Steve Bull's Blog, page 1346

July 17, 2017

Navigating Through the Storms

Several weeks ago I had to drive west on the Pennsylvania Turnpike to pick up my son after his sophomore year at Penn State. I’ve made this trip a dozen times over the last few years, since this is my second son attending Penn State, with a third starting in the Fall. It’s a tedious, boring, protracted, four hour trek through the rural countryside of the Keystone State. During these trips my mind wanders, making connections between the landscape and the pressing issues facing the world. I can’t help but get lost in my thoughts as the miles accumulate like dollars on the national debt clock.

More often than not I end up making the trip in the midst of bad weather. And this time was no different. The Pennsylvania Turnpike is a meandering, decades old, dangerous, mostly two lane highway for most of its 360 mile span. Large swaths of the decaying interstate are under construction, as the narrative about lack of infrastructure spending is proven false by visual proof along the highways and byways of America.

The real infrastructure crisis is below ground in urban shitholes where 100 year old water and sewer pipes fail on a regular basis, but bankrupt Democrat politicians divert their steadily declining tax revenues to bloated pensions of government lackeys. Infrastructure spending is only interesting to politicians if they can name it after themselves and have a ribbon cutting ceremony. Replacing water and sewer pipes before they explode isn’t sexy, so it won’t be done.

A winding two lane highway, with a speed limits of 70 mph, and jam-packed with 18 wheelers driven by sometimes sleepy and often aggressive truckers already leads to a pressure packed few hours. Add rain to the mixture and you ratchet up the blood pressure.

…click on the above link to read the rest of the article…

Peak Bull: Fake Economy, and Fake News

Peak Bull: Fake Economy, and Fake News

[Urgent Note: David Stockman warns that the nation’s economy and a massive debt ceiling hangs in the balance as Wall Street’s peak bull stocks carry on. The economist is on a mission to send his new book TRUMPED! A Nation on the Brink of Ruin… and How to Bring It Back out to every American who responds, absolutely free. Click here for more details.]

The American economy has been mangled by decades of assault on capitalist prosperity.

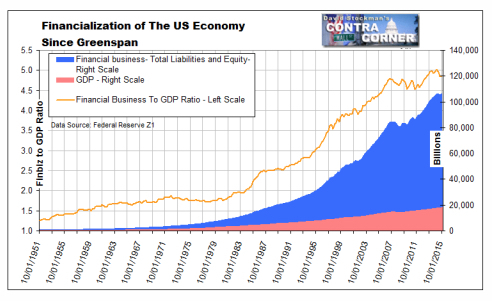

Growth is now dying because the Federal Reserve’s hit on corporate America that has strip-mined its balance sheets to feed the halls of Wall Street. Trillions of dollars have been thrown into financial engineering (stock buybacks, M&A deals and leveraged recaps) while neglecting real investment and productivity in Flyover America.

The single most important thing that speculators and bulls on Wall Street should be looking at now is where we came from. If Wall Street understood this, they wouldn’t continue to expect the “born again” Reagan stimulus that has been imagined since Trump’s inauguration.

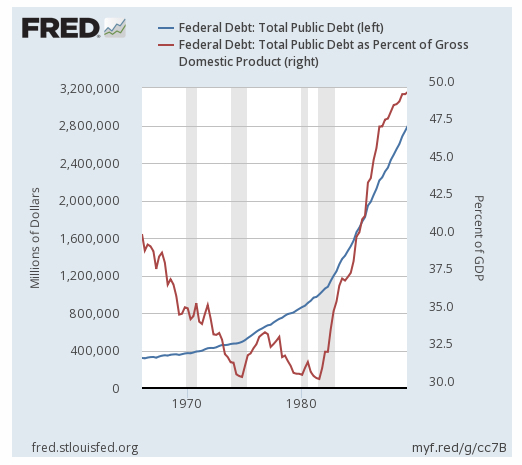

The extent of what actually happened during the Reagan era is also important to examine. In the eight years after Reagan’s tax bill got handed out, the national debt and defense budget exploded. We had more red ink during in that eight year period than during the first 190 years of the Republic – in fact it doubled.

The national debt, which you can see starting in 1980 went from around $800-900 billion to well over $3 trillion. The share of GDP soared during that period.

This is how the Reagan defense and tax cuts were funded. The move left the nation’s fiscal accounts in a dramatically different condition than when it started. Even Ronald Reagan, with his best of intentions, went in believing he was going to end up with less national debt and balanced budgets – though he ended up adding $1.8 trillion.

…click on the above link to read the rest of the article…

US Shale Production Just Hit A New All Time High

One month ago, we reported that based on recent data, June oil output from shale producers would post the first double-digit production growth since July of 2015, when oil prices tumbled and a substantial portion of US production was briefly taken offline. While the final data has yet to be tabulated, it is safe to say that this is now the case.

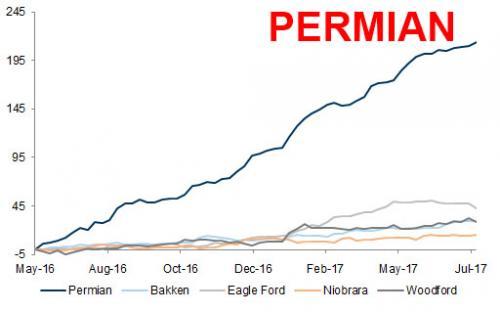

Indicatively, while over the past year total U.S. production was up roughly 525kb/d, virtually all of it, or 98.5%, was the result of horizontal rig production in the Permian Basin, where output rose by just over half a million barrels per day.

The Permian basin has been leading the increase in horizontal oil rig count (+184%)

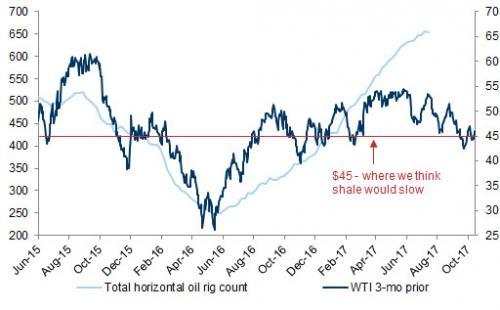

Also of note is that while US rig shows not signs of slowing yet, in its latest Weekly Oil Rig Monitor, Goldman predicted that $45/bbl is the price below which shale output would finally slow, although that price may also prove a substantial hurdle for many gulf budgets, whose all in cost of production – including mandatory and discretionary government outlays – is roughly the same if not higher.

Rig count (lhs), WTI spot prices (rhs, $/bbl, 3-mo lag)

But what is more notable, is that according to the June EIA Drilling Prodctivity Report forecast, in July total shale (note: not total) basin output would rise by 127kb/d from May’s 5.348mmb/d, and hit 5.475 mmb/d, surpassing the previous record of 5.46 mmb/d reached in March 2015. Today the EIA released its latest Drilling Productivity Report, and while the number is not official just yet, it is safe to say that as of July, the total US shale basin is producing a record amount of crude oil, which the EIA pegged at 5.472mmb/d, up almost exactly as predicted, and is expected to rise by a further 113kb/d in August to a new all time high of 5.585mmb/d.

…click on the above link to read the rest of the article…

Canadian Home Sales Crash In June

The Canadian Real Estate Association says home sales in June posted their largest monthly drop since 2010, with the Greater Toronto market leading the decline.

This is the third monthly decline in a row…

Under the covers, it’s Toronto that is suffering the most…

Toronto existing home sales drop 37.7% y/y

Average Toronto existing home price fell 5.8% m/m

Average Toronto existing home price up 6.3% y/y

Vancouver existing home sales drop 12.2% y/y

Average Vancouver existing home price fell 3.2% m/m

Average Vancouver existing home price up 2.7% y/y

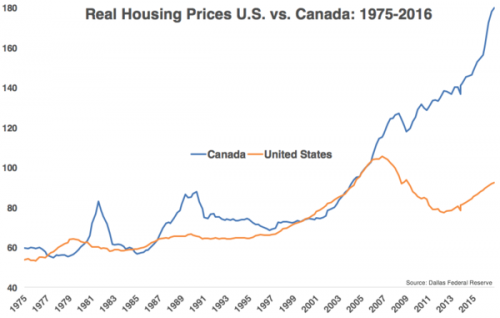

And as a reminder, there appears to be plenty of room for this to fall further…

When A “Black Swan” Will No Longer Do: China Warns Beware The “Gray Rhino”

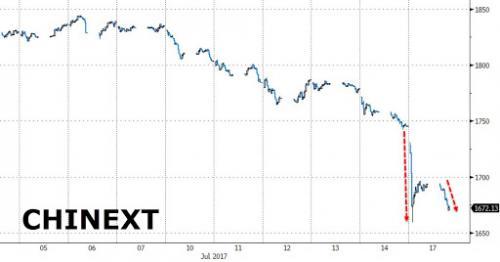

Early this morning, we discussed the unexpected tumble in the Chinese small-cap stock index, the ChiNext, will plunged by over 5%…

… as a result of growing concerns that a new round of deleveraging is about to be imposed by Beijing following the conclusion of China’s 5th National Financial Work Conference (NFWC), which was attended by president Xi Jinping, and set the agenda for critical financial reforms over the coming years. As the People’s Daily noted on Monday:

The meeting, presided over by President Xi Jinping, was held against the backdrop of growing enterprise debt, an overheating real estate market, and overcapacity in such sectors as low-end manufacturing.

Furthermore, the commentary touched on the recent OECD finding that the debt of non-financial enterprises in China reached 170% of its GDP in 2016, and warned that “in its 2017 China Financial Stability Report released early this month, China’s central bank, People’s Bank of China, pointed to “the risk of bubbles” emerging in some parts of the country. The report notes that housing loans comprised a quarter of all loans, and accounted for 44.8% of all new lending since the start of this year.”

Perhaps the biggest outcome from the weekend Conference was the creation of a financial “super-regultor” meant to tackle the growing threat of a financial crisis, and among its broad conclusions were i) To make finance better serve the real economy; ii) To contain financial risks; and iii) To deepen financial reforms. The proposed reforms are the result of the unprecedented increase in overall Chinese debt, which while promoting growth – in this case China’s latest 6.9% GDP print – is also leading to a relentless buildup of risks. And while until now Chinese regulators had homed in on financial-sector excesses, the latest probe – Bloomberg notes – is now widening to debt in the broader economy, “a shift that prompted a sell-off in domestic stocks.”

…click on the above link to read the rest of the article…

Expediency and Magical Thinking

Humanity appears to default to magical thinking when faced with untenable situations that demand systemic change.

How would extraterrestrial anthropologists characterize Earth’s dominant socio-economic system? It’s not difficult to imagine their dismaying report:

“Earth’s economy glorifies waste. Its economists rejoice when a product is disposed as waste and replaced with a new product. This waste is perversely labeled ‘growth.’

Aimless wandering that consumes fossil fuels is likewise rejoiced as ‘growth.’

The stripping of the planet’s oceans for a few favored species of edible fish is also considered ‘growth’ as the process of destroying the ocean ecosystem generates sales of the desired seafood.

Even more perversely, the resulting shortages are also causes of rejoicing by the planet’s elites, as their ability to purchase the now-scarce resources boosts their social status and grandiose sense of self-worth.

This glorification of waste is the same dynamic that destroyed the civilization on Zork.

Earth’s economy also glorifies exploitation, as this maximizes profits, which appears to be the planetary equivalent of a secular religion that everyone believes as a Natural Law.

Thus slavery and monopoly are highly valued as the most reliable sources of profits. If ethical concerns limit the actual ownership of humans, Earth’s economy incentivizes feudal arrangements that share characteristics of servitude and bondage. In the current era, the favored mechanisms are over-indebtedness (debt-serfdom) and taxation by the state, which extracts approximately 40% of all labor via threat of imprisonment.

Earth’s elites exhibit a pathological preference for micro-managing the commoners via criminalizing much of everyday life and imposing extremely harsh punishments for any dissent or resistance to elite domination.

…click on the above link to read the rest of the article…

July 14, 2017

Visa Trying to Bribe Merchants to Stop Taking Cash

The war on cash is escalating. A big driver isn’t central banks who want to be able to inflict negative interest rates on savers, or Treasuries who see cash transactions as hiding revenues from their tax collectors, but the payment networks that want to kill cash (and checks!) as competitors to their oh so terrific (and fee-gouging) credit and debit cards.

However, one bit of good news is there doesn’t appear to be much enthusiasm on the buyer, as in merchant, end.

First, the overview from the Wall Street Journal:

Visa Inc. has a new offer for small merchants: take thousands of dollars from the card giant to upgrade their payment technology. In return, the businesses must stop accepting cash.

The company unveiled the initiative on Wednesday as part of a broader effort to steer Americans away from using old-fashioned paper money. Visa says it is planning to give $10,000 apiece to up to 50 restaurants and food vendors to pay for their technology and marketing costs, as long as the businesses pledge to start what Visa executive Jack Forestell calls a “journey to cashless.”

There are good reasons to think this initiative won’t get far.

Customer resistance. Food vendors, and in particular restaurants, are low margin businesses with fickle customers who have little to no loyalty. Why risk driving business away?

Aside from the fact that some customers prefer cash, a related issue is that using cards and smartphones often seem to be a tax on time. I really hate using chip cards. Mag cards were often faster than cash, since you swiped and could stuff the card back in your wallet while the transaction was being approved.

…click on the above link to read the rest of the article…

Nomi Prins: Easy Money Policy Allows for Another Crisis

Nomi Prins: Easy Money Policy Allows for Another Crisis

Nomi Prins joined The Foreign Correspondents’ Club of Japan in Tokyo to discuss the banking landscape and state of financial regulations in the Trump era. The central bank historian and financial expert also took a deep dive into the shifting relations between the United States and Japan and what easy money policy has meant for financial markets.

The author began the discussion noting that, “A lot of things have happened in the past months in particular within finance and trade alliances amongst countries in the Trump era.”

Speaking on the recent gathering of world leaders Prins’ notes, “One of the things that came out of the G20 is whether it is America last in terms of the alliances occurring today. The American first policy is pushing new diplomacy and agreements with countries that have not spoken with one another in the past. This is happening for two reasons. One, from a standpoint of protecting the commonality of the world. It is filling the gap between receding powers versus rising power. Two, it is an anti-protectionist move.”

Prins’ then builds on easy money policy stating, “We still have a problem of banks that are too big to fail. We still have a problem where the initial financial crisis that happened ten years ago in the United States, that was the result of the banks being too large and too speculative… in using the guarantees that the U.S government has provided to bank depositors and the provisions provided in the Glass-Steagall. Those deposits have become a guarantee for banks to become bigger and a guarantee for financial crises to become something that the government subsidizes. Our Federal Reserve, our central bank, also subsidizes this.”

…click on the above link to read the rest of the article…

The 75,000 Mile Wide Hole In The Sun Could Black Out Earth’s Communications

The sunspot spotted by NASA as our sun creeps toward its solar minimum is 75,000 miles wide. That has huge implications for our satellites and communications systems, and the sunspot could cause some blackouts on Earth.

The huge sunspot has the potential to send out dangerous solar flares known to take out important communication equipment, satellites, and even huge sections of the power grid. This sunspot is the first to appear after the sun was spotless for 2 daysand the dark core is larger than the Earth.

A 75,000-mile wide sunspot just appeared.

Nasa’s Solar Dynamics Observatory first detected the huge spot last week, and it appears to have lingered through to this week.

Sunspots are darker, cooler areas on the surface of the sun, caused by interactions with the sun’s magnetic field. They tend to appear in regions of intense magnetic activity, and when that energy is released, solar flares and huge storms erupt from sunspots. Such a storm could create stunning auroras around the world, as well as play havoc with power grids, potentially causing blackouts in some areas. –DailyMail

NASA released a statement about the newly visible sunspot. “A new sunspot group has rotated into view and seems to be growing rather quickly,” they said. “It is the first sunspot to appear after the sun was spotless for two days, and it is the only sunspot group on the sun at this moment.”

Watch the video below to see the sunspot rotate into view.

“It could be the source for some solar flares, but it is too early to predict just what it will do,” NASA continued. Forecasters from the NOAA say that there is a 25 percent chance of M-class flares today because the sunspot is directly facing our planet.

…click on the above link to read the rest of the article…

Visualizing The Dark Side Of The Web

The term Dark Web is evocative. It conjures up images of hitmen, illegal drugs, and pedophilia. One imagines a place where the dark side of human nature flourishes away from the eyes – and laws – of society at large.

Today’s infographic, from Cartwright King Solicitors, cuts through the mystique and provides an entertaining and practical overview of the Deep Web and the Dark Web.

…click on the above link to read the rest of the article…