Gennaro Cuofano's Blog, page 136

December 12, 2021

What Is Disruptive Innovation? Disruptive Innovation In A Nutshell

Disruptive innovation as a term was first described by Clayton M. Christensen, an American academic and business consultant whom The Economist called “the most influential management thinker of his time.” Disruptive innovation describes the process by which a product or service takes hold at the bottom of a market and eventually displaces established competitors, products, firms, or alliances.

Understanding disruptive innovationChristensen first introduced the theory behind disruptive innovation in his 1997 book The Innovator’s Dilemma and a follow-up entitled The Innovator’s Solution. In the books, he posited that there were two types of technologies businesses dealt with. Sustainable technologies enabled a business to improve its performance over a predictable timeframe and remain competitive. Disruptive technologies, on the other hand, were less predictable and potentially more devastating to industry competitiveness.

Disruptive innovation typically occurs when a product or service establishes itself at the bottom of a market. This process is facilitated by the product being less expensive and thus more accessible than competitor products, which tend to be expensive, sophisticated, and accessible to relatively few consumers.

It’s important to note that disruptive innovations are not breakthrough technologies that turn good products into great products. Instead, they are simply innovations that make products or services more accessible and affordable to a larger percentage of the population.

Why does disruptive innovation occur?Disruptive innovation occurs because most companies tend to innovate faster than their customers’ needs evolve. This causes a situation where the end product or service is too sophisticated, complex, or expensive for the majority of consumers in a target audience.

So why do companies pursue innovation? Historically, innovation has been associated with success as it helps the business corner the higher end of the market with the most profitable products. But this strategy leaves room at the bottom end of the market for a disruptive innovator to enter and potentially become a threat.

Disruptive innovators tend to operate in markets characterized by lower gross margins, smaller target markets, and simpler products and services. These traits make the bottom end of the market unprofitable and undesirable for firms that have already developed sustaining innovations.

What are the ingredients for disruptive innovation?In the previous section, we talked about the conditions necessary for a new company to enter the bottom end of the market.

Let’s now explain how this new company can become disruptive by looking at the required ingredients:

Enabling technology – or technology that can significantly change or improve the way consumers do things. The speed with which disruptive innovation can occur is a function of how quickly enabling technology is developed and improved upon for mass uptake. Having said that, it should be noted that the speed of disruption is not the sole determinant of success.Coherent value network – for disruptive innovation to occur, the network of suppliers, distributors, and partners must also benefit from the enabling technology. It is not enough for consumers alone to benefit.Innovative business model – this is simply a business model that targets consumers at the bottom end of the market with innovative products. Since the model is characterized by low-profit margins and simpler product design, the solutions should be easy to use and economical to produce. Examples of disruptive innovationThere are countless examples of disruptive innovation in business. In this section, we’ll take a look at some of the more interesting case studies.

AcademiaEncyclopedia Britannica was a market leader in encyclopedias and had been printed for 244 years until the last copy was released in 2012.

The publisher, Encyclopaedia Britannica, Inc., had the high end of the market cornered, with each edition selling for over $1000.

However, print encyclopedias were quickly usurped by free, digital versions such as Wikipedia. Wikipedia offered an encyclopedia of unlimited size that was portable and updated constantly. Encyclopedia Britannica, with its vast bulk and update cycles lasting more than a year, was ultimately displaced by a disruptive innovator.

Media entertainmentAt its peak, video and game rental company Blockbuster operated more than 9,000 stores and employed approximately 84,300 people.

Though video and game rentals were relatively cheap, increasing data speeds and bandwidth instituted a general shift toward video streaming.

Blockbuster was displaced by smaller players such as Netflix, who offered a cheaper and more convenient alternative. Today, the company owns the rights to more than 13,000 titles, with prices starting a mere $8.99/month.

PhotographyFilm companies such as Kodak enjoyed market dominance in the photography industry for decades. The company’s photographic film products were synonymous with quality and professionalism, but Kodak was eventually displaced by digital camera manufacturers such as Canon, Sony, Pentax, and Nikon.

Digital photography disrupted film photography because it was more convenient and required less expertise to develop photographs. Though digital cameras were relatively expensive when they first appeared, the number of digital photographs a consumer could take was not limited by the cost or restrictiveness of film.

TransportationTo date, Concorde is the only supersonic jet that has entered into commercial production. High operating costs and limited seat capacity meant Concorde tickets were mostly purchased by the wealthy or super-wealthy.

Concorde services ended in 2003 due to high operating costs and a high-profile accident. However, the rising affordability of small, private jets was also a contributing factor. Though these jets did not travel at supersonic speed, their quieter operation meant they could fly routes off-limits to the extremely loud Concorde.

Many private jet owners also enjoyed the ability to fly between airports without having to move through the airport terminal with hundreds of commercial passengers.

Key takeaways:Disruptive innovation describes the process by which a product or service takes hold at the bottom of a market and eventually displaces established competitors, products, firms, or alliances. The term was popularised by American academic and business consultant Clayton M. Christensen.Disruptive innovation occurs since most companies tend to innovate faster than their customers’ needs evolve. Innovation typically favors products or services that are too sophisticated, complex, or expensive for the target audience.For a market entrant to become a disruptive innovator, there are three crucial ingredients. Technology with the capacity to significantly improve the way consumers do things must first exist. This technology must also benefit suppliers and contractors. Lastly, there must also be a business model that targets consumers at the bottom end of the market with innovative products.Connected Strategy Frameworks Ansoff Matrix You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.Read: Ansoff Matrix In A Nutshell

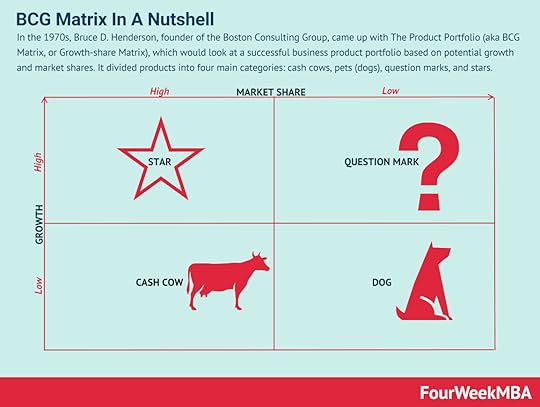

BCG Matrix In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Read: BCG Matrix

Balanced Scorecard First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.Read: Balanced Scorecard

Blue Ocean Strategy A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Read: Blue Ocean Strategy

PEST Analysis The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.

The PESTEL analysis is a framework that can help marketers assess whether macro-economic factors are affecting an organization. This is a critical step that helps organizations identify potential threats and weaknesses that can be used in other frameworks such as SWOT or to gain a broader and better understanding of the overall marketing environment.Read: Pestel Analysis

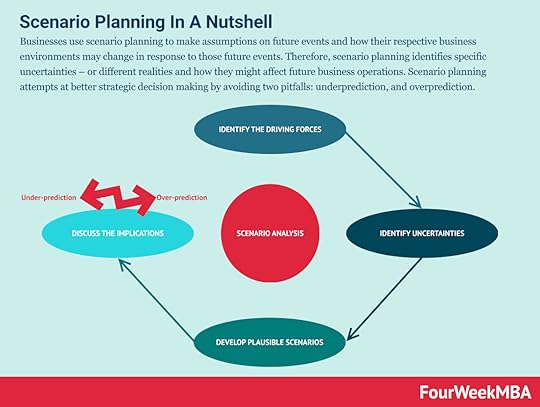

Scenario Planning Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.

Businesses use scenario planning to make assumptions on future events and how their respective business environments may change in response to those future events. Therefore, scenario planning identifies specific uncertainties – or different realities and how they might affect future business operations. Scenario planning attempts at better strategic decision making by avoiding two pitfalls: underprediction, and overprediction.Read: Scenario Planning

SWOT Analysis A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.

A SWOT Analysis is a framework used for evaluating the business’s Strengths, Weaknesses, Opportunities, and Threats. It can aid in identifying the problematic areas of your business so that you can maximize your opportunities. It will also alert you to the challenges your organization might face in the future.Read: SWOT Analysis In A Nutshell

Growth Matrix In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).

In the FourWeekMBA growth matrix, you can apply growth for existing customers by tackling the same problems (gain mode). Or by tackling existing problems, for new customers (expand mode). Or by tackling new problems for existing customers (extend mode). Or perhaps by tackling whole new problems for new customers (reinvent mode).Read: Growth Matrix In A Nutshell

Comparable Analysis Framework A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.

A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.Read: Comparable Analysis Framework In A Nutshell

Business Model Canvas The business model canvas is a framework proposed by Alexander Osterwalder and Yves Pigneur in Busines Model Generation enabling the design of business models through nine building blocks comprising: key partners, key activities, value propositions, customer relationships, customer segments, critical resources, channels, cost structure, and revenue streams.

The business model canvas is a framework proposed by Alexander Osterwalder and Yves Pigneur in Busines Model Generation enabling the design of business models through nine building blocks comprising: key partners, key activities, value propositions, customer relationships, customer segments, critical resources, channels, cost structure, and revenue streams.Read: Business Model Canvas In A Nutshell

Business Experimentation Business experiments help entrepreneurs test their hypotheses. Rather than define the problem by making too many hypotheses, a digital entrepreneur can formulate a few assumptions, design experiments, and check them against the actions of potential customers. Once measured, the impact, the entrepreneur, will be closer to define the problem.

Business experiments help entrepreneurs test their hypotheses. Rather than define the problem by making too many hypotheses, a digital entrepreneur can formulate a few assumptions, design experiments, and check them against the actions of potential customers. Once measured, the impact, the entrepreneur, will be closer to define the problem.Read: Business Experimentation

Speed Reversibility

The speed-reversibility Matrix, by FourWeekMBA will help you understand how to allocate the resources based on the worst-case-scenario-test.

Read: Speed-Reversibility Matrix

Blue Ocean A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost-value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.Read: Blue Ocean Strategy

BCG Matrix In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.

In the 1970s, Bruce D. Henderson, founder of the Boston Consulting Group, came up with The Product Portfolio (aka BCG Matrix, or Growth-share Matrix), which would look at a successful business product portfolio based on potential growth and market shares. It divided products into four main categories: cash cows, pets (dogs), question marks, and stars.Read more: BCG Matrix

AIDA Model AIDA stands for attention, interest, desire, and action. That is a model that is used in marketing to describe the potential journey a customer might go through before purchasing a product or service. The AIDA model helps organizations focus their efforts when optimizing their marketing activities based on the customers’ journeys.

AIDA stands for attention, interest, desire, and action. That is a model that is used in marketing to describe the potential journey a customer might go through before purchasing a product or service. The AIDA model helps organizations focus their efforts when optimizing their marketing activities based on the customers’ journeys.Read more: AIDA Model

Pirate Funnel Venture capitalist, Dave McClure, coined the acronym AARRR which is a simplified model that enables to understand what metrics and channels to look at, at each stage for the users’ path toward becoming customers and referrers of a brand.

Venture capitalist, Dave McClure, coined the acronym AARRR which is a simplified model that enables to understand what metrics and channels to look at, at each stage for the users’ path toward becoming customers and referrers of a brand.Read more: Pirate Funnel

The post What Is Disruptive Innovation? Disruptive Innovation In A Nutshell appeared first on FourWeekMBA.

December 9, 2021

How Does FTX Work And Make Money?

FTX is a cryptocurrency exchange platform headquartered in the Bahamas but incorporated in Antigua and Barbuda. The platform was founded by Sam Bankman-Fried who became inspired to make money for the greater social good while studying at MIT.On a mobile-based trading app, retail and institutional traders can buy and sell futures, options, leveraged tokens, fiat currency, cryptocurrency, and non-fungible tokens (NFTs). Users can receive discounts on trading fees by using the native token FTT.FTX makes money through various trading fees, including maker fees, taker fees, NFT fees, and margin borrower interest. The company also charges interest on its institutional loan service and collects a fee from merchants that want to accept cryptocurrency as a form of payment.FTX Origing Story

FTX is a cryptocurrency exchange platform headquartered in the Bahamas but incorporated in Antigua and Barbuda. The platform was founded by Sam Bankman-Fried who became inspired to make money for the greater social good while studying at MIT.On a mobile-based trading app, retail and institutional traders can buy and sell futures, options, leveraged tokens, fiat currency, cryptocurrency, and non-fungible tokens (NFTs). Users can receive discounts on trading fees by using the native token FTT.FTX makes money through various trading fees, including maker fees, taker fees, NFT fees, and margin borrower interest. The company also charges interest on its institutional loan service and collects a fee from merchants that want to accept cryptocurrency as a form of payment.FTX Origing StoryFTX is a cryptocurrency exchange platform headquartered in the Bahamas but incorporated in Antigua and Barbuda. The platform was founded by Sam Bankman-Fried in 2019.

While studying at MIT, Bankman-Fried stumbled upon the philosophy of effective altruism. The movement, which was founded by two Oxford University professors, encourages individuals to use evidence and reason to determine how to benefit others as much as possible. Inspired by a meeting with one of these professors, he decided to devote his life to earning money for the express purpose of giving it away to those in need.

In the summer of his junior year, he decided to intern at Wall Street firm Jane Street Capital. There, he discovered a passion for trading ETFs and Bitcoin, with the latter making him thousands of dollars in arbitrage profit between American and Japanese exchanges. This income was then used to found Alameda Research, a quantitative trading firm moving as much as $25 million in Bitcoin daily.

Over time, however, Bankman-Fried and his associates grew tired of the one-dimensionality of mainstream exchanges. Since they were mostly designed for inexperienced retail traders, most only allowed the buying and selling of cryptocurrencies. This provided the impetus for the launching of FTX in June 2019, a platform now known for offering more sophisticated derivative products including futures, options, and tokenized stocks that track the value of real shares in companies such as Tesla and BioNTech.

In July 2021, it was reported that FTX was averaging $10 billion in daily trading volume across more than 1 million users. Recent figures suggest the company is worth around $18 billion.

How does FTX work?On the FTX platform, retail and institutional traders can buy and sell futures, options, leveraged tokens, fiat currency, cryptocurrency, and non-fungible tokens (NFTs).

Trading is performed in a mobile-based app, which lets traders build a customized interface layout using drag and drop boxes.

The company has also developed an exchange token for use in the FTX ecosystem called FTT. Users receive lower trading fees for holding FTT and the token can also be used as futures collateral and for staking.

FTX customers can also receive a branded debit card which lets them spend crypto assets on offline purchases.

How does FTX make money?In line with its diverse product offering, FTX has a varied revenue generation strategy. In this section, we’ll take a look at some of the main sources of income.

Trading feesMost revenue is derived from trading fees, with the company utilizing a tiered structure as follows:

Tier 1 – 0.020% maker fee and 0.070% taker fee.Tier 2 (30-day volume over $2 million USD) – 0.015% maker fee and 0.060% taker fee.Tier 3 (30-day volume over $5 million) – 0.010% maker fee and 0.055% taker fee.Tier 4 (30-day volume over $10 million) – 0.005% maker fee and 0.050% taker fee.Tier 5 (30-day volume over $25 million) – 0.000% maker fee and 0.045% taker fee.Tier 6 (30-day volume over $50 million) – 0.000% maker fee and 0.040% taker fee.As noted earlier, these fees can be reduced if the user stakes FTT. Taker fees can be reduced to as little as 0.015% depending on the amount staked.

What’s more, the company charges borrowers a daily interest rate when margin trading. Leveraged tokens, which allow users to take a leveraged position in a cryptocurrency of their choice, also come with a 0.10% redemption fee and 0.03% daily management fee.

LoansFor its most sophisticated traders that meet certain criteria, FTX will extend a line of credit.

The company collects interest on these loans, with the interest rate likely to be dependent upon the prior trading performance of the entity and how much collateral they can access.

NFT feesFTX NFTs is an NFT marketplace launched in September 2021 and built on the Solana blockchain.

Here, the company makes money by charging a 5% fee to both the buyer and the seller on each trade or sale.

InvestmentsSince its inception, FTX has made several investments in other related start-ups.

These include $150 million to acquire the cryptocurrency tracking app Blockfolio and a $100 million investment with two other partners in Web3 gaming development.

In many cases, FTX sells the investment at a later date for a profit. In the interim, it collects valuable user data that guides its expansion or product development strategies.

Interchange and payment feesLike many neobanks and related organizations, FTX makes money on interchange fees.

These fees are paid by the merchant to FTX whenever a customer uses its branded debit card to make a purchase. Note that FTX has to share this fee with the card issuer Visa.

For businesses that want to accept cryptocurrency as a form of payment, they can sign up for FTX Pay. For the privilege, FTX charges a 1% fee of the total purchase amount.

Connected Business Concepts According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability! A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain. The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index. BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web.

BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web. In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger. In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar! In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology.

In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology. Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises.

Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises. Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain.

Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain. In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains.

In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains. Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation.

Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation. Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.

Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.Get The 450 Pages Blockchain Business Models Book

Read Next: Coinbase Business Model, Metamask, Rainbow.

Read Also: BAT Token, Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Solana, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does FTX Work And Make Money? appeared first on FourWeekMBA.

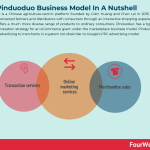

The Pinduoduo Business Model In A Nutshell

Pinduoduo is a Chinese agriculture-centric platform founded by Colin Huang and Chen Lei in 2015. The platform connected farmers and distributors with consumers through an interactive shopping experience. Today, it offers a much more diverse range of products to ordinary consumers.Pinduoduo has a typical revenue generation strategy for an eCommerce giant under the marketplace business model. Pinduoduo also offers advertising to merchants in a system not dissimilar to Google’s PPC advertising model.Pinduoduo Origin Story

Pinduoduo is a Chinese agriculture-centric platform founded by Colin Huang and Chen Lei in 2015. The platform connected farmers and distributors with consumers through an interactive shopping experience. Today, it offers a much more diverse range of products to ordinary consumers.Pinduoduo has a typical revenue generation strategy for an eCommerce giant under the marketplace business model. Pinduoduo also offers advertising to merchants in a system not dissimilar to Google’s PPC advertising model.Pinduoduo Origin StoryPinduoduo is a Chinese agriculture-centric platform founded by Colin Huang and Chen Lei in 2015. The platform originally connected farmers and distributors with consumers through an interactive shopping experience.

Pinduoduo is the fourth start-up for ex-Google employee Colin Huang, who had prior experience in developing eCommerce algorithms and chat-based gaming systems. Huang had the vision to combine the best elements of Chinese giants Alibaba and Tencent since the two companies did not understand how the other made money. Indeed, Alibaba struggled to create an online community despite achieving great success selling online goods. Tencent, on the other hand, was a social media conglomerate that had failed to leverage its massive user base in eCommerce.

Central to the future success of Pinduoduo was Huang’s belief that shopping was like a game. To that end, users on the platform could enjoy large discounts if they were able to convince family and friends to purchase in bulk. Translating this idea into a working platform required more work and an initial $8 million round of funding. Pinduoduo then went on an aggressive recruitment drive, seeking out new graduates hungry for success and single individuals unburdened by family commitments in particular.

Pinduoduo started by selling fruits and vegetables with more attractive fees than competitors such as Alibaba and JD.com. This attracted millions of working-class, price-conscious Chinese citizens who pushed monthly revenue to $152 million by 2016. Many of these citizens lived in remote or rural areas where it had been previously uneconomical to ship products.

To profit from the more affluent end of the market, Pinduoduo began onboarding international brands such as Nike and Apple. No longer confined to agricultural products, the platform now sells a range of items including liquor, cosmetics, clothing, electronics, and baby supplies.

In April 2021, Pinduoduo surpassed Alibaba to become China’s largest eCommerce site in terms of annual active users. Four months later, the company posted its first quarterly profit of $372 million.

Pinduoduo revenue generationPinduoduo has a typical revenue generation strategy for an eCommerce giant under the marketplace business model. The company makes money through transaction services, merchandise sales, and online marketing services.

Transaction servicesThe company charges merchants fees for transaction-related services provided, and it also rewards merchants who sell high-quality products

and provide superb services with preferential fee rates.

In this case, the company, as it highlights in the financials, “charges fees for transaction services to merchants for sales transactions completed on the Group’s platform, where the Group does not take control of the products provided by the merchants at any point in the time during the

transactions and does not have latitude over pricing of the merchandise.”

The fees are determined as a percentage of the purchase price of the merchandise sold by merchants.

Transaction services revenues represented about 10% of the company’s revenues in 2020, per its financials.

Merchandise salesMerchandise sales are generated as a small portion of revenues from online direct sales, where the company acquires products from suppliers and sells them directly to users.

How does the merchandise sales model work?

As the company shows in its financials, in certain cases it acquires merchandise from suppliers and sells directly to consumers. Thus acting as a principal for and taking control of the merchandise.

Merchandise sales revenues represented about 10% of the company’s revenues in 2020, per its financials.

Online marketing servicesAs reported in its financials, Pinduoduo provides online marketing services primarily to “allow merchants to bid for keywords that match product listings appearing in search results on its platform and advertising placements such as banners, links and logos. The placement and the price for such placement are determined through an online bidding system.”

In a similar vein to Google’s PPC advertising, Pinduoduo merchants can also bid for keywords to have their product listings show in search results.

The online bidding system determines the price paid by each merchant and where the ad will be placed on the platform, which uses recommendation algorithms to show highly targeted ads based on a user’s browsing behavior.

The advertising platform also covers video ads, through browsing rather than searching.

As the company highlights display marketing services are provided allowing merchants to place advertisements on the platform primarily at

fixed prices. As highlighted merchants will “prepay for display marketing which is accounted for as customer advances and deferred revenues and revenues are primarily recognized over the period during which the advertising services are provided.”

Over 80% of the company’s revenues came from online marketing services in 2020.

Connected Business Concepts Alipay is a Chinese mobile and online payment platform created in 2004 by entrepreneur Jack Ma as the payment arm of Taobao, a major Chinese eCommerce site. Alipay, therefore, is the B2C component of Alibaba Group. Alipay makes money via escrows transaction fees, a range of value-added ancillary services, and through its Credit Pay Instalment fees.

Alipay is a Chinese mobile and online payment platform created in 2004 by entrepreneur Jack Ma as the payment arm of Taobao, a major Chinese eCommerce site. Alipay, therefore, is the B2C component of Alibaba Group. Alipay makes money via escrows transaction fees, a range of value-added ancillary services, and through its Credit Pay Instalment fees. Taobao is a Chinese eCommerce website, and it is among the most visited websites in the world. Within it also comprises its payment arm, Alipay. Taobao is part of the Alibaba Group, founded by Chinese tech entrepreneur Jack Ma. The company makes money via its Tmalls (e-commerce platform), and through Alipay, mostly via its Escrow service fees.

Taobao is a Chinese eCommerce website, and it is among the most visited websites in the world. Within it also comprises its payment arm, Alipay. Taobao is part of the Alibaba Group, founded by Chinese tech entrepreneur Jack Ma. The company makes money via its Tmalls (e-commerce platform), and through Alipay, mostly via its Escrow service fees. WeChat is a “super app” or an app that can do many things, from messaging to mobile payments and social media. Developed by Tencent, WeChat is among the most popular Super Apps in China. WeChat makes money via value-added services (with services like Moments, Public Accounts, and Gaming), advertising, and payments on the transaction processed through it.

WeChat is a “super app” or an app that can do many things, from messaging to mobile payments and social media. Developed by Tencent, WeChat is among the most popular Super Apps in China. WeChat makes money via value-added services (with services like Moments, Public Accounts, and Gaming), advertising, and payments on the transaction processed through it. Read Next: Alibaba Business Model, What Does Tencent Own, WeChat Business Model, Taobao Business Model, Alipay Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Pinduoduo Business Model In A Nutshell appeared first on FourWeekMBA.

How Does MetaMask Work And Make Money?

MetaMask is a software cryptocurrency wallet for the Ethereum blockchain. The platform is the brainchild of Ethereum blockchain advocate Joseph Lubin. The MetaMask wallet is available as a Chrome or Firefox browser extension. Alternatively, it can be accessed through an app. MetaMask makes money on swap fees when users compare or swap Ethereum-based tokens. The company also charges management fees to institutions that desire a more seamless DeFi investment experience.

MetaMask origin storyMetaMask is a software cryptocurrency wallet for the Ethereum blockchain. The platform was created by American blockchain software technology company ConsenSys in 2016.

ConsenSys in turn was founded by Joseph Lubin, a champion of Ethereum’s ecosystem construction responsible for more than 50 well-known growth projects. Lubin is also thought to be a multi-billionaire after being one of the biggest buyers of Ether during its initial crowdfunding.

Essentially, ConsenSys is a start-up studio that incorporates and launches Ethereum-based businesses and provides technology services to other companies. One such business was MetaMask, which was launched in July 2016 and developed by former Apple engineers Aaron Davis and Dan Finlay.

Though uptake was initially sluggish, MetaMask benefitted from the CryptoKitties NFT craze and the increased publicity around cryptocurrency in general. The wallet, which allowed users to exchange and store Ethereum-based tokens, surpassed 1 million downloads in early 2018. Beta versions of an app for Android and iPhone arrived just over a year later.

During the summer of 2020, MetaMask achieved the magical mark of 1 million active monthly users. This number was largely facilitated by the increased usage of DeFi protocols including Yearn Finance, Curve, and MakerDAO.

Today, MetaMask is known as the most useful Ethereum open-source wallet in the world, enabling users to manage their Ethereum assets easily. The platform now boasts more than 10 million monthly active users, with the surge in popularity coming from developing nations such as Vietnam and Nigeria.

How does MetaMask work?The MetaMask wallet is installed as a Chrome or Firefox browser extension. Alternatively, it can be accessed through an app.

The sign-up process requires the user to come up with a password, after which they will be shown twelve so-called “seed words” that they must remember. These words are used if a password is forgotten.

Users can then deposit or send currency and are protected by a private key which is stored locally on their computer. For near 100% security, the MetaMask wallet can be connected to hardware wallets such as Ledger and Trezor.

How does MetaMask make money?MetaMask revenue generation occurs via swap fees, management fees, and merchandise sales. Let’s take a look at these in more detail below.

Swap feesMost company revenue is derived from swap fees, which are charged when users compare and swap tokens within MetaMask itself.

A swap fee, or service fee, of 0.875% is automatically factored into each quote. This feature combines data from decentralized exchange aggregators and market makers to ensure network costs are minimized.

Management feesMetaMask also makes money from MetaMask Institutional, a wallet designed for trading firms and other financial organizations.

MetaMask Institutional offers the same functionality as the consumer wallet, but it also provides access to qualified custodial platforms that help the business make DeFi investments. This is done without comprising operational efficiency, compliance requirements, or institution-required security.

Management fees for this service are undisclosed.

Merchandise salesLastly, the company makes money by selling branded merchandise in its online store.

Items for sale include t-shirts, hats, mugs, activewear, and apparel for pets such as dogs.

Connected Business Concepts According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability! A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain. The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index. BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web.

BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web. In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger. In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar! In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology.

In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology. Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises.

Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises. Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain.

Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain. In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains.

In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains. Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation.

Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation. Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.

Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.Get The 450 Pages Blockchain Business Models Book

Read Also: BAT Token, Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Solana, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does MetaMask Work And Make Money? appeared first on FourWeekMBA.

How Does Rainbow (Wallet) Work And Make Money?

Rainbow is a fun, simple, and secure Ethereum wallet that helps users manage their assets. The platform was founded by Christian Baroni, Mike Demarais, and Jin Chung in 2019 to make Ethereum technologies more accessible to non-savvy consumers.Rainbow onboards casual users into Web3 in much the same way that Robinhood onboards casual investors into traditional equities. Users can pay for ETH using Apple Pay infrastructure and can connect to other wallets such as MetaMask. Unlike some cryptocurrency exchanges, Rainbow does not hold assets on the behalf of its users. Rainbow revenue generation is undisclosed, though it is likely the platform earns a commission from third-party cryptocurrency exchanges or other infrastructure providers. With a core focus on NFTs, the company may also take a percentage of NFT minting fees as a commission.Origin Story

Rainbow is a fun, simple, and secure Ethereum wallet that helps users manage their assets. The platform was founded by Christian Baroni, Mike Demarais, and Jin Chung in 2019 to make Ethereum technologies more accessible to non-savvy consumers.Rainbow onboards casual users into Web3 in much the same way that Robinhood onboards casual investors into traditional equities. Users can pay for ETH using Apple Pay infrastructure and can connect to other wallets such as MetaMask. Unlike some cryptocurrency exchanges, Rainbow does not hold assets on the behalf of its users. Rainbow revenue generation is undisclosed, though it is likely the platform earns a commission from third-party cryptocurrency exchanges or other infrastructure providers. With a core focus on NFTs, the company may also take a percentage of NFT minting fees as a commission.Origin StoryRainbow is a fun, simple, and secure Ethereum wallet that helps users manage their assets. The platform was founded by Christian Baroni, Mike Demarais, and Jin Chung in 2019.

The trio came together with a mission to make navigating Ethereum technologies simpler for the average consumer. Baroni used to contract design for Microsoft while he was at high school and then took a job at Stripe at the age of 17. Demarais immersed himself in computer design and website creation from a young age, dropping out of college to work as an engineer at several user-focused start-ups. Chung, on the other hand, was a relative newcomer to the industry. She majored in computer science engineering and would later write trading tools for equity derivatives and algorithms for eBay’s recommendation systems.

What resulted from this experience was Rainbow, which would become the world’s most well-known Ethereum mobile interfaces. The company founders leveraged their unique backgrounds to create narrowly-tailored UI/UX to both on-ramp non-crypto users and facilitate new Web3 behaviors.

Rainbow is also the wallet of choice for NFT collectors, with the company envisioning a future world where friends can follow each other across the Metaverse. More specifically, users will be able to showcase their on-chain history, on-chain collectibles, and on-chain access to others.

How does Rainbow work?Rainbow onboards casual users into Web3 in much the same way that Robinhood onboards casual investors into traditional equities.

Users can purchase ETH or other ERC-20 tokens using Apple Pay infrastructure, with the process of on-ramping casual users into the Ethereum ecosystem taking no more than thirty seconds.

Unlike crypto exchanges such as Coinbase, Rainbow does not hold assets on behalf of its users.

Rainbow also enables users to:

Send, receive, and trade assets from their wallet without going through a financial institution.Trade on the leading decentralized exchange Uniswap.Connect to dApps and websites such as Yearn, Aave, and Compound.Purchase and display crypto art from sites such as Foundation, Zora, and OpenSea. Showcase their favorite digital art on social media by sharing a Rainbow profile.Importantly, users can also use an existing Ethereum wallet such as MetaMask with Rainbow.

How does Rainbow make money?Like many cryptocurrency wallets, Rainbow charges transaction fees whenever a user performs actions like swapping currencies, sending assets, and minting NFTs.

Though exact revenue generation methods are undisclosed, many similar wallets earn commissions from a range of third-party services incorporated into the platform. These may include cryptocurrency exchanges such as Changelly and fiat infrastructure providers such as Simplex. The company may also charge a swap fee for users of Uniswap.

Rainbow also charges gas fees whenever a change is made to the Ethereum blockchain. However, it should be remembered that the company is simply passing these fees to the user and does not profit from them.

The company has plans to introduce additional features to reduce gas fees by making the Ethereum ecosystem more efficient.

Connected Business Concepts According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability! A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain. The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index. BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web.

BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web. In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger. In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar! In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology.

In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology. Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises.

Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises. Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain.

Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain. In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains.

In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains. Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation.