Gennaro Cuofano's Blog, page 133

December 26, 2021

What Is The House Money Effect? The House Money Effect In A Nutshell

The house money effect was first described by researchers Richard Thaler and Eric Johnson in a 1990 study entitled Gambling with the House Money and Trying to Break Even: The Effects of Prior Outcomes on Risky Choice. The house money effect is a cognitive bias where investors take higher risks on reinvested capital than they would on an initial investment.

Understanding the house money effectIn the paper, Thaler and Johnson ask the reader to consider a scenario where they were attending a convention in Las Vegas. While passing the slot machines in a casino one night, they place a quarter in one slot machine and win $100.

The pair then asks the reader to consider how their gambling behavior might be affected for the rest of the evening. In other words, would they be tempted to make a few more serious wages – even if they usually refrained from the practice? The answer, in most cases, is yes. The individual would continue to place bets in the casino with house money.

Today, the house money effect is more commonly associated with investors. The effect suggests some investors tend to enter into positions with higher risk if they have already made a profit from the initial investment. Windfall trades may also induce the house money effect. When an investor triples their money in four months, for example, they may bet it all on another risky trade instead of taking profit or investing more conservatively.

Why does the house money effect occur?The house money effect occurs because of the distinction investors make between their own capital in the form of wages or savings and the capital gains made on an investment.

In simple terms, the house money effect describes a tendency for the investor to take on more risk with money obtained easily or unexpectedly. Capital earned through employment or other means is not invested in the same way since the capital itself is harder to “earn”.

To demonstrate the attraction of easy-won gains, Thaler and Johnson conducted a study with two groups. The first group was told they’d won $30 and could take part in a coin toss to gamble a portion of their winnings. Heads would reduce the winnings to $21 and tails would increase them to $39. The second group was given a more simple proposition: they could either accept the $30 or toss the coin under identical terms to the first group.

While the expected value for each group was the same, the members of the group who were told they’d won the money were more likely to take the coin toss and risk losing their money. The second group, whose money was not associated with gambling, was much more conservative and decided to cash out their $30.

Key takeaways:The house money effect is a cognitive bias where investors take higher risks on reinvested capital than they would on an initial investment.The house money effect was first described by researchers Richard Thaler and Eric Johnson in 1990. They described the effect in the context of a gambler in Las Vegas, who becomes more inclined to bet with house money after winning $100 on a slot machine.The house money effect occurs because of the distinction investors make between their own capital in the form of wages or savings and the capital gains made on an investment. Capital gains are considered more easily attained, so the investor is comfortable taking on more risk when investing them.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkRelated Business Concepts As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty. The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not. The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist.

The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist. The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty. The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased.

The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased. The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves. Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s. The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it.

The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it. Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).

Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches). The Hawthorne Effect refers to an inclination of some people to work harder or perform better when they know they are being observed. The effect is most associated with those who are experiment participants, who alter their behavior due to the attention they are receiving and not due to any manipulation of independent variables. Therefore, the Hawthorne Effect describes the tendency for a person to change their behavior with the awareness that they are being observed.

The Hawthorne Effect refers to an inclination of some people to work harder or perform better when they know they are being observed. The effect is most associated with those who are experiment participants, who alter their behavior due to the attention they are receiving and not due to any manipulation of independent variables. Therefore, the Hawthorne Effect describes the tendency for a person to change their behavior with the awareness that they are being observed. In statistics, the Simpson Paradox happens when a trend clearly shows up in clusters/brackets of data. But it disappears or at worse it reverses when the data is grouped and combined. In short, the Simpson paradox shows that when the data moves from clusters to combined data, it hides several distributions, which end up creating a biased overall effect.

In statistics, the Simpson Paradox happens when a trend clearly shows up in clusters/brackets of data. But it disappears or at worse it reverses when the data is grouped and combined. In short, the Simpson paradox shows that when the data moves from clusters to combined data, it hides several distributions, which end up creating a biased overall effect.  Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.The post What Is The House Money Effect? The House Money Effect In A Nutshell appeared first on FourWeekMBA.

Buy Now Pay Later Companies

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Affirm Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Affirm Business Model

Started as a pay-later solution integrated into merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Klarna Business Model

Started as a pay-later solution integrated into merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Klarna Business Model Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.Splitit Business Model

Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.Splitit Business Model Splitit is a fintech company founded by Israeli entrepreneurs Gil Don and Alon Feit in 2009. The platform was initially created to allow consumers to use existing credit to make BNPL purchases.Splitit relies on transaction fees to make money, with the exact fee depending on how and when the merchant chooses to be paid. Splitit does not charge consumers for late or missed payments. Nor does it charge interest on purchases. Instead, the company relies on transaction value and mass consumer uptake to make money.Quadpay Business Model

Splitit is a fintech company founded by Israeli entrepreneurs Gil Don and Alon Feit in 2009. The platform was initially created to allow consumers to use existing credit to make BNPL purchases.Splitit relies on transaction fees to make money, with the exact fee depending on how and when the merchant chooses to be paid. Splitit does not charge consumers for late or missed payments. Nor does it charge interest on purchases. Instead, the company relies on transaction value and mass consumer uptake to make money.Quadpay Business Model

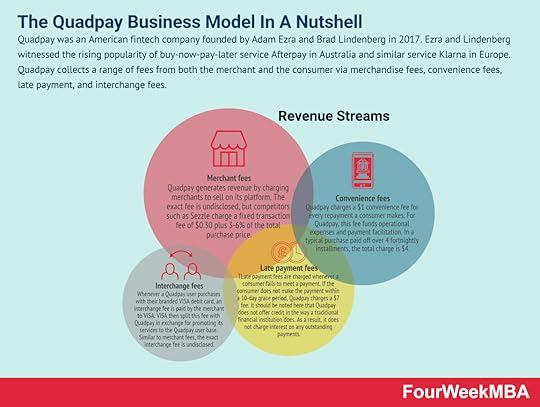

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Venmo Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Venmo Business Model Stripe Business Model

Stripe Business Model Revolut Business Model

Revolut Business Model

Revolut is an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.

Revolut is an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.Read Next: Affirm Business Model, Chime Business Model, Coinbase Business Model, Klarna Business Model, Paypal Business Model, Stripe Business Model, Robinhood Business Model.

Read Also: How Does PayPal Make Money

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Buy Now Pay Later Companies appeared first on FourWeekMBA.

Afterpay Competitors In A Nutshell

Afterpay is an Australian fintech company operating in Australia, Canada, the United Kingdom, New Zealand, and the United States. Founded in 2014 by Nick Molnar and Anthony Eisen, the company enjoyed a first-mover advantage in the buy-now-pay-later (BNPL) space. Less than seven years later, the company reached 13.1 million active customers with gross sales amounting to $10.1 billion. Despite its success, some suggest the company has lost its edge in the buy-now-pay-later space with the emergence of several high-profile competitors exerting their influence and giving merchants more choice.

ZipZip is another Australian fintech company founded approximately one year before Afterpay. The company offers the interest-free Zip Pay digital wallet with BNPL functionality and also the free budget planner and personal finance app Pocketbook. For those desiring a line of credit for larger purchases, Zip Money is also available.

Zip is perhaps the largest Afterpay competitor in the Australian and New Zealand markets, processing $893.5 million in transaction volume during Q4 FY21 alone. However, Zip also has a significant presence in North America after acquiring QuadPay for $400 million in June 2020.

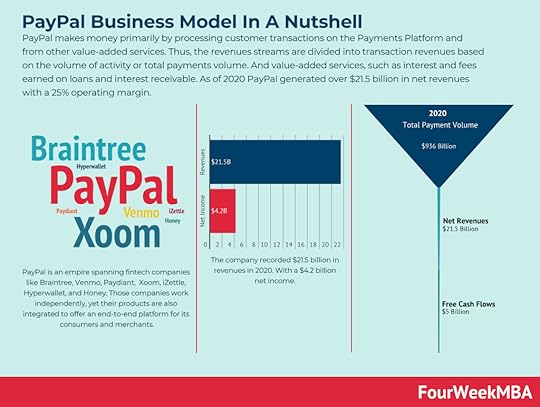

PayPal PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenues streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2020 PayPal generated over $21.5 billion in net revenues with a 25% operating margin.

PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenues streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2020 PayPal generated over $21.5 billion in net revenues with a 25% operating margin. In March 2021, PayPal announced plans to launch its deferred payment service for Australian merchants. The service, dubbed PayPal Pay in 4, was launched in the US, UK, and France the previous year in response to high consumer demand.

The payment service appears in the PayPal wallet at checkout and eCommerce businesses can also advertise the option using a dedicated button on their website. When it was launched in Australia, PayPal Pay in 4 was immediately available to the more than 9 million PayPal members.

Read Also: How Does PayPal Make Money

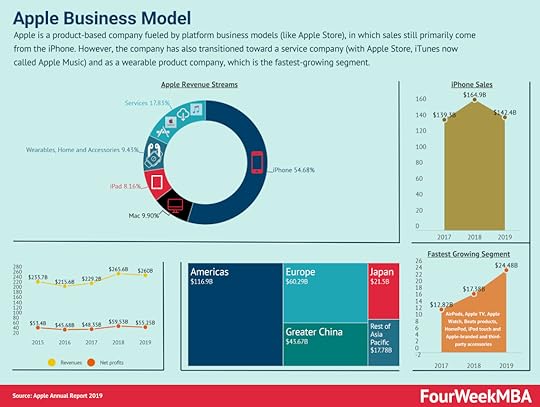

Apple Apple is a product-based company fueled by platform business models (like Apple Store), in which sales still primarily come from the iPhone. However, the company has also transitioned toward a service company (with Apple Store, iTunes now called Apple Music) and as a wearable product company, which is the fastest-growing segment.

Apple is a product-based company fueled by platform business models (like Apple Store), in which sales still primarily come from the iPhone. However, the company has also transitioned toward a service company (with Apple Store, iTunes now called Apple Music) and as a wearable product company, which is the fastest-growing segment. Bloomberg reported in July 2021 that Apple was working on a service to let shoppers pay for purchases in installments. The loans would be underwritten by Goldman Sachs Group Inc., a partner of the company since the Apple credit card was launched in 2019.

Apple represents a significant source of competition in the fertile North American market. The tech giant also recently announced it would partner with Affirm PayBright to offer a BNPL solution for Apple device purchases in Canada.

The Commonwealth Bank of AustraliaThe Commonwealth Bank of Australia is a large multinational bank with business interests across Australia, New Zealand, Asia, the US, and the UK.

The bank launched StepPay in August 2021, a BNPL service for purchases over $100. More than 86,000 consumers pre-registered for the service before it was released in Australia. StepPay can be added to the existing CommBank app or digital wallet on smartphones and tablets.

Splitit Splitit is a fintech company founded by Israeli entrepreneurs Gil Don and Alon Feit in 2009. The platform was initially created to allow consumers to use existing credit to make BNPL purchases.Splitit relies on transaction fees to make money, with the exact fee depending on how and when the merchant chooses to be paid. Splitit does not charge consumers for late or missed payments. Nor does it charge interest on purchases. Instead, the company relies on transaction value and mass consumer uptake to make money.

Splitit is a fintech company founded by Israeli entrepreneurs Gil Don and Alon Feit in 2009. The platform was initially created to allow consumers to use existing credit to make BNPL purchases.Splitit relies on transaction fees to make money, with the exact fee depending on how and when the merchant chooses to be paid. Splitit does not charge consumers for late or missed payments. Nor does it charge interest on purchases. Instead, the company relies on transaction value and mass consumer uptake to make money.Splitit is a BNPL service where consumers and businesses can leverage their existing Visa and Mastercard credit cards. Unlike competitor services, Splitit is not new financing. This means customers avoid paying interest because they aren’t required to carry new debt.

Splitit reported a 31% increase in year-on-year merchant sales volume in Q3 2021. Approximately 1.8 billion cardholders now have access to the platform with the company having a presence in over 30 countries.

Key takeaways:Afterpay is an Australian fintech company founded in 2014 by Nick Molnar and Anthony Eisen. The company enjoyed a first-mover advantage in the BNPL space but is now subject to increased competition in the Australian and North American markets.Zip and the Commonwealth Bank of Australia are the most significant competitors in the Australian market, with the latter having access to a large user base. Tech behemoths Apple and PayPal have also entered the industry, with Apple announcing plans to offer a BNPL solution in the United States and Canada in partnership with Goldman Sachs and Affirm respectively.Read Next: Afterpay Business Model

Read Also: How Does PayPal Make Money

Connected Fintech Business ModelsFintech Business Models Venmo Business Model

Venmo Business Model Stripe Business Model

Stripe Business Model Coinbase Business Model

Coinbase Business Model How Does Zelle Make Money

How Does Zelle Make Money Klarna Business Model

Klarna Business Model Affirm Business Model

Affirm Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Afterpay Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Afterpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Revolut Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Revolut Business Model

Revolut is an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.

Revolut is an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Afterpay Competitors In A Nutshell appeared first on FourWeekMBA.

Monroe’s Motivated Sequence In A Nutshell

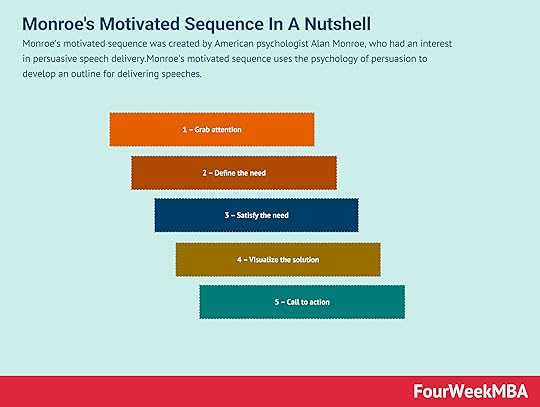

Monroe’s motivated sequence was created by American psychologist Alan Monroe, who had an interest in persuasive speech delivery. Monroe’s motivated sequence uses the psychology of persuasion to develop an outline for delivering speeches.

Understanding Monroe’s motivated sequencePersuasive public speaking skills are important in business. Persuasion can create cohesion within a group around a specific goal or vision. Persuasion can also be used to motivate and encourage team members to hit important deadlines.

Some of these greatest persuasive speakers include Steve Jobs, Martin Luther King, Winston Churchill, and Barack Obama. Many believe that these individuals were simply born with the tools required to become effective public speakers.

However, this is not entirely true. Monroe discovered that these skills can be learned by following a simple methodology.

The five steps of Monroe’s motivated sequenceTo assist in crafting a compelling and persuasive speech, Monroe advocated following these five steps:

1 – Grab attentionFirst and foremost, grab the attention of the audience by telling a joke or asking a rhetorical question. This step is crucial. Depending on the quality of the introduction, people will decide whether your speech is worth their attention.

Primarily, this is achieved through trust and authority. Show the audience why the topic is relevant to them and give the speech credibility with supporting data, videos, charts, or images.

2 – Define the needUse this second step to help the audience understand that there is a problem or challenge that needs addressing. Explain the consequences of the problem not being solved in a way that is relevant to them.

Relevancy can be emphasized by using practical, real-world examples. Again, each should be supported by appropriate facts or data.

3 – Satisfy the needNow it is appropriate to let the audience know that you can satisfy their needs. It’s important to elaborate on the solution in terms that are easily understood. To ensure that the audience is on the same page, it can be useful to repeat the main concepts periodically.

4 – Visualize the solutionHow will the speech prepare the audience for taking action to satisfy their need? Without coming across the wrong way, the speaker should clarify what the future will entail if the solution is not enacted.

Conversely, the benefits of enacting the solution should also be highlighted to contrast both choices.

5 – Call to actionIn the final step, the speaker must tell the audience what they want them to do. In some cases, the plan of action may simply be to do nothing or refrain from certain actions.

The audience must feel they are a part of the solution. Provide several courses of action and allow them to choose. This increases a sense of empowerment as each individual feels in control of their destiny.

Lastly, the speaker should conclude with a powerful closing remark that ties the speech together. Some will also opt to take questions from the audience at this point.

Key takeawaysMonroe’s motivated sequence is an outline for delivering effective speeches using the power of persuasion.Monroe’s motivated sequence can be used in business to motivate employees to work toward a shared vision or meet important deadlines.Monroe’s motivated sequence provides five steps for delivering a persuasive speech. Importantly, the skill of persuasive public speaking can be learned.Connected Frameworks To The Monroe’s Motivated SequenceSix Thinking Hats The Six Thinking Hats model was created by psychologist Edward de Bono in 1986, who noted that personality type was a key driver of how people approached problem-solving. For example, optimists view situations differently from pessimists. Analytical individuals may generate ideas that a more emotional person would not, and vice versa.Value Stream Mapping

The Six Thinking Hats model was created by psychologist Edward de Bono in 1986, who noted that personality type was a key driver of how people approached problem-solving. For example, optimists view situations differently from pessimists. Analytical individuals may generate ideas that a more emotional person would not, and vice versa.Value Stream Mapping Value stream mapping uses flowcharts to analyze and then improve on the delivery of products and services. Value stream mapping (VSM) is based on the concept of value streams – which are a series of sequential steps that explain how a product or service is delivered to consumers.Affinity Grouping

Value stream mapping uses flowcharts to analyze and then improve on the delivery of products and services. Value stream mapping (VSM) is based on the concept of value streams – which are a series of sequential steps that explain how a product or service is delivered to consumers.Affinity Grouping Affinity grouping is a collaborative prioritization process where group participants brainstorm ideas and opportunities according to their similarities. Affinity grouping is a broad and versatile process based on simple but highly effective ideas. It helps teams generate and then organize teams according to their similarity or likeness.Fishbone Diagram

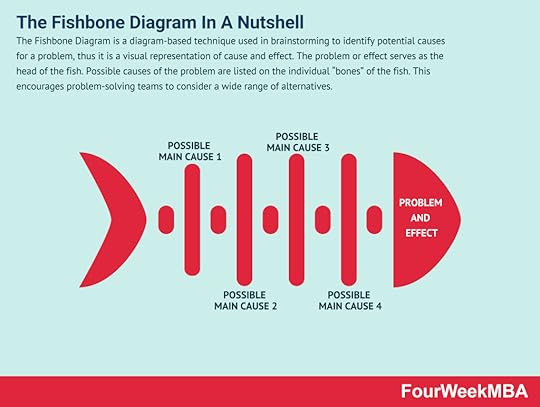

Affinity grouping is a collaborative prioritization process where group participants brainstorm ideas and opportunities according to their similarities. Affinity grouping is a broad and versatile process based on simple but highly effective ideas. It helps teams generate and then organize teams according to their similarity or likeness.Fishbone Diagram The Fishbone Diagram is a diagram-based technique used in brainstorming to identify potential causes for a problem, thus it is a visual representation of cause and effect. The problem or effect serves as the head of the fish. Possible causes of the problem are listed on the individual “bones” of the fish. This encourages problem-solving teams to consider a wide range of alternatives.SCAMPER Method

The Fishbone Diagram is a diagram-based technique used in brainstorming to identify potential causes for a problem, thus it is a visual representation of cause and effect. The problem or effect serves as the head of the fish. Possible causes of the problem are listed on the individual “bones” of the fish. This encourages problem-solving teams to consider a wide range of alternatives.SCAMPER Method Eighteen years later, it was adapted by psychologist Bob Eberle in his book SCAMPER: Games for Imagination Development. The SCAMPER method was first described by advertising executive Alex Osborne in 1953. The SCAMPER method is a form of creative thinking or problem solving based on evaluating ideas or groups of ideas.MECE Framework

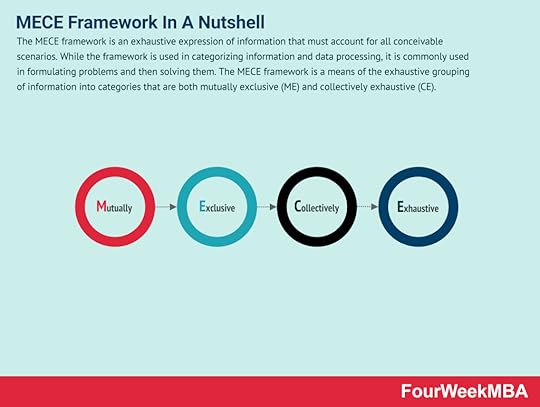

Eighteen years later, it was adapted by psychologist Bob Eberle in his book SCAMPER: Games for Imagination Development. The SCAMPER method was first described by advertising executive Alex Osborne in 1953. The SCAMPER method is a form of creative thinking or problem solving based on evaluating ideas or groups of ideas.MECE Framework The MECE framework is an exhaustive expression of information that must account for all conceivable scenarios. While the framework is used in categorizing information and data processing, it is commonly used in formulating problems and then solving them. The MECE framework is a means of the exhaustive grouping of information into categories that are both mutually exclusive (ME) and collectively exhaustive (CE).Nadler-Tushman Congruence

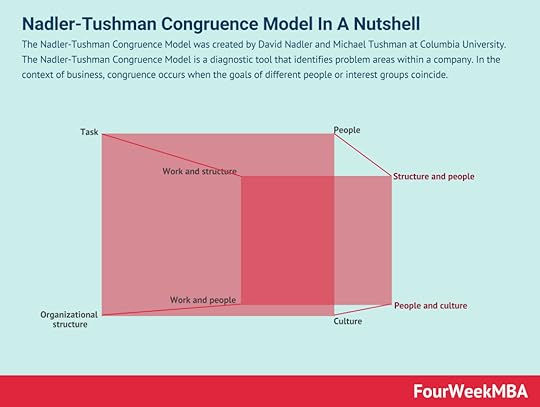

The MECE framework is an exhaustive expression of information that must account for all conceivable scenarios. While the framework is used in categorizing information and data processing, it is commonly used in formulating problems and then solving them. The MECE framework is a means of the exhaustive grouping of information into categories that are both mutually exclusive (ME) and collectively exhaustive (CE).Nadler-Tushman Congruence The Nadler-Tushman Congruence Model was created by David Nadler and Michael Tushman at Columbia University. The Nadler-Tushman Congruence Model is a diagnostic tool that identifies problem areas within a company. In the context of business, congruence occurs when the goals of different people or interest groups coincide.Lewin’s Change Management

The Nadler-Tushman Congruence Model was created by David Nadler and Michael Tushman at Columbia University. The Nadler-Tushman Congruence Model is a diagnostic tool that identifies problem areas within a company. In the context of business, congruence occurs when the goals of different people or interest groups coincide.Lewin’s Change Management Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.

Lewin’s change management model helps businesses manage the uncertainty and resistance associated with change. Kurt Lewin, one of the first academics to focus his research on group dynamics, developed a three-stage model. He proposed that the behavior of individuals happened as a function of group behavior.Main Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDistribution ChannelsMarketing StrategyPlatform Business ModelsNetwork EffectsMain Case Studies:

Amazon Business ModelApple Mission StatementNike Mission Statement Amazon Mission StatementApple DistributionThe post Monroe’s Motivated Sequence In A Nutshell appeared first on FourWeekMBA.

December 23, 2021

How Does PayPal Make Money? PayPal Business Model In A Nutshell

PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenues streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2020 PayPal generated over $21.5 billion in net revenues with a 25% operating margin.

The rise of the PayPal MafiaYou might not see PayPal’s business model as the most interesting one. Yet, the story of PayPal is compelling as this is the place where the so-called PayPal mafia was born.

This group of talented individuals would create among the most valued companies in the Silicon Valley. Let’s start with the deal that made this possible.

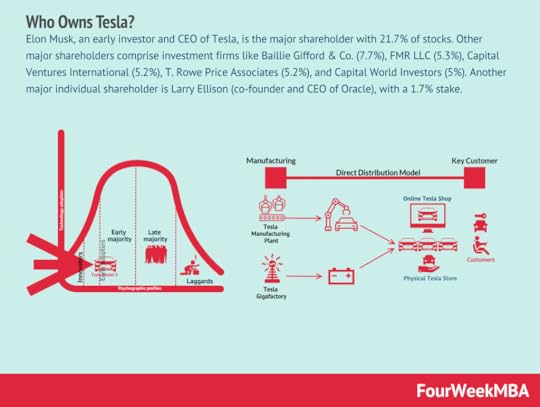

Who owns PayPal?Before we dive into the PayPal business models, it is important to notice that as of the time of this writing PayPal is a sub-organization of eBay, purchased for $1.5 billion in 2002.

That was the deal which made rich people like Peter Thiel, Elon Musk, and Reid Hoffman, which respectively founded companies like Founders Fund, Tesla and LinkedIn.

The deal was sealed just a few months after PayPal went public. In fact, at the time eBay customers made up up the bulk of PayPal’s users.

As reported on cnet.com “63 percent of dollar volume for transactions in the first nine months of 2001 came from settling auction purchases, particularly on eBay.“

It is interesting to dive a bit into PayPal origin story, as it uncovers some critical strategic insights on its early growth and users acquisition, until its deal with eBay.

PayPal origin storyPayPal founded in 1998 by a company called Confinity. In fact, just in 1999 PayPal was launched as a money transfer system.

At the time Confinity had a fierce competitor, called X.com. This was a company founded by Elon Musk (yes that Musk!). The companies rather than compete with each other, they just merged to take over the payment industry.

Once the company merged, they could finally focus on the commercial strategy. Rather than boiling the ocean, PayPal started with a small niche at the time, until they monopolized it and grew further.

Little business strategy note: If you’re familiar with Peter Thiel’s book Zero to One, he explains how the business world is about monopolies rather than competition. In fact, if you attended even for a day business school, you might have learned about the myth of market competition and how this is what makes capitalism work. In reality, how Peter Thiel pointed out capitalism is way more about monopolizing a market to grab most of its profits. In fact, in a situation of perfect competition, margins are so thin that companies can go easily go bankrupt. The real market dominator is the one that takes it all. Thus, the reason why many are not aware of this can be attributed to the fact that monopolies reframe their market position to hide the fact that they control a particular market. They do it because this is the secret that makes them successful. The moment when regulators and market players will find out about a monopoly they’ll try to bring it down.

PayPal’s first growth hack: The bot that gave the company a bit of tractionIn his book “The PayPal Wars” Eric M. Jackson, part of the so-called PayPal mafia (the group of people that would be part of PayPal before its acquisition by eBay) were looking for a way to grow their users’ base, fast.

PayPal management understood they had to acquire users, quickly on an already established platform. At the time they identified eBay as the place where “power users” would help PayPal scale up.

There was an issue though. They were trying to use a classic growth hacking strategy, called OPN (others’ people network). In other words, when you start a venture and can’t leverage yet on your branding (it’ll take years), you need a faster route.

One way is to leverage on distribution agreements with large platforms. However, it’s very hard at the beginning to close any of those deals. Why? For several reasons. First, as your start-up is still small, you don’t have yet anything to offer to the distributor.

Second, a distribution agreement requires at times a certain level of organizational structure to handle the deal, which a start-up might not have. Third, and most important. A large corporation like eBay at the time has a strong brand.

This is an asset but also a liability. In short, getting into a distribution agreement with a start-up that is now yet “known” would represent a too high risk to bear for the established companies.

As PayPal could not leverage on a distribution agreement with eBay, it had to find a “growth hack” to scale up. In short, an unofficial way to use eBay to grow their users’ base.

At the time eBay had purchased a startup, named Billpoint, to make the transactions on the website smooth.

However, also covering the transactions side of the site for eBay was still too risky, as fraud detection was a primary concern. As Eric M. Jackson explains in “The PayPal Wars” this was too much of a concern for eBay as a listed company.

This, in turn, gave PayPal time to come up with a strategy before Billpoint could be rolled out.

The strategy was meant to wipe out competition and take over the payment market. At that point, one idea came to mind, which was to enter in as many actions as possible and then convince the other part of the transaction to use PayPal as payment.

This strategy would be expensive but a good marketing acquisition tactic. How to scale this up? One option was to hire a web farm in Asia. Or, employ a bot (a computer program) that would look for specific auctions and bid on them.

In the end, they went with the bot, on charity auctions with the aim of exposing PayPal to as many eBay users as possible. The bot together with other marketing and product initiatives brought PayPal to over 10,000 users per day.

Growth picked up yet the competitive landscape was still very challenging, with companies, like X.com that were threatening PayPal existence.

A little caveat: the story of this paragraph was inspired from the book “The PayPal Wars” a self-published book, based on account of a marketing employee at PayPal. Take this story as a reference, not as history as the account of the author might bias it.

The merger that brought together PayPal and X.comAs reported by Julie Anderson on Quora:After the merger everyone tried to play nicely together at first, but – as has been widely chronicled from various perspectives – it took just a few months before the differences in opinion turned ugly. Elon took a vacation that year and I’ve always hated that I didn’t realize they were going to oust him as CEO in time; he called that day from somewhere in Africa and asked “How bad is it?” and I said “Not that bad. I think it’s going to be okay.” Middle of the night I sat straight up in bed and headed back to the office; the lights were blazing and everyone was there. It was done by morning, the company became known as PayPal, and that was that.Whether or not the merger was painful and whether or not it created conflicts it also brought together a group of very smart people, the so-called PayPal Mafia.The PayPal Mafia phenomenon

A group of people that were called PayPal Mafia after the eBay deal went on to create many prominent start-ups that would contribute in the later years to the Silicon Valley scene:

Jawed Karim (Youniversity Ventures),Jeremy Stoppelman (founded Yelp with Russel Simmons),Andrew McCormack (partner at venture capital firm Valar Ventures),Premal Shah (non-profit organization Kiva),Luke Nosek (Founders Firm),Ken Howery (VP at Clarium Capital),David Sacks (produced “Thank You for Smoking”),Peter Thiel (created hedge fund Clarium Capital and Founders Firm),Keith Rabois (held senior positions at LinkedIn, Slide),Reid Hoffman (LinkedIn),Max Levchin (Slide. Google bought it for $182 million in 2010),Roelof Botha (Sequoia Capital),Russel Simmons (Yelp),Elon Musk (Tesla, SpaceX).Read Also: PayPal Mafia

The PayPal acquisition by eBayFinally in 2001, after a few months from PayPal IPO, eBay decided to buy the payment company. We don’t know the “real reasons” for eBay to acquire PayPal.

It seems though that at the time most PayPal users were coming from eBay. As reported by a release on July 2002:

The agreement also should benefit eBay shareholders. The combination of the two networks should expand both platforms while minimizing shared operational costs. Strengthening the marketplace and realizing the efficiencies made possible by the acquisition will increase the value of both businesses.

In other words, on the one hand, eBay users were already accustomed to PayPal. On the other hand, PayPal could allow eBay to tap into a new audience as reported in the same press release:

PayPal, which will continue to operate as an independent brand, is a leading online payments solution. Approximately 60% of PayPal’s business takes place on eBay, making it the most preferred electronic payment method among eBay users. The remaining 40% occurs primarily among small merchants who constitute a potential new audience for eBay. Likewise, eBay’s community of 46 million users worldwide represents a growth opportunity for PayPal. eBay’s current payment service, eBay Payments by Billpoint, will be phased out after the close of the transaction.

It is important to notice here that the acquisition of Billpoint that was to meant to allow eBay to have its own transactions system to speed up payments and enable fraud prevention was not successful.

As it failed, this might also have been a critical reason for eBay to purchase PayPal at that price.

PayPal business model dissectedWe’re going to see the ecosystem the company was able to build throughout the years via acquisitions and international expansion. We’ll also look at the overall business model.

PayPal Network Effects ExplainedPayPal network effects, or competitive moats are based on a few key strenghts. As the company highlights from its financials:

Two-sided network—PayPal offers an end-to-end product experiences while gaining valuable insights into customer behavior.Scale, the company has been growing organically for years. As of 2020, it had 377 million active accounts, of which 348 million consumer active accounts and 29 million merchant active accounts.Brands—PayPal comprises a galaxy of fintech brands spanning from PayPal as core product, Braintree, Venmo, Xoom, Hyperwallet, iZettle, and Honey.Risk and Compliance Management—the core platform uses built-in tokenization to keep customer information secure, and to help ensure we process legitimate transactions around the world, while identifying and minimizing illegal, high-risk, or fraudulent transactions.Regulatory—over the years the company has been building a portfolio of regulatory licenses, which enable it to operate in markets around the world. This is a key competitive moat for companies operating in the financial field, as without licenses it’s not possible to operate in may juristiciton. And it does play as a disincentive for new players, as it might take massive investments in time and financial resources to gain these licenses. PayPal Customer Segments, Key Partners and Value PropositionsPayPal serves two main segments/key partners:

Merchants. And Consumers. Merchant Value PropositionAs PayPal highlights in its financials, the key elements that make up its offering for merchants is to help:

Cuustomer Value PropositionGrow and expand their businesses by providing global reach and powering all aspects of digital checkout. We offer alternative payment methods, including access to credit solutions, provide fraud prevention and risk management solutions, reduce losses through proprietary protection programs, and offer tools and insights for leveraging data analytics to attract new customers and improve sales conversion

For customers, some of the key values offered comprise:

The PayPal family: the galaxy of payment systems and apps around PayPalProviding affordable consumer products intended to democratize the management and movement of money. We provide consumers with a digital wallet that enables them to send payments to merchants more safely using a variety of funding sources, which may include a bank account, a PayPal Cash or Cash Plus account balance, a Venmo account balance, our consumer credit products, a credit card, debit card, or other stored value products such as coupons, gift cards, and eligible credit card rewards.

PayPal, as part of eBay over the years, has created an ecosystem of payments that comprise platforms and mobile gateways that allow it to penetrate several markets. Around PayPal there are other four primary brands:

BraintreeVenmoPaydiantXoomWhat is Braintree?

In 2013 Braintree, a company that allows acceptance and processing of payments got acquired by PayPal in 2013. This was an all-cash deal of $800 million, and as reported by Tech Crunch after the acquisition, eBay Inc.

President and CEO John Donahoe said: “Bill Ready [CEO of Braintree] and his team add complementary talent and technology that we believe will help accelerate PayPal’s global leadership in mobile payments.“

What is Venmo?Venmo has become so prominent among millennials that it has become a verb (“venmo me money”):

When your brand name becomes a verb (just like “Google it”) that company might be on the right path to success. Braintree acquired Venmo in 2012:

Thus, before Braintree would become part of PayPal, it acquired Venmo, an app that allows users to share and make payments with friends for a variety of services.

The social aspect of this app is critical, and it is also what makes Venmo so successful among millennials.

What is Paydiant?The Paydiant Platform is a white label mobile wallet solution. Thus, it provides solutions for merchants and banks, as well as for resellers and distributors, and point-of-sale and ATM providers.

In short, they can deploy branded mobile wallet apps that work at the point of purchase at retail, restaurant, fuel site, cash access atm, and other in-person locations.

What is Xoom?Xoom is a PayPal service that provides worldwide money transfers. It allows consumers to send money, pay bills and reload mobile phones from the United States to 52 countries.

As pointed out by PCmag “Xoom lets you send money to recipients in 66 different countries, as well as top up cell plans and pay utilities abroad. It’s a convenient and well-designed service, though its rates are less favorable than some of the competition.“

PayPal Growth Strategy ExplainedAs PayPal highlights, the growth strategy moves along four main areas:

Growing the core business: by expanding global capabilities, customer base and scale, increasing customers’ use of products and services by better addressing everyday needs related to accessing, managing, and moving money, and expanding the adoption of solutions by merchants and consumers; Expanding the value proposition for merchants and consumers: by being technology and platform agnostic, partnering with merchants to grow and expand their business online and in-store, and providing consumers with simple, secure, and flexible ways to manage and move money across different markets, merchants, and platforms; Forming strategic partnerships: by building new strategic partnerships to provide better experiences for customers, offering greater choice and flexibility, acquiring new customers, and reinforcing role in the payments ecosystem; Seeking new areas of growth: organically and through acquisitions and strategic investments in existing and new international markets around the world and focusing on innovation both in the digital and physical world. Revenue streamsPayPal revenue streams are classified into the following two categories:Transaction revenues: Net transaction fees charged to consumers and merchants primarily based on the volume of activity, or Total Payments Volume Other value-added services:Net revenues derived principally from interest and fees earned on loans and interest receivable As pointed out in the 2017 annual report:

As pointed out in the 2017 annual report:Transaction revenues grew more slowly than both TPV and number of payment transactions in 2017 due primarily to a higher proportion of person-to-person (“P2P”) transactions, primarily from our PayPal and Venmo products from which we earn lower rates and foreign exchange hedging losses. The percentage growth in transaction revenues was lower than the percentage growth in TPV and payment transactions in 2016 primarily due to a higher proportion of P2P transactions (including our Venmo products) for which we earn lower rates, and a higher portion of TPV generated by large merchants who generally pay lower rates with higher transaction volume. The impact of increases or decreases in prices charged to our customers did not significantly impact transaction revenue growth in 2017 or 2016 .If you don’t measure it, you can’t improve it: PayPal key metrics to measure its business success

As Peter Drucker would put it, “if you can’t measure it, you can’t improve it.”

This principle applies to any business model. In a way, the metrics a business picks up to measure its success as a business are also indicative of its culture and values that it tries to create. Of course, financial metrics have to be easy to measure.

Which in some ways allow them to be very actionable. On the other hand, a business model will have several kinds of metrics that might in part be disjoined from the bottom line. In PayPal’s cases we have a few KPIs (key performance metrics):

Active customers accountsPayment transactionsTotal payment volume

An active customer account is a registered account that successfully sent or received at least one payment or payment reversal through our Payments Platform, excluding transactions processed through our gateway and Paydiant products, in the past 12 months.

This is the definition of active customer account given by PayPal. As of 2017 PayPal had 227 million active customer accounts, a 16% growth compared to 2016.

What is the number of payment transactions?Number of payment transactions is defined as the total number of payments, net of payment reversals, successfully completed through our Payments Platform, excluding transactions processed through our gateway and Paydiant products.

As of 2017, 7.6 billion payment transactions went through PayPal, up of 26% compared to 2016.

What is TPV?TPV is the value of payments, net of payment reversals, successfully completed through our Payments Platform, excluding transactions processed through our gateway and Paydiant products

The total payment volume was $451 billion, up of 27% compared to 2016.

Strategic partnershipsFor PayPal success it is crucial the company keeps building new strategic partnerships to provide better experiences to customers, offering greater choice and flexibility. In short, the value of PayPal is given by the strength of the ecosystem it creates.

Seeking new areas of growthPayPal growth is also part of the long-term plan. The growth can be driven by international markets expansion and innovation in the digital technology landscape.

What is the PayPal value proposition?As highlighted in the annual report PayPal focuses on trust and simplicity, providing risk management and insights from our two-sided Payments Platform and being technology and platform agnostic.

Two-sided PlatformPayPal is a classic example of a two-sided platform. The platform connects merchants and consumers. Thus, it gains valuable insights into customer behavior through data.

The aim is to keep the platform both brand and technology agnostic. This aspect is critical as it leverages on trust.

BrandingBranding is a critical building block of PayPal overall strategy. In fact, over the years the company has been able to build a trusted brand. There’s no transaction without trust and PayPal is at this stage a globally recognized brand.

CompetitionThe competitive landscape shows several challenges:

retain and engage both merchants and consumers part of the two-sided platform;show merchants incremental sales via end-to-end services;safety and security of transactionsthe simplicity of fee structure;ability to develop products and services across multiple commerce channelstrust in dispute resolution and buyer and seller protection programs;customer service;brand recognition and preference;the website, mobile platform and application onboarding, ease-of-use, speed, availability, and dependability;the technology and payment agnostic nature of Payments Platform;system reliability and data security;ease and quality of integration into third-party mobile applications and operating systems;quality of developer tools other vital challenges are related to the regulatory landscape:A quick glance at PayPal financials

In 2017 the company recorded over $13 billion in revenues and almost $1,8 billion in net income.

Total operating expenses increased by $1.7 billion, or 18 %, in 2017 and $1.5 billion or 19% in 2016. Operating income increased $541 million, or 34%, in 2017 and $125 million, or 9% in 2016. Net income increased by $394 million, or 28%, in 2017 and $173 million, or 14%, in 2016.

PayPal in numbersSource: PayPal Financials

PayPal generated over $21.5 billion in 2020, with a 25% operating margin, 377 million active accounts (up 24% from 2019), 40.9 payment transacitons per active account. And a total payment volumne of $936 billion.

PayPal ESG StrategySource: PayPal Financials

PayPal business model explained in an infographic

PayPal started out as a service launched by Confinity, and it eventually became a service offered by the merger between Confinity and X.com.

The team behind the initial traction phase and before PayPal arrived at the deal with eBay comprised brilliant people, the so-called PayPal Mafia. Many former PayPal employees would take part in the development of a new startup that became critical in the Silicon Valley landscape.

After the deal with eBay, PayPal has grown to become a giant that comprises other companies like Braintree and Venmo. Today PayPal is a two-sided platform which success depends on its ability to cope with the competitive and regulatory landscape.

Connected Fintech Business ModelsFintech Business Models

Stripe Business Model

Stripe Business Model Coinbase Business Model

Coinbase Business Model How Does Zelle Make Money

How Does Zelle Make Money Klarna Business Model

Klarna Business Model Affirm Business Model

Affirm Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Afterpay Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Afterpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Revolut Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Revolut Business Model

Revolut an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.Related to PayPal Story

Revolut an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.Related to PayPal Story

Other hand-picked business models:

Business Models How Does Venmo Make Money? the Peer-To-Peer Payment App for MillennialsHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedThe Power of Google Business Model in a NutshellHow does PayPal make its profits?

PayPal makes money primarily by processing customer transactions. Therefore most of its money comes from transactions revenues. As of 2020 PayPal generated over $21.5 billion in net revenues with a 25% operating margin.

How does PayPal make money if it's free?PayPal is a free service, but it makes money via transaction revenues. Indeed, as the company offers an end-to-end transaction platform when transactions go through the company collects a fee on top of each transaction.

What is PayPal's biggest competitor?PayPal competitors are those offering end-to-end payment services for either consumers or merchants. Among these competitors, we have Google with Google Pay, Square with Cash App, and Apple with Apple Pay.

{ "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "How does PayPal make its profits? ", "acceptedAnswer": { "@type": "Answer", "text": "<p>PayPal makes money primarily by processing customer transactions. Therefore most of its money comes from transactions revenues. As of 2020 PayPal generated over $21.5 billion in net revenues with a 25% operating margin. </p>" } } , { "@type": "Question", "name": "How does PayPal make money if it's free? ", "acceptedAnswer": { "@type": "Answer", "text": "<p>PayPal is a free service, but it makes money via transaction revenues. Indeed, as the company offers an end-to-end transaction platform when transactions go through the company collects a fee on top of each transaction. </p>" } } , { "@type": "Question", "name": "What is PayPal's biggest competitor?", "acceptedAnswer": { "@type": "Answer", "text": "<p>PayPal competitors are those offering end-to-end payment services for either consumers or merchants. Among these competitors, we have Google with Google Pay, Square with Cash App, and Apple with Apple Pay. </p>" } } ] }The post How Does PayPal Make Money? PayPal Business Model In A Nutshell appeared first on FourWeekMBA.

December 20, 2021

How Do Streamers Make Money?

Streamers are no longer exclusively defined as the long, narrow strips of decorative material used in celebrations and other special events. In the era of the internet, streamers are individuals who spend their time creating content for a community of engaged and passionate fans. Many streamers broadcast themselves playing video games to live audiences, while others hold virtual cooking demonstrations or simply chat with others. The video live streaming industry is worth approximately $70 billion and is projected to grow to $224 billion in the next seven years.

AdvertisingAdvertising is a common way to make money as a streamer, particularly for those who have an established presence. Advertising may appear before, during, and after a live stream, with most streamers making around 10 to 30 cents per ad view on YouTube.

On the Twitch platform, advertising fees vary according to the season and demand. However, advertising revenue is typically between $2 and $10 per 1,000 views.

Partnership programsSome streaming platforms also run exclusive partnership programs for their very best streamers.

The Twitch Partner Program is an invite-only scheme designed for streamers who built their community from scratch. Streamers get access to additional revenue streams such as a three-tiered monthly subscription model and the ability to run video commercials. They also get access to custom subscriber badges and emotes, which we will talk about in more detail below.

It is estimated that the top ten Twitch partners gross an estimated $20 million.

Fan donationsStreamers also make money via fan donations.

Twitch users can cheer on their favorite streamers by purchasing a virtual good called a bit – equivalent to $0.01. In return, streamers can customize their channel and reward their most supportive subscribers with a range of emotes, which are Twitch-specific symbols used to express a range of in-chat feelings and emotions. These two acts work to reinforce each other, increasing fan engagement and increasing revenue across multiple channels.

YouTube does not have an in-built donation system, but many streamers there take donations via Patreon or Streamlabs instead.

Paid subscriptionsFor Twitch users, subscription income is a significant source of revenue. They earn 50% of all subscription fees which are offered in increments of $4.99, $9.99, and $24.99 per month.

YouTube gamers can also offer paid subscriptions, though the streamer must have at least 30,000 subscribers and be a YouTube Partner. Creators decide how much they will charge subscribers and what perks subscribers will receive across the various tier options.

SponsorshipsLive streamers are also sponsored by brands that operate in a similar niche or industry. These sponsorships can take the form of a single campaign or evolve into a longer-term brand ambassadorship.

As you may have guessed, video game sponsorships are the most common. These brands may send the streamer products to use or promote to their audiences. Alternatively, some brands will pay for the travel expenses and sign-up fees associated with the streamer participating in a tournament or competition.

Affiliate marketingProvided they meet certain criteria, streamers can sign up for an affiliate program and promote Amazon products through their channels.

Betting is another source of affiliate income that is starting to become more popular. Professional players and esports athletes are partnering with betting providers to allow bets to be placed on in-game outcomes during live streams. In exchange for sending users to the betting site, the streamer takes a cut of the revenue.

MerchandiseYouTube streamers can choose up to 12 items to display on a merchandise shelf provided they source their products from a list of partnering suppliers.

Many Twitch users also sell a range of branded and highly personalized merchandise, though the process there is a little more involved. Streamers will be required to design their goods through a service like Canva and then sell them through an eCommerce platform such as Shopify or Redbubble.

Key takeaways:The video live streaming industry is worth approximately $70 billion and is projected to grow to $224 billion in the next seven years. The ways streamers make money today are as interesting as they are varied.Streamers utilize video advertising, which is shown before, during, and after live streaming events. For larger audiences, fan donations and paid subscriptions are effective ways to make money.Streamers are also sponsored in short and long-term arrangements by industry or niche-related brands. Others prefer to earn revenue by engaging in affiliate marketing. Merchandise is also a worthwhile income stream, despite it being the most labor intensive.Connected Revenue Models Blogging is a prevalent and well-established practice, with popular blogging platform WordPress powering many websites on the internet. While a few successful bloggers really make money, those who do usually monetize through affiliate marketing, Google AdSense (or other advertising platforms), sponsorships, memberships, or selling their own digital and physical products.

Blogging is a prevalent and well-established practice, with popular blogging platform WordPress powering many websites on the internet. While a few successful bloggers really make money, those who do usually monetize through affiliate marketing, Google AdSense (or other advertising platforms), sponsorships, memberships, or selling their own digital and physical products.  Online influencer marketing is a relatively new creation, but it has fundamentally changed how brands communicate with consumers. People with targeted audiences are now the focus of advertising efforts. Influencers can tap from small to larger audiences thus, giving companies another way to promote their products. Indeed, influencers make money by selling digital products via sponsorships and affiliations, brand ambassadors programs, and physical products.

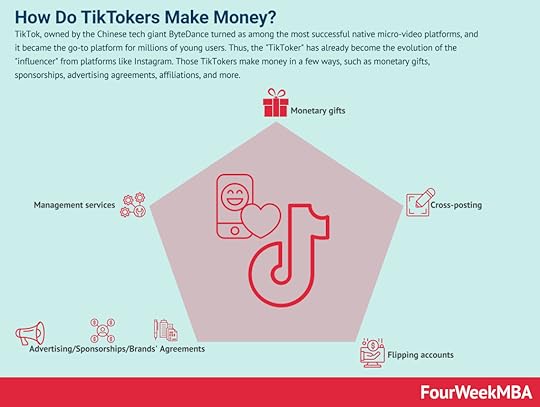

Online influencer marketing is a relatively new creation, but it has fundamentally changed how brands communicate with consumers. People with targeted audiences are now the focus of advertising efforts. Influencers can tap from small to larger audiences thus, giving companies another way to promote their products. Indeed, influencers make money by selling digital products via sponsorships and affiliations, brand ambassadors programs, and physical products.  TikTok, owned by the Chinese tech giant ByteDance turned as among the most successful native micro-video platforms, and it became the go-to platform for millions of young users. Thus, the “TikToker” has already become the evolution of the “influencer” from platforms like Instagram. Those TikTokers make money in a few ways, such as monetary gifts, sponsorships, advertising agreements, affiliations, and more.

TikTok, owned by the Chinese tech giant ByteDance turned as among the most successful native micro-video platforms, and it became the go-to platform for millions of young users. Thus, the “TikToker” has already become the evolution of the “influencer” from platforms like Instagram. Those TikTokers make money in a few ways, such as monetary gifts, sponsorships, advertising agreements, affiliations, and more. Read Also: What Is Influencer Marketing, How To Become An Influencer, Types Of Influencers, Instagram Marketing, How Does Instagram Make Money, How Does TikTok Make Money, TikTok Marketing.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Do Streamers Make Money? appeared first on FourWeekMBA.

What Is The C2C Business Model? The C2C Business Model In A Nutshell

The C2C business model describes a market environment where one customer purchases from another on a third-party platform that may also handle the transaction. Under the C2C model, both the seller and the buyer are considered consumers. Customer to customer (C2C) is, therefore, a business model where consumers buy and sell directly between themselves. Consumer-to-consumer has become a prevalent business model especially as the web helped disintermediate various industries.

Understanding the C2C business modelIn the offline world, the customer-to-customer business model has existed for years. Take the humble farmers market, for example, where farmers pay market organizers for a stall where they can sell their produce to consumers. The classifieds section of a newspaper is also a typical example of the C2C model.

The model has also become popular online due to advances in eCommerce technology, with eBay considered a pioneer of the strategy when it was launched in 1995. The C2C model has also benefitted from the rise of the sharing economy, where goods and services are shared on a community-based online platform. Companies in this space include Airbnb, Uber, Spacer, Airtasker, and Gumtree.

Four types of C2C business model platformsMost C2C platforms make money by charging sellers a listing fee or collecting a small commission on each successful transaction.

Examples of these platforms include:

Exchange of goods platformsWhich connects buyers and sellers looking to exchange physical goods. Some of these platforms exist in website and app form and allow both parties to complete the transaction in person. Examples include eBay and Etsy.

Exchange of services platformsWhere buyers and sellers come together to exchange money for services. Freelancing platforms such as Fiverr, Upwork, and 99designs are commonly cited examples. However, there are also platforms selling dog walking, house sitting, and employment services.

Auction platformsHere, sellers list goods at a minimum price and allow buyers to bid on them for a set time. Auction platforms such as eBay offer an assortment of goods, while others are more specialized. For example, Sotheby’s is known for luxury and collector items while Copart sells used and wholesale vehicles.

Payment platformsThese C2C platforms exist to facilitate transactions between the buyer and seller, with many also charging a small fee when sellers transfer earnings to their bank accounts. Examples include Stripe, PayPal, and Payoneer.

Strengths of the C2C business modelThere are several obvious benefits for buyers and sellers under the C2C model: