Steve Bull's Blog, page 1343

August 3, 2017

Bitcoin, Gold and Silver

Precious Metals Supply and Demand Report

That’s it. It’s the final straw. One of the alternative investing newsletters had a headline that screamed, “Bitcoin Is About to Soar, But You Must Act by August 1 to Get In”. It was missing only the call to action “call 1-800-BIT-COIN now! That number again is 800 B.I.T..C.O.I.N.”

Bitcoin, daily. In terms of the gains recorded between the lows of 2009 and the recent highs (from less eight hundredths of a US cent per bitcoin, or $1 = 1,309.2 BTC, the first officially recorded value of BTC, to $3,000 per bitcoin, or $1 = 0.000333333 BTC), the bubble in bitcoin by now exceeds every historical precedent by several orders of magnitude, including the infamous Tulipomania and Kuwait’s Souk-al-Manakh bubble. In percentage terms BTC has increased by about 392,760,000% in dollar terms (more than 392 million percent) since its launch eight years ago. Comparable price increases have otherwise only occurred in hyperinflation scenarios in which the underlying currency was repudiated as a viable medium of exchange. Our view regarding its prior non-monetary use value and hence its potential to become money differs slightly from that presented by Keith below. We will post more details on this soon, for now we only want to point out that we believe there is room for further debate on this point. [PT] – click to enlarge.

Bitcoin, daily. In terms of the gains recorded between the lows of 2009 and the recent highs (from less eight hundredths of a US cent per bitcoin, or $1 = 1,309.2 BTC, the first officially recorded value of BTC, to $3,000 per bitcoin, or $1 = 0.000333333 BTC), the bubble in bitcoin by now exceeds every historical precedent by several orders of magnitude, including the infamous Tulipomania and Kuwait’s Souk-al-Manakh bubble. In percentage terms BTC has increased by about 392,760,000% in dollar terms (more than 392 million percent) since its launch eight years ago. Comparable price increases have otherwise only occurred in hyperinflation scenarios in which the underlying currency was repudiated as a viable medium of exchange. Our view regarding its prior non-monetary use value and hence its potential to become money differs slightly from that presented by Keith below. We will post more details on this soon, for now we only want to point out that we believe there is room for further debate on this point. [PT] – click to enlarge.

Is it about to go up? Maybe. We don’t know. And everyone should by now be skeptical of all “rocket to take off on XYZ date” claims. Between them, surely these newsletters have predicted thousands of the past zero blastoffs of gold and silver since 2011.

We have discussed bitcoin in the past, to argue that it is not money (a video here, and articles here and here). Bitcoin is not money because it is not a good. It’s just a number in a database. Money is a kind of good (genus). The most marketable kind (differentia).

…click on the above link to read the rest of the article…

India’s Economy Crashes After “Mind-Bogglingly Inane” Tax System Strikes Back

With just a hint of schadenfreude, we note that, following our discussion of “how to destroy an economy”, India’s Composite PMI collapsed to 46.0 in July – its lowest on record (well below the kneejerk lows after demonetization in November) as the “mind-bogglingly inane” new tax system and demonetization efforts continue to crush the poor and feed the wealthy.

As Goldman Sachs notes India’s Nikkei Markit services PMI contracted in July after reaching a 8-month high in June, following a decline of manufacturing PMI on Tuesday. The fall was led by a significant decline in new business, suggesting a worsened business sentiment after the GST implementation on July 1.

Main points:

India’s Nikkei Markit services PMI contracted to 45.9 (the lowest reading since September 2013). Combined with the manufacturing PMI reported on Tuesday, the July composite PMI fell to 46.0, the lowest reading since March 2009.

Among subcomponents, the new business index fell the most to 45.2 (from 53.3 in June), reflecting disruptions caused by the GST.

As the press release from Markit Economics mentioned, “Most of the contraction was attributed to the implementation of the goods & services tax and the confusion it caused”.

The employment index for services fell to 48.9 (from 51.8 in June).

That said, the index for business expectations rose to a 11-month high to 62.3, suggesting optimism from services providers about the future once they have more clarity about the new tax system.

The output price index rose to 54.6 (from 51.0 in June), while the input price index moderated to 51.7.

Overall, PMI data for July suggest a significant drag on new business activity post the GST implementation. That said, optimism expressed by both manufacturers and services providers about the future is encouraging and suggest a potential improvement in activity once businesses adjust to the new tax system.

From 8-month highs to record lows… why does any one put any faith in the useless ‘soft’ surveys?

…click on the above link to read the rest of the article…

Geopolitical Tensions Are Designed To Distract The Public From Economic Decline

Tracking geopolitical and fiscal developments over the past several years is a bit like watching a slow motion train wreck; you know exactly what the consequences of the events will be, you try to warn people as much as possible, but, ultimately, you cannot reverse the disaster. The disaster has for all intents and purposes already happened. What we are witnessing is the aftermath as a forgone conclusion.

This is why whenever someone asks me as an economic and political analyst “when the collapse is going to happen,” I have to shake my head in bewilderment. The “collapse” is here now. It is done. It is a historical fact. It’s just that not many people have the eyes to see it yet, primarily because they are hyper-focused on all the wrong things.

For many centuries now, elitists in power have understood the value of geopolitical distraction as a tool for controlling the masses. If you examine the underlying motivations behind the majority of wars between nations regardless of the era, you will in most cases discover that the power brokers on both sides tend to be rather friendly with each other. In fact, monarchies and oligarchies are historically notorious for fabricating diplomatic tensions and conflicts in order to force populations back under their control. That is to say, wars and other man-made conflicts give the citizenry something to react to, instead of hunting down the establishment cabal like they should.

One of the greatest illusions of human progress is the notion that most conflicts happen at random; that there are two sides and that those sides are fighting over ideological differences. In truth, most conflicts have nothing to do with ideological differences between governments and financial oligarchs.

…click on the above link to read the rest of the article…

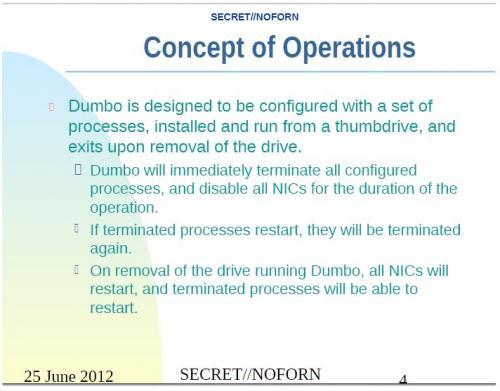

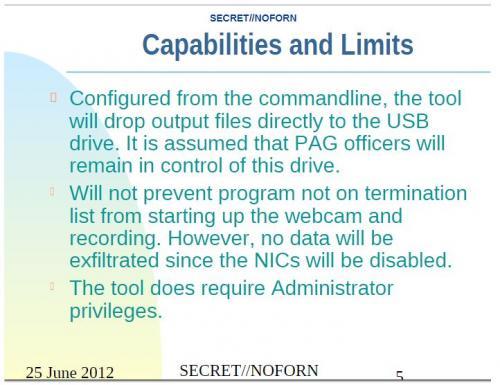

Wikileaks Reveals “Dumbo”: Tool That Allows CIA To Shut Down Cameras And Microphones

Since Wikileaks began releasing classified CIA documents back in March as part of its “Vault 7” series of leaks, purportedly the largest document dump in the agency’s history, it has publicly unveiled programs with innocent sounding names like “Marble”, “Scribbles” and “Archimedes” that the agency employs to help execute its operations, or to cover its tracks.

On Thursday, the group released the 19th installment in its series by publishing a series of documents detailing how the agency uses a custom-designed hacking exploit called “Dumbo” to destroy, or manufacture, evidence during field operations, according to a Wikileaks press release.

The CIA filed a request that such a tool back in 2012, according to a powerpoint presentations describing what capabilities it would need.

In a field guide for the tool, dated July 2015, the agency says “the intelligence community has identified a need…for a capability to suspend processes utilizing webcams and corrupt any video recordings that could compromise a PAG deployment.”

Once installed on a computer running the Windows operating system via a thumb drive, Dumbo identifies webcams and microphones and stops them from recording. The program notifies its operator of any files that were actively being written so that they can be corrupted or deleted, according to the field manual.

“Dumbo works by discovering which processes have access to the physical camera device and uses that information to corrupt video files. In some instances, programs emulate a camera input to other programs; such is the case with Fujitsu’s YouCam.exe. When this occurs, YouCam.exe will have control of the actual webcam, and feed input to other processes that record images to files as needed. In this scenario, Dumbo will suspend YouCam.exe but will not be able to detect the other processes to which YouCam.exe is feeding images.

…click on the above link to read the rest of the article…

July 31, 2017

It’s better to turn cautious too soon…

It’s better to turn cautious too soon…

En route to Chile

One of the greatest investors in the world is getting worried…

Howard Marks is the billionaire founder of Oaktree Capital, one of the largest and most successful investment firms in the world.

A few times each year Marks write up his thoughts about financial markets– he calls them ‘investment memos’.

And he just released his latest one with a very clear message: it’s time to be cautious.

From Marks’ memo…

I think it’s better to turn cautious too soon (and thus perhaps underperform for a while) rather than too late, after the downslide has begun, making it hard to trim risk, achieve exits and cut losses.

Marks admits this bull market could continue. But he’s happy taking chips off the table in today’s particularly dangerous market.

Asset prices are high across the board – the S&P 500 is trading at 25 times trailing 12-month earnings compared to a long-term median of 15 – and prospective returns are low.

Meanwhile, we’re also seeing record-low complacency amongst investors.

Just this morning the Wall Street Journal published data from Yardeni Research showing that percentage of ‘bearish’ investors who believe that the market will fall is near its lowest level since 1987.

The Volatility Index (VIX), a statistic which measures ‘fear’ in the market place, is at its ALL-TIME lowest point in its entire 27-year existence – hitting 8.84 last week, compared to above 80 in 2008.

The VIX hit 8.89 on December 27, 1993. From Marks:

The index was last this low when Bill Clinton took office in 1993, at a time when there was peace in the world, faster economic growth and a much smaller deficit. Should people really be as complacent now as they were then?

Compare that today, where market pitfalls abound…

– North Korea is threatening to nuke the US

– Donald Trump is firing his entire cabinet

…click on the above link to read the rest of the article…

Hong Kong Interbank Rates Spike To Highest Since Lehman

For only the third time since Lehman, the price of liquidity in the Hong Kong Dollar interbank markets has exploded higher.

Overnight HKD Hibor soared over 60 basis points to 0.71407% in Monday trading – the highest since October 2008…

Note that the two previous spikes were around year-end, so this is unusual in both its velocity and size.

Of course, the narrative of a panic in Asian liquidity is not a good one for supporting risk assets and so the spike is being dismissed as a one-off due to several factors (as Bloomberg reports)…

Monday’s rise in Hong Kong dollar overnight interbank rate was due to major fund providers being more cautious in lending at month-end, and because of demand from some market players, a Hong Kong Monetary Authority spokesperson writes in an emailed reply to questions from Bloomberg. Interest rates subsided when fund providers responded by lending out more Hong Kong dollars. Relatively large movements in short- dated interest rate Monday was probably a result of thin market conditions ahead of the month-end. The market continued to function normally.

Monday’s sudden spike in HKD overnight funding cost is probably due to short-term funding activities, likely for I Squared Capital’s purchase of Hutchison Telecom’s unit and HSBC share buyback announcement, says Angus To, deputy head of research at ICBC International Research.

Rate likely to drop soon as HKD liquidity remains ample in general, To says in a phone call.

So just ignore the fact that the HKD liquidty markets just exploded due to month-end (well it hasn’t before – see chart) and some M&A (there’s been no M&A in the last 9 years?)… it’s probably nothing.

The Race Against Time

For decades, in discussing the ever-increasing hegemony of the world’s principal governments (US, EU, et al.), I’ve been asked repeatedly, “When will the governments understand that this obsession they have to become all-powerful is not in the interests of the people?”

The answer to this question has also remained the same for decades: never.

Although most all thinking people will readily admit that they regard their government (and governments in general) to be both overreaching and corrupt, they somehow attribute political leaders with a desire to serve the people. This is almost never true.

In my own experience in working with (and against) political leaders in multiple jurisdictions, I’ve found them to be remarkably similar to each other in their tendency to be shortsighted, self-aggrandising, and almost totally indifferent to the well-being of their constituents. Indeed, it’s a real rarity to encounter a political leader who does not fit this description.

Therefore, we should take as a given that all political leaders will continue to pursue their own power and wealth, at the expense of their citizenries.

Well, here, history informs us that this is not the case. All governments will tax the people as much as they can, regulate them as much as they can, socially dominate them as much as they can, and remove as many rights as they can. However, they rarely totally succeed and, even when they do, the clock is ticking against them.

This, then, begs the question: “If they won’t stop themselves in this progression, is there no other outcome than eventual total slavery to the government?”

In 1999, I began to warn that the US military would steadily increase its warfare against other nations and would only cease their military expansion if and when economic collapse made it impossible to continue the expansion.

…click on the above link to read the rest of the article…

July 30, 2017

MAULDIN: One Of These 3 Black Swans Will Likely Trigger A Global Recession By End Of 2018

Exactly 10 years ago, we were months way from a world-shaking financial crisis.

By late 2006, we had an inverted yield curve steep to be a high-probability indicator of recession. I estimated at that time that the losses would be $400 billion at a minimum. Yet, most of my readers and fellow analysts told me I was way too bearish.

Turned out the losses topped well over $2 trillion and triggered the financial crisis and Great Recession.

Conditions in the financial markets needed only a spark from the subprime crisis to start a firestorm all over the world. Plenty of things were waiting to go wrong, and it seemed like they all did at the same time.

We don’t have an inverted yield curve now. But when the central bank artificially holds down short-term rates, it is difficult if not almost impossible for the yield curve to invert.

We have effectively suppressed the biggest warning signal.

But there is another recession in our future (there is always another recession), which I think will ensue by the end of 2018. And it’s going to be at least as bad as the last one was in terms of the global pain it causes.

Below are three scenarios that may turn out be fateful black swans. But remember this: A harmless white swan can look black in the right lighting conditions. Sometimes, that’s all it takes to start a panic.

Black Swan #1: Yellen Overshoots

It is clear that the US economy is not taking off like the rocket some predicted after the election:

President Trump and the Republicans haven’t been able to pass any of the fiscal stimulus measures we hoped to see.

Banks and energy companies are getting some regulatory relief, and that helps; but it’s a far cry from the sweeping healthcare reform, tax cuts, and infrastructure spending we were promised.

…click on the above link to read the rest of the article…

Our Brave New ”’Markets”’

How HFT algorithims risk a massive sudden sell-off

One thing is clear: These aren’t your daddy’s markets anymore.

Why? Because about 10 years ago the Rise of the Machines (aka high frequency trading algorithms) completely altered the terrain of what we call the ‘capital markets.’

Let’s look at this as a before and after story.

Before the machines, markets were a place that humans with roughly equal information and reflexes set the prices of financial assets by buying and selling. Fundamentals mattered.

After the machines took over, markets became dominated — in terms of volume, liquidity and pricing — by machines that operate in time frames of a millionth of a second. The machines and their algorithms use remorseless routines and trickery — quote stuffing, spoofing, price manipulations — to ‘get their way.’

Fundamentals no longer matter; only endless central bank-supplied liquidity does. Because such machines and their coders are very expensive and require a lot of funding.

The various financial markets are so distorted that I first resorted to putting that word in quotes – “markets” – to signify that they are not at all the same as in the past. In recent years I’ve taken to putting double quote marks – “”markets”” – in attempt to drive home their gross distortion. Not only are todays “”markets”” something the human traders of a generation ago would fail to recognize, they’re no longer a place where human actions of any sort have much of a remaining role.

Why care about this? Two big reasons:

Such “”markets”” are easily manipulated by central banks and other state actors by virtue of their automated responses to liquidity injections. Are the markets going down when you don’t want them to? Just use any one of several highly leveraged means of signaling to the computers that it’s time to buy instead of sell. Common leverage points include the Japanese Yen-to-USD price level, selling VIX to lower volatility, and buying massive quantities of index futures ‘all at once.’

…click on the above link to read the rest of the article…

It’s Your Money But You Can’t Have It: EU Proposes Account Freezes to Halt Bank Runs

If there is a run on the bank, any bank in the EU, you better be among the first to get your money out.

Although it’s your money, the EU wants to Freeze Accounts to Prevent Runs at Failing Banks.

European Union states are considering measures which would allow them to temporarily stop people withdrawing money from their accounts to prevent bank runs, an EU document reviewed by Reuters revealed.

The move is aimed at helping rescue lenders that are deemed failing or likely to fail, but critics say it could hit confidence and might even hasten withdrawals at the first rumors of a bank being in trouble.

The proposal, which has been in the works since the beginning of this year, comes less than two months after a run on deposits at Banco Popular contributed to the collapse of the Spanish lender.

Giving supervisors the power to temporarily block bank accounts at ailing lenders is “a feasible option,” a paper prepared by the Estonian presidency of the EU said, acknowledging that member states were divided on the issue.

EU countries which already allow a moratorium on bank payouts in insolvency procedures at national level, like Germany, support the measure, officials said.

“The desire is to prevent a bank run, so that when a bank is in a critical situation it is not pushed over the edge,” a person familiar with German government’s thinking said.

The Estonian proposal was discussed by EU envoys on July 13 but no decision was made, an EU official said. Discussions were due to continue in September. Approval of EU lawmakers would be required for any final decision.

Under the plan discussed by EU states, pay-outs could be suspended for five working days and the block could be extended to a maximum of 20 days in exceptional circumstances, the Estonian document said.

…click on the above link to read the rest of the article…