Gennaro Cuofano's Blog, page 155

May 24, 2021

How Does Gopuff Make Money? The Gopuff Business Model In A Nutshell

Gopuff is a digital delivery service headquartered in Philadelphia, Pennsylvania. Gopuff differs from other delivery services. It purchases, stores, and sells its own inventory; profit is generated when the company can sell an item for more than the cost of purchasing and storing it. Gopuff also charges a flat $1.95 delivery fee, with the company proudly admitting that it does not surge or hike prices. In addition, Gopuff Fam is a monthly membership program offering several free perks. The company also sells advertising to brands in the form of high-visibility product placements.

History of GopuffGopuff is a digital delivery service headquartered in Philadelphia, Pennsylvania.

The service was founded by university students Yakir Gola and Rafael Ilishayev in 2013. Responsible for stocking their college townhouse with snacks and essentials, the pair realized that repeatedly visiting the store to re-supply goods was time-consuming. What’s more, this process impeded their ability to balance studies with work, family, and friends.

Gola and Ilishayev would spend subsequent nights drafting app mock-ups on the back of their lecture notes. Three months later, they were selling convenience items on campus from the back of their Plymouth Voyager. An app was then launched in December 2013. To grow the business, they convinced university professors to pitch the app to fellow students by offering free products such as bottle openers and lighters.

Gopuff items are stored and then sold by the company, so the co-founders also needed to convince local distributors to partner with them. Gola and Ilishayev continued to make deliveries as they earned their degrees, using profits to expand into Chicago and Washington, D.C.

In late 2015, the company raised its first round of venture funding. Gopuff now operates over 250 micro-fulfillment centers in approximately 650 cities across the United States.

Gopuff revenue generationGopuff has several revenue generation streams. Following is a look at each.

Item markupAs noted, Gopuff differs from other delivery services in that it purchases, stores, and sells its own inventory.

Revenue, and more importantly profit, is generated when the company can sell an item for more than the cost of purchasing and storing it.

This business model allows Gopuff to manage its inventory levels, reducing the likelihood that a product will be out of stock. Order fulfillment is also much faster, with order pickers having the delivery ready before the courier arrives.

As a direct seller, however, Gopuff must invest in warehousing space whenever it expands. Expensive liquor licenses must also be paid for in the applicable jurisdictions.

Delivery feeGopuff charges a flat $1.95 delivery fee, with the company proudly admitting that it does not surge or hike prices.

An additional $2 is added to any delivery containing alcohol. This fee ensures the compliant delivery of alcohol products and associated ID verification.

To maintain a flat delivery fee, each order must have a total value of at least $10.95.

Gopuff FamGopuff Fam is a monthly membership program offering several free perks.

The most significant of these perks is a free delivery option on all orders for $5.95/month.

Advertising and consumer dataThe company also sells advertising to brands in the form of high-visibility product placements.

One notable example is Nightfood, an ice-cream start-up that paid Gopuff almost $600,000 for priority placement on the app. The deal also included Gopuff giving the start-up insights into who was buying its ice cream and when they were buying it.

Key takeaways:Gopuff is an American digital delivery service for common household goods and alcohol. It was founded by university students who noted that continually restocking their college townhouse was time-consuming and inconvenient. As a direct purchaser and storer of inventory, Gopuff makes money by selling items for a profit. It also charges a flat delivery fee for orders over a certain amount. Gopuff charges $5.95/month for a membership program offering discounts and free shipping. It also sells advertising placements and aggregated consumer data to brands.Read Also: How Does Amazon Make Money, How Does Instacart Make Money, How Does DoorDash Make Money, How Does Postmates Make Money, How Does Grubhub Make Money, How Does Uber Eats Make Money, The Walmart Business Model, Last-Mile Delivery: The Anti-Network Effects And Why It’s Such A Hard Problem.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Gopuff Make Money? The Gopuff Business Model In A Nutshell appeared first on FourWeekMBA.

How Does FabFitFun Make Money? The FabFitFun Business Model In A Nutshell

FabFitFun is an online subscription box service sending electronics, cosmetics, fitness, wellness, and fashion items every quarter. Founded in 2010, it started as a simple website, and as it gained popularity, thus following later on a similar subscription-based model to Birchbox. It now generates revenues through membership services and brand sponsorships.

History of FabFitFunFabFitFun is an online subscription box service sending items in electronics, cosmetics, fitness, wellness, and fashion every quarter.

The company was founded by brothers Daniel and Michael Broukhim and Katie Echevarria Rosen Kitchens in 2010. FabFitFun was initially launched as a website providing female-oriented content, featuring a newsletter and deals section among other things.

After three years of consistently publishing content, the site started to become very popular. Witnessing the popularity of Birchbox, the founders set about monetizing their traffic. In early 2013, they sold 2,000 boxes to site users in just two days. These boxes were intended to mimic the so-called “swag bags” of full-size products given to editors at brand-sponsored events.

By 2016, the platform had surpassed 200,000 subscribers after receiving the first round of funding totaling $3.5 million. When similar businesses experienced a downturn, FabFitFun continued to grow by partnering with influencers and brands and building a strong community through video content.

In late 2019, the platform passed 1 million members and $300 million in sales.

FabFitFun revenue generationMost FabFitFun revenue comes from monthly subscriptions.

In this case, there are two options:

Annual – $45 per box, billed annually at $179.99. This gives users four boxes per year with up to eight different products. Users can also customize their entire box and get early access to add-ons, sales, and shipping.Seasonal – $49.99 per box, billed quarterly. On this plan, customers can only choose a maximum of four customizations per box.Both options contain products from premium and emerging brands. These subscription plans also give access to the FabFitFun Shop, online community, and streaming video channel.

FabFitFun StyleFabFitFun Style is an exclusive personalized styling service for members who must take a quiz to answer questions about their preferred styles and body shape.

With this information, a stylist selects five to six items of tailored clothing and ships them to the customer. The company charges a non-refundable $20 Styling Fee for this service, though the cost can be recouped if the user decides to keep one or more items from the box.

A FabFitFun Styling Pass can also be used to cover the cost of the Styling Fee. This is a prepaid voucher that serves as a form of credit for the purchase of styling services and fashion items.

Brand sponsorshipsWhen FabFitFun assembles its boxes, the company works with brands who want to advertise their products through the subscription service.

Brands may opt to let the company feature its products for free. Alternatively, they may pay an advertising fee.

Key takeawaysFabFitFun is an American online subscription box service for beauty, cosmetic, health, fitness, and electronics products. The service was originally launched as a content website offering female-oriented advice and deals.FabFitFun generates revenue through a subscription service, offering two plans according to how frequently the customer would like to pay. The company also charges for a personalized styling service based on information from user questionnaires.FabFitFun works with brands whilst assembling the products for its boxes. Brands may offer products for free in exchange for extra exposure. They may also pay the company an advertising fee.Read Next: Subscription Business Model, How Does BoxyCharm Make Money, How Does Birchbox Make Money, How Does Dollar Shave Club Make Money, How Does Stitch Fix Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does FabFitFun Make Money? The FabFitFun Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Stitch Fix Make Money? The Stitch Fix Business Model In A Nutshell

Stitch Fix is an American online personal styling service using algorithms and data science to recommend clothing based on style, budget, and size. It was founded in 2011 by Katrina Lake to help women discover and explore their personal style through a client-focused shopping experience. Stitch Fix has a surprisingly diverse revenue generation model for an online clothing retailer, from clothes sales to a styling fee of $20 charged by the company approximately two weeks before an order is sent out. The company also designs, produces, and then sells clothing under the Hybrid Designs brand.

History of Stitch FixStitch Fix is an American online personal styling service, using algorithms and data science to recommend clothing based on style, budget, and size.

Stitch Fix was founded in 2011 by Katrina Lake, with initial operations based in her apartment in Cambridge, Massachusetts. She created Stitch Fix to help women discover and explore their personal style through a client-focused shopping experience. She also lamented that the fashion industry was ripe for innovation, with most still purchasing their clothes in brick-and-mortar stores.

Initially, the company was called Rack Habit. It was funded by a credit card with a $6,000 limit and sold clothes to friends and family that Lake had purchased in fashion stores around Boston. Through word-of-mouth, the company began to grow and secured angel investment funding in April 2011. The next two years saw thousands of users flock to Stitch Fix, but subsequent investors were hesitant to provide funding because of high levels of unsold inventory.

In 2014, the company started to become cash-flow positive. Three years later, Lake led an IPO on the NASDAQ – becoming the first woman to do so at the time. The platform now targets men and children in addition to women and boasts over 32.5 million active clients.

Stitch Fix revenue generationFor an online clothing retailer, Stitch Fix has a surprisingly diverse revenue generation model.

Let’s take a look at it now.

Clothes salesStitch Fix purchases clothing in bulk from designer brands and endeavors to sell them for a profit. Margins are characteristically slim in the fashion industry because of high competition and constantly shifting consumer trends.

However, the company can maximize profits by employing a team of over 100 data scientists. This data can be made into algorithms that notify the company when an item is likely to become out of stock. Algorithms also predict various clothing parameters that sell best, including particular styles, sizes, and colors.

Perhaps the most significant contribution of data is in Stitch Fix recommendations. Over 80% of customers have used the recommendations tool in search of inspiration for their next purchase. This retains clients, encourages repeat purchases, and maximizes revenue.

Styling feesA styling fee of $20 is charged by the company approximately two weeks before an order is sent out.

This fee covers the expenses associated with a professional stylist picking out five items to send to each customer. If a customer decides to purchase any of the five pieces, the styling fee is credited toward the total cost of their purchase.

Private labelsThe company also designs, produces, and then sells clothing under the Hybrid Designs brand.

Creative direction is provided by algorithms that use data science to identify gaps in the clothing market. Once a gap has been identified, a team of Stitch Fix designers ensures the finished piece has an on-trend look. Margins for this clothing range are higher because the company utilizes vertical integration.

Shop Your LooksShop Your Looks is the name given to the online marketplace where Stitch Fix users can purchasing clothing directly.

Purchasers can discover entire outfits based on previous personalized deliveries. The more data the company has on a customer, the more tailored the clothing suggestions will be.

Key takeawaysStitch Fix is an American online personal styling service. It was founded by Katrina Lake who wanted to provide a platform for women to explore their clothing style via a personalized shopping experience.Stitch Fix makes money by purchasing bulk clothing from designer brands and reselling it for a profit. Although profits tend to be slim in fashion, the company maximises profits by using data science to manage inventory levels and provided tailored customer recommendations.Stitch Fix collects a $20 fee in exchange for providing professional styling advice to consumers. It also sells a range of own-brand clothing using algorithms to identify gaps in the market.Read Next: Subscription Business Model, How Does BoxyCharm Make Money, How Does Birchbox Make Money, How Does Dollar Shave Club Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Stitch Fix Make Money? The Stitch Fix Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Dave Make Money? The Dave Business Model In A Nutshell

Dave is a digital banking service founded by Jason Wilk, John Wolanin, and Paras Chitrakar in 2016, and it gained traction by offering basic services like overdraft protection and automated budgeting telling a user when their account balance was close to zero. The company makes money via membership fees, cash advance fees, donations, interchange fees, and a service called “Side Hustle.”

History of DaveDave is a digital banking service founded by Jason Wilk, John Wolanin, and Paras Chitrakar.

According to the company website, the trio created Dave after becoming frustrated with overdraft fees while studying at college. With customer confidence in the big banks at historically low levels, they recognized that 2016 was the perfect time to develop the new platform. The very name of the company also stems from this battle with the big banks, who are collectively referred to as Goliath by the company founders.

Initially, Dave offered simple solutions to simple problems. Chief among them were overdraft protection and automated budgeting telling a user when their account balance was close to zero.

The platform was launched in early 2017 after participation in the FinLab innovation accelerator program. Seed funding of $3 million was raised soon after, headlined by billionaire entrepreneur Mark Cuban.

The company now offers no-interest cash advances, income creation, and un-bounceable checks. It has already eclipsed 8 million users and hopes to disrupt the $30 billion in bank overdraft fees collected annually.

Dave revenue generationDave’s revenue generation is much the same as similar financial services or neobank companies.

However, there are some slight differences.

Let’s take a look at how the company makes money.

Membership feesAt the low price of $1 per month, Dave provides its users with overdraft protection via cash advances, automatic budgeting tools, and access to gig-related jobs.

The company claims membership fees help it connect to customer banks and send predictive texts whenever account balances become dangerously low.

Cash advance feesDave also offers cash advances to users. The exact amount is determined by assessing the financial health of an individual and calculating how much they can pay back without risking an overdraft fee.

Eligible users can receive up to $100 no more than two days after applying. If the advance is needed within eight hours, the company charges an express fee of between $1.99 and $5.99.

DonationsRather uniquely, Dave also generates revenue from donations – or tips as the company likes to call them.

The company uses aspects of behavioral psychology to encourage donations. Indeed, Dave will plant a tree for each tip it receives. As a smaller player, it also paints itself as being more deserving of consumer funds than its competitors in the big banks.

Interchange feesWhen a Dave user purchases with their branded debit card, the merchant pays an interchange fee to the card issuer. A portion of this interchange fee is then given to Dave.

In this case, the card issuer is Evolve Bank & Trust.

Side Hustle by DaveSide Hustle by Dave is designed to hook up users with local, flexible side hustles that fit with their busy schedules.

This is facilitated by a network of partners who post jobs users can apply for from their smartphones. Some typical examples of available jobs include rideshare drivers, dog walkers, and food couriers.

Here, Dave earns money from referral fees. The aforementioned partners pay the company a commission for each new employee it sends their way.

Key takeaways:Dave is an American digital banking service founded in 2016 by Jason Wilk, John Wolanin, and Paras Chitrakar. The trio created the company to help the average consumer avoid costly overdraft fees.Dave offers a membership option where it sends consumers a message to help them avoid a negative account balance. It also accepts donations, encouraging customers to tip the company using behavioral psychology.Side Hustle by Dave is a service offering improved cash flow for Dave users. The company earns a fee from selected job partners for referring new employees.Read More: How Does Webull Make Money, How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Dave Make Money? The Dave Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Webull Make Money?

Webull is an online trading platform, allowing users to trade stocks, options, and exchange-traded funds. It makes money through order flow (profit between bid-ask price). In late 2019, Webull strategically partnered with Nasdaq TotalView to give traders access to in-depth market data via two subscription options. Margin trading is also available on the Webull platform. In addition, the company collects monthly interest on the loans it issues to traders. Webull also charges short selling fees if an investor wants to borrow shares of a company before selling them.

History of WebullWebull is an online trading platform, allowing users to trade stocks, options, and exchange-traded funds.

Webull was founded by former Alibaba Group employee Wang Anquan in 2017 but headquartered in New York City. The company was initially funded by Fumi Technology, a Chinese company that Anquan founded a year earlier in 2016.

Early in the piece, Anquan had ambitions to legitimize his business by establishing a presence in North America. He subsequently hired Wall Street veteran Anthony Denier to serve as CEO.

When the Webull service launched in 2017, it provided sophisticated charting tools to help traders make better decisions. However, Anquan saw the rise in popularity of investment platform Robinhood and pivoted accordingly.

After securing millions from successive funding rounds, Webull purchased commercial television advertising slots to grow its user base quickly. It also partnered with influencers and offered free stock a sign-up incentive for new customers.

Webull now has a user base of over 2 million retail investors.

Webull revenue generationWebull has a similar revenue generation model to many other online investment platforms.

Order flow paymentWhen users place an order on the Webull platform, the order is sent to a market maker who then compensates the company for deal flow. This can simply be defined as the rate at which the market maker receives investment offers.

Compensation is made possible through generating a profit on the bid-ask spread. In other words, the difference between the quoted rate for a given sale (bid) and buy (ask). Webull only earns a fraction of this profit, but revenue is more significant when one considers how many trades are executed on its platform daily.

SubscriptionsIn late 2019, Webull strategically partnered with Nasdaq TotalView to give traders access to in-depth market data.

There are two subscription options:

Level 1 – a freemium option including data on equities, indices, forex, futures, and data from over 100 stock exchanges.Level 2 – a more detailed option enabling investors to better analyze the market depth of a single security. This level displays the 30 best bids and asks which can identify more strategic buying and selling opportunities. Webull offers this service for $1.99/month.Margin tradingMargin trading is also available on the Webull platform. The company collects monthly interest on the loans it issues to traders.

Interest rates are governed by the debit balance as follows:

Up to $25,000 – 6.99%.$25,000.01-$100,000 – 6.49%.$100,000.01-$250,000 – 5.99%.$250,000.01-$500,000 – 5.49%.$500,000.01-$1,000,000 – 4.99%.$1,000,000.01-$3,000,000 – 4.49%.Over $3,000,000.01 – 3.99%.Short selling feesWebull also charges short selling fees if an investor wants to borrow shares of a company before selling them. Revenue generation here comes from interest fees the investor pays on the value of the borrowed shares while their position is open.

Short selling is only available to those with a balance exceeding $2,000.

Key takeaways:Webull is an online trading platform headquartered in New York City but majority-owned by the Chinese company Fumi Technology. It was founded in 2017 by Wang Anquan as a sophisticated chart trading platform.Webull earns money from order flow like many similar platforms. A more unique offering is provided through a partnership with Nasdaq TotalView. This partnership gives traders access to detailed market depth analytics for a small monthly fee.Webull also earns interest fees on margin trading and short selling. Fees are based on the amount of capital or stock borrowed.Read More: How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Webull Make Money? appeared first on FourWeekMBA.

How Does Cameo Make Money? The Cameo Business Model In A Nutshell

Cameo is a video-sharing website based in Chicago and founded in 2016 by Steven Galanis, Martin Blencowe, and Devon Spinnler Townsend. The platform gives anyone the chance to get a shout-out from the personalities (actors, musicians, athletes, and more) available on the platform. Cameo generates revenue by taking a 25% commission from every personalized shout-out it facilitates.

History of CameoCameo is a video-sharing website based in Chicago and founded in 2016 by Steven Galanis, Martin Blencowe, and Devon Spinnler Townsend.

The idea for the company came after Blencowe showed Galanis a video of Seattle Seahawks player Cassius Marsh congratulating a friend of Blencowe’s on the birth of their child. Blencowe noted that the friend often talked about how much they loved the video, which subsequently spurred Galanis into action.

The pair then recruited Townsend, an expert in short-form videos with millions of views on Vine. In March 2017, bookcameo.com was launched because the trio could not afford the cameo.com domain. Early iterations of the platform were riddled with bugs, but it nevertheless grew in popularity thanks to a large supply of available celebrities. In fact, Cameo was able to recruit 1,600 of them after only 12 months in operation.

Cameo experienced an increase in usage because of the coronavirus pandemic. With many unable to attend birthdays, weddings, and other special events, consumers had to find different ways of celebrating or sending tributes. With production facilities locked down, many more celebrities also joined the platform as a way to supplement their income.

The company fulfilled approximately 1.3 million celebrity shout-outs in 2020. Sensing its massive potential, social media giant Facebook is now developing a similar service called Super.

Cameo revenue generation The Cameo website makes you connect with personalities available on the platform, where users can book a “shout-out” mostly used for birthday parties, or other ceremonies, where the celebrity endorsement becomes a gift (Image Source: cameo.com)

The Cameo website makes you connect with personalities available on the platform, where users can book a “shout-out” mostly used for birthday parties, or other ceremonies, where the celebrity endorsement becomes a gift (Image Source: cameo.com)Cameo generates revenue by taking a 25% commission from every personalized shout-out it facilitates.

These personalized messages are offered by a diverse range of well-known and lesser-known celebrities, including musicians, athletes, influencers, actors, and comedians.

The commission the company receives depends on the price each celebrity charges for a video. To some extent, this depends on their level of fame. Less recognizable social media influencers may charge as little as a few dollars for a shout-out. On the other hand, stars like Ice Cube, Caitlyn Jenner, and Joe Montana have been known to charge anywhere between $500 and $2,500.

Celebrities can also offer Zoom calls with fans and are generally two or even three times the price of a shout-out video.

There is also the capacity to chat with a celebrity over instant messaging, with each message limited to 250 characters.

Cameo for BusinessCameo for Business allows companies to:

Create celebrity-driven ad content at scale.Create new sales opportunities via top-of-funnel prospecting.Add celebrities to events and conferences.Celebrate company, team, or individual achievements.Develop memorable employee training programs.Businesses can opt to approach celebrities directly and pitch an opportunity. In this case, Cameo charges a 5% service fee.

This fee is waived if the business signs up to the C4B plan, a feature-rich option with a dedicated customer success representative, prioritized requests, compilation videos, centralized billing, and access to add-ons.

Key takeaways:Cameo is a North American celebrity video sharing website where users can pay for a personalized message from one of their favorite stars.Cameo makes money by taking a 25% commission for every transaction it facilitates. This commission is more lucrative for high-profile celebrities who can charge more for their services.Cameo also offers a similar service for businesses that want to incorporate celebrity content into ad content, sales prospecting, conferences, and employee training programs. Cameo charges a 5% service fee if the business wants to approach a celebrity directly.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Cameo Make Money? The Cameo Business Model In A Nutshell appeared first on FourWeekMBA.

How Does The RealReal Make Money?

The RealReal is an online and offline marketplace selling authenticated luxury goods including jewelry, watches, home accessories, and clothing. The company charges consignment fees for managing the sales of applicable products. The company charges consignment fees for managing the sales of applicable products. The company also offers two premium membership options for buyers.

Original StoryThe RealReal is an online and offline marketplace selling authenticated luxury goods including jewelry, watches, home accessories, and clothing.

Founder and entrepreneur Julie Wainwright established the company in 2011 after a shopping trip with a friend to a wealthy part of Silicon Valley. Wainwright noted that her friend made several purchases of second-hand designer items from a boutique fashion store. Curious, she began researching the second-hand luxury industry that same evening. Her new idea was also validated after experiencing difficulty in selling her designer pieces via eBay and pawnbrokers.

The RealReal commenced operations with Wainwright working from her kitchen table and visiting consignors at their homes with a U-Haul. Soon after, she moved into a proper office and secured a large warehouse to store clothing.

By 2012, the start-up had amassed 750,000 members. But the platform had trouble maintaining supply in its marketplace. As a result, it employed over 100 consignors to source more items. Some would even stop people on the street to ask them if the clothes they were wearing were for sale. In 2017, the first physical store opened in New York City, allowing the company to interact with buyers and sellers. Fifteen more stores followed.

Today, the company sells used and new items. It has also formed partnerships with Gucci and Burberry to sell exclusive items not available elsewhere. Recent figures show The RealReal now has over 17 million members.

The RealReal revenue generationThe RealReal makes money in two primary ways: consignment fees and membership subscription fees.

Following is a look at each.

Consignment feesThe company charges consignment fees for managing the sales of applicable products.

The exact fee depends on:

Total net sales for the seller over one year.Total item price – higher-priced items attract lower consignment fees.Total item demand – again, higher demand items attract lower consignment fees.With that in mind, the RealReal Rewards program offers three tiers based on sales volume:

VIP – for sellers with more than $10,000 in annual net sales. Here, the company takes 30%.Icon – for sellers with between $1,501 and $9,999 in annual net sales. Icon sellers are subject to a 40% consignment fee.Insider – for sellers under $1,500 in annual net sales. The consignment fee for Insider sellers is 45%.For those selling single items outside of the rewards program, fees vary by item category:

15%

watches with a resale price exceeding $2,500.20%

Handbags and sneakers with a resale price of $5,000 and $500 respectively.30%

Handbags sold for $1,000 to $4,999.Watches sold for $1,000 to $2,499.Jewelry sold for more than $1,000.Single art items sold for more than $196.Home items with a resale list price exceeding $1,000 (excluding furniture).50%

Any items with a resale price of between $146-195.Home items with a resale price of $146 or more.60%

Any item with a resale price under $145.MembershipsThe company also offers two premium membership options for buyers:

First Look ($10/month) – giving members 24-hour advanced access to sales and exclusive invites to monthly promotions via email.First Look Platinum ($30/month) – offering the additional feature of unlimited free upgrades to 48-hour shipping. Note that this service is only available in the continental United States for fashion, jewelry, and watches. For deliveries to Alaska and Hawaii, there is a subsequent charge of $5.Key takeawaysThe RealReal is an online and offline marketplace selling authentic luxury new and used goods. It was founded by Julie Wainwright after she witnessed her friend purchase a large amount of second-hand designer fashion.The RealReal makes money by charging consignment fees to those who wish to sell on its platform. Fees vary by item sale price, historical sales volume, item demand, and whether the sale is part of the RealReal Rewards program.The RealReal also makes a less significant amount of money from two premium membership options for buyers. They can receive exclusive access to promotions and receive two-day shipping to the continental United States for certain items.Read Also: How Does Farfetch Make Money, How Does eBay Make Money, How Does Tiffany Make Money, Bernard Arnault Empire: LVMH Group Business Model, The Kering Group Multi-Brand Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does The RealReal Make Money? appeared first on FourWeekMBA.

April 30, 2021

Artificial Intelligence Business Models

As any digital business, Baidu needs a continuous stream of traffic to monetize its pages. In 2017 Baidu managed to lower its Traffic Acquisition Costs as a percentage of its revenues at 11.4%. Primarily driven from its Baidu Union Members, and its iQIYI services. The former allows Baidu to have inexpensive content served by third-parties members. The latter will enable Baidu to have high-quality premium content at a low cost.ByteDance (TikTok) Business Model

As any digital business, Baidu needs a continuous stream of traffic to monetize its pages. In 2017 Baidu managed to lower its Traffic Acquisition Costs as a percentage of its revenues at 11.4%. Primarily driven from its Baidu Union Members, and its iQIYI services. The former allows Baidu to have inexpensive content served by third-parties members. The latter will enable Baidu to have high-quality premium content at a low cost.ByteDance (TikTok) Business Model TikTok is the Chinese creative social media platform primarily driven by short-form video content. It launches challenges of various types to tap into the creativity of its users and generate engaging (if not addicting content) accessible via an infinite feed. TikTok primarily makes money through advertising, thus making it an attention-based business model.C3.ai Business Model

TikTok is the Chinese creative social media platform primarily driven by short-form video content. It launches challenges of various types to tap into the creativity of its users and generate engaging (if not addicting content) accessible via an infinite feed. TikTok primarily makes money through advertising, thus making it an attention-based business model.C3.ai Business Model C3 AI is a cloud-based Enterprise AI SaaS company. It built a set of proprietary applications (known as the C3 AI suite) that offer its clients the ability to integrate digital transformation applications with fast deployment and no overheads. C3 AI makes money primarily via its subscription services and professional fees.Google (Alphabet) Business Model

C3 AI is a cloud-based Enterprise AI SaaS company. It built a set of proprietary applications (known as the C3 AI suite) that offer its clients the ability to integrate digital transformation applications with fast deployment and no overheads. C3 AI makes money primarily via its subscription services and professional fees.Google (Alphabet) Business Model Google has a diversified business model, primarily making money via its advertising networks that, in 2019, generated over 83% of its revenues, which also comprise YouTube Ads. Other revenue streams include Google Cloud, Hardware, Google Playstore, and YouTube Premium content. In 2019 Google made over $161 billion in total revenues.Open AI

Google has a diversified business model, primarily making money via its advertising networks that, in 2019, generated over 83% of its revenues, which also comprise YouTube Ads. Other revenue streams include Google Cloud, Hardware, Google Playstore, and YouTube Premium content. In 2019 Google made over $161 billion in total revenues.Open AI Founded less than six years ago, OpenAI maintains a philosophy that giant corporations should not control progressive technology development. The non-profit organization aims to research artificial intelligence (AI) to discover its potential and benefits to society. The goal is to produce open-source software and applications that allow various researchers to develop AI systems. Since the beginning of the organization, it has racked up several impressive achievements, which is the primary focus of this article.

Founded less than six years ago, OpenAI maintains a philosophy that giant corporations should not control progressive technology development. The non-profit organization aims to research artificial intelligence (AI) to discover its potential and benefits to society. The goal is to produce open-source software and applications that allow various researchers to develop AI systems. Since the beginning of the organization, it has racked up several impressive achievements, which is the primary focus of this article. GPT-3 is Open AI’s latest natural language prediction model. With the emergence of Artificial Intelligence (AI) in the business landscape, this is one of the tools that will quickly increase in popularity. The Generative Pre-trained Transformer 3 offers limitless access to computing on top of its cloud infrastructure, promoting scalability. Nevertheless, GPT-3 should be the next big thing in tech. Following the rise of deep learning, advanced technology will transform how business gets conducted globally.Deep Mind

GPT-3 is Open AI’s latest natural language prediction model. With the emergence of Artificial Intelligence (AI) in the business landscape, this is one of the tools that will quickly increase in popularity. The Generative Pre-trained Transformer 3 offers limitless access to computing on top of its cloud infrastructure, promoting scalability. Nevertheless, GPT-3 should be the next big thing in tech. Following the rise of deep learning, advanced technology will transform how business gets conducted globally.Deep Mind As one of the largest artificial intelligence research facilities, DeepMind aims to advance the technologies of AI. DeepMind was acquired by large tech corporation Google for $600 million in 2014. Since the organization’s founding, it raked plenty of achievements shaping the world we live in today.IBM Business Model

As one of the largest artificial intelligence research facilities, DeepMind aims to advance the technologies of AI. DeepMind was acquired by large tech corporation Google for $600 million in 2014. Since the organization’s founding, it raked plenty of achievements shaping the world we live in today.IBM Business Model Started in 1911 as a Computing-Tabulating-Recording Company (CTR), called then International Business Machines by 1924. IBM primarily makes money by five segments (cognitive solutions, global business services, technology services, and cloud platforms, systems, and global financing) with also innovative products such as IBM Watson and IBM Blockchain.Intel Business Model

Started in 1911 as a Computing-Tabulating-Recording Company (CTR), called then International Business Machines by 1924. IBM primarily makes money by five segments (cognitive solutions, global business services, technology services, and cloud platforms, systems, and global financing) with also innovative products such as IBM Watson and IBM Blockchain.Intel Business Model Founded in 1968 by Gordon Moore, which would go on to formulate one of the most reliable laws in technology, Intel has been able to survive and thrive through several waves of technology. Intel is transitioning from becoming a PC-centric company to becoming a data-centric company. NVIDIA Business Model

Founded in 1968 by Gordon Moore, which would go on to formulate one of the most reliable laws in technology, Intel has been able to survive and thrive through several waves of technology. Intel is transitioning from becoming a PC-centric company to becoming a data-centric company. NVIDIA Business Model NVIDIA is a GPU design company, which develops and sells enterprise chips for industries spacing from gaming, data centers, professional visualizations, and autonomous driving. NVIDIA serves major large corporations as enterprise customers, and it uses a platform strategy where it combines its hardware with software tools to enhance its GPUs’ capabilities. Microsoft Business Model

NVIDIA is a GPU design company, which develops and sells enterprise chips for industries spacing from gaming, data centers, professional visualizations, and autonomous driving. NVIDIA serves major large corporations as enterprise customers, and it uses a platform strategy where it combines its hardware with software tools to enhance its GPUs’ capabilities. Microsoft Business Model Microsoft has a diversified business model spanning across Office products, Windows, Gaming (Xbox), Search Advertising (Bing), Hardware, LinkedIn, Cloud and more. Tencent

Microsoft has a diversified business model spanning across Office products, Windows, Gaming (Xbox), Search Advertising (Bing), Hardware, LinkedIn, Cloud and more. Tencent  Tencent is a Chinese multinational conglomerate founded in 1998 by Ma Huateng, Zhang Zhidong, and Xu Chenye. Among its various global subsidiaries are companies in the online services, music, and artificial intelligence industries. But it is perhaps best known for its interest in the video game sector – both as a game developer for the Chinese market and the acquirer of several established gaming companies. Tencent is a vast company with a stake in more than 600 companies. Following is a look at some of the companies and subsidiaries it has a majority stake in.

Tencent is a Chinese multinational conglomerate founded in 1998 by Ma Huateng, Zhang Zhidong, and Xu Chenye. Among its various global subsidiaries are companies in the online services, music, and artificial intelligence industries. But it is perhaps best known for its interest in the video game sector – both as a game developer for the Chinese market and the acquirer of several established gaming companies. Tencent is a vast company with a stake in more than 600 companies. Following is a look at some of the companies and subsidiaries it has a majority stake in.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Artificial Intelligence Business Models appeared first on FourWeekMBA.

Online Payment Companies Business Models

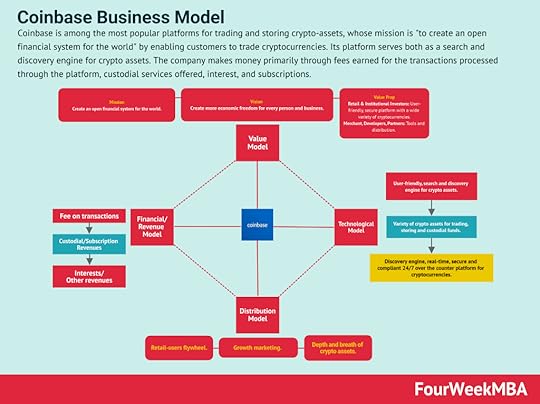

Coinbase is among the most popular platforms for trading and storing crypto-assets, whose mission is “to create an open financial system for the world” by enabling customers to trade cryptocurrencies. Its platform serves both as a search and discovery engine for crypto assets. The company makes money primarily through fees earned for the transactions processed through the platform, custodial services offered, interest, and subscriptions.PayPal Business Model

Coinbase is among the most popular platforms for trading and storing crypto-assets, whose mission is “to create an open financial system for the world” by enabling customers to trade cryptocurrencies. Its platform serves both as a search and discovery engine for crypto assets. The company makes money primarily through fees earned for the transactions processed through the platform, custodial services offered, interest, and subscriptions.PayPal Business Model PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenues streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2017 PayPal generated over $13 billion in net revenues and almost $1.8 billion in net income. Venmo Business Model

PayPal makes money primarily by processing customer transactions on the Payments Platform and from other value-added services. Thus, the revenues streams are divided into transaction revenues based on the volume of activity or total payments volume. And value-added services, such as interest and fees earned on loans and interest receivable. As of 2017 PayPal generated over $13 billion in net revenues and almost $1.8 billion in net income. Venmo Business Model Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.Stripe Business Model

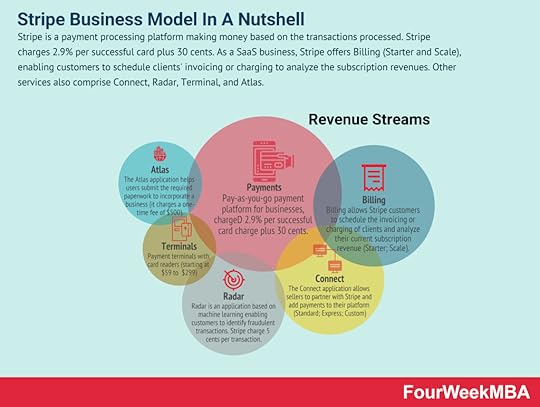

Venmo is a peer-to-peer payments app enabling users to share and make payments with friends for a variety of services. The service is free, but a 3% fee applies to credit cards. Venmo also launched a debit card in partnership with Mastercard. Venmo got acquired in 2012 by Braintree, and Braintree got acquired in 2013 by PayPal.Stripe Business Model Stripe is a payment processing platform making money based on the transactions processed. Stripe charges 2.9% per successful card plus 30 cents. As a SaaS business, Stripe offers Billing (Starter and Scale), enabling customers to schedule clients’ invoicing or charging to analyze the subscription revenues. Other services also comprise Connect, Radar, Terminal, and Atlas.Square Business Model

Stripe is a payment processing platform making money based on the transactions processed. Stripe charges 2.9% per successful card plus 30 cents. As a SaaS business, Stripe offers Billing (Starter and Scale), enabling customers to schedule clients’ invoicing or charging to analyze the subscription revenues. Other services also comprise Connect, Radar, Terminal, and Atlas.Square Business Model Squarespace is a North American hosting and website building company. Founded in 2004 by college student Anthony Casalena as a blog hosting service, it grew to become among the most successful website building companies. The company mostly makes money via its subscription plans. It also makes money via customizations on top of its subscription plans. And in part also as transaction fees for the website where it processes the sales.Klarna Business Model

Squarespace is a North American hosting and website building company. Founded in 2004 by college student Anthony Casalena as a blog hosting service, it grew to become among the most successful website building companies. The company mostly makes money via its subscription plans. It also makes money via customizations on top of its subscription plans. And in part also as transaction fees for the website where it processes the sales.Klarna Business Model Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.Zelle Business Model

Klarna is a financial technology company allowing consumers to shop with a temporary Visa card. Thus it then performs a soft credit check and pays the merchant. Klarna makes money by charging merchants. Klarna also earns a percentage of interchange fees as a commission and for interests earned on customers’ accounts.Zelle Business Model Zelle is a peer-to-peer payment network that indirectly benefits the banks’ consortium that backs it. Zelle also enables users to pay businesses for goods and services, free for users. Merchants pay a 1% fee to Visa or Mastercard, who share it with the bank that issued the card.

Zelle is a peer-to-peer payment network that indirectly benefits the banks’ consortium that backs it. Zelle also enables users to pay businesses for goods and services, free for users. Merchants pay a 1% fee to Visa or Mastercard, who share it with the bank that issued the card.Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsThe post Online Payment Companies Business Models appeared first on FourWeekMBA.

Denial Of Service Attack And Why It Matters To Understand Blockchain Business Models

A denial of service (DoS) attack is a deliberate action by a malicious actor to disrupt access to websites, email, accounts, devices, or other network resources. Distributed denial of service attacks is a more evolved and complex form of DoS attack. Distributed denial of service attacks is a more evolved and complex form of DoS attack. A key difference between the two is that a DDoS attack sends illegitimate requests to a system from multiple sources. This makes it extremely difficult for the victim to first detect and then stop.

Understanding a denial of service attackThe first denial of service attack was created by David Dennis in 1974 who wrote a program to force university library computers to power down.

In the modern era, DoS attacks describe any deliberate action to deprive legitimate users of services or resources they expect to be able to access. High-profile organizations are often the victims of such attacks, including those in banking, commerce, and media. Trade and governmental organizations are also frequently targeted.

Although DoS attacks do not typically result in the theft of information or other significant assets, rectifying an outage is often time and resource-intensive.

The two main types of denial of service attacksFlooding servicesThe most common DoS attack occurs when a malicious party floods a network server with traffic. Illegitimate service requests with fake return addresses are sent to the target server, overloading it with traffic.

As the server attempts to process these fabricated requests, the server becomes overwhelmed and legitimate users cannot access it.

Flood attacks include:

Buffer overflow attacks – one of the more common DoS attacks where more traffic is sent to a network address than it was designed to handle. It encompasses the two attacks listed below and is also used to exploit bugs specific to particular networks or applications.ICMP flood – in this case, spoofed packets are sent to ping every computer on a misconfigured network. By attacking more than one machine, the effect is amplified by the network. An ICMP flood is commonly called a smurf attack or ping of death.SYN flood – here, requests are sent to connect to a server without completing a three-way handshake. This attack continues until all open ports are saturated with requests, leaving them in an occupied status. As requests are constantly sent, there are no open ports for legitimate users to connect to.Crash attacksCrash attacks occur less frequently than flooding attacks. Put simply, a crash attack describes the malicious actor transmitting a bug that exploits flaws in a system and causes it to crash.

This leaves legitimate users unable to access important services.

Distributed denial of service attacks (DDoS)Distributed denial of service attacks are a more evolved and complex form of DoS attack.

A key difference between the two is that a DDoS attack sends illegitimate requests to a system from multiple sources. This makes it extremely difficult for the victim to first detect and then stop.

A DDoS attack is carried out by a network of hacked computers (called zombie computers or bots) which collectively form a network of bots or a botnet. In some instances, networks are comprised of millions of computers.

The Amazon Web Services attack of 2020 is perhaps the most recent extreme example of a DDoS attack. Vulnerable third-party servers were hit for three straight days and peaked at an eye-watering 2.3 terabytes per second.

Key takeaways:A denial of service attack is a deliberate action by a malicious actor to disrupt websites, email, accounts, devices, or other important network services.

A DoS attack may be performed by flooding and subsequently overwhelming a network server with traffic. A much less common method involves infecting systems with bugs to exploit flaws or vulnerabilities.

A distributed denial of service is a more complex and potent form of DoS attacks. It uses networks of infected computers to send vast amounts of information to the intended victim.

Read Next: Proof-of-stake, Proof-of-work, Bitcoin, Ethereum, Blockchain.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsRevenue ModelsTech Business ModelsBlockchain Business Models FrameworkThe post Denial Of Service Attack And Why It Matters To Understand Blockchain Business Models appeared first on FourWeekMBA.