Steve Bull's Blog, page 1347

July 14, 2017

The Technical Failure That Could Clear The Oil Glut In A Matter Of Weeks

OPEC exports have come under pressure this week from technical threats to oil fields, with Saudi Arabia’s Manifa problems grabbing the headlines.

Saudi Aramco CEO Amin Nasser, while addressing the World Petroleum Congress in Istanbul, stated that the outlook for oil supplies is “increasingly worrying”, due to a loss of $1 trillion ($1000 billion) in investments last year. The skepticism shown by a majority of financial analysts and oil commentators about the real threat to global oil (and gas) production volumes was countered by the news that the production at Saudi Aramco’s main offshore oil field, Manifa, has been hit by technical problems. News sources reported that the output from Saudi Aramco’s massive Manifa oilfield has been hit by a technical problem. The impact of this possible technical mishap is not to be underestimated. Aramco’s Manifa is one of its biggest oilfields, with a targeted production capacity of around 900,000 bpd, to be brought onstream in two phases. At present, the main issue being reported on is that there has been corrosion of the water injection system, which is used to keep pressure in the reservoir. No facts have emerged about the total impact on the Manifa production capacity, but unnamed sources are already quoting ‘millions of dollars’ of losses. The current reports are not really worrying, as corrosion control in a water injection system is only a technical challenge. Maintenance of the field is expected, resulting in a shut-down of production – something that has been confirmed by Sadad Al Husseini, former VP Aramco. If the all production needs to be shut-down, Saudi Aramco’s overall production capacity will be cut by 900,000bpd.

…click on the above link to read the rest of the article…

“Financial Crisis” Coming By End Of 2018 – Prepare Urgently

“Financial Crisis Of Historic Proportions” Is “Bearing Down On Us”

John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.”

Source: Financial Times

Source: Financial Times

Mauldin is a New York Times bestselling author and respected investment expert and his excellent analysis concludes with advice to prepare urgently for the financial “crisis of historic proportions” which is “once again bearing down on us”:

“You and I can’t control whether banks are ready, but we can control whether we are ready. I am working on a number of fronts to help you. My brief time away convinced me beyond any doubt that a crisis of historic proportions is once again bearing down on us. We may have little time to prepare. We definitely have no time to waste.“

His financial crisis warning is important as Mauldin is no perma-bear. Indeed up until now his central thesis was that we were in the “muddle through economy” and that the U.S. economy and global economy would “muddle” along and we would avoid a financial crisis. So not only has he changed his central thesis but he has gone from being neutral and mildly positive to being very bearish and concerned about a severe financial crisis.

Mauldin is a long time advocate of owning physical gold including gold coins as financial insurance – taking delivery and secure storage.

…click on the above link to read the rest of the article…

We Do These Things Because They’re Easy: Our All-Consuming Dependence on Debt

A world in which “we do these things because they’re easy” has one end-state: collapse.

On September 12, 1962, President John F. Kennedy gave a famous speech announcing the national goal of going to the moon by the end of the decade. (JFK’s speech on going to the moon.) In a memorable line, Kennedy said we would pursue the many elements of the space program “not because they are easy, but because they are hard.”

Our national philosophy now is “we do these things because they’re easy”– and relying on debt to pay today’s expenses is at the top of the list. What’s easier than tapping a line of credit to buy whatever you want or need? Nothing’s easier than borrowing money, especially at super-low rates of interest.

We are now totally, completely dependent on expanding debt for the maintenance of our society and economy. Every sector of the economy–households, businesses and government–all borrow vast sums just to maintain the status quo for another year.

Compare buying a new car with easy, low-interest credit and saving up to buy the car with cash. How easy is it to borrow $23,000 for a new $24,000 car? You go to the dealership, announce all you have to put down is a trade-in vehicle worth $1,000. The salesperson puts a mirror under your nose to make sure you’re alive, makes sure you haven’t just declared bankruptcy to stiff previous lenders, and if you pass those two tests, you qualify for a 1% rate auto loan. You sign some papers and drive off in your new car. Easy-peasy!

…click on the above link to read the rest of the article…

How Social Media Stifles Free Speech

Even more problematic is that those platforms are free to delete the pages and posts of users they deem to have violated whatever they decide are “community standards.” This includes judging content supportive of, for example, restricting migration in Europe.

Facebook, for example, also often permits real hate speech while banning websites that expose this hate speech.

Ultimately, the only way to keep the United States safe is by protecting its citizens’ ability to discuss ideas that without fear. If we lose our freedom of expression on the internet, we lose our democracy.

One of the greatest contemporary battles for individual liberty and freedom of the press is being conducted in cyber space.

Today, political, journalistic and corporate elites are in the process of trying to control, and even rewrite, “story lines” of history and current events with which they might disagree, and that they see slipping through their fingers.

It is a form of censorship akin to banning the printing press or preventing open debate in the literal and proverbial public square.

Facebook, for example, also often permits real hate speech while banning websites that expose this hate speech.

There are, however, constitutional and legal measures that can and should be taken to protect Americans from having their right to express themselves as they wish – without causing harm to public safety or engaging in illegal activity — violated every time they log in to their social media accounts.

New laws need to be codified to prevent what have become virtual utilities such as Facebook, Google, Twitter and YouTube from steering debate in a particular ideological direction.

One argument against holding these social media giants accountable is that they are private companies, and that consumers can simply stop using them.

…click on the above link to read the rest of the article…

China Warns Japan: “Get Used To Our Warplanes”, Sends Spy Ship Near Alaska

In an unexpectedly brazen rattling of sabers, just days after China deployed troops to its first foreign base in Djibouti, a move which the Global Times clarified is “about protecting its own security, not about seeking to control the world, Beijing made a less than subtle reversal, when it told Japan on Friday to “get used to it” after it flew six warplanes over the Miyako Strait between two southern Japanese islands in a military exercise.

It all started late on Thursday night, when Japan’s defense ministry issued a token statement describing the flyover by the formation of Xian H-6 bombers, also known as China’s B-52, earlier that day as “unusual”, while noting that there had been no violation of Japanese airspace.

The flyover was hardly surprising: the Chinese navy and air force have been carrying out a series of exercises in the Western Pacific in recent month, both as they hone their ability to operate far from their home shores, as well as a trial balloon to gauge the reactions of their increasingly more nervous neighbors.

What made this flyover different, is that usually following a formal protest by the “offended” country, Beijing would take note and issue a token statement of its own, “neither admitting nor denying” guilt, but certainly without assurances of further transgressions. But not this time. On Friday the Chinese defense ministry said it was “legal and proper” for its military aircraft to operate in the airspace and that it would continue to organize regular training exercises according to “mission requirements.”

In other words, Beijing pushed back against Japan’s complaint suggesting that China had not only done nothing wrong, but that this behaviour would escalate:

…click on the above link to read the rest of the article…

Rig Count Rises To April 2015 Highs As Analysts Warn “Oil Market Rebalancing Hasn’t Even Started Yet”

After falling for the first time this year two weeks ago, Baker Hughes reports US oil rig count rose once again (up 2 to 765) for the 24th week in the last 25, to the highest since April 2015.

“The so-called re-balancing is likely to happen later than earlier,” Michael Poulsen, an analyst at Global Risk Management Ltd, said on Friday.

It does appear we have reached an inflection point in the rig count numbers (if the historical relationship with crude holds)…

While EIA cut its 2018 production outlook, this week saw the effect of field maintenance in Alaska and Tropical Storm Cindy in the Gulf of Mexico fall away and production surged once again this week – to new cycle highs…

And the lagged rig count trend suggests crude production has further to rise yet…

Crude prices have been active today with macro headlines hurting and machines helping ramp any dip… the rig count create iunstant selling which was instantly bid back upo,,,

And while US crude production just jumped to cycle highs (and shale production we believe reached a record high), OilPrice.com’s Nick Cunningham notes the oil market rebalancing hasn’t even started yet…

Global oil production surged in June “as producers opened the taps,” according to a new report from the International Energy Agency (IEA). OPEC was a major culprit, with Libya and Nigeria doing their best to scuttle the production cuts made by other members.

But it wasn’t just those two countries, who are exempted from the agreed upon reductions. OPEC’s de facto leader, Saudi Arabia, also boosted output by an estimated 120,000 bpd in June, from a month earlier. That put Saudi production above 10 million barrels per day (mb/d) for the first time in 2017.

…click on the above link to read the rest of the article…

July 13, 2017

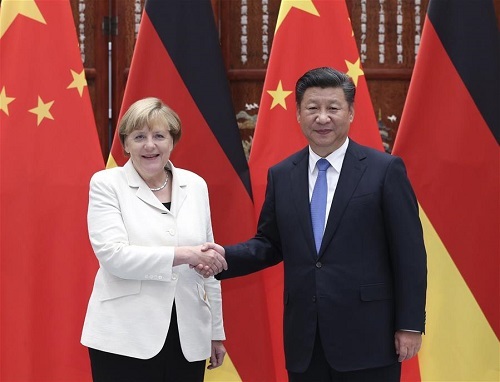

The New World Order Will Begin With Germany And China

In numerous articles over the years I have outlined in acute detail the agenda for a future one-world economic and governmental system led primarily by banking elites and globalists; an agenda they sometimes refer to as the “New World Order.” The term has gained such public exposure and notoriety recently that the globalists have fallen back to using different terminology. Some of them, like the International Monetary Fund’s Christine Lagarde, refer to it as the “global economic reset.” Others call it the “new multilateralism.” Still others refer to it as the “end of the unipolar order,” referring to the slow death of the U.S. economy as the central pillar of the global economy.

Whatever label they decide to use, all of them signal a full spectrum destabilization of the “old world” financial and geopolitical system and the ascendance of a tightly controlled one world edifice dominated openly by globalist hubs like the IMF and the BIS.

Too many people, even in the liberty movement, tend to examine only the veneer of this agenda. Some have deluded themselves into thinking the U.S. and the dollar are actually the core of the NWO and are therefore indispensable to the globalists. As I have shown time and time again, the Federal Reserve is now on a fast track to complete its sabotage of the U.S. economy; they would not be instigating instability and crisis to deflate the massive fiscal bubbles they have created unless America was at least partially expendable.

Some believe the NWO is a purely “western” construct and that eastern nations are defending themselves against an encroaching globalist empire. I have also shown that this is nonsense, and that eastern nations work closely with the same exact globalists they are supposedly at war with. This includes Russia’s Vladimir Putin, a figure often ignorantly praised by select liberty activists.

…click on the above link to read the rest of the article…

How Dumb Is the Fed?

Bent and Distorted

POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed?

The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

They’re not the best map readers, that much is known for certain. [PT]

They’re not the best map readers, that much is known for certain. [PT]

[O]ur message to the folks in Jackson Hole this week [at the annual central banker meeting there] is that the end of the Fed’s reckless experiment in social engineering via QE and near-zero interest rates will end in tears.

“Momentum” stocks like Tesla, to paraphrase our friend Dani Hughes on CNBC last week, will adjust and the mother of all rotations into bonds and defensive stocks will ensue. We must wonder aloud if Chair Yellen and her colleagues on the FOMC fully understand what they have done to the US equity markets. […]

Once the hopeful souls who’ve driven bellwethers such as Tesla and Amazon into the stratosphere realize that the debt driven game of stock repurchases really is over, then we’ll see a panic rotation back into fixed income and defensive stocks.

If you believe the newspapers, the Fed has begun a “tightening cycle.” It is on course to raise its key interest rate, little by little, in quarter-point increments.

It must know that this is a perilous thing to do. After so much market manipulation over such a long period, prices all up and down the capital structure – from junk bonds to quality stocks and solid real estate – have been bent and distorted.

After all, that was the idea: drive up the price of stocks and bonds by driving down interest rates. People would be forced to spend or invest their money rather than save it. And higher financial asset prices would make the rich feel even richer.

…click on the above link to read the rest of the article…

Our Financial Buffers Are Thinning

The fragility of our financial buffers will only be revealed when they fail in the next crisis.

While buffer has a specific meaning in chemistry, I am using the word in the broad sense of a reserve resource that absorbs the initial destructive impacts of crises or system overloads. Marshland along a sea coast is a buffer against destructive storm waves, for example.

A savings account acts as a buffer against financial drawdowns or losses of income that would otherwise quickly cascade into a full-blown crisis.

Redundancy of resources can act as a buffer. If an airline maintains an aircraft in reserve, this reserve plane acts as a buffer against the disruption to the airline’s scheduled flights should one of its aircraft be unexpectedly removed from service by a mechanical failure. The reserve aircraft can replace the plane that was withdrawn from service with minimal disruption.

Stockpiles act as buffers against supply disruptions. A storage tank of oil buffers a refinery against any delay in its incoming shipments of crude oil. Supplies of food and water buffer against severe natural disasters that disrupt regional water service and food deliveries.

Credit can act as a financial buffer against unexpectedly high expenses or declines in revenue. If a tire on our vehicle goes flat during a road trip and we only have a few dollars cash, a credit card buffers the disruption by funding the replacement tire and labor.

But over-using credit can end up thinning our financial buffers. If someone starts using their credit card not as an emergency buffer but to augment their cash income–in effect, acting as if the borrowed money was a pay raise rather than a loan–their credit line diminishes to near-zero and when they actually need credit for an emergency, it’s no longer available.

…click on the above link to read the rest of the article…

Is This The Generation That Is Going To Financially Destroy America?

Did you know that the federal government is going to spend more than 4 trillion dollars this year? To put that into perspective, U.S. GDP for the entire year of 2017 is going to be somewhere between 18 and 19 trillion dollars. So when you are talking about 4 trillion dollars you are talking about a huge chunk of our economy. But of course the federal government doesn’t bring in 4 trillion dollars a year. At the beginning of Barack Obama’s first term, we were 10.6 trillion dollars in debt, and now we are nearly 20 trillion dollars in debt. That means that we have been adding more than a trillion dollars a year to the national debt. When you break that down, that means that we have essentially been stealing more than a hundred million dollars from future generations of Americans every single hour of every single day to pay for our debt-fueled lifestyle. Even Federal Reserve Chair Janet Yellen is warning that this is not sustainable, and yet we just keep on doing it.

Did you know that the federal government is going to spend more than 4 trillion dollars this year? To put that into perspective, U.S. GDP for the entire year of 2017 is going to be somewhere between 18 and 19 trillion dollars. So when you are talking about 4 trillion dollars you are talking about a huge chunk of our economy. But of course the federal government doesn’t bring in 4 trillion dollars a year. At the beginning of Barack Obama’s first term, we were 10.6 trillion dollars in debt, and now we are nearly 20 trillion dollars in debt. That means that we have been adding more than a trillion dollars a year to the national debt. When you break that down, that means that we have essentially been stealing more than a hundred million dollars from future generations of Americans every single hour of every single day to pay for our debt-fueled lifestyle. Even Federal Reserve Chair Janet Yellen is warning that this is not sustainable, and yet we just keep on doing it.

Nobody can pretend that what we have today is the kind of limited federal government that our founders intended. When federal spending accounts for more than 20 percent of GDP, it is hard to argue that we haven’t moved very far down the road toward socialism. As I mentioned above, total federal spending will surpass 4 trillion dollars for the first time ever in 2017…

Both the Congressional Budget Office and the White House Office of Management and Budget project that federal spending will top $4 trillion for the first time in fiscal 2017, which began on Oct. 1, 2016 and will end on Sept. 30.

In its “Update to the Budget and Economic Outlook: 2017 to 2027” published last week, CBO projected that total federal spending in fiscal 2017 will hit $4,008,000,000,000.

…click on the above link to read the rest of the article…