Steve Bull's Blog, page 1356

June 25, 2017

Get Ready for ‘QT1’: A First Look at the Federal Reserve’s Hidden Policy

Get Ready for ‘QT1’: A First Look at the Federal Reserve’s Hidden Policy

[Ed. Note: Jim Rickards’ latest New York Times bestseller, The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis, is out now. Learn how to get your free copy – HERE. This vital book transcends rhetoric from the Federal Reserve to prepare you for what you should be watching now.]

The Federal Reserve is now setting out on a new path for quantitative tightening (QT) after nine years of unconventional quantitative (QE) easing policy. It is the evil twin of QE which was used to ease monetary conditions when interest rates were already zero.

First, it is important to examine QE and QT in a broader context of the Fed’s overall policy toolkit. Understanding the many tools the Fed has, which of them they’re using and what the impacts are will allow you to distinguish between what the Fed thinks versus what actually happens.

We have a heavily manipulated system. For years, if not decades, monetary policy has been flipping back and forth between how the economy actually works and what the Fed believes works.

QE was a policy of printing money by buying securities from primary dealers and to ease monetary conditions when interest rates were at zero. QT takes a different approach.

In QT, the Fed will “sell” securities to the primary dealers, take the money, and make it disappear. This is an attempt to ultimately reduce the money supply and implement a policy of tightening money.

There’s a bit of a twist to that selling. Today the Fed’s balance sheet stands at $4.5 trillion. It started at $800 billion in 2008 and has increased over five times that since the crisis. Now they’re going to try to get the balance sheet back to normal levels.

…click on the above link to read the rest of the article…

“It’ll Be An Avalanche”: Hedge Fund CIO Sets The Day When The Next Crash Begins

While most asset managers have been growing increasingly skeptical and gloomy in recent weeks (despite a few ideological contrarian holdouts), joining the rising chorus of bank analysts including those of Citi, JPM, BofA and Goldman all urging clients to “go to cash”, none have dared to commit the cardinal sin of actually predicting when the next crash will take place.

On Sunday a prominent hedge fund manager, One River Asset Management’s CIO Eric Peters broke with that tradition and dared to “pin a tail on the donkey” of when the next market crash – one which he agrees with us will be driven by a collapse in the global credit impulse – will take place. His prediction: Valentine’s Day 2018.

Here is what Peters believes will happen over the next 8 months, a period which will begin with an increasingly tighter Fed and conclude with a market avalanche:

“The Fed hikes rates to lean against inflation,” said the CIO. “And they’ll reduce the balance sheet to dampen growing financial instability,” he continued. “They’ll signal less about rates and focus on balance sheet reduction in Sep.”

Inflation is softening as the gap between the real economy and financial asset prices is widening. “If they break the economy with rate hikes, everyone will blame the Fed.” They can’t afford that political risk.

“But no one understands the balance sheet, so if something breaks because they reduce it, they’ll get a free pass.”

“The Fed has convinced itself that forward guidance was far more powerful than QE,” continued the same CIO.

“This allows them to argue that reversing QE without reversing forward guidance should be uneventful.” Like watching paint dry. “Balance sheet reduction will start slowly. And proceed for a few months without a noticeable impact,” he said. “The Fed will feel validated.” Like they’ve been right all along.

…click on the above link to read the rest of the article…

Epic Pictures From Arizona’s Heatwave: “Everything Is Literally Melting”

Ask any Arizonan whether their summers are more tolerable because “it’s a dry heat” and you’re likely to be asked to turn your oven to 150 degrees, stick your head inside for 20 minutes and report back as to whether or not the humidity within the oven ever crossed you mind. Probably not.

And while Arizonans have learned to cope with the “dry heat,” this summer has been particularly brutal for people living in the Southwest as temperatures have already soared to over 120 degrees in certain areas. What’s worse, it’s only June.

And while the heatwave may not be that fun for the people living through it, it does making for some amazing pictures of stuff melting.

Perhaps that plastic mailbox post wasn’t such a great idea in retrospect.

…click on the above link to read the rest of the article…

Italian Taxpayers To Foot €17 Billion Bill As Rome Bails Out Another Two Insolvent Banks

Two weeks after the first, and biggest, European bank bail-in took place under the relatively new European bank resolution mechanism, the EBRD, when Spain’s Banco Popular wiped out the holders of its most risky securities, including equity and AT bonds, and then selling what was left of the bank to Santander for €1 – a process that took place without a glitch – Italy may have just killed any hope of a European banking union, when the bailout of two small banks made a “mockery” of Europe’s new regulation.

Late on Sunday, Italy passed a decree that will effectively sell the good part of the two banks to Intesa, Italy’s second-largest and best-capitalized bank. Intesa said last week that it would be willing to buy the best assets for a token price of €1 as long as the government assumed responsibility for liquidating the banks’ large portfolio of sour loans. As a result, Italy said it would commit as much as €17 billion in taxpayer funds to clean up the two failed “Veneto” banks in one of Italy’s wealthiest regions and support the takeover of their good assets by Intesa Sanpaolo SpA for a token amount. After an emergency cabinet meeting on Sunday, Finance Minister Pier Carlo Padoan said the Italian government will provide Milan-based Intesa with about €5.2 billion euros to allow it to take on Banca Popolare di Vicenza SpA and Veneto Banca SpA assets without hurting capital ratios, The European Commission, in a separate statement, said it approved the plan for the two banks and that it is in-line with state-aid rules.

Unlike the Banco Popular bail-in by Santander, however, Intesa would only take on the good assets. PM Gentiloni said the lenders will be split into good and bad banks and that the firms, with taxpayers on the hook for the bad banks.

…click on the above link to read the rest of the article…

June 24, 2017

Shhhh! It’s TOP Secret: Fake News For Your Eyes Only

The absurd hysteria over Russia continues today from yours and my favorite Russia-hysteria promotion site: the Washington Post.

Fake News For Your Eyes Only

Today’s joke of the day is an “exclusive” fake-news story from WaPo regarding Obama’s Secret Struggle to Punish Russia for Putin’s Election Assault.

Early last August, an envelope with extraordinary handling restrictions arrived at the White House. Sent by courier from the CIA, it carried “eyes only” instructions that its contents be shown to just four people: President Barack Obama and three senior aides.

Inside was an intelligence bombshell, a report drawn from sourcing deep inside the Russian government that detailed Russian President Vladimir Putin’s direct involvement in a cyber campaign to disrupt and discredit the U.S. presidential race.

But it went further. The intelligence captured Putin’s specific instructions on the operation’s audacious objectives — defeat or at least damage the Democratic nominee, Hillary Clinton, and help elect her opponent, Donald Trump.

The material was so sensitive that CIA Director John Brennan kept it out of the President’s Daily Brief, concerned that even that restricted report’s distribution was too broad. The CIA package came with instructions that it be returned immediately after it was read. To guard against leaks, subsequent meetings in the Situation Room followed the same protocols as planning sessions for the Osama bin Laden raid.

Obama told Putin that “we knew what he was doing and [he] better stop or else,” according to a senior aide who subsequently spoke with Obama. Putin responded by demanding proof and accusing the United States of interfering in Russia’s internal affairs.

The Washington Post is withholding some details of the intelligence at the request of the U.S. government.

Detailed Timeline of Allegations

In its “exclusive” fake news article, WaPo provided a detailed timeline of every allegation. It provided zero proof of anything.

WaPo even mocked Wikileaks for demanding proof.

…click on the above link to read the rest of the article…

Two Italian Zombie Banks Toppled Friday Night

ECB shuts down Veneto Banca and Banca Popolare di Vicenza.

When banks fail and regulators decide to liquidate them, it happens on Friday evening so that there is a weekend to clean up the mess. And this is what happened in Italy – with two banks!

It’s over for the two banks that have been prominent zombies in the Italian banking crisis: Veneto Banca and Banca Popolare di Vicenza, in northeastern Italy.

The banks have combined assets of €60 billion, a good part of which are toxic and no one wanted to touch them. They already received a bailout but more would have been required, and given the uncertainty and the messiness of their books, nothing was forthcoming, and the ECB which regulates them lost its patience.

In a tersely worded statement, the ECB’s office of Banking Supervision ordered the banks to be wound up because they “were failing or likely to fail as the two banks repeatedly breached supervisory capital requirements.”

“Failing or likely to fail” is the key phrase that banking supervisors use for banks that “should be put in resolution or wound up under normal insolvency proceedings,” the statement said. This is the first Italian bank liquidation under Europe’s new Single Resolution Mechanism Regulation. The ECB explained:

The ECB had given the banks time to present capital plans, but the banks had been unable to offer credible solutions going forward.

Consequently, the ECB deemed that both banks were failing or likely to fail and duly informed the Single Resolution Board (SRB), which concluded that the conditions for a resolution action in relation to the two banks had not been met. The banks will be wound up under Italian insolvency procedures.

…click on the above link to read the rest of the article…

June 23, 2017

US Oil Rig Count Rises For 23rd Straight Week But High Costs Drive Investors Out Of The Permian

The number of oil rigs in America has now risen for 23 straight weeks (and 50 of the last 52 weeks), up 11 to 758 in the last week – the highest since April 2015. “It’s becoming bearish mania,” said Phil Flynn, senior market analyst at Price Futures Group Inc. in Chicago. “If we keep going down, we’re not going to be adding rigs in a few months, we’re not going to be adding production”

And we suspect, given the lagged reaction to prices, that inflection point in rig counts is close…

And the last chance for the week for the bulls just left…

US crude production (in the Lower 48) has been on a tear (with one brief interruption) tracking the lagged rise in rig counts almost perfectly…

And the rising rig count has been driven mainly by The Permian…

But as Oil & Gas 360 notes, high acreage costs beginning to affect economics in the Delaware, driving investors away from The Permian.

The Permian has enjoyed a rush of capital since oil prices began to recover from a low of $26.21 in February of last year.

The play is home to some of the best economics in the country, making it a prime target for E&P companies looking to maximize profit in a lower price environment. But the surge in land costs is leaving little room for new investors to profit.

The Delaware basin, the Permian’s hottest zone, is beginning to become a victim of its own success. EnerCom Analytics’ well economic models indicate that the internal rates of return (IRRs) in the Delaware are now lower than those seen in the Midland due to the high cost of land.

…click on the above link to read the rest of the article…

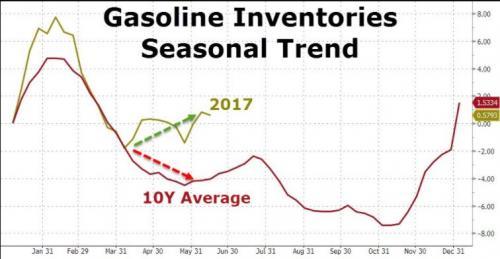

Largest East Coast Pipeline Reveals Demand For Gasoline Is Crashing

There’s a reason this week’s EIA survey showing gasoline and oil supplies declining has failed to stop RBOB prices from collapsing to 7-month lows: The start of the summer has done nothing to revive sluggish demand. That’s because despite what the EIA survey said, little has been done to reduce record fuel inventories.

The squeeze has gotten so bad, Northeast Colonial Pipeline Co., the operator of the biggest US fuel pipeline system, said that demand to transport gasoline to the country’s populous northeast is the weakest in six years, the latest symptom of a global oil market grappling with oversupply. It’s notable that this peak has arrived despite the advent of the summer driving season, which has seen gasoline demand pull back from last year’s record highs, according to Reuters.

Because of the oversupply in the northeast, “line space”… the cost of renting “space” on the pipeline to assure one’s ability to get supplies of gasoline when necessary… has gone negative, according to Reuters. What can be more exemplary of excess inventories and of reduced demand for gasoline than this?

Refiners are in part to blame for the problem – they have continued to pump motor fuel at record levels for the second year in a row, worsening the oversupply problem, for fear of losing access to pipeline capacity.

More broadly, attempts by large producers to reduce global supplies have failed to meaningfully raise the price of oil. And with good reason: Traders have been skeptical of an agreement between OPEC and non-OPEC producers, including Russia, to extend last year’s supply cut, and already they’re concerns are being validated: Iraq has said it plans to increase production later this year despite the agreement.

…click on the above link to read the rest of the article…

The Velocity of Money Myth

Effect of changes in money supply on economic activity and prices is a velocity of money.

It is alleged that when the velocity of money rises, all other thing being equal, the buying power of money declines ie the prices of goods and services rise. The opposite occurs when velocity declines.

If, for example, it was found that the quantity of money had increased by 10% in a given year, while the price level as measured by the consumer price index has remained unchanged it would mean that there must have been a slowing down of about 10% in the velocity of circulation.

Main stream view of what velocity is

According to popular thinking the idea of velocity is straightforward. It is held that over any interval of time, such as a year, a given amount of money can be used again and again to finance people’s purchases of goods and services. The money one person spends for goods and services at any given moment can be used later by the recipient of that money to purchase yet other goods and services.

For example, during a year a particular ten-dollar bill might have been used as following: a baker John pays the ten-dollars to a tomatoe farmer George. The tomatoe farmer uses the ten-dollar bill to buy potatoes from Bob who uses the ten dollar bill to buy sugar from Tom. The ten-dollars here served in three transactions. This means that the ten-dollar bill was used 3 times during the year, its velocity is therefore 3.

A $10 bill, which is circulating with a velocity of ‘3’ financed $30 worth of transactions in that year. Consequently, if there are $3000billion worth of transactions in an economy during a particular year and there is an average money stock of $500 billion during that year, then each dollar of money is used on average 6 times during the year (since 6*$500 billion =$3000).

…click on the above link to read the rest of the article…

The Price that Julian Assange Pays

People who challenge power are often viewed by their supporters as more icons than human beings thus missing the personal costs of their actions, a reality that Julian Assange’s mother revealed to Randy Credico and Dennis J Bernstein.

June 19 marked the fifth full year that Wikileaks founder Julian Assange spent at the Ecuadorian embassy in London, where he was given asylum against the threat of arrest from a Swedish prosecutor pursuing a sex-abuse investigation (since dropped) and possible extradition to the United States for a potential espionage charge related to publication of U.S. secrets.

To gain insights into what this long ordeal has meant to Assange, an Australian native, Randy Credico of WBAI’s “On the Fly” and Dennis Bernstein of “Flashpoints” on Pacifica Radio interviewed Assange’s mother, Christine Assange. The interview also explored the deep history that led her son to found Wikileaks and to challenge the enormous powers of the U.S. and British governments by exposing the truth about their dangerous, deadly and often illegal policies.

WikiLeaks founder Julian Assange

Randy Credico: I guess I should begin by asking, how long has it been since you’ve seen your son Julian?

Christine Assange: A number of years, but we communicate.

RC: Yes, you communicate, but it’s not the same, so far away. It must be difficult. I mean he’s not in prison, but it may as well be prison. I know for a mother to be separated from her son like this, it must be grueling, and a difficult row to hoe on a daily basis.

…click on the above link to read the rest of the article…