Gennaro Cuofano's Blog, page 134

December 19, 2021

Blockchain in Supply Chain: The Use Cases of Blockchain in the Supply Chain

The management of today’s supply chains across all industries is incredibly challenging. In order for supply chain operations to remain successful, end-to-end communication is absolutely essential. Whichever form this end-to-end communication takes, it requires no global restraints while remaining robust and transparent. In this context, the role of blockchain in Supply Chain Management is growing in popularity due to the complexity and lack of transparency in today’s supply chains.

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through customers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through customers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.The use of blockchain in the supply chain can improve transparency and traceability while also lowering administrative expenses.

This research will look into how blockchain is or will be improving Supply Chain Management.

Why Companies are Incorporating Blockchain in their Supply ChainA distributed digital ledger gets referred to as a blockchain. Transactions get recorded in the ledger as a series of blocks that are linked together in a chain. The ledger gets distributed across numerous computers, updated as the blockchain changes.

Due to the system that enables blockchains to work, data within a block cannot get changed, and tampering with blocks is nearly impossible. Every transaction has a single source, enabling a comprehensive transaction flow verification and audibility in the supply chain management. This feature means that, in the case of blockchain in the supply chain, businesses may develop trust that transactions are correct and secure — even when there is little to no trust between the participants.

For example, suppose a company works with suppliers and logistic carriers worldwide. In that case, it will track all parts and ensure that they are authentic without relying on third parties and intermediaries. Ultimately, blockchain technology enables firms to function in a “zero trust” environment in supply chain management.

Blockchain Use Cases for the Supply Chain IndustryBitcoin is the most well-known Blockchain implementation. However, Blockchain’s distributed ledger properties enable it to help execute and monitor any transaction, not only cryptocurrencies. For one, the deployment of Blockchain in the supply chain gets driven by reliability and integrity.

When it comes to large-scale supply chain transactions, regardless of how strong of a business relationship two parties have, the added security of blockchain technology is beneficial. Since hundreds or thousands of partners must do business as efficiently as possible, supply chain management can use and benefit from blockchain technology.

Distributed Ledger Technology solutions that use blockchain in the supply chain enable worldwide trading partners to interact securely and with consensus over shared facts, increasing efficiency, transparency, and visibility. Immutability into the provenance of commodities, the elimination of reconciliation burden across numerous parties, real-time visibility to do track and trace analysis, identify risks, and expedite physical and financial supply chains are examples of blockchain use cases for supply chains.

Although supply chain blockchain implementations are still scarce, a growing number of many more supply chain management use cases for blockchain are being explored, including:

Supply Chain LogisticsWith so many go-betweens and so much back and forth between partners, friction is a key issue in modern supply chains. As a result, suppliers, providers, and customers interact through third-party businesses rather than dealing directly with each other. In supply chain logistics, blockchain promises that transactions may be verified, documented, and coordinated autonomously without the involvement of third parties. This removes an entire layer of complexity from global supply chains.

Supply Chain FinanceBlockchain and supply chain finance solutions are growing in popularity. These solutions offer overall process efficiency improvements as well as enhance the transparency and security of all transactions. Invoice payment terms, for example, are typically 30 days but can be much longer. Companies may use smart contracts to trigger immediate payments when the product is delivered and signed for by merging supply chain financing and blockchain technology.

Supplier PaymentsAs blockchain technology currently stands, some solutions already offer fast, secure, and low-cost money transfers. They utilized encrypted distributed ledgers to track the transfer of funds using cryptocurrencies. With this distributed ledger, anyone can view the transfer of funds between two people. All they need is the wallet address of each party to verify the successful transfer of funds.

The coffee business is one example of a supply chain blockchain for supplier payment. Bext360 is employing blockchain technology to improve supply-chain productivity by better tracking all aspects of the global coffee trade, from farmer to consumer. This implementation o blockchain in the supply chain ensures direct payment to farmers as soon as their products get sold, thanks to the use of cryptocurrencies.

Food SafetyCross-contamination and isolation are difficult to track and isolate in many food safety situations. Lack of data and insight into the supply chain results in sluggish response times when an issue develops. Plus, it results in excessive waste and recalls’ financial and reputational costs. Thus, a consortium is employing blockchain in supply chain tracking to ensure that all product movement and status are transparent across the supply chain.

Companies like Nestle, Walmart, and Unilever are utilizing blockchain to identify and eliminate the source of foodborne illness in the supply chain.

Traceability of Cold ChainFood and pharmaceutical products have a lot in common regarding storage and shipping. Temperature, humidity, vibration, and other environmental variables can get recorded using blockchain and IoT sensors on products. The data gets recorded in a blockchain, and smart contracts ensure that any readings that move out of range are automatically corrected.

Walmart’s creative use of blockchain to trace the source and quality of its pork products arriving from China is one early example of blockchain in the food supply chain. Walmart now requires all of its spinach and lettuce suppliers to use blockchain due to the technology’s success in the supply chain.

ConclusionA company’s ability to successfully implement blockchain in the supply chain is contingent on their solution’s ability to provide the performance and scalability they require. Moreover, supply chain development should look into methods to incorporate blockchain into operations where it makes the most sense now that the technology is constantly maturing. Blockchain technologies that can embed trust and efficiency into a wide range of transactions are needed to transform the supply chain business.

Learn More From The Book Blockchain Business Models

Read Next: Ethereum, Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Other Commercial Applications On Top Of The Blockchain Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain.

Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain. An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.

An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.Decentralized Autonomous Organizations

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized).

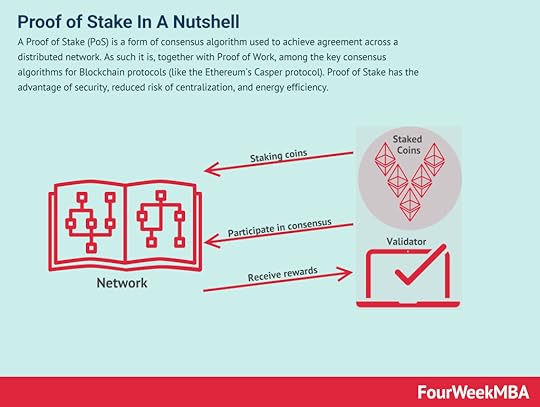

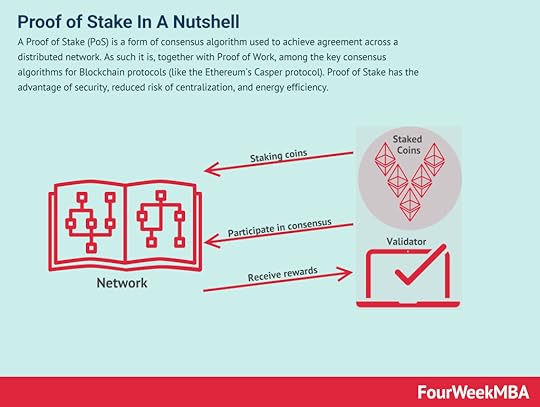

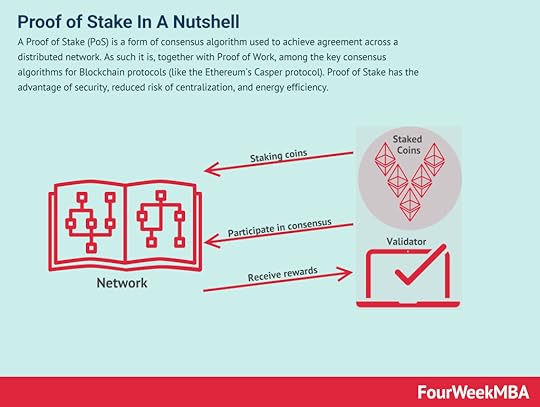

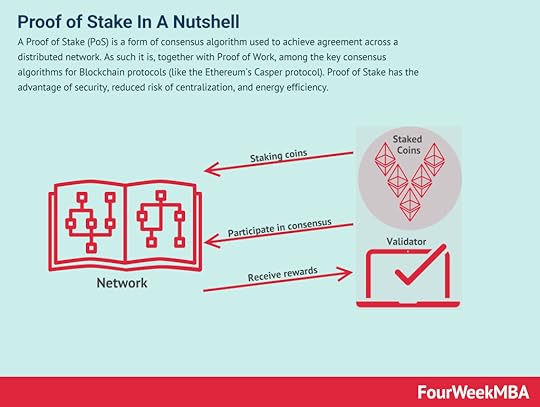

Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized). A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Blockchain in Supply Chain: The Use Cases of Blockchain in the Supply Chain appeared first on FourWeekMBA.

Blockchain in Healthcare: The Use Cases of Blockchain in Healthcare

The term “blockchain” has become one of the most popular buzzwords in the realm of medical technology, and for a good reason. However, it is also a loaded term due to its ambiguity. The term blockchain is slightly different depending on the industry. This distinction and understanding are especially interesting and beneficial to the healthcare field. Simply stated, blockchain can transform the healthcare industry. Patients may be properly focused on at the heart of all operations once it gets fully deployed, which will get completely revamped with improved security, privacy, and accessibility.

But how does blockchain make all of this possible? You will explore the looming relationship between blockchain and healthcare in this research.

What Blockchain is ForBlockchain is a sophisticated technology that allows many parties to share and access data securely. In essence, blockchain can aid digital health by securely communicating data across disparate healthcare systems with patient consent.

The most innovative feature of blockchain, delivered through a carefully balanced blend of powerful cryptography and built-in incentives, eliminates the need for a centrally governing authority and instead distributes power among all participants in the blockchain ecosystem.

One of the most significant advantages of a decentralized system is that end-users – particularly consumers and businesses – would have far greater transparency and control over how their data gets utilized. As a result, one of the long-term goals of disruptive blockchain-enabled companies is to decentralize the data economy. Thus, they can reclaim power from companies that centralize large datasets for competitive advantage, rather than placing control over how personal and proprietary data gets used in the hands of people and organizations.

Blockchain Use Cases in HealthcareNew blockchain healthcare use cases emerge every day, potentially transforming the healthcare system. Many healthcare and blockchain startups are working on or have already deployed blockchain-based systems to help both professionals and patients improve their healthcare.

Blockchain is becoming a vital tool for healthcare, transforming the business worldwide by decentralizing patient health records, tracking drugs, and boosting payment choices.

Transparency in the Supply ChainAssurance of the provenance of medical goods to establish their validity is a key concern in the healthcare sector, as it is in many others. Customers can have complete visibility and transparency of the things they are buying by using a blockchain-based system to trace items from the manufacturing site to each stage of the supply chain.

This transparency is critical for the industry, particularly in developing economies where counterfeit prescription medications are responsible for tens of thousands of deaths each year. It is also becoming more critical for medical equipment, which is rapidly growing as more remote health monitoring is adopted, attracting the attention of unscrupulous actors.

MediLedger is a notable example of a blockchain system that allows organizations along the prescription drug supply chain to verify the legitimacy of medicines, expiration dates, and other critical data.

FarmaTrust also plans to use its blockchain to solve the same issue.

The blockchain of FarmaTrust will get divided into four sections: Pharmaceutical firms benefit from regulatory compliance since it ensures that they are following government requirements; Track & Trace to control inventory wherever it moves; Supply Chain Visibility for when a drug is changed or altered in any manner; and finally, the Consumer Confidence App allows users to view the medication’s lifespan.

Patient-Centric Electronic Health RecordsEvery country and area is grappling with the issue of data silos, which means that patients and their healthcare professionals have an incomplete picture of their medical history.

According to a study released by Johns Hopkins University, medical errors resulting from poorly coordinated treatment were the third greatest cause of death in the United States in 2016. These medical errors include planned actions not executed as intended or errors of omission throughout patient records.

One possible answer to this challenge is to develop a blockchain-based medical record system that can be integrated with existing electronic medical record software and serve as a single, encompassing view of a patient’s data. It is important to highlight that actual patient data is not stored on the blockchain. Instead, each new record added to the blockchain, whether a doctor’s note, a prescription, or a test result, is converted into a unique hash function, a short string of letters and numbers. Every hash function is special, and you can only decipher it with the authorization of the data owner — the patient.

Therefore, any change to patient records and the patient’s disclosure consent gets recorded as a blockchain transaction. Medicalchain is a leading example of a company that works with healthcare providers to adopt blockchain-enabled Electronic Medical Records (EMRs).

Credential Verification of Medical StaffYou can use blockchain technology to track the experience of medical professionals in the same way that you can use it to track the provenance of a medical good. To better streamline the hiring process at healthcare organizations, companies are beginning to develop blockchain-based solutions for creating credentials for newly hired staff members. For example, ProCredEx, based in the United States, created a system based on a blockchain protocol for verifying the credentials of medical staff.

Insurance and Supply Chain Settlements with Smart ContractsUsing blockchain-based systems from companies like Chronicled and Curisium, pharmaceutical companies, medical device OEMs, wholesalers, insurers, and healthcare providers, can authenticate their identities like the following:

OrganizationsLog contract detailsTrack transaction of goods and servicesCurrent and passed invoicing details for all goods and servicesThis type of environment goes beyond supply chain management to enable healthcare trading partners and insurance providers to operate on entirely digital and, in some circumstances, automated contract terms.

Instead of each player having their version of contracts, they can significantly reduce disputes over payment chargeback claims for prescription medicines and other goods by having shared digital agreements between manufacturers, distributors, and healthcare organizations logged on a blockchain ledger.

ConclusionWhile many innovative and intriguing blockchain solutions have sprouted from leading organizations worldwide, this is only the start of something bigger. Push the boundaries of medical technology while establishing the groundwork for a data-driven future that will result in massive medical advances: Consider implementing blockchain in the healthcare sector today!

Learn More From The Book Blockchain Business Models

Read Next: Ethereum, Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Other Commercial Applications On Top Of The Blockchain Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain.

Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain. An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.

An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.Decentralized Autonomous Organizations

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized).

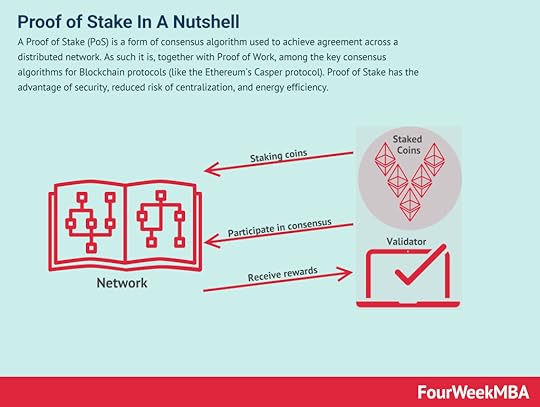

Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized). A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Blockchain in Healthcare: The Use Cases of Blockchain in Healthcare appeared first on FourWeekMBA.

Blockchain in Government: Blockchain Use Cases in the Government

Like other major companies, governments have difficulty coordinating processes among various stakeholders. On the other hand, governments need to give greater transparency, impartiality, and accountability to the public than most other institutions. Data management is a major difficulty that government entities must surmount to succeed in these undertakings, particularly in the digital era.

Regrettably, traditional centralized data management systems are inadequate to tackle governmental issues. The single point of failure in the traditional client-server approach compromises data security, and transparency is difficult to achieve if government databases are centralized. The result gets delayed, inefficient, and opaque operations for everything from property title registration to voting for most governments.

That result is part of the reason government entities are not as timely and efficient as anyone would like.

Because blockchain ensures high service availability and data integrity, any industry that relies on a trusted third party or requires a solid guarantee of security and governments around the world should consider using blockchain solutions.

This research looks at how blockchain can help with some of the most pressing concerns in government services.

What Blockchain can do in the GovernmentBlockchain technology ensures that every copy of data is always accessible, verifiable, and trustworthy. In terms of data dispersion, it works similarly to an old photocopying machine in that it can make copies of any object available to everyone who uses it. Moreover, it functions more like a notary public in terms of the trust, ensuring that any copy of data is genuine and that the copies cannot be forgotten or counterfeited. Finally, it works like a general ledger in transaction processing, requiring transactions to get recorded in the same order.

A set of replicated servers known as nodes gets used in handling data exchange, transaction processing, and validation. Each node uses a consensus mechanism to reach an agreement with all other nodes regarding a particular transaction without the need for human intervention.

The primary purpose of such a system is to leverage replication to offer security, notably availability and integrity, while also allowing distributed servers to act as a centralized decision-maker.

Blockchain Use Cases in the GovernmentThe main use cases show how to use blockchain technology to remedy flaws in current government processes. These use cases also emphasize the significance of a multi-faceted and complete approach to blockchain-based governance.

They frequently mention important restrictions and drawbacks to using this unique technology. While technology improvements may help overcome these restrictions, governments must assess the costs and benefits of blockchain-based governance systems.

Here are some of the most notable blockchain use cases in the government.

Land Title RegistriesSeveral governments have begun experimenting with land title registers based on blockchain technology. Some initiatives, such as those in Sweden, are driven to improve efficiency in a transaction-heavy business. Others, such as those in Honduras and India, are working to strengthen property rights and increase transparency in a process that is prone to corruption.

Individuals might verify their land rights via blockchain-based land registries, safe, decentralized, publicly verifiable, and unchangeable records. These characteristics decrease the potential for self-interested land rights manipulation and strengthen the overall resilience of land ownership.

Government Contracting or Public ProcurementGovernment contracting, also known as public procurement, is the world’s largest marketplace for government spending and the leading source of official corruption. This government process is a hotbed of corruption in high-income and low-income countries due to various causes.

Vendor selection is a complicated and opaque process that requires a great deal of human judgment. These inefficiencies waste a lot of money, distort market prices, impede healthy competition, and frequently result in inferior goods and useless services.

By facilitating third-party oversight of tamper-evident transactions and enabling greater objectivity and uniformity through automated smart contracts, a blockchain-based process can directly address procurement’s corruption-risk factors, improving the transparency and accountability of transactions and actors.

Electronic VotingConcerns about election security, voter registration integrity, poll accessibility, and voter turnout have prompted countries to look into blockchain-based voting platforms as a way to boost trust and participation in critical democratic processes.

In this regard, the decentralized, transparent, immutable, and encrypted properties could help reduce election interference and increase poll accessibility.

Registries of Beneficial Corporate OwnershipConcerns over opaque or undeclared beneficial company ownership have risen in the wake of recent corruption scandals worldwide. As it stands right now, anyone with the right connections and enough money can use gray-area firms for laundering money, bribing individuals, or lobbying government officials in an illegal way.

To better track conflicts of interest and illegal conduct, many governments are beginning to build a central registry for beneficial business ownership. Blockchain-based registries that are tamper-proof and widely accessible could provide much-needed transparency and disclosure.

Critical Infrastructures such as the Energy SectorEnergy, food and agriculture, and transportation are among the 16 key infrastructures identified by the US Department of Homeland Security. Moreover, security and resilience establish a national policy to strengthen and sustain secure, functional, and resilient critical infrastructure.

The application of blockchain in critical infrastructures has gotten extensively researched due to the nature of critical infrastructures. Other disciplines, like the energy sector, are under study by governments worldwide, in addition to the financial and healthcare industries, which are both considered essential infrastructures. For example, to establish the “Energy Internet,” the Department of Energy has granted various projects to industry and academia.

The goal is to provide an advanced management system for distributed energy resources that will enable peer-to-peer communication that is quick, scalable, and secure.

Ultimately, the energy sector can use blockchain in various ways, from energy trade to IoT device management and energy resource management.

ConclusionBlockchains have progressed beyond cryptocurrencies to serve a broader purpose that you may apply to a wide range of applications, especially those that require high service availability and data integrity.

Nevertheless, blockchain has valuable properties, notably tamper-evident and permanent databases and record-keeping, that could improve transparency, accountability, and public engagement in sectors that significantly impact democratic governance and global development.

Lear More From The Book Blockchain Business Models

Read Next: Ethereum, Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Other Commercial Applications On Top Of The Blockchain Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain.

Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain. An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.

An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.Decentralized Autonomous Organizations

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized).

Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized). A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Blockchain in Government: Blockchain Use Cases in the Government appeared first on FourWeekMBA.

Blockchain in Gaming and Metaverse: Blockchain Use Cases in Gaming and Metaverse

The phrase “Metaverse” gets formed from the words “meta,” which means virtual, and “transcendence,” and “verse,” which is a backformation of the word universe. While it sounds like a word straight out of a superhero or sci-fi movie, it is a real and influential aspect of the current cryptocurrency landscape.

As technology advances, the number of people who utilize the Metaverse grows. As activities at the same level as reality continue to progress, gaining more occupants, a vast amount of data gets generated. The metaverse’s data is valuable in and of itself. Moreover, data volume, the relevance of reliability, and the level of security are all expanding in the Metaverse.

In order to ensure the safety and diversity of the content in metaverse gaming, blockchain technology provides a dependable ledger tied to the content in the games. That way, designers and players alike can ensure the dependability of data in Gaming and Metaverse.

This research will tap into the use cases of blockchain in Gaming and Metaverse.

Blockchain Use Cases in Gaming and MetaverseFirst, it is crucial to understand that the Metaverse and blockchain are not separate concepts that have evolved in isolation. When used together, they will reach their full potential. Because they all contain various properties and functions that complement one another, merging will make them greater than the sum of their parts.

Some notable blockchain use cases get created by integrating blockchain with the Gaming and Metaverse sector.

GamingWithin the metaverse, full-fledged games are already being developed. These games will lead to some exciting use cases for the metaverse with the way blockchain can be tied to in-game assets. The Sandbox is a virtual world where anybody can develop their games and landscapes and purchase and trade digital commodities and assets using the Ethereum-based blockchain money $Sand. Notably, Atari and Aardman Animations, the maker of Shaun the Sheep, have already set up shop in the Sandbox.

Crypto gaming is already a big business, encompassing online casino-style games and the more recent gaming concept known as “play-to-earn.”

Currently, the most popular game is Axie Infinity, which has over a million daily active users training and fighting digital creatures in a similar way to Pokemon.

Axie Infinity is an NFT-based online video game developed by Sky Mavis, a Vietnamese game studio founded by Trung Nguyen in 2018. Nguyen combined his interest in blockchain accountability and the CryptoKitties craze to launch the game in August 2018. Sky Mavis generates the bulk of its revenue via the 4.25% fee it charges on all in-game purchases. This includes land purchases, monster NFT trading, and monster breeding. Axie Infinity requires that all new players purchase three monsters to get started. Since the cost can run into hundreds of dollars, Sky Mavis will lend players the monsters and collect a 30% interest fee once the player starts earning currency.

Axie Infinity is an NFT-based online video game developed by Sky Mavis, a Vietnamese game studio founded by Trung Nguyen in 2018. Nguyen combined his interest in blockchain accountability and the CryptoKitties craze to launch the game in August 2018. Sky Mavis generates the bulk of its revenue via the 4.25% fee it charges on all in-game purchases. This includes land purchases, monster NFT trading, and monster breeding. Axie Infinity requires that all new players purchase three monsters to get started. Since the cost can run into hundreds of dollars, Sky Mavis will lend players the monsters and collect a 30% interest fee once the player starts earning currency.It varies from Nintendo’s game in that winners are given the cryptocurrency SLP, with the best earning around $250 each day — a substantial sum in the underdeveloped countries where the game is most popular.

The world may anticipate blockchain gaming flourishing in the next several years if metaverse lives up to its hype.

Virtual CurrenciesCryptocurrencies like Bitcoin, Litecoin, and Ether, the Ethereum blockchain’s token, are built on blockchains, decentralized, distributed databases secured by encryption.

The metaverse has the potential to create a virtual world like that of “Ready Player One,” where people may play, work, and socialize with their friends in immersive environments without ever having to leave their homes. And, of course, anyone who knows anything about human nature can predict that one of the most popular activities people will want to do while they are there will be shopping and buying goods.

In this context, people may already use cryptocurrency to purchase virtual real estate parcels within the Decentraland online environment. Aside from property, consumers will purchase digital representations of almost anything they can buy in the actual world. Governments are also getting in on the game, with Barbados recently opening the world’s first metaverse embassy utilizing Decentraland.

On the other hand, buying goods is likely to be just the start of blockchain-based money in the metaverse. Decentralized finance (De-Fi) is a fast-growing field that is well-suited to operate within virtual worlds and surroundings, another reason to expect to see more metaverse-based lending, borrowing, trading, and investing.

DecentralizationIt is crucial to keep in mind that, as with all future forecasts, much of this is simply guesswork and speculation; no one knows how the metaverse will work just yet.

However, the future of blockchain remains bright and full of potential. Specifically, blockchain’s ability to enable smart contracts and decentralized autonomous organizations (DAOs) opens the door to alternative digital realities that don’t get controlled by Silicon Valley behemoths. They can be “owned” and regulated by the people who use them through safe voting processes and complex blockchain functionalities like staking.

NFTsNFTs – which stand for non-fungible tokens and got chosen as Collins Dictionary’s word of the year for 2021 – are expected to play a significant role in the metaverse, according to several forecasts. NFTs are tokens that live on a blockchain and can be used to establish ownership of related digital assets, to put it as simply as possible. They have mostly been used for trading digital art, but they may theoretically get linked to anything, including virtual avatars, game assets, and real estate.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. Accessing sections of the metaverse and showing that someone has the right to regulate who can or cannot visit or use a certain portion of a virtual environment is a key use of NFTs. Moreover, NFTs can get used as a prize in many of the blockchain games that will exist in the metaverse, as an alternative to the other common sort of blockchain-dwelling token – cryptocurrencies – which are fungible and hence, not unique.

In addition, in the metaverse, one of the key functions of NFTs will be to assign value to objects. Because digital data gets made up of solely ones and zeros, it can theoretically get reproduced and distributed indefinitely. Because NFTs may be used to verify that someone is the legitimate owner of a given thing, they provide a framework for attributing value to digital objects.

ConclusionVarious, enormous volumes of secondary and tertiary data get generated in the Metaverse due to the activity of many users. This data has a unique identifying tag and gets utilized as traceable data in the blockchain-based Metaverse.

In the end, individuals are likely to have a mix of both when businesses create and maintain their metaverses in which they set the rules, coexisting with publicly-owned decentralized metaverses. Finally, the world can be quite certain that blockchain will play a critical role in creating the metaverse.

Learn More From The Book Blockchain Business Models

Read Next: Ethereum, Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Other Commercial Applications On Top Of The Blockchain Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain.

Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain. An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.

An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.Decentralized Autonomous Organizations

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized).

Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized). A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Blockchain in Gaming and Metaverse: Blockchain Use Cases in Gaming and Metaverse appeared first on FourWeekMBA.

Blockchain in Finance: How Blockchain is Taking Over Fintech

Fintech, like many other technology-based businesses, is always changing. New banking apps appear to be regularly launching, promising radical new payment management and processing methods. While this business has been steadily expanding, the emergence of blockchain technology promises to revolutionize finance technology to a never-before-seen extent.

Today, despite its association with cryptocurrencies like Bitcoin, Blockchain’s use cases are constantly growing into new areas of finance.

This research will explore how Blockchain is slowly changing the game in the Fintech industry by making it stronger, more secure and robust, while also increasing the options of use throughout the community.

What is a Blockchain?Blockchain is essentially a database, albeit a digital, decentralized one.

A blockchain gets created by a chain of blocks containing transaction data, a hash identity, and node information. They have immutable features that link them to the previous block. Each block has a subsequent ration of stored data, making capturing, organizing, and tracking assets much easier. Once the right amount of information is stored, another block will be added to the chain.

On a blockchain network, assets can be tangible and intangible, and you can trade nearly anything of value. Thus, for all parties involved, it lowers risk and expenses.

How Blockchain WorksThe data is validated and stored in the blockchain’s database. As a result, it has the authority to validate a transaction. However, the blockchain doesn’t just store data; it also stores every transaction detail.

In a nutshell, this is how a Blockchain works:

User requests for any type of transaction, including those with or without contracts, bitcoin, information, or other data.The critical data now gets forwarded to the P2P network’s various nodes (the people involved in the transaction) for validation.The algorithms record and update the node validity and the user status.When the transaction is complete, a new block gets added to the preceding block with the recorded data.Blockchain Use Cases in FintechThe blockchain is essentially an immutable block. It is possible to create a full ecosystem of financial apps using the technology. Using blockchain technology, you can transform regular financial processes into transparent procedures based on secure and efficient transactions.

When used appropriately, blockchain can establish a fintech ecosystem that will transform the financial industry.

Here are some of its most notable use cases.

Smart ContractsThe smart contract is an innovative branch of Blockchain. Smart contracts can potentially alter the automation process in the future completely. Smart contracts will become more intelligent with artificial intelligence (AI) or edge intelligence, triggering AI choices.

In this regard, R3 and its member banks launched trade finance prototypes in 2016, which employed smart contracts to conduct factoring transactions and letters of credit. Smart contracts have a lot of clout in areas with a lot of escrow. It is a win-win situation when a synchronized chain of activities occurs upon if/else statements drawn by both sides.

KYCCompanies must comply with Know Your Customer regulations to experience frictionless payment developments. However, it is difficult to determine the customer’s identity without intruding on their privacy. Blockchain’s transparency allows for identity verification without revealing the user’s genuine identity. It may sound like a lot of jargon, but the protocol enables the establishment, verification, and transaction of digital identities for all counterfeits.

TradingEven in today’s digital environment, trading companies across the world still heavily rely on paperwork. Not only that but payments and transfers get delayed if you trade over the weekend. Because vendors use trading systems worldwide, there is a need to create a system that allows all participants to inspect and validate the trade readily. The trading system should ensure that all participants have accurate entries and that users can securely make adjustments at any time.

This trading is exactly what blockchain is supposed to do with a generic ledger to improve the overall process. And, because data gets updated in real-time, the flow of information is quick, making it simple to make business decisions and policies based on it. By lowering shorting risks and boosting accountability, such a strategy enhances the entire lifespan of the trade.

Recurring PaymentsPayments in B2B typically take 3-4 days to process, which is rather inconvenient nowadays. The paperwork is dependent on the middlemen in the process, which prolongs the sales cycle even more. Intelligent contracts can be a good fit because of their clear agreement conditions, making recurring payments every month or year effortless. The contract only moves to the next level of the process if both parties are convinced, giving the buyer and seller ultimate control.

Borderless PaymentsBlockchain allows for decentralized currency, which means you may make payments and transfers without going via a bank. It can also aid faster and easier payments because money transfers from one account to another are less expensive. Payment processing fees also get reduced because blockchain transfers do not require third-party consent, and banks do not require resources to transmit payments.

Blockchain technology will help to improve the global currency flow. Normally, banks impose a remittance fee of 10-15% of the amount transferred. This fee is reduced to 3% when using blockchain.

Because all participants in a blockchain transaction must provide their approval, and anybody can review the updated ledger after the transaction, blockchain payments are extremely safe.

You can also utilize P2P transfer to transfer funds because you do not need a third party. Banks can compete with fintech firms and offer their fintech-related services.

ConclusionIn the field of finance, blockchain has a lot of potential uses. There is also a slew of blockchain startups developing cryptocurrencies and blockchain apps in the hopes of providing rapid and transparent fintech services. Blockchain can transform the way banks do business by enabling faster payments, easier audits, and more comprehensive identification despite its drawbacks.

The rise of blockchain technology is expected to boost fintech development, paving the path for true democratization of finance and allowing individuals to manage their wealth as they would want to.

Learn More From The Book Blockchain Business Models

Read Next: Ethereum, Blockchain Business Models Framework Decentralized Finance, Blockchain Economics, Bitcoin.

Read Also: Proof-of-stake, Proof-of-work, Blockchain, ERC-20, DAO, NFT.

Other Commercial Applications On Top Of The Blockchain Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain.

Decentralized finance (DeFi) refers to an ecosystem of financial products that do not rely on traditional financial intermediaries such as banks and exchanges. Central to the success of decentralized finance is smart contracts, which are deployed on Ethereum (contracts that two parties can deploy without an intermediary). DeFi also gave rise to dApps (decentralized apps), giving developers the ability to build applications on top of the Ethereum blockchain. An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.

An ERC-20 Token stands for “Ethereum Request for Comments,” which is a standard built on top of Ethereum to enable other tokens to be issued. Based on a smart contract that determines its rules, the ERC-20 enables anyone to issue tokens on top of Ethereum. As they are using a standard, those are interoperable. ERC-20 Tokens are critical to understanding the development of Ethereum as a business platform.Decentralized Autonomous Organizations

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner.

A decentralized autonomous organization (DAO) operates autonomously on blockchain protocol under rules governed by smart contracts. DAO is among the most important innovations that Blockchain has brought to the business world, which can create “super entities” or large entities that do not have a central authority but are instead managed in a decentralized manner. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized).

Blockchain companies use sharding to partition databases and increase scalability, allowing them to process more transactions per second. Sharding is a key mechanism underneath the Ethereum Blockchain and one of its critical components. Indeed, sharding enables Blockchain protocols to overcome the Scalability Trilemma (as a Blockchain grows, it stays scalable, secure, and decentralized). A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like Ethereum’s Casper protocol). Proof of Stake has the advantage of the security, reduced risk of centralization, and energy efficiency.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Blockchain in Finance: How Blockchain is Taking Over Fintech appeared first on FourWeekMBA.

December 18, 2021

What Is Greenwashing? Greenwashing In A Nutshell

The term “greenwashing” was first coined by environmentalist Jay Westerveld in 1986 at a time when most consumers received their news from television, radio, and print media. Some companies took advantage of limited public access to information by portraying themselves as environmental stewards – even when their actions proved otherwise. Greenwashing is a deceptive marketing practice where a company makes unsubstantiated claims about an environmentally-friendly product or service.

Understanding greenwashingOne such company was Chevron, which produced a series of television and print advertisements in an attempt to convince the public of its green credentials. Various ad campaigns depicted Chevron employees appearing to protect bears, sea turtles, and butterflies, among many other animals. The commercials had their desired effect, with the company winning an Effie advertising award in 1990.

Later, Chevron’s dubious claims were made the subject of a Harvard Business School study. The study became notorious among scholars and environmentalists alike, who proclaimed the company to be the gold standard of greenwashing.

Greenwashing is the corporate practice of making sustainability claims to cover a questionable environmental record. Companies use greenwashing techniques when promoting their products to appeal to the environmentally-conscious consumer, with buzzwords such as “sustainable”, “ecofriendly”, and “natural” frequently cited.

There may be some degree of truth in the environmental claims an organization makes. However, these claims are deliberately exaggerated or misrepresented to mislead consumers for financial gain.

The six sins of greenwashingIn an earlier 2007 study, environmental firm TerraChoice examined thousands of products from six category-leading big box stores.

The study, which aimed to describe, understand, and quantify the growth of greenwashing, found there were six common greenwashing patterns (or sins):

Hidden trade-offs

Where a company suggests a product is green based on a single environmental attribute while ignoring other, more important issues. For example, paper towel and copy paper is promoted as being made from recycled or sustainable timber with no mention made of manufacturing impacts such as air or water pollution.

No proof

Where a claim is made that cannot be substantiated by easily accessible information. Household lights and lamps are promoted as energy efficient without any real evidence backed by hard data. Shampoos and other personal care products also claimed they were not tested on animals with little supporting evidence.

Vagueness –

These are claims that are so poorly defined that their meaning is likely to be misconstrued by consumers. Companies that claim their products are “chemical-free” are misleading because chemicals are found in everything from plants and animals to water. Similarly, “non-toxic” claims are vague because every substance is toxic in the correct dosage.

Irrelevance –

Irrelevant claims may be truthful but are unimportant and unhelpful to consumers seeking green products. Products that promote themselves as chlorofluorocarbon (CFC) free are irrelevant since their use has been banned for decades.

Lesser of two evils

These are “green” or “organic” products that may hold true within their category but that risk distracting the consumer from the more significant impacts of the category as a whole. Organic tobacco is touted as a green alternative to normal tobacco, but it still poses the same health risks for the smoker.

Fibbing –

As the name suggests, these claims are simply false. Less than 1% of the products in the study displayed this pattern. Nevertheless, a dishwasher detergent purporting to be packaged in 100% recycled paper was made from plastic. Several shampoo products also claimed to be organic, but the researchers did not find evidence of any such certification.

Key takeaways:Greenwashing is a deceptive marketing practice where a company makes unsubstantiated claims about an environmentally-friendly product or service. The phrase itself was coined in 1986 around the time oil company Chevron was making false claims about their environmental credentials.There may be some degree of truth in a greenwashing campaign, though the intent of the company is always to mislead consumers for financial gain. Greenwashing was discovered to occur across six common patterns, or sins. These include hidden trade-offs, no proof, vagueness, irrelevance, the lesser of two evils, and fibbing.Other Types Of Marketing Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

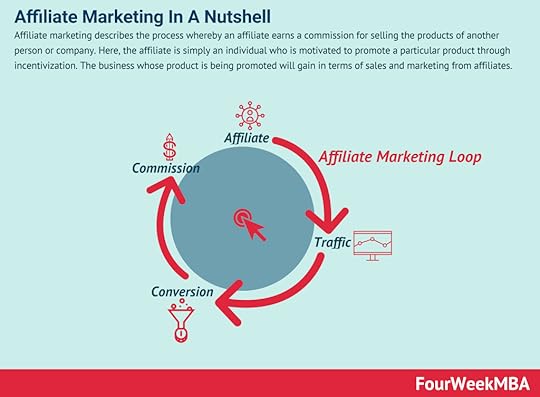

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

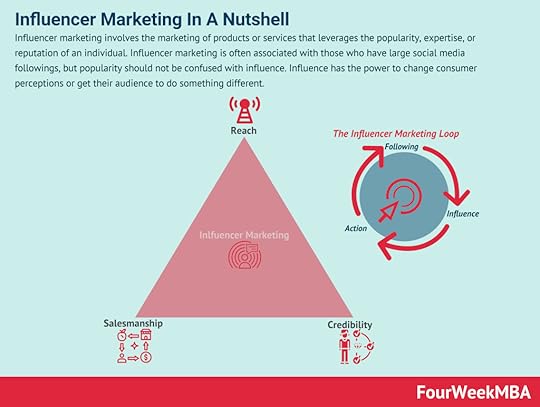

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

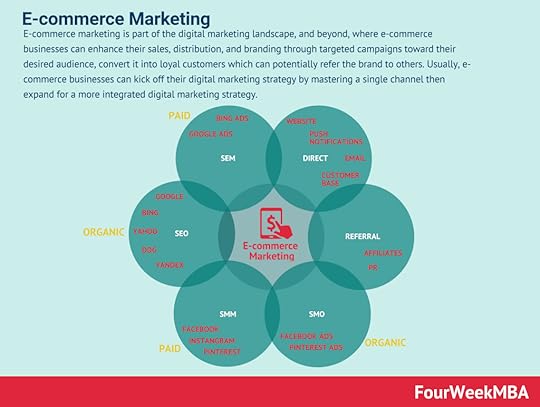

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

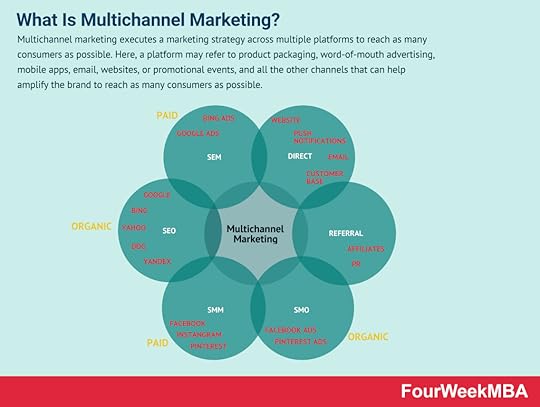

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

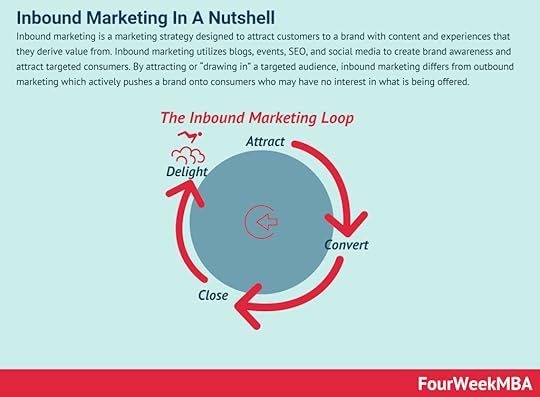

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

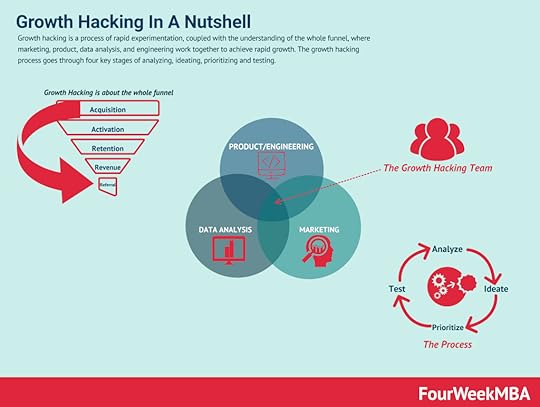

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

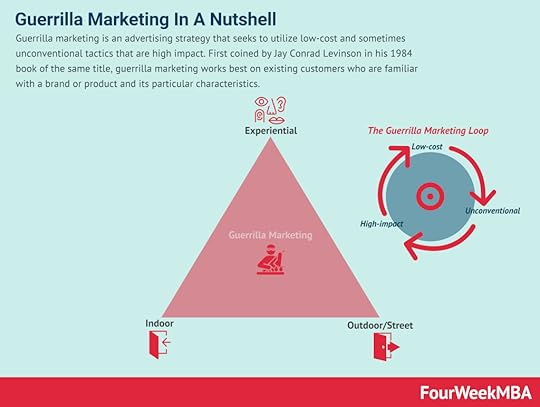

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

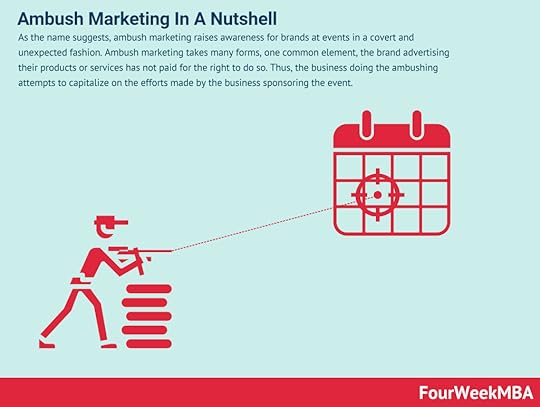

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Greenwashing? Greenwashing In A Nutshell appeared first on FourWeekMBA.

The Brokerage Business Model In A Nutshell