Steve Bull's Blog, page 1348

July 13, 2017

Visa Trying to Bribe Merchants to Stop Taking Cash

The war on cash is escalating. A big driver isn’t central banks who want to be able to inflict negative interest rates on savers, or Treasuries who see cash transactions as hiding revenues from their tax collectors, but the payment networks that want to kill cash (and checks!) as competitors to their oh so terrific (and fee-gouging) credit and debit cards.

However, one bit of good news is there doesn’t appear to be much enthusiasm on the buyer, as in merchant, end.

First, the overview from the Wall Street Journal:

Visa Inc. has a new offer for small merchants: take thousands of dollars from the card giant to upgrade their payment technology. In return, the businesses must stop accepting cash.

The company unveiled the initiative on Wednesday as part of a broader effort to steer Americans away from using old-fashioned paper money. Visa says it is planning to give $10,000 apiece to up to 50 restaurants and food vendors to pay for their technology and marketing costs, as long as the businesses pledge to start what Visa executive Jack Forestell calls a “journey to cashless.”

There are good reasons to think this initiative won’t get far.

Customer resistance. Food vendors, and in particular restaurants, are low margin businesses with fickle customers who have little to no loyalty. Why risk driving business away?

Aside from the fact that some customers prefer cash, a related issue is that using cards and smartphones often seem to be a tax on time. I really hate using chip cards. Mag cards were often faster than cash, since you swiped and could stuff the card back in your wallet while the transaction was being approved.

…click on the above link to read the rest of the article…

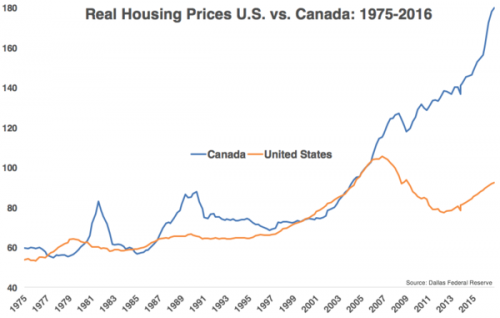

IMF Rings The Alarm On Canada’s Economy

Shortly after yesterday’s rate hike by the Bank of Canada, its first since 2010, we warned that as rates in Canada begin to rise, the local economy which has seen a striking decline in hourly earnings in the past year, which remains greatly reliant on a vibrant construction sector, and where households are the most levered on record, if there is anything that can burst the local housing bubble, it is tighter monetary conditions. And a bubble it is, as the chart below clearly demonstrates… one just waiting for the pin, which as we suggested yesterday in “”Canada Is In Serious Trouble” Again, And This Time It’s For Real“, may have finally been provided thanks to the Bank of Canada itself.

Now, one day after our warning, the IMF has doubled down and on Thursday issued its latest consultation report, in which it said that while Canada’s economy has regained some momentum, it warned that business investment remains weak, non-energy exports have underperformed, housing imbalances have increased and uncertainty surrounding trade negotiations with the United States could hurt the recovery.

The report – which concerningly was written even before the BOC hiked rates by 0.25% – also said the Bank of Canada’s current monetary policy stance is appropriate, and it cautioned against tightening.

“While the output gap has started to close, monetary policy should stay accommodative until signs of durable growth and higher inflation emerge,” the IMF said, adding that rate hikes should be “approached cautiously”.

Directors noted that Canada’s financial sector is well capitalized and has strong profitability, but that there are rising vulnerabilities in the housing sector… Directors agreed that monetary policy should stay accommodative and be gradually tightened as signs of durable growth and

inflation pressures emerge.

…click on the above link to read the rest of the article…

July 12, 2017

It’s Time For Local Communities to Take Charge and Experiment – Decentralize or Die (Part 2)

And when we mark the progress already accomplished in that direction, in spite of and against the State, which tries by all means to maintain its supremacy of recent origin; when we see how voluntary societies invade everything and are only impeded in their development by the State, we are forced to recognize a powerful tendency, a latent force in modern society.

– Peter Kropotkin

Before I get started, I want to emphasize that while the ideas in this three-part series focus on the U.S. and its particular structure of governance, the basic concepts can and should be applied throughout the world. If I believe in anything at all, it’s the idea that concentrations of power, whether government or corporate, represent the greatest threat to human freedom and liberty and this must be understood and resisted by all of us. Ok, so let’s get started.

Although many crucial functions are centralized, the U.S. still provides its citizens with various ways to exercise local power and we’ve already started to see a resurgence of such efforts across the nation. Whether or not we agree with the various state proposals out there trying to shake things up, we should all encourage the efforts. We all win from local populations experimenting with different ideas. Some will fail spectacularly, while others will pave the way for more reasonable policies across the nation.

Perhaps the greatest success of localized action in my lifetime was initiated by my adopted home state of Colorado, as its residents led the way with cannabis legalization in 2012, following the passage of Amendment 64. If we had continued to wait for the feds to do something we would have ended up waiting forever.

…click on the above link to read the rest of the article…

Ever more official lies from the US government

The false reality constructed for Americans parallels perfectly the false reality constructed by Big Brother in George Orwells’ dystopian novel 1984.

Consider the constant morphing of “the Muslim threat” from al-Qaeda to the Taliban, to al-Nusra, to ISIS to ISIL, to Daesh with a jump to Russia. All of a sudden 16 years of Middle East wars against “terrorists” and “dictators” have become a matter of standing up to Russia, the country most threatened by Muslim terrorism, and the country most capable of wiping the United States and its vassal empire off of the face of the earth.

Domestically, Americans are assured that, thanks to the Federal Reserve’s policy of quantitative easing, that is, flooding the financial markets with newly printed money that has driven up the prices of stocks and bonds, America has enjoyed an economic recovery since June of 2009, which must be one of the longest recoveries in history despite the absence of growth in median real family incomes, despite the growth in real retail sales, despite the falling labor force participation rate, despite the lack of high value-added, high productivity, high wage jobs.

The “recovery” is more than a mystery. It is a miracle. It exists only on fake news paper.

According to CNN, an unreliable source for sure, Jennifer Tescher, president and CEO of the Center for Financial Services Innovation, reports that about half of Americans report that their living expenses are equal to or exceed their incomes. Among those aged 18 to 25 burdened by student loans, 54% say their debts are equal to or exceed their incomes. This means that half of the US population has ZERO discretionary income. So what is driving the recovery?

Nothing. For half or more of the US population there is no discretionary income there with which to drive the economy.

…click on the above link to read the rest of the article…

OPEC Admits It Has A Problem: It Is Still Producing Too Much Oil

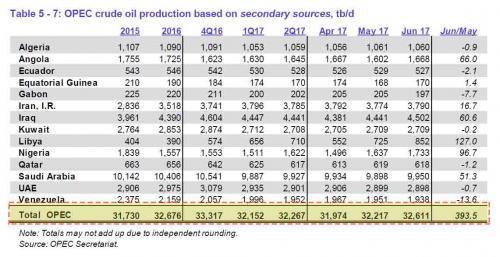

In its just released lastest market report for the month of July, OPEC admitted it has a problem: more than six months after the Vienna deal that was supposed to bring supply and demand in balance, the oil cartel confirmed it is pumping too much, not only in 2017, but also in 2018, blaming shale production as the primary reason behind the oversupply.

First, looking at historical data, according to secondary sources, production among the 14 OPEC member states rose by a whopping +394k b/d in June to 32.611mb/d. The biggest monthly increases took place in those nations that had previously been supply constrained and which are exempt from the output cut accord: Libya +127k b/d, and Nigeria +97k, although even Saudi Arabia saw a substantial pick up in production, which rose by +51k b/d m/m to 9.95m b/d, the highest since the start of the year. More ominously, in direct communications to OPEC, Saudi reported a monthly increase of +190k b/d m/m, up to 10.07m b/d, suggesting that as discussed yesterday, Saudi commitment to production cuts may be “waning.”

In total, OPEC admitted that output exceeded demand in 1H this year and was set for overproduction in 2018: the total output of 32.6m b/d in June was more than the 32.2m b/d it expects will be needed in 2018.

Just as striking was the report’s suggestion that OPEC and non-OPEC’s accord to cut production was not deep enough according to Bloomberg calculations: despite reducing production, the organization’s data show it oversupplied markets by ~700k b/d in 1H this yr. Still, surplus oil stockpiles in developed nations fell in May to 234m bbl; if OPEC maintains June output levels, it will reduce global surplus by ~70m bbl in 2H, although as we reported previously much of this is due to US oil exports which artificially depressed US commercial inventory stocks.

…click on the above link to read the rest of the article…

On Borrowed Time

There are a number of things you don’t want to hear a central banker say. One of those things just popped out of Janet Yellen’s mouth – “I don’t believe we will see another financial crisis in our lifetime.” That has to be up there with Irving Fisher’s deathless observation from 17 October 1929 that “Stock prices have reached what looks like a permanently high plateau” or John Maynard Keynes’ comparably adept forecast from 1927 that “We will not have any more crashes in our time.”

So far, so anecdotal. How about some data to back up the thesis that, as Thorstein Polleit puts it, the super bubble is in trouble ?

First, define your Super Bubble. We can do this in two ways. One relates to longevity (how long has the bull run lasted ?), the other to valuation (how expensive is the market now ?). The global bond bull began back in 1981, when 30 year US Treasury yields peaked at 15.2%. Now, over 35 years later, long bond yields are below 3%.

Polleit expresses it a little differently, citing the p/e ratio of bonds so that they might more fairly be compared to stocks. To calculate the p/e ratio of a government bond, he divides 1 by the 10 year government bond yield. His results are shown below.

Source: Thomson Financial / Thorstein Polleit

¹For bonds, calculated as 1 divided by the 10 year government bond yield

In his words,

You do not need to be a financial market wizard to see that especially bond markets have reached bubble territory: bond prices have become artificially inflated by central banks’ unprecedented monetary policies. For instance, the price-earnings-ratio for the US 10-year Treasury yield stands around 44, while the equivalent for the euro zone trades at 85. In other words, the investor has to wait 44 years (and 85 years, respectively) to recover the bonds’ purchasing price through coupon payments.

…click on the above link to read the rest of the article…

July 11, 2017

Derivatives Trading Legend: “As Little As A 4% Decline In One Day Could Start A Critical Crash”

After building out Merrill’s mortgage trading floor basically from scratch, then moving to the buyside at Pimco, several weeks ago Harley Bassman, more familiar to many traders as the “Convexity Maven” – a legend in the realm of derivatives (he helped design the MOVE Index, better known as the VIX for government bonds) – decided to retire (roughly one year after his shocking suggestion that the Fed should devalue the dollar by buying gold).

But that did not mean he would stop writing, and just a few days after exiting the front door at 650 Newport Center Drive in Newport Beach for the last time, Bassman wrote his first full article as a “free man”, in which the topic was, not surprisingly, derivatives and specifically the recent collapse in vol – and convexity – what prompted it, but most importantly and what everyone wants to know: what threshold would be sufficient to finally launch the next “critical mass” market move (i.e. crash) and, just as importantly, what could catalyze it.

He answer all of the above in his latest fascinating note.

Bassman’s full thoughts below:

“Rambling near the Edge”

Last month I attended the EQD (Equity Derivatives) Conference in Las Vegas. Diverse speakers opined upon a variety of topics, but a common theme was noting the near record low of both Implied and Realized Volatility in the financial markets. But despite the VIX kissing its nadir, realized volatility has plumbed even lower depths, and thus it was reported that strategies that engaged in selling Equity Volatility had both superior returns as well as the loftiest Information (Sharpe) Ratios among the dozens of strategies offered.

…click on the above link to read the rest of the article…

“We Are Forced To Strike Back”: Russia Set To Expel 30 US Diplomats, Seize US Assets

When Obama announced the expulsion of 35 Russian diplomats and the seizure of Russian diplomatic compounds in Maryland last December, in response to alleged Russian interference in the election, Putin just smiled and said Russia would not retaliate, expecting that relations between Russia and the US would normalize under president Trump. Six months later, relations have not only not normalized but have deteriorated further following the latest round of sanctions against Russia despite daily allegations that Trump colluded with the Kremlin to convince several million Americans to vote against Hillary.

And, as a result, Putin’s patience appears to have run out, and according to Russian newspaper Izvestiya, the Kremlin is set to expel around 30 US diplomats and freeze some US assets in a retaliatory move against Washington.

View image on Twitter

Follow

Sputnik ✔@SputnikInt

Moscow may expel about 30 US diplomats, freeze some US assets in Russia https://sptnkne.ws/eSg6 #USRussia

12:41 AM – 11 Jul 2017

Quoting a Foreign Ministry source, the Izvestiya newspaper says the move is due to the failure to reach an agreement on two Russian diplomatic compounds in the US seized by the outgoing Obama administration in December last year.

“There is a preliminary agreement on holding a meeting between Russian Deputy Prime Minister Sergey Ryabkov and US Under Secretary of State Thomas Shannon in St. Petersburg. If the compromise is not found there, we will have to take such measures,” a source in the Russian Foreign Ministry told the Izvestiya newspaper.

Izvestiya also cited Andrey Klimov, a senator in the upper house of Russia’s parliament, who said that “Russia had already waited more than six months for the Trump administration to improve the relationship between the two countries” and was now forced to strike back.

…click on the above link to read the rest of the article…

The Return Of The “Minsky Moment”

“The emergence of money manager capitalism means that the financing of the capital development of the economy has taken a back seat to the quest for short-run total returns.” – Circa 1992.

Wall Street has forgotten the great financial crisis.

A sense of relief has settled firmly on the legendary asphalt artery between Trinity and the FDR Drive.

Looks like they got away with another one.

Nobody else will, so let me say it (at least mean it): Thank you, Mr. & Mrs. Taxpayer.

Again. Sincerely. Thank you. Now, let’s get on with blowing your wealth out of the water again, just as portfolios have made it back to even. Older, a bit pudgier, more forehead than before.

Oh wait, that’s me.

As the Great Recession gets pulled into the mist, obfuscated by the misleading but comforting math of market return averages and a bull that has rarely stumbled, Wall Street is more defiant than ever to broadcast:

“See? We told you so! The markets always rebound in time!”

Time. That precious commodity you’d pay more than you’re worth, for.

The concept of time holds little relevance to Wall Street. After all, its life expectancy may be considered perpetual. Eight years, seventeen years, whatever time it takes to recover from a poor cycle is irrelevant and may be celebrated. A human life is different. We die. We can’t be so flippant over lost time.

You know all too well about how painful it is to recover from losses.

Understandable why it makes sense that Main Street, or why Americans vividly recall the Great Recession. They’re older and unless in the top 1%, not much richer. They’re also skeptical of the so-called economic recovery as inflation-adjusted median incomes have remained stagnant for close to a decade. Read: The Illusion of Declining Debt-To-Income Ratios.

…click on the above link to read the rest of the article…

Connecticut Capital Hartford Downgraded To Junk By S&P

One week ago, Illinois passed its three year-overdue budget in hopes of avoiding a downgrade to junk status, however in an unexpected twist, Moody’s said that it may still downgrade the near-insolvent state, regardless of the so-called budget “deal.” In fact, a downgrade of Illinois may come at any moment, making it the first U.S. state whose bond ratings tip into junk, although as of yesterday, credit rating agencies said they were still reviewing the state’s newly enacted budget and tax package. The most likely outcome is, unfortunately for Illinois, adverse: “I think Moody’s has been pretty clear that they view the state’s political dysfunction combined with continued unaddressed long-term liabilities, and unfavorable baseline revenue performance as casting some degree of skepticism on the state’s ability to manage out of the very fragile financial situation they are in,” said John Humphrey, co-head of credit research at Gurtin Municipal Bond Management.

And yet, while Illinois squirms in the agony of the unknown, another municipality that as recently as a month ago was rumored to be looking at a bankruptcy filing, the state capital of Connecticut, Hartford, no longer has to dread the unknown: on Tuesday afternoon, S&P pulled off the band-aid, and downgraded the city’s bond rating by two notches to BB from BBB-, also known as junk, citing “growing liquidity pressures” and “weaker market access prospects”, while keeping the city’s General Obligation bonds on Creditwatch negative meaning more downgrades are likely imminent.

“The downgrade to ‘BB’ reflects our opinion of very weak diminished liquidity, including uncertain access to external liquidity and very weak management conditions as multiple city officials have publicly indicated they are actively considering bankruptcy,” said S&P Global Ratings credit analyst Victor Medeiros. Hartford has engaged an outside law firm with expertise in financial restructuring.

…click on the above link to read the rest of the article…