Steve Bull's Blog, page 1355

June 26, 2017

Trump’s ANWR move could spawn epic oil, natural gas battle: Fuel for Thought

Oil majors thirsty for reserves likely to line up for any lease sale

President Trump has uncorked yet another controversy over energy vs the environment and it promises to be a heavyweight battle.

The White House budget proposal includes a revenue line of almost $2 billion from selling oil and gas leases in the richly oil-prospective northeastern coastal plain of the Arctic National Wildlife Refuge (ANWR) in Alaska.

Until the climate change debate came along, leasing and drilling in the ANWR (pronounced an-war) Coastal Plain was arguably the most ferociously contested item on the oil and gas industry’s wish list at the national level.

First, a little background: In 1960, less than one year after Alaska became a state, Congress created the Arctic National Wildlife Range.

Twenty years later, the Alaska National Interest Lands Conservation Act (ANILCA) expanded the Arctic Range to 18 million acres, renamed it the Arctic National Wildlife Refuge, designated 8 million acres as National Wilderness, designated three rivers as National Wild Rivers, and called for wildlife studies and an oil and gas assessment of 1.5 million acres of the ANWR Coastal Plain (the 1002 area).

There is not enough space here to track the tortuous history of legal and regulatory battles and failed legislation that has marked efforts to either develop oil and gas in the ANWR Coastal Plain or to lock it up against development permanently.

Suffice to say that ANILCA granted surface and subsurface rights to the Inupiat Native Americans living near the North Slope village of Kaktovik on the ANWR Coastal Plain, seismic studies were conducted on Inupiat land, and what has been called the “the tightest hole of all time” (KIC-1) was drilled and plugged on that acreage by a group led by Chevron.

Only a handful of people have ever known the well results—and no one has spilled the beans yet.

…click on the above link to read the rest of the article…

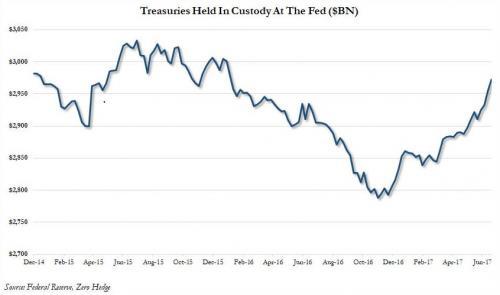

How The Fed Helps The US Spy On Foreign Governments

It’s widely known that the Federal Reserve has been tasked by Congress with a “dual mandate” to maintain stable consumer-goods prices, low unemployment and – oh yes – buoyant equity prices. However, as Reuters revealed on Monday, the central bank has another legally binding obligation that might upset some of its clients: Helping the US intelligence community spy on foreign governments.

Some 250 foreign central banks and governments keep $3.3 trillion of their assets at the Federal Reserve Bank of New York. It is this little-known custodial role, which we have however highlighted frequently to show the true change in foreign holdings of US paper, that allows US intelligence agencies to leverage information about activity in certain accounts.

Specifically, senior officials from the Treasury and other government departments have turned to these otherwise confidential accounts several times a year to analyze the asset holdings of the central banks of Russia, China, Iraq, Turkey, Yemen, Libya and others, according to more than a dozen current and former senior Fed and Treasury officials who spoke with Reuters.

It was not immediately clear how the “confidential” information differs from the public, except that it likely breaks down the holdings by source nation. The Reuters report surfaced at a time when the value of assets held by the central bank is rapidly expanding as foreign reserve managers scoop up US Treasurys at an aggressive clip, something we first highlighted in February when concerns emerged that foreigners were selling based on data from the delayed Treasury International Capital report.

The terms of the Fed’s custodial agreements stipulate that it can share information with US government entities on a “need to know” basis. Ironically, the service was advertised in a 2015 slide presentation as “safe and confidential,” according to Reuters. However, the “need to know” standard is easily circumvented as the central bank has conveniently avoided creating a working definition of “need to know.”

…click on the above link to read the rest of the article…

Noted Short Seller Marc Cohodes Comments On The Recent Events At Home Capital

The past two months have been a roller coaster ride for Home Capital shareholders culminating in the announcement of Berkshire Hathaway’s investment in the company this week. But the deal raises at least as many questions as it answers, not least of which is whose interests are being served? There are many professed facts about the company and the events of the last two months that just don’t add up. We think shareholders and the public are still a long way from discovering the truth of what has transpired at the company. Given the evident intervention in the Home Capital drama by various arms of the Canadian government, there must be something vital to the economy at stake here. It seems to us that a deep dive into the Home Capital story is in order.

It all starts with Gerry

The most salient fact to know about Home Capital is that it is a veritable extension of the person who ran it for almost 30 years, Gerald Soloway. Soloway and fellow Home Capital board member John Marsh gained control of a public shell company in 1986 and merged the then tiny Home Savings of St. Catharines into the shell. From this humble start, Soloway grew Home into the 9th largest bank in Canada, and was by all accounts, a domineering presence within the company (so domineering, in fact, that he was viewed internally as still running the company even after handing the CEO reins to Martin Reid.) In a very real way, the culture of the company reflects the values and character of Soloway himself. So far so good, a Canadian success story, right? The fly in the ointment is that Soloway is a serial, convicted fraudster, going back even before the start of the Home Capital story, and it appears that many of the business practices of the company reflect his penchant for cutting corners.

…click on the above link to read the rest of the article…

Joseph Tainter: The Collapse Of Complex Societies

What history predicts about our future prospects

By popular demand, we welcome Joseph Tainter, USU professor and author of The Collapse Of Complex Societies (free book download here).

Dr. Tainter sees many of the same unsustainable risks the PeakProsperity.com audience focuses on — an overleveraged economy, declining net energy per capita, and depleting key resources.

He argues that the sustainability or collapse of a society follows from the success or failure of its problem-solving institutions. His work shows that societies collapse when their investments in social complexity and their energy subsidies reach a point of diminishing marginal returns. From Tainter’s perspective, we are likely already past the tipping point towards collapse but just don’t know it yet:

Sustainability requires that people have the ability and the inclination to think broadly in terms of time and space. In other words, to think broadly in a geographical sense about the world around them, as well as the state of the world as a whole. And also, to think broadly in time in terms of the near and distant future and what resources will be available to our children and our grandchildren and our great grandchildren.

One of the major problems in sustainability and in this whole question of resources and collapse is that we did not evolve as a species to have this ability to think broadly in time and space. Instead, our ancestors who lived as hunter-gatherers never confronted any challenges that required them to think beyond their locality and the near term(…)

We have developed the most complex society humanity has ever known. And we have maintained it up to this point. I have argued that technological innovation and other kinds of innovation evolve like any other aspect of complexity. The investments in research and development grow increasingly complex and reach diminishing returns.

…click on the above link to read the rest of the article…

First India Bans Cash, Now It’s Targeting Gold

In November of last year, India banned certain cash notes in a bold move to force businesses into the banking system to better harvest more taxes from its livestock. Now, under the guise of “improving transparency” and forming a “common market,” India has begun targeting gold with new taxes, regulation, and incentives for citizens to turn over their undeclared gold to the financial sector.

Roughly 86% of India’s economic activity happened in cash at the time much of it was banned. Presumably that includes the $19-billion-per-year retail gold industry. Again, it appears that India’s government (central bankers) wants a bigger cut of the action and to better track the private assets of citizens.

Bloomberg has been reporting that India’s government is teaming up with crony gold dealers to plan a complete revamp of its gold policy – which is always code for “control, regulate and tax.”

Bloomberg reports:

India, which vies with China as the top consumer of bullion, is working on new policies to improve transparency and help expand its $19 billion gold jewelry industry, according to people with knowledge of the matter.

The plans being worked out by the finance and commerce ministries along with industry groups should be finalized by the end of March, the people said, asking not to be identified because they aren’t authorized to speak publicly….

The start of a spot bullion exchange, to make gold supply more transparent and help enforce purity standards, is under consideration, the people said. An import tax of 10 percent could also be reduced as the government seeks to eliminate smuggling, they said. The plans also include a dedicated bank for the jewelry industry, according to one of the people.

…click on the above link to read the rest of the article…

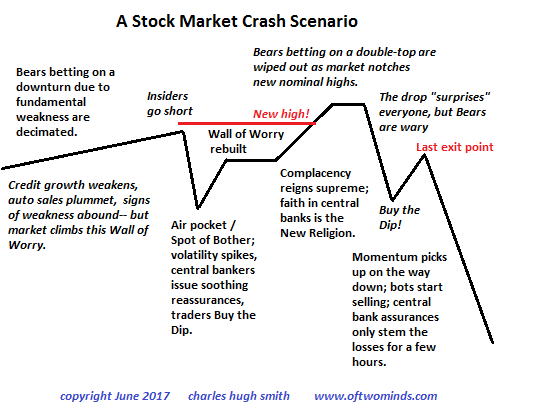

A Stock Market Crash Scenario

The one thing we can know with certainty is it won’t be easy to profit from the crash.

After 8+ years of phenomenal gains, it’s pretty obvious the global stock market rally is overdue for a credit-cycle downturn, and many research services of Wall Street heavyweights are sounding the alarm about the auto industry’s slump, the slowing of new credit and other fundamental indicators that a recession is becoming more likely.

Few have taken the risk of projecting a date for the crash, this gent being a gutsy outlier: Hedge Fund CIO Sets The Day When The Next Crash Begins.

Next February is a good guess, as recessions and market downturns tend to lag the credit market by about 9 months.

My own scenario is based not on cycles or technicals or fundamentals, but on the psychology of the topping process, which tends to follow this basic script:

When there are too many bearish reports of gloomy data, and too many calls to go long volatility or go to cash, the market perversely goes up, not down.

Why? This negativity creates a classic Wall of Worry that markets can continue climbing. (Central banks buying $300 billion of assets a month helps power this gradual ascent most admirably.) The Bears betting on a decline based on deteriorating fundamentals are crushed by the steady advance.

As Bears give up, the window for a Spot of Bother decline creaks open, however grudgingly, as central banks make noises about ending their extraordinary monetary policies by raising interest rates a bit (so they can lower them when the next recession grabs the global economy by the throat).

As bearish short interest and bets on higher volatility fade, insiders go short.

…click on the above link to read the rest of the article…

June 25, 2017

The World Is Going Down With Trump

On June 21 the editorial board of the Washington Post, long a propaganda instrument believed to be in cahoots with the CIA and the deep state, called for more sanctions and more pressure on Russia.

One second’s thought is sufficient to realize how bad this advice is. The orchestrated demonization of Russia and its president began in the late summer of 2013 when the British Parliament and Russian diplomacy blocked the neoconned Obama regime’s planned invasion of Syria. An example had to be made of Russia before other countries began standing up to Washington. While the Russians were focused on the Sochi Olympic Games, Washington staged a coup in Ukraine, replacing the elected democratic government with a gang of Banderite neo-nazi thugs whose forebears fought for Hitler in World War II. Washington claimed it had brought democracy to Ukraine by putting neo-nazi thugs in control of the government.

Washington’s thugs immediately began violent attacks on the Russian population in Ukraine. Soviet war memorials were destroyed. The Russian language was declared banned from official use. Instantly, separatist movements began in the Russian parts of Ukraine that had been administratively attached to Ukraine by Soviet leaders. Crimea, a Russian province since the 1700s, voted overwhelmingly to seperate from Ukraine and requested to be reunited with Russia. The same occurred in the Luhansk and Donetsk regions.

These independent actions were misrepresented by Washington and the presstitutes who whore for Washington as a “Russian invasion.” Despite all facts to the contrary, this misrepresentation continues today. In US foreign policy, facts are not part of the analysis.

…click on the above link to read the rest of the article…

Why The Next Recession Will Morph into a Decades Long Depressionary Event…Or Worse

Economists spend inordinate time gauging the business cycle that they believe drives the US economy. However, the real engine running in the background (and nearly entirely forgotten) is the population cycle. The positive population cycle is such a long running macro trend thousands of years in the offing that it’s taken for granted. It is wrongly assumed that upon every business cycle downturn, accommodative monetary and fiscal policies will ultimately spur greater demand and restart the business cycle once the excess capacity and inventories are drawn down. However, I contend that the population cycle has been the primary factor in ending each recession…and this most macro of cycles is now rolling over. Without this, America (nor the world) will truly emerge from the next recession…instead it will morph into an unending downward cycle of partial recoveries…contrary to all contemporary human experience.

The evidence for my contention begins with the 25-54yr/old US population, which peaked in December 2007 and remains below that peak ever since (this population is presently about 400k fewer than Dec of ’07). However, total US full time employment is now 3.6 million above the previous peak in 2007. This 25-54 to FT employment relationship is now 1:1…just as it was in 1980 and 1970.

[image error]

Annual change in 25-54yr/old US population vs. annual change in total full time US employees (below). The macro population cycle provided millions of new adults (consumers) and their increased demand restarted the more frequent gyrations of the micro business cycles…until 2008 and again now in 2017. Some may take note that the Federal Reserve cost of money (the Federal Funds Rate in blue) generally followed the population cycle, only making some deviations for the business cycle along the way.[image error]But the change per 8 year periods of the 25-54yr/old population and total US full time employment turns out to be not so dissimilar. In fact, it’s a pretty nice correlation.

…click on the above link to read the rest of the article…

Obama Ordered Cyberweapons Implanted Into Russia’s Infrastructure

A new report from the Washington Post today quoted a series of Obama Administration officials [5] reiterating their official narrative on Russia’s accused hacking of the 2016 election. While most of the article is simply rehashes and calls for sanctions, they also revealed a secret order by President Obama in the course of “retaliation” for the alleged hacking.

This previously secret order involved having US intelligence design and implant a series of cyberweapons into Russia’s infrastructure systems, with officials saying they are meant to be activated remotely to hit the most important networks in Russia and are designed to “cause them pain and discomfort [7].”

The implants, developed by the NSA, are designed to hit Russian networks deemed “important to the adversary and that would cause them pain and discomfort if they were disrupted,” a former U.S. official told the Post.

They could be activated in the event that Russia attacked a U.S. power grid or interfered in a future U.S. presidential race.

The US has, of course, repeatedly threatened “retaliatory” cyberattacks against Russia, and promised to knock out broad parts of their economy in doing so. These appear to be the first specific plans to have actually infiltrate Russian networks and plant such weapons to do so.

Despite the long-standing nature of the threats, by the end of Obama’s last term in office this was all still in the “planning” phases. It’s not totally clear where this effort has gone from there, but officials say that the intelligence community, once given Obama’s permission, did not need further approval from Trump to continue on with it, and he’d have actually had to issue a countermanding order, something they say he hasn’t.

…click on the above link to read the rest of the article…

EXPOSED: CIA drug connection shows how they support USD and manipulate foreign markets

(GLOBALINTELHUB.COM) – 6/26/2017 — Drugs have been a part of human society forever – however far back you go, humans have used drugs in one form or another; medicine, recreation, spirituality (Shamans of simple tribes often ate psychedelics). In the world today there is an interesting schism between the puritan “America” and “Europe” about this issue – in Europe they consider drug addiction a health issue, and in places like Switzerland you can literally get strong narcotics like heroin from the Government. In America it’s the opposite, there is an exploding prison population for small non-violent offenses. But as with many things in America there are lots of ironies and hypocrisies, America also has the highest per capita rate of users of legal pharmaceuticals ‘drugs’ – and is one of the only countries in the world where drug companies are allowed to advertise on TV (In Europe you won’t see commercials for Prozac, Viagra, or other questionably useful drugs).

As the CIA represents the main head of the octopus that controls America’s society on behalf of their Illuminati owners, it is only fitting that the CIA has its hand in the international drug trade. It is also an interesting side note that since its early days the CIA has been interested in drugs for the use of interrogation, mind control, crowd control, and other purposes. In fact there have been suggestions based on circumstantial evidence that the entire ‘hippie’ movement came straight out of a CIA drug lab vis a vis Tim Leary and other affiliated icons.

…click on the above link to read the rest of the article…