Gennaro Cuofano's Blog, page 127

January 9, 2022

What Is A Price Floor? Price Floor In A Nutshell

A price floor is a control placed on a good, service, or commodity to stop its price from falling below a certain limit. Therefore, a price floor is the lowest legal price a good, service, or commodity can sell for in the market. One of the best-known examples of a price floor is the minimum wage, a control set by the government to ensure employees receive an income that affords them a basic standard of living.

Understanding price floorsA price floor is also known as a price support since it prevents a price from falling below a certain level. In the agricultural industry, some countries have enacted laws to reduce volatility in farm prices and by extension, farm income.

During periods of low rainfall and low productivity, farmers are protected by the price floor and receive some surety of a basic income. This is achieved by the government entering the market and purchasing the product to increase demand and keep prices higher. The United States government, for example, spends around $20 billion on price support subsidiaries which are distributed to about 39% of the nation’s 2.1 million farms.

Price floor typesThere are two types of price floor.

1 – Binding price floorThis is a price floor that is greater than the market equilibrium point where supply equals demand. In this scenario, the price floor causes an excess of supply in the market but producers will benefit if the higher price they can charge offsets the lower quantity sold.

Consumers, on the other hand, are disadvantaged because they must pay more for a lower quantity of products.

2 – Non-binding price floorNon-binding price floors are set lower than the market equilibrium point. As a result, they do not impact the market price or the quantity that is demanded or supplied.

We can then conclude that a price floor is only effective when it is set above the point where supply equals demand. In other words, a price floor that is set below the equilibrium point will be below market value.

Other effects of a price floor on the marketSome of the intended and unintended consequences of a price floor include:

The formation of a black marketWhen a binding price floor sets prices above the market value, a black market can form since producers are keen to sell their surplus products. In the NFL, for example, a price floor on season tickets made it difficult for fans to sell them because it was above the price many were prepared to pay. In response, a black market was created to give ticketholders unrestricted access to buyers.

Exorbitant pricesAs we hinted at earlier, consumers often have to pay more for the same product. When a price floor of $10 is set for a $9 pizza, consumers must find an extra $1. For this reason, price floors are sometimes seen as corporate welfare.

Lower demandAn extension of increased prices is lower demand as consumers seek out substitute goods that are not subject to a price floor.

Excess productionAnother consequence of a price floor above the equilibrium point is overproduction. Producers are encouraged to supply the market with the promise of higher prices, but this causes the demand to increase and a surplus to form. In the case of the agricultural industry, producers are further incentivized to oversupply the market because they know the government will purchase excess production.

Key takeaways:A price floor is a control placed on a good, service, or commodity to stop its price from falling below a certain limit.There are two types of price floor. In a binding price floor, the control is set above the equilibrium point where supply equals demand. In a non-binding price floor, the control is set below the equilibrium point.The creation of a price floor has various consequences, including the formation of a black market, exorbitant consumer prices, lower demand, and excess production.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes. A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.

A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.  Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services. In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Is A Price Floor? Price Floor In A Nutshell appeared first on FourWeekMBA.

Spotify Competitors

Spotify is the world’s largest music streaming platform with over 381 million users across 184 markets around the world. The company was founded by Martin Lorentzon and Daniel Ek in 2008 in response to the shutdown of peer-to-peer music service Napster. Spotify became a success because it was the first company to determine how to distribute music legally and compensate the music industry at the same time. The platform now offers various curated music discovery services, music stations, audio customization, and private listening. In recent times, it has also ventured into the streaming of audiobooks, podcasts, comedy, poetry, and short stories.

Apple MusicMany consider Apple Music to be a close second to Spotify because it is the best choice for those consumers already invested in the Apple ecosystem of products.

Apple Music is one of the few platforms to offer spatial audio for no extra charge. The platform adjusts the frequencies each ear hears and applies directional audio filters to make it appear as if the music is coming from the sides, the rear, and even from above the listener.

Apple Music also employs human music experts in addition to algorithms to recommend music to listeners. Access to over 90 million songs can be had for $10/month.

Amazon MusicAmazon Music was launched in the United States in September 2007 under the brand Amazon MP3. The company’s music streaming platform is accessible from a range of devices, including the Amazon.com web player, iOS, Windows, Alexa-enabled technology, smart televisions, and some vehicles.

Amazon Music offers access to over 75 million songs, millions of podcast episodes, and spatial audio listening. The first three months are free, after which the user is charged $7.99/month. Amazon Prime customers get free access to the service for as long as they remain members.

PandoraPandora is one of the most popular streaming sites in the United States market with approximately 70 million active monthly users. The company works on a freemium, ad-supported model with the paid service Pandora Premium in direct competition with the Spotify offering.

Users can tune into existing genre stations or create their own stations. Pandora also incorporates social media features such as a thumbs up or thumbs down rating for music tracks and other listener metrics. Using this data, the platform is well suited to aspiring artists who want exposure to the right audience.

Unique to the platform is the proprietary Music Genome Project, which the company claims is the most detailed music analysis ever performed. To that end, Pandora employs a team of trained musicologists to analyze over 450 musical attributes and provide personalized recommendations to users.

YouTube MusicYouTube Music is a music streaming app and desktop product from YouTube. Free users can listen to music with ads while paid subscribers can access an audio-only mode to listen to a song without being distracted by the video.

YouTube Music is the successor to Google Play Music, so the platform retains the latter’s original music locker system and users can transfer their music libraries over with ease.

At $11.99 per month after a one-month free trial, YouTube Music is a little more expensive than its competitors. However, YouTube Premium users can access it for free.

QobuzQobuz is a French music streaming service founded in 2007 with a focus on delivering the best sound quality available. Qobuz offers 24-bit FLAC files up to 192 kHz, which makes the platform perfect for audiophiles and those who enjoy classical or jazz music.

Qobuz features more than 70 million tracks and 500,000 album reviews. There are three subscription plans to choose from, with the entry-level plan selling for $16.66/month.

Key takeaways:Spotify became a success because it was the first company to determine how to distribute music legally and compensate the music industry at the same time. Several competitors have emerged in recent years with more or less the same business model.Apple Music and Amazon Music are Spotify’s two largest competitors, with both companies leveraging their existing user bases and brand following.YouTube is another competitor with an existing user base – though its music platform is a little more expensive and is perhaps less developed than Spotify. Stalwart Pandora and French platform Qobuz are also Spotify competitors serving more niche markets.Read Next: Spotify Business Model, Apple Business Model, Amazon Business Model, YouTube Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Spotify Competitors appeared first on FourWeekMBA.

January 8, 2022

What happened to Apple Maps?

Apple Maps is a web mapping service created by Apple. The service was first launched in September 2012 on Apple devices where it replaced the default service Google Maps. The platform drew near-instant criticism from users and pundits alike, with The Guardian reporting in October of the same year that Apple Maps was the company’s $30 billion mistake. This sentiment was echoed by The New York Times reporter David Pogue, who noted that “Maps is an appalling first release. It may be the most embarrassing, least usable piece of software Apple has ever released.”

Google Maps partnershipIn 2007, Steve Jobs unveiled the first-ever iPhone to a captive audience. But he was also joined on stage by Google CEO Eric Schmidt, who announced that all Apple smartphones would feature Google Maps as the default mapping application.

The partnership was profitable for both companies initially, but it became more complicated when Google’s Android operating system started to gain traction. Android competed with iOS, which presented a quandary since Google Maps was effectively supporting the competition.

Google then asked Apple for access to iPhone user data to improve Google Maps, a request that did not sit well with Apple as a more conservative company that respected user privacy. In response, Google withheld several critical updates to Google Maps for iOS, giving the Android version an instant competitive advantage.

With the relationship between the two companies now acrimonious, Apple ended its partnership with Google despite having a year left to run on the contract.

Destined for failureA resentful and bitter Steve Jobs then rushed the development of Apple Maps which meant it was always destined to fail. Once the app was released, there were countless usability issues, including the inaccurate placement of famous landmarks, poor or inconsistent navigation, and lackluster search results.

As if that wasn’t enough, some locations were misspelled, given the wrong name, or omitted from the map entirely. Railway stations were either missing or shown as parks, and parks were sometimes labelled as airports. In Dubin, Northern Ireland, a public farm called “Airfield” was displayed in the app as an airport which authorities believed would be misleading for a pilot needing to make an emergency landing.

Navigational errors were perhaps the most concerning, however. In one instance, the app instructed drivers in Alaska to turn across an active runway at Fairbanks International Airport. In another, tourists in Australia were directed into the middle of a remote desert after requesting directions to Mildura – a city with a population of around 33,000 people.

In the wake of the app’s poor performance and similarly poor public image, Apple fired senior vice president of iOS software Scott Forstall after he refused to make a public apology. Richard Williamson, the overseer of the company’s mapping team, followed suit soon after.

Incoming CEO Tim Cook then suggested users switch to Bing Maps instead.

RejuvenationThe Apple Maps user experience has been much improved in recent years, with the company spending billions of dollars to make the app more becoming of the Apple brand.

Apple no longer relies on third-party mapping data from providers such as TomTom, which means the maps it provides are more accurate. The company collects data from users and a fleet of vehicles and drones that roam the streets of America and users praise the app for its 3D graphics and virtual flyover functionality.

Apple Maps is now integrated with the privacy-centric search engine DuckDuckGo in a not-so-subtle reference to the company’s ill-fated relationship with Google. While the company now has around 12% of the mobile map app market cornered, it is still a distant second to Google Maps with approximately 80%.

Key takeaways:Apple Maps is a web mapping service created by Apple. The service was first launched in September 2012 on Apple devices where it replaced the default service Google Maps.Apple Maps was borne out of a relationship with Google that turned sour. Enraged and resentful, Steve Jobs rushed the development and release of the app which meant it was plagued by usability issues. Many of these were deleterious to human health.Apple invested billions into the app with the appointment of Tim Cook, removing its dependence on third-party data providers, among other things. However, it is debatable as to whether Apple Maps can claw back any significant market share from Google Maps.More About Apple:

The Trillion Dollar Company: Apple Business Model In A NutshellApple Distribution: The Apple Store Is Not About Selling iPhonesRevisiting The Apple-NeXT Deal And Why It MatteredA Decade-Long Evolution Of Apple Sales By ProductsWho Owns Apple? How The Trillion Dollar Apple Inc. Has Changed HandsApple vs. Google Business Models In A NutshellMain Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Apple Maps? appeared first on FourWeekMBA.

What happened to Anki?

Anki was a start-up with a core focus on robotics and artificial intelligence. The company, which incorporated robotics technology into children’s toys, was founded by Boris Sofman, Mark Palatucci, and Hanns Tappeiner in 2010. The first product Anki released was a racing game called Anki Drive, where users raced toy cars not dissimilar to those from the Hot Wheels franchise with their smartphones. The company also released an interactive robot called Cozmo which was so sophisticated that it was used in robotics classes at Carnegie Mellon University. The robot was a hit with consumers too as it became the bestselling toy of 2017 on Amazon in the United States. After raising more than $200 million in funding with multiple successful products in the market, Anki declared bankruptcy in April 2019 leaving 200 employees without a job.

Product longevityThe buzz associated with the Anki brand started to diminish in 2018 as the company distanced itself from being known as a simple toy robotics company.

This was helped by Vector, a sophisticated robot Anki marketed as part of the family. While the technological prowess of Vector was undisputed, technology alone could not sustain the sales required to keep the company afloat.

Indeed, while Vector had a loveable personality and an impressive feature list, the novelty for children and adults wore off rather quickly. The most tragic aspect of Vector’s launch, however, was the fact that competitors such as Jibo and Mayfield Robotics had released similar products beforehand and failed spectacularly.

Economic and product mismanagementWith an annual turnover of $100 million in 2018 and millions more in the bank thanks to successive funding rounds, the cash management of the company was also questionable.

Anki was known to hire expensive talent from Dreamworks and Pixar to develop the software necessary for Cozmo. What’s more, the manufacturing process to produce these robots was complex and difficult to scale, which increased costs.

This meant the robots themselves were expensive to purchase. The Cozmo alone retailed for $180, which put it up against video game consoles that were slightly more expensive but offered so much more in terms of versatility.

The writing was on the wall when the company recapitalized in September 2018 after venture investor Marc Andreessen resigned from his director role. Recapitalization is a strategy that reconfigures a company’s financial structure to survive through a difficult economic period.

Failed funding and industry sentimentDespite rumors the company was a takeover target for the likes of Microsoft and Amazon, Anki encountered an obstacle it could not overcome in April 2019. Sofman announced that “a significant financial deal at a late stage fell through with a strategic investor and we were not able to reach an agreement.”

Some believe the deal fell through because of negative industry sentiment around social robots as a business model. This was caused by the technology not yet being at a level where robots could become meaningful members of a household.

Others believe the funding deal would require Anki to develop a standalone licensed robot in partnership with a well-known brand. Though a popular move with some toy companies, Anki was not interested in pursuing this path – perhaps because it was more interested in seeing its innovations and vision come to fruition.

Asset acquisitionEducational tech firm Digital Dream Labs purchased assets belonging to the defunct company in January 2020.

As part of the acquisition, CEO David Hanchar announced the company would use the assets to develop Vector and keep some aspects of the original company intact.

Key takeaways:Anki was a start-up with a core focus on robotics and artificial intelligence. The company declared bankruptcy in April 2019 leaving 200 employees without a job soon after reporting annual revenue of $100 million.Anki was to some extent ahead of its time. It had a grand vision for robots to become family members but the technology was not sufficiently advanced to make that dream a reality. As a result, the novelty of its expensive toys soon wore off.Several last-ditch efforts to secure funding failed for various reasons, but the specifics have never been disclosed. One possible explanation is that industry sentiment likely made venture capital firms reluctant to invest in social robotics.Read Next: Axie Infinity Business Model, Play-to-earn business model, Free-to-play business model, Epic Games, Fortnite, Play-to-earn business model, gaming industry.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Visual Concepts The play-to-earn model is a business model allowing gamers to farm or collect cryptocurrency and NFTs that can be sold on the market. This model has become a standard already in the “crypto gaming industry,” where the blockchain-based games enable token economics to kick in as an incentives mechanism at scale for users to play and be engaged.

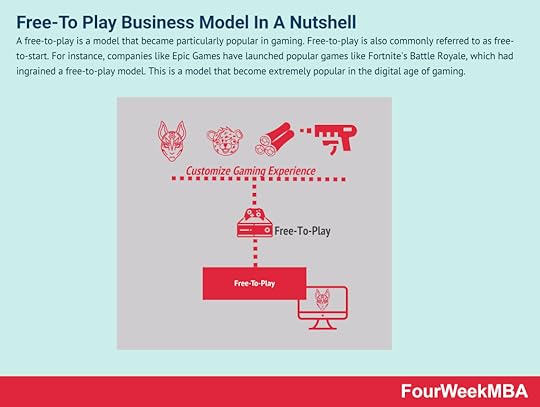

The play-to-earn model is a business model allowing gamers to farm or collect cryptocurrency and NFTs that can be sold on the market. This model has become a standard already in the “crypto gaming industry,” where the blockchain-based games enable token economics to kick in as an incentives mechanism at scale for users to play and be engaged. A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

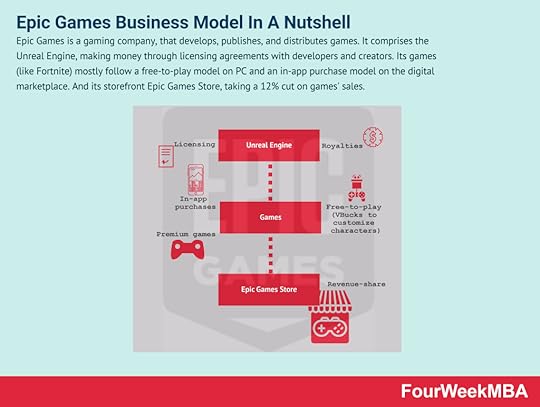

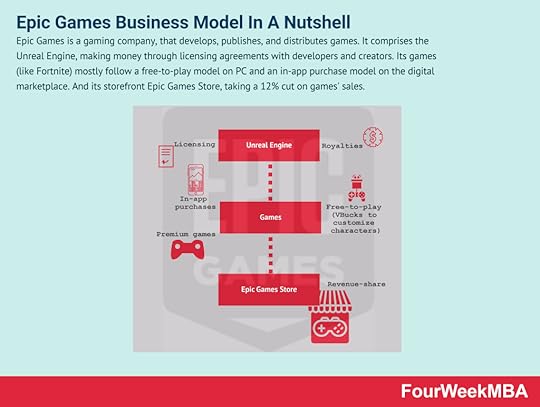

A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming. Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.

Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales. Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.

Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.The post What happened to Anki? appeared first on FourWeekMBA.

What happened to Cyberpunk 2077?

Cyberpunk 2077 is an action role-playing video game that was first released in December 2020. The game, which had been announced as early as 2012, was developed by Polish game studio CD Projekt. The game is set in a dystopian future where part-human, part-machine mercenaries carry out sabotage missions against evil corporations. The buzz around the release of Cyberpunk 2077 was incredible. The game attracted some 8 million pre-orders and actor Keanu Reeves was also cast as a main character. In the lead-up to its release, CD Projekt kept the game under wraps and only shared copies with select news outlets and gaming publications. Ultimately, Cyberpunk 2077 failed to match the significant expectations the company built over almost a decade. Let’s take a look at the story of what happened to the game below.

Internal conflict and hypeGame developers were concerned that the grand promises made by management would not be achievable. Indeed, the endlessly explorable world coupled with ultra-customizable characters meant the premise sold to gamers was far from becoming a reality.

The game was intended to be released in April 2019, but there were persistent rumors in Poland that the company was behind schedule. Several top executives departed around the same time, while many others took to the business review site Glassdoor to voice their frustrations. There, it was revealed that CD Projekt suffered from frequently missed deadlines, toxic workplace culture, incompetence, and a lack of planning.

Unsurprisingly, the release date was pushed back to January 2020. It was then delayed once again to September 2020 due to COVID-19 and then two more times to the end of the year after the company admitted it had a lot of bugs to fix.

Performance issuesAfter almost a decade of hype, Cyberpunk 2077 was released on December 10, 2020.

However, several performance issues were already evident. Artificial intelligence used in combat was anything but intelligent and random bugs blocked players out of missions. Furthermore, the mechanics were infantile and not what developers had initially promised. Users could not get their characters to perform basic tasks such as running, driving, or picking up weapons.

These issues attracted widespread public criticism, with consumers blaming investors for the rushed release and lamenting that the game was incompatible with older consoles. They also created social media videos on the multitude of sometimes hilarious glitches in the game, including tanks falling from the sky or cars exploding into flames for no apparent reason.

In response to the disaster, Sony and Microsoft offered full refunds, with the former making the drastic decision to remove the game from the PlayStation store.

Long employee hoursAround the same time, The Guardian also noted the irony of a game exploring the pitfalls of capitalism that was developed by a company forcing its employees to work 6 or 7-day weeks for more than a year.

While the so-called practice of “crunching” is common in the industry, CD Projekt co-founder Marcin Iwiński made specific mention of the fact that the company would be more “humane” than its competitors. In an interview with gamer website Kotaku, he explained that “We are known for treating gamers with respect. And I actually would [like] for us to also be known for treating developers with respect.”

However, the company later admitted it required employees to crunch for an extended period of time as the release date was pushed back on several occasions.

ImprovementsIn 2021, numerous updates were released to improve stability and performance. However, issues remain on certain platforms.

Cyberpunk 2077 reappeared in the PlayStation store in June 2021 and many are optimistic the game can realize its full potential. This potential was to some extent vindicated when the game won the “Outstanding Story-Rich Game” category at the 2021 Steam Awards.

Key takeaways:Cyberpunk 2077 is an action role-playing video game that was first released in December 2020. The game, which had been announced as early as 2012, was developed by Polish game studio CD Projekt.Cyberpunk 2077 was plagued with comical and not-so-comical performance issues, drawing widespread criticism from consumers and investors. Some publications questioned the contradiction between the game’s anti-capitalist themes and its tendency to force employees to work long hours.Numerous updates were made to Cyberpunk 2077 in 2021, but some issues remain. Nevertheless, the game was credited at the 2021 Steam Awards and has re-appeared in the PlayStation store.Read Next: Axie Infinity Business Model, Play-to-earn business model, Free-to-play business model, Epic Games, Fortnite, Play-to-earn business model, gaming industry.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Visual Concepts The play-to-earn model is a business model allowing gamers to farm or collect cryptocurrency and NFTs that can be sold on the market. This model has become a standard already in the “crypto gaming industry,” where the blockchain-based games enable token economics to kick in as an incentives mechanism at scale for users to play and be engaged.

The play-to-earn model is a business model allowing gamers to farm or collect cryptocurrency and NFTs that can be sold on the market. This model has become a standard already in the “crypto gaming industry,” where the blockchain-based games enable token economics to kick in as an incentives mechanism at scale for users to play and be engaged. A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

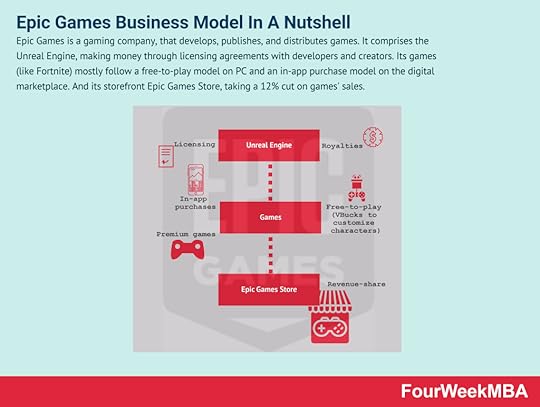

A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming. Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.

Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales. Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.

Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.The post What happened to Cyberpunk 2077? appeared first on FourWeekMBA.

What happened to Gaia Online?

Gaia Online is a social networking and forum-based website with an anime theme. The site was launched in February 2003 and was founded by Derek Liu, Long Vo, and Josh Gainsbrugh. Members of the community are called Gaians and each is represented by a custom avatar that can be used to communicate with others. Users also receive the currency Gaia Platinum as they post in the forum or participate in various other activities and contests. The currency is used to personalize individual avatars, homes, and cars, with members able to exchange real cash for Gaia Platinum if they want access to these perks more quickly. Just four years after launch, Gaia Online boasted 2 million monthly unique visitors and was one of the most popular social media websites on the internet. Success would relatively short-lived, however, as the platform started to neglect its core user base.

HyperinflationGaia Online operated an early iteration of a virtual economy. During the initial years of the platform, the Gaia Platinum in-game currency was called Gaia Gold.

The company was cognizant of introducing features that rewarded users with excessive amounts of gold that may cause inflation. It even made a promise to members that it would never allow anyone to purchase the gold with cash since it would cause inflation and give members with greater financial means an advantage on what was a mostly free platform.

When a new CEO and COO was appointed in 2013, Gaia Online ultimately reneged on its promise and introduced a gold generator to increase site revenue. For the small sum of 99 cents, users received a supposedly random amount of gold as a reward – though the amount received was almost always significant. Within just a few days, inflation and then hyperinflation set in with prices in the marketplace increasing many times over. In an attempt to keep up with rising inflation, the Gold Generator continued to run to allow members to afford marketplace items.

GamificationIn the space of a few short years, items in the marketplace that once sold for thousands of gold were now available for amounts in the billions. Gaia Platinum was then introduced to curb inflation, with 1 Platinum worth 10 million of the original Gaia Gold currency.

Many long-term members left the site in disgust, while others complained to site management who replied with the standard response that they would look into the matter.

Some then began looking into COO Jason Loia, discovering that he was an advocate of gamification and had made a presentation on how to get people addicted to online games. The COO, who was later dubbed “Goldemort”, left the company in December 2016 and the CEO followed suit thereafter.

The return of the co-founderGaia Online co-founder Derek Liu then returned to his former position at the company. He removed the gold generator immediately and made a promise to return the platform to some semblance of normality.

In hindsight, the damage had already been done. As noted earlier, hyperinflation had caused much of the user base to migrate to other sites such as a Facebook as forums as a form of social communication also started to wane in popularity. What’s more, the previous management had left Liu with almost no money to keep the site operational.

Gaia Online continues to operate today despite several failed attempts to increase the user base with new games and features.

Key takeaways:Gaia Online is a social networking and forum-based website with an anime theme. The site was launched in February 2003 and was founded by Derek Liu, Long Vo, and Josh Gainsbrugh.Gaia Online operated an early version of a virtual economy, where in-game currency could be exchanged to customize avatars, homes, and vehicles. The company carefully managed the economy to keep inflation in check, but a change in management saw hyperinflation set in.Gaia Online co-founder Derek Liu returned to his original role in late 2016 with the former CEO and COO leaving the company. While Liu made efforts to reduce inflation and attract users, the platform would never recapture the popularity it enjoyed in the early 2000s.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Gaia Online? appeared first on FourWeekMBA.

What happened to HQ Trivia?

HQ Trivia is a trivia video game first released in 2017 where users can win prize money by participating in live trivia games. The platform was founded by Colin Kroll and Rus Yusupov after they sold the social media platform Vine to Twitter. HQ Trivia was a near-instant success, with the mobile app boasting more than 700,000 players connected to a single trivia game in December that same year. While the platform was valued at $100 million in March 2018, users started to decline a few months later at an alarming rate. After just three years in operation, CEO Yusupov noted in a company memo that “lead investors are no longer willing to fund the company, and so effective today, HQ Trivia will cease operations and move to dissolution.”

Novelty factor and increased competitionThe game lost its novelty factor rather quickly because the company did not consider it important to introduce new features or make the game more exciting.

To some extent, the lack of innovation was facilitated by Yusupov who was a slow decision-maker and in some cases, avoided making decisions entirely. The game instead relied on increasing the cash prize to keep players interested, but this became difficult over time because the prize money had to be split between more and more winners.

Exacerbating the lack of novelty was the increase in the popularity of trivia as a business model. Two online competitors were launched around the same time as HQ Trivia and, to make matters worse, several American television studios also created their own apps.

LeadershipKroll and Yusupov also had a difficult time raising money because of Kroll’s time at Twitter where he was accused of indecent behavior toward women. Combined with Yusupov’s tendency to make slow decisions and his self-centered nature, this made the company vulnerable.

After Kroll died in December 2018, Yusupov was instituted as CEO where an employee petition to have him removed was soon passed around. The initiative ultimately failed, so many employees chose to resign instead. This further hindered the company’s ability to release new products or respond to technical issues.

Trivia host and platform stalwart Scott Rogowsky then resigned from his role to host a show about Major League Baseball. He left HQ Trivia with a few choice words about its leadership, noting on Twitter that it was “poisoned with a lethal cocktail of incompetence, arrogance, short-sightedness & sociopathic delusion.”

Technical issuesTrivia streams frequently lagged and many games had to be restarted from the beginning. Users became enraged after they were eliminated from games for no reason.

As early as 2018, software programs such as the HQ Trivia Assistant also started to become prevalent on the platform. These programs could answer questions with up to 90% accuracy which caused more people to win games and take an ever-smaller share of the prize money.

For example, there were more than 9,000 winners at the end of a game held in February 2018, with each winner receiving the paltry sum of 23 cents in prize money. What’s more, some reported having to wait three months for the funds to land in their accounts.

Revenue decreasesHQ Trivia initially generated millions in sponsorship revenue from the likes of Nike and Google. It even partnered with television stations such as NBC and CBS to promote their programs.

However, revenue declined because of the factors mentioned above. In response, the platform moved to a model where game winners were compensated with credits that could be redeemed for merchandise. It also made attempts to increase its user base by offering a Wheel of Fortune-themed game and one based on photo challenges.

ReincarnationIn February 2020, Yusupov stated that the company had run out of cash after a potential acquisition deal failed. Four days later, however, he noted that he had secured a deal to maintain the operation of the platform including the 25 staff that were recently made redundant.

On March 30, 2020, HQ Trivia once again held trivia competitions.

Key takeaways:HQ Trivia is a trivia video game first released in 2017 where users can win prize money by participating in live trivia games. The platform was founded by Colin Kroll and Rus Yusupov after they sold the social media platform Vine to Twitter.The novelty of HQ Trivia wore off quickly for consumers because leadership avoided introducing new features. The lack of novelty was exacerbated by new competitors and a style of leadership that did not favor decisive action.HQ Trivia was also beset with technical issues. Games frequently lagged and some players were eliminated from games for no reason. Automated software programs also reduced the legitimacy of the platform and decreased the amount of money a winning entrant could receive.Read Next: Free-to-play business model, Epic Games, Fortnite, Play-to-earn business model, gaming industry.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Visual Concepts A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming.

A free-to-play is a model that became particularly popular in gaming. Free-to-play is also commonly referred to as free-to-start. For instance, companies like Epic Games have launched popular games like Fortnite’s Battle Royale, which had ingrained a free-to-play model. This is a model that become extremely popular in the digital age of gaming. Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales.

Epic Games is a gaming company, that develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. Its games (like Fortnite) mostly follow a free-to-play model on PC and an in-app purchase model on the digital marketplace. And its storefront Epic Games Store, taking a 12% cut on games’ sales. Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.

Epic Games owns Fortnite; Tim Sweeney, co-founder, and CEO is the major shareholder, with more than 50% of the company. And Tencent with a stake of over 40% of the company. Epic Games develops, publishes, and distributes games. It comprises the Unreal Engine, making money through licensing agreements with developers and creators. While Fortnite primarily follows a free-to-play model with up-sells and digital in-app purchases.The post What happened to HQ Trivia? appeared first on FourWeekMBA.

What happened to MoviePass?

MoviePass was a subscription-based movie ticket service founded by Stacy Spikes, Hamet Watt, and Tony B. Casti in 2011. The service enabled consumers to purchase a certain number of movie tickets per month and then check in to the cinema using an app. In February 2018, the $9.95 per month service was available in 91% of all cinemas across the United States and the platform boasted over 2 million users. In September 2019, however, the platform was shut down with parent company Helios and Matheson Analytics filing for Chapter 7 bankruptcy protection in January 2020.

Unsustainable business modelThe business model of MoviePass was unsustainable from the moment the platform came into existence. In simple terms, the company served as an intermediary by purchasing movie tickets at list price and then selling them to consumers.

The co-founders hoped most customers would use the service less than others. This approach is known as the breakage model, where companies depend on unredeemed prepaid services as a revenue source. For example, fitness companies rely on some customers never using their gym membership to offset the cost of those who exercise regularly.

As it turned out, however, consumers were attracted by discounted movie tickets and used the service frequently. This meant the company was losing money on almost every customer it managed to attract.

Helios and Matheson acquisitionMoviePass was acquired by Helios and Matheson in 2017, a software distribution and consulting company listed on the NASDAQ. MoviePass CEO Mitch Lower then partnered with Helios and Matheson CEO Ted Farnsworth to set about securing some extra revenue streams.

Both believed the only way the company could survive was to attract more users to the platform and negotiate a commission on ticket sales with cinemas. To increase the user base, prices were reduced by more than 80% despite protestations from co-founder Stacy Spikes.

Though the company was losing even more money per customer, it nevertheless managed to attract another 1 million subscribers in just three months. MoviePass management was aware of the cash burn, but they wanted to sell the data from their extensive user base to other companies in the industry or use it as leverage in future deals.

Failed business diversificationMoviePass then expanded into three additional revenue streams:

Data monetization and advertising.MoviePass Ventures – a new division to acquire and release existing films with the help of a distributor.MoviePass Films – a new venture for the company to create and distribute its own films.Only the first revenue stream, data monetization, and advertising complemented the existing business model. But even it was not viable because the company could not sell the data at scale. In other words, no advertiser would pay for access to just over 200,000 subscribers spread across the U.S

MoviePass Ventures and MoviePass Films also failed because both ventures were outside the company’s area of expertise, and it showed. For example, the mob film Gotti was financed by MoviePass for $10 million but only earned $6 million at the box office. It would prove to be one of many critical and commercial failures.

Endless controversyThe company also seemed to be in a perpetual state of controversy.

Lowe once publicly boasted that MoviePass tracked the location of its users before backtracking after the inevitable response from consumers. Some consumers were also prohibited from watching certain films with little or no explanation provided and the app itself was prone to systemic crashes.

Poor customer service was also prevalent. Customers became irate because MoviePass was hesitant to refund their money, while others were upgraded to more expensive plans without their permission. These and other misleading practices attracted the attention of the FTC, who settled with MoviePass out of court for an undisclosed amount.

Helios and Matheson were also sued by investors and then by a group of Reddit consumers who initiated proceedings on not one but two occasions.

In the coup de grâce for MoviePass, the company was delisted from the NASDAQ in early 2019 after flooding the market with shares to keep it afloat. After losing 99% of its value, the platform was shut down for good in September 2019.

Key takeaways:MoviePass was a subscription-based movie ticket service founded by Stacy Spikes, Hamet Watt, and Tony B. Casti in 2011. The platform was initially popular – perhaps too popular – and was shut down in September 2019.MoviePass was doomed to failure from the moment it began operations. The company relied on the breakage model to drive revenue, but its movie tickets proved so popular that it made a loss on nearly every customer. MoviePass was also embroiled in a controversy that resulted in litigation from investors and consumers alike.Acquiring company Helios and Matheson set about introducing additional revenue streams such as advertising, data monetization, and film production and distribution. Data monetization was the only stream that complemented the existing business model but it was not viable because MoviePass had a relatively small audience.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to MoviePass? appeared first on FourWeekMBA.

January 6, 2022

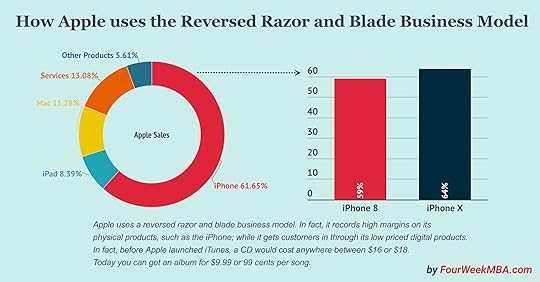

What Is the Razor and Blade Business Model? Apple’s Reversed Razor and Blade Strategy

The razor and blade business model is a strategy that relies on selling what is supposed to be the primary product at a low price or given away for free; while complementary goods get sold at high margins. For instance, Gillette’s razor would cost a few bucks. Instead, a set of blades will be 3-4 times more expensive. Companies like Apple, instead, follow a variation of that, called reverse razor and blade where the core product (the iPhone) is sold at wide premium, and the ancillary products/services (apps) are mostly free, or inexpensive.

https://fourweekmba.com/wp-content/uploads/2022/01/Razor_and_Blade_Strategy.mp4Apple and the reversed razor and blade business modelIf you ever bought an iPhone, you’re aware of the fact that it can cost as much like a computer. In fact, Apple rather than decrease its prices overtime is actually uses the opposite strategy. In fact, the latest confirmation of this strategy comes from the iPhone X, which has an even higher margin compared to the iPhone 8. As reported by reuters.com:

The iPhone X smartphone costs $357.50 to make and sells for $999, giving it a gross margin of 64 percent, according to TechInsights, a firm that tears down technology devices and analyzes the parts inside. The iPhone 8 sells for $699 and has a gross margin of 59 percent.

In short, In this case, the iPhone is the blade. What is the razor then? That is the iTunes or the set of digital products Apple made available through its store. In fact, when Apple launched iTunes, a CD would cost anywhere between $16 or $18. Today you can get an album for $9.99 or 99 cents per song.

In fact, as reported by billboard.com:

Steve Jobs “said to us, ‘There’re two things you have to accept: 99 cents for every single song, and every song has to be sold as a single.’ And we went home and swallowed hard because that was tough for us to accept for us as a music industry…. If certain songs were really popular we should be able to set the price at whatever we thought was the right price as opposed to the $1 price. Steve said, ‘You know, you’ve got to keep it simple, you’ve got to keep it clean.’”

Thomas Hesse: President, Corporate Development and New Businesses, Chief Digital Officer at Bertelsmann. He was Chief Strategy Officer for BMG Music Entertainment when the iTunes Music Store launched.

Understanding the razor-blade business model

The razor blade business model, also known as the razor-razorblade model, involves selling a product at a lower price to then selling a related product later for a profit. The razor and blade business model has been popularized by King C. Gillette, founder of safety razor company Gillette, which sold a durable razor at cost while selling disposable blades at a premium.

The razor blade business model, also known as the razor-razorblade model, involves selling a product at a lower price to then selling a related product later for a profit. The razor and blade business model has been popularized by King C. Gillette, founder of safety razor company Gillette, which sold a durable razor at cost while selling disposable blades at a premium.The razor blade business model, also known as the razor-razorblade model, involves selling a product at a lower price to then selling a related product later for a profit. The razor and blade business model has been popularized by King C. Gillette, founder of safety razor company Gillette, which sold a durable razor at cost while selling disposable blades at a premium.

The razor blade business model describes the strategic positioning of one product as free or complimentary to boost sales of a dependent product that generates revenue.

The model is often attributed to King C. Gillette, founder of safety razor company Gillette. The entrepreneur reasoned that if he could sell consumers a durable razor handle for very little, he could sell the disposable replacement blades at a premium price.

The company reaped the rewards of Gillette’s strategy since the expensive blades needed to be replaced constantly. What’s more, the consumer had no choice but to purchase them as they were the only blades that were compatible with the razor handle. The strategy was such a success that current owner Proctor & Gamble continues to use it today.

The razor-blade business model intends to avoid competition by offering a free or low-cost product in the first instance – even if the business must incur a loss. Once customer loyalty has been attained, the company has an easier time selling them more profitable products.

Note that the razor-blade model is similar to the freemium model, where digital products and services are offered for free under the expectation that a consumer will pay for features at some future point.

Companies utilizing the razor-blade business modelAside from razor blades themselves, there are many other brands in different industries utilizing this business model.

Let’s take a look at a few of these below:

Keurig – the company sells a range of single-serve coffee makers, with some available for less than $100. Where Keurig makes money is in the sale of coffee pods, with a 6-pack alone retailing for around $20. Microsoft, Nintendo, and Sony – these companies have almost always sold their video game consoles at close to cost price or less. The razor-blade model is prevalent in the industry because consoles require hardware updates and price cuts to ensure they remain relevant over long periods. The “blade” in this case is the video game itself. Hewlett Packard – HP has a wide range of printers, with some of the cheapest retailing for around the same cost as an ink refill. The company is counting on its customers having to constantly replace the toner cartridges to make moneyPotential limitations of the razor-blade business modelThe benefits of the razor-blade business model for businesses are well stated. But there do also exist some limitations:

Environmental costs – some companies using the model have been criticized for the amount of waste they generate. In today’s world, businesses are expected to be environmental stewards and those that are seen to be destructive will lose customers to their competitors. Coffee pod brands were banned in some workplaces because their compositional mix of plastic, metal and coffee grounds made them impossible to recycle.Brand resentment – some consumers also become resentful of the company for effectively forcing them to use a certain product. This feeling may be exacerbated by prices the consumer considers too expensive. For example, many consumers are bemused by the fact that the price of ink is comparable to the price of a printer.Outlay risk – brands who implement the razor-blade model always run the risk that they will not recoup their initial costs. If the business is heavily subsidizing the initial product, poor sales in the premium product may result in an overall loss.Competition – when a company sells its premium product with a higher margin, a competitor can offer the same product for less without incurring the expenses associated with developing the free or low-cost product.Key takeaways:The razor blade business model also known as the razor-razorblade model, involves selling a product at a lower price to then sell a related product later for a profit.The razor blade business model has been used by brands such as Keurig, Microsoft, Nintendo, Sony, and Hewlett Packard.The razor blade business model endeavors to reduce competition and enable consumers to try a product at a low cost before turning them into repeat buyers. However, the model has been associated with environmental concerns and brand resentment. There is also the risk that the premium product becomes unprofitable or a new competitor emerges.Other handpicked related business models:

How Does PayPal Make Money? The PayPal Mafia Business Model ExplainedHow Does WhatsApp Make Money? WhatsApp Business Model ExplainedHow Does Google Make Money? It’s Not Just Advertising! How Does Facebook Make Money? Facebook Hidden Revenue Business Model ExplainedMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessThe Google of China: Baidu Business Model In A NutshellAccenture Business Model In A Nutshell Salesforce: The Multi-Billion Dollar Subscription-Based CRMHow Does Twitter Make Money? Twitter Business Model In A NutshellHow Does DuckDuckGo Make Money? DuckDuckGo Business Model ExplainedHow Amazon Makes Money: Amazon Business Model in a NutshellHow Does Netflix Make Money? Netflix Business Model ExplainedBusiness resources:

The Ultimate Guide to Market SegmentationSuccessful Types of Business Models You Need to KnowThe Complete Guide To Business DevelopmentBusiness Strategy: Definition, Examples, And Case StudiesWhat Is a Business Model Canvas? Business Model Canvas ExplainedBlitzscaling Business Model Innovation Canvas In A NutshellWhat Is a Value Proposition? Value Proposition Canvas ExplainedWhat Is a Lean Startup Canvas? Lean Startup Canvas ExplainedMarketing Strategy: Definition, Types, And ExamplesMarketing vs. Sales: How to Use Sales Processes to Grow Your BusinessHow To Write A Mission StatementWhat is Growth Hacking?Growth Hacking Canvas: A Glance At The Tools To Generate Growth IdeasOther business models patterns:

Hidden revenue business modelOne-for-one business modelRazor and blade revenue modelCash conversion cycle or cash machine business modelPeer-to-peer business modelMulti-sided platform business modelDirect sales business modelFreemium business modelAffiliate marketing business modelSubscription business model(Management) consulting business modelAgency-based business modelVertically integrated supply chain business modelE-commerce marketplace business modelThe discount business model that focuses on high qualityAttention merchant business modelPrivacy as an innovative business modelThe most successful franchising business model in the worldOn-demand subscription-based business modelUser-generated content business modelThe educational niche business modelA mix of chain and franchise business modelInstant news business modelBlockchain-based business modelsMulti-brand business modelFamily-owned integrated business modelHumanist enterprise business modelDirect-to-consumers business modelEnterprise business model built on complex salesDistribution based business modelThe post What Is the Razor and Blade Business Model? Apple’s Reversed Razor and Blade Strategy appeared first on FourWeekMBA.

January 5, 2022

Poshmark Competitors

Poshmark is a social commerce marketplace where users can buy and sell new or used clothing. The company was founded in 2011 by Manish Chandra, Tracy Sun, Gautam Golwala, and Chetan Pungaliya. Poshmark is one of many companies looking to profit from the explosive growth in the second-hand clothing and resale industry, which is expected to be worth around $51 billion by 2023. Scores of women, in particular, are opting to sell their unwanted fashion items online instead of donating them to charity or thrift stores.

ThredUp ThredUp is an online sustainable fashion company founded by James Reinhart in 2009. Reinhart got the idea for ThredUp after realizing he had a closet full of clothes he did not want to wear and could not sell.ThredUp makes money by charging a commission on every piece of clothing sold on its platform. The exact commission depends on the listing price, which the company determines by analyzing the brand, size, seasonality, quality, and age of the item.ThredUp also charges customers a fee if they want to have their old clothing items processed by the company within a week.

ThredUp is an online sustainable fashion company founded by James Reinhart in 2009. Reinhart got the idea for ThredUp after realizing he had a closet full of clothes he did not want to wear and could not sell.ThredUp makes money by charging a commission on every piece of clothing sold on its platform. The exact commission depends on the listing price, which the company determines by analyzing the brand, size, seasonality, quality, and age of the item.ThredUp also charges customers a fee if they want to have their old clothing items processed by the company within a week.ThredUp is an online consignment and thrift store founded by James Reinhart in 2009.

The company claims it operates one of the largest online platforms for women’s and kids’ apparel, featuring over 35,000 brands from Gap to Gucci. To date, the company has processed over 100 million garments and has saved customers $3.3 billion off recommended retail price.

Sellers on the platform use a payout estimator to determine how much their unwanted clothes are worth. Unsold items can be returned to the seller or the company will recycle them.

Depop Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion.

Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion.Depop is a peer-to-peer social eCommerce company with a significant presence in the United States, United Kingdom, Australia, New Zealand, and Italy.

The vast majority of items sold on Depop are used, vintage, or repurposed clothing. The platform is modeled on Instagram, allowing users to post pictures to a profile page along with descriptions, product-specific hashtags, and prices.

Depop has a user base of 21 million with most under the age of 26. The platform is the 10th most visited shopping platform in the United States for Gen Z consumers.

Vinted Vinted is an online shopping marketplace with a strong secondhand component. The company makes money via its buyer protection service. The buyer pays a fee to Vinted in exchange for services like customer support, insurance, and tracked shipping; Shipping costs; Wardrobe Spotlight (helping users boost the visibility of their items). And Bumping listed items.

Vinted is an online shopping marketplace with a strong secondhand component. The company makes money via its buyer protection service. The buyer pays a fee to Vinted in exchange for services like customer support, insurance, and tracked shipping; Shipping costs; Wardrobe Spotlight (helping users boost the visibility of their items). And Bumping listed items.Vinted is an online marketplace allowing users to buy, sell, or exchange new and preloved clothing items and accessories. The company was founded in Lithuania by Milda Mitkute and Justas Jankauskas and now boasts a community of 45 million users around the world.

Vinted has a focus on sustainable, high-street brands such as Zara, New Look, and Boohoo. The app is simple to use and, unlike competitors, is free for sellers to list their items.

Vestiaire CollectiveVestiaire Collective is a pre-owned sustainable fashion platform founded by Maximillian Bittner in 2019. Since its inception, the company has encouraged users to get their high-end fashion items out of storage and back into circulation.

To that end, it uses a resale model with a curated catalog of designer brands such as Stella McCartney, Celine, and Isabel Marant. Each item is verified for authenticity and quality, with over 3,000 such items posted to the platform each day.

The company reached unicorn status in March 2021 after announcing a €178 million round of funding to contribute to app technology enhancements.

TradesyTradesy is an online resale marketplace for women’s fashion founded by Tracy DiNunzio in 2009. Although the company started as a platform where brides could buy and sell wedding dresses, Tradesy now offers a range of high and low-end fashion items and accessories.

For sellers, Tradesy offers a seamless fulfillment process. The company offers product image enhancement and a pre-paid shipping kit with branded packaging while also taking care of any product returns.

In the United States alone, Tradesy has over 7 million users saving up to 90% on luxury and designer clothing items.

Key takeaways:Poshmark is a social commerce marketplace where users can buy and sell new or used clothing. The company is one of many looking to profit from the explosive growth in the second-hand clothing and resale industry.Poshmark competitors include online consignment and thrift store ThredUp and peer-to-peer social eCommerce company Depop. Both have user bases in the tens of millions.Lithuanian platform Vinted has a significant global presence and allows sellers to list items for free. Vestiaire Collective is a recent addition to the list of Poshmark competitors, with over 3,000 luxury preloved items posted daily.Read Next: Poshmark Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Poshmark Competitors appeared first on FourWeekMBA.