Gennaro Cuofano's Blog, page 130

January 3, 2022

What Is A Brownfield Investment? Brownfield Investment In A Nutshell

A brownfield investment normally occurs when an organization wants to begin operating in a new country without incurring the expensive start-up costs associated with a greenfield investment. For the purposes of this article, a greenfield investment is one where a new production facility is constructed from scratch. A brownfield investment is the lease or purchase of a pre-existing production facility in a foreign country.

Understanding a brownfield investmentA brownfield investment is a form of foreign direct investment which makes use of existing infrastructure by either merging, acquiring, or leasing that infrastructure. That is, the foreign company or individual invests in a business already established in another country. For the business entering a foreign country, this approach reduces costs and shortens the time to production.

While a brownfield investment is a low-cost, developed asset, it may still require ongoing capital expenditure. Many brownfield investments are associated with considerable development or construction as part of expansionary, enhancement, or retro-fitting programs.

Brownfield investment examplesTo understand how a brownfield investment plays out in the real world, consider these examples:

VodafoneThe British telecommunications company acquired a majority stake in Hutchison Essar, India’s fourth-largest mobile operator. The multi-billion investment saw Vodafone gain a controlling interest in the company. In the process, Vodafone established itself in the Indian telecom market through an established player.

Tata MotorsIndian automotive manufacturer Tata Motors acquired fellow British manufacturer Jaguar in 2008. The all-cash deal, worth $2.8 billion, gave Tata the right to establish a manufacturing plant and two design centers in the United Kingdom.

DisneyIn 2006, The Walt Disney Company acquired computer animation studio Pixar in a deal worth $7.4 billion. In acquiring Pixar, Disney gained access to advanced animated movie technology. The company also inherited Pixar’s unique culture and creative team, which it admitted was responsible for “some of the most innovative and successful films in history.”

Advantages and disadvantages of brownfield investmentsAdvantagesQuick access to a new marketSince much of the infrastructure is already provided, the company can enter a foreign market in a relatively short space of time. What’s more, the existing firm may have an established network of vendors, suppliers, and distributors.

Regulatory approvalsSimilarly, an existing firm with environmental or bureaucratic approvals in place means the acquiring firm can begin operations sooner and save time and money. This advantage is likely to grow over time as environmental approvals become increasingly difficult to obtain.

Skilled employeesAs we saw in the Disney acquisition of Pixar, some brownfield investments allow the controlling company to benefit from a skilled and productive workforce. In fact, it may be the sole reason a company makes such an investment in the first place.

DisadvantagesOutdated infrastructureThere is always the risk that a brownfield investment requires a major infrastructure upgrade. In some cases, the cost of the upgrade may be comparable to the cost of a greenfield investment.

Repatriation lawsSome countries impose restrictions on how much profit can be taken back to the home country of the acquiring company.

Buyer’s remorseNo matter how good the investment appears on paper, it is unlikely the acquiring company will find a facility with the type of capital, labor, equipment, and technology that suits its needs completely. The discomfort arising from buyer’s remorse must be prepared for and accepted if the business is to succeed in a less than ideal foreign market.

Key takeaways:A brownfield investment is the lease or purchase of a pre-existing production facility in a foreign country. Many such investments are associated with expansionary, enhancement, or retro-fitting programs.An example of a brownfield investment is the Vodafone acquisition of Hutchison Essar to enter the Indian telecommunications market. Another example is Disney, which acquired Pixar to inherit its advanced computer animation studios and a team of creative designers.Brownfield investments may help an organization enter a new market more efficiently with regulatory approvals, infrastructure, and a skilled workforce in place. However, there is a risk the acquired infrastructure is costly to maintain or replace. Some countries also enforce restrictive profit laws.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Financial ConceptsBusiness Incubator A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.Angel Investing

A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.Angel Investing An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.Venture Capital

An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.Venture Capital A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.Economic Moat

A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.Economic Moat Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.Meme Investing

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.Meme Investing Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.Payment for Order Flow

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.Payment for Order Flow Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.What is a SPAC

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.What is a SPAC A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.Pac-Man Defense

A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.Pac-Man Defense The Pac-Man defense is a tactic used by a company that is the subject of a hostile takeover. The Pac-Man defense is a response to a hostile takeover attempt with another hostile takeover attempt. In essence, the company that was the subject of the original takeover turns the tables on the acquiring company by trying to take it over in turn.

The Pac-Man defense is a tactic used by a company that is the subject of a hostile takeover. The Pac-Man defense is a response to a hostile takeover attempt with another hostile takeover attempt. In essence, the company that was the subject of the original takeover turns the tables on the acquiring company by trying to take it over in turn.The post What Is A Brownfield Investment? Brownfield Investment In A Nutshell appeared first on FourWeekMBA.

January 2, 2022

What Is The Pac-Man Defense? The Pac-Man Defense In A Nutshell

The Pac-Man defense is a tactic used by a company that is the subject of a hostile takeover. The Pac-Man defense is a response to a hostile takeover attempt with another hostile takeover attempt. In essence, the company that was the subject of the original takeover turns the tables on the acquiring company by trying to take it over in turn.

Understanding the Pac-Man defenseThe Pac-Man defense is named after the Pac-Man video game. In the game, the eponymous character is chased by four colored ghosts who are trying to eat him. If the Pac-Man eats a Power Pellet, however, he can turn around and eliminate the ghosts.

Target companies use the same approach in the hope that the acquiring company abandons its takeover attempt. The acquiring company may institute a large-scale purchase of the target company’s shares, but this may be countered by the target company buying back those shares and then purchasing shares in the acquiring company.

How is the Pac-Man defense funded?The success of the strategy depends on whether the target company has the financial clout to purchase enough shares in the acquiring company to be a credible threat.

This may be facilitated via:

The sale of assets and business units – to generate enough cash to buy large amounts of shares in the acquirer, the target company can sell off non-vital assets or non-core business units.Capital raises – the target can also borrow cash from a lender or undertake a capital raise funded by retail or institutional investors. If the latter is done via a share issuance, it has the advantage of increasing the number of outstanding shares an acquiring company would need to purchase to take a controlling interest.Accessing a war chest – which refers to a cash reserve many companies maintain for use in adverse events or to take advantage of unexpected opportunities. The war chest usually contains assets that can easily be liquidated such as treasury bills and bank deposits.Pac-Man defense examplesHere are some real-world examples of where the Pac-Man defense has been employed:

Porsche and VolkswagenAs early as 2005, Porsche made several failed attempts to purchase a controlling interest in Volkswagen. When the company share price decreased in the wake of the GFC, Volkswagen took the opportunity to purchase discounted Porsche shares. In 2012, Volkswagen acquired 100% of Porsche to end what had become a seven-year saga between the two companies.

Bendix Corporation and Martin MariettaIn 1982, Bendix Corporation attempted a hostile takeover of building materials firm Martin Marietta. The latter sold off multiple business units and borrowed over $1 billion to thwart the attempt, with Bendix Corporation owning 70% of Martin Marietta and Martin Marietta then becoming the owner of 50% of Bendix Corporation. The Pac-Man defense was used by both companies in the back-and-forth and was an expensive exercise for both parties. In the end, Allied Corporation acted as a white knight and acquired Bendix Corporation in 1983.

Wolverhampton & Dudley and MarstonBritish brewery Wolverhampton & Dudley launched a hostile takeover of competitor Marston in 1998 after a friendly takeover failed. Marston then used the Pac-Man defense to acquire 73.5% of Wolverhampton & Dudley and prevent the takeover. This was the first time the strategy had been used outside of the United States.

Key takeaways:The Pac-Man defense is a tactic used by a company that is the subject of a hostile takeover. In essence, the company turns the tables on the acquiring company by trying to take it over in turn.The Pac-Man defense depends on the target company having the financial means to purchase a controlling interest in the acquiring company. Money must be raised through the sale of assets and non-core business units. Capital raises and war chests can also be used to fund the defense.The Pac-Man defense is perhaps best exemplified by Porsche’s failed takeover attempt of Volkswagen. The latter used the Global Financial Crisis to purchase Porsche shares at a discount and ultimately acquire a 100% stake.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Financial ConceptsBusiness Incubator A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.Angel Investing

A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.Angel Investing An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.Venture Capital

An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.Venture Capital A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.Economic Moat

A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.Economic Moat Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.Meme Investing

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.Meme Investing Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.Payment for Order Flow

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.Payment for Order Flow Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.What is a SPAC

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.What is a SPAC A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.

A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.The post What Is The Pac-Man Defense? The Pac-Man Defense In A Nutshell appeared first on FourWeekMBA.

What Is The Outcome Bias? The Outcome Bias In A Nutshell

Outcome bias describes a tendency to evaluate a decision based on its outcome and not on the process by which the decision was reached. In other words, the quality of a decision is only determined once the outcome is known. Outcome bias occurs when a decision is based on the outcome of previous events without regard for how those events developed.

Understanding outcome biasOutcome bias is common in humans because we tend to be self-evaluative. We tend to look back at what we’ve done and use any lessons learned to measure our future performance. This can be a useful trait in some circumstances, but it can also be a problem when something bad happens.

When a decision results in a poor outcome, we tend to place more importance on the outcome of a decision. We may be overly self-critical or indeed critical of others when compared to instances where a decision resulted in a positive outcome. It does not matter if the decision-making process was well considered or if the likelihood of success was down to chance.

This is not to say that outcome bias does not occur when there is a favorable outcome. Consider an individual who decides to invest in real estate after learning that a friend made a significant capital gain. Outcome bias causes the individual to become preoccupied with how much money was made and in the process, ignore the mechanisms behind their friend’s success. Perhaps a government stimulus package for new home builders was a contributing factor, or maybe a combination of low-interest rates and a knack for identifying undervalued property was the cause.

The outcome bias in businessIn business, an overemphasis on performance is creating an outcome-centric culture in which someone must lose in order for someone else to win.

As a result, outcome bias is present in many performance-related situations including:

RecruitmentA hiring manager is only considered successful if the employee they recruit performs well. With less emphasis on the reasoned and fair recruitment process, employees are led to believe that they are either good at their job or bad at their job. When evaluations are based on a binary result and not on the quality of an employee’s decision-making, good luck is rewarded over competence or expertise.

Product developmentProducts are judged according to how well they were received in the market, rather than the product development-related processes and systems that made the product a reality in the first place.

LeadershipOnce an outcome is known, the outcome bias also hinders our ability to evaluate whether a leadership decision was good or bad. Fearful of negative repercussions, outcome bias can make some leaders risk-averse. Conversely, irresponsible leaders who make reckless decisions are rewarded if their decision results in a positive outcome. In this case, the subordinates who doubted the leader’s ability may be subject to harsh treatment from others.

Avoiding outcome biasCritical thinking is one way of avoiding outcome bias. Instead of focusing on outcomes, we need to focus on the process as a whole.

Like many cognitive biases, however, outcome bias can be difficult to address on our own. We may sabotage ourselves by quitting too early or ignoring certain information we don’t like. In this situation, it can be helpful to collaborate with a colleague or superior to understand the underlying causes of the bias.

In any case, consider these questions:

What led us to make the decision?Was there a better process we could have followed in making the decision?Could we have liaised with other people?What information did we have at our disposal? What information did we not have?Could we have obtained more data?Was it necessary to decide at the point the decision was made?Were there previously unknown external factors that may have skewed the decision?Key takeaways:Outcome bias occurs when a decision is based on the outcome of previous events without regard for how those events developed.Outcome bias in business tends to occur in the recruitment process, product development, and leadership. Most conspire to create an outcome-centric culture in organizations where one person has to lose for another to win.Outcome bias can be avoided with critical thinking and a commitment to focusing on processes. Discussing the bias with a trusted colleague or supervisor can be a good way to uncover its underlying causes.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkRelated Business Concepts As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty. The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not. The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist.

The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist. The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty. The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased.

The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased. The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves. Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s. The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it.

The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it. Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).

Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches). The Hawthorne Effect refers to an inclination of some people to work harder or perform better when they know they are being observed. The effect is most associated with those who are experiment participants, who alter their behavior due to the attention they are receiving and not due to any manipulation of independent variables. Therefore, the Hawthorne Effect describes the tendency for a person to change their behavior with the awareness that they are being observed.

The Hawthorne Effect refers to an inclination of some people to work harder or perform better when they know they are being observed. The effect is most associated with those who are experiment participants, who alter their behavior due to the attention they are receiving and not due to any manipulation of independent variables. Therefore, the Hawthorne Effect describes the tendency for a person to change their behavior with the awareness that they are being observed. In statistics, the Simpson Paradox happens when a trend clearly shows up in clusters/brackets of data. But it disappears or at worse it reverses when the data is grouped and combined. In short, the Simpson paradox shows that when the data moves from clusters to combined data, it hides several distributions, which end up creating a biased overall effect.

In statistics, the Simpson Paradox happens when a trend clearly shows up in clusters/brackets of data. But it disappears or at worse it reverses when the data is grouped and combined. In short, the Simpson paradox shows that when the data moves from clusters to combined data, it hides several distributions, which end up creating a biased overall effect. Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.The post What Is The Outcome Bias? The Outcome Bias In A Nutshell appeared first on FourWeekMBA.

What Are Masstige Brands? Masstige Brands In A Nutshell

Masstige is a portmanteau of the words “mass” and “prestige”. The term was made popular by Michael Silverstein and Neil Fiske in their 2008 book Trading Up and in a Harvard Business Review article entitled Luxury for the Masses. Masstige brands are mass-produced goods that are marketed as prestigious or luxurious to an aspirational audience.

Understanding masstige brandsMasstige brands rose to prominence during the 1980s and 1990s as economic growth lead to increasing disposable incomes, lower unemployment rates, and a growing wealthy class in emerging countries. Once the domain of a small, elite group of wealthy consumers, the so-called “democratisation of luxury” has today made luxury products accessible to a larger population.

This new class of luxury goods is less expensive than traditional luxury goods while still retaining aspects of a brand’s original prestige and value. With that in mind, there are two key components of a masstige brand:

They must be considered luxury or premium products, andThey must have price points that fill the gap between mid-market and super-premium.The consumers for whom luxury has been made more accessible come from the middle and upper-middle classes who purchase luxury goods as a form of self-reward and indulgence. This contrasts with luxury purchases made by the rich, which are mostly driven by status.

This emerging class of luxury product evangelists is perhaps best described by James Twitchell in his 2002 book Living It Up: Our Love Affair with Luxury. Twitchell noted that “These new customers for luxury are younger than clients of the old luxe used to be, they are far more numerous, they make their money far sooner, and they are more flexible in financing and fickle in choice. They do not stay put. They now have money to burn.”

Masstige brand categoriesBefore we list some masstige brand categories, it is important to note that not every category is appropriate for the masstige approach. Masstige brands must complement existing product lines and enrich the brand experience without creating overlap or conflict.

With that said, most masstige brands encompass the following categories:

EyewearDesigner fashion brands such as Dolce & Gabbana and Prada also sell sunglasses and other eyewear to broaden their respective target audiences. Porsche is another premium brand that has entered this space.

AutomobilesDespite earning a reputation as a luxury sedan manufacturer, BMW now sells a watered-down version of the luxury sedan known as the 1 Series. Brand prestige is maintained to some extent since the vehicle still wears the BMW badge. Ferrari also sells branded merchandise including hats, clothing, and even computers without that merchandise competing with the brand’s core identity that is rooted in sports cars.

Beauty productsWomen love masstige beauty brands because they offer comparable quality and trendiness to luxury brands but for a fraction of the cost. Indeed, the affordable price point combined with the aura of luxuriousness allows women to feel like they’ve treated themselves without breaking the bank.

FashionCompanies such as Zara exemplify the idea of selling taste and style to the masses. The fashion retailer imitates the clothing and store design of luxury brands and also takes inspiration from their advertising strategies. Armani Haute Couture jeans sell for $900, but the company also sells a $100 pair to appeal to brand-conscious wearers.

HomewaresAmerican home furnishing chain Pottery Barn sells homewares that are considered premium. However, these products are widely available and are sold at price points more affordable than more exclusive brands.

Key takeaways:Masstige brands are mass-produced goods that are marketed as prestigious or luxurious to an aspirational audience.Masstige brands are purchased by middle and upper-middle-class consumers as a form of self-reward or indulgence. Traditional luxury brands, on the other hand, were once the domain of the rich who purchased them as a status symbol.Masstige brands must complement existing product lines and not dilute or conflict with brand identity. These brands are most prevalent in eyewear, automobiles, beauty products, fashion, and homewares.Main Free Guides:

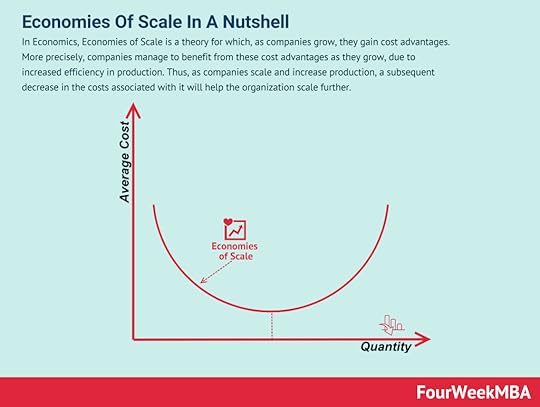

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

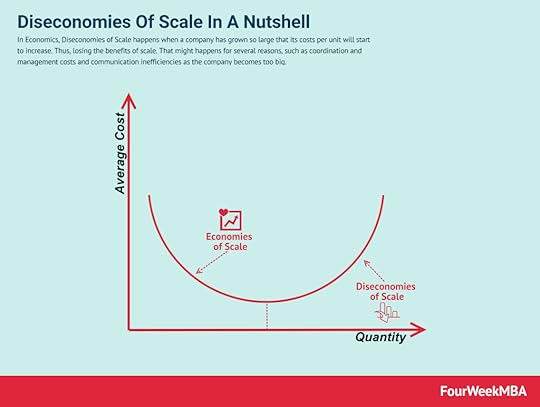

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Are Masstige Brands? Masstige Brands In A Nutshell appeared first on FourWeekMBA.

What Is Neuromarketing? Neuromarketing In A Nutshell

Neuromarketing is the application of neuroscience and cognitive science to marketing. The strategy gathers information from the human subconscious to determine why consumers choose one product over another.Neuromarketing information is collected by measuring brain activity related to specific brain functions using sophisticated and expensive technology such as MRI machines. Some businesses also choose to make inferences of neurological responses by analyzing biometric and heart-rate data.Neuromarketing is the domain of large companies with similarly large budgets or subsidies. These include Frito-Lay, Google, and The Weather Channel.Understanding neuromarketing

Neuromarketing is the application of neuroscience and cognitive science to marketing. The strategy gathers information from the human subconscious to determine why consumers choose one product over another.Neuromarketing information is collected by measuring brain activity related to specific brain functions using sophisticated and expensive technology such as MRI machines. Some businesses also choose to make inferences of neurological responses by analyzing biometric and heart-rate data.Neuromarketing is the domain of large companies with similarly large budgets or subsidies. These include Frito-Lay, Google, and The Weather Channel.Understanding neuromarketingFor consumers, decision-making used to be easy. Today, however, they are inundated with information and even the simplest products come attached with endless choices.

The humble bottle of mineral water is one such example, with hundreds of brands now selling the product in the United States alone. This begs the question: how does a consumer choose between brands when there can only be so much variance in a tasteless product? In other words, what makes a consumer choose Aquafina over Evian? There may be no clear-cut answer to these questions. Nevertheless, the purchasing decision may be influenced by the design of the bottle or a personal experience the consumer had with the brand itself.

The point here is that consumers make most of their purchasing decisions subconsciously. Despite this fact, many businesses persist with traditional market research methodologies such as focus groups and surveys. But if we accept that consumers cannot consciously express the subconscious reasons for a purchasing decision, we can then accept that traditional strategies are somewhat ineffective.

This is where neuromarketing is useful since it is the only way to gather information from the human subconscious. Using this information, marketing teams can better understand how to develop, price, and advertise products and services.

How is neuromarketing information collected?This vital information is collected in two ways:

The measurement of neurological brain activityWhich directly measures brain activity related to specific brain functions using EEG, fMRI, and steady-state topography (SST). For example, steady-state topography measures the speed of electrical activity on the surface of the brain and links variance in certain areas to specific metrics like memory coding and engagement.

The inference of neurological responses by proxyThis approach uses eye tracking, facial coding, and biometric data such as heart rate monitoring. It is not as robust as the first method because it is not underpinned by true neuroscience and the resultant data allows for broader interpretation.

Using these approaches, neuromarketing has been used primarily in product design testing, user experience (UX) design, cross-platform testing, audio branding testing, rebranding, and second-by-second optimization of television advertisements.

Neuromarketing examplesIt’s important to note that neuromarketing is an expensive undertaking for any organization.

For example, an entry-level functional magnetic resonance imaging (fMRI) machine can cost as much as $300,000, with premium machines retailing for more than $500,000. What’s more, the price of a single electroencephalogram (EEG) study may run as high as $20,000.

This means neuromarketing is primarily used by large companies or those that are heavily subsidized. Examples include:

GoogleThe search giant partnered with MediaVest and biometrics researcher NeuroFocus to evaluate how users responded to the semi-transparent overlay ads in YouTube videos. Forty individuals took part in the study, with their responses measured against criteria such as emotional engagement and attention.

The Weather Channel (TWC)This company also partnered with NeuroFocus in preparation for the launch of a new series entitled When Weather Changed History. A combination of EEGs, eye-tracking technology, and galvanic skin response (GSR) was used to ensure the company’s commercials and documentary content had maximum impact on the viewer.

Frito-LayAmerican snack-food manufacturer Frito-Lay analyzed the female brain to determine why most women preferred fruit and vegetables over its line of salty snacks. The company discovered that the part of the brain responsible for processing memory and emotion was larger in females and they often looked for characters they could empathize and relate with. Decision-making areas of the brain were also larger, which meant female consumers were more prone to feelings of guilt. In response, Frito-Lay redesigned its snack packaging to prominently feature healthy ingredients. The company then released an advertising campaign making explicit connections between women, exercising, healthy eating, and of course Frito-Lay snacks.

Types Of Marketing Connected To Neuromarketing Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

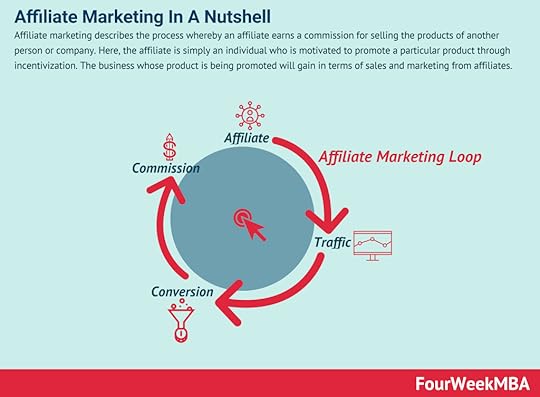

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

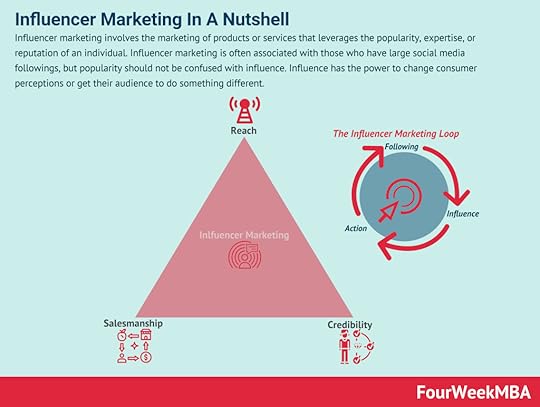

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

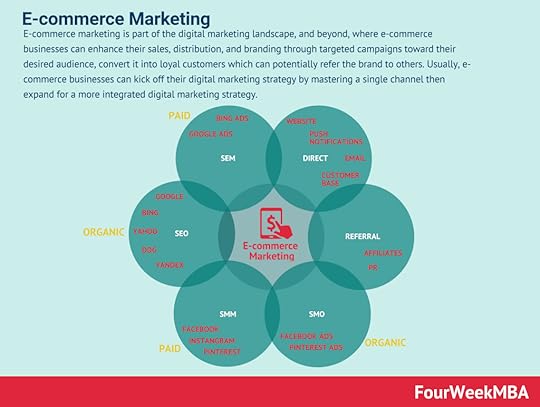

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

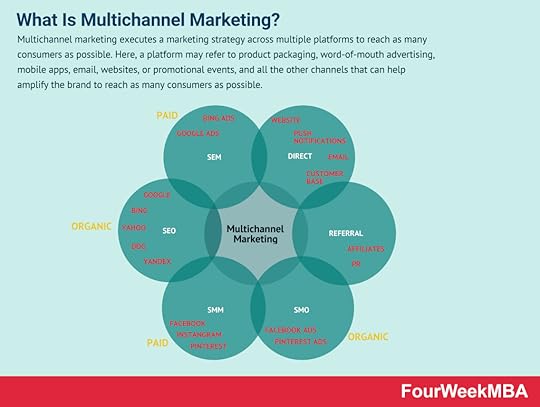

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

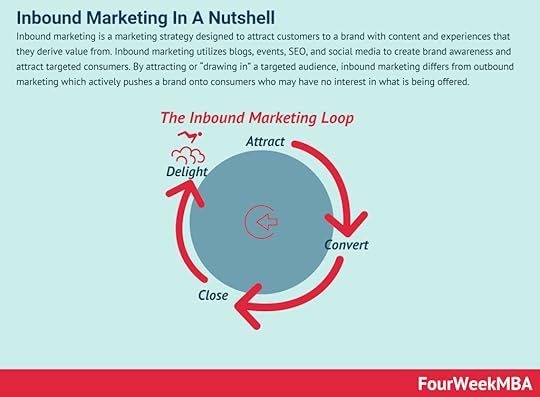

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

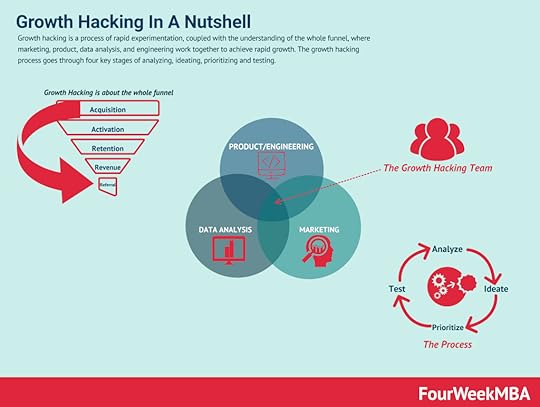

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

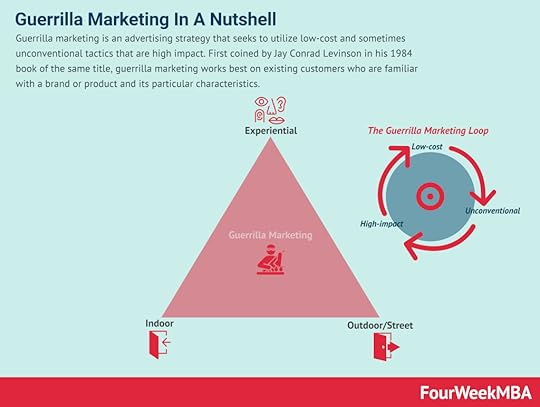

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Neuromarketing? Neuromarketing In A Nutshell appeared first on FourWeekMBA.

What Is Monopolistic Competition? Monopolistic Competition In A Nutshell

Monopolistic competition describes a scenario where many firms compete by selling products that are differentiated from one other and hence are not perfect substitutes. Product differentiation may be due to the brand, product quality, location, or marketing strategy. Monopolistic competition describes an industry where many firms offer products or services that are similar (but not perfect) substitutes.

Understanding monopolistic competitionMonopolistic competition combines elements of a monopoly and perfect competition – a theoretical market state in which companies sell identical products and have equal market share. The term was first used by economists Edward Chamberlain and Joan Robinson in the 1930s to explain the competition that existed between firms with similar (but not identical) products.

Firms that are in monopolistic competition have a comparable and relatively low degree of market power. They are said to be price makers, or companies that can dictate the price they charge for goods because there are no perfect substitutes in the market. Importantly, prices can be lowered without inciting a price war which is a common problem in oligopolies.

As more firms enter a monopolistic market, the elasticity of the demand curve increases. This means consumers become more sensitive to price, with a small price increase causing demand for a product to vanish. Profit in the short term is positive, but over the long term, it approaches zero as marginal revenue equals marginal cost.

As a result, monopolistic competition is characterized by increased spending on advertising and marketing as firms seek to attain a competitive advantage.

Characteristics of monopolistic competitionTo summarise and expand upon the information presented above, consider the following characteristics of monopolistic competition:

The presence of many firms and many consumers, with no firm having total control over the marketplace.Few barriers to entry or exit. This means the market is dynamic as companies can easily enter or exit the market at their discretion.Differentiated but similar products and services. Consumers perceive there to be differences between products that are not based on price.Firms operate independently. That is, they operate with the knowledge that their actions will not affect the actions of other firms. Potential supernormal profits in the short term. One firm can profit from identifying a gap in the market until competing firms move in and offer similar products.Normal profits in the long run. Due to low barriers of entry, a new firm may see an existing firm make supernormal profits and enter the market to take their share. As competitors flock to an untapped market segment, profits are reduced to zero over time.Imperfect information – with many firms offering slightly different products, a consumer may find it more difficult to make a purchasing decision. In the insurance industry, for example, several comparison sites now exist to help consumers understand the sometimes vague but important distinctions between products.Examples of monopolistic competitionMonopolistic competition is present in many familiar industries. Examples include:

Clothing and apparelClothing items are inherently similar because each is designed for the same purpose. Brand and style differentiation is common in this industry.

RestaurantsWhich compete on food quality and customer service. Among Indian restaurants, for example, product differentiation is key since each offers more or less the same regional dishes. What’s more, there are also relatively few barriers to opening a new restaurant.

AccommodationThe accommodation industry is also characterized by many firms offering the same service. Each provider differentiates itself with minor variations in quality level or access to perks.

HairdressingAnother industry where the barriers to entry are low. The ability for a hairdresser to offer quality customer service and earn repeat business is the point of differentiation here.

Coffee shopsLike most retail or food and beverage outlets, there are countless coffee shops around the world selling the same product. Product differentiation occurs via the quality of the coffee beans and the level of customer service. These establishments may also offer Wi-Fi or be located within bookstores to stand out.

Key takeaways:Monopolistic competition describes an industry where many firms offer products or services that are similar (but not perfect) substitutes. The term was first used by economists Edward Chamberlain and Joan Robinson in the 1930s.Monopolistic competition has many characteristics, including the presence of many firms and consumers, low entry and exit barriers, short-term supernormal profits, long-term normal profits, and imperfect information.Monopolistic competition is present in many familiar industries, including clothing and apparel, restaurants, accommodation, hairdressing, and coffee shops.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Is Monopolistic Competition? Monopolistic Competition In A Nutshell appeared first on FourWeekMBA.

What Is An Oligopsony? Oligopsony In A Nutshell

An oligopsony is a market form characterized by the presence of only a small number of buyers. These buyers have market power and can lower the price of a good or service because of a lack of competition. In other words, the seller loses its bargaining power because it is unable to find a buyer outside of the oligopsony that is willing to pay a better price.

Understanding an oligopsonyAn oligopsony is a market for a product or service dominated by a few large buyers. The concentration of demand means each buyer has power over the seller to keep prices low.

An oligopsony is the opposite of an oligopoly, where the market is dominated by a few sellers that inflate prices in the absence of competition from other supply sources.

In addition to the presence of relatively few buyers, there are a few more traits that define an oligopsony:

It develops in a market of imperfect competition since buyers are the entities exercising market power. Imperfect competition is also associated with significant barriers to entry and prohibitive start-up costs.Each buyer is connected. Thus, the policies of one buyer will have repercussions for the other buyers.The presence of homogeneous products, or any product that cannot be distinguished from competing products from different suppliers. Most commodities including vegetables, fruits, oil, grains, and metals are homogeneous goods.Buyers also ensure market costs provide them with a certain amount of profit that does provide an incentive for competition to enter the market.Oligopsony examplesHere are a few examples of an oligopsony in a real-world scenario: