How Does FTX Work And Make Money?

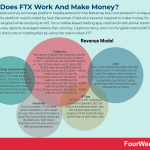

FTX is a cryptocurrency exchange platform headquartered in the Bahamas but incorporated in Antigua and Barbuda. The platform was founded by Sam Bankman-Fried who became inspired to make money for the greater social good while studying at MIT.On a mobile-based trading app, retail and institutional traders can buy and sell futures, options, leveraged tokens, fiat currency, cryptocurrency, and non-fungible tokens (NFTs). Users can receive discounts on trading fees by using the native token FTT.FTX makes money through various trading fees, including maker fees, taker fees, NFT fees, and margin borrower interest. The company also charges interest on its institutional loan service and collects a fee from merchants that want to accept cryptocurrency as a form of payment.FTX Origing Story

FTX is a cryptocurrency exchange platform headquartered in the Bahamas but incorporated in Antigua and Barbuda. The platform was founded by Sam Bankman-Fried who became inspired to make money for the greater social good while studying at MIT.On a mobile-based trading app, retail and institutional traders can buy and sell futures, options, leveraged tokens, fiat currency, cryptocurrency, and non-fungible tokens (NFTs). Users can receive discounts on trading fees by using the native token FTT.FTX makes money through various trading fees, including maker fees, taker fees, NFT fees, and margin borrower interest. The company also charges interest on its institutional loan service and collects a fee from merchants that want to accept cryptocurrency as a form of payment.FTX Origing StoryFTX is a cryptocurrency exchange platform headquartered in the Bahamas but incorporated in Antigua and Barbuda. The platform was founded by Sam Bankman-Fried in 2019.

While studying at MIT, Bankman-Fried stumbled upon the philosophy of effective altruism. The movement, which was founded by two Oxford University professors, encourages individuals to use evidence and reason to determine how to benefit others as much as possible. Inspired by a meeting with one of these professors, he decided to devote his life to earning money for the express purpose of giving it away to those in need.

In the summer of his junior year, he decided to intern at Wall Street firm Jane Street Capital. There, he discovered a passion for trading ETFs and Bitcoin, with the latter making him thousands of dollars in arbitrage profit between American and Japanese exchanges. This income was then used to found Alameda Research, a quantitative trading firm moving as much as $25 million in Bitcoin daily.

Over time, however, Bankman-Fried and his associates grew tired of the one-dimensionality of mainstream exchanges. Since they were mostly designed for inexperienced retail traders, most only allowed the buying and selling of cryptocurrencies. This provided the impetus for the launching of FTX in June 2019, a platform now known for offering more sophisticated derivative products including futures, options, and tokenized stocks that track the value of real shares in companies such as Tesla and BioNTech.

In July 2021, it was reported that FTX was averaging $10 billion in daily trading volume across more than 1 million users. Recent figures suggest the company is worth around $18 billion.

How does FTX work?On the FTX platform, retail and institutional traders can buy and sell futures, options, leveraged tokens, fiat currency, cryptocurrency, and non-fungible tokens (NFTs).

Trading is performed in a mobile-based app, which lets traders build a customized interface layout using drag and drop boxes.

The company has also developed an exchange token for use in the FTX ecosystem called FTT. Users receive lower trading fees for holding FTT and the token can also be used as futures collateral and for staking.

FTX customers can also receive a branded debit card which lets them spend crypto assets on offline purchases.

How does FTX make money?In line with its diverse product offering, FTX has a varied revenue generation strategy. In this section, we’ll take a look at some of the main sources of income.

Trading feesMost revenue is derived from trading fees, with the company utilizing a tiered structure as follows:

Tier 1 – 0.020% maker fee and 0.070% taker fee.Tier 2 (30-day volume over $2 million USD) – 0.015% maker fee and 0.060% taker fee.Tier 3 (30-day volume over $5 million) – 0.010% maker fee and 0.055% taker fee.Tier 4 (30-day volume over $10 million) – 0.005% maker fee and 0.050% taker fee.Tier 5 (30-day volume over $25 million) – 0.000% maker fee and 0.045% taker fee.Tier 6 (30-day volume over $50 million) – 0.000% maker fee and 0.040% taker fee.As noted earlier, these fees can be reduced if the user stakes FTT. Taker fees can be reduced to as little as 0.015% depending on the amount staked.

What’s more, the company charges borrowers a daily interest rate when margin trading. Leveraged tokens, which allow users to take a leveraged position in a cryptocurrency of their choice, also come with a 0.10% redemption fee and 0.03% daily management fee.

LoansFor its most sophisticated traders that meet certain criteria, FTX will extend a line of credit.

The company collects interest on these loans, with the interest rate likely to be dependent upon the prior trading performance of the entity and how much collateral they can access.

NFT feesFTX NFTs is an NFT marketplace launched in September 2021 and built on the Solana blockchain.

Here, the company makes money by charging a 5% fee to both the buyer and the seller on each trade or sale.

InvestmentsSince its inception, FTX has made several investments in other related start-ups.

These include $150 million to acquire the cryptocurrency tracking app Blockfolio and a $100 million investment with two other partners in Web3 gaming development.

In many cases, FTX sells the investment at a later date for a profit. In the interim, it collects valuable user data that guides its expansion or product development strategies.

Interchange and payment feesLike many neobanks and related organizations, FTX makes money on interchange fees.

These fees are paid by the merchant to FTX whenever a customer uses its branded debit card to make a purchase. Note that FTX has to share this fee with the card issuer Visa.

For businesses that want to accept cryptocurrency as a form of payment, they can sign up for FTX Pay. For the privilege, FTX charges a 1% fee of the total purchase amount.

Connected Business Concepts According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability!

According to Joel Monegro, a former analyst at USV (a venture capital firm) the blockchain implies value creation in its protocols. Where the web has allowed the value to be captured at the applications layer (take Facebook, Twitter, Google, and many others). In a Blockchain Economy, this value might be captured by the protocols at the base of the blockchain (for instance Bitcoin and Ethereum). However, according to blockchain investor Paivinen due to ease of forking, incentives to compete and improved interoperability and interchangeability also in a blockchain-based economy, protocols might get thinner. Although the marginal value of scale might be lower compared to a web-based economy, where massive scale created an economic advantage. The success of the Blockchain will depend on its commercial viability! A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency.

A Proof of Stake (PoS) is a form of consensus algorithm used to achieve agreement across a distributed network. As such it is, together with Proof of Work, among the key consensus algorithms for Blockchain protocols (like the Ethereum’s Casper protocol). Proof of Stake has the advantage of security, reduced risk of centralization, and energy efficiency. A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins.

A Proof of Work is a form of consensus algorithm used to achieve agreement across a distributed network. In a Proof of Work, miners compete to complete transactions on the network, by commuting hard mathematical problems (i.e. hashes functions) and as a result they get rewarded in coins. Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like.

Non-fungible tokens (NFTs) are cryptographic tokens that represent something unique. Non-fungible assets are those that are not mutually interchangeable. Non-fungible tokens contain identifying information that makes them unique. Unlike Bitcoin – which has a supply of 21 million identical coins – they cannot be exchanged like for like. A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model.

A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain. The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index. BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web.

BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web. In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger.

In 2012, co-founders Christian Larsen and Jed McCaleb created Ripple, a technology acting as both a pre-mined cryptocurrency called XRP and a digital payment platform enabling monetary transactions. Where Ripple is the tech company, XRP is the decentralized ledger. In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar!

In 2014, Jed McCaleb – which also played a key role in the development of Ripple – created a cryptocurrency to provide fast, reliable, and affordable money transactions. The same cryptocurrency has considerably grown seven years later. It is now one of the most stellar cryptocurrencies to provide a real-time platform that links banks, payment systems, and people. Meet, Stellar! In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology.

In early 2019, a joint project between TRON and BitTorrent Foundation called BitTorrent Token came to fruition. BitTorrent Token launched to tokenize in-demand file-sharing protocol and enhance content delivery and bandwidth accessibility with blockchain technology. Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises.

Chainlink is considered the most established decentralized oracle network. As an ecosystem housing several decentralized oracle networks running simultaneously. As a decentralized oracle service built on Ethereum, Chainlink has the power to support the development of blockchain solutions for both traditional businesses and enterprises. Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain.

Uniswap is a renowned decentralized crypto exchange created in 2018 and based on the Ethereum blockchain, to provide liquidity to the system. As a cryptocurrency exchange technology that operates on a decentralized basis. The Uniswap protocol inherited its namesake from the business that created it — Uniswap. Through smart contracts, the Uniswap protocol automates transactions between cryptocurrency tokens on the Ethereum blockchain. In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains.

In essence, Polkadot is a cryptocurrency project created as an effort to transform and power a decentralized internet, Web 3.0, in the future. Polkadot is a decentralized platform, which makes it interoperable with other blockchains. Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation.

Designed and created as an alternative to Ethereum, Cardano claims to be the first decentralized blockchain protocol to use a scientific approach and undergo a peer evaluation. Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.

Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.Get The 450 Pages Blockchain Business Models Book

Read Next: Coinbase Business Model, Metamask, Rainbow.

Read Also: BAT Token, Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Solana, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness CompetitionBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does FTX Work And Make Money? appeared first on FourWeekMBA.