Patrick O'Shaughnessy's Blog, page 34

September 8, 2014

A Complete Investor Curriculum & More--The Millennial Money Pre-Order Offer

I am very excited to see my first book, Millennial Money, hit shelves on October 14th. I think you’ll love the book, but I also want to provide you with more. I have put together a package of extra content—designed to help you be a better investor—that will be available only to those who pre-order the book.

The Offer

If you pre-order the book, I will send you the following four pieces of exclusive extra content:

All you have to do pre-order a copy of the book on Amazon, Barnes & Noble, or Indie Bound and send the order receipt to patrick.w.oshaughnessy@gmail.com with the subject line “millennial money pre-order.” I will then send you the collection of extra content—pretty simple!

You can see more info on the book at Amazon.

The offer will be available up until October 13th, the day before publication.

If you know any millennials who may benefit from this book, forward this offer their way. With your support, we can make this a successful book that helps a lot of people build a brighter financial future.

All my best,

Patrick

P.S. Here are some early reviews for the book and a visual preview of the extras:

Reviews on Amazon

Review on Forbes.com

“O’Shaughnessy provides sound advice that will give millennials the advantages they need to improve their financial future.”-- Publishers Weekly

"Patrick has done something very unique: he's written a highly readable book that speaks up—not down—to young investors, while keeping things sophisticated enough so that even veteran investors will find indispensable insights within."—Joshua M. Brown, author of Clash of the Financial Pundits and on-air contributor to CNBC

“If someone had given me this book when I was in my 20s, I’d be a billionaire today. Buy this book for someone you love who is in their 20s. They will think kindly of you when they are in their 60s.”—Barry L. Ritholtz, Chief Investment Officer, Ritholtz Wealth Management

“Patrick has got it right. The sooner you start investing, the more you make. Patrick’s recommendation to invest broadly in international stocks is also spot on for young investors. This book is a must read for anyone from their 20’s to 40’s.”—Tim McCarthy, Former President, Charles Schwab and author of The Safe Investor

“Most young investors I know have abandoned stocks, and that's a big mistake. O’Shaughnessy lays out a clear path for building wealth over a lifetime with a key message: start now, invest globally, and master your own behavior.”—Meb Faber, CIO, Cambria Investment Management, and author of The Ivy Portfolio

"Patrick O'Shaughnessy has written an accessible, thought-provoking guide to helping Millennials make the right financial decisions." —Kevin Roose, Bestselling author of Young Money

“Patrick’s book is a must read for my generation, and anyone who cares about building a more secure life for themselves and their loved ones. His message is clear: the time to act is now and the future is ours to take!” —Bryce Dallas Howard, Actress

September 5, 2014

For Apple, the iPhone 6 Doesn't Matter. Valuation Does.

Should you invest in Apple? As the market eagerly awaits the September 9th launch of a suite of new Apple products, this question occupies the airwaves. Back in April, I wrote that Apple looked attractive despite negativity about the company. Below is an updated objective look at Apple based on two key criteria for evaluating a stock: valuation and shareholder orientation. These two variables are more helpful for predicting future performance than prognostications about products and forecasts of earnings growth rates (which is where all the Apple attention seems focused).

The iPhone 6 and iWatch sound great, but they don’t matter nearly as much as valuation or shareholder yield. Let’s look at how Apple stacks up by these factors versus the rest of the market (hint: pretty damn good).

Value

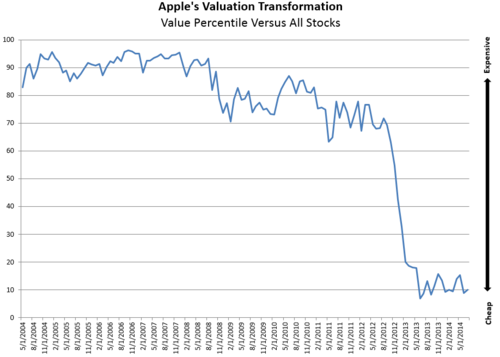

Apple went from a very expensive market darling focused on growth, to a very cheap market laggard with significant dividend and share repurchase programs.

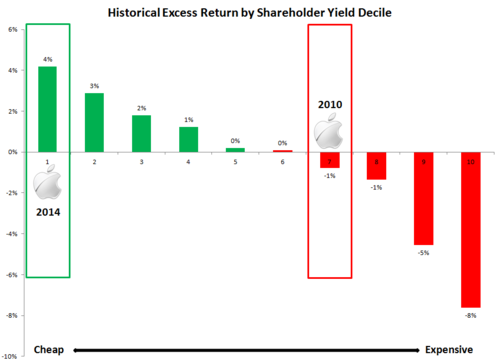

Between 2010 and 2012, perception was that Apple was the greatest company in the world. In 2010, Apple was more expensive than 75% of the market based on a combination of simple measures like price-to-earnings, price-to-sales, and price-to-cash flow. Now, in 2014, it is cheaper than 90% of companies, based on those same measures. Look how quickly the change happened. Market perception can turn on a dime.

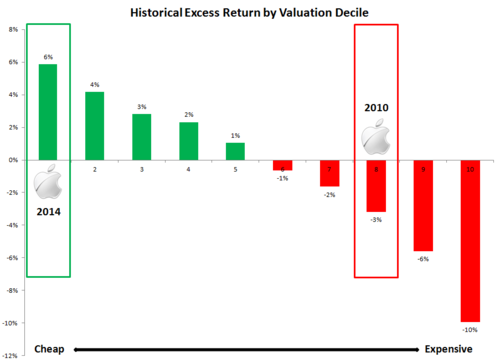

Valuation has been a powerful factor for predicting future returns throughout history. In fact, the cheapest 10% of stocks, on average, have outperformed the market by nearly 6% per year since 1963. Today, Apple sits in this cheapest valuation bucket.

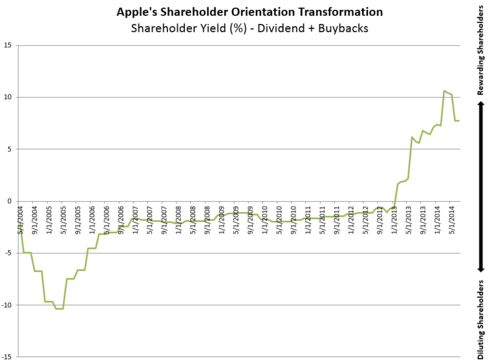

Shareholder Orientation

The other key change in Apple (from the investor’s perspective) is its orientation towards its shareholders. For years, it issued new shares, diluting existing shareholders (shown as negative shareholder yield in the figure below) and paid no dividends. They’ve since pulled a 180, buying back a huge number of shares and paying a regular dividend. Again the change happened fast.

Shareholder yield, just like valuation, has also been a powerful predictor of future returns. Companies that pay impressive dividends and buyback significant amounts of their share have outperformed the market by roughly 4% per year since 1963. Again, Apple sits in the best group by shareholder yield today.

Apple Inc. vs. $AAPL

The consensus earlier this year was that Apple, the company, has less potential than it did a few years ago, but history suggests that its stock has much more potential than it did a few years ago.

Apple Inc., the company, has taken its licks since it first peaked at $700 in 2012—but has come roaring back. $AAPL, the stock, has transformed in ways that should make investors take notice. Investors should always buy cheaper companies that reward their shareholders rather than expensive stocks dilute them. Of course Apple itself may flounder and underperform the market, but the odds are that a large basket of stocks with similar characteristics (cheap valuations, high shareholder yields) will do very well over the long term. In anticipation of September 9th, remember that products and earnings growth rates may be exciting, but value matters more.

August 27, 2014

6 Things To Do In Your Early 20's

20 year olds: you'll be amazed by how much you change in the next decade. You have the chance to get off on the right foot where most (myself included) did not. Below are a few things I wish I knew at 20.

I wrote this list because of a hugely popular question at Quora: what important things does a 20-year old need to know about money and finance. One answer—from James Altucher—caught my attention. I always enjoy Altucher's take on things, and his answer is mostly great, so check it out.

Not everything I suggest below relates directly to money & finance, but most of my suggestions will lead to a better career, which will lead to more happiness, and hopefully more money.

Altucher advocates against the traditional personal finance model, which goes: get a steady job, save and invest 10%-20% of your income, spend responsibility, and retire (inevitably) rich. Altucher suggests that you "choose yourself" by building your own business rather than being a functionary cog in a large corporate machine.

Altucher is right about this: functionary jobs are being absorbed, automated, and programmed away. I've seen it in my business (asset management) and many others. But I think there is a happy medium between James's "choose yourself" model and the traditional personal finance model. Even if you work at a large company, you can still choose yourself by carving out a role in which you are exceptionally skilled and valuable. Here are the six things that I think are most important for any 20 year old.

1. READ & LEARN. Reading is the best thing you can do to help yourself. Read about investing & money, for sure (here are four books to get you started, and you can sign up for a monthly list of books I send out here), but also read about many other things.

Read Alan Watts, Joseph Campbell, Daniel Kahneman, and Jiddu Krishnamurti--they will teach you to think for yourself.

Read James Altucher, Steven Pressfield (the War of Art & Turning Pro), and Joseph Campbell (again)--they will teach you to take life into your own hands.

Read Will & Ariel Durant--they will teach you that the lessons of history (which go unheeded by most) are invaluable and that history is ever-repeating.

Read David Mitchell, Denis Johnson, & Anne Lamott -- they will make you relish language and life.

Read Unbroken, The Boys in the Boat, Shadow Divers, & The Tiger-- because life is hard, but incredible.

Read deeply about the topics that interest you most, because deep knowledge and insight is going to be valuable in the future, even as many jobs are automated away.

2. SAVE & INVEST. Altucher advocates against saving, against college, and against buying a house. Here's what I think:

College was a mediocre experience for me. I went to Notre Dame, so it was almost worth it for the football alone, but the classroom environment just wasn't my cup of tea. I didn't really start learning until I graduated and began reading on my own. College, for me, wasn't worth the money--but that is only because I got my first (and only) job at my father's company—a job for which I was at first unqualified. If you don't go to college, it harder to get a first job. I was (and am) outrageously lucky, most aren't. Buying a house is often a bad idea financially but a good idea personally. I agree with Morgan Housel, so just read his thoughts here.As for saving & investing, the basic math is irrefutable: if you save even small amounts when you are very young, and invest that money into the global stock market, it will grow to a considerable sum over 40-50 years. To say otherwise is to ignore centuries of history. Read Simple Wealth, Inevitable Wealth. Read my book when it comes out. Then go open up an investment account (at Schwab, Wealthfront, or Vanguard) and get started. Youth is the most important advantage you will ever have in investing, don't squander it! Think about investing in terms of the potential of every dollar, and you’ll find that youth trumps everything.3. NETWORK. Ugh, networking. I straddle the fence between introvert and extrovert and think cocktail parties are the most painful place on the face of the planet. I resisted networking for many years, but have ramped it up recently. Even after a short period, I’ve learned that meeting people with shared interests is one of the best things you can do in life. It is fun, engaging, challenging, and often leads to unexpected insights and opportunities. Of all the things I did wrong in my early 20's, this is the one that I wish I'd done differently. Meet people, share ideas.

4. EXPERIMENT & FAIL. Experimenting, by its very nature, means that you will fail. Get comfortable with failure and rejection early on in life because 1) they happen all the time and 2) you can't get anywhere great without failing a lot along the way. One easy way to fail often is to write. First drafts of anything are always failures. You learn, improve, and move on.

Do random things outside your comfort zone. Go to toastmasters and learn to speak in public (a rare skill that pays dividends), sit in a sensory deprivation tank for a few hours, try acupuncture, meditate, or give $5-20 away to random people every day for a month. I came up with the structure of my book while sitting in the sensory deprivation tank. Good things happen when you experiment.

5. DRINK LESS. I used to drink so much. Especially in high school, but also in college and in my early 20's. By your late 20's (where I am now), you'll drink a lot less and be very happy about it. Hangovers get in the way of all the above suggestions. Drinking is good, drinking too much is terrible.

6. DISCONNECT MORE. The biggest addiction today is distraction. I stand on the Stamford, Connecticut train platform every night with hundreds of other commuters. Each night I look up and down the platform, and every single person is buried in their phone. We are distracted all of the time, which leaves no time for thinking. We are well on our way to being the fat people from Wall-E. If you just disconnect and think, you’ll get ahead.

In Turning Pro, Steven Pressfield says “ambition is the most primal and sacred fundament of our being. To feel ambition and to act upon it is to embrace the unique calling of our souls. Not to act upon that ambition is to turn our backs on ourselves and on the reason for our existence.” In my early 20’s, I was lazy, drank too much, and saved too little. I ignored my ambition. The sooner you pursue your ambition, the better off you’ll be—financially and otherwise. Hopefully the above suggestions can help you do so.

August 25, 2014

The Hidden History of the S&P 500

The historical return of the S&P 500 is quoted everywhere, usually back to 1926. But did you know that it wasn’t composed of 500 stocks until 1957? Or that it was not adaptive to changing market conditions until 1988? The history of the S&P 500 is full of interesting facts.

· S&P originally tracked 233 stocks, but it was too hard to maintain daily or hourly quotes on that many stocks before computers, so the S&P 90 was created in 1928. The S&P 90 was 50 industrial stocks, 20 railroad stocks, and 20 utility stocks, and performance data was made available as often as hourly. S&P also kept track of the original 233 stocks, but reported on them weekly.

· The original S&P 500 (in 1957) was 425 industrial stocks, 60 utilities, and 15 railroads. All 500 were listed on the New York Stock Exchange (NYSE). The 500 stocks covered roughly 90% of the total market value of the entire market.

· In 1976, the composition changed to 400 industrials, 40 utilities, 40 financials, and 20 transportation stocks. It is amazing that financials were not included until the mid 1970’s! Many financial stocks traded over the counter (OTC), which had previously made them harder to incorporate. Transports now included airlines, freight, and trucking companies instead of just railroads.

· In 1988, the 400-40-40-20 model was finally abandoned to make the index more responsive to changes in the economy. This old fixed model proved un-adaptive in a fast paced economy.

Like many similar institutional structures, the S&P 500 was, at points, behind the times. Like the fairly arbitrary process for selecting the constituents of the Dow Jones Industrial Average (DJIA), the S&P constituent selection process resulted in an imperfect measure of the total market for long periods. Just more evidence that almost nothing in investing is perfectly precise.

Source: Read much more here

August 21, 2014

The 3 Keys to Investing in Energy Stocks

Omnia bona quoad perfora” (Loosely, All prospects look good until drilled)

In Energy, Part I, I explored the impressive—but highly volatile—returns of energy stocks. In this part, I’ll explore how to find the best individual energy stocks. As we will see, the secret to success in the energy sector is similar to the secret in the consumer staples sector: focus on high quality, cheap stocks. Value has been the most successful factor for choosing energy stocks, but the value strategy can be enhanced by insisting on high return on capital and a low reliance on external debt & equity financing.

In this sector series, I’ll highlight “factors” that can be quickly calculated and compared across a wide universe of stocks. I’ll cluster these stock selection factors into several key categories: valuation, profitability, momentum, and quality. I’ll also include some factors that do not add value historically, despite their appeal (e.g. return on equity). Many popular metrics for evaluating energy stocks require a higher touch than I’ll use here (such as Enterprise value divided by proven & probably reserves). I'm working on a more detailed project to address the more nuanced measures.

What Matters for Stock Selection

Today, there are just 170 U.S. stocks in the sector with a market cap greater than $200MM. If you include international stocks listed on a U.S. exchange (usually as an American depository receipt (ADR)), there are 329 stocks.

My analysis of factors separates the universe into quintiles (buckets that represent 20% of the market sorted by a factor, or roughly 65 stocks each today). I’ve tried to include as many factors as possible that are available at free screening services like www.finviz.com, but I’ve also included some factors that are not available from the free screening services.

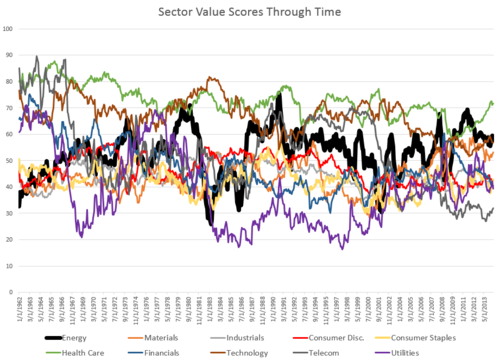

Value

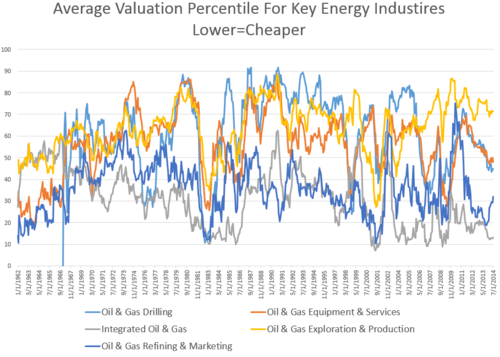

The valuation of energy stocks has varied considerably through time. Look at the thick black line in the chart below. Measured against all stocks, energy stocks are sometimes among the most expensive in the market (late 70’s, early 90’s) and sometimes among the cheapest (early-mid 60’s, 80’s).

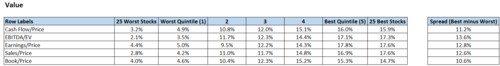

While the valuation of the entire sector ebbs and flows, investing only in the cheapest stocks within the sector has led to very impressive results. The panel below breaks the universe of energy stocks into quintiles based on different valuation factors. The analysis is run since 1963, and the quintiles are rebalanced on a rolling annual basis (so if you were to run a similar strategy, you’d want to hold positions for 12 months—this holds true for all other factors referenced below).

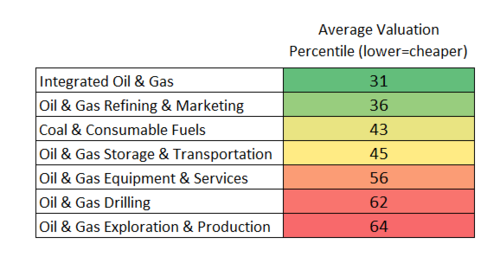

Clearly, buying cheaper stocks works. All five value factors can point you to sector-beating stocks, but EBITDA/EV works best. Where do these factors point you within the energy sector? Here is the historical valuation percentile (similar to the one above) for the various sub-industries within the Energy sector (average for the whole period and a time series).

It is no surprise that integrated stocks are the cheapest, on average, because they’ve delivered the strongest long term returns (value and returns are intimately related). Nor is it surprising that upstream, E&P stocks are the most expensive (and have among the worst returns). Bottom line: buying the cheaper energy stocks leads to superior results.

Quality

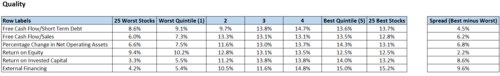

There are many ways to measure quality, but here are the results for a few factors within the energy sector:

Two key lessons stand out.

· Return on total invested capital (where invested capital=book equity + book debt – current cash) is a great way of differentiating energy stocks based on quality. Companies earning higher returns on their capital have in turn delivered higher future returns for their investors.

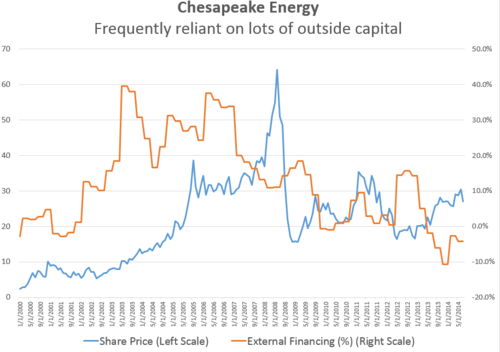

· Financing is an extremely important component of the energy business. Especially among upstream exploration and production companies, enormous amounts of capital are often required to acquire land and extract oil & gas. Some companies, like Chesapeake Energy, have historically issued huge amounts of capital to fund expansion. Chesapeake’s “external financing” in the chart below is calculated as the total amount of net capital raised (debt & equity issued minus debt & equity retired/bought back) divided by the average assets of the company. Huge capital issuers like Chesapeake have fared poorly, on average.

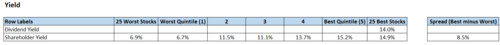

Yield

Two measurements of yield are effective in the energy sector: dividend yield and shareholder yield[i]. I’ve only included the top 25 stock portfolio for dividend yield[ii].

Buying stocks with higher yields has been an effective strategy. Companies paying regular dividend (whose yield is high because the stock is out of favor) have been reliable investments. While helpful, yield is not as powerful as value when selecting energy stocks.

Momentum

Finally, the trend can—to some degree—be your friend when choosing energy stocks. Those that have appreciated the most over the prior six months go on to outperform in the following year, on average.

Conclusion

Picking stocks in the energy sector is much more complicated than I have explored here, but this is a good starting point. Higher quality companies which are trading at discounts and are less reliant on outside capital have historically done very well. As always, let me know your thoughts by commenting below or emailing me at patrick.w.oshaughnessy@gmail.com. I am working on a much more detailed exploration of energy which will include history, industry overview, stock selection, and issues for the future. If you have topics that you would consider “must cover” issues for this project PLEASE LET ME KNOW! I really appreciate the feedback.

IMPORTANT DISCLOSURE! These backtests do not include any costs whatsoever and so should be taken with a grain of salt. While a once-per-year trading strategy is fairly easy to trade these days, the costs can still be significant when trading in small cap names. These test also have a fairly small sample size. With just about 300 stocks at any given time, the energy sector is small. The good news is that the factors that work in the energy sector work in the other nine sectors too, as we will see over the course of this series, and also work in international and emerging markets (which are nice out of sample tests).

Calculation Notes: everything, as always, is rebalanced on a rolling annual basis to avoid seasonality in the results. Only stocks with an inflation adjusted market cap above $200MM are included in the sample. Going smaller can improve results, but leads to trading and liquidity concerns. Due to several comments about excluding international stocks in part I, I’ve included non-U.S. stocks that have a U.S. listing in this study. Results are similar if the universe is U.S. stocks only, but are improved for the most part with a larger (global) universe.

[i] Shareholder yield = dividends yield plus buyback yield (% change in shares outstanding in prior year, negative better)

[ii] Dividend yield doesn’t “quintile” cleanly because of a group of stocks with zero yield.

August 11, 2014

Four Books For New Investors

Investing can be a daunting subject. I’ve always felt it should be a part of the high school curriculum, because we leave high school and college woefully underprepared to save and invest our money (8 years of French, though?!). Reading is the antidote to this problem. Below are four books which serve as a great introduction to smart investing. I am always the most intimidated by a subject (and therefore least likely to start learning) when I know nothing about it. As such, I’ve chosen books that are accessible, fun, and easy reads.

Simple Wealth, Inevitable Wealth by Nick Murray. If a loved one needed to learn about investing, and I could only give them one book, this would be it. This book takes nothing for granted. Murray explains the basics of saving and investing in well written, plain English, and gives new investors most everything they need to know to work towards a comfortable and prosperous retirement. As Murray says, “no matter how much money you have, if you’re still worried, you aren’t wealthy.”

The Little Book of Common Sense Investing by Jack Bogle. Jack Bogle and his company Vanguard have done more good for investors than anyone else. They’ve made it easy and incredibly cheap to access the entire stock market in a way that was impossible just a few decades ago. Bogle has written several books, but this one—which is short and sweet—is the best for new investors.

The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money by Carl Richards. If you want to be a successful investor, then controlling your own behavior is more important than your actual investment strategy. We are our own worst enemy when it comes to investing. This great book explains how to avoid getting in your own way and instead make smart decisions with your money.

The Richest Man in Babylon by George Clason. I don’t know about you, but I love when things are explained in narrative form, with heavy use of metaphor and analogy. This book is designed to explain the basics of saving and investing using a fun story. What you’ll see is that personal finance isn’t complicated at all, you just need to get off on the right foot.

There are many great books on investing, but these four will serve as a solid foundation on which to build. If you want more suggestions, I send out 3-4 each month. To receive those suggestions, you can sign up here.

August 6, 2014

The Putrid Portfolio

Just like it would be any investor's dream to have perfect foresight, it would be any short-seller's dream to know which stocks were going to fall by the highest percentages every year. In an earlier post, we saw that identifying a “perfect portfolio” ahead of time using valuation and other measures was basically impossible. But today we will see that finding the worst stocks, “the putrid portfolio,” may be much easier.

The putrid portfolio is formed by using perfect foresight to select the 25 stocks from a large cap universe that will perform the worst over the next 12 months. Think of this portfolio as Jim Chanos’s dream. Its historical return (since 1963): negative 50% per year!

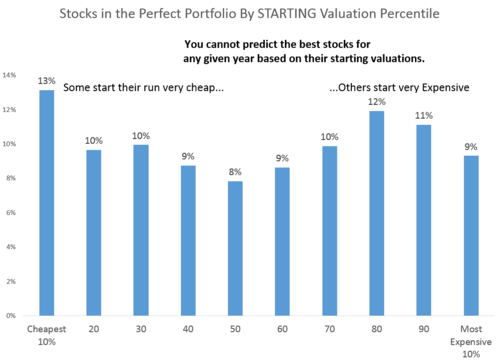

Wouldn’t it be great if these stocks could be identified ahead of time, so that you could avoid them or short the hell out of them? Turns out valuation is a good starting point for finding these putrid stocks ahead of time.

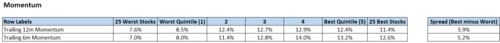

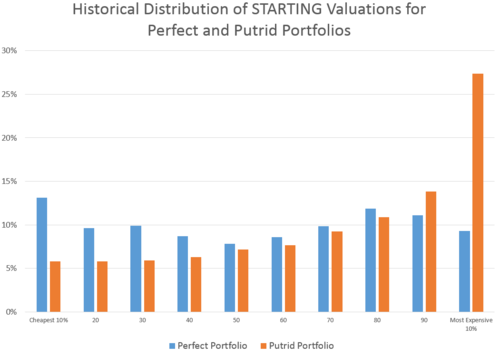

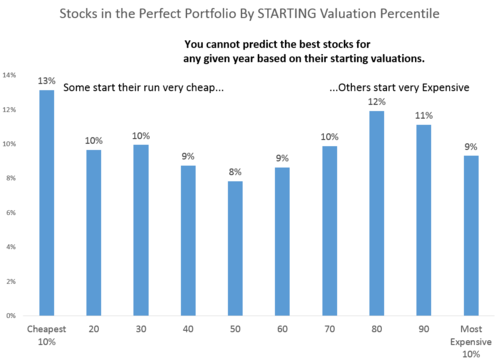

As a reminder, valuation was not a great guide for finding the best performers. Here is the historical distribution by STARTING valuation for the stocks in the perfect portfolio over the past 50 years. Pretty random. Some started expensive, others cheap.

But here it is for the “putrid portfolio.” There is a clear and strong relationship between valuation and putridity. Nearly a third of the worst performers each year started their terrible run trading at very expensive multiples.

Here are the two charts together.

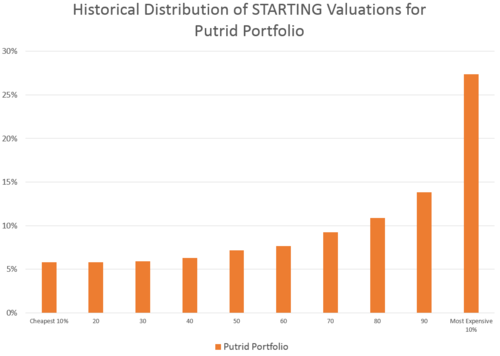

Why does this happen? Remember that valuations are a proxy for expectations. Higher price multiples (of earnings, cash flow, sales, etc) mean that the market is expecting big things from these expensive stocks. Often they have great prospects and great stories which seduce investors. Turns out, investors are often overly optimistic about these companies.

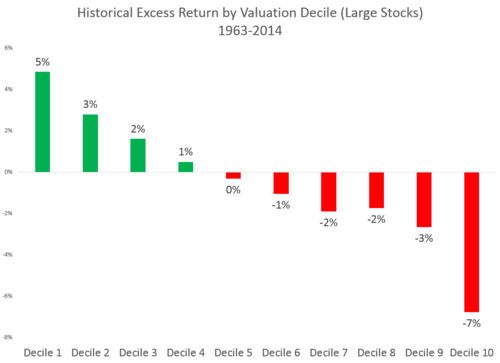

This phenomenon lines up neatly with the historical excess returns by valuation decile among larger stocks, shown below. Cheap stocks outperform by a nice margin (nearly 5%). But more interesting is the fact that the most expensive stocks underperform by an even wider margin (7%).

I’ve reached this conclusion in many different posts, but it bears repeating here. Some stocks priced at huge multiples (think $TWTR) will deliver outstanding returns. But as a group, expensive stocks have always delivered terrible returns relative to the market, and you would be smart to avoid them entirely rather than trying to pick the few diamonds in the market rough. You’ll miss out on the most fun stories, but your portfolio will be healthier for it.

August 5, 2014

Your Help With Millennial Money

My first book, Millennial Money, will be on shelves October 14th, and I need your help.

The book covers the why and the how of investing for millennials. It explains all the key ingredients for long-term investing success, and highlights the tremendous opportunity that exists for the youngest generation of investors.

Investing isn't a topic in high school, but it should be. Learning the right investing lessons early on in life can make a world of difference to someone's lifelong financial well-being. My hope is to provide a piece of that education for as many young people as possible. To do so, I would love if you could take a few minutes to fill out this brief form below.

My goal is to understand what motivates you to buy a book, other than the obvious things like good reviews, a catchy title & cover, press coverage, and so on. I'll use your responses to tailor the exclusive items offered in my pre-order campaign (in late August/early September), and to tailor my efforts come launch day. I deeply appreciate any help you can offer!

Get On The Pre-Order List

If you'd like to hear about the pre-order offer once it is finalized, enter your email here

What motivates you to buy a book?

Are there sources (blogs, podcasts, websites, or anything else) that influence your book buying decisions? If so, I'd love to hear about them. I want to reach as wide an audience as possible and am willing to try just about any tactic, Any and all ideas are welcome.

Pre-Order Offer: what would most interest you? *

I am going to offer several exclusive items for those that pre-order the book. Which of the following items would you be interested in? Please check all that you'd find interesting

Investor Curriculum - A comprehensive list of books, articles, and videos distilled from 11 years of reading and research

Do it Yourself Stock Screen - A full article with step by step instructions (and historical results) for a stock screen that you can run using a free online screening tool

Personalized Book Suggestions - You tell me what you are interested in, I select 1-3 books that you would enjoy

One on One - A one on one call to discuss investing

Millennial Money Research List - A full list of my sources for the book and how you can use them

Other Pre-Order Offers

Are there other extras that would interest you that are not listed above? If so, please enter any ideas below.

Thank you very much for your input!

Finally, if you run a website, podcast, or newsletter, and would like an advance review copy of the book, email me at patrick.w.oshaughnessy@gmail.com with your website/podcast details and approximate audience size and I'll work on getting you an early copy of the book.

Many thanks to all, with your help I think this launch will be a huge success!

Patrick

America, Inc.

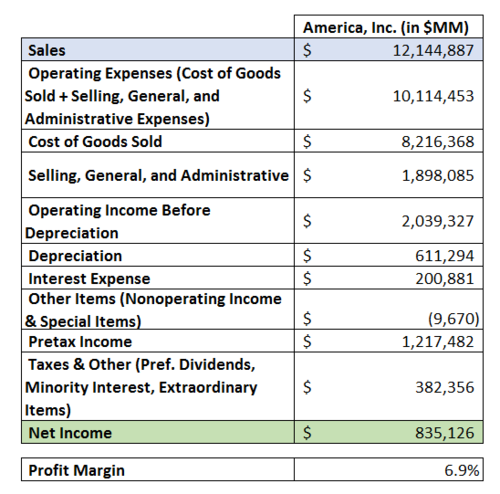

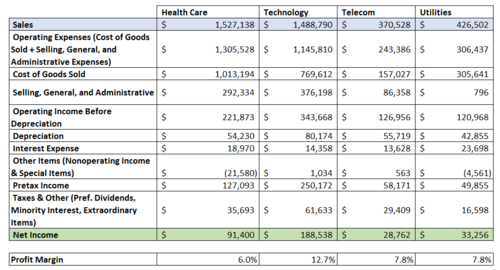

American business is a beast. Here is its income statement, as of June 30, 2014[i]:

$12 trillion in sales, over the last year. The costs of doing business remain high, but even at an aggregate profit margin of 6.9%, American enterprise is generating $835B in profits[ii].

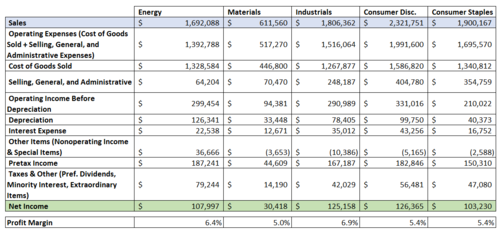

We can think of each economic sector as a subsidiary of America, Inc. Here is how they stack up.

Consumer stocks alone make up $4.2T of total sales, but margins are lower at 5.4%. Energy continues to dominate, as offshoots of Rockefeller’s original Standard Oil—Exxon and Chevron—continue to produce massive profits 155 years after the first “rock oil” was discovered in Pennsylvania.

America, Inc. continues to lead in technology, where its companies are earning an aggregate profit margin of 12.7%. Telecom and Utility stocks are much smaller “subsidiaries,” with combined sales of less than $700B, but both sport healthy margins.

America, Inc. is a quite the business: diversified, innovative, and massively profitable. This begs a question for millennials: would you rather sit in cash, or buy a slice of America Inc. ($SPY) with the click of a button[iii]?

[i] I’ve excluded financials for this post, because they don’t fit cleanly into traditional income statements. With financials included, total sales would be roughly $14T and net income would top $1T.

[ii] To be included in this calculation, a company has to be domiciled in the U.S., ADRs and other foreign stocks listing on a U.S. exchange are NOT included. I've excluded micro caps, but they don't add up to much. Private companies are NOT included in these calculations

[iii] I know I always argue against home bias, and indeed I think $ACWI is a better option for total global exposure, but I am just having some fun here.

August 4, 2014

The Perfect Portfolio

The best investing super-power would be perfect foresight. Imagine if every year you knew which 25 stocks (from a large, liquid universe just to keep things reasonable[i]) would be the best performers over the next year? This foresight would translate into outrageous annual returns over the past 50 years of 80% per year[ii]! Wouldn’t it be great if you could know about these stocks ahead of time? Even just one or two?

Last year’s “perfect portfolio” would have included Facebook, Tesla, Delta Airlines, Netflix, Orange (formerly France Telecom), and Alcoa. These companies came from all different corners of the market, and many would have doubled your money in just one year.

As exciting as these returns are, the important thing about these companies is that there is no rhyme or reason to how they look at the beginning of their run. I ran a profile of all “perfect portfolio” stocks since 1963, hoping to find traits or factors which these stocks had in common. Maybe they were often super-cheap to start the year, or had huge recent price momentum, or were stocks of outstanding quality. But none of these hopes proved true.

Let’s look at their starting valuations, for example. It is well established that cheap stocks outperform expensive stocks over time. But perfect portfolio stocks came from across the valuation spectrum. They were almost evenly distributed across starting valuation percentiles (where percentiles were calculated based on simple measures like price-to-earnings and price-to-sales).

The same story was true for momentum and quality (two other proven ways to select outperformers): there were no common traits among the best performing stocks.

The sad fact is that headline-making high flying stocks are impossible to identify ahead of time with any degree of consistency. Of course, investors will never stop trying to find this market equivalent of the Holy Grail. Sadly for investors, this grail quest will result in high costs and frustration, not 80% returns.

[i] Large defined as any stock with a market cap larger than the entire universe’s average market cap. Today would have a market cap floor of $7.3 billion

[ii] Of course, these returns are impossible in the real world. If you started with $1,000,000 and earned 80% annual returns, you’d own the entire global stock market (all $70 trillion of it) by your 27th year. You’d also end up owning entire companies early on and be unable to trade and earn the 80% returns for long.