Steve Bull's Blog, page 1359

June 18, 2017

SkyNet is sentient and will destroy your investments and pension

SkyNet is Sentient and Will Destroy Your Investments and Pension

Do you really want to know about how SkyNet controls your investments and pension via the various financial markets? I ask with all sincerity because the subject is not pleasant and may even be frightening to those who have followed a strict diet of financial ignorance.

Once you know, it is nearly impossible to un-know. And just as there is never only one weed in the garden, knowing this inevitably leads to a critical juncture where one must then decide if they wish to know more or simply curl up in the fetal position on the bathroom floor.

You see, when “We the Mindless Minions” (desperately) wish to avoid responsibility for knowing, while the specific tactics used may vary greatly, the theme remains pretty consistent. I call it the Sgt. Schultz defense.

“I know nothing, I see nothing and I was never here.”

A variation of the theme, usually employed when among others, thus we cannot claim total ignorance about the uncomfortable subject presently being discussed, is brilliant in its ability to disavow responsibility while passing the buck to someone (anyone) at a higher pay grade.

“They would never let that happen/do that,” or the always reassuring “I’m sure someone’s looking into that as we speak.” Now how about those (fill in this blank with any sport, celebrity, politician, TV show or viral cat video).

Disavowing knowledge or responsibility, passing the buck and then changing the subject is the time tested way to live in blissful ignorance. Or as I have grown fond of saying, unconscious incompetence with a heaping side order of willful ignorance.

…click on the above link to read the rest of the article…

Coming Apart: The Imperial City At The Brink

Thomas Cole Destruction of Empire 1836The Conflicts Forum, directed by former British diplomat and MI6 ‘ranking figure’ Alastair Crooke, sent me another unpublished article by Alastair and asked if the Automatic Earth would publish it. But of course. Previous articles by Alastair published here are: ‘End of Growth’ Sparks Wide Discontent in October 2016, Obstacles to Trump’s ‘Growth’ Plans in November 2016 and What is this ‘Crisis’ of Modernity? in January 2017.

Here’s Alastair again:

Alastair Crooke: David Stockman routinely refers to President Trump as the ‘Great Disrupter’. But this is not a bad quality, he insists. Rather, it is a necessary one: Stockman argues (my paraphrasing) that Trump represents the outside force, the externality, that tips a ‘world system’ over the brink: It has to tip over the brink, because systems become too ossified, too far out on their ‘branch’ to be able to reform themselves. It does not really matter so much, whether the agency of this tipping process (President Trump in this instance), fully comprehends his pivotal role, or plays it out in an intelligent and subtle way, or in a heavy-handed, and unsubtle manner. Either serve the purpose. And that purpose is to disrupt.

Alastair Crooke: David Stockman routinely refers to President Trump as the ‘Great Disrupter’. But this is not a bad quality, he insists. Rather, it is a necessary one: Stockman argues (my paraphrasing) that Trump represents the outside force, the externality, that tips a ‘world system’ over the brink: It has to tip over the brink, because systems become too ossified, too far out on their ‘branch’ to be able to reform themselves. It does not really matter so much, whether the agency of this tipping process (President Trump in this instance), fully comprehends his pivotal role, or plays it out in an intelligent and subtle way, or in a heavy-handed, and unsubtle manner. Either serve the purpose. And that purpose is to disrupt.

Why should disruption be somehow a ‘quality’? It is because, during a period when ‘a system’ is coming apart, (history tells us), one can reach a point at which there is no possibility of revival within the old, but still prevailing, system. An externality of some sort – maybe war, or some other calamity or a Trump – is necessary to tip the congealed system ‘over’: thus, the external intrusion can be the catalyst for (often traumatic) transformational change.

Stockman puts it starkly: “the single most important thing to know about the present risk environment [he is pointing here to both the political risk as well as financial risk environment], is that it is extreme, and unprecedented.

…click on the above link to read the rest of the article…

NATO Holds Defense Drill Simulating Russian Invasion Of Baltics

NATO officials are growing increasingly nervous about the possibility of an invasion of the Baltic states ahead of Russian wargames planned this fall on the border of Belarus and Poland that could involve as many as 100,000 troops. That “anxiety” was on display this week, when US and British troops carried out the first NATO military exercise that involved a simulated defense of the Suwalki Gap, an area in northern Poland on the border with Lithuania that serves as the gateway to the Baltic region.

In other words, a drill against a Russian invasion of the Baltics states, and by extension, Europe.

NATO officials described the area as a “choke point” that, if it were taken by an invading force, could potentially isolate the Baltic states from their NATO allies, according to Reuters.

“The gap is vulnerable because of the geography. It’s not inevitable that there’s going to be an attack, of course, but … if that was closed, then you have three allies that are north that are potentially isolated from the rest of the alliance”, said U.S. Lieutenant General Ben Hodges.

“We have to practice, we have to demonstrate that we can support allies in keeping (the Gap) open, in maintaining that connection,” he said.Since Russia’s annexation of Ukraine back in 2014, NATO has shifted four battlegroups totaling just over 4,500 troops to Estonia, Latvia, Lithuania and Poland.

US and UK aircraft took part in the exercises, alongside troops from Poland, Lithuania and Croatia in a simulated defense of the potential flashpoint in an area several hours’ drive from where a U.S. battalion is stationed at Orzysz base in Poland, Reuters reported.

…click on the above link to read the rest of the article…

China’s “Ghost Collateral” Arrives In Canada, “Heralding A Crisis”

Two weeks ago, a key China-linked concern that made headlines back in 2013 and 2014 reemerged after an extensive analysis by Reuters reporter Engen Tham found that China’s “ghost collateral” problem, or collateral that was either rehypothecated between two or more loans, or simply did not exist, had not only not gone away but was still as prevalent as ever if not worse.

The report, a continuation of extensive reporting conducted on this site, said that 60% of all loans issued in China’s system are backed by property, and that China’s property values are “wildly misleading, which is part of the reason that China’s credit rating was recently downgraded.” Reuters reported that Chinese lenders are prone to fraud with loan officers turning a blind eye to the quality of collateral and knowingly accepting dubious and even fraudulent documents.

Now, in a follow up by the Vancouver Sun’s Sam Cooper, the real estate reporter explains that China’s “ghost collateral” problem has jumped across the Pacific and is threatening the Canadian banking system.

As Cooper notes, “as a result of the flood of money pouring from Mainland China into Vancouver real estate in recent years, some financial experts say they believe Canadian banks are directly exposed to shadow lending in China and the risks of so-called “ghost collateral”, collateral that may not exist or is used continuously to secure loans for multiple borrowers.”

And the stunner: “Postmedia confirmed that Canadian banks are allowed by the federal regulator, the Office of the Superintendent of Financial Institutions, to accept collateral from China to secure real estate mortgages in B.C.”

“OSFI does not dictate what type of collateral (federally regulated banks) can accept,” spokeswoman Annik Faucher said. “Whether the borrower is foreign or domestic, OSFI (allows) financial institutions to compete effectively and take reasonable risks.”

…click on the above link to read the rest of the article…

Monetary Madness and Rabbit Consumption

Down the Rabbit Hole

“The hurrier I go, the behinder I get,” is oft attributed to the White Rabbit from Lewis Carroll’s, Alice in Wonderland. Where this axiom appears within the text of the story is a mystery. But we suspect the White Rabbit must utter it about the time Alice follows him down the rabbit hole.

Pick a rabbit to follow…

Pick a rabbit to follow…

No doubt, today’s wage earner knows what it means to work harder, faster, and better, while slip sliding behind. However, for many wage earners the reasons why may be somewhat mysterious. At first glance, they may look around and quickly scapegoat foreigners for their economic woes.

Yet like Wonderland, things are often not as they first appear. When it comes to today’s financial markets, there is hardly a connection to the real economy at all. Stock markets are just off record highs, yet 6 in 10 Americans don’t have $500 to cover an unexpected bill.

A curious fellow may look around and find more questions than answers. Where is the money coming from? Where is it going?

Before he knows it, he’s gone down the rabbit hole where he observes the darnedest things. He may even discover that the Federal Reserve, with its fiat money, has created and perpetuated insane and incomprehensible levels of debt. And that this, in turn, has blown the economy up into a massive financial bubble.

Before he knows it, he’s gone down the rabbit hole where he observes the darnedest things. He may even discover that the Federal Reserve, with its fiat money, has created and perpetuated insane and incomprehensible levels of debt. And that this, in turn, has blown the economy up into a massive financial bubble.

…click on the above link to read the rest of the article…

U.S-Led Coalition Shoots Down Syrian Warplane

Update: U.S. Central Command issued a statement saying the plane was downed “in collective self-defense of Coalition-partnered forces,” identified as fighters of the Syrian Democratic Forces near Tabqah. It is unclear if these particular “forces” were getting their funding from Saudi Arabia or Qatar.

And a quick situational take from Worldview:

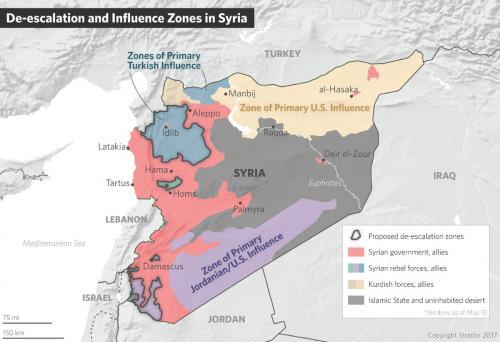

A U.S. Navy fighter jet shot down a Syrian government Su-22 fighter jet on June 18 that had dropped bombs on Syrian rebel forces fighting the Islamic State in Syria, ABC News reported. The U.S.-led coalition said in a statement that its focus is on fighting the militant group, and not fighting the Syrian government or Russian forces, but it will defend coalition forces coming under attack. The incident occurred in a town south of Tabqa, Syria, which had been retaken from the Islamic State by the Syrian Democratic Forces, an umbrella group of Syrian Kurdish and Arab rebel forces, in preparation for the offensive on the stronghold of Raqqa.

The downing is the latest escalation between the U.S.-led coalition and pro-government forces in Syria. The United States has also recently conducted airstrikes at pro-Syrian government forces that have moved into a deconfliction zone around the town of at al-Tanf in southwest Syria, which is the location of a coalition training base for local forces fighting the Islamic State.

Meanwhile, the Syrians are not happy with the US strike:

…click on the above link to read the rest of the article…

June 11, 2017

Is Another Spanish Bank about to Bite the Dust?

Stockholders and junior bondholders fear a “bail-in.”

After its most tumultuous week since the bailout days of 2012, Spain’s banking system is gripped by a climate of fear, uncertainty and distrust. Rather than allaying investor nerves, the shotgun bail-in and sale of Banco Popular to Santander on Tuesday has merely intensified them. For the first time since the Global Financial Crisis, shareholders and subordinate bondholders of a failing Spanish bank were not bailed out by taxpayers; they took risks in order to make a buck, and they bore the consequences. That’s how it should be. But bank investors don’t like not getting bailed out.

Now they’re worrying it could happen again. As Popular’s final days showed, once confidence and trust in a bank vanishes, it’s almost impossible to restore them. The fear has now spread to Spain’s eighth largest lender, Liberbank, a mini-Bankia that was spawned in 2011 from the forced marriage of three failed cajas(savings banks), Cajastur, Caja de Extremadura and Caja Cantabria.

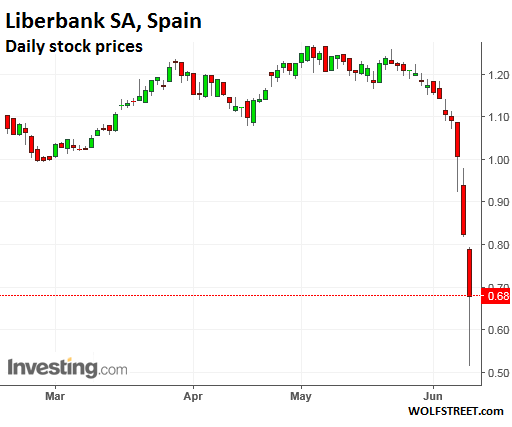

This creature’s shares were sold to the public in May 2013 at an IPO price of €0.40. By April 2014, they were trading above €2, a massive 400% gain. But by April 2015, shares started sinking. By May 2017, they were trading at around €1.20.

But since the bail-in of Popular, Liberbank’s shares have seriously crashed as panicked investors fled. Scenting fresh blood, short sellers were piling in. On Friday alone, shares plunged another 17%. At one point, they were down 38% before bouncing at the close of trading, much of it driven by the bank’s own share buybacks:

In the last three weeks a whole year’s worth of steadily rising gains on the stock market have been completely wiped out. The main causes of concern are the bank’s high risk profile and low coverage rate.

…click on the above link to read the rest of the article…

Tomgram: Nomi Prins, In Washington, Is the Glass(-Steagall) Half Empty or Half Full?

Remember when “draining the swamp” was something the Bush administration swore it was going to do in launching its Global War on Terror? Well, as we all know, that global swamp of terror only got muckier in the ensuing years. (Think al-Qaeda in the Arabian Peninsula, think ISIS.) Then, last year, that swamp left terror behind and took up residence in Washington, D.C. In the 2016 presidential campaign, Donald Trump swore repeatedly that, along with building his wall and locking “her” up, he was going to definitively drain the Washington swamp, ridding the national capital of special interests once and for all. (“It is time to drain the swamp in Washington, D.C.,” he typically said. “This is why I’m proposing a package of ethics reforms to make our government honest once again.”) “Drain the swamp” became one of the signature chants at his rallies.

No sooner had he been elected, however, then he decided to “retire” the concept of draining the swamp — and little wonder. After all, he quickly began appointing hordes of “former lobbyists, lawyers and consultants” to agencies where they were to help “craft new policies for the same industries in which they recently earned a paycheck.” Then his administration started issuing waivers to those new appointees, allowing them to “take up matters that could benefit former clients.” News of just who got those waivers was kept secret and only released after publicity about them took a truly bad turn. Here’s a typical example of one of them, as reported by the New York Times: “A… waiver was given to Michael Catanzaro, who until January was registered as a lobbyist for companies including Devon Energy, an oil and gas company, and Talen Energy, a coal-burning electric utility.

…click on the above link to read the rest of the article…

Debt-Based Money Corrodes Society

Debt-Based Money Corrodes Society

We open today’s reckoning with a hypothesis:

The current monetary system debauches the culture.

Long-suffering readers are familiar with our… diminished regard for paper money.

Paper money — or digital money nowadays — is the great bogeyman of the boom/bust cycle. It inflates bubbles of every model and make.

Meanwhile, paper money fuels big government… as oxygen fuels fire.

But paper money’s effects on the culture?

“It has a very important impact on our culture,” writes economist Jorg Guido Hulsmann.

Under “natural money” like gold Hulsmann explains, prices tend to fall over time.

So natural money encourages the virtues of saving… thrift… deferred gratification. It sets the mind to the future:

In a free economy with a natural monetary system, there is a strong incentive to save money… Investments in savings accounts or other relatively safe investments also play a certain role, but cash hoarding is paramount.

Before the 20th century, explains Hulsmann, debt was a cultural taboo… a big scarlet “D.”

Credit for households was virtually unknown, he says. And only the poorest households resorted to debt-financed consumption.

Ah, but then the 20th century came along with its wars… its social movements… and its cranks…

Gold is a famously uncooperative agent of change.

It resists social uplift, in the same way an old man resists a new pair of shoes.

It turns away from the sound of trumpets.

“You go over there,” gold says. “I’m staying here.”

“The trouble with gold is that it turns its back on world improvers, empire builders and do-gooders,” wrote Bill Bonner and our leader Addison Wiggin in Empire of Debt.

“The nice thing about gold is that it is so unresponsive,” they continued. “It neither laughs nor applauds.”

And that’s why it couldn’t last…

Only a debt-backed system of paper money could finance the great wars, the social improvements and the fevered dreams of the 20th century.

…click on the above link to read the rest of the article…

The Inconvenient Truth of Consumer Debt

It’s acceptable to build infinitely high levels of household debt — as long as rates never rise.

Ready for a rainy day?Photographer: Anoek De Groot/AFP/Getty Images

Oh, but for the days the hawks had a hero in Sydney. Against the backdrop of a de facto currency war, the Reserve Bank of Australia stood as a steady pillar of strength. The RBA held the line on interest rates, maintaining a floor of 2.5 percent, even as its global central bank peers drove rates to the zero bound and beyond into negative territory.

The abrupt end to the commodities supercycle drove the RBA to join the global currency war. The mining-dependent nation’s economy was so debilitated that policy makers felt they had no choice but to ease financial conditions. In February 2015, after an 18-month honeymoon, the RBA reduced its official rate to 2.25 percent, marking the start of a cycle that ended last August with the fourth cut to a record low of 1.5 percent.

The Bank of Canada has taken a similar journey in recent years. It embarked upon a mild tightening campaign in 2010 that raised the overnight loan rate from a record low of 0.25 percent to 1 percent in September 2010. The bank maintained that level until early 2015. Two weeks before the RBA’s first cut, the Bank of Canada lowered rates to 0.75 percent. The January move, which shocked the markets, was followed in July 2015 with an additional ease to 0.5 percent, where it remains today.

Bank of Canada Governor Stephen Poloz, who replaced Mark Carney after he departed to head the Bank of England, explained the moves as necessary to counter the downside risks to inflation emanating from the oil price shock to the country’s economy.

Two resource-rich economies reacting similarly to body blows is intuitive enough. They eased the pressure on their given economies.

…click on the above link to read the rest of the article…