Gennaro Cuofano's Blog, page 137

December 5, 2021

Core Company Values

Core company values are clearly articulated principles about organizational vision and mission.

These values guide the fundamental beliefs that help employees within a company function as a team and work toward shared goals. Usually, core company values relate to company growth, business relationships, and customer relationships. At the most simplistic level, specific examples include integrity, trust, honesty, fun, passion, and humility.

From the perspective of the business, having a core set of values facilitates better decision-making, collaborative teamwork, and the communication of core principles to clients, customers, and other important stakeholders. Organizations that do not define their core values run the risk that some values will evolve on their own and negatively impact the business.

What’s more, core company values have a profound effect on employee satisfaction. The presence of appropriate values has been positively linked with employee satisfaction, with one study finding over 75% of individuals considered it important to work for an organization with robust culture and values. In a similar LinkedIn survey, 26% of employees would forego a fancy title and 65% would accept a lower salary before dealing with a lack of company values and the poor company culture that results.

With all of that said, let’s explore the core company values that exist across multiple organizations.

Amazon Core ValuesAmazon defines core company values in terms of fourteen leadership principles. These principles are used daily from discussing new projects to determining the best problem-solving approach.

Amazon fundamental principles that drove and drive the company are:Customer ObsessionOwnershipInvent and SimplifyAre Right, A LotLearn and Be CuriousHire and Develop the BestInsist on the Highest StandardsThink BigBias for ActionFrugalityEarn TrustDive DeepHave Backbone; Disagree and CommitDeliver Results

Amazon fundamental principles that drove and drive the company are:Customer ObsessionOwnershipInvent and SimplifyAre Right, A LotLearn and Be CuriousHire and Develop the BestInsist on the Highest StandardsThink BigBias for ActionFrugalityEarn TrustDive DeepHave Backbone; Disagree and CommitDeliver ResultsThey include:

Customer obsession – start with the customer and work backward.Ownership – leaders are long-term thinkers who do not sacrifice long-term value for short-term results.Invent and simplify – leaders expect teams to innovate and invent with the overarching goal of simplification. They also accept that new or radical ways may cause the company to be misunderstood for long periods.Are right, a lot – this means leaders tend to be correct more often than not. They exercise sound judgment and good instincts.Learn and be curious – continuous improvement is prioritized through the exploration of new possibilities. Hire and develop the best – every hire and promotion must raise performance standards. Leaders must be able to identify exceptional talent and motivate them to grow through coaching.Insist on the highest standards – leaders have extremely high standards that others may consider unreasonable. Nevertheless, these standards deliver high-quality products and ensure process errors or defects are identified early.Think big – since thinking small is a self-fulfilling prophecy.Bias for action – every decision does not require in-depth analysis. Speed matters in business and most decisions are reversible in any case. Frugality – this means accomplishing more with less.Earn trust – for a leader, this means being vocally self-critical and listening attentively, speaking candidly, and treating others with respect.Dive deep – leaders carry out a range of tasks, with no task beneath them. Skepticism is healthy when factual evidence does not align with anecdotal evidence.Have backbone (disagree and commit) – decisions should be challenged when there is disagreement, regardless of whether it may cause embarrassment or awkwardness. Compromise should never occur for the sake of social cohesion.Deliver results – inputs are delivered on time and at the right quality level despite setbacks.Accenture Core ValuesAccenture claims its core values shape its culture and define its character. Core values are exhibited through individual behaviors that guide decision-making.

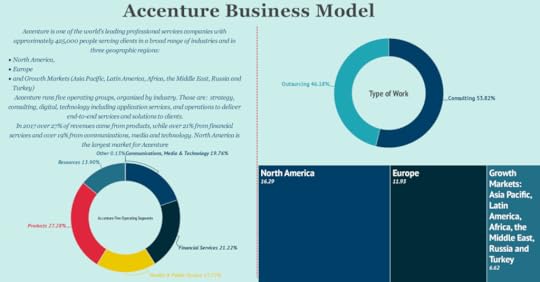

Accenture is one of the world’s leading professional services companies with approximately 425,000 people serving clients in a broad range of industries and in three geographic regions:North America,Europeand Growth Markets (Asia Pacific, Latin America, Africa, the Middle East, Russia, and Turkey)Accenture runs five operating groups, organized by industry. Those are: strategy, consulting, digital, technology including application services, and operations to deliver end-to-end services and solutions to clients.In 2017 over 27% of revenues came from products, while over 21% from financial services and over 19% of communications, media and technology. North America is the largest market for Accenture.

Accenture is one of the world’s leading professional services companies with approximately 425,000 people serving clients in a broad range of industries and in three geographic regions:North America,Europeand Growth Markets (Asia Pacific, Latin America, Africa, the Middle East, Russia, and Turkey)Accenture runs five operating groups, organized by industry. Those are: strategy, consulting, digital, technology including application services, and operations to deliver end-to-end services and solutions to clients.In 2017 over 27% of revenues came from products, while over 21% from financial services and over 19% of communications, media and technology. North America is the largest market for Accenture.Accenture’s six company values include:

Client value creation – this means helping clients become high-performance businesses through the establishment of long-term relationships.One global network – exceptional customer service is delivered to clients wherever they do business. This is achieved by leveraging the power of global insight, relationships, and collaboration.Respect for the individual – Accenture values diverse and unique contributions in a trusting, open, and inclusive work environment.Best people – encompassing the attracting and recruiting of the best available talent that demonstrate a “can-do” attitude.Integrity – where words and behavior are aligned and employees take responsibility for their actions.Stewardship – or an obligation to build a better, more robust company for future generations to enjoy. Stewardship also includes protecting the Accenture brand, fulfilling stakeholder needs and expectations, and improving global communities.Google Core ValuesGoogle mission is “to organise the world’s information and make it universally accessible and useful.”

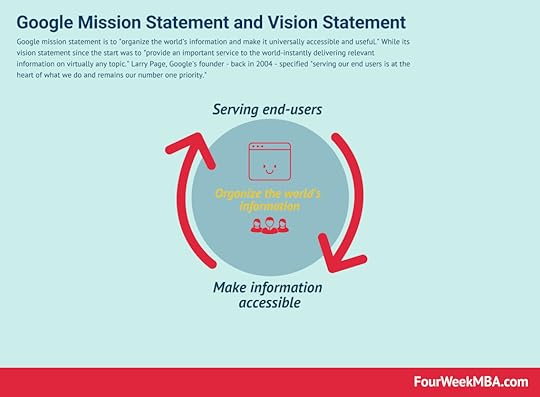

Google mission statement is to “organize the world’s information and make it universally accessible and useful.” Its vision statement is to “provide an important service to the world-instantly delivering relevant information on virtually any topic.” In 2019, Sundar Pichai emphasized a renewed mission to allow people “to get things done!”

Google mission statement is to “organize the world’s information and make it universally accessible and useful.” Its vision statement is to “provide an important service to the world-instantly delivering relevant information on virtually any topic.” In 2019, Sundar Pichai emphasized a renewed mission to allow people “to get things done!” Google is a platform, and a tech media company running an attention-based business model. As of 2020, Alphabet’s Google generated over $182 billion in revenues. Almost $147 billion came from Google Advertising products (Google Search, YouTube Ads, and Network Members sites). They were followed by over $21 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium), followed by Google Cloud, which generated over $13 billion in 2020.

Google is a platform, and a tech media company running an attention-based business model. As of 2020, Alphabet’s Google generated over $182 billion in revenues. Almost $147 billion came from Google Advertising products (Google Search, YouTube Ads, and Network Members sites). They were followed by over $21 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium), followed by Google Cloud, which generated over $13 billion in 2020.Here are the ten values which help the company realize its mission:

Focus on the user and all else will follow – providing a clean, consistent, simple, and transparent user experience is paramount.It’s best to do one thing really, really well – for Google, this is search. Fast is better than slow – Google recognizes that for consumers, time is valuable. Services should be fast enough for the modern web.Democracy on the web works – the company acknowledges that Google search works because of the millions of individual content creators online. The company also recognizes the importance of democracy in open source software development.You don’t need to be at your desk to need an answer – this means pioneering new technologies and mobile solutions so consumers can get what they want wherever they may be. You can make money without doing evil – Google is a business that generates revenue through relevant, transparent, and non-flashy text-based advertisements. These characteristics ensure the integrity of the AdWords and Adsense platforms.There is always more information out there – researchers continue to develop ways of bringing the world’s information to people seeking answers.The need for information crosses all borders – Google has offices in more than 60 countries with more than 180 internet domains across 130 different languages. Though conceived in California, more than half of all Google search results are served outside the United States.You can be serious without a suit – employees should be energetic, passionate people from diverse backgrounds with creative approaches to work and life. Google understands that great ideas result from sound company culture.Great just isn’t good enough – Google considers being great at something as a starting point – not an endpoint. To that end, the company sets goals it knows it cannot achieve in the short term. This helps it stretch and progress further than employees or the organization as a whole might believe is possible.Key takeaways:Core company values are clearly articulated principles about organizational vision and mission. These values guide the fundamental beliefs that help employees within a company function as a team and work toward shared goals.Amazon defines core company values in terms of fourteen leadership principles, including customer obsession, ownership, learn and be curious, and hire and develop the best.Accenture claims its core values shape organizational culture and character, while Google has a set of ten core values that help it achieve its mission of making information accessible to everyone.Read Also:

Amazon Mission StatementApple Mission Statement and Vision StatementGoogle Mission Statement and Vision StatementA Quick Glance At Uber Mission StatementWalmart Mission Statement and Vision StatementNike Mission Statement and Vision StatementMicrosoft Mission StatementMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Core Company Values appeared first on FourWeekMBA.

What happened to Polyvore?

Polyvore was a community-based social commerce website founded by Pasha Sadri in 2007. While decorating his new house, Sadri, an engineer at Yahoo, found himself cutting furniture ideas and color patches out of magazines and arranging them on an inspiration board. At some point, he considered that these boards could be created more easily online. The basis for their construction was Yahoo Pipes, which Sadri used with fellow Yahoo engineers Guangwei Yuen and Jianing Hu to launch the first version of the Polyvore platform in 2007. Three years later, the platform received 6.6 million unique visitors with revenue mostly dependent on affiliate links. This number had increased to 20 million monthly users by 2016, with the Pinterest-esque curated shopping service amassing some 100 million items. On April 5, 2018, Polyvore was acquired by Canadian retailer Ssense with operations to cease immediately.

So what happened to Polyvore? Ssense acquisitionWhen Polyvore was acquired by Ssense, the Montreal-based fashion platform and retailer suggested the coming together of both companies was synergistic: “We believe that Ssense is the right community for the Polyvore members, and we’re inspired by their commitment to offering a directional mix of the most coveted labels in the world.”

Though never publicly confirmed, the company’s motivation to acquire Polyvore was likely its large and devoted user base. But somewhat ironically, the acquisition angered the very customers it was hoping to secure. Polyvore users took to social media to lament the loss of friend networks and personal blogs that had taken years to create. Many also made a promise to never purchase from Ssense and urged others to do the same.

User dataIn a statement of its own, Polyvore told users that their personal data would be shared with Ssense so that it could send them promotional information.

However, one wonders why user data was shared between the platforms when the two brands could not be more different. In one corner was Polyvore, a democratized fashion platform where brand discovery was a crowdsourced, community experience. In the other corner was Ssense, a platform for the uber-cool fashionista with an editorial department writing about arty and intellectual topics such as Croatian brutalism and sound art.

While there was some degree of overlap between the two services, most users of the much more low-key Polyvore were never going to find a home on the suave and sophisticated Ssense platform. The inability for Ssense management to realize this fact was more or less confirmed when Polyvore fans reacted badly to the acquisition.

At the time of writing, it is unclear as to whether Ssense has any plans to bring back the features that made Polyvore such a hit.

Key takeaways:Polyvore was a community-based social commerce website founded by Pasha Sadri in 2007. Two years after reaching a peak of 20 million monthly active users, the platform was acquired by Canadian retail platform Ssense and shut down almost immediately.Though never publicly confirmed, the company’s motivation to acquire Polyvore was likely its large and devoted user base. However, Polyvore fans reacted badly to the news that their curated accounts and friend networks would be lost. Ssense suggested that its community was appropriate for Polyvore members. In reality, however, the two platforms attracted a different sort of customer with limited overlap in content or fashion preferences.Read Next: Poshmark, ThredUp, eBay, Vinted, Craigslist, Depop, Wish.

Connected Visual Business Models Poshmark is a social commerce mobile platform that combines social media capabilities to its e-commerce platform to enable transactions. It makes money with a simple model, where for each sale, Poshmark takes a 20% fee on the final price, for sales of $15 and over, and a flat rate of $2.95 for sales below that. As a mobile-first platform, its gamification elements and the tools offered to sellers are critical to the company’s growth.

Poshmark is a social commerce mobile platform that combines social media capabilities to its e-commerce platform to enable transactions. It makes money with a simple model, where for each sale, Poshmark takes a 20% fee on the final price, for sales of $15 and over, and a flat rate of $2.95 for sales below that. As a mobile-first platform, its gamification elements and the tools offered to sellers are critical to the company’s growth.  Wish is a mobile-first e-commerce platform in which users’ experience is based on discovery and customized product feed. Wish makes money from merchants’ fees and merchants’ advertising on the platform and logistic services. The mobile platform also leverages an asset-light business model based on a positive cash conversion cycle where users pay in advance as they order goods, and merchants are paid in weeks.

Wish is a mobile-first e-commerce platform in which users’ experience is based on discovery and customized product feed. Wish makes money from merchants’ fees and merchants’ advertising on the platform and logistic services. The mobile platform also leverages an asset-light business model based on a positive cash conversion cycle where users pay in advance as they order goods, and merchants are paid in weeks.  Vinted is an online shopping marketplace with a strong secondhand component. The company makes money via its buyer protection service. The buyer pays a fee to Vinted in exchange for services like customer support, insurance, and tracked shipping; Shipping costs; Wardrobe Spotlight (helping users boost the visibility of their items). And Bumping listed items.

Vinted is an online shopping marketplace with a strong secondhand component. The company makes money via its buyer protection service. The buyer pays a fee to Vinted in exchange for services like customer support, insurance, and tracked shipping; Shipping costs; Wardrobe Spotlight (helping users boost the visibility of their items). And Bumping listed items. Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion.

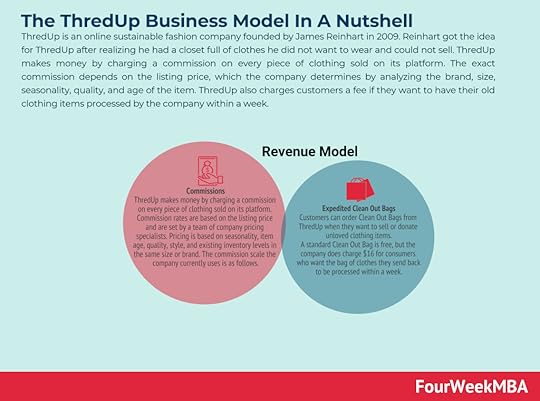

Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion. ThredUp is an online sustainable fashion company founded by James Reinhart in 2009. Reinhart got the idea for ThredUp after realizing he had a closet full of clothes he did not want to wear and could not sell.ThredUp makes money by charging a commission on every piece of clothing sold on its platform. The exact commission depends on the listing price, which the company determines by analyzing the brand, size, seasonality, quality, and age of the item.ThredUp also charges customers a fee if they want to have their old clothing items processed by the company within a week.

ThredUp is an online sustainable fashion company founded by James Reinhart in 2009. Reinhart got the idea for ThredUp after realizing he had a closet full of clothes he did not want to wear and could not sell.ThredUp makes money by charging a commission on every piece of clothing sold on its platform. The exact commission depends on the listing price, which the company determines by analyzing the brand, size, seasonality, quality, and age of the item.ThredUp also charges customers a fee if they want to have their old clothing items processed by the company within a week.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Polyvore? appeared first on FourWeekMBA.

What happened to Telltale Games?

Telltale Games was an American video game developer founded by Kevin Bruner, Dan Connors, and Troy Molander in 2004. The company established itself as an adventure game developer with its own game engine supporting an episodic release schedule. Perhaps the most iconic Telltale game was the 2012 title The Walking Dead, which introduced a more narrative-directed approach. In other words, players could make choices that affected future events in the game or even the way in which sequels eventuated. The company continued to prosper in the following years, releasing episodic interpretations of Guardians of the Galaxy, Batman, Game of Thrones, and Minecraft. Despite an apparently winning formula, Telltale Games declared bankruptcy in October 2018 after laying off around 90% of its total workforce a month earlier.

MismanagementThe success of The Walking Dead was a company maker, giving Telltale Games the necessary clout to work with companies like Marvel and HBO. However, this success would prove to be a double-edged sword.

Developers went on a relentless quest to add the charm of The Walking Dead into all the company’s future games. Essentially, this was stipulated by the major license holders that struck deals with Telltale Games. But the company board of directors also put pressure on the company to replicate the success of The Walking Dead in other titles.

A preoccupation with what had worked in the past caused the company to develop games based on tired and overused concepts. As a result, creativity and experimentation were stifled.

Outdated softwareTelltale Games developed a proprietary game engine known as the Telltale Tool. Though initially successful, the engine eventually became obsolete and the company refused to upgrade or replace it.

For one, the Telltale Tool did not have a dedicated physics system. This required that the elements in an action system be created by hand, which took vast amounts of time and money away from critical operations. The lack of a dedicated physics system also caused characters to appear rigid and lifeless, with some games plagued with bugs, erased saves, and purchases that didn’t carry through.

According to co-founder Kevin Bruner, there were internal discussions around upgrading to Unreal but the transition was considered too disruptive. Belated attempts in June 2018 to replace the Telltale Tool with Unity were a case of too little, too late.

Competition and market positioningThe games industry evolved in 2013 with the release of the Xbox One and PlayStation 4. Both platforms offered superior graphics and titles such as God of War and The Last of Us arguably told better stories to boot.

This put Telltale Games in a predicament. It found itself competing with lesser-known studios that were producing comparable games with much lower operating costs. But it was also competing against larger players with more manpower and superior development engines.

Stuck in the middle, so to speak, consumers grew weary of the lack of evolution in Telltale Games titles. Critics also suggested the company had a fundamental misunderstanding of the market. For example, its interpretation of Guardians of the Galaxy featured dark themes even though the comic and movie franchise has always been associated with comedy. Telltale Games also developed a more sophisticated version of Minecraft for teenagers and young adults – despite the game enjoying the most success with children.

Company cultureSome former employees also criticized the company culture of Telltale Games after Bruner took over as CEO.

Bruner was known to micromanage employees and criticize them in public. He also discarded many of the submissions they had made, which resulted in employees having to work 100-hour weeks just to meet deadlines.

The toxic management style of Bruner also resulted in The Walking Dead project leads Sean Vanaman and Jake Rodkin quitting the company. The departure of this crucial personnel exacerbated the lack of creativity and enthusiasm for subsequent releases.

Key takeaways:Telltale Games was an American video game developer founded by Kevin Bruner, Dan Connors, and Troy Molander in 2004. Telltale Games declared bankruptcy in October 2018 despite releasing multiple successful games.Telltale Games management was preoccupied with the success of The Walking Dead which could not be replicated in subsequent, unrelated releases. Outdated development software also caused inefficiencies and games riddled with bugs.Telltale Games suffered competition from smaller and larger players, a fact made worse by the company not understanding its audience or market position.Read Next: Free-to-play business model, Epic Games, Fortnite, Play-to-earn business model, gaming industry.

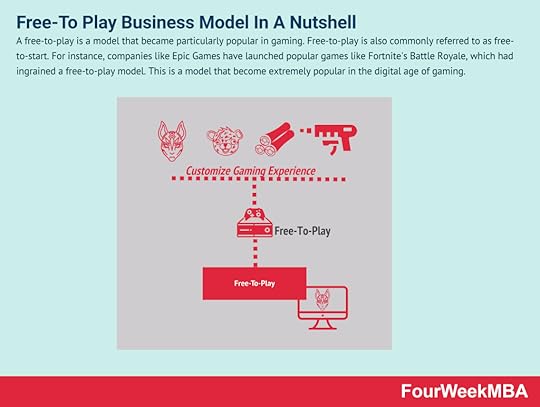

Connected Visual Concepts A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

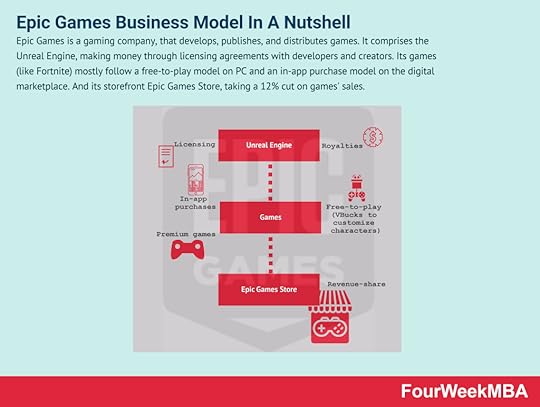

A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming. Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.

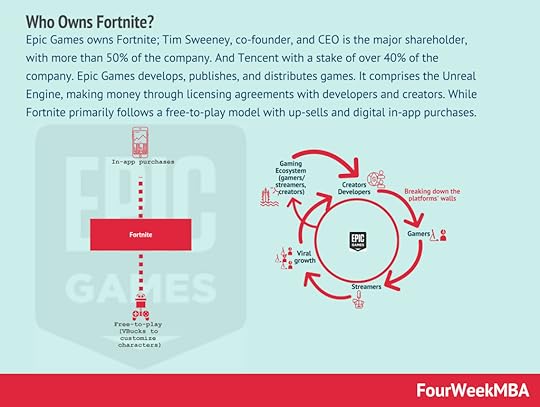

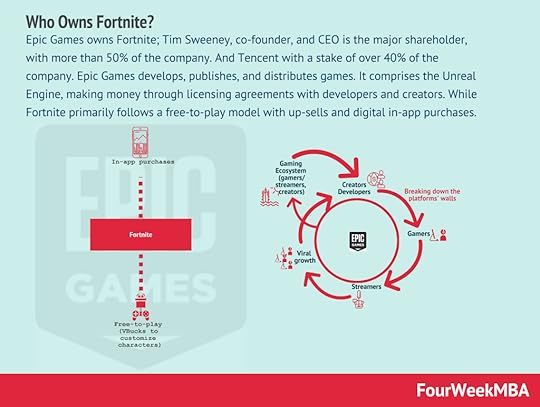

Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales. Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.

Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Telltale Games? appeared first on FourWeekMBA.

What Happened To Paragon?

Paragon was a free-to-play multiplayer online battle arena game produced by Epic Games. Powered by Unreal Engine 4, the game was launched in March 2016 with the free-to-play version made available five months later. In January 2017, Epic Games reported the game already had 832,000 active players, with many praising the game for its true third-person nature. Successive seasons were released over the next year with each added skin proving extremely profitable.

However, in a statement released on January 26, 2018, Epic Games announced that “After careful consideration, and many difficult internal debates, we feel there isn’t a clear path for us to grow Paragon into a MOBA that retains enough players to be sustainable.” At the time, the game had not even progressed beyond the beta phase.

CompetitionParagon was essentially Epic’s attempt to cash in on the multiplayer online battle arena (MOBA) subgenre. However, the game struggled to establish a significant following in competition with established titles such as League of Legends and Dota 2.

Fellow Epic title Fortnite: Battle Royale was arguably the most significant competitor to Paragon. Updates to Paragon were slow as game developers jumped over to Fortnite to help manage its unexpected and rapid growth.

In a candid admission on Reddit, developers noted that “Our efforts have always been focused on growing the game. While each of these incarnations has been beloved by a core community, none has been large enough to achieve mainstream success. This, combined with the humbling success of Fortnite has caused us to question if we have a good path to grow Paragon and make it thrive.”

Player retentionThe game also suffered from player retention issues, with new players seldom sticking with the game after their first month.

Like its developers, many Paragon players took to Reddit to voice their concerns. Some of the major reasons behind a lack of retention include:

Card system and itemization – some players found the card system confusing, with some suggesting Paragon developers were being different for the sake of it. While the vast majority of MOBAs have active and purchasable items, Epic’s card system lacked the flexibility of peer systems and made effective counter-play almost impossible.Stability – since the game never progressed beyond the beta phase, it tended to frequently crash at the start of matches. Lack of ranked mode – many players also lamented that there was no ranked mode in Paragon with season rewards. Without this crucial feature, the game lacked a competitive edge because there was less incentive to succeed or win. Lack of depth – Paragon gameplay was too simplistic and shallow, with no depth to combat exchanges or duels. Heroes, or the playable characters in Paragon, had too few active abilities or too many targeted abilities. This allowed their capabilities to be easily mastered.Content releaseIn September 2018, Epic Games released $17 million worth of Paragon content and assets for free to Unreal Engine 4 creators.

In the years following the demise of Paragon, this content has spawned several new games including Predecessor, Fault, and Project CORE. Predecessor was developed by Omeda Studios with a $2.2 million grant, with the company being comprised almost entirely of members of the Paragon community.

Ultimately, Paragon was a game with huge potential that found itself in the wrong place at the wrong time. Thanks in part to a devoted following, elements of the original game appear likely to live on for the foreseeable future.

Key takeaways:Paragon was a free-to-play multiplayer online battle arena game produced by Epic Games. After initial success, the developer announced it would be shutting the game down after failed attempts to make it sustainable.Paragon struggled to gain traction in the MOBA subgenre amongst established titles such as Dota 2, League of Legends, and Epic’s own Fortnite Battle Royal. This lack of traction was no doubt exacerbated by poor player retention caused by multiple perceived game deficiencies. Paragon content was given away for free by Epic Games in September 2018, with many of its most prized assets forming the basis for several other games.Read Next: Free-to-play business model, Epic Games, Fortnite, Play-to-earn business model, gaming industry.

Connected Visual Concepts A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.  Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.

Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.  Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.

Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases. Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Happened To Paragon? appeared first on FourWeekMBA.

December 3, 2021

What Is Direct-to-consumer? The Direct-to-consumer Business Model In A Nutshell

Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer. In this way, the company can cut through intermediaries and increase its margins. However, to be successful the direct-to-consumers company needs to build its own distribution, which in the short term can be more expensive. Yet in the long-term creates a competitive advantage.

Understanding direct-to-consumerSome estimates suggest eCommerce sales will surpass $6 trillion by 2024, with approximately $175 billion occurring via the direct-to-consumer model in the United States alone.

Direct-to-consumer is a strategy where a business sells directly to consumers through an online medium. The approach is in stark contrast to more traditional B2B strategies, where a manufactured product may pass through a wholesaler, distributor, and retailer before it is purchased by the consumer.

Manufacturers operating under the D2C model must necessarily wear the hat of the wholesaler, distributor, and retailer in addition to meeting their production and fulfillment responsibilities. So why would a manufacturer take on more work voluntarily? There are two answers to this question, and both are related to the evolving needs and expectations of modern consumers.

For one, consumers prefer to go directly to the source when purchasing from a specific brand. For example, a golf fanatic is more likely to visit the TaylorMade website than they are a traditional sports retailer when looking for more information. When more consumers are going direct to TaylorMade, this also means the company can no longer rely on third-party sports retailers to adequately sell its products. Essentially, TaylorMade may be forced to adopt the direct-to-consumer model and make its products available for direct sale.

Advantages of the direct-to-consumer modelWhile it is clear manufacturers may have to take on extra work, there are nevertheless quite a few benefits to adopting the direct-to-consumer model:

Customer data – manufacturers who sell to a retailer or wholesaler are less exposed to important purchasing data regarding their products. The D2C model helps manufacturers learn more about their target audience, resulting in smarter product development and increased awareness around consumer trends and demand.Customer experience – selling direct to the consumer means the business has control over the entire buyer journey. The business will learn where consumers shop and how they prefer to pay. By interacting with consumers directly, the business can offer more responsive customer support and develop targeted and consistent marketing campaigns using SMS or email, among other channels.Brand engagement and reputation – many businesses who sell through a retailer have little say in how their products are presented. Retail salespeople may have limited interest or knowledge in promoting their range, which can lead to a poor first impression of the brand itself. In the D2C model, manufacturers ensure the company brand and associated products are painted in the best light possible.Direct-to-consumer examplesHere are three companies utilizing the direct-to-consumer model:

Glossier – a cosmetics company founded by blogger Emily Weiss, who built a strong relationship with her readers before developing products to sell to them. By asking consumers what they wanted directly, Weiss was able to bypass selling her goods in traditional cosmetics retailers.Dollar Shave Club – a company that was started because its founders were tired of paying for expensive razor blades in supermarkets. Dollar Shave Club sells cheap razors direct-to-consumer on a subscription basis.Casper – a manufacturer and direct seller of innovative mattresses, pillows, sheets, weighted blankets, and even dog beds. Casper enables consumers to avoid buying these items from aggressive salespeople in traditional furniture stores.Key takeaways:Direct-to-consumer (D2C) is a business model where companies sell their products directly to the consumer without the assistance of a third-party wholesaler or retailer.Despite requiring extra work and involvement, direct-to-consumer has several benefits for manufacturers. They include more transparent customer buying data, a higher-quality customer experience, and increased brand engagement and reputation.Examples of businesses employing the D2C model include Glossier, Dollar Shave Club, and Casper.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Direct-to-consumer? The Direct-to-consumer Business Model In A Nutshell appeared first on FourWeekMBA.

The Top Venture Capital Companies In A Nutshell

Venture capital (VC) companies invest in the products and services consumers use every day, from booking accommodation through VRBO to purchasing groceries through Instacart. Venture capital companies fund and mentor young or emergent start-up companies with high growth potential. Commonly, these are firms with an innovative product or business model in information technology, biotechnology, or clean technology. Unlike private equity firms, VC companies tend to take a minority stake of 50% or less for each investment they make. These investments have a high risk of failure, so venture capital firms invest in a portfolio of companies with the expectation that at least one will become successful.

Sequoia CapitalSequoia Capital is a California-headquartered venture capital firm that invests in the mobile, internet, energy, media, and retail sectors. Since it was founded in 1972, the company claims early-stage involvement in companies with a now aggregate public market value of $3.3 trillion. Some of the more notable companies Sequoia Capital invested in include Instagram, Zoom, Oracle, Apple, LinkedIn, and WhatsApp.

DST GlobalDST Global is a venture capital firm founded in 2009 by Russian entrepreneur Yuri Milner. The company has offices in New York, London, Beijing, Hong Kong, and Silicon Valley.

DST Global is one of the world’s leading internet investment companies, with investments in Alibaba, Spotify, Twitter, Facebook, Acorns, DraftKings, Klarna, Slack Technologies, and Robinhood.

Tiger Global ManagementTiger Global Management is a New York City-based investment firm specializing in consumer, financial technology, internet, and software companies.

Tiger Global Management tends to focus on growth-oriented private companies with an emphasis on American, Chinese, and Indian businesses. The firm prefers to partner with dynamic entrepreneurs in charge of market-leading growth companies.

Notable investments, which range from Series A to pre-IPO funding, include Glassdoor, GitLab, Square, Quora, and Postmates.

Y CombinatorY Combinator is an American tech start-up accelerator founded in March 2005 by Paul Graham, Jessica Livingston, Robert Morris, and Trevor Blackwell. The company’s accelerator program is well known amongst start-ups, having funded over 3,000 ventures to date.

Y Combinator interviews and selects two or more intakes of companies on an annual basis. Successful applicants receive seed funding, professional advice, and industry connections in exchange for Y Combinator taking a 7% stake.

Recent accelerator program graduates include Women Who Code, Brex, Rappi, and Upsolve.

Kleiner PerkinsKleiner Perkins is an American VC firm with a preference for incubation, early-stage, and growth companies. The company was founded in 1972 by Eugene Kleiner, Thomas Perkins, Frank J. Caulfield, and Brook Byers. The New York Times described Kleiner Perkins as “perhaps Silicon Valley’s most famous venture firm”.

Kleiner Perkins has made several high-profile investments over the years. The company invested $200 million toward smartphone innovation in 2008, with another $500 million toward a growth-stage clean technology fund a year later. In 2010, the sFund was also established with $250 million to invest in social start-ups.

To that end, Kleiner Perkins has been an early investor in companies such as Amazon, Compaq, Google, Nest, Sun Microsystems, Slack, Zynga, Modern Health, DJI, and Coursera.

Key takeawaysVenture capital companies fund and mentor young or emergent start-up companies with high growth potential. Unlike private equity firms, VC companies tend to take a minority stake of 50% or less for each investment they make.Sequoia Capital is a firm that has invested in early-stage growth companies now worth a combined $3.3 trillion. Tiger Global Management prefers to partner with entrepreneurs running market-leading businesses from Series A to pre-IPO funding.Y Combinator runs a tech accelerator program that offers specialized knowledge and industry contacts to start-ups in exchange for a 7% stake. Kleiner Perkins is perhaps the most notable VC firm, investing hundreds of millions of dollars into social, clean technology, and smartphone innovation start-up funds.Read Next: Venture Capital Advantages And Disadvantages, What Is Bootstrapping, What Is Ramen Profitability, The Three Engines Of Growth.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Top Venture Capital Companies In A Nutshell appeared first on FourWeekMBA.

December 2, 2021

Disadvantages Of Franchising For Franchisor And Franchisee

Some of the most successful companies in America operate under a franchise business model. But for every success story, there is an instance where franchising caused a less than optimal outcome. The franchisor may have to open four or five franchises to get the equivalent financial gain of operating one store themselves. Franchising also carries an inherent litigation risk and relatively high set-up costs. For the franchisee, the main disadvantages are reduced profit margins, restrictive regulations, and the potential for conflict resulting from power imbalances.

Franchising origin storySome of the most well-known companies in the United States owe much of their success to franchising, including McDonald’s, Anytime Fitness, The UPS Store, Burger King, Ace Hardware, and 7-Eleven.

For every franchising success story, however, there is a franchising failure. Blockbuster franchises failed because the company CEO believed the business model was sustainable. Krispy Kreme’s foray into franchising also failed because the opening of new stores did not mirror the popularity of its products. What’s more, the company allowed too many franchisors to open in the same area, creating unnecessary competition and forcing some stores to close.

In this article, we’ll discuss some of the key disadvantages of franchising for both the franchisee and the franchisor.

Read Our Full Analysis Here: Franchising Business Models.

Disadvantages of franchising for the franchisorPer-unit contributionIn a franchising agreement, it should first be noted that the franchisor does not profit from every dollar the franchisee makes. In other words, the revenue the franchisor collects from the franchisee is a fraction of what it could make owning and operating the franchise unit itself.

Assuming the franchise itself is profitable, the business may need to sell four or five franchises to realize the same financial again.

Litigation riskFranchisors are also exposed to litigation. For better or worse, litigation is a part of American culture and so the risk of being sued must be treated with respect. McDonald’s being hit with a multimillion-dollar lawsuit over the temperature of its coffee is perhaps the most obvious example.

Litigation risk can be minimized to some extent by developing a rock-solid contractual agreement. These agreements help protect the franchisor against workplace injuries, customer “slip and fall” accidents, and employment liability around harassment, wrongful termination, and so forth.

CostFranchising is a relatively low-cost means of expansion, but this does not mean it is no-cost. Some of the major costs a franchisor can expect to meet include:

Business plan creation and financial analysis.Developing a franchise operations manual with quality control documents, systems, and processes for the franchisee. Marketing plans and other associated material.Training employees on the franchising process.Negotiating third-party vendor agreements on behalf of the franchisee.Read Our Full Analysis Here: Franchising Business Models.

Disadvantages of franchising for the franchiseeReduced marginsMany franchisees are required to pay ongoing royalties to the franchisor based on total gross sales. Furthermore, the franchisee may be required to pay regular advertising costs and a charge for training services.

This means profit margins will be negatively impacted.

Restrictive regulationsWhile the franchisee operates with some degree of autonomy, the scope of their decision-making is nonetheless limited by the franchise agreement.

Depending on the nature of the agreement, the franchisor has ultimate control over the business location, opening hours, pricing, signage, store layout, advertising, marketing, décor, and resale conditions.

ConflictIn any business arrangement, there is potential for conflict – particularly when one party is more powerful than the other.

In theory, the franchise agreement is used to clarify contentious issues. But in many cases, the franchisee does not have the financial clout to take the franchisor to court. Whether the disagreement is due to a lack of support or a simple clash of personalities, it is imperative that the franchisee understand the franchisor’s personality or management style before signing an agreement.

Read Our Full Analysis Here: Franchising Business Models.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Disadvantages Of Franchising For Franchisor And Franchisee appeared first on FourWeekMBA.

History Of Financial Bubbles

Tulip mania, also known as the Dutch tulip bubble, was a period during the 17th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637. Trading became increasingly more organized in these rare tulips, with companies established to grow, buy, and sell them. Cultivation techniques also improved, which caused more and more people to speculate on tulip bulb prices.

Mississippi BubbleThe Mississippi bubble occurred when a fraudulent fiat banking system was unleashed in a French economy on the verge of bankruptcy. Happened in the 1700s, the Mississippi bubble was among the most incredible financial bubbles of human history. The scapegoat of this financial bubble was John Law, which introduced the concept of central banking, by convincing King Louis XV to restore France’s prosperity through monetary stimulus, something unprecedented before.

South Sea BubbleThe South Sea Bubble describes the financial collapse of the South Sea Company in 1720, which was formed to supply slaves to Spanish America and reduce Britain’s national debt. The story behind the South Sea Bubble is somewhat complicated. However, it begins with the formation of the South Sea Company in 1711 by Robert Harvey.

Stock Market Crash of 1929The Stock Market Crash of 1929 was a major American stock market crash in October 1929 that precipitated the beginning of the Great Depression. Various causes stood behind the financial collapse of 1929, some of which attributed to speculation, government mismanagement, and oversupply.

Japanese Lost DecadeThe Japanese asset price bubble resulted in greatly inflated real estate and stock market prices between 1986 and 1991 which resulted in the largest Japan financial bubble, which also caused a decade of economic stagnation for the Japanese economy.

Dot-com BubbleThe dot-com bubble describes a rapid rise in technology stock equity valuations during the bull market of the late 1990s. The stock market bubble was caused by rampant speculation of internet-related companies. In part, this was caused by the easily available liquidity in the markets combined with the rise of Internet companies. After the dot-com bubbles, the survived Internet companies learned how to master a leaner playbook.

2007-8 Global Financial CrisisThe global financial crisis (GFC) refers to a period of extreme stress in global financial markets and banking systems between 2007 and 2009, which changed the financial system culminating in the Dodd-Frank Wall Street Reform and Consumer Protection Act. The seeds of the global financial crisis can be traced back to the 1970s, with the Community development Act leading to the creation of a massive derivative market based on real estate assets (subprime). This coupled with easy liquidity, and speculation has led to financial turmoil compared to the 1929 stock market crash.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post History Of Financial Bubbles appeared first on FourWeekMBA.

What Was Tulip Mania? The Dutch Tulip Bubble Explained

Tulip mania, also known as the Dutch tulip bubble, was a period during the 17th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637. Trading became increasingly more organized in these rare tulips, with companies established to grow, buy, and sell them. Cultivation techniques also improved, which caused more and more people to speculate on tulip bulb prices.

Understanding tulip maniaTulip mania occurred in the Netherlands between 1634 and 1637. Tulips were a relatively new status symbol for wealthy Dutch citizens at the time, with some hard to cultivate varieties producing rare flowers that had striped or speckled petals.

Trading became increasingly more organized in these rare tulips, with companies established to grow, buy, and sell them. Cultivation techniques also improved, which caused more and more people to speculate on tulip bulb prices.

Though the practice attracted some regulatory oversight, stock traders pushed tulip prices to astronomical levels. The most expensive tulips sold for around 5,000 guilders – equivalent to the price of a well-appointed house and more than twenty times the annual income of a skilled carpenter.

Perhaps inevitably, the prices peaked and dramatically collapsed over a week during February 1637. Three months later, tulip bulbs were back to trading at normal prices.

What caused the Dutch tulip bubble?Tulip mania is frequently cited as the classic example of a financial bubble, with many naïve and uninformed investors entering the market and then losing everything because of unsustainable price rises. However, considering that the bubble did not cause a widespread ripple effect in the Dutch economy, an alternative theory may explain its demise.

The most accepted explanation is that with so many people cultivating rare bulbs, they simply become more abundant and less desirable. This theory is supported by the fact that the crash occurred in February at a time when tulip bulbs begin to emerge from the Dutch soil. Bulb traders may have witnessed this proliferation during their travels and realized certain flowers were less rare than they had imagined.

Whatever the cause of Tulip mania, the consequences for buyers and sellers alike were painful. Many transactions were not basic exchanges of cash for bulbs but promises to pay for bulbs in the future. Disagreement over who owed what to whom between buyers without money and sellers without bulbs was rife.

Implications for tulip mania in the 21st centuryToday, tulip mania has become a catchphrase for insanity in markets where high prices are attached to items with little value or utility. Indeed, similar price cycles have been observed in the trade of Beanie Babies, baseball cards, and non-fungible tokens (NFTs).

The so-called South Sea Bubble, where a shipping company was formed to reduce national debt through slavery, is a more historical example of investment mania leading to a market crash.

Key takeaways:Tulip mania was a period during the 17th century where contract prices for tulip bulbs reached extremely high levels before crashing in 1637.The causes of tulip mania have perhaps been distorted over the centuries, with many assuming it was one of the first examples of a market bubble bursting. However, the proliferation of once rare tulip bulbs probably lead to them becoming less desirable. Tulip mania remains a popular term to describe markets where high prices are associated with low value or low utility items, including baseball cards, Beanie Babies, and NFTs.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Was Tulip Mania? The Dutch Tulip Bubble Explained appeared first on FourWeekMBA.

What Was The Global Financial Crisis? How The 2007-8 Global Financial Crisis Affected The Business World Forever

The global financial crisis (GFC) refers to a period of extreme stress in global financial markets and banking systems between 2007 and 2009, which changed the financial system culminating in the Dodd-Frank Wall Street Reform and Consumer Protection Act. The seeds of the global financial crisis can be traced back to the 1970s, with the Community development Act leading to the creation of a massive derivative market based on real estate assets (subprime). This coupled with easy liquidity, and speculation has led to financial turmoil compared to the 1929 stock market crash.

Understanding the global financial crisisThe global financial crisis resulted from a sequence of events culminating in the near-total collapse of the banking system.

Some analysts suggest the origins of the global financial crisis can be traced back to the 1970s with the introduction of the Community Development Act. The act, which created a market for subprime mortgages, forced banks to loosen their lending criteria for lower-income borrowers. Industry deregulation in the 1980s almost removed the barriers for lenders to limit mortgage interest rates. Two decades later, the industry was booming with the deregulation allowing lenders to charge up to 60% interest on mortgages.

In the years leading up to the crisis, mortgage lenders developed many new products with opaque and predatory terms. A two-sided mortgage market began to emerge, where borrowers from minority groups were served by subprime lenders and higher-income borrowers were served by conventional lending institutions.

Subprime mortgages were often based on what the borrower claimed they earned. In other words, there was no requirement for them to prove their income. Lenders did not care if borrowers defaulted on their loans because they made their money upfront in the form of closing costs and brokerage fees. If the borrower did default, the lender had already made thousands of dollars on the deal. Many choose to simply sell their loans to Wall Street, effectively kicking the can down the street.

Between 1994 and 2005, the subprime mortgage market grew from $35 billion to $665 billion. As the industry grew, so too did the abusive and predatory lending practices. Industry experts and advocates called for a regulatory response to an emerging crisis, as mass property foreclosures affected cities including Philadelphia, Atlanta, and New York.

The global financial crisis reaches a climaxThe amount of subprime mortgage debt continued to increase during the early 2000s when the Federal Reserve Board cut interest rates to avoid a recession. Loose and predatory lending practices combined with cheap money caused a housing boom which created mass speculation and a real estate bubble.

Meanwhile, the banks that had bought secondary subprime mortgages bundled them with prime mortgages. This meant there was no way for investors to properly understand the risks of subprime products.

When the subprime market collapsed, one-fifth of homes in the United States were purchased with subprime loans. Subprime borrowers began to default on loans that were worth more than the value of their homes, which simply accelerated real estate price declines.

On September 29, 2008, the House of Representatives rejected a move to create a $700 billion fund to acquire toxic mortgages. The Dow Jones Industrial Average, NASDAQ, and S&P 500 all suffered historical one-day losses.

With no market for the toxic debt of subprime mortgages, the subsequent cascade of subprime lender failures created liquidity contagion that reached the upper tiers of the banking system. Major investment banks including Bear Stearns and Lehman Brothers collapsed under the weight of their exposure to subprime loans, despite their “too big to fail” status. A further 450 smaller banks followed suit over the next five years.

Sensing that its failure would bring down the entire financial system, the government poured more than $180 billion into American International Group (AIG). The Bank of America also received bailout money, including $100 billion in guarantees to help it acquire failing financial companies and absorb their losses.

For borrowers, interest rates were lowered to almost zero after 2008. Two years later, massive financial reform was introduced by President Obama in the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Key takeaways:The global financial crisis (GFC) refers to a period of extreme stress in global financial markets and banking systems between 2007 and 2009. The global financial crisis was precipitated by changes to legislation in the 1970s. The changes created the subprime mortgage industry and forced banks to loosen their lending criteria for lower-income borrowers.When the subprime market collapsed in 2008, one-fifth of homes in the United States had been purchased with subprime loans. Bear Stearns and Lehman Brothers collapsed because of their excessive exposure to toxic debt, while consumers were left with mortgages far exceeding the value of their homes. In the aftermath of the GFC, interest rates were reduced to near zero and there was sweeping financial reform.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Was The Global Financial Crisis? How The 2007-8 Global Financial Crisis Affected The Business World Forever appeared first on FourWeekMBA.