another 133 years until it was disestablished in 1853.

Key takeaways:The South Sea Bubble describes the financial collapse of the South Sea Company in 1720, which was formed to supply slaves to Spanish America and reduce Britain’s national debt.Investors saw the potential for the South Sea Company to collect interest on the loan in addition to collecting profits from its gold, silver, and slave interests. Positive sentiment was also driven by the actions of the government. Lucrative trade profits never materialized, which caused the share price to become dangerously overvalued. Instead, the South Sea Company operated more like a bank and less like a shipping business. Capital invested from waves of new investors was redistributed to older investors in an early Ponzi scheme. The share price crashed in December 1720, with many South Sea Company directors impeached or imprisoned.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is The South Sea Bubble? The South Sea Bubble And The Rise Of Financial Bubbles appeared first on FourWeekMBA.

What Was The Mississippi bubble? The Mississippi Bubble And The Birth Of Central Banking

The Mississippi bubble occurred when a fraudulent fiat banking system was unleashed in a French economy on the verge of bankruptcy. Happened in the 1700s, the Mississippi bubble was among the most incredible financial bubbles of human history. The scapegoat of this financial bubble was John Law, which introduced the concept of central banking, by convincing King Louis XV to restore France’s prosperity through monetary stimulus, something unprecedented before.

Understanding the Mississippi bubbleThe Mississippi bubble is one of the most significant asset bubbles in modern history.

In 1716, the excessive spending of former king Louis XIV left France on the verge of bankruptcy. To restore France’s prosperity and revolutionize her monetary systems, regent to the new King Louis XV met with John Law, a Scottish financier and banker.

Law proposed to replace the metallic currency with a paper-based currency based on government debt that had been converted into shares in a company. Circulating debt, he argued, would provide companies with credit that could be used as equity in commercial ventures and revitalize the French economy.

Desperate for a solution, the regent wholeheartedly endorsed Law’s strategy. He was then appointed Controller General of Finances of France and created the Banque Générale Privée, which accepted metallic currency deposits and issued loans and withdrawals in paper currency. The new paper notes were immediately popular and had the desired effect of stimulating economic activity in the beleaguered nation.

With governmental support, Law decided to acquire the Mississippi Company and in the process, gained a trading monopoly with then French Louisiana. The stock price of the Mississippi Company increased further as its power expanded to encompass all trade and tax collection outside of Europe.

Mass hysteriaIn early 1719, investor hysteria around the Mississippi Company was high. Rumors abounded of precious metal reserves in Louisiana, while many others invested in the company for the promise of dividends or because of Law’s growing celebrity.

When the regent authorized the issuance of 300,000 shares to finally pay off the French national debt, investors swarmed Law’s residence as commoners jostled with high society for a piece of the company. Encampments sprung up in the parks nearby, and soldiers were called to clear the streets each night. Thievery of company shares was also common.

HyperinflationHyperinflation reached a peak of 23% in January 1720 as the market price of company shares reached a peak of 10,000 livres. This was caused by Law’s unending willingness to issue more banknotes to fund purchases of shares in his company.

Soon after, the share price began to fall as investors tried to take profits in gold and silver. Many of these investors, realizing the share price could not rise indefinitely, liquidated their holdings and sent capital gains abroad.

In response, Law made desperate attempts to arrest the share price decline. He capped redemption in gold and silver to avoid depleting his reserves and made the paper notes legal tender to legitimize paper currency in the eyes of the public. This caused hyperinflation to set in as the amount of paper currency circulating in the economy was many times the value of gold and silver reserves.

Share prices continued to decline as Law’s attempts became increasingly comical. In one example, authorities conscripted 6,000 workers to parade through the streets of Paris carrying mining equipment. This gesture, the authorities hoped, would give the impression that the Mississippi Company had struck gold.

By the middle of May, inflation was so severe that Law attempted to force deflation by devaluing all paper currency to 50% of its face value.

The bursting of the Mississippi bubbleUltimately, French authorities had to admit that the number of paper notes issued exceeded the value of gold and silver held by the banks. The company share price crashed to just 1,000 livres by the end of 1720, representing a 1900% decrease since its peak less than a year earlier.

Though the crash was not directly attributable to Law, he was nonetheless made a scapegoat and banished from his post as Controller General. Amidst a wave of convictions against investors suspected of having made illegal profits, Law was forced to flee France altogether.

The astronomical debt of his former company was taken over by the state, which was forced to raise taxes to retire it. The Mississippi bubble caused widespread investor revulsion of the stock market in the country, which hampered the development of French capitalism and industry for decades.

It would be another 80 years before France would again introduce paper money into its economy.

Key takeaways:The Mississippi bubble occurred when a fraudulent fiat banking system was unleashed in a French economy on the verge of bankruptcy.Scottish banker John Law proposed that the French transition from gold and silver-based currency to paper currency. Law theorized that he could sell shares in the Mississippi Company to pay off French national debt. When the company secured total control of European trade and tax collection, investor speculation increased to unsustainable levels.The company share price reached its peak in January 1720 as more and more speculative investors entered the fray. Law continued to issue banknotes to fund share purchases, which inevitably caused hyperinflation. Less than twelve months later, shares in the Mississippi Company declined by 1900% and Law had to flee France in disgrace.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Was The Mississippi bubble? The Mississippi Bubble And The Birth Of Central Banking appeared first on FourWeekMBA.

November 27, 2021

How Does Monday.com Make Money? Monday.com Business Model In A Nutshell

Monday.com is a cloud-based, work management platform created by Roy Mann, Eran Kampf, and Eran Zinman in 2012. The company was founded to overcome the challenges associated with scaling quickly.Monday.com makes money by selling its platform to global organizations via several subscription plans. A free plan with very basic features is offered to small teams, grading to an enterprise option for large and complex organizations.Monday.com subscription plan pricing is determined by the size of the team a business wants to onboard to the platform. Pricing also varies according to whether the business pays monthly or annually.Monday.com origin story

Monday.com is a cloud-based, work management platform created by Roy Mann, Eran Kampf, and Eran Zinman in 2012. The company was founded to overcome the challenges associated with scaling quickly.Monday.com makes money by selling its platform to global organizations via several subscription plans. A free plan with very basic features is offered to small teams, grading to an enterprise option for large and complex organizations.Monday.com subscription plan pricing is determined by the size of the team a business wants to onboard to the platform. Pricing also varies according to whether the business pays monthly or annually.Monday.com origin storyMonday.com is a cloud-based platform enabling companies to create their own applications and work management software. The company was founded as daPulse in 2012 by Roy Mann, Eran Kampf, and Eran Zinman.

Monday.com was created in response to the challenges the co-founders faced when endeavoring to quickly scale organisations. The story begins with former Wix executive Mann collaborating with research and development guru Zinman. The two came together to launch the platform – then known as daPulse – in February 2014. It was an instant success, allowing teams to assign tasks, mark completed work, and send email updates to app-averse colleagues.

Despite the instant success of the platform, its name was mocked by users who could not understand what the term was supposed to mean. The platform was renamed Monday.com in November 2017 which the company claimed more closely aligned with its “broader commitment to spark a dialogue on how to improve working together as humans.”

In July of 2018 and 2019, the company raised a total of $200 million across two funding rounds. Investors were impressed by revenue growth in the tens of millions and a low churn rate among paid users in more than 200 business verticals.

Today, the company employs more than 700 people and can boast approximately 110,000 customers. Some of the more notable clients include Costco, Adobe, Uber, Unilever, and Universal Studios.

Monday.com revenue generationMonday.com makes money by selling its cloud-based platform to global organizations.

The company does this by offering several subscription plans according to the number of seats (users) the business desires. Each plan, which is listed below, has a minimum team size of three and is billed annually:

Basic ($11 per seat per month) – a simplified internal communication and project building platform for small teams. Features include unlimited viewers and items, 5GB storage, and priority customer support.Standard ($14 per seat per month) – for businesses that wish to collaborate with external stakeholders and optimize their team processes. Extra features include guest access, Gantt charts, calendar view, and 250 automations and integrations per month.Pro ($22 per seat per month) – to streamline complex team workflows with advanced features such as time-tracking, dependency columns, private boards and documents, and up to 25,000 monthly automations and integrations.Enterprise (prices available on request) – a solution with enterprise-level scaling, security, and governance. Additional features include advanced analytics, multi-level permissions, tailored onboarding, and premium support.Read More: Cloud Business Models, IaaS vs PaaS vs SaaS, AIaaS Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Monday.com Make Money? Monday.com Business Model In A Nutshell appeared first on FourWeekMBA.

The Southwest Airlines Business Model In A Nutshell

Southwest Airlines is a low-cost American commercial airline company founded by Herbert Kelleher and Rollin King in 1967. The company began operations in Texas at a time when interstate travel was heavily regulated.Southwest Airlines makes money across three categories: passenger revenue, transport revenue, and revenue for ancillary services such as early check-in.Southwest Airlines recorded profits for 47 straight years, with the streak only broken by the coronavirus pandemic. The success of the company in an industry with slim to non-existent profits is due to intelligent route selection, flexible seating, free checked baggage, and a point-to-point destination strategy.Southwest Airlines origin story

Southwest Airlines is a low-cost American commercial airline company founded by Herbert Kelleher and Rollin King in 1967. The company began operations in Texas at a time when interstate travel was heavily regulated.Southwest Airlines makes money across three categories: passenger revenue, transport revenue, and revenue for ancillary services such as early check-in.Southwest Airlines recorded profits for 47 straight years, with the streak only broken by the coronavirus pandemic. The success of the company in an industry with slim to non-existent profits is due to intelligent route selection, flexible seating, free checked baggage, and a point-to-point destination strategy.Southwest Airlines origin storySouthwest Airlines is a low-cost American commercial airline company founded by Herbert Kelleher and Rollin King in 1967.

Kelleher and King developed the concept for Southwest Airlines in a San Antonio hotel bar. The original business plan was illustrated on a cocktail napkin with a triangle connecting the Texan cities of San Antonio, Dallas, and Houston.

Initially, the company operated flights within the state of Texas only. Federal authorities controlled interstate air travel in the United States at the time, deciding where an airline could fly and how much it could charge. This turned out to be a blessing in disguise for Southwest Airlines, enabling it to establish a strong presence in Texas where it was free to undercut competitors including Braniff and Texas International. During those early years, the company was also known for its ability to turn planes around in just ten minutes.

When President Jimmy Carter signed the Airline Regulation Act on October 24, 1978, the company began introducing routes around the United States. A service between Houston and New Orleans was the first such route, with additional flights to Tulsa, Oklahoma City, and Albuquerque following in 1979. That same year, the company introduced self-ticketing machines to make the check-in process more efficient.

Over the following decades, Southwest Airlines stayed true to its low-fare brand. For a customer checking in two bags, the company claims its fares will be the lowest on offer in 87% of cases. Competition-beating prices are possible because Southwest operates Boeing 737s exclusively, enabling it to save money on training mechanics and pilots on a range of different aircraft. The company also prefers routes between smaller airports where taxes and gate access are more affordable.

Third-quarter operating revenue for 2021 was $4.7 billion, representing a 161% year-over-year increase. The company now services routes to over 100 destinations across the United States, Mexico, Central America, and the Caribbean.

Southwest Airlines revenue generationSouthwest Airlines generates revenue by providing domestic and international airline services.

Revenue is spread across three categories:

Passenger revenue – or the sale of domestic and international airline tickets to travelers. Transportation revenue – encompassing shipping and freight services, andOther revenue – derived from the sale of ancillary services such as early check-in and in-flight purchases. Unlike other airlines, Southwest does not charge premium seating fees and offers light refreshments such as peanuts and crackers for free. ProfitabilityWhile the company uses a revenue generation strategy common to many airlines, its successful business model deservers further mention. Before the COVID-19 pandemic grounded planes around the world, Southwest Airlines made a profit for 47 consecutive years between 1973 and 2019.

Despite operating in an industry where it is notoriously difficult to do so, the company has managed to not only survive but thrive.

This has been achieved in the following ways:

Intelligent route selection – as noted in the previous section, the airline prefers to operate routes where airport taxes are minimal. It also chooses routes where it is more likely to sell every seat.Flexible seating – Southwest doesn’t assign seat numbers to passengers. This means that if a plane is swapped out with a different seating configuration, the company doesn’t have to reissue boarding passes.Free checked baggage – while most airlines charge for checked baggage, Southwest does not. Former Vice President of ground operations Chris Wahlenmeier explained the reasoning: “When you charge people to check bags they try to carry more on, sometimes more than can fit in the overhead bins. That results in more bags being checked at the gate, right before departure. And that wastes time.”Point-to-point destinations – lastly, Southwest flights are point-to-point. This means the plane lands, turns around, and travels back to where it came from. The point-to-point strategy is seen as less vulnerable to delays than flying into major hubs, which are connected to hundreds of different airports and experience heavy air traffic as a result. A simpler network also means the company wastes less time searching for lost luggage, with Southwest boasting a bag completion rate of 99.6%.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Southwest Airlines Business Model In A Nutshell appeared first on FourWeekMBA.

The Toyota Business Model In A Nutshell

Toyota is a Japanese automobile manufacturer founded in 1937 by Kiichiro Toyoda. Toyoda started the company with funding from the sale of his father’s automatic loom technology.Toyota makes almost 90% of its revenue through the sale of passenger and commercial vehicles. The company also makes money through its Toyota Financial Services arm, funding automotive loans and credit cards while also leasing vehicles. Toyota earns a small percentage of its total revenue through investments in other car manufacturers and industries such as biotechnology, aerospace, and robotics.Toyota origin story

Toyota is a Japanese automobile manufacturer founded in 1937 by Kiichiro Toyoda. Toyoda started the company with funding from the sale of his father’s automatic loom technology.Toyota makes almost 90% of its revenue through the sale of passenger and commercial vehicles. The company also makes money through its Toyota Financial Services arm, funding automotive loans and credit cards while also leasing vehicles. Toyota earns a small percentage of its total revenue through investments in other car manufacturers and industries such as biotechnology, aerospace, and robotics.Toyota origin storyToyota is a Japanese automobile manufacturer founded in 1937 by Kiichiro Toyoda.

The Toyota story begins almost twenty years before the company was incorporated. In 1918, Kiichiro’s father Sakichi invented the world’s first automatic loom. The loom, which reduced manufacturing defects and increased yields, was later sold to British company Platt Brothers for £100,000.

Sakichi then gave the proceeds to his son to develop automotive technology at Toyota, with the first passenger car dubbed the Model AA created in 1936. During the late 1940s, Toyota was able to benefit from Japan’s alliance with the United States. This would give rise to The Toyota Way management philosophy and Toyota Production System lean manufacturing process, with the latter also inspired by Sakichi’s original loom technology.

Toyota was also quick to profit from the emerging Japanese middle class in the 1960s with the release of the Corolla mid-size passenger sedan. The company experienced a period of rapid growth during this time, exporting large numbers of vehicles to foreign markets where they quickly gained a reputation for reliability, affordability, and fuel efficiency.

In 1986, Toyota partnered with General Motors to develop a new manufacturing facility in California. Luxury subsidiary Lexus was launched in 1989, with the company’s first hybrid vehicle, the Toyota Prius, launched in 1997.

Today, Toyota produces vehicles under five different brands: Toyota, Daihatsu, Hino, Lexus, and Ranz. The company also has significant stakes in Mazda, Subaru, Suzuki, Isuzu, and Yamaha, among others.

Though figures vary from year to year, the Camry, RAV4, and Corolla are often among the top five best-selling car models in the world. More broadly speaking, Toyota sold 9.386 million passenger vehicles during 2020.

Toyota revenue generationToyota generates the bulk of its revenue through the sale of automotive vehicles, with a smaller percentage coming from its financial services division.

Let’s take a look at these streams in more detail.

Vehicle salesApproximately 88% of Toyota’s revenue comes from automotive sales.

Automotive sales encompass passenger vehicles, minivans, and commercial vehicles such as trucks, buses, and forklifts. Vehicle sales are segmented into distinct business units based on brand and geographic region. Luxury brand Lexus is considered one of the most profitable.

Toyota also manufactures and sells automotive parts, components, and accessories to other car manufacturers.

Financial services divisionToyota Financial Services is a subsidiary that finances automotive loans, credit cards, and other services such as vehicle leasing.

Revenue from this subsidiary was 7.9% for the 2021 financial year.

Other servicesThe remainder of Toyota’s revenue, approximately 4%, comes from other services.

This includes investments the company has made in the housing, telecommunications, biotechnology, aerospace, and robotics industries. It also includes the aforementioned stakes Toyota has taken in competing automotive companies.

Read Next:

Tesla Business ModelTesla Mission StatementWho Owns TeslaTesla SWOT AnalysisElon Musk CompaniesThe Elon Musk’s StoryWho Owns Volkswagen?Connected to Toyota business model Elon Musk, an early investor and CEO of Tesla, is the major shareholder with 21.7% of stocks. Other major shareholders comprise investment firms like Baillie Gifford & Co. (7.7%), FMR LLC (5.3%), Capital Ventures International (5.2%), T. Rowe Price Associates (5.2%), and Capital World Investors (5%). Another major individual shareholder is Larry Ellison (co-founder and CEO of Oracle), with a 1.7% stake.

Elon Musk, an early investor and CEO of Tesla, is the major shareholder with 21.7% of stocks. Other major shareholders comprise investment firms like Baillie Gifford & Co. (7.7%), FMR LLC (5.3%), Capital Ventures International (5.2%), T. Rowe Price Associates (5.2%), and Capital World Investors (5%). Another major individual shareholder is Larry Ellison (co-founder and CEO of Oracle), with a 1.7% stake. Elon Musk is one of the richest people in the world, with his main ownership in Tesla, making him worth more than a hundred billion dollars. The companies founded by Elon Musk range from electric vehicles and renewable energies, with Tesla, rockets, with SpaceX, infrastructure, with The Boring Company, and neurotechnology with Neuralink.

Elon Musk is one of the richest people in the world, with his main ownership in Tesla, making him worth more than a hundred billion dollars. The companies founded by Elon Musk range from electric vehicles and renewable energies, with Tesla, rockets, with SpaceX, infrastructure, with The Boring Company, and neurotechnology with Neuralink.  Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, eventually turned into a mass manufacturing electric car maker.

Elon Musk, seen as one of the most visionary tech entrepreneurs from the Silicon Valley scene, started his “career” as an entrepreneur at an early age. After selling his first startup, Zip2, in 1999, he made $22 million, which he used to found X.com, which would later become PayPal, and sell for over a billion to eBay (Musk made $180 million from the deal). He founded other companies like Tesla (he didn’t start it but became a major investor in the early years) and SpaceX. Tesla started as an electric sports car niche player, eventually turned into a mass manufacturing electric car maker. Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Toyota Business Model In A Nutshell appeared first on FourWeekMBA.

What Is A Long-Tail Business Model? Long-Tail Business Model In A Nutshell

The long tail business model was popularised by former Wired Magazine editor Chris Anderson, who coined the phrase “long tail” and wrote a book on the subject called The Long Tail: Why the Future of Business Is Selling Less of More. The long tail business model suggests companies can profit from selling low-volume niche products. In theory, selling a significant number of these products is more profitable than selling fewer, more popular products.

Understanding the long tail business modelTo explain the long tail business model as simply as possible, let us begin by taking a look at the traditional retail model. Most businesses generate profit by marketing and selling a relatively small number of popular but profitable items. The long tail model favors the opposite approach, with a focus on selling a larger number of less popular, low-demand niche items.

Anderson suggested the collective market share of these niche items could exceed the market share of just a few more popular items. However, this would only occur if the business in question had a sizeable distribution channel.

Online auction site eBay is perhaps the best example of the long tail business model in action. The success of the platform is due to the vast quantities of buyers and sellers who trade in smaller quantities of niche or non-bestseller items.

In his article, Chris Anderson explained:

You can find everything out there on the Long Tail. There’s the back catalog, older albums still fondly remembered by longtime fans or rediscovered by new ones. There are live tracks, B-sides, remixes, even (gasp) covers. There are niches by the thousands, genre within genre within genre: Imagine an entire Tower Records devoted to ’80s hair bands or ambient dub. There are foreign bands, once priced out of reach in the Import aisle, and obscure bands on even more obscure labels, many of which don’t have the distribution clout to get into Tower at all.

The long tail has been an incredible way for tech companies, once startups – now turned into tech giants – to gain popularity and redefine entire industries. For instance, Google enabled you to find any information, anywhere, also on the most arcane blogs, as long as it seemed relevant.

YouTube could help you find videos related to any microniche. Amazon could help you find books on any topic, even the seemingly most obsure. Netflix helped users find the most improbable movies, also from independent producers.

It’s worth pointing out, that as those companies scaled up, and became tech giants, they also, in part, smoothed up their algorithms to skew information toward more recognizable and known brands.

Yet the long tail business model remains an incredible way to scale up markets dominated by incumbents. As they offer opportunities to consumers to find options that incumbents don’t want or can’t offer.

Take the case of how Google, now Alphabet, at this stage prioritizes known media brands in search, or known authors, as more trusted sources of information. Which, at the scale of the company is critical, because they can’t get things wrong. While, when initially scaling up a company like Google had the option to offer more unconventional results to users. Yet, this option is much less limited today.

Structure of the long tail business modelThe long tail business model is represented by a long tail distribution curve.

Once upon a time, the only way to sell a product was through a bricks-and-mortar store. Since each store was constrained by its total physical floor space, businesses produced or showcased only the most popular products. These high sales volume products make up the head of the long tail distribution.

In the middle torso section of the curve, the number of available products increases while their individual value decreases. The curve eventually flattens into the long tail, comprising the myriad niche products that are relatively unpopular and sell in smaller quantities.

When eCommerce achieved critical mass, consumers shifted away from buying items in physical stores and toward buying them online. More to the point, they transitioned from buying popular, high-volume items to more unique, low-volume items.

For merchants, this shift is significant. As the torso and tail sections of the curve continue to grow, they become a more viable market and source of income.

Long tail business model featuresThe long tail business model has several characteristic features:

Lower distribution, storage, and merchandising costsCentralized storage facilities tend to be less expensive to operate than retail chains that must manage multiple physical stores. Distribution, logistics, and inventory management are more efficient. What’s more, the business has access to more consumer buying data and is not limited by finite floor space.

Crowd contributionSearch engines like Google index long-tail keywords which connect buyers with the sellers of niche items. Google also connects consumers with reviews or collaborations involving long-tail products, increasing their visibility in the search engines and by extension, the number of consumers that become aware of them. These items can sit on virtual shelves indefinitely and there is no requirement that they are sold quickly to free up space.

Recommendation servicesCompanies such as Netflix and Spotify have also introduced personalized content recommendations on their respective platforms. These services introduce niche content to consumers, which shifts their attention away from more mainstream content. In the case of Netflix, the shift is being amplified since the streaming service is now developing content based on long-tail viewing preferences.

Key takeaways:The long tail business model suggests companies can profit from selling low-volume niche products. In theory, selling a significant number of these products is more profitable than selling fewer, more popular products.The long tail business model is at least partly explained by the consumer shift to purchasing items online. Free from the physical constraints of limited floor space, merchants can produce or sell as many different niche items as they desire.The long tail business model is characterized by lower merchandising, distribution, and storage costs. Crowd contribution and recommendation services are also central to increasing the visibility of long-tail products.Connected business concepts The term “crowdsourcing” was first coined by Wired Magazine editor Jeff Howe in a 2006 article titled Rise of Crowdsourcing. Though the practice has existed in some form or another for centuries, it rose to prominence when eCommerce, social media, and smartphone culture began to emerge. Crowdsourcing is the act of obtaining knowledge, goods, services, or opinions from a group of people. These people submit information via social media, smartphone apps, or dedicated crowdsourcing platforms.

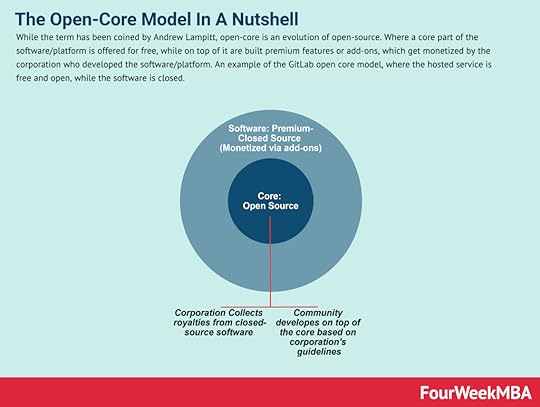

The term “crowdsourcing” was first coined by Wired Magazine editor Jeff Howe in a 2006 article titled Rise of Crowdsourcing. Though the practice has existed in some form or another for centuries, it rose to prominence when eCommerce, social media, and smartphone culture began to emerge. Crowdsourcing is the act of obtaining knowledge, goods, services, or opinions from a group of people. These people submit information via social media, smartphone apps, or dedicated crowdsourcing platforms. While the term has been coined by Andrew Lampitt, open-core is an evolution of open-source. Where a core part of the software/platform is offered for free, while on top of it are built premium features or add-ons, which get monetized by the corporation who developed the software/platform. An example of the GitLab open core model, where the hosted service is free and open, while the software is closed.

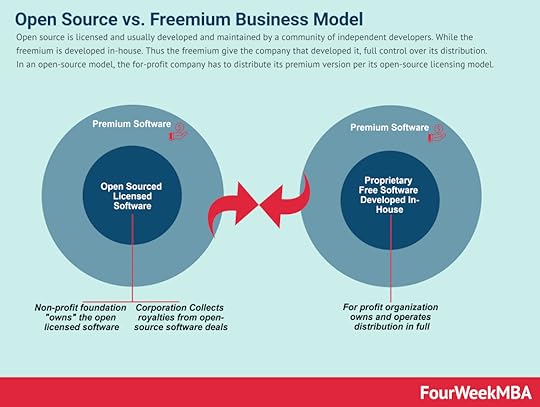

While the term has been coined by Andrew Lampitt, open-core is an evolution of open-source. Where a core part of the software/platform is offered for free, while on top of it are built premium features or add-ons, which get monetized by the corporation who developed the software/platform. An example of the GitLab open core model, where the hosted service is free and open, while the software is closed. Open source is licensed and usually developed and maintained by a community of independent developers. While the freemium is developed in-house. Thus the freemium give the company that developed it, full control over its distribution. In an open-source model, the for-profit company has to distribute its premium version per its open-source licensing model.

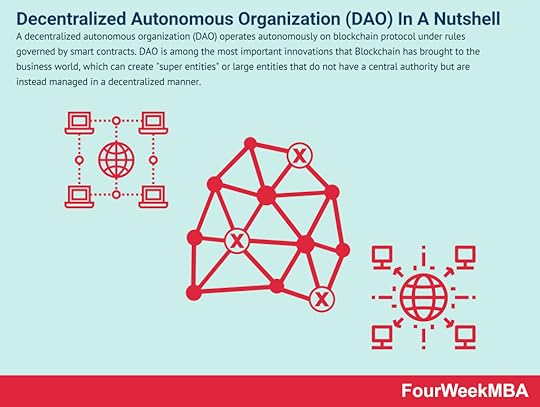

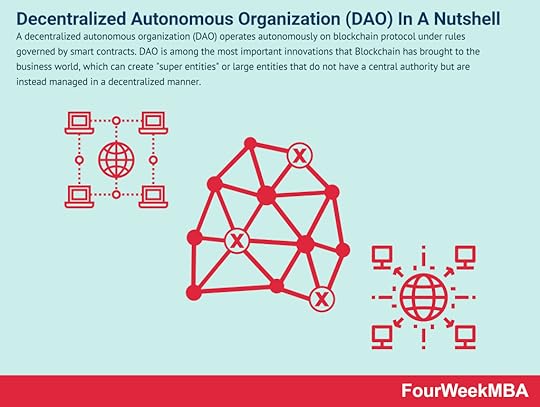

Open source is licensed and usually developed and maintained by a community of independent developers. While the freemium is developed in-house. Thus the freemium give the company that developed it, full control over its distribution. In an open-source model, the for-profit company has to distribute its premium version per its open-source licensing model. A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is A Long-Tail Business Model? Long-Tail Business Model In A Nutshell appeared first on FourWeekMBA.

What Is A Crowdsourcing Business Model? The Crowdsourcing Business Model In A Nutshell

The term “crowdsourcing” was first coined by Wired Magazine editor Jeff Howe in a 2006 article titled Rise of Crowdsourcing. Though the practice has existed in some form or another for centuries, it rose to prominence when eCommerce, social media, and smartphone culture began to emerge. Crowdsourcing is the act of obtaining knowledge, goods, services, or opinions from a group of people. These people submit information via social media, smartphone apps, or dedicated crowdsourcing platforms.

Understanding crowdsourcingEssentially, crowdsourcing describes the process of collecting input from a large group of people. This group of people is a third-party unrelated to the business seeking results and usually performs the necessary tasks on a voluntary basis.

Consumer reviews on a product or service represent the most basic form of crowdsourcing, with freelancing sites and knowledge repositories such as Wikipedia owing much of their success to the collective power of people.

However, the strategy is also used in more complex scenarios where engineering, scientific, or other technical expertise is required. Businesses also use social media platforms like Twitter, Facebook, and Instagram to crowdsource new ideas for products and services.

Crowdsourcing typesCrowdsourcing is an industry experiencing rapid growth and innovation, with the chosen approach depending on the outcome the business desires.

With that said, here is a look at three crowdsourcing types:

CrowdfundingWhere large groups of people come together to fund a project. SeedInvest Technology is a popular platform for start-ups, while creative professionals looking to raise money prefer Patreon.

Crowd-wisdomWhere companies seek out the collective opinion of a group of people on a variety of topics, including election outcome predictions and investor behavior on the stock market. Crowd-wisdom is based on the idea that large groups of people are collectively smarter than individual experts in terms of problem-solving, decision-making, innovation, and prediction. Examples of platforms include Quora, Reddit, and Stack Exchange.

Micro-taskingWhere a large project is separated into smaller tasks for completion by a crowd. Starbucks employed micro-tasking when it asked fans to design a new motif for its coffee cups. Amazon’s Mechanical Turk is another example of a micro-tasking platform.

Benefits of crowdsourcingFor organizations, there are many obvious and not-so-obvious crowdsourcing benefits. We have listed a few of these below:

ScalabilityA problem many businesses face when trying to scale is a lack of adequate resources. Crowdsourcing enables the business to cut costs by farming out small portions of the project to remote workers who offer more attractive rates. In some cases, the work may even be done for free.

Addresses knowledge gapsCrowdsourcing is also used to fill knowledge gaps quickly and easily. There is no need for the organization to undertake a costly and time-consuming recruitment process.

Reduces operational costs – businesses can also reduce or avoid many of the overhead costs of hiring skilled or unskilled labor. These costs include employee salaries, benefits, and training. Crowdsourcing may also obviate the need for a dedicated workspace and associated equipment and utility costs.

Better consumer engagementWhen a group of people is energized and motivated to work collaboratively or share their opinion, they tend to be more engaged in the task at hand. With consumer attention spans now lasting a mere eight seconds, participating in the crowdsourcing process is likely to hold their attention for longer than a traditional marketing strategy might.

Key takeaways:Crowdsourcing is the act of obtaining knowledge, goods, services, or opinions from a group of people. Information is submitted via social media, smartphone apps, or dedicated crowdsourcing platformsCrowdsourcing types include crowdfunding, crowd-wisdom, and micro-tasking, with each type resulting in a different outcome for the business. Crowdsourcing helps organizations scale because the work is performed by remote employees or in some cases, voluntarily. The strategy also addresses knowledge gaps, reduces operational costs, and increases consumer engagement.Connected business concepts While the term has been coined by Andrew Lampitt, open-core is an evolution of open-source. Where a core part of the software/platform is offered for free, while on top of it are built premium features or add-ons, which get monetized by the corporation who developed the software/platform. An example of the GitLab open core model, where the hosted service is free and open, while the software is closed.

While the term has been coined by Andrew Lampitt, open-core is an evolution of open-source. Where a core part of the software/platform is offered for free, while on top of it are built premium features or add-ons, which get monetized by the corporation who developed the software/platform. An example of the GitLab open core model, where the hosted service is free and open, while the software is closed.  Open source is licensed and usually developed and maintained by a community of independent developers. While the freemium is developed in-house. Thus the freemium give the company that developed it, full control over its distribution. In an open-source model, the for-profit company has to distribute its premium version per its open-source licensing model.

Open source is licensed and usually developed and maintained by a community of independent developers. While the freemium is developed in-house. Thus the freemium give the company that developed it, full control over its distribution. In an open-source model, the for-profit company has to distribute its premium version per its open-source licensing model. A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner. Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is A Crowdsourcing Business Model? The Crowdsourcing Business Model In A Nutshell appeared first on FourWeekMBA.

What Is A UI Design Pattern? UI Design Pattern In A Nutshell

Design patterns were originally used in architecture and programming to optimize solutions known to work within specific contexts. Solutions occurring frequently enough then morphed into formulas that could be reused as necessary. Some of the design patterns people encounter daily include apps with tab bars, websites with top navigation, and login screens with two input fields and a submit button. User interface (UI) design patterns are proven and reusable solutions to commonly occurring user interface problems.

Understanding UI design patternsAs a cooking recipe provides the ingredients and method for making a recognizable dish, so too does a user design pattern in providing a predictable and identifiable solution to an interface design problem.

For users, the structural and behavioral features of a pattern are familiar. Rather than reinvent the wheel, teams can leverage this knowledge to develop better products. Design patterns should never take the place of informed product development. Instead, they should be used to guide design decisions by modifying them to suit the user and business needs.

There are many ways to make a curry, but there are certain basic ingredients that make one recognizable. The same is also true for UI design patterns. Teams have a general model for how to create a recognizable pattern and can add or subtract ingredients to make their version unique.

The four main types of UI design patternThere are four main types of UI design patterns. Each is based on specific design cases and usually target core site functions, including:

Input and output – these design patterns relate to how the user interacts with the site by submitting information. It also deals with output, where the site responds by submitting feedback in return.Content structuring – perhaps the most obvious and recognizable design patterns are those that organize site content and make it more accessible.Social sharing – or patterns that enable the user to promote or share the site on social media.Navigation – which helps guide the user around the site and assists them if they become lost.The three levels of UI design patternsProduct discovery coach Anders Toxboe further categorizes UI design patterns according to how they help a site. Many choose to visualize each category as a level in a pyramid.

With that said, let’s start from the bottom and work upwards.

1 – ImplementationAt the bottom of the pyramid are design patterns contextual to each design case that deliver a consistent if unremarkable experience.

These patterns are the most strict, with governing rules tending to black and white. Examples include search boxes placed in the upper right corner and 100 x 100-pixel square thumbnail images.

2 – FlowOn the second level are recurring solutions that solve common design problems in terms of functionality and flow. Designers must choose between alternatives that solve the same problem. However, both options affect the flow and composition of the user experience as opposed to the consistency of the experience at the implementation level.

To determine the best way to gather input from users, designers may choose between the Lazy Registration and Account Registration design patterns.

3 – ContextAt the highest level of the pyramid are design patterns that define what context the user is in. In other words, these are design patterns specific to the type or genre of the site in question.

A professional music artist, for example, will need design patterns appropriate for tour calendars, a biography page, and a checkout system for merchandise sales.

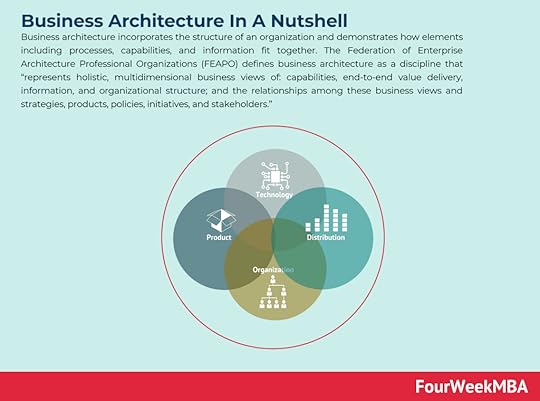

Key takeaways:UI design patterns (UI) design patterns are proven and reusable solutions to commonly occurring user interface problems.UI design patterns can be categorized into four types: input and output, content structuring, social sharing, and navigation. Each is based on specific design cases and typically targets core website functions.UI design patterns can also be categorized according to how they help a site. In this case, there are three types represented by the levels of a pyramid: implementation, flow, and context. At the bottom of the pyramid are design patterns that help sites provide a consistent user experience. As one moves up the pyramid, the user experience is defined by flow, composition, and context.Connected business concepts to UI design patterns Business architecture incorporates the structure of an organization and demonstrates how elements including processes, capabilities, and information fit together. The Federation of Enterprise Architecture Professional Organizations (FEAPO) defines business architecture as a discipline that “represents holistic, multidimensional business views of: capabilities, end-to-end value delivery, information, and organizational structure; and the relationships among these business views and strategies, products, policies, initiatives, and stakeholders.”

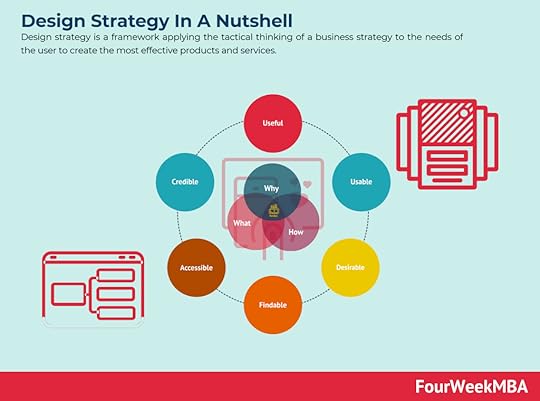

Business architecture incorporates the structure of an organization and demonstrates how elements including processes, capabilities, and information fit together. The Federation of Enterprise Architecture Professional Organizations (FEAPO) defines business architecture as a discipline that “represents holistic, multidimensional business views of: capabilities, end-to-end value delivery, information, and organizational structure; and the relationships among these business views and strategies, products, policies, initiatives, and stakeholders.” Design strategy is a framework applying the tactical thinking of a business strategy to the needs of the user to create the most effective products and services.

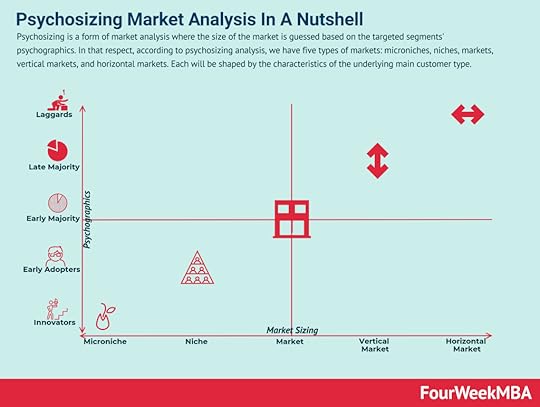

Design strategy is a framework applying the tactical thinking of a business strategy to the needs of the user to create the most effective products and services. Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.

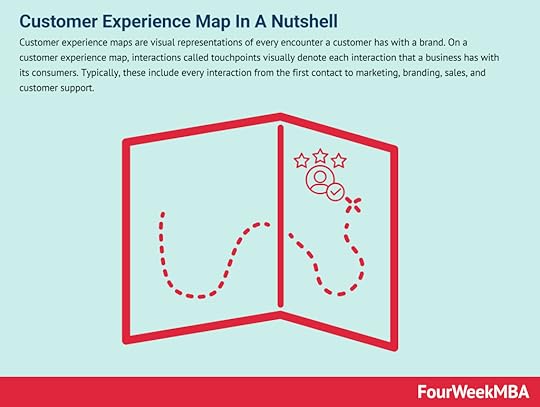

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type. Customer experience maps are visual representations of every encounter a customer has with a brand. On a customer experience map, interactions called touchpoints visually denote each interaction that a business has with its consumers. Typically, these include every interaction from the first contact to marketing, branding, sales, and customer support.

Customer experience maps are visual representations of every encounter a customer has with a brand. On a customer experience map, interactions called touchpoints visually denote each interaction that a business has with its consumers. Typically, these include every interaction from the first contact to marketing, branding, sales, and customer support. The customer journey – sometimes called the buyer or user journey – tells the customer experience with a business, brand, product, or service. A customer journey is an alternative approach to other linear models like the sales funnel which hypothesize that most customers follow the same path.

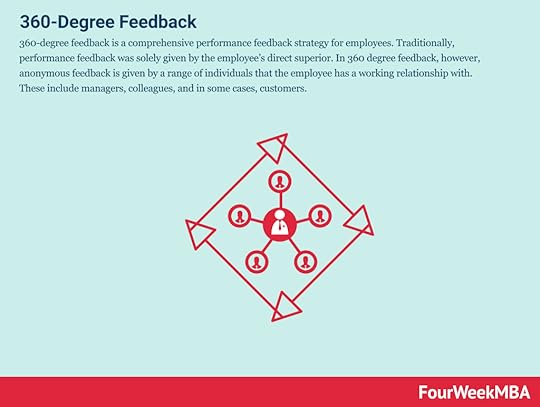

The customer journey – sometimes called the buyer or user journey – tells the customer experience with a business, brand, product, or service. A customer journey is an alternative approach to other linear models like the sales funnel which hypothesize that most customers follow the same path. 360-degree feedback is a comprehensive performance feedback strategy for employees. Traditionally, performance feedback was solely given by the employee’s direct superior. In 360 degree feedback, however, anonymous feedback is given by a range of individuals that the employee has a working relationship with. These include managers, colleagues, and in some cases, customers.

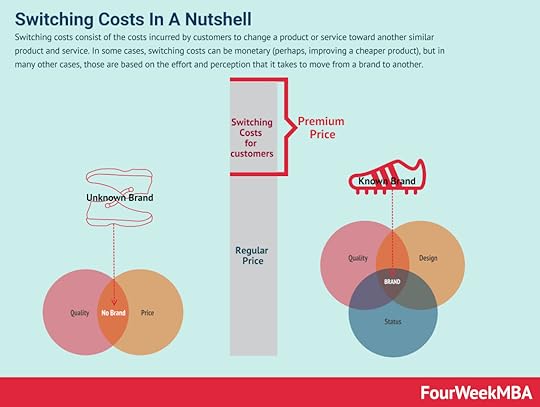

360-degree feedback is a comprehensive performance feedback strategy for employees. Traditionally, performance feedback was solely given by the employee’s direct superior. In 360 degree feedback, however, anonymous feedback is given by a range of individuals that the employee has a working relationship with. These include managers, colleagues, and in some cases, customers. Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another.

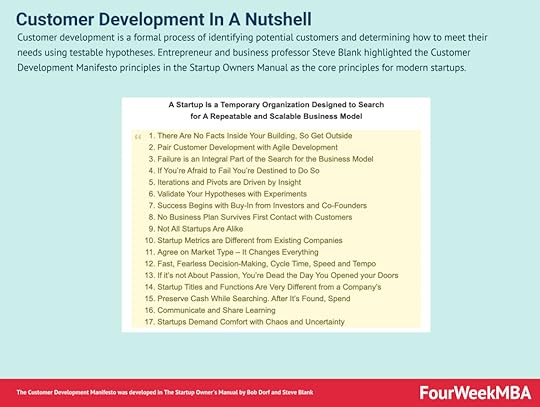

Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another. Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups.

Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is A UI Design Pattern? UI Design Pattern In A Nutshell appeared first on FourWeekMBA.