Gennaro Cuofano's Blog, page 125

January 11, 2022

Wholesale Examples In A Nutshell

A wholesale business purchases goods in bulk from a supplier and then sells them to other merchants in smaller quantities. The wholesaler relies on economies of scale to make a profit. Most wholesale businesses do not sell to the end-user. However, two exceptions are commodities trader Trafigura and big-box retailer Costco. Sysco is the largest wholesale foodservice distributor in the United States while McKesson Corporation is the largest distributor of pharmaceutical drugs and various other healthcare products and technology.

IntroductionA wholesale business purchases goods in bulk from a supplier and then sells them to other merchants in smaller quantities. The wholesaler relies on economies of scale to receive a discount price from the manufacturer and then adds mark-up before selling to the merchant. Most merchants are not the end-user of the product, but as we will discover later, there are exceptions to this rule.

Wholesalers play an important role in the market. They maintain supply-demand equilibrium by storing goods until there is merchant demand. What’s more, a wholesaler is responsible for the distribution and transportation of goods from their warehouse and bears the risks associated with product shrinkage or fluctuations in demand.

The rest of this article will be devoted to discussing some specific wholesale business examples.

Costco With a substantial part of its business focused on selling merchandise at the low profit-margin, Costco also has about fifty million members that each year guarantee to the company over $2.8 billion in steady income at high-profit margins. Costco uses a single-step distribution strategy to sell its inventory.

With a substantial part of its business focused on selling merchandise at the low profit-margin, Costco also has about fifty million members that each year guarantee to the company over $2.8 billion in steady income at high-profit margins. Costco uses a single-step distribution strategy to sell its inventory.Costco, also known as Costco Wholesale Corporation, is an American multinational big-box retail chain founded by James Sinegal, Jeffrey Brotman, Sol Price, and Robert Price in 1976.

Costco is a membership-only warehouse that requires consumers to purchase a membership before they can shop. The company is somewhat unusual in that it is a retailer and a wholesaler at the same time. In other words, Costco purchases wholesale products from the manufacturer and sells them to the end-user. However, the company also sells the same goods to other businesses under a more traditional wholesale business model.

TrafiguraTrafigura is a Singaporean commodity wholesaler that was established in 1993. The company sources raw commodities from miners and fossil fuel producers and, like Costco, supplies end-users which include power plants, construction companies, and state governments.

Despite only existing for approximately 30 years, Trafigura is the largest private metals trader in the world with total revenue for 2021 of $231.3 billion.

SyscoSysco Corporation is an American multinational involved in the wholesale distribution of kitchen equipment, food products, and tabletop items to restaurants, schools, and health facilities. The company also distributes products to hotels and other food services companies such as Sodexo and Aramark.

Sysco is the largest wholesale foodservice distributor in the United States with over 600,000 clients in 90 countries.

Toyota TsushoToyota Tsusho is a trading arm of the Toyota Group of companies. The corporation’s primary function is to support Toyota’s automotive division and supply other vehicle manufacturers with wholesale parts.

However, Toyota Tsusho is a vast company with additional interests in metals, machinery, energy, chemicals, electronics, food and customer service, and logistics.

McKesson CorporationMcKesson Corporation is the largest distributor of pharmaceutical drugs, healthcare technology, care management devices, and medical supplies in North America.

The corporation distributes 33% of all pharmaceuticals across the continent with the company reporting full-year revenue of $238.2 billion in May 2021.

Read Next: Wholesale Business Model.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Case StudiesRead Also: Costco Business Model

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55%, and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more.

Costco runs a high-quality, low-priced business model powered by its memberships that draw customers’ loyalty and repeat purchases. Top institutional investors comprise The Vanguard Group, with 8.55%, and BlackRock with 5.39%. Top individual shareholders comprise Craig Jelinek, Charles T. Munger (Warren Buffet partner and co-owner of Berkshire Hathaway), James Murphy, and more.Read Also: Marketplace Business Models

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.Read Also: Food-Delivery Business Models

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer.

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer.The post Wholesale Examples In A Nutshell appeared first on FourWeekMBA.

What Is A Prototype? Prototyping In A Nutshell

A prototype is a sample version or simulation of a product that is used to evaluate a process or concept. The intention of creating a prototype is to test and validate ideas before they are communicated to stakeholders and ultimately, the product development team. Prototypes can be as simple as a storyboard sketch drawn on paper that captures the user experience or as detailed as a full-scale mock-up.

What makes up a prototype?A fundamental reason for developing prototypes is their ability to pinpoint and solve user experience issues. Indeed, the involvement of end-users in the process allows UX teams to optimize the user experience as the product takes shape. This ensures that solutions can be implemented as required, which allows the company to avoid expensive last-minute fixes.

Prototypes must possess four core characteristics:

Interactivity – this describes the degree of functionality that is open to the user. For example, it may be fully functional, partially functional, or view-only. Good prototypes should also be able to carry out the functions of the product itself.Precision – a good prototype should have a precise shape, size, or material quantity. Precision is expressed as either low-fidelity (process simulations) or high-fidelity (realistic, working simulations).Representation – the prototype should also be a good representation of the design, not only in terms of appearance but also in the way the product works. Evolution (improvisation) – this describes the entire lifecycle of the prototype. Some are created and tested before being discarded and replaced with an improved iteration. Other prototypes may be created and successively improved upon over time to form the end product. The best prototypes are improvised with the least amount of effort.How does prototyping work?While exact procedures will vary from one organization to the next, there are three general steps to prototyping. These are discussed below:

Prototype – the team starts by building a visual and functional prototype based on requirements set forth by the client. User experience and design best practices are both considered at this stage.Review – here, the developers share the prototype with their teams and evaluate it according to how well it satisfies the needs of the client. The prototype is then shared with the client who may provide additional feedback to the team’s initial evaluation.Refine – when feedback is provided, the developers can then set about improving or refining various aspects of the prototype.Note that there is a common misconception that the process only needs to be completed once or twice and at the end of the design process. Depending on the complexity of the design, the team may be required to cycle through four or five prototyping sessions or continue to iterate until all stakeholders are satisfied.

Key takeaways:A prototype is a sample version or simulation of a product that is used to evaluate a process or concept. Prototypes help teams pinpoint and solve user experience issues earlier in the process and avoid expensive fixes later on.A prototype possesses four main characteristics: interactivity, precision, representation, and evolution (improvisation).Prototyping involves a three-step process where teams develop a prototype, seek client feedback, and then refine the prototype according to that feedback. The process should be repeated multiple times, particularly for more complex products.Connected Business Frameworks Product development, known as the new product development process comprises a set of steps that go from idea generation to post-launch review, which help companies analyze the various aspects of launching new products and bringing them to market. It comprises idea generation, screening, testing; business case analysis, product development, test marketing, commercialization, and post-launch review.

Product development, known as the new product development process comprises a set of steps that go from idea generation to post-launch review, which help companies analyze the various aspects of launching new products and bringing them to market. It comprises idea generation, screening, testing; business case analysis, product development, test marketing, commercialization, and post-launch review. The term “user experience” was coined by researcher Dr. Donald Norman who said that “no product is an island. A product is more than the product. It is a cohesive, integrated set of experiences. Think through all of the stages of a product or service – from initial intentions through final reflections, from first usage to help, service, and maintenance. Make them all work together seamlessly.” User experience design is a process that design teams use to create products that are useful and relevant to consumers.

The term “user experience” was coined by researcher Dr. Donald Norman who said that “no product is an island. A product is more than the product. It is a cohesive, integrated set of experiences. Think through all of the stages of a product or service – from initial intentions through final reflections, from first usage to help, service, and maintenance. Make them all work together seamlessly.” User experience design is a process that design teams use to create products that are useful and relevant to consumers. A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives.

A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives. Empathy mapping is a visual representation of knowledge regarding user behavior and attitudes. An empathy map can be built by defining the scope, purpose to gain user insights, and for each action, add a sticky note, summarize the findings. Expand the plan and revise.

Empathy mapping is a visual representation of knowledge regarding user behavior and attitudes. An empathy map can be built by defining the scope, purpose to gain user insights, and for each action, add a sticky note, summarize the findings. Expand the plan and revise. Perceptual mapping is the visual representation of consumer perceptions of brands, products, services, and organizations as a whole. Indeed, perceptual mapping asks consumers to place competing products relative to one another on a graph to assess how they perform with respect to each other in terms of perception.

Perceptual mapping is the visual representation of consumer perceptions of brands, products, services, and organizations as a whole. Indeed, perceptual mapping asks consumers to place competing products relative to one another on a graph to assess how they perform with respect to each other in terms of perception. Value stream mapping uses flowcharts to analyze and then improve on the delivery of products and services. Value stream mapping (VSM) is based on the concept of value streams – which are a series of sequential steps that explain how a product or service is delivered to consumers.

Value stream mapping uses flowcharts to analyze and then improve on the delivery of products and services. Value stream mapping (VSM) is based on the concept of value streams – which are a series of sequential steps that explain how a product or service is delivered to consumers. Prioritization plays a crucial role in every business. In an ideal world, businesses have enough time and resources to complete every task within a project satisfactorily. The MoSCoW method is a task prioritization framework. It is most effective in situations where many tasks must be prioritized into an actionable to-do list. The framework is based on four main categories that give it the name: Must have (M), Should have (S), Could have (C), and Won’t have (W).

Prioritization plays a crucial role in every business. In an ideal world, businesses have enough time and resources to complete every task within a project satisfactorily. The MoSCoW method is a task prioritization framework. It is most effective in situations where many tasks must be prioritized into an actionable to-do list. The framework is based on four main categories that give it the name: Must have (M), Should have (S), Could have (C), and Won’t have (W). The scaled agile framework (SAFe) helps larger organizations manage the challenges they face when practicing agile. The scaled agile framework was first introduced in 2011 by software industry guru Dean Leffingwell in his book Agile Software Requirements. The framework details a set of workflow patterns for implementing agile practices at an enterprise scale. This is achieved by guiding roles and responsibilities, planning and managing work, and establishing certain values that large organizations must uphold.

The scaled agile framework (SAFe) helps larger organizations manage the challenges they face when practicing agile. The scaled agile framework was first introduced in 2011 by software industry guru Dean Leffingwell in his book Agile Software Requirements. The framework details a set of workflow patterns for implementing agile practices at an enterprise scale. This is achieved by guiding roles and responsibilities, planning and managing work, and establishing certain values that large organizations must uphold. Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy.

Kanban is a lean manufacturing framework first developed by Toyota in the late 1940s. The Kanban framework is a means of visualizing work as it moves through identifying potential bottlenecks. It does that through a process called just-in-time (JIT) manufacturing to optimize engineering processes, speed up manufacturing products, and improve the go-to-market strategy. As pointed out by Eric Ries, a minimum viable product is that version of a new product that allows a team to collect the maximum amount of validated learning about customers with the least effort through a cycle of build, measure, learn; that is the foundation of the lean startup methodology.

As pointed out by Eric Ries, a minimum viable product is that version of a new product that allows a team to collect the maximum amount of validated learning about customers with the least effort through a cycle of build, measure, learn; that is the foundation of the lean startup methodology. A leaner MVP is the evolution of the MPV approach. Where the market risk is validated before anything else.

A leaner MVP is the evolution of the MPV approach. Where the market risk is validated before anything else.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is A Prototype? Prototyping In A Nutshell appeared first on FourWeekMBA.

Integrated Marketing Communication In A Nutshell

Integrated marketing communication (IMC) is an approach used by businesses to coordinate and brand their communication strategies. Integrated marketing communication takes separate marketing functions and combines them into one, interconnected approach with a core brand message that is consistent across various channels. These encompass owned, earned, and paid media. Integrated marketing communication has been used to great effect by companies such as Snapchat, Snickers, and Domino’s.

Understanding integrated marketing communicationIntegrated marketing communication (IMC) is an approach used by businesses to coordinate and brand their communication strategies.

Once upon a time, brands transmitted information to broad and somewhat untargeted sections of the population via television and radio. Marketing campaigns were very much a one-way affair, with products and services advertised to consumers with little consideration for their particular needs or wants.

The term “integrated marketing communication” was coined in 1989 as businesses started to realize that a unified brand message across multiple platforms would reinforce the brand itself. There was also a realization that other forms of advertising were more cost-effective and essential to facilitating growth.

Integrated marketing communication is a strategic approach to marketing integration. It takes separate marketing functions and combines them into one, interconnected approach with a core brand message that is consistent across various channels. To that end, IMC can be used to create clear and consistent communication across:

Owned media – customer service, direct messaging, social media, and user experience.Paid media – direct marketing and offline or programmatic advertising.Earned media – organic search (content marketing), public relations, and social media influencer outreach.Integrated marketing communication examplesTo better understand how a brand message may be unified and made more consistent, let’s take a look at a few real-world examples.

Domino’s AnyWare campaignDomino’s realized that when its customers were hungry, they desired a simple pizza ordering process where they could avoid having to select from an exhaustive list of toppings or repeatedly be required to enter their credit card information.

To streamline the process, the Domino’s AnyWare campaign created a zero-click order process with pizza profiles for each customer and their favorite orders saved in the system. To make ordering pizza even more convenient, consumers can now order from multiple platforms including Messenger, Slack, Google Home, and Alexa.

SnickersChocolate bar manufacturer Snickers launched the “You’re not you when you’re hungry” advertising campaign with celebrity cameos depicting how an ordinary person would turn into someone else when they were hungry.

The campaign launched on television and then spread to print advertisements, social media, and the product itself, where words such as “savage” and “hangry” occupied the space where the normal label would be. After a 2015 Superbowl ad featuring celebrities such as Danny Trejo and Steve Buscemi, there was an 18,000% increase in YouTube searches for Snickers chocolate bars.

SnapchatThe social media app Snapchat released a line of glasses in 2016 that allowed users to take photographs or create videos and upload them to a mobile device via Bluetooth.

To create buzz around the product, the company engaged in a marketing campaign where vending machines known as “Snapbots” were installed in select cities around the world. Each machine sold glasses for $129.99 and became a place where fans could converse about the product while they waited in line.

Snapchat cleverly used integrated marketing communication to blend a physical vending machine with its digital app. The company attracted more attention to the product than if it had used the app in isolation and, through word of mouth, created a positive feedback loop where social media buzz built on itself as more consumers wanted a piece of the action.

Types Of Marketing Connected To Integrated Marketing Strategy Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

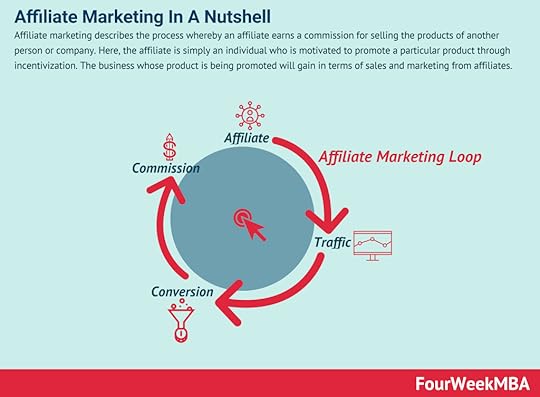

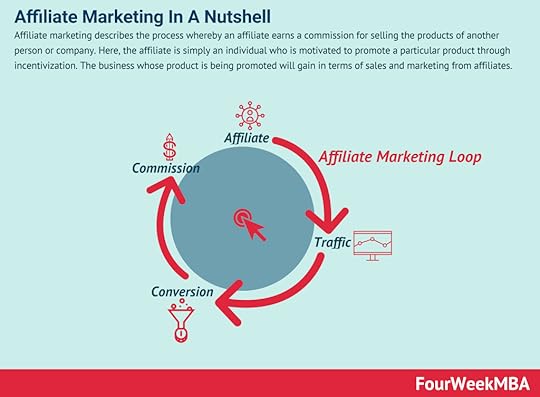

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

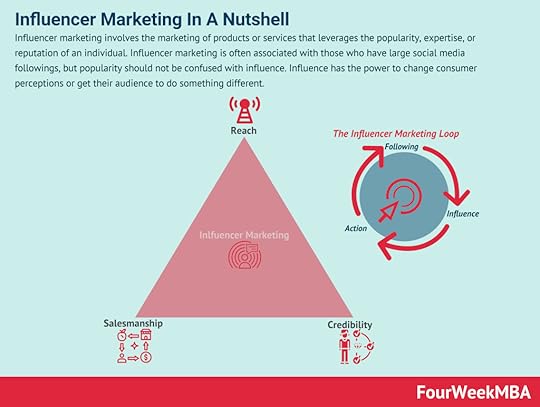

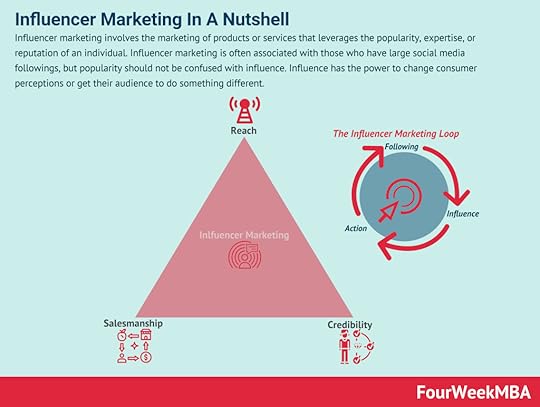

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

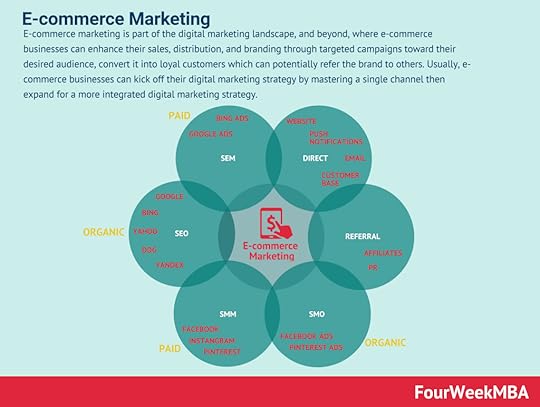

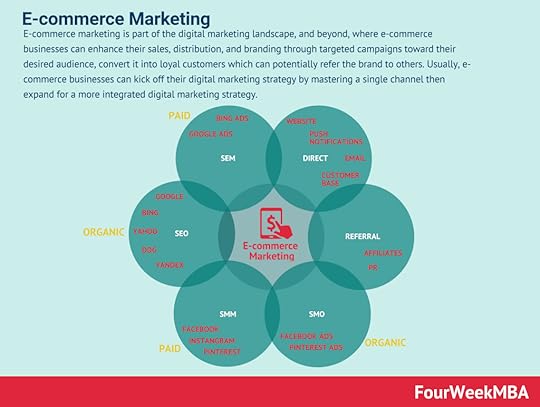

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

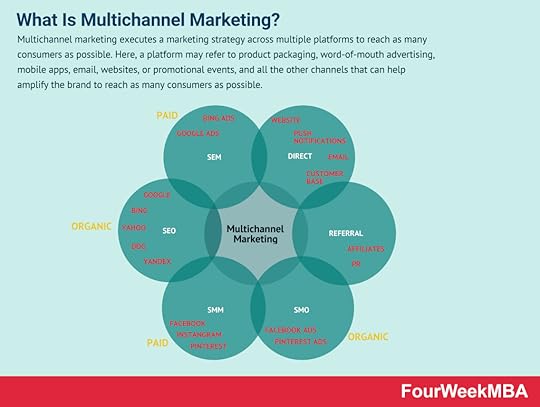

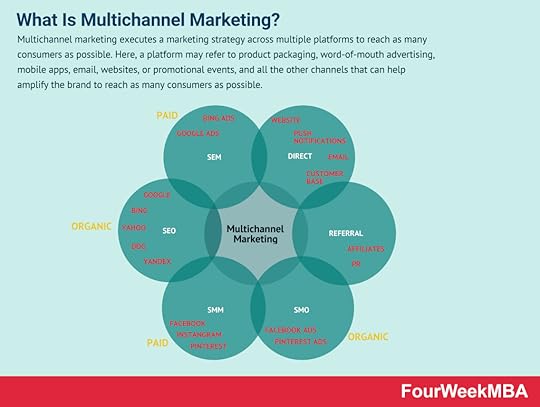

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

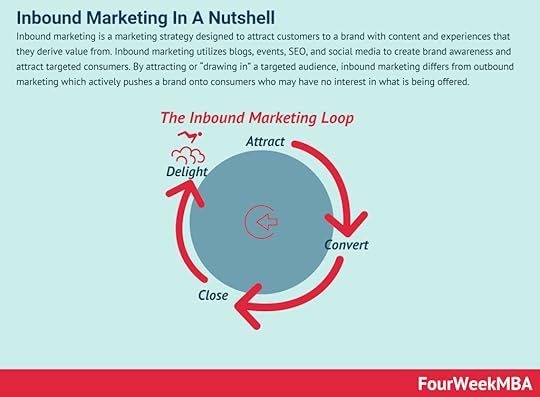

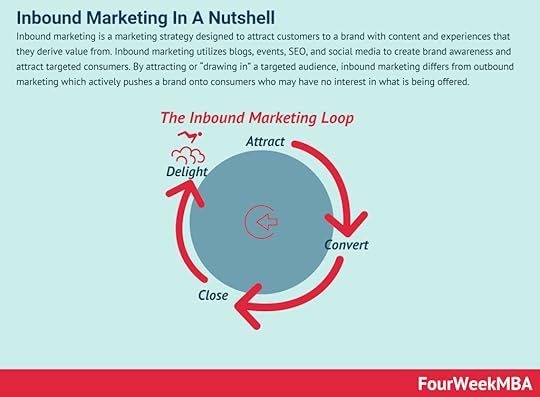

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

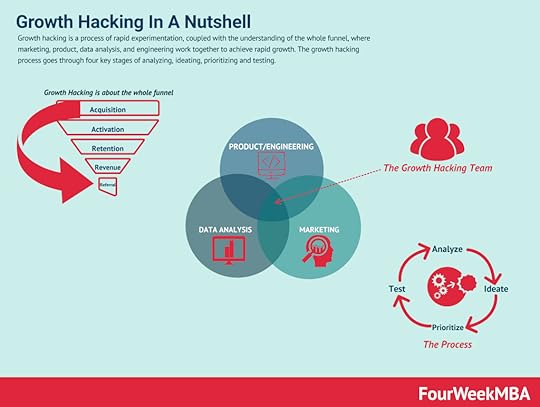

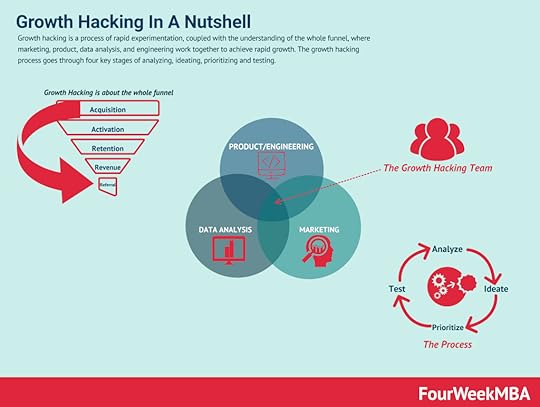

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

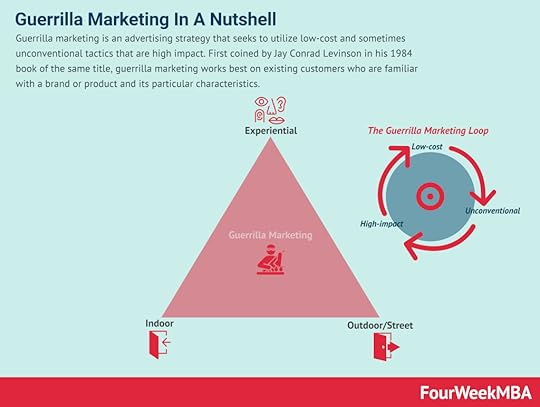

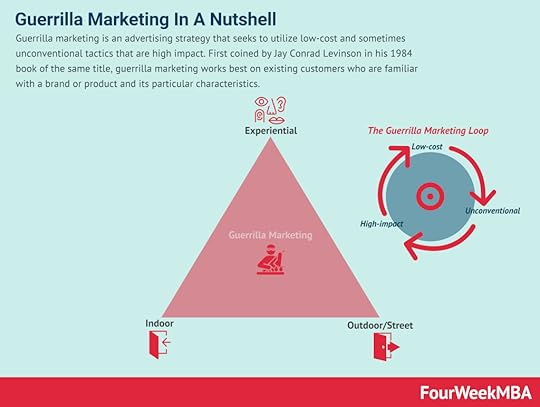

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

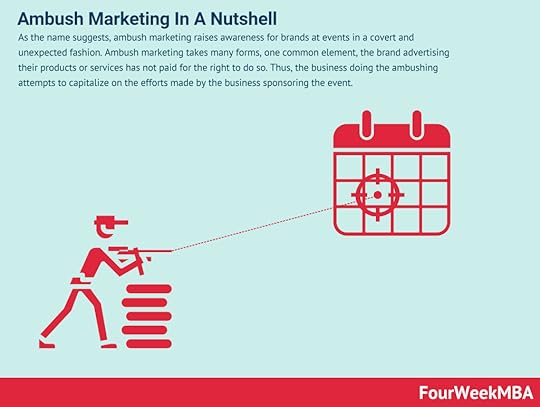

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Integrated Marketing Communication In A Nutshell appeared first on FourWeekMBA.

What Is Brand Recall? Brand Recall In A Nutshell

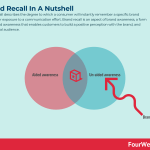

Brand recall describes the degree to which a consumer will instantly remember a specific brand name after exposure to a communication effort. Brand recall is an aspect of brand awareness, a form of un-aided awareness that enables customers to build a positive perception with the brand, and build a loyal audience.

Understanding brand recallIn world markets characterized by extreme competition, there are few things more valuable to a business than the space it occupies at the front of a consumer’s mind.

Brand recall is an aspect of brand awareness, though the two terms are sometimes used interchangeably. There are two different types of brand awareness:

Aided awareness – where the consumer remembers a company with the aid of a clue, andUn-aided awareness – where the consumer remembers a company in association with a particular industry or product. This is sometimes called top of mind awareness.In essence, brand recall is a form of un-aided awareness that dictates how consumers think and feel about a specific brand. Brand recall strategies focus on creating positive associations between the company and the consumer, with the primary intention to build an audience of loyal customer advocates.

How is brand recall calculated?Brand recall can simply be calculated as the percentage of individuals that can recollect a brand.

To arrive at the brand recall value, the number of participants able to recall a brand is divided by the total number of participants in a study and multiplied by 100. As a general rule, any score above 50% is considered desirable.

Data is collected from surveys or focus groups with written questions – but some businesses may also choose to use visual or auditory cues.

How can businesses increase brand recall?Most experts agree that a memorable brand has to be consistent, defined, and differentiated. To encapsulate these qualities, it is useful to write a brand manifesto that declares the views, intentions, and motives of the brand.

Then, it is a matter of following these guidelines:

Create a memorable logoThe most effective logos are clean, simple, and evoke certain emotions. They must also be consistent in appearance across various channels.

Color considerationColor is a core driver of brand recall, with different colors also responsible for evoking a wide gamut of emotions. The chosen color(s) should match the nature of the business. For example, consumers associate environmental companies with shades of green.

Create a memorable brand nameIt stands to reason that the brand names consumers recall most often are short, simple, and easily spelled or pronounced. The holy grail for a business is when its brand name becomes a verb and enters everyday language. Examples include Uber, Google, Xerox, PayPal, and Photoshop.

Create a powerful unique selling proposition – what can the business offer the consumer that they can’t get anywhere else? Coca-Cola devotees understand that other companies offer comparable soda, but it is only Coca-Cola that they associate with fun and happy experiences they can share with friends.

Brand recall examplesWhile we cannot speak for everyone, there are a few brands in existence that are easily recalled by the majority of consumers. When an individual heads to the store to purchase soda, for example, there is a reasonable likelihood that Coca-Cola or Pepsi will be the brand they recall.

Here are some more examples:

Luxury vehicles – BMW, Mercedes, Rolls Royce, and Audi.Technology – Apple, Google, and Samsung.Sportswear – Nike, Under Armour, and Adidas.Key takeaways:Brand recall describes the degree to which a consumer will instantly remember a specific brand name after exposure to a communication effort.Brand recall data is collected via surveys and focus groups with a range of written, auditory, and visual cues. Brand recall itself is expressed as a percentage, with any score above 50% considered desirable.Businesses can increase brand recall by creating a memorable logo and brand name and ensuring their unique selling proposition is truly unique. They should also consider their colors carefully to ensure consumers make the right association with their brand. Types Of Marketing Connected To Brand Recall Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Brand Recall? Brand Recall In A Nutshell appeared first on FourWeekMBA.

How does Zubie make money?

Zubie is a connected-car app and service for business and rental vehicle fleets. The app was founded in 2012 as a joint venture between retailer Best Buy and mobile-centric venture firm OpenAir Equity Partners.

Zubie is ostensibly the brainchild of Best Buy, who believed in the idea of a connected car at a time when the internet was transitioning from desktop to mobile and it seemed that almost every other device had internet connectivity as standard. The company tried to develop the technology and IP behind Zubie but failed for various reasons, with a lack of funding cited as one reason.

Venture capitalist Tim Kelly then got involved in the project through his connection with OpenAir Equity Partners, with both companies pitching the thesis of a connected car to the investor in the hopes that he would develop the technology and take the company forward. Sold on the idea, Kelly was ultimately appointed CEO.

Zubie had to raise a substantial sum of money in developing a prototype. This process was difficult to initially, but after 20 or 30 meetings with venture capital firms, the company secured a large commitment from BP Ventures and home cable provider Comporium. BP was particularly interested in how automotive data could be used to time engine oil changes and better understand customer demographics across its numerous gas stations.

Zubie manufactures a hardware dongle that allows customers and businesses to add their vehicles to the Internet of Things (IoT). The dongle can provide basic information detailing how long a trip took or the amount of fuel used. However, it can also track driving habits, mapping areas where the driver engaged in rapid acceleration, hard braking, and speeding. If that wasn’t enough, Zubie also analyses important vehicle diagnostics and can identify potential engine problems ahead of time.

In more recent years, the Zubie product has expanded into providing custom telematics and data services for insurance carriers, vehicle rental fleets and automotive dealerships, service centers, and manufacturers. Revenue is estimated at $3.6 million per year, with some of the company’s major clients including Hertz, Budget, Toyota, Nissan, and Avis.

Zubie revenue generationZubie makes money by selling three core products: Zubie Asset Trak, Zubie Rental Connect, and Zubie Fleet Connect. The company also likely makes money from partnerships with insurance companies.

Let’s take a look at these in more detail.

Zubie Asset TrakZubie Asset Trak is a fleet and equipment management platform for a range of vehicles, including fork trucks, generators, packers, skid steers, and even cleaning equipment.

Asset Trak can recover lost or stolen assets, provide device tamper alerts, and send notifications when a vehicle moves with motion monitoring and custom geofences.

The device itself, which costs $99, is a rechargeable battery-powered device smaller than a deck of playing cards.

There are three funding options here based on the length of annual commitment:

One-year subscription ($16/month or $175/year).Two-year subscription ($15/month or $162.50/year).Three-year subscription ($14/month or $152/year).For either option, there is a 30-day free trial.

Zubie Rental ConnectZubie Rental Connect is a car rental fleet management platform helping companies manage their inventory intelligently and efficiently.

Here, there are two plans:

Standard – with features such as live map, geofence alerts, trip history, real-time fuel and odometer readings, inventory insight reports, and engine and battery alerts.Premium – with all Standard features plus device tampering alerts, automated check-in, hazardous driving alerts, and a dashcam for shuttle buses.Prices for both plans are available on request. It can be assumed prices depend on the number of vehicles in a customer’s rental fleet.

Zubie Fleet ConnectZubie Fleet Connect helps a business protect and optimize its vehicle fleet with a single device connected to the company’s software platform. The solution is ideal for vehicles in the construction, home services, and transportation industries.

There are three plans available here, with businesses able to receive a discount on their monthly bill if they commit to two or three years:

Light ($18/month) – for easy GPS tracking with real-time location updates provided every 5 minutes and trip history logs retained for 6 months.Standard ($22/month) – a driver and vehicle performance product with location updates every 3 minutes and trip history logs retained for 13 months. Standard users can also purchase a dashcam for $399 plus $10/month.Premium ($27/month) – a comprehensive fleet management system with locational updates provided in less than 60-second intervals and trip history logs retained for 2 years. Premium users have access to the Zubie API which allows them to synchronize fleet assets or incorporate trip or event data into their business workflows.Insurance company partnershipsZubie also helps insurance companies roll out usage-based insurance (UBI) programs through simple and efficient telematics deployment. These programs feature high-quality data, reliable cell coverage, and scalable cloud analytics.

Businesses can also acquire or retain customers via branded devices and a fully customizable user experience across mobile, web, and email. Perhaps most importantly, Zubie UBI programs help a business engage with its clients to make driving easier and safer.

Though not officially disclosed, it can be assumed Zubie charges for this deployment service.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How does Zubie make money? appeared first on FourWeekMBA.

Gymshark Business Model In A Nutshell

Gymshark is a British fitness apparel and accessories company founded by Ben Francis and Lewis Morgan in 2012.

Gymshark began with Francis and Morgan drop shipping body-building supplements online. The following year, Francis began designing and manufacturing a line of fitness apparel in his garage with a meager £1,000 in savings.

The apparel was an instant success, with Gymshark stock selling out on the first day of a fitness trade show in Birmingham. The company was also able to make several important contacts with industry icons to help spread awareness of the Gymshark brand.

In 2016, Francis and Morgan left university to focus on the business full time as revenue surpassed £250,000. Revenue then surpassed £100 million as the company moved into a new headquarters and opened an office in Hong Kong.

Today, Gymshark is worth around $1.45 billion – with products sold to consumers in 180 countries.

Understanding the Gymshark business modelTo at least partly explain the meteoric rise of Gymshark, let’s now take a look at its business model in terms of products, marketing, expenses, and operating profit.

Product rangeGymshark sells a diverse range of men’s and women’s fitness apparel, including crop tops, bottoms, leggings, hoodies, jackets, shorts, underwear, sports bras, tank tops, and t-shirts. The company also sells accessories such as bottles, bags, headwear, socks, and equipment.

MarketingThe popularity of Gymshark apparel is largely due to the company’s marketing strategy.

Gymshark was one of the first companies to employ influencer marketing, donating its products to weight lifting and gym influencers on YouTube and Facebook. Importantly, the company also championed lesser-known individuals to insert itself into the burgeoning gym culture.

This culture is reinforced whenever a consumer makes a purchase, with Gymshark sending a message welcoming them to the Gymshark family of like-minded individuals striving toward common goals. What’s more, the company regularly hosts various events in cities across the world where fans can meet famous athletes and apparel designers.

By making fan interaction a priority, Gymshark has built a strong and loyal following in what is an ultra-competitive market.

ExpensesGymshark works on the direct-to-consumer (DTC) model. The company does not operate physical stores, instead preferring to ship items directly to consumers.

Under the DTC model, the biggest expenses are distribution and customer service costs. Without traditional retailers dealing with customer support and fulfillment, the company must wear these costs instead.

Operating profitGymshark has remained profitable as it has scaled, which is rare when compared to its peers. To some extent this is due to the direct-to-consumer model, which has allowed the company to remain unaffected by COVID-19 store closures.

Between 2014 and 2019, operating profit sat comfortably in the range of 9-20%. Pre-tax profit for the year to July 2020 was also healthy at £30.5 million.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Gymshark Business Model In A Nutshell appeared first on FourWeekMBA.

Monopoly Examples In A Nutshell

A monopoly is a market structure characterized by the presence of a single, dominant individual or enterprise that is the sole supplier of a product or service. Monopolies are associated with a lack of competition and an absence of viable product substitutes. As a consequence, the company can sell products and services at prices that result in substantial profits.

These market conditions can arise by themselves or be instituted by the government to build infrastructure or encourage economic growth. Vertical integration can also encourage a monopoly to form. In short, this occurs when the supply chain of a company is integrated with and owned by that company.

Not all monopolies are illegal, with many businesses cornering the market simply because they offer a superior product. A firm will only attract the attention of regulators if it attained monopoly status via predatory or exclusionary conduct.

With that said, let’s take look at some of the many historic and modern monopoly examples.

Standard OilStandard Oil was an American producer, transporter, and refiner of oil founded by John D. Rockefeller in 1870.

Rockefeller used a variety of tactics to purchase as many competitor refineries as he could and entered into secret deals with railroad companies to reduce shipping costs. These efforts resulted in Standard Oil controlling 90% of the oil refining market in the United States after little more than a decade in operation.

Standard Oil’s rise to prominence made it the first great industrial company in the world to become a monopoly. However, it was ultimately sued by the U.S. Justice Department in 1909 under antitrust laws and was ordered to break up into 34 independent entities two years later.

De Beers GroupDe Beers Group is a corporation that specializes in the mining and trading of diamonds. It is also a manufacturer of diamonds for industrial purposes. It was founded by British politician and mining magnate Cecil Rhodes in 1888.

The company had a monopoly in the diamond trade for almost 100 years before excess supply from Australian, Canadian, and Russian mines increased competition. From a peak of around 85%, De Beers is now the second-largest distributor at a more meager 30%.

Luxottica

Luxottica, formally Luxottica Group PIVA, is a vertically-integrated Italian eyewear manufacturer and designer that was founded by Leonard Del Vecchio in 1961.

Luxottica merged with French optics company Essilor in January 2017, with the resultant entity from the $50 billion deal controlling more than 25% of global eyewear sales.

Brands under the Luxottica banner include Ray-Ban, Armani Exchange, Chanel, Versace, Prada, and Ralph Lauren. The company also owns multiple insurance companies and related optical departments at department stores such as Target and Sears. It has been criticized for monopolistic practices with price markups approaching 1000%.

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through customers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.YKK

In business, vertical integration means a whole supply chain of the company is controlled and owned by the organization. Thus, making it possible to control each step through customers. in the digital world, vertical integration happens when a company can control the primary access points to acquire data from consumers.YKKThe YKK Group is a Japanese conglomerate founded by Tadao Yoshida in 1934.

The group is the world’s largest manufacturer of zippers, which are used in products such as dresses, jeans, jackets, camping equipment, and boating equipment.

After the Second World War, the conglomerate purchased an automated zipper manufacturing machine from the United States. Over time, it continued to innovate and took steps to control every aspect of the manufacturing process itself. In a 1998 Los Angeles Times article, it was explained that The YKK Group “smelts its own brass, concocts its own polyester, weaves and color-dyes cloth for its zipper tapes…” and so forth.

Despite the presence of hundreds of cheaper Chinese manufacturers, YKK produces around 50% of all zippers sold globally. This equates to about 7 billion units.

Saudi AramcoSaudi Aramco is a petroleum and natural gas company founded in 1933 and is the operator of the world’s most extensive hydrocarbon network. The company also owns the largest onshore and offshore oil fields in addition to a colossal natural gas reserve.

Saudi Aramco has a monopoly on oil production in Saudi Arabia and the company is also a significant exporter of the commodity. Having said that, the company’s dominant presence in the oil industry has been eroded to some extent by the COVID-19 pandemic and the shift toward renewable energy sources.

Key takeaways:A monopoly is a market structure characterized by the presence of a single, dominant individual or enterprise that is the sole supplier of a product or service.Standard Oil was the world’s first great industrial monopoly, at one point controlling 90% of the oil market in the United States. De Beers Group had a similar stranglehold on diamonds for almost a century before excess supply reduced its market share.Luxottica is an Italian vertically-integrated eyewear brand that controls more than a quarter of global eyewear sales. The YKK Group and Saudi Aramco have monopolies in fossil fuel production and zipper sales respectively.Connected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Monopoly Examples In A Nutshell appeared first on FourWeekMBA.

What Is The Freelance Business Model?Freelance Business Model In A Nutshell

The freelance business model is a B2B model where the freelancer sells their own services to other businesses. Under the freelance business model, a freelancer sells their own services to other businesses.

Understanding the freelance business modelWhile there is some conjecture around the precise definition of a freelancer, it is important to note that someone who sells their services to consumers is considered an entrepreneur. More to the point, the business model an entrepreneur utilizes is business-to-consumer (B2C).

The freelance business model is here to stay. According to a report released by business management platform Spera, more than 33% of the 54 million workers in the United States identify as a freelancer.

Developing a freelance business modelIn this section, we’ll take a look at a general approach to developing a freelance business model:

What does being a freelancer entail?The freelance industry is romanticized unlike any other. Those who are outside the industry assume the freelancer enjoys an idyllic existence where they live on a tropical beach in Thailand free from the overbearing presence of a boss.

However, the role of a freelancer can be stressful. The individual must be able to advertise and market themselves in addition to delivering quality work. They must also manage their workload effectively and wear different hats for different clients.

Many freelancers post adverts on designated platforms or are contacted by clients directly. Designated platforms act as mediators and ensure both parties are satisfied. In the case of direct communication, a contract outlining the scope of the work and fair compensation is vital. These contracts can also describe confidentiality or non-compete clauses.

Discovering a nicheThere are countless niches to be targeted in a freelance business model, including marketing, translating, videography, voiceovers, writing, graphic design, bookkeeping, and data entry to name just a few.

Freelancers should focus on one skill at first. However, since most niches are quite competitive, it can also be effective to combine two or more skills and develop a robust unique value proposition. For example, a freelance writer with a background in law may specialize in editing or writing complex legal documents.

Goal-setting and work-life balanceOnce a suitable niche has been identified, it is important to set a few personal and professional goals. Personal goals help with achieving an optimum work-life balance, which can be problematic for some freelancers. One individual may commit to taking a five-minute rest for every 60 minutes of work, for instance.

Professional goals are mostly related to income which in turn defines what price a freelancer can charge and how many hours they need to work to earn a living. Pricing is a much-debated but critical component of the freelance business model. A base price can be established by looking at what other freelancers charge for similar services. Furthermore, a freelancer should never undercut the value of their time or their work just to land the contract.

Building a solid customer baseFor the freelancer, building a solid customer base means first doing some due diligence on the client beforehand. How have they been received by other freelancers? Were they exposed as rude, unrealistic, or demanding? Then, it is important to market one’s services via email, networking, social media, content, or any other traditional form of promotion.

It is also imperative that the freelancer becomes comfortable with rejection. The self-promotion that comes from pitching work to clients may take a while to get used to it, but those that do tend to develop a competitive edge.

Freelancers should strive to build a customer base of satisfied clients who are more likely to make repeat purchases and leave constructive yet positive reviews. This can reduce some of the income insecurity inherent to the freelance business model.

Key takeaways:Under the freelance business model, a freelancer sells their own services to other businesses. Note that an individual who sells products and services to consumers is technically considered to be an entrepreneur. The freelance business model is romanticized to some extent. However, freelancers must be multi-skilled, resilient, and be comfortable with rejection, uncertainty, and a lack of income security.The freelance business model involves discovering a niche and combining skills to develop a unique value proposition. It is also important to build a solid customer base of repeat buyers and be able to set a price that properly values the services rendered.Connected Business Concepts A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more.

A marketplace is a platform where buyers and sellers interact and transact. The platform acts as a marketplace that will generate revenues in fees from one or all the parties involved in the transaction. Usually, marketplaces can be classified in several ways, like those selling services vs. products or those connecting buyers and sellers at B2B, B2C, or C2C level. And those marketplaces connecting two core players, or more. In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer.

In the food delivery business model companies leverage technology to build platforms that enable users to have the food delivered at home. This business model usually is set up as a platform and multi-sided marketplace, where the food delivery company makes money by charging commissions to the restaurant and to the customer. The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example.

The wholesale model is a selling model where wholesalers sell their products in bulk to a retailer at a discounted price. The retailer then on-sells the products to consumers at a higher price. In the wholesale model, a wholesaler sells products in bulk to retail outlets for onward sale. Occasionally, the wholesaler sells direct to the consumer, with supermarket giant Costco the most obvious example. A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks.

A retail business model follows a direct-to-consumer approach, also called B2C, where the company sells directly to final customers a processed/finished product. This implies a business model that is mostly local-based, it carries higher margins, but also higher costs and distribution risks. A B2B2C is a particular kind of business model where a company, rather than accessing the consumer market directly, it does that via another business. Yet the final consumers will recognize the brand or the service provided by the B2B2C. The company offering the service might gain direct access to consumers over time.