Steve Bull's Blog, page 1349

July 10, 2017

The Breaking Point & Death Of Keynes

You can almost hear the announcer for the movie trailer;

“In a world stricken by financial crisis, a country plagued by spiraling deficits and cities on the verge of collapse – a war is being waged; gauntlet’s thrown down and at the heart of it all; two dead white guys battling over the fate of the economy.”

While I am not so sure it would actually make a great movie to watch – it is the ongoing saga we will continue to witness unfold over the next decade. While the video below is entertaining, it does lay out the key differences between Keynesian and Austrian economic theories.

Just last week, the Federal Reserve released a report which forms the basis of the semi-annual testimony Ms. Yellen will give to Congress this week. There was much in this report which suggests the models the Federal Reserve continues to use are at best flawed and, at worst, broken.

For decades, ivory tower economists have heaped high praise on Keynesian policies as they have encouraged Governments to drive deeper into debt with the expectation of reviving economic growth.

The problem is – it hasn’t worked.

Here’s proof. Following the financial crisis, the Government and the Federal Reserve decided it was prudent to inject more than $33 Trillion in debt-laden injections into the economy believing such would stimulate an economic resurgence. Here is a listing of all the programs.

…click on the above link to read the rest of the article…

Eric Peters: “We Are About To Reach The Top Of The Wall Of Worry… And Then Look Down”

Following up on Eric Peters’ contrarian comments about “technological disruption”, in which he said that “we should be careful not to overlook the possibility that today’s disruptive technology companies may be not much more than mechanisms to drive wages down to subsistence levels”, in the One River CIO’s latest letter, Peters reverts back to his familiar, macro self with the following brief allegory on recent events, which as always cuts through the noise to highlight what is important, in this case that “the chasm between policy and reality has never been wider” which he says “matters little, until you arrive at the top of the wall of worry. And then look down.”

Here are the choice excerpts from his latest letter:

“Absolutely,” answered Trump, as sure as sure can be. You see, the reporter had asked if Mexico would pay. She couldn’t help herself, we’re fixated by walls. We need them; to build, to topple, to scale.

They define us, give us purpose. Walls surround us, they’re everywhere, literally, metaphorically.

“We are showing that the world doesn’t have to go 100 years back in time,” announced Tusk, symbolically isolating America, while breaking down the wall that separates Europe and Japan.

“The deal is the birth of the world’s largest, free industrialized economic zone,” said Abe, shaking hands, the barrier surrounding his little island crumbling.

But of course, the most formidable walls exist in our delicate minds. Steel and stone structures all succumb to determined efforts to overcome them; the Iron Curtain, Berlin Wall, Great Wall.

But self-doubt is another matter entirely, a barrier towering above all others, the greatest obstacle ever created. In its shadow stands worry. But this wall can be climbed. And eight years into a historic bull market, we’re approaching the top.

…click on the above link to read the rest of the article…

Janet Yellen: False Prophet of Prosperity

Federal Reserve Chair Janet Yellen recently predicted that, thanks to the regulations implemented after the 2008 market meltdown, America would not experience another economic crisis “in our lifetimes.” Yellen’s statement should send shivers down our spines, as there are few more reliable signals of an impending recession, or worse, than when so-called “experts” proclaim that we are in an era of unending prosperity.

For instance, in the years leading up to the 2008 market meltdown, then-Fed Chair Ben Bernanke repeatedly denied the existence of a housing bubble. In February 2007, Bernanke not only denied that “sluggishness” in the housing market would affect the general economy, but predicted that the economy would expand in 2007 and 2008. Of course, instead of years of economic growth, 2007 and 2008 were marked by a market meltdown whose effects are still being felt.

Yellen’s happy talk ignores a number of signs that the economy is on the verge of another crisis. In recent months, the US has experienced a decline in economic growth and the value of the dollar. The only economic statistic showing a positive trend is the unemployment rate — and that is only because the official unemployment rate does not count those who have given up looking for work. The real unemployment rate is at least 50 percent higher than the manipulated “official” rate.

A recent Treasury Department report’s called for rolling back of bank regulations could further destabilize the economy. This seems counterintuitive, as rolling back regulations usually contributes to economic growth. However, rolling back bank regulations without ending subsidies like deposit insurance that create a moral hazard that incentivizes banks to engage in risky business practices could cause banks to resume the unsound lending practices that were a major contributor to the growth, and collapse, of the housing bubble.

…click on the above link to read the rest of the article…

We’re Good People, Really We Are!

The disgrace of America’s putative intellectual class is nearly complete as it shoves the polity further into dysfunction and toward collapse. These are the people Nassim Taleb refers to as “intellectuals-yet-idiots.” Big questions loom over this dynamic: How did the thinking class of America sink into this slough of thoughtlessness? And why – what is motivating them?One path to understanding it can be found in this sober essay by Neal Devers, The Overton Bubble , published two years ago on TheFuturePrimaeval.net — a friend turned me on to it the other day (dunno how I missed it). The title is a reference to the phenomenon known as the Overton Window. Wikipedia summarizes it:

The Overton Window, also known as the window of discourse, is the range of ideas the public will accept…. The term is derived from its originator, Joseph P. Overton (1960–2003), a former vice president of the Mackinac Center for Public Policy….

Devers refines the definition:

The Overton Window is a concept in political sociology referring to the range of acceptable opinions that can be held by respectable people. “Respectable” of course means that the subject can be integrated with polite society. Respectability is a strong precondition on the ability to have open influence in the mainstream.

This raises another question: who exactly is in this corps of “respectable people” who set the parameters of acceptable thought? Primarily, the mainstream media — The New York Times, The WashPo, CNN, etc. — plus the bureaucratic functionaries of the permanent government bureaucracy, a.k.a. the Deep State, who make and execute policy, along with the universities which educate the “respectable people” (the thinking class) into the prevailing dogmas and shibboleths of the day, and finally the think tanks and foundations that pay professional “experts” to retail their ideas.

…click on the above link to read the rest of the article…

Australia’s oil stock coverage on record low

In prime time evening news of the Australian public broadcaster ABC TV, on 21 June 2017, the business presenter Alan Kohler tried to explain a fall in oil prices by “record oil inventories around the world”

http://www.abc.net.au/news/business/kohler-report/

Well, let’s go around the world on a map and stay where we are, in Australia. In google, type in the search word “Australian Petroleum Statistics” and you get this website:

http://www.environment.gov.au/energy/petroleum-statistics

Click on the latest issue and then on the download PDF file, in this case April 2017

Search for the word “stocks” and that brings you to tables 6 and 7

Table 7 End of month stocks of petroleum, consumption cover

In the last column “IEA days of net imports coverage it is 89.5 days for 2010/11 and 55.2 days for 2015/17. Go to the bottom of the column and it’s 50.5 days. The year-on-year decline is 3.1%. That doesn’t look like a record now. If anything, it’s a record low. Let’s put that into a graph:

Fig 1: Australia’s net imports coverage in days as defined by IEA

Fig 1: Australia’s net imports coverage in days as defined by IEA

Australia is a member of the IEA (International Energy Agency)

Fig 2: Australian Prime Minster shaking hands with IEA’s Fatih Birol, Feb 2017

Fig 2: Australian Prime Minster shaking hands with IEA’s Fatih Birol, Feb 2017

We check the coverage on the IEA website and find 48 days for March

Fig 3: Australia in comparison with other countries

https://www.iea.org/netimports/

But this number of 50 days is just a calculated average of all oils and fuels. In terms of consumption cover for crude oil and the most important fuels the numbers are much lower as shown in the following graphs.

…click on the above link to read the rest of the article…

July 2017 Stormwatch: Climate Change

Many years ago, not long after I first got onto the internet, I created a website to try to encourage community groups to make preparations for the hard times to come. It was titled “The Stormwatch Project” — why, yes, I was a Jethro Tull fan back in the day; how did you guess?

Traceability in Farming Supply Chains

TRACEABILITY IN FARMING SUPPLY CHAINS

There are growing environmental challenges and people are increasingly aware of the environment. This awareness has extended to social issues faced around the world. Businesses within farming supply chains are concerned about these issues – they have to ensure that they are addressed within their operations to gain a competitive advantage.

Customers are asking critical questions about the social and environmental credentials of the food they eat. Customers want to know what farmers are doing within their own powers to improve the environment. They want to be rest assured that efforts are being made by supply chain players to combat climate change, reduce water scarcity and land pollution and so on.

In the context of social issues, customers want to understand the social conditions associated with the food they buy. They want to know if measures have been taken to ensure that no element of child labour was used to grow and produce their food crops, they want to be sure that farm workers were not exposed to health risks, and that workers are paid decently and so on.

In the same vein, environmentalists have come to terms with the fact that the environment has social dimensions attached to it. For example, people are part of the environment and it is expected that environmental protection measures being applied across all sectors of the economy should also put people into considerations – any measure that is deemed good for the environment should also be good for human lives and vice-versa before it can be implemented in any sector of the economy. As a result, efforts to improve environmental sustainability are also geared towards the creation of positive social impacts.

…click on the above link to read the rest of the article…

Freedom Is Not Necessarily The Absence Of Tyranny

Is it true that freedom is an overly idealized concept? Perhaps, but it is one of the few concepts worthy of idealization. It is so worthy, that it is worth dying for.

Since the dawn of recorded history human beings have fought and sacrificed to attain freedom. It is an inherent psychological construct. It is a principle that is rooted not only in the mind of man, but his spirit or soul. Scientists in the realm of the mind have struggled for generations to understand where it comes from — others have sought to dismiss it as a fanciful notion or societal construct. Nihilists claim it doesn’t really exist, while other people center their entire lives on the proliferation of it. The concept of freedom, love it or hate it, is central to all cultures and all civilizations. The most common dismissal of the idea of freedom that I have seen is the argument that none of us is really free because “tyranny exists”. Tyranny is a constant, therefore, in the view of the nihilists, freedom cannot exist. I believe this dim way of thinking stems from a misconception of what freedom is and where it comes from.

Freedom, first and foremost, begins in the mind, or the heart; whatever you are inclined to put more stock in. To think critically or to imagine wildly is indeed to be free. Tyranny, by extension, rises from the mire and muck in the physical world around us and ends in the mind and the heart. If one is free of mind, then one is never truly enslaved.

I have heard so many times the ignorant accusation that freedom requires action before consequence. That is to say, if you have suffered the consequences of a tyrannical system, then you have already failed to prevent your own enslavement. This is not how freedom functions. It has never worked this way.

…click on the above link to read the rest of the article…

From Growth to Degrowth: a Brief History

The notion of economic growth as a regular, ongoing, self-sustained process no longer holds up to critical analysis. Even during what’s been called “The Glorious Thirty” – the years between the end of World War II and the 1974 oil crisis – growth occurred almost solely in industrialized countries and involved a minority of the world population; it was built on the senseless waste and pillaging of limited natural resources, access to cheap fossil fuels, dependency on killer technologies and the creation of global inequalities and imbalances that would prove to be unbearable and unsustainable.

The notion of economic growth as a regular, ongoing, self-sustained process no longer holds up to critical analysis. Even during what’s been called “The Glorious Thirty” – the years between the end of World War II and the 1974 oil crisis – growth occurred almost solely in industrialized countries and involved a minority of the world population; it was built on the senseless waste and pillaging of limited natural resources, access to cheap fossil fuels, dependency on killer technologies and the creation of global inequalities and imbalances that would prove to be unbearable and unsustainable.When it became evident that geophysical limits could bring growth to a halt, the concepts of durable or sustainable development were proposed. The 1987 Brundtland Report, Our Common Future, advocated for “clean” growth that guarantees ecological sustainability, development and social justice all at the same time. This proposal became the backbone of the 1992 Rio de Janeiro Earth Summit. However, the explosion of inequalities and the fact that we have gone beyond the ecological limits of the planet have rendered hopes for sustainable development obsolete.

With economic and financial globalization, the integration of the world markets is said to be what will achieve development, which often involves countries assuming massive debts and making huge payments to service them. These, in turn, drive forced growth to guarantee repayment. It is thus no longer about balancing the three pillars of sustainable development – growth, social justice and the sustainability of the planet – but rather entrusting the task of caring for society and the Earth to the economy and the market.

…click on the above link to read the rest of the article…

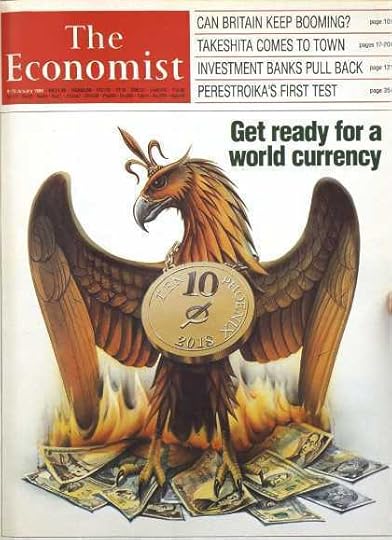

The Economist: World Currency By Jan. 9, 2018

Get Ready F...

Get Ready For A World Currency

Get Ready for the Phoenix

January 9, 1988, Vol. 306, pp 9-10

THIRTY years from now, Americans, Japanese, Europeans, and people in many other rich countries, and some relatively poor ones will probably be paying for their shopping with the same currency. Prices will be quoted not in dollars, yen or D-marks but in, let’s say, the phoenix. The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century.

–

At the beginning of 1988 this appears an outlandish prediction. Proposals for eventual monetary union proliferated five and ten years ago, but they hardly envisaged the setbacks of 1987. The governments of the big economies tried to move an inch or two towards a more managed system of exchange rates – a logical preliminary, it might seem, to radical monetary reform. For lack of co-operation in their underlying economic policies they bungled it horribly, and provoked the rise in interest rates that brought on the stock market crash of October. These events have chastened exchange-rate reformers. The market crash taught them that the pretence of policy co-operation can be worse than nothing, and that until real co-operation is feasible (i.e., until governments surrender some economic sovereignty) further attempts to peg currencies will flounder.

…

The new world economy

The biggest change in the world economy since the early 1970’s is that flows of money have replaced trade in goods as the force that drives exchange rates. as a result of the relentless integration of the world’s financial markets, differences in national economic policies can disturb interest rates (or expectations of future interest rates) only slightly, yet still call forth huge transfers of financial assets from one country to another.

…click on the above link to read the rest of the article…