Ruth Soukup's Blog, page 74

September 25, 2015

5 Things to Do Now for a Happier Holiday

Today I am happy to welcome back my friend Cherie Lowe from the Queen of Free, who has graciously joined us here at LWSL as a regular monthly contributor. Cherie is the author of the amazing book, Slaying the Debt Dragon, which she wrote after paying off more than $127,000 in debt! I am so excited to have her bringing her wealth of knowledge & experience on this subject to LWSL–please join me in making her feel right at home!

* * *

This is a Guest Post from Cherie at Queen of Free

Look. I can’t see through the other side of the screen but I know some of you are glaring at me right now. I can even hear what you’re saying (even if it’s just in your head).

Quit talking about Christmas.

We haven’t even had Halloween yet.

It’s not even October.

Everyone just wants to skip right over Thanksgiving.

I mean, can’t you even be grateful before you start talking about gifts?!

I get it. And a part of me completely agrees with you. It seems like the decorations and the store displays creep out earlier and earlier each year. Before you know it, the aisles of your super-center will be bedecked with green and red in the middle of August.

However, as a family who has tackled and then paid off quite a bit of debt ($127,482.30 to be exact), I know what can happen if you don’t prepare for the holiday season. In January, you’ll hate yourself for overspending and maybe even borrowing to celebrate Christmas. You’ll wish you could travel back in time and make better decisions. You’ll long for a way to undo the financial damage you’ve done and you may never even recover from a lack of planning.

So while I’m not rushing the season, I’m basically future you, here to remind you that each year December 25th pops up on the calendar and to celebrate well, you need a blueprint to keep the happy in your holidays.

Have Difficult Conversations (Now)

Let’s be legit. Some of you purchase gifts for too many people. Passing presents around in a circle has gotten wildly out of control. You’re buying for your cousin’s aunt’s neighbor’s nephew. You drop $50 on the checkout clerk at the grocery store.

Don’t misunderstand me. It’s OK to be generous. It’s a wonderful thing to bless your friends and family with gifts at Christmas. However, it’s not OK to have zero boundaries.

But you can’t wait until December 24th or even 1st to have difficult conversations about gift giving. For some families it may even be too late in October if there are shoppers who begin their process midyear.

Time is on your side the earlier you begin to wade into the waters of who you are and aren’t purchasing gifts for this year. Looking for some strategies to open up the discussion? Check out this post on Uncomfortable Christmas Gift Giving Conversations.

Start Saving Money (Now)

I’ll be honest, I’d prefer you begin the process of building a holiday fund on December 26th. However, there’s still plenty of time to begin socking back cash so that you don’t have to spend money you don’t have this Christmas. You can choose to set aside a percentage of your regular paycheck.

Have unexpected funds come your way? Don’t blow through them. Bank them and keep your seasons merry and bright.

Make Extra Money (Now)

Again, time is on your side to help you make extra money to fill in the gaps you need to keep your budget balanced this year. Even if you can’t pick up a second job or seasonal employment, there are plenty of ways to rake in the dough.

Begin by sorting through your jewelry box to find any broken or unwanted gold pieces. I’m not talking about your great grandmother wedding ring. But you might be surprised at how much that necklace you never wear (or can’t wear because it snapped in two) is worth.

You can also sell other items in your home. From the treadmill piled high with laundry to the collection of baskets you have amassed to the décor items from three years ago, one person’s trash is truly another’s treasure. You could choose to have a garage sale during the pleasant fall weather. Or you could simply post pictures of items to Facebook, seeing if anyone is interested.

Books, clothes, kids’ toys – your inventory is much larger than you realize. For even more ideas, check out 5 Ways to Make Christmas Cash.

Begin Budgeting (Now)

A handful of years ago, I would have groaned and made ugly faces at you if you told me I needed to budget for Christmas. Budgets and I did not get along. In fact, I saw budgets as killjoys and ugly ogres.

After six years of faithfully forecasting our finances, budgeting is now my best friend. By the way, I found that merely changing my lens on the process and referring it to as forecasting instead of using the “b” word gave me a better attitude. Instead of focusing on what a budget limits me to do, I recognize that a budget actually allows me to accomplish so much more.

Think through all of the areas of spending possible. Believe it or not, this might be easier now than when the holiday approaches. From food to photos or even fashion (you might need a new ugly Christmas sweater after all), holiday spending reaches far beyond gift giving. A little distance will allow you to drill down each category and target an amount you’d like to stick to this year. Don’t know where to begin? Check out these free printable Christmas budget forms.

Pledge to Remain Debt Free (Now)

In the fall, everyone’s an idealist. We won’t overspend this year. We won’t borrow money to celebrate a holiday. We won’t over eat or over do it or over commit.

Somewhere mid December, all of our “won’t”s turn into “Why not?”s and then in January we’re left with only the “Why did I?”s. This is precisely why you should take a pledge to remain Debt Free this Christmas season now.

Long before you purchase your holiday ham or turkey, in a time before Black Friday ads and irresistible deals, make yourself a promise to refrain from using plastic to make your purchases. I love this free printable because I can put it on my refrigerator and in my planner for a visual reminder of my goal. It anchors my soul and keeps me focused.

Pen your own promise or borrow mine, but dedicate yourself to the pursuit of remaining debt free this year.

You don’t have to rush through the days that lead up to Christmas. However, you do need to use the time you have to ensure this holiday season is truly happy. Solomon – the wisest man to ever live – once said “Careful planning puts you ahead in the long run; hurry and scurry puts you further behind.” Proverbs 21:5 The Message

There’s no need to hurry and scurry. Plan your holiday spending to safeguard your bank account and your soul.

Cherie Lowe is an author, speaker and hope bringer.

Her book Slaying the Debt Dragon details her family’s quest to eliminate over $127K in debt in just under four years. As her alter ego the Queen of Free, Cherie provides offbeat money saving tips and debt slaying inspiration on a daily basis.

Pin It

The post 5 Things to Do Now for a Happier Holiday appeared first on Living Well Spending Less®.

September 23, 2015

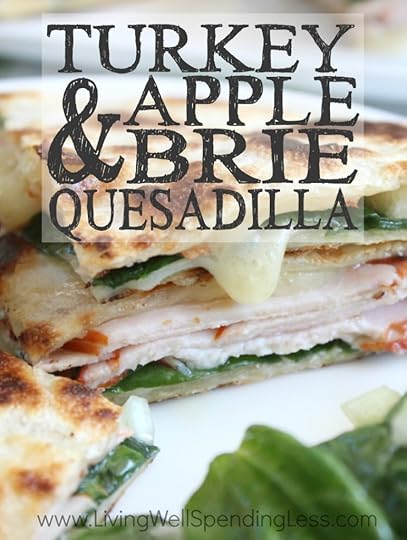

Turkey, Apple & Brie Quesadilla

September is here and that means the return of busy weeknights filled with homework and football practice. Between spelling words, packing lunches, and shuttling the kids to and from the football field, who has time to give dinner more than a fleeting thought? On nights like these it’s tempting to pick up the phone and order a pizza, but that would take a serious toll on our wallets (and our waistlines)!

Instead of taking a detour to the nearest drive-thru, I rely on quick and easy meals like these Apple & Brie Quesadillas to get us through the hustle and bustle of the busy school week. This tasty meal comes together in under 10 minutes and requires only a handful of wholesome ingredients- spinach, apples, Brie cheese, sliced turkey, and tortillas are all you need.

My favorite thing about this effortless meal is that it’s a dish that the whole family will enjoy. That’s right, fellow moms, it’s possible to not only get your kids to eat spinach but to like it too! Spinach is a superfood that packs a nutritious punch of vitamins and minerals. I guess Popeye knew what he was doing after all!

Each bite of these Turkey, Apple & Brie Quesadillas has the perfect balance of crunchy tortilla and creamy, melty cheese. The fresh Granny Smith apples offer just a hint of tangy sweetness and pair perfectly with the peppered turkey and earthy spinach. We like to serve our quesadillas hot out of the pan alongside of a simple spinach apple and fennel salad (a double dose of healthy yum)!

The school year has just begun and we’ve got many busy weeks yet to come. I’m sure there will be the occasional take-out order, but with a few quick, easy, and nutritious meals like this in my back pocket, I know our family is ready to stay healthy and wholesome in the days ahead.

Here is what you need:

6 Flour tortillas (fajita size works best)

5.8 oz Brie cheese, rind removed and cut into small pieces

Fresh spinach, roughly 1 cup, stems removed

1-2 Granny Smith apples, thinly sliced

1/4 lb thinly sliced deli style turkey (I used a peppercorn turkey).

Step 1: On one tortilla, layer together the Brie cheese, spinach, apple slices and several pieces of turkey. Then, on another tortilla place more Brie cheese.

Step 2: Next, in a large nonstick pan over medium heat, cook the tortillas until they are golden brown and the cheese has fully melted.

Step 3: Once both tortillas have cooked, combine them together and press lightly so that the cheese spreads throughout the quesadilla.Slice into wedges and serve immediately. Enjoy!

Print This!

Recipe: Turkey Apple & Brie Quesadillas

Summary: This tasty meal comes together in just ten minutes and is sure to please even the pickiest of eaters.

Ingredients

6 Flour tortillas (fajita size works best)

5.8 oz Brie cheese, rind removed and cut into small pieces

Fresh spinach, roughly 1 cup, stems removed

1-2 Granny Smith apples, thinly sliced

1/4 lb thinly sliced deli style turkey (I used a peppercorn turkey)

Instructions

On one tortilla, layer together the Brie cheese, spinach, apple slices and several pieces of turkey. Then, on another tortilla place more Brie cheese.

Next, in a large nonstick pan over medium heat, cook the tortillas until they are golden brown and the cheese has fully melted

Once both tortillas have cooked, combine them together and press lightly so that the cheese spreads throughout the quesadilla. Slice into wedges and serve immediately. Enjoy!

Preparation time: 5-7 minutes

Cooking time: 10 minute(s)

Number of servings (yield): 3

The post Turkey, Apple & Brie Quesadilla appeared first on Living Well Spending Less®.

September 21, 2015

When Your Friends Let You Down

What is it about female friendships that can send us right back to junior high? Most of the time I tend to think that at 37 years old, I am well past all that girl drama. I have lots wonderful acquaintances, but only a very small handful of people I would consider my close friends, my “people.”

What is it about female friendships that can send us right back to junior high? Most of the time I tend to think that at 37 years old, I am well past all that girl drama. I have lots wonderful acquaintances, but only a very small handful of people I would consider my close friends, my “people.”

Those are the ones I trust completely, the ones I can pour my heart out to, and the ones who I know will be there for me no matter what, the ones who are immune to all the jealousy and pettiness and cattiness that so often crops up between us women. They are the ones for which no explanation is necessary when we haven’t talked for a while, the ones who can pick up exactly where we left off, like no time has passed. The ones who understand that life gets crazy sometimes, and don’t take it personally.

They are the ones who won’t ever let me down.

Except, of course, when they do.

What then?

Not so long ago I found myself in exactly this situation. One of my very closest friends was suddenly not so close anymore, and I had no idea why. For a while I tried to blow it off, to brush away that gnawing gut feeling that something wasn’t quite right. And then, when the feeling didn’t go away, I even called to apologize. I told her I wasn’t sure what I had done, but it just felt like something wasn’t right, and that I was genuinely sorry for anything I may have done that had caused the rift I was feeling. She laughed it off and assured me that it was nothing, but still the uneasiness lingered.

I wondered if I might just be paranoid.

But as time went on, it became more and more clear that I wasn’t just being paranoid. The uneasiness remained and instead, this friend, the one I had trusted and leaned on, admired and looked up to, stayed up until all hours talking to, the one I would do anything for, was quite clearly no longer interested in my friendship. She stopped responding to emails and text messages and suddenly no longer had time to chat, even though I could see from her social media posts that she was making time for lots of other friends.

And then, in the moment I needed her most, she completely let me down. I had reached out to ask for help on a project that was very important to me, sent her both a long email explaining what was going on, and two text messages asking her to check her email. She ignored them all.

It crushed me.

All at once I felt like I was 14 years old again. I replayed every conversation, every email, every text message over and over again in my head. I cried. Then I got angry. Then I cried some more. What had I done?

Finally, feeling completely lost, I called my friend Edie to talk about it. As my accountability partner, I knew she would probably have some good advice. If nothing else, she would be a shoulder to cry on. I half hoped she would commiserate with me and reassure me that this other friend was just a jerk and I would be perfectly justified to never speak to her again.

But that’s not quite what happened.

While she did commiserate and fully understand exactly why I so was hurt and angry, her advice took me completely off guard.

I think you should give her grace, she said quietly.

Every part of me protested. But she is the one who should apologize! She is the one who hurt me! She doesn’t deserve grace!

No, she doesn’t, Edie agreed. But neither do we.

Oh.

Chagrined and humbled, I promised to try to give grace, even if I didn’t feel like it. And wouldn’t you know it? Not 24 hours later, an opportunity arose. The friend who had let me down now needed me.

Friends, I had to dig deep. The last thing on earth I felt like doing was helping the friend that had just wounded me without an ounce of remorse or a word of apology.

But I did it anyway.

And you know what? It didn’t fix our damaged friendship. There was no dramatic change of heart, no “aha” moment, no tearful reconciliation. Just the opposite, in fact–in the time since, she has let me down several more times, and I have simply had to come to terms with the fact that our friendship will probably never again be what it once was.

But although it didn’t fix anything, it did make me feel better. It took away the bitterness that was filling up my heart and allowed me to let go of the hurt and anger I was feeling. It has also allowed me to have a lot more compassion, and to see that perhaps the problem isn’t something I’ve done, but maybe just a result of something she is going through.

It often takes a whole lot of effort and intentionality to be a good friend. It means being willing to put yourself out there and to risk being hurt. And, inevitably, because we are making ourselves vulnerable, there will be times where our friends disappoint us and let us down. They will hurt our feelings. They will annoy us. They will forget to show up or say something stupid, or make a decision we don’t agree with. They will be flawed and imperfect and inadequate. In other words, they will be human.

And although we may be justified in our anger or our hurt, the truth is that there have probably been plenty of times when we’ve been the ones to let our friends down, the ones who said something careless, the ones who didn’t come through, the ones in need of grace. At least I know I have.

In order to have a friend, we must BE a friend, and ultimately that means showing grace when our friends don’t come through the way we want them to. It means forgiving when necessary, looking for the good instead of the bad, and treating them the way we’d like to be treated, the way we’ve already been treated.

Even when we don’t feel like it.

Pin It

The post When Your Friends Let You Down appeared first on Living Well Spending Less®.

September 18, 2015

What Every Mom Needs to Know About Investing

I don’t know about you, but just the idea of investing completely intimidates me. It just seems so complicated, so out of reach, so scary…..like one of those things you are supposed to understand, but too embarrassed to ask anyone about. Oh sure, many of us “invest” when the opportunity presents itself—opening a 401(k) when our company offers us one, maybe purchasing a life insurance policy or inheriting some money invested in mutual funds. But then, if you are anything like me, we conveniently forget to think about it.

Of course, deep down, there’s this nagging feeling, isn’t there? This idea that we SHOULD understand investing clearly, and we COULD be making our money work for us.

Part of finding financial peace is about getting control of your finances and your debt, then making progress by starting to save money. Understanding finances and basic investing concepts can also be part of that journey.

There’s nothing worse than feeling like we don’t have a handle or understanding on something, particularly when it comes to money. It can be uncomfortable, even embarrassing to admit lack of knowledge about something we use on a daily basis, but it is important to refuse to let yourself be intimidated. After all–you are certainly not alone! The good news is that you don’t have to become an expert. However, gaining a basic understanding of the difference between a mutual fund, a stock, a bond, an IRA or a 401(k) is a good thing. It will only serve to enrich you as a person and to help you feel more in control.

Investing: Starting Out on the Right Foot

One of the hardest parts of investing is being in the right place to do so. Before you start to think about investing, it is important to make sure you’re completely out of debt. Yes, I know that’s hard to stomach. But think about it—if you’re only earning 3% on your investments, but you’re paying 6% interest on your debts, you aren’t doing yourself any favors. (For more advice on paying down debt, check out our Debt Free Living section!)

Of course we often hear these amazing statistics about how if a person starts investing at age 25 they’ll be ready to retire with millions at 65, whereas someone starting in their 40s may not retire until 70 and still have to live on a meager income. Unfortunately, this is true—investing at a younger age will yield a much higher and better outcome. You’re getting your money to work for you right away and you’re earning interest so you can take larger risks.

We all want to be that person. Realistically, though, most of us have taken a few steps on our journey that may have lead us down the wrong financial path for a while. Perhaps you still have major student loan debt that you and your spouse are trying to pay off. Maybe you have credit card debts and car payments—and maybe you frittered away money in your twenties like it grew on trees….but that doesn’t mean it is too late!

Hopefully by now you’ve learned a few things and you’re starting to get on the right track. If you’re still new to this “living well on a budget” thing and you’re looking for ways to get started with your finances, check out Living Well Spending Less, 12 Secrets of the Good Life or join our 31 Days of Living Well & Spending Zero Challenge.

Several years ago, my husband and I attended the life-changing Financial Peace University through our church, and it really helped us get started down a better path to financial stability. In both FPU and his book, The Total Money Makeover, Dave Ramsey outlines several steps to achieving financial peace. The FIRST step is to immediately save a $1,000 emergency fund, the second is to get out of debt, and the third is to establish a larger emergency savings fund of 3 to 6 months of income.

It sounds daunting, but there are many ways you can get there. It’s a huge lifestyle change and growth experience for many of us. My husband and I are still on our journey, but it’s amazing how fast things start to come together with a little faith, prayer, dedication and reframing of your thoughts.

But once you have the first three steps covered…where do you go next?

Priority One: Retirement Planning

Before you start going for the real-estate market or start living out your philanthropic dreams, it’s important to consider your retirement. Many employers offer a 401(k) (or 403(b) if you work for a nonprofit) match or contribution. If you’re lucky enough to have such an offer—take it! These are pre-tax contributions to your retirement and your employer’s matching contribution allows you to grow your fund twice as fast!

Once you’re investing the maximum percent your employer will match, consider investing an additional 10 to 15% of your income in a traditional IRA or a Roth IRA. A traditional IRA offers a tax-free investment vehicle for your retirement. A Roth IRA offers you tax-free withdrawal upon retirement. Both have penalties (and taxes) should you choose to withdraw your money early, so it’s not recommended unless you are facing very dire circumstances.

There are a wide array of options as to “how” to invest your retirement funds. Mutual funds are typically the safest and most practical option. There are different packages that can help manage risk of investment, but the variety can get quite confusing. Work with a financial advisor (first check out this list of Dave Ramsey’s Endorsed Local Providers) to help you navigate the numerous options available.

Some investment funds offer a regular rate of growth and some are more aggressive. There are people who work very hard calculating risk factors and setting up fund packages so that they are balanced and safe. If you have a low risk tolerance because you’re getting closer to retirement and you might not have time to recover from a loss, then you’ll want to go with less aggressive funds.

Moving your invested funds around too often or too quickly is one of the biggest ways to lose money when investing. Anyone who watches the news knows the market can go way up and way down based on the latest news story, weather crisis or other outside factors. Panicking and moving money around causes investors to lose big dollars. Be wise and trust your financial advisors—they’re paid to steer you in the right direction. Plus, they do well if you do well, so they have a vested interest in your success.

You should have some form of life insurance as well. Find something with a 15-year term and a benefit of 8 to 10 times your annual income. This protects your loved ones and provides for your spouse and children in the case of an untimely death. Whole or Universal Life are “cash value” permanent policies, meaning you have the option of borrowing against them. That said, the premiums are often astronomically high. So for most people they’re not a good option, especially compared to term policies.

Priority Two: Save for College

In my What Every Mom Needs to Know about Paying for College post, I recommend you first ensure you are in a good financial place before starting to save for your child’s college education. (Think of it as securing your own oxygen mask before helping others)

Once you’ve ensured your future is secure, you’re living debt free, and your retirement money is well invested, starting a savings vehicle for your kids’ college can be a great idea. Look into an ESP (Educational Savings Plan), or if you have a larger amount to invest, try a 529 plan. Both of these vehicles are set up specifically to help parents save for their children.

Priority Three: Secure Your Future

So, once ALL of your steps are completed: you’ve paid off your debt, you’ve got a nice savings put away for emergencies, you’re contributing a healthy amount to retirement, and your children are ready for college…well, first, have a glass of wine and pat yourself on the back! This is an amazing place to be!

If you’re ready to invest, I highly recommend that you meet with a financial advisor to discuss your options. A good advisor will spend time getting to know you and your spouse in order to assess your comfort level with risk. In our assessment, for example, my husband and I discovered that while I am very comfortable with risk (more of an entrepreneur mindset) my husband doesn’t like risk at all. Our advisor very wisely helped us come up with a plan that took both those preferences into account.

As a general rule, the safest and most practical option is in mutual funds, but there are lots of are other savings vehicles and options including bonds, CDs, single stocks and annuities. Once you’re safely and comfortable invested, real estate can be a good option as well.

Financial Freedom Means Choices

The joy of financial freedom is that you have options as you continue to grow your wealth, provide for your family, and give back to others. Imagine the wonderful feeling of using your financial solvency to help those in need, leave a legacy behind, or make a difference in your community! It’s all within your grasp once you have control over your finances, and you’re committed to living within your means, no matter what your income. Good luck on your journey!

Pin It

The post What Every Mom Needs to Know About Investing appeared first on Living Well Spending Less®.

September 16, 2015

Browned Butter Pasta with Peas

I’ll be the first to admit that I’m not really a foodie. Don’t get me wrong, I love food, and I don’t mind cooking, but most of the time, in the midst of a busy day/week/month/year, I just want food that tastes good, whips up fast, doesn’t use a ton of dishes and does use the pantry staples I already have on hand.

This simple browned butter pasta with peas definitely fits the bill! With just five super easy ingredients (that you probably already have on hand) it comes together in just 20 minutes for an effortless, budget-friendly meal your whole family will love! (And if your family needs a little meat, you could always throw in some cooked turkey or ham!)

4 TBSP butter

1 14oz bag frozen peas

1 box bow tie pasta

1 cup Parmesan cheese shredded

2 TBSP olive oil

salt & pepper, to taste (optional)

Step 1: Boil water, then add pasta and cook till al dente.

Step 2: While pasta is cooking, heat large sauce pan over med-high heat and melt the 4TBSP of butter until browned.

Step 3: Add peas and olive oil to saucepan, reduce heat slightly and saute until peas are heated thoroughly. Keep warm until pasta is done cooking.

Step 4: Drain pasta & return to pot. Add peas to pasta.

Step 5: Toss pasta and peas with Parmesan cheese. Season with salt and pepper to taste. Serve immediately.

Print This!

Recipe: Browned Butter Pasta with Peas

Summary: This delicious dinner comes together in 20 minutes with just 5 budget-friendly ingredients!

Ingredients

4 TBSP butter

1 14oz bag frozen peas

1 box bow tie pasta

1 cup Parmesan cheese shredded

2 TBSP olive oil

Instructions

Boil water, then add pasta and cook till al dente, per box instructions

While pasta is cooking, heat large sauce pan over med-high heat and melt the 4TBSP of butter until browned.

Add peas and olive oil to saucepan, reduce heat slightly and saute until peas are heated thoroughly. Keep warm until pasta is done.

Drain pasta; return to pot. Add peas to pasta.

Toss with Parmesan cheese. Season with salt and pepper to taste

Preparation time: 3-5 minutes

Cooking time: 10-15 minute(s)

Number of servings (yield): 4-6

Pin It

The post Browned Butter Pasta with Peas appeared first on Living Well Spending Less®.

September 14, 2015

Periscope 101: What It Is, Why It Matters, & How to Start

There’s a brand new app that has taken the social media world by storm over the last few months, and while I’m just starting to figure it out myself, I’m so excited about it that I think it warrants it’s very own blog post.

What It Is

You may have already heard of it, or maybe not–it’s called Periscope, and it seriously rocks. In a nutshell it is a platform that allows users to conduct live broadcasts anytime and anywhere. Those watching the broadcast can comment, ask questions, and “heart” the broadcaster in real time, and the broadcaster can read the comments as he or she is talking. (And, in case you are wondering, it’s free.)

I’ll be honest, I tried to ignore it at first. I mean, really, who has time for yet ANOTHER social media platform, much less one that involves live broadcasting? Right?

But then, hearing so many people talking about it….I got curious, so I downloaded the app and started watching. Almost instantly, I was hooked. There is something incredibly powerful and FUN about watching and interacting with someone in real time.

Why it Matters

Let’s face it–we can all use a little extra encouragement & motivation sometimes! There is something so reassuring about knowing we’re not alone, and that other people sometimes face the same struggles that we are too afraid to talk about.

In fact, if you subscribe to my weekly email newsletter, you know that the newsletter is the space where I keep it totally real, and where I lay it all out there. Each week I share personal lessons from my own life and experience, and include a strong dose of encouragement, inspiration, and motivation. I look forward to writing that letter each week, and I also LOVE all the responses I get back. Reading my email on Friday afternoon, and hearing what is going on in YOUR lives is my favorite part of the whole week. It reminds me why I do what I do.

And then…Periscope happened.

After a few weeks of watching, I decided to take the plunge and start broadcasting, because I realized very quickly that this is an element that Living Well Spending Less has been missing. I don’t always get super personal here on the blog, because want it to be an amazing resource, full of well-researched, in-depth posts that you can refer to again and again.

Periscope is a little different. Oh, don’t get me wrong, my Periscope show–like this blog–is still very much dedicated to discovering the Good Life (on a budget), but on Periscope, you just get me (@RuthSoukup), totally unscripted, along with a strong daily dose of encouragement, motivation, and inspiration.

For instance, last week I “scoped” about creating good habits for fall, 3 things that hold us back (& what to do about them, finding inspiration, choosing your ONE thing amid a busy world, and even how to pick yourself up when life knocks you down, where I talked very honestly about my own struggle with depression.

I also watched a variety of inspiring scopes, everything from business & blogging tips to ideas for goal setting, saving money, improving my marriage, and even how to make salsa.

Now, the thing about Periscope is that it is best watched live, because you can interact and ask questions or comment in real time. However, if you can’t make it live, you can view the replay right on the Periscope app for up to 24 hours after the broadcast.

That said, I have also set up a page at Katch.me/RuthSoukup to store all my past Periscope broadcasts, if you want to see those as well. You can find it HERE.

If you are planning to join us in October for 31 Days of Living Well & Spending Zero, you should especially consider getting started on Periscope, as I will be hosting live scopes related to each day’s challenge, which should be a LOT of fun!

How to Get Started

If you haven’t yet downloaded the Periscope app, I encourage you to do that HERE. Don’t worry–it is completely free! If nothing else, even if you’re not ready for a new social media platform, just secure your name before someone else does (or you might regret it in 2016!)

Once you have downloaded the app & signed in, getting started is really easy:

First, search for the people you want to follow by clicking on the “People” icon all the way to the right and hitting the small magnifying glass in the top left corner. (To find me, just search for @RuthSoukup. I usually try to scope daily sometime between 10 & 11am EST.) Periscope will notify you when the people you are following are live.

While watching a broadcast, you can leave interact, ask questions, and participate in the discussion by typing into the comments at the bottom of the screen. You can also give hearts (Periscope’s way of letting the broadcaster know you like what their saying) by tapping the left side of your screen.

If you can’t watch a broadcast live, you can catch the replay for up to 24 hours after the initial broadcast. The recent broadcasts of the people you follow will appear in your home screen.

To start your own live broadcast, simply choose the broadcast icon, then type in the name or subject of your broadcast and press the start button. People following you will be instantly notified that you are live.

And really, that is about it–easy, right? I’ve never really posted about any type of social media before, but this is one I am really excited about, and I would love to have you join me!

P.S. Today I’ll be scoping about procrastination and some easy ways to overcome it! Look for me around 10:30am EST.

Pin It

The post Periscope 101: What It Is, Why It Matters, & How to Start appeared first on Living Well Spending Less®.

September 11, 2015

5 Simple Habits That Will Transform Your Finances

This is a guest post from Kalyn of Creative Savings

Managing money is a never-ending process. As much as I wish it were just another item on my to-do list that I could check off and declare officially done, that’s simply not the case!

You know the phrase, “out of sight, out of mind”? That’s exactly what happens when you don’t stay on top of your money. You forget what you’ve spent, and quickly lose sight of those lofty savings goals you wrote down at the beginning of the year.

While some might say you need to budget once a month, plan weekly check-in’s, or have an occasional money chat with your spouse to stay on track, I think it requires much more maintenance than that to avoid potential money leaks. Daily habits are the key to success, and these 5 will keep you focused on the goals ahead!

1. Spend Smart

Almost every single day we spend money — whether it’s on a quick grocery store run, pumping gas in the car, or purchasing an item we found online. But what we often fail to do, is ask simple questions about the money we spend, such as:

Could I get by without this item?

Could I get it for FREE, or could I borrow it?

Is there any way I can I get for less?

I know that seems like a lot of questions when you’re picking up something really simple like a bag of apples or a package of socks, but the answers are as easy as a 5 minute search online for a printable coupon, downloading a money saving app, or waiting a few weeks until an item pops up on Craigslist instead of paying full price.

The point is to think through any purchases you might possibly make that day before heading out to the store and handing over your hard-earned money. Just a few minutes of brainpower could be the difference between a few dollars, or a few hundred!

2. Keep Track of Receipts

I’m a big proponent of expense tracking {yes, down to the very last penny!}, and even have a little receipt jar in my office where every receipt goes after I get home from the store or running errands. This saves me loads of time that I would have previously spent digging around in pants pockets or purses trying to make sure I didn’t miss anything.

I might not get to entering in all my receipts every day {this is usually a once a week process}, but it’s a visual reminder of what I’m spending every day, and that’s what counts. When my little jar is stuffed full in just a couple of days, I know my spending is getting out of control, and I need to be a little more careful.

Instead of the paper/pen route, you could also download a receipt tracking app, like Smart Receipts {Android} or OneReceipt {Apple}, and snap a picture of your receipt to create an instant digital footprint.

3. Check Your Bank Account

Sometimes we don’t always have a receipt for purchases we make. For example, have you ever signed up for automatic payments, or had a receipt emailed to you from a department store?

These purchases quickly bury themselves in your inbox if you don’t stay on top of them. I like to check my bank account every day so I don’t miss anything and always know what’s going in and what’s coming out.

This is also a good idea if you carry a credit card. Check your account every day, or every other day, and keep an eye out for unauthorized purchases. If you wait too long, you might have hundreds charged to your card, without even knowing it — yikes!

4. Find Ways to Be Thrifty Around the House

Managing money isn’t just about spending, it’s about saving too, and there are so many creative ways to do this right at home! Here are a few things that will save a few dollars every day:

Eat at Home — Start meal planning and/or freezer cooking to avoid spending money at overpriced restaurants. You should also be diligent about eating leftovers to eliminate waste.

Experiment with Homemade Cleaners — It’s incredibly easy to make your own cleaning products and they cost pennies compared to bottles at the store. You probably have most, if not all, of the supplies in your pantry.

Take Time to Organize — Organization really does save you time and money, and it’s unbelievable how many treasures you find when you take the time to properly label and put things away.

Repurpose and Reuse — Our grandparents were very diligent in finding alternative uses for supplies that could very well have gone straight to the trash. Before throwing an item away, see if you can give it new life. Just be careful not to let it turn into clutter!

5. Communicate with Your Spouse

I find that the best way to get my spouse on board with any financial goals, is to keep him in the loop. If my husband has no idea what he can and cannot spend, he will probably spend more often than not!

A quick chat in the morning or evening about any purchases we need to make that day makes all the difference. I also like to physically show him our budget and bank accounts so he knows exactly where we stand and how much money we have designated for each expense.

Maybe your spouse is the one that actually does the finances. I still encourage you to ask questions and communicate just to keep yourself informed. Working together not only leads to a stronger marriage, it avoids potential money conflicts too.

If you’re tired of feeling like you can’t stay on top of your money, try one or two of these habits until they become just another part of your daily routine. Then add on a couple more until you’re practicing all 5 without really thinking about it. You just might find that managing your money isn’t so much of a chore after all!

Kalyn Brooke is a full-time writer and blogger at CreativeSavingsBlog.com, where she gives a fresh perspective on frugal

living, and the kick-in-the-pants you need to create a budget from scratch. She lives in beautiful Southwest Florida with her news-photographer husband and one terribly destructive rabbit. She loves making to-do-lists, reading good books, eating chocolate peanut butter ice cream, and pursuing big big dreams… all carefully planned out, of course.

Pin It

The post 5 Simple Habits That Will Transform Your Finances appeared first on Living Well Spending Less®.

September 9, 2015

Honey Almond Peanut Butter Bars

This is a guest post from Gina of Kleinworth & Co.

It’s that time of year where goodies & treats become more abundant. But you know what doesn’t become more abundant, time! Seems that the more the calendar fills with things to do, the more the demands keep piling on. So with all the bake sales, school functions & all the other commitments that happen once kids are back in school & the holiday season is upon us, I really start relying on my quick & simple no-bake recipes. With all the things to do, who has time for baking all day? I know I want to be in & out in as little time as possible without compromising flavor.

So I came up with these really easy bars that you can make in the microwave. How great is that? If you can mix, microwave & stir – then you can make these delicious Honey Almond Peanut Butter Bars that everyone will love! Let me show you how quick & easy the process is.

Here is what you need:

1- 1/2 cups peanut butter chips (10 oz. bag)

1 (14 ounce) box Kashi Go Lean Crunch Honey Almond Flax Cereal

3/4 cup corn syrup

4 tbsp butter

1-1/2 cups mini marshmallows

Step 1: Combine peanut butter chips, corn syrup, butter & mini-marshmallows in a microwave safe bowl. Heat on high 2-2-1/2 minutes, stirring in between each minute until almost completely smooth.

Step 2: Remove from microwave & immediately add cereal. Working quickly – fold cereal into melted mixture until coated & mixed thoroughly.

Step 3: Transfer to parchment lined 9×13 pan & press into a flat even layer. Let sit at room temperature for 1-2 hours to firm or if you are like me & can’t wait- refrigerate 20 minutes to chill until firm.

Step 4: Once firm, cut into squares & enjoy.

Print This!

Recipe: Honey Almond Peanut Butter Bars

Summary: This super simple recipe uses items you may already have on hand to create a healthy after school snack.

Ingredients

1-1/2 cups peanut butter chips (10 oz bag)

1 (14 ounce) box Kashi Go Lean Crunch Honey Almond Flax Cereal

3/4 cup corn syrup

4 tbsp butter

1-1/2 cups mini marshmallows

Instructions

Combine peanut butter chips, corn syrup, butter & mini-marshmallows in a microwave safe bowl. Heat on high 2-2-1/2 minutes, stirring in between each minute until almost completely smooth.

Remove from microwave & immediately add cereal. Working quickly – fold cereal into melted mixture until coated & mixed thoroughly.

Transfer to parchment lined 9×13 pan & press into a flat even layer. Let sit at room temperature for 1-2 hours to firm or if you are like me & can’t wait- refrigerate 20 minutes to chill until firm.

Once firm, cut into squares & enjoy.

Preparation time: 5-7 minutes

Cooling time: 1-2 hours at room temperature or 20 minutes in fridge.

Number of servings (yield): 12-16

Gina, author of Kleinworth & Co, is a busy homeschooling

mom to 3 great kids ages 11-17. She likes to find new ways to make life simple & streamlined on a budget. She loves to share easy DIY projects, fun crafts with the kids & a whole lot of recipes, with a few photography tips sprinkled in occasionally too.

Pin It

The post Honey Almond Peanut Butter Bars appeared first on Living Well Spending Less®.

September 7, 2015

5 Steps for Finding Your Decorating Style

This is a guest post from Tasha of DesignerTrapped.com

Do you struggle every time you pick out a piece of furniture or art for your home because you just are not sure what your style is? Do you envy friends who seem to effortlessly decorate their home in a style that suits them perfectly? Today, I am going to share with you five simple tips to determine your decorating style PLUS four tips to achieve it on a budget!

1. Browse magazines

1. Browse magazinesPinterest is great too, but there are so many beautiful images on Pinterest at one time, that it can be difficult to zero in on a style that you are most drawn to. Instead, flip through magazine pages one by one and tear out the photos of rooms and homes that you are most drawn to. There is no right or wrong–just tear out what you love! Study what you tear out and identify what the images have in common.

2. Take an online quiz

There are a ton of online quizzes that are designed to help you find your decorating style. Choose a couple of design style quizzes to take at your leisure. If they end in similar results, you are definitely on the right track. They are fun and really can help you define your style. I recommend this one from Houzz and this one from Better Homes and Gardens.

3. Look to your wardrobe

Take a good, hard look at your favorite clothing items. Pay attention to the colors and textures. Are they mostly neutral? If so, you may prefer a neutral color palette for your home. Are your favorite clothes made with lots of color and bold patterns? If so, go for a similar look when choosing textiles for your home.

4. Pay attention to the exterior of homes

When you drive around your city or town, what houses make your heart go pitter patter? Are they traditional brick homes, or are they minimalist and modern? If you love modern homes, you will likely enjoy the clean lines and minimalism of modern home decor also. If you love traditional homes, you will likely love traditional furniture, such as sofas with rolled arms.

5. Take an inventory of your current decor

Walk through your house and take notes. In each room, make a list of furniture/art/accessories you love, and a separate list of those you wish you could replace. Then, review the list of things you love to see what they have in common and write those down. Keep that list with you every time you make a purchase for your home–it will serve as a great guide to keep you true to your style!

Once you have a better idea of what your style is, you have to figure out a way to achieve it without spending a fortune. The following 4 bonus tips will help you do just that!

Paint

Never underestimate the power of paint! It is inexpensive and versatile. You can paint nearly anything. I have painted cabinets, walls, floors (vinyl and wood), furniture, even my kitchen backsplash! Paint will give you a fresh new look on a dime.

Do it yourself

You can save a ton of money by tackling a room makeover by yourself. Paint the walls yourself. Make the curtains and pillows yourself. Refinish or paint the furniture yourself. Do not be afraid to give it a shot! Many DIY jobs are easily tackled by even the most inexperienced homeowner. Browse DIY blogs and talk to staff at your home improvement stores for tips on DIY jobs.

Shop flea markets, consignment stores, yard sales & Craigslist

Purchasing furniture brand new is simply not an option for many people on a tight budget. The good news is that you can find great deals on furniture, light fixtures and art at flea markets, consignment stores, Craigslist and even yard sales. Hunting down deals can be fun and you often find pieces that are much better quality than many things that are manufactured these days.

Go shopping in your own house

This is my favorite tip! I completely refreshed my laundry room by spending only $71 out of pocket because I reused old curtains, paint and accessories that I had in our attic. You would never know it! Those curtains that did not fit in the dining room of your new home may be perfect in another room. Go into your attic, closets and/or basement and discover new ways to use old decor.

Tasha Agruso blogs at Designer Trapped in a Lawyer’s Body,

where you can find tons of thrifty DIY renovations and simple craft and home decor projects, like her popular painted vinyl floors and dotted, washable Sharpie mugs. She will inspire you to create a beautiful and happy home on a budget. She lives in Greensboro, North Carolina with her firefighter husband and 4-year-old twin girls. They are a typical, busy family and are proof that you can beautify your home one simple project at a time without breaking the bank.

Pin It

The post 5 Steps for Finding Your Decorating Style appeared first on Living Well Spending Less®.

September 4, 2015

How to Plan Your Trip to Australia

G’day mate!

If you follow me on Instagram, (and if you don’t—please do! I share a ton of great tips, daily inspiration, and lots of fun peeks behind-the-scenes), you know that my family and I recently returned from a three-week trip to Australia. I was invited to speak there at the ProBlogger conference and, since some of our expenses would be covered by the conference, we decided to make the most of it and take the whole family along.

While getting back to the real world has been a little rough, I can’t say enough good things about the trip. It was absolutely amazing! We saw and did a lot in our three weeks, but even more than that, we loved watching our kids expand their horizons and come into their own on this trip. I think there is just something about travel—especially international travel—that changes you.

Of course that’s not to say that our entire trip was sunshine and roses, or that everything was perfectly perfect all of the time—it wasn’t! We made mistakes, got lost, had a few freak-outs, battled car-sickness, got annoyed with one another, packed the wrong things, and forgot things along the way.

But in the grand scheme of things, those bumps along the way were simply part of the grand adventure, and we learned a LOT!

One of the things we learned right away, is that Australia is a BIG country. Geography wise, it is almost as big as the continental United States. We quickly discovered that this makes planning a trip extremely overwhelming! It felt like there was so much to do and see, and so many choices, and such a huge amount of area to cover that every time we sat down to plan the trip, we were immediately overwhelmed by the choices. It literally took us months just to nail down an itinerary.

Thus, I thought it might be helpful to share what we learned from planning our Australia experience for those of you may also be pondering a trip Down Under sometime soon.

Set a Budget

I’m just going to say it—Australia is expensive! And I’m not just talking about the flight over, either. Between hotels, restaurants, car rentals, and activities, travel costs can add up quickly, especially when the cost of almost everything in Australia is higher than we are used to. If you are traveling with kids, those costs add up even quicker! We were shocked to discover that hotels often charge for extra people (even kids), and that kids meals even in quick-service restaurants are regularly in the $10-15 range rather than the $3-5 range like we are used to! Thus, it is important to plan accordingly!

Setting a realistic budget from the get-go will help you make sure that you don’t overdo it or try to pack too much in, especially if you will be gone for an extended period of time. And be sure to give yourself a buffer of extra just-in-case money. Trust us, you’ll need it!

Start Planning as Early as Possible

Because of the costs involved, it is important to start planning as early as possible in order to find as many savings along the way as possible. A few months ago I discovered a phenomenon called “travel hacking” that actually saved us quite a bit of money on this trip.

I’m sure I’ll be writing about it more in depth very soon, but basically the concept involves earning rewards point through credit card bonuses in order to earn free flights and hotel stays. Obviously this is only a good plan if you are extremely diligent about paying off credit card balances each month, and also only if you have a way of meeting the minimum spend requirements to earn the bonuses.

Before the trip, both my husband and I were able to earn 25,000 points each on our Starwood Preferred Guest Amex card, which gave us four free nights in some very nice hotels like the Westin in Sydney (normally $400 per night!) and the Sheraton in downtown Melbourne (normally $300 per night!) We also earned enough Choice rewards to get us a free nights at a Quality Inn in Brisbane and at the Clarion in Melbourne.

Save Where You Can

Knowing that Australia is expensive and that there are going to be unavoidable costs along the way, it is important to look for ways to save wherever you can, even in small ways.

Had I started travel hacking more than two months before our trip, I probably could have gotten nearly all of our hotel stays for free, but I just didn’t have quite enough time to accrue the necessary points. Live and learn! In any case, we were happy to save where we could. For our remaining nights, we made sure to check a variety of different sites for the lowest rate, and then to contact the hotel directly to match it. Most have a price rate guarantee that will match the lowest competitor and give you an extra discount or even a free night. These policies helped us save hundreds on hotel stays throughout the country.

Saving on food is a necessity too, given how expensive it is to eat at restaurants. For a portion of our trip, when we rented a car and traveled down the coast from Sydney to Melbourne, we stayed in apartment hotels along the way, most of which we found on Expedia.com. These generally had a kitchen, which allowed us to buy groceries and cook our own food, which helped us save a bundle.

In the cities we ate a lot of street food rather than going to expensive sit-down restaurants. (Pie Face was a big favorite of ours!) There is no tipping in Australia—restaurant servers make around $17 an hour—so the food at full service restaurants is priced accordingly to account for this. Also, the service isn’t very good. Those times we did go to a full service restaurant, our youngest daughter, who is not at all shy, got very good at walking into the kitchen to ask for the check!

One other tip is to sign up for every loyalty program that you can ahead of the trip, but particularly for the hotel brands that you know you will be staying with. Many of them offer free Internet to loyalty members when you book through their website, which can save you up to $20 a day in hotel WiFi fees!

Know What You Enjoy

I think this is probably one of the most important things about making your trip a success. There is so much to do in Australia that you can easily get lost in the choices, but ultimately the success of your trip will depend on focusing on the things that you and your family enjoy doing the most.

When it comes right down to it, we are not really city people, nor are we foodies. We don’t love museums or galleries or looking at endless buildings for days on end, and we are not really interested in trying all the latest restaurants. Instead, my husband and I really enjoy getting off the beaten path, while our kids just want to see as many animals as possible.

Thus, for us, we knew that two days in Sydney would be plenty (and it was!) and one of those days was spent at the Taronga Zoo. However, I’m sure lots of other people could happily spend a whole week in Sydney and still not see everything they wanted to. Although we stayed two nights in Melbourne, we spent one of the days getting out of the city to drive along the Great Ocean Road.

If you are a city person, I would say that spending time in Sydney is a must, but that both Melbourne and Brisbane are absolutely lovely, in totally different ways. Melbourne, in the far south, feels very cosmopolitan, with lots of cool restaurants and beautiful historic buildings. Brisbane, which is further north and has a much more laid-back vibe. It also has a beautiful walking path with some great parks that my kids really enjoyed.

If you are more of an outdoorsy type person, or, if like us, you prefer getting off the beaten track (and seeing animals), Tasmania is definitely worth a visit, and Cairns, in the far north, is an absolute must-see. (Cairns is also the jumping off point for seeing the Great Barrier Reef.)

If you’re interested in beaches or surfing, there are no shortage of options. The Gold Coast is a good option if you are traveling in the winter (our summer), or the Great Ocean Road, which is home to the famous Bells Beach, would probably be fabulous in the summer, though the cold didn’t seem to phase the surfers while we were there!

If you want to see the Australian outback, you’ll want to plan a trip to Alice Springs and Uluru. This is one thing we really debated about, but ultimately we chose Tasmania this time around, mostly because it was a lot less expensive. And now, of course, we have a reason to go back!

Consider Your Transportation

I can’t say this strongly enough, so I’ll say it again—Australia is a BIG country! If you want to see more than just the city you fly into, you are going to have to figure out how to move around, and the type of transportation you decide on will play a big role in helping you to figure out what you can and can’t do. Here is a quick rundown of what’s available:

Car rental-renting a car will give you the most flexibility if your goal is to get out of the cities and explore the coastal areas, or even the outback. Car rentals are reasonably priced in Australia, and camper vans are also very popular as rentals, which could help you save on hotel costs if you decide to camp for part of your trip. For traveling with a family, this is probably the most cost effective option. That said, it is important to know that Australians drive on the left, which can take some getting used to! My husband did all the driving on our trip, (I’ll just say it—I am NOT a good driver, even in the best of circumstances, so it is really best that I don’t drive whenever possible!), and he did a great job, only going the wrong way a few times.

Public Transit-most of the bigger cities, like Sydney, Melbourne, & Brisbane, have trains that will get you from the airport to the city center, as well as extensive networks of public transportation that are pretty easy to navigate. Sydney has something called “Family Fun Day Sundays” that allows you to get a transit pass for the whole day for just $2AUD per person, which is a really good deal. (Keep in mind that you must have kids with you!) Likewise, Melbourne has a free city loop tram that allows you to easily navigate the whole city center area.

Train-Australia has a fairly extensive network of passenger trains that can get you from city to city without too much effort, and the prices are fairly reasonable, though everything adds up fast when you multiply it times four for a family. Ultimately, this is one option we didn’t end up using too much, though we did take a fun scenic train ride through the rainforest while in Cairns.

Airplane-Australia has several domestic carriers that offer low-cost flights from city to city. We flew four different times within the country, and chose to fly Virgin Australia on all of our inter-country flights because VA is a partner airline to Delta. This allowed us to take advantage of the reciprocal partner benefits (since I have Platinum Medallion status on Delta.) The best perk was free access to the Virgin Australia lounges at all of the airports, where we would take advantage of the extensive buffet and get free meals whenever possible. (Remember—save where you can!)

Don’t Forget about the Weather!

Australia is in the Southern Hemisphere, which means that their seasons are opposite of the United States. Thus, if you are traveling in the summer, it will be winter there. However, like the United States, there is a pretty big difference in temperature from the northern end of the country (where it is warmest) to the southern end (where it is much cooler.)

If you are planning to visit different areas in both the southern and northern parts of the country, you will need to pack for both warm and cold. Being from Florida, we were actually excited about the cooler temperatures, but we probably could have packed a few more warm clothes. We ended up wearing the same few items almost every day for the first half of our trip!

The weather will definitely impact what you see and do. For instance, if visiting the Great Barrier Reef is high on your list, you will want to go during the Australian winter, as during the summer the water is full of deadly box jellyfish. Likewise, Uluru is better during the winter, as during the summer it gets oppressively hot. On the other hand, Sydney, Melbourne, and Tasmania are probably a little better in the spring, fall, and summer.

Give Yourself Down Time—You’ll Need It

One of the hardest parts about planning a trip is leaving time to just relax when there is SO MUCH you want to do and see! The first eight days of our trip were jam packed, moving to a different hotel every single night. By the time we got to Hobart, Tasmania, where we had planned to stay at one hotel for three nights in a row, we were definitely ready for a day of rest!

This is especially true when traveling with kids. Sometimes they need time to just be kids! We made a point to stop at playgrounds when we saw them, or to stop at beaches and parks and let the girls just run around and play, and honestly, I think those were probably some of their happiest memories of the trip!

Be Prepared for Tech Issues

Although Australia is a half a world away, in many ways it doesn’t feel all that different from the US. There are no language barriers, it is fairly easy to navigate your way around, and even many of the stores and restaurants are familiar, especially in the big cities. Even so, international travel always presents a few challenges that it is important to be prepared for.

First, their outlets are different, and they use 220 voltage, rather than 110. Thus, if you will need power for any reason, you should come armed with a converter and a a few plug adapters. After my old adapter failed on our trip to Peru earlier this year, I bought this converter on Amazon, and was incredibly impressed. It worked great and had enough plugs and USB ports to charge all of our devices at once. (Keep in mind that while it does come with several adapters, it did not come equipped with an adapter for Australia. Luckily I had also bought this 3-pack of Australian plug adapters just in case!)

Also, cell phones require an international plan, and international data is expensive! If we were to do it again, we would have definitely bought a prepaid phone to use just in Australia. Even with minimal use, we exceeded our data limits multiple times, and were faced with a couple hundred dollars in overage costs when we got home. We probably could have saved a bundle—and had much better service—by simply purchasing a prepaid cell plan as soon as we got there.

* * *

Overall, Australia is an incredible country, with so much to take in that you could stay for a year and still not even come close to seeing it all! Better yet, the people are amazing—seriously the warmest, friendliest, and most hospitable people I have ever met. With a little planning, I guarantee it will be one of the best vacations you ever have!

Pin It

The post How to Plan Your Trip to Australia appeared first on Living Well Spending Less®.