Bec Wilson's Blog, page 4

February 1, 2025

Superannuation cap to rise: what it means for your retirement

Feature: Superannuation cap to rise: what it means for your retirement

Course: Kicks off on the 13th Feb

From Bec’s Desk: Back in the hot seat

SMH/TheAge: Retirees reap the rewards after another year of sky-high super returns

Prime Time: Knowing when to retire

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

Now for a message from our terrific sponsors… Viking.

Enjoy Free Flight Offers on 2025-2027 Voyages with Viking’s Explorer Sale

Enjoy Free Flight Offers on 2025-2027 Voyages with Viking’s Explorer SaleSail with Viking to extraordinary shores and for a limited time, enjoy free flight offers with your booking.

Whether by river or ocean, Viking has crafted unforgettable journeys across all seven continents so you can explore more of the world. With 150 unique itineraries ranging from 8 to 170 days in duration, discover immersive experiences and cultural enrichment in every destination you visit.

Book your 2025-2027 cruise by 31 March 2025 and enjoy free flight offers with Viking’s river, ocean or expedition voyages, valued up to AU$2,400 per person.* Plus receive AU$500 shipboard credit with any ocean and expedition booking. (*T&C’s apply)

Super cap to rise: what it means for your retirement

Super cap to rise: what it means for your retirement

The latest CPI figures landed this week, confirming that from 1 July 2025, the transfer balance cap (TBC) will increase from $1.9 million to $2 million. This means Australians can shift more of their super into the tax-free retirement phase.

Super contribution caps are tied to a different benchmark (AWOTE), which hasn’t increased enough to trigger a change. So for now, the limits on Non-Concessional Contributions (NCC) and Concessional Contributions (CC) are staying the same.

If you’re already in retirement phase or approaching it, this increase could give you a better opportunity to maximise tax-free super earnings. The transfer balance cap sets the limit on how much you can transfer into a retirement-phase pension account, where earnings are not subject to tax. Any amount over this cap remains in an accumulation account, where earnings are taxed at 15%.

The increase is triggered by the latest CPI figures released this week, confirming that indexation targets have been met, pushing the cap up to $2 million from July 2025.

How does this affect someone planning for retirement?If you haven’t yet started a retirement-phase pension and you have in excess of $1.9M to consider, the new $2 million cap applies in full after it kicks in in July 2025. If you’ve already used part of your cap, your remaining cap will increase in proportion to the unused amount. For example, if you haven’t yet moved any super into retirement phase, you can now transfer up to $2 million tax-free from July 2025. If you’ve previously used $1.4 million of your cap, your personal cap will increase proportionally, meaning you’ll have more room to transfer additional super into the tax-free phase.

With more of your super eligible for the tax-free retirement phase, your investment earnings won’t be subject to the 15% accumulation tax, helping to stretch your retirement savings further. This is particularly beneficial in a rising market, where compounding tax-free returns can significantly boost long-term income.

What should you do?For those nearing retirement, now is the time to review your super strategy to make the most of the increased cap – if you are someone with close to $2M in super to manage. Checking your super balance to see how much you can transfer, reviewing your fund’s performance to ensure it aligns with your income needs, and speaking to a financial adviser to optimise your transition to retirement phase are all key steps.

While the increase happens automatically, a little planning can help you make the most of the higher limit. If your balance is just over the $1.9 million cap, you might consider keeping contributions in accumulation mode until the change kicks in. Not many will be at this level, but it’s still useful to know. As always, chat with an adviser for personalised advice on how this fits into your strategy.

It’s been a bit of a whirlwind week—half spent freezing in Canada on the most wonderful family break, then flying home, only to be hit with Queensland’s intense heat. In between sweating it out, I’ve been deep in prep mode—getting the course ready, writing newsletters, and pulling together fresh articles. Now that the year is kicking into gear, I can’t wait to share what’s ahead… but for now, you’ll have to watch this space.

I’m well and truly back at my desk, signing books and packing welcome packs like a demon for our biggest-ever cohort of the How to Have an Epic Retirement Flagship Course—hundreds and hundreds are already in! If you haven’t locked in your spot yet and missed the early bird deal, don’t panic—you can still use LASTMINUTE15 for 15% off the full-priced program. But don’t wait too long—I need time to get your welcome pack in the mail! The course kicks off on the 13th February - and runs for six weeks. There’s more information on our website here.

Welcome packs underway — hundreds of signed books and workbooks ready to go out!

Welcome packs underway — hundreds of signed books and workbooks ready to go out!This week’s podcast was an absolute delight to record! If you're thinking about retiring, you won’t want to miss my conversation with Terri Bradford. She brings a fantastic mix of personal experience and professional insight—it’s a must-listen. Be sure to tune in!

Last week, so many of you jumped into the comments on the newsletter, and I was thrilled to see such lively discussions around the topics raised. Now, we’re taking it a step further—some of your questions will be answered in an upcoming podcast! So, keep the comments and questions coming—your input helps me help you.

Lastly, I’m loving getting your questions, ideas and letters. I love hearing from you and being guided by you on what really matters as you approach retirement. Please, send your letters to me simply by pressing reply to this email.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Retirees reap the rewards after another year of sky-high super returns

Retirees reap the rewards after another year of sky-high super returns

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 26th January 2025.

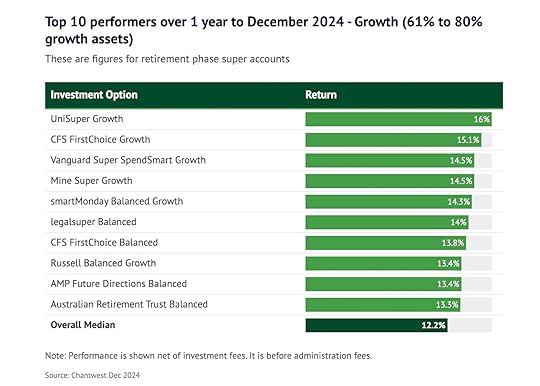

The official data is in, and 2024 was a ripper of a year for super. But the real winners? Retirees in pension-phase funds, who locked in even better returns than their accumulation-phase counterparts.

That’s not surprising – tax-free earnings give them a natural edge. But what’s worth paying attention to is just how much better some funds performed.

This raises a key question: Are you making the most of the upside retirement phase funds are achieving? If you’re already in pension phase, is your fund delivering top-tier returns over the long and the short term?

And if you’re still in accumulation, are you planning your transition into the retirement phase wisely to maximise the benefits? The gap between an average fund and a high-performing one adds up significantly over the long term – and in retirement, every dollar counts.

For most Aussies still in accumulation, growth funds (those with 61-80 per cent in growth assets) delivered a solid 11.4 per cent over the calendar year according to data sourced this week from Chantwest. But if you were in pension phase? Even better – an average return of 12.2 per cent.

That’s a clear win over the S&P/ASX 200’s 11.2 per cent gain (dividends included). Not bad at all, especially when you remember that every cent of those pension-phase returns is tax-free.

Leading the pack in both phases was Unisuper’s Growth Fund, which returned 16 per cent in retirement phase against 14.7 per cent in accumulation, followed closely by CFS FirstChoice at 15.1 per cent in retirement and 13.6 per cent in accumulation; and Mine Super with returns of 14.5 per cent in retirement phase and 13.4 per cent in accumulation.

This article continues — Read on, in The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

Knowing when to retire

Knowing when to retireToday’s episode is all about navigating one of the biggest transitions we face in midlife: knowing when and how to step back from full-time work—or even retire. I’m joined by the inspiring Terri Bradford, former Head of Wealth Management at Morgans Financial, who spent 25 years as a leader in the finance industry. With her extensive expertise, Terri made the bold decision to transition into a flexible, part-time pre-retirement phase—what I like to call her Prime Time. And she joins us today to help everyone better understand how to know when the time is right.

Terri’s story is both relatable and a testament to her deep understanding of this space. She shares how her decision was shaped by health challenges, demanding travel schedules, and a desire to prioritise her relationships and well-being. From her unique vantage point as a financial expert, she offers us actionable insights into recognising the signs it’s time to step back, planning for financial and emotional readiness, and avoiding the pitfalls many people face when making this transition.

But Terri’s journey isn’t just about stepping back—it’s also about staying connected to meaningful work, rediscovering hobbies, and embracing reinvention. I’m quite sure her thoughtful perspective and expert advice will resonate with you — whether you’re actively planning your next phase or just starting to explore what your life might look like in five or ten years and when time might be right for you to explore the ‘R’ word. Let’s dive in!

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online and Big W online too. Or pick up a copy at your local Big W, or QBD stores.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

January 25, 2025

Think you need $1 million+ to retire? These new benchmarks might surprise you

Feature: How much do you really need in savings to retire? New benchmarks

Course: Last call on earlybird spots

From Bec’s Desk: A quick break

SMH/TheAge: Could mandatory annuities solve our retirement woes?

Prime Time: Everything you need to know about weight loss drugs

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

The Autumn Flagship Course now 25% off - last weekend

The Autumn Flagship Course now 25% off - last weekendTime is running out! Our 25% off Earlybird deal on the Autumn Edition of the How to Have an Epic Retirement Flagship Course ends this Sunday.

The program begins on 13th February, with kickoff packs being sent out next week. Don’t miss your chance to secure your spot at this discounted rate—book now before prices go up!

This six-week program is the only high-quality, live, and interactive retirement education experience available, designed to give you the tools, confidence, and clarity to create the retirement you deserve.

Get in now while there’s still time to save! Want to learn more or download our brochure? ➡️ visit the website here

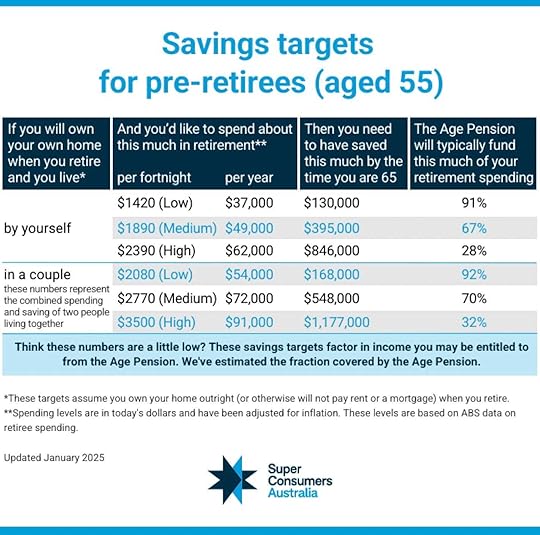

Think you need $1 million to retire? These new benchmarks might surprise you

Think you need $1 million to retire? These new benchmarks might surprise youSome new and different benchmarks to consider.

If there’s one question that keeps pre-retirees awake at night, it’s this: How much is enough to retire? For years, we’ve been bombarded with figures like $1 million or more, making many people feel like they’re running an unwinnable race. In the book, How to Have an Epic Retirement, I explain in detail how to calculate your own number—which is the best way to go about predicting how much you need.

But this week, some benchmarks I don’t normally report on were released: the Super Consumers Australia benchmarks. They’ve created a really helpful table to guide people who are in pre-retirement today, both singles and couples, about how much they might need to retire based on their current fortnightly cost of living expectations. It’s a refreshingly practical way to approach retirement planning because it ties your savings target to how you actually live, instead of throwing generic figures at you and hoping for the best.

The numbers take into account the age pension and help you contemplate what portion of your retirement income will be subsidised by it over time too. Interestingly, these benchmarks come in much lower than the widely used Retirement Standard provided by the Association of Superannuation Funds of Australia (ASFA), making them a valuable tool for evaluating your planning — especially if you’re planning for retirement without ‘a lot’ of money.

Now that you’ve had a look, let’s explore some of the conclusions you might be able to draw, depending on your circumstances.

A modest lifestyle and the age pension can work if you own your own homeLet’s start with the surprising reality: if you’re planning to spend $37,000 per year in retirement (a "low" cost lifestyle in today’s dollars) and you own your home outright, you might only need $130,000 in savings according to these benchmarks. Why? Because the Age Pension could cover up to 91% of your retirement income needs in this situation. The key is to focus before retirement on owning a home you can afford. If you haven’t already taken the time to understand it, take time to learn about ‘the sweet spot’. You can read more about it here.

Retiring as a couple makes a huge difference to the cost of retirementThere’s no doubt about it: retiring as part of a couple makes a big difference to how much you can afford. Let’s say you and your partner want to spend $72,000 a year (a "medium" cost lifestyle today by these benchmarks). You’d need $548,000 in combined savings by age 65 to make it work. Compare that to a single person aiming to spend $49,000 a year, who would need $395,000. The difference between the two really highlights the power of sharing costs like utilities, groceries, and even travel expenses.

The age pension: a significant contributor to a comfortable retirement for manyOne of the most interesting insights from these numbers is just how much the Age Pension is doing the heavy lifting in Australia today. For medium spenders, it’s covering 67% of a single person’s retirement needs and 70% for couples. That’s massive. And more than 62% of retirees today draw on the age pension in some form or another. So you’re expected to consider it in your planning.

What about big-spending retirements?For those dreaming of a higher-spending lifestyle—let’s say $91,000 a year as a couple or above—the target for superannuation savings when you retire at 65 (the average age of retirement in Australia) jumps to $1.17 million or above. That’s a big number for some to contemplate saving, but it’s important to remember that it can come from multiple sources. Many retirees contemplate downsizing, tapping into investments outside super, or even working part-time during the early years of retirement to allow them to build up their superannuation nest egg to higher levels.

If these numbers raise questions — leave them for me in the comments and I’ll answer them in future newsletters.

With the new year still in its early weeks, the second edit for Prime Time (the book) underway, and the first draft of International Epic Retirement off to the publishers, I took a bit of a break — taking off for a quick visit to see my daughter in Canada before the year hits full swing. It’s been a lovely end to the Christmas and New Year holidays and a great reward for finishing my book. Hopefully - you didn’t even notice I was gone as I really can do a lot of what I do while I’m on the road.

This week will see me back on Aussie soil and firmly in the thick of 2025 with the kickoff of the How to Have an Epic Retirement Flagship Course now just two weeks away. I have books to sign and mailbags to pack — lots and lots of mailbags — an exciting prospect as we gear up for the largest Epic Course cohort ever for this program.

I’m also diving into proactive action for the year ahead — preparing speeches, programs and podcasts to make navigating pre-retirement and retirement easier. If you’re organising retirement planning events this year and are looking for a speaker/educator, do keep me in mind. I love educating people on how to have an epic retirement — whether it’s for corporate groups or individual consumers.

And finally, don’t hesitate to reach out with your questions, ideas and letters. I love hearing from you and being guided by you on what really matters as you approach retirement. Please, send your letters to bec@epicretirement.com.au.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Could mandatory annuities solve our retirement woes?

Could mandatory annuities solve our retirement woes?

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 26th January 2025.

The Grattan Institute has dropped a report this week that’s got everyone talking. It tackles a familiar issue: Australians are nervous about spending their retirement savings.

Most retirees live off the income their super generates, leaving the capital untouched to pass on as a legacy. The problem? Many are living far below the standard they could comfortably afford, simply because they’re too cautious to dip into their savings. And the real purpose of superannuation – to fund our retirements is being neglected.

In today’s The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

In today’s The Age, The Sydney Morning Herald, Brisbane Times and WA Today. The report also points out what we’ve all been saying for years: the superannuation system is far too complex, and there’s virtually no support to help people figure out how to navigate retirement once they stop working.

The proposed solution? The Grattan Institute suggests the government step in and start offering lifetime annuities – products that already exist that are designed to provide retirees with a secure, steady income stream for life.

It even floated the idea of making these annuities mandatory, so everyone has some peace of mind in retirement and no one has to worry about running out of money.

It’s a bold suggestion, and for me, it raised some big questions about whether lifetime annuities could be the key to giving Australians the confidence to spend their super and live more comfortably. Whether it’s the shake-up we need or just another idea that will spark a lot of debate, one thing is clear: the way we think about funding our retirement needs to change.

I’m going to set aside the controversial calls of the Grattan Institute for now and instead focus on the big lessons we can take from this report. And there are three...

This article continues — Read on, in The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

Everything you need to know about weight loss drugs

Everything you need to know about weight loss drugsMetabolism, weight loss, and the science behind midlife health with Professor Michael Cowley from Monash University.

It's that time of year again—the gyms are packed, everyone's talking about their new diet, and we’re all vowing to be our best selves in 2025. But let’s face it, for those of us in midlife, weight loss can feel like an uphill battle, no matter how many resolutions we make. So, what’s really going on with our bodies? And could the buzzworthy weight-loss drugs like Ozempic, Mounjaro and Wegovy be the game-changer they’re hyped up to be?

In this episode, I sit down with Professor Michael Cowley, a leading physiologist and weight loss expert from Monash University, to separate the myths from the facts. We dive into what actually happens to your metabolism as you age, how these drugs work, and what they’re really doing to your body. Whether you’re curious about the science, considering your options, or just want a deeper understanding of how to tackle weight gain in midlife, this conversation is a must-listen.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online and Big W online too. Or pick up a copy at your local Big W, or QBD stores.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

January 18, 2025

Wealth versus financial confidence: Which is more important?

In this edition

Feature: Wealth versus Financial Confidence - which is more important?

Course: Earlybird spots still available

From Bec’s Desk: Winding the crank back up

SMH/TheAge: We need to change how we talk about retirement at work

Prime Time: A New Year financial checklist for Prime Timers with Paul Benson

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

Romance never retires: Could you be Australia’s first Golden Bachelor?

Are you ready for a fresh start, the love of your life, or another chance at romance? We’re helping over-60s find love! The Golden Bachelor is coming to Australian TV, reimagining the dating scene for singles in their sixties—and we’re thrilled to be part of the journey. It’s time to celebrate love, connection, and new beginnings—because romance has no age limit!

Warner Bros is on the hunt for inspirational men in their sixties to take centre stage as Australia’s very first Golden Bachelor. If you—or someone you know—are ready to prove that it’s never too late to find your happily-ever-after, this is your moment.

Don’t delay — Apply now or nominate someone below and show the world that life—and love—truly begins at 60.

Wealth versus financial confidence: Which is more important?

Wealth versus financial confidence: Which is more important? When people hear about “having an epic retirement,” a lot of them immediately think it’s all about building wealth. But it’s not. It’s about creating a life you actually want to live—and one you can afford to aspire to.

The truth is, you can have an epic retirement without being rich. It comes down to three things: your attitude, your way of living, and your financial confidence. So, let’s take a closer look at each, because all of them are important when preparing for this next phase of your life.

Your attitude: building curiosity

Retirement isn’t just about coasting. The best retirements come from curiosity and a willingness to keep learning and growing.

Ask yourself: Do I already think I know everything, or am I curious about new things? I believe wholeheartedly that an epic retirement comes from wanting to know more—about the world, about yourself, and about the things that interest you. But to explore that, you need to stop and think: What am I curious about?

It’s something many people don’t give much thought to until midlife, or even until they stop working and wonder, What’s important to me now? The best way to work on it is to start thinking about what you’d like to learn or dive into. Maybe it’s a hobby, a skill, or a topic you’ve always been curious about. Then, take action:

Read books.

Take courses.

Follow experts on YouTube or

Subscribe to newsletters.

Curiosity creates energy, purpose, and momentum—three things that can make retirement epic.

Your way of living: proactive not passive

Do you wait for opportunities to appear in front of you, or do you go looking for them? This is a big question when it comes to how you live your life.

An epic retirement is rarely passive. It comes from actively seeking out what fulfills you. Maybe that’s self-improvement, trying something new, or putting yourself out there in ways you didn’t before. Waiting around rarely leads to satisfaction.

If you’re unsure where to start, try this: Pick one small, meaningful thing you’ve been putting off and just go for it. It might be as simple as joining a local group, taking a fitness class, or committing to one day a week for something you love.

Your financial confidence: knowing what’s possible

Financial confidence isn’t about being wealthy; it’s about knowing how to use what you’ve got to live the life you want.

Here’s the thing: When you know how much you have, what that money can do, and what your limits are, you can stop stressing and start planning. Confidence comes from clarity.

How do you build it?

Get clear on your budget. Know what you spend, where you can save, and what’s realistic for your lifestyle.

Understand your investments. Know how your money is working for you, what kind of return you can expect, and what the risks are if markets underperform.

Learn your pension system. Find out if you’re eligible, and if so, whether it’s for a full pension, part pension, or just a seniors card.

Test it out. Practise living on your retirement budget for a month. You’ll quickly see what works and what needs tweaking.

When you’re clear on your financial situation, you can make decisions that align with your goals—whether that’s travelling, downsizing, or just enjoying the little things that make life special.

Ultimately, an epic retirement isn’t about being rich—it’s about living a live you’re happy living. It’s about having the confidence to know you’re in control, the curiosity to keep growing, and the proactive mindset to build the life you want.

You don’t need millions to retire happily. You just need to start thinking, planning, and taking small steps to prepare. Make it epic!

The Autumn Flagship Course now 25% off - but not for long

The Autumn Flagship Course now 25% off - but not for longOur Autumn Edition of the How to Have an Epic Retirement Flagship Course has had a facelift and an update — and it’s all ready for 2025. And, the program is booking up nicely, giving you plenty of peers to learn alongside. There’s a 25% early bird discount for a few days more - so make sure you get your bookings in.

Want to learn more or download our brochure? ➡️ visit the website here

The year is underway, the next course is selling (like 🥞) and my book Prime Time is now in the second round of editing. Rather exciting start to the year eh. I’m really enjoying being back amongst it.

This year I’ve vowed to do more on social — making regular little educational videos for Facebook and Instagram. So if you don’t follow me already — please do so my efforts are worthwhile 😆.

Facebook: facebook.com/becwilsonepic

Instagram: instagram.com/epicretirement

It’s been simply a week of winding the crank back up to full pace.

The Epic Retirement Club is back on Facebook after a couple of weeks off (yes you can pause a giant Facebook group). It’s full of vigor, with some new international moderators joining the team (welcome guys).

I’m setting my intentions into action this year. I promised myself that after the holidays I would find a new team/group sport to get involved in. Something I could learn and build skills in. Top on my shortlist is pickleball - so I’ve found a club and am headed off to try it out in two weeks. I’ll report back. What are you promising yourself you’re going to try this year?

Tell me in the comments.

Now - don’t forget to send me your letters - I need ideas, topics and feedback all the time! I love them. Please, send them to bec@epicretirement.com.au.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

We need to change how we talk about retirement at work

We need to change how we talk about retirement at workExtract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 19th January 2025.

For some, retirement is a milestone to celebrate openly with their workplace peers – a confidently shared countdown bubbling over with ideas for travel, family time, or long-awaited hobbies. For others, it’s a secret closely guarded until the very last moment.

Why is retirement such a taboo topic in so many workplaces? And, more importantly, what are the financial and professional consequences of staying silent – for you and your boss?

In my Facebook Group, the Epic Retirement Club, members often ask to post anonymously, afraid their colleagues might uncover their plans or even associate them with the “retirement genre,” like it’s a dirty word.

This hesitancy is rooted in fear – of being sidelined or treated differently before they’re ready, and fear that their workplace doesn’t have their back at all.

With only 31 per cent of Australians retiring by choice in 2024, it’s clear many feel they have no control over when or how they leave work unless they stay silent. Staying silent, however, often makes things worse and it certainly perpetuates the cycle.

Why workplaces should evolveWorkplaces would be more appealing if they tried harder to combat ageism and created cultures where workers feel they can discuss their future.

Workplaces are evolving rapidly, and the signs are clear: AI and automation are driving significant changes across industries. Entire roles are being redefined or phased out in some sectors, while others are grappling with labour shortages that hinder growth.

At the same time, the concept of retirement is shifting. Gone are the days when employees worked until December 20, clocked off, and never returned to the workforce.

Increasingly, research shows that a gradual transition – working less overtime or exploring part-time phases and taking sabbaticals before full retirement – can provide significant benefits for both employees and employers.

Many other older workers also choose to access their super while continuing to work, maintaining their engagement with the workforce. Thanks to remarkable improvements in health spans, so many people have both the energy and expertise to contribute meaningfully, albeit in new and different ways.

Employers who ignore these trends really do risk losing invaluable experience and missing out on effective succession planning opportunities that might have helped them better embed responsible work practices in younger employees.

This article continues — Read on, in The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

A New Year financial checklist for Prime Timers

A New Year financial checklist for Prime TimersWe're getting our financial house in order for 2025 with Financial Planner and Columnist, Paul Benson. Learn the things he does and teaches people to do every new year.

Welcome to 2025, Prime Timers! It’s our first show back. And we’re kicking off the year the way we plan to continue—by getting our financial house in order. This week, I’m thrilled to welcome back one of our favourite guests, Financial Planner Paul Benson from Guidance Financial Services. Paul’s here to guide us through a New Year’s checklist of must-do financial actions for midlifers.

We’re diving into the steps we should be taking right now to set ourselves up for a smooth and successful year ahead. Paul’s bringing us five key priorities, each packed with practical advice and a few timeless lessons that will make navigating your finances in 2025 that little bit easier.

Let’s get into it!

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online and Big W online too. Or pick up a copy at your local Big W, or QBD stores.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

January 11, 2025

The holidays are over: let’s get serious about 2025

Feature: The holidays are over: let’s get serious about 2025

From Bec’s Desk: A quick update

SMH/TheAge: How to retire early

Prime Time: Our top six podcasts by listens… have a listen to these.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

The Autumn Flagship Course now 25% off - but not for long

The Autumn Flagship Course now 25% off - but not for longOur Autumn Edition of the How to Have an Epic Retirement Flagship Course has had a facelift and an update — and it’s all ready for 2025. And, the program is booking up nicely, giving you plenty of peers to learn alongside. There’s a 25% early bird discount for a few days more - so make sure you get your bookings in.

Want to learn more or download our brochure? ➡️ visit the website here

Here’s a smart idea - Why not ask your boss to pay for it?! Quite a few of our recent attendees had asked their companies to support them doing the course. And increasingly, I’m getting asked about whether companies can offer it to their staff as a workplace benefit. Yes - they can! So can super funds!

And, if you’re part of a couple — you can do it together on the one ticket, simply by purchasing an extra workbook during the sign up.

Here’s what some of the nearly 1000 people who’ve completed the course in 2024 already say about it.

I would recommend the course to anyone who has ever wondered whether they really know what a truly fulfilling retirement looks like, or could be. Thanks to what I learned over the six weeks I'm now looking forward to my own retirement with confidence and a sense of excitement that simply wasn't there pre-course.” -- Eve

Great course. Great content. I found it very helpful to think about the various facets of retirement that have been raised.” -- Tom

So glad I took the plunge to do this course. I has given me greater confidence about how I would like to approach my own epic retirement. The content was practical and very informative. I will be recommending to my friends." -- Jack

This course has changed the way I think about the next twenty years. I am so excited by the potential of what I want to achieve in the future - as if I was a twenty-year-old again. Thank you Bec - your course has provided me with so much to think about and the resources to find all the answers to my queries. What a difference your course has made to my confidence and future happiness." -- Gail

There’s lots more testimonials in the brochure.

The holidays are over: let’s get serious about 2025

The holidays are over: let’s get serious about 2025

Let’s get some rubber on the road for 2025. Source: Canva

Let’s get some rubber on the road for 2025. Source: CanvaThe holidays are winding down, and for most of us, Monday marks the return to normal life. But instead of just reflecting on New Year’s resolutions, I want to challenge you to take practical steps to improve your money game this year.

This is when intentions meet reality. Let’s make 2025 the year we stop flying blind with our finances and start taking meaningful action toward building the life we want.

Set clear goals for your prime timeIf you’re in your 40s, 50s, or 60s, this is the time to focus on achievable financial goals that prepare you for your prime time and retirement years. Retirement isn’t about giving up work completely—it’s about shifting to a life where passive income takes the lead, and you have more control over how you spend your time. Setting incremental goals can help you boost your financial confidence and create a solid foundation for the years ahead.

Step up your budgeting gameIf you don’t have an up-to-date budget, now’s the time to create one. Flying blind in today’s high-inflation world is risky, so revisit your spending habits and build a 2025 cost-of-living budget that reflects current realities. Be intentional with your spending—ditch what’s unnecessary, and redirect those savings toward meaningful goals like paying off your mortgage, making extra super contributions, or growing your investment portfolio.

Audit your subscriptions and direct debitsThe start of the year is perfect for a deep dive into recurring expenses. Look at your credit card and bank statements—are you paying for services you no longer use or can bundle more effectively? Last week, I found three unnecessary subscriptions and consolidated others into better plans, saving us hundreds annually. It’s worth the effort, and those savings can fund your future goals.

Get proactive with investmentsYour superannuation and other investments are key to your financial future. Log into your accounts, monitor your returns, and check the fees you’re paying. Are you taking the right level of risk to meet your goals? Understand the power of compounding—it’s the gift that keeps on giving if you manage it well.

Learn how super worksIf you’re in your 40s, 50s, or 60s, superannuation is a cornerstone of your financial future. Use its tax advantages wisely: contribute extra, understand investment strategies, and maximise your returns and get a grip on the retirement phase of super. The system rewards informed decision-makers, so make 2025 the year you get smart about super.

Once you’ve nailed the foundations, treat yourself! Set lifestyle goals that fit your budget and give you something to look forward to. It’s fine to aim for the fun stuff—but only after you’ve built the financial base to support it. Let’s make 2025 the year we take charge and build a life we love.

We’re baack! Wasn’t that a lovely break! This week marks the return of my newspaper columns, the Prime Time podcast and this newsletter. I hope you enjoyed the time off as much as I did.

Over the Christmas break I was still pretty busy on other things that needed to get done. I finished the first edit of Prime Time (the book), so the publisher now has a fully edited manuscript headed into layout design. It’s a great experience the second time around. They hardly chopped any words in the edit either.

We’ve been busy updating the course with all the latest stats and figures, giving it a fresh facelift to kick off the new year in style - with even more functionality. And while we were at it, we gave the whole Epic brand a little glow-up too! This is because we’re building up the Epic Retirement Institute this year as a serious provider of retirement education. Watch this space.

And then it was all about family time. And that was magic.

I’m back at my desk - and the epic retirement course is booking fast. I can’t wait to get your letters when you’re back too. I love them. Please, send them to bec@epicretirement.com.au. or, so I know you’re out there - leave me a comment!

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

So you want to retire early? Here’s how to do it.

So you want to retire early? Here’s how to do it.Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 12th Jan 2025.

As we ease back into work after a few indulgent weeks off, it’s natural for the thought to creep in: could I retire early?

Early retirement – or even just stepping away from work you don’t enjoy – is one of those big, aspirational goals that crosses everyone’s mind at some point. The reasons are as varied as they are compelling.

For some, it’s the grind of a stressful job that leaves them feeling burnt out; for others, it’s a growing sense of boredom and a longing for life beyond the daily routine. Then there are those who simply crave more time with their family or a chance to pursue passions put on hold.

Whatever the motivation, the idea of stepping back early, whether into part-time work or full retirement, before traditional retirement age has a strong pull for many in their 50s – especially at this time of year.

But let’s get real: early retirement takes serious planning. It’s not just about leaving work behind – it’s about building a life where financial security and flexibility go hand in hand.

And it comes with its own set of challenges, like funding more years in retirement, having less time to grow your savings through contributions and compounding, and navigating the reality that you can’t access your super until you’re 60 or later.

But if the idea of retiring early has taken hold and won’t let go, it’s time to talk about how to make it happen – because successful planning follows a clear and deliberate process.

How can you get yourself retirement ready? Read on, in The Age, The Sydney Morning Herald, Brisbane Times and WA Today.

Top six podcasts for 2024

Top six podcasts for 2024Our first podcast for 2025 comes out on Thursday. But in the meantime I want to highlight some of our most popular episodes so far. Here’s a shortlist you can check out quickly.

The 7 things you need to know before retiring

Exercise for longevity: How muscle mass improves your lifespan

The BIG retirement mistakes people make and how to avoid them

How to beat relevance deprivation syndrome with Jim Kilkenny

Why grandparents are the glue for families today

Debunking the myths of Hormone Replacement Therapy (HRT) with Dr Ginni Mansberg

HAVE A WANDER THROUGH ALL THE EPISODES OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online and Big W online too. Or pick up a copy at your local Big W, or QBD stores - a reprint has just arrived in stores.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

December 30, 2024

Setting some epic goals for 2025

I’m on holidays—hopefully, you are too! But I couldn’t resist interrupting the break to bring you some guilt-free motivation for the new year. Let’s face it, the New Year often comes with the pressure to reflect on the year gone by, inspired (or maybe daunted) by those beautifully curated Instagram posts. If you’re not one of those people, you’re in good company (I’m not either - just authentic me).

Instead of adding to the noise, I want to make this refreshingly simple—no fluff, no woowoo. Just a practical, guilt-free way to use this natural window for goal setting and set yourself up for an epic 2025.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

Here’s a snippet from my upcoming book, Prime Time, on the science and power of goal setting:

“Scientifically, a goal is recognised as a desired outcome that wouldn’t happen without some form of intervention. IThat is, it’s a detour from the path of least resistance in our lives. That makes them pretty important if we’re trying to be active about what happens in our lives. But when you really dig down, goals are even more important than that.

When we set a goal, we’re really saying to ourselves that we want to put the effort in to achieve something that hasn’t happened yet and isn’t likely to happen on its own.”

So as you ease into 2025, think about what outcomes you want to nudge into existence. Keep it practical, make it meaningful, and let’s make this year one to remember.

Reflecting and setting some epic goalsAs 2024 winds down, take a moment to look back—whether it’s been a year of exciting wins or a time of learning and growth.

2025 is your opportunity to build on what worked, pivot from what didn’t, and focus on creating a year that’s bigger, better, and perfectly aligned with the life you want.

The key? Be your own driver. No one else is steering the wheel of your life—this is your journey, your choices, and your opportunity to shape the year you truly want. Own what comes next and make it nothing short of epic.

How can you make that happen?Start by asking yourself: Where do I want to be this time next year? Picture it. Imagine the life, the lifestyle, and the warmth that surrounds you. Get clear on that vision—whether it’s metaphorical or literal—and then work backwards. Be realistic and optimistic at the same time.

What choices will you need to make differently to bring that vision to life?

Maybe it’s setting the wheels in motion for retirement.

Maybe it’s leaning into your Prime Time and continuing to work on projects you’re passionate about.

Maybe it’s choosing to spend time with loved ones to build stronger bonds.

Or maybe it’s getting your financial gears in order, shifting your investments, and ending 2025 feeling more secure and in control.

They’re your goals, and if you don’t set them, you can’t aim for them. So take the time to dream big, map it out, and make those goals as epic as you are. Here’s to a brilliant new year ahead—let’s make it count.

Here’s a simple little six question quiz to get you thinking about the year ahead.

I’ve built you a simple quiz to help with your goal setting. Take a moment to reflect and answer these questions honestly—there’s no right or wrong answers, just a chance to get clear on what matters to you in 2025. It’s just 7 questions — designed to get you thinking about what’s important to you.

Take the 2025 goal setting quiz

I wish you a truly happy New Year—here’s to making 2025 nothing short of epic together! Got a goal you want to share? Tell me in the comments here…

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Learn how to have an epic retirement in just six weeks

Learn how to have an epic retirement in just six weeksWith the new year just around the corner, it’s the perfect time to set the wheels in motion for an epic 2025. 🚀

Here’s your friendly reminder: the Autumn Edition of the How to Have an Epic Retirement Flagship Course kicks off on 13th February 2025. 🎉

Are you ready to make big progress in the year ahead? Let’s do this together! 💡

The 25% Earlybird Discount is still available but not for much longer as the course is booking up. Don’t miss out on locking in the best price we offer for this course—just $359 (down from $479).

And here’s the best part: couples can join in together by simply purchasing an additional workbook at sign-up. (I want everyone to learn and benefit from this stuff!)

Ready to start planning your epic retirement? Then don't delay as the discount won't last. ➡️ Book your place at the earlybird discount now

Want to learn more or download our course brochure? ➡️ visit the website here

Here’s what some of the nearly 1000 people who’ve completed the course in 2024 say about it.

“Completing this course was very useful to help guide me (and my partner) through discussions we had perhaps skirted around before and focused me on topics I was avoiding. Helped us to be a LOT more prepared when going to a financial advisor for personal advice” Lyn

“The course covered so many aspects I have wondered about, providing clarity and very useful information, particularly in relation to the financial and future aged care aspects. However I have also greatly benefited from becoming aware of the more holistic aspects including happiness and fulfillment, with the checklists and ideas broadening my outlook, as well as gaining insight into the transitional period of adjustment, which I hadn't previously considered. I would recommend this course to my family and friends and anyone who is contemplating retirement but unsure about the process or desired outcome.” Tracey

So glad I took the plunge to do this course. I has given me greater confidence about how I would like to approach my own epic retirement. The content was practical and very informative. I will be recommending to my friends." -- Jack

This course has changed the way I think about the next twenty years. I am so excited by the potential of what I want to achieve in the future - as if I was a twenty-year-old again. Thank you Bec - your course has provided me with so much to think about and the resources to find all the answers to my queries. What a difference your course has made to my confidence and future happiness." -- Gail

There’s lots more testimonials in the brochure.

What's included in the course?It's packed with value for the $359 earlybird price!

🌴 There's 14 modules/8.5 hours of on-demand education videos, dripped by week (yes! you can watch them in your own time)

🌴 Live Q&As with retirement experts each week (6 events over 6 weeks where you ask the questions)

🌴 A practical, professionally published 150 page printed workbook - posted to you (also provided in digital)

🌴 An engaging online community for course participants to interact and do challenges

🌴 Quizzes to help deepen your knowledge

🌴 And a signed copy of How to Have an Epic Retirement - the book - posted to you

Complete the program alongside a whole cohort approaching retirement. Learn how to make your retirement truly epic and have fun doing it.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

December 21, 2024

Five game-changing tips for everyone retiring this year

Course: The next program is kicking off on the 13th February 2025

Feature: Five game-changing tips for everyone retiring this year

From Bec’s Desk: It’s the last Epic Retirement newsletter of 2024

Prime Time: Bec’s mailbag: Your questions answered

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

6 weeks of epic retirement education AND six live Q&As with the retirement industry's best

6 weeks of epic retirement education AND six live Q&As with the retirement industry's bestThe How to Have an Epic Retirement Flagship Course for February 2025 is booking up. And the reason why I think that is is that it is more than just a course.

I want you to grasp the big lessons, but I also want you to develop your curiosity and confidence, learning about this stage from other experts too.

So I've asked a really respected selection of retirement industry experts along for one live Q&A per week during the six weeks of the course. This is in addition to the 14 module course program + 150 page workbook, a signed copy of How to Have an Epic Retirment and so much more (see below).

There’s a 25% early bird discount for a limited time, but it won’t last.

The course kicks off on the 13th February 2025.

Want to learn more or download our NEW brochure? ➡️ visit the website here

Here’s what some of the 650+ people who’ve completed the course in 2024 already say about it.

So glad I took the plunge to do this course. I has given me greater confidence about how I would like to approach my own epic retirement. The content was practical and very informative. I will be recommending to my friends." -- Jack

This course has changed the way I think about the next twenty years. I am so excited by the potential of what I want to achieve in the future - as if I was a twenty-year-old again. Thank you Bec - your course has provided me with so much to think about and the resources to find all the answers to my queries. What a difference your course has made to my confidence and future happiness." -- Gail

There’s lots more testimonials in the brochure.

A couple looks into their Epic Retirement, wondering what comes next: Source: Dall-eFive game-changing tips for everyone retiring this year

A couple looks into their Epic Retirement, wondering what comes next: Source: Dall-eFive game-changing tips for everyone retiring this yearI’ve got some food for thought for everyone stepping into their Prime Time or Epic Retirement right now.

To everyone retiring this month and next – congratulations!

What an incredible week it has been! Every few minutes in The Epic Retirement Club, someone has shared their big news: “I just finished my last shift!” “I’ve retired after 39 years as a teacher!” “I can’t believe it—I’ve just retired!”

From all corners of the globe, these announcements have been flooding our Facebook group, each one brimming with excitement and emotion. It’s enough to send chills down your spine and maybe even bring a little tear to your eye—the pure joy and anticipation in every single post is just infectious.

This week, to go with my Christmas message, I’ve got some food for thought for everyone stepping into their Prime Time or Epic Retirement right now. You’ve truly inspired me with your energy and enthusiasm. In fact, I’ve decided to officially name this time of year “Epic Retirement Week”—the week before Christmas break-up—every single year from now on.

As you head into this new phase, here are five little pieces of food-for-thought to carry with you into Christmas and beyond:

1. Time is now your currency – spend it wiselyFor years, your life has been shaped by work obligations, family commitments, and the need to earn money. But now, as you sail into your Epic Retirement or Prime Time, it’s time to realise that time is your most valuable currency.

Spend it intentionally, doing things that feel meaningful to you—especially in these early days. A great way to start is by making a simple list:

Things that will give you a return on your time (joy, purpose, connection).

Things that won’t (the ones you’re ready to let go of).

Some ideas:

Make a weekly date with family members you love but haven’t had enough time for.

Dive into a hobby you’ve been putting off—or rekindle an old one.

Create a morning routine that brings you joy instead of the rush out the door.

2. Retirement isn’t a destination – it’s just the beginningMany of you have been aiming for retirement like it’s the finish line. But here’s the truth: getting here is just the start. The good bits begin now—but only if you make them happen.

Think of this as the second (or third) act of your life. It’s a time to be curious about what’s possible:

What skills do you want to build or use in this phase?

How can you fill your days with things that light you up—like volunteering, joining a social group, or exploring a part-time job?

If it’s all too overwhelming — just pick one or two things to try on for size.

3. Start with a ‘bridge’ project to ease the transitionIt’s natural to want a bit of downtime after years of work. But I challenge you to find something to jumpstart your retirement—a bridge project to help you transition.

Having something to focus on, whether it’s physical or mental, can reduce that feeling of irrelevance some people experience when they suddenly stop working (or recognise they have three months later). It gives you a sense of connection and purpose while you adjust to this new chapter and find the next things.

Ideas for a bridge project:

Tackle a home renovation or decluttering project.

Research and write your family history.

Start learning a new language and plan a trip to use it.

4. Let spending reflect your valuesYes, financial planning matters. But retirement isn’t just about money—it’s about living intentionally.

Take a moment to reflect on your spending habits. Are they aligned with what you truly care about? Use this time to reset your financial goals to match your values:

Invest in experiences over things—your future self will thank you for the memories.

Prioritise your health—it’s your greatest asset now.

Enjoy life now, while still saving wisely for later.

5. Give yourself grace – change can be messyRetirement can feel a bit like stepping off a treadmill that’s been running for decades. It might be exhilarating, disorienting, or even unsettling. And that’s okay.

Give yourself time to find your rhythm. Embrace the mix of feelings—excitement, discomfort, even sadness—and allow them to flow through you. This is a season of self-discovery, so be patient with yourself.

Two big things to keep in mind:

You may need a few months just to relax and decompress.

You might try new things and realise they’re not for you—and that’s perfectly fine.

Lean into this phase with curiosity, not judgement. The beauty of your Prime Time and your Epic Retirement is that it’s yours to shape, one day at a time — because hopefully you have the financial confidence to not be led by the need to work anymore.

Congratulations again—your Epic Retirement or Prime Time is here. Here’s to making this Christmas and the year ahead truly unforgettable!

It’s the last Epic Retirement newsletter of 2024

What a year it has been! I have to start by saying thankyou to each and every one of you.

I have so much to be grateful for, excited about, and proud of as we wrap up 2024. But mostly, I’m just incredibly thrilled with the amazing interest in How to Have an Epic Retirement and, more importantly, in seeing so many of you building your own epic retirements so proudly and keenly.

My book ends 2024 back in the Amazon Top 200, sold out across Australia in major retail bookstores, with another reprint already underway and plenty of orders in the queue. It’s also the #3 bestselling self-help book by an Australian author in 2024—an absolute dream come true!

The Epic Retirement Flagship Course now boasts nearly 1,000 alumni, and the reviews? Pretty much all five stars. That’s what I call an incredible first year!

The Epic Retirement Club on Facebook has grown to nearly 270,000 members worldwide and is growing like topsy. I have to give a HUGE thanks to our incredible moderation team for keeping everything running smoothly.

The Prime Time podcast has surpassed 360,000 downloads—and it’s only a year old and released weekly! A massive thank you to Nine podcasts for letting me loose. And to all our listeners for being such passionate supporters and recommenders of the show.

And to everyone who spreads the word about How to Have an Epic Retirement and everything I’m working on—thank you from the bottom of my heart.

Prime Time—my next book—came back from the editor yesterday (and they didn’t change much!). I’ll be spending my holidays polishing the manuscript into its final shape, and I couldn’t be more excited to share it with you in 2025 as well as bring to life the international editions of How to Have an Epic Retirement which are coming to live now.

Holiday closure updates

The Epic Retirement Club (our huge Facebook group) will be taking a break from 23rd December to 7th January.

My newsletters will pause during this time as well - but not for too long — I can’t stay away.

My regular columns in The Age and The Sydney Morning Herald will return on 12th January.

The Prime Time podcast finished up this week and will resume on 16th January.

In the meantime, the Epic Retirement Flagship Course is on sale with a 25% off Earlybird Deal, but time is ticking! If you want to lock in the best price, now’s the time to book your place—it’ll get a bit more expensive as we get closer to kickoff.

And don’t forget to send me your letters! I love them. Please, send them to bec@epicretirement.com.au.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Bec’s mail bag: your questions answered

Bec’s mail bag: your questions answered

Hello, Primetimers! It’s the final episode of Prime Time for 2024, and we're celebrating YOU—our amazing community—with stories, questions, and reflections that define what Prime Time is all about. Join Bec and producer Gen Rule for a heartwarming finale before we return in 2025 with more exciting guests and topics to inspire your Prime Time journey.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online - they are still doing next day shipping in most capital cities - so you might get a copy before Christmas. It’s the only place I know there’s definitely stock available.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

December 14, 2024

So you want to plan for an early retirement? Here’s the process

Course: Selling spots like hotcakes 🥞

Feature: So you want to plan for an early retirement? Here’s the process

From Bec’s Desk: Watching a giant wave of retirement crash on the Epic Retirement community

Prime Time: Why 'grandparents are the glitter glue' for families across Australia

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

The Autumn Flagship Course is now on sale

The Autumn Flagship Course is now on saleOur next course - The Autumn Edition - of the How to Have an Epic Retirement Flagship Course is selling like hotcakes. Its 25% off right now for Earlybirds but it won’t be at this price for long.

This is the first course for 2025 — and it kicks off on the 13th February. I can’t wait.

Want to learn more or download our NEW brochure? ➡️ Visit the website here to download a brochure ➡️ Book your place.

If you’re wondering whether it’s good - read the feedback from our Alumni.

"Excellent course! Recommended to me by a friend for which I am very grateful. I have already embarked on my retirement journey so only regret is that I didn't know about this sooner. However the content of the course was very comprehensive so there is still so much to think about and to work through. I am sure that it will help me to have an 'epic retirement'. :)" Lyn

"Completing this course was very useful to help guide me (and partner) through discussions we had perhaps skirted around before and focused me on topics I was avoiding. Helped us to be a LOT more prepared when going to a financial advisor for personal advice" Monica

This course has changed the way I think about the next twenty years. I am so excited by the potential of what I want to achieve in the future - as if I was a twenty-year-old again. Thank you Bec - your course has provided me with so much to think about and the resources to find all the answers to my queries. What a difference your course has made to my confidence and future happiness." -- Gail

That’s just the beginning! Download the brochure available on the website for more feedback and inspiration.

So you want to plan for an early retirement? Here’s the process

So you want to plan for an early retirement? Here’s the processEarly retirement is one of those big life goals that gets people dreaming.

Whether you’re burnt out because it’s the end of the year in a stressful job, or you simply have a desire to spend more time with family, or maybe you’ve got a vision of life outside the grind – in your Prime Time years – which so many in their 50s are starting to feel. Frankly, the idea of retiring early or shifting gears to an easier life can be exciting—but it needs some serious planning.

Early retirement comes with unique challenges. You’re dealing with more years to fund yourself through, less time to build up savings, and different rules about when you can access your super.

So, let’s dive into the key areas to consider when you want to think about making early retirement a reality.

1. Think about your official retirement firstRetiring early doesn’t mean you can skip the basics of long-term retirement planning. If anything, you need to think even more carefully about ensuring your money lasts—especially when you have decades ahead to fund your living and lifestyle ambitions through.

Many people who want to retire early get excessively focussed on building savings outside of super, but stop and think about it – that would have them neglecting the enormous tax advantages that super offers (and boy oh boy they’re good!). Here’s why that’s a mistake in my opinion.

We pay less tax when we contribute to super and we also pay less tax when our super generates income and returns. That means the earlier you get money into super and compounding for you, leveraging those lower tax rates, the bigger it will grow.

And, once we’ve retired officially, by reaching 60 and giving up work; or by accessing our super unconditionally at 65, we can withdraw our super tax free. This makes it one of the most efficient vehicles for funding retirement.

Your goal should be to build your super early and let time and compounding do their thing. Maximise concessional contributions (like salary sacrifice) and non-concessional contributions while you’re earning. Once you know your long-term retirement is covered, you can shift focus to what you’ll need to fill the gap in your Prime Time years – the years before you can access super and want flexibility.

2. Figure out how you’ll fill your gap - the years before you can get your superHere’s the tricky part about early retirement: unless you’re past preservation age and meet the conditions of release, your super is off-limits. That means you need a plan to fund your ‘early retirement’ (or I prefer the term Prime Time) flexibility until you can access it.

You can fill the gap in two sensible ways – you can build a pot of money you can spend down; or you can build a sustainable investment portfolio that can provide you with a steady income.

Let’s consider both.

Build a pot of fundsIf your plan is to head into a more flexible way of life (your Prime Time) at 55 you might want to focus on saving the amount you want to have in income, for the years you want to have it. So, if you need $70,000 per year, and you want to go 5 years early, then you’ll need 5 times $70,000. And it makes good sense to invest this conservatively, unless you’re ok with having to change your plans if the markets fall apart.

Build an investment portfolioThe other option is to build up an investment portfolio that’s designed to deliver a steady income through dividends and other distributions that won’t run dry before you hit preservation age of 60. This is a strategy that will need some careful planning - and maybe benefit from some advice to ensure you’re invested in the right kinds of investments for your goals.

And in either case, you’re going to need to be tax-savvy. Any income you earn outside super will be taxable, so minimising capital gains tax and managing your effective tax rate is crucial.

Short-term savings to spend down: If you’re retiring, say, five years before preservation age, you might focus on building a pot of money outside super that you plan to spend down completely. For example, if you need $50,000 a year, you’ll need $250,000 in accessible savings. To avoid market volatility, it’s a good idea to keep these funds in cash or low-risk investments.

A sustainable investment portfolio: Alternatively, you can build a portfolio designed to deliver steady income (think dividends or distributions) or withdrawals that won’t run out before you hit preservation age. This strategy requires careful planning to ensure your withdrawals align with your long-term needs.

Both approaches require you to think about tax. Income from investments outside super is taxable, so keeping your effective tax rate in mind is crucial.

3. Demolish your debtsIf you’re serious about an early retirement, one of the most powerful things you can do is eliminate big, recurring expenses—starting with your mortgage.

Housing is usually the single biggest cost for Australians. Paying off your home before retirement doesn’t just give you peace of mind; it slashes the amount you need to fund your lifestyle. Without a mortgage, you need far less income, and every dollar you save on repayments is effectively tax-free and can be deployed towards savings or lifestyle.

For example, the average Australian mortgage costs around $3,900 a month. To cover this in early retirement, you’d need nearly $1.2 million in investments at a 4% withdrawal rate. Compare that to a mortgage-free lifestyle, and your income needs drop significantly.

It’s not just about the mortgage, either. Look at your broader expenses:

Can you downsize your home to free up equity?

Are there other big-ticket costs you can clear before you retire?

Reducing your expenses doesn’t mean giving up the good stuff; it’s about clearing the big hurdles so you can spend more on what you truly value.

4. Make flexibility your focusEarly retirement – or I still prefer to think about it as entering a period of life with greater choice and flexibility, our Prime Time – isn’t just about quitting your job—it’s about creating options. Whether it’s stepping back to part-time work, changing careers, or focusing on hobbies and passions, financial independence is all about choice.

The key to flexibility is building a solid foundation:

A well-funded super for long-term security.

A pot of funds that lets you live well before you reach preservation age.

Minimal debt and streamlined expenses for peace of mind.

When you focus on these three things, you’re not just planning for early retirement—you’re setting yourself up for a life that’s rich in freedom, purpose, and opportunity. You’re setting yourself up to have choices.

The first giant wave of Epic retirements has arrived! This year, The Epic Retirement Club has truly come alive as tens of thousands of people in our community use the year end to call ‘time’ on their retirement, and the excitement is electric. Our community is buzzing this week with so many of our members who joined throughout the year sharing their retirement photos, celebrating their workplace farewells, and wondering with anticipation about what lies ahead. We’ve welcomed so many new members too — as you spread the word about your epic retirements.

If you look around your own community, you might notice the same trend—so many people taking the leap into retirement in the lead-up to Christmas. It’s a time of reflection, celebration, and new beginnings this year, and it’s clear that the choice to retire has never felt more possible—or more exhilarating.

I’m so excited for each and every one of you! And if you’re still in the planning phase, I hope you watch with joy and inspiration, knowing that one day, this could be you stepping into your own Epic Retirement. If you want a bird-eye view of the excitement - simply pop into the Epic Retirement Club and say hi.

—

If you’re winding down for the Christmas season, I want to wish you a very Merry Christmas and a Happy New Year! I’ll still be around and will send out a few newsletters over the last days of December and the month of January. But, the podcast will take a short hiatus after this week’s episode and return mid-January. In the meantime, it’s a great chance to dive into the back catalogue if you haven’t already—most episodes are evergreen, packed with valuable lessons we can all learn from. This week’s with Dr Michael Carr-Gregg will put a smile on your face — it did mine.

The newspaper articles are off until the 12th January; the Epic Retirement Club on Facebook is going to go on pause from the 23rd Dec - 7th Jan too.

I’m going to spend Christmas and the summery weeks between my home and the beach, and in between swims and meals I’ll be working on the edit review of Prime Time and finishing the manuscript for the International edition of How to Have an Epic Retirement. It’s peaceful work and it’s interesting trying to piece together the ways people can best understand the choices they have. Then, once I hit the editing deadlines I’m taking a break.

To everyone who has been part of the Epic Retirement and Prime Time community this year, a heartfelt thank you. Your readership, support, and enthusiasm mean the world to me, and I feel truly grateful.

There are so many people to thank for making this year truly Epic! A special shoutout to the incredible community moderators of The Epic Retirement Club on Facebook—David, Stephen, Yvonne, Jillian, Robert, William, and Marcaus—you’re absolute legends! To Genevieve and Joe and the team at Nine Podcasts and the many wonderful guests we’ve had, you rock! To my editor at The Age and The Sydney Morning Herald apologies for so many words - what fun we’ve had! And my publisher Sophie - magnificent. To my course team - Nina, Alex and Brooke - amazing; and our expert guests Mark, Andrew, David, Jen, Fiona, Sue and Rowena - thankyou you’re superb! To our sponsors and supporters a huge thankyou - we couldn’t do it without you. And, of course, a huge thank you to everyone who shared the Epic message and helped others find their way to this community. You’ve made it all the more special!

I’m lucky enough to do what I love because you enjoy and benefit from it—and I never take for granted the importance of keeping it useful, entertaining, and interesting for you.

So, as summer in Australia rolls in, take the time to soak it all up. Talk to your loved ones about your dreams, goals, and hopes for the future. Then, start turning those conversations into plans for 2025—because there’s no better time to bring your vision to life! And if this year marks your retirement - enjoy the transition and embrace it for what it is — change can be both exciting and terrifying all at once.

I’m here to help. Don’t hesitate to write me a letter at bec@epicretirement.com.au. Merry Christmas and Happy Holidays.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Why 'grandparents are the glitter glue' for families across AustraliaWe learn the recipe for building a great relationship with your grandchildren right from the start

Why 'grandparents are the glitter glue' for families across AustraliaWe learn the recipe for building a great relationship with your grandchildren right from the start

In this episode, I’m joined by one of Australia’s most trusted psychologists, Dr Michael Carr-Gregg. He’s a renowned expert on mental health and families, the author of 18 books, and a familiar voice as a broadcaster. Today, we’re diving into an exciting and quickly-evolving topic: grandparenting in the modern world.

Many of our Prime Timers are approaching this pivotal stage of life or early in their grandparenting years and are trying to navigate their role carefully. But the role of a grandparent isn’t what it used to be—it’s more dynamic, complex, and meaningful than ever before. In fact Dr Carr-Gregg says that grandparents are the ‘glitter glue’ for Australian families.

Dr Carr-Gregg’s latest book, Grandparents: A Practical Guide to Navigating Grandparenting Today, is packed with invaluable insights. On the show, he shares the big lessons every modern grandparent needs to know—including his recipe for building a great relationship with your grandchildren right from the start.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

The little book that could!

Last of all, We’re finishing the year with How to Have an Epic Retirement as the #3 best selling self help book in Australia by an Aussie author for 2025! If you haven’t read the book - well, you’ll probably find it’s sold out in stores like Big W and Dymocks who usually stock it (do have a look - you might find one!). You can order your copy from Amazon online. Or you can ask a bookstore to order it in.

I have a few copies in my little online store - if you want them sent by Express Post. The last Australia Post window is 16th December.

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

December 7, 2024

Why the cost of a comfortable retirement has skyrocketed over the past 20 years

Course: February is here! Book your place now

Feature: Why the cost of a comfortable retirement has skyrocketed over the past 20 years

From Bec’s Desk: The week for lasts

SMH/TheAge: This new law could transform your retirement, but the clock is ticking

Prime Time: Housing, interest rates and the economy for 2025

Thanks for reading Epic Retirement Australia! Subscribe for free to receive new posts and support my work.

Autumn Edition of the

How to Have an Epic Retirement

Flagship Course is Here!

Autumn Edition of the

How to Have an Epic Retirement

Flagship Course is Here!We’re thrilled to announce that bookings are now open for the first course of 2025, the Autumn Edition of our How to Have an Epic Retirement Flagship Course! 🎉

🌟 Early Bird Special: Be among the first 200 to book and enjoy a 25% discount. Spots are filling up fast—our Friday launch was met with an incredible response, and we couldn’t be more excited! 🌟

📖 Want all the details? Check out our brand-new brochure or learn more on our website. ➡️ Visit the website here ➡️ Book now

Here’s what participants from the Summer Edition had to say:

"Excellent course! Recommended to me by a friend for which I am very grateful. I have already embarked on my retirement journey so only regret is that I didn't know about this sooner. However the content of the course was very comprehensive so there is still so much to think about and to work through. I am sure that it will help me to have an 'epic retirement'. :)" Lyn

"Completing this course was very useful to help guide me (and partner) through discussions we had perhaps skirted around before and focused me on topics I was avoiding. Helped us to be a LOT more prepared when going to a financial advisor for personal advice" Monica

And that’s just the beginning! Download the brochure available on the website for more feedback and inspiration.

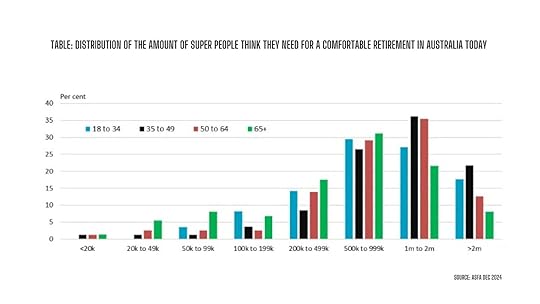

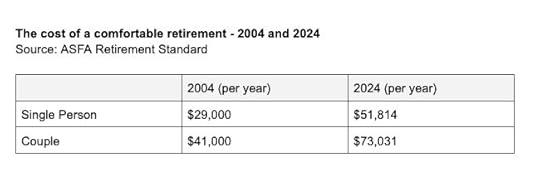

Why the cost of a comfortable retirement has skyrocketed over the past 20 years

Why the cost of a comfortable retirement has skyrocketed over the past 20 yearsIt’s interesting to see just how far we’ve come as a nation here in Australia.

Do you remember life 20 years ago? The iPod was cutting-edge tech, petrol didn’t make us wince at the bowser, and retirement planning felt simpler. Back then, most people’s retirement plans revolved around the Age Pension and defined benefit schemes. They expected to live into their early 80s, not their 90s, and their idea of comfort didn’t include jet-setting, eating out regularly, or upgrading their tech every few years.