Steve Bull's Blog, page 1352

June 30, 2017

Will Central Banks Derail The Shale Boom?

The U.S. Federal Reserve has already increased interest rates several times, most recently in June, with promises to do much more. Rate hikes pose a problem for the oil industry, which has used debt to underpin a drilling boom across the U.S. shale patch. Higher rates could raise the cost of drilling.

But low oil prices, and few prospects for a strong rebound in the near-term – and possibly even the medium- and long-term – undercut the rationale for higher rates. After all, inflation is soft, and low commodity prices have a lot to do with that.

In fact, the decline of oil prices this year has led to even lower inflation than expected, not just in the U.S., but also in Europe. The Fed has insisted that weak inflation is “transitory,” but more people are starting to wonder if that is true. “There is now a much bigger chance that there will be an important disinflationary impact from lower oil prices,” Thierry Wizman, global interest rates and currencies strategist for Macquarie, told MarketWatch. With oil prices and broader inflation low, why raise rates?

Still, the Fed seems intent on moving forward. And the Bank for International Settlements (BIS), a group of central banks from around the world, urged central banks a few days ago to continue the “great unwinding.” That is, the extraordinary monetary stimulus stemming from the 2008-2009 financial crisis needs to be reined in. Fed chair Janet Yellen has warned about overpriced asset classes, a side effect of loose monetary policy. The hawkish Fed thinks that monetary policy needs to tighten in order to prevent overheating. Related: The Downturn Is Over, But U.S. Oil Companies Face A Huge Problem

…click on the above link to read the rest of the article…

June 29, 2017

Qatar May be Turning Its Back on the US Dollar — and We All Know What That Means

(ANTIMEDIA) — Late last week, Saudi Arabia and other members of the Gulf Cooperation Council (GCC) that are involved in attempting to isolate Qatar sent the tiny Gulf nation a list of 13 demands. They are insisting that Qatar meet these demands within ten days or face unspecified further action.The list of demands includes Qatar shutting down Al-Jazeera and its affiliate stations; shutting down other news outlets that Qatar funds, including Middle East Eye; curbing diplomatic ties with Iran and expelling members of Iran’s Revolutionary Guard; terminating the Turkish military presence in Qatar; consenting to monthly audits for the first year following acceptance of the demands, and aligning itself entirely with the other Gulf and Arab countries militarily, politically, socially, and economically – to name but a few.

The most ludicrous of the demands is that Qatar must end its interference in sovereign countries’ internal affairs. Qatar does interfere in a number of countries, including Libyaand Syria, but as the German Foreign Minister explained, this list of demands directly challenges Qatar’s sovereignty. Who is interfering with whose sovereignty, exactly?

Unsurprisingly, Qatar has dismissed the list of demands as neither reasonable nor actionable. Surely, the Saudi-led anti-Qatar alliance is aware of this. It would be tantamount to asking Great Britain to shut down the BBC and expel American troops – it just wouldn’t happen. All of the world’s major newspapers are complicit in running state-sanctioned propaganda, and singling Al-Jazeera out is hardly fair or practical.

In that context, Saudi Arabia and its friends have given Qatar a list of demands they cannot conceivably meet and imposed a ten-day deadline to concede or face unspecified further action. Qatar was essentially doomed from the start of this rift, and it’s only just beginning. As Newsweek lamented, “the demands are designed to be impossible to comply with.”

…click on the above link to read the rest of the article…

In “Unprecedented Step” US Sanctions Chinese Entities With Ties To North Korea

After allegedly pressuring the Chinese government to act first and adopt sanctions against nearly 10 local entities who the US claims provided North Korea with materials used in its nuclear program, the US has decided to act. In an unprecedented step, the Treasury Department slapped financial sanctions on two Chinese nationals and a Chinese shipping company over their ties to North Korea stemming from its nuclear program, according to Reuters.

The Trump administration also proposed sanctions against a Chinese bank of helping North Korea launder money and cut the institution off from the US financial system, in a major step that at least on the surface, is aimed at convincing China to put more pressure on Pyongyang to abandon its missile and nuclear programs, according to the Financial Times. The US Treasury designated the bank in question, the Bank of Dandong, as a “foreign bank of primary money laundering concern” and also imposed sanctions on two Chinese individuals and one Chinese company.

The Treasury Department said in a statement it was sanctioning Wei Sun for links to the Foreign Trade Bank of the Democratic People’s Republic of Korea, Hong Ri Li for his links to North Korean banking executive Song-hyok Ri, as well as the Dalian Global Unity Shipping Co Ltd of Dalian, China.

The moves come one week after top US and Chinese officials met for strategic talks in Washington in which the US side tried to persuade China to take more action on North Korea. Steven Mnuchin, Treasury secretary, said the US was “sending an emphatic message across the globe that we will not hesitate to take action against persons, companies, and financial institutions who enable this [North Korean] regime”.

…click on the above link to read the rest of the article…

Forget Draghi, Crude Matters

Despite Mario Draghi’s supposedly misinterpreted comments earlier this week, there are global indications that the best of this round has already been reached. Policymakers are always going to claim things are improving, that much is given. But there is tremendous difference between that and what has occurred, especially if it is indeed rolling over worldwide.

The earliest indicators for China’s economy in June signal that the manufacturing sector may be poised to decelerate, while other challenges loom in the second half of this year.

Small- and medium-sized enterprises showed the lowest level of confidence in 16 months, a gauge of manufacturing drawn from satellite imagery slumped, and conditions in the steel business remained lackluster.

At the center of the story is as always crude oil. There are, of course, direct effects of the ups and downs (more down than up) in the energy market. As the price of it rises there will be more exploration, drilling, production, and transportation required. Some of that has already happened, and accounts for some part of this economic recuperation.

The larger effects are in sentiment, or at least the kind they might measure in PMI’s or surveys. It bears repeating that when the global downturn arrived in early 2015, economists worldwide assured everyone not to worry. They had several plausible reasons for taking that position, flawed as they were. Overall, however, especially from a US perspective the big contrary indicator was WTI.

Dismissing it as a mere “supply glut”, actual economic agents especially in industry would have known better. Even if these important marginal changes weren’t completely understood, it didn’t take any special knowledge or complex series of regressions to link the crash in oil to reduced demand for goods globally. In that way, oil became the best real-time indicator for economic demand and its overall direction no matter what Janet Yellen would say.

…click on the above link to read the rest of the article…

Yes, Ms. Yellen…There Will Be Another Financial Crisis

Yes, Ms. Yellen…There Will Be Another Financial Crisis

Janet Yellen, Federal Reserve Chair, recently stated;

“Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will.”

That is a pretty bold statement to make considering that every one of her predecessors failed to predict the negative consequences of their actions.

Will there will be another “Financial Crisis” in our lifetimes?

Yes, it is virtually guaranteed.

The previous “crisis” wasn’t about just “an asset gone bad,” but rather the systemic shock caused by a “freeze” in the credit markets when Lehman Brothers filed for bankruptcy. Counterparties evaporated, banks froze lending and the credit market ceased to function.

Credit, not the stock market, is the “lifeblood” of the economy.

Of course, it is all good now because the Federal Reserve says so with Ms. Yellen placing a great amount of faith in the Federal Reserve’s own carefully constructing, and recently released results, of “bank stress tests.” Interestingly, EVERY bank passed with flying colors. In other words, the Millennial generation has now passed the baton of “Everybody Gets A Trophy” to the banking sector.

“Test results released by the Federal Reserve show that the 34 institutions under scrutiny have enough capital to make it through the two scenarios regulators posed — one akin to the financial crisis and another entailing a shallower downturn.

Under the scenarios, the banks tested ‘would experience substantial losses.’ However, in total, the institutions ‘could continue lending to businesses and households, thanks to the capital built up by the sector following the financial crisis.’

In the most severe scenario, bank losses are projected to be $493 billion. In the less severe, the losses were put at $322 billion.”

…click on the above link to read the rest of the article…

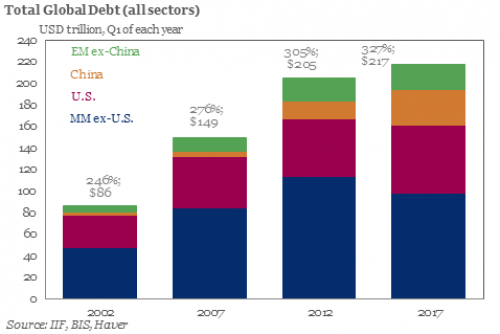

Global Debt Hits A New Record High Of $217 Trillion; 327% Of GDP

The Institute of International Finance is perhaps best known for its periodic – and concerning – reports summarizing global leverage statistics, and its latest Q1 report was the most troubling yet, because what it found was that in a period of so-called “coordinated growth”, global debt hit a new all time high of $217 trillion, or over 327% of global GDP, up $50 trillion over the past decade. So much for Ray Dalio’s beautiful deleveraging, oh and for those economists who are still confused why r-star remains near 0%, the chart below has all the answers.

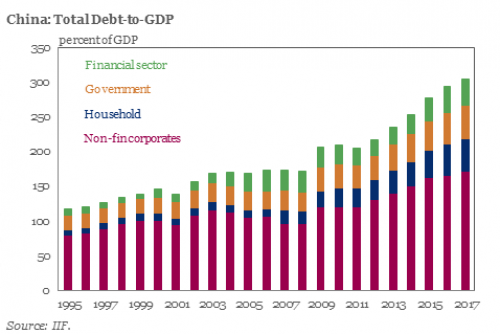

Not surprisingly, China continues to be the biggest source of global debt growth, with the country’s total debt load now surpassing 300%.

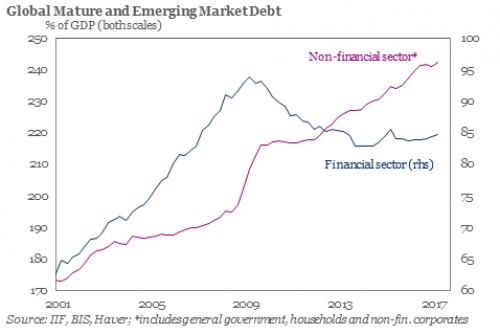

While much of the debt issuance at the financial sector level has moderated in recent years, supplanted by outside money created by central banks, debt in the non-financial sector has continued to grow, and as of Q1 2017, hit an all time high of 242% of GDP.

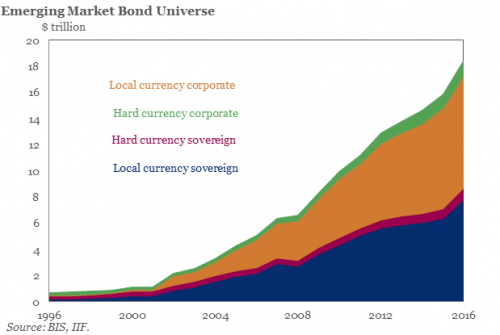

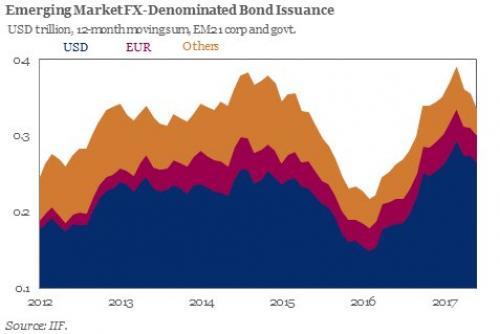

An interesting observation by the IIF: despite the recent dollar strength (if not so much in the past quarter), dollar bond issuance in Emerging Markets has been on a tear over the past year.

Another notable observation: while the EM bond universe has increased by $2.5 trillion to $18.4 trillion since 2016, only 25% of this debt is tradeable via benchmark bond indices.

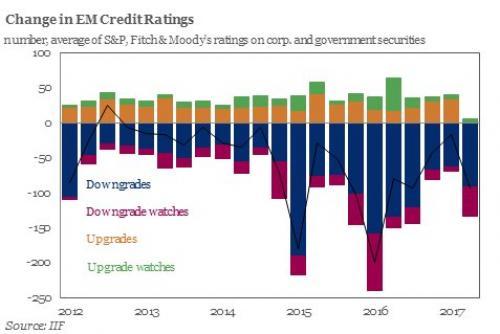

What is more troubling, however, is the IIF’s observation that despite the relentless foreign portfolio inflows into EM, the credit quality of many emerging markets has deteriored rapidly in the past year.

This is an especially acute problem because there is over $1.9 trillion in EM bonds and loans coming due by the end of 2018. Should the EM sector fall out of favor with investors, and if the debt can not be rolled over, it could result in substantial liquidity events across the EM space.

…click on the above link to read the rest of the article…

What Problems Are We Solving by Increasing Complexity?

The incremental increase in systemic complexity is rarely if ever recognized as a problem that additional complexity can’t solve.

The Collapse of Complex Societies fame has observed that societies increase complexity to solve pressing problems that cannot be resolved with existing solutions.

What is complexity in this context? More organization, more layers of management, higher levels of specialization, an expansion of roles and differentiated areas of expertise, more channels of communication, more feedback loops, and an increase in the quantity and types of communication.

All of which consumes more energy and more treasure, not just to build the infrastructure of this increased complexity but to train the staff and maintain the higher costs going forward.

Which raises the obvious question: how does increasing cost solve anything? Doesn’t increasing the cost of a system create the problems resulting from taking money from some other source to pay the higher costs?

There are several different answers to this question.

1. The problem that must be solved is an existential threat to the society, and therefore cost is no longer an issue. World War II offers a historical example of an existential threat requiring a vast expansion of complexity and cost.

The upside of this dynamic is the problem is resolved relatively decisively by either victory or defeat. The downside is the vast sums borrowed to fund the war effort must be paid, or at least the interest must be paid–or the enormous debts must be renounced, crippling trust and the credit system.

2. The gains reaped by increasing complexity more than offset the higher costs. Amazon seems to offer a commercial example of this dynamic. By investing heavily in complex technology, Amazon has created financial incentives for consumers to shop online and have their purchases delivered to their door.

…click on the above link to read the rest of the article…

Feeding Frenzy in the Echo Chamber

Willem de Kooning Police Gazette 1955The best comment on the June 13 Jeff Sessions Senate testimony, and I’m sorry I forgot who made it, was that it looked like an episode of Seinfeld. A show about nothing. Still, an awful lot of voices tried to make it look like it was something life- and game-changing. It was not. Not anymore than Comey’s testimony was, at least not in the sense that those eager to have these testimonies take place would have liked it to be.

Comey shone more of an awkward light on himself rather than on Donald Trump, by admitting that he had leaked info on a private conversation with the president he served at the time. Not quite nothing, but very little to satisfy the anti-Trump crowd. It’s just that there’s so many in that crowd, and most in denial, that you wouldn’t know it unless you paid attention.

To cut to the chase of the issue, it’s no longer possible -or at least increasingly difficult- to find coverage in the US -and European- press of anything related to either Trump or Russia that doesn’t come solidly baked in a partisan opinionated sauce.

For instance, I have a Google News page, somewhat personalized, and I haven’t been able to open it for quite some time without the top news articles focusing on Trump and/or Russia, and all the ones at the very top are invariably from the New York Times, Washington Post, CNN, The Hill, Politico et al.

But I am not interested in those articles. These ‘news’ outlets -and you really must ask whether using the word ‘news’ is appropriate here- dislike anything Trump and Putin so much, for some reason, that all they do is write ‘stuff’ in a 24/7 staccato beat based on innuendo and allegations, quoted from anonymous sources that may or may not actually exist.

…click on the above link to read the rest of the article…

Was Petya Ransomware a DELIBERATE Cyberattack on Ukraine? Here’s How It Could Happen To Us

The Petya Ransomware attack hit globally, but one country, in particular, was devastated by it. The Ukrainian infrastructure was brought own by the attack, where the epicenter occurred, and now, experts are suggesting that it may have been deliberate and state-sponsored.

The ostensible purpose of all that damage was to make money — and yet there’s very little money to be found. Most ransomware flies under the radar, quietly collecting payouts from companies eager to get their data back and decrypting systems as payments come in. But Petya seems to have been incapable of decrypting infected machines, and its payout method was bizarrely complex, hinging on a single email address that was shut down almost as soon as the malware made headlines. As of this morning, the Bitcoin wallet associated with the attack had received just $10,000, a relatively meager payout by ransomware standards.

It leads to an uncomfortable question: what if money wasn’t the point? What if the attackers just wanted to cause damage to Ukraine? (source)

This is not the first time Ukraine has been under siege by cyberattack. In fact, the battle has been nearly constant for quite some time.

Ukrainian cybersecurity analysts view Ukraine as the primary target, and the Petya outbreak as just another strike in their ongoing cyberwar with organized and relentless hackers that the Ukrainian government has publicly linked to Russian state actors. “I think this was directed at us,” says Roman Boyarchuk, the head of the Center for Cyber Protection within Ukraine’s State Service for Special Communications and Information Protection. “This is definitely not criminal. It is more likely state-sponsored.”

…click on the above link to read the rest of the article…

The Power Grid Is Far More Vulnerable to Cyber Attacks Than Most People Realize

In December of 2015, 230,000 people in Western Ukraine lost power after 30 substations were mysteriously shut off. Contrary to what most people assumed at the time, this wasn’t an innocuous power outage. The authorities would later admit that the loss of power was caused by a cyber attack, which marked the first time that malware was successfully used to attack a power grid. A similar, albeit more sophisticated cyber attack, occurred one year later just outside of Kiev. Given the current tensions between Russia and Ukraine, it’s widely believed that the Russian government was responsible for these incidents.

In December of 2015, 230,000 people in Western Ukraine lost power after 30 substations were mysteriously shut off. Contrary to what most people assumed at the time, this wasn’t an innocuous power outage. The authorities would later admit that the loss of power was caused by a cyber attack, which marked the first time that malware was successfully used to attack a power grid. A similar, albeit more sophisticated cyber attack, occurred one year later just outside of Kiev. Given the current tensions between Russia and Ukraine, it’s widely believed that the Russian government was responsible for these incidents.

However, there’s more to this story than meets the eye. A computer security company has been investigating these attacks, and has discovered the malware that was used to take down the grid. They’ve found that it’s far more dangerous and easier to use than anyone realized before.

The danger of the malware is that it can automatically trip the breakers within a power system that keep the electrical lines from being overloaded. If one breaker is tripped, the load is shipped to another portion of the power grid. If enough are tripped, in the right places, it’s possible to create a cascading effect that will eventually overload the entire system, said Weatherford, who was formerly the chief security officer at the North American Electric Reliability Corporation, the regulatory authority for North American utilities.

“In some cases, it could then take days to restart all the plants,” he said.

Two things stand out about the malware, dubbed “Industroyer” by the researchers — it’s an order of magnitude easier to use than previous programs and it wasn’t actually deployed to do any real damage, meaning whoever’s behind the December attack might simply have been testing the waters.

…click on the above link to read the rest of the article…