Steve Bull's Blog, page 1351

July 4, 2017

A War on Globalism

Have you ever wondered why Donald Trump is so deeply hated by the elite? It isn’t because he is a Republican. In fact, there are lots of Republicans out there that the elite absolutely love. The truth is that the reason the elite have such deep animosity toward Trump is because he is fighting their globalist agenda. When Trump talks about a border wall or a travel ban, the elite hate that because they ultimately want a world where national borders have been made meaningless. And when Trump talks about tearing up trade agreements that really freaks them out because they have been working very hard to try to merge the economies of the planet into a single global economic system. Worst of all for the globalists was when Trump pulled out of the Paris climate agreement. For decades the elite have been using such international agreements to impose their values on the entire planet, and now the leader of the most powerful nation in the world is standing up to them.

Unfortunately, most of the members of Congress are still embracing the globalist agenda, and this puts them directly at odds with Trump. So just because someone is a “Republican” does not mean that they care about American sovereignty. Sadly, sometimes Republicans are actually some of the worst offenders when it comes to pushing globalist causes.

This is why we need a new political war against globalism. It wasn’t enough just to get Trump into the White House, because the globalists in Congress seem determined to block most of the things that he is trying to do. So we need to kick the globalists out and replace them with true patriots that truly want to restore our republic.

…click on the above link to read the rest of the article…

The Saudi-Qatar rift has elements of world war potential

The First and the Second World War were the culmination of rivalries that go as far back as over a thousand years, when Charlemagne subjugated the Saxon tribes inhabiting modern Germany, and creating the Carolingian Empire. The political successors of Franks, France, and Saxons, the latter morphing into the Holy Roman Empire, then Prussia, then Germany, would continue to fight border wars until the bloodiest of them all, World War 2, inflicted enough destruction to both to force them to give up military means for the reciprocal arrangements.

The First World War was triggered by a regional episode, the assassination of the Archduke of Austria, Franz Ferdinand, by Serb nationalists that put in motion the alliance of the German world, Austria and Prussia against the British, French and Russian one.

Just like the two world wars in Europe were triggered by a single event, so can long standing, unresolved rivalries for power and influence over the Middle East result in the mother of all wars.

Qatar and Saudi Arabia have collaborated in the recent years to overthrow the Assad presidency in Syria and replace it with a Sunni Muslim leader that would allow the creation of a pipeline from Qatar to Europe, for the benefit of the Gulf countries.

The failure of the American-Saudi-Qatari coalition however re-opened old wounds. In the recent weeks, the Saudi-led bloc, including Jordan, Egypt and Bahrain has broken all ties with Qatar, accusing it of working with terrorist groups and having too close ties with Iran. Since then, having cashed in on the support of US President Trump, Saudis have given a list of 13 demands to Qatar, which the latter has no intention to comply with.1)

In the meanwhile, very much like WW1 preparations, the game of alliances has started: Qatar, having lost the protection of the Arab world, sought it elsewhere, and found in Turkey.2)

…click on the above link to read the rest of the article…

You Want a Picture of the Future? Imagine a Boot Stamping on Your Face

We have arrived, way ahead of schedule, into the dystopian future dreamed up by such science fiction writers as George Orwell, Aldous Huxley, Margaret Atwood and Philip K. Dick.

Much like Orwell’s Big Brother in 1984, the government and its corporate spies now watch our every move.

Much like Huxley’s A Brave New World, we are churning out a society of watchers who “have their liberties taken away from them, but … rather enjoy it, because they [are] distracted from any desire to rebel by propaganda or brainwashing.”

Much like Atwood’s The Handmaid’s Tale, the populace is now taught to “know their place and their duties, to understand that they have no real rights but will be protected up to a point if they conform, and to think so poorly of themselves that they will accept their assigned fate and not rebel or run away.”

And in keeping with Philip K. Dick’s darkly prophetic vision of a dystopian police state—which became the basis for Steven Spielberg’s futuristic thriller Minority Report which was released 15 years ago—we are now trapped into a world in which the government is all-seeing, all-knowing and all-powerful, and if you dare to step out of line, dark-clad police SWAT teams and pre-crime units will crack a few skulls to bring the populace under control.

Minority Report is set in the year 2054, but it could just as well have taken place in 2017.

Seemingly taking its cue from science fiction, technology has moved so fast in the short time since Minority Report premiered in 2002 that what once seemed futuristic no longer occupies the realm of science fiction.

…click on the above link to read the rest of the article…

The Next Financial Crisis Is Not Far Away

Recently, a Spanish group called “Ecologist in Action” asked me to give them a presentation on what kind of financial crisis we should expect. They wanted to know when it would be and how it would take place.

The answer I had for the group is that we should expect financial collapse quite soon–perhaps as soon as the next few months. Our problem is energy related, but not in the way that most Peak Oil groups describe the problem. It is much more related to the election of President Trump and to the Brexit vote.

I have talked about this subject in various forms before, but not since 2016 energy production and consumption data became available. Most of the slides in this presentation use new BP data, through 2016. A copy of the presentation can be found at this link: The Next Financial Crisis.1

Slide 1

Most people don’t understand how interconnected the world economy is. All they understand is the simple connections that economists make in their models.

Slide 2

Energy is essential to the economy, because energy is what makes objects move, and what provides heat for cooking food and for industrial processes. Energy comes in many forms, including sunlight, human energy, animal energy, and fossil fuels. In today’s world, energy in the form of electricity or petroleum makes possible the many things we think of as technology.

In Slide 2, I illustrate the economy as hollow because we keep adding new layers of the economy on top of the old layers. As new layers (including new products, laws, and consumers) are added, old ones are removed. This is why we can’t necessarily use a prior energy approach. For example, if cars can no longer be used, it would be difficult to transition back to horses.

…click on the above link to read the rest of the article…

July 1, 2017

Foonie? As loonie turns 30, it’s time to think of a name for a $5 coin: Don Pittis

And while we’re at it, Canadians must lose their attachment to those pesky nickels

Canadian astronaut Chris Hadfield presents Bank of Canada Governor Stephen Poloz with the $5 bill he took into space. Maybe next time, it will be a coin. (Ryan Remiorz/Canadian Press)

Foonie doesn’t really work, so Canadians will have to put on their thinking caps to figure out a name for the $5 coin.

As the loonie turns 30 this week, painful though it may be, we must inevitably begin to prepare ourselves to say goodbye to our blue Wilfrids.

This is not an inside scoop from the Bank of Canada; officially there is no plan to kill the bill.

But there is evidence it is already on the minds of Canadians: The Royal Canadian Mint includes a query about a $5 coin in its list of frequently asked questions.

‘Cost-saving measure’

“The decision to issue a new circulation coin is the responsibility of the Canadian government,” says the mint’s answer to that FAQ. “There are currently no plans to make $5 coins or discontinue the $5 bill.”

However the final line of the FAQ could be taken as a hint: “The $2 coin was introduced as a cost-saving measure in 1996.”

In other words, it has been more that 20 years since the last time a bill was replaced by a money-saving coin.

You can see why the mint would want to soften us up in advance.

Get ready to say goodbye to Wilfrid Laurier, Canada’s seventh prime minister, though the tough new polymer bills may give him more staying power than the paper ones and twos. (Bank of Canada)

As we witnessed during the long and divisive battle to be rid of a penny that had become absurdly valueless, families were divided for and against the copper-coloured coin. Evidently people have an odd attachment to their money.

…click on the above link to read the rest of the article…

Many European Banks Would Collapse Without Regulators’ Help: Fitch

Only two things keep these banks alive: “a State willing to support them and a regulator that does not declare them insolvent.”

Dozens of Greek, Italian, Spanish and even German lenders have volumes of troubled assets higher or similar to that of Spain’s fallen lender Banco Popular. They, too, are at risk of insolvency. This stark observation came from Bridget Gandy, director of financial institutions for Fitch Ratings, who spoke at a conference in London on Thursday.

The troubled banks include:

Greece’s HB, Piraeus, NBG, Eurobank and Alpha;

Italy’s Monte dei Pachi di Siena (which is in the process of being rescued with state funds), Carige (9th largest bank, now under ECB orders to raise capital or else), CreVal, and the two collapsed banks, Veneto and Vicenza (whose senior bondholders were bailed out last weekend);

Germany’s Bremer Landesbank (which just cancel interest payments on its CoCo bonds) and shipping lender HSH Nordbank.

Spain’s Liberbank and majority state-owned BMN and Bankia, which are completing a merger after private-sector institutions refused to buy BMN. Now, the problems on BMN’s balance sheet belong to Bankia, which already has its own set of issues, Gandy said.

That many of Europe’s banks are teetering on the brink of insolvency is not exactly new news. Most of the problems that caused the financial crisis have not been resolved. As the financial journalist and former investment banker Nomi Prins said in a 2015 interview with Dutch media group VPRO, “in Europe there still exist massive amounts of trades (on banks’ balance sheets) that are underwater and going wrong every day.”

…click on the above link to read the rest of the article…

The Looming Energy Shock

Carlos E. Santa Maria/Shutterstock

The Looming Energy Shock

The next oil crisis will arrive in 3 years or less

There will be an extremely painful oil supply shortfall sometime between 2018 and 2020. It will be highly disruptive to our over-leveraged global financial system, given how saddled it is with record debts and unfunded IOUs.

Due to a massive reduction in capital spending in the global oil business over 2014-2016 and continuing into 2017, the world will soon find less oil coming out of the ground beginning somewhere between 2018-2020.

Because oil is the lifeblood of today’s economy, if there’s less oil to go around, price shocks are inevitable. It’s very likely we’ll see prices climb back over $100 per barrel. Possibly well over.

The only way to avoid such a supply driven price-shock is if the world economy collapses first, dragging demand downwards.

Not exactly a great “solution” to hope for.

Pick Your Poison

This is why our view is that either

the world economy outgrows available oil somewhere in the 2018 – 2020 timeframe, or

the world economy collapses first, thus pushing off an oil price shock by a few years (or longer, given the severity of the collapse)

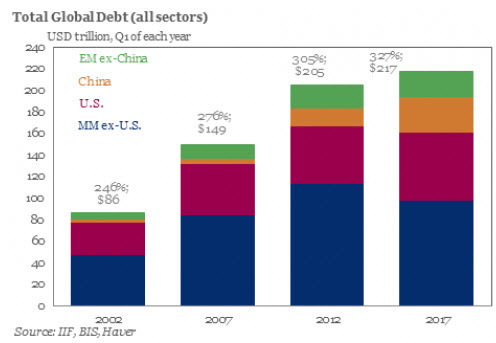

If (1) happens, the resulting oil price spike will kneecap a world economy already weighted down by the highest levels of debt ever recorded, currently totaling some 327% of GDP:

(Source)

Remember, in 2008, oil spiked to $147 a barrel. The rest is history — a massive credit crisis ensued. While there was a mountain of dodgy debt centered around subprime loans in the US, what brought Greece to its knees wasn’t US housing debt, but its own unsustainable pile of debt coupled to a 100% dependence on imported oil — which, figuratively and literally, broke the bank.

…click on the above link to read the rest of the article…

Kyle Bass Warns Of “Tectonic Shift” In US-China Relationship

Hayman Capital’s Kyle Bass ventured on to CNBC this morning to drop some painful truth bombs about Trump’s “drastically changed Chinese diplomacy” and China’s looming “come-uppance.”

Bass began by highlighting what he calls a “tectonic shift” in US-China relations in the last few days, pointing to two crucial events…

1. Things changed drastically when US launched unilateral sanctions on China over North Korea…

“Xi is a control freak and he absolutely doesn’t appreciate the United States acting unilaterally”

2. Things escalated when Trump sold $1.4bn in weapons to Taiwan, angering Beijing more as Bass notes:

“Taiwan was the one area which Beijing has asked Trump to stay away from during his meeting at Mar-a-Lago.”

“Since the death of Otto Warmbier, any chance of meetings with North Korea are now off.. and our diplomatic relationship with China took a major step for the worse yesterday.“

Bass notes that “China is trying to make marginal changes in its balance of trade with US – buying beef once again and importing a lot more crude oil from the US.”

But then Bass shifts to the potentially even more precarious situation under the hood of China’s economy. As Reuters reports, China’s leaders want the restructuring of their massive non-performing loans problem to address financial risks while avoiding big employee lay-offs, and have instigated ‘cure by committee’..

“The solution for zombie firms isn’t just bankruptcy,” a Shandong-based banking official told Reuters. “The impact of bankruptcy is just too big. Just think about the thousands of workers. Social stability is key.”

Stability is always uppermost in the minds of Chinese leaders, and even more so this year, ahead of the five-yearly party congress this autumn, when a new generation of senior leaders will be selected.

…click on the above link to read the rest of the article…

“From Horrific To Catastrophic”: Court Ruling Sends Illinois Into Financial Abyss

First Maine, then Connecticut, and finally late on Friday, confirming the worst case outcome many had expected, Illinois entered its third straight fiscal year without a budget as Republican Governor Bruce Rauner and Democratic lawmakers failed to agree on how to compromise over the government’s chronic deficits, pushing it closer toward becoming the first junk-rated U.S. state.

By the end of Friday – the last day of the fiscal year – Illinois legislators failed to enact a budget, and while negotiations continued amid some glimmers of hope and lawmakers planned to meet over the weekend, the failure marked a continuation of the historic impasse that’s left Illinois without a full-year budget since mid-2015, and which, recall, S&P warned one month ago will likely result in a humiliating and unprecedented downgrade of the 5th most populous US state to junk status.

Then came the begging.

According to Bloomberg, on Friday Illinois House Speaker Michael Madigan, a Democrat who controls much of the legislative agenda, pleaded with rating companies to “temporarily withhold judgment” as lawmakers negotiate. “Much work remains to be done,” the Democrat said on the floor of the House Friday, before the chamber adjourned for the day. “We’ll get the job done.”

Meanwhile, the state remains without a spending plan, its tax receipts and outlays mostly on “autopilot”, leaving it with a record $15 billion of unpaid bills as it spent over $6 billion more than it brought in over the past year, and with $800 million in interest on the unpaid bills alone. The impasse has devastated social-service providers, shuttering services for the homeless, disabled and poor. The lack of state aid has wrecked havoc on universities, putting their accreditation at risk.

…click on the above link to read the rest of the article…

June 30, 2017

Furious China “Outraged” By U.S. Sale Of $1.4BN In Weapons To Taiwan

One day after the US announced it would sell $1.42 billion in weapons to China’s offshore nemesis Taiwan, Beijing lashed out at the United States, saying it was “outraged” and demanded the US revoke immediately its “wrong decision”, saying it contradicted a “consensus” President Xi Jinping reached with his counterpart, Donald Trump, in talks in April in Florida.

The proposed U.S. package for Taiwan includes technical support for early warning radar, high speed anti-radiation missiles, torpedoes and missile components.

The sales would send a very wrong message to “Taiwan independence” forces, China’s embassy in Washington said in a statement. A U.S. State Department spokeswoman said on Thursday the administration had told Congress of seven proposed sales to Taiwan, the first under the Trump administration. “The Chinese government and Chinese people have every right to be outraged,” the embassy said.

Besides token bluster, however, this time China also warned that Trump’s action was counter to the agreement reached with Xi in Palm Beach, suggesting retaliation will likely be imminent. “The wrong move of the U.S. side runs counter to the consensus reached by the two presidents in and the positive development momentum of the China-U.S. relationship,” the embassy said.

This was the second major diplomatic escalation between the US and China in just the past 24 hours, with the US announcing late yesterday the first sanction imposed on Chinese entities for ties with North Korea, a move which likewise was slammed by the Chinese press.

As a reminder, one of Trump’s initial diplomatic snafus was to implicitly recognize Taiwan when he spoke over the phone with its president Tsai Ing-wen shortly after the election, in the process infuriating Beijing. China regards Taiwan as a wayward province and has never renounced the use of force to bring it under its control. China’s Nationalists fled to the island after losing the civil war with China’s Communists in 1949. The United States is the sole arms supplier to Taiwan.

…click on the above link to read the rest of the article…