Patrick O'Shaughnessy's Blog, page 31

February 10, 2015

The Very Cheapest Stocks (Price/Book) Do Very Badly

Book to price is a bad value factor. It is a decent stock selection factor overall, but relative to the other ways of measuring value (earnings to price, cash flow to price, EBITDA/EV, etc) it is sub par.

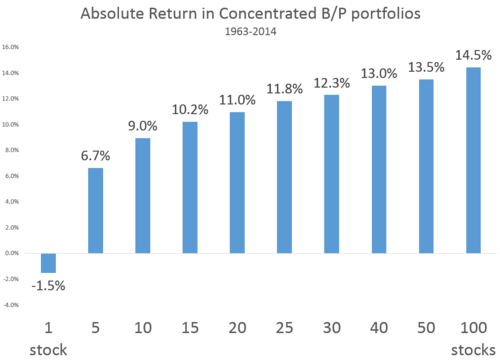

I've been interested lately in very concentrated value portfolios, and found it interesting that when running very small portfolios (as little as 1 stock selected per month, with an annual holding period) based on book/price, you wouldn't have done very well (and would have lost money in the one stock versions!)

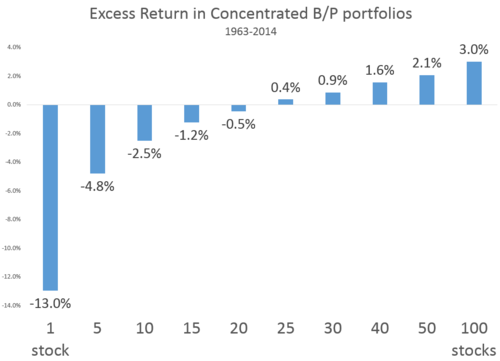

Here are the absolute and excess returns for concentrated book/price portfolios since 1963. It is not until you get to 25 stocks that the return of the concentrated portfolio edges out the market's average rate of return (11.45% in this period). I also ran concentrated portfolios of the most expensive stocks by book/price and was very interested to find that for the 5 and 10 stock versions, the expensive portfolios outperformed the cheap ones (barely, but still)! Once you get to larger baskets of stocks, then things normalize and cheap beats expensive.

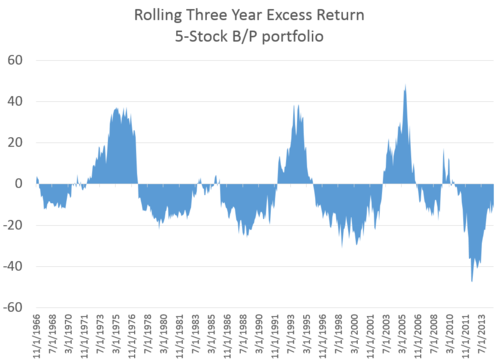

Let's consider the 5-stock version as an example (which underperforms the equal-weighted market by nearly 5% per year). Below are the rolling 3-year excess returns for that portfolio: consistently bad with occasional periods of brilliance.

These stocks tend to be very different from other value stocks. The 5 cheapest stocks at the end of 2014, for example, failed to crack even the cheapest 1/3 of all stocks as measured by a composite value score (e/p, fcf/ev, ebitda/ev, s/p, shareholder yield). Four of the five have negative earnings, so look very expensive by other measures.

Unlike with other value factors, these results suggest that you do NOT want to own a very small basket of stocks that are only cheap based on this mediocre measure of value. Stick to other value factors instead.

January 26, 2015

More on Profit Margins

Jesse Livermore has a characteristically great and thorough look at U.S. profit margins up on his website, which I highly recommend.

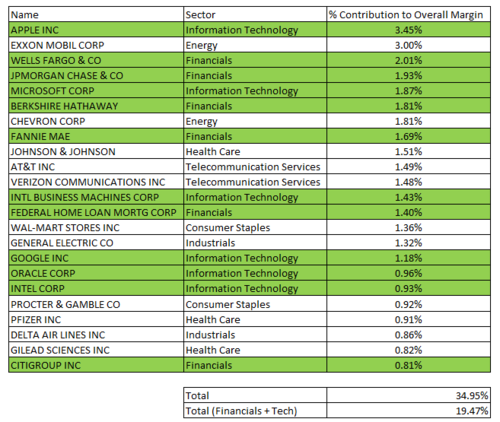

I've written about margins a few times in the past and find them fascinating. Jesse's key point is how important financial and technology stocks are to current U.S. profit margins, so I thought I'd add some fuel to the fire. Below are the top 24 stocks by contribution to overall margin in the U.S.

This means that Apple, for example, is responsible for 3.45% of the markets overall net profit margin (the math is (Apple's margin (21.6%) * Apple's share of the overall markets sales (1.27%) / the markets overall margin (7.98%)) = 3.45%). These 24 companies alone determine about 1/3 of the U.S. markets total profit margin. 12 of these 24 are financial or tech stocks--a notably disproportionate total given that these are just 2 of the 10 GICS sectors.

These 12 financial/tech stocks make up 19.5% of the markets margin.

The future of U.S. margins, then, rest squarely on their shoulders. Their average margin is 19.8%. That is damn high! Who knows if these are sustainable, but these are the companies that matter most. I'd love to hear what you think about their sustainability.

January 22, 2015

Buffett wisdom that you may not have heard before

I work hard to not quote or invoke Warren Buffett too often. His wisdom is ubiquitous and he doesn’t need another preacher. But I came across some unique insights from Mr. Buffett through a third party that I feel compelled to share.

These notes came from Jason Ke Wang (@Wangkejason), a graduate student earning his MBA at Stanford. I met Jason at our offices as he was in the middle of an incredible tour visiting many of the biggest names in investing: Bogle, Lou Simpson, Joel Greenblatt, and of course Buffett. He was generous enough to share his notes with me and allow me to share them here.

Buffett answered 16 questions across two and a half hours, and I was struck by several pearls that I hadn’t heard before (although I am sure he has mentioned elsewhere). Lots of what he said was similar to other statements he has made in public appearances and letters, but these ideas (or at least the wording of them) stuck out. Emphasis is always mine.

On sourcing investment ideas:

“Found Berkshire in Moody’s Manual for Industries. You may think that today competition has increased and information is easily available but I used the same approach to find Korean stocks a few years back. Read the Korean stock manual one Sunday afternoon and found 15-20 stocks that way”

I love that old methods can still work. People are still lazy.

One of my favorites was this thought on the importance of speaking, writing, and communicating well.

At your age the best way you can improve yourself is to learn to communicate better. Your results in life will be magnified if you can communicate them better. The only diploma I hang in my office is the communications diploma I got from Dale Carnegie in 1952… “Without good communication skills you won’t be able to convince people to follow you even though you see over the mountain and they don’t”

On crisis management:

- If you have a city of 330,000 people (the number of people Berkshire employs) there are bound to be some people who are doing wrong. Try very hard to set the tone at the top. Send a two page letter to all employees every two years:

“We have all the money we need. We also have the best reputation one could possibly have. If you lose money, that’s something which is easy to earn back. But if you lose reputation, it is extremely difficult to earn that back. Act in a way such that if your actions were published in the local newspaper you would not be ashamed of your neighbors and friends reading that story. Play in the center of the field. I am old and cannot see the boundaries at the edge, don’t venture there”

- If a problem does occur there are four things you need to do

1. Get it right – get the facts right

2. Get it fast – move to action swiftly

3. Get it out – get it completely out of the system

4. Get on – move on

- Never let a problem sit unattended to

Misc others.

Long Term Capital (LTCM) – “they were right about everything except human emotion”

- Only way to stop a panic in today’s times is to have someone say with absolute authority, “I will do whatever it takes to make this right.”

- “The next panic will most likely come from a cyber/nuclear/biological or chemical attack on the US. The ability of psychotics, religious fanatics etc. to impact people has tremendously increased since 1945 (atomic bombing of Hiroshima and Nagasaki)”

- “The US will always bounce back. Our system really works, if you have cash during a time of panic, BUY”

- The auto industry has been the one of the most important industries during Buffett’s investing career. He has extensive knowledge of auto. Despite that he doesn’t feel comfortable buying auto stocks. Instead he chose to buy an auto dealer with 78,000 dealerships across the US. Simply because five years from now, he doesn’t know which model will sell but he does know that the auto dealer will sell it. This is the same story in tech, Buffett does not know who the leader will be.

“Every year I go the Microsoft Summit and face people with 180 IQs and tell them that if you asked me to choose between giving up a $10mn airplane and a $100 computer, I would choose the airplane. Why then, do you still charge me only $100 for the computer. You 180 IQs are not that smart.”

“It is very important to associate with people who are better than you, you will move in that direction. It’s just smart to do that. Not just people who are better in terms of IQ but also people who are better in terms of character”

As always, some great advice from Buffett. Thanks again to Jason for sharing.

January 7, 2015

Asset Management, Saving Lives

Did you know that asset management helps to fight crime and protect families? Let me explain. By day I am a portfolio manager at O’Shaughnessy Asset Management (“OSAM”). Our largest and (one of our) longest standing client is firm with whom we have been partnered since 1997. It has been a remarkable partnership, but last night the relationship indirectly contributed to the protection and safety of my brother-in-law and his family.

Back in 2007, members of our team at OSAM and at our client’s firm got Louisville Slugger bats to commemorate the 10 year anniversary of our partnership, inscribed with our names and a nice message. A few years later, when visiting the client, a good friend at the client’s firm (who had received a commemorative bat) told me that he kept his bat by his bedside for peace of mind and protection.

When I moved to the suburbs about 3 months ago, I remembered his story and bought a bat for myself to keep by MY bedside (but forgot the origin story of the bat itself). I thought it was a great idea, so I suggested that a number of other friends and family also buy bats. My logic was that if you swing a Louisville Slugger as hard as you can and connect with any part of an intruder’s body, they are toast for at least a little while. This seemed to me a compelling option for self-defense.

Well, my brother-in-law agreed and bought a bat, and last night at 2am used that bat as he screamed and chased two burglars out of his house!

A homeowner with only a bat in his hand to protect his young child and wife sleeping in their North Stamford home was able to scare off two early morning intruders Wednesday, police said… a 34-year-old homeowner sleeping in bed with his wife heard someone break the window of his back door just before 2 a.m. After hearing the glass shatter and someone opening up the rear door and entering the home, the man was able to grab a baseball bat and run out the bedroom door to defend his 10-month-old child and wife… After yelling at them and threatening to beat them with the bat, the two turned tail and ran back down the stairs and through the door they had moments earlier broken through.

Everyone involved is doing well. Only after telling my friend this story did he remind me that the bat which inspired the idea in the first place was in fact the bat we had given him 8 years ago! Asset management: fighting crime, saving lives (indirectly…sorta…well not really, it was all my brother-in-law and his wife’s smart reactions. But I still think it’s a great story!)

December 29, 2014

How Sherlock Holmes Can Make You A Better Investor

Successful investing can only result from good thinking or good luck. Because we only control the former, I am always on the lookout for books about the process of thinking. One such book is A Few Lessons from Sherlock Holmes. Holmes’s approach is rules-based, disciplined, and often unconventional: three hallmarks of many successful investors and superior investing strategies. Holmes would have been a great investor, so below I present the best lessons he has to offer modern investors. At the end of this article, I've included further reading for each point mentioned.

Holmes believed in casting a wide intellectual net: he believed that a broad education is key:

Considering many ideas over a wide range of disciplines give us perspective and help us consider the big picture or many aspects of an issue Breadth of view...is one of the essentials of our profession. The interplay of ideas and the oblique uses of knowledge are often of extraordinary interest. (Holmes; The Valley of Fear)… One’s ideas must be as broad as Nature if they are to interpret Nature. (Holmes; A Study in Scarlet)

There is a lot of Sherlock Holmes in Charlie Munger, who also advocates a wide ranging understanding of the major disciplines. Like Munger, Holmes was also a fan of “inverted” thinking: working backwards to tackle hard problems:

In solving a problem of this sort, the grand thing is to be able to reason backward. That is a very useful accomplishment, and a very easy one, but people do not practice it much. In the everyday affairs of life it is more useful to reason forward, and so the other comes to be neglected. (Holmes; A Study in Scarlet)

Sherlock is also a believer in the power of probabilities:

While the individual man is an insoluble puzzle, in the aggregate he becomes a mathematical certainty. You can, for example, never foretell what any one man will do, but you can say with precision what an average number will be up to. Individuals vary, but percentages remain constant. So says the statistician. (Holmes; The Sign of the Four)

Replace the word “person” with the word “stock” in the above paragraph and you’d be well on your way to a smart strategy. Probabilistic reasoning is the best way to think about markets, but it is very hard to do in practice because we tend to get caught up in individual companies. To build an investing process dependent on probabilities requires steadfast discipline, because probabilities only work if you stick with them (value investing is one great example). There is a reason casinos do well: the probabilities are on their side and the rules never change. Sherlock realized the power of such a consistent approach:

Don’t forget common sense My simple art...is but systematized common sense. (Holmes; The Blanched Soldier)

The acquirement of method is more or less possible for us all...It is only by adhering rigidly to a definite routine with patient after patient and day after day that a proper reflex can be obtained. (Thomas McCrae; The Method of Zadig)

Finally, Holmes realized the power of learning from history, because most current events are just old patterns wearing new clothes:

Sorrow is often wisdom’s companion but it is better to learn from others sorrow to prevent our own

Mr. Mac, the most practical thing that you ever did in your life would be to shut yourself up for three months and read twelve hours a day at the annals of crime. Everything comes in circles...The old wheel turns, and the same spoke comes up. It’s all been done before, and will be again. (Holmes; The Valley of Fear)

It is easy to be wise after the event. (Holmes; Thor Bridge)

Here, then, is the Sherlock Holmes outline for a great investor, along with a follow up item for each point (in parentheses)

Understand the basics across a number of different disciplines (read about Charlie Munger’s latticework of mental models).Think backwards from effect to cause rather than trying to predict the future (read more about inverted thinking for investors at Old School Value)Put yourself on the right side of market probabilities (read about how valuation can help you sort of market probabilities)Make your process rules based (check out What Works on Wall Street for a survey of systematic, rules-based strategies)Learn as much as you can from history (read Devil Takes the Hindmost )Stick with Sherlock, and your investing future will be bright.

P.S. This coming month’s book list will be devoted to books in this vein, so sign up over here if you have not already.

December 19, 2014

Technology Cash Machines

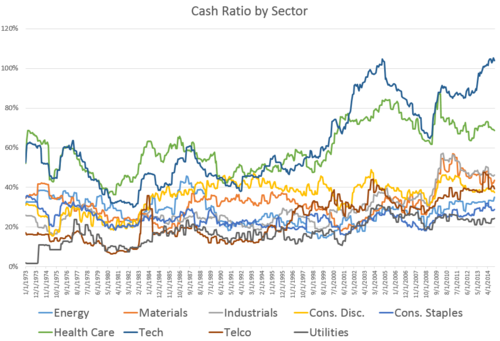

You'd be uncomfortable if you didn't have enough cash to pay your bills, right? Well its the same story for companies--its good to have cash to cover your short term liabilities. I was curious how balance sheets looked today by a measure called the cash ratio, which is a convenient measure of short-term liquidity. The results revealed an amazing trend in one corner of the market...

The cash ratio is calculated as cash (and short term equivalents) divided by all current liabilities, where current liabilities are short term debt, accounts payable, income taxes payable, and misc other items.

So how do stocks look? Do they have their liabilities well covered? Here is what the market's cash ratio looks like over the past few decades (higher is better).

Pretty damn good looking trend, eh? Well, the market has changed a lot. The majority of this trend is coming from one sector: cash rich technology stocks. Here is the same ratio broken out by sector:

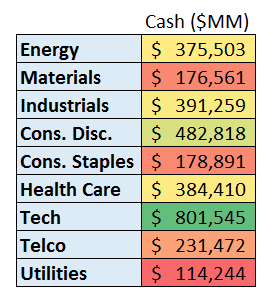

These technology companies are like Scrooge McDuck, swimming in dough. All U.S. listed technology stocks are sitting on more than $800 Billion in cash and short term equivalents...almost double the next closest sector. Oh, and these numbers don't include long-term investments (Apple alone has $130B categorized as long term investments, which many consider part of their cash hoard).

as of 11/30, all U.S. listed stocks, Cash + Short Term Equivalents

Any thoughts on this trend? I am amazed by the ability of these technology firms to generate cash without significant liabilities. No wonder Silicon Valley is booming.

null

December 10, 2014

5 Predictions for 2015

1. Everyone will continue to make predictions despite overwhelming evidence that predictions are useless.

My father has been an incredible mentor, but you’d be surprised how few investing lessons he’s ever taught me. There were never lessons about ratios or sectors or discounted cash flows. Instead when I was growing up there was just one simple requirement: if you want something, produce a compelling argument and we will give you what you want. The emphasis was almost exclusively on how to think and how to build an argument with good evidence. I was rarely taught what to think.

But there is one thing he taught me which still sticks with me (mostly because I had no idea what the hell he was talking about, I was 12 years old). He said, “People are deterministic thinkers in a probabilistic world.”

Over the years I figured out that he meant was that we are pattern junkies obsessed with identifying patterns and extrapolating them into the future, and we fail because the future isn’t pre-ordained and deterministic. His lesson was: you should never bet on specific outcomes, but rather bet on high probability outcomes. This is very good investing advice.

But sadly humans don’t think like that. We see two of something and automatically predict a third. My favorite example of our pattern addiction is a study referenced by Jason Zweig in his book Your Money & Your Brain, which pitted humans against pigeons. Both humans and pigeons were show two lights, one red and one green, which were flashed 20 times per round. The lights were rigged such that the green one flashed 16 of the 20 times (80%), but other than this rule the sequence was entirely random. Rewards were given to people and pigeons when they guessed the next light correctly. The pigeons quickly figured out that the best strategy was to just guess green all the time, and their average score was about 80% correct. But us stupid humans, obsessed with prediction and patterns, constantly tried to outsmart the odds by guessing red occasionally—the end result being a score of just 68%. Stupid humans.

The best way to look at the future is as Howard Marks suggested in his last memo, “the future should be viewed not as a fixed outcome that’s destined to happen and capable of being predicted, but as a range of possibilities and, hopefully on the basis of insight into their respective likelihoods, as a probability distribution.”

Bottom line: I predict that our predictions will suck.

2. Some book will be a massive bestseller, and no one will read it. We should create an award for this perennial snoozer and call it “the Piketty.” Mark Twain had it right: a ‘classic’ is a book which people praise and don’t read.

3. Some asset class, currently despised, will explode upward. Energy stocks, perhaps[i]?

4. I will announce a huge and very fun new project at some point during 2015—one that will require your help. I know this one is coming true ;)

5. I hate predictions so much I can’t even come up with 5.

Happy Holidays!

[i] THIS IS NOT A PREDCTION

null

December 9, 2014

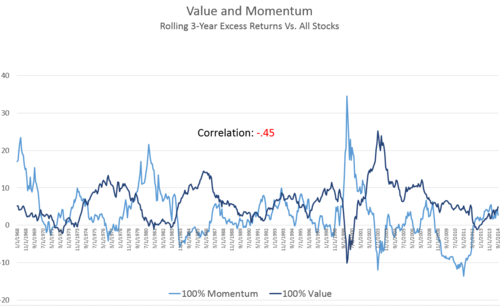

Value + Momentum: The Tortoise and the Hare

Buy cheap stocks, or follow the trend? Two conflicting (and often exact opposite) strategies that have both worked well through market history. Momentum, when it’s working well, can be unstoppable for years. When it’s not working, it can lead to horrendous results relative to the market. Value has been steadier, but it too undergoes periods of significant underperformance. So what about combining these two ideas by looking for cheap stocks that the market is just beginning to notice? Think of the combination as the best aspects of the tortoise and the hare.

First, consider the results for a pure value and a pure momentum strategy[i]. Here are the rolling 3-year excess returns of these two strategies (best decile) versus all stocks since the 1960’s.

Notice that momentum is much choppier, but it has three separate 3-year periods when it outperforms by more than 20% per year for three years! Value only reaches that level once.

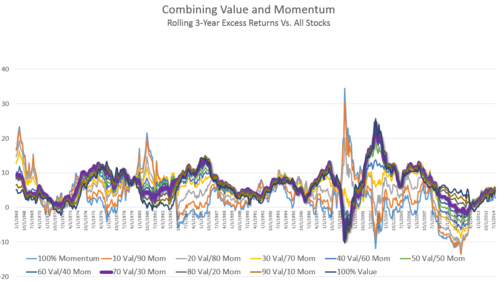

So what if you combined these ideas? I ran a series of tests combining value and momentum into a single factor, giving weights from 0-100 for both value and momentum factors—so, for example, a 50/50 combination gives equal weight to a stock’s momentum rank in the universe and its value rank in the universe. The long-term and rolling results for the best decile portfolios are listed below.

Best decile portfolios, 1/1965-9/2014

The best combination, measured by risk vs. volatility, was 70% value, 30% momentum. This strategy focuses on cheap stocks, but avoids those that are still in relative free fall versus the market. Check out the best and worst case 3-year returns for pure momentum. At one point (late 90’s) it outperformed by more than 34% per year for three years (that is more than 140% cumulative outperformance). Of course momentum was terrible during the market recovery following the 2009 bottom, underperforming by more than 13% per year for three years, causing many to abandon the momentum strategy.

In the rolling returns above, you can see that combinations of the two factors are much steadier performers. Value was crushed in the late 90's, for example, but including some momentum in the mix would have mitigated the damage.

With factor investing all the rage, it’s good to know that both of these strategies work, and that they work at different times. But the most powerful combination is a strategy that measures both value and momentum at the stock level. Both value and momentum have had 3-year periods where they underperformed the market by more than 10% annualized. But the worst case for a 50/50 combination of value and momentum? Just 5.5% annualized underperformance over three years.

Bottom line, the tortoise and the hare both have their merits: cheap valuations rule AND the trend is your friend. Look for stocks that have both.

P.S. while these two factors are powerful, other factors matter too. Value and Momentum are two of the five factors that I explore in Chapter 6 of Millennial Money, so check out the holiday offers for the book over here.

[i] Momentum is defined as trailing 6-month total return, value is defined as a combination of price-to-sales, price-to-earnings, EBITDA/EV, and Free Cash Flow/EV. The best decile portfolios are rebalanced on a rolling annual basis.

null

December 7, 2014

Millennial Money Holiday Extras

Hey all, in the spirit of the holidays I've put together 3 offers for those that order Millennial Money for themselves or for their loved ones. For 17 bucks a book, you can light a fire under the rears of young people you know to get them started saving & investing. You can see the details here...

December 2, 2014

The Best Books of 2014

Anyone that reads this site knows I am a book nut. I read about one hundred books this year, and thought it would be fun to share the best of them. You can also get 3-4 of my favorite books each month by signing up over here (added bonus, I have a holiday offer going out in the next few days for my book Millennial Money, and subscribers will get the first crack at the biggest offer). Here are my favorite books, along with a favorite passage from each.

Security Analysis, Sixth Edition by Ben Graham and David Dodd

Confession: until this year I had not read this book cover to cover. That is like a devout Catholic saying he’s never finished reading the bible. It is long, nuanced, and sometimes behind the times--but there is so much useful information in this book, it really should be required reading. The sixth edition has commentaries from huge names like Seth Klarman and Howard Marks, and I would have paid full price for the Klarman section alone. Make sure to read those great commentaries. Here is Klarman, on the durability of the value investing strategy:

Because our nation’s founders could not foresee—and knew they could not foresee—technological, social, cultural, and economic changes that the future would bring, they wrote a flexible constitution that still guides us over two centuries later. Similarly, Benjamin Graham and David Dodd acknowledged that they could not anticipate the business, economic, technological, and competitive changes that would sweep through the investment world over the ensuing years. But they, too, wrote a flexible treatise that provides us with the tools to function in an investment landscape that was destined—and remains destined—to undergo profound and unpredictable change.

Scientific Advertising by Claude C. Hopkins,

The Robert Collier Letter Book by Robert Collier,

Split-Second Persuasion: The Ancient Art and New Science of Changing Minds by Kevin Dutton,

and Ogilvy on Advertising by David Ogilvy

My side project this year was books on persuasion, influence, and sales. I believe that effective communication is essential in the investing business, and wanted to understand the principles behind swaying people’s opinion and getting them to take action. What I learned above all else is that people only care about something if there is something in it for them. Write about yourself, by all means, but only do so if your story is a metaphor for the reader’s own experience. I got a huge response from a story about my start in the investing business because so many others had gone through the same thing and loved to talk about it.

These four books were my favorite, offering diverse and useful principles for communicating well and selling people on your ideas.

Here is Robert Collier:

It matters not whether you are trying to sell him a rain-coat, making him a proposal of marriage, or asking him to pay a bill. In each case, you want him to do something for you. Why should he? Only because of the hope that the doing of it will bring him nearer his heart's desire, or the fear that his failure to do it will remove that heart's desire farther from him… Appeal to the reason, by all means. Give people a logical excuse for buying that they can tell to their friends and use to salve their own consciences. But if you want to sell goods, if you want action of any kind, base your real urge upon some primary emotion!

Zero to One by Peter Thiel

Technology, says Thiel, is defined as doing more with less. I loved the thought provoking nature of this concise book. It encourages contrarian thinking, which is a powerful force. The simple exercise of asking oneself “how can I make something ten times better” has led to some interesting results for me personally (a few huge projects in the works as a result, more on that to come).

The best place to look for secrets is where no one else is looking. Most people think only in terms of what they’ve been taught; schooling itself aims to impart conventional wisdom. So you might ask: are there any fields that matter but haven’t been standardized and institutionalized? Physics, for example, is a real major at all major universities, and it’s set in its ways. The opposite of physics might be astrology, but astrology doesn’t matter. What about something like nutrition? Nutrition matters for everybody, but you can’t major in it at Harvard. Most top scientists go into other fields. Most of the big studies were done 30 or 40 years ago, and most are seriously flawed. The food pyramid that told us to eat low fat and enormous amounts of grains was probably more a product of lobbying by Big Food than real science; its chief impact has been to aggravate our obesity epidemic. There’s plenty more to learn: we know more about the physics of faraway stars than we know about human nutrition. It won’t be easy, but it’s not obviously impossible: exactly the kind of field that could yield secrets.

Monsters: The 1985 Chicago Bears and the Wild Heart of Football by Rich Cohen. If you like football, this is the book for you. it is jam packed with incredible characters, stories, history, and factoids. I read it in one sitting. I loved this passage about a Bears player skipping warm-ups to stand in the middle of the field and just stare at the opposing team:

Not long ago, McMichael told Chicago interviewer Mark Bazer that he’d been playing a role in those years, a character named Mongo. “I’d go stand at the fifty-yard line and stare at the other team before the game,” he explained. “I wouldn’t warm up with the guys. I would just stand and stare. Wade Wilson, a quarterback from that time, looked me up at a convention. The first thing he said was, ‘Steve, do you remember me?’ I said, ‘I remember you, quarterback. I’m like a vicious predator on the Serengeti. I remember all the wounded gazelles.

Waking Up: A Guide to Spirituality Without Religion by Sam Harris

Harris is a controversial figure, but this book was a breath of fresh air. It explores happiness, meditation, and the mind in a thoughtful and useful narrative. I don’t know how he does it, but somehow Harris fills the book with passages like this:

It is possible, however, if not actually plausible, to seize this evidence from the other end and argue, as Aldous Huxley did in his classic The Doors of Perception, that the primary function of the brain may be eliminative: Its purpose may be to prevent a transpersonal dimension of mind from flooding consciousness, thereby allowing apes like ourselves to make their way in the world without being dazzled at every step by visionary phenomena that are irrelevant to their physical survival. Huxley thought of the brain as a kind of “reducing valve” for “Mind at Large.” In fact, the idea that the brain is a filter rather than the origin of mind goes back at least as far as Henri Bergson and William James. In Huxley’s view, this would explain the efficacy of psychedelics: They may simply be a material means of opening the tap.

The Prize and The Quest, by Daniel Yergin

The history of oil, told in The Prize and the first section of The Quest, is the most entertaining real story I’ve ever read. These books take a while, and are filled with detail, but you will walk away astonished.

It was called “Seneca Oil” after the local Indians and in honor of their chief, Red Jacket, who had supposedly imparted its healing secrets to the white man. One purveyor of Seneca Oil advertised its “wonderful curative powers” in a poem: The Healthful balm, from Nature’s secret spring, The bloom of health, and life, to man will bring; As from her depths the magic liquid flows, To calm our sufferings, and assuage our woes.

The River of Doubt: Theodore Roosevelt's Darkest Journey by Candice Millard

A fast read and a remarkable story of endurance. I am obsessed with explorers of all kinds, people who go it alone and figure things out for themselves. Roosevelt was an explorer:

“The ordinary traveller, who never goes off the beaten route and who on this beaten route is carried by others, without himself doing anything or risking anything, does not need to show much more initiative and intelligence than an express package,” Roosevelt sneered. “He does nothing; others do all the work, show all the forethought, take all the risk—and are entitled to all the credit. He and his valise are carried in practically the same fashion; and for each the achievement stands about on the same plane.”

No Boundary: Eastern and Western Approaches to Personal Growth by Ken Wilber

This book really struck a chord with me. The core idea of breaking down boundaries (dualities) was brilliant. Here are a few passages:

Not knowing how near Truth is, People seek it far away—what a pity! They are like he who, in the midst of water, Cries in thirst so imploringly.

Most of our “problems of living,” then, are based on the illusion that the opposites can and should be separated and isolated from one another. But since all opposites are actually aspects of one underlying reality, this is like trying to totally separate the two ends of a single rubber band. All you can do is pull harder and harder—until something violently snaps. Thus we might be able to understand that, in all the mystical traditions the world over, one who sees through the illusion of the opposites is called “liberated.” Because he is “freed from the pairs” of opposites, he is freed in this life from the fundamentally nonsensical problems and conflicts involved in the war of opposites.

As Wei Wu Wei put it: Why are you unhappy? Because 99.9 percent Of everything you think, and Of everything you do, Is for yourself— And there isn’t one.

Only parts suffer, not the Whole. And this realization, when stated “negatively” by the mystics, says, “You are released from suffering when you realize the part is an illusion—there is no separate self to suffer.” When stated “positively,” it says, “You are always the Whole, which knows only freedom, release, and radiance. To realize the Whole is to escape the fate of a part, which is only suffering, pain, and death.”

The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies by Erik Brynjolfsson, Andrew McAfee

Such a fun book about the future. Automation is eating the world, and the economic landscape is changing fast. What skill will remain valuable? The authors explore this and many other questions in detail.

Rapid and accelerating digitization is likely to bring economic rather than environmental disruption, stemming from the fact that as computers get more powerful, companies have less need for some kinds of workers. Technological progress is going to leave behind some people, perhaps even a lot of people, as it races ahead. As we’ll demonstrate, there’s never been a better time to be a worker with special skills or the right education, because these people can use technology to create and capture value. However, there’s never been a worse time to be a worker with only ‘ordinary’ skills and abilities to offer, because computers, robots, and other digital technologies are acquiring these skills and abilities at an extraordinary rate.

Those were my favorites this year, but it was a great year over all. You can find others that I have recommended here and signup to receive more each month here. Be on the lookout for my upcoming holiday offers for Millennial Money, and have a great holiday season.

null