Ruth Soukup's Blog, page 70

November 11, 2015

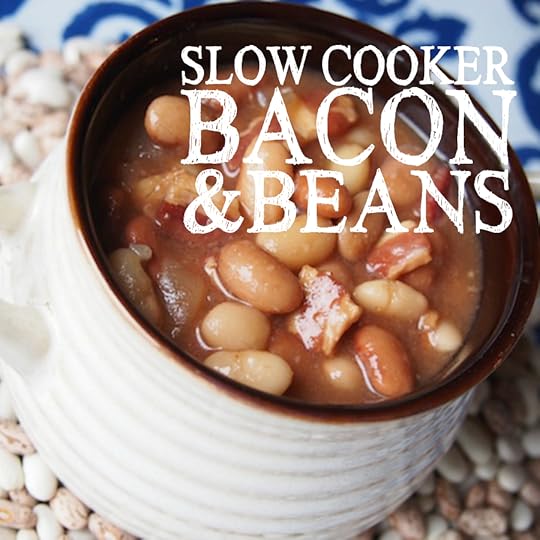

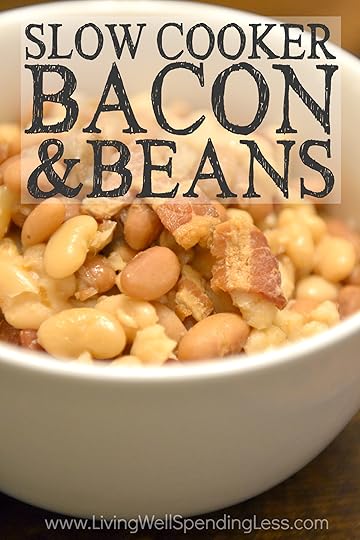

Slow Cooker Bacon & Beans

November is in full swing, with the holidays right around the corner. As much as I’d like to believe things should be slowing down soon, the reality is that they probably won’t. And that is exactly why it is SO important to have a good selection of quick & easy slow cooker recipes up my sleeve–just like today’s easy slow-cooker Bacon and Beans.

With just a few budget-friendly easy ingredients, it comes together in minutes, then freezes beautifully until you’re ready to throw it in the crockpot, no pre-soaking, or thawing required. Seriously, it couldn’t be any easier! Even better? It was a huge hit. (Of course with bacon as one of the main ingredients, how could it not be?)

While my family likes just the basic version of this recipe, you can also jazz it up a bit to taste with either barbecue sauce, tabasco & chili powder, or even brown sugar & molasses. Also, be sure to use the Ham-Beens brand beans, as they include a flavor packet that helps season your beans. They can be found at most major grocery stores!

Here is what you need:

1 bag Hurst’s HamBeens Slow Cooker Bacon & Beans ®

8 cups water

1 lb. bacon strips, cut into 1/4 pieces

1 medium white onion, diced

1/2 teaspoon minced garlic (from jar or fresh)

salt & pepper to taste

Step 1: Rinse and sort through the dry beans. Check for any unwanted debris and discard.

Step 2: Chop onion and set aside.

Step 3: Cook bacon according to these directions. Let cool and cut into 1/4 pieces.

Step 4: In large bowl, combine beans, bacon, onion, garlic, flavor packet and water. Stir until packet contents are dissolved.

Step 5: Divide mixture into two gallon size freezer bags (be sure to label bags first!) Freeze until needed.

Step 6: Cook in a 4-6 quart slow cooker on high for 4-5 hours or on low for 8-9 hours. Remove lid for last 30 minutes if you prefer a thicker consistency.

Omit the bacon to make these vegetarian… the smoky bacon flavor seasoning gives you a lot of great flavor!

Print This!

Recipe: Slow Cooker Bacon & Beans

Summary: It doesn’t get any easier than this simple but classic combo of bacon and beans!

Ingredients

1 bag Hurst’s HamBeens Slow Cooker Bacon & Beans ®

8 cups water

1 lb. bacon strips, cut into 1/4 pieces

1 medium white onion, diced

1/2 teaspoon minced garlic (from jar or fresh)

salt & pepper to taste

Instructions

Rinse and sort through the dry beans. Check for any unwanted debris and discard.

Chop onion and set aside.

Cook bacon according to these directions. Let cool and cut into 1/4 pieces.

In large bowl, combine beans, bacon, onion, garlic, flavor packet and water. Stir until packet contents are dissolved.

Divide mixture into two gallon size freezer bags (be sure to label bags first!) Freeze until needed.

Cook in a 4-6 quart slow cooker on high for 4-5 hours or on low for 8-9 hours. Remove lid for last 30 minutes if you prefer a thicker consistency.

Omit the bacon to make these vegetarian… the smoky bacon flavor seasoning gives you a lot of great flavor!

Preparation time: 10-15 minutes

Cooking time: 4 to 8 hours in slow-cooker. Depending on temperature setting.

Number of servings (yield): 16

This post was underwritten by Hurst Beans. All opinions are mine. Established in 1938, the N.K. Hurst Co. is a 4th generation family business based in Indianapolis, IN. Hurst’s HamBeens® are the nations #1 selling dry bean brand and can be found in grocery stores nationwide. For more info, please visit www.hurstbeans.com.

Pin It

The post Slow Cooker Bacon & Beans appeared first on Living Well Spending Less®.

November 9, 2015

How to Organize Your Holiday Season

I’m still not quite sure how it is already November, but here we are, with another holiday season upon us. And I don’t know about you, but the older I get (I’m now 37, for those of you who are wondering), the more I crave simplicity for the holidays. It’s so easy to get caught up in the production of it all, the cards and the lights and the decorations and the presents and the parties and the pageants to attend….am I alone in feeling like sometimes it is all just a bit….much?

And I hope I don’t sound like a Grinch, because I don’t feel like one. I love this time of year–Thanksgiving and Christmas and everything that comes in between. But this year I just want a little less focus on all the STUFF, and a little more focus on the things that matter most of all.

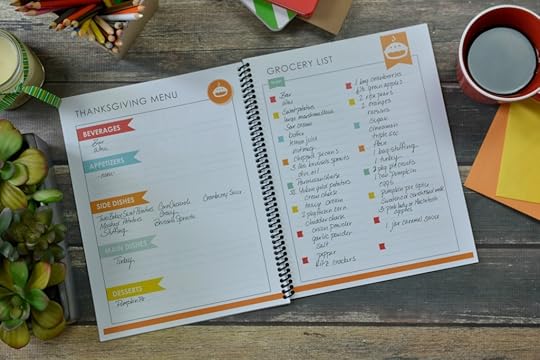

Every year for the past five years here at Living Well Spending Less we have put together a FREE Holiday Planner intended to help all of us create more joy and less stress around the holidays. I absolutely love it, and I know many of you do too. But it occurred to me this year that I’ve never shared how I actually use it in my own life to plan a stress free holiday.

And so, today, I thought it might be helpful to share the steps I use to organize my holiday season in order to stay on task, stay under budget, and keep stress to a minimum.

STEP 1: Refocus Your Priorities

The first page of our holiday planner is by far the most important–so important, in fact, that if you are only going to print out and use ONE page of the planner, this would be the one that would have the biggest impact on your holiday season. I definitely recommend that you involve your family in this one as well. When my kids were younger, my husband and I would fill it out together, but now that our kids are a little older, we can do it as a family. It’s especially important to take everyone’s thoughts and ideas into consideration, both for the things you want to do and for the things you don’t.

STEP 2: Look Over the Holiday Checklists

You shouldn’t feel like you need to follow these checklists step by step, but they can help give you a general idea of what your own timeline should be for planning your meals and activities throughout the season. Go ahead and cross out any items that don’t apply to you–it’s okay, you don’t need to do everything!

STEP 3: Fill Out Your November & December Calendars

Take the time to mark out all the important dates that you already know about–church events, school concerts, parades, parties, etc., then take time right now to block out a few days just for your family, especially for the things you all agreed about wanting to do this year. Because here’s the thing–if you don’t intentionally make time for those items now, when things get busy later it will be easy for that time to slip away. Make them a priority by getting them on the calendar! I also recommend that you block out time for gift & grocery shopping so that you don’t feel pressed for time later on.

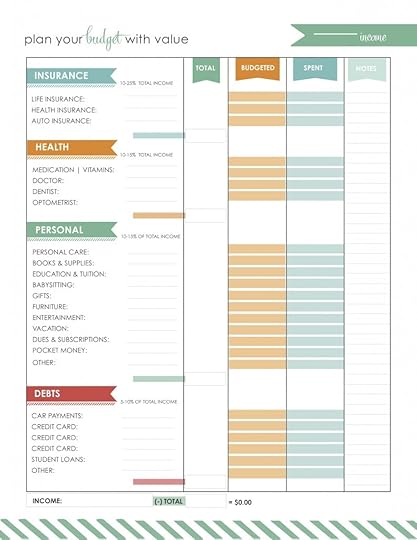

STEP 4: Create Your Holiday Budget

Be realistic about what you can afford to spend this year on everything from food to gifts to travel and activities. The reality is that there is nothing more stressful than facing a pile of bills come January. Avoid that frustration early by being proactive about telling your money where to go. If funds are tight, be honest with your friends and family, and even your kids, and put the focus on spending time together, not spending more than you can afford.

STEP 5: Create Your Holiday Menus & Shopping List

The grocery stores always have the most amazing sales in November and December, and with a little pre-planning it is possible to keep even the most lavish menus to a reasonable budget. That’s why it is so important to start with you menu planning early. Decide on your Thanksgiving, Christmas & baking recipes as soon as possible, then create a master grocery list that you can bring along to the store each week and stock up on the items you need as they go on sale. (For more details about keeping your holiday grocery budget in check, be sure to read our in-depth article on How to Save on Food for the Holidays.)

STEP 6: Plan Your Gift List

Take some time to jot down notes about who you will need to buy gifts for this year, what your budget is for each person, and what you plan to buy or make for them. There are detailed gift pages for family members and close friends, as well as a extended gift list for those other important people you’ll want to remember–teachers, neighbors, babysitters, etc.

STEP 7: Organize Your Christmas Card List

Christmas cards are one of my favorite holiday traditions, but I’ll be the first to admit–they are a LOT of work (not to mention expensive!) In fact, for the first time ever my husband and I are considering not even sending them out this year. While that decision is still yet to be decided, it is important to make sure you stay organized when it comes to your card list. If you only have a few cards to send, our holiday card planning pages are the perfect way to keep track of your list. For longer lists, you may want to use an Excel spreadsheet!

* * *

And, believe it or not, this is really all it takes to plan and organize a (relatively) stress-free holiday season! All seven of these steps can easily be completed in an afternoon, and a few hours of effort early can be the difference between chaos and calm this year. I challenge you to give it a try and see for yourself! (By the way, in case you are wondering, I printed my planner at Staples and had it coil bound, but you can just as easily print it at home.)

To have your FREE 2015 Holiday Planner PDF sent straight to your email inbox, simply click the button below. When you opt in, you’ll also get access to our free (& amazing!) Best Year Ever mini course–just our little way of saying Happy Holidays!

Pin It

The post How to Organize Your Holiday Season appeared first on Living Well Spending Less®.

November 6, 2015

How to Have a Healthy Relationship With Money

This is a guest post from Brad Hewitt, author of Your New Money Mindset

I get more than a little crazy when I hear the word sale! The moment I think I’m getting a great deal, I lose all common sense — I’ll buy just about anything marked 50 percent off.

At my first job I discovered that wearing a coat and tie was obligatory for just about every male with a desk job. I decided that I needed more than the one suit my parents had bought for me. One of my coworkers told me about a discount store nearby. It sounded like the perfect place for me! At the store I spotted exactly what I was looking for: the sale rack. Nothing hanging there was even mildly eye-catching. Nothing was my size. But when something is marked down, those issues are mere details. I picked an ugly brown pattern that was the best of the worst. I honestly didn’t think it looked too bad. I should have known otherwise when the salesperson tried to talk me out of it.

I didn’t wear that suit for long. My parents saw it and were horrified—so aghast that they bought me another suit and threw in a sport coat. Given their frugal streak—which I inherited—you can guess how bad I must have looked. (I would like to say I learned my lesson, but as I write, I’m wearing a pair of shoes I also purchased on sale. I’m confident they’ll feel comfortable when they eventually stretch out.)

Is wanting more bad?

At the most basic level, there is nothing wrong with wanting more. Jesus himself says, “I have come that [you] may have life, and have it to the full” (John 10:10). The quest for abundance—for ourselves and others—is a healthy human instinct. Longing for a better life, to improve ourselves and our family’s circumstances, and to leave the world better than we found it are all parts of how God made us.

But yet, that natural desire to have a better life is overtaken by the loud voice of our culture telling us “more is better.” There is always a new iPhone or iPad or iSomething coming out. When everyone else is sprinting in a full-out race to have more, it’s tough to stand on the sidelines. And it’s tough to know what a healthy desire for abundance is, versus an unhealthy belief that “more” makes you happy.

It’s that struggle that led me to collaborate with a colleague to write a book about how to have a healthy relationship with money. There are three reasons we think this journey is incredibly important.

Why having a healthy money relationship matters

First, Jesus makes money a crucial topic. It’s impossible to miss in Scripture how often he talks about our unhealthy relationship with money, and how easily we make money an idol that usurps the place of more important things. Jesus aims to lead us to life, and we can think of nothing better than that.

Second, this journey will change you. However you would describe your feelings about money—unease, tension, bondage, discouragement, dissatisfaction, even boredom—we want to help you break free from the debilitating effects of consumerism.

Third, the transformation you experience will change the world. We believe that if people—especially Christians—could have a healthier relationship with money, it would change the world. We envision a world of human flourishing where both a financial sense of well-being and joyful generosity prevail. We believe change can happen better, faster, and further than any of us think possible. We truly believe that people can be free from the slavery of a consumer culture by having a right relationship with money as taught by Jesus and other voices of Scripture, and as a result they will live openheartedly with their time, energy and money.

Taking the first steps

Imagine a life where you control your money instead of your money controlling you. Don’t believe your money is in control? Do you find yourself wrestling with credit card debt you can’t pay off, or a car you can’t afford, or a house worth less than you owe on it? Do you find the “happiness” of buying something online becoming more and more of a habit? Here are some steps you can take to start considering how to have a healthier relationship with money and find a more openhearted way of living:

1. Evaluate

First, take a look at your current relationship with money. You can use an online assessment tool like the New Money Mindset Assessment tool. You’ll get four scores; each score measures one aspect of your relationship with money. Or simply take some time to look at your habits and think about the role of money in your life.

2. Give

Next, try adding more “good stuff” to your life. By that I don’t mean another round of spending! I’m talking about leading with generosity grounded in grace. Instead of putting all your energy into cutting, focus on giving. If you’re stingy, like I am, try tipping a little extra for services, or buying the nicer present that you normally wouldn’t. And it doesn’t have to be financial. Send a thank you email to one person each day, every day for a week; pay someone an unexpected compliment; spend more time listening to someone. Or sign up for a volunteer shift . When you choose to live generously, you break your own persistent desire for more.

3. Shrink the Change

Another approach is what the Heath brothers (Chip and Dan Heath, Switch: How to Change Things When Change Is Hard) call “Shrink the Change.” Take housecleaning, for example. If you tell yourself you have to clean the whole house, the Heath brothers suggest you might never get started. But if you clean for ten minutes and then stop, they would say that’s a success, just to get started. Try applying that concept to money. If saving 10% more each month feels out of reach, start with one percent more than you save right now. Aim to increase by one-percent every three to six months until you reach your goal. By making the goal easily attainable, you can get yourself started.

Another approach is what the Heath brothers (Chip and Dan Heath, Switch: How to Change Things When Change Is Hard) call “Shrink the Change.” Take housecleaning, for example. If you tell yourself you have to clean the whole house, the Heath brothers suggest you might never get started. But if you clean for ten minutes and then stop, they would say that’s a success, just to get started. Try applying that concept to money. If saving 10% more each month feels out of reach, start with one percent more than you save right now. Aim to increase by one-percent every three to six months until you reach your goal. By making the goal easily attainable, you can get yourself started.

* * *

A life-giving, grace-filled, abundant life spoken of in Scripture is possible. Start with the steps outlined here, and then, if you want to dig deeper to explore a healthy relationship with money, pick up a copy of our book, Your New Money Mindset.

Brad Hewitt is CEO of Thrivent Financial, a not-for-profit,

Fortune 500 financial services firm focused on helping Christians be wise with money and live generously. He is also the co-author of Your New Money Mindset, a book that shares personal experience, Biblical passages and timely research, to reveal that financial happiness and security have little to do with how much money you have, and a lot to do with the role money plays in your life. Brad and his wife live in Minnesota.

Pin It

The post How to Have a Healthy Relationship With Money appeared first on Living Well Spending Less®.

November 4, 2015

5 Ingredient Pumpkin Muffins

This is a guest post from Gina of Kleinworth & Co.

It’s that time of year when everyone goes a little pumpkin crazy. The weather is cooler & we are all ready to hunker down, find some cozy blankets & embrace all things fall. One of those things definitely includes pumpkin flavored everything. Fortunately there are so many wonderful things you can make with pumpkin puree. It’s also relatively healthy when you use it in recipes.

Since I have been on a kick of homemade breakfasts for my family for the last couple years now, I decided to add a little fall to the mornings & make some simple pumpkin muffins. There are a multitude of recipes for pumpkin muffins floating around Pinterest these days & I have tried many of them. But I keep coming back to my good ol’ tried & true recipe I have been using for years. It’s simple & easy & takes just a handful of ingredients.

Here is what you need:

1 box vanilla or white cake mix

1 can (15 oz) 100% pure pumpkin

2 tsp pumpkin pie spice

1 bag pumpkin spice morsels

1/2 bag chocolate chunks

Step 1: Start by preheating the oven & spraying your muffin tins. I used one standard size tin & one mini muffin tin with this recipe.

Step 2: Combine all ingredients except the chocolate chunks in your mixer bowl & beat on medium until fully combined.

Step 3: Spoon your batter into your muffin tins & add chocolate chunks to the top of each muffin.

Step 4: Bake & remove when toothpick test is clean. For the mini muffins it was about 20 minutes & 30 minutes for the full size.

These are so delicious. Definitely the best way to pack some fall flavor into your morning. They are always a hit with my family.

I really love making these on a Friday afternoon. That way I have them ready for Saturday morning coffee. It’s a wonderful breakfast to enjoy before we kick off the hustle of the weekend. Plus with all the nutrients that pumpkin puree adds to these- they keep me full for a really long time. Also- if you want to eliminate the chocolate chunks or replace them with nuts, that works too. That’s what is so great about this recipe. It’s easily adaptable to whatever you’re craving at the time.

Print This!

Recipe: 5 Ingredient Pumpkin Muffins

Summary: Fall is in the air and that means enjoying pumpkin muffins for breakfast, lunch or any time of day.

Ingredients

1 box vanilla or white cake mix

1 can (15 oz) 100% pure pumpkin

2 tsp pumpkin pie spice

1 bag pumpkin spice morsels

1/2 bag chocolate chunks

Instructions

Start by preheating the oven & spraying your muffin tins. I used one standard size tin & one mini muffin tin with this recipe.

Combine all ingredients except the chocolate chunks in your mixer bowl & beat on medium until fully combined.

Spoon your batter into your muffin tins & add chocolate chunks to the top of each muffin.

Bake & remove when toothpick test is clean. For the mini muffins it was about 20 minutes & 30 minutes for the full size.

Preparation time: 5-7 minutes

Cooking time: 20-30 minute(s)

Number of servings (yield): 12-24 depending on muffin tray used

Gina, author of Kleinworth & Co, is a busy homeschooling

mom to 3 great kids ages 11-17. She likes to find new ways to make life simple & streamlined on a budget. She loves to share easy DIY projects, fun crafts with the kids & a whole lot of recipes, with a few photography tips sprinkled in occasionally too.

Pin It

The post 5 Ingredient Pumpkin Muffins appeared first on Living Well Spending Less®.

November 2, 2015

Holiday Planner 2015

Happy November my friends! After a whole month of zero spending, I have to admit that I am pretty darn excited that it is time to start planning & preparing for the holiday season once again!

Of course, as much as I love the holidays, I also know that it can be a challenge at this time of year to keep our stress and budgets under control. There is seemingly always one more present to buy, one more ingredient to get, or one more card to send. While it is easy to put off dealing with the repercussions until later, all those little costs can add up to a lot more stress come January. Even more importantly, as a parent, I want my kids to grow up knowing the true meaning of Christmas, remembering happy memories with our family, the special traditions and the joy of giving back, not just the stuff.

I have learned over the years that good planning is SO key! It is so important to decide now what you can afford to spend, and to break it down into categories to get a clear idea of what that means for your family. And in the spirit of stockpiling, planning your menus, grocery lists, and gift needs ahead of time will also mean giving yourself an opportunity to stock up on the items you need when they are at their lowest possible price. (For more tips on keeping your Thanksgiving & Christmas food budget in check, be sure to also read this post on How to Save on Food for the Holidays.)

Each year here at LivingWellSpendingLess.com we put together a Holiday Planner to help you prioritize, set a budget, plan your meals, create a gift list, and make the most of your holiday season. Each year we also take your feedback & suggestions in order to make the planner even better the next year.

I am happy to report that with more than twice as many pages as previous years, the 2015 holiday planner is absolutely AMAZING! And, better yet, it is now available for you to download and print (and it is absolutely FREE!)

When you download the planner you’ll also get access to our free Best Year Ever Mini Course, a four part video series that will help you with goal setting, budgeting, meal planning, and organizing your mornings. It is the perfect way to establish good habits now to ensure success in 2016. I honestly think it might just be the coolest project we have ever done, and I am so so SO excited to share it with you!

GET MY HOLIDAY PLANNER!

NOTE: The signup button should appear directly ABOVE this sentence. If for some reason it doesn’t, instead use the signup box found HERE! Thanks!

Pin It

The post Holiday Planner 2015 appeared first on Living Well Spending Less®.

October 31, 2015

Day 31: What Not To Do Now

This is the last day of our 31 Days of Living Well & Spending Zero challenge. Start with Day One here.

* * *

Day 31. The end. If you’ve made it this far, you should feel very proud of yourself. You made it! You survived an entire month of spending zero! In a world where the solution for every problem is to buy something new, you managed to make it an entire month using the things you already had. Way to go!

Tomorrow your zero-spending challenge will be over, and you can go back to spending what you want, when you want. I would like to encourage you to be intentional with how you end this challenge, to put some serious thought into where you want to go from here. To make this your new beginning. You can pretend this challenge never happened, or you can use what you’ve learned to make some permanent positive changes to your spending habits.

This month has been so awesome. We have saved so much money and my husband is so happy! I thought it would be hard, and I guess sometimes it was, but mostly it was really motivating! —Denise

After today, you have a choice of two paths: (1) Go straight to the store, credit card in hand, and start swiping, treating yourself to all the things you’ve said no to all month, or (2) Learn from this past month, apply the principles and ideas you’ve worked on, and grow toward a place of financial peace.

Option 1 is an immediate “fix.” I guarantee you that for a few minutes it will make you feel better. You’ll have that high that spending gives you. You’ll enjoy your Frappuccino and those new ballet flats and a manicure and lunch at Panera. But then the elation will fade … and you’ll take a look at your bank account and get that sinking feeling of panic that you get when you know you might not make it through the month financially. You’ll argue with your spouse and worry about long-term plans for your kids.

Option 2 is the long-term growth plan. No more sick feeling when you look at your bank account! No more fights over money! Commit today to take this momentum that you’ve built up over the last month and use it to propel you towards a financially stable future. While, yes, you may need to restock your pantry, go to your repertoire of freezer meal recipes and plan out meals for this month, so you can spend much less and eat at home!

Ruth, I have to admit that I am a little sad that this is the last day of the challenge. I loved all your posts and it’s been so motivating and inspiring to read them each day. Although I can’t say I followed everything to the letter, it did make me take a closer look at my spending and cut back a lot. —Amanda

Keep speed cleaning your house each day and keep things tidy and in order so you can quickly see what you have on hand. Commit to your closet, and in the future only spend money on items you truly need that are quality made and will last. No more buying simply because it was on sale.

How can you use your newfound abilities to barter and trade for what you need? Think of checking your resources and seeing if you can find an item for free before you run out and buy something. Keep up your meal swaps and trade agreements with friends. Maybe you can trade babysitting, housekeeping, or dog walking. Get creative!

The next time you need a gift, I’ll bet you have a few DIY ideas in mind. Think of ways you can give of yourself, rather than resort to another gift card or store-bought item. Learn a new craft and use those skills to create gifts for the next holiday or birthday.

Most importantly, spend quality time with your significant other and your kids. It doesn’t mean you need to drop hundreds of dollars on vacations and amusement parks. A simple game day can be just as much fun. Learn to appreciate the little things, nurture yourself so you can nurture others, and understand that giving up on spending doesn’t mean giving up on all luxury or happiness.

POST-CHALLENGE DOS & DON’TS

DO review your finances at this point. Compare what you spent this month with previous months. The first time my husband and I did this challenge we were absolutely shocked to discover that we spent less during our challenge month than in any other month in our marriage. Seriously.

DON’T run out and buy everything you wanted during the challenge. Just as I said above: I know you want to, but don’t. Give it a day or two before you run to the store. Make a list. Think about the things you really need versus what you want.

DO carry these lessons forward as you plan your budget for the future. Consider upcoming holidays, birthdays, and vacations, and make accommodations, but ask yourself if there are ways you can save—things you can make or trade for, or if there’s a service you can give rather than a gift.

DON’T run out and restock your entire pantry if you still have food. It’s hard to resist the urge, but sit down and make a deliberate plan for the next month. Check what you have on hand, and consider making freezer meals to save time and money. Rather than running to a restaurant, buy the ingredients to make the dish you’re craving. (Go ahead—make those cheddar bay biscuits rather than taking yourself out to Red Lobster.)

DO consider some new ways to save at the grocery store. If you take away anything from this challenge, hopefully it’s that you’ll eat at home a little more and go out just a little less. That alone will save you a bundle. Planning careful trips to the grocery store and using coupons to save money can really help to stretch your budget.

DON’T forget to get creative and have fun! Refashion your clothing, eat out at home, get fearlessly crafty, and enjoy yourself. Having a good time doesn’t need to cost you, and in fact, sometimes it can be more fun to spend less. You’ll feel the satisfaction of being resourceful and of creating something you can be proud of!

DO consider revisiting this challenge again. My husband and I regularly practice no-spend months, and doing so has changed our lifestyle and way of thinking. Deliberately not spending actually becomes kind of fun!

This has been amazing, resourceful, helpful, life-changing, and totally awesome! Thank you for sharing this with us. You have truly changed my mindset and my life view. God bless! —Peggy

Congratulations—you did it!

Get your printable post-challenge “do” worksheet here.

Get your printable post-challenge “don’t” worksheet here.

* * *

Don’t forget that I will be broadcasting LIVE each day on Periscope (usually between 10am and 11am EST). You can find and follow me there at @RuthSoukup. Be sure to also share your photos on Instagram for a chance to win daily prizes. (Get the contest details HERE.) Finally, be sure to check out our BLOG TOUR page, where you can find all sorts of additional ideas and inspiration from other bloggers who are taking the #31dayLWSZ challenge this month too!

How has this challenge changed you? What are some of your goals for the future?

Pin It

The post Day 31: What Not To Do Now appeared first on Living Well Spending Less®.

October 30, 2015

Day 30: Plan for the Future

This is the thirtieth day of our 31 Days of Living Well & Spending Zero challenge. Start with Day One here.

* * *

It’s hard to think much about the future when we are busy trying to make it through the day. The future always seems so big, so uncertain—a looming, yet far off, nebulous, sometimes frightening thing. None of us have a crystal ball (at least I don’t!), so it’s hard to predict what’s coming up next.

However, there are always some certainties. You will always have to come up with money for housing, utilities, food, transportation, and the needs of your children. You will probably require healthcare, and you might want to help your kids out with college or wedding expenses. Also, of course, down the road there’s retirement.

Even the uncertainties are a certainty—disabilities and accidents can befall anyone at any time, as can sudden unemployment, or even major catastrophes like a fire or flood, or minor ones like a car repair or unforeseen bill. It’s not a matter of if, but of when. We need to be prepared.

Assessing your experiences over the past four weeks (all those ups and downs) has helped you reduce your spending short-term. However, the goal of this project is also to start you down the real road to long-term financial peace and safety.

If you haven’t already, today’s the day to start thinking about how to get yourself out of debt, how to set up an emergency fund, how to start saving, and how to start and contribute to a retirement fund and possibly a college fund.

I know planning for the future can seem like a lot of work, but today I want you to step back and really assess the “why.”

Think about why you chose to participate in this journey, and why you should continue. Research ways you can start getting out of debt, and start saving for these big-picture, future investments. Think about how you’re going to stick to these spending changes and make them permanent to better set yourself up for a positive future.

Since you already completed your budget assessment and Beginner’s Guide to Savings yesterday, you probably have an idea of your monthly expenses. So how can you set up an emergency fund and use any savings and extra income to get out of debt and reach some of your financial goals?

Don’t try to tackle it all at once.

As I pointed out yesterday, change is hard. We form attachments to things and habits, but sometimes we have to let go to move forward with positive change. Focus on the true needs of your family and start to make the steps. Assess your debt and find ways to pay down as much as you can. Start saving so that life’s little emergencies won’t break you or send you further down a debt spiral.

Of course, it’s hard to know what the future may hold, but imagine (in an ideal world) how you picture your retirement. How do you imagine your children’s education shaping up? Do you have any other expenses coming down the pipeline—braces, care of loved ones (an aging parent, for example), or plans to move, return to school, or change jobs? Once you know what your safety net needs to hold, it’s easier to discover ways to build it.

Today’s assignment is to gain an understanding of the “why” you are here and to research steps to a positive future. Here are some helpful resources to help you get started.

8 FINANCIAL PLANNING RESOURCES

5 Habits of Successful Debt Slayers (from Living Well Spending Less)

How to Not Give Up on Your War on Debt (from Living Well Spending Less)

10 Smart Ways to Build an Emergency Fund (from Living Well Spending Less)

Top 10 Ways to Prepare for Retirement (from Dol. gov)

How to Save for Retirement on a Low Income (from US News & World Report)

How Much Should I Save for Retirement? (from Christian PF)

How 401k Plans Work (from How Stuff Works)

Guide to College Savings Plans (from CNN Money)

My bank does a rewards program for saving, so every $1,000 you put in your savings per year, you get an extra $50 plus the interest! So I just started a savings account two months ago to pay off student loans. I’m planning to pay off more than the minimum balance at a time so I pay less interest, and by this time next year I’m hoping to have a nice chunk of money to put down on it. —Denise

Familiarize yourself with the terms and ideas surrounding a 401k, retirement savings, college savings plans, and other valuable ways to prepare for the future—even if you aren’t sure they are for you, or if they seem unattainable right now. Sketch out an idea of what you want for the financial future of you and your family.

Answer a few questions for yourself, do some research, and start planning for tomorrow—today! Use your newfound zero-spending abilities as a launchpad to reach your ideal financial future.

* * *

Don’t forget that I will be broadcasting LIVE each day on Periscope (usually between 10am and 11am EST). You can find and follow me there at @RuthSoukup. Be sure to also share your photos on Instagram for a chance to win daily prizes. (Get the contest details HERE.) Finally, be sure to check out our BLOG TOUR page, where you can find all sorts of additional ideas and inspiration from other bloggers who are taking the #31dayLWSZ challenge this month too!

Pin It

The post Day 30: Plan for the Future appeared first on Living Well Spending Less®.

October 29, 2015

Day 29: Reassess Your Budget

This is the twenty-ninth day of our 31 Days of Living Well & Spending Zero challenge. Start with Day One here.

* * *

You’re very nearly done, so it’s time to kick your feet up, pat yourself on the back, and … wait. Not yet. We still have a little bit of work to do. I know you’ve worked very hard—your house is clean , you’ve probably eaten your way through most of your pantry, and you likely have more than a few creative recipes under your belt. You’ve fostered your creativity and maximized your resources.

At this point it would be really easy to say, “Yup, I’m done” and walk away, but that’s not how this works.

Part of this project is self-discovery, and we need to think about what you’ve learned on this journey and how you’re going to make it stick.

You probably won’t keep “spending zero” all the time, but it’s time to assess your budget and see where you are. I’m not going to lie. This isn’t going to be easy. It’s not something that has a quick fix.

Change is hard. Budgeting is hard.

But you can do this! So let’s roll up our sleeves and get it done. As I tell my girls, I never neglect to do something just because it’s hard. It’s the things you work hardest for that will reward you the most.

Today’s assignment is to complete our LWSL Cash Flow Budget Worksheet. This will give you a good handle on where you are and where you’re going. We’re going to take a look at your expenses and see what you’re doing right and what areas you could improve on. Then we’re going to set a few goals!

I mainly keep track of my cash flow. I have budget categories, but I don’t monitor them closely. I should, though. —Michelle

What’s that? You already have a budget? Well, even if that’s the case, there’s still work to be done! You could work on reducing your fixed expenses, such as your mortgage, rent, or insurance rates. (Get more advice on how to do that here. Or you could work on cutting down your variable expenses, such as your grocery bill, utility expenses, and even how much you are paying for gas and transportation. Check out these tips for ideas.

After these last four weeks, this won’t be nearly as hard as you think!

Let’s get down to business!

Get your printable LWSL cash flow budget worksheet page 1 here.

Get your printable LWSL cash flow budget worksheet page 2 here.

* * *

Don’t forget that I will be broadcasting LIVE each day on Periscope (usually between 10am and 11am EST). You can find and follow me there at @RuthSoukup. Be sure to also share your photos on Instagram for a chance to win daily prizes. (Get the contest details HERE.) Finally, be sure to check out our BLOG TOUR page, where you can find all sorts of additional ideas and inspiration from other bloggers who are taking the #31dayLWSZ challenge this month too!

Do you keep close track of your budget, or do you find it easier to turn a blind eye? What is the scariest part of creating a budget? Where can you cut expenses?

Pin It

The post Day 29: Reassess Your Budget appeared first on Living Well Spending Less®.

October 28, 2015

Day 28: Week 4 Reflection

This is the twenty-eighth day of our 31 Days of Living Well & Spending Zero challenge. Start with Day One here.

* * *

Wow! Can you believe you’re almost done? You made it four whole weeks! That’s pretty amazing. I know it’s been tough, but you’ve soldiered through and now you’ve got just seventy-two hours to go. Woot!

In this past week, we learned ways you can earn a little extra money, and how to tap into your existing resources to barter, trade, and sell items to get what you need. We also had a little fun with a date night and some family activities! I hope you and your loved ones really explored what it means to have quality time together without spending money. How did your kids feel about the challenge?

One of the things I loved about this week was that I really started to think about the sustainability of spending “zero” as a lifestyle. Granted, very few of us can manage to truly spend zero, but many of us can learn to cut back on excess and separate out the needs from the wants.

So often we get caught up in the mentality that buying something or running to the store will solve our problems. We throw money at things without addressing the real issues. We buy entertainment and turn our imaginations off. Doing this challenge really forces you to open up your mind to alternative answers to life’s questions of “what to eat,” “what to wear,” and “what to do.” You can get by spending less. And in some (many) cases, less is actually more.

Going without forces us to appreciate the things we do have. It forces us to turn off the television and focus on our significant other. It helps us to haul out the pillows and build a fort with our kids, play games, and use our imaginations.

Those are the memories that will sustain you through life—not how much you had or bought, but rather, the things you did and the way you spent time and appreciated those around you.

With that, I give you your weekly reflection sheet. Take a moment to explore your feelings and what you learned this week as we approach the end of our challenge. Note your highs and lows, and biggest lessons learned. This week was surely unique for all of us. Documenting your experiences will help you review and reflect later—and learn so much more from your experiences.

Overall, I must say: way to go!

I’ve been most inspired by blogs like yours that keep me motivated when I want to give up. My biggest struggle has been time management and getting enough sleep through this 31 Days series. —Claire

Get your printable week 4 reflection sheet here.

* * *

Don’t forget that I will be broadcasting LIVE each day on Periscope (usually between 10am and 11am EST). You can find and follow me there at @RuthSoukup. Be sure to also share your photos on Instagram for a chance to win daily prizes. (Get the contest details HERE.) Finally, be sure to check out our BLOG TOUR page, where you can find all sorts of additional ideas and inspiration from other bloggers who are taking the #31dayLWSZ challenge this month too!

How did you maximize your resources this week? What have you enjoyed most about this challenge so far? What has been the hardest part?

Pin It

The post Day 28: Week 4 Reflection appeared first on Living Well Spending Less®.

October 27, 2015

Day 27: Have Fun With Your Family

This is the twenty-seventh day of our 31 Days of Living Well & Spending Zero challenge. Start with Day One here.

* * *

Believe it or not, we are rapidly approaching the end of our 31 Days. How have you done? Can you believe you’ve made it for almost four weeks without spending?

To celebrate, I think it is high time we plan a little family fun. Even if your kids are great at entertaining themselves, by Day 27 of the challenge they’re probably starting to get just a little antsy for activities and fun! I was surprised at how well my kids adapted to the challenge. They really were on board and helped keep me on track. Still, it’s not always easy on the kids, and if your experience has been anything like mine, I’m sure you’ve had to say no more than a few times.

There are plenty of free activities you can do as a family. In fact, kids have the best imaginations and creativity and can be satisfied with very little. I’ve seen my girls play dollhouse with homemade furniture and Barbie dresses made out of Kleenex … for hours. To kick-start your planning, though, check out this list of ideas for free family fun.

25 IDEAS FOR FREE FAMILY FUN

Play a “chore cards” game—okay, so maybe doing chores doesn’t scream “family fun,” but this is actually a great way to get your kids to enjoy participating in housework. Take a deck of cards and write one chore task on each one (i.e., unload dishwasher, vacuum living room, dust bookshelves). Gather your family members at the table, shuffle the cards, and deal them to everyone until there are none left. The cards in each person’s hands are the chores they must do, but everyone is allowed to trade cards (and tasks). The first person to finish all their chores wins!

Build with Legos—most kids love Legos, but even more so when their parents join in the fun. Working together to build something big, like a castle or a city, is a lot of fun and helps your kids improve their construction skills by learning from you.

Play hide-and-go-seek—our family has had some of our best and funniest moments playing this simple game. It works indoors or out with all different ages. Be warned, though—it can go on for hours!

Rake leaves or do other yardwork—working outside together as a family can be incredibly satisfying. Get your kids to help rake leaves, then have fun jumping in them together. Shovel snow during winter, or plant flowers together in the spring. In the summer, watering the garden can turn into fun running through the sprinklers!

Play board games—age-appropriate board games are a great way to spend an afternoon. Added bonus? Teaching your kids all sorts of important and essential life skills such as problem solving, sportsmanship, math, reading, and more! Our current favorites include Candyland, Cootie, and Qwirkle. Keep your eyes peeled at garage sales, or ask friends of older children if their kids have outgrown any games.

Do a puzzle—depending on your kids’ ages, break out a “hard” puzzle—100 pieces or more—and spend a few hours working on it together.

Have a movie night—nothing makes my kids happier than movie night. We get all the sleeping bags, blankets, and pillows in the house and build a comfy nest on the floor. We then pop popcorn and make hot chocolate and settle in to watch our movie of choice. (The local library has a great selection of kids’ movies you can check out for free!)

Build a fort—grab some old blankets and sheets and spend the afternoon creating a super cool hideout with tables, chairs, and other furniture. Or build an outdoor fort with brush, branches, leaves, or rocks. You can even add some Christmas lights for extra ambiance.

Go to the beach—the beach is a lot of fun whether it’s hot and sunny or not. Collect shells, run from waves, build a sand castle, or dip your toes. If you don’t live near the ocean, try a river, lake, or pond. Explore the water and see what you can find!

Make homemade Play-Doh—let the kids help with the process of making Play-Doh , and then spend the afternoon making your own dough creations. Use a rolling pin and cookie cutters for even more fun.

Have a cooking decorating contest—let the kids help with the baking, then gather a variety of icing and other cookie decorating supplies and see who can come up with the most creative design. Award prizes for different categories—most creative, most beautiful, funniest, sweetest, and so on.

Go for a bike ride—explore an area of town close by your house, or bring your bikes to a popular bike trail.

Do an upcycling project together—this is a great way to create something useful and teach your kids about recycling and reusing. For ideas, show your kids the awesome upcycling projects from Day 18, then decide what to make. Let them help gather the supplies or check for free stuff on Craigslist, and then get to work.

Do a family art project—break out the crayons, markers, and paints and a large canvas or paper and go crazy! You could do something more structured like this handprint family tree or this fingerprint heart , or simply just let your kids lead.

Visit a free museum—lots of community museums offer free admission days. Check your local chamber of commerce website for ideas.

Do a free craft project at a local hardware store—both Home Depot and Lowe’s offer free kids’ workshops. Home Depot holds theirs on the first Saturday of the month while Lowe’s offers one every other Saturday. Check with your local store for details.

Make a time capsule—fill a box with mementos from your life right now—pictures, trinkets, letters to yourself, and so on. Then seal your box and either bury it or put it away some place where you won’t open it for ten or twenty years.

Make homemade gifts—making gifts together is a great way to teach your kids about the joy of giving and the importance of giving from the heart, not just giving “stuff.” Brainstorm some ideas for useful or thoughtful gifts you can make together and then get busy! See Day 16 for some crafty ideas.

Do a funny photo shoot—gather dress-up clothes and any crazy hats, scarves, and other funny accessories you can find and set up a photo booth. Take turns taking pictures of each other looking wacky, or set up the self-timer and get some silly family photographs.

Have a Wii Bowling tournament—break out the old Wii Sports games you haven’t played in years and have an old-school family bowling tournament. Make it an event by serving bowling alley inspired grub!

Visit a free local festival—check out your local paper or community website to find out what free events are happening in or around your town.

Watch a Dock Dogs competition—if you’ve never watched these amazing dogs leap off the dock, competing to see who can jump the farthest, then you’re missing out! Competitions are free to watch. Check out the Dock Dogs website for an upcoming event in your area.

Have a garage sale—entice your kids to help by letting them keep the proceeds, or promise to use the money for a fun family outing. See Day 22 for more tips.

Go to the library—most libraries have great kids’ sections with books, games, and free events or story time. Many libraries also often host summer reading contests where your kids can earn prizes for the reading they do every day.

Go fishing—if you don’t have the right equipment or know-how, try asking a friend or family member who does to give your family a fishing lesson. Who knows? You might even come home with dinner!

Depending on the ages and interests of your children, you may need to adapt a little. (Teenagers might need different motivation and activities than an adaptable seven-year-old.) Don’t let that keep you from having a great time with the whole family!

Just found out we can go eagle spotting for free! —Lisa

Your assignment today is to spend time as a family doing something totally new that you’ve never done before. Get creative and find something free that you can all do together!

* * *

Don’t forget that I will be broadcasting LIVE each day on Periscope (usually between 10am and 11am EST). You can find and follow me there at @RuthSoukup. Be sure to also share your photos on Instagram for a chance to win daily prizes. (Get the contest details HERE.) Finally, be sure to check out our BLOG TOUR page, where you can find all sorts of additional ideas and inspiration from other bloggers who are taking the #31dayLWSZ challenge this month too!

Pin It

The post Day 27: Have Fun With Your Family appeared first on Living Well Spending Less®.