Gennaro Cuofano's Blog, page 126

January 10, 2022

How Does Waze Make Money? The Waze Business Model In A Nutshell

Waze is a Google-owned subsidiary that provides community-driven satellite navigation software. The company was originally founded by Israeli entrepreneurs Ehud Shabtai, Amir Shinar, and Uri Levine in 2006.

The idea for Waze came from Shabtai, a computer science graduate who had difficulty using a car navigation system gifted to him by a friend. The problem with these products at the time was that they incorporated an expensive GPS and built-in maps with no ability to forecast traffic congestion or other route delays. In other words, they only showed a driver where to go to reach their destination.

Shabtai wanted to address this problem with a rather unusual idea. He envisioned Waze to be a navigation system where each driver would construct the map as they traveled along the road. The app would then collect the location of all active users in the system via GPS so that others could find less crowded routes and balance traffic flow.

Waze was then unveiled to Israeli users in late 2008 and had amassed 80,000 users by May of the following year. The co-founders hired a new CEO, Noam Bardin, who then toured the United States to drum up support for the app’s eventual Blackberry release in 2009.

Since the success of the app relied on crowdsourced information, it needed to become available on as many platforms as possible. This included the newly released iPhone, but also Nokia cell phones and even Windows. The company also released a Pacman-esque game in the app with real prizes to increase user uptake.

In December 2011, Waze was available in the United Kingdom and the United States. The company announced a partnership with no fewer than twelve American broadcast stations which would incorporate Waze data in their traffic reports. Growth from here was exponential, no doubt helped by Apple’s failed attempt to launch a similar map platform. Sensing an opportunity, Google then acquired Waze for $1.1 billion in June 2013.

With many people confined to their homes during the COVID-19 pandemic, the number of miles driven on the platform decreased by as much as 70%. Despite this, the company boasts around 140 million monthly active users around the world and is the second most popular map app behind Google Maps.

Waze revenue generationWaze has a relatively diverse revenue generation strategy, making money from advertising, carpool service fees, brand referral fees, and the sale of its beacon hardware.

Without further ado, let’s delve into this strategy below.

AdvertisingMost Waze revenue comes from brands that pay to advertise on the platform. There are four different ways this can occur:

Pin ads – which tell the user that a brand’s store lies along their driving route.Search ads – which appear when a driver searches for services such as gas stations.Takeover ads – these are billboards only displayed when the car has come to a stop.Arrow ads – these ads tell the driver that a participating business is nearby.Waze earns money on a cost-per-impression (CPI) basis, with each impression costing the advertiser $0.002. For smaller customers, advertising spend starts at $2 per day. Larger brands must spend at least $100 per day.

Waze CarpoolAs the name suggests, Waze Carpool allows users to get paid by becoming carpool drivers.

Drivers keep 100% of the fare, which is normally determined by the distance traveled, the number of travelers in the carpool, and local gas prices.

However, the company charges a service fee in certain circumstances. This is a commission taken from the driver’s total payment.

Referral feesWaze also partners with many brands and earns a referral fee when a Waze user purchases or subscribes to one of their products or services.

Unsurprisingly, many of these brands offer products that can be enjoyed whilst driving. Examples include Spotify, Pandora, Deezer, and YouTube Music.

Waze beaconsWaze beacons are installed in tunnels where the GPS signal is often lost.

The beacon itself is a battery-operated device that sends a one-way signal to a user’s phone or tablet. This allows Waze to continue routing drivers and collect traffic data from underground roads.

Each beacon device costs $28.50, with the company suggesting 42 beacons be installed for every mile of underground road.

Read Next: Google Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Waze Make Money? The Waze Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Varo Make Money?

Varo is an American mobile-only neobank founded by Colin Walsh and Kolya Klymenko in 2015.

Like many similar platforms, Walsh and Klymenko founded Varo to create a bank that would appeal to millennials and other consumers disillusioned with traditional financial institutions. The company was also founded with the social mission to lower the cost of banking and help consumers improve their financial health.

The social impact of Varo as a neobank is considered especially important, with a 2017 U.S. Federal Reserve report suggesting 40% of Americans would not be able to cover a $400 emergency expense without borrowing money or selling a possession.

To that end, the Varo platform offers no-fee banking, low-interest personal loans, automated savings tools, and customizable in-app spend tracking and financial goal setting. Some of these features were facilitated by Varo securing a national bank charter from the United States government in August 2020 – the first consumer fintech company to do so.

In September 2021, Varo raised $510 million in Series E funding to be valued at $2.5 billion. In announcing the deal, the company revealed it had doubled its user base to 4 million and tripled its revenue in the previous thirteen months. Varo is now the third-largest neobank in the United States after Chime and Simple.

Varo revenue generationIn keeping with its company mission, Varo offers an affordable no-fee bank account with no minimum balance. There are no transfer fees, foreign transaction fees, and there is also no fee for replacing a lost or stolen debit card.

However, the company does earn revenue through various other charges and also makes money via brand partnerships.

Below is a look at the particulars of each revenue stream.

Interchange feesWhenever a customer uses their Varo Visa debit card, the participating merchant must pay an interchange fee to Visa which is then shared with Varo.

Brand partnershipsVaro also partners with other mission-driven companies that seek to help people better manage their finances.

The products and services of these brands are offered to Varo customers through the company’s existing marketing channels. Alternatively, Varo may cross-sell certain brands in its app as an alternative user service such as bills and insurance.

Varo is compensated when a user purchases from one of these brands, with the exact fee determined by the contractual agreement between both parties.

Other feesAside from interchange fees, Varo also charges other fees including:

Out-of-network withdrawal fees – customers are charged $2.50 per withdrawal when using an ATM outside of Varo’s network.Cash withdrawal fees – over-the-counter cash withdrawal fees also attract a $2.50 charge.Cash advance fees – customers are charged $3 for a $50 cash advance, $4 for a $75 cash advance, and $5 for a $100 cash advance. These fees are waived for military personnel and their families.Late payment fees – a $15 late payment fee is charged for every late payment in the Varo Believe Program, which is an initiative that helps a customer rebuild their credit score by making regular scheduled payments.Connected Fintech Business ModelsFintech Business Models Venmo Business Model

Venmo Business Model Stripe Business Model

Stripe Business Model Coinbase Business Model

Coinbase Business Model How Does Zelle Make Money

How Does Zelle Make Money Klarna Business Model

Klarna Business Model Affirm Business Model

Affirm Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Afterpay Business Model

Started as a pay-later solution integrated to merchants’ checkouts, Affirm makes money from merchants’ fees as consumers pick up the pay-later solution. Affirm also makes money through interests earned from the consumer loans, when those are repurchased from the originating bank. In 2020 Affirm made 50% of its revenues from merchants’ fees, about 37% from interests, and the remaining from virtual cards and servicing fees.Afterpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Afterpay is a FinTech company providing as a core service the “buy now pay later” solution. When a consumer purchases a product, Afterpay pays the seller and asks the consumer to pay 25%. The remaining 75% is paid in three, fortnightly installments that are also interest-free. Afterpay, in turn, makes money via merchant and late fees.Quadpay Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Revolut Business Model

Quadpay was an American fintech company founded by Adam Ezra and Brad Lindenberg in 2017. Ezra and Lindenberg witnessed the rising popularity of buy-now-pay-later service Afterpay in Australia and similar service Klarna in Europe. Quadpay collects a range of fees from both the merchant and the consumer via merchandise fees, convenience fees, late payment, and interchange fees.Revolut Business Model

Revolut is an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.

Revolut is an English fintech company offering banking and investment services to consumers. Founded in 2015 by Nikolay Storonsky and Vlad Yatsenko, the company initially produced a low-rate travel card. Storonsky in particular was an avid traveler who became tired of spending hundreds of pounds on currency exchange and foreign transaction fees. The Revolut app and core banking account are free to use. Instead, money is made through a combination of subscription fees, transaction fees, perks, and ancillary services.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Varo Make Money? appeared first on FourWeekMBA.

How Does Uniswap Make Money?

Uniswap is a decentralized cryptocurrency exchange founded by former Siemens mechanical engineer Hayden Adams in 2018. The exchange utilizes an automated market-making system rather than a traditional order book for transactions on the Ethereum blockchain.

The Uniswap story begins shortly after Adams was made redundant from his job at Siemens. Feeling down and directionless, he messaged friend Karl Floersch who was working on the consensus protocol Casper FFG at the Ethereum Foundation. Floersch reframed the bad news as the best thing that could have happened to Adams, encouraging him to make a fresh start and learn everything there was to know about Ethereum and smart contracts.

Adams agreed to the proposal, but to broaden his skillset, Floersch suggested he work on a decentralized exchange (DEX) incorporating an on-chain automated market maker with various unique characteristics. The idea had already been proposed by Reddit user and Ethereum founder Vitalik Buterin, who as it happens also came up with the name Uniswap.

Some months later, Adams started work on turning Buterin’s idea into a functional product with financial and other assistance from Floersch and high school friend Uciel Vilchis. After securing a $100,000 grant from the Ethereum Foundation, Uniswap was eventually launched in November 2018.

The platform was praised for being affordable, user-friendly, and intuitive. But what makes Uniswap unique is that the platform solves the problem of high spreads for illiquid assets on order-book exchanges. This issue exists because there is little incentive for professional market makers to provide liquidity on thinly traded assets. With Uniswap, however, anyone can act as a market maker by depositing assets into a pool and earning fees based on the amount of trading activity.

Uniswap became the first decentralized finance (DeFi) protocol to generate $1 billion in liquidity provider fees in August 2021. The company also enjoys a dominant market share among DEX platforms of 63.8%, which equates to approximately 2.5 million users.

Uniswap revenue generationUniswap is a decentralized protocol backed by the crypto hedge fund Paradigm. This means the platform does not make any money per se, with all fees user-controlled and collected by traders who provide liquidity.

The current transaction fee paid to liquidity providers is based on a three-tier system of 0.05%, 0.3%, or 1% depending on which tier offers the best deal for each trade. These fees are added to the liquidity pool by default, but providers can redeem them at any time.

While it is unclear as to whether the company takes a portion of the transaction fee, it is more likely Uniswap has reserves of the governance token UNI and sells the token periodically to cover maintenance and other expenses.

According to the Uniswap website, 21.266% of the initial four-year allocation of UNI will be held by team members and future employees. As the tokens are distributed over this period, the value of Uniswap’s collective holding will increase.

Lear More From The Book Blockchain Business Models

Read Next: Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Connected Business Concepts According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability! A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Uniswap Make Money? appeared first on FourWeekMBA.

How Does Sweatcoin Make Money?

Sweatcoin is an app that rewards users with virtual currencies for exercising and otherwise being active. The company behind the app was founded by Russian entrepreneurs Anton Derlyatka, Danil Perushev, Egor Khmelev, and Oleg Fomenko in 2014.

Derlyatka and Fomenko came up with the idea for Sweatcoin when Fomenko lost the motivation to exercise after his previous start-up failed. The pair, who are based in London and once climbed Kilimanjaro together, realized people didn’t exercise because they prioritized short-term pleasure over long-term gains.

Perhaps more to the point, Fomenko believed that exercise had economic value and set about creating a platform that gave users instant gratification for physical activity. Sweatcoin was subsequently launched in 2016, with the app paying users 0.95 sweatcoins for every 1,000 steps they take outdoors. Once a user has accumulated enough sweatcoins, they can exchange their currency for fitness gear, gift cards, shoes, workout classes, and even Apple watches.

To stop users from gaming the system, Sweatcoin uses a smartphone’s inbuilt step sensor to track movement. This is then verified by a proprietary algorithm that double-checks the readings for speed, consistency of movement, and location to eliminate any false data.

According to the company’s LinkedIn profile, there are now more than 40 million Sweatcoin members across 42 countries, with the United States representing the largest market.

Sweatcoin revenue generationSweatcoin works with over 300 brands that want to connect with health-conscious audiences. These brands encompass mindfulness apps, coffee companies, insurance companies looking to promote healthier lifestyles, and governments wanting to reduce their healthcare expenditure, among many others.

These partnerships serve two purposes. For one, they serve as the value behind each sweatcoin which encourages users to exercise.

They also provide revenue for Sweatcoin itself in the form of brand promotions and partnerships. We’ll explain these in more detail below.

Brand promotionsMost Sweatcoin revenue comes from the revenue it earns from promoting other brands in the marketplace section of its app. The marketplace is where users can spend their hard-earned sweatcoin, and the company takes a commission from every “sale”.

The exact commission is negotiated between Sweatcoin and each brand. For some companies, particularly those selling fitness products, the arrangement is more likely to be lucrative.

Brand partnershipsBrand partnerships include those with larger healthcare and insurance providers. For example, Sweatcoin announced a partnership with Hannover Re where it provided the global insurance company with health-related data.

Another deal was struck with the National Health Service (NHS) in the UK to develop an exercise program for individuals considered a high risk of developing Type 2 diabetes.

Longer-term, the company is committed to working with local and national governments to help them encourage their citizens to be more physically active. In fact, Anton Derlyatka once noted that their big picture use case for Sweatcoin was to have the currency comprise some part of personal income tax.

The company is in all likelihood compensated for brand partnerships, but again, the exact amount is down to the contractual agreement between both parties.

AdvertisingA far less significant source of revenue is in-app advertising.

Users are offered a random number of sweatcoins for watching an ad, with the company making a small amount of money from the advertiser on per-view basis.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Sweatcoin Make Money? appeared first on FourWeekMBA.

How Does Substack Make Money? The Substack Business Model In A Nutshell

Substack is an American online publishing platform that was created by Chris Best, Hamish McKenzie, and Jairaj Sethi in 2017. Substack provides publishing analytics and design infrastructure enabling writers to send newsletters to paying subscribers.

McKenzie and Best became friends while working at messaging app company Kik, with McKenzie working part-time in communications while writing a book and Best one of the company’s founders and also its chief technology officer.

In the middle part of 2017, the pair were looking for a new project and discovered a mutual concern for the state of the media industry. Journalists, they argued, had long been constrained in the sort of content they could produce by editors, advertisers, and page-view metrics. What’s more, consumers were bombarded with so much media content that they spent every waking second in a distracted state.

Best and McKenzie then created Substack to change writer incentives so they could get paid by their readers and not by advertisers. They hoped that if a reader paid to consume content, they would be more selective about what they consumed and thus value it more highly.

The co-founders then recruited Bill Bishop as their very first publisher in October 2017. Bishop, who authored a newsletter on everything China called Sinocism, earned six figures in revenue from his first day writing on the Substack platform. For the next five months, Substack recruited writers on an invite-only basis before opening the doors to the general public in February 2018.

Around the same time, the Substack team joined the Y Combinator accelerator program and received multiple rounds of funding as a result. The funds were used to add additional features and attract various high-profile political writers and journalists. Growth then picked up as the creator economy subscription model for which Substack was known began to gather momentum.

Substack recently surpassed 1 million subscriptions, representing more than 500,000 individuals who pay to read newsletters. The top ten writers collectively earn more than $20 million a year on the platform.

Substack revenue generationSubstack operates under the subscription-based business model. To drive revenue, the company takes a percentage of the subscription fee a writer charges for access to their content.

Writers keep 90% of their subscription fee minus a credit card fee charged by Stripe, with Substack taking the remaining 10%.

For example, a writer who charges $10 per month will forfeit $1 per subscriber to Substack. The same commission structure also applies to writers who charge an annual subscription fee.

Substack likely takes a larger commission from higher-profile writers who were initially lured to the platform with an up-front payment.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Substack Make Money? The Substack Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Steam Make Money? The Steam Business Model In A Nutshell

Steam is a digital, video game distribution service created by American video game developer and publisher Valve Corporation in 2003.

Steam started as a way for Valve to control the patching process for games like Counter-Strike. The platform was also used to prevent cheating and provide easier access to content produced by the game developer. However, Steam required a constant internet connection at a time when only 20% of American households had access to broadband internet. What’s more, the interface was clunky and players were often locked out of the games they purchased as the platform’s authentication servers struggled to cope with demand.

Nevertheless, the 2004 release of Half-Life 2 – which could only be played with a Steam account – increased the popularity of the platform with three prominent packages emblazoned across the Steam storefront. The following year, Valve made a decision that would essentially make the platform what is today. They decided that Steam would move away from being a humble patch distributor and allow third-party developers to host and sell their own games.

Steam continued to grow in the following years, adding a competitive eSport scene and features more common to social media sites such as friend community groups and integration with review service Metacritic. The Steam Workshop was released in 2011 after a major user interface overhaul, enabling gamers to create and upload content directly to the platform. Many such contributions were used in Counter-Strike Global Offensive and Team Fortress 2, with Valve’s introduction of skins to CSGO saving the game from ruin.

The Steam Marketplace was released in 2012, allowing in-game items to be bought and sold using funds from digital wallets. Two years later, Steam transitioned from a gaming platform to one providing game services. Users could transform their laptops and tablets into wireless monitors to stream games or broadcast their sessions live to family and friends.

Steam now features almost 30,000 games from major publisher releases to independent titles and everything in between. There are an estimated 120 million monthly active users who logged a combined total of 31.3 billion hours of playtime in 2020.

Steam revenue generationSteam utilizes the online marketplace model where it connects buyers with sellers. The company collects various fees and commissions for providing services, facilitating transactions, and giving game developers exposure to a vast audience.

With that in mind, here is a more detailed look at how the company makes money.

CommissionsMost company revenue comes from the commissions Steam charges on the sale of a game.

The exact commission depends on the game’s net sales volume:

Net sales volume of under $10 million – 30% commission.Net sales volume between $10-50 million – 25% commission.Net sales volume over $50 million – 20% commission.Steam Direct feeSteam Direct is a submission path designed to provide a streamlined, transparent, and affordable route for new game developers to submit games to the Steam platform.

For each new submission, the developer is required to pay an app deposit fee of $100. The deposit fee is recoupable from the payment made if the app reaches $1,000 in gross adjusted revenue.

Transaction feesSteam collects a transaction fee of 5% to protect against fraudulent incidents and also to cover the cost of future Steam economy features.

The minimum transaction fee is $0.01 and is charged to the buyer based on the total item cost.

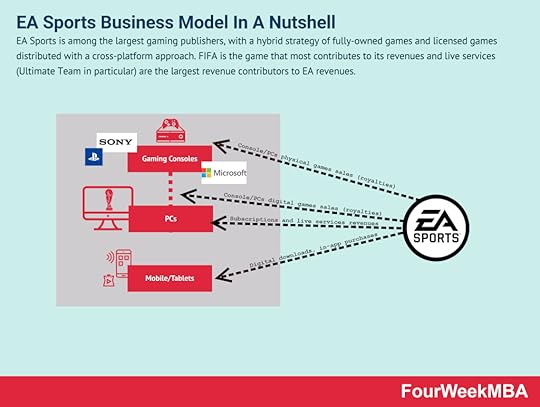

Connected Business Models EA Sports is among the largest gaming publishers, with a hybrid strategy of fully-owned games and licensed games distributed with a cross-platform approach. FIFA is the game that most contributes to its revenues and live services (Ultimate Team in particular) are the largest revenue contributors to EA revenues.

EA Sports is among the largest gaming publishers, with a hybrid strategy of fully-owned games and licensed games distributed with a cross-platform approach. FIFA is the game that most contributes to its revenues and live services (Ultimate Team in particular) are the largest revenue contributors to EA revenues. The gaming industry, part of the entertainment industry, is comprised of three main types of players. From game engines, which help developers build their games. To publishing gaming houses. And gaming consoles. While the prevailing business model for decades has been that of selling the console at cost, and make money on games. Digital games changed the way games are distributed and sold, and it opened up the way to free-to-play models.

The gaming industry, part of the entertainment industry, is comprised of three main types of players. From game engines, which help developers build their games. To publishing gaming houses. And gaming consoles. While the prevailing business model for decades has been that of selling the console at cost, and make money on games. Digital games changed the way games are distributed and sold, and it opened up the way to free-to-play models. Roblox is an online gaming platform where users can create avatars and explore various gaming experiences. Each experience will be monetized based on how its developer has structured the game. For instance, free games allow users to spend the platform’s currency, called Robux, to get specific enhancements or purchase items like clothing accessories for the avatars, simulated gestures from the Roblox Avatar Marketplace. Therefore, Roblox makes money by earning a commission on each transaction and through its internal ad network.

Roblox is an online gaming platform where users can create avatars and explore various gaming experiences. Each experience will be monetized based on how its developer has structured the game. For instance, free games allow users to spend the platform’s currency, called Robux, to get specific enhancements or purchase items like clothing accessories for the avatars, simulated gestures from the Roblox Avatar Marketplace. Therefore, Roblox makes money by earning a commission on each transaction and through its internal ad network. Tencent is a Chinese multinational conglomerate founded in 1998 by Ma Huateng, Zhang Zhidong, and Xu Chenye. Among its various global subsidiaries are companies in the online services, music, and artificial intelligence industries. But it is perhaps best known for its interest in the video game sector – both as a game developer for the Chinese market and the acquirer of several established gaming companies. Tencent is a vast company with a stake in more than 600 companies. Following is a look at some of the companies and subsidiaries it has a majority stake in.

Tencent is a Chinese multinational conglomerate founded in 1998 by Ma Huateng, Zhang Zhidong, and Xu Chenye. Among its various global subsidiaries are companies in the online services, music, and artificial intelligence industries. But it is perhaps best known for its interest in the video game sector – both as a game developer for the Chinese market and the acquirer of several established gaming companies. Tencent is a vast company with a stake in more than 600 companies. Following is a look at some of the companies and subsidiaries it has a majority stake in. A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming. The play-to-earn model is a business model allowing gamers to farm or collect cryptocurrency and NFTs that can be sold on the market. This model has become a standard already in the “crypto gaming industry,” where the blockchain-based games enable token economics to kick in as an incentives mechanism at scale for users to play and be engaged.

The play-to-earn model is a business model allowing gamers to farm or collect cryptocurrency and NFTs that can be sold on the market. This model has become a standard already in the “crypto gaming industry,” where the blockchain-based games enable token economics to kick in as an incentives mechanism at scale for users to play and be engaged. Candy Crush Saga is a match-three puzzle video game developed and published by King, a company specializing in social network-based games. Businessman Riccardo Zacconi co-founded King in 2003 after selling a subscription dating service he had also founded several years previous. The initial source of income for King was advertising revenue, but this strategy was abandoned in 2013. Today, Candy Crush Saga uses the freemium model (free to play) of revenue generation.

Candy Crush Saga is a match-three puzzle video game developed and published by King, a company specializing in social network-based games. Businessman Riccardo Zacconi co-founded King in 2003 after selling a subscription dating service he had also founded several years previous. The initial source of income for King was advertising revenue, but this strategy was abandoned in 2013. Today, Candy Crush Saga uses the freemium model (free to play) of revenue generation.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Steam Make Money? The Steam Business Model In A Nutshell appeared first on FourWeekMBA.

How does Spaceship make money?

Spaceship is an online micro-investment platform founded by Dave Kuhn, Andrew Sellen, Paul Bennet, and Kaushik Sen in 2016.

Spaceship was founded to create a product that would disrupt the Australian investment industry, which at the time was dominated by outdated governmental practices and a distinct lack of diversity and transparency. The platform is targeted at millennial consumers who have become disenfranchised from investing because of excessive fees, complicated processes, or jargon-heavy products.

Spaceship Super was launched in 2017, a retirement fund the company claims can be set up in as little as five minutes. Spaceship Voyager was launched the following year, offering a simple and affordable way to invest in over 200 companies across various diversified portfolios.

Many of the companies users can invest in meet what Spaceship calls “Where the World is Going” criteria, with Spotify, Apple, Tesla, Square, and Microsoft the most obvious examples. Investors who consider ESG criteria to be more relevant can invest in another portfolio comprised of companies such as Atlassian, Shopify, Starbucks, and Nvidia.

Spaceship surpassed $1 billion in funds under management during July 2021 and boasted over 200,000 users across Australia.

Spaceship revenue generationSpaceship makes money by charging management fees, investment fees, and administration fees across its various investment and superannuation (retirement) products. Let’s take a look at these below.

InvestmentSpaceship Universe Portfolio – for investors who want a portfolio comprised of companies with growth potential or a competitive advantage. Some of the criteria Spaceship considers include innovation, the presence of a moat, robust management, and high expected returns.Spaceship Earth Portfolio – for investors who want a portfolio of companies making a positive impact on people and the planet.Spaceship Origin Portfolio – for investors who want exposure to some of the world’s largest companies, including Alphabet, Amazon, and Johnson & Johnson.The management fee for all three portfolios is $2.50/month for balances exceeding $100. Note that there are no other fees or costs, even if the user wants to set up multiple portfolios.

SuperannuationSpaceship GrowthX Option – the company’s flagship investment option with a diversified portfolio of global technology companies. Spaceship charges a 0.196% investment fee and an administration fee of $78 + 0.720% per annum.Spaceship Global Index Option – for the index investor looking for a passive investment option. The portfolio is predominantly comprised of finance, healthcare, consumer discretionary, industrial, and communication services companies. Here, Spaceship charges no investment fee but does charge an administration fee of $78 + 0.577% per annum.For both superannuation products, the administration fee is waived for balances under $6,000.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How does Spaceship make money? appeared first on FourWeekMBA.

How Does Sorare Make Money? The Sorare Business Model In A Nutshell

Sorare is a fantasy football platform developed by Nicolas Julia and Adrien Montfort in 2018. The platform enables players to buy, sell, trade, and manage a virtual team using digital player cards on the Ethereum blockchain.

In late 2017, Julia and Montfort discovered NFTs which enabled the creation of scarce digital items. The allure of NFTs struck a very personal chord with Julia, who noted that “We as human beings have been collecting things for centuries in the physical space. With NFTs, there is now the possibility of collecting something digital.”

Sorare is a fantasy football game where NFT collectibles are based on real-world football players and clubs. Securing licensing deals with these clubs was a boon for the co-founders, especially when one considers that Sorare was an unproven start-up operating in an industry shrouded in misconception and complexity.

To play the game, participants need to own NFT cards which range in abundance from limited to rare, super rare, and unique. These cards are acquired via packs sold by the company or on a secondary marketplace by owners who auction them off. The ability to use NFT collectibles in a competitive environment is what differentiates Sorare from similar platforms.

Users can join a variety of different leagues, including those designed for rookie players or region-focused tournaments. On game day, the user assembles a team of five with points awarded based on the real-world performance of each player. The team that receives the most points is the winner and may themselves be awarded with Ether or rare cards.

In September 2021, Sorare raised $680 million in Series B funding to be worth $4.3 billion. The platform now boasts 228 officially licensed football clubs.

Sorare revenue generationSorare makes money by the issuance and sale of new NFT playing cards on its platform.

While the cost of minting new NFTs for thousands of players might be considered prohibitive, Sorare runs on the Ethereum L2 network Starknet. This allows the company to bundle many transactions together and reduce the cost per minted card.

Playing cards can be purchased in a few different ways:

New signings – where cards have been minted by Sorare and listed for sale without any previous owners. These cards are sold in an auction system, with prices starting at around 0.004 ETH or approximately $16. How much the company makes from minting new NFTs is determined by their scarcity and to a lesser extent, the player who is featured on the card.Transfer market – where players purchase from other players on a secondary NFT marketplace. At the time of writing, Sorare does not make any money in this space. The company even covers the gas fee and, in some cases, has reduced the fee to zero to improve the user experience.Direct offers – new cards can also be acquired by approaching other players directly and making sending them an offer on one of their team members. Sorare does not yet have plans to charge a fee for facilitating this transaction.Connected Business Concepts According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability! A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Sorare Make Money? The Sorare Business Model In A Nutshell appeared first on FourWeekMBA.

January 9, 2022

Software-as-a-service Companies

The software-as-a-service (SaaS) industry has become among the largest tech industries today. Software-as-a-service describes any cloud-based application delivery and consumption business model where companies charge users a subscription fee depending on their desired level of functionality.

The first modern example of a SaaS company is probably Salesforce, which launched its customer relationship management (CRM) platform in 1999. Back in those days, subscription-based software was considered unviable for large enterprises.

Over time, however, internet technology became sufficiently advanced that providers removed bandwidth limitations – which enabled business processes to become faster and more reliable as a result. Additional improvements in terms of ease of use, core functionality, and cost-efficiency have contributed to the exponential growth of the industry seen today.

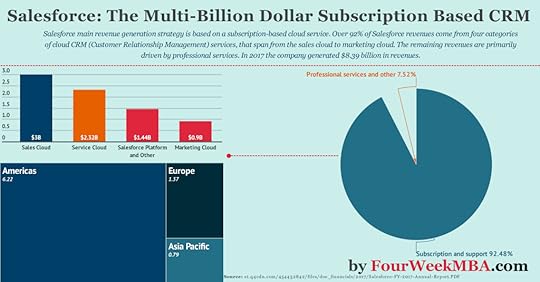

Salesforce Salesforce main revenue generation strategy is based on a subscription-based cloud service. Over 92% of Salesforce revenues come from four categories of cloud CRM (Customer Relationship Management) services, that span from the sales cloud to marketing cloud. The remaining revenues are primarily driven by professional services. In 2017 the company generated $8.39 billion in revenues.

Salesforce main revenue generation strategy is based on a subscription-based cloud service. Over 92% of Salesforce revenues come from four categories of cloud CRM (Customer Relationship Management) services, that span from the sales cloud to marketing cloud. The remaining revenues are primarily driven by professional services. In 2017 the company generated $8.39 billion in revenues.  Salesforce is a cloud-based customer relationship management (CRM) provider, allowing businesses to build meaningful and sustained relationships with their customers. With robust, customizable software that integrates with social media, Gmail, and Microsoft Outlook, the Salesforce CRM platform is rated highly among businesses of all shapes and sizes. Recent data has shown that the company has captured 19.5% of the global CRM market.

Salesforce is a cloud-based customer relationship management (CRM) provider, allowing businesses to build meaningful and sustained relationships with their customers. With robust, customizable software that integrates with social media, Gmail, and Microsoft Outlook, the Salesforce CRM platform is rated highly among businesses of all shapes and sizes. Recent data has shown that the company has captured 19.5% of the global CRM market. Salesforce was founded by Marc Benioff, Parker Harris, Dave Moellenhoff, and Frank Dominguez, who were the first people to launch a platform with the sole intention to offer software-as-a-service.

In addition to providing a CRM product, Salesforce also offers customer service, analytics, application development, and marketing automation for enterprise clients.

AdobeAdobe was founded in 1982 by John Warnock and Charles Geschke. The company is perhaps most associated with its flagship software for creatives such as photographers and graphic designers.

The company generated revenue of $4.216 billion in 2011, but sales started to flatline soon after. This was caused by the rapid advancement of creative software, which exposed Adobe’s slow 18 to 24-month product update cycle.

The Adobe Creative Cloud monthly subscription was released the following year to grow the user base, with over 4 million creatives on the platform by 2015.

Shopify Shopify is an e-commerce platform enabling merchants to commercialize their products via a monthly subscription fee, and additional services provided by the platform. Its core business is subscription-based, even though in 2018, the company made over 50% of its revenues from another stream called merchant solutions.

Shopify is an e-commerce platform enabling merchants to commercialize their products via a monthly subscription fee, and additional services provided by the platform. Its core business is subscription-based, even though in 2018, the company made over 50% of its revenues from another stream called merchant solutions.Shopify is a B2C eCommerce platform founded in 2006 by Tobias Lütke, Daniel Weinand, and Scott Lake.

Shopify is feature-rich and simple to use for businesses that are new to the world of eCommerce. The SaaS-based sales system saves merchants the hassle of having to maintain a server and there is a range of subscription plans to suit various sized companies.

Features include product, order, and inventory management, multiple sales channels, and multi-vendor integration.

In just fifteen short years, Shopify has grown from humble beginnings to become one of the fastest-growing eCommerce platforms online. The Shopify eCommerce solution is perhaps best suited to users who desire an easy, flexible and affordable starter solution for their online store. The provider now has upwards of 820,000 stores accounting for 20% of the total market share. However, the continued success of any company in the dynamic digital market is never guaranteed.Atlassian

In just fifteen short years, Shopify has grown from humble beginnings to become one of the fastest-growing eCommerce platforms online. The Shopify eCommerce solution is perhaps best suited to users who desire an easy, flexible and affordable starter solution for their online store. The provider now has upwards of 820,000 stores accounting for 20% of the total market share. However, the continued success of any company in the dynamic digital market is never guaranteed.AtlassianAtlassian is an Australian software company founded by Mike Cannon-Brookes and Scott Farquhar in 2002. Total revenue for the fiscal year 2021 was $2.1 billion.

Atlassian is one of the foremost providers of collaboration tools for distributed and remote workforces. It is a so-called “pure-play” SaaS company devoid of bells and whistles with solutions tailored to meet various team sizes and functions.

Products under the Atlassian banner include Confluence, Trello, and Bitbucket.

ZohoZoho is an Indian B2B multinational tech company specializing in web-based business tools.

The company, which was founded in 1996 by Tony Thomas and Sridhar Vembu, offers a suite of productivity and other tools via the SaaS approach. Zoho addresses use cases across human resources, marketing, IT service management, customer relationship management, and workplace collaboration.

In January 2020, the platform surpassed 50 million users from small, medium, and large enterprises.

SAPThough not exclusively a SaaS provider, German multinational SAP deserves a mention. The company is the largest non-American software company in terms of revenue and the largest in Germany with a market cap of around $168 billion.

In terms of its software-as-a-service offering, the company’s products are mostly the result of several acquisitions, such as Fieldglass, Concur, and Ariba to name a few. Having said that, it also sells proprietary sales cloud, sales intelligence, and CRM-based products.

Key takeaways:Software-as-a-service describes a cloud-based application delivery and consumption business model where companies charge users a subscription fee depending on their desired level of functionality.The first modern example of a SaaS company is Salesforce because it was founded with the sole intention of offering software-as-a-service. Adobe is another SaaS company that adopted the model in response to declining sales in 2011.Other companies include eCommerce platform Shopify, remote workforce collaboration provider Atlassian, and Indian B2B productivity firm Zoho. German multinational firm SAP is also a significant player despite having other interests.Read More: Cloud Business Models, IaaS vs PaaS vs SaaS, AIaaS Business Model.

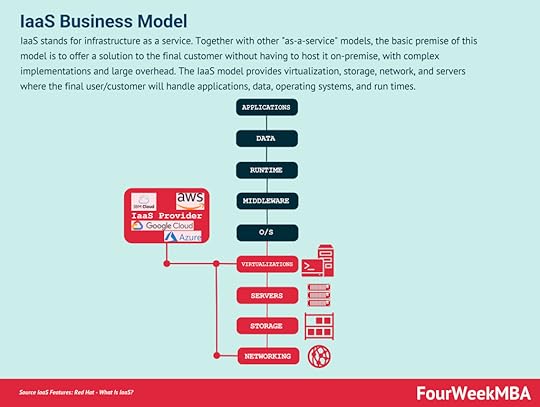

Infrastructure as a service (IaaS) IaaS stands for infrastructure as a service. Together with other “as-a-service” models, the basic premise of this model is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. The IaaS model provides virtualization, storage, network, and servers where the final user/customer will handle applications, data, operating systems, and run times.

IaaS stands for infrastructure as a service. Together with other “as-a-service” models, the basic premise of this model is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. The IaaS model provides virtualization, storage, network, and servers where the final user/customer will handle applications, data, operating systems, and run times.Read Also: IaaS Business Model

Platform as a service (PaaS) PaaS stands for the platform as a service. Together with other “as-a-service” models, this model’s basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. The PaaS model is a form of evolved cloud computing. The provider, together with virtualization, storage, network, and servers, provides middleware and runtime to the user/customer, which only handles data and applications.

PaaS stands for the platform as a service. Together with other “as-a-service” models, this model’s basic premise is to offer a solution to the final customer without having to host it on-premise, with complex implementations and large overhead. The PaaS model is a form of evolved cloud computing. The provider, together with virtualization, storage, network, and servers, provides middleware and runtime to the user/customer, which only handles data and applications.Read Also: PaaS Business Model

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Software-as-a-service Companies appeared first on FourWeekMBA.

What Is Sensory Marketing? Sensory Marketing In A Nutshell

Sensory marketing describes any marketing campaign designed to appeal to the five human senses of touch, taste, smell, sight, and sound. Technologies such as artificial intelligence, virtual reality, and the Internet of Things (IoT) are enabling marketers to design fun, interactive, and immersive sensory marketing brand experiences. Long term, businesses must develop sensory marketing campaigns that are relevant and effective in eCommerce.

Understanding sensory marketingThere has been a lot of research over the past few decades into how the five senses can affect consumer purchase decisions. The sum total of this research has resulted in a new field called sensory marketing, which seeks to relate to consumers on an emotional level via the five senses of touch, taste, smell, sight, and sound.

Sensory marketing was once confined to brick-and-mortar businesses that endeavored to engage shoppers and keep them in the store for as long as possible. With the COVID-19 pandemic accelerating the shift toward eCommerce, some question whether sensory marketing is still as relevant as it once was.

The good news is that sensory marketing is still a valuable tool in the arsenal of any modern business. Visual campaigns will always be popular online, but evolving technologies such as artificial intelligence, virtual reality, and the Internet of Things (IoT) are also enabling marketers to design fun, interactive, and immersive brand experiences that engage other senses.

Sensory marketing examplesAll five senses play an important role in creating an emotional association with a brand. Let’s take a look at how sensory marketing is playing out in the real world.

TasteTaste encompasses the five sensations of sour, sweet, umami, bitter, and salty. When an individual tastes a product, they use the other four senses in unison to determine whether they enjoy something. For the business, it is important to move beyond the basic and widespread technique of product sampling toward creating a memorable experience.

New Orleans beer brand Second Line gave consumers the chance to sample a new IPA by taking selfies with branded props and be directed to the nearest store that stocked the beer. While consumers came to taste the beer, they also got to experience the hospitality that the southern part of America is famous for.

TouchHow can the consumer fall in love with a product or service with a hands-on experience?

Duct tape brand Duck Tape launched the Duck Tape Rolls Across America Tour to create brand awareness, engage consumers, and increase sales at retail locations. A large and very bright green bus toured the country with a range of interactive activities for duct tape enthusiasts, including product tutorials, fun craft projects, and life-size sculptures.

SmellMost consumers appreciate the smell of baked bread in a supermarket or a signature scent in the cosmetics section of a department store. These smell-based experiences are no accident, with companies using them to connect consumers with some of their earliest and fondest memories.

American bakery chain Cinnabon deliberately locates its ovens near the front of each store to ensure the aroma of fresh-baked goods permeates the surrounding area. The tactic has proven so successful that some stores maintain the scent throughout the day by warming sheets of cinnamon and brown sugar.

SightThe role of sight in consumer purchasing does not need much explanation. Consumers recognize brands, logos, images, text, and even color schemes in a mostly subconscious process.

Traditional strategies favor simple product displays, which work to some extent. However, modern businesses should also consider art, videos, advertising banners, magazines, whitepapers, and online catalogs. To create that much-desired emotional experience, visual stimuli can also be paired with auditory stimuli.

The Reunion Tower affords consumers commanding views of the city of Dallas from a height of 561 feet. While this experience is a feast for the eyes, visitors can also download a virtual reality app that enhances the traditional experience of looking out from a tall structure.

SoundSound is also a widely used technique in marketing, though the efficacy of radio jingles and television advertisements is debatable. Nevertheless, studies have shown that music is an important emotion regulator and that 75% of consumers will remain in a store if they enjoy the music that is being played.

To that end, Victoria Secret broadcasts classical music in its stores to create an atmosphere suggestive of a luxury shopping experience.

Key takeaways:Sensory marketing describes any marketing campaign designed to appeal to the five human senses of touch, taste, smell, sight, and sound.Sensory marketing encompasses a range of creative strategies across the five human senses. For best results, sensory marketing should incorporate at least two different senses in a single campaign.Types Of Marketing Connected To Sensory Marketing Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

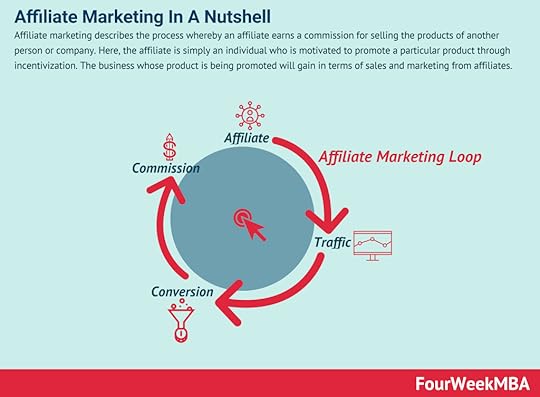

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

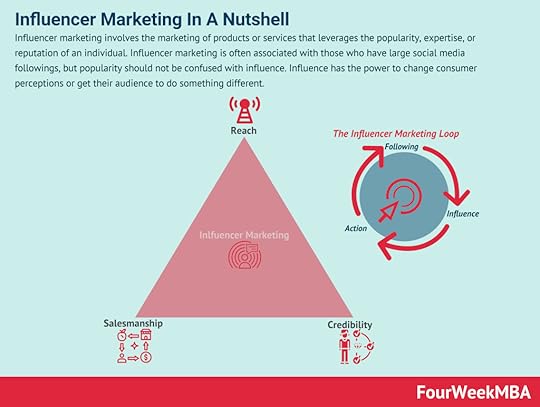

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

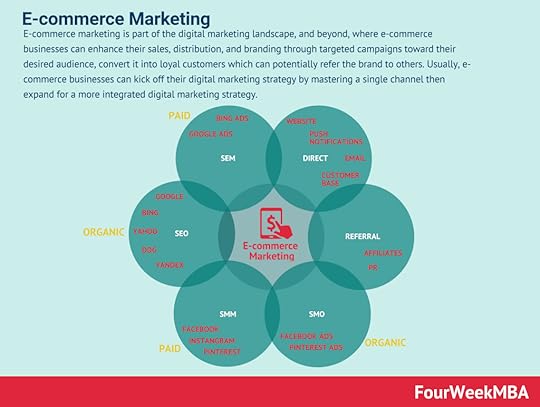

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

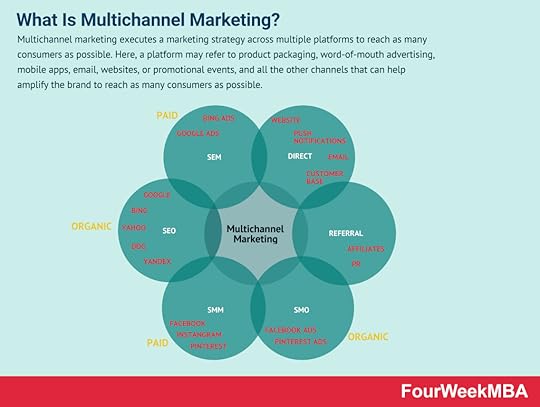

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

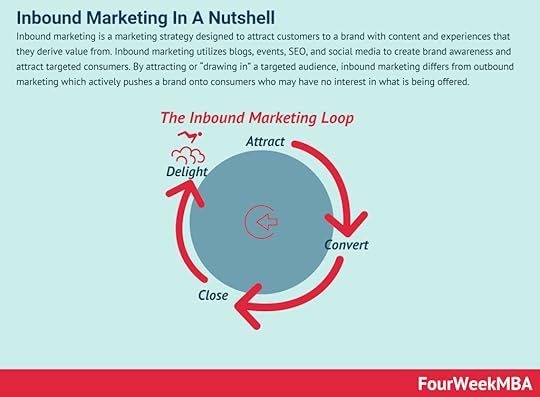

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

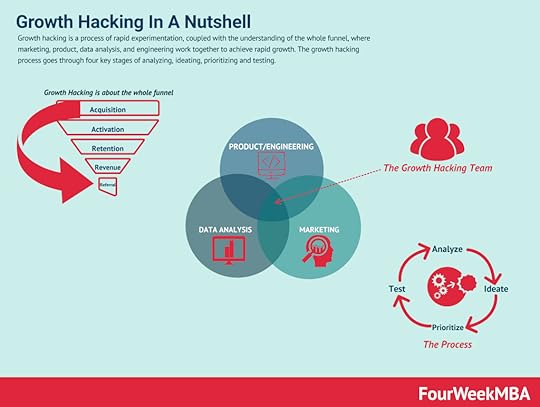

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

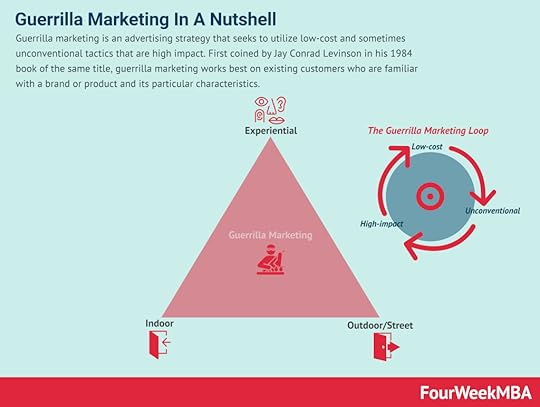

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

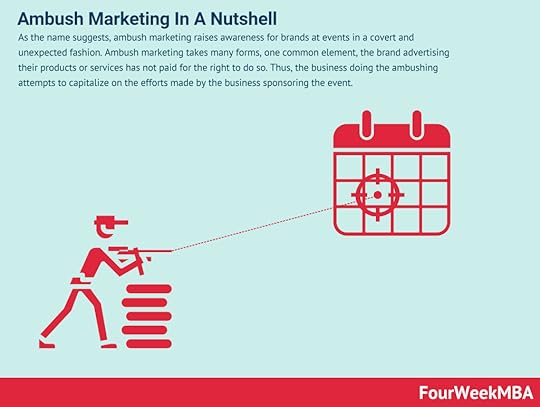

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Sensory Marketing? Sensory Marketing In A Nutshell appeared first on FourWeekMBA.