Gennaro Cuofano's Blog, page 154

May 25, 2021

How Does Zola Make Money? The Zola Business Model In A Nutshell

Zola is an online wedding retailer, planner, and registry. It enables couples to register for experiences, gifts, and cash funds, founded in New York City by Shan-Lyn Ma and Nobu Nakaguchi in 2013. Zola generates revenue from the purchases in much the same way as any online retailer. For example, when a wedding guest purchases an experience such as a wine tour, Zola takes 20% of the total purchase price. This percentage doubles to 40% for physical product purchases.

History of ZolaZola is an online wedding retailer, planner, and registry. It enables couples to register for experiences, gifts, and cash funds.

The company was founded in New York City by Shan-Lyn Ma and Nobu Nakaguchi in 2013. When asked about the origins of Zola, Ma recounted attending multiple weddings in the same year and becoming frustrated at the outdated, inconvenient, and impersonal nature of wedding registries.

With a background in creating engaging eCommerce shopping experiences, Ma partnered with product designer Nobu Nakaguchi. The latter also lamented the cumbersome process of planning his wedding ten years earlier. The pair then partnered with Gilt Groupe founder Kevin Ryan to build a new company for modern weddings and their savvy guests.

Initially, Zola was a wedding registry service. After repeated requests from Zola users, the service expanded in 2017 to include Zola Weddings – a free service offering guest list management, RSVP tracking, and customizable checklists. A partnership with home décor retailer Crate & Barrel followed soon after, enabling registry gifts to be selected from over 3,500 branded products. In 2019, the first bricks-and-mortar store was opened in the Flatiron District of New York City.

Recent estimates suggest Zola has an annual revenue of $120 million and has helped over 600,000 couples plan their weddings since its launch.

Zola revenue generationZola is first and foremost an eCommerce store. The company claims it carries over 100,000 gifts and experiences from more than 1,000 brands.

More importantly, the Zola app is designed to appeal to younger generations who want a seamless shopping experience. Products can be added to (or removed from) a registry with a simple swipe. If an item is out of stock, the app provides helpful alternative suggestions.

Zola generates revenue from the purchases in much the same way as any online retailer. When a wedding guest purchases an experience such as a wine tour, Zola takes 20% of the total purchase price. This percentage doubles to 40% for physical product purchases.

While these percentages are comparable to similar businesses, Zola can increase profit margins by avoiding the costs associated with warehousing inventory. Instead, the vast majority of items are shipped directly from the manufacturer or company providing the experience.

Cash requestsWhen engaged couples request cash gifts, Zola charges a 2.4% fee. This fee is the lowest of its kind when compared to the fees of similar wedding registry companies.

Couples can choose to pay this fee themselves or pass it on to their guests. In any case, Zola does not make a profit here because the fee covers the transaction fee charged by the credit card company.

Key takeawaysZola is a North American wedding retailer that also offers registry and planning services. The company was created after co-founder Shan-Lyn Ma discovered buying wedding gifts online to be inconvenient, impersonal, and outdated. Zola makes money by selling over 100,000 items and experiences in its eCommerce store. The company does not hold physical inventory, instead taking 20% of the total price of experiences and 40% for products.Zola also charges a fee for processing cash gifts. Ostensibly, this offsets the transaction fee charged to Zola by the credit card provider.Read Also: How Does Wix Make Money, Wish Mobile E-commerce Platform Business model, How Amazon Makes Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Zola Make Money? The Zola Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Shazam Make Money? The Shazam Business Model In A Nutshell

Shazam is a music, movie, advertising, and television show recognition app created in 1999 by Chris Barton, Philip Inghelbrecht, Avery Wang, and Dhiraj Mukherjee, as a service to recognize songs. In 2018, Shazam was acquired by Apple in a deal worth $400 million. Before Apple acquired the company, Shazam made money by selling advertising spots to other businesses.

History of ShazamShazam is a music, movie, advertising, and television show recognition app.

It was created in 1999 by Chris Barton, Philip Inghelbrecht, Avery Wang, and Dhiraj Mukherjee. Smartphones and music services such as iTunes had yet to be invented, and Barton lamented that he could never recognize the songs he heard on the radio. With Mukherjee, he had the idea to partner with radio stations to identify songs on air and sell music to listeners.

Early versions of Shazam required users to call a number and hold the phone close to the radio to receive a text identifying the song. Shazam had over 1 million songs in its database by 2002, but a lack of technology meant song identification was slow and cumbersome.

Nevertheless, the founders tried various business models over the ensuing years. For a while, Shazam made money through reverse charge text messages. It also made deals with ringtone companies and mobile handset manufacturers. Venture funding then became difficult to source as the platform continued to grow in the wake of the dot-com recession.

In 2018, Shazam was acquired by Apple in a deal worth $400 million.

Today, Shazam searches a database of approximately 30 million songs and can identify a track in around two seconds. The app can also handle remixes, cover-band versions, and background noise.

Shazam revenue generationBefore the company was acquired by Apple, Shazam made money by selling advertising spots to other businesses. It also offered a premium version of the app called Shazam Encore.

Advertising in particular was a significant source of income for the company, making it profitable for the first time in 14 years. Despite this, Apple decided to remove advertising from Shazam in late 2018. In 2020, the premium app was also made free.

So how does it make money? Read on to find out.

Digital salesWhen a user identifies a song on Shazam, they have the option to purchase it on iTunes.

In 2016, Shazam gave users the option to play songs on Spotify and other streaming services. In fact, it was sending over 1 million visitors a day to third-party services and collecting hundreds of millions of dollars in digital sales.

After the Apple acquisition, the collection of referral fees became limited to iTunes. Revenue has probably also suffered because of the general decline in digital music purchases over the last decade.

User dataAn indirect source of revenue for Shazam and Apple lies in user data.

Operating for over 20 years and with 20 million searches per day, the platform likely has a vast amount of data on user media content preferences and selections.

How Apple plans to monetize this information is open to interpretation. It may for example use this data to determine what sort of content is produced for the Apple streaming service Apple TV.

Alternatively, Apple may already sell the data in aggregated, anonymized form to interested parties. These include record labels, artists, television directors, and music or movie production companies.

Key takeawaysShazam is a media recognition app developed by Chris Barton, Philip Inghelbrecht, Avery Wang, and Dhiraj Mukherjee in 1999. Barton was inspired to create the app to help users identify songs they heard on the radio.Before being acquired by Apple, Shazam was a profitable company thanks largely to advertising revenue. The premium version of the app, Shazam Encore, was also made free after the acquisition.Shazam makes money via digital sales, encouraging users to purchase the songs they heard on iTunes. The company may also sell vast stores of user data to interested parties.Read Also: How Does SoundCloud Make Money, How Does Spotify Make Money, How Does Signal Make Money, How Does Snapchat Make Money, How Does TikTok Make Money, Clubhouse Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Shazam Make Money? The Shazam Business Model In A Nutshell appeared first on FourWeekMBA.

How Does Viber Make Money? The Viber Business Model In A Nutshell

Viber is an instant messaging and VoIP platform created by Talmon Marco and Igor Magazinnik in 2010, acquired by Japanese eCommerce giant Rakuten in a deal worth $900 million. Viber generates revenues via Viber Out, which allows users to call friends, family, or colleagues in 60 countries around the world using VoIP (charged at $5.99/month); Viber for Business, an advertising solution for businesses who want to connect with their target audience through instant messaging and through Viber stickers.

History of ViberViber is an instant messaging and VoIP platform created by Talmon Marco and Igor Magazinnik in 2010.

At the time, Marco was in a long-distance relationship and noted that communicating with his girlfriend in Hong Kong while based in New York City was rather expensive. This inspired him to find a cheaper alternative.

He reached out to entrepreneur and businessman Igor Magazinnik whom he met while serving in the Israeli Defence Forces. Before establishing Viber, the pair created P2P file sharing service iMesh which would ultimately provide the capital necessary to launch their new venture.

Once in operation, Viber was funded exclusively by friends and family for the first two years. The pair also hired developers in Cyprus and Belarus to keep costs low. The app was immediately successful, with the iOS version receiving 350 million downloads in the first six months. Viber users could easily call each other and synchronize contacts with their cell numbers. This was in stark contrast to competitors such as Skype that required users to create a buddy list of registered contacts.

In 2014, Viber was acquired by Japanese eCommerce giant Rakuten in a deal worth $900 million. The platform has 250 million active monthly users worldwide, with many concentrated in Russia, Eastern Europe, the Middle East, and some Asian countries.

Viber revenue generationMarco and Magazinnik intended for Viber to remain free. However, several revenue generation strategies were implemented after it was acquired in 2016.

Following is a look at each.

Viber OutViber Out allows users to call friends, family, or colleagues in 60 countries around the world using VoIP. The company notes that collectively, these countries represent more than 75% of the global population.

To access the service, users receive a one-week free trial to make unlimited calls. Thereafter, Viber will charge $5.99/month.

Alternatively, users can purchase pay-as-you-go credit to make international calls. This credit can then be exchanged for call minutes which vary from country to country.

Viber for BusinessViber for Business is an advertising solution for businesses who want to connect with their target audience through instant messaging. Some of the more notable organizations to use this service include Coca-Cola and the World Wildlife Fund (WWF).

Viber for Business caters to the complete user journey of each customer:

Attract – marketing teams can reach a wide audience with in-app ads, stickers, offers, and targeted messages.Interact – enabling customer segmentation to customize marketing messages.Transact – here, Viber makes the process of making an in-app purchase effortless.Stay in contact – to build a long-term relationship, merchants can then follow up with further ads, messages, and promotions to reward loyalty.Prices for this service are charged monthly and specific to the business and geographic region.

Viber stickers and gamesViber stickers are a colorful way for users to express themselves in a chat.

Users can create their own stickers for free or pay for stickers in the Sticker Market. Most paid sticker packs are available for around $2.

Single and multi-player games are also offered on the platform. Again, some are free while others are available for a fee.

Key takeaways:Viber is an instant messaging and VoIP platform founded by Talmon Marco and Igor Magazinnik. The idea for the platform came at a time when Marco was in a long-distance relationship and paying for expensive international phone calls.Viber Out is a monthly subscription plan allowing users to call non-Viber users in 60 countries across the world. The company also sells pay-as-you-go credit to users which are exchanged for call minutes.Viber for Business is a complete instant messaging marketing solution for businesses. Prices are available upon request.Read Also: How Does Telegram Make Money, How Does WhatsApp Make Money, How Does Zoom Make Money, How Does Signal Make Money, How Does Snapchat Make Money, How Does TikTok Make Money, Clubhouse Business Model, Microsoft Subsidiaries.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Viber Make Money? The Viber Business Model In A Nutshell appeared first on FourWeekMBA.

How Does OLX Make Money? The OLX Business Model

OLX, or OnLine eXchange, is a Dutch domiciled online marketplace for buying and selling goods and services. Unlike similar online marketplaces, OLX does not charge money for facilitating the transaction between the buyer and the seller. Instead, the company focuses on acquiring as much traffic as possible to earn money through advertising revenue and premium listings.

History of OLXOLX, or OnLine eXchange, is a Dutch domiciled online marketplace for buying and selling goods and services.

The platform was founded by Fabrice Grinda and Alec Oxenford to provide a Craigslist-style platform to users outside of the USA. Indeed, Grinda noticed that larger online marketplaces such as eBay and Craigslist had shown very little interest in establishing a presence in developing markets.

As a result, the co-founders began work on the platform to cater specifically to consumers in these markets. Integration with Facebook and Twitter was key, as was a platform that would be mobile-friendly. Perhaps most importantly, the service had to be free since many did not have access to credit or debit cards.

The OLX platform launched in Argentina in 2006 and quickly spread to other parts of Latin America, Asia Pacific, Africa, and Eastern Europe. In 2010, OLX was acquired by South African internet and media giant Naspers.

Today, OLX continues to operate as a standalone platform. More than 300 million people in 30 countries use OLX each month to buy and sell cars, bikes, houses, household goods, and fashion items.

OLX revenue generationUnlike similar online marketplaces, OLX does not charge money for facilitating the transaction between the buyer and the seller.

Instead, the company focuses on acquiring as much traffic as possible to earn money through advertising revenue and premium listings.

With that said, let’s take a look at both revenue sources in more detail.

Advertising revenueAdvertising revenue comes via serving Google Adsense ads on the OLX platform. Revenue is based on cost per one thousand impressions (CPM), cost per view (CPV), or cost per click (CPC).

Some countries also incorporate a Google custom search bar, otherwise known as a programmable search engine. When an OLX customer searches for a product, they are shown a list of relevant ads and products. The company earns further Adsense revenue from this source.

OLX also sells banners and other advertisements that occupy high visibility areas on the platform.

Featured AdsFeatured Ads is a premium OLX service allowing sellers to display listings in the first four places at the top of a product category page.

Aside from geographical location, pricing for this service is dependent on the product category and the number of days the seller wants an ad to run.

The Featured Ads service is particularly useful for sellers who wish to sell high-ticket items in popular categories. Without paying a small premium, listings for popular items are quickly pushed to the second or third page of search results.

Key takeawaysOLX is a Dutch-domiciled online marketplace for buyers and sellers of cars, houses, fashion items, and other household goods. It was created by Fabrice Grinda and Alec Oxenford to provide a free online marketplace for consumers in developing nations.OLX prides itself on being a free platform for buyers and sellers. Instead, it generates revenue via Google Adsense in several ways.OLX also earns revenue from sellers who want to pay to have their ads in high-visibility areas for longer.Read Also: How Does eBay Make Money, How Does Amazon Make Money, How Does Lazada Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does OLX Make Money? The OLX Business Model appeared first on FourWeekMBA.

How Does MrBeast Make Money? MrBeast Net Worth Explained

MrBeast is the online pseudonym for YouTuber and philanthropist Jimmy Donaldson. MrBeast started to gain traction in 2015 after producing a series of videos mocking his colleagues for their video introductions. MrBeast makes money via brand sponsorships, advertising, and merchandise.

History of MrBeastMrBeast is the online pseudonym for YouTuber and philanthropist Jimmy Donaldson.

Donaldson was born in 1998 in the state of Kansas. At the age of 13, he uploaded his first YouTube video in February 2012 under the username “MrBeast6000”.

In the early days, Donaldson was obsessed with gaming the YouTube algorithm. One minute his channel would feature Minecraft highlights, while the next he would provide commentary on the wealth of his fellow video creators.

MrBeast started to gain traction in 2015 after producing a series of videos mocking his colleagues for their video introductions. He hit 30,000 followers a few months before filming himself counting to 100,000. Although this process reportedly took 44 hours, the video went viral and has almost 23 million views at last count. He followed up with similarly viral videos of spinning a fidget spinner for 24 hours and watching the same music video for 10 hours straight.

By November of 2017, MrBeast passed 1 million subscribers. His video content diversified to include challenge and donation videos, giving away cars for free and donating thousands to smaller content creators, waitresses, and Uber drivers. He also successfully ran a fundraising campaign to plant 20 million trees by the end of 2019, earning donations from Elon Musk and Twitter CEO Jack Dorsey to name a couple.

Today, MrBeast employs about 30 people to produce content for over 62 million subscribers.

MrBeast revenue generationTo fund his philanthropic efforts, Donaldson makes money in a few different ways.

Each method is more or less dependent on his videos becoming viral.

Brand sponsorshipsAs the MrBeast channel gained traction, it started working with progressively larger brands including Quidd, CSGO Lotto, Honey, and TikTok.

In effect, brands are falling over themselves to work with Donaldson because he is making such a positive difference in the world. Indeed, philanthropy and giving back to society are values brands want to be associated with. Brands also realize that MrBeast produces a style of content designed to go viral – a highly valued skill in a world with short consumer attention spans.

AdvertisingAccording to Social Blade, Donaldson makes between $126,000 to $2 million per month in YouTube ad revenue from his primary channel.

It should be noted that the creator has six additional YouTube channels, with the majority having subscriber counts in the millions. These include MrBeast Gaming, Beast Reacts, MrBeast Shorts, MrBro, MrBeast 2, and Beast Philanthropy.

MerchandiseMrBeast also sells branded merchandise at shopmrbeast.com, with 100% of the profits going toward a food pantry for the disadvantaged.

Products for sale include apparel, backpacks, caps, drink bottles, hats, and socks.

MrBeast BurgerUsing funds from his YouTube exploits, Donaldson opened his first MrBeast Burger fast-food restaurant in Wilson, North Carolina in 2020. Initially, the YouTuber paid people to eat there and gave way prizes to diners.

MrBeast Burger now operates as a ghost kitchen chain, where delivery-only orders are prepared by third-party restaurants. There are now over 600 locations across the United States, Canada, and Europe.

Key takeaways:MrBeast – otherwise known as Jimmy Donaldson – is an American YouTube star known for his comedic stunts and philanthropy.MrBeast earns a significant amount of revenue from YouTube ad revenue. His ability to produce viral content also means brands are willing to pay a premium to be featured on his channel.MrBeast also sells assorted merchandise and operates a fast-food restaurant chain called MrBeast Burger. The delivery-only chain now operates in more than 600 locations.Read Also: Who Is Elon Musk? The Elon Musk’s Story, How Does Elon Musk Make Money, Elon Musk Companies, Bill Gates Companies, Jeff Bezos Companies, Warren Buffett Companies.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does MrBeast Make Money? MrBeast Net Worth Explained appeared first on FourWeekMBA.

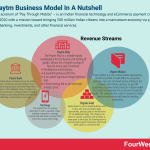

How Does Paytm Make Money? The Paytm Business Model In A Nutshell

Paytm – an acronym of “Pay Through Mobile” – is an Indian financial technology and eCommerce payment company founded in 2010 by Vijay Shekhar Sharma as a recharge platform for mobile phone and satellite television customers then transitioned its mission toward bringing 500 million Indian citizens into a mainstream economy via payments, commerce, banking, investments, and other financial services. The company makes money via its The Paytm Mall (a mobile-based marketplace for the buying and selling of goods). Also, Digital Gold, a service enabling Paytm users to buy, sell, and store digital gold. Paytm Bank allows customers to pay for utility, insurance, investment, and loan products from a dedicated savings account.

History of PaytmPaytm – an acronym of “Pay Through Mobile” – is a financial technology and eCommerce payment company based in Uttar Pradesh, India.

It was founded in 2010 by Vijay Shekhar Sharma as a recharge platform for mobile phone and satellite television customers. Sharma’s $2 million investment in Paytm was seen as risky at the time because of a lack of telecommunications infrastructure in India.

However, the platform quickly gained traction. By offering 24/7 customer service, the company was able to win over consumers traditionally distrustful of digital banking services. In 2014, the Paytm Wallet was launched and quickly integrated into Uber and the Indian railway booking system. A year later, the wallet added education fees, electricity, gas, metro recharges, and water payments.

Paytm became the first Indian payment app to reach 100 million downloads in 2017. New features continued to be rolled out, including Paytm Gold, Paytm for Business, and mobile gaming platform Gamepind.

Today, the Paytm company mission seeks to bring 500 million Indian citizens into a mainstream economy via payments, commerce, banking, investments, and other financial services. As of March 2021, the platform processes over 1.2 billion monthly transactions.

Paytm revenue generationPaytm has an interesting and diverse revenue generation strategy.

Following is a look at some of the ways the company makes money.

Paytm MallThe Paytm Mall is a mobile-based marketplace for the buying and selling of goods.

Sellers are charged a range of fees for every sale, including:

Marketplace commissions – which vary according to the product or product category.A payment gateway (PG) fee – or a transaction fee of 2.7%.A so-called logistical charge (delivery fee) – based on the mode of shipment.A fixed closing fee as per the total product price.Paytm WalletFirstly, it’s important to note that the Paytm Wallet is a semi-closed wallet approved by the Reserve Bank of India (RBI). As a payment gateway, users can send and receive money or put it toward other Paytm services.

As per RBI guidelines, customer funds sitting in a digital wallet must then be deposited into an escrow account by Paytm. The company then collects interest on these funds in partnership with specific banking institutions.

Digital GoldDigital Gold is a service enabling Paytm users to buy, sell, and store digital gold. Alternatively, physical gold can be delivered for an additional charge.

The company has plans to connect customers with jewelers at some point in the future. By allowing them to convert physical gold into jewelry, Paytm will likely collect a commission fee.

RechargeThe original form of revenue generation is still in operation today, enabling customers to recharge internet data and direct-to-home (DTH) television, among other things.

Here, the company collects a commission from each recharge of around 2-3%. Since Paytm processes billions of transactions each month, it can negotiate a higher commission rate than most other facilitators in this space.

Paytm BankPaytm Bank allows customers to pay for utility, insurance, investment, and loan products from a dedicated savings account.

Given that Paytm Bank is not a bank in the traditional sense, it cannot loan money to users to pay for these products. Instead, it makes money by cross-selling financial services and collecting a commission on each sale.

The company also collects fees associated with non-affiliated ATM withdrawals, balance checks, PIN change requests, and SMS alerts.

Key takeaways:Paytm is an Indian financial technology company founded by Vijay Shekhar Sharma. Founded in 2011, the venture was seen as risky given a lack of infrastructure in the country and a general distrust of digital banking.Paytm has a diverse revenue generation strategy. Paytm Mall is a mobile-based marketplace where sellers are charged various fees to sell items. Paytm Wallet is a digital payment gateway where the company makes money on interest sitting in user accounts.Paytm also sells digital and physical gold and collects a raft of fees from its personal banking service, Paytm Bank.Read More: How Does TD Ameritrade Make Money, How Does Dave Make Money, How Does Webull Make Money, How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Paytm Make Money? The Paytm Business Model In A Nutshell appeared first on FourWeekMBA.

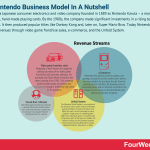

The Nintendo Business Model In A Nutshell

Nintendo is a Japanese consumer electronics and video company founded in 1889 as Nintendo Karuta – a manufacturer of decorated, hand-made playing cards. By the 1980s, the company made significant investments in a rising technology: video games. It then produced popular titles like Donkey Kong and, later on, Super Mario Bros. Today Nintendo generates revenues through video game franchise sales, e-commerce, and the Unfold System.

History of NintendoNintendo is a Japanese consumer electronics and video company headquartered in Kyoto, Japan.

The company was founded in 1889 as Nintendo Karuta – a manufacturer of decorated, hand-made playing cards. Nintendo would produce these cards for over seven decades, but sales fell after the cards became associated with gambling and Japanese organized crime.

In 1950, 22-year-old Hiroshi Yamauchi took control over Nintendo and expanded the product range to include toys and amusement arcades. Over twenty years later, Yamauchi made a significant investment in an emerging technology: video games. The popular title Donkey Kong was released in 1980, catapulting the company to the global stage.

The even more successful Super Mario Bros. was released five years later, named after the landlord who owned Nintendo’s American headquarters. The success of the game was nicely complemented by the release of the Game Boy in 1989, the first handheld electronic game console. This pioneering success has been built upon with the subsequent releases of consoles including the Super Nintendo Entertainment System, Nintendo 64, Nintendo DS, GameCube, Wii, and Nintendo Switch.

Today, the company continues to be an innovative player in gaming and consumer electronics. Profits in 2020 were 376.6 billion JPY, or approximately $3.6 billion.

Nintendo revenue generationTraditionally, console-based home entertainment companies make money via the continual creation and licensing of games.

Let’s take a look at how this plays out for Nintendo.

Video game franchise salesNintendo is well-known for regularly adding too many of its video game franchises with periodic releases. For example, the Super Mario franchise has been running since 1985.

This strategy builds brand loyalty and allows the company to charge a relatively high price for its products.

eCommerceNintendo sells gaming consoles, games, and gaming accessories via their online store.

Games are also available for purchase directly from the gaming console interface. By allowing users to download games with an internet connection, the company saves money on the distribution and physical production of games.

Unfold SystemThe Nintendo Unfold System is an evolution of the franchise sales model.

Instead of Nintendo paying developers to make and release new titles, the onus is on the consumer to pay to expand a single game. An unfolding game differs from expansion packs or franchise titles in that entire parts of the game are hidden and locked at release. As the customer becomes more invested, they pay Nintendo to unlock additional features, adventures, or lands.

For the company, this is seen as a far less risky strategy than franchising. Rather than building a new game on the same platform as the existing game, Nintendo simply keeps the existing base and charges the customer for any new features it develops.

In theory, the Unfold System expansion method can be used indefinitely. Games may have no endpoint and a new version may only be necessitated by a console upgrade.

Smash Bros: UltimateThe fighting game Smash Bros: Ultimate is already utilizing the Unfold System. Users must now purchase a season pass to take part in each game iteration – otherwise known as a season.

In 2019, the first season was charged at $24.99. This fee gave players access to exclusive items, stages, and five new characters. The following year, the game was unfolded further to incorporate a second season that was charged at $29.99 for six new characters.

Pokémon – which Nintendo owns a 32% stake in – has also added new lands and adventures using this revenue strategy.

Key takeawaysNintendo is a video game and consumer electronics company headquartered in Kyoto, Japan. The company was founded in 1889 as a manufacturer of decorative, hand-made playing cards.Nintendo makes money by creating and licensing video games. The company has been particularly successful in building brand loyalty via high-quality franchise releases.Nintendo also sells access to additional game features as part of its Unfold System. Instead of paying developers to build new games on the same base, players pay Nintendo to expand access within a single game.Read Also: How Does Discord Make Money, Epic Games Business Model, Gaming Industry And Its Business Models, Free-To-Play Business Model, EA Sports Business Model, How Does Twitch Make Money, Roblox Business Model, What Does Tencent Own? Inside The Tencent Business Model.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post The Nintendo Business Model In A Nutshell appeared first on FourWeekMBA.

May 24, 2021

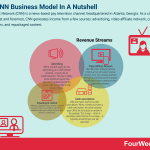

How Does CNN Make Money? The CNN Business Model In A Nutshell

Cable News Network (CNN) is a news-based pay television channel headquartered in Atlanta, Georgia. As a cable channel, first and foremost, CNN generates income from a few sources: advertising, video affiliate network, cable subscriptions, and repackaged content.

History of CNNCable News Network (CNN) is a news-based pay television channel headquartered in Atlanta, Georgia.

The multinational was founded in 1980 by media proprietor Ted Turner and Reese Schonfeld. Anchored by husband and wife team David Walker and Lois Hart, CNN became the first 24-hour news service. In the process, it also became the first American channel devoted entirely to news coverage.

In the ensuing decades, the reach of CNN expanded significantly. Content now encompasses multiple cable and satellite television, website content, and specialized closed-circuit channels. The company now operates no fewer than 42 bureaus, 31 of which are based internationally. A second, dedicated news channel called CNN2 (the precursor to HLN) launched in 1982.

During the 1990-91 Gulf War, CNN was the only news outlet with the ability to communicate from inside Iraq. This bolstered the network’s reputation as a news provider and also made some of its (previously unknown) reporters household names.

Today, the company remains a popular source of news content. With approximately 2.366 million primetime viewers, CNN is second only to Fox News for viewership.

CNN revenue generationAs a cable channel first and foremost, CNN generates income from a few sources.

Let’s now take a look at each.

AdvertisingWhen a brand wants to run advertising on a CNN-owned channel, it must pay an advertising fee. This fee is likely to be significant given the channel is ranked second for prime time viewership in the United States.

Brands can also pay to promote themselves on the CNN website, which is heavy in news article sidebar and footer advertising.

Video Affiliate NetworkThe CNN Video Affiliate Network (VAN) is a form of hosted revenue sharing. Here, the company provides the technical infrastructure necessary for affiliates to host content on their local news websites.

Once the videos are live, CNN collects advertising revenue which it then shares with the affiliate.

VAN content incorporates:

CNN ad sales – where inventory is bundled and made into a national network suitable for sale to national advertisers.Content hub – which aggregates, normalizes, and synchronizes CNN content with content provided by local news services.Local news organizations – who manage their local inventory and can monetize content at their discretion.Cable subscriptionsCNN also makes money via cable subscriptions. When a viewer purchases a cable subscription, the cable company pays CNN a fee to include its content in the package. This charge – which is sometimes called the fee-for-carriage – is typically around $8 per year per subscriber.

It should be noted that this fee is charged regardless of whether the customer actually watches CNN.

Repackaged contentCNN also repackages news content in limited scenarios. News is provided to airports on a closed channel and a similar service is also offered in some hotels.

Lastly, foreign networks may also pay CNN to repurpose content for their news bulletins.

Key takeaways:CNN is an American multinational news-based pay television channel. Founded by Ted Turner and Reese Schonfeld, it became the channel to offer dedicated, 24-hour news coverage.With high prime-time ratings, CNN likely makes a significant amount of money from TV advertising. Digital advertising is also prevalent on the CNN website.CNN also collects a fee-for-carriage, or a fee cable providers must pay for hosting its content. In limited circumstances, the company also sells repurposed content to hotels, airports, and foreign affiliated networks.Read Also: Who Owns Fox News, How Does Yahoo Make Money, How Does Google Make Money.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does CNN Make Money? The CNN Business Model In A Nutshell appeared first on FourWeekMBA.

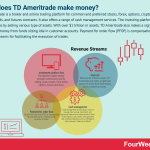

How Does TD Ameritrade Make Money?

TD Ameritrade is a broker and online trading platform for common and preferred stocks, forex, options, cryptocurrency, mutual funds, and futures contracts. It also offers a range of cash management services. The investing platform gains commissions by selling various type of assets. With over $1 trillion in assets, TD Ameritrade also makes a significant amount of money from funds sitting idle in customer accounts. Payment for order flow (PFOF) is compensation TD Ameritrade earns for facilitating the execution of trades.

History of TD AmeritradeTD Ameritrade is a broker and online trading platform for common and preferred stocks, forex, options, cryptocurrency, mutual funds, and futures contracts. It also offers a range of cash management services.

TD Ameritrade was founded in 1971 by now billionaire philanthropist John Joseph Ricketts. During the 1970s, the Securities and Exchange Commission eliminated the practice of fixed brokerage commissions. TD Ameritrade – then operating as Omaha Securities – was one of the first major brokerage firms to break the mold and offer discounted commissions.

The firm would continue its pioneering culture in the following decades. It was the first to offer touch-tone phone trading in 1988. Six years later, it was involved in executing the first online trade after acquiring K. Aufhauser & Co. TD Ameritrade then helped grow and improve online trading for self-directed investors in the late 1990s. It started to offer features modern investors take for granted, including online options order entry, extended trading hours, and electronic, email-based trade confirmations.

In the modern era, TD Ameritrade continues to be a beacon of success. It now manages over 11 million client accounts representing more than $1 trillion in assets.

TD Ameritrade revenue generationAs the provider of multiple financial services, TD Ameritrade has an extremely diverse revenue generation model. This is particularly impressive considering the company offers a commission-free investment option with no platform fees, data fees, or trade minimums.

Here is a very general look at some of the main sources of revenue.

Investment platformStocks – the online trading of stocks is free, while trades made via a phone system are $5 and broker-assisted trades are $25.Exchange-traded funds (ETFs) – as above, with commission-free ETFs also being free to trade.Options – online options trading is subject to a 65 cent fee per contract. Trades made via the interactive phone system are $5 plus 65 cents per contract, while the broker-assisted option is available for $25 plus 65 cents per contract.Futures – futures trading is available for $2.25 per contract. Exchange and regulatory fees are also applicable.Forex – TD Ameritrade offers Forex currency pair trading in 10,000 unit increments. While there is no commission, the cost of the trade depends on the bid/ask spread.InterestWith over $1 trillion in assets, TD Ameritrade also makes a significant amount of money from funds sitting idle in customer accounts.

It does this by lending it out to other financial institutions and then making a profit on the net interest margin. This occurs when the amount of interest collected from borrowers is more than the amount of interest paid out to consumers who have funds in a checking account.

Recent figures show that 28% of company revenue comes from net interest margin.

Cash managementA cash management account allows users to manage their savings, investment, and retirement funds from a single interface.

Since TD Ameritrade is not a bank, it has partnered with certified institutions such as TD Bank to hold customers’ funds on its behalf.

Here, the company earns money through the net interest margin we mentioned in the previous section. Through its relationship with TD Bank, it also earns affiliate income for referring business to the bank. Depending on the account selected, customers may also have to pay a monthly maintenance fee. This fee may or may not be shared with TD Ameritrade.

Payment for order flowPayment for order flow (PFOF) is compensation TD Ameritrade earns for facilitating the execution of trades.

Essentially, the company earns a referral fee for directing order flow to a specific market maker. This fee is a mere fraction of 1%, but revenue multiplies quickly as millions of trades may be facilitated daily.

Key takeaways:TD Ameritrade is an established online investment platform and a broker. It was founded by John Joseph Ricketts in 1971 and is seen as a pioneer in providing investment services for individuals. It was the first to offer commission-free trading and was involved in the first online trade in 1994.TD Ameritrade operates on a commission-free trading model. Therefore, it generates revenue through phone or broker-assisted trades in various types of securities. It also earns over a quarter of total revenue in net interest margin.TD Ameritrade offers a checking account in partnership with banks such as TD Bank where it earns affiliate income for referring businesses. Lastly, the company generates revenue via payment for order flow.Read More: How Does Dave Make Money, How Does Webull Make Money, How Does Betterment Make Money, How Does Wealthfront Make Money, How Does M1 Finance Make Money, How Does Mint Make Money, How Does NerdWallet Make Money, How Does Acorns Make Money, How Does SoFi Make Money, How Does Stash Make Money, How Does Robinhood Make Money, How Does E-Trade Make Money, How Does Coinbase Make Money, How Does Affirm Make Money, Fintech Companies And Their Business Models.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does TD Ameritrade Make Money? appeared first on FourWeekMBA.

How Does Drizly Make Money? The Drizly Business Model In a nutshell

Drizly is a North American alcohol eCommerce platform headquartered in Boston, Massachusetts. It was founded by Justin Robinson, Spencer Frazier, and Nick Rellas in 2012 after graduating from Boston College. Licensing fees are the most significant source of income for Drizly. These monthly fees are charged to independent liquor stores and retailers in exchange for using the Drizly platform.

History of DrizlyDrizly is a North American alcohol eCommerce platform headquartered in Boston, Massachusetts.

It was founded by Justin Robinson, Spencer Frazier, and Nick Rellas in 2012 after the trio graduated from Boston College. Rellas is the man credited with providing the idea for the company after trying to purchase beer in the middle of the night.

Inspired to learn more, he would later spend hours researching the intricacies of the alcoholic beverage industry. Rellas discovered a tightly regulated industry controlled by various tiers of producers, distributors, and retailers. Importantly, those holding expensive liquor licenses had so far avoided developing an eCommerce presence.

As a result, the co-founders had to adapt. They adopted a revenue model that would bypass the need to acquire a liquor license and developed proprietary technology to verify the age of customers. In 2013, Drizly launched in the Boston area. A year later, it released an Android app and expanded into New York.

The platform underwent a major revamp in 2016, becoming a marketplace where consumers could compare liquor prices and delivery options. A cannabis delivery service was also added in 2020.

In February 2021, Uber acquired Drizly in a stock and cash deal worth $1.1 billion. The company continues to operate as a standalone app under the Uber app ecosystem.

Drizly revenue generationThe company has an interesting and varied means of generating revenue.

Licensing fees are perhaps the most significant source of income for Drizly. These monthly fees are charged to independent liquor stores and retailers in exchange for using the Drizly platform.

They range from $100 to $10,000, depending on the total transaction volume, store location, and the type of liquor sold, among other things.

Delivery feesFor the vast majority of Drizly markets, there is a flat $5 delivery fee applied to each order. This helps Drizly retail partners offset at least some of the delivery cost. In some locations such as New York City, delivery is free.

Service feesDrizly also charges a $1.99 service fee on each purchase. According to the company, this fee is used to improve its products and services.

Cancellation feesUnder certain circumstances, canceled orders will also attract a fee:

A $20 restocking fee will be charged if a cancellation is made after an order has left a Drizly retail partner store. This includes orders made through a third-party courier.A $5 cancellation fee will be charged if the cancellation is made before the courier picks up the order.AdvertisingDrizly also earns advertising revenue from brands that wish to advertise on its platform. Here, there is a high likelihood the company earns money on a fixed fee basis.

Key takeawaysDrizly is an American eCommerce platform headquartered in Boston, Massachusetts. Co-founder Nick Rellas got the idea for the company after attempting to purchase beer in the middle of the night.Drizly collects a licensing fee from retail partners in exchange for being featured on its platform. These fees are based on several factors, including transaction volume, product type, and store location.Drizly also collects delivery, service, and cancellation fees under certain circumstances. Furthermore, the company sells advertising space and potentially, consumer buying data.Read Also: How Does Amazon Make Money, How Does Instacart Make Money, How Does DoorDash Make Money, How Does Postmates Make Money, How Does Grubhub Make Money, How Does Uber Eats Make Money, The Walmart Business Model, Last-Mile Delivery: The Anti-Network Effects And Why It’s Such A Hard Problem.

Main Free Guides:

Business ModelsBusiness StrategyBusiness DevelopmentDigital Business ModelsDistribution ChannelsMarketing StrategyPlatform Business ModelsTech Business ModelBlockchain Business ModelThe post How Does Drizly Make Money? The Drizly Business Model In a nutshell appeared first on FourWeekMBA.