Gennaro Cuofano's Blog, page 128

January 5, 2022

What Is A Ponzi Scheme? Ponzi Scheme In A Nutshell

A Ponzi scheme is an investment scam where existing investors generate returns via money collected from new investors. The scam was named after Charles Ponzi, an Italian con artist who promised a 50% return within 45 days or a 100% return within 90 days on postal coupons in the 1920s. When something changes hands without a core underlying product or service, it might fall under a Ponzi scheme, thus requiring caution from potential investors.

Understanding a Ponzi schemeA Ponzi scheme is an investment scam where existing investors are paid with funds collected from new investors.

Ponzi’s scheme ran for over a year before his deception was uncovered, costing investors the equivalent of $258 million in today’s money. Though author Charles Dickens had written about similar scams as early as 1844, Ponzi received considerable press coverage on his arrest and he would be forever associated with the scheme.

The most nefarious element of a Ponzi scheme is the belief held by victims that profits are coming from proper business activities such as product sales or investment returns. In the process, they remain unaware that other victims are the source of the funds.

Ponzi schemes operators focus most of their efforts on attracting new investors. The scheme may run for as long as people continue to invest and are satisfied to the extent that they do not ask to cash out their investments.

Characteristics of a Ponzi schemeIn truth, many Ponzi schemes share a few common characteristics. These include:

Consistent (out of the market) returnsLegitimate investments tend to fluctuate in value as market values increase and decrease. In a Ponzi scheme, the investment appears to generate positive returns irrespective of market conditions.

Unlicensed sellers (usually not officially recognized)Investment professionals are required under various state and federal laws to be registered. Many Ponzi schemes involve unlicensed investors who may claim to be representatives of a real or imagined company.

Difficulty receiving payments (illiquidity)Despite the apparent success of the scheme, it can be difficult for participants to cash out their investment or realize gains. Some promoters may tempt them to remain in the scheme with the lure of higher returns in the future.

Secretive or sophisticated strategies (opacity)The way con artists profit from the Ponzi Scheme is quite simple, but they describe the investment strategy to victims in terms or processes that are difficult to understand. Others will be vague or tell the individual to keep the investment a secret from family and friends.

Ponzi scheme examplesIn the years since Charles Ponzi, investors continue to fall victim to Ponzi schemes despite increased awareness and information around the technique.

Here are just a few examples from the 21st century:

Gerald PayneGreater Ministries International was an Evangelical Christian ministry headed by Gerald Payne. An IRS investigation in 2001 found that Payne had instituted a Ponzi scheme where almost $500 million was fleeced from 18,000 investors.

Bernie MadoffStockbroker and investment adviser Bernie Madoff operated a Ponzi scheme in the asset management unit of his firm Bernard L. Madoff Investment Securities. The scheme was the largest in history and many believe it ran for decades. Estimates suggest Madoff collected $64.8 billion from approximately 4,800 investors.

Scott RothsteinWho used his Florida law firm to convince investors to invest in fake legal settlements. Rothstein collected $1.2 billion from investors and was later sentenced to 50 years in prison for his crime.

Key takeaways:A Ponzi scheme is an investment scam where existing investors are paid with funds collected from new investors.Some of the common characteristics of Ponzi schemes include consistent returns, unlicensed sellers, difficulty receiving payments, and secretive or sophisticated investment strategies.Ponzi schemes continue to occur in the modern age despite increased awareness around the practice. Investment adviser Bernie Madoff is the most notable example having collected almost $65 billion over many decades.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Financial Concepts A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States.

A business incubator is an organization that helps start-up companies or entrepreneurs develop their businesses. Assistance usually takes the form of dedicated office space, management training, and venture capital funding. According to the National Business Incubation Association, there are more than 1,400 incubators in the United States. An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return.

An angel investor is usually a high net-worth individual who invests in early-stage start-ups in exchange for equity in the company. Angel investors are wealthy private investors focused on financing small business ventures in exchange for an equity stake. Unlike a venture capital firm, an angel investor invests their own capital during the early stages of a start-up when the risk of failure is relatively high, yet it might in the long-term unlock higher rates of return. A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples.

A venture capitalist generally invests in companies and startups which are still in a stage where their business model needs to be proved viable, or they need resources to scale up. Thus, those companies present high risks, but the potential for exponential growth. Therefore, venture capitalists look for startups that can bring a high ROI and high valuation multiples. Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have.

Economic or market moats represent the long-term business defensibility. Or how long a business can retain its competitive advantage in the marketplace over the years. Warren Buffet who popularized the term “moat” referred to it as a share of mind, opposite to market share, as such it is the characteristic that all valuable brands have. Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns.

Meme stocks are securities that go viral online and attract the attention of the younger generation of retail investors. Meme investing, therefore, is a bottom-up, community-driven approach to investing that positions itself as the antonym to Wall Street investing. Also, meme investing often looks at attractive opportunities with lower liquidity that might be easier to overtake, thus enabling wide speculation, as “meme investors” often look for disproportionate short-term returns. Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee.

Payment for order flow consists of a “kickback” or commission that the broker routing customers to a market maker (in charge of enabling the bid and ask price) will pay a commission to the broker as a sort of market-making fee. A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC.

A special purpose acquisition company (SPAC) is a company with no commercial operations that are created to raise capital through an IPO to acquire another company. The SPAC is also called for that reason a “blank check company” as it will use the money provided by investors to enable private companies to go public via the SPAC. The Pac-Man defense is a tactic used by a company that is the subject of a hostile takeover. The Pac-Man defense is a response to a hostile takeover attempt with another hostile takeover attempt. In essence, the company that was the subject of the original takeover turns the tables on the acquiring company by trying to take it over in turn.

The Pac-Man defense is a tactic used by a company that is the subject of a hostile takeover. The Pac-Man defense is a response to a hostile takeover attempt with another hostile takeover attempt. In essence, the company that was the subject of the original takeover turns the tables on the acquiring company by trying to take it over in turn.The post What Is A Ponzi Scheme? Ponzi Scheme In A Nutshell appeared first on FourWeekMBA.

What Is The Paradox of Thrift? The Paradox of Thrift In A Nutshell

The paradox of thrift was popularised by British economist John Maynard Keynes and is a central component of Keynesian economics. Proponents of Keynesian economics believe the proper response to a recession is more spending, more risk-taking, and less saving. They also believe that spending, otherwise known as consumption, drives economic growth. The paradox of thrift, therefore, is an economic theory arguing that personal savings are a net drag on the economy during a recession.

Understanding the paradox of thriftWhen consumers choose to save their money over spending it in a recession, this harms the businesses that sell goods and services. The business experiences fewer sales and a decrease in productivity and cannot sustain as many employees as a result. When some of these employees lose their jobs, they have less disposable income to spend and the recession may deepen.

This disconnect between individual and group rationality is the basis of the paradox of thrift. Consumers reduce their consumption and attempt to increase their savings during a recession because it makes sense for them to do so. But it does not make sense for the broader economy since consumer savings are removed from the circular flow of income. This means they cannot contribute to an increase in consumption and demand.

The paradox of thrift and the circular flow model The circular flow of income model was first introduced by French-Irish economist Richard Cantillon in the 18th century. Cantillon’s initial model was relatively primitive and was progressively expanded upon by Karl Marx and John Maynard Keynes, among others. The circular flow of income is a model that illustrates how money, goods, and services move between sectors in an economic system.

The circular flow of income model was first introduced by French-Irish economist Richard Cantillon in the 18th century. Cantillon’s initial model was relatively primitive and was progressively expanded upon by Karl Marx and John Maynard Keynes, among others. The circular flow of income is a model that illustrates how money, goods, and services move between sectors in an economic system.The paradox of thrift can be explained by the circular flow model which demonstrates how money moves through society. In general terms, money flows from producers to workers as wages and then from workers to producers as payment for a product or service.

The circular flow model starts with the household sector and consumer spending. To boost this spending, Keynes said banks needed to lower interest rates to make saving money in a bank account less attractive. If this strategy was ineffective, the government could use deficit spending to take on debt and use its power to stimulate demand in the economy.

Criticisms of the paradox of thriftThe paradox of thrift has been criticized by neo-classical economists.

These economists believe that a consumer saving their money sends a signal to the market that they do not want to consume any goods or services at current prices. To counteract this scenario, producers can lower their prices or change the goods and services being produced. In essence, the lack of consumption forces the market to optimize and does not, as Keynes suggested, reduce future output.

To a lesser extent, the paradox of thrift also ignores the ability of a bank to lend out consumer savings to other consumers or companies to stimulate demand. Neoclassical theorists also suggest that consumer savings are essential to growth and technological innovation, with a capital threshold reached before such innovation can raise the total output of an economy.

Lastly, the paradox of thrift ignores Say’s Law of Markets, a classical economic theory that states that goods must be produced before they can be exchanged. In other words, the source of demand in an economy is due to the production and sale of goods for money and not from money (spending) itself.

Key takeaways:The paradox of thrift is an economic theory arguing that personal savings are a net drag on the economy during a recession.The paradox of thrift is based on a disconnect between individual and group rationality. Consumers reduce their consumption and attempt to increase their savings during a recession, but this removes money from the circular flow of income and exacerbates the problem in the broader economy.The paradox of thrift has attracted criticism from neo-classical economists who suggest that markets will self-correct when faced with low consumer demand. The paradox of thrift also ignores the ability of banks to lend out consumer savings to stimulate demand in the economy.Read Next: Circular Flow Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Is The Paradox of Thrift? The Paradox of Thrift In A Nutshell appeared first on FourWeekMBA.

What Are Public-Private Partnerships And How They Work? Public-Private Partnerships In A Nutshell

A public-private partnership (PPP) involves collaboration between the public and private sectors that can be used to finance, build, or operate infrastructure projects. Public-private partnerships are unique to some extent, but many share common characteristics such as service orientation, whole life costing, risk allocation, long-term relationships, and transparency.

Understanding public-private partnershipsPublic-private partnerships are defined by a long-term contract between a private party and a government agency where the aim is to provide a public asset or service.

In most cases, a private company provides the capital for government projects and services up-front and then collects a fee from taxpayers or the government over the duration of the contract. The private sector also tends to be responsible for the design, construction, and operation of the asset in addition to the maintenance required over its useful life.

The PPP model is entrenched in many countries and is used for:

Economic infrastructure – such as roads, airports, dams, bridges, sewerage systems, and public transportation systems, andSocial infrastructure – such as schools, hospitals, sports facilities, entertainment centers, and prisons.The fundamental characteristics of a public-private partnershipWhile every PPP has unique characteristics, there are a few principle features that are common to almost every contract. These include:

Service-orientationThe PPP approach has a core focus on delivering long-term public services including transportation, electricity, and water. There must always be adequate and prior consultation with end-users and other stakeholders before the commencement of project construction.

Whole life costingThe total cost of the project is computed for its entire life span, encompassing initial capital expenditure, maintenance, modification, and decommissioning costs.

Risk allocationSince many infrastructure projects involve high risk, both the private and public sectors are allocated a share of the risk to reduce their respective exposure.

Long-term relationshipsPublic-private partnerships may last for decades because of the time required to construct the asset and its longer useful life. The private company is paid for services rendered so long as it continues to meet key performance indicators.

TransparencyAs a funding tool, PPPs are no stranger to controversy as many believe the public return on investment is lower than the ROI enjoyed by the private funder. World-class standards of transparency concerning public and corporate governance are thus important to enhance the credibility of a public-private partnership.

Examples of a public-private partnershipIn this section, we’ll take a look at some specific public-private partnership examples in the United States:

Gateway ArchWhen the Gateway Arch in St. Louis, Missouri experienced a decline in visitors, the Gateway Arch Park Foundation raised $250 million in conjunction with an $86 million government grant to upgrade the monument. The partnership resulted in a 30% increase in attendance.

Puerto RicoA consortium of United States and Canada-based firms partnered with Puerto Rican electricity provider Luma. The provider had failed to improve or maintain the power network which resulted in frequent power outages. The consortium now oversees transmission, distribution, billing, capital improvements, and human resources.

The Merced 2020 ProjectThe University of California Merced partnered with a coalition of local entities in a deal worth $1.3 billion. The funds went toward the expansion of the university with projects such as student housing, classrooms, research space, recreational facilities, and counseling services.

Key takeaways:Public-private partnerships involve collaboration between the public and private sectors that are used to finance, build, or operate infrastructure projects.Public-private partnerships are unique to some extent, but many share common characteristics such as service orientation, whole life costing, risk allocation, long-term relationships, and transparency.Examples of public-private partnerships involving American companies include the Gateway Arch and Puerto Rican power network revitalization. A PPP was also used to secure $1.2 billion to fund the expansion of UC Merced.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Are Public-Private Partnerships And How They Work? Public-Private Partnerships In A Nutshell appeared first on FourWeekMBA.

What Is Purchase Intention? Purchase Intention In A Nutshell

Purchase intention is a measure of the strength of a consumer’s intention to perform a specific behavior or make a decision to purchase a product or service. Usually purchase intents are classified according to four types: informational (awareness), investigative intent (consideration), navigational (consideration/conversion), transaction intent (conversion).

Understanding purchase intentionPurchase intention is the willingness of a consumer to buy a product or service.

While the concept appears rather simplistic at first glance, it is important to note that purchase intention cannot be evaluated with a simple yes or no answer. In truth, many factors affect purchase intention such as consumer knowledge, product packaging, celebrity endorsement, or the general perception of a product among friends and relatives.

Purchase intention is the single most important customer metric in eCommerce, but many businesses build customer segments around a buyer persona and consider their work to be finished. In a study conducted by Google in 2015, it was found that marketers who focused on demographics and ignored purchase intention could be missing more than 70% of potential customers.

To illustrate this point, Google noted that 40% of baby-related products were purchased by people who lived in households without the babies they were purchasing for. These are individuals such as grandparents, birthday guests, and baby shower attendees, among others. However, the point here is that none of these individuals are the parents with the newborn baby.

Thus, it stands to reason that to neglect purchase intention is to neglect, in some cases, the majority of the target audience. Marketers who take the time to understand it will enjoy a host of benefits, including improved conversion rates, profit margins, customer lifetime value, brand equity, and marketing channel ROI.

The four types of customer purchase intentionFor online businesses, there are four types of customer purchase intention. In other words, every consumer lands on a website with a different goal in mind.

The four purchase intention types are as follows.

1 – Informational intent (awareness)Consumers in this stage are concerned with reading information to educate themselves on a topic. For example, a consumer searching for information on cosmetics that do not inflame sensitive skin may read an article that helps them understand how to solve their problem.

For the business, the goal is to create brand awareness and provide the consumer with educational resources that move them down the marketing funnel.

2 – Investigative intent (consideration)Consumers in the investigation stage are currently exploring their options via additional research. This may include comparison websites, product and brand reviews, and social listening.

Due to the sheer number of different products available today, consumers spend more time with an investigative intent than they do any other intent. As a result, the business must show the consumer value propositions that are relevant to them and clearly explain what sets their brand apart from competitors.

Consumer finance platform NerdWallet incorporates product comparisons and user reviews to make personalized product recommendations across multiple niche market segments.

3 – Navigational intent (consideration or conversion)Navigational intent means the consumer is visiting a specific website or a brand’s online store. Since they are seeking out a specific brand or website address, navigational intent is associated with higher purchase intent.

Businesses must keep the consumer on their platform at all costs or risk losing them to the competition. Product promotions and personalized messages or customer experiences can be effective strategies.

4 – Transactional intent (conversion)Transactional intent is the type most equate with actual purchase intent. These consumers have a propensity to purchase, which means they are interested in acquiring a product or service.

Conversion should be the aim of the game for all businesses at this stage. This can be facilitated via incentivized, time-limited, or personalized promotions. For example, many eCommerce retailers offer consumers a 10% discount in exchange for their email addresses. Others may promise free shipping if the order amount exceeds a certain threshold.

Key takeaways:Purchase intention is a measure of the strength of a consumer’s intention to perform a specific behavior or make a decision to purchase a product or service.Studies by Google have shown that focusing on customer demographics and ignoring purchase intention is to neglect, in some cases, the majority of a company’s target audience.There are four types of purchase intention which correlate with various stages of a marketing funnel. For eCommerce businesses, knowing which type of intent a website visitor displays is crucial in making them more motivated to buy.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business.

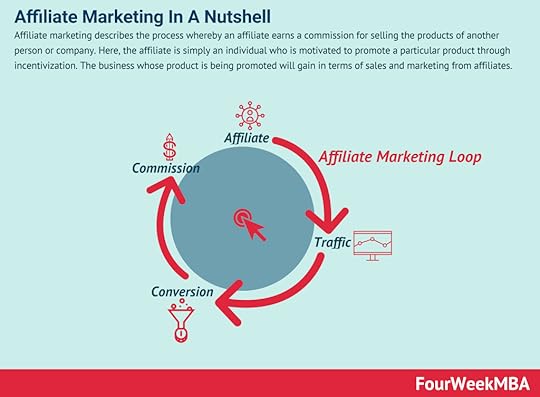

Email marketing leverages a set of tactics to build a stronger brand, drive traffic to your products, and build a solid funnel for converting leads into loyal customers. While email marketing isn’t new, it’s still one of the most effective marketing strategies to build a valuable business. Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates.

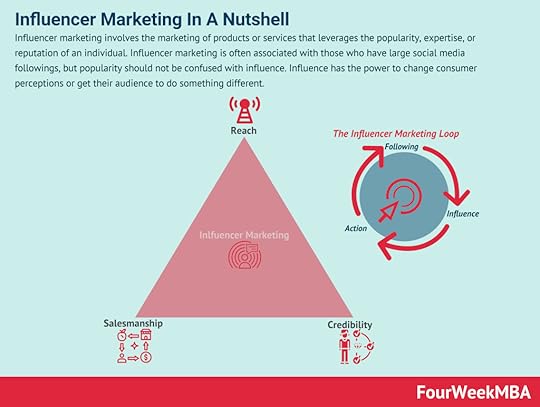

Affiliate marketing describes the process whereby an affiliate earns a commission for selling the products of another person or company. Here, the affiliate is simply an individual who is motivated to promote a particular product through incentivization. The business whose product is being promoted will gain in terms of sales and marketing from affiliates. Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different.

Influencer marketing involves the marketing of products or services that leverages the popularity, expertise, or reputation of an individual. Influencer marketing is often associated with those who have large social media followings, but popularity should not be confused with influence. Influence has the power to change consumer perceptions or get their audience to do something different. Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products.

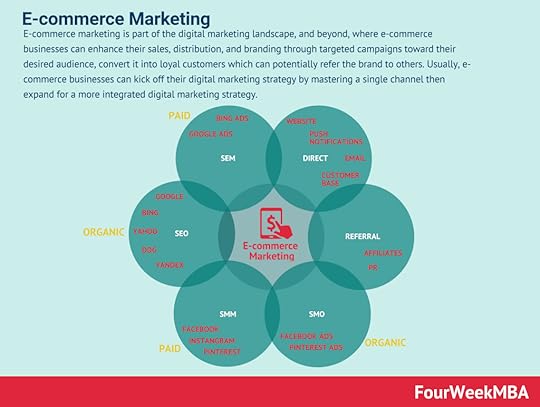

Sustainable marketing describes how a business will invest in social and environmental initiatives as part of its marketing strategy. Also known as green marketing, it is often used to counteract public criticism around wastage, misleading advertising, and poor quality or unsafe products. E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy.

E-commerce marketing is part of the digital marketing landscape, and beyond, where e-commerce businesses can enhance their sales, distribution, and branding through targeted campaigns toward their desired audience, convert it into loyal customers which can potentially refer the brand to others. Usually, e-commerce businesses can kick off their digital marketing strategy by mastering a single channel then expand for a more integrated digital marketing strategy. Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns.

Buzz marketing leverages the power of word-of-mouth advertising to create products or services with enough novelty that they go viral. In many cases, buzz marketing leverages on versatile content that can easily scale and be readapted to various contexts and fear of missing out (FOMO) to amplify the effect of word-of-mouth campaigns. Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature.

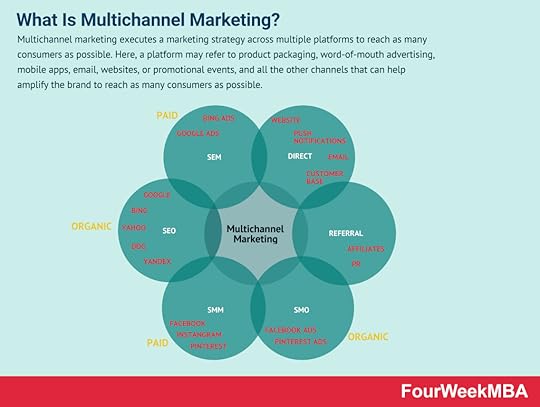

Shotgun marketing is a form of above-the-line (ATL) marketing, where popular mediums such as TV and radio are used to market to a mass audience. This technique of marketing targets as many consumers as possible. Also known as mass marketing, the technique attracts a large number of leads that, on average, might be of lower quality in nature. Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible.

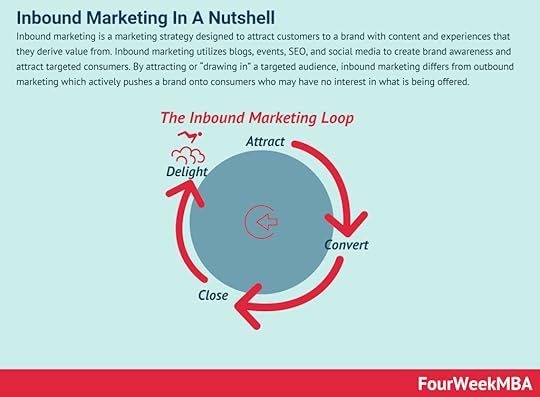

Multichannel marketing executes a marketing strategy across multiple platforms to reach as many consumers as possible. Here, a platform may refer to product packaging, word-of-mouth advertising, mobile apps, email, websites, or promotional events, and all the other channels that can help amplify the brand to reach as many consumers as possible. Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered.

Inbound marketing is a marketing strategy designed to attract customers to a brand with content and experiences that they derive value from. Inbound marketing utilizes blogs, events, SEO, and social media to create brand awareness and attract targeted consumers. By attracting or “drawing in” a targeted audience, inbound marketing differs from outbound marketing which actively pushes a brand onto consumers who may have no interest in what is being offered. With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market.

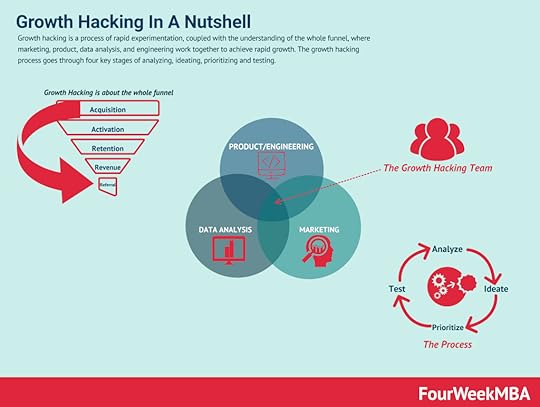

With partnership marketing, two or more companies team up to create marketing campaigns that help them grow organically with a mutual agreement, thus making it possible to reach shared business goals. Partnership marketing leverages time and resources of partners that help them expand their market. Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget.

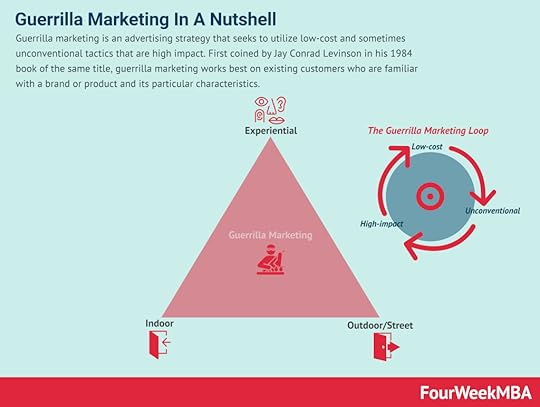

Growth marketing is a process of rapid experimentation, which in a way has to be “scientific” by keeping in mind that it is used by startups to grow, quickly. Thus, the “scientific” here is not meant in the academic sense. Growth marketing is expected to unlock growth, quickly and with an often limited budget. Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics.

Guerrilla marketing is an advertising strategy that seeks to utilize low-cost and sometimes unconventional tactics that are high impact. First coined by Jay Conrad Levinson in his 1984 book of the same title, guerrilla marketing works best on existing customers who are familiar with a brand or product and its particular characteristics. As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event.

As the name suggests, ambush marketing raises awareness for brands at events in a covert and unexpected fashion. Ambush marketing takes many forms, one common element, the brand advertising their products or services has not paid for the right to do so. Thus, the business doing the ambushing attempts to capitalize on the efforts made by the business sponsoring the event. Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.

Relationship marketing involves businesses and their brands forming long-term relationships with customers. The focus of relationship marketing is to increase customer loyalty and engagement through high-quality products and services. It differs from short-term processes focused solely on customer acquisition and individual sales.The post What Is Purchase Intention? Purchase Intention In A Nutshell appeared first on FourWeekMBA.

What Is Rational Choice Theory? Rational Choice Theory In A Nutshell

Rational choice theory states that an individual uses rational calculations to make rational choices that are most in line with their personal preferences. Rational choice theory refers to a set of guidelines that explain economic and social behavior. The theory has two underlying assumptions, which are completeness (individuals have access to a set of alternatives among they can equally choose) and transitivity.

Understanding rational choice theoryRational choice theory is used to model decision-making – particularly in the field of microeconomics – where it helps economists better understand the collective behavior of individuals and how their actions impact society as a whole.

The theory makes two assumptions that describe rational choice:

Completeness – this means the individual can say which option they prefer among a set of alternatives. They may prefer A over B, B over A, or both (indifference).Transitivity – this refers to the property of preference relationships where if A is preferred over B, and B is preferred to C, then A must be preferable to C. The relationship between A and C will be determined by the strongest preference relationship in a set of alternatives.The preferences themselves can also be:

Strict – when an individual prefers A over B and does not view them as equally preferred.Weak – when an individual strictly prefers A over B or is indifferent between the two.Indifferent – when the individual prefers neither A nor B.From these preferences for choice alternatives, various individuals, businesses, and governments can develop utility functions that best reflect those preferences.

Rational choice theory and utility functionThe preference of an individual is often described by its utility function, which defines their preferences for goods and services beyond their explicit monetary value. Utility function is a measure of how much someone desires something and, as a result, varies from person to person. By extension, utility functions can reflect one’s attitude to risk acceptance, risk neutrality, or risk aversion.

The idea that rational choices were made to maximize utility function arose in the 19th century. Utilitarian philosophers were seeking to develop an index that could measure how beneficial different governmental policies were for different people. Around the same time, proponents of Adam Smith also endeavored to refine the economist’s ideas about how an economic system based on individual self-interest would work.

Some realized the two approaches could be combined. Indeed, utility-maximization has several characteristics that help account for its continued dominance in economics. Indeed, the approach has several important benefits for governments and policymakers:

The development of welfare criteriaRational choice theory incorporates the principle that people’s own choices should determine government welfare criteria. These criteria are effective because they are aligned with modern democratic values.

Compact theoryPredictions of individual behavior can be made with a simple description of the individual’s objectives and constraints. The approach is considered more streamlined than psychological theories which posit that choices depend on a much wider array of factors.

Wide scopeUtility maximization also has a spectacularly wide scope. It has been used by governments to analyze choices in consumption, savings, education, child-bearing, migration, and crime. In business, it also has been used to evaluate decisions concerning output, recruitment, and investing.

Rational choice theory assumptionsRational choice theory makes the following assumptions:

Every action is rational and is made by considering rewards and costs.For an action to be completed, the reward must outweigh the cost.When the value of a reward is less than the value of the costs incurred, the individual will cease performing the action.Individuals use the resources at their disposal to optimize rewards.As a result, the theory argues that an individual is in control of their decisions because they use rational considerations to evaluate the potential benefits and consequences. They do not make choices that are based on unconscious drivers, traditions, or external influences.

The three concepts of rational choice theoryRational choice theory is based on three concepts:

Rational actors

Or the individuals in an economy who make rational choices based on the available information. As we noted earlier, rational actors seek to maximize their advantage and minimize their losses wherever possible.

Self-interest – or actions undertaken by the individual that elicit a personal benefit. Adam Smith was one of the first to use self-interest in the context of economic theory.

The invisible hand – a metaphor and theory for the hidden forces that shape a free market economy. The theory argues that the best interests of society are fulfilled when individuals act in their own self-interest via freedom of production and consumption.

Criticisms of rational choice theoryThere do exist several criticisms of rational choice theory, with most related to a belief that few people are consistently rational in the choices they make. Since people are not rational all of the time, assuming rationality to be the case may lead to incorrect conclusions.

For one, rational choice theory does not account for non-self-serving behavior such as philanthropy or any other situation where there is a cost but no reward to the individual. What’s more, the theory does not account for ethics or values and the impact of these on decision-making.

Many others suggest that rational choice theory ignores social norms. In other words, most people follow standard or accepted ways of behaving irrespective of whether they will personally benefit from doing so. Similarly, some individuals will behave in habitual ways and stick to established routines even in the face of higher costs and lower benefits.

Though somewhat outdated, Smith’s assumption that individuals acting in their own self-interest benefits society is also flawed. Fishermen who catch as many fish as possible are responsible for the collapse of wild fish populations. Cattle farmers clearing rainforest for pasture causes habitat loss and soil degradation. In these cases, self-interest is irrational and does not benefit society. In fact, these choices are delusional, myopic, ignorant, and destructive.

Key takeaways:Rational choice theory is a set of guidelines that explain economic and social behavior. The theory is used to model decision-making in microeconomics to help economists understand the behavior of individuals and their impact on society as a whole.Rational choice theory enables individual preferences to be represented as utility functions. These functions define consumer preferences for goods and services that extend beyond the monetary value of those goods and services. The maximization of utility is used in economic management and the development of policy.Since rational choice theory assumes human decision-making to be rational, critics suggest it does not account for situations where it is irrational. This may occur in instances where an individual displays non-self-serving behavior such as philanthropy. It may also occur when the individual makes decisions based on habitual ways of operating or societal conformity.Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward.

A network effect is a phenomenon in which as more people or users join a platform, the more the value of the service offered by the platform improves for those joining afterward. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.

State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage. The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.

The boom and bust cycle describes the alternating periods of economic growth and decline common in many capitalist economies. The boom and bust cycle is a phrase used to describe the fluctuations in an economy in which there is persistent expansion and contraction. Expansion is associated with prosperity, while the contraction is associated with either a recession or a depression.The post What Is Rational Choice Theory? Rational Choice Theory In A Nutshell appeared first on FourWeekMBA.

What Is Price Sensitivity? Price Sensitivity In A Nutshell

Price sensitivity can be explained using the price elasticity of demand, a concept in economics that measures the variation in product demand as the price of the product itself varies. In consumer behavior, price sensitivity describes and measures fluctuations in product demand as the price of that product changes.

Understanding price sensitivityPrice sensitivity helps a business with one of the most difficult tasks it will encounter: the striking of a balance between selling its products at a price consumers can afford while making a profit at the same time.

High price sensitivity indicates that consumers are more likely to reject purchasing a product in favor of another product. Low price sensitivity, on the other hand, indicates that consumers are willing to pay the stated price and may even be willing to pay more.

Read Next: Price Elasticity.

Factors that influence price sensitivityUnderstanding the machinations of the consumer mind when faced with a purchasing decision is critical if a business is to price its products appropriately.

With that in mind, here are some of the many factors that influence price sensitivity:

Price and qualityBuyers are less sensitive to price if the product is of superior quality or a status symbol, such as a luxury car or designer watch.

UniquenessPrice sensitivity also depends on whether the product or brand is unique. A consumer is likely to be less sensitive if purchasing a pair of Air Jordans because they cannot be substituted with something else. However, the consumer purchasing a loaf of bread will be more sensitive to price because there are many alternative brands.

Ease of comparisonIf a product can be easily compared with similar products in the marketplace then price sensitivity tends to be higher. This is related to uniqueness.

Reference priceWhen comparing similar products from multiple merchants, consumers form a reference price based on their observations and comparisons. Provided the products are more or less the same, the consumer may be more willing to choose a product based on price.

Available incomePrice sensitivity also increases when consumers have less money in the bank, whether that be due to personal circumstances or broader economic factors such as a recession. This is especially true of more expensive items.

How can businesses measure price sensitivity?For best results, the business should have a deep understanding of the various market segments within its target audience. Each will perceive the value of a product differently, which means their price sensitivity will also differ.

Once the audience has been segmented, the business needs to move beyond the simple question of “How much would you pay for this product?”

In practice, this can be done in several ways.

Price ladder methodThis involves asking potential customers about their intention to purchase a specific product at a specific price on a scale of 1 to 10. If the customer reports an intention to buy below a particular threshold, then the price is considered low and they are asked if they intend to purchase again in the future.

Data analysis can also be performed to evaluate the percentage of the market that would buy at any given price point.

Van Westendorp modelNamed after Dutch economist Peter van Westendorp, this method asks a series of questions to identify critical psychological price points and gauge consumer purchasing power.

Importantly, the method is based on real-world market data. It can be adapted according to whether the business plans to introduce a pricing change or wants to determine consumer perception of its products with respect to competitors.

Gabor-Granger methodThe Gabor-Granger method was developed in the 1960s by economists Clive Granger and Andre Gabor.

The method is a convenient and practical survey method where participants are introduced to a product and then exposed to a random price chosen from a predetermined list. If the participant is willing to buy the product at that price, they are shown the product again with a higher price attached.

This process is repeated until the highest price a participant is willing to pay is determined. In some cases, the price may need to be lowered on multiple occasions until an agreeable price is reached.

Key takeaways:Price sensitivity is the degree to which the price of a product affects consumer purchasing behavior. High price sensitivity indicates that a consumer is more likely to choose an alternative product, while low price sensitivity indicates that the consumer is willing to pay the stated price or maybe more.Price sensitivity can be understood by considering the machinations of the consumer’s mind when making a purchasing decision. Indeed, they may be weighing up price, quality, uniqueness, ease of comparison, reference price, and available income.The price sensitivity of various market segments should be analyzed for best results. Analysis techniques include the price ladder method, Van Westendorp model, and Gabor-Granger method.Read Next: Price Elasticity.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkConnected Business Concepts In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further.

In Economics, Economies of Scale is a theory for which, as companies grow, they gain cost advantages. More precisely, companies manage to benefit from these cost advantages as they grow, due to increased efficiency in production. Thus, as companies scale and increase production, a subsequent decrease in the costs associated with it will help the organization scale further. In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows.

In Economics, a Diseconomy of Scale happens when a company has grown so large that its costs per unit will start to increase. Thus, losing the benefits of scale. That can happen due to several factors arising as a company scales. From coordination issues to management inefficiencies and lack of proper communication flows. In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.

In a negative network effect as the network grows in usage or scale, the value of the platform might shrink. In platform business models network effects help the platform become more valuable for the next user joining. In negative network effects (congestion or pollution) reduce the value of the platform for the next user joining.  Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets.

Creative destruction was first described by Austrian economist Joseph Schumpeter in 1942, who suggested that capital was never stationary and constantly evolving. To describe this process, Schumpeter defined creative destruction as the “process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one.” Therefore, creative destruction is the replacing of long-standing practices or procedures with more innovative, disruptive practices in capitalist markets. Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth.

Happiness economics seeks to relate economic decisions to wider measures of individual welfare than traditional measures which focus on income and wealth. Happiness economics, therefore, is the formal study of the relationship between individual satisfaction, employment, and wealth. In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production.

In a command economy, the government controls the economy through various commands, laws, and national goals which are used to coordinate complex social and economic systems. In other words, a social or political hierarchy determines what is produced, how it is produced, and how it is distributed. Therefore, the command economy is one in which the government controls all major aspects of the economy and economic production. The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty.

The term “animal spirits” is derived from the Latin spiritus animalis, loosely translated as “the breath that awakens the human mind”. As far back as 300 B.C., animal spirits were used to explain psychological phenomena such as hysterias and manias. Animal spirits also appeared in literature where they exemplified qualities such as exuberance, gaiety, and courage. Thus, the term “animal spirits” is used to describe how people arrive at financial decisions during periods of economic stress or uncertainty. State capitalism is an economic system where business and commercial activity is controlled by the state through state-owned enterprises. In a state capitalist environment, the government is the principal actor. It takes an active role in the formation, regulation, and subsidization of businesses to divert capital to state-appointed bureaucrats. In effect, the government uses capital to further its political ambitions or strengthen its leverage on the international stage.