Gennaro Cuofano's Blog, page 147

July 16, 2021

What happened to Periscope?

Periscope was a live streaming video app developed by Joe Bernstein and Kayvon Beykpour in 2013 acquired by Twitter in 2015 before it was launched to the public and was steadily absorbed thereafter. The official reason for Periscope to be discontinued was the cost for Twitter of maintaining it as a standalone app. Therefore, the failure of Twitter to maintain Periscope and to enhance its monetization determined its failure.

BackgroundPeriscope was a live streaming video app developed by Joe Bernstein and Kayvon Beykpour in 2013. Beykpour became inspired to develop the app after reading about protests in Istanbul on Twitter without being able to see what was transpiring.

Before the app was even launched, it was purchased by Twitter in 2015 to address the rapid growth of competitors offering Meerkat. Periscope was an immediate success, surpassing 10 million accounts four months after release. Twitter also noted that users were watching the equivalent of 40 years of content on the platform each day.

December 2016 marked a pivotal point for Periscope as some of its features began to be integrated into the main Twitter app. Four years later, Twitter announced it would be discontinuing Periscope effective as of March 2021.

Let’s take a look at why Periscope met its end after just six years.

Rising maintenance costsIn a statement detailing the March 2021 shutdown, Twitter noted that the core Periscope app was “in an unsustainable maintenance-mode state, and has been for a while. Over the past couple of years, we’ve seen declining usage and know that the cost to support the app will only continue to go up over time.”

Maintenance costs were also high because Twitter had to maintain two separate apps with an overlap in functionality. As the user base for Periscope decreased, there was not a similar and appreciable decrease in operational costs.

Twitter integrationRelated to high maintenance cost was the way in which Periscope was steadily absorbed into the main Twitter app.

Integration started as early as 2016, with Twitter incorporating the Periscope Live Broadcast feature into its mobile app. That same year, Twitter made a deal with the NFL to stream Thursday Night Football games while relegating Periscope to streaming behind-the-scenes content only.

Effectively, the Twitter platform became as functional as Periscope but with a much bigger audience.

Squad acquisitionSome argue the demise of Periscope was influenced by Squad – a video and audio chat service acquired by Twitter in December 2020.

The acquisition of Squad was less important than what Twitter planned to do with it. A company announcement regarding the acquisition stated that the Squad app was being retired with more immediacy and its video features absorbed by Twitter.

That the similar acquisition of Periscope took so long was largely due to COVID-19 and other projects taking priority in 2020. But it did highlight Twitter’s preference to acquire companies and absorb their features into its platform completely.

Key takeaways:Periscope was a live streaming video app developed by Joe Bernstein and Kayvon Beykpour in 2013. The app was acquired by Twitter in 2015 before it was launched to the public and was steadily absorbed thereafter.For Twitter, the cost of maintaining Periscope as a standalone app became too high. What’s more, a decrease in the Periscope user base did not mean the app was cheaper to operate.Twitter’s acquisition of video service Squad had little impact on the demise of Periscope. But in a broader sense, the Squad acquisition was representative of Twitter acquiring other companies to increase functionality.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Periscope? appeared first on FourWeekMBA.

What happened to Pan Am?

Pan Am was a pioneering American airline company founded in 1927 by Juan Trippe, by the 1980s its aircrafts were also cultural icons of the sky and the Pan Am brand came to symbolize the golden age of air travel. However, by the 1990s Pan Am experienced chronic cash flow issues for many years, exacerbated by the exorbitant price it paid for a domestic route network. Despite selling many assets, a mechanic strike and the Lockerbie disaster further helped the company go bankrupt.

BackgroundPan Am, formally known as Pan American World Airways, was an American commercial airline company founded by Juan Trippe in 1927.

Pan Am was a pioneer of the aviation industry and was the largest international air carrier in the United States from 1927 until 1991. The company introduced the widespread use of jet aircraft, jumbo jets, and computerized reservation systems. Its aircraft were also cultural icons of the sky and the Pan Am brand came to symbolize the golden age of air travel

Despite its longevity and success, the company was forced to file for bankruptcy protection on January 8, 1991, after 64 years in operation.

The story of Pan Am’s demise is perhaps a little less clear than some other companies. Read on to get a sense of what contributed to its downfall.

Oil crisisAt its peak in the early 1970s, Pan Am had a new fleet of Boeing 747s allowing the airline to fly large numbers around the world with fewer stops. In 1970 alone, it carried 11 million passengers to over 86 countries.

Three years later, the Yom Kippur war broke out along the Sinai Peninsula when multiple Arab states attacked Israel. Oil embargoes were placed on the United States, leading to oil shortages that crippled the aviation industry.

Every airline was affected by the shortage and subsequent rise in fuel cost. But Pan Am felt it more intensely because it was already losing ground to competitors and had a fleet of large planes requiring a lot of fuel.

Stagnation and regulationThe mid-1970s were also a time of economic stagnation in the United States, with the outsourcing of jobs and inflation compounded energy shortages. Consumers took fewer international vacations which left Pan Am unable to fill its jumbo jets.

In 1978, the government deregulated the airline industry allowing individual carriers to make pricing more competitive. In response, Pan Am sold the rights to its Pacific routes to United Airlines for $750 million.

With ambitions to enter the U.S. domestic market, Pan Am then paid $437 million to acquire National Airlines and its route network in 1980. Ultimately, the acquisition was not a good fit for Pan Am. The company lost $18.9 million in the year after the deal was struck and had to sell its head office and chain of hotels to fund the business.

Mechanics strikePan Am mechanics went on strike in 1985 over low wages, and for good reason. They were the lowest-paid mechanics of any U.S. airline by a considerable margin, which only highlighted the gap between Pan Am and its competitors.

To remain viable, the company had drastically reduced its wages bill through mass terminations and wage cuts to retained employees. It also sold its flagship Pacific Division to United Airlines in 1985 – which cut the carrier’s route network by a quarter.

Lockerbie disasterIn 1988, a Pan Am Boeing 747 crashed outside the small Scottish town of Lockerbie with 259 people killed instantly. A further 11 people were killed on the ground. Forensic investigators found that a bomb had been carried aboard and detonated.

Pan Am was later sued for failing to implement proper security measures. It was forced to pay out more than $350 million in compensation and suffered immense reputational damage.

BankruptcyOil prices began rising again with the advent of the Gulf War in 1990.

Pan Am suddenly found itself operating an aging fleet of airlines with demand for transatlantic flights low. What’s more, the company was still reeling from the Lockerbie disaster a couple of years previous.

The company made a last-ditch effort to stay in operation by selling off more core assets but was forced into bankruptcy in 1991.

In the past 30 years, Pan Am has enjoyed a significant following from aviation enthusiasts and its legacy is protected by various historical foundations and online communities. The brand name itself has been used at Pan Am Railways since 1998.

Key takeaways:Pan Am was a pioneering American airline company founded in 1927 by Juan Trippe. The company declared bankruptcy in 1991 after 64 years in the skies.Pan Am began a slow and steady decline after a series of unrelated but detrimental events occurred in the 1970s. Oil prices were high because of embargoes placed on the United States. Economic stagnation also meant consumers were more averse to international travel. Lastly, the airline sector was deregulated which meant more competition.Pan Am experienced chronic cash flow issues for many years, exacerbated by the exorbitant price it paid for a domestic route network. Despite selling many assets, the mechanic strike and Lockerbie disaster meant the company could not absorb a second oil crisis in 1990.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Pan Am? appeared first on FourWeekMBA.

What happened to General Motors?

General Motors (GM) is an American multinational company founded in 1908. By the 1931 to early 2000s, GE was among the most successful companies in America, and yet as the financial crisis hit in 2008, General Motors filed for Chapter 11 bankruptcy reorganization on June 8, 2009, after losing more than $90 billion in the previous four years. General Motors was effectively split in two during Chapter 11 bankruptcy proceedings. The new company took GM’s best brands and operations, while the old company kept its massive liabilities.

BackgroundGeneral Motors (GM) is an American multinational company with a core focus on the design and manufacture of vehicles, vehicle parts, and the selling of financial services. It was founded in 1908 by William C. Durant, Charles Stewart Mott, and Frederic L. Smith.

GM enjoyed a 60% market share in the United States at its peak and was the worst’s largest automobile manufacturer from 1931 until 2007. Thanks also to one of the most prominent CEOs of America’s history, Jack Welch:

However, by the 2000s, and as the financial crisis of 2008 hit the automaker industry very badly, General Motors filed for Chapter 11 bankruptcy reorganization on June 8, 2009, after losing more than $90 billion in the previous four years. The Government-backed deal saw the original company sell its assets and some subsidiaries to form a new company using the General Motors trademark.

Today, General Motors remains a significant global presence producing 6.829 million vehicles in 2020 with revenue of $122.48 billion.

Following is a look at the fall and subsequent rebirth of the American giant.

Fixed operating costsWhen General Motors experienced a decline in sales, it could not cut costs because many of its expenses were fixed.

This made the company somewhat unique as a manufacturer. In most cases, operating costs fall as sales fall because fewer units are being produced. That is, the business can employ fewer staff and spend less money on raw materials.

However, GM employees were on union contracts. The company could have closed a manufacturing facility to reduce costs, but this did not guarantee employees would lose their jobs. Union employees also received company pensions and health care coverage which were also fixed costs.

As a result, GM posted enormous losses as sales declined with expenditure remaining largely the same.

Automotive industry crisisThe so-called automotive industry crisis lasted from 2008 to 2010 and was the result of the Global Financial Crisis (GFC) and subsequent recession.

In the years before the GFC, General Motors invested heavily in SUVs and pick-up trucks with poor fuel economy. As the recession pushed gasoline prices up, the company experienced a decline in sales as consumers looked to other makers for fuel-efficient cars. This situation was made worse by a rise in the cost of raw materials.

BankruptcySaddled with high levels of debt, GM predicted it would run out of cash by mid-2009 without government funding, a merger, or the sale of assets. Government loans were then handed out to GM on the condition that it produced a plan for future financial viability.

The Obama administration then endorsed the sale of General Motors’ operational assets to a new company called NGMCO Inc. (or “New GM”). The latter would take on GM’s most profitable brands and operations, leaving the former with most of the liabilities.

The restructuring then took place before the bankruptcy filing to make the new company profitable. This enabled proceedings to conclude in a matter of days and not be dragged out for years as creditors scrambled to recoup their costs. Nevertheless, it became the largest industrial bankruptcy in history with General Motors $173 billion in debt.

Normal operations continued throughout the proceedings with operations outside the U.S. unaffected. The “new” General Motors then emerged just 40 days later.

RebirthGeneral Motors then undertook a restructuring program. The company discontinued the Pontiac and Saturn brands and sold Saab to Dutch automaker Spyker. It was left with four divisions: Buick, Cadillac, Chevrolet, and GMC.

In 2010, GM held a momentous IPO and regained its title as the largest automaker in the world the following year.

Key takeaways:General Motors is an American multinational automobile designer and manufacturer. It was the world’s largest automaker for 76 years before filing for bankruptcy in 2009.General Motors was exposed in the wake of the GFC as rising gas prices saw consumers look elsewhere for fuel-efficient cars. GM also had several employee-related fixed costs which it had to meet as sales revenue declined.General Motors was effectively split in two during Chapter 11 bankruptcy proceedings. The new company took GM’s best brands and operations, while the old company kept its massive liabilities. Pro-manufacturing U.S. governments helped underwrite the transition with the new GM holding an IPO in 2010.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to General Motors? appeared first on FourWeekMBA.

Why Nokia Failed? What happened to Nokia In A Nutshell

Nokia is a Finnish telecommunications, consumer electronics, and information technology company founded in 1865 which by 1998, had overtaken Motorola to become the world’s largest mobile phone brand. The Nokia brand is now controlled by HMD Global – a company founded by former Nokia employees that released a line of smartphones in 2017. The company’s failure to keep up with software-based iOS and Android operating systems made it lose its market leader position.

BackgroundNokia is a Finnish telecommunications, consumer electronics, and information technology company founded in 1865 by Fredrik Idestam, Leo Mechelin, and Eduard Polón.

Nokia is perhaps best known for its mobile phones which dominated the industry before the invention of the smartphone. Not only were Nokia products built to last with long battery life, they were also a fashion statement.

In 1998, Nokia overtook Motorola to become the world’s largest mobile phone brand. Nine years later, it amassed a staggering 51% of the total global market share.

As is often the case, however, a meteoric rise is followed by a similarly meteoric fall.

So what happened to Nokia?

Hardware focusNokia was great at building device hardware, but a device built on software was the way of the future.

When the company realized this fact, Apple and Android had already developed their own app-based software and were years ahead.

Nokia would forever remain trapped by its unwieldy, device-centric operating system called Symbian. With each new Nokia mobile phone, there were release delays as code had to be developed and then tested. By 2009, the company was using 57 different and incompatible versions of its archaic operating system.

And indeed, in its falling history, Nokia also counted one of the worst selling phones. The idea was pretty good (combining gaming with phones), but the UX and the timing not as good:

Operating system resistanceWhen Google entered the smartphone market in 2008, peers such as Samsung, Huawei, and Motorola switched to the Android operating system to remain competitive.

Nokia remained reluctant to do the same until 2011 when it partnered with Microsoft to secure Windows Phone as its primary OS. Unfortunately, Android can now be found in 80% of all smartphones while Windows Phone no longer exists.

Nokia belatedly switched to Android in 2014, but the damage had been done.

Mismanagement and poor cultureIn a paper titled Distributed Attention and Shared Emotions in the Innovation Process: How Nokia Lost the Smartphone Battle, researchers published the results of 76 interviews with Nokia management staff.

Among the revelations were that:

Nokia suffered from organizational fear with temperamental leaders and frightened middle managers being the status quo.Some management staff intimidated their subordinates by accusing them of not being ambitious enough. Others lacked technical competence which influenced their assessment of technological limitations during goal-setting. In comparison, similar positions at Apple were all held by competent engineers.Senior leadership was afraid of not meeting quarterly targets.Executives were also afraid to publicly acknowledge or comment on the inferiority of Symbian.Top executives were wary of admitting inferiority to Apple for fear of losing investors, suppliers, or customers.Aside from the poor culture, the decision to move from an organizational structure to a matrix structure in 2004 also harmed Nokia. Power struggles ensued with many key personnel departing the company soon after.

Nokia todayUnlike many other companies, Nokia’s failure to innovate did not lead to bankruptcy or acquisition.

Today, Nokia appears to have left mobile phone development in the past. The Nokia brand is now controlled by HMD Global – a company founded by former Nokia employees that released a line of smartphones in 2017.

The company still manufactures hardware and is involved in the roll-out of the 5G wireless network, among other things.

It also earns a considerable income from the hundreds of patents it owns and licenses to mobile phone vendors.

Key takeaways:Nokia is a Finnish telecommunications, consumer technology, and information technology company founded in 1865. It enjoyed 51% of the global market share for mobile phones in 1998.Nokia’s device-based hardware system was cumbersome and outdated, but the company persisted with it while competitors developed the software-based iOS and Android operating systems. By the time Nokia phones offered Android, the company had been left behind.Corporate mismanagement within Nokia was rife and culture suffered as a result. Internally and externally, the company failed to acknowledge its diminishing relevance and market share.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Why Nokia Failed? What happened to Nokia In A Nutshell appeared first on FourWeekMBA.

What happened to Borders?

Borders Group Inc. was a book and music retail chain founded by brothers Tom and Louis Borders in 1971. Acquired by Kmart in 1992, Borders was slow to react to the boom in eCommerce and it continued to open new stores with high overheads as Barnes & Noble developed an online presence and e-reader. It also sold books through the Amazon platform for seven years instead of developing its own site.

BackgroundBorders Group Inc. was a book and music retail chain founded by brothers Tom and Louis Borders in 1971.

From a single store in Ann Arbor, Michigan, Borders operated 1,249 stores at its peak in 2003 with a presence in the United Kingdom, Singapore, and Australia.

No more than eight years later, Borders filed for Chapter 11 bankruptcy protection and was unable to find a buyer. The last stores closed in September 2011 with rival Barnes & Noble acquiring Borders’ trademarks and customer list.

Borders was an early innovator in inventory management with passionate store managers who believed in book-selling. Its stores also had extensive selections with adequate browsing space, cafés, and community outreach programs.

So what went wrong? Many will assume Borders was just another victim of the Amazon juggernaut. But the story of Borders’ downfall starts much earlier and is more complex.

Kmart acquisitionBorders was acquired by Kmart in 1992 for $125 million, with the Borders brothers leaving the book business for good.

This is when the trouble started for the company. Kmart had purchased the mall-based book chain Waldenbooks eight years previous but was struggling to make it profitable. Essentially, Kmart hoped that Borders senior leadership could somehow turn Waldenbooks around.

Waldenbooks and Borders were not a good fit culturally or commercially, and many senior Borders staff resigned as a result. This further exposed Kmart, ill-equipped to deal with a division experiencing competitive pressure from Barnes & Noble and Crown Books.

Borders was eventually spun out in 1995 and renamed Borders Group.

Store merchandisingAs the eCommerce movement gathered momentum, Borders Group continued to open new brick-and-mortar stores. The company also added CDs and DVDs to its stores just as iTunes and file-sharing networks became popular.

At the same time, Barnes & Noble began focusing on its online presence and developed an early e-reader called the Nook. The failure to develop an e-reader would prove to be a significant missed opportunity for Borders.

Amazon affiliationBorders eventually started selling online by outsourcing its operations to Amazon. Essentially, visitors to the Borders website would be directed to the Amazon store.

As a seller of books itself, partnering with Amazon did not make sense financially. When customers were interviewed outside a West Virginia store, one reader admitted she browsed books in Borders stores and then ordered them straight from Amazon.

Too many stores and too much debtBorders operated hundreds of stores at its peak but they were big and had high overhead costs. This left the company financially exposed at a time when consumers were moving online. Furthermore, an estimated 70% of all Borders stores were in direct competition with a Barnes & Noble outlet.

Debt was also a problem for Borders, with the company restructuring twice after the GFC to manage the $350 million it owed.

BankruptcyIn its February 2011 bankruptcy filing, the company cited its expansion strategy as one of the key reasons for its demise.

Borders noted that many stores were simply unprofitable and that it had signed too many 15 to 20-year leases which made them difficult to sell.

Key takeaways:Borders was an American book and music store chain founded in 1971 by brothers Tom and Louis Borders. After almost 40 years in business, Borders filed for bankruptcy in 2011.Borders was acquired by Kmart in 1992 and joined Waldenbooks under the Kmart Umbrella. Borders executives were then instructed to resurrect Waldenbooks, but the two subsidiaries were not a good cultural or commercial fit.Borders was slow to react to the boom in eCommerce. It continued to open new stores with high overheads as Barnes & Noble developed an online presence and e-reader. It also sold books through the Amazon platform for seven years instead of developing its own site.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post What happened to Borders? appeared first on FourWeekMBA.

July 8, 2021

A Glance At The Fashion Industry

The fashion industry has been evolving since the dawn of time.

However, mass media like TV and Cinema became the primary propellers for various fashion trends.

From luxury to fast fashion and more.

Audrey Hepburn’s 1961, Breakfast at Tiffany well epitomizes the acceleration of mass fashion trends.

By the 1980s the most prominent fashion brands had been born like Fendi (1925), Gucci (1921), Prada (1913), Chanel (1909), Burberry (1856), Louis Vuitton (1854), Hermès (1837).

And by the 1990s those fashion brands would start being merged into giant, multi-brand luxury corporations (LVMH and Kering will give us the picture):

LVMH is a global luxury empire with over €46 billion in revenues for 2018 spanning across several industries: wines and spirits, fashion and leather goods, perfumes and cosmetics, watched and jewelry, and selective retailing. It comprises brands like Louis Vuitton, Christian Dior Couture, Fendi, Loro Piana, and many others.

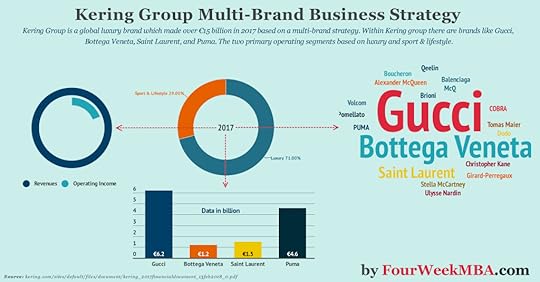

LVMH is a global luxury empire with over €46 billion in revenues for 2018 spanning across several industries: wines and spirits, fashion and leather goods, perfumes and cosmetics, watched and jewelry, and selective retailing. It comprises brands like Louis Vuitton, Christian Dior Couture, Fendi, Loro Piana, and many others.  Kering Group follows a multi-brand business model strategy, where the central holding helps the brands and Houses part of its portfolio to leverage on economies of scale while creating synergies among them. At the same time, those brands are run independently. Kering is today a global luxury brand which made over €15 billion in 2017 based on this multi-brand strategy. Within Kering group there are brands like Gucci, Bottega Veneta, Saint Laurent, and Puma. The two primary operating segments based on luxury and sport & lifestyle.

Kering Group follows a multi-brand business model strategy, where the central holding helps the brands and Houses part of its portfolio to leverage on economies of scale while creating synergies among them. At the same time, those brands are run independently. Kering is today a global luxury brand which made over €15 billion in 2017 based on this multi-brand strategy. Within Kering group there are brands like Gucci, Bottega Veneta, Saint Laurent, and Puma. The two primary operating segments based on luxury and sport & lifestyle.Only a few brands, (like Prada) would escape consolidation and stay independent.

Yet, while by the 1990s this trend consolidated, and by the 2000s, most of the Luxury Fashion industry is in the hands of a few giants (LVMH also managed to take over Tiffany).

In the same span of time, a separate phenomenon emerged: Fast Fashion.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs.While Luxury brands targeted the higher end of the market, by emphasizing quality, uniqueness (or at least scarcity), and status. Fast fashion brands focused on the opposite side of the market. Focusing on speed, variety, and low prices.

Zara epitomized that evolution, as part of the Inditex empire:

With over €25 billion in sales in 2017, the Spanish Fast Fashion Empire, Inditex, which comprises eight sister brands, has been able to grow over the years thanks to a strategy of expansion of its flagship stores in the exclusive locations around the globe. Its largest brand, Zara contributed to over 65% of the group revenue. The country that contributed the most to the fast-fashion Empire sales was Spain, with over 16% of its revenues.

With over €25 billion in sales in 2017, the Spanish Fast Fashion Empire, Inditex, which comprises eight sister brands, has been able to grow over the years thanks to a strategy of expansion of its flagship stores in the exclusive locations around the globe. Its largest brand, Zara contributed to over 65% of the group revenue. The country that contributed the most to the fast-fashion Empire sales was Spain, with over 16% of its revenues. Zara is a brand part of the retail empire Inditex. Zara business model, with over €18 billion in sales in 2018 (comprising Zara Home), and an integrated retail format with quick sales cycles. Zara follows an integrated retail format where customers are free to move from physical to digital experience.

Zara is a brand part of the retail empire Inditex. Zara business model, with over €18 billion in sales in 2018 (comprising Zara Home), and an integrated retail format with quick sales cycles. Zara follows an integrated retail format where customers are free to move from physical to digital experience.By the 2010s the web had finally managed to scale to billions of people and a further penetration happened as smartphones equipped with shopping apps took over.

This enabled a transition from fast fashion (with a focus on speed, shortened manufacturing cycles, and effective logistics, and focused on operating flagship stores where items could be easily distributed) to ultra-fast fashion (where the focus on speed was achieved also thanks to an only-online presence, thus cutting operational costs, and focusing on shorter manufacturing cycles and global logistics).

The Ultra Fashion business model is an evolution of fast fashion with a strong online twist. Indeed, where the fast-fashion retailer invests massively in logistics, warehousing, its costs are still skewed toward operating physical retail stores. While the ultra-fast fashion retailer mainly moves its operations online, thus focusing its cost centers toward logistics, warehousing, and a mobile-based digital presence.

The Ultra Fashion business model is an evolution of fast fashion with a strong online twist. Indeed, where the fast-fashion retailer invests massively in logistics, warehousing, its costs are still skewed toward operating physical retail stores. While the ultra-fast fashion retailer mainly moves its operations online, thus focusing its cost centers toward logistics, warehousing, and a mobile-based digital presence. ASOS and Boohoo well represented this change:

ASOS is a British online fashion retailer founded in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Deborah Thorpe. As an online fashion retailer, ASOS makes money by purchasing clothes from wholesalers and then selling them for a profit. This includes the sale of private label or own-brand products. ASOS further expanded on the fast fashion business model to create an ultra-fast fashion model driven by short sales cycles and online mobile e-commerce as main drivers.

ASOS is a British online fashion retailer founded in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Deborah Thorpe. As an online fashion retailer, ASOS makes money by purchasing clothes from wholesalers and then selling them for a profit. This includes the sale of private label or own-brand products. ASOS further expanded on the fast fashion business model to create an ultra-fast fashion model driven by short sales cycles and online mobile e-commerce as main drivers. Boohoo – sometimes referred to as Boohoo.com – is an English online fashion retailer founded in 2006 by Mahmud Kamani and Carol Kane in the historic textile district of Manchester. Boohoo makes money by selling fashion items for more than the cost of manufacturing, advertising, marketing, and distributing them.

Boohoo – sometimes referred to as Boohoo.com – is an English online fashion retailer founded in 2006 by Mahmud Kamani and Carol Kane in the historic textile district of Manchester. Boohoo makes money by selling fashion items for more than the cost of manufacturing, advertising, marketing, and distributing them. On a parallel track, companies like Patagonia had been emphasizing much more on sustainability, thus building their brands on the premise of slow fashion.

Slow fashion is a movement in contraposition with fast fashion. Where in fast fashion it’s all about speed from design to manufacturing and distribution, in slow fashion instead quality and sustainability of the supply chain are the key elements.

Slow fashion is a movement in contraposition with fast fashion. Where in fast fashion it’s all about speed from design to manufacturing and distribution, in slow fashion instead quality and sustainability of the supply chain are the key elements. While slow fashion took over, also another evolution of fast fashion made it to the masses: real-time retail.

Real-time retail involves the instantaneous collection, analysis, and distribution of data to give consumers an integrated and personalized shopping experience. This represents a strong new trend, as a further evolution of fast fashion first (who turned the design into manufacturing in a few weeks), ultra-fast fashion later (which further shortened the cycle of design-manufacturing). Real-time retail turns fashion trends into clothes collections in a few days cycle or a maximum of one week.

Real-time retail involves the instantaneous collection, analysis, and distribution of data to give consumers an integrated and personalized shopping experience. This represents a strong new trend, as a further evolution of fast fashion first (who turned the design into manufacturing in a few weeks), ultra-fast fashion later (which further shortened the cycle of design-manufacturing). Real-time retail turns fashion trends into clothes collections in a few days cycle or a maximum of one week.Well exemplified by SHEIN, real-time retail brings the concept of fast fashion to another level. Where fashion trends are made and fast followed through digital channels, and also operations are primarily online and logistics global:

SHEIN is an international B2C fast fashion eCommerce platform founded in 2008 by Chris Xu. The company improved on the ultra-fast fashion model by leveraging real-time retail, which quickly turned fashion trends in clothes’ collections through its strong digital presence and successful branding campaigns.

SHEIN is an international B2C fast fashion eCommerce platform founded in 2008 by Chris Xu. The company improved on the ultra-fast fashion model by leveraging real-time retail, which quickly turned fashion trends in clothes’ collections through its strong digital presence and successful branding campaigns. Read Next: LVMH, Kering, Prada, Fast Fashion, Zara, Inditex, Ultra-Fast Fashion, ASOS, Boohoo, Slow Fashion, Real-Time Retail, SHEIN.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post A Glance At The Fashion Industry appeared first on FourWeekMBA.

McDonald’s Speedee System

As explained on McDonald’s website “Dick and Mac McDonald moved to California to seek opportunities they felt unavailable in New England.” In 1948 they launched Speedee Service System featuring 15 cent hamburgers. As the restaurants gained traction that led the brothers to begin franchising their concept until they reached nine operating restaurants. The Speedee System was the foundation of the success of the first McDonald’s in San Bernardino, California.

Quick HistoryA native Chicagoan, Ray Kroc, in 1939 was the exclusive distributor of a milkshake mixing machine, called Multimixer. In short, he was a salesman.

He visited the McDonald brothers in 1954 and was impressed to their business model which led to him becoming their franchise agent. He opened up the first restaurant for McDonald’s System, Inc., until in 1961 he acquired McDonald’s rights to the brother’s company for $2.7 million.

The McDonald brothers speedee system enabled the first store to operate at very high speed and efficiency, and yet still serve a great burger. In fact, while the initial take from the McDonald brothers was that you could make great burgers in little time, and make them very inexpensive, those could still be done with great ingredients and maintain a high quality.

In fact, McDonald’s would be able to serve them at low price thanks to the fact it bore less operational costs, since there were no servers, it was mostly a self-service experience and the menu was very limited.

While the concept of Fast Food developed already in the early 1900s, that really took off later on, as the McDonald brothers opened their first restaurant.

However, as Ray Kroc took over McDonald’s the concept also changed in meaning. Indeed, as the restaurants scaled their operations the focus was more and more on speed, thus bringing to the quality of food down, and associating fast food with a lesser food experience.

The major institutional shareholders comprise The Vanguard Group (8.98%), BlackRock (7.1%), and State Street Corporation (5.2%). Major individual shareholders comprise Kevin Ozan (Executive Vice President and Chief Financial Officer), Stephen Easterbrook (President and CEO), and other John Rogers, Jr. investor, philanthropist, Ariel Capital Management founder. And a few other individual shareholders.

The major institutional shareholders comprise The Vanguard Group (8.98%), BlackRock (7.1%), and State Street Corporation (5.2%). Major individual shareholders comprise Kevin Ozan (Executive Vice President and Chief Financial Officer), Stephen Easterbrook (President and CEO), and other John Rogers, Jr. investor, philanthropist, Ariel Capital Management founder. And a few other individual shareholders.

Starbucks is a multinational coffee chain headquartered in Seattle, Washington. It was founded by Jerry Baldwin, Zev Siegl, and Gordon Bowker in 1971. From a single and very humble bean roasting store in Pike Place Market, the company is now a global giant operating almost 33,000 stores around the world. This large global footprint obviously increases the competition for Starbucks in many different markets. The coffee industry itself is also highly competitive, with established players including McDonald’s and Dunkin’ Donuts.

Starbucks is a multinational coffee chain headquartered in Seattle, Washington. It was founded by Jerry Baldwin, Zev Siegl, and Gordon Bowker in 1971. From a single and very humble bean roasting store in Pike Place Market, the company is now a global giant operating almost 33,000 stores around the world. This large global footprint obviously increases the competition for Starbucks in many different markets. The coffee industry itself is also highly competitive, with established players including McDonald’s and Dunkin’ Donuts. Read Also: McDonald’s Business Model, McDonald’s SWOT Analysis, McDonald’s Pestel Analysis.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post McDonald’s Speedee System appeared first on FourWeekMBA.

July 7, 2021

Fast Fashion Companies

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs.

Fash fashion has been a phenomenon that became popular in the late 1990s, early 2000s, as players like Zara and H&M took over the fashion industry by leveraging on shorter and shorter design-manufacturing-distribution cycles. Reducing these cycles from months to a few weeks. With just-in-time logistics, flagship stores in iconic places in the largest cities in the world, these brands offered cheap, fashionable clothes and a wide variety of designs. Zara is a brand part of the retail empire Inditex. Zara business model, with over €18 billion in sales in 2018 (comprising Zara Home), and an integrated retail format with quick sales cycles. Zara follows an integrated retail format where customers are free to move from physical to digital experience.

Zara is a brand part of the retail empire Inditex. Zara business model, with over €18 billion in sales in 2018 (comprising Zara Home), and an integrated retail format with quick sales cycles. Zara follows an integrated retail format where customers are free to move from physical to digital experience. ASOS is a British online fashion retailer founded in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Deborah Thorpe. As an online fashion retailer, ASOS makes money by purchasing clothes from wholesalers and then selling them for a profit. This includes the sale of private label or own-brand products. ASOS further expanded on the fast fashion business model to create an ultra-fast fashion model driven by short sales cycles and online mobile e-commerce as main drivers.

ASOS is a British online fashion retailer founded in 2000 by Nick Robertson, Andrew Regan, Quentin Griffiths, and Deborah Thorpe. As an online fashion retailer, ASOS makes money by purchasing clothes from wholesalers and then selling them for a profit. This includes the sale of private label or own-brand products. ASOS further expanded on the fast fashion business model to create an ultra-fast fashion model driven by short sales cycles and online mobile e-commerce as main drivers. SHEIN is an international B2C fast fashion eCommerce platform founded in 2008 by Chris Xu. The company improved on the ultra-fast fashion model by leveraging real-time retail, which quickly turned fashion trends in clothes’ collections through its strong digital presence and successful branding campaigns.

SHEIN is an international B2C fast fashion eCommerce platform founded in 2008 by Chris Xu. The company improved on the ultra-fast fashion model by leveraging real-time retail, which quickly turned fashion trends in clothes’ collections through its strong digital presence and successful branding campaigns.  Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion.

Depop is a peer-to-peer shopping app founded by Simon Beckerman in 2011 at the Italian technological incubator and start-up center H-FARM. Depop experienced tremendous growth in the following years, thanks largely to word-of-mouth advertising and social sharing. The platform now boasts more than 21 million users. Marketplace giant Etsy has plans to acquire Depop in the third quarter of 2021 for a cash deal worth $1.625 billion. Boohoo – sometimes referred to as Boohoo.com – is an English online fashion retailer founded in 2006 by Mahmud Kamani and Carol Kane in the historic textile district of Manchester. Boohoo makes money by selling fashion items for more than the cost of manufacturing, advertising, marketing, and distributing them.

Boohoo – sometimes referred to as Boohoo.com – is an English online fashion retailer founded in 2006 by Mahmud Kamani and Carol Kane in the historic textile district of Manchester. Boohoo makes money by selling fashion items for more than the cost of manufacturing, advertising, marketing, and distributing them.  Urban Outfitters is a multinational lifestyle retail corporation with a company headquarters in Philadelphia, Pennsylvania. The company was founded in 1970 by Richard Hayne, Judy Wicks, and Scott Belair.

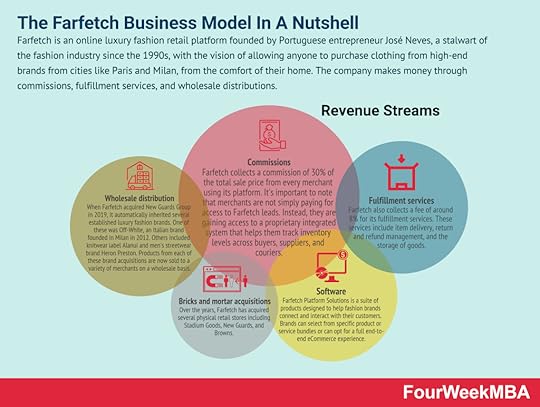

Urban Outfitters is a multinational lifestyle retail corporation with a company headquarters in Philadelphia, Pennsylvania. The company was founded in 1970 by Richard Hayne, Judy Wicks, and Scott Belair.  Farfetch is an online luxury fashion retail platform founded by Portuguese entrepreneur José Neves, a stalwart of the fashion industry since the 1990s, with the vision of allowing anyone to purchase clothing from high-end brands from cities like Paris and Milan, from the comfort of their home. The company makes money through commissions, fulfillment services, and wholesale distributions.

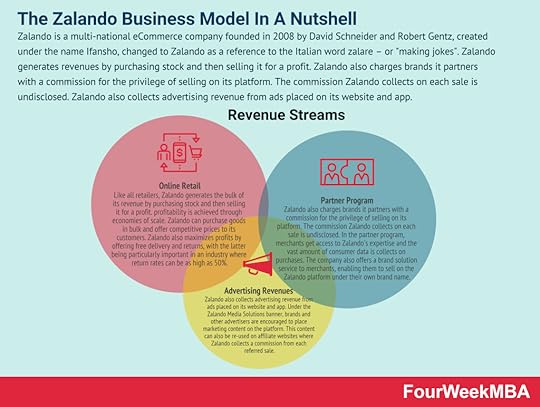

Farfetch is an online luxury fashion retail platform founded by Portuguese entrepreneur José Neves, a stalwart of the fashion industry since the 1990s, with the vision of allowing anyone to purchase clothing from high-end brands from cities like Paris and Milan, from the comfort of their home. The company makes money through commissions, fulfillment services, and wholesale distributions. Zalando is a multi-national eCommerce company founded in 2008 by David Schneider and Robert Gentz, created under the name Ifansho, changed to Zalando as a reference to the Italian word zalare – or “making jokes”. Zalando generates revenues by purchasing stock and then selling it for a profit. Zalando also charges brands it partners with a commission for the privilege of selling on its platform. The commission Zalando collects on each sale is undisclosed. Zalando also collects advertising revenue from ads placed on its website and app.

Zalando is a multi-national eCommerce company founded in 2008 by David Schneider and Robert Gentz, created under the name Ifansho, changed to Zalando as a reference to the Italian word zalare – or “making jokes”. Zalando generates revenues by purchasing stock and then selling it for a profit. Zalando also charges brands it partners with a commission for the privilege of selling on its platform. The commission Zalando collects on each sale is undisclosed. Zalando also collects advertising revenue from ads placed on its website and app.Read Next: Boohoo, Farfetch, Zalando, Urban Outfitters, SHEIN, ASOS, Zara, Fast Fashion, Ultra-Fast Fashion, Real-Time Retail.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Fast Fashion Companies appeared first on FourWeekMBA.

17 Incredible Business Failures Explained

On September 15, 2008, the company filed for Chapter 11 bankruptcy proceedings following an exodus of clients, share price depreciation, and devaluation of assets. With $613 billion in debt, it was the largest such filing in United States history and is generally accepted to have precipitated the Global Financial Crisis (GFC).

American ApparelThe company filed for bankruptcy in October 2015 and then again in November 2016. Almost 2,500 employees were terminated in January 2017 as the company began shutting its factories and over 100 stores worldwide.

Toy “R” UsThe company filed for bankruptcy in September 2017 after almost 70 years in operation, with stores closing in the United States, United Kingdom, and Australia the following year. Stores in Canada, Europe, and Asia were also sold to third parties. While many casual observers may attribute the failure of Toys “R” Us to competitors such as Amazon, several causes contributed to its failure.

RadioShackFounded in 1921 by brothers Theodore and Milton Deutschmann. RadioShack was an industry leader in the tech world of the late 1970s and early 1980s. The company failed to capitalize on the PC and portable device revolutions that followed. This forced bankruptcy proceedings in 2015 where the RadioShack brand was sold off to various entities around the world.

Forever 21Forever 21 is a North American fast fashion retailer founded by the husband and wife team Do Won Chang and Jin Sook Chang in 1984, making $700,000 in revenue during its first year and by becoming a global player with over $4 billion in revenues and across 480 locations in the US alone by 2015. Only four years later, a 32% drop in global sales forced Forever 21 to file for bankruptcy. Several factors, such as too aggressive expansion, lack of proper online commerce strategy and lack of focus might have contributed.

GawkerIn June 2016, Gawker announced a bankruptcy filing related to a lawsuit instigated by retired professional wrestler Hulk Hogan. Two months later, Gawker Media announced its flagship blog would cease operations. After publishing a video of Hulk Hogan having sex with his best friend’s wife without permission set the company on a path to bankruptcy. Hogan sued in a Florida court and as a result, Gawker was forced to pay out $140 million in damages. Hogan lawsuit was founded in secret by billionaire Peter Thiel.

EnronThe so-called “Enron scandal” describes a series of events resulting in one of the largest bankruptcy filings in United States history. The scandal consisted of a mixture of bad culture, aggressive sales incentives, and serious accounting manipulations, resulting in one of the greatest American scandals of history.

CompaqCompaq was an American information technology company founded by Rod Canion, Jim Harris, and Bill Murto with just $3000 in 1982. Compaq rose to prominence in the 1990s as the largest supplier of PC systems after becoming the first company to clone an IBM PC legally and successfully. The company was acquired by Hewlett Packard in 2002 for $24.2 billion. Compaq products were rebranded as part of a new range of lower-end HP computers and the Compaq brand was discontinued in 2013.

KodakKodak is an American analog photography company founded in 1892 by George Eastman and Henry A. Strong. By the 2010s as the photography market had been flipped upside down by the rise of smartphones and digital photography, Kodak didn’t manage to adapt to this new market, thus losing its market leadership.

AltavistaAltaVista was a search engine created in 1995 by a group of researchers attempting to make finding files on a public network easier. Despite its obvious power, AltaVista fell into disuse like many similar (but arguably inferior) services including Infoseek, AOL Search, Excite, and Ask Jeeves. The advent of Google as market leader helped make AltaVista much less relevant, thus making it fall in disuse among consumers.

PalmPalm, Inc. was an American manufacturer of personal digital assistants (PDAs) and other electronics. founded in 1992 by Jeff Hawkins, its popularity tended to be restricted to early adopters. Despite the company revolutionizing mobile computing, it no longer exists today. Palm’s demise was caused by poor decision-making, squandered resources, and misplaced effort. The company got stuck in the “chasm.”

FriendsterFriendster was a social networking service founded by Jonathan Abrams in 2002. Early versions of Friendster functioned in much the same way as eventual successor Facebook. As the social media market consolidated, by 2009, Friendster was purchased by Malaysian company MOL Global. That same year, MOL Global sold 18 Friendster patents to Facebook. Friendster remained relatively popular in southeast Asia for a few more years until it was shut down in 2015.

StumbleUponFounded in 2001, StumbleUpon was a discovery and advertisement engine pushing content recommendations to users in the form of “stumbles”. As the competition started to increase as more businesses tried to emulate its success. Many users were lost to rivals such as Pinterest, Reddit, and Digg after the StumbleUpon algorithm started to become outdated and made the site unresponsive. To remain financially viable, StumbleUpon terminated 30% of its workforce in 2013. The company failed to achieve further funding while other companies like Pinterest became tech unicorns.

QuibiQuibi was an American short-form streaming platform for mobile devices, founded in 2018 by Jeffrey Katzenberg and targeted a younger demographic by delivering content in 10-minute episodes called “quick bites”. Once the coronavirus pandemic took hold, the audience Quibi was targeting was forced to stay at home and as a result, consumed content through more traditional channels. Just eight months after launch, Quibi shut down in December 2020.

BlockbusterBlockbuster was an American home movie and video game rental service founded in 1985 by David Cook. By the 1990s the company reached its peak, with thousands of stores in the US. And yet by the 2000s Less than a decade later, Blockbuster filed for bankruptcy with almost $1 billion in debt. Today, a single store remains in Bend, Oregon. Many attribute the failure of Blockbuster to Netflix, however, the failure was a lack of adaptation of its business model to the rising of streaming as a service.

NapsterNapster was a pioneering peer-to-peer music sharing service founded by Shawn Fanning, John Fanning, and Sean Parker in 1999. The platform reached peak popularity in February 2001 with over 80 million users sharing cassette tapes, vinyl records, rare albums, bootleg recordings, and the latest hits in mp3 form. After a protracted court battle, the court ruled in favor of the RIAA which forced Napster to shut down its network late in 2001. This represented a great lesson for later players, like Apple, who took advantage of it to build a successful platform like iTunes.

NetscapeNetscape – or Netscape Communications Corporation – was a computer services company best known for its web browser. The company was founded in 1994 by Marc Andreessen and James H. Clark as one of the first and most important start-ups on the internet. The Netscape Navigator web browser was released in 1995 and it became the browser of choice for the users of the time. By November 1998, it had been acquired by AOL which tried unsuccessfully to revive the popularity of the web browser. Ten years later, Netscape was shut down entirely.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post 17 Incredible Business Failures Explained appeared first on FourWeekMBA.

New Business Model: New Business Models Examples On Top Of The Blockchain

The blockchain-based ecosystem is giving rise to many potential business models. A business model based on the blockchain will have several components such as an underlying blockchain protocol setting the rules for the token and the incentives for miners/stakers, developers, users, and investors.

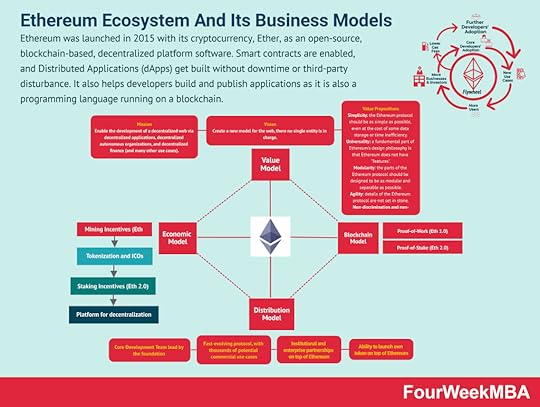

[image error]A Blockchain Business Model according to the FourWeekMBA framework is made of four main components: Value Model (Core Philosophy, Core Values and Value Propositions for the key stakeholders), Blockchain Model (Protocol Rules, Network Shape and Applications Layer/Ecosystem), Distribution Model (the key channels amplifying the protocol and its communities), and the Economic Model (the dynamics/incentives through which protocol players make money). Those elements coming together can serve as the basis to build and analyze a solid Blockchain Business Model. Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain.

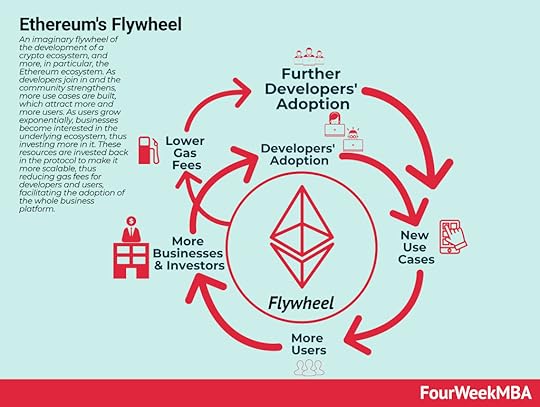

Ethereum was launched in 2015 with its cryptocurrency, Ether, as an open-source, blockchain-based, decentralized platform software. Smart contracts are enabled, and Distributed Applications (dApps) get built without downtime or third-party disturbance. It also helps developers build and publish applications as it is also a programming language running on a blockchain. An imaginary flywheel of the development of a crypto ecosystem, and more, in particular, the Ethereum ecosystem. As developers join in and the community strengthens, more use cases are built, which attract more and more users. As users grow exponentially, businesses become interested in the underlying ecosystem, thus investing more in it. These resources are invested back in the protocol to make it more scalable, thus reducing gas fees for developers and users, facilitating the adoption of the whole business platform.

An imaginary flywheel of the development of a crypto ecosystem, and more, in particular, the Ethereum ecosystem. As developers join in and the community strengthens, more use cases are built, which attract more and more users. As users grow exponentially, businesses become interested in the underlying ecosystem, thus investing more in it. These resources are invested back in the protocol to make it more scalable, thus reducing gas fees for developers and users, facilitating the adoption of the whole business platform.  BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web.

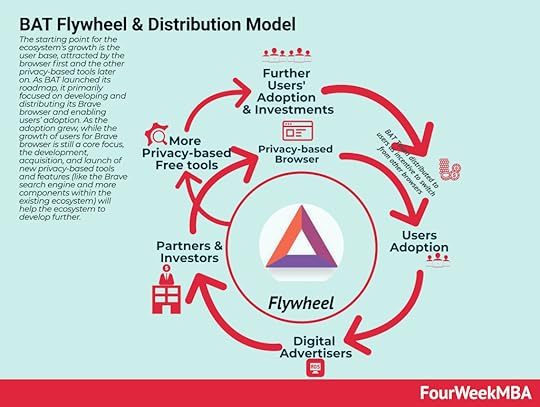

BAT or Basic Attention Token is a utility token aiming to provide privacy-based web tools for advertisers and users to monetize attention on the web in a decentralized way via Blockchain-based technologies. Therefore, the BAT ecosystem moves around a browser (Brave), a privacy-based search engine (Brave Search), and a utility token (BAT). Users can opt-in to advertising, thus making money based on their attention to ads as they browse the web.  The starting point for the ecosystem’s growth is the user base, attracted by the browser first and the other privacy-based tools later on. As BAT launched its roadmap, it primarily focused on developing and distributing its Brave browser and enabling users’ adoption. As the adoption grew, while the growth of users for Brave browser is still a core focus, the development, acquisition, and launch of new privacy-based tools and features (like the Brave search engine and more components within the existing ecosystem) will help the ecosystem to develop further.

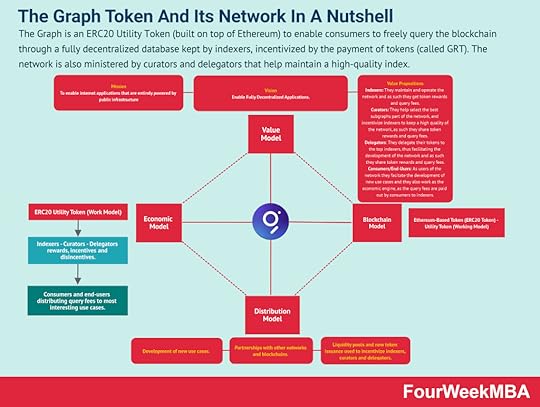

The starting point for the ecosystem’s growth is the user base, attracted by the browser first and the other privacy-based tools later on. As BAT launched its roadmap, it primarily focused on developing and distributing its Brave browser and enabling users’ adoption. As the adoption grew, while the growth of users for Brave browser is still a core focus, the development, acquisition, and launch of new privacy-based tools and features (like the Brave search engine and more components within the existing ecosystem) will help the ecosystem to develop further.  The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index.

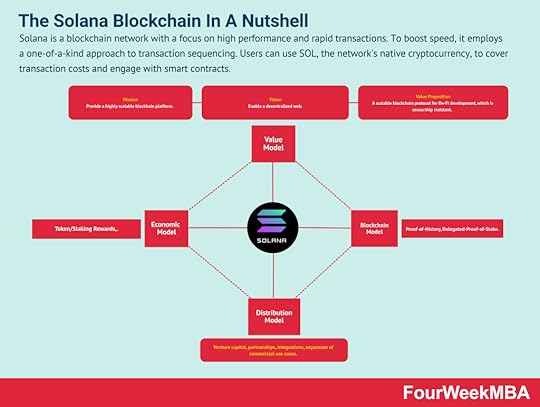

The Graph is an ERC20 Utility Token (built on top of Ethereum) to enable consumers to freely query the blockchain through a fully decentralized database kept by indexers, incentivized by the payment of tokens (called GRT). The network is also ministered by curators and delegators that help maintain a high-quality index. Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts.

Solana is a blockchain network with a focus on high performance and rapid transactions. To boost speed, it employs a one-of-a-kind approach to transaction sequencing. Users can use SOL, the network’s native cryptocurrency, to cover transaction costs and engage with smart contracts. Monero is one of the cryptocurrencies recognized for its privacy-oriented features. When it initially launched in April 2014, Monero was called BitMonero with the symbol XMR which translates to Esperanto.

Monero is one of the cryptocurrencies recognized for its privacy-oriented features. When it initially launched in April 2014, Monero was called BitMonero with the symbol XMR which translates to Esperanto. Get The 450 Pages Blockchain Business Models Book

Read Also: Proof-of-stake, Proof-of-work, Bitcoin, Dogecoin, Ethereum, Blockchain, BAT, Monero, Ripple, Litecoin, Stellar, Dogecoin, Bitcoin Cash, Filecoin.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post New Business Model: New Business Models Examples On Top Of The Blockchain appeared first on FourWeekMBA.