Steve Bull's Blog, page 1344

July 30, 2017

The Perfect Crash Indicator Is Flashing Red

What’s the last big toy you buy when things have been good for a really long time and you already have all the other toys? An RV, of course. A dubious thing to own if you already have a house, but when the good times seem likely to roll on forever, why the hell not?

And what’s the first thing you sell when you lose your job and your stocks are tanking? That very same RV. Which makes new RV sales a useful indicator of our place in the business cycle.

What does it say now? Here you go:

Notice the mini-spike in the late 1990s and the major spike in mid-2000s, both of which were followed by corrections. Now note the mega-spike from 2010 and 2016.

And how are things going so far this year? Well, the space is on fire:

‘The RV space is on fire’: Millennials expected to push sales to record highs

(CNBC) – RV shipments are expected to surge to their highest level ever, according to a forecast from the Recreation Vehicle Industry Association.It would be the industry’s eighth consecutive year of gains.

Thor Industries and Winnebago Industries posted huge growth in their most recent earnings report.

Those shipments are accelerating, and should grow even more next year, the group said. Sales in the first quarter rose 11.7 percent from 2016.

Much of the growth can be attributed to strong sales of trailers, smaller units that can be towed behind an SUV or minivan, which dominate the RV market. The industry also is drawing in new customers.

As the economy has strengthened since the Great Recession, and consumer confidence improved, sales have picked up, said Kevin Broom, director of media relations for RVIA.

…click on the above link to read the rest of the article…

Zombie Corporations Litter Europe, Kept Alive by ECB

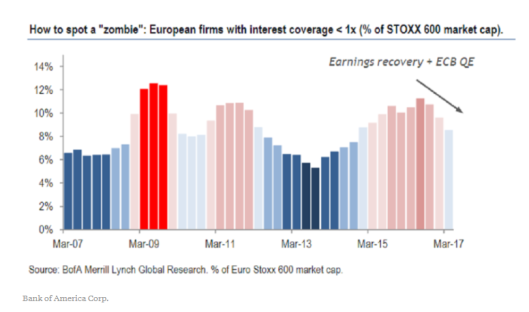

Bank of America says 9% of European firms have subpar interest coverage. Bloomberg covers the story in its report Zombie Companies Littering Europe May Tie the ECB’s Hands for Years.

Watch out for the zombies.

The plethora of companies propped up by the European Central Bank will limit policy makers’ ability to withdraw monetary stimulus that’s been supporting the continent’s bond market since the financial crisis, according to strategists at Bank of America Corp. About 9 percent of Europe’s biggest companies could be classified as the walking dead, companies that risk collapse if the support dries up, according to the analysts.

“Monetary support in Europe over the last five years has allowed companies with weak profitability to continue to refinance their debt and stave off defaults,” analysts led by Barnaby Martin wrote in a note Monday. “This supports the point that our economists have been making: that the ECB will likely be very slow and patient in removing their extraordinary stimulus over the next year and a half.”

The strategists classify zombies as non-financial companies in the Euro Stoxx 600 with interest-coverage ratios — earnings relative to interest expenses — at 1 or less. The thinking goes that companies in this category are particularly vulnerable to rising interest rates.

The ECB’s dovish tone last week — pushing back the timing for a decision on the future of its bond-buying program until possibly October — confirms it will embark on a gradual pace of tightening in order to juice the economic recovery, according to Bank of America. It reckons the ECB’s taper will start in January 2018, with the first increase to the deposit rate projected in the spring of 2019, compared with consensus expectations for a hike in October 2018, according to overnight index swap contracts compiled by Bloomberg.

…click on the above link to read the rest of the article…

Rome’s Transport System Faces “Meltdown,” On Brink Of Collapse

New York City’s deteriorating subway has a rival for world’s most dysfunctional public transportation system. After only three months on the job, Bruno Rota, the head of Rome’s public-transit company has announced that he’s leaving his post, saying that the Italian capital city’s decaying transportation system should declare bankruptcy, according to Reuters.

Rota’s departure is an embarrassment for the anti-establishment five-star movement and one of its most high-profile politicians, Rome Mayor Virginia Raggi. Since taking office last year, Raggi’s administration has been paralyzed by internal tumult while the city’s infrastructure has continued to decay. The party’s failures in Rome suggest that it’s not prepared to govern, and may have contributed to Five-Star’s losses in a series of municipal elections last month. Meanwhile, the situation could hurt the party’s chances in next year’s general election.

Rome Mayor Virginia Raggi

“Bruno Rota quit Atac on Friday, just three months after taking charge of the Italian capital’s bus, metro and tram network, saying he was unable to salvage the firm and feared possible legal action tied to any eventual collapse.

“It is an appalling scandal,” said Rota, who was called down to Rome after helping to turn around the transport system in the northern city of Milan. “The situation is worse than you can imagine,” he told la Repubblica newspaper.

Rota’s dramatic departure has triggered yet another crisis for the city’s 5-Star administration, which won power last year in what was seen as a litmus test of whether the anti-establishment group was ready to run Italy.”

City officials are publicly criticizing Raggi, saying that Rome needs a “change in direction” after the city nearly adopted water rationing laws last week amid a worsening drought.

…click on the above link to read the rest of the article…

July 25, 2017

Central Banks ARE The Crisis

Walter Langley Never morning wore to evening but some heart did break 1894If there’s one myth -and there are many- that we should invalidate in the cross-over world of politics and economics, it‘s that central banks have saved us from a financial crisis. It’s a carefully construed myth, but it’s as false as can be. Our central banks have caused our financial crises, not saved us from them.

It really should -but doesn’t- make us cringe uncontrollably to see Bank of England governor-for-hire Mark Carney announce -straightfaced- that:

“A decade after the start of the global financial crisis, G20 reforms are building a safer, simpler and fairer financial system. “We have fixed the issues that caused the last crisis. They were fundamental and deep-seated, which is why it was such a major job.”

Or, for that matter, to see Fed chief Janet Yellen declare that there won’t be another financial crisis in her lifetime, while she’s busy-bee busy building that next crisis as we speak. These people are now saying increasingly crazy things, and that should make us pause.

Central banks don’t serve people, or even societies, as that same myth claims. They serve banks. Even if central bankers themselves believe that this is one and the same thing, that doesn’t make it true. And if they don’t understand this, they should never be let anywhere near the positions they hold.

You can pin the moment central banks went awry at any point in time you like. The Bank of England’s foundation in 1694, the Federal Reserve’s in 1913, the ECB much more recently. What’s crucial in the timing is where and when the best interests of the banks split off from those of their societies. Because that is when central banks will stop serving those societies. We are at such a -turning?!- point right now. And it’s been coming for some time, ‘slowly’ working its way towards an inevitable abyss.

…click on the above link to read the rest of the article…

Migrations Always Bring Infectious Diseases

A new report by the Robert Koch Institute (RKI), has confirmed that there has been a sharp rise in disease since 2015 with the arrival of the refugees in Germany. The disease is tuberculosis and just being exposed to a person in the same restaurant carries the rise of you becoming infected as well. Of course raising this topic will cause many to call it racism. Yet in fact, travel to Asia and if you even look sick, they pull you over and will send you to quarantine.

Back in 1492, Columbus sailed the ocean blue as they say and returned with more than discovering a new continent. He and his crew brought back a new disease to Europe – Syphilis. New skeletal evidence confirmed that Columbus and his crew brought back syphilis to Europe. In turn, Europeans brought disease to America that wiped out Indians.

Take AIDS or HIV. Scientists have identified the origin of HIV tracing it to a specific type of chimpanzee in West Africa. It was probably transmitted to humans and mutated into HIV when humans hunted these chimpanzees for meat.

Gaëtan Dugas (1953 – 1984), was a Canadian flight attendant who became regarded as “patient zero” for AIDS in the United States, although that was disputed by others claiming there were others around the same time. Nevertheless, regardless of who brought it from Africa to America, someone did. Such disease travels historically with migrations. The reintroduction of tuberculosis to Europe can end up being a serious epidemic in the years ahead.

In the Footsteps of Rome: Is Renewal Possible?

Once the shared memories of these values are lost, the Empire ceases to exist; there is nothing left to reform or renew.

Is renewal / recovery from systemic decline possible? The history of the Roman Empire is a potentially insightful place to start looking for answers. As long-time readers know, I’ve been studying both the Western and Eastern (Byzantine) Roman Empires over the past few years.

Both Western and Eastern Roman Empires faced existential crises that very nearly dissolved the empires hundreds of years before their terminal declines.The Western Roman Empire, beset by the overlapping crises of invasion, civil war, plague and economic upheaval, nearly collapsed in the third century C.E. (Christian Era, what was previously A.D.) — 235 to 284 C.E., fully two hundred years before its final dissolution in the fifth century (circa 476 C.E.).

Meanwhile, the Eastern Roman Empire (Byzantine Empire) faced similar crises in the seventh and eighth centuries, as its capital of Constantinople was besieged by the Persians in 626 C.E. and the Arab caliphate in 674 C.E. and again in 717 C.E. The invasions which preceded the sieges stripped the empire of wealthy territories and the income those lands produced.

In both cases, the Empire not only survived but recovered a substantial measure of its former resilience and stability. Fortune delivered strong leadership at the critical moment: leadership that was able to protect itself from petty, self-aggrandizing domestic rivals, force the reorganization of failed, self-serving bureaucracies, inspire the populace to make the necessary sacrifices for the common good, win decisive military victories that ended the threat of invasion, and generate a moral claim to leadership via personal rectitude and/or participation in a religious revival.

Absent such strong, stable, legitimate leadership, neither empire would have survived their existential crisis.

…click on the above link to read the rest of the article…

The ECB Morphs into the Mother of All “Bad Banks”

More than just a few “fallen angels.”.

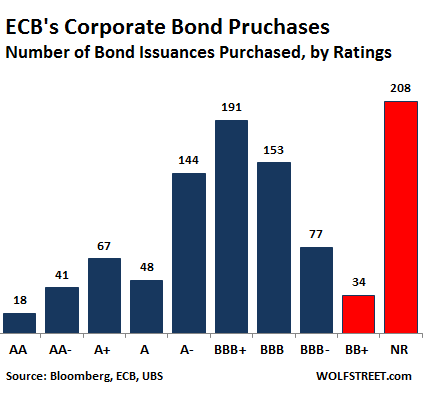

As part of its QE operations, the ECB continues to pour billions of freshly created euros each month into corporate bonds – and sometimes when it buys bonds via “private placements” directly into some of Europe’s biggest corporations and the European subsidiaries of non-European transnationals. Its total corporate bond purchases recently passed the €100 billion threshold. And it’s growing at a rate of roughly €7 billion a month. And it’s in the process of becoming the biggest “bad bank.”

When the ECB first embarked on its corporate bond-buying scheme in March 2016, it stated that it would buy only investment-grade rated debt. But shortly after that, concerns were raised about what might happen if a name it owned was downgraded to below investment grade. A few months later a representative of the bank put such fears to rest by announcing that it “is not required to sell its holdings in the event of a downgrade” to junk, raising the prospect of it holding so-called “fallen angels.”

Now, sixteen months into the program, it turns out that the ECB has bought into 981 different corporate bond issuances, of which 34 are currently rated BB+, so non-investment grade, or junk. And 208 of the issuances are non-rated (NR). So in total, a quarter of the bond issuances it purchased are either junk or not rated (red bars):

The ECB initially said it would only buy bonds that are “rated” — and rated investment grade. Thus having a quarter of the bonds on its books either junk or not rated represents a major violation of that promise.

The ECB is clearly loading up on risk and possibly bad credit that Draghi’s successor is going to have to eat at some point further down the road.

…click on the above link to read the rest of the article…

Russia’s Real Endgame

Russia’s Real Endgame

Russia’s Putin has never taken his eye off the ball. His ambition is not global hegemony or European conquest. Putin seeks what Russia has always sought: regional hegemony and a set of buffer states in eastern Europe and central Asia that can add to Russia’s strategic depth.

It is strategic depth — the capacity to suffer massive invasions and still survive due to an ability to retreat to a core position and stretch enemy supply lines — that enabled Russia to defeat both Napoleon and Hitler. Putin also wants the modicum of respect that would normally accompany that geostrategic goal.

Understanding Putin is not much more complicated than that.

In the twenty-first century, a Russian sphere of influence is not achieved by conquest or subordination in the old Imperial or Communist style. It is achieved by close financial ties, direct foreign investment, free trade zones, treaties, security alliances, and a network of associations that resemble earlier versions of the EU.

Russian military intervention in Crimea and eastern Ukraine is best understood not as a Russian initiative, but as a Russian reaction. It was a response to U.S. and U.K. efforts to attack Russia by pushing aggressively and prematurely for Ukraine membership in NATO. This was done by deposing a Putin ally in Kiev in early 2014.

This is not to justify Russia’s actions, merely to put them in a proper context. The time to peel off Ukraine for NATO was 1999, not 2014.

The Russian-Ukraine situation is a subset of the broader U.S.-Russian relationship. Here, the opposition comes not just from domestic opponents but from the globalist elite.

The Globalist Roots of Today’s Brewing Conflict

Globalization emerged in the 1990s as a consequences of the end of the Cold War and the reunification of Germany. For the first time since 1914, Russia, China and their respective empires could join the U.S., Western Europe and their former colonies in Latin America and Africa in a single global market.

…click on the above link to read the rest of the article…

Banks Are Scheming to Dominate a Future Cashless Society

(ANTIMEDIA) — Visa recently announced its new Cashless Challenge program, which offers $10,000 to restaurants willing to transition into accepting only digital payments. As the largest credit card processor in the U.S., it’s no surprise Visa is spearheading this campaign. Under the guise of increasing transparency and efficiency, they’ve partnered with governments around the world to help convert financial systems into cashless models, but their real incentive is the billions of dollars in extra transaction fees it would generate.

“We are declaring war on cash,” Visa spokesman Andy Gerlt proudly proclaimed after the program was announced.

The food-based small businesses Visa is targeting are among those that benefit most from accepting cash from customers. When transactions are for amounts less than $10, the fees charged cut significantly into profits. Only 28% of food trucks currently accept credit card payments because of the huge losses they incur from them. The bribe from Visa may seem appealing up front but will be mostly paid back to them over the next few years in fees alone.

Liz Garner, Vice President of the Merchant Advisory Group, which represents over 100 of the largest businesses in the U.S., explained some of the hurdles faced when dealing with card networks:

“For many businesses – both large and small – the cost of accepting plastic cards and other forms of electronic payments is one of their highest operating costs. Most business owners have no qualms about paying reasonable fees for business services, and they do so every day for items such as cleaning services, security systems, Wi-Fi, and other basic needs. However, they have the ability to negotiate for those services in a fair and transparent marketplace, which they do not with the two major credit and debit card networks….Credit card and debit card fees are dictated directly by Visa and MasterCard and are imposed on the majority of merchants in a take-it-or-leave-it fashion.

…click on the above link to read the rest of the article…

“Deeply-Flawed Western Economic Models” Are Undermining The Worst Global Recovery In History

With stocks at record highs, seemingly proving that everything must be awesome in the world, Chris Watling, chief executive of Longview Economics, shocked CNBC on Friday by reminding them that “this is undoubtedly the lowest quality economic recovery we have seen globally… full stop.”

The reason is simple, Watling continued,

“the economic model is deeply flawed and the system in the west is deeply flawed, particularly in the English speaking part of the world and it needs to change.”

The Longview Economics CEO explained that a debt-laden global economy could be vulnerable to looming interest rate hikes because,

“This is a world that is more indebted than it was before the global financial crisis in 2007, there’s no productivity growth, asset prices are very elevated, a lot of debt that corporates have built up has gone to share buy backs (and) the number of ‘zombie companies’ has doubled since 2007.”

Watling’s warnings confirm bond-king Bill Gross’ recent warning that the course of global central banks toward tightening policy could be detrimental for the economic recovery. He argued that raising interest rates would increase the cost of short-term debt that corporations and individuals currently hold.

When asked whether an imperfect system constituted a clear and present danger for the financial markets, Watling replied:

“Whatever you want to call it doesn’t really matter but these sorts of things always unwind when you tighten money. The problem is judging what is tight? And that is sort of the million dollar question.”

Will that pain begin in October?