Steve Blank's Blog, page 52

June 1, 2011

Why Board Meetings Suck – Part 1 of 2

There are none so blind as those who will not see.

Jonathan Swift

What's Wrong With Today's Board Meetings

As customer and agile development reinvent the Startup, it's time to ask why startup board governance has not kept up with the pace of innovation. Board meetings that guide startups haven't changed since the early 1900's.

It's time.

Reinventing the board meeting may offer venture-backed startups a more efficient, productive way to direct and measure their search for a profitable business model.

Reinventing the board meeting may offer angel-funded startups – which because of geography or size of investment typically don't have formal boards or directors – to attract experienced advice and investment outside of technology clusters (i.e. Silicon Valley, New York).

Here's how.

Because We've Always Done It This Way

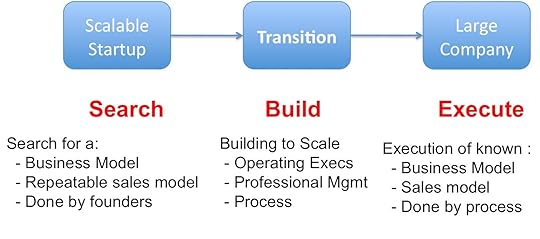

The combination of Venture Capital and technology startups is only about 50 years old. Rather than invent a new form of corporate governance, venture investors adopted the traditional board meeting structure from large corporations. Yet boards of large companies exist to monitor efficient strategy and execution of a known business model. While startups eventually get into execution mode, their initial stages are devoted to a non-linear, chaotic search for a business model: finding product/market fit to identify a product or service people will buy in droves at a sustainable, profitable pace.

In the last few years, our understanding that startups are not smaller versions of large companies, made us recognize that startups need their own tools, different from those used in existing companies: Customer Development – the process to search for a Business Model, the Business Model Canvas – the scorecard to measure progress in the search, and Agile Engineering – the tools to physically construct the product.

Yet while we've reinvented how startups build their companies, startup investors are still having board meetings like it's the 19th century.

Why Have a Board Meeting?

From a VC's point of view there are two reasons for board meetings.

1) It's their fiduciary responsibility. Once a startup gets going, it has asymmetric information. Investors get board seats to assure themselves and their limited partners that they are duly informed about their investment.

2) Investors believe that their experience and guidance can maximize their return. Here it's the board that has asymmetric knowledge. A veteran board can bring 50-100x more experience into a board meeting than a first time founder. (VC's sit on 6 – 12 boards at a time. Assume an average tenure of 4 years per board. Assume two veteran VC's per board. = 50-100x more experience.)

From a founder's point of view there are three reasons for board meetings.

1) It's an obligation that came with the check.

2) Founders who have a great board do recognize the uncanny pattern recognition skills that good VC's bring.

3) An experienced board brings an extensive network of customers, partners, help in recruiting, follow-on financing, etc.

What's Wrong With a Board Meeting?

The Wrong Metrics. Traditional startup board meetings spend an insane amount of wasted time using Fortune 100 company metrics like income statements, cash flow, balance sheet, waterfall charts. The only numbers in those documents that are important in the first year of a startup's life are burn rate and cash balance. Most board meetings never get past big company metrics to focus on the crucial startup numbers. That's simply a failure of a startup board's fiduciary responsibility.

The Wrong Discussions. The most important advice/guidance that should come from investors in a board meeting is about a startup's search for a business model: What are the business model hypotheses? What are the most important hypotheses to test now? How are we progressing validating each hypothesis? What do those numbers/metrics look like? What are the iterations and Pivots – and why?

Not Real-time. Startup board meetings occur every 4-6 weeks. While that's great when you showed up in your horse and buggy, the strategy-to-tactic-to implementation lag is painful at Internet speeds. And unless there's rigor in the process, because there is no formal structure for follow up, tracking what happened as a result of meeting recommendations and action items gets lost in the daily demands of everyone's work. (Of course great VC's mix in coffees, phone calls, coaching and other non-board meeting interactions but it's ad hoc and not always done.)

Wastes Founders Time. For the founders, "the get ready for the board meeting" drill is often a performance rather than a snapshot. Powerpoints, spreadsheets and rehearsals consume time for materials that are used once and discarded. There are no standards for what each side (board versus management) does. What is the entrepreneur supposed to be doing? What are the board members supposed to be contributing?

The Wrong Structure. If you read advice on how to run a board meeting you'll get advice that would have felt comfortable to Andrew Carnegie or John D. Rockefeller.

In the age of the Internet why do we need to get together in one room on a fixed schedule? Why do we need to wait a month to six weeks to see progress? Why don't we have standards for what metrics VC's want to see from their early stage startup teams?

Angels In America

For angel-funded startups, life is even tougher. Data from the Startup Genome project shows that startups that have helpful mentors, listen to customers, and learn from startup thought leaders raise 7x more money and have 3.5x better user growth. If you're in a technology cluster like Silicon Valley you may be able to attract ad hoc advice from experienced investors. But very little of it is formal, and almost none of it approaches the 50-100x experience level of professional investors.

As there's no formal board, most of these angel/investors meetings are over coffees. And lacking a board meeting there's no formal mechanism to get investor advice. Angel investments in mobile and web apps today are approaching the "throw it against the wall and see if it sticks" strategy.

And for startups outside of technology clusters, there's almost no chance of attracting Silicon Valley VC's or angels. Geography is a barrier to investment.

So given all this, the million dollar question is: Why in the age of the Internet haven't we adopted the tools we build/sell to solve these problems?

In the next post – Reinventing the Board Meeting.

Lessons Learned

Early stage board meetings are often clones of large company board meetings

That's very, very wrong

Angel-funded startups have no formal mechanism for experienced advice

There's a better way

Filed under: Big Companies versus Startups: Durant versus Sloan, Business Model versus Business Plan, Lean LaunchPad, Teaching, Venture Capital

Reinventing the Board Meeting – Part 1 of 2

There are none so blind as those who will not see.

Jonathan Swift

What's Wrong With Today's Board Meetings

As customer and agile development reinvent the Startup, it's time to ask why startup board governance has not kept up with the pace of innovation. Board meetings that guide startups haven't changed since the early 1900's.

It's time.

Reinventing the board meeting may offer venture-backed startups a more efficient, productive way to direct and measure their search for a profitable business model.

Reinventing the board meeting may offer angel-funded startups – which because of geography or size of investment typically don't have formal boards or directors – to attract experienced advice and investment outside of technology clusters (i.e. Silicon Valley, New York).

Here's how.

Because We've Always Done It This Way

The combination of Venture Capital and technology startups is only about 50 years old. Rather than invent a new form of corporate governance, venture investors adopted the traditional board meeting structure from large corporations. Yet boards of large companies exist to monitor efficient strategy and execution of a known business model. While startups eventually get into execution mode, their initial stages are devoted to a non-linear, chaotic search for a business model: finding product/market fit to identify a product or service people will buy in droves at a sustainable, profitable pace.

In the last few years, our understanding that startups are not smaller versions of large companies, made us recognize that startups need their own tools, different from those used in existing companies: Customer Development – the process to search for a Business Model, the Business Model Canvas – the scorecard to measure progress in the search, and Agile Engineering – the tools to physically construct the product.

Yet while we've reinvented how startups build their companies, startup investors are still having board meetings like it's the 19th century.

Why Have a Board Meeting?

From a VC's point of view there are two reasons for board meetings.

1) It's their fiduciary responsibility. Once a startup gets going, it has asymmetric information. Investors get board seats to assure themselves and their limited partners that they are duly informed about their investment.

2) Investors believe that their experience and guidance can maximize their return. Here it's the board that has asymmetric knowledge. A veteran board can bring 50-100x more experience into a board meeting than a first time founder. (VC's sit on 6 – 12 boards at a time. Assume an average tenure of 4 years per board. Assume two veteran VC's per board. = 50-100x more experience.)

From a founder's point of view there are three reasons for board meetings.

1) It's an obligation that came with the check.

2) Founders who have a great board do recognize the uncanny pattern recognition skills that good VC's bring.

3) An experienced board brings an extensive network of customers, partners, help in recruiting, follow-on financing, etc.

What's Wrong With a Board Meeting?

The Wrong Metrics. Traditional startup board meetings spend an insane amount of wasted time using Fortune 100 company metrics like income statements, cash flow, balance sheet, waterfall charts. The only numbers in those documents that are important in the first year of a startup's life are burn rate and cash balance. Most board meetings never get past big company metrics to focus on the crucial startup numbers. That's simply a failure of a startup board's fiduciary responsibility.

The Wrong Discussions. The most important advice/guidance that should come from investors in a board meeting is about a startup's search for a business model: What are the business model hypotheses? What are the most important hypotheses to test now? How are we progressing validating each hypothesis? What do those numbers/metrics look like? What are the iterations and Pivots – and why?

Not Real-time. Startup board meetings occur every 4-6 weeks. While that's great when you showed up in your horse and buggy, the strategy-to-tactic-to implementation lag is painful at Internet speeds. And unless there's rigor in the process, because there is no formal structure for follow up, tracking what happened as a result of meeting recommendations and action items gets lost in the daily demands of everyone's work. (Of course great VC's mix in coffees, phone calls, coaching and other non-board meeting interactions but it's ad hoc and not always done.)

Wastes Founders Time. For the founders, "the get ready for the board meeting" drill is often a performance rather than a snapshot. Powerpoints, spreadsheets and rehearsals consume time for materials that are used once and discarded. There are no standards for what each side (board versus management) does. What is the entrepreneur supposed to be doing? What are the board members supposed to be contributing?

The Wrong Structure. If you read advice on how to run a board meeting you'll get advice that would have felt comfortable to Andrew Carnegie or John D. Rockefeller.

In the age of the Internet why do we need to get together in one room on a fixed schedule? Why do we need to wait a month to six weeks to see progress? Why don't we have standards for what metrics VC's want to see from their early stage startup teams?

Angels In America

For angel-funded startups, life is even tougher. Data from the Startup Genome project shows that startups that have helpful mentors, listen to customers, and learn from startup thought leaders raise 7x more money and have 3.5x better user growth. If you're in a technology cluster like Silicon Valley you may be able to attract ad hoc advice from experienced investors. But very little of it is formal, and almost none of it approaches the 50-100x experience level of professional investors.

As there's no formal board, most of these angel/investors meetings are over coffees. And lacking a board meeting there's no formal mechanism to get investor advice. Angel investments in mobile and web apps today are approaching the "throw it against the wall and see if it sticks" strategy.

And for startups outside of technology clusters, there's almost no chance of attracting Silicon Valley VC's or angels. Geography is a barrier to investment.

So given all this, the million dollar question is: Why in the age of the Internet haven't we adopted the tools we build/sell to solve these problems?

In the next post – Reinventing the Board Meeting.

Lessons Learned

Early stage board meetings are often clones of large company board meetings

That's very, very wrong

Angel-funded startups have no formal mechanism for experienced advice

There's a better way

Filed under: Big Companies versus Startups: Durant versus Sloan, Business Model versus Business Plan, Teaching, Venture Capital

May 29, 2011

Tune In, Turn On, Drop Out – The Startup Genome Project

In April 2010 I received an email that said, "I'm an incoming Stanford student in the fall and working on a project that a number of people suggested I get in touch with you about."

Ok, I get a lot of these. Is this some grad student or post doc who wanted to do some independent study?

The email continued, "The problem I'm working on is that many founders are either making uninformed decisions or inefficiently learning the new skills they need. The solution I'm exploring is a just in time learning methodology that accelerates founders' learning curve by aggregating relevant content, peers and mentors."

Hmm, now I'm getting intrigued. This sounded like one heck of an interesting guy and it's a subject I care about. I wondered where he got his MBA from?

The email closed by saying, "The project is a hybrid between academic and entrepreneurial circles and I'd really love to begin a dialogue with people in the academic world also interested in solving this problem. Your name has come up a lot in that regard. Let me know if this interests you and if you have any time to speak."

It was signed Max Marmer.

I set up a meeting and at Cafe Borrone some kid who looked 18-years old came up to me and introduced himself as Max. "How old are you? I asked. "18," he replied.

Holy sx!t.

When I asked Max why he was interested in solving entrepreneurial education problems he replied, "I was always interested in big picture trends for where the world is headed. I spent time with organizations like the Institute for the Future and Singularity University. My conjecture became that the world's biggest problem isn't poverty or disease or any oft-stated major problem, but that we don't have enough people engaged in trying to solve these problems. A big piece of the solution lies in the scalable impact of entrepreneurship and an increase of successful entrepreneurs. But potential impact consistently fails to be realized because of self-destruction."

I don't think I touched my sandwich. I tried to remember what I was doing at 18 and whatever it was I wasn't this. Max continued, "That's why I'm really interested in ways of optimizing the entrepreneurship ecosystem to allow more entrepreneurs to go from idea to reality. To do this requires: a methodology, tools and systematically reducing friction."

I was feeling pretty old. Max set the record for smarts divided by age.

Tune In, Turn On, Drop Out

Max entered Stanford in the fall of 2010 as a freshman, took as many of the engineering entrepreneurship classes as he could and independent study with me. (He was part of the Sandbox network - a group of incredibly smart under 30 year olds.)

Max dropped out of Stanford after his first quarter.

But he left to work on what he told me he came to do - crack the innovation code of Silicon Valley and share it with the rest of the world. He set up Blackbox.vc, a seed accelerator for technology startups (and one of the tour stops for entrepreneurs from around the world.) They went to work gathering deep knowledege of what makes successful Internet startups.

Max and his partners interviewed and analyzed over 650 early-stage Internet startups. Today they released the first Startup Genome Report— a 67 page in-depth analysis on what makes early-stage Internet startups successful.

Startup Genome Report

Some of their key findings:

1. Founders that learn are more successful: Startups that have helpful mentors, track metrics effectively, and learn from startup thought leaders raise 7x more money and have 3.5x better user growth.

2. Startups that pivot once or twice times raise 2.5x more money, have 3.6x better user growth, and are 52% less likely to scale prematurely than startups that pivot more than 2 times or not at all.

3. Many investors invest 2-3x more capital than necessary in startups that haven't reached problem solution fit yet. They also over-invest in solo founders and founding teams without technical cofounders despite indicators that show that these teams have a much lower probability of success.

4. Investors who provide hands-on help have little or no effect on the company's operational performance. But the right mentors significantly influence a company's performance and ability to raise money. (However, this does not mean that investors don't have a significant effect on valuations and M&A)

5. Solo founders take 3.6x longer to reach scale stage compared to a founding team of 2 and they are 2.3x less likely to pivot.

6. Business-heavy founding teams are 6.2x more likely to successfully scale with sales driven startups than with product centric startups.

7. Technical-heavy founding teams are 3.3x more likely to successfully scale with product-centric startups with no network effects than with product-centric startups that have network effects.

8. Balanced teams with one technical founder and one business founder raise 30% more money, have 2.9x more user growth and are 19% less likely to scale prematurely than technical or business-heavy founding teams.

9. Most successful founders are driven by impact rather than experience or money.

10. Founders overestimate the value of IP before product market fit by 255% .

11. Startups need 2-3 times longer to validate their market than most founders expect. This underestimation creates the pressure to scale prematurely.

12. Startups that haven't raised money over-estimate their market size by 100x and often misinterpret their market as new.

13. Premature scaling is the most common reason for startups to perform worse. They tend to lose the battle early on by getting ahead of themselves.

14. B2C vs. B2B is not a meaningful segmentation of Internet startups anymore because the Internet has changed the rules of business. We found 4 different major groups of startups that all have very different behavior regarding customer acquisition, time, product, market and team.

———

I'm not sure I believe every one of the report conclusions – it just covers very early stage web startups, and the methodology is still shaky – but this is a landmark study. I think these guys have gone a long way to turn hypotheses about early-stage Internet startups into facts. And they're just getting started.

Congratulations. A+

Download the full Startup Genome report here.

——-

I can't wait to see what Max does by the time he's 21.

Filed under: Customer Development, Teaching, Venture Capital

May 27, 2011

Greatest Hits – The Gigaom Interview

Om Malik runs Gigaom, probably the most interesting and technically accurate sites on the blogosphere.

He had me in for an interview. We covered a wide range of topics.

0:22 – the Entrepreneurial explosion

1:45 – Are we in a Bubble?

3:20 - The Last Bubble

6:30 – Rules for the New Bubble

8:05 – Metrics for Success

10:10 – Total Available Market in the Billions

11:45 – Is this a Really a Bubble – the greater fool theory

13:00 – VC's – The Pact With the Devil

14:10 – What to Use VC's $'s for?

15:36 – How to Get Customer Centric – an unnatural act

17:00 – The Secrets to Social Networks – Bowling Alone

17:45 – Who Are the Best Entrepreneurs?

18:45 – Entrepreneurs are Artists

21:39 – What Makes Silicon Valley Special?

22:50 – Risk and Culture in Silicon Valley

Filed under: Customer Development, Lean LaunchPad, Teaching, Venture Capital

May 21, 2011

The Four Steps to the Epiphany is Now in French

The Four Steps to the Epiphany (Les quatre étapes vers l'épiphanie) is now available in French.

Order it from the Bookediton.com (Search for Les quatre étapes vers l'épiphanie)

Thanks to Antoine Bruyns for making the French version happen.

It joins the Japanese version (アントレプレナーの教科書 [単行本(ソフトカバー)available on Amazon.

Thanks to Tsutsumi Takashi for making it happen in Japanese.

Collect the set!

Filed under: Uncategorized

May 17, 2011

Philadelphia University Commencement Speech – May 15th 2011

I am honored to be with you as we gather to celebrate your graduation from Philadelphia University.

While I teach at Stanford and Berkeley, to be honest… this is the closest I've ever gotten to a college graduation.

I realize that my 15 minutes up here is all that's between you and the rest or your life, so if I can keep you awake, I'm going to share 4 short stories from my life.

My first story is about finding your passion.

My parents were immigrants… Neither of them had been to college—my mother graduated from high school but my father left school after the 7th grade. Still, like many immigrants, they dreamed that someday their children would go to college… Unfortunately that was their dream—but it wasn't mine.

I ended up at Michigan State because I got a scholarship…Once I got there, I was lost…unfocused…and had no idea of who I was and why I was in school. I hated school.

One day my girlfriend said, "You know some of us are working hard to stay here. But you don't seem to care.Why don't you find out what you really want to do?"

That was the moment I realized I, …not anyone else…was in charge of my life.

I took her advice. I dropped out of Michigan State University after the first semester.

In the middle of a Michigan winter, I stuck out my thumb and hitchhiked to Miami, the warmest place I could think of.

I had no idea what would be at the end of the highway. But that day I began a pattern that I still follow—stick out your thumb and see where the road takes you.

I managed to find a job at the Miami International Airport loading racehorses onto cargo planes. I didn't like the horses, but the airplanes caught my interest.

Airplanes were the most complicated things I had ever seen. Unlike other kids who were fans of the pilots, I was in awe of the electronics technicians in charge of the planes' instruments. I would hang around the repair shop just helping out wherever I could. I didn't know anything, so I didn't get paid…

But soon some technician took me under his wing and gave me my first tutorial on electronics, radar and navigation. I was hooked. I started taking home all the equipment manuals and would read them late into the night.

For the first time in my life, I found something I was passionate about.

And the irony is that if I hadn't dropped out, I would never have found this passion…the one that began my career. If I hadn't discovered something I truly loved to do, I might be driving a cab at the Miami airport.

My life continued to follow this same pattern…I'd pursue my curiosity, volunteer to help, and show up a lot. Again and again, the same thing would happen… people would notice that I cared…and I'd get a chance to learn something new.

Now that you paid for your degree…I'm going to let you in on a secret. It's your curiosity and enthusiasm that will get you noticed and make your life interesting—not your grade point average.

But at the time…as excited as I was…I couldn't see how my passion for airplanes and avionics could ever get me anywhere. Without money, or a formal education, how could I learn about them?

The answer turned out to be a war.

My second story is about Volunteering and Showing Up.

In the early 1970's, as some of you might remember, our country was in the middle of the Vietnam War—-and the Air Force was happy to have me.

I enlisted to learn how to repair electronics. The Air Force sent me to a year of military electronics school. While college had been someone else's dream, learning electronics had become mine.

After electronics school, when most everyone else was being sent overseas to a war-zone, I was assigned to one of the cushiest bases in the Air Force, right outside of Miami.

My first week on the base… our shop chief announced: "We're looking for some volunteers to go to Thailand." I still remember the laughter and comments from my fellow airmen. "You got to be kidding… leave Miami for a war in Southeast Asia?"

Others wisely remembered the first rule in the military: never volunteer for anything. Listening to them, I realized they were right. Not volunteering was the sane path of safety, certainty and comfort.

So I stepped forward, raised my hand—and I said, "I'll go."

Once again, I was going to see where the road would take me. Volunteering for the unknown…which meant leaving the security of what I knew…would continually change my life.

Two weeks later I was lugging heavy boxes across the runway under the broiling Thailand sun. My job was to replace failed electronic warfare equipment in fighter planes as they returned from bombing missions over North Vietnam.

As I faced yet another 110-degree day, I did consider that perhaps my decision to leave Miami might have been a bit hasty. Yet every day I would ask, "Where does our equipment come from… and how do we know it's protecting our airplanes?"

The answer I got was, "Don't you know there's a war on? Shut up and keep doing what you're told."

Still I was forever curious. At times continually asking questions got me in trouble…

once it almost sent me to jail…

but mostly it made me smarter.

I wanted to know more. I had found something I loved to do.. …and I wanted to get better at it.

When my shift on the flightline was over, my friends would go downtown drinking. Instead, I'd often head into the shop and volunteer to help repair broken jammers and receivers. Eventually, the shop chief who ran this 150-person shop approached me and asked, "You're really interested in this stuff, aren't you?" He listened to me babble for a while, and then walked me to a stack of broken electronic equipment and challenged me troubleshoot and fix them.

Hours later when I was finished, he looked at my work and told me, "We need another pair of hands repairing this equipment. As of tomorrow you no longer work on the flightline." He had just given me a small part of the electronic warfare shop to run.

People talk about getting lucky breaks in their careers. I'm living proof that the "lucky breaks" theory is simply wrong. You get to make your own luck. 80% of success in your career will come from just showing up. The world is run by those who show up…not those who wait to be asked.

Eighteen months after arriving in Thailand, I was managing a group of 15 electronics technicians.

I had just turned 20 years old.

My third story is about Failure and Redemption

After I left the military, I ended up in Palo Alto, a town south of San Francisco. Years later this area would become known as Silicon Valley.

For a guy who loved technology, I was certainly in the right place. Endlessly curious, I went from startups in military intelligence to microprocessors to supercomputers to video games.

I was always learning. There were times I worried that my boss might find out how much I loved my job…and if he did, he might make me pay to work there. To be honest, I would have gladly done so. While I earned a good salary, I got up and went to work every day not because of the pay, but because I loved what I did.

As time went on, I was a co-founder or member of the starting team for six high-tech startups…

With every startup came increasing responsibility. I reached what I then thought was the pinnacle of my career when I raised tens of millions of dollars and became CEO of my seventh startup… a hot new video game company. My picture was in all the business magazines, and made it onto the cover of Wired magazine. Life was perfect.

And then one day it wasn't.

It all came tumbling down. We had believed our own press, inhaled our own fumes and built lousy games. Customers voted with their wallets and didn't buy our products. The company went out of business. Given the press we had garnered, it was a pretty public failure.

We let our customers, our investors, and our employees down. While it was easy to blame it on others…and trust me at first I tried… in the end it was mostly a result of my own hubris—the evil twin of entrepreneurial passion and drive.

I thought my career and my life were over. But I learned that in Silicon Valley, honest failure is a badge of experience.

In fact, unlike in the movies, most startups actually fail. For every Facebook and Zynga that make the press, thousands just never make it at all.

All of you will fail at some time in your career…or in love, or in life.

No one ever sets out to fail. But being afraid to fail means you'll be afraid to try. Playing it safe will get you nowhere.

As it turned out, rather than run me out of town on a rail, the two venture capital firms that had lost $12 million in my failed startup actually asked me to work with them.

During the next couple years…and much humbler… I raised more money and started another company, one that was lucky enough to go public in the dot.com bubble.

In 1999… with the company's revenue north of $100 million…I handed the keys to a new CEO and left. I had married a wonderful woman and together we had two young daughters.

I decided that after 20 years of working 24/7 in eight startups, I wanted to go home and watch my kids grow up.

Which brings me to my last story—There's a Pattern Here.

When I retired I found myself with lots of time to think.

I began to reflect about my career and what had happened in my 21 years with startups in Silicon Valley.

I was all alone in a ski cabin with the snow falling outside…with my wife and daughters out on the slopes all day… I started to collect my thoughts by writing what I had hoped would become my memoirs.

Eighty pages later, I realized that I had some great stories as an entrepreneur and a failed CEO. But while writing them was a great catharsis, it was quickly becoming clear that I'd even have to pay my wife and kids to read the stories.

But the more I thought about what I had done, and what other entrepreneurs had tried, I realized something absurdly simple was staring at me. I saw a repeatable pattern that no else had ever noticed.

Business schools and investors were treating new companies like they were just small versions of large companies. But it struck me that startups were actually something totally different. Startups were actually like explorers—searching for a new world, where everything—customers, markets, prices—were unknown and new.

These startups needed to be inventive as they explore, trying new and different things daily. In contrast, existing companies, the Wal-Mart's and McDonalds, already had road maps, guide books and playbooks—they already know their customers, markets, and prices. To succeed they just need to do the same thing every day.

Now it would have been easy to say, "Nah, this can't be right—every smart professor at Harvard and Wharton and Stanford believes something different."

In fact, in your lives this will happen to you.

You will have a new idea, and people will tell you, "That can't be right because we've always done it this way."

Ignore them….. Be persistent… Never give up. Innovation comes from those who see things that other don't.

As a retired CEO, I had a lot of free time. So I was often invited to be a guest lecturer at the business school at Berkeley. They thought I could tell stories about what it was like to start a company. I was generous with my time…and I showed up a lot.

But I began to nag the head of the department about this new idea I had…one that basically said that everything you learn about starting new companies in business schools was wrong. I thought that there was a better a way to teach and manage startups than the conventional wisdom of the last 40 years. And to their credit…Berkeley's Business School and then Stanford's Engineering School let me write and teach a new course based on my ideas.

Now…a decade later… that course called Customer Development… is the basis of an entirely new way to start companies.

If you're in a technology company or build a web or mobile application, it's probably the only way to start a company.

How did this happen? By showing up a lot and questioning the status quo.

These days I write a weekly blog about entrepreneurship. At the end of each post, I conclude with lessons learned—a kind of Cliff Notes of my key takeaways. So in case you haven't been listening, that's how I'll finish up today.

–

Be forever curious.

Volunteer for everything.

Show up a lot.

Treat failure as a learning experience.

Live life with no regrets.

Remembering…There is no undo button.

Congratulations again to you all…and thank you very much.

Filed under: Air Force, Family/Career, Teaching

May 10, 2011

The Lean LaunchPad at Stanford – The Final Presentations

The Stanford Lean LaunchPad class was an experiment in a new model of teaching startup entrepreneurship. This last post – part nine – highlights the final team presentations. Parts one through eight, the class lectures, are here, Guide for our mentors is here. Syllabus is here.

This is the End

Class lectures were over last week, but most teams kept up the mad rush to talk to even more customers and further refine their products. Now they were standing in front of us to give their final presentations. They had all worked hard. Teams spent an average of 50 to 100 hours a week on their companies, interviewed 50+ customers and surveyed hundreds (in some cases thousands) more.

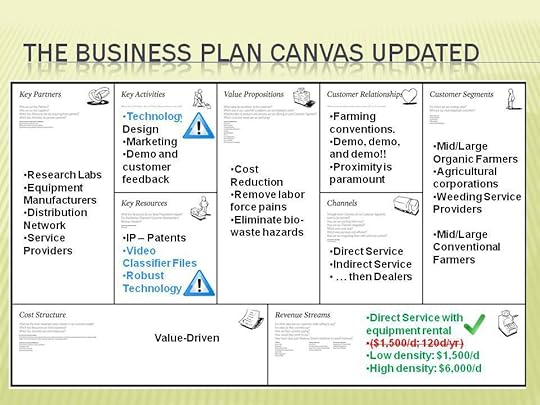

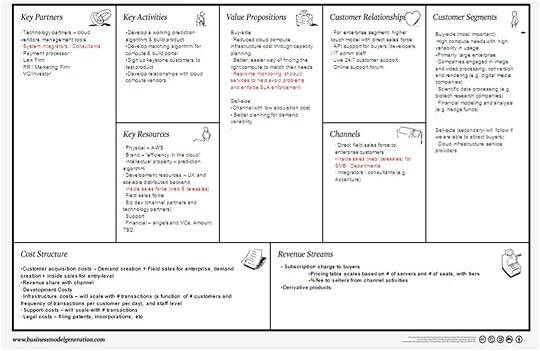

While the slide presentations of each team are interesting to look at, that's actually the sideshow. What really matters are the business model canvas diagrams in the body and appendix of each presentation. These diagrams are the visual representation of the how and the what a team learned in the class – how they tested their hypotheses by getting out of the building using the Customer Development process and what they learned about each part of their business model.

By comparing the changes the teams made week-to-week-week in their business model canvas diagrams, you'll see the dynamics of entrepreneurship, as they iterate and Pivot over time. We believe these are the first visual representations of learning over time.

Team Agora

If you can't see the Agora slides above, click here.

Team Autonomow

If you can't see the Autonomow slides above, click here.

(p.s. they're going to make a company out of this class project, and they're hiring engineers.)

Team Blink Traffic

If you can't see the Blink traffic slides above, click here.

Team D.C. Veritas

If you can't see the D.C. Veritas slides above, click here.

Team Mammoptics

If you can't see the Mammoptics slides above, click here.

Team OurCrave

If you can't see the OurCrave slides above, click here.

Team PersonalLibraries

If you can't see the PersonalLibraries slides above, click here.

Team PowerBlocks

If you can't see the PowerBlocks slides above, click here.

Team Voci.us

If you can't see the Voci.us slides above, click here.

———

Why Did We Teach This Class?

Many entrepreneurship courses focus on teaching students "how to write a business plan." Others emphasize how to build a product. We believe the former is simply wrong and the later insufficient.

Business plans are fine for large companies where there is an existing market, existing product and existing customers, but in a startup all of these elements are unknown and the process of discovering them is filled with rapidly changing assumptions. Experienced entrepreneurs realize that no business plan survives first contact with customers. So our goal was to teach something actually useful in the lives of founders.

Building a product is a critical part of a startup, but just implementing build, measure, learn without a framework to understand customers, channel, pricing, etc. is just another engineering process, not building a business. In the real world a startup is about the search for a business model or more accurately, startups are a temporary organization designed to search for a scalable and repeatable business model. Therefore we developed a class to teach students how to think about all the parts of building a business, not just the product.

There was no single class to teach aspiring entrepreneurs all the skills involved in searching for a business model (business model design, customer and agile development, design thinking, etc.) in one quarter. The Lean LaunchPad was designed to fill that void.

What's Different About the Class?

The Lean LaunchPad class was built around the business model / customer development / agile development solution stack. Students started by mapping their assumptions (their business model) and then each week they tested these hypotheses with customers and partners outside in the field (customer development) and used an iterative and incremental development methodology (agile development) to build the product.

The students were challenged to get users, orders, customers, etc. (and if a web-based product, a minimum feature set) all delivered in 8 weeks. Our goal was to get students out of the building to test each of the nine parts of their business model, understand which of their assumptions were wrong, make adjustments and continue to iterate based on what they learned. They learned first-hand that faulty assumptions were not a crisis, but a learning event called a pivot —an opportunity to change the business model.

What Surprised Us?

The combination of the Business Model Canvas and the Customer Development process was an extremely efficient template for the students to follow – even more than we expected.

It drove a hyper-accelerated learning process which led the students to a "information dense" set of conclusions. (Translation: they learned a lot more, in a shorter period of time than in any other entrepreneurship course we've ever taught or seen.)

The process worked for all types of startups – not just web software but from a diverse set of industries – wind turbines, autonomous vehicles and medical devices.

Insisting that the students keep a weekly blog of their customer development activities gave us insight into their progress in powerful and unexpected ways. (Much more on this in subsequent blog posts.)

What Would We Change?

In this first offering of the Lean Launchpad class we let students sign up without being part of a team. In hindsight this wasted at least a week of class time. Next year we'll have the teams form before class starts. We'll hold a mixer before the semester starts so students can meet each other and form teams. Then we'll interview teams for admission to the class.

Make Market Size estimates (TAM, SAM, addressable) part of Week 2 hypotheses

Show examples of a multi-sided market (a la Google) in Week 3 or 4 lectures.

Be more explicit about final deliverables; if you're a physical product you must show us a costed bill of materials and a prototype. If you're a web product you need to build it and have customers using it.

Teach the channel lecture (currently week 5) before the demand creation lecture (currently week 4.)

Have teams draw the diagram of "customer flow" in week 3 and payment flows in week 6.

Have teams draw the diagram of a finance and operations timeline in week 9.

Find a way to grade team dynamics – so we can really tell who works well together and who doesn't.

Video final presentations and post to the web. (We couldn't get someone in time this year)

It Takes a Village

While I authored these blog posts, the class was truly a team project. Jon Feiber of Mohr Davidow Ventures and Ann Miura-Ko of Floodgate co-taught the class with me (with Alexander Osterwalder as a guest lecturer.) Thomas Haymore was our great teaching assistant. We were lucky to get a team of 25 mentors (VC's and entrepreneurs) who selflessly volunteered their time to help coach the teams. Of course, a huge thanks to the 39 Stanford students who suffered through the 1.0 version of the class. And finally special thanks to the Stanford Technology Ventures Program; Tom Byers, Kathy Eisenhardt, Tina Selig for giving us the opportunity to experiment in course design.

E245, the Lean LaunchPad will be offered again next Winter. See you there!

Filed under: Business Model versus Business Plan, Lean LaunchPad, Teaching

May 3, 2011

The LeanLaunch Pad at Stanford – Class 8: Key Resources, Activities and Expense Model

The Stanford Lean LaunchPad class was an experiment in a new model of teaching startup entrepreneurship. This post – part eight – was the last formal lecture. Parts one through seven of the lectures are here, Syllabus is here.

While this is the last lecture, the teams still have one more week to work on their companies, and then they have their final presentations – for 30% of their grade. All the teams have crossed the Rubicon.

Week 8 of the class.

Last week the teams tested their Revenue Models hypotheses: what are customers willing to pay for? This week they were testing their hypotheses about Partners. Partners are the external companies whose product or service combines with your Value Proposition to create a complete customer solution or "whole product" to satisfy customers. For example, Apple needed music from their record label partners to make the original iPod and iTunes experience complete. (The concept of Partners, took some explanation as some teams confused partners with the Distribution Channel.)

The Nine Teams Present

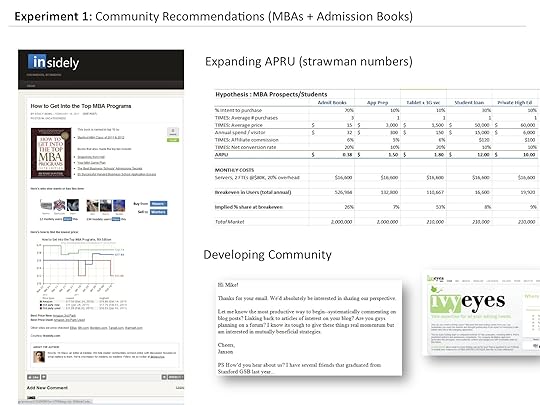

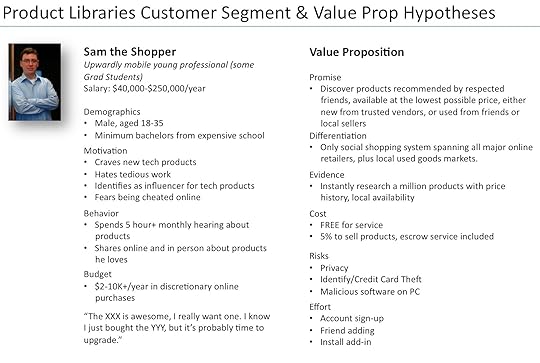

PersonalLibraries was now an on-line "social shopping system." After a week of hectic customer discovery, the team further refined their new business model. Their minimum viable product would be "Trusted Advice on products tailored to your needs by people and groups relevant to you." Their initial customer segment were upwardly mobile professionals with $2-10K discretionary purchases/year (excluding travel,) and their revenue model was affiliate program fees.

With the clock ticking down to the end of the class the team appeared to give up sleep for the remainder of the quarter. They contacted a dozen admissions consulting firms, ran three Usertesting.com video interviews on a social shopping tool, surveyed 40 Stanford students on their on-line shopping habits, and then did another survey of 700 Stanford MBA students (!) to find out what books they'd recommend for prospective students. They used that data as their first "trusted advice" for the new website they built in a week. http://insidely.com/books/

Within the week they were #6 in Google search results for "Stanford Admission Books."

Amazingly it looked like the PersonalLibraries team had restarted the company and found a segment where customers wanted their product. They had another week to go until their final presentations. This looks like a race to the wire.

If you can't see the slides above, click here.

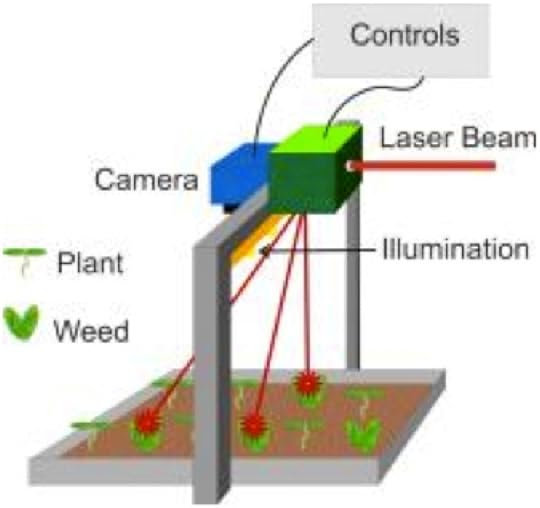

Autonomow, the robotic farm weeder, spent part of the week investigating Partners that could help them build a more complete offering for farmers. The team talked to an agricultural sensor expert at U.C. Davis, a German applied Laser research group, a California organic farmer who wanted to be an Earlyvangelist, four service partners and three weed/pest management consultants.

On the technology front, last week they tested whether their Carrotbot (their research platform they built to gather data for machine vision/machine learning) could tell the difference between a carrot and a weed in a farm field versus the lab. This week the team started investigating whether the spectral reflectance curves of healthy green plants are different from weeds, and if so could an infrared Hyperspectral imaging camera be better suited than their current visible light camera for weed/plant recognition.

But what got our attention was when they told us they were investigating what it takes to kill a weed in the field. Their answer? With a laser.  Way cool.

Way cool.

They spent the week sorting through some basic laser technical questions. How much energy does it take to kill a weed? Answer: About 5 Joules of energy. Next question: How much energy will the laser require? Answer: If the robotic weeder is traveling at 1.5 mph, the laser needs to kill the weed in about 10 milliseconds; therefore the laser needs to put out no more than 500 watts of energy. What wavelength of laser? Answer: The most cost effective wavelength is 800-900nm ~ $20/watt. But water (the main ingredient in a weed) best absorbs light at higher frequencies – think microwaves. Final question: Is the improved absorption efficiency worth the extra cost? Testing for all of these is required.

If you can't see the slides above, click here.

The next team was D.C. Veritas, building a low cost wind turbine for cities. Last week the team did mass interviews of city officials across the United States to understand the project approval process inside a city. This week they broadened the discussion with interviews with the city planner in Mariposa, Texas and the city engineer from Rapid City, South Dakota.

They worked on understanding their partners. D.C. Veritas needs three types of partners: installers (to reduce their overhead,) certification authorities (who would provide credibility) and government and research labs (for testing facilities).

Of real interest was their evolving view of their revenue model. Instead of selling a city the wind turbine hardware, their revenue model moved to a Wind Power Purchase Agreement, a long term contract with a city to buy the electricity generated by the D.C. Veritas turbines.

If you can't see the slides above, click here.

The Agora Cloud Services team was now making a tool set for managing Amazon Web Services cloud compute usage. They believed their tools could save customers 30% of their Amazon bill. Their value proposition was to provide service matching, capacity planning and usage monitoring & control. They had another 3 interviews, this time with potential partners and integrators.

If you can't see the slides above, click here.

The Week 8 Lecture: Q&A and Summing Up

Our lecture covered Key Resources and Cost Structure. The textbooks for this class were Alexander Osterwalder's Business Model Generation (along with the Four Steps to the Epiphany). So who better to have as a surprise guest lecturer for our last class than Alexander Osterwalder himself.

His lecture covered: What resources do you need to build your business? How many people? What kind? Any hardware or software you need to buy? Any IP you need to license? How much money do you need to raise? When? Why? Importance of cash flows? When do you get paid vs. when do you pay others?

Our assignment for the teams during their final week: What's your expense model? What are the key financials metrics for costs in your business model? Costs vs. ramp vs. product iteration? Access to resources. Where is the best place for your business? Where is your cash flow break-even point? Assemble a resources assumptions spreadsheet. Include people, hardware, software, prototypes, financing, etc. When will you need these resources? Roll up all the costs from partners, resources and activities in a spreadsheet by time.

The last part of their assignment is their final presentation – a "Lessons Learned" summary of their work over the entire quarter – which will count for 30% of their grade. To help them get ready for their final, one of our mentors plans to hold a mandatory "story-telling" workshop, to assist them in assembling their final presentation.

If you can't see the slides above, click here.

———

Over the last few weeks as our students presented, we had a growing feeling that we were seeing something extraordinary. Our teaching objective was to take engineers (with a smattering of MBA's) and give them an immersive hands-on experience of how an idea becomes a profitable business. We taught them theory, methodology, and practice using Customer Development and business model design.

Watching them we realized that we had found a way to increase the information density a student team could acquire in eight short weeks. But what was truly awe-inspiring was the breathtaking speed and tempo of the teams' Pivots.

All teams had all accomplished something remarkable, but it won't be clear what a singular achievement this was until we see their final presentations.

Stay tuned for the last post – the Final Presentations and Lessons Learned.

Filed under: Business Model versus Business Plan, Lean LaunchPad, Teaching

April 28, 2011

The LeanLaunch Pad at Stanford – Class 7: Revenue Model

The Stanford Lean LaunchPad class was an experiment in a new model of teaching startup entrepreneurship. With one week and one more updates to go, this post is part seven. Parts one through six are here, Syllabus is here.

With a week to go the teams are starting to look like opening night before the big play. Teams are iterating and pivoting right and left, one team threw their entire business model out the window and did a complete restart, and another team was having a meltdown over personalities.

Week 7 of the class.

Last week the teams were testing their hypotheses about their Channel (how a company delivers its value proposition (i.e. its product or service) to its customers. This week they were testing their hypotheses about Revenue Models: what are customers really willing to pay for? How? Are you generating transactional or recurring revenues? Is it a multi-sided market, and if so who's the user versus who's the payer.

The Nine Teams Present

The first team up was PersonalLibraries the team making a reference management system for discovering, organizing and citing researchers' readings. Oops. No more. The team looked at the potential revenue and concluded that the outlook for this business with this customer segment was dismal. They decided to do something more dramatic than just a Pivot. They did a restart. They moved from "Reference Libraries" to "Product Libraries"— an on-line social shopping system. (If this had been a real startup rather than a class we would have had the team test many more variants on customer segment, revenue models, channels, etc before such an extreme move.)

They quickly came up with a new business model canvas, value proposition and customer segment.

The team hasn't been getting much sleep as they have a week and a half to make meaningful progress. Lets see what they can pull off.

The team hasn't been getting much sleep as they have a week and a half to make meaningful progress. Lets see what they can pull off.

If you can't see the slides above, click here.

Autonomow, the robotic farm weeder had a busy week. In talking to their sales channel (farm equipment dealers) and customers (organic farmers) they realize they have an opportunity to come up with a unique revenue stream. Instead of selling or leasing the equipment they are going to charge for leasing according to weed density in the farm fields. The denser the weeds the higher the rental price per day. Customers and dealers agree that it's a fair deal. Wow.

On the way to the WorldAg Expo their Carrotbot (their research platform they built to gather data for machine vision/machine learning) hit the farm fields near Avenal, California.

The videos of the robot in the field were priceless.

and

.

At the World Ag Expo in Tulare the team encounters its first potential competitor – "Robocrop." (No kidding, I couldn't make this up.)  The Robocrop Precision Guidance System for row crop cultivators uses a camera to shift a hitch so cultivators can cut very close to the plant rows and the Robocrop InRow is a robotic weeder.

The Robocrop Precision Guidance System for row crop cultivators uses a camera to shift a hitch so cultivators can cut very close to the plant rows and the Robocrop InRow is a robotic weeder.

If you can't see the slides above, click here.

The next team was D.C. Veritas, the team building a low cost residential wind turbine wind turbine for cities and utilities.Last week the team pivoted and their wind turbine is now embedded into street and highway light poles.

This week the D.C. Veritas team put it into overdrive and did mass interviews of city officials across the United States. In Palo Alto they talked to the financial and utilities mangers. In Williamstown, West Virginia they spoke to the city planner and a member of the budget committee. In Oklahoma City, Oklahoma it was the city engineer and director of public works. In Amarillo, Texas they had interviews with the head of the bidding process, the Street light manager, Director of Public Works and the utilities engineer.

They quickly got a good handle on the canonical project approval process inside a city.

They combined their understanding of the city approval process with the data they gleaned from customer interviews and developed preliminary archetypes.  These represented the different customers in the approval cycle inside a city.

These represented the different customers in the approval cycle inside a city.

If you can't see the slides above, click here.

Agora Cloud Services

The Agora team, a marketplace for cloud computing, (a relative island of calm in a turbulent sea of other teams) now believed their business was providing a tool set for managing Amazon Web Services cloud compute usage. They believed they could build tools that would save customers 30% of their Amazon bill by provide service matching, capacity planning and usage monitoring & control.  The team was a paragon of steady and relentless progress. They had another 4 interviews with potential customers and consultants.

The team was a paragon of steady and relentless progress. They had another 4 interviews with potential customers and consultants.

If you can't see the slides above, click here.

The Week 7 Lecture: Partners

Our lecture this week covered Partners. Which partners and suppliers leverage your model? Who do you need to rely on?

Our assignment for the teams for next week: What partners will you need? Why do you need them and what are risks? Why will they partner with you? What's the cost of the partnership? What are the benefits for an exclusive partnership? What are the incentives and impediments for the partners?

If you can't see the slides above, click here.

———

The pressure was on. The other five teams were also furiously iterating and pivoting. The JointBuy team (the one that sent out 16,000 emails last week) realized that their low-fidelity website they used to test key concepts needed to get real to attract buyers and sellers in volume. The team pulled a week of all nighters and turned the wireframe prototype into a fully functioning site.

In almost every entrepreneurship class with a team project there's a team that can't figure out how to work together. These are the same problems one sees in real startups (disagreements over who controls the vision, team members not pulling their weight, disillusionment with the team direction, individuals uncomfortable in rapid decision making with less than perfect data, etc.) We give the students an escalation path if they're having interpersonal problems (mentors – to Teaching Assistant – to Professors) to see if they can first worth through the issues without our intervention. While these are always painful we try to teach that they are part of the learning process. Better you encounter the problems in a classroom than after you raised a venture round.

At this point in the class almost all the teams are in a full sprint to the finish line. Next week, the last lecture. Then the final presentations.

Filed under: Business Model versus Business Plan, Lean LaunchPad, Teaching

April 26, 2011

The Apprentice – Entrepreneur Version

We are all apprentices in a craft where no one ever becomes a master

Ernest Hemingway

Silicon Valley is built on simple myths – one of the most pervasive is that all winning startups are founded straight out of school by 20 year olds from Stanford or Harvard. The reality is these are the exceptions not the rule.

Too Old at 30?

I was having coffee with an ex-student at the ranch, watching our bobcat hunt in the front lawn. This student had called and said he had to meet - "I'm having a career crisis," was how he described it. I invited him to make the drive down.

As the story unfolded, it turned out that he just turned 30 and realized that he hadn't founded a company yet. "Everyone now starts a company out of school. All my classmates who were interested in entrepreneurship have started their own companies. I've just been working my way up the ladder." He explained that he had a progressively set of better jobs at companies that were in the "build" phase. These ex-startups had found a repeatable business model and were putting the processes in place to grow into a large company. They had hired operating executives and were starting to scale.

"Well what's wrong with what you've been doing?" I asked. "Oh, I've learned a ton," he replied. "If I had started a company out of school I would have made all kind of stupid mistakes."

Ok I wondered, the problem is what? "So how have your friends done?" We watched as the bobcat patiently stalked a gopher. "Hmm" he said, "A few did ok, but most of them cratered their startups. For the amount of money they made most of them would have been better off working at Walmart."

Slow Learner

I told him he wasn't alone. Early in my career I apprenticed at companies that had recently been startups, hadn't yet gone public and were still innovative. My career was a slow 20-year progression from training instructor to product marketing manager to VP of Marketing. It wasn't until my 7th startup that I was a CEO in a startup I co-founded (and its failure left a crater so deep it had it's own Iridium layer.)

Perhaps the most important part of this non-metoric career trajectory was the mentoring I received. I managed to work for, with, and around people who were truly skilled at what they did. Some of them consciously taught and shared their skills. For others I tried my best to suck out every bit of what they knew and emulate the best of their skills. (At times the learning was painful, but it was never forgotten.)

While the Silicon Valley myth is that all winning startups are founded straight out of school it's just not true.

No Longer a Startup

In raw numbers, most engineers and MBA's aren't founding companies, they're going to work for others who have; Facebook, Google, Zynga, Four Square, Twitter, etc. While the jobs at these companies are still incredibly challenging, and passion and innovation may still pervade their company cultures, the startup risk ("will we run out of money before we find our customers?") is gone. As great as these companies may be, they are no longer startups. (A startup is a temporary organization searching for a repeatable and scalable business model.)

But employees in these ex-startups are getting the best hands-on education for entrepreneurship there is – as apprentices.

Apprentice

As we watched the bobcat make a meal out of the gopher I offered that his career was proceeding just fine. Someday, he'll hear a calling, pull his head out of his computer, look around and say, "I can do this myself."

And the cycle of creative destruction will begin anew.

Lessons Learned

Not all startups are founded by 20-somthings straight out of college

Working for companies that were recently startups is a great way to apprentice

These companies can you give a lifetime of mentorship hard to achieve in other ways

When you're ready you'll hear a calling, and it won't be a job

Filed under: Big Companies versus Startups: Durant versus Sloan, Family/Career

Steve Blank's Blog

- Steve Blank's profile

- 381 followers