Gennaro Cuofano's Blog, page 135

December 16, 2021

The Concierge Business Model In A Nutshell

The concierge business model is based on the personal concierge services a business provides to other businesses, employees, and individuals. The concierge business model is one in which a company provides a variety of services to businesses, employees, and individuals. Concierge services were once the domain of the rich and were mostly found in luxury hotels and other such establishments. However, many small business owners are now offering their services to increasingly-time poor consumers with disposable income.

Understanding the concierge business modelThe services a concierge provides are extremely diverse and to some extent, depend on the individual needs of the client. However, most provide personal services that help the customer achieve a better work-life balance.

Examples of services provided under the concierge business model include:

Grocery shopping.Laundry and dry cleaning.Travel arrangements such as booking flights, hotels, or rental cars.Home organization.General errands such as taking the children to school or booking a doctor’s appointment.Making restaurant reservations.Small event or party planning.Gift purchasing. Interior design, andLifestyle consulting, which may include personal or professional assistant services.Concierge services were once the domain of the rich and were mostly found in luxury hotels and other such establishments. However, many small business owners are now offering their services to increasingly-time poor consumers with disposable income.

Elements of a successful concierge business modelThe concierge business model is relatively simple. Nevertheless, there are some important factors to keep in mind for those thinking of entering the industry:

Consider the market – there are two broad concierge business model categories: corporate and personal. Corporate services include planning business trips and scheduling meetings, while personal services encompass nearly any household chore or otherwise mundane or time-consuming task. In some instances, concierge services may straddle both categories.Focus on high value – consumers from lower socio-economic backgrounds are not going to be attracted to concierge services for obvious reasons. The focus should always be on middle and high-income earners. Generation X and Millennial professionals also desire concierge services because they like to work hard and protect their leisure time. Don’t neglect marketing – it is also important to market concierge services to new and existing clients. The concierge services industry is likely to become more competitive over time, so market differentiation should not be neglected. Build the right relationships – like other freelance industries, those who work under the concierge business model may have difficulty earning a consistent and reliable income. It is important the entrepreneur builds the sort of client relationships that result in repeat or long-term business.Key takeaways:The concierge business model is one in which a company provides a variety of services to businesses, employees, and individuals.Once the domain of the wealthy, concierge services are now popular among time-poor consumers who desire a greater work-life balance. Some of the services on offer include home organization, travel arrangement booking, interior design, grocery shopping, restaurant reservations, and general errands such as dropping children off at school.The concierge business model is relatively straightforward, but concierge providers should begin by considering whether they want to provide corporate services, personal services, or a mixture of both. What’s more, providers should focus on middle and upper-class consumers and not discount the importance of marketing campaigns and long-term client relationships.Connected Business Concepts A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more. In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer.

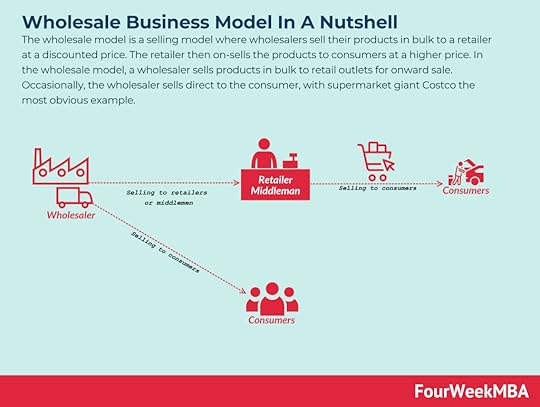

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer. The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.

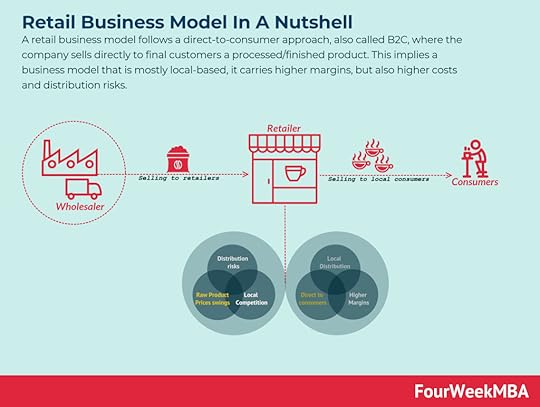

The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example. A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.  A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time.

A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Concierge Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Wealthfront Make Money?

Wealthfront is an automated Fintech investment platform providing investment, retirement, and cash management products to retail investors, mostly making money on the annual 0.25% advisory fee the company charges for assets under management. It also makes money via a line of credits and interests on the cash accounts.

Origin storyBased in California, Wealthfront is an automated investment service providing investment, retirement, and cash management products to retail investors.

It was founded in 2008 by Benchmark co-founder Andy Rachleff and Dan Carroll as a mutual fund analysis company. The company quickly pivoted into wealth management, growing its assets under management in the following years.

In 2020, Wealthfront made the Business Insider Top 10 Best Robo Advisors. Shortly thereafter, the company updated its mission statement to position itself as a company that favored people and not institutions.

Wealthfront now targets tech-savvy Millennials offering them an automated, data-driven investment service with significantly lower fees.

Wealthfront business modelThe Wealthfront revenue model is mostly based on the annual 0.25% advisory fee the company charges for assets under management. For example, an individual with $7000 under management would be charged $1.46 per month.

Although this fee is less than a quarter of the industry average, Wealthfront trusts that their lower fee model will attract larger investor balances. This is particularly important for the company when one considers that they do not charge a management fee for any balance under $5000.

The company also passes on a 0.07-0.13% fund fee to the consumer. This is a fee charged by the companies that manage the index funds Wealthfront ultimately invests in.

College savings planWealthfront also offers a 529 college savings plan, allowing parents to put away money for the future tuition of their children.

The plan is a regular investment strategy using low-risk index funds to minimize capital gains tax. For this service, Wealthfront charges the same 0.25% advisory fee plus an administration fee of 0.01-0.05%. Exchange-traded fund (ETF) managers also pass on a fee of 0.11-0.15%.

Portfolio line of creditWealthfront also offers a line of credit, allowing consumers to borrow money directly from the company.

Depending on the amount borrowed, Wealthfront charges interest fees of between 2.40 to 3.65%.

Cash accountsFor consumers wanting a banking solution, Wealthfront has them covered with a range of various account types suited to individual needs.

The company earns revenue on the cash in customer accounts by lending it out to other institutions. It also makes money whenever the customer makes a purchase using their debit card.

In this scenario, merchants typically pay a 1% fee to Visa which is then shared with Wealthfront.

Key takeaways:Wealthfront is a financial services platform aimed at Millennial consumers who desire a low-fee investment and banking platform.Wealthfront drives the majority of its revenue through a low-cost management fee model. Although it makes less money in management fees than some other platforms, it hopes to attract larger portfolio balances in the growing retail investor market.Wealthfront also makes money by offering a direct line of credit to eligible consumers, charging interest according to the amount borrowed. The company also gives young parents the ability to invest in their children’s college tuition, helping them minimize capital gains tax in the process.Connected Business Models Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts.

Betterment is an American financial advisory company founded in 2008 by MBA graduate Jon Stein and lawyer Eli Broverman. Betterment makes money via investment plans, financial advice packages, betterment for advisors, betterment for business, cash reserve, and checking accounts.  M1 Finance is a North American online trading platform for common and preferred stocks and exchange-traded funds (ETFs). The company also offers margin lending, cash management, and a checking or debit account service. M1 Finance has a standard assortment of revenue streams for an investment platform. As a market maker earns money on the bid-ask spread, M1 Finance also offers a single premium subscription dubbed M1 Plus, and through interest and interchange fees.

M1 Finance is a North American online trading platform for common and preferred stocks and exchange-traded funds (ETFs). The company also offers margin lending, cash management, and a checking or debit account service. M1 Finance has a standard assortment of revenue streams for an investment platform. As a market maker earns money on the bid-ask spread, M1 Finance also offers a single premium subscription dubbed M1 Plus, and through interest and interchange fees. SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization.

SoFi is an online lending platform that provides affordable education loans to students, and it expanded into financial services, including loans, credit cards, investment services, and insurance. It makes money primarily via payment processing fees and loan securitization. Read Also: Robo-Advisors, SoFi Business Model, Betterment Business Model, M1 Finance Business Model.

Read Next:

How Does Robinhood Make MoneyHow Does Venmo Make MoneyHow Does Honey Make MoneyHow Does YouTube Make MoneyHow Does Telegram Make MoneyHow Does Discord Make MoneyMain Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post How Does Wealthfront Make Money? appeared first on FourWeekMBA.

What Is Hindsight Bias? The Hindsight Bias In A Nutshell

Hindsight bias is the tendency for people to perceive past events as more predictable than they actually were. The result of a presidential election, for example, seems more obvious when the winner is announced. The same can also be said for the avid sports fan who predicted the correct outcome of a match regardless of whether their team won or lost. Hindsight bias, therefore, is the tendency for an individual to convince themselves that they accurately predicted an event before it happened.

Understanding hindsight biasBefore the event takes place, someone may predict an outcome with an educated guess – but there is no way of knowing for certain what will transpire. After the event occurs, the same person may convince themselves they knew what was going to happen before it happened. This is why the hindsight bias is often called the “I knew it all along” phenomenon.

Under the assumption of being able to predict the future, hindsight bias causes overconfidence in the individual and they become less critical of their decisions as a consequence. Ultimately, this leads to poor decision-making.

What causes hindsight bias?Hindsight bias is caused by three main variables, or inputs:

Cognitive inputs – some people remember an earlier prediction about an event with distorted or fabricated memories. In the process, they may find it easier to recall information consistent with their current knowledge and construct a narrative that makes sense.Motivational inputs – others believe the world is a predictable place and that event outcomes are predictable and inevitable. They take comfort in this belief and consider it to be infallible.Metacognitive inputs – when an individual can explain how and why an event happened, they are more likely to believe the outcome was easily foreseeable.Hindsight bias in businessHindsight bias can be seen in the following business scenarios:

Investing – when an investor purchases shares and sells them for a profit, the decision will appear obvious and the investor may congratulate themselves. When share prices decline, many investors claim they had been expecting a negative trend for some time despite not hedging against it.Marketing and sales – the internal development of marketing and sales campaigns should also consider hindsight bias because it plays a critical role in responsible and accountable decision making. This culture is important in predicting market trends, developing the right communication strategy, and implementing the best crisis management plan.Accounting – auditors in accounting firms are often blamed in hindsight for failing to foresee and anticipate the financial problems of their clients. Studies have shown that hindsight bias influences several key auditing processes, including audit opinion decisions, going concern judgments, and internal control evaluations.Key takeaways:Hindsight bias is the tendency for an individual to convince themselves that they accurately predicted an event before it happened. The phenomenon causes overconfidence and the individual becomes less critical of their decisions as a result.Hindsight bias is caused by three variables, or inputs. These include cognitive inputs, motivational inputs, and metacognitive inputs.In business, hindsight bias can at least partly explain the behavior of investors and traders. The effect also occurs during sales and marketing decision-making and in the accounting industry.Related Business Concepts As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty. The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not. The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist.

The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist. The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty. The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased.

The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased. The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves. Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s. The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it.

The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it. Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).

Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Hindsight Bias? The Hindsight Bias In A Nutshell appeared first on FourWeekMBA.

What Is The Hedonic Treadmill? The Hedonic Treadmill In A Nutshell

The hedonic treadmill was first described in a 1971 essay entitled Hedonic Relativism and Planning the Good Society. The authors described a tendency for people to keep a stable baseline level of happiness despite positive or negative external events. The hedonic treadmill, therefore, is a theory positing that people repeatedly return to a baseline level of happiness, irrespective of what happens to them.

Understanding the hedonic treadmillHowever, the concept itself was alluded two almost 200 years earlier by philosopher and writer Jean-Jacques Rousseau. In his 1754 Discourse on Inequality, he wrote: “Since these conveniences by becoming habitual had almost entirely ceased to be enjoyable, and at the same time degenerated into true needs, it became much more cruel to be deprived of them than to possess them was sweet, and men were unhappy to lose them without being happy to possess them.”

No one can escape the hedonic treadmill because it impacts nearly every aspect of life. One person may dream of buying a house or starting a new career and fantasize about the happiness these events will bring. However, when these dreams become a reality, the happiness is neither as sustained nor as intense as they envisioned.

Note that the baseline level of happiness varies from person to person. While most people are happy most of the time, some individuals will default to a more neutral or negative baseline.

Real-world examples of the hedonic treadmillThe hedonic treadmill is most often associated with high impact positive and negative events, including:

Winning the lottery – winning a large sum of money is a happy experience initially, but the individual tends to revert to their previous baseline after the novelty wears off. Some lottery winners may find their happiness decrease because of the way money changes their relationships with family and friends.Becoming an amputee – those who lose a limb in an accident or for some other reason experience a tremendous amount of physical and emotional pain. Though they are left with a permanent disability, most return to their previous happiness level.Finding a new partner – many attribute falling in love to be one of the most enjoyable experiences in life. However, two people in a relationship quickly become habituated to each other and may experience negative emotions as a result.The hedonic treadmill in marketingThe hedonic treadmill is one of the main reasons a brand has to deliver new and different versions of its core message to maintain customer engagement over time.

For instance, American insurer Allstate launched a series of advertising campaigns where the company mascot, Mr. Mayhem, portrayed several different disasters that might require the target audience to make an insurance claim. Each disaster comprised a single episode, with each episode designed to provide a new, unexpected, and novel way of communicating Allstate’s brand message.

The hedonic treadmill also impacts product development. After the initial success of Angry Birds began to wane, game developers had to diversify and start releasing subsequent versions to secure the attention of the target audience. Stuffed toys and other physical merchandise were also sold to maintain some degree of novelty in the brand.

Key takeaways:The hedonic treadmill is a theory positing that people repeatedly return to a baseline level of happiness, irrespective of what happens to them.The hedonic treadmill is most associated with high impact positive and negative events such as winning the lottery, becoming an amputee, or entering into a new relationship.In business, the hedonic treadmill encourages businesses to develop new and different versions of their core brand message to keep customers engaged.Related Business Concepts As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty. The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not. The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist.

The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist. The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty. The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased.

The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased. The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves. Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s. The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it.

The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it. Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).

Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).The post What Is The Hedonic Treadmill? The Hedonic Treadmill In A Nutshell appeared first on FourWeekMBA.

What Is The Hawthorne Effect? The Hawthorne Effect In A Nutshell

The Hawthorne Effect refers to an inclination of some people to work harder or perform better when they know they are being observed. The effect is most associated with those who are experiment participants, who alter their behavior due to the attention they are receiving and not due to any manipulation of independent variables. Therefore, the Hawthorne Effect describes the tendency for a person to change their behavior with the awareness that they are being observed.

Understanding the Hawthorne EffectThe Hawthorne Effect has also been discussed in the context of industrial and organizational psychology. Researcher Henry A. Landsberger, who first described the effect, conducted landmark studies in the 1920s and 30s after being commissioned by an electric company to determine if there was a relationship between productivity and work environment.

During the studies, Landsberger examined aspects such as the timing of breaks, workplace lighting, and the length of the workday. In one particular study into the effect of decreasing light levels on worker productivity, Landsberger found that employees worked harder in response to the changes but then decreased their output once the test concluded.

It was later found that any change to the workplace caused an increase in productivity. Many of these changes might appear to lower productivity at first glance, such as longer workdays or the elimination of work breaks. The researchers concluded that employees were responding to increased attention from supervisors and not from experimental variables.

Subsequent research into the Hawthorne Effect

Subsequent research into the Hawthorne Effect suggested that Landsberger’s original results were somewhat overstated. In 2009, a University of Chicago study went over the data and discovered that other factors played a role in employee productivity. The study also found that many of Landsberger’s conclusions were simply not supported by the data.

Nevertheless, the study did concede that the Hawthorn Effect was a real – if not weak – phenomenon. Five years later, a systematic review published in the Journal of Clinical Epidemiology found the phenomena to exist across 19 different experiments. The review also acknowledged that more research needed to be done to determine the mechanism(s) behind the Hawthorn Effect.

With that said, some factors which may influence productivity include:

Demand characteristics – where study participants match their behavior to subtle clues a researcher may exhibit regarding the experiment hypothesis. Novelty effects – sometimes, performance increases because of the novelty associated with being monitored. Performance feedback – in the original study, increased attention from researchers was thought to have increased performance feedback. This in turn resulted in productivity improvements.The Hawthorne Effect in businessHere are some scenarios where the Hawthorne Effect may occur in business:

Management technique – observation of employees is a double-edged sword. Employees who know they are being observed may improve their performance because of increased accountability. On the other hand, performance may decline if the employee perceives there to be an ulterior motive for the superior observing them.Education – the Hawthorne effect has been proven to have very little impact on school-age children, but teachers observed by a camera or a person sitting in on their class tended to perform better. Start-up growth – the Hawthorn Effect can also be used in new companies to encourage innovative ideas and collaboration. Employee observation means opinions are heard and respected, which in turn invokes certain emotions that motivate the employee to strive for a common purpose. Attentive observation can also be used to monitor employees as they collaborate in teams, with more productive team members tending to assume leadership of the group and deliver better outcomes.Key takeaways:The Hawthorne Effect describes the tendency for a person to change their behavior due to an awareness of being observed. The phenomenon was first described by Henry A. Landsberger in a series of experiments in the 1920s and 30s.Subsequent research into the Hawthorne Effect suggested that Landsberger’s original results were exaggerated. Indeed, the phenomenon may be supplemented by demand characteristics, novelty effects, and performance feedback.The Hawthorne Effect commonly occurs during employee-manager interactions. It may also increase teacher performance in the classroom and enhance ideation, leadership, and collaboration in young companies.Related Business Concepts As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty.

As highlighted by German psychologist Gerd Gigerenzer in the paper “Heuristic Decision Making,” the term heuristic is of Greek origin, meaning “serving to find out or discover.” More precisely, a heuristic is a fast and accurate way to make decisions in the real world, which is driven by uncertainty. The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not.

The recognition heuristic is a psychological model of judgment and decision making. It is part of a suite of simple and economical heuristics proposed by psychologists Daniel Goldstein and Gerd Gigerenzer. The recognition heuristic argues that inferences are made about an object based on whether it is recognized or not. The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist.

The representativeness heuristic was first described by psychologists Daniel Kahneman and Amos Tversky. The representativeness heuristic judges the probability of an event according to the degree to which that event resembles a broader class. When queried, most will choose the first option because the description of John matches the stereotype we may hold for an archaeologist. The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored.

The take-the-best heuristic is a decision-making shortcut that helps an individual choose between several alternatives. The take-the-best (TTB) heuristic decides between two or more alternatives based on a single good attribute, otherwise known as a cue. In the process, less desirable attributes are ignored. The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty.

The concept of cognitive biases was introduced and popularized by the work of Amos Tversky and Daniel Kahneman since 1972. Biases are seen as systematic errors and flaws that make humans deviate from the standards of rationality, thus making us inept at making good decisions under uncertainty. The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased.

The bundling bias is a cognitive bias in e-commerce where a consumer tends not to use all of the products bought as a group, or bundle. Bundling occurs when individual products or services are sold together as a bundle. Common examples are tickets and experiences. The bundling bias dictates that consumers are less likely to use each item in the bundle. This means that the value of the bundle and indeed the value of each item in the bundle is decreased. The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves.

The Barnum Effect is a cognitive bias where individuals believe that generic information – which applies to most people – is specifically tailored for themselves. Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s.

Nudge theory argues positive reinforcement and indirect suggestion is an effective way to influence the behavior and decision making of individuals or groups. Nudge theory was an idea first popularized by behavioral economist Richard Thaler and political scientist Cass Sunstein. However, the pair based much of their theory on heuristic research conducted by psychologists Daniel Kahneman and Amos Tversky in the 1970s. The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it.

The bullwhip effect describes the increasing fluctuations in inventory in response to changing consumer demand as one moves up the supply chain. Observing, analyzing, and understanding how the bullwhip effect influences the whole supply chain can unlock important insights into various parts of it. Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).

Maslow’s Hammer, otherwise known as the law of the instrument or the Einstellung effect, is a cognitive bias causing an over-reliance on a familiar tool. This can be expressed as the tendency to overuse a known tool (perhaps a hammer) to solve issues that might require a different tool. This problem is persistent in the business world where perhaps known tools or frameworks might be used in the wrong context (like business plans used as planning tools instead of only investors’ pitches).Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipThe post What Is The Hawthorne Effect? The Hawthorne Effect In A Nutshell appeared first on FourWeekMBA.

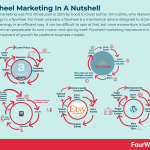

What Is Flywheel Marketing? Flywheel Marketing In A Nutshell

Flywheel marketing was first introduced in 2001 by Good to Great author Jim Collins, who likened the strategy to a flywheel. For those unaware, a flywheel is a mechanical device designed to store rotational energy in an efficient way. It can be difficult to spin at first, but once momentum is built, the flywheel can perpetuate its own motion and spin by itself. Flywheel marketing has become a critical component of growth for platform business models.

Understanding flywheel marketingFlywheel marketing is a model that helps explain the momentum that results when an organization unites around delivering a superior customer experience.

In the context of business, Collins noted there was “no single killer innovation, no solitary lucky break, no miracle moment; rather, the process resembles relentlessly pushing a giant, heavy flywheel, turn upon turn, building momentum until a point of breakthrough and beyond.”

Unlike the traditional marketing funnel, flywheel marketing suggests the sales process is never truly complete. The wheel will slow down to reflect a disconnect between sales and customer success and speed up to reflect improvements in customer experience and conversion rate.

When the flywheel is in motion, so to speak, clients are retained and will recommend a product or service to others via word-of-mouth marketing. Since the focus is on customer retention, flywheel marketing is relevant to any business regardless of industry, size, or type.

The four stages of flywheel marketingLike the traditional marketing funnel, flywheel marketing comprises several stages:

1 – ActivationIn the first stage of flywheel marketing, the business endeavors to attract new customers in several ways.

Typically, this encompasses a high-converting website showcasing the relevant expertise and case studies. Some businesses will also choose to entice leads with coupons, discounts, or free trials and track the results of their efforts.

2 – AdoptionOnce a customer has been acquired, the business must determine how to keep them coming back. In the second stage, newly acquired customers start using the product or service and are constantly searching for more value.

Product tutorials and walkthroughs can be used to foster a sense of realization among consumers that the product they are using is precisely what they need.

3 – AdorationThe adoration stage focuses on creating users who love products and services and look forward to using them regularly. For the business, the best possible outcome is a cohort of customers who act as brand ambassadors and set the stage for brand advocacy.

Customer adoration can be facilitated by:

Sharing resources via social media or a newsletter, such as a free webinar.Conducting surveys to determine which product features fans would love to see incorporated. Compelling customers to upgrade to premium plans and reap the hidden benefits.4 – AdvocacyDuring the advocacy stage, happy and satisfied customers become brand advocates via user testimonials, reviews, referrals, and user-generated content. Each is a potential source of new leads, with brand advocates essentially acting as a marketing team for the business itself.

While many brand advocates will need no motivation to speak well of a product or service, affiliate programs and other rewards can help incentivize some users to help keep the flywheel spinning.

Key takeaways:Flywheel marketing is a cyclical and self-sustaining marketing model that generates a steady stream of qualified leadsThe flywheel marketing sales process is never truly complete. The wheel slows down to reflect a disconnect between sales and customer success and speeds up as a result of improvements in customer experience and conversion rate.Flywheel marketing consists of four stages: activation, adoption, adoration, and advocacy. Each stage helps the business attract qualified leads and turn them into brand advocates that will promote its products and services.Other Types Of Marketing Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

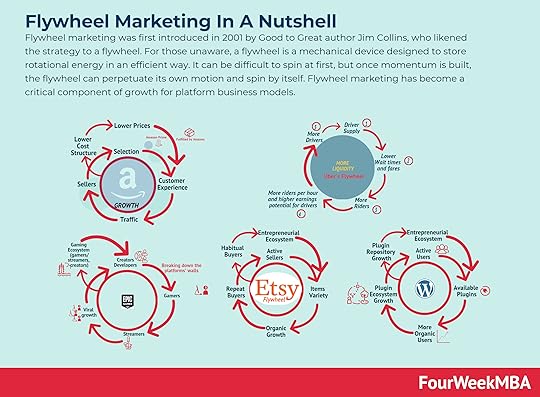

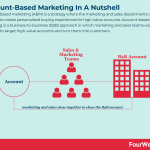

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

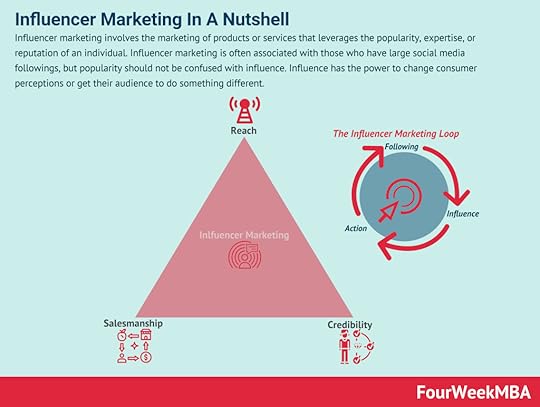

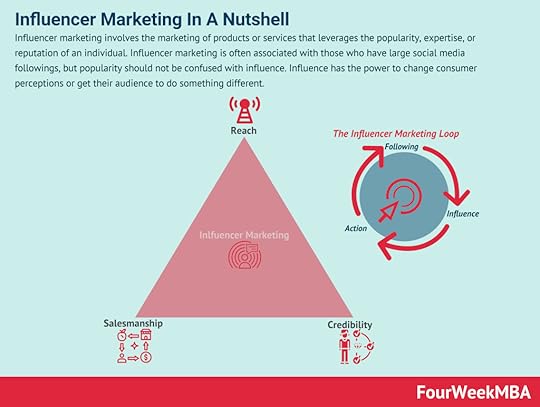

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

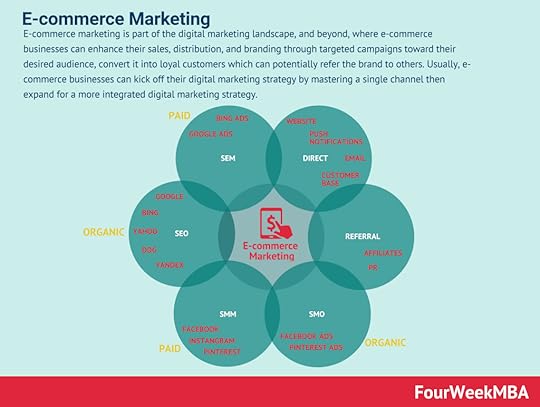

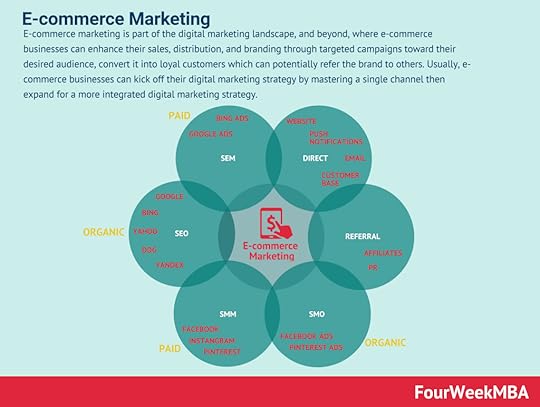

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

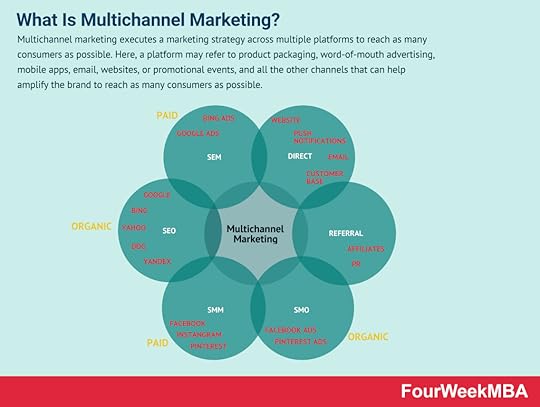

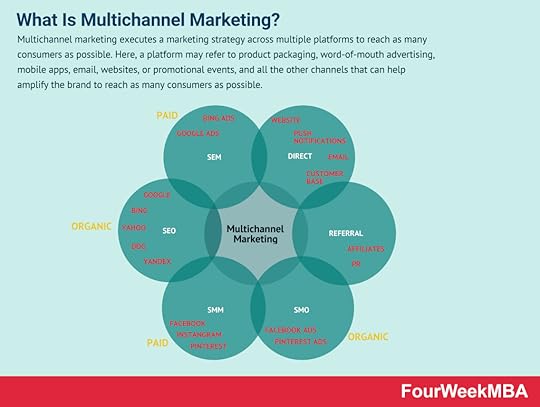

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

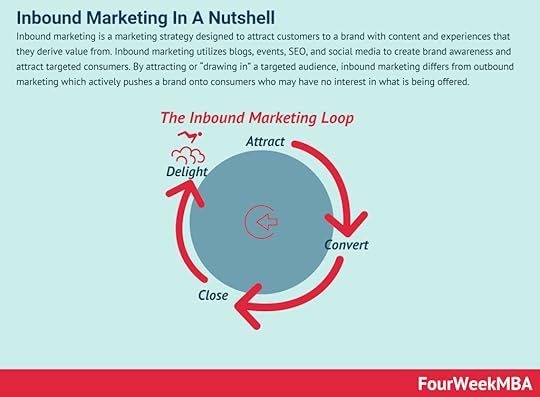

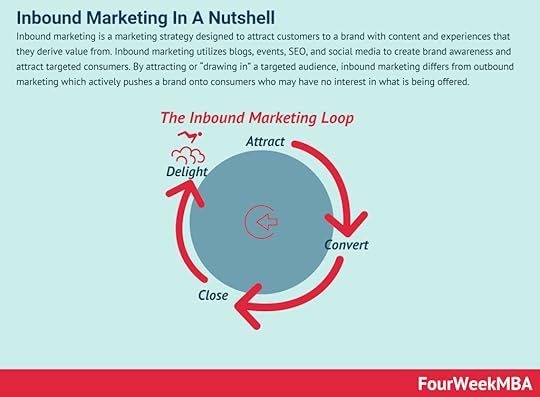

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

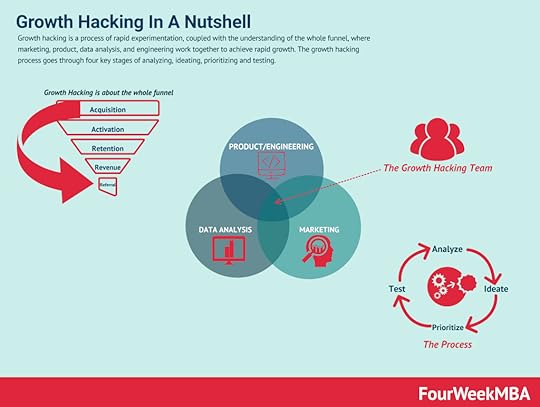

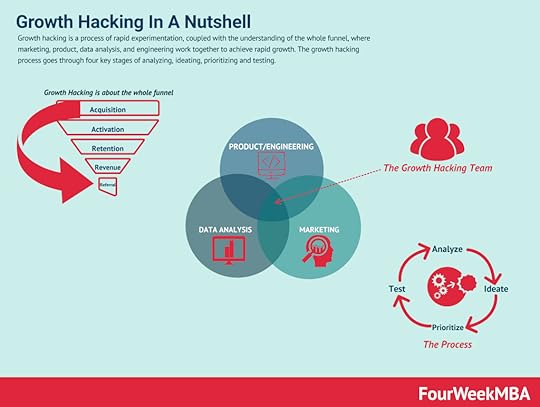

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

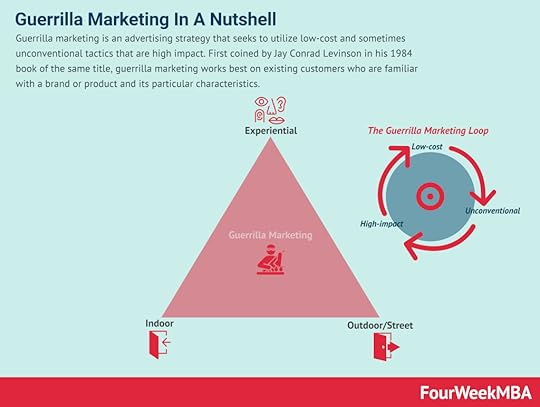

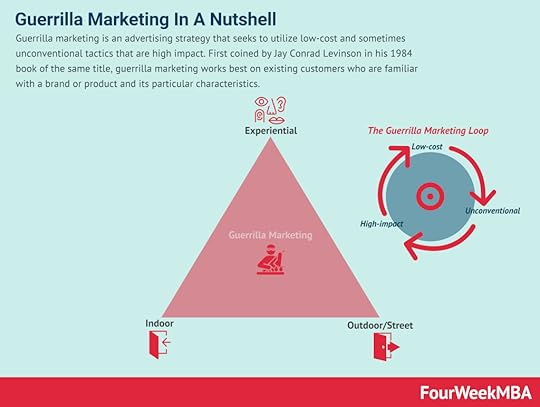

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

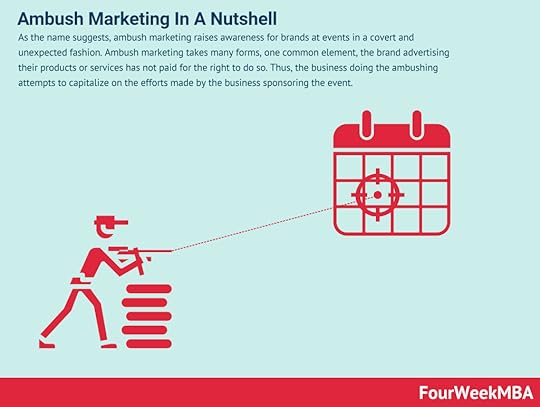

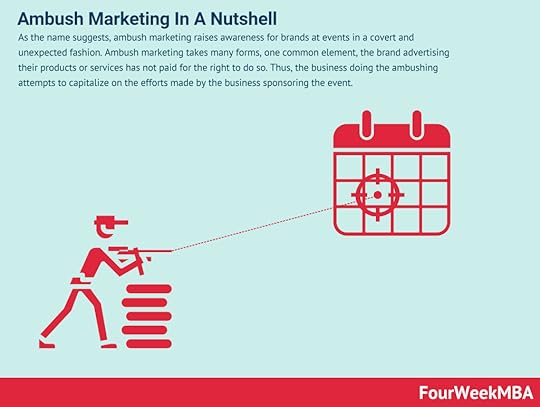

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Flywheel Marketing? Flywheel Marketing In A Nutshell appeared first on FourWeekMBA.

December 15, 2021

What Is The Affiliate Business Model? The Affiliate Business Model In A Nutshell

Affiliation business models are an evolution of advertising business models. Instead of making money based on a user action, like an impression or a click, they make money based on conversion. Under the affiliate business model, a business pays commissions to affiliates who promote and sell products on its behalf. Therefore, if the user converts through the link provided by the affiliate, it will generate a commission. That is why affiliate business models often have a completely different logic than advertising business models. Advertisers make money from bot impressions and clicks. The affiliate mostly makes money if there is a conversion (even though affiliate schemes also include pay-per-impression and pay-per-click campaigns).

Understanding the affiliate business modelWhile affiliate marketing and the concept of revenue sharing predates the internet, the strategy has become a staple for many online businesses and has played a significant part in the success of eCommerce itself.

Entrepreneur and inventor William J. Tobin was the first person to implement affiliate marketing in an online business. The online flower retailer was founded in 1994 and had amassed almost three thousand affiliate partners before it was sold to Federated Department Stores six years later. Tobin was encouraged to patent his technology in 1996, but the patent itself was not issued until 2000.

This opened the door for Amazon who, after witnessing Tobin’s success, launched its own affiliate program in 1996. The Amazon Associates affiliate program was the first such program made available to the general public. Webmasters could display custom banners that linked back to the Amazon website with a unique tracking ID and receive a percentage-based commission on any resultant sales.

Today, approximately 2.3% of all websites using advertising networks are Amazon Associates members. The model remains popular because it is a relatively passive source of income for merchants. For the affiliate, the business model allows them to promote products and earn an income without the hassle of shipping and customer service.

The essential elements of the affiliate business modelThe affiliate business model relies on the interaction between two or more of the following elements:

The affiliate (publisher)The affiliate is the entity that promotes a third-party product to its target audience in exchange for a commission on every successful sale. The first affiliates promoted products by reviewing them in blog posts, but products are now promoted on social media accounts and in videos.

The merchant (advertiser)The seller of the product who may also be the product manufacturer. The merchant can be a large retail conglomerate such as Amazon or an individual craftsperson on Etsy.

The network (middleman)In some cases, there is also a network that connects merchants with affiliates and handles product payment and delivery for a fee. Many affiliate networks rely on the affiliate business model to generate all their revenue.

The customerOr the individual who buys the product after being referred by the affiliate. Historically, the customer was unaware that their purchase was part of affiliate marketing. But recent legislative changes made by the Federal Trade Commission (FTC) now stipulate that the affiliate must disclose its relationship to the merchant when promoting products and services.

Payment methods under the affiliate business modelThere are five main ways an affiliate can be paid under the affiliate business model, although usually affiliates are mostly paid through pay-per-sale:

Pay-per-click (PPC) – where the affiliate is paid whenever their links are clicked. Note that in most cases, the affiliate must create and manage ad campaigns at their own expense and are only paid once a conversion (sale) takes place.Pay-per-impression (PPI) – where the affiliate is paid when a consumer visits the merchant’s site. In some cases, pay-per-impression also encompasses revenue based on how many times consumers view display or text ads.Pay-per-lead (PPL) – here, the affiliate is paid when an individual clicks on an affiliate link and completes some desired action such as filling out an online form. Payroll software company Gusto pays $25 to affiliates for every lead that signs up for a free trial of its product.Pay-per-call – where affiliates are paid for each call they make to a potential customer. This approach is favored by service companies such as home-improvement contractors and real estate agents. Pay-per-sale (PPS) – the most common form of payment where the affiliate receives a percentage commission from every sale they facilitate. Merchants set the exact percentage, with rates varying according to the product category. For example, Amazon offers a 1% commission on baby products but 3% on headphones, musical instruments, pet products, and furniture.Key takeaways:Under the affiliate business model, a business pays commissions to affiliates who promote and sell products on its behalf. The Amazon Associates affiliate program was the first such program to be made available to the general public.The affiliate business model may have up to four essential elements: the affiliate, the merchant, the network, and the customer. Many customers were unaware they were participating in the model until an FTC ruling forced affiliates to disclose their position.The affiliate can earn money in five core ways: pay-per-click, pay-per-impression, pay-per-lead, pay-per-call, and pay-per-sale. In each case, the merchant dictates how much the affiliate will be paid for completing a certain action.Read Next: Google Business Model, Facebook Business Model, Asymmetric Business Models, Attention-Based Business Models.

Connected Business Models Google is a platform, and a tech media company running an attention-based business model. As of 2020, Alphabet’s Google generated over $182 billion in revenues. Almost $147 billion came from Google Advertising products (Google Search, YouTube Ads, and Network Members sites). They were followed by over $21 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium), followed by Google Cloud, which generated over $13 billion in 2020.

Google is a platform, and a tech media company running an attention-based business model. As of 2020, Alphabet’s Google generated over $182 billion in revenues. Almost $147 billion came from Google Advertising products (Google Search, YouTube Ads, and Network Members sites). They were followed by over $21 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium), followed by Google Cloud, which generated over $13 billion in 2020. Facebook is an attention-based business model. As such, its algorithms condense the attention of over 2.4 billion users as of June 2019. Facebook advertising revenues accounted for $31.9 billion or 98.66% of its total revenues. Facebook Inc. has a product portfolio made of Instagram, Messenger, WhatsApp, and Oculus.

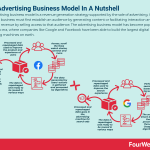

Facebook is an attention-based business model. As such, its algorithms condense the attention of over 2.4 billion users as of June 2019. Facebook advertising revenues accounted for $31.9 billion or 98.66% of its total revenues. Facebook Inc. has a product portfolio made of Instagram, Messenger, WhatsApp, and Oculus. In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is The Affiliate Business Model? The Affiliate Business Model In A Nutshell appeared first on FourWeekMBA.

What Is The Advertising Business Model? The Advertising Business Model In A Nutshell

The advertising business model is a revenue generation strategy supported by the sale of advertising. In general, a business must first establish an audience by generating content or facilitating interaction and then earn revenue by selling access to that audience. The advertising business model has become popular in the web era, where companies like Google and Facebook have been able to build the largest digital advertising machines on earth.

Understanding the advertising business modelThe advertising business model has long been associated with newspapers, magazines, radio, television, and any other medium where advertising revenue is critical to the survival of the business.

Today, the model is a staple of many online businesses, from eCommerce sites such as Amazon to search engines such as Google and everything in between. In most cases, the model is only successful if the business can generate large volumes of targeted traffic. Revenue in this context is generated in three main ways:

Advertisers pay website owners to display advertising on their site.Advertisers pay website owners to refer visitors to the advertiser’s website.Advertisers pay website owners to display advertising messages with the ability for the consumer to click through to their website.As more businesses monetize their content, website owners have tried to counter the rising prevalence of ad-blockers by serving native ads which mimic normal content. This, some suggest, has caused an arms race between consumers using ad-blockers and businesses hiding their content behind paywalls.

Despite recent conjecture that it may become obsolete, the advertising business model will continue to be a significant strategy moving forward. Once established, the model enables businesses to make money without the hassle of selling a product or a service. What’s more, advertisers are often willing to pay more for access to a highly targeted or engaged audience.

Four basic advertising strategiesWhile there are many ways a business can earn money from advertising, the following four categories cover the vast majority of advertisement models in the digital space:

Display advertisingMost of these are banner ads, which have been declining in popularity as consumers become more averse to them. These ads are small, digital billboards placed around content and can be animated or static. They are commonly used to depict a fast visual story that promotes brand identity, with revenue collected according to the cost-per-impression (CPM) model.

Video advertisingUnsurprisingly, video ads are now the predominant form of advertising because they are entertaining and can tell a brand story in a way that a banner ad never could. They are typically shown pre-roll, mid-roll, or post-roll in a video the consumer is already watching. Since they are relevant and contextual, the viewer is more open to watching them.

Mobile advertisingThese are optimized for mobile content consumption and include video, app, display, search, and social-based ads. Mobile advertising often works under the cost-per-lead model.

Native advertisingConsidered the least disruptive ads because they are incorporated into a piece of content. Like many video ads, native ads are relevant and contextual. They may take the form of videos, photos, or blog posts with a simple text link to the product manufacturer’s website. Google Adsense is one example of native advertising where advertisers pay website owners whenever their ads are clicked on by the user.

Key takeaways:The advertising business model is a revenue generation strategy supported by the sale of advertising. The business must first establish an audience by generating content or facilitating interaction and then earn revenue by selling access to that audience.The advertising business model is still relevant today as online consumers become more averse to traditional promotional strategies. What’s more, the strategy is attractive to website owners who want to monetize their audiences and earn revenue without the hassle of selling a product or service.There are four general advertising types under the advertising business model: display advertising, video advertising, mobile advertising, and native advertising. Many argue display advertising is now redundant as consumers become savvier and spend more of their time watching videos on smartphones.Read Next: Google Business Model, Facebook Business Model, Asymmetric Business Models, Attention-Based Business Models.

Connected Business Models Google is a platform, and a tech media company running an attention-based business model. As of 2020, Alphabet’s Google generated over $182 billion in revenues. Almost $147 billion came from Google Advertising products (Google Search, YouTube Ads, and Network Members sites). They were followed by over $21 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium), followed by Google Cloud, which generated over $13 billion in 2020.

Google is a platform, and a tech media company running an attention-based business model. As of 2020, Alphabet’s Google generated over $182 billion in revenues. Almost $147 billion came from Google Advertising products (Google Search, YouTube Ads, and Network Members sites). They were followed by over $21 billion in other revenues (comprising Google Play, Pixel phones, and YouTube Premium), followed by Google Cloud, which generated over $13 billion in 2020. Facebook is an attention-based business model. As such, its algorithms condense the attention of over 2.4 billion users as of June 2019. Facebook advertising revenues accounted for $31.9 billion or 98.66% of its total revenues. Facebook Inc. has a product portfolio made of Instagram, Messenger, WhatsApp, and Oculus.

Facebook is an attention-based business model. As such, its algorithms condense the attention of over 2.4 billion users as of June 2019. Facebook advertising revenues accounted for $31.9 billion or 98.66% of its total revenues. Facebook Inc. has a product portfolio made of Instagram, Messenger, WhatsApp, and Oculus. In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus have a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility.  In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models.

In an asymmetric business model, the organization doesn’t monetize the user directly, but it leverages the data users provide coupled with technology, thus having a key customer pay to sustain the core asset. For example, Google makes money by leveraging users’ data, combined with its algorithms sold to advertisers for visibility. This is how attention merchants make monetize their business models. Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is The Advertising Business Model? The Advertising Business Model In A Nutshell appeared first on FourWeekMBA.

What Is Account-Based Marketing? Account-Based Marketing In A Nutshell