Gennaro Cuofano's Blog, page 123

January 17, 2022

List of angel investors

Angel investors are high net-worth individuals that invest in the early stages of a startup company in exchange for equity. They may also be referred to as seed investors, angel funders, private investors, or business angels. Angel investors invest in ideas and entrepreneurs, with profits a more secondary concern. In addition to providing vital early capital and having an appetite for risk, many also offer their industry skills, expertise, networks, and mentorship services.

Wei GuoWei Guo is a Chinese angel investor who has invested in more than 400 companies through his investment firm Wei Fund. The fund, which was established in 2004, has been associated with companies such as Scout, Chariot, Worklife, and Vitroid.

Guo subsequently launched a $50 million second fund called UpHonest Capital with an investment portfolio consisting of Instacart, Dialpad, and American satellite manufacturer Astranis, to name a few.

Daniel CurranDaniel Curran is a Silicon Valley angel investor with an enviable track record of successful exits.

In 2019, Curran was ranked the seventh most successful angel investor based on investment volume and successful exits. Curran invested in 23 companies that made an estimated return of 600% over the previous four years.

Some of Curran’s notable exits include Dollar Shave Club, VetPronto, and Zirtual.

Fabrice GrindaFabrice Grinda is a French angel investor and entrepreneur with notable investments including Airbnb, Alibaba, Beepi, Brightroll, and Palantir.

Grinda is also the founder of the online classifieds site OLX. He prefers to invest in similar marketplaces that connect buyers and sellers but is also involved with online travel, social commerce, and location-based services.

Grinda can boast over 250 exits from 700 angel investments.

Mark Cuban Mark Cuban is a billionaire entrepreneur, television personality, investor, and media proprietor. With an estimated net worth of $4.4 billion, Cuban is best known for being the owner of NBA team Dallas Mavericks and one of the investors on the reality television series Shark Tank.

Mark Cuban is a billionaire entrepreneur, television personality, investor, and media proprietor. With an estimated net worth of $4.4 billion, Cuban is best known for being the owner of NBA team Dallas Mavericks and one of the investors on the reality television series Shark Tank.Mark Cuban is a billionaire entrepreneur and the owner of the Dallas Mavericks NBA team, among other pursuits. Cuban is one of the most successful angel investors on the planet and is reported to receive over 1,000 pitches per day.

According to his AngelList profile, Cuban invests in “companies that I think are compelling, differentiated and run by motivated entrepreneurs.”

Matt MullenwegMatt Mullenweg is a jazz saxophonist and is also the founder of WordPress.

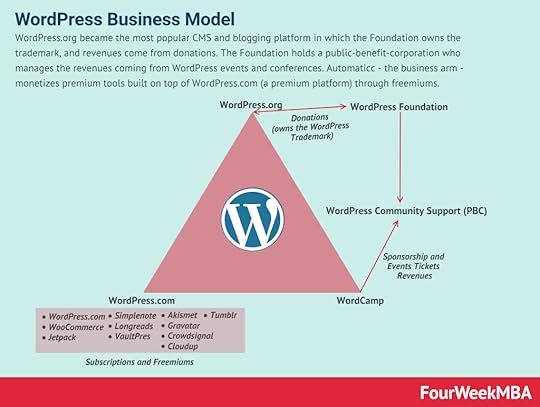

WordPress.org became the most popular CMS and blogging platform in which the Foundation owns the trademark, and revenues come from donations. The Foundation holds a public-benefit-corporation who manages the revenues coming from WordPress events and conferences. Automaticc – the business arm – monetizes premium tools built on top of WordPress.com (a premium platform) through freemiums.

WordPress.org became the most popular CMS and blogging platform in which the Foundation owns the trademark, and revenues come from donations. The Foundation holds a public-benefit-corporation who manages the revenues coming from WordPress events and conferences. Automaticc – the business arm – monetizes premium tools built on top of WordPress.com (a premium platform) through freemiums.Mullenweg is an angel investor that tends to invest in startups at the seed stage with some customer traction. Owing to his WordPress roots, he favors companies that are developing open source products.

Mullenweg also provides advice and mentorship at Techstars, an American seed accelerator that has funded companies such as Bench, Digital Ocean, Plated, and Simple Energy.

Saad AlsogairSaad Alsogair is a University of Jordan graduate who resides in Saudi Arabia.

Alsogair is a practicing dermatologist and has made more than 400 investments in startups such as Buffer, Notion, Ripple, and Unsplash. In 2021, he authored a book called Your Idea, Their Money to help entrepreneurs secure their first round of investment funding.

Key takeaways:Angel investors are high net-worth individuals that invest in the early stages of a startup company in exchange for equity.Angel investors include Chinese businessman Wei Guo, who manages two investment funds, and Daniel Curran, who has a proven track record of exits.WordPress founder Matt Mullenweg is also an angel investor, preferring to invest in open source companies. French entrepreneur and OLX founder Fabrice Grinda, on the other hand, tends to invest in marketplaces that connect buyers and sellers.Read Next: Angel Investing, Venture Capital, Angel Investors vs. Venture Capitalists.

Connected Business Concepts Circle of Competence The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual.

The circle of competence describes a person’s natural competence in an area that matches their skills and abilities. Beyond this imaginary circle are skills and abilities that a person is naturally less competent at. The concept was popularised by Warren Buffett, who argued that investors should only invest in companies they know and understand. However, the circle of competence applies to any topic and indeed any individual. Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have. The Buffet Indicator is a measure of the total value of all publicly-traded stocks in a country divided by that country’s GDP. It’s a measure and ratio to evaluate whether a market is undervalued or overvalued. It’s one of Warren Buffet’s favorite measures as a warning that financial markets might be overvalued and riskier.

The Buffet Indicator is a measure of the total value of all publicly-traded stocks in a country divided by that country’s GDP. It’s a measure and ratio to evaluate whether a market is undervalued or overvalued. It’s one of Warren Buffet’s favorite measures as a warning that financial markets might be overvalued and riskier. Warren Buffett is an American investor, business tycoon, and philanthropist. Known as the “Oracle of Omaha”, Buffett is best known for his strict adherence to value investing and frugality despite his immense wealth. He is among the wealthiest people in the world. Most of his wealth is tied up in Berkshire-Hathaway and its 65 subsidiaries.Connected Financial Concepts to Value Investing

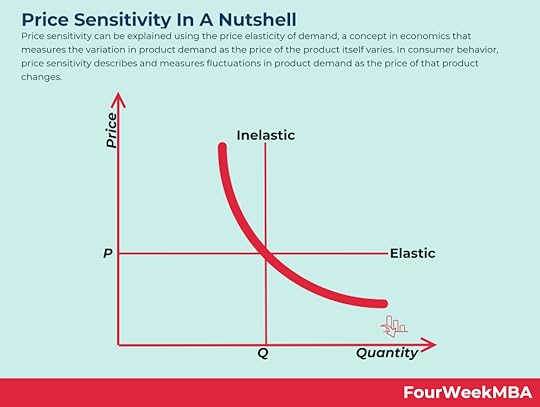

Warren Buffett is an American investor, business tycoon, and philanthropist. Known as the “Oracle of Omaha”, Buffett is best known for his strict adherence to value investing and frugality despite his immense wealth. He is among the wealthiest people in the world. Most of his wealth is tied up in Berkshire-Hathaway and its 65 subsidiaries.Connected Financial Concepts to Value Investing Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes. A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.

A price ceiling is a price control or limit on how high a price can be charged for a product, service, or commodity. Price ceilings are limits imposed on the price of a product, service, or commodity to protect consumers from prohibitively expensive items. These limits are usually imposed by the government but can also be set in the resale price maintenance (RPM) agreement between a product manufacturer and its distributors.  Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services.

Price elasticity measures the responsiveness of the quantity demanded or supplied of a good to a change in its price. It can be described as elastic, where consumers are responsive to price changes, or inelastic, where consumers are less responsive to price changes. Price elasticity, therefore, is a measure of how consumers react to the price of products and services. In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post List of angel investors appeared first on FourWeekMBA.

What Is Remarketing? Remarketing In A Nutshell

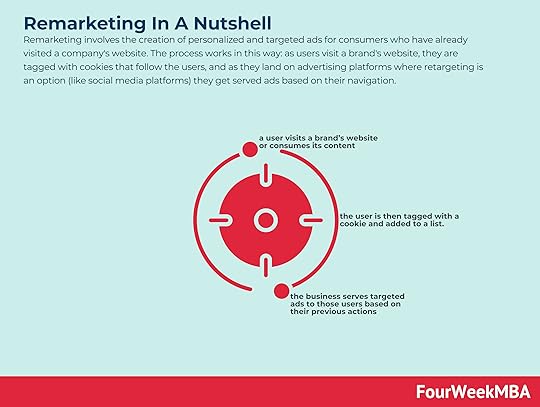

Remarketing involves the creation of personalized and targeted ads for consumers who have already visited a company’s website. The process works in this way: as users visit a brand’s website, they are tagged with cookies that follow the users, and as they land on advertising platforms where retargeting is an option (like social media platforms) they get served ads based on their navigation.

Understanding remarketingRemarketing is based on the simple premise that it is more effective to advertise to consumers who already know a brand as there is more chance they will purchase something. Given 96% of consumers leave a website without making a purchase, it is crucial businesses continually re-engage with visitors and keep their brands top of mind.

The process of remarketing can be illustrated in three steps:

First, a user visits a brand’s website or consumes its content.The user is then tagged with a cookie and added to a list.Lastly, the business serves targeted ads to those users based on their previous actions.Note that users will be able to see remarketing ads while they are browsing the web, reading from their favorite news app, or consuming video content on YouTube. That is, the user does not need to revisit the site where they were first tagged to see the ads.

Different types of remarketingThere are various types of remarketing according to how users are added to the list. These include:

StandardThe most common form where display ads are shown to website visitors on other websites and apps. Google’s Display Network reaches 90% of internet browsers across multiple platforms.

Mobile appsWhere ads are shown exclusively in mobile apps and websites.

Search enginesThese ads are shown in search engines to users who have already visited a brand’s website. This allows the business to serve ads to consumers who are interested in a product or service and are still looking for information.

DynamicThis form of remarketing is similar to the standard version. However, the ads are more personalized according to the products and services viewed.

Remarketing examplesThe specifics of each remarketing campaign will differ from customer to customer. With that in mind, here is a general look at some real-world examples:

NikeOnce a user has searched its store for shoes, Nike displays remarketing ads on other sites where the user can scroll through a list of “personalised” sneakers. To finish, the company includes a call to action to encourage shoppers to purchase on its website.

AirbnbThe accommodation provider is also known for displaying remarketing ads in a user’s Facebook news feed. These ads feature a photo of the accommodation listing with a prominent “Book Now” call to action button.

SpotifyThe music streaming platform uses traditional display marketing to target users as they surf the web. Some ads incorporate a promotion where the user can receive three months of Spotify Premium for free. The promotion targets existing Spotify listeners who may be hesitant to upgrade their subscriptions.

Key takeaways:Remarketing involves the creation of personalized and targeted ads for consumers who have already visited a company’s website. Remarketing campaigns can take a few different forms according to how users are added to a promotional list. Standard remarketing is the form used by the Google Display Network, but there are also dynamic, search engine, and mobile app forms.Remarketing by definition is a personalized experience for each user. Nevertheless, some general examples of the strategy in action include those from Spotify, Airbnb, and Nike.Connected Marketing Concepts Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

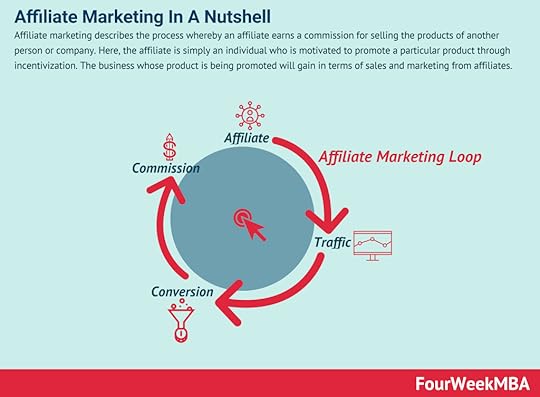

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

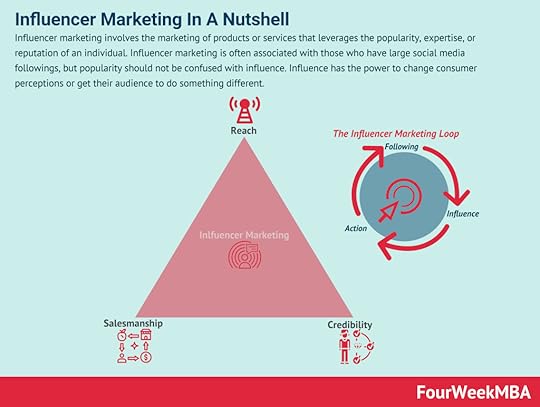

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

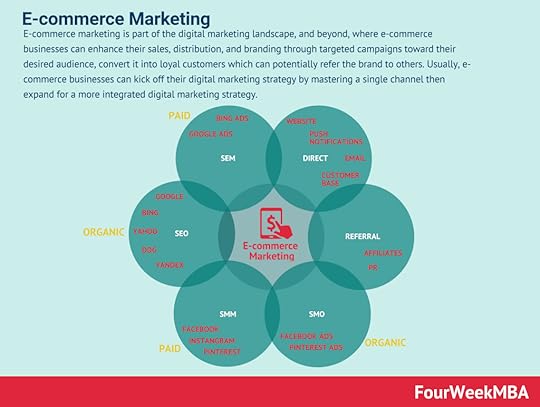

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

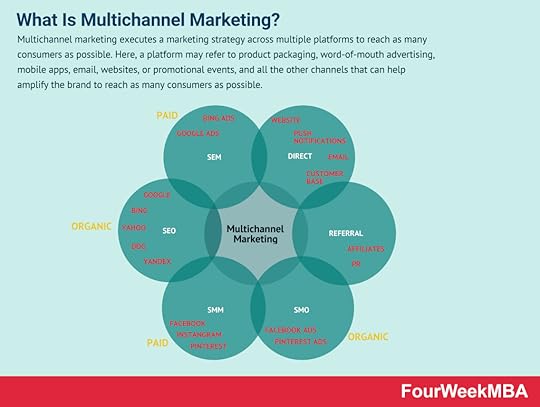

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

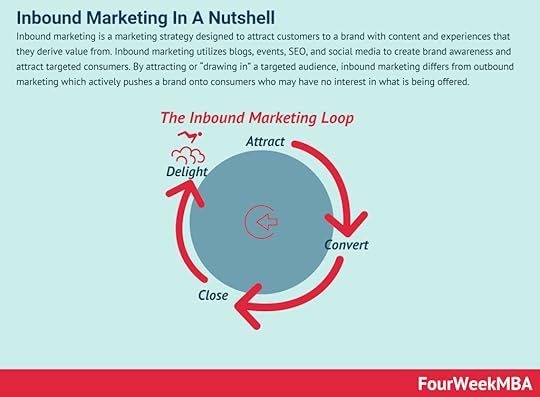

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

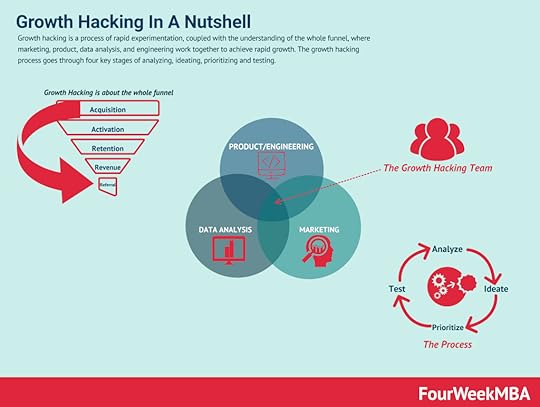

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

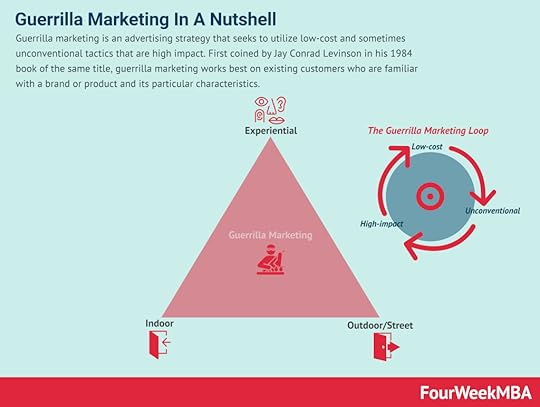

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Remarketing? Remarketing In A Nutshell appeared first on FourWeekMBA.

What Is Data Monetization? Data Monetization In A Nutshell

Data monetization describes the process of a business using data to obtain an economic benefit. In essence, data monetization is the process of utilizing data to increase revenue. According to management firm McKinsey & Company, an increasing share of the most successful companies in the world incorporate data and analytics to fuel their growth.

Understanding data monetizationData is becoming increasingly ubiquitous as the widespread adoption of big data systems and Internet of Things (IoT) devices allow consumers and businesses alike to collect data on anything and everything. In fact, it is estimated that the world creates around 2.5 million terabytes of data every day, with more than 90% created in the past two years.

Despite the relative ease with which data can be collected and analyzed, the practice of monetizing data remains relatively uncommon. Research out of Germany discovered that less than one in five companies had established data monetization initiatives and a mere 0.5% use data in decision making. Instead, most companies spend vast amounts of time and money storing their data instead of determining how they can make money from it.

Data has undebatable intrinsic value, but the most value is derived when the business demonstrates the ability to derive insights from that data and monetize it accordingly.

How is data monetized?Different data monetization methods will be appropriate to different companies according to their particular business strategies, growth stage, or industry.

Here are a few ways data can be monetized:

Data as a service – the most simple method where data is sold to customers in a raw, anonymous, or aggregate form. The customer is responsible for analyzing the data to facilitate a financial gain.Analytics-enabled platform as a service – these are platforms sold to customers that provide scalable and versatile data analytics in real-time. They can be cloud-based or installed on-premise and can incorporate a wide array of data formats.Insight as a service – where internal and external data sources are combined and analyzed to generate insights. This method tends to be confined to specific contexts and datasets. For example, John Deere combined external soil and weather data with internal crop timing and fertilizer usage data to create an intelligent farming system that is sold to farmersHow can businesses successfully incorporate data monetization?To understand how a business can incorporate data monetization, consider these pointers:

Understand the role and value of dataIn theory, data should facilitate business performance, reduce risk, and prove compliance. However, this can only occur when the business understands the relevance of its data and how valuable it is. Some companies fail to realize this as they do not consider data to be an asset.

Data monetization must be embedded into strategyBusiness strategy should always be underpinned by data management initiatives and vice versa. It is important management understands how data is connected to strategy before it implements structures to monetize it.

This requires the company to assemble a cross-functional, multi-disciplinary team with members from sales, marketing, operations, and data management.

Communicating the value of data to facilitate growthAs the studies mentioned in previous sections have demonstrated, data monetisation remains a mystery in some organizations. Even when the practice is in place, employees may not understand the underlying reasons for its success.

Communicating the value of data monetisation to internal and external stakeholders will become paramount in ensuring market competitiveness, among other things.

Key takeaways:Data monetization describes the process of a business using data to obtain an economic benefit. Despite the relative ease with which data can now be collected, the practice remains relatively uncommon.Data monetization can be monetized in a few different ways. These include data as a service, analytics-enabled platform as a service, and insight as a service.To ensure businesses make the most of their data, it is important they first understand its role and value. Data and business strategy must also support each other and the value of data should be understood by internal and external stakeholders.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelWhat Is EntrepreneurshipConnected Analysis FrameworksFailure Mode And Effects Analysis

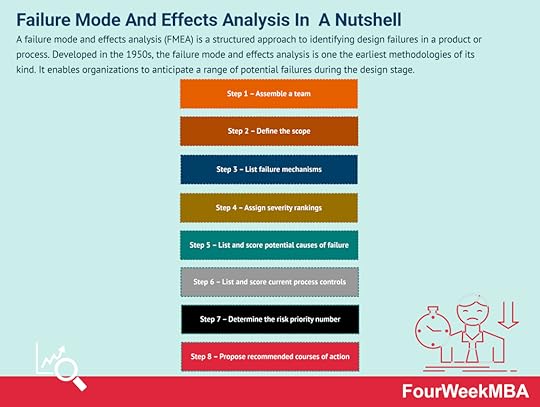

A failure mode and effects analysis (FMEA) is a structured approach to identifying design failures in a product or process. Developed in the 1950s, the failure mode and effects analysis is one the earliest methodologies of its kind. It enables organizations to anticipate a range of potential failures during the design stage.

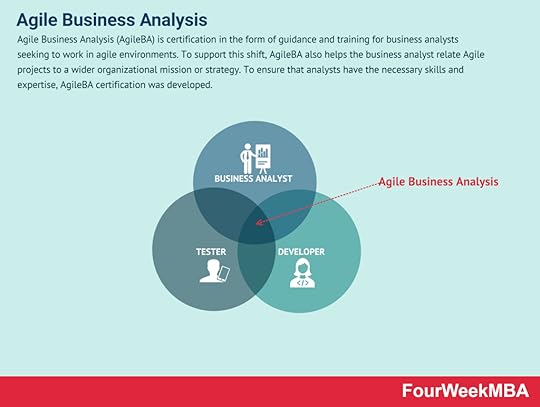

A failure mode and effects analysis (FMEA) is a structured approach to identifying design failures in a product or process. Developed in the 1950s, the failure mode and effects analysis is one the earliest methodologies of its kind. It enables organizations to anticipate a range of potential failures during the design stage. Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed.

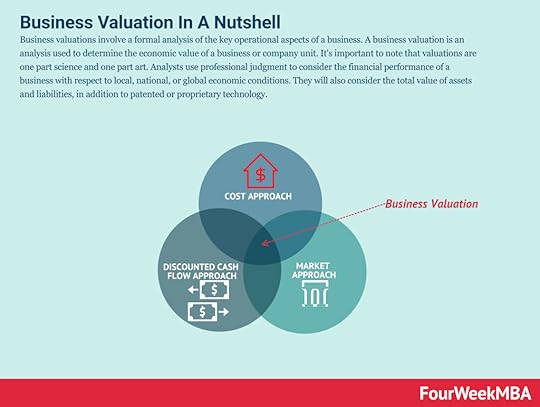

Agile Business Analysis (AgileBA) is certification in the form of guidance and training for business analysts seeking to work in agile environments. To support this shift, AgileBA also helps the business analyst relate Agile projects to a wider organizational mission or strategy. To ensure that analysts have the necessary skills and expertise, AgileBA certification was developed. Business valuations involve a formal analysis of the key operational aspects of a business. A business valuation is an analysis used to determine the economic value of a business or company unit. It’s important to note that valuations are one part science and one part art. Analysts use professional judgment to consider the financial performance of a business with respect to local, national, or global economic conditions. They will also consider the total value of assets and liabilities, in addition to patented or proprietary technology.

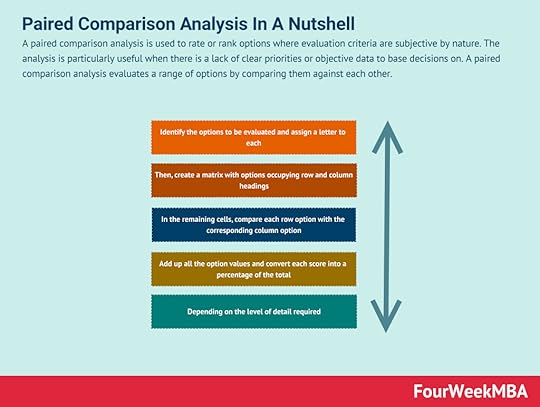

Business valuations involve a formal analysis of the key operational aspects of a business. A business valuation is an analysis used to determine the economic value of a business or company unit. It’s important to note that valuations are one part science and one part art. Analysts use professional judgment to consider the financial performance of a business with respect to local, national, or global economic conditions. They will also consider the total value of assets and liabilities, in addition to patented or proprietary technology. A paired comparison analysis is used to rate or rank options where evaluation criteria are subjective by nature. The analysis is particularly useful when there is a lack of clear priorities or objective data to base decisions on. A paired comparison analysis evaluates a range of options by comparing them against each other.

A paired comparison analysis is used to rate or rank options where evaluation criteria are subjective by nature. The analysis is particularly useful when there is a lack of clear priorities or objective data to base decisions on. A paired comparison analysis evaluates a range of options by comparing them against each other. The Monte Carlo analysis is a quantitative risk management technique. The Monte Carlo analysis was developed by nuclear scientist Stanislaw Ulam in 1940 as work progressed on the atom bomb. The analysis first considers the impact of certain risks on project management such as time or budgetary constraints. Then, a computerized mathematical output gives businesses a range of possible outcomes and their probability of occurrence.

The Monte Carlo analysis is a quantitative risk management technique. The Monte Carlo analysis was developed by nuclear scientist Stanislaw Ulam in 1940 as work progressed on the atom bomb. The analysis first considers the impact of certain risks on project management such as time or budgetary constraints. Then, a computerized mathematical output gives businesses a range of possible outcomes and their probability of occurrence. A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives.

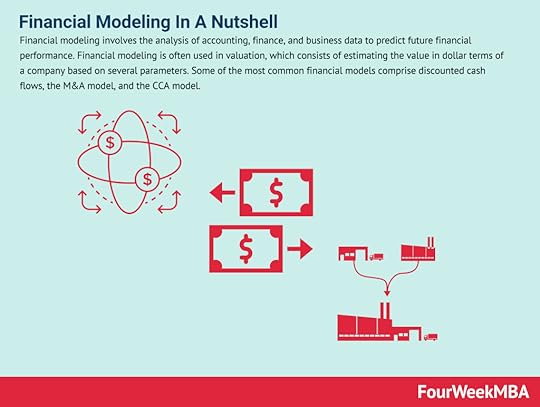

A cost-benefit analysis is a process a business can use to analyze decisions according to the costs associated with making that decision. For a cost analysis to be effective it’s important to articulate the project in the simplest terms possible, identify the costs, determine the benefits of project implementation, assess the alternatives. Financial modeling involves the analysis of accounting, finance, and business data to predict future financial performance. Financial modeling is often used in valuation, which consists of estimating the value in dollar terms of a company based on several parameters. Some of the most common financial models comprise discounted cash flows, the M&A model, and the CCA model.

Financial modeling involves the analysis of accounting, finance, and business data to predict future financial performance. Financial modeling is often used in valuation, which consists of estimating the value in dollar terms of a company based on several parameters. Some of the most common financial models comprise discounted cash flows, the M&A model, and the CCA model.The post What Is Data Monetization? Data Monetization In A Nutshell appeared first on FourWeekMBA.

What Are An Angel Investor And A Venture Capitalist? Angel Investors vs. Venture Capitalists

An angel investor is a wealthy individual who uses their own money to invest in small businesses. A venture capitalist, on the other hand, is an individual or firm that makes a similar investment using money pooled from other companies, corporations, and pension funds. Venture capitalists do not invest their own money. In many cases, venture capitalists need angel investors to understand businesses with great potential from a very early stage.

Understanding angel investorsThe angel investor provides capital to an early-stage start-up in exchange for equity or convertible debt. Some angel investors will also provide mentorship and advice, while others form syndicates and collectively invest in businesses.

Most angel investors are accredited by the Securities Exchange Commission (SEC) provided they meet one of two conditions:

Their annual income was at least $200,000 for the past two years. This increases to $300,000 if the individual files taxes with a spouse.They have a minimum net worth of $1 million, excluding the value of their primary residence.When Amazon was a startup, for example, Jeff Bezos received $300,000 from his parents and a further $1 million from twenty wealthy investors who contributed $50,000 each.

Note that angel investors serve as the bridge between the initial financing needs of a startup and more significant capital requirements as it grows. They are focused on helping the entrepreneur build their business and, at least initially, are less concerned with making a profit.

Angel investor advantagesAngel investors tend to be less risk-averse than traditional financial institutions. In most cases, they do not expect to be paid back if the venture they are financing fails.

Entrepreneurs also benefit from the wealth of industry knowledge and experience that many such investors bring to the table.

Understanding venture capitalistsVenture capitalists are employees of venture capital firms that invest using money from other companies, large corporations, and pension funds.

While angel investors are a critical early source of funding, venture capitalists provide funding for more established startups to help them transition through various growth stages into mergers, acquisitions, or IPOs.

Venture capitalist investment also tends to be more significant, with a single investment typically in the range of $3-5 million and lasting around a decade. In return, venture capitalists expect to be involved in operations and may request a seat on the board of directors.

In 2005, Facebook founder Mark Zuckerberg received a Series A funding round from venture capitalists worth $12.7 million.

Venture capital advantagesVenture capital funding is ideal for businesses that want to scale quickly. Like angel investment, there is generally no expectation that the money is paid back if the business fails.

Some venture capitalists are also well connected. In other words, they have a vast network of professional contacts that the startup can access to secure additional funding or recruit experienced talent.

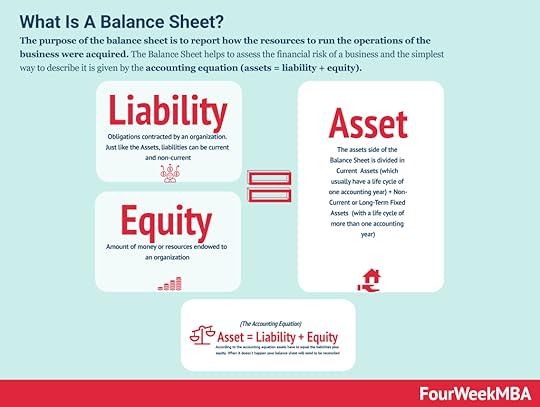

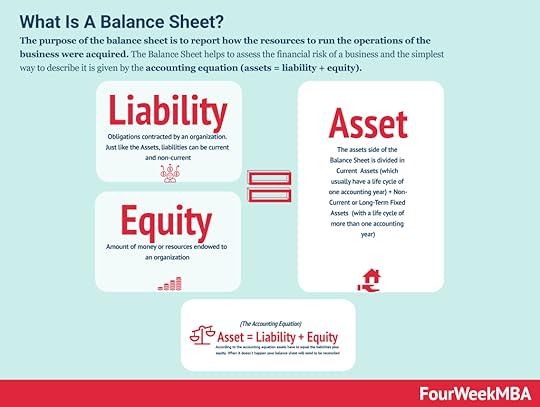

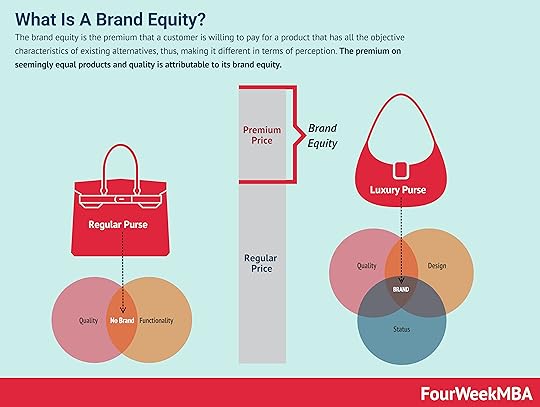

Key takeaways:An angel investor is a wealthy, accredited individual who uses their own money to invest in small businesses. A venture capitalist is an individual or firm that invests the money of other companies, corporations, and pension funds.Angel investors provide capital to early-stage start-ups in exchange for equity or convertible debt. They may also provide mentorship and play a critical role in sustaining the operations of early-stage startups. Venture capitalists invest significant sums of money over longer timeframes to help startups undertake mergers, acquisitions, or IPOs. In exchange, many venture capital firms request a seat on the startup’s board of directors.Connected Business Frameworks The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity).

The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity). The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at a fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called P&L statement).

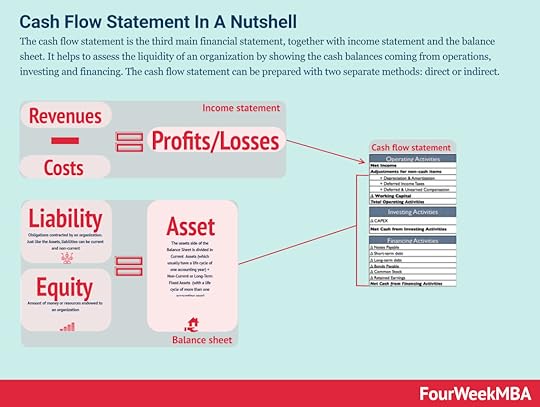

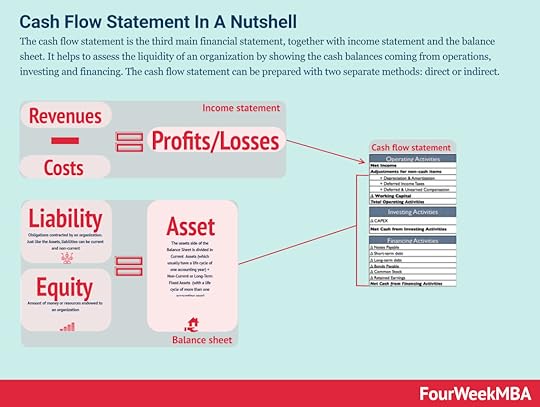

The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at a fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called P&L statement). The cash flow statement is the third main financial statement, together with an income statement and the balance sheet. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.

The cash flow statement is the third main financial statement, together with an income statement and the balance sheet. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.Finanial Structure Modeling

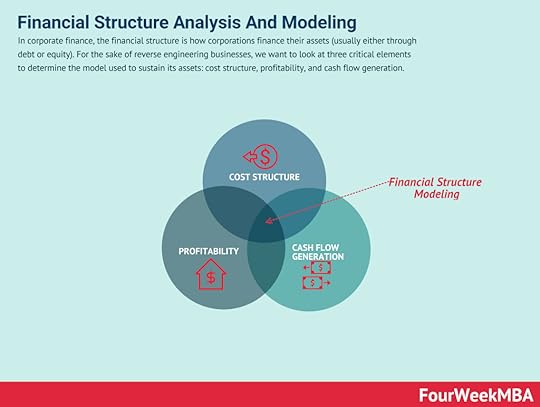

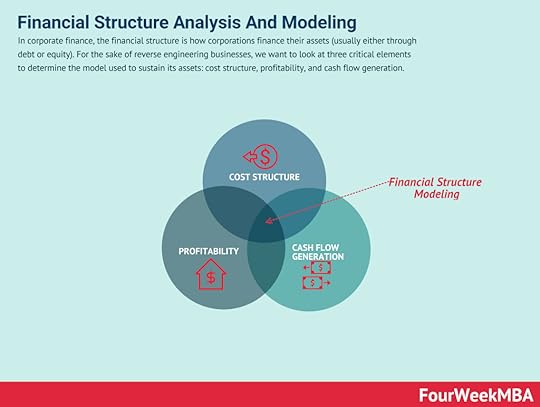

In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity). For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.

In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity). For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.Tech Modeling

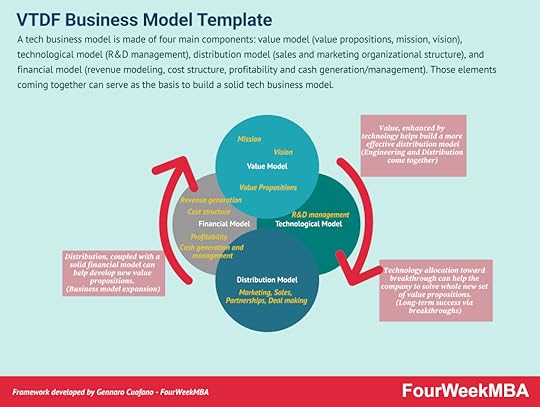

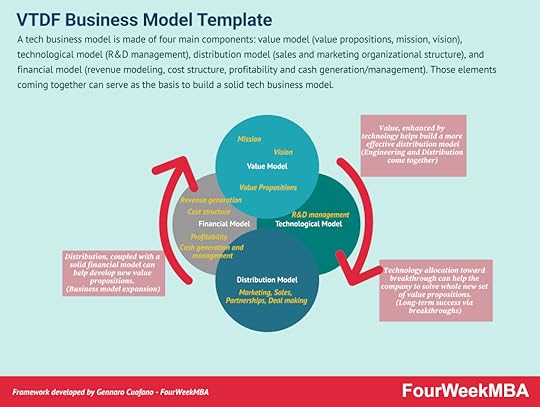

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.Read Next: Income Statement, Balance Sheet, Cash Flow Statement, Financial Structure, WACC, CAPM.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Are An Angel Investor And A Venture Capitalist? Angel Investors vs. Venture Capitalists appeared first on FourWeekMBA.

What Is The Startup Lifecycle? Startup Lifecycle In A Nutshell

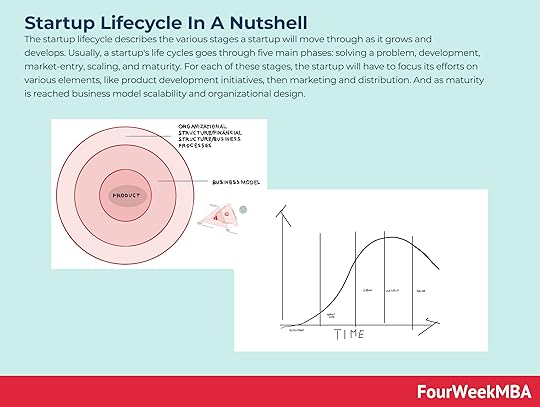

The startup lifecycle describes the various stages a startup will move through as it grows and develops. Usually, a startup’s life cycles goes through five main phases: solving a problem, development, market-entry, scaling, and maturity. For each of these stages, the startup will have to focus its efforts on various elements, like product development initiatives, then marketing and distribution. And as maturity is reached business model scalability and organizational design.

Understanding the startup lifecycleEvery startup company is different, but most will encounter the same few stages as they grow and develop. Collectively, these stages make up the startup lifecycle.

For the management of a startup, understanding the lifecycle is a useful way to anticipate future obstacles. It can also assist in the development of a robust business plan that helps reduce some of the doubt and uncertainty that is common in early-stage companies.

The founders must avoid the temptation to cut corners and move to the next stage before the company is ready. This can be avoided by management focusing on their own journey (and not the journey of a competitor) and ensuring the client remains a priority throughout.

The five stages of the product lifecycleThere are various startup lifecycle models in existence, with most interpretations featuring three, four, five, or even seven stages.

In this article, we will discuss a five-stage interpretation.

Stage 1 – Solving a problem The 5 Whys method is an interrogative problem-solving technique that seeks to understand cause-and-effect relationships. At its core, the technique is used to identify the root cause of a problem by asking the question of why five times. This might unlock new ways to think about a problem and therefore devise a creative solution to solve it.

The 5 Whys method is an interrogative problem-solving technique that seeks to understand cause-and-effect relationships. At its core, the technique is used to identify the root cause of a problem by asking the question of why five times. This might unlock new ways to think about a problem and therefore devise a creative solution to solve it. Every great business idea starts with a problem that needs to be solved. To ensure the solution is commercially viable, the startup must determine whether there is demand for it among consumers. Then and only then should it research the target audience and develop a specific buyer persona.

Demand can be tested by creating a crowdfunding campaign or by sending traffic to a landing page with an offer. Provided there is interest, the startup can subsequently develop the blueprint for a minimum viable product (MVP). To fund this stage, the founders often rely on donations from friends and family.

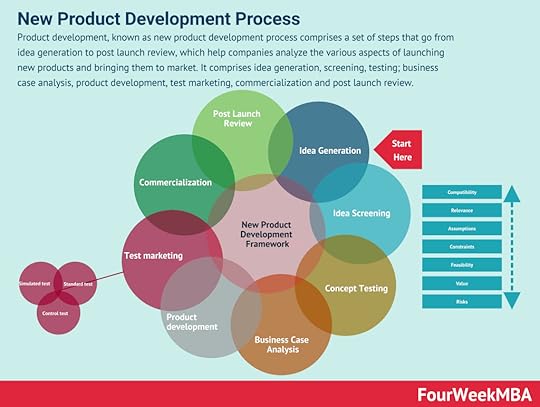

Stage 2 – Development Product development, known as new product development process comprises a set of steps that go from idea generation to post launch review, which help companies analyze the various aspects of launching new products and bringing them to market. It comprises idea generation, screening, testing; business case analysis, product development, test marketing, commercialization and post launch review.

Product development, known as new product development process comprises a set of steps that go from idea generation to post launch review, which help companies analyze the various aspects of launching new products and bringing them to market. It comprises idea generation, screening, testing; business case analysis, product development, test marketing, commercialization and post launch review.In the second stage, the startup builds the minimum viable product with the smallest possible investment in time and capital. Once the MVP has been released, it is important to onboard some users and seek their feedback.

The MVP should be improved upon over time to reach a point where it can solve a real user problem. Note that the priority is not to make the product perfect but to attract seed funding interest from investors in preparation for stage three.

A leaner MVP is the evolution of the MPV approach. Where the market risk is validated before anything elseStage 3 – Market entry

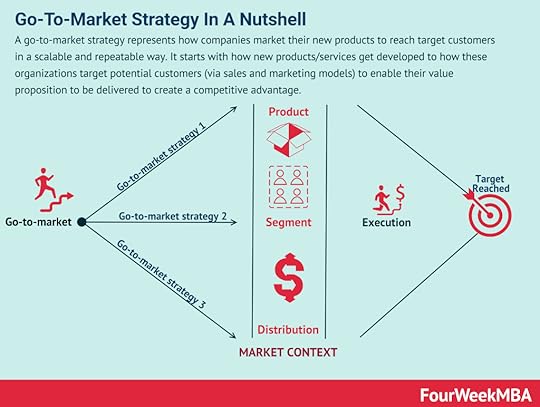

A leaner MVP is the evolution of the MPV approach. Where the market risk is validated before anything elseStage 3 – Market entry A go-to-market strategy represents how companies market their new products to reach target customers in a scalable and repeatable way. It starts with how new products/services get developed to how these organizations target potential customers (via sales and marketing models) to enable their value proposition to be delivered to create a competitive advantage.

A go-to-market strategy represents how companies market their new products to reach target customers in a scalable and repeatable way. It starts with how new products/services get developed to how these organizations target potential customers (via sales and marketing models) to enable their value proposition to be delivered to create a competitive advantage.The third stage of the startup lifecycle describes a company that is ready to optimize its product and enter the market. It has demonstrated the viability of its business model using data gathered from the MVP and has attracted interest from angel investors, crowdfunding platforms, or micro venture-capital firms.

Every company should strive for product-market fit. This is a scenario where the target audience is purchasing the product, using the product, and telling others about their experience. The third stage is characterized by a lot of trial and error as the startup tests various channels and marketing strategies.

Stage 4 – Scaling Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale.

Business scaling is the process of transformation of a business as the product is validated by wider and wider market segments. Business scaling is about creating traction for a product that fits a small market segment. As the product is validated it becomes critical to build a viable business model. And as the product is offered at wider and wider market segments, it’s important to align product, business model, and organizational design, to enable wider and wider scale. Scaling is one of the most critical stages of the startup lifecycle. The startup must double down on the channels it has identified as the most effective and expand its team by hiring specialists with the knowledge necessary to drive the company forward. In most cases, these initiatives will require venture capital funding.

Once a channel has reached saturation point, it is important to repeat the process and secure another channel to ensure growth is sustainable.

Stage 5 – MaturityA mature startup is one that has an established presence in the market, has a reasonable customer retention rate, and is making a profit.

Where the company heads from here is at the discretion of the founders. Some will choose to solidify their presence by holding an IPO or acquiring other companies, while others may be serial entrepreneurs who want to sell the company and work on the next big idea.

Key takeaways:The startup lifecycle describes the various stages a startup will move through as it grows and develops.The startup lifecycle helps entrepreneurs anticipate future obstacles and develop a business plan that removes some of the uncertainty inherent in early-stage companies. However, the company should never cut corners in an attempt to progress through each stage of the lifecycle prematurely.The startup lifecycle can be explained in five stages: solving a problem, development, market-entry, scaling, and maturity.Connected Business Frameworks The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity).

The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity). The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at a fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called P&L statement).

The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at a fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called P&L statement). The cash flow statement is the third main financial statement, together with an income statement and the balance sheet. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.

The cash flow statement is the third main financial statement, together with an income statement and the balance sheet. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.Finanial Structure Modeling

In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity). For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.

In corporate finance, the financial structure is how corporations finance their assets (usually either through debt or equity). For the sake of reverse engineering businesses, we want to look at three critical elements to determine the model used to sustain its assets: cost structure, profitability, and cash flow generation.Tech Modeling

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.

A tech business model is made of four main components: value model (value propositions, mission, vision), technological model (R&D management), distribution model (sales and marketing organizational structure), and financial model (revenue modeling, cost structure, profitability and cash generation/management). Those elements coming together can serve as the basis to build a solid tech business model.Read Next: Income Statement, Balance Sheet, Cash Flow Statement, Financial Structure, WACC, CAPM.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is The Startup Lifecycle? Startup Lifecycle In A Nutshell appeared first on FourWeekMBA.

What Is Wireframing? Wireframing In A Nutshell

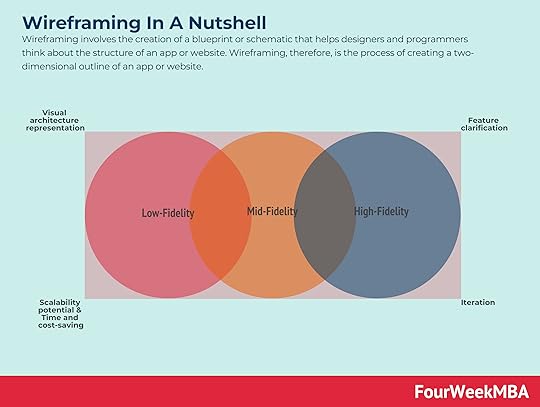

Wireframing involves the creation of a blueprint or schematic that helps designers and programmers think about the structure of an app or website. Wireframing, therefore, is the process of creating a two-dimensional outline of an app or website.

Understanding wireframingThese outlines are called wireframes and provide an overview of user flow, information architecture, functionality, and page structure or layout. Since many wireframes represent an initial concept, other elements such as color, graphics, and styling feature less prominently.

Wireframes can be created digitally or simply drawn by hand. They are used to foster stakeholder consensus before the interface is sent to the developers to be built out.

Five reasons to incorporate wireframingWireframing is an important part of the design process and should not be overlooked or rushed. Consider these seven reasons for incorporating the approach:

Visual architecture representationWireframing is often the first point at which the project is represented visually. They also improve on the somewhat abstract nature of a flowchart with something more tangible.

Feature clarificationWireframing also communicates concepts or ideas that some stakeholders may not understand in a theoretical sense. In other words, the process stipulates how certain features will function, where they will reside, and their utility.

Scalability potentialA wireframe can also be implemented to ensure a website can cope with content growth. For example, a company that plans to increase its product offering from 50 to 200 will want a website that can accommodate this increase without impacting usability or site architecture.

Time and cost-savingThe process of wireframing saves time since the development team has a better grasp on what it is building. There is also increased clarity around content creation. Wireframes themselves are quick and inexpensive to produce, allowing the company to identify user pain points for relatively little expenditure.

IterationSome businesses make the mistake of trying to combine the functionality and layout of their website with more creative or brand-related aspects in one step. However, wireframing is an iterative process where aspects are considered one at a time. This allows the client to provide feedback earlier and avoid costly fixes later.

Three different types of wireframesThere are three main types of wireframes.

Low-fidelityThese serve as the starting point of a design and as a result, feature simple visual representations that are created without a scale or sense of pixel accuracy. They tend to be primitive and exclude details that could serve as a distraction.

Low-fidelity wireframes can be used in situations where there are multiple product concepts and the designer needs to know which one to pursue.

Mid-fidelityMid-fidelity wireframes depict a more accurate representation of an app or website and are one of the most commonly used.

They feature components with more detail that allow them to be differentiated from one another, but they still omit potentially distracting elements. For example, various shades of black and white may be utilized to provide visual prominence between specific elements.

These wireframes tend to be created using a digital tool such as Balsamiq or Sketch.

High-fidelityHigh-fidelity wireframes incorporate detailed, pixel-specific layouts, written content, and imagery. This makes them well suited to more complex projects such as interactive maps or menu systems.

As a result, high-fidelity wireframes are used in the final stages of the product design lifecycle.

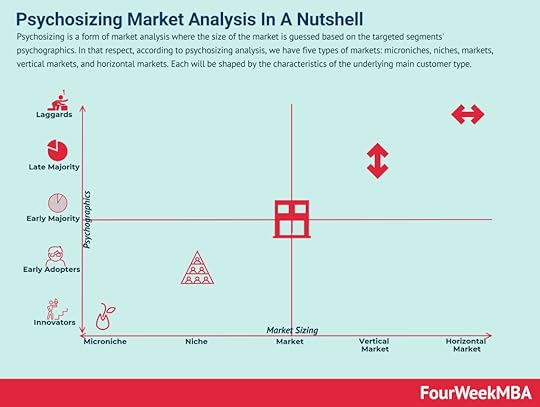

Key takeaways:Wireframing is the process of creating a two-dimensional outline of an app or website.Wireframing is an important part of the design process and should be rushed, overlooked, or combined with other processes. There are many reasons to incorporate the process, including visual architecture representation, time and cost savings, scalability potential, and feature clarification.Wireframing incorporates three wireframe types: low-fidelity, mid-fidelity, and high-fidelity. Each is associated with a particular level of detail and stage in the product lifecycle. Connected Business Concepts Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type.

Psychosizing is a form of market analysis where the size of the market is guessed based on the targeted segments’ psychographics. In that respect, according to psychosizing analysis, we have five types of markets: microniches, niches, markets, vertical markets, and horizontal markets. Each will be shaped by the characteristics of the underlying main customer type. Customer experience maps are visual representations of every encounter a customer has with a brand. On a customer experience map, interactions called touchpoints visually denote each interaction that a business has with its consumers. Typically, these include every interaction from the first contact to marketing, branding, sales, and customer support.

Customer experience maps are visual representations of every encounter a customer has with a brand. On a customer experience map, interactions called touchpoints visually denote each interaction that a business has with its consumers. Typically, these include every interaction from the first contact to marketing, branding, sales, and customer support. 360-degree feedback is a comprehensive performance feedback strategy for employees. Traditionally, performance feedback was solely given by the employee’s direct superior. In 360 degree feedback, however, anonymous feedback is given by a range of individuals that the employee has a working relationship with. These include managers, colleagues, and in some cases, customers.

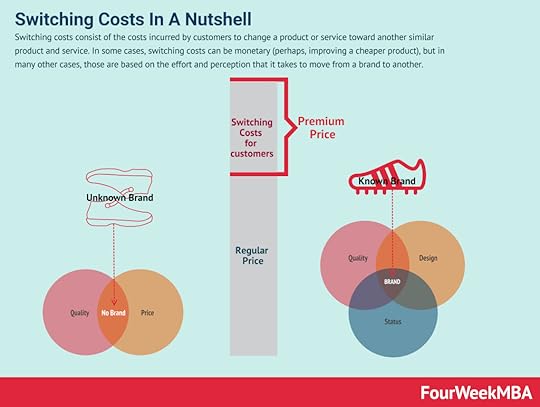

360-degree feedback is a comprehensive performance feedback strategy for employees. Traditionally, performance feedback was solely given by the employee’s direct superior. In 360 degree feedback, however, anonymous feedback is given by a range of individuals that the employee has a working relationship with. These include managers, colleagues, and in some cases, customers. Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another.

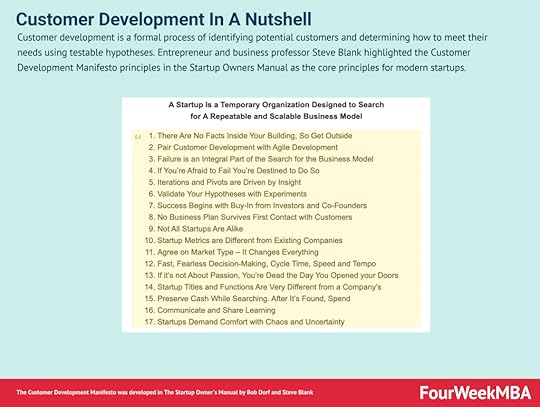

Switching costs consist of the costs incurred by customers to change a product or service toward another similar product and service. In some cases, switching costs can be monetary (perhaps, improving a cheaper product), but in many other cases, those are based on the effort and perception that it takes to move from a brand to another. Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups.

Customer development is a formal process of identifying potential customers and determining how to meet their needs using testable hypotheses. Entrepreneur and business professor Steve Blank highlighted the Customer Development Manifesto principles in The Startup Owner’s Manual as the core principles for modern startups.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What Is Wireframing? Wireframing In A Nutshell appeared first on FourWeekMBA.

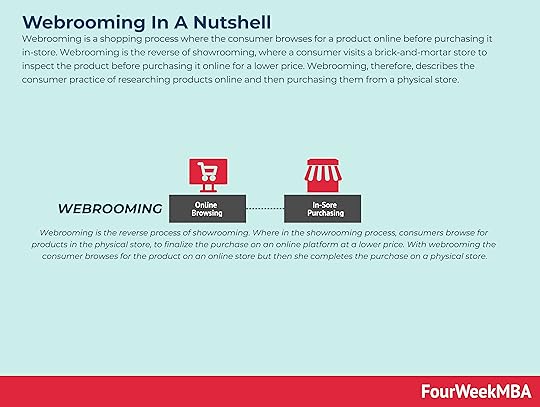

What Is Webrooming? Webrooming In A Nutshell

Webrooming is a shopping process where the consumer browses for a product online before purchasing it in-store. Webrooming is the reverse of showrooming, where a consumer visits a brick-and-mortar store to inspect the product before purchasing it online for a lower price. Webrooming, therefore, describes the consumer practice of researching products online and then purchasing them from a physical store.

Understanding webroomingStudies show that webrooming is most common for products such as appliances (58% of all purchases), electronics (54%), and apparel (49%). The practice is mostly utilized by Gen X consumers, who perform detailed product research online before buying, and Millennial consumers, who rely on devices to improve their in-store experience.

What causes webrooming?Here are some of the key drivers of webrooming:

Shipping cost – some consumers purchase in-store because they want to avoid having to pay for shipping.Tactile experience – others want to be able to see and touch a product before they commit to purchasing it. Somewhat counterintuitively, the desire for a tactile experience is also a driver of showrooming. Store availability – according to online publication Small Business Trends, some 42% of consumers check store inventory levels online before visiting a store to avoid wasting a trip. In other words, their primary intention is to purchase in-store.Product returns – a certain percentage of consumers also want to be able to return products to a physical store. In general, returning a product in-store is considered easier than posting an item back to an online retailer.Impatience – webrooming also occurs because consumers do not want to order online and be forced to wait for the product to be delivered.The future of webroomingCritics of the shift toward eCommerce believe that practices such as showrooming force bricks-and-mortar stores out of business. However, it may be that the retailers who suffer in this environment are those that are caught out by rapidly changing consumer preferences.

To survive in the modern retail industry, businesses must allow consumers to easily switch between online and offline purchases. This means catering to a mixture of showrooming and webrooming across stores, apps, websites, and any other channel a consumer considers when making a purchase decision.

Webrooming seems to have strengthened in the past years. While showrooming, on the other hand, was reported by only 57% of consumers. This data indicates that the future of webrooming – and by extension, physical retail stores – is not as uncertain as some critics propose.

Key takeaways:Webrooming describes the consumer practice of researching products online and then purchasing them from a physical store.Webrooming tends to be concentrated on appliances, electronics, and apparel. In general, the practice is caused by avoidance of shipping costs, the desire for a tactile experience, store inventory levels, easier product returns, and impatience.Some propose that showrooming and eCommerce will make webrooming and bricks-and-mortar stores unviable. However, data indicates that webrooming is more popular and that retailers should incorporate a mixture of both to cater for consumers.Read Next: Showrooming, Webrooming vs. Showrooming.

Main Free Guides:

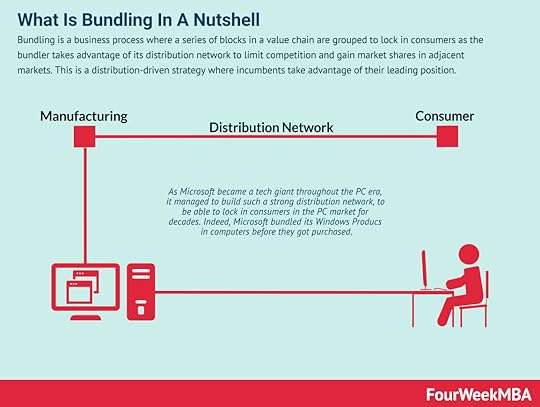

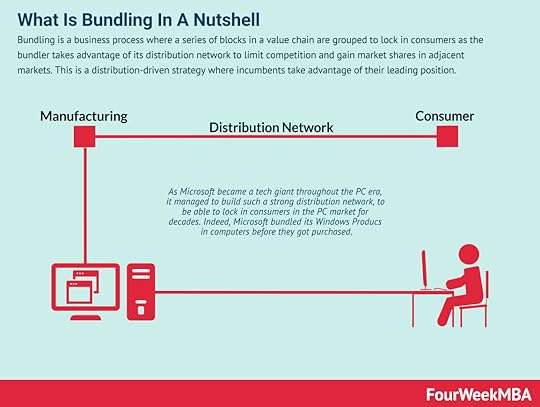

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Phenomena Bundling is a business process where a series of blocks in a value chain are grouped to lock in consumers as the bundler takes advantage of its distribution network to limit competition and gain market shares in adjacent markets. This is a distribution-driven strategy where incumbents take advantage of their leading position.

Bundling is a business process where a series of blocks in a value chain are grouped to lock in consumers as the bundler takes advantage of its distribution network to limit competition and gain market shares in adjacent markets. This is a distribution-driven strategy where incumbents take advantage of their leading position.

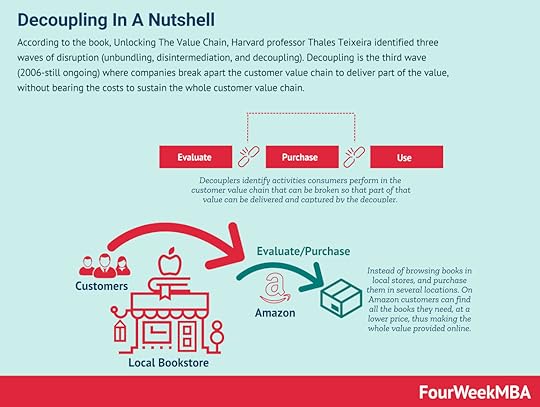

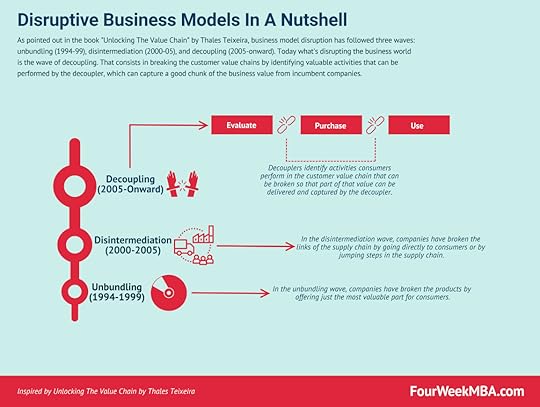

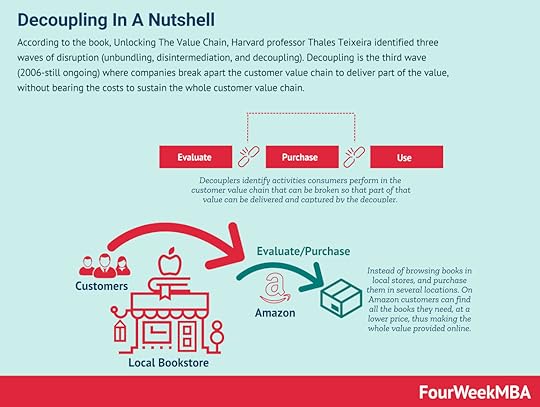

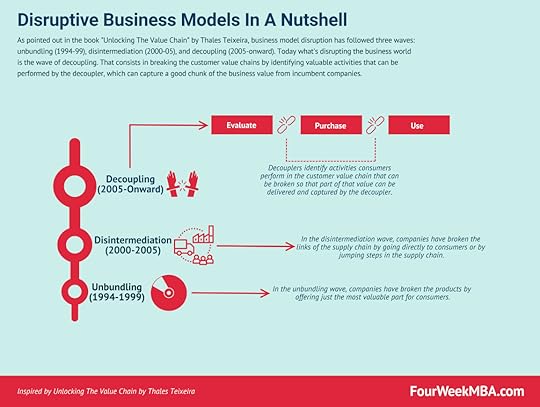

According to the book, Unlocking The Value Chain, Harvard professor Thales Teixeira identified three waves of disruption (unbundling, disintermediation, and decoupling). Decoupling is the third wave (2006-still ongoing) where companies break apart the customer value chain to deliver part of the value, without bearing the costs to sustain the whole value chain.

According to the book, Unlocking The Value Chain, Harvard professor Thales Teixeira identified three waves of disruption (unbundling, disintermediation, and decoupling). Decoupling is the third wave (2006-still ongoing) where companies break apart the customer value chain to deliver part of the value, without bearing the costs to sustain the whole value chain.

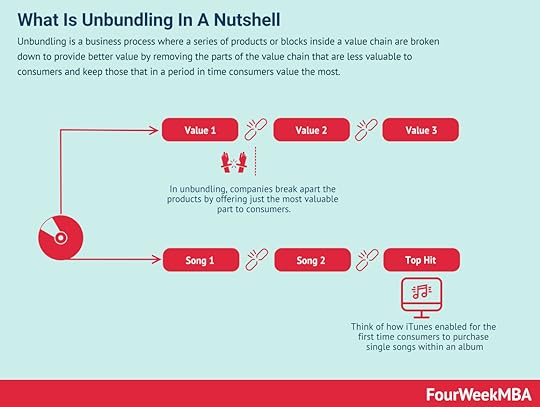

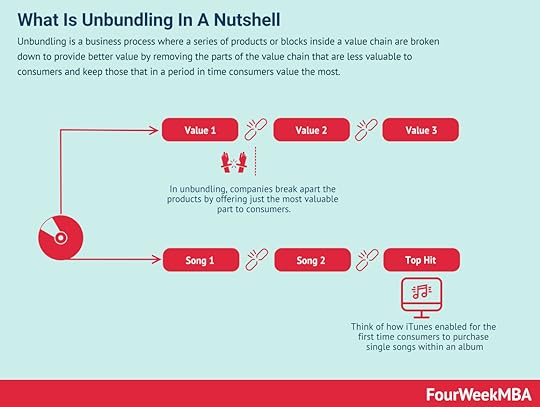

Unbundling is a business process where a series of products or blocks inside a value chain are broken down to provide better value by removing the parts of the value chain that are less valuable to consumers and keep those that in a period in time consumers value the most.

Unbundling is a business process where a series of products or blocks inside a value chain are broken down to provide better value by removing the parts of the value chain that are less valuable to consumers and keep those that in a period in time consumers value the most.

As pointed out in the book “Unlocking The Value Chain” by Thales Teixeira, business model disruption has followed three waves: unbundling (1994-99), disintermediation (2000-05), and decoupling (2005-onward). Today what’s disrupting the business world is the wave of decoupling. That consists in breaking the customer value chains by identifying valuable activities that can be performed by the decoupler, which can capture a good chunk of the business value from incumbent companies.

As pointed out in the book “Unlocking The Value Chain” by Thales Teixeira, business model disruption has followed three waves: unbundling (1994-99), disintermediation (2000-05), and decoupling (2005-onward). Today what’s disrupting the business world is the wave of decoupling. That consists in breaking the customer value chains by identifying valuable activities that can be performed by the decoupler, which can capture a good chunk of the business value from incumbent companies.

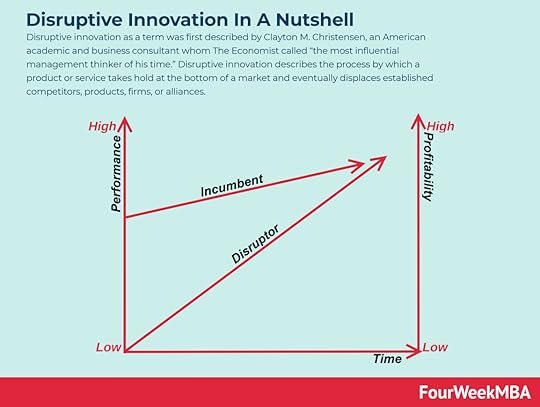

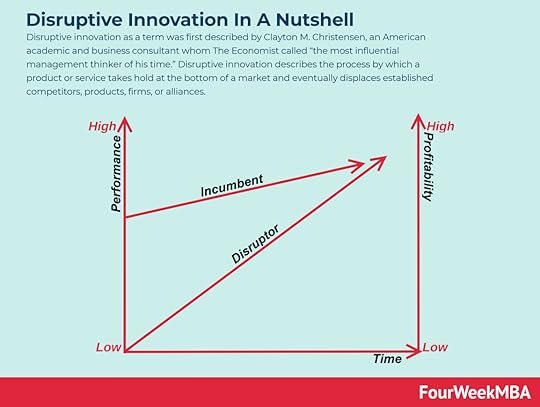

Disruptive innovation as a term was first described by Clayton M. Christensen, an American academic and business consultant whom The Economist called “the most influential management thinker of his time.” Disruptive innovation describes the process by which a product or service takes hold at the bottom of a market and eventually displaces established competitors, products, firms, or alliances.

Disruptive innovation as a term was first described by Clayton M. Christensen, an American academic and business consultant whom The Economist called “the most influential management thinker of his time.” Disruptive innovation describes the process by which a product or service takes hold at the bottom of a market and eventually displaces established competitors, products, firms, or alliances.

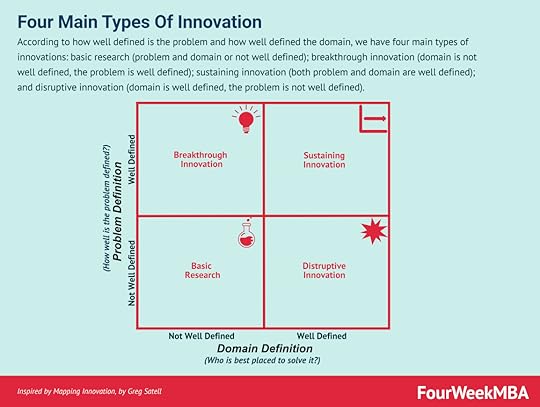

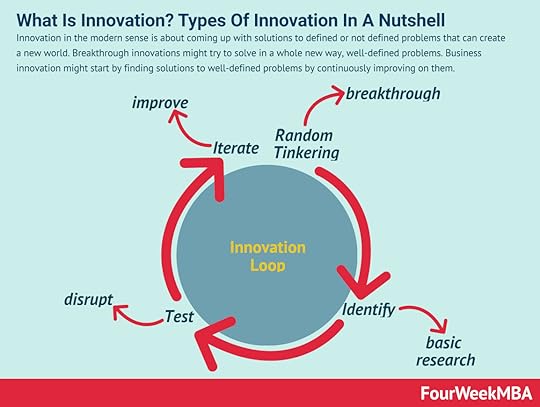

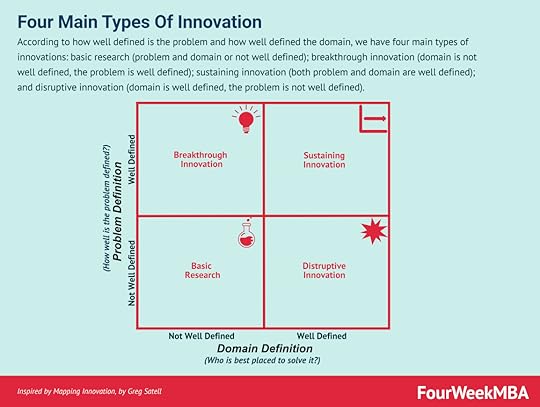

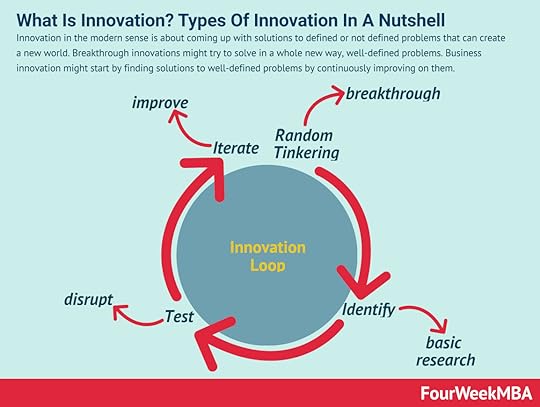

According to how well defined is the problem and how well defined the domain, we have four main types of innovations: basic research (problem and domain or not well defined); breakthrough innovation (domain is not well defined, the problem is well defined); sustaining innovation (both problem and domain are well defined); and disruptive innovation (domain is well defined, the problem is not well defined).

According to how well defined is the problem and how well defined the domain, we have four main types of innovations: basic research (problem and domain or not well defined); breakthrough innovation (domain is not well defined, the problem is well defined); sustaining innovation (both problem and domain are well defined); and disruptive innovation (domain is well defined, the problem is not well defined).

According to how well defined is the problem and how well defined the domain, we have four main types of innovations: basic research (problem and domain or not well defined); breakthrough innovation (domain is not well defined, the problem is well defined); sustaining innovation (both problem and domain are well defined); and disruptive innovation (domain is well defined, the problem is not well defined).

According to how well defined is the problem and how well defined the domain, we have four main types of innovations: basic research (problem and domain or not well defined); breakthrough innovation (domain is not well defined, the problem is well defined); sustaining innovation (both problem and domain are well defined); and disruptive innovation (domain is well defined, the problem is not well defined).The post What Is Webrooming? Webrooming In A Nutshell appeared first on FourWeekMBA.