Ruth Soukup's Blog, page 68

January 6, 2016

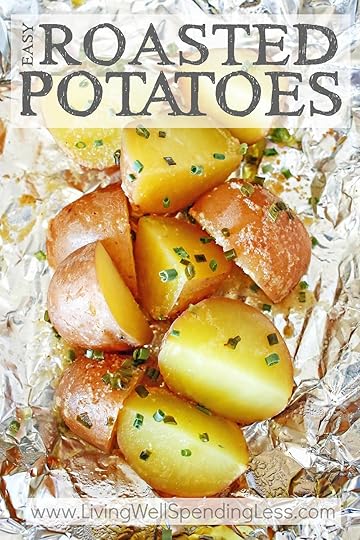

Easy Roasted Potatoes

This is a guest post from Gina of Kleinworth & Co.

With the holidays behind us I’m sure ready to scale back & simplify things around here. How about you? From the things I commit to on my calendar all the way down to the choices I make for dinner, I want things to be easier than ever. It doesn’t hurt if it’s quick too, because we all know that dinner time can be so chaotic already. So what better way to ease things up than to make some simple, almost effortless side dishes to satisfy your hungry family.

I love making these Easy Roasted Potatoes because they are packed full of flavor, nutrients & only require a handful of ingredients & less than 30 minutes to make. I can literally get these going, pop them in the oven & I’m free to work on my main dish. By the time that’s done- so are these potatoes & it all comes together perfectly. If your kids are older like mine, you could even have them help with this while you work on the other dishes. Sometimes I like to have my kids wash & prep the potatoes & other times I have them preparing salad as I work on getting these foil packets together.

Here is what you need:

6-12 baby red potatoes- washed & quartered

4 tbsp olive oil

1 tbsp lemon juice

1 tsp salt

2 tsp granulated garlic

Chives for garnish (optional)

Step 1: Start by preheating the oven & cutting your potatoes. I like to quarter them so they are more bite size.

Step 2: Place potatoes on sheets of foil on a large baking sheet. Combine olive oil, lemon juice & seasonings in small bowl & whisk until combined. Spoon over your potatoes – it’s not going to coat them completely, that’s okay.

Step 3: Fold the foil in & pinch tightly so it’s sealed closed. Bake about 17-25 minutes or until tender.

These are so delicious. I love serving them along side fried chicken or my favorite garlic butter filet Mignon. I love that these are simple enough that I can get the kids in the kitchen & learning. They already know that they can eat quick & still keep it healthy which is great. You can make dinner less of a chore when the recipes are swift & easy like this one.

Print This!

Recipe: Easy Roasted Potatoes

Summary: These potatoes come together with just a few ingredients and make a great side dish for any meal.

Ingredients

6-12 baby red potatoes- washed & quartered

4 tbsp olive oil

1 tbsp lemon juice

1 tsp salt

2 tsp granulated garlic

Chives for garnish (optional)

Instructions

Start by preheating the oven & cutting your potatoes. I like to quarter them so they are more bite size.

Place potatoes on sheets of foil on a large baking sheet. Combine olive oil, lemon juice & seasonings in small bowl & whisk until combined. Spoon over your potatoes – it’s not going to coat them completely, that’s okay.

Fold the foil in & pinch tightly so it’s sealed closed. Bake about 17-25 minutes or until tender.

Cooking time: 17-25 minute(s)

Number of servings (yield): 4

Gina, author of Kleinworth & Co, is a busy homeschooling

mom to 3 great kids ages 11-17. She likes to find new ways to make life simple & streamlined on a budget. She loves to share easy DIY projects, fun crafts with the kids & a whole lot of recipes, with a few photography tips sprinkled in occasionally too.

* * *

Pin It

The post Easy Roasted Potatoes appeared first on Living Well Spending Less®.

January 4, 2016

12 Secrets of Motivated People

Have you ever looked at a celebrity mom and wondered how she somehow manages to get so much done? We all have the same amount of time in a day. So why is Angelina Jolie somehow able to balance raising six kids with working for the United Nations AND directing and starring in multiple award-winning films, all while looking fabulous and being married to Brad Pitt?

In other words, why do some people seem to achieve so much more than others?

Part of it’s the fact that celebrities have a great deal of control over how they spend their time. If you’re a working single mom of three who’s barely making ends meet, chances are you don’t have the luxury of an entourage (don’t we wish!) or the finances to jet off to the south of France whenever you need a reboot.

Despite the doldrums of normalcy, there are many people who manage to achieve quite a bit in their day, while for others 24 hours can seem like barely enough time to get one or two things checked off the list. Part of it’s prioritizing, part of it’s attitude, and part of it’s perception. Just as it was outlined the famous 1989 Stephen Covey game-changing book, the 7 Habits of Highly Effective People, there are certain commonalities motivated people have. By learning and applying these ideas, we can all become the type of person who can “Get ‘er done.”

1. They LOVE Their Calendars

Prioritizing, scheduling, setting a timer and blocking out time to achieve tasks are at the absolute basic foundation of getting anything done. Whenever you’re faced with a task, assess it (before it even gets a coveted spot on your calendar). Is this something in line with your values and worth your time? Own your calendar and schedule and don’t allow anything to eat it up that’s not worth it.

Once a task is deemed worthy, get it on your calendar. Whether you use Google Calendar or a paper planner like our Living Well Planner™, block out time and even consider setting a timer. Being cognizant of the way your time is spent (and avoiding distractions and time wasters) is key in managing those 24 hours and packing in as many worthwhile activities as possible.

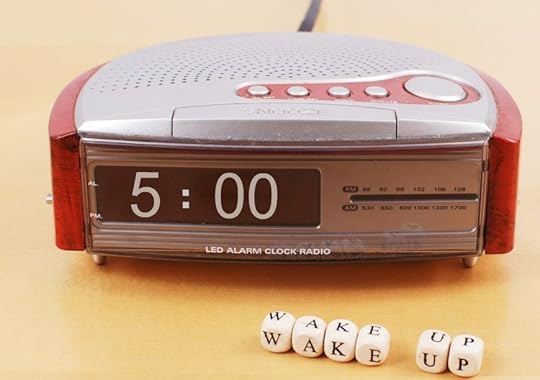

2. They Get Up Early and They Eat That Frog For Breakfast

Eating the frog means tackling the most difficult task first. We’re only given so much time in a day and if you tackle the big jobs and the hard stuff first, then the little stuff and easy stuff can fill in the cracks.

“But, Ruth…I am NOT a morning person,” you’re saying. I get it. Not everyone is. However, universally, getting up a little bit early does help you get things done. Try pushing yourself to get up 10 minutes earlier each day until you gradually hit the desired wakeup time. (Adjust your bedtime accordingly.)

Maybe you’re not functional at 5 am or maybe you do your best work late at night, but there’s something to be said for being out and about during “normal” business hours. Getting to the store, making appointments, or even getting to the gym in the morning can mean you beat the crowds and get things done in a more efficient way. Create a morning routine that works for you.

Even if your “morning” starts at 10 am, make it a routine and tackle your difficult tasks first. Don’t start down the rabbit hole of email checking and social media updates first thing. Instead, do some concrete activities to get your day started—exercise, move to get your blood flowing, drink a big glass of water (and a big coffee if you need it) and wake up ready to tackle the world.

3. They Set Concrete, Achievable SMART Goals

Goals are funny things. Sometimes a goal can be too lofty, too nebulous, or too hard and it just fizzles out and dies. Motivated people know achieving goals keeps motivation flowing. Every time you accomplish something, it’s little “rush” as you check it off your list. Harness momentum by making your goals achievable and concrete.

SMART stands for “Specific, Measurable, Attainable, Realistic and Timely.” Things like “get skinny” are too non-specific. (How much weight do you want to lose? By when? How will you do it? How will you know when you are at “skinny”?) Instead try things setting goals like this: “I will walk five days a week and track my food to lose 1-2 pounds per week for the next six weeks, to meet my overall goal of losing 10 pounds.”

The difference in setting concrete, achievable SMART goals is you’ll taste the thrill of victory each time you take a step in the right direction. You’ll be able to measure your success clearly and redirect yourself should you get off-track or sidelined. Try our Goal Setting Workbook if you need help getting started.

4. They Invest in Themselves

Motivated people know they can be their own worst enemy or their own biggest cheerleader. To be motivated, you have to make your goals and dreams a priority. It can seem selfish or counterintuitive, but think of it like training for a marathon or learning to play piano. You have to invest time in practicing every single day. You must schedule out time, and if it’s really your dream, keep your eye on the long-term outcomes.

Chances are, whatever your dream, it will probably benefit your spouse and family in the long run. If you keep that fact in mind, investing the time, effort and resources in yourself doesn’t seem as selfish. Your happiness and achievement will reflect positively on those around you so investing in yourself is worth every penny. If you have a goal of going back to school, then look at the time and tuition as an investment in your long-term desire to get a better career and accomplish your life goals. See? Everybody wins.

5. They Break Off Bite-Sized Pieces

Goals are a series of small steps. Getting things done and harnessing your motivation means not getting overwhelmed by the big picture (which can quickly derail and frustrate the best of intentions). Any time a task seems too daunting or unattainable break it down into smaller steps.

A few years ago, there was a big trend in “52 week savings” goals. (As in, put away $1 on week one, $2 week two and so on.) The reason this was so successful is people built on a little, manageable goal each week and ended up with $1,400 at the end of the year.

The same results go for the popular “Couch to 5K” program. Each week there are three workouts gradually building up to running an entire 5K. Motivated people understand making the first step is the hardest. After that, it’s about simply completing the small task in front of you, a little at a time.

6. They Know When to Turn Off or Tune Out

There’s a growing trend of turning off your cellphone and going on a digital detox. Whether it’s an hour or two a day right before bed or taking a full-blown digital “Sabbath” once a week, people are understanding the power of disconnecting from the Internet, television and electronics—and reconnecting with their loved ones.

Motivated people understand while the Internet can be a great resource and a powerful tool for good, it can also become a huge distraction and time-waster. Unplugging yourself or managing your social media time, email hours and other distracting habits can help you achieve more in a shorter amount of time.

If you have a very difficult time keeping yourself off Pinterest or the FB, try a website blocking app like Freedom or Anti-Social. You might be surprised at how much time you suddenly have when you let go of these distracters. At the very least, learn to put your cellphone down during conversation and keep it off at the dinner table. That’s just called having good manners!

7. They Take Personal Responsibility

We’ve all heard the mantra YOU are responsible for your own happiness. One thing motivated people understand is that the power to change, to achieve what we want, and to conquer whatever goals we have set, is within us. Many of us have overcome great personal hardships and circumstances beyond our control that may have been painful or held us back, but the power to overcome is always there.

Sharing my own story of being delivered by Grace and overcoming challenges has been a source of motivation for me. Knowing I’m no more important or special than anyone else, and yet, I’ve been able to come so far (and I’m still working on it) has made me realize my purpose to be an example for others who might be facing similar struggles. We have to take responsibility for ourselves and know we’re in control of our own lives. Through the Grace of God, we can find the power within ourselves to tackle anything that comes our way. The power is within.

8. They Find Joy in the Journey

Motivated people are focused on the finish line, but they also find joy in the journey to the end goal. No one who wins a gold medal skiing hates to be on the slopes and there are no Grammy award winning musicians who just HATE singing. If you are passionate about what you’re doing and working towards your goals, there should be joy and accomplishment every step of the way.

Think of it like a vacation. If you’ve ever been on a road trip to visit some great destination, you know full well half the fun and most of the memories are built on the road and not at the destination.

Every step towards your goals should be a learning experience and an opportunity to try something new. Motivated people know it’s about reframing your perception to create a new lifestyle as opposed to a simple race to the finish.

9. They Don’t Give Up

This is one of the most difficult “secrets” to apply, but it’s the most important. Motivated people don’t give up. They know there are always setbacks to achieving anything. They know there will be some days when the house is a wreck, and you lose your temper and you question your existence and purpose and well, just about everything.

The difference is, when things fall apart, the motivated don’t quit. Not to say every goal is achieved, but motivated people understand sometimes it’s about reframing and rerouting, but never giving up. If you’re trying to pay off your debt, teach your children about responsibility, or do something else that seems almost impossible (and may make you think you’ve lost your mind), don’t give up.

10. They Rely on Others

Like the entourage of Oprah and Martha, your own entourage can help you stay motivated and keep you on your path. I find blogging to be a huge accountability check (let me tell you—people don’t hold back their opinions online) and it’s pretty motivating to know when I’ve stated a goal, I have readers I have to answer to.

Posting your goals to social media, asking for a weekly “accountability check” with a friend, or relying on your spouse to keep you in check can help you keep a handle on the big picture and head off any roadblocks you might not see coming.

Similarly, motivated people know when they need to delegate and ask for help. Maybe you need to set up a babysitting co-op, a meal swap or another activity to free up a little time for yourself. Look for ways to make your life easier, so you’ll have the time to achieve your goals. Don’t be afraid to raise the “Help Me” sign now and again, either. You’ll be amazed at how many people are looking for an opportunity to serve others, and want a chance to help.

11. They Don’t Fear Failure

When I decided homeschooling wasn’t fitting our family there was a feeling like, “I’ve failed. I’ve done this all wrong.” And yes, it was very humbling. I had to reframe and think about the fact my goal was still on “providing the best education for my children.” So, with that outcome in mind, I wasn’t failing but rather choosing a different path. I wasn’t giving up on the goal of seeing my kids’ education through, but I realized I needed different resources and a new plan.

There will be failures along the way and that’s just part of achievement. So many of us hold ourselves back because we’re afraid we’ll fail, look “stupid,” or feel foolish. It’s about overcoming that self-doubt. So you might fail or you might have to go at something from a different angle. That’s okay! No one will remember most of the things we find embarrassing anyway.

Almost all of us have a mortifying childhood story—a time when we wet our pants or fell down in front of everyone…and you know what? Everyone has one of those stories and no one remembers anybody else’s. What does that tell us? We will be remembered for our achievements, not for the times we failed. So pick yourself up and keep going!

12. They Understand Their Motivations

What drives you? Is it the desire for financial success? Is it the goal to be the best at something? To win? Understanding your motivations, harnessing them and using them to shape your focus is a powerful way to stay true to your goals.

Many of us have many motivations. We’re driven by our desire to protect and provide for our families. We’re driven by our faith and values. We’re propelled by our feelings for our spouse and our desire to make them happy. We can also be motivated by internal factors like our drive to prove ourselves, to grow and become more intelligent, to put a title of “Dr.” in front of our name, or to bring home a bigger paycheck and afford the things we want.

Sometimes we might feel guilty about motivators. It sounds selfish to think, “I want to be the best” or “I want to be well off.” But underneath those seemingly selfish goals there’s often the desire to provide for and help those around us. There’s a desire to be an example to others and to reflect our purpose.

For me, it’s knowing and believing with all my heart that I am living the life I was called to lead. Over the years I have realized that my own struggles in different areas of my life have led me to look for solutions, and I am passionate about sharing those solutions with others–ultimately it is that call that has me jumping out of bed each day!

If you haven’t quite found your motivation yet, I encourage you to keep looking. Start implementing some of these secrets into your own life, and you might just be surprised by how the motivation starts to flow!

Pin It

The post 12 Secrets of Motivated People appeared first on Living Well Spending Less®.

December 26, 2015

How to Plan Your Best Year Ever

5 Simple Habits That Could Change Everything

5 Simple Habits That Could Change EverythingI don’t know about you, but I am a total sucker for new beginnings. To me there is nothing quite like the promise of a whole new year, of a fresh start and a blank slate, where I can reflect both on where I’ve been and where I want to go. Ever the optimist, I am always utterly convinced that each New Year will be the best yet.

I don’t think that this is necessarily such a bad thing.

Because while I rarely achieve ALL that I set out to in any given year, that optimism does motivate me to at least achieve SOME of what I want to get done, and I am always hopeful that someday I will actually check all those boxes off my list.

But over the years, I have also learned a thing or two about not just being a goal setter, but a goal achiever. I have also learned that while big dreams can be helpful, the act of reaching those dreams requires daily effort, and that if I really want to get things done, I need to create simple but powerful habits in my everyday life.

These are the five habits I am currently working on in my own life, five habits that have transformed the way I approach my days, and habits that have gotten me closer to my dreams than ever before. They are small tweaks, minor adjustments that over time have made a big impact. And if you ever struggle with getting things done or balancing all the pieces of a busy life, these five simple habits might just help you too!

By the way–if you haven’t yet signed up for our free Best Year Ever Mini Course, I highly, highly recommend that you do so as soon as possible! Through four powerful video lessons, it covers everything I talk about in this post in much more detail, and includes a printable workbook that will give you everything you need to set yourself up for massive success this year. To join, simply click the button below.

1.Write Down Your Goals

There is no habit more powerful than the habit of setting concrete, actionable, written goals. It is one thing to ponder a course of action in your mind, or to daydream about all those cool things you might like to do someday; it is a whole other to actually take the time to write them down. Writing down your goals makes them real, and once they are real, you can’t ignore them.

I like to start my year by setting no more than 5 major long-term goals for my work and personal life, as well as at least a few long-term home improvement goals. I keep these in an area I can look at them every single day (for me it is the first page of my Living Well Planner™, but you could tape them to your bathroom mirror or keep a list anywhere else you will refer to it frequently.) This helps me keep one eye on the big picture, so that I always know what I am working towards.

On the first day of each month, I also take a few minutes to set smaller monthly goals. These are things that help break down the larger goals and get me closer to the finish line.

Regardless of whether you are setting a long-term or a monthly goal, it is important to make sure each goal is specific, measurable, actionable, and has a clear time limit so you will know, beyond a shadow of doubt, exactly when you’ve achieved it.

2. Start Each Day Well

The second most transformative habit you can establish this year is to start each day with a productive routine that sets the tone for your entire day. It is smart to take ten minutes first thing each morning—perhaps over your first cup of coffee—to make a plan for the day.

Start with a quick brain dump of all the things you might want or need to get done, then take the time to mark each task as an “A” task (the most important things that absolutely must get done), a “B” task (important things that probably should get done), or a “C” task (things you’d like to get to if there is time). If there are any “D” tasks, just go ahead and cross them off your list.

Be very careful to allow yourself just three and only three “A” tasks, and make sure at least one of those “A” tasks is something related to one of your long term goals. From there, all that’s left is to start working your way through your list, “A” tasks first.

3. Tell Your Money Where to Go

I started this blog in 2010, not because I was a money-saving expert, but just the opposite—I am often a disaster with money, and I needed a way to hold myself accountable. Amazingly enough, that accountability worked, and in the years since, I have learned firsthand that developing the discipline to create a plan for your money each month is a habit that can’t help but spill over into every other aspect of our lives. Likewise, we can’t live a productive, contented, and joy-filled life when our finances are in complete disarray.

The best way to avoid the underlying anxiety that comes from financial missteps is to actively tell your money where to go by taking just a few minutes once a month to write out a concrete cash flow plan. The concept is really pretty simple, and doesn’t have to take long, but the results are life-changing. And, just like with goals, it is really important that this budget gets written down. Make it real and make it count!

For more concrete advice on creating a plan for your money, I highly recommend Dave Ramsey’s Total Money Makeover. It is a game changer when it comes to getting your financial life back on track.

4. Plan Your Meals

Hungry people make bad decisions. It’s a fact. And like with money, when we don’t have a plan for what we are going to eat, we end up making poor choices on an empty stomach, choices that we probably wouldn’t have made otherwise, and that we end up regretting later.

Luckily, the solution to this is simple. Take 15 minutes once a week to sketch out a rough meal plan for the week. It doesn’t have to be fancy, and your meal choices don’t have to be gourmet. You can even take advantage of a meal planning service such as E-Meals. But do take the time to come up with something, because just a little proactive planning once a week can save you hours of hassle and possibly even hundreds of dollars over the course of a year.

For more tips on how to figure out the best meal planning system for you and your family, check out our Meal Planning 101 guide.

5. Use a Planner

While the world we live in is increasingly digital, there is still something almost magical about the process of putting pen to paper. It engages our brain in a way that even the coolest apps in the world can’t quite duplicate. Moreover, a well-designed planner that allows you to get all these things—your goals, your daily task list, your cash flow budget, and even your meal plan—out of your head and into one easy-to-find place is the perfect tool to help eliminate overwhelm and keep you right on track.

Of course everyone’s brains work just a little bit differently, so it is super important to find a planner or organizer that works well with your own style. This process can take some trial and error, but I recommend that you compare and contrast several different options to figure out which one is the best fit for your own needs and preferences. Don’t assume that because one planner didn’t work for you that a different style won’t work either.

Our own Living Well Planner was designed to fit perfectly within the framework of everything we write about here at LWSL. It offers pages for both long term and monthly goal setting, as well as monthly budget planning pages, and weekly planning pages that allow you to plan both your schedule and your meals at a glance. It works by simplifying all those things that have to be done in order to allow more room for those things that matter most.

In the end, becoming a better goal achiever, and not just a goal setter, is all about the patterns we establish in our everyday lives. If you’re ready to make this your best year yet, start with these five simple habits—write down your goals, start your mornings well, tell your money where to go, plan your meals, and begin using a paper planner or organizer. They are five small tweaks that might just change everything.

Here’s to an absolutely amazing 2016!

P.S. Don’t forget to sign up for our free Best Year Ever Mini Course as soon as possible! Through four powerful video lessons, it covers everything I talk about in this post in much more detail, and includes a printable workbook that will give you everything you need to set yourself up for massive success this year. To join, simply click the button below.

P.S. Don’t forget to sign up for our free Best Year Ever Mini Course as soon as possible! Through four powerful video lessons, it covers everything I talk about in this post in much more detail, and includes a printable workbook that will give you everything you need to set yourself up for massive success this year. To join, simply click the button below.

Pin It

The post How to Plan Your Best Year Ever appeared first on Living Well Spending Less®.

December 21, 2015

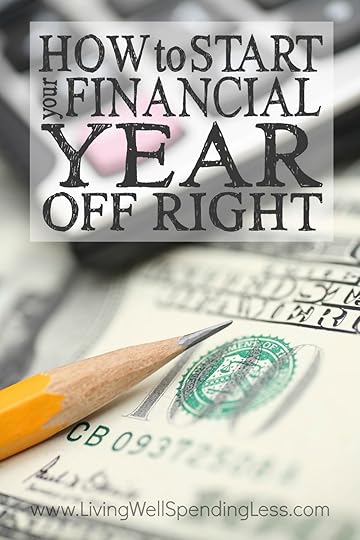

How to Start Your Financial Year Off Right

Today I am happy to welcome back my friend Cherie Lowe from the Queen of Free, who has graciously joined us here at LWSL as a regular monthly contributor. Cherie is the author of the amazing book, Slaying the Debt Dragon, which she wrote after paying off more than $127,000 in debt! I am so excited to have her bringing her wealth of knowledge & experience on this subject to LWSL–please join me in making her feel right at home!

* * *

This is a Guest Post from Cherie at Queen of Free

“The journey of one thousand miles begins with one step.”Lao Tzu

The more time I spend breathing on the planet, the more I realize we’re all walking somewhere. No one really stands completely still. We run toward goals or we run away from problems. We chase dreams or flee from nightmares. We are always in motion. Even our inactivity has direction. If we remain motionless, we’re still heading in the opposite direction of our objectives.

A new year provides the perfect opportunity to put plans into action. Ripe with potential, we see endless possibilities. And perhaps our own unrestrained jubilation during the holidays causes the need to scale back. Our finances or eating habits or lack of exercise or staying up too late or imbibing in too much Christmas cheer – take your pick – may be a little out of control and need some course correction.

So we organize and research and plan and budget. And we whisper a prayer that this time it will be different, that we’ll have the fortitude to stick with it and the wherewithal to beat back temptation. Then some of us take that one step and actually begin working the plan to eliminate debt, reach savings goals, and scale back our spending. But others? They stand in the distance, longing to take the first step but terrified of what it might entail.

How can you become the brave traveler who takes that first step instead of the backward moving aimless jogger headed in the wrong direction? How can you make this year your best financial year and come out of the gates racing forward?

Stop Making Excuses

For years, we delayed paying off our massive mound of debt ($127,482.30 to be exact).

The timing just wasn’t right.

We didn’t have enough money.

We needed a new car.

Our kids had to have new shoes.

The roof.

That trip we really wanted to take.

There were so many “reasons” why we just couldn’t begin the process. Not now at least. Maybe someday, but just not today.

While there may have been some legitimacy is all of the above, now I can see they were just excuses. Excuses we made primarily because we were afraid.

Afraid that we would have to make difficult sacrifices.

Afraid that it was impossible.

Afraid that we would fail.

While it might seem like our fears simply delayed the inevitable they did more than that. During our years of excuse making, the debt multiplied.

Your first financial assignment of this year is to drop the excuses. Over and over again, I tell people, “There is no good time to begin paying off debt, there is only today.” And the maxim rings true no matter your financial goal.

Gooooaaaaalllll!

Now that we’ve moved beyond the tough love necessary to launch your journey, it’s time to put your feet in motion.

Begin by clearly defining your goals and then putting pen to paper. Did you know you are 42% more likely to achieve goals if you physically write them down? Who wouldn’t want to increase their odds of achieving their dreams by 42%?

Be as specific as possible when outlining your financial aims. Don’t just say I want to pay off all my debt or save X amount of dollars. Instead, drill down how much and in what time frame.

Be realistic, too. Consider your current income, ways you might raise more income (selling things, taking on extra work, scaling back your lifestyle) when clarifying goals. We’re not talking about a fairytale dream board filled with wishful thinking. Instead you need focused obtainable mile markers.

Get Your Organizational Act Together

Next, tackle the difficult task of actually doing the heavy lifting of financial organization. For some of us (hi there, it’s me), this can be incredibly difficult. Block off an afternoon to get an accurate picture of your current economic situation. Gather statements and receipts. Comb through online and paper documentation.

And then begin to budget. I know what you’re thinking. You hate budgets. You always have hated them, you always will. I’ll be honest. Budgets haven’t been my bestie either.

In fact, I had to alter my semantics and refer to the entire process as “forecasting.” Clueless as where to begin? Check out these free printable budget forms, read 31 Debt Free Missions: (Re)Build Your Budget and How to Organize Your Monthly Finances.

Seek Out Inspiration

Few are able to travel the road to their financial aspirations alone. You need encouragement. You need ideas. You need inspiration.

While we were paying off debt, I listened to the Dave Ramsey show daily. After four solid years of tuning in over and over again, I could answer most of the questions callers tossed out. Heck, even my kids could because they had heard the consistent replies so many times. Listening to the broadcast wasn’t about learning new information for me. It was about finding hope in the stories of other people who had traveled and similar path and were now standing where I wanted to be.

Whether they are people you see day to day or individuals you may only encounter through the radio, books, or the Internet, you need inspiration to help you achieve your financial goals this year. I’d love to share more of our story through Slaying the Debt Dragon (you can also catch my husband Brian and I January 5-6 on the Focus on the Family broadcast). And of course I’d recommend Ruth’s book Living Well Spending Less and pre-ordering Unstuffed: Decluttering Your Home, Mind, and Soul. From YouTube channels to podcasts to taking a class like Financial Peace University, countless opportunities to connect abound.

Chase down those influences that remind you your goals are attainable, voices who have lived through the same process and survived, or find people on the same journey who can cheer you along.

This is your year. No more pretending you’re standing still when you’re actually moving in the wrong direction. No more running from your problems, making excuses, or being vague on what you want to accomplish. You can own your dreams. You take that first step.

And we’ll be right here cheering you along.

Cherie Lowe is an author, speaker and hope bringer.

Her book Slaying the Debt Dragon details her family’s quest to eliminate over $127K in debt in just under four years. As her alter ego the Queen of Free, Cherie provides offbeat money saving tips and debt slaying inspiration on a daily basis.

Pin It

The post How to Start Your Financial Year Off Right appeared first on Living Well Spending Less®.

December 18, 2015

How to Save $10,000 This Year

What would YOU do with $10,000?

It’s fun to think about, especially if you’re in a place of financial peace and security. Presents? A vacation? Deluxe spa day? Realistically, for most of us, $10,000 would be enough to build an emergency fund or make a dent in our debt, leading us towards financial peace of mind.

In Dave Ramsey’s 7 Baby Steps to Financial Peace, the first step is to put away $1,000. We’ve talked about 10 smart ways to build up your emergency fund and get the savings ball rolling. The next step is to pay down your debt and the third is to put away a fund to cover 3-6 months of bills.

$10,000 is a great goal to aim for. It may not seem attainable at first—let’s face it, that’s a huge chunk ‘o change. It’s daunting. I promise though: it is doable. With smart planning, budgeting and yes, a few sacrifices, you could have that balance in your bank account one year from today.

Start Smart

If you have your $1,000 emergency fund stocked away, you’re already an experienced saver! Your “baby” emergency fund covers those surprise expenses that pop up—the dog is sick and needs to go to the vet, the car has a flat tire, the coil burned out on your water heater, etc.—all those oops moments that would’ve had you reaching for the credit card in the past. (Here’s how to save that first $1,000.) If you’ve built it up, you’re probably feeling at least a slight sense of relief and not a sinking fear when you log in to your online banking.

The next step is to pay down your debt. While of course it’s important to save—and $10,000 is a great goal—don’t start socking away $10,000 while creditors are knocking down your door. The interest rate on savings won’t make up for the money you’re losing to debt collectors, especially on credit cards, small loans and medical bills. Get yourself on an even playing field with solid financial footing first.

Once your debt’s under control or paid off to a point you’re comfortable with, then it’s time to start!

You might be thinking, “Great, but my income barely covers my bills, how do I find wiggle room for savings?”

Get Serious About Budgeting

Sit down and take a hard look at your monthly budget. If you aren’t feeling budget savvy or if you need a refresher course, try our Beginner’s Guide to Savings to get started. This eight-week plan will get you in the savings mindset. You can also use our worksheet to examine your budget and check out 10 Painless Ways to Save.

Check with your tax accountant to ensure you’re withholding the right amount on your taxes or use this IRS publication to assess. If you feel you need to allocate money towards your savings, rather than paying above your employer match on your 401(k) or toward the principle on your mortgage, then you may need to make a change. Consider refinancing your home if your interest rate isn’t competitive.

Watch your budget for any flexibility. It’s time to examine areas like your phone plan (dump your landline), your insurance, and other high-cost areas like utilities. If it’s been over a year since you examined your budget for areas that could use tightening, roll up your sleeves and start making phone calls and cuts.

Are you making any budget mistakes you need to resolve? Are there subscriptions you can cancel? Can you cut out cable, let go of your high-speed internet, or gym membership? Even the best budgeters can find ways to tighten use on utilities, cut out memberships, or find alternative ways to save. An average of $25 savings on six monthly bills per month will save you $1800 a year!

The key to successful budgeting is consistency. You can’t just do it once and call it good–it is something you need to revisit and reevaluate every single month. (Which is exactly why our Living Well Planner™ includes a full 2-page budget spread for every month–to help you stay on top of your finances so you can tell your money where to go!)

Go on a Spending Freeze

If you commit to the goal of $10,000, kick off your plan with a month of zero spending! It will get you into the “savings mindset” and help you build momentum toward your goal. Take our 31 Day No Spend Challenge and see how much you can save by simply cutting out all peripheral spending for a month. This means no gourmet coffees, hair appointments, or trips to the store for a little something. It also means at the end of the challenge you’ll have a new approach to spending and the way you view savings.

Aiming for four “no spend” months throughout the year can help you in leaps and bounds to hit your goal. On average, cutting out peripheral spending, eating at home, finding free activities and smart ways to save on things you need (like bartering and recycling) can save you $500-$1,000 a month. Do it four times and you’re $4,000 closer to your goal.

Save on Food

While you’re freezing on spending, you may find you’re doing more freezer cooking as well. Eating at home is one of the best ways to save money. Restaurants can be fun, delicious and wonderful experiences, but the markup on food costs is shocking. Cooking meals at home, bagging your family’s lunches and planning snacks ahead will save you surprising amounts of money.

There are also many ways to save on your groceries—even cut your grocery bill in half. On the months you do a spending freeze, eat what you have on hand, enjoy your freezer meals, and plan ahead. During the months you’re spending, plan with coupons, sales matching, stocking up on staples, eating less meat and meal planning to make your grocery dollars stretch and stretch.

It may sound lofty and I’ll admit when I first started it was all a little intimidating, but once you get going, the prospect of saving money on food gets fun and a little addicting! You’ll find yourself delighted when the cashier tells you the total for your cart full of groceries costs less than a quarter of what you used to spend. I’ve actually giggled out loud in the grocery line. If you save $750 a month through careful planning, for the eight months you’re spending, you can save $6,000 over the year.

Save on Extras

Planning ahead for things like gifts and parties and getting thrifty helps. Saving is hard, but it doesn’t mean life should be joyless and miserable. There are still ways to throw fabulous parties on a budget, make gifts from home, and learn how to decorate on a shoestring. Yes, it’s a little more work than running to the store or shelling out for the latest item, but in the end it’s more satisfying and rewarding.

Look for areas where you can make thrifty choices, like buying the cheapest gas, opting for an at-home car wash, dying your hair at home, and buying items second-hand. Clean out your house and organize the items you have stored away to eliminate “panic buying” when you think you’re out of lightbulbs or batteries.

This is also the time to learn minor repairs. Can you fix something small on the car or replace the fluids? Are you paying someone to mow your lawn? Can you swap babysitting with a neighbor? Don’t pay someone to do something you can do yourself. Yes, it might be more convenient, but over the next year, vow to DIY as much as you can.

Are there other entertainment plans you can forgo…or even put off your vacation plans? Can you deal with your clunker car for another year or dust off your bike and commute to work when the weather’s nice? Even a carpool can save you hundreds in gas over the course of a year (and hey, it’s better for the environment)! By trading extras, doing it yourself, or making do, you can save $100-$200 a month (at least), which means another $2,400 saved this year.

Earn Extra Money

If you’ve done everything above, you should have a plan to hit your $10,000 goal this year, or even exceed it. Let’s say, though, you’re still thinking, “But I am already doing ALL these things, and I still can’t find any room to save.” The answer? Maybe it’s time to consider new ways to earn extra money.

Many of us have talents and resources we’re underutilizing. Even picking up an evening job a few nights a week can help you make ends meet if you’re struggling. There are also many ways to earn money from home. Consider your talents and your previous experience. I never believed I could earn a living and support my family through blogging (and it’s an incredible privilege I am grateful for every day), but I knew I could try to generate some supplemental income and that’s how I got started.

If you aren’t sure you can commit to a job from home, get yourself signed up with a few easy ways to earn money online by doing things you’re already doing. A surprising number of companies offer ways to earn by doing things like watching videos, filling out surveys, or using their sites to search and shop. They may not generate hundreds and hundreds of dollars, but it can help bring in a little extra to help you meet your savings goals.

Revisit Your Plan—Often

If you’re serious about your goal, you have to keep your “eye on the prize.” Literally. Revisit your goal often and assess your budget and bank account weekly to make sure you’re staying on track. Worksheets, journals and organizational tools can help you hold the edge on your plan and ensure money doesn’t fall through the cracks.

$10,000 is a lofty goal, but it’s not unrealistic for many of us, if you employ some smart strategies and start living more within your budget and means. Remind yourself of the reasons you want to save and regularly take a moment to think of the peace and relief you will feel when you meet your goal. While it’s fun to imagine the things we would spend an “extra” $10,000 on, the biggest satisfaction comes from being able to keep your family safe and cared for and having enough so you can help those important people in your life. Keeping that focus in mind will help you meet your $10,000 goal!

Pin It

The post How to Save $10,000 This Year appeared first on Living Well Spending Less®.

December 16, 2015

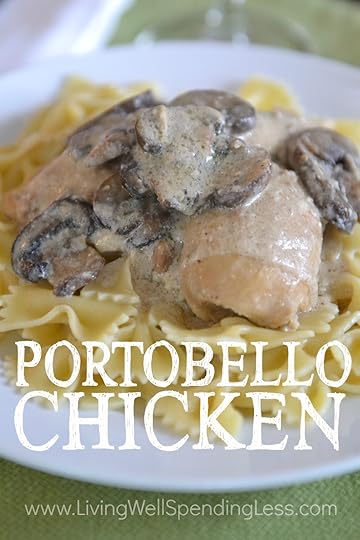

Portobello Chicken

It’s no secret that we LOVE quick & easy freezer meals around here, especially ones that use budget-friendly chicken! Believe it or not, this tender, juicy, flavor-packed Portobello Chicken might just be our easiest recipe yet. It’s got just 5 easy ingredients (not counting salt & pepper), but tastes like you spent hours in the kitchen. It’s even fancy enough to serve to guests.

To make it as part of a freezer cooking day, just split the soup mixture & chicken into multiple bags, then throw it right into the freezer–no cooking required! Making it ahead of time is not necessary, though, as it is equally delicious just marinated in the refrigerator.

You can use any type of chicken but my family much prefers the boneless, skinless chicken thighs, which are a darker, juicier meat and also tend to be cheaper than the boneless skinless breasts.

Here is what you need:

4 pounds boneless skinless chicken breasts or thighs

2 cans cream of mushroom soup

1 16oz container sour cream

1 8oz. package baby Portobello mushrooms, cleaned & sliced

2 tsp dried parsley

salt & pepper

Step 1: Whisk together soup, sour cream, mushrooms, parsley, & salt & pepper to taste.

Step 2: Divide chicken into 2 gallon size freezer bags (be sure to label bags first!) Divide soup mixture into bags and make sure soup mixture covers all chicken; freeze until needed.

Step 4: On cooking day, place frozen chicken directly into crockpot. Cook on high 5-6 hours, or on low 7-8 hours.

Step 5: Optional! If desired, serve over a bed of egg noodles.

Print This!

Recipe: Portobello Chicken

Summary: This simple yet savory meal tastes like you spent hours in the kitchen.

Ingredients

4 pounds boneless skinless chicken breasts or thighs

2 cans cream of mushroom soup

1 16oz container sour cream

1 package baby Portobello mushrooms, cleaned & sliced

2 tsp dried parsley

salt & pepper

2 cups egg noodles (optional; for cooking day only)

Instructions

Whisk together soup, sour cream, mushrooms, parsley, & salt & pepper to taste.

Divide chicken into 2 gallon size freezer bags (be sure to label bags first!) Divide soup mixture into bags and make sure soup mixture covers all chicken; freeze until needed.

On cooking day, place frozen chicken directly into crockpot. Cook on high 5-6 hours, or on low 7-8 hours.

Optional! If desired, serve over a bed of egg noodles.

Preparation time: 5-7 minutes

Cooking time: 5-6 hours on high or 7-8 hours on low in crockpot.

Number of servings (yield): 4

The post Portobello Chicken appeared first on Living Well Spending Less®.

December 14, 2015

Where to Find Stocking Stuffers that Won’t Break the Bank

This is a guest post from Kelli of Freebie Finding Mom

This is a guest post from Kelli of Freebie Finding Mom

Let’s talk stocking stuffers.

Have you ever noticed that it’s those small last minute things that always seem to blow your holiday budget out of the water? Each individual item seems harmless on its own, but when you add them up, then multiply them by the number of people in your family, the expenses can quickly get out of control.

While shopping for stocking stuffers throughout the year is probably strategy, there are still plenty of places to score a deal, even with just 10 shopping days left until Christmas. And while a few of these tips might not help you too much this year, they will help you get a head start on avoiding the last minute crunch for NEXT year.

So, where should you look? Glad you asked!

Dollar Stores

Whether you regularly frequent dollar stores or not, they can be great places to find stocking stuffers… especially for young kids. Get creative and be flexible about your stocking stuffers. For example, outdoor toys like chalk and bubbles, regular dollar store finds, may not be winter weather appropriate but they can give your little one something to look forward to.

Target $1 Bins

The next time you pass through Target, take a few minutes to riffle through the $1 bins near the front door. You may be surprised at what you find. However, be careful not to buy something just because it is inexpensive! When looking at items, ask yourself “Who would I gift this too?”, and once you have a name, “Would they find it useful?” If you can’t answer those two questions, move on!

Freebies

Snag freebies from stores like Kroger during the Kroger free Friday download. In the past, they have done holiday inspired freebies such as free chocolate around Valentine’s Day.

Follow your favorite stores, brands, and frugal living bloggers on social media to be the first to know about freebies and other hot deals that may make for great stocking stuffers.

Oriental Trading

This site has a myriad of inexpensive items that make for fun stocking stuffers such as stickers, bubbles, kids jewelry, activity books, and more. Bonus: You can buy these products in bulk which is great if you have multiple stockings to fill.

As a side note, the would-be stocking stuffers on Oriental Trading can also be used as fun and frugal party favors.

Thrift Stores

Hit up thrift stores and secondhand stores on a regular basis for stocking stuffers. Some thrift stores have special discount days so be sure to ask about that. Don’t forget “niche” thrift stores. For example, if you want to add a book to a stocking stuffer be sure to visit Half Price Books (they also have CDs and DVDs).

Recyclebank

Recyclebank is a program that partners with cities to encourage people to recycle. When you join Recyclebank, you earn points for recycling. These points can be exchanged for great rewards like gift certificates, magazine subscriptions, and much more. In fact, there are more than 4,000 different rewards on the site!

See if your city is a partner, sign up, and start earning (and saving the planet). You can use the points you earn to score stocking stuffers for free. Recyclebank is a great place to get stocking stuffers for older children or adults.

Handmade Gifts

It’s not too late to whip up a few of your own handmade gifts for just pennies on the dollars. For ideas, check out these 10 easy gifts you can make for $10 or less.

Amazon

Amazon has thousands of inexpensive “add-on” items to choose from that can be shipped in just two days, provided you are a Prime member and have a total order of $25 or more. And if you are overwhelmed by all the choices? Check out these 10 fun ideas for $10 or less that are sure to please everyone on your list.

Christmas Clearance

While you are thinking about getting ahead for next year, don’t forget to check out the after Christmas sales to score some incredible deals on stocking stuffers, especially at department stores like Kohls or Macy’s, big box stores like Target and Walmart, and even drugstores like CVS and Walgreens. Also, if you really are shopping at the last minute, keep in mind that most of these stores start their after Christmas sales a day or two BEFORE Christmas!

* * *

Use these resources to start scoring inexpensive stocking stuffers today. Not only will starting your Christmas shopping early save you money, it’ll also save you stress. While everyone else is running around in December, fighting the weather and crowds, you’ll be able to kick back and relax with a cup of hot chocolate.

Kelli Bhattacharjee is the owner of FreebieFindingMom.com,

a blog dedicated to helping everyone take control of their finances and live frugally. If you need more cheap stocking stuffer inspiration, here are 101 inexpensive stocking stuffer ideas. In addition, learn more about Kroger’s free Friday download to start saving now!

The post Where to Find Stocking Stuffers that Won’t Break the Bank appeared first on Living Well Spending Less®.

December 11, 2015

29 Ways to Earn Extra Cash Fast

Whether it is the upcoming holidays, a budget miscalculation, or just an unforeseen expense, sometimes when life’s little (or big) emergencies crop up there is a need to get some extra cash in your pocket TODAY. While I strongly recommend that everyone set up their emergency fund to draw from when the basement floods, your husband needs an emergency root canal, or the dog eats all of your kid’s socks.

Even so, there are times when an emergency fund just won’t cover it. We’ve all been in situations where we’re between the proverbial rock and hard place—and frankly, it stinks. It’s stressful and anxiety provoking.

What do you do then?

Well, luckily there are many ways you can generate extra cash quickly—and many you can even do from home. Here are some ideas…

1.Hold a Yard Sale

In one Saturday you can generate hundreds of dollars, clean out your garage and house, and even enjoy yourself. Organizing a garage sale, rummage or yard sale (whatever term you prefer) is pretty easy with a few planning steps. Get some friends and your kids on board to help and get selling! And if the weather is crummy? Well, see number 2 ebook

2. Sell on Craigslist or Fac

Craigslist is a great place to sell items locally and generate some fast cash. You can post offers for dog walking, babysitting, and more. Plus, you can sell everything from sports equipment to small appliances.

3. Sell Your Handheld Electronics

Raise your hand if you have a stash of old (but still working) cellphones, iPods and other small electronics. Gazelle will give you money for trading in and selling your electronic devices. Bonus—you’re cleaning out clutter!

4. Enlist a Crowd

If you have an emergency (and a strong social media network), gofundme.com can lend a helping hand. Personal crowdfunding can seem, well, tacky for posts of “help my family go to Disneyland for the fifth time,” but for medical bills, pet and household emergencies, or projects for a greater good, they can be very successful. Friends are often willing to help out and it’s literally just a matter of asking.

5. Sell Your Space

Depending on regulations in your area, you may be able to rent your space on Airbnb, or HomeAway, especially if there’s a pending event, conference or festival in your area. If your home is kid friendly (and childproof), Kid & Coe is another way to list your space. If you live close to a popular venue, you can also sell your driveway as a parking space or an extra slot in your garage.

6. Share Your Ride

If you commute, consider picking up a passenger or two from your area. The wear and tear on your car is the same and you can make some extra cash doing something routine. Post your rideshare offer on your corporate site, at a local coffee shop, library or another spot fellow commuters frequent. Many people are thrilled to be able to enjoy their coffee and read the news on their smartphone while you navigate through gridlock.

If you particularly enjoy driving, consider joining Uber or Lyft. Ladies who live in larger cities can also consider partnering with She Taxis, which caters to rides by women for women. If you have an extra vehicle, rent it out with RelayRides or Getaround. If you’re lucky enough to have a boat, consider Boatbound when it’s not in use.

7. Pick Up a Gig

There are several sites offering short-term gigs, jobs and quick temp assignments to the right worker. Check out Gigwalk (technical, virtual assistant and administrative assignments), Zaarly (yardwork, handyman and home service jobs), and CloudFactory (crowdtesting, transcriptioning and beta testing). Put your skills to work! Virtual assistant programs such as eaHELP and freelance programs such as Upwork can also help you get started with a side gig or two.

Post your skills on Fiverr to make $5 at a time. Users post skills such as “I will design your small business logo” or “I will draw a portrait of your dog.” If you’d prefer more substantial tasks, try TaskRabbit where you can earn money for cleaning, delivering items, helping someone move, or other local jobs.

8. Earn Money Online

InboxDollars, Swagbucks, SurveySpot and MySurvey can help you generate extra income just by taking surveys, playing games or watching short videos online. It’s simple to sign up and the surveys are interesting and fun to complete. Sometimes you’re asked to review a product or check out a website. Make a lot of purchases on the web? Ebates gives you back money for online purchases. Apps OhmConnect and Ibotta give you money for your utility use and grocery purchases.

While you won’t earn millions (or probably even hundreds), Amazon’s Mechanical Turk offers you pay and credit for performing simple tasks, testing sites, and doing transcription. The pay can be quite low, but if you’re someone who likes to have a simple task while watching TV or during idle time, the tasks are often interesting and some are really fast.

9. Take It Back

Did you make an impulse purchase you’re now regretting? Is there something sitting in your closet with the tags or did you get a birthday gift you just don’t want? Assess what you have around your home that’s returnable for store credit or cash back. You might be surprised to find an item or two taking up space and that could mean money in your pocket.

10. Cut the Extras

Maybe you’ve tried a spending freeze and you’ve already cut out all of the budget-eating “extras” (like cable, phone, eating out, gym membership, etc.). If you haven’t done it yet and you’re trying to earn cash fast—stop spending on the little luxuries and you may be surprised what you’ll save. Can you work out from home? Reduce your cellphone plan or share a line? Is there another area of your budget that could use some pruning?

11. Advertise

Did you know some companies pay you to be a driving billboard? Go to Free Car Media to see if there’s a local company that will pay you for simply putting a sign on your car. Yes, it can make the pickup line at school a bit embarrassing for your kids, but it’s simple and it requires almost no extra effort.

12. Make Items to Sell

We all know Etsy. If you’re wise about posting and you have a unique talent for making jewelry, art and gifts, you can earn a great income from an Etsy business. Redbubble allows you to design shirts, stickers, wall art and more and make a profit each time someone purchases your design. If you enjoy graphic design, photography or drawing, get your designs printed on nearly any item under the sun.

13. Clear Out Your Closet

If you’ve organized and paired down your closet, you might not have an overflow of extras. However, kids are constantly growing into the next size up (especially shoes—how do their feet grow so fast?!) and our own styles and sizes can change over the seasons. Put your clothing on eBay (handbags, brand names, or collectable items) or visit your local consignment store. Apps such as Depop are a great way to “quick list” your items with a few picture snaps from your phone. Just be honest about the condition of items and as thorough as possible in your descriptions.

14. Get Green

You can recycle soda cans, scrap metals and demolition wiring. You can also get money for electronics and items that would otherwise just get dumped in a landfill. Many municipalities offer programs to give you extra cash back when you bring in items made of aluminum, copper and even plastic and glass.

15. Teach a Community Class

Do you have a talent you could share with kids, teens, community members or seniors? Afterschool programs, community education classes and senior centers are often desperate for teachers who can do cooking demonstrations, sewing, art or music. Not only is it a fulfilling way to share your talents, but you can earn anywhere from $15 to $50 an hour!

16. Teach from Home

If your area doesn’t offer many community education options, consider opening your home to students and teach art, piano, voice, tutoring, or even computer basics. Offering lessons right from the convenience of your home means you have access to all your own materials and you can control the hours. Connect with your child’s school or ask friends and neighbors if anyone’s interested in sharing some of your knowledge.

17. Pawn It

With eBay and other virtual sales platforms, pawnshops might seem obsolete, but you can still generate some quick cash by selling off antique jewelry, coins, silverware, musical instruments and other items. Do some research beforehand to make sure you’re getting a fair price. The advantage of pawning items is leaving the shop with cash in-hand. You might not get to hold out for the highest bidder, but if you really need fast money it can do the trick.

18. Donate Plasma

As I said before, not every item on this list is for every person. If you’re squeamish about blood donation and needles freak you out, then this might not be a good option for you. There are many blood banks that pay anywhere from $15 to $50 for blood plasma donations. Not only do you earn money, but you’re helping someone who may have a rare or life-threatening disease who can benefit from your donation. Visit donatingplasma.org to find a local bank.

19. Sit for Cash

Babysit, housesit, dog sit—maybe you haven’t thought of yourself as a “babysitter” since your teen years, but you can earn quite a bit of money giving parents a night out. Most parents are thrilled to find an experienced and responsible adult who doesn’t mind keeping an eye on their little ones. Similarly, check Craigslist or your neighborhood listings for housesitting gigs, as well as dog walking and dog sitting. If you’re home during the day, it can be a simple way to get extra exercise and get your pet fix!

20. Do Seasonal Jobs

Many neighborhoods have residents who might not be able to put up decorations, winterize their yard, do leaf removal or pull weeds due to physical abilities or time constraints. Get your services out there! Make flyers, have a few conversations or even go door to door and offer to help with moving items, putting up holiday décor and clearing walks. Be clear about your abilities, time constraints and price, and you’ll find you can earn money in your own neighborhood.

21. Look for Free Money

Check for any “free money” you might have around. This means couch cushions, old handbags and coat pockets. Check through your stash of gift cards and any virtual certificates and coupons you might have acquired. If you have gift cards you don’t want, trade them in on Cardpool towards stores where you’ll actually use it. While you’re at it, check out the US Treasury and your state’s site for any unclaimed funds. You may have money out there you don’t even know about! Cash your coins in at the bank or take them to your convenient local Coinstar kiosk.

22. Be a Test Subject

Similar to donating plasma, this one isn’t for everyone, but if you go to ClinicalTrials.gov or CenterWatch you can find listings of clinical trials you may be qualified for. Participating in trials can be a way to access free medical care as well, and it can be a good option for smoking cessation, sleep aids and dietary aids. Many paid trials are safe and highly monitored, and some can even be very simple.

23. Pick Up an Extra Shift at Work

If you’re in the workforce, your own office might offer a few extra jobs you can do on the side. If your boss mentions they need to get in a temp to clean up files, scan documents, help clean the office or another simple task, make them an offer. Many employers are thrilled to have someone already vetted and familiar with the office who’s willing to do the extra work. It might mean a weekend or some long evenings, but it’s a great way to pick up extra dollars.

24. Be a Mystery Shopper

Consumer testing and mystery shopping is a big market. Companies pay you to simply try their products or shop at their stores, then provide a review and assessment of your experience. There are also many ways to sign up for free product samples, letting you try items before spending extra money on them.

25. Become a Temp

If you aren’t ready to take the plunge and get a full-time job, consider temp or seasonal help, especially around the holidays (and during the summers in resort towns). Lawn and garden centers hire people in the spring to help for just a few months. Retailers always need extra help over Christmas. Temp agencies can fit you with a few weeks or months of work and some temp-to-permanent positions let you “try” a job for a while before you make a commitment.

26. Be a Coach or Ref

Social leagues, community sports groups and even Little League and kids’ sports are often looking for coaches and refs to help during games. Usually advertised through your community parks and recreation department, these gigs pay $10-$25 a pop and can be a fun way to get involved in a sport you love—plus, it gets you on your feet.

27. Go into Personal Organizing

Are you great at organizing? If your house is already organized and you’re ready to help others, consider offering your services as a personal organizer. Sit down with people and help them clear the clutter from their life. If you’re technically inclined, you can also offer to organize files and assist with virtual housekeeping.

28. Be a Photographer

If you take great photos, FOAP is a site where you can share stock photos and earn money each time one of your photos is purchased and used. This is a great tool for bloggers who may take many photos, maybe you don’t use them on your personal site, but you’d hate to just delete them.

29. Play it Again

Give new life to sports equipment, books, videogames and musical instruments. If you have a guitar collecting dust in the attic or your son has given up his hockey dreams for soccer, there are many places that purchase gently used sports items and musical instruments. Similarly, books and other media can be sold on Amazon or taken to your local Half Price Books.

While some require more commitment and some ideas might not be quite the right fit, there IS fast cash out there, you just need to know where to look. Before you have to make choices that can put you in dire financial stress (like taking on a short-term loan or a high-interest credit card), save your stress and consider these ideas when you need a little (or more) cash…and fast.

Pin It

The post 29 Ways to Earn Extra Cash Fast appeared first on Living Well Spending Less®.

December 9, 2015

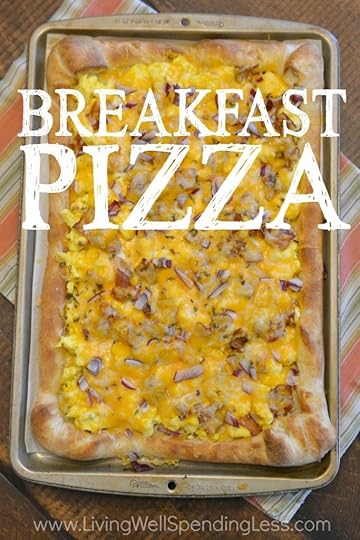

Breakfast Pizza

I don’t know how it is in your house, but in my house we are BIG fans of breakfast, especially on the weekend! My husband and I even get a little competitive when it comes to who does breakfast best. I’ll admit that his omelets are pretty much to-die for, but this yummy breakfast pizza, made with my perfect scrambled eggs, has definitely given him a run for the money.

I don’t know how it is in your house, but in my house we are BIG fans of breakfast, especially on the weekend! My husband and I even get a little competitive when it comes to who does breakfast best. I’ll admit that his omelets are pretty much to-die for, but this yummy breakfast pizza, made with my perfect scrambled eggs, has definitely given him a run for the money.

While there is nothing especially complicated about this recipe, it probably isn’t something I’d attempt on a school day unless I had precooked the bacon the night before. It does, however, make for perfect weekend brunch fare, and also makes enough to feed a crowd (or at least a few hungry teenagers!)

1 refrigerated pizza crust

8 eggs, scrambled (use this recipe or your own)

1/2 pound cooked bacon, cut into bite size pieces (use these easy instructions for no-mess bacon)

2 cups cheddar or jack cheese, shredded

¼ cup chopped red onion (optional)

dried parsley (optional)

Step 1: Preheat oven to 425; Unroll pizza crust onto parchment paper covered cookie sheet.

Step 1: Preheat oven to 425; Unroll pizza crust onto parchment paper covered cookie sheet.

Step 2: Bake crust for about 6-8 minutes, until edge begins to set.

Step 2: Bake crust for about 6-8 minutes, until edge begins to set.

Step 3: Remove crust from oven & spread scrambled eggs overtop.

Step 3: Remove crust from oven & spread scrambled eggs overtop.

Step 4: Sprinkle with bacon, then cover with shredded cheese.

Step 4: Sprinkle with bacon, then cover with shredded cheese.

Step 5: If desired, sprinkle with red onion & parsley for extra color & flavor.

Step 5: If desired, sprinkle with red onion & parsley for extra color & flavor.

Step 6: Bake 9-13 minutes longer, until crust is set and cheese is melted and bubbly.

Step 6: Bake 9-13 minutes longer, until crust is set and cheese is melted and bubbly.

Step 7: Cut into pieces with pizza cutter & serve.

Step 7: Cut into pieces with pizza cutter & serve.

Print This!

Recipe: Breakfast Pizza

Summary: This combo of all your favorites puts a new twist on breakfast.

Ingredients

1 refrigerated pizza crust

8 eggs, scrambled (use this recipe or your own)

½ pound cooked bacon, cut into bite size pieces

2 cups cheddar or jack cheese, shredded

¼ cup chopped red onion (optional)

dried parsley (optional)

Instructions

Preheat oven to 425; Unroll pizza crust onto parchment paper covered cookie sheet.

Bake crust for about 6-8 minutes, until edge begins to set.

Remove crust from oven & spread scrambled eggs overtop.

Sprinkle with bacon, then cover with shredded cheese.

If desired, sprinkle with red onion & parsley for extra color & flavor.

Bake 9-13 minutes longer, until crust is set and cheese is melted and bubbly.

Cut into pieces with pizza cutter & serve.

Preparation time: 5-7 minutes

Cooking time: 20-25 minute(s)

Number of servings (yield): 8

The post Breakfast Pizza appeared first on Living Well Spending Less®.

December 7, 2015

15 Bean Soup Jar Gift

The holiday season is upon us, and if you are anything like me, you’ve got a long list of people you’d like to remember this year! I’m a firm believer that it is the thought that counts, and I also love the idea of giving something homemade and edible instead of just more STUFF! (Because let’s face it–the last thing most of us need is more stuff!

But what happens when you don’t have enough time to bake (or when baking isn’t really your thing?) Wouldn’t it be nice to have some sort of food gift alternative that doesn’t require hours in the kitchen?

Enter the 15 Bean Soup Jar.

It’s cute, it’s useful, it’s inexpensive to make, and it literally comes together in minutes. Seriously–what more do you need? And while the bean jar on it’s own makes a great gift, you could also present it in a cute basket with the additional ingredients–smoked sausage, an onion, garlic, & can of tomatoes for a complete meal on the go. Oh, and there is also a vegetarian version of the 15 Bean Soup available as well, just in case your giftee doesn’t eat meat!

Here is what you need:

HamBeens 15 Bean Soup® mix

large mason jar

wide mouth canning jar lid & ring

pretty scrapbook paper or fabric

printable tag

ribbon

Step 1: Trace the canning lid on the back of your scrapbook paper, then cut out circle.

Step 2: Fill jar with beans.

Step 3: Place seasoning packet on top of beans.

Step 4: Place canning lid on top of jar, then cover with scrapbook paper circle and secure with canning ring.

Step 5: Secure tag (download it HERE) with cooking instructions to jar with a pretty ribbon.

Step 6: To prepare soup, simply simply add rinsed beans to crockpot with 1 chopped onion, 8 cups of water or stock, 1 clove garlic, & 1 pound chopped smoked sausage or cooked ham. Cook on high for 5 hours or low for 7-8 hours until beans are tender. Stir in 1 15oz. can diced tomatoes & heat 30 minutes more. Serve with crusty bread. For a vegetarian version, omit the meat & add 1/2 cup each of chopped carrots & celery instead.

Print This!

Recipe: 15 Bean Soup Gift Jar

Summary: This simple and practical gift is perfect for teachers, neighbors and friends!

Ingredients

HamBeens 15 Bean Soup® mix

large mason jar

wide mouth canning jar lid & ring

pretty scrapbook paper or fabric

printable tag

ribbon

Instructions

Trace the canning lid on the back of your scrapbook paper, then cut out circle.

Fill jar with beans.

Place seasoning packet on top of beans.

Place canning lid on top of jar, then cover with scrapbook paper circle and secure with canning ring.

Secure tag with cooking instructions to jar with a pretty ribbon.

To prepare soup, simply simply add rinsed beans to crockpot with 1 chopped onion, 8 cups of water or stock, 1 clove garlic, & 1 pound chopped smoked sausage or cooked ham. Cook on high for 5 hours or low for 7-8 hours until beans are tender. Stir in 1 15oz. can diced tomatoes & heat 30 minutes more. Serve with crusty bread. For a vegetarian version, omit the meat & add 1/2 cup each of chopped carrots & celery instead.

* * *

This post was underwritten by Hurst Beans. All opinions are mine. Established in 1938, the N.K. Hurst Co. is a 4th generation family business based in Indianapolis, IN. Hurst’s HamBeens® are the nations #1 selling dry bean brand and can be found in grocery stores nationwide. For more info, please visit www.hurstbeans.com.

Pin It

The post 15 Bean Soup Jar Gift appeared first on Living Well Spending Less®.