Rodrigo Constantino's Blog, page 401

December 5, 2011

Vira-latas

LUIZ FELIPE PONDE, Folha de SP

O brasileiro tem complexo de vira-lata. Adora bancar o chique falando mal de si mesmo.

Principalmente quando alguém chique (leia-se, europeu) fala mal do Brasil. Um modo específico de nosso complexo de vira-lata é achar a Europa o máximo.

Quem conhece bem a Europa e ultrapassou a caipirice de achar tudo lindo por lá sabe que os europeus são (também) arrogantes, metidos, preconceituosos e exploradores e pensam, ainda hoje, que somos uns "índios" mal alimentados, ignorantes e mal-educados.

Claro que há exceções, portanto, não se faz necessário que europeus me escrevam jurando que são legais, ou que seus avós são legais, ou que seus cachorros são criados com todos os direitos humanos, mesmo porque, apesar de que isso não é sabido, ninguém pode ajuizar sobre sua própria virtude.

Lamento pela gente que se julga "crítica e consciente", mas todo mundo que se acha legal por definição é um mentiroso.

Se você for uma leitora que um dia mochilando pela Europa transou com um europeu (europeus costumam adorar brasileiras, porque acham nossas mulheres fáceis e doces, coisa rara nas mulheres europeias de hoje em dia, que a cada dia se tornam mais chatas, competitivas e estéreis), não confunda o papo que teve com ele antes do coito com o fato de que os europeus nos acham subdesenvolvidos. Inclusive porque para eles você é fácil porque é subdesenvolvida.

Sim, achar a Europa o máximo é coisa de gente caipira e brega. Se você pensa assim, tome um remédio. Ou minta.

Recentemente, um intelectual europeu em visita ao Brasil fez críticas ao país. Nada que não saibamos sobre nós mesmos. Mas, logo, alguns intelectuais e artistas vira-latas tiveram um orgasmo porque o "sinhozinho" falou mal das "zelites".

Sim, a elite brasileira pode ser bem brega na sua condição de elite de colônia. E horrorosa na sua ignorância "luxuosa". Aqui, ostentação é destino. Pessoas educadas sabem que a felicidade (seja lá no que for) deve ser guardada a sete chaves. Só gente brega "mostra" que é feliz. Neste caso, um toque de melancolia é elegância.

Por exemplo, o hábito de cultuar restaurantes pretensiosos como "de Primeiro Mundo" porque são caros é comum entre nós.

Dizer que você esteve em tal restaurante "caríssimo" (sempre pretensioso) é atestado de breguice. Mas julgar alguém "superinteligente" porque vem da Europa também é brega.

É fácil posar de "culto e crítico" e ficar horrorizado com nossas injustiças sociais quando se teve a chance de ganhar muito dinheiro ao longo da história à custa das injustiças sociais dos outros. Europeu que se faz de rogado pela injustiça no mundo só cola em vira-lata.

Por outro lado, se a riqueza cultural europeia é óbvia, e não se trata de negar este fato, ela se deve em grande parte às injustiças sociais europeias do passado e não ao seu "estado de bem-estar social" atual. Este tipo de "estado" produz apenas banalidades e monotonias de classe média.

Uma grande falácia é supor que injustiça social e riqueza cultural sejam excludentes, pelo contrário. Ou que justiça social produza necessariamente originalidade intelectual.

Não sou um "patriota", patriotismo é para canalhas. Calabar -que optou pelos holandeses em detrimento dos portugueses no Pernambuco colonial- pode ter razão. Falo aqui apenas de nosso complexo de vira-lata.

É muito comum que grandes intelectuais estrangeiros venham a nossa terra inculta e falem um "feijão com arroz" básico supondo que somos ignorantes mesmo e por isso não precisam suar a camisa diante de nossas plateias que sacodem seus ouros, exibem seus decotes e orelhas de livros.

Já vi isso acontecer várias vezes. Também no mundo acadêmico isso acontece, não só no mundo da filosofia de luxo.

Um grande professor que tive e que vive na Europa há anos me disse certa feita que até hoje os europeus não acreditam que "na volta das caravelas que colonizaram as Américas" pode haver algum "índio" que seja igual ou melhor do que eles.

A afetação moral em europeus não é muito diferente da afetação intelectual de nossos decotes de marca.[image error]

O brasileiro tem complexo de vira-lata. Adora bancar o chique falando mal de si mesmo.

Principalmente quando alguém chique (leia-se, europeu) fala mal do Brasil. Um modo específico de nosso complexo de vira-lata é achar a Europa o máximo.

Quem conhece bem a Europa e ultrapassou a caipirice de achar tudo lindo por lá sabe que os europeus são (também) arrogantes, metidos, preconceituosos e exploradores e pensam, ainda hoje, que somos uns "índios" mal alimentados, ignorantes e mal-educados.

Claro que há exceções, portanto, não se faz necessário que europeus me escrevam jurando que são legais, ou que seus avós são legais, ou que seus cachorros são criados com todos os direitos humanos, mesmo porque, apesar de que isso não é sabido, ninguém pode ajuizar sobre sua própria virtude.

Lamento pela gente que se julga "crítica e consciente", mas todo mundo que se acha legal por definição é um mentiroso.

Se você for uma leitora que um dia mochilando pela Europa transou com um europeu (europeus costumam adorar brasileiras, porque acham nossas mulheres fáceis e doces, coisa rara nas mulheres europeias de hoje em dia, que a cada dia se tornam mais chatas, competitivas e estéreis), não confunda o papo que teve com ele antes do coito com o fato de que os europeus nos acham subdesenvolvidos. Inclusive porque para eles você é fácil porque é subdesenvolvida.

Sim, achar a Europa o máximo é coisa de gente caipira e brega. Se você pensa assim, tome um remédio. Ou minta.

Recentemente, um intelectual europeu em visita ao Brasil fez críticas ao país. Nada que não saibamos sobre nós mesmos. Mas, logo, alguns intelectuais e artistas vira-latas tiveram um orgasmo porque o "sinhozinho" falou mal das "zelites".

Sim, a elite brasileira pode ser bem brega na sua condição de elite de colônia. E horrorosa na sua ignorância "luxuosa". Aqui, ostentação é destino. Pessoas educadas sabem que a felicidade (seja lá no que for) deve ser guardada a sete chaves. Só gente brega "mostra" que é feliz. Neste caso, um toque de melancolia é elegância.

Por exemplo, o hábito de cultuar restaurantes pretensiosos como "de Primeiro Mundo" porque são caros é comum entre nós.

Dizer que você esteve em tal restaurante "caríssimo" (sempre pretensioso) é atestado de breguice. Mas julgar alguém "superinteligente" porque vem da Europa também é brega.

É fácil posar de "culto e crítico" e ficar horrorizado com nossas injustiças sociais quando se teve a chance de ganhar muito dinheiro ao longo da história à custa das injustiças sociais dos outros. Europeu que se faz de rogado pela injustiça no mundo só cola em vira-lata.

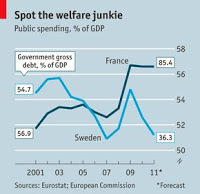

Por outro lado, se a riqueza cultural europeia é óbvia, e não se trata de negar este fato, ela se deve em grande parte às injustiças sociais europeias do passado e não ao seu "estado de bem-estar social" atual. Este tipo de "estado" produz apenas banalidades e monotonias de classe média.

Uma grande falácia é supor que injustiça social e riqueza cultural sejam excludentes, pelo contrário. Ou que justiça social produza necessariamente originalidade intelectual.

Não sou um "patriota", patriotismo é para canalhas. Calabar -que optou pelos holandeses em detrimento dos portugueses no Pernambuco colonial- pode ter razão. Falo aqui apenas de nosso complexo de vira-lata.

É muito comum que grandes intelectuais estrangeiros venham a nossa terra inculta e falem um "feijão com arroz" básico supondo que somos ignorantes mesmo e por isso não precisam suar a camisa diante de nossas plateias que sacodem seus ouros, exibem seus decotes e orelhas de livros.

Já vi isso acontecer várias vezes. Também no mundo acadêmico isso acontece, não só no mundo da filosofia de luxo.

Um grande professor que tive e que vive na Europa há anos me disse certa feita que até hoje os europeus não acreditam que "na volta das caravelas que colonizaram as Américas" pode haver algum "índio" que seja igual ou melhor do que eles.

A afetação moral em europeus não é muito diferente da afetação intelectual de nossos decotes de marca.[image error]

Published on December 05, 2011 10:28

Chávez's 40-Year Plan to Conquer Vice

By MARY ANASTASIA O'GRADY, WSJ

Venezuela's Hugo Chávez says his Bolivarian Revolution needs more time to produce its utopian fruits. "We barely have 10 years here," he told a crowd of supporters in Caracas last week. "We will take it to 10 more and 10 more and 10 more to construct the new social virtues."

In that time, Mr. Chávez pledged, "we will deepen the socialist revolution: socialism, socialism and more socialism. We have to deepen the struggle and defeat the vices of the past that still persists among us: violence, insecurity, corruption, selfishness, individualism."

Considering that the human condition hasn't changed much since we got kicked out of the garden, a 40-year plan to conquer vice seems pretty ambitious. But Mr. Chávez has never suffered a lack of self-confidence. Of course being an individual is hardly a vice. On the other hand, notably absent from his list was another perennial transgression that has yet to be defeated in Venezuela: the central bank's sinful practice of printing money to finance the government.

Double-digit inflation has been the Venezuelan norm for decades. An annual rate below 20% since 1987 has been the exception; this year the International Monetary Fund expects a 25% increase in the price level.

Of course Mr. Chávez does not blame the central bank for inflation. In his school of economics rising prices are caused by producers, suppliers and merchants, who control the availability of goods and continually charge more for their products so that they can have a fatter profit. The solution to this injustice against the consumer, according to chavismo, is price controls. When they don't work, the answer is more of the same.

It was 2003 when the Chávez government introduced its first big wave of price controls. That year inflation exceeded 31%. Since then prices have been frozen on a wide variety of food items—meat, corn flour, rice, bread, sugar, coffee, powdered milk, cooking oil—and a host of other products and services, including cement and building materials, domestic air travel, private education and medical clinics. The main effect is that many items that used to be readily available are now scarce. Yet inflation stubbornly persists.

The inflation tax hits the poor the hardest and they are Mr. Chávez's most important constituents. Thus, in August he officially redoubled his efforts to control inflation by decreeing the "law of costs and fair prices." This sweeping new legislation creates a regulator charged with monitoring what consumers are charged, analyzing those charges by researching the cost of production and setting "just" prices. An army of 4,000 apparatchiks will make up "committees" that will fan out around the country to report and denounce noncompliance. Hoarders, speculators or anyone found guilty of price gouging will be prosecuted. Offenders can be fined, lose their property, be banned from commerce, and even go to jail.

Among Mr. Chávez's more amusing traits—providing you don't live in Venezuela—is his unshakable belief that he can dictate what the Austrian classical-economist Ludwig Von Mises called "human action." Thousands of years of experience suggest otherwise, most recently in the Soviet Union. But never mind. It is Venezuela's destiny to suffer central-planning hubris all over again.

Mr. Chávez recognizes at least some limitations. He knows he cannot decide, from the commanding heights, every price in the Venezuelan economy on day one. So his latest effort will start small. On Nov. 22 his government added 19 new products, mostly in the area of personal hygiene and home-cleaning, to the list of items with frozen prices. By Dec. 15 regulators will have analyzed the cost to make these products—advertising and marketing costs not included—and will decide what they should be sold for. Once those prices are set, the bean counters will move on to other goods.

Mr. Chávez has asked the regulators to keep a close eye on foreign-based companies like Colgate-Palmolive, Pepsi, Coca-Cola, Nestle, GlaxoSmithKline, and Johnson and Johnson. The Italian milk company Parmalat, now controlled by the French Lactalis Group, has already been accused of hoarding. But the large Venezuelan food producer Polar is also in Mr. Chávez's cross-hairs.

Putting aside the absurdity of government bureaucrats overruling the laws of supply and demand, there is also the problem that many producers require dollars—which are not available at the official exchange rate—to pay for imported inputs. If the state insists on using the artificially strong Bolivar exchange rate to calculate costs, the vast majority of producers will either be judged guilty of overcharging or go out of business.

Consumers are anticipating what will ensue. In recent weeks the local press has reported that shops have been cleaned out of many price-controlled items. Sources say that products that are hard to find in stores can usually be purchased from street vendors at market prices.

In the meantime the government is feeding inflation by ramping up spending ahead of the election. Maybe Mr. Chávez will need more than 40 years to cure original sin.

Published on December 05, 2011 04:28

Realismo e utopia

Meu novo artigo para o OrdemLivre.org sobre os perigos da utopia, com base no livro "Missa Negra" de John Gray.[image error]

Published on December 05, 2011 03:31

December 3, 2011

China's Hard Landing

Editorial do WSJ

The state-led growth model is leading the country into trouble

The People's Bank of China's surprise announcement Wednesday of a half percentage point cut in banks' required reserve ratio is an admission that the economy is facing stiff headwinds. Consumer price inflation remains relatively high at 5.5%, and the true level of inflation as reflected in the GDP deflator is probably closer to 10%.

Most analysts expected monetary easing to start next year when inflation had subsided further. But then most China analysts were predicting a "soft landing" for the economy. The data in recent days suggest the stagflation trend will continue and the landing may be bumpy.

Property prices have fallen for three consecutive months and the trend is accelerating. HSBC's and the government's own purchasers managers' indices of corporate sentiment took a big tumble in November, falling into negative territory for the first time since early 2009. This time China can't export its way out of its domestic problems, since external demand is shrinking.

China is a poster child for the Austrian school of economics' theory of the business cycle. After undertaking the biggest stimulus program the world has ever seen in response to the global financial crisis, the country is drowning in unproductive investments financed with credit.

The government spent 15% of GDP largely on public works projects in inland regions, financed with loans from the state-owned banks. Investment as a share of GDP soared to 48.5% in 2010, and the M2 measure of money supply ballooned to 140% that of the U.S.

Now comes the hangover. The public works projects are winding down, unleashing a wave of unemployment and an uptick in social unrest. The banks' nonperforming loans are rising, and local governments are insolvent. The country is littered with luxurious county government offices, ghost cities of empty apartment blocks, unsafe high-speed rail lines and crumbling highways to nowhere.

One effect of negative real interest rates was a nationwide bubble in private housing, with the average price of an urban apartment reaching eight times the average annual income. Real estate is the most popular investment for the wealthy, according to a central bank survey in September. Millions of luxury apartments are vacant, even as there is a shortage of affordable housing for the poor.

Property construction became "the most important sector in the universe," in the words of UBS economist Jonathan Anderson. It directly accounts for about 13% of the economy, 20% if one includes related industries like concrete and steel. It also provided 40% of local government revenues through land sales.

Worsening inflation forced the government to put on the brakes this year. As with most property busts, transactions dried up, followed by a free fall in prices. Land prices were down 60% year on year in September. Property developers are slashing prices of new homes to stave off bankruptcy.

Beijing recognizes the dangers of a property bubble and deliberately popped this one by telling banks to cut back loans to developers. The government seems to be determined to force some of the smaller developers to the wall, both to force consolidation in the industry and convince the remaining developers to get on board with the state-run program of building low-income housing.

Earlier this year banking regulators conducted stress tests that supposedly showed the financial system can withstand a 40% fall in property prices. Loans to developers and mortgages account for about 20% of the banks' loan books. But since the health of the wider economy is tied to property, China could face a scenario close to that of the U.S. in recent years. Because the private market for housing was tiny 10 years ago when the current boom began, the country has never experienced a broad-based decline in property prices.

The government and the more sanguine analysts say low-income housing construction will pick up the economic slack, as activity at the top end of the market contracts. The problem is that even if the government meets its goals, the program is still too small to save the economy. Barclays estimates that it will contribute one percentage point to growth in 2011, and 0.5 percentage points in 2012.

There is no easy way to avoid the bust that is coming. The silver lining is that China's increasingly state-led growth model will be discredited, and a debate will begin on restarting the reforms that stalled in the mid-2000s. A financial sector that allocates credit based on politics rather than price signals led China into this mess. Popular pressure to dismantle crony capitalism is building, and the Communist Party would be wise to get in front of it while it can.[image error]

The state-led growth model is leading the country into trouble

The People's Bank of China's surprise announcement Wednesday of a half percentage point cut in banks' required reserve ratio is an admission that the economy is facing stiff headwinds. Consumer price inflation remains relatively high at 5.5%, and the true level of inflation as reflected in the GDP deflator is probably closer to 10%.

Most analysts expected monetary easing to start next year when inflation had subsided further. But then most China analysts were predicting a "soft landing" for the economy. The data in recent days suggest the stagflation trend will continue and the landing may be bumpy.

Property prices have fallen for three consecutive months and the trend is accelerating. HSBC's and the government's own purchasers managers' indices of corporate sentiment took a big tumble in November, falling into negative territory for the first time since early 2009. This time China can't export its way out of its domestic problems, since external demand is shrinking.

China is a poster child for the Austrian school of economics' theory of the business cycle. After undertaking the biggest stimulus program the world has ever seen in response to the global financial crisis, the country is drowning in unproductive investments financed with credit.

The government spent 15% of GDP largely on public works projects in inland regions, financed with loans from the state-owned banks. Investment as a share of GDP soared to 48.5% in 2010, and the M2 measure of money supply ballooned to 140% that of the U.S.

Now comes the hangover. The public works projects are winding down, unleashing a wave of unemployment and an uptick in social unrest. The banks' nonperforming loans are rising, and local governments are insolvent. The country is littered with luxurious county government offices, ghost cities of empty apartment blocks, unsafe high-speed rail lines and crumbling highways to nowhere.

One effect of negative real interest rates was a nationwide bubble in private housing, with the average price of an urban apartment reaching eight times the average annual income. Real estate is the most popular investment for the wealthy, according to a central bank survey in September. Millions of luxury apartments are vacant, even as there is a shortage of affordable housing for the poor.

Property construction became "the most important sector in the universe," in the words of UBS economist Jonathan Anderson. It directly accounts for about 13% of the economy, 20% if one includes related industries like concrete and steel. It also provided 40% of local government revenues through land sales.

Worsening inflation forced the government to put on the brakes this year. As with most property busts, transactions dried up, followed by a free fall in prices. Land prices were down 60% year on year in September. Property developers are slashing prices of new homes to stave off bankruptcy.

Beijing recognizes the dangers of a property bubble and deliberately popped this one by telling banks to cut back loans to developers. The government seems to be determined to force some of the smaller developers to the wall, both to force consolidation in the industry and convince the remaining developers to get on board with the state-run program of building low-income housing.

Earlier this year banking regulators conducted stress tests that supposedly showed the financial system can withstand a 40% fall in property prices. Loans to developers and mortgages account for about 20% of the banks' loan books. But since the health of the wider economy is tied to property, China could face a scenario close to that of the U.S. in recent years. Because the private market for housing was tiny 10 years ago when the current boom began, the country has never experienced a broad-based decline in property prices.

The government and the more sanguine analysts say low-income housing construction will pick up the economic slack, as activity at the top end of the market contracts. The problem is that even if the government meets its goals, the program is still too small to save the economy. Barclays estimates that it will contribute one percentage point to growth in 2011, and 0.5 percentage points in 2012.

There is no easy way to avoid the bust that is coming. The silver lining is that China's increasingly state-led growth model will be discredited, and a debate will begin on restarting the reforms that stalled in the mid-2000s. A financial sector that allocates credit based on politics rather than price signals led China into this mess. Popular pressure to dismantle crony capitalism is building, and the Communist Party would be wise to get in front of it while it can.[image error]

Published on December 03, 2011 04:25

December 2, 2011

Bomba demográfica

Rodrigo Constantino, para o Instituto Liberal

O jornal O Globo estampa em sua página: "Expectativa de vida subiu 11 anos desde 1980". A expectativa de vida do brasileiro alcançou 73,48 anos em 2010, segundo pesquisa divulgada pelo IBGE. Com os avanços da medicina mundial e com o crescimento econômico, os brasileiros podem viver mais tempo, apesar de ainda estarmos distante da média dos países mais desenvolvidos.

A contrapartida desta boa notícia é o aumento do rombo na Previdência Social. Com os brasileiros cada vez vivendo mais, e com um modelo de aposentadoria ineficiente, o tamanho do buraco à frente só tende a crescer. Hoje, a demografia ainda joga a favor, pois o Brasil é um país jovem. Mas este "bônus demográfico" não será eterno. Em coisa de uma década, a fotografia já será muito diferente. Teremos uma quantidade bem maior de aposentados em relação à população economicamente ativa. As contas previdenciárias serão insustentáveis com base no modelo atual.

O problema é que mexer em algo cujo impacto negativo ocorrerá apenas dentro de uma década exige a postura de um estadista, que foca nas próximas gerações e não nas próximas eleições. Não é razoável esperar tal postura deste governo, que já deu inúmeras provas de ser extremamente populista e só pensar na perpetuação do poder, custe o que custar. Em outra reportagem de O Globo, por exemplo, o jornal destaca: "Transferência de renda é gasto que mais cresce".

Este é um governo que não faz reformas estruturais, que não investe nem facilita a vida dos investidores, e que criou uma bomba-relógio com seus mecanismos populistas de transferência de renda e crédito. Para piorar, fomos lançados de volta no tempo pelo ministro Guido Mantega, com pacotes quase semanais no afã de controlar todas as variáveis econômicas de cima para baixo. Surfamos a onda chinesa com o auxílio da abundância de capital no mundo, mas não fizemos nada para colocar a economia em uma trajetória sustentável de elevado crescimento.

O custo do desgoverno petista não será alto apenas no quesito da ética, com um grau de corrupção nunca antes visto na história do país (o Brasil ocupa a 73ª posição em uma lista composta por 183 países no ranking de corrupção da ONG Transparência Internacional). O custo será econômico também. Os míopes ainda não conseguem enxergar isso, pois só olham as árvores, mas não a floresta.

Quando a economia chinesa desaquecer de forma mais acentuada, quando o custo do capital voltar a subir no mundo, ou quando nossa demografia deixar de ser tão favorável, aí a tragédia grega vai parecer brincadeira de criança perto da crise que o Brasil enfrentará. As sementes foram plantadas pelo governo petista.[image error]

Published on December 02, 2011 05:45

December 1, 2011

Entrevista na rádio Roquette Pinto

Minha entrevista na rádio do governo do Estado do Rio de Janeiro sobre o lançamento do meu novo livro, LIBERAL COM ORGULHO.[image error]

Published on December 01, 2011 13:43

Sweden and the euro: Out and happy

The Economist

WHEN Swedes voted in 2003 on whether or not to join the euro, most political and business leaders were strongly in favour. Today even the euro's supporters are grateful to the 56% of voters who said no. As worried investors push up yields on government bonds right across the euro zone, yields on Swedish ten-year bonds have fallen to 1.7%, more than half a point below German Bunds.

Anders Borg, the finance minister, still thinks that in the long run Sweden should join the euro. But he seems happy to be out for now. Fears that Sweden, a small export-based economy, might suffer if it kept the krona were a strong pro-euro argument in 2003. Yet Mr Borg says that Sweden has gained something from standing aside. "Being an outsider, you must make sure your competitiveness and public finances are in order. We have had to impose on ourselves a self-discipline that euro countries did not feel they needed. If you know the winter will be very cold, you have to ensure the house has been built well. Otherwise you will freeze."

In Sweden this translates into tight fiscal policy, a budget surplus of some 0.1% of GDP and a shrinking public debt. With memories still fresh of the banking and housing bust in the early 1990s, all political parties accept the need for sound public finances. Exports fell after the financial crisis in 2008 but have bounced back, helped by a weaker krona. Last year GDP expanded by 5.7%. This year it may grow by another 4.4%; third-quarter figures were better than expected. Yet Sweden will be hurt by the euro zone's troubles. Exports make up half of GDP and many companies report slowing foreign demand. Growth could drop below 1% next year.

The centre-right government plans to impose stricter capital rules on Sweden's four big banks (Handelsbanken, Nordea, SEB and Swedbank) than elsewhere. The finance ministry wants to see tier one capital worth 12% of risk-weighted assets by 2015, five points above the Basel minimum. The aim is to avert any chance of Swedish taxpayers again paying for "irresponsible risk-taking".

Mr Borg often urges fiscal prudence on his European colleagues. Sweden has given emergency loans to Ireland, Latvia and Iceland as they, according to Mr Borg, have shown a credible ambition to clean up their economic mess. He is less forgiving of Italy and Greece, saying they need to do much more. It is a pity that Sweden is too small to make much impact on the wider European economy—and that Mr Borg has so often found himself preaching to the deaf.[image error]

Published on December 01, 2011 13:41

Entrevista para o IMIL

Minha rápida (9 min) entrevista para o Instituto Millenium sobre meu novo livro, "Liberal com Orgulho".[image error]

Published on December 01, 2011 03:40

November 30, 2011

Ajuda ao DCE da UnB

Recebi de um colega liberal e reproduzo aqui. Eles merecem todo apoio possível.

"Amigos liberais,

Escrevo para pedir ajuda ao Diretório Central dos Estudantes

da UNB.

Como devem saber, a nova gestão "Aliança pela Liberdade"

empossada há poucas semanas é claramente anti-esquerda

e sim liberal. O grupo tem membros do IL-Brasília e, de

certa forma, decorreu de idéias do saudoso Nelson Lehmann.

O novo DCE está em dificuldades. Está sendo intimidado pela

esquerda radical. Precisam de toda ajuda possível.

No dia 10.12.2011 (sábado), referido DCE fará uma reunião

para pessoalmente receber qualquer apoiador que deseje

aparecer. Será às 16hrs no auditório 4 no Instituto de Biologia

(IB), que fica ao lado da saída sul do Instituto Central de Ciências,

ICC (minhocão). Mais informações estão no site institucional.

Qualquer ajuda é bem-vinda, mesmo a simples solidariedade,

apoio moral e articulação. Não importa a ideologia, mas sim

que os apoiadores do novo DCE se conheçam, estejam

juntos e saibam que não estão sozinhos.

Peço que repercutam a presente mensagem. Peço que vão

ao evento. Peço que levem amigos. A hora é agora.

Um abraço e até lá

Henrique de Mello Franco"[image error]

"Amigos liberais,

Escrevo para pedir ajuda ao Diretório Central dos Estudantes

da UNB.

Como devem saber, a nova gestão "Aliança pela Liberdade"

empossada há poucas semanas é claramente anti-esquerda

e sim liberal. O grupo tem membros do IL-Brasília e, de

certa forma, decorreu de idéias do saudoso Nelson Lehmann.

O novo DCE está em dificuldades. Está sendo intimidado pela

esquerda radical. Precisam de toda ajuda possível.

No dia 10.12.2011 (sábado), referido DCE fará uma reunião

para pessoalmente receber qualquer apoiador que deseje

aparecer. Será às 16hrs no auditório 4 no Instituto de Biologia

(IB), que fica ao lado da saída sul do Instituto Central de Ciências,

ICC (minhocão). Mais informações estão no site institucional.

Qualquer ajuda é bem-vinda, mesmo a simples solidariedade,

apoio moral e articulação. Não importa a ideologia, mas sim

que os apoiadores do novo DCE se conheçam, estejam

juntos e saibam que não estão sozinhos.

Peço que repercutam a presente mensagem. Peço que vão

ao evento. Peço que levem amigos. A hora é agora.

Um abraço e até lá

Henrique de Mello Franco"[image error]

Published on November 30, 2011 10:22

Blame It on Berlin

Editorial do WSJ

The euro bailout caucus wants the Germans to write a blank check.

Which century is this anyway? We ask because elite opinion is once again blaming Germany for ruining the rest of Europe, if not the entire world economy. All that's missing are references to the Kaiser or Herr Schicklgruber, but we hope the Germans don't fall for this global guilt trip.

Berlin's alleged sin is its reluctance to write a blank check to save the euro—either by underwriting a new euro-zone fiscal union, or granting permission for the European Central Bank to buy trillions in sovereign debt. The chant comes in unison from the debtor nations themselves, the bailout caucus in Brussels, an Obama White House concerned about its re-election, and liberal pundits worried that their welfare-state economic model is under assault. Like the "rich" in America who must pay their "fair share," the Germans are supposed to pay up to save a united Europe.

***

The reality is that the Germans—along with the Dutch and the Finns—are the rare Europeans who understand that saving the euro requires more than a blank check. It requires a new political commitment to better economic policy. Chancellor Angela Merkel and her cabinet are as euro-centric as the French, but they realize that money alone won't solve Europe's more fundamental debt and growth problem.

It's certainly true that the Germans have benefited from the euro, which is one reason they want to preserve it. Their exports have flourished, often to other European countries, thanks to a stable currency and free-trade zone. But one reason for their relative economic success is that Germany is a rare European country that used the early years of the euro to reform its labor markets and improve fiscal policies. While the Greeks and Italians used their years of near-German borrowing rates to live beyond their means, the Bavarians became more competitive.

Until the crisis hit Italy, the rest of Europe still didn't think it had a problem. Politicians said the markets were acting in predatory fashion, rather than sensibly recalibrating the risk of sovereign default. Even now, 18 months into this euro mess, only the recent jump in sovereign bond yields has caused Italy and France to realize they have to shape up.

Europe's original sin in this crisis was not letting Greece default, remaining in the euro but shrinking its debt load as it reformed its economy. The example would have sent a useful message of discipline to countries and creditors alike. The fear at the time was that a default would spread the contagion of higher bond rates, but those rates have soared despite the bailouts of Greece and Portugal.

By now the policy choices are more painful. One option is to let the euro zone break up, one country at a time or all at once, but the costs of dissolution would be very high. At best it would mean a deep recession, as debts and contracts were recalculated in national currencies, and savers and investors fled to the safest havens. This is something no one but doctrinaire devaluationists should want.

The second option is the blank check, starting with the ECB printing trillions in euros to buy up sovereign debt. This might crush bond yields, at least for a while, but the minute those yields fall the pressure for economic reform will also ease.

Meanwhile, the ECB will have sacrificed its independence under political duress, while gambling that printing trillions of euros won't lead to inflation down the road. This would be a short-term palliative to get the French and Americans past the next election.

The third option, and the one the Germans seem to prefer, is a closer fiscal union across the euro zone with stricter rules on debt and deficits. This is the essence of the tentative Franco-German plan leaked over the weekend. In return for issuing euro bonds or perhaps granting countries access to ECB bond purchases, Germany would require those nations to live by German-approved fiscal rules. This has the virtue of distinguishing between countries that follow the rules and those that don't, enforcing good behavior with carrots and bad with sticks.

This is better than the other options, but it too is no panacea. Germany isn't about to send the Wehrmacht to Rome or Athens to enforce fiscal policy. So enforcement would still largely depend on the political will of the countries themselves. Such debt and deficit rules could also be counterproductive if they led to growth-killing tax increases instead of spending cuts and entitlement reforms.

It's no accident that Ireland, with its 12.5% corporate tax rate that has attracted export businesses, is climbing out of its debt hole faster than are Portugal, Spain or Greece. Any new fiscal rules need to allow for tax and labor-policy competition.

***

The tragedy is that the euro-zone countries failed to abide by their original fiscal rules, a failure that has brought them to this unhappy pass. The Brussels-Washington bailout caucus now wants to extend the damage to monetary policy by printing more euros and worrying about the consequences later.

In opposing that option, the Germans are said to be imposing their Prussian morality on everyone else. But without reforms, the countries of southern Europe will never pull out of their downward debt spiral. The Germans are at least telling the truth.[image error]

The euro bailout caucus wants the Germans to write a blank check.

Which century is this anyway? We ask because elite opinion is once again blaming Germany for ruining the rest of Europe, if not the entire world economy. All that's missing are references to the Kaiser or Herr Schicklgruber, but we hope the Germans don't fall for this global guilt trip.

Berlin's alleged sin is its reluctance to write a blank check to save the euro—either by underwriting a new euro-zone fiscal union, or granting permission for the European Central Bank to buy trillions in sovereign debt. The chant comes in unison from the debtor nations themselves, the bailout caucus in Brussels, an Obama White House concerned about its re-election, and liberal pundits worried that their welfare-state economic model is under assault. Like the "rich" in America who must pay their "fair share," the Germans are supposed to pay up to save a united Europe.

***

The reality is that the Germans—along with the Dutch and the Finns—are the rare Europeans who understand that saving the euro requires more than a blank check. It requires a new political commitment to better economic policy. Chancellor Angela Merkel and her cabinet are as euro-centric as the French, but they realize that money alone won't solve Europe's more fundamental debt and growth problem.

It's certainly true that the Germans have benefited from the euro, which is one reason they want to preserve it. Their exports have flourished, often to other European countries, thanks to a stable currency and free-trade zone. But one reason for their relative economic success is that Germany is a rare European country that used the early years of the euro to reform its labor markets and improve fiscal policies. While the Greeks and Italians used their years of near-German borrowing rates to live beyond their means, the Bavarians became more competitive.

Until the crisis hit Italy, the rest of Europe still didn't think it had a problem. Politicians said the markets were acting in predatory fashion, rather than sensibly recalibrating the risk of sovereign default. Even now, 18 months into this euro mess, only the recent jump in sovereign bond yields has caused Italy and France to realize they have to shape up.

Europe's original sin in this crisis was not letting Greece default, remaining in the euro but shrinking its debt load as it reformed its economy. The example would have sent a useful message of discipline to countries and creditors alike. The fear at the time was that a default would spread the contagion of higher bond rates, but those rates have soared despite the bailouts of Greece and Portugal.

By now the policy choices are more painful. One option is to let the euro zone break up, one country at a time or all at once, but the costs of dissolution would be very high. At best it would mean a deep recession, as debts and contracts were recalculated in national currencies, and savers and investors fled to the safest havens. This is something no one but doctrinaire devaluationists should want.

The second option is the blank check, starting with the ECB printing trillions in euros to buy up sovereign debt. This might crush bond yields, at least for a while, but the minute those yields fall the pressure for economic reform will also ease.

Meanwhile, the ECB will have sacrificed its independence under political duress, while gambling that printing trillions of euros won't lead to inflation down the road. This would be a short-term palliative to get the French and Americans past the next election.

The third option, and the one the Germans seem to prefer, is a closer fiscal union across the euro zone with stricter rules on debt and deficits. This is the essence of the tentative Franco-German plan leaked over the weekend. In return for issuing euro bonds or perhaps granting countries access to ECB bond purchases, Germany would require those nations to live by German-approved fiscal rules. This has the virtue of distinguishing between countries that follow the rules and those that don't, enforcing good behavior with carrots and bad with sticks.

This is better than the other options, but it too is no panacea. Germany isn't about to send the Wehrmacht to Rome or Athens to enforce fiscal policy. So enforcement would still largely depend on the political will of the countries themselves. Such debt and deficit rules could also be counterproductive if they led to growth-killing tax increases instead of spending cuts and entitlement reforms.

It's no accident that Ireland, with its 12.5% corporate tax rate that has attracted export businesses, is climbing out of its debt hole faster than are Portugal, Spain or Greece. Any new fiscal rules need to allow for tax and labor-policy competition.

***

The tragedy is that the euro-zone countries failed to abide by their original fiscal rules, a failure that has brought them to this unhappy pass. The Brussels-Washington bailout caucus now wants to extend the damage to monetary policy by printing more euros and worrying about the consequences later.

In opposing that option, the Germans are said to be imposing their Prussian morality on everyone else. But without reforms, the countries of southern Europe will never pull out of their downward debt spiral. The Germans are at least telling the truth.[image error]

Published on November 30, 2011 02:13

Rodrigo Constantino's Blog

- Rodrigo Constantino's profile

- 32 followers

Rodrigo Constantino isn't a Goodreads Author

(yet),

but they

do have a blog,

so here are some recent posts imported from

their feed.