Gennaro Cuofano's Blog, page 152

June 6, 2021

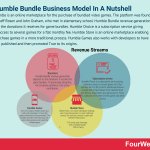

How Does Humble Bundle Make Money? The Humble Bundle Business Model In A Nutshell

Humble Bundle is an online marketplace for the purchase of bundled video games. The platform was founded in 2010 by Jeff Rosen and John Graham, who met in elementary school. Humble Bundle revenue generation depends on the donations it receives for game bundles. Humble Choice is a subscription service giving customers access to several games for a flat monthly fee. Humble Store is an online marketplace enabling users to purchase games in a more traditional process. Humble Games also works with developers to have their games published and then promoted True to its origins.

History of HumbleHumble Bundle is an online marketplace for the purchase of bundled video games. These games are sold at a price determined by the buyer with a portion of the proceeds going to charity and the game developer.

The platform was founded in 2010 by Jeff Rosen and John Graham who met in elementary school. In 2003, Rosen had started a development company with his brother called Wolfire Games while the pair were still in high school. After graduating in 2008, the brothers sought to assemble a team and make Wolfire a dedicated development studio.

As an independent producer, the founders experimented with promotional strategies to get their products noticed. Initially, they teamed up with developer Unknown Worlds to promote the new release Natural Selection 2. The game would be offered for a limited period and at a significant discount if pre-ordered with Overgrowth, a game Rosen was developing. The experiment proved successful, with both companies seeing record sales days.

Bundling was then combined with the pay-what-you-want model after Rosen saw it employed to great effect elsewhere. The first Humble Bundle launched in May 2010, with a collection of six games netting $1.27 million in just ten days. Rosen and Graham then decided to join start-up accelerator Y Combinator and focus on the bundling strategy full-time. The platform expanded to include music bundles, games, and a digital products store.

In 2017, Humble Bundle was acquired by media giant IGN in an undisclosed deal. The company continues to operate as an independent organization with a focus on charitable donations and promoting unknown developers.

Humble Bundle revenue generationDonationsHumble Bundle revenue generation depends on the donations it receives for game bundles.

It’s helpful to note that donations are defined as the total price a customer wishes to pay for each bundle. The donation as such is then split amongst the charity and the game developer. In some cases, customers can opt to send a portion of the donation to Humble Bundle itself.

To encourage donations, the company publishes a list of top contributors. Some entities have been known to spend a lot of money to appear on the list and promote themselves as charitable. More importantly, this enables Humble Bundle to make more money.

Subscription serviceHumble Choice is a subscription service giving customers access to several games for a flat monthly fee.

For $12/month, additional features include 20% off purchases in the Humble Store (see below). Subscribers also get access to Trove – a collection of Humble-owned games and other classics.

Humble StoreHumble Store is an online marketplace enabling users to purchase games in a more traditional process.

For each sale, revenue is again split between three parties:

75% to the game developer.15% to Humble Bundle.10% to charity.Humble GamesTrue to its origins, Humble Games also works with developers to have their games published and then promoted. The company provides initial financing and a team to help produce and market the finished game.

Pricing for this service is based on a contractual agreement between the company and the developer. Revenue may be in the form of royalty fees or a commission for each sale facilitated on the Humble Bundle platform.

Key takeaways:Humble Bundle is an online marketplace for the production, development, marketing, and promotion of video games. The platform was created by Jeff Rosen and John Graham in 2010 to promote games as an independent developer.Humble Bundle accepts donations for each game bundle it sells. This donation is then split with the game developer and a charity in a proportion determined by the buyer.Humble Bundle makes money by offering a monthly subscription service giving users access to additional games and discounts. It also makes money through the sale of single games in the Humble Store digital marketplace.Read also: Inside The Epic Games Empire, How Much Money Has Fortnite Made?, Gaming Industry, EA Sports Business Model, How Does Discord Make Money, The Free-To-Play Business Model, The Nintendo Business Model, How Does Unity Work And Make Money, Roblox Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Humble Bundle Make Money? The Humble Bundle Business Model In A Nutshell appeared first on FourWeekMBA.

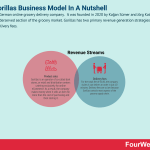

How Does Gorillas Make Money? The Gorillas Business Model In A Nutshell

Gorillas is a German online grocery delivery company. It was founded in 2020 by Kağan Sümer and Jörg Kattner to target an underserved section of the grocery market. Gorillas has two primary revenue generation strategies: product sales, and delivery fees.

Histry of GorillasGorillas is a German online grocery delivery company.

It was founded in 2020 by Kağan Sümer and Jörg Kattner to target an underserved section of the grocery market. Sümer identified that consumers organized their grocery shopping around the supply chain needs of the supermarket, rather than the supermarket being organized around the purchasing needs of the consumer.

The result is that most consumers tend to make a weekly, bulk purchase of groceries. This tendency has resulted in an emphasis on long-life shelf products where even fresh food is made to last as long as possible. Shopping habits based on supply chain needs are also detrimental to consumers who prefer to make smaller but more frequent purchases. Furthermore, the model is inconvenient for those who forget to purchase one or two items from a recipe.

To solve this problem, Sümer and Kattner asked themselves how a consumer might react to a company serving them with what they needed, when they needed it. Ultimately, they hypothesized consumers would shift from purchasing groceries weekly to purchasing them as required.

With a small amount of seed funding, Sümer bought some groceries from a local supermarket and stored them in his flat. When an order was received, he made deliveries on his bicycle in the local neighborhood to ensure customers did not have to wait. Buoyed by initial success, the service was expanded to a district in Berlin housing 165,000 people. Rapid delivery times and late opening hours then increased word-of-mouth advertising.

The service is now available in every major German city and is beginning to expand into other areas of Europe. In March 2021, Gorillas became the fastest German start-up to reach unicorn status, with a valuation of over $1 billion.

Gorillas revenue generationGorillas has two primary revenue generation strategies.

Let’s take a look at both below.

Product salesGorillas is an operator of so-called dark stores, or retail and distribution centers catering exclusively for online eCommerce.

As a result, the company makes money when it sells an item for more than the cost of purchasing and then storing it. Profits are also increased by the dark store model since Gorillas can better track when inventory is running low. This helps them avoid unfulfilled orders and increases customer satisfaction.

Delivery times are also much shorter as warehouse staff are better able to coordinate with courier staff to process orders quickly.

Delivery feesFor the small fee of €1.80, the company claims it can deliver an order in just 10 minutes.

Delivery fees are so low because Gorillas controls most aspects of the grocery supply chain.

It should also be noted that these fees cover costs associated with delivery and do not make the company a profit.

Key takeaways:Gorillas is a German online grocery delivery platform. It was founded by Kağan Sümer and Jörg Kattner in 2020 to give consumers fast and convenient access to on-demand grocery items.Gorillas operate a network of dark stores, making money by purchasing grocery items and selling them for a profit. Revenue generation is maximized by efficient inventory management and coordination between distribution and courier staff.Gorillas also charge a small delivery fee to deliver orders anywhere in around 10 minutes. The company does not make money on this fee per se, instead relying on the dark store model as the primary source of profits.Read Also: How Amazon Makes Money, Instacart Business Model, Last-Mile Delivery, Delivery Apps And Their Business Models, How Does Uber Eats Make Money, How Does Grubhub Make Money, How Does DoorDash Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Gorillas Make Money? The Gorillas Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Jysk Make Money? Jysk’s Ikea Alternative Business Model

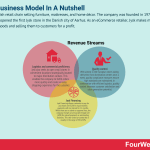

Jysk is a Danish retail chain selling furniture, mattresses, and home décor. The company was founded in 1979 by Lars Larsen, who opened the first Jysk store in the Danish city of Aarhus. As an eCommerce retailer, Jysk makes money by purchasing goods and selling them to customers for a profit.

History of JyskJysk is a Danish retail chain selling furniture, mattresses, and home décor.

The company was founded in 1979 by Lars Larsen, who opened the first Jysk store in the Danish city of Aarhus. After serving an apprenticeship in a drapery store and moving into the furniture business, Larsen decided he wanted to establish a bedding chain.

At the time, Larsen had practically no money. But through sheer energy and ambition, he managed to onboard several suppliers and a bank willing to fund his venture. Larsen would continue to use this small branch of the Danish Norresundby Bank until he died in 2019.

For the first 22 years of operation, Jysk was known as Jysk Sengetøjslager – Danish for “Jutlandic Bedding Store”. In Denmark, people from the Jutland Peninsula are associated with thoroughness, modesty, and honesty. Larsen sought to embody these values in his business to become a trustworthy retailer offering the best deals.

Today, Jysk is the largest Danish multinational retailer. It operates almost 3,000 stores in 50 countries worldwide. Like many similar businesses, Jysk experienced a surge in revenue as a result of the coronavirus pandemic, earning €4.1 billion for the 2019/20 financial year.

Jysk revenue generationAs an eCommerce retailer, Jysk makes money by purchasing goods and selling them to customers for a profit.

Jysk initially differentiated itself in the competitive furniture and home décor market with its distinctive blue and white goose logo. The goose represents premium goose-down feathers, which are used in duvet covers and pillows to provide extra warmth.

This differentiation was important to the early success of the company. Operating exclusively in Scandinavia, Jysk had access to consumers who placed a high price on a good night’s sleep. In other words, Scandinavian culture is such that most consumers do not balk at spending hundreds of euros on pillows and bedding.

Logistics and commercial proficiencyJysk also seeks to open small stores in convenient locations strategically located to major distribution centers. This enables the company to fulfill orders more quickly and create an easy shopping experience for the customer.

Order fulfillment times have also been decreased by the company reducing its reliance on Asian-made products. This also increases profit potential as supply chain costs are minimized.

Costs have been reduced further by establishing distribution facilities in Eastern Europe, a market which it views as underserved and underdeveloped. In 2018, the company opened a facility in Bulgaria to reduce freight costs by a factor of 10 million trucking kilometers per year.

Quality controlWith almost 2,500 European stores taking deliveries from distribution centers once a week, quality compliance measures ensure high standards are maintained.

Each center has inbound and outbound quality checks, with specialist staff inspecting products rigorously. Jysk also collaborates with suppliers by conducting regular factory audits and holds twice-annual assembly days where furniture is put together to validate quality.

In combination with efficient logistics, quality control increases customer satisfaction and sales generation potential.

Jysk FinancingJysk Financing allows customers to pay for purchases over $200 in equal monthly payments with no interest for 12 months.

While there are no admin or approval fees, the company charges an annual percentage rate (APR) for missed payments or outstanding balances. This rate varies by country but is usually in the range of 30 to 40%.

Key takeaways:Jysk is a Danish multinational furniture and home décor retailer. It was founded in 1979 by Lars Larsen who wanted to create a bedding chain embodying the values of Jutlandic people.Jysk gained traction in the Scandinavian market by selling premium goose-down products to consumers accustomed to paying hundreds of euros. The company then spread throughout Europe with the strategic placement of Jysk stores and distribution centers. Jysk also has a focus on quality control to increase customer satisfaction and revenue. Regular audits of supplier factories and biannual assembly days ensure the company is known for quality products.Read Next: Who Owns IKEA? IKEA Business Model, IKEA Competitors, IKEA Effect, ALDI Business Model, Tesco PESTEL Analysis.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post How Does Jysk Make Money? Jysk’s Ikea Alternative Business Model appeared first on FourWeekMBA.

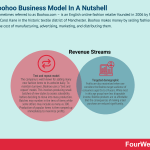

The Boohoo Business Model In A Nutshell

Boohoo – sometimes referred to as Boohoo.com – is an English online fashion retailer founded in 2006 by Mahmud Kamani and Carol Kane in the historic textile district of Manchester. Boohoo makes money by selling fashion items for more than the cost of manufacturing, advertising, marketing, and distributing them.

History of BoohooBoohoo – sometimes referred to as Boohoo.com – is an English online fashion retailer.

The company was founded in 2006 by Mahmud Kamani and Carol Kane in the historic textile district of Manchester. Kamani originally worked as a delivery driver for his father Abdullah, owner of wholesale garment business Pinstripe. Kane was also an employee for Pinstripe, having taken a position as a senior designer in 1993.

With eCommerce still a relatively new concept, the pair set out to create a platform selling direct to shoppers by removing the retail middleman. From the beginning, the Boohoo business model was focused on offering ultra-fast and ultra-cheap clothing. Unlike competitors such as Asos, all Boohoo clothes are own-brand giving the company more control over profit margins.

With the vast majority of its clothes manufactured in the United Kingdom, the company is also able to adapt to social media-fuelled fashion trends quickly. In fact, company chief executive John Lyttle once noted a new design could be on the Boohoo website in as little as 48 hours from conception. In any case, over 3,000 new styles are added weekly with an average price of just $17.

In 2014, Boohoo completed an IPO valuing the business at £560 million. Revenue in 2020 amounted to £1.235 billion.

Boohoo revenue generationBoohoo makes money by selling fashion items for more than the cost of manufacturing, advertising, marketing, and distributing them.

However, its profit strategy is somewhat unique and has been enabled the company to increase revenue while others had experienced negative growth.

Test and repeat modelThe company is well known for adding many new fashion items to its website daily. To maintain turnover, Boohoo uses a “test and repeat” model. This involves producing small batches of new styles to assess saleability before deciding to move into mass production. Batches may number in the tens of items while some others may include as many as 300. Production of popular items is then ramped up immediately to maximize profits.

It is thought the business model is an adaptation of a strategy used by Inditex. Indeed, the Spanish retail giant has used a similar strategy to adapt to new tastes and trends while managing a network of over 7,300 stores.

As a so-called fast-fashion retailer, Boohoo arguably makes more money than some competitors by staying abreast of current trends. But this business model has attracted criticism because of poor working conditions in factories. Many clothing items are also destined for landfill, either because of poor quality or fluctuating fashion trends.

Targeted demographicProfits are also maximized when one considers the Boohoo target audience of consumers aged 16 to 24 years.

While most in this age group have less disposable income, Boohoo products are so affordable that the consequences of making a bad purchase are reduced significantly. The company’s tendency to produce on-trend items also taps into the younger generation’s preference for newness and social acceptance. These values are unlikely to change, so the Boohoo business model is likely to be one that could carry it well into the future.

Key takeaways:Boohoo is an English online fast-fashion retailer. It was founded by Mahmud Kamani and Carol Kane, both with prior experience working for Manchester textile business Pinstripe.Boohoo makes money by selling clothing items for a profit. Profits are maximized by using the test and repeat model to assess whether an item is likely to sell in large volumes before mass production.Boohoo also maximizes profits by selling to a target demographic that craves consistently new and on-trend clothing that is also affordable.Read Next: A Quick Glance At Zara Business Model, How Amazon Makes Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post The Boohoo Business Model In A Nutshell appeared first on FourWeekMBA.

May 30, 2021

RASCI Matrix In A Nutshell

A RASCI matrix is used to assign and then display the various roles and responsibilities in a project, service, or process. It is sometimes called a RASCI Responsibility Matrix. The RASCI matrix is essentially a project management tool that provides important clarification for organizations involved in complex projects.

Understanding a RASCI matrixWhen used correctly, the matrix facilitates a shared understanding of participant roles and responsibilities supported by accessible and explicit documentation. As a result, the matrix can be used to help projects plagued by inefficiencies move forward.

Stakeholder roles and responsibilities are divided into five categories which comprise the RASCI acronym:

Responsible (R) – who are the stakeholders doing the work to complete a task? Responsible stakeholders are the creators of deliverables and have decision-making power.Accountable (A) – this person oversees the task to ensure it is carried out correctly. They are ultimately accountable for any work performed.Support (S) – who can support the implementation of a task, service, or process?Consulted (C) – describing stakeholders who give valuable input while the work is in progress. They are actively engaged in the project.Informed (I) – informed stakeholders are those who have no direct involvement in the project but require regular updates.Creating a RASCI matrixCreating a RASCI matrix is simple. It is a matter of following these steps:

On a matrix, start by listing each of the stakeholders in a row across the top. These may be listed by job titles such as Project Manager. Alternatively, list the names of the people involved.Then, identify every task associated with completing a project and list each on the left-hand side in a single column.Complete each cell in the RASCI matrix by assigning responsible, accountable, supporting, consulting, and informed stakeholders. This can be done by marking each cell with the first letter of each role in capitals.RASCI matrix best practicesWhen completing the matrix, it’s important to make sure the theoretical assigning of roles and responsibilities will work in practice. This helps project teams avoid conflicts and ambiguities before they have a chance to evolve.

To help with this process, consider the following common scenarios:

Too many Rs for a single stakeholder – does one stakeholder have too much work assigned to them? Reduce their workload if necessary.Too many Rs for a single task – do some tasks have more than one responsible person? To avoid power struggles, ensure only one person is responsible for each task.No empty cells – it is important for businesses to objectively assess whether every stakeholder needs to be involved in every project task. Can responsible stakeholders be changed to consulted stakeholders? Can consulted stakeholders become informed?Multiple As – there should be only one accountable person for each task. Multiple accountable persons slow decision-making and encourage conflict.Multiple Cs – too many consulted stakeholders can also slow down a project. Only stakeholders with valuable expertise should be consulted regularly. Most consultants should be kept informed but only asked for advice in extenuating circumstances.Key takeaways:The RASCI matrix displays the various roles and responsibilities of key stakeholders in a project, service, process, or task.The RASCI matrix is an acronym of five key categories of stakeholder: responsible, accountable, support, consulted, and informed.The RASCI matrix is simple to complete, but it must make sense in practical terms. Businesses need to follow a few best practices to ensure the matrix guides streamlined project management.Read Also: RAPID Framework, RACI Matrix, 3×3 Sales Matrix, Value/effort Matrix, SFA matrix, Value/Risk Matrix, Reframing Matrix, Kepner-Tregoe Matrix.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post RASCI Matrix In A Nutshell appeared first on FourWeekMBA.

RAPID Framework In A Nutshell

The RAPID framework is a tool used to help businesses make important decisions. The RAPID framework was developed by global consultancy firm Bain & Company, which noted that “high-quality decision making and strong performance go hand in hand.”

Understanding the RAPID frameworkNevertheless, clear and well-defined decision-making processes in many organizations are impeded by uncertainty over roles or responsibilities. This causes wasted time, confusion, frustration, and ultimately, failure.

To address this issue, Bain & Company developed a tool to help clarify decision-making accountability. It is loosely based on the acronym RAPID which is based on five key roles that must be assumed when making any decision:

Recommend (R) the decision or action. Who is the person or group of people responsible for recommending an action as part of an expected outcome?Agree (A) to the decision or action. Who is the person or group of people tasked with agreeing to a decision? This might include customers, suppliers, stakeholders, department heads, or key executives. If a decision is not fully supported, this should be reflected in the final proposal.Perform (P) the action item. This role encompasses those tasked with carrying out the action. This role must be staffed with relevant knowledge and expertise.Input (I) – who will provide factual input to a recommendation to generate support from employees? Depending on the ease of implementation and chance of success, this input may or may not be reflected in the final proposal.Decide (D) to make the decision. Importantly, the decision must be made by a single person – referred to as the decision owner. If a business feels the need to involve multiple people in a decision, then it may benefit from splitting a project into smaller parts.RAPID framework best practicesIf nothing else, the RAPID framework requires patience, discipline, and practice. It also requires discerning judgment since not every decision will be suited to a rigorous evaluation process.

With that said, here are a few tips for using the framework:

If key personnel identify that the RAPID framework is applicable, each of the five key roles must be filled before a decision is required. These people must then be notified of their responsibilities as a matter of priority.Ensure recommendations, inputs, and agreements are clearly defined. To help avoid confusion, clarify the level of input each role is providing and also the context it is provided in.While the RAPID framework is useful for larger organizations or projects with added complexity, businesses must avoid using it for every single decision. Overuse can cause efficiency problems the framework was trying to solve in the first place.Benefits of the RAPID frameworkSome of the benefits of the RAPID framework include:

Thoughtful decision-making – many decision-makers benefit from a systematic and logical decision-making process. It forces them to slow down and give greater accountability to those most deserving of it. With the most qualified people involved, the less qualified are excluded as a natural consequence.Increased buy-in – many assume excluded staff are somehow less invested in the decision as a result. However, the reverse is true when there is some degree of transparency. As staff understand who is involved in making the decision and what the process entails, they become more engaged and supportive. High-quality recruiting – the increase in clarity also has ramifications for the recruitment process. The RAPID framework allows recruiters to clearly define the authority and responsibility an interviewee would have in the company if successful. This allays concerns regarding decision-making scope and the pre-existing chain of command.Higher impact decisions. Perhaps an obvious benefit, but one that is worth mentioning. Businesses that make better decisions generally make higher impact decisions that help them achieve their goals more effectively.Key takeaways:The RAPID framework is a tool used by businesses to help them make better decisions. It was developed by consultancy firm Bain & Company.The RAPID framework is based on an acronym of five key decision-making roles. Each role may be assigned to an individual or group of people.The systemic nature of the RAPID framework forces decision-making to slow down and become more insightful. It also increases employee buy-in for those not directly involved in the process. Lastly, the framework encourages high-impact decision-making enabling goals to be achieved more quickly.Read Also: RACI Matrix, 3×3 Sales Matrix, Value/effort Matrix, SFA matrix, Value/Risk Matrix, Reframing Matrix, Kepner-Tregoe Matrix.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post RAPID Framework In A Nutshell appeared first on FourWeekMBA.

History of Walmart

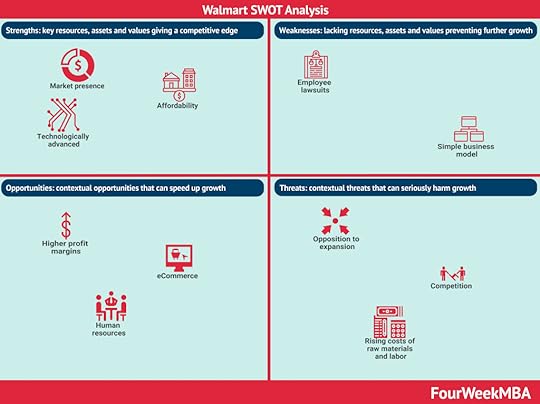

Walmart is an American multinational retail corporation operating hypermarkets, grocery stores, and discount department stores. It was founded by Sam Walton in Arkansas in 1962.

Walton was a military veteran who moved to Newport, Arkansas after his service ended in 1945. Walton and his wife Helen then purchased their first Ben Franklin variety store franchise.

After five years in operation, Sam had fulfilled his wish to make the franchise the top store in the state. He achieved this through exemplary customer service and low prices, a personal philosophy still important to Walmart today.

In 1950, the Waltons were forced to move on after the landlord refused to renew their lease.

The move to Bentonville, ArkansasWalton then began scouring northwest Arkansas for somewhere to establish a new presence. In Bentonville, he found a small variety store whose owner was willing to sell. He called this Ben Franklin franchise Walton’s Five and Dime, marketing it as the “most up-to-date, modern variety store in Northwest Arkansas.”

Between 1951 and 1962, Walton would open a further 14 stores in small, rural towns. He believed discount stores could thrive in these places provided products were sold at the cheapest price possible. He went to Ben Franklin with this strategy, but they were uninterested after learning their margins would have to be cut in half.

As a result, Walton decided to strike out alone.

The first Walmart store and further expansionThe first Walmart store opened in Rogers, Arkansas in 1962. Sam and Helen provided 95% of the required funding, so they had to make it work. To increase their odds of success, Sam would travel the country and learn everything he could about discount retailing.

In 1968, Walmart expanded into Missouri and Oklahoma and opened its first distribution center in Bentonville. The following year, Walmart Stores was incorporated and held an IPO. By 1972, Sam Walton had enough money to build 15 more stores. Facing stiff competition from retail giants such as Kmart, Walmart stock was offered on the New York Stock Exchange on August 15 that same year.

By the end of the decade, Walmart grew to 276 stores in 11 different states. The company made several acquisitions during this time, including 16 Mohr Value Stores and the Hutcheson Shoe Company.

Coming of ageIn 1980, Walmart became the fastest company to reach $1 billion in sales after just 18 years in operation. As the company continued to expand into other U.S. states, so too did Walton’s aspirations.

The first Walmart Supercenter opened in 1988, at the time an experimental hypermarket selling traditional groceries alongside other services. These included pet shops, garden centers, optical centers, pharmacies, and photo processing labs. Sam’s Club was also created around this time, a membership-only retail warehouse club offering exclusive savings on shipping, fuel, and prescriptions, among other things.

In 1990, Walmart became the top retailer in the United States – a title it still holds over three decades later.

Key takeaways:Walmart was founded by Sam Walton who started his retail career by operating a Ben Franklin variety store franchise. Walton believed in delivering value to the customer through exemplary customer service and low prices.Walton would go on to operate 15 Ben Franklin franchises but decided to create his own chain after disagreements with the owners over profit margins.The first Walmart store opened in Arkansas in 1962. Expansion throughout the United States was facilitated by an IPO in 1969 and a debut on the NYSE in 1972. By 1980, Walmart surpassed $1 billion in annual revenue and began experimenting with hypermarket and membership-only retail models. Walmart’smission can be summarized as “helping people around the world save money and live better – anytime and anywhere – in retail stores and through eCommerce.” While its vision is to “make every day easier for busy families.” Walmart defines “busy families” as the bull’s eye of its business strategy.

Walmart’smission can be summarized as “helping people around the world save money and live better – anytime and anywhere – in retail stores and through eCommerce.” While its vision is to “make every day easier for busy families.” Walmart defines “busy families” as the bull’s eye of its business strategy. From humble beginnings just over 50 years ago, Walmart has grown to become the world’s largest retail company. A single small discount store in Arkansas has now expanded to over 11,000 stores in 28 countries. Some reports suggest that the company now makes $1.8 million of profit every hour.

From humble beginnings just over 50 years ago, Walmart has grown to become the world’s largest retail company. A single small discount store in Arkansas has now expanded to over 11,000 stores in 28 countries. Some reports suggest that the company now makes $1.8 million of profit every hour.Read next: Walmart Business Model, Walmart SWOT Analysis, Who Owns Walmart, How Amazon Makes Money, Business Strategy Lessons From Costco Business Model, How Best Buy Business Model Transformation Saved It From Sure Failure, How Does Instacart Make Money.

Related: History of Amazon, History Of Apple, History Of Starbucks, History Of McDonald’s, History of WhatsApp, History Of Bitcoin, History Of Google.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post History of Walmart appeared first on FourWeekMBA.

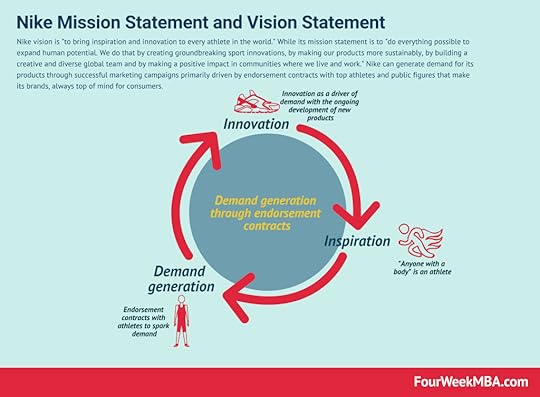

History of Nike

Nike, Inc. is an American multinational corporation best known for the marketing and sales of footwear, sports equipment, apparel, and related accessories and services. The company is also actively engaged in research and development in the aforementioned areas.

Nike was the brainchild of Phil Knight. While studying at the University of Oregon, Knight was a keen middle-distance runner and competed on the university track and field team. Knight’s coach was Bill Bowerman, an intensely competitive man with a passion for tinkering with running shoes to optimize performance.

After graduating, Knight studied for an MBA at Stanford. There, he wrote a paper arguing that running shoe manufacturing should move from Germany to Japan where labor was cheaper. To put his idea to the test, Knight then traveled to Japan and struck a deal with Onitsuka Co. (now known as Asics) to export shoes to the United States.

Blue Ribbon SportsAs part of the deal, Knight founded Blue Ribbon Sports in 1964 to become the official U.S. distributor of Japanese running shoes. Bowerman also supported the new venture by providing product design ideas in exchange for 50% ownership of the company.

Knight started by selling shoes from the trunk of his Plymouth Valiant at track meets. Initial demand was promising, with many athletes preferring his shoes over the more expensive alternatives from Adidas or Puma. Excellent sales results allowed the pair to hire their first full-time employee in 1965. The first Blue Ribbon Sports retail store opened the following year in Santa Monica, California.

The ever-inquisitive Bowerman then proposed a new shoe design to Onitsuka that provided better support to runners. Named the Tiger Cortez, the shoe became instantly recognized for its sturdiness, stylishness, and comfort.

Nike rebrandingDespite the success of the Tiger Cortez, relations between Blue Ribbon Sports and Onitsuka soured some years later. Knight claimed the Japanese company was trying to wriggle out of an exclusivity deal to destroy his company. Onitsuka responded by claiming Knight was selling his own version of the Tiger Cortez under a new line called “Nike”.

Perhaps inevitably, the two companies parted ways in 1971. A subsequent lawsuit allowed both parties to sell essentially the same shoes under two different brand names.

Blue Ribbon Sports was then renamed Nike after the Greek goddess of victory. The idea for the name came from Jeff Johnson, the first employee Knight and Bowerman had hired six years previously. The trio then reached out to Carolyn Davidson, a design student at Portland State University. She created the now infamous Nike swoosh logo for $35, which Knight was initially ambivalent about.

Twelve years later, Knight grew to love the logo and decided to hold a luncheon to honor Davidson’s contribution to the company. He awarded her a gold Swoosh ring and an undisclosed amount of Nike stock as proper payment for services rendered.

Innovation, expansion, and endorsementsNike continued to grow steadily during the 70s and 80s, with Bowerman developing the iconic, high-traction Waffle Trainer after noticing the grooves in his waffles during breakfast one morning.

Growth was also supported by clever advertising, with the 1988 “Just Do It” campaign becoming a household slogan.

In 1994, Nike struck a deal with NBA player Michael Jordan before he became one of the greatest basketballers of all time. Despite being released in 1985, the Nike Air Jordans continue to be popular around the world. In fact, the shoes netted the company $2.8 billion in 2018 alone.

Nike similarly maintains brand relevance today, partnering with high-profile sports stars in basketball, golf, football, baseball, and athletics.

Key takeaways:Nike was founded as Blue Ribbon Sports in 1965 by Phil Knight and Bill Bowerman. Knight was a former student of Bowerman’s on the University of Oregon track and field team.Nike as a company name was suggested by the first employee Jeff Johnson, who claimed the idea came to him in a dream.The Nike swoosh logo was developed in 1971 by college student Carolyn Davidson for the princely sum of $35. Knight was ambivalent about the logo at first but properly rewarded Davidson for her contribution to the success of the company in 1983. Nike vision is “to bring inspiration and innovation to every athlete in the world.” While its mission statement is to “do everything possible to expand human potential. We do that by creating groundbreaking sport innovations, by making our products more sustainably, by building a creative and diverse global team and by making a positive impact in communities where we live and work.”

Nike vision is “to bring inspiration and innovation to every athlete in the world.” While its mission statement is to “do everything possible to expand human potential. We do that by creating groundbreaking sport innovations, by making our products more sustainably, by building a creative and diverse global team and by making a positive impact in communities where we live and work.”

Nike has a matrix organizational structure incorporating geographic divisions. Nike’s matrix structure is also present at the regional and sub-regional levels. Managerial responsibility is segmented according to business unit (apparel, footwear, and equipment) and function (human resources, finance, marketing, sales, and operations).

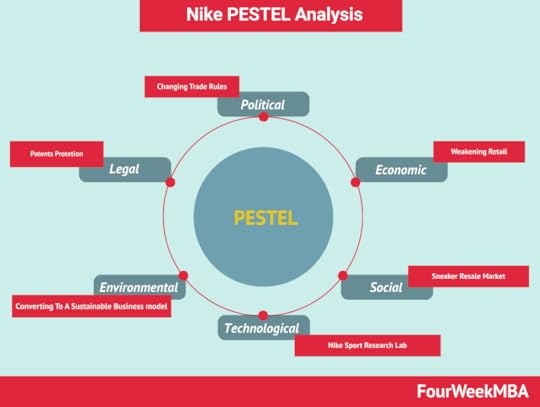

Nike has a matrix organizational structure incorporating geographic divisions. Nike’s matrix structure is also present at the regional and sub-regional levels. Managerial responsibility is segmented according to business unit (apparel, footwear, and equipment) and function (human resources, finance, marketing, sales, and operations). Read Next: Nike Competitors, Nike Organizational Structure, Organizational Structure, Nike Business Model, Nike Mission, Nike SWOT, Nike Pestel.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post History of Nike appeared first on FourWeekMBA.

History of Netflix

Netflix is an over-the-top content platform and production company founded in 1997 by entrepreneurs Reed Hastings and Marc Randolph.

During the late 1990s, video rental stores such as Blockbuster dominated the lucrative home entertainment market. But Hastings in particular became frustrated after forgetting to return a movie by the due date and having to pay a $40 fee. This frustration was compounded by the inconvenience of the rental process, with customers having to select and then return a rental to the store themselves.

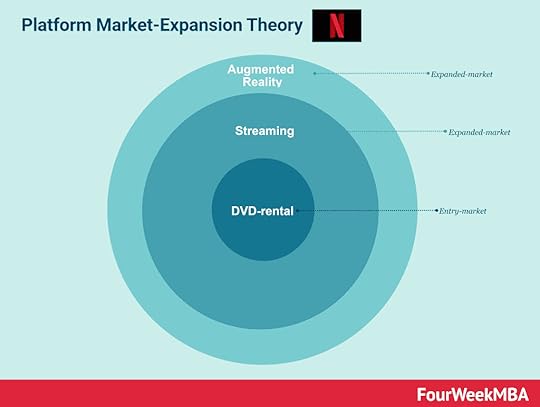

Sensing a shift away from VHS to newer technologies, Netflix began as a rent-by-mail DVD service in April 1998. Initially, users browsed a list of movies on the Netflix website and then placed an order. Hasting and Randolph would then mail the DVDs, charging around $4 per movie plus $2 postage.

Netflix as a subscription servicePurchasing movies online and having them delivered to your door was a revolutionary concept in 1999. Netflix then changed the status quo once more by shifting to a subscription model.

Here, users paid a fixed monthly fee to rent as many movies as they liked. Importantly, there were no late fees. Netflix customers could return a movie whenever they wanted, but could not rent a new DVD until they posted the old one back.

This disruption to the movie rental industry was so swift that large players such as Blockbuster were caught unprepared. This was partly because customers loved Netflix, but also because Blockbuster failed to take advantage of new opportunities. When Hastings approached the company in 2000 about a partnership, then-CEO John Antioco famously laughed him off. That same year, Netflix introduced a personalized movie recommendation system using member ratings on past titles to predict future choices.

Between 1999 and 2003, Netflix built a customer base of 1 million subscribers. This doubled to 2 million in 2004 and then again to 4.2 million in 2005.

Netflix as a streaming serviceNetflix introduced Watch Now in 2007, a streaming service allowing members to watch television shows and movies on their personal computers. The service started with a meager 1,000 titles and placed limits on the number of hours of free streaming.

In 2008, Netflix partnered with consumer electronics brands to allow streaming on video game consoles, Blu-ray players, and TV set-top boxes. In 2009, the company held a competition with $1 million in prize money to develop an algorithm better able to predict user content preferences.

Over the next few years, Netflix expanded into Canada, Latin America, the United Kingdom, Ireland, Scandinavia, and the Caribbean. With 25 million members reached by 2012, a Netflix button started to be incorporated into TV remote controls.

Over-the-top content and productionSo-called over-the-top content describes content offered directly to viewers via the internet.

Many Netflix television shows, documentaries, and movies have been funded and produced directly by the company to critical acclaim. The company has received many Emmy nominations and Academy Awards for programs such as House of Cards, ROMA, Godless, Orange is the New Black, and The Square.

High-quality content and expansion into Europe then helped the company pass 50 million members in 2014. By 2016, Netflix was available in more than 190 countries and 21 languages.

Key takeaways:Netflix is an over-the-top content platform and production company founded by Reed Hastings and Marc Randolph in 1997. Hastings wanted to make the video rental industry more customer-friendly by abolishing late fees and making the rental process more convenient.Netflix signed up 1 million users to its DVD rental subscription service between 1999 and 2003. The company then released a streaming service in 2007.Netflix is a pioneer of self-produced, award-winning films and television shows. It is now available in multiple languages in most of the world’s countries. Netflix is a subscription-based business model making money with three simple plans: basic, standard, and premium, giving access to stream series, movies, and shows. The company is profitable, yet it runs on negative cash flows due to upfront cash paid for content licensing and original content production.

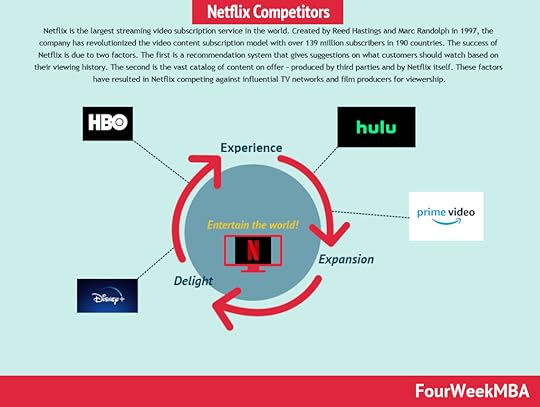

Netflix is a subscription-based business model making money with three simple plans: basic, standard, and premium, giving access to stream series, movies, and shows. The company is profitable, yet it runs on negative cash flows due to upfront cash paid for content licensing and original content production. Netflix is the largest streaming video subscription service in the world. Created by Reed Hastings and Marc Randolph in 1997, the company has revolutionized the video content subscription model with over 139 million subscribers in 190 countries. The success of Netflix is due to two factors. The first is a recommendation system that gives suggestions on what customers should watch based on their viewing history. The second is the vast catalog of content on offer – produced by third parties and by Netflix itself. These factors have resulted in Netflix competing against influential TV networks and film producers for viewership.

Netflix is the largest streaming video subscription service in the world. Created by Reed Hastings and Marc Randolph in 1997, the company has revolutionized the video content subscription model with over 139 million subscribers in 190 countries. The success of Netflix is due to two factors. The first is a recommendation system that gives suggestions on what customers should watch based on their viewing history. The second is the vast catalog of content on offer – produced by third parties and by Netflix itself. These factors have resulted in Netflix competing against influential TV networks and film producers for viewership.

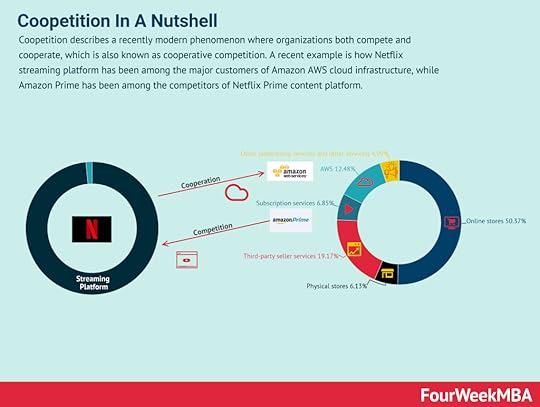

Coopetition describes a recently modern phenomenon where organizations both compete and cooperate, which is also known as cooperative competition. A recent example is how Netflix streaming platform has been among the major customers of Amazon AWS cloud infrastructure, while Amazon Prime has been among the competitors of Netflix Prime content platform.

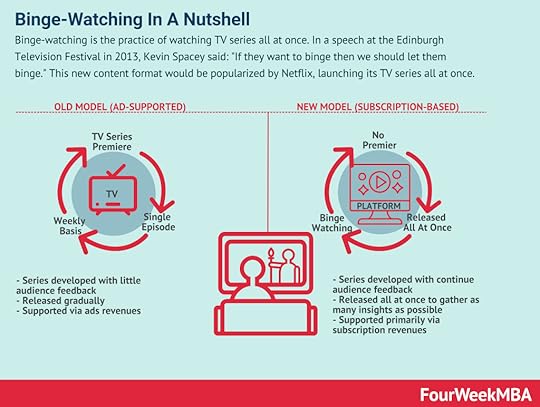

Coopetition describes a recently modern phenomenon where organizations both compete and cooperate, which is also known as cooperative competition. A recent example is how Netflix streaming platform has been among the major customers of Amazon AWS cloud infrastructure, while Amazon Prime has been among the competitors of Netflix Prime content platform. Binge-watching is the practice of watching TV series all at once. In a speech at the Edinburgh Television Festival in 2013, Kevin Spacey said: “If they want to binge then we should let them binge.” This new content format would be popularized by Netflix, launching its TV series all at once.

Binge-watching is the practice of watching TV series all at once. In a speech at the Edinburgh Television Festival in 2013, Kevin Spacey said: “If they want to binge then we should let them binge.” This new content format would be popularized by Netflix, launching its TV series all at once.Read Also: Netflix Business Model, Netflix Competitors, Binge-Watching, Netflix SWOT Analysis, Netflix Vision Statement, Is Netflix Profitable.

Read Next: How Does Discord Make Money, How Does Twitch Make Money, Why Amazon Prime Is The Key To Amazon Business Model Long-Term Success, What Is the Cost per First Stream Metric? Amazon Prime Video Revenue Model Explained, Why Did Amazon Buy MGM.

Related: History of Amazon, History Of Apple, History Of Starbucks, History Of McDonald’s, History of WhatsApp, History Of Bitcoin, History Of Google.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post History of Netflix appeared first on FourWeekMBA.

History of Nintendo

Nintendo is a multinational video game and consumer electronics company headquartered in Kyoto, Japan.

The history of Nintendo goes back centuries. In 1633, Japan cut off relations with the West and banned all foreign playing cards because they encouraged illegal gambling. Successive games were introduced and then banned as Japanese card makers sought to establish their own home-grown card games.

One game worth mentioning is Hanafuda, which replaced numbers with months of the year and pictures to get around the ban. Although it too was eventually made illegal, Japanese citizens loved Hanafuda and continued to play it in secret.

In the late 1800s, the government relaxed its laws on certain playing cards. One citizen who welcomed this news was 29-year-old Fusajiro Yamauchi, an avid Hanafuda player. He saw the potential in monetizing Hanafuda and founded a company called Nintendo Koppai in 1889.

Early days of NintendoInitially, Yamauchi sold hand-made pictorial Hanafuda cards made from the bark of a mulberry tree. Nintendo quickly experienced immense popularity in Japan as consumers appreciated the art and quality construction of each card.

Yamauchi ran the business for 40 years before retiring in 1929. The company was run for another 20 years by his son-in-law Sekiryo Kaneda before he too was forced to retire after suffering a stroke.

This opened the door for Kaneda’s grandson, Hiroshi Yamauchi, who took the helm at the tender age of 21.

A new directionWhen Yamauchi took the reins in 1949, his lack of experience was met with resentment by employees. He was also a ruthless leader, firing anyone who disagreed with him and having the final say on any new product idea.

However, Yamauchi did many things to advance the company during this tenure. He started selling western playing cards, the first Japanese company to do so in over 300 years. Nintendo also established the first such licensing deal with Disney to have its characters appear in card decks for party and family games.

When card game sales started to drop after the Tokyo Olympics in 1964, Yamauchi realized he had to pivot quickly. While inspecting the languishing playing card assembly line, he noticed an employee playing with a mechanized, extendable hand. Later dubbed the Ultra Hand, Yamauchi was so taken with the invention that he immediately ordered it into production. Nintendo would later sell 1.2 million Ultra Hands, announcing its presence on the toy market as a serious contender.

Electronic toysThe inventor of the Ultra Hand, Gunpei Yokoi, was also completing an engineering degree at the time.

Ultimately, his interests would steer Nintendo into the emerging electronic toy industry. Nintendo partnered with Sony to develop a home electronic version of popular arcade light gun games. In 1972, the company acquired the Japanese distribution rights to the Magnavox Odyssey – the first video game console. Five years later, Nintendo released its own video console called the Color TV-Game featuring six pre-programmed games.

By 1980, business was booming for Nintendo. It entered the North American market with Donkey Kong following soon after for the coin-operated arcade market. The highly successful Super Mario Bros. franchise was released in 1983 and continues to be updated to this day.

The company has continued to innovate since the explosion in popularity of electronic games. Consoles including the Game Boy, Nintendo DS, Wii, and Nintendo Switch have all enjoyed prolonged success with gamers around the world.

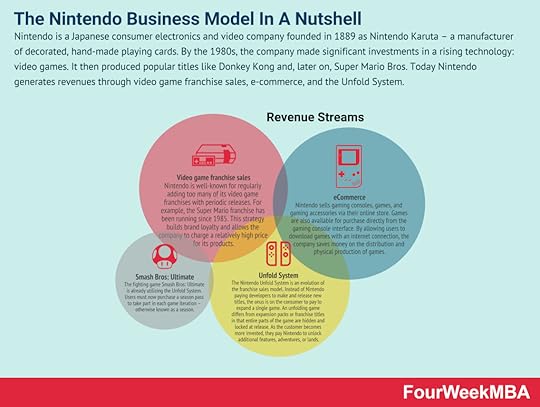

Key takeaways:Nintendo is a Japanese multinational consumer electronics and video company founded in 1889. Initially, the company sold hand-made pictorial playing cards for the popular game Hanafuda.Nintendo pivoted into toy manufacturing after playing card popularity declined in 1964. Then-CEO Hiroshi Yamauchi noticed an assembly line worker playing with a mechanized extendable hand which he immediately put into mass production. The Ultra Hand would sell 1.2 million units.The Ultra Hand inventor Gunpei Yokoi provided the impetus for Nintendo moving into electronic games. The company partnered with Sony to offer arcade games at home and also acquired the distribution rights to the first home video game console. Nintendo is a Japanese consumer electronics and video company founded in 1889 as Nintendo Karuta – a manufacturer of decorated, hand-made playing cards. By the 1980s, the company made significant investments in a rising technology: video games. It then produced popular titles like Donkey Kong and, later on, Super Mario Bros. Today Nintendo generates revenues through video game franchise sales, e-commerce, and the Unfold System.

Nintendo is a Japanese consumer electronics and video company founded in 1889 as Nintendo Karuta – a manufacturer of decorated, hand-made playing cards. By the 1980s, the company made significant investments in a rising technology: video games. It then produced popular titles like Donkey Kong and, later on, Super Mario Bros. Today Nintendo generates revenues through video game franchise sales, e-commerce, and the Unfold System.Read Next: Nintendo Business Model, How Does Discord Make Money, Epic Games Business Model, Gaming Industry And Its Business Models, Free-To-Play Business Model, EA Sports Business Model, How Does Twitch Make Money, Roblox Business Model, What Does Tencent Own? Inside The Tencent Business Model.

Read Also: History of Amazon, History Of Apple, History Of Starbucks, History Of McDonald’s, History of WhatsApp, History Of Bitcoin, History Of Google.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post History of Nintendo appeared first on FourWeekMBA.