Gennaro Cuofano's Blog, page 129

January 4, 2022

What Is Price Elasticity? Price Elasticity In A Nutshell

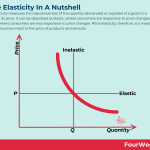

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Understanding price elasticityConsumers are sensitive to the price of a product or service when deciding whether to make a purchase decision. While most consumers are more likely to purchase a cheap product and less likely to purchase an expensive product, the role of price in the decision-making process is more nuanced.

Gasoline is one example of a product with inelastic demand. Consumer demand for the product is less responsive to price changes because it is considered a vital commodity. Common products with elastic demand include soft drink, cereal, clothing, electronics, and vehicles. Consumers are more responsive to changes in price because these products are not considered necessities and there are readily available substitutes.

Price elasticity data is valuable to a marketing team. The data enables them to determine how the market will react to price changes to existing products and whether such a reaction will impact the company’s bottom line.

The four types of price elasticityThere are four types of price elasticity, with each used to explain the relationship between two economic variables:

Price elasticity of demand (PED)A measure of the change in consumption of a good or service in relation to a change in its price.

Price elasticity of supply (PES)A measure of the change in the supply of a good or service in response to a change in its price.

Cross elasticity of demand (XED)This is a measure of the change in demand for one good in response to a change in demand for another good.

Income elasticity of demand (YED)A measure of the change in demand for a good in response to a change in the buyer’s income.

Factors that affect elastic and inelastic demandIn the introduction, we touched on some of the factors affecting elastic and inelastic demand. Let’s take a more detailed look at these below.

Factors affecting elastic demandAvailable substitutesWhen there are many products of a similar type available, those with a lower price are more attractive than those that are more expensive. Chocolate bars are one example.

Homogenous productsSimilarly, the presence of homogenous products gives consumers more choice and freedom. Demand for insurance is not affected by price increases because there is always a provider offering cheaper premiums.

Lower switching costsIf there are no costs associated with switching products, then demand is less likely to be impacted by price. For example, there is no cost to the consumer in switching to Mercedes if they consider BMW sedans to be too expensive.

Factors affecting inelastic demandPurchase frequencyConsumers tend to spend more money on one-off purchases such as a new car or smartphone.

Lack of substitutesIf there are no suitable alternatives, then demand tends to be elastic. For example, demand for milk does not change if prices rise by 10% because for most people, there is no substitute.

Geographical locationSome goods and services are inelastic because a company has geographical dominance. In most sports stadiums, food and beverage retailers can raise prices without affecting demand because fans have no choice but to purchase from them.

Basic necessitiesSome products are necessary to survival, including medication, electricity, water, and some food items. Demand for these goods and services is unresponsive to price changes.

Key takeaways:Price elasticity is a measure of how consumers react to the price of products and services. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes.Price elasticity data is valuable to a marketing team. This data enables them to determine how the market will react to price changes to existing products and whether such a reaction will impact the company’s bottom line.Factors affecting elastic demand include available substitutes, homogenous products, and lower switching costs. Factors affecting inelastic demand, on the other hand, include infrequent purchasing, a lack of substitutes, geographical location, and whether the product is a basic necessity.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Is Price Elasticity? Price Elasticity In A Nutshell appeared first on FourWeekMBA.

What Is Private Labeling? The Private Labeling Business Model In A Nutshell

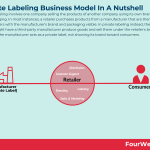

Private labeling involves one company selling the products of another company using its own branding and packaging. In most instances, a retailer purchases products from a manufacturer that are then sold to consumers with the manufacturer’s brand and packaging visible. In private labeling instead, the retailer might have a third-party manufacturer produce goods and sell them under the retailer’s brand. Therefore the manufacturer acts as a private label, not showing its brand toward consumers.

Understanding private labelingSometimes, however, the retailer may sell private label products that are manufactured by a contract or third-party manufacturer and sold under its own brand name. The retailer acts as a de facto product manufacturer by controlling what goes in the product, how it is presented, and what the label looks like.

Private labeling is present in most consumer product categories, including personal care, beverages, pet food, cosmetics, condiments, dairy items, frozen foods, clothing, and household cleaners. In Australia and the United States, private label brands account for 18.1% and 17.7% of all retail sales revenue respectively. In Europe, these brands are more popular, comprising 41% of sales in the United Kingdom and 42% in Spain for example.

Examples of private labelingFollowing is a look at some of the companies making a success of private labeling:

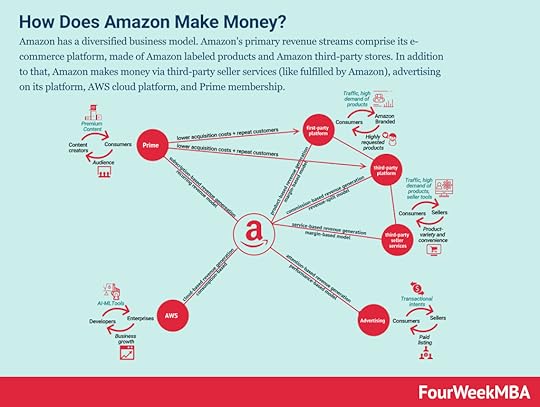

Amazon Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership.

Amazon has a diversified business model. Amazon’s primary revenue streams comprise its e-commerce platform, made of Amazon labeled products and Amazon third-party stores. In addition to that, Amazon makes money via third-party seller services (like fulfilled by Amazon), advertising on its platform, AWS cloud platform, and Prime membership. The eCommerce giant owns over 100 private label brands that appear across various categories including food and beverage, electronics, and automotive. Many of Amazon’s private-label brands are created to mimic the success of brands that sell well on its platform. Examples include Amazon Essentials, Revly, Nod, and Happy Belly.

Trader Joe’sAmerican grocery chain Trader Joe’s sources most of its products from third-party manufacturers including PepsiCo and Snyder’s-Lance, the second largest salty snack maker in the United States.

Costco In a retail business model, usually, the company has direct access to final customers, which will consume a final version of the product/service, sold in units, and at higher margins. Where in a wholesale business model, instead, a company usually sells raw products in bulk to retailers and middlemen who sell directly to customers. In a hybrid model (like Costco) the wholesaler also sells to final customers.

In a retail business model, usually, the company has direct access to final customers, which will consume a final version of the product/service, sold in units, and at higher margins. Where in a wholesale business model, instead, a company usually sells raw products in bulk to retailers and middlemen who sell directly to customers. In a hybrid model (like Costco) the wholesaler also sells to final customers. The retailer’s Kirkland Signature private label range sells everything from batteries to wine to rotisserie chicken. The company reported in 2020 that it made $39 billion in revenue from the Kirkland brand alone in the previous twelve months.

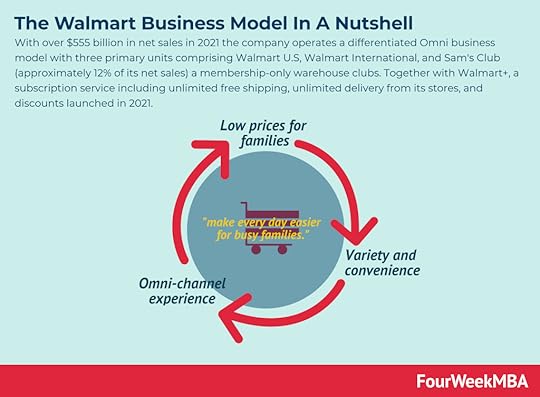

Walmart With over $555 billion in net sales in 2021 the company operates a differentiated Omni business model with three primary units comprising Walmart U.S, Walmart International, and Sam’s Club (approximately 12% of its net sales) a membership-only warehouse clubs. Together with Walmart+, a subscription service including unlimited free shipping, unlimited delivery from its stores, and discounts launched in 2021.

With over $555 billion in net sales in 2021 the company operates a differentiated Omni business model with three primary units comprising Walmart U.S, Walmart International, and Sam’s Club (approximately 12% of its net sales) a membership-only warehouse clubs. Together with Walmart+, a subscription service including unlimited free shipping, unlimited delivery from its stores, and discounts launched in 2021. Which has recently made a foray into private label apparel for men, women, and children. The supermarket chain also operates private label brands in wine, toys, tools, and consumer technology.

Advantages of private labelingPrivate labeling has several benefits for the business that extends beyond the simplification of the product development process.

These include:

Control over costsDespite not manufacturing the product, retailers still control the product pricing strategy and can optimize production costs to increase profit margins. Retailers also have the final say over specifics such as product quality, pricing, ingredients, and volume.

Product rotationRetailers also use private label products to accelerate product rotation. Companies such as Nordstrom sell private label products to increase their responsiveness to seasonal trends and compete with fast-fashion retailers such as H&M.

Market stabilityIn countries where private label products are prevalent, consumers choose them for their quality, consistency, and affordability. Thanks to lower price points, private label products can boast steady sales even amid a recession. Since there is more stability and less price inelasticity, retailers may even increase their order quantities during economic downturns.

Nevertheless, there are some disadvantages too.

Disadvantages of private labelingProduction dependenceWhile retailers have control over many aspects of private labeling, they do not have control over the product manufacturer. Inefficient processes could cause inventory or quality issues and, in a worst-case scenario, the manufacturer may declare bankruptcy and severely disrupt operations.

Brand dilution and loyaltySome consumers perceive private label products to be of poor quality, which can cause brand dilution for a retailer’s more premium brands. Furthermore, building any sort of brand loyalty to a bulk, low-cost product is difficult.

CostSome manufacturers will ask for an initial payment if it is the first time they are working with a retailer. There may also be a stipulated minimum order quantity to ensure both parties profit from the arrangement. These factors make private label products a challenge for retailers with smaller budgets.

Key takeaways:Private labeling involves one company selling the products of another company using its own branding and packaging.Private labeling is used successfully by companies such as Amazon, Trader Joe’s, Costco, and Walmart.Private labeling gives retailers more control over costs and product development and also allows them to maintain sales in economic downturns. However, the approach is only as robust as the product manufacturer and some companies may find it difficult to build brand loyalty in a low-cost product from scratch.Business Models Related To Private Labeling Consumer-to-manufacturer (C2M) is a model connecting manufacturers with consumers. The model removes logistics, inventory, sales, distribution, and other intermediaries enabling consumers to buy higher quality products at lower prices. C2M is useful in any scenario where the manufacturer can react to proven, consolidated, consumer-driven niche demand.

Consumer-to-manufacturer (C2M) is a model connecting manufacturers with consumers. The model removes logistics, inventory, sales, distribution, and other intermediaries enabling consumers to buy higher quality products at lower prices. C2M is useful in any scenario where the manufacturer can react to proven, consolidated, consumer-driven niche demand. A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time.

A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time.

Account-based marketing (ABM) is a strategy where the marketing and sales departments come together to create personalized buying experiences for high-value accounts. Account-based marketing is a business-to-business (B2B) approach in which marketing and sales teams work together to target high-value accounts and turn them into customers.

Account-based marketing (ABM) is a strategy where the marketing and sales departments come together to create personalized buying experiences for high-value accounts. Account-based marketing is a business-to-business (B2B) approach in which marketing and sales teams work together to target high-value accounts and turn them into customers.

A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.

The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.Direct-to-Consumer Business Model

Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage.

Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

We can classify e-commerce businesses in several ways. General classifications look at three primary categories:

We can classify e-commerce businesses in several ways. General classifications look at three primary categories:– B2B or business-to-business, where therefore a business sells to another company.

– B2C or business-to-consumer, where a business sells to a final consumer.

– C2C or consumer-to-consume, or more peer-to-peer where consumers sell to each other.

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.

The more you move from consumers to enterprise clients, the more you’ll need a sales force able to manage complex sales. As a rule of thumb, a more expensive product, in B2B or Enterprise, will require an organizational structure around sales. An inexpensive product to be offered to consumers will leverage on marketing.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Private Labeling? The Private Labeling Business Model In A Nutshell appeared first on FourWeekMBA.

Direct And Indirect Competitors

Direct competitors are companies that offer the same product or service and that might have the same business and financial profile. Indirect competitors, on the other hand, are companies whose products or services while different could potentially satisfy the same customer needs. Competition in the digital era has become way more fluid, thus it’s important to take into account various overlapping factors to assess the competitive landscape.

Direct competitorsDirect competitors are two or more companies that offer the same product or service in the same market to satisfy the same consumer need.

McDonald’s and Burger King are one example with their respective Big Mac and Whopper hamburgers. Direct competition also occurs between Apple and Samsung smartphones in the consumer electronics industry.

Identifying direct competitorsCompanies can identify their direct competitors in the following ways:

Customer feedback – the first and most obvious way is to survey consumers. Who were the various brands they considered before making a purchase?Market research – a more intensive process requiring the business to gather information from the websites and social media accounts of related businesses. Are their prices, values, business methods, online activities, or customer loyalty programs similar? Social media – consumers often share their buying experiences on platforms such as Reddit, Quora, and Tumblr. Others will ask for brand-specific recommendations.Indirect competitorsIndirect competitors describe businesses that offer different approaches to consumers to reach the same goal or satisfy the same need.

Many assume McDonald’s only competes with other fast-food restaurants, but the company also indirectly competes with home cooking, diet plans, and subscription meal boxes. Each of the businesses involved in offering these services is an indirect competitor because they are satisfying the same consumer need to avoid hunger.

When discussing indirect competition, it is also important to note that the comparison may be between two companies or two products. Indeed, the Monash University Marketing Dictionary says this about indirect competition: “A product that is in a different category altogether but which is seen as an alternative purchase choice; for example, coffee and mineral water are indirect competitors.”

Identifying indirect competitorsIndirect competition can be identified using these methods:

Keyword research – companies can use a dedicated keyword research tool to identify competitors who are targeting the same keywords. Alternatively, it may also be useful to perform a simple Google search for a broad keyword and take note of the competitors occupying the first few positions.Content research – many indirect competitors also write SEO-friendly blog posts and landing pages that are closely related to a product or service. In this context, indirect competitors may include businesses, individual bloggers, and publications.Key takeaways:Direct competitors are companies that offer the same product or service. Conversely, indirect competitors are companies whose products or services while different could potentially satisfy the same customer needs.McDonald’s and Burger King are one example of direct competitors with their respective Big Mac and Whopper hamburgers. Businesses endeavoring to determine their direct competitors can do so via market research, customer feedback, and social media.McDonald’s also has indirect competitors, including home-cooked meals, diet plans, and subscription meal boxes. Each of these is a McDonald’s competitor because they address the same need.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkCompanion Business Frameworks To The Competitive Analysis The multi-criteria analysis provides a systematic approach for ranking adaptation options against multiple decision criteria. These criteria are weighted to reflect their importance relative to other criteria. A multi-criteria analysis (MCA) is a decision-making framework suited to solving problems with many alternative courses of action.

The multi-criteria analysis provides a systematic approach for ranking adaptation options against multiple decision criteria. These criteria are weighted to reflect their importance relative to other criteria. A multi-criteria analysis (MCA) is a decision-making framework suited to solving problems with many alternative courses of action.

The SPACE (Strategic Position and Action Evaluation) analysis was developed by strategy academics Alan Rowe, Richard Mason, Karl Dickel, Richard Mann, and Robert Mockler. The particular focus of this framework is strategy formation as it relates to the competitive position of an organization. The SPACE analysis is a technique used in strategic management and planning.

The SPACE (Strategic Position and Action Evaluation) analysis was developed by strategy academics Alan Rowe, Richard Mason, Karl Dickel, Richard Mann, and Robert Mockler. The particular focus of this framework is strategy formation as it relates to the competitive position of an organization. The SPACE analysis is a technique used in strategic management and planning.

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.

Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed.

Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed.

Business valuations involve a formal analysis of the key operational aspects of a business. A business valuation is an analysis used to determine the economic value of a business or company unit. It’s important to note that valuations are one part science and one part art. Analysts use professional judgment to consider the financial performance of a business with respect to local, national, or global economic conditions. They will also consider the total value of assets and liabilities, in addition to patented or proprietary technology.

Business valuations involve a formal analysis of the key operational aspects of a business. A business valuation is an analysis used to determine the economic value of a business or company unit. It’s important to note that valuations are one part science and one part art. Analysts use professional judgment to consider the financial performance of a business with respect to local, national, or global economic conditions. They will also consider the total value of assets and liabilities, in addition to patented or proprietary technology.

Social psychologist Kurt Lewin developed the force-field analysis in the 1940s. The force-field analysis is a decision-making tool used to quantify factors that support or oppose a change initiative. Lewin argued that businesses contain dynamic and interactive forces that work together in opposite directions. To institute successful change, the forces driving the change must be stronger than the forces hindering the change.

Social psychologist Kurt Lewin developed the force-field analysis in the 1940s. The force-field analysis is a decision-making tool used to quantify factors that support or oppose a change initiative. Lewin argued that businesses contain dynamic and interactive forces that work together in opposite directions. To institute successful change, the forces driving the change must be stronger than the forces hindering the change.

In his 1985 book Competitive Advantage, Porter explains that a value chain is a collection of processes that a company performs to create value for its consumers. As a result, he asserts that value chain analysis is directly linked to competitive advantage. Porter’s Value Chain Model is a strategic management tool developed by Harvard Business School professor Michael Porter. The tool analyses a company’s value chain – defined as the combination of processes that the company uses to make money.

In his 1985 book Competitive Advantage, Porter explains that a value chain is a collection of processes that a company performs to create value for its consumers. As a result, he asserts that value chain analysis is directly linked to competitive advantage. Porter’s Value Chain Model is a strategic management tool developed by Harvard Business School professor Michael Porter. The tool analyses a company’s value chain – defined as the combination of processes that the company uses to make money.

It’s possible to identify the key players that overlap with a company’s business model with a competitor analysis. This overlapping can be analyzed in terms of key customers, technologies, distribution, and financial models. When all those elements are analyzed, it is possible to map all the facets of competition for a tech business model to understand better where a business stands in the marketplace and its possible future developments.

It’s possible to identify the key players that overlap with a company’s business model with a competitor analysis. This overlapping can be analyzed in terms of key customers, technologies, distribution, and financial models. When all those elements are analyzed, it is possible to map all the facets of competition for a tech business model to understand better where a business stands in the marketplace and its possible future developments.

The TOWS Matrix is an acronym for Threats, Opportunities, Weaknesses, and Strengths. The matrix is a variation on the SWOT Analysis, and it seeks to address criticisms of the SWOT Analysis regarding its inability to show relationships between the various categories.

The TOWS Matrix is an acronym for Threats, Opportunities, Weaknesses, and Strengths. The matrix is a variation on the SWOT Analysis, and it seeks to address criticisms of the SWOT Analysis regarding its inability to show relationships between the various categories.

A SOAR analysis is a technique that helps businesses at a strategic planning level to:

A SOAR analysis is a technique that helps businesses at a strategic planning level to:Focus on what they are doing right.

Determine which skills could be enhanced.

Understand the desires and motivations of their stakeholders.

Developed by American academic Michael Porter, the Four Corners Analysis helps a business understand its particular competitive landscape. The analysis is a form of competitive intelligence where a business determines its future strategy by assessing its competitors’ strategy, looking at four elements: drivers, current strategy, management assumptions, and capabilities.

Developed by American academic Michael Porter, the Four Corners Analysis helps a business understand its particular competitive landscape. The analysis is a form of competitive intelligence where a business determines its future strategy by assessing its competitors’ strategy, looking at four elements: drivers, current strategy, management assumptions, and capabilities.

The 3C Analysis Business Model was developed by Japanese business strategist Kenichi Ohmae. The 3C Model is a marketing tool that focuses on customers, competitors, and the company. At the intersection of these three variables lies an effective marketing strategy to gain a potential competitive advantage and build a lasting company.

The 3C Analysis Business Model was developed by Japanese business strategist Kenichi Ohmae. The 3C Model is a marketing tool that focuses on customers, competitors, and the company. At the intersection of these three variables lies an effective marketing strategy to gain a potential competitive advantage and build a lasting company.The post Direct And Indirect Competitors appeared first on FourWeekMBA.

What Are Customer Retention Strategies? Customer Retention Strategies In A Nutshell

Customer retention strategies are used by businesses to retain their existing customers and build positive relationships with them. Customer retention itself is the ability for a business to turn its customers into repeat buyers and prevent them from doing business with a competitor. Some of these strategies comprise responsive customer support, customer loyalty programs, email marketing, customer surveys, and contextual customer support.

Understanding customer retention strategiesCustomer retention strategies are those that help an organization retain customers.

Customer retention is more efficient and more profitable than customer acquisition, which aims to move customers through a marketing funnel and convince them to buy products or services.

Perhaps unsurprisingly, customer retention strategies are the lifeblood of subscription-based companies and service providers. Regardless of the business, however, customer retention strategies must focus on improving the customer experience to a point where customers are willing to recommend a brand to their friends or family.

Five customer retention strategiesHere are five ways a business can make its customer experience more convenient, personal, or rewarding:

Responsive customer supportResearch proves that agile and responsive customer support results in higher customer satisfaction. In fact, a 2021 study found that 73% of surveyed customers considered speedy support resolutions the key to a good experience. Even when a problem cannot be solved right away, it is important businesses respond as quickly as possible to set the process in motion.

Customer loyalty programsThese are an effective way to boost customer retention because the promise of rewards motivates customers to purchase more frequently. Businesses can award customers points simply for creating a new account. Others may reward customers based on the total purchase amount or offer a discount code for a subsequent order. Today, buyer analytics data makes it easy for a business to determine its most loyal customers and reward them accordingly.

Email marketing Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. A customer retention strategy where purchase frequency is the focus. Many businesses shy away from email marketing, but in truth, the approach can be used to develop deeper relationships with customers before and after an initial purchase. Email marketing should always add value and not be seen as a carte blanche excuse to spam customers with offers.

Customer surveysThese are critical to determine what the business is doing right and what it could do better. While an organization can never please every customer on every occasion, surveys are used to gather important feedback that can help identify overlooked patterns or trends. This feedback can be supplemented by customer support officers who can identify complaints or problem topics that reoccur frequently.

Contextual customer supportFor consumers, there is often nothing worse than having the explain the same problem multiple times to different support staff. To increase customer retention, staff can use a tool such as Zendesk to give them context and personalize the experience. For example, support staff can easily pull up information on a customer’s contact details, notes, preferred language, and any previous conversations to get up to speed quickly.

Key takeaways:Customer retention strategies are those that help an organization retain customers.Customer retention strategies are particularly important to subscription-based businesses. However, the supreme importance of customer retention over customer acquisition is relevant to any organization regardless of its business model.Examples of customer retention strategies include responsive customer support, customer loyalty programs, email marketing, customer surveys, and contextual customer support.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Frameworks You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing.

You can use the Ansoff Matrix as a strategic framework to understand what growth strategy is more suited based on the market context. Developed by mathematician and business manager Igor Ansoff, it assumes a growth strategy can be derived by whether the market is new or existing, and the product is new or existing. The Blitzscaling business model canvas is a model based on the concept of Blitzscaling, which is a particular process of massive growth under uncertainty, and that prioritizes speed over efficiency and focuses on market domination to create a first-scaler advantage in a scenario of uncertainty.

The Blitzscaling business model canvas is a model based on the concept of Blitzscaling, which is a particular process of massive growth under uncertainty, and that prioritizes speed over efficiency and focuses on market domination to create a first-scaler advantage in a scenario of uncertainty. A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost–value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers.

A blue ocean is a strategy where the boundaries of existing markets are redefined, and new uncontested markets are created. At its core, there is value innovation, for which uncontested markets are created, where competition is made irrelevant. And the cost–value trade-off is broken. Thus, companies following a blue ocean strategy offer much more value at a lower cost for the end customers. Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace.

Business analysis is a research discipline that helps driving change within an organization by identifying the key elements and processes that drive value. Business analysis can also be used in Identifying new business opportunities or how to take advantage of existing business opportunities to grow your business in the marketplace. A gap analysis helps an organization assess its alignment with strategic objectives to determine whether the current execution is in line with the company’s mission and long-term vision. Gap analyses then help reach a target performance by assisting organizations to use their resources better. A good gap analysis is a powerful tool to improve execution.

A gap analysis helps an organization assess its alignment with strategic objectives to determine whether the current execution is in line with the company’s mission and long-term vision. Gap analyses then help reach a target performance by assisting organizations to use their resources better. A good gap analysis is a powerful tool to improve execution. The business model canvas is a framework proposed by Alexander Osterwalder and Yves Pigneur in Busines Model Generation enabling the design of business models through nine building blocks comprising: key partners, key activities, value propositions, customer relationships, customer segments, critical resources, channels, cost structure, and revenue streams.

The business model canvas is a framework proposed by Alexander Osterwalder and Yves Pigneur in Busines Model Generation enabling the design of business models through nine building blocks comprising: key partners, key activities, value propositions, customer relationships, customer segments, critical resources, channels, cost structure, and revenue streams. The lean startup canvas is an adaptation by Ash Maurya of the business model canvas by Alexander Osterwalder, which adds a layer that focuses on problems, solutions, key metrics, unfair advantage based, and a unique value proposition. Thus, starting from mastering the problem rather than the solution.

The lean startup canvas is an adaptation by Ash Maurya of the business model canvas by Alexander Osterwalder, which adds a layer that focuses on problems, solutions, key metrics, unfair advantage based, and a unique value proposition. Thus, starting from mastering the problem rather than the solution. A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.

A digital channel is a marketing channel, part of a distribution strategy, helping an organization to reach its potential customers via electronic means. There are several digital marketing channels, usually divided into organic and paid channels. Some organic channels are SEO, SMO, email marketing. And some paid channels comprise SEM, SMM, and display advertising.The post What Are Customer Retention Strategies? Customer Retention Strategies In A Nutshell appeared first on FourWeekMBA.

What Is Corporate Social Responsibility? Corporate Social Responsibility In A Nutshell

Corporate social responsibility (CSR) is a self-regulating business model that helps an organization remain socially accountable to itself, its stakeholders, and the general public. Corporate social responsibility is typically categorized into four types: environmental, ethical, philantropic, and economic.

Understanding corporate social responsibilityFor most of recorded history, businesses have been driven by the singular desire to turn a profit, with money-making potential impacting every action taken or initiative pursued.

However, modern businesses have started to realize that they must do more than simply maximize profits for shareholders and executives. They now have a social responsibility to act in the best interests of employees, consumers, and society as a whole.

Corporate social responsibility is a form of self-regulation where the business strives to become socially accountable. While there is no single way to implement CSR principles, employees, consumers, and other stakeholders are now more likely to choose a brand that contributes to society in some shape or form.

To illustrate the importance of corporate social responsibility, a 2017 study found that 63% of American citizens hoped businesses would drive social and environmental change without being forced to do so by the government. Almost 75% said they would not do business with a company if it supported an issue contradictory to their own beliefs.

Corporate social responsibility typesCorporate social responsibility is typically categorized into four types:

EnvironmentalOne of the most common forms of CSR is environmental responsibility. Here, companies seek to become environmentally friendly by reducing their greenhouse gas emissions and increasing their reliance on renewable energy. Alternatively, some companies choose to offset their environmental impact by planting trees or funding scientific research.

EthicalOr any practice that compels the organization to behave in a fair and ethical manner, including the equitable treatment of stakeholders, leadership, investors, suppliers, employees, and customers. Ethical responsibility may also be demonstrated by an organization paying above minimum wage or making a commitment to avoid sourcing products from child labor.

PhilanthropicWhere a business aims to make a positive impact on society by donating to charities, non-profits, or a similar organization of their own making. Certified B Corporations are a new kind of business type that balances purpose with profit. These organisations are legally required to consider the impact of their decisions on stakeholders.

EconomicThe foundation for environmental, ethical, and philanthropic responsibility for without profit, the business would not survive long enough to implement other initiatives.

Corporate social responsibility case studiesWho are the companies leading the way in corporate social responsibility?

Let’s take a look at three examples below:

Starbucks Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model.

Starbucks is a retail company that sells beverages (primarily consisting of coffee-related drinks) and food. In 2018, Starbucks had 52% of company-operated stores vs. 48% of licensed stores. The revenues for company-operated stores accounted for 80% of total revenues, thus making Starbucks a chain business model. On its website, Starbucks states that “It’s our commitment to do things that are good to people, each other and the planet. From the way we buy our coffee, to minimising environmental impact, to being involved in local communities.” To that end, Starbucks only purchases responsibly grown, ethically traded coffee. The company is also on a mission to donate 100 million coffee trees to suppliers by 2025 and also offers a pioneering college program for its employees.

LegoOver the years, the Danish toy company has invested millions of dollars into addressing climate change and reducing waste. The company has an ambitious goal to go carbon neutral by 2022. It also recently launched the Lego Replay scheme, where unwanted Lego bricks are donated and redistributed to children in need.

TOMS The strategy was popularized by TOMS Shoes in 2006, with the shoe company donating a new pair of shoes to a child in a developing country for every pair of shoes sold to a consumer. The one-for-one business model is based on the idea that for every consumer purchase, an equivalent or similar product is given away to someone in need.

The strategy was popularized by TOMS Shoes in 2006, with the shoe company donating a new pair of shoes to a child in a developing country for every pair of shoes sold to a consumer. The one-for-one business model is based on the idea that for every consumer purchase, an equivalent or similar product is given away to someone in need.A shoe, eyewear, and apparel company that was founded with corporate social responsibility embedded in its mission. TOMS donates a pair of shoes to disadvantaged children from more than 50 countries with every customer purchase. The company also has a strong environmental focus, with shoes made from hemp, organic cotton, and recycled polyester. Shoe boxes are also made from 80% consumer waste and printed with soy-based ink.

Key takeaways:Corporate social responsibility (CSR) is a business model helping an organization remain socially accountable to itself, its stakeholders, and the general public. Most consumers now expect businesses to adopt CSR principles before they make a purchase.Corporate social responsibility is broadly divided into four different types: environmental, ethical, philanthropic, and economic. The latter is important in ensuring the business remains viable long enough to make a positive impact.Starbucks is a company with established corporate social responsibility principles, sourcing fair-trade coffee beans and donating coffee plants to its farmers. Danish toy company Lego is reducing toy waste and donating used bricks to those in need, while shoe company TOMS matches every shoe purchase with a donation to disadvantaged children in over 50 countries.Read Next: ESG Criteria, Competitive Intelligence.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Frameworks To Corporate Social Responsibility Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace.

Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace. Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes. An effective risk management framework is crucial for any organization. The framework endeavors to protect the organization’s capital base and revenue generation capability without hindering growth. A risk management framework (RMF) allows businesses to strike a balance between taking risks and reducing them.

An effective risk management framework is crucial for any organization. The framework endeavors to protect the organization’s capital base and revenue generation capability without hindering growth. A risk management framework (RMF) allows businesses to strike a balance between taking risks and reducing them. Timeboxing is a simple yet powerful time-management technique for improving productivity. Timeboxing describes the process of proactively scheduling a block of time to spend on a task in the future. It was first described by author James Martin in a book about agile software development.

Timeboxing is a simple yet powerful time-management technique for improving productivity. Timeboxing describes the process of proactively scheduling a block of time to spend on a task in the future. It was first described by author James Martin in a book about agile software development. Herzberg’s two-factor theory argues that certain workplace factors cause job satisfaction while others cause job dissatisfaction. The theory was developed by American psychologist and business management analyst Frederick Herzberg. Until his death in 2000, Herzberg was widely regarded as a pioneering thinker in motivational theory.

Herzberg’s two-factor theory argues that certain workplace factors cause job satisfaction while others cause job dissatisfaction. The theory was developed by American psychologist and business management analyst Frederick Herzberg. Until his death in 2000, Herzberg was widely regarded as a pioneering thinker in motivational theory. The Kepner-Tregoe matrix was created by management consultants Charles H. Kepner and Benjamin B. Tregoe in the 1960s, developed to help businesses navigate the decisions they make daily, the Kepner-Tregoe matrix is a root cause analysis used in organizational decision making.

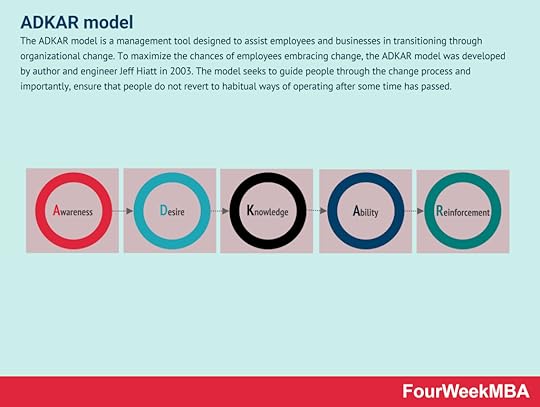

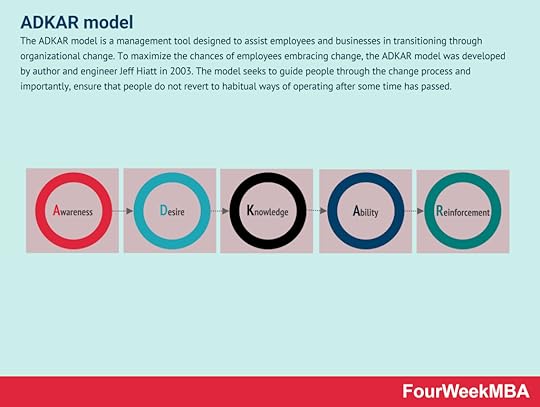

The Kepner-Tregoe matrix was created by management consultants Charles H. Kepner and Benjamin B. Tregoe in the 1960s, developed to help businesses navigate the decisions they make daily, the Kepner-Tregoe matrix is a root cause analysis used in organizational decision making. The ADKAR model is a management tool designed to assist employees and businesses in transitioning through organizational change. To maximize the chances of employees embracing change, the ADKAR model was developed by author and engineer Jeff Hiatt in 2003. The model seeks to guide people through the change process and importantly, ensure that people do not revert to habitual ways of operating after some time has passed.

The ADKAR model is a management tool designed to assist employees and businesses in transitioning through organizational change. To maximize the chances of employees embracing change, the ADKAR model was developed by author and engineer Jeff Hiatt in 2003. The model seeks to guide people through the change process and importantly, ensure that people do not revert to habitual ways of operating after some time has passed. The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution.

The CATWOE analysis is a problem-solving strategy that asks businesses to look at an issue from six different perspectives. The CATWOE analysis is an in-depth and holistic approach to problem-solving because it enables businesses to consider all perspectives. This often forces management out of habitual ways of thinking that would otherwise hinder growth and profitability. Most importantly, the CATWOE analysis allows businesses to combine multiple perspectives into a single, unifying solution. Agile project management (APM) is a strategy that breaks large projects into smaller, more manageable tasks. In the APM methodology, each project is completed in small sections – often referred to as iterations. Each iteration is completed according to its project life cycle, beginning with the initial design and progressing to testing and then quality assurance.

Agile project management (APM) is a strategy that breaks large projects into smaller, more manageable tasks. In the APM methodology, each project is completed in small sections – often referred to as iterations. Each iteration is completed according to its project life cycle, beginning with the initial design and progressing to testing and then quality assurance. A holacracy is a management strategy and an organizational structure where the power to make important decisions is distributed throughout an organization. It differs from conventional management hierarchies where power is in the hands of a select few. The core principle of a holacracy is self-organization where employees organize into several teams and then work in a self-directed fashion toward a common goal.

A holacracy is a management strategy and an organizational structure where the power to make important decisions is distributed throughout an organization. It differs from conventional management hierarchies where power is in the hands of a select few. The core principle of a holacracy is self-organization where employees organize into several teams and then work in a self-directed fashion toward a common goal. The CAGE Distance Framework was developed by management strategist Pankaj Ghemawat as a way for businesses to evaluate the differences between countries when developing international strategies. Therefore, be able to better execute a business strategy at the international level.

The CAGE Distance Framework was developed by management strategist Pankaj Ghemawat as a way for businesses to evaluate the differences between countries when developing international strategies. Therefore, be able to better execute a business strategy at the international level. First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business.

First proposed by accounting academic Robert Kaplan, the balanced scorecard is a management system that allows an organization to focus on big-picture strategic goals. The four perspectives of the balanced scorecard include financial, customer, business process, and organizational capacity. From there, according to the balanced scorecard, it’s possible to have a holistic view of the business. Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity.

Scrum is a methodology co-created by Ken Schwaber and Jeff Sutherland for effective team collaboration on complex products. Scrum was primarily thought for software development projects to deliver new software capability every 2-4 weeks. It is a sub-group of agile also used in project management to improve startups’ productivity. Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.The post What Is Corporate Social Responsibility? Corporate Social Responsibility In A Nutshell appeared first on FourWeekMBA.

What Is Competitive Intelligence? Competitive Intelligence In A Nutshell

Competitive intelligence is the systematic collection of information by a company on its industry, business environment, competitors, products, and consumers. Insights are then used to help the company develop its strategy or improve its competitive position. Competitive intelligence can be assessed according to seven elements: sector intelligence, market intelligence, competitive intelligence, innovation intelligence, sales intelligence, procurement & supply chain intelligence, and Environmental, social, & governance (ESG) intelligence.

Understanding competitive intelligenceToday, the rate of competition and market disruption is cause for concern for many businesses. According to research by Accenture, 63% of companies are currently experiencing disruption with 44% of those companies highly susceptible to the phenomena.

Competitive intelligence helps a business secure and maintain a competitive advantage by developing a core strategy based on data-backed predictions. In other words, the business uses competitive intelligence to capture, analyze, and then act on information related to their particular competitive landscape. This information can be gleaned from the market, competitors, products, supply chain, industry, and target audience.

Perhaps unsurprisingly, there are many benefits to developing strategies based on competitive intelligence. These strategies enable businesses to:

Identify industry trends or competitive threats ahead of time.Better analyze their strengths and weaknesses. Allocate resources more efficiently. Maximize their return on investment (ROI), andImprove product development and product launching.The seven elements of competitive intelligenceThe seven elements of competitive intelligence help remind businesses that there is more to the approach than simply analyzing its competitors.

To develop a broad, holistic strategy, each business should consider the following seven elements of intelligence:

Sector intelligence External economies of scale describe factors beyond the control of a company that are present in the same industry and that lead to cost benefits. These factors may be positive or negative industry or economic trends. External economies of scale, therefore, are business-enhancing factors occurring outside a company but within the same industry.

External economies of scale describe factors beyond the control of a company that are present in the same industry and that lead to cost benefits. These factors may be positive or negative industry or economic trends. External economies of scale, therefore, are business-enhancing factors occurring outside a company but within the same industry.Sectors are large groups of companies with similar primary business activities such as finance, healthcare, and communications. Sector intelligence evaluates large-scale economic trends and fluctuations.

Market intelligence A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.

A comparable company analysis is a process that enables the identification of similar organizations to be used as a comparison to understand the business and financial performance of the target company. To find comparables you can look at two key profiles: the business and financial profile. From the comparable company analysis it is possible to understand the competitive landscape of the target organization.As the name suggests, market intelligence pertains to information about the market the business operates in. Market intelligence can strengthen market positioning and clarify competitors, customers, growth opportunities, and current or future problems. Since most markets are dynamic, the business needs to prioritize the regular collection of market intelligence to remain competitive.

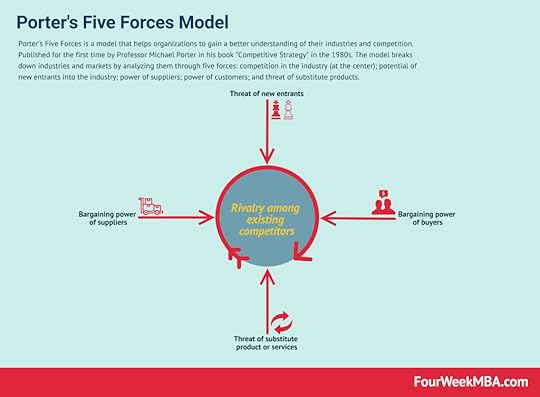

Competitive intelligence Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forces

Porter’s Five Forces is a model that helps organizations to gain a better understanding of their industries and competition. Published for the first time by Professor Michael Porter in his book “Competitive Strategy” in the 1980s. The model breaks down industries and markets by analyzing them through five forcesWhich is focused on the movements and decisions of competitors in a given industry. How is the competitor negotiating sales deals or developing products? What are the key takeaways from their marketing campaigns?

Innovation intelligence An innovation funnel is a tool or process ensuring only the best ideas are executed. In a metaphorical sense, the funnel screens innovative ideas for viability so that only the best products, processes, or business models are launched to the market. An innovation funnel provides a framework for the screening and testing of innovative ideas for viability.

An innovation funnel is a tool or process ensuring only the best ideas are executed. In a metaphorical sense, the funnel screens innovative ideas for viability so that only the best products, processes, or business models are launched to the market. An innovation funnel provides a framework for the screening and testing of innovative ideas for viability.Businesses need to innovate without overextending themselves and diluting their brand. Disruptive businesses need to find gaps in a market where innovation is likely to be commercially viable.

Sales intelligence A sales cycle is the process that your company takes to sell your services and products. In simple words, it’s a series of steps that your sales reps need to go through with prospects that lead up to a closed sale.

A sales cycle is the process that your company takes to sell your services and products. In simple words, it’s a series of steps that your sales reps need to go through with prospects that lead up to a closed sale.This is a form of data-backed intelligence where sales teams create customer profiles, generate leads, and close accounts. Sales intelligence encourages businesses to monitor the market for certain triggers which indicate that a customer is ready to buy.

Procurement and supply chain intelligence The supply chain is the set of steps between the sourcing, manufacturing, distribution of a product up to the steps it takes to reach the final customer. It’s the set of step it takes to bring a product from raw material (for physical products) to final customers and how companies manage those processes.

The supply chain is the set of steps between the sourcing, manufacturing, distribution of a product up to the steps it takes to reach the final customer. It’s the set of step it takes to bring a product from raw material (for physical products) to final customers and how companies manage those processes.This type of collective intelligence gives the business insight into supply and demand figures, production costs, storage costs, regulatory and taxation costs, material supply intelligence, and competitive sales prices. Essentially, procurement and supply chain intelligence details the required rate of production based on demand.

Environmental, social, and governance (ESG) intelligence Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace.

Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace. ESG intelligence tracks the environmental footprint of a business and details the sustainability measures introduced by competitors. ESG also encompasses social welfare and humanitarian initiatives and the relationships between organizations and national and foreign governments. As consumer awareness around ESG principles increases, organizations must incorporate them into their strategies to remain competitive.

Key takeaways:Competitive intelligence is the collection of information by a company on its industry, business environment, competitors, products, and consumers. Insights are used to help the company develop its strategy or improve its competitive position.Strategies based on competitive intelligence help a business improve product development, identify industry trends or competitive threats ahead of time, and maximize return on investment.The seven elements of competitive intelligence remind businesses that there is more to the approach than simply analyzing competitors. Intelligence must also be considered from a sector, market, innovation, sales, procurement, and ESG perspective.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Frameworks To Competitive Intelligence Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace.

Environmental, social, and governance (ESG) criteria comprise a set of standards socially responsible investors use to evaluate a company based on three main criteria: environmental, social, and corporate governance. Combined they help assess the social responsibility effort of companies in the marketplace.  Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes.

Change is an important and necessary fact of life for all organizations. But change is often unsuccessful because the people within organizations are resistant to change. Change management is a systematic approach to managing the transformation of organizational goals, values, technologies, or processes. An effective risk management framework is crucial for any organization. The framework endeavors to protect the organization’s capital base and revenue generation capability without hindering growth. A risk management framework (RMF) allows businesses to strike a balance between taking risks and reducing them.