Bec Wilson's Blog, page 15

September 7, 2023

A significant rise to the age pension and rent assistance

It’s been a week filled with good news. The more than 2.6 million retirees who rely on the age pension can now see another lift in their income from September 20, and for those eligible for rent assistance there is a significant boost too. And, if you are just outside the limits for the Commonwealth Seniors Health Card now, you should double check, because the limits have been given a boost, indexing for inflation.

In a welcome announcement, the Australian government has unveiled increases to income support payments and pensions, providing much-needed financial relief to millions of Australians. These adjustments, set to take effect on September 20, come as part of the government's commitment to addressing the rising cost of living. The move follows the introduction of a comprehensive $14.6 billion cost of living package earlier this year.

Here are the key changes that will be implemented from September 20 that affect retirees:

Recipients of the age pension will receive an increase to the single pension rate of $32.70 to $1096.70 per fortnight, and for couples combined, the rate will increase by $49.40 to $1653.40. These figures include Pension Supplement and Energy Supplement. And the net effect could be more than $2500 in the hip pocket for some couples.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

In addition to this, income support recipients who are renting will enjoy an increase in the maximum rates of Commonwealth Rent Assistance. Single people will see the maximum rate rise by $27.60 to $184.80 per fortnight and couples will see the maximum rate increase by $32.34 to $217.28 per fortnight.

And finally, the income Limits for Commonwealth Seniors Health Card recipients will also be indexed, increasing by $5400 to $95,400 per annum for singles and by $8640 to $152,640 per annum for couples combined.

Other supplementary payments, including Telephone Allowance and Utilities Allowance, will also be indexed.

The real costs of a longer, healthier retirement

I have to admit being a little obsessed by the opportunity to live longer lives, and the need to live healthier as we do so. So, I dug deep into The Intergenerational Report 2023 this week to see how the government is projecting life expectancy to change for people who make it to the age of 65 over the rest of their lifetime.

Of course my obsession lies partly in trying to calculate how much money people really need to live out an epic retirement, and how we can better plan for, and expectation manage our goals of living a longer life.

They’re also pretty selfish. I want to live longer, and healthier for my years ahead than the generations before me.

So, what did I discover? I think the government are presenting the ‘safe’ and statistically correct picture of our ageing population, as you would expect. In fact, I believe the Intergenerational Report could be an exciting understatement for longevity in the decades ahead of us and today’s middle-agers and younger generations might live longer than the government charts can show.

And if they do, they’d want to get far more proactive about their health because you will pay if you don’t.

The good news is, our country can afford us to live longer, finally, thanks to the growth and advancement of superannuation, something we could not have said 20 years ago.

My conclusion, you should bet on living longer than the government thinks you will, and you should start looking after your health better now. Investing in your health now might just be the wisest long-term financial decision you can make.

Let me dive into why. The government statistics projected to 2062/63 in the Intergenerational report look conservative to many experienced actuaries around the country. That’s because they are based on historical statistical analysis which doesn’t factor in any rapid advancements in science or modern medicine.

I have to say, I don’t believe that we won’t see some major health breakthroughs in the next forty years.

The current life expectancy for men who reach the age of 65 is 85, and for women it is 87.7. This new edition of The Intergenerational Report projects that over the next 40 years, that number will rise by 4.7 years for men and 3.5 years for women, to predict an average life length of 89.7 for men and 91.2 for women. That’s a good increase, but in a recent report presented to the UK parliament, it was suggested that 50 per cent of people born after 1971 could live to the age of 100 if we take in advancements in science and technology in our lifetime - something historical statistics cannot do.

So what does that mean for retirement planning? It means you should look at your own family history, health practices and environment to consider whether you are likely to be one of the ‘lucky ones’.

Then decide the number of years you will budget to live for in retirement based on your own situation. You might consider trying this life span calculator built by actuaries who have considered these things deliberately in their projections.

One jarring piece of data buried deep in the report is the insight that Australian men on average spend 88 per cent of their lives in full health, while women spend around 87 per cent, meaning that today, the average Australian health span is 74.8 for men, and 76.3 for women.

Over the next 40 years, if health spans rise at a similar level, today’s middle-agers will expect to remain healthy to the age of 78.9 for men, and 79.3 for women. That would see a man live an average of 8.8 years in less favourable health, and a woman live 11.9 years.

The personal cost of this could be enormous, impacting how much we should budget for home care services and healthcare in our later lives, in a way many people have not accounted for in their retirement planning to date.

Over the decades ahead of us, home care and aged care systems are predicted to be operated on an increasingly user-pays basis, rather than with the high levels of government subsidy they now operate, and as this happens, if your body is not in good health, you will have to pay for it.

As a woman myself, the idea of spending 11.9 years in poor health is too many and motivates me to try and beat the statistics! The science of ageing is showing us a variety of ways we can try to improve our health span. But it does require each person to take more responsibility for their own exercise, diet and act in the prevention of chronic illness, perhaps more than we do on average in Australia right now.

There’s no doubt, The Intergenerational Report speaks loudly to those planning for retirement in the next 10, 20 or even 30 years: longer lives to budget for, better health spans, but still longer periods of our lives spent in ill-health that we will have to pay for care in.

Clearly that makes our health one of the best investments on offer.

This article was first published on 2nd and 3rd September 2023, in The Sydney Morning Herald, The Age, Brisbane Times and WA Today, in both print and digital. You can see the whole article here.

August 31, 2023

Two monumental signposts for retirees and pre-retirees this week

We all know deep down that retirement is changing quickly, being shaped by a new and aspirational generation - you - into what they want it to become. And this week there was two pieces of data out that light the way for those retiring anytime soon: new data on the age people are retiring at in Australia right now, and an increase to the amount you need to retire in comfort. So today, dive deeper with me.

(continues below)

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

In this newsletter:Article: Two monumental signposts for retirees and pre-retirees this week

Personal note: From Bec’s Desk

Sydney Morning Herald/The Age Article: Five ways to check if your super fund is retirement-friendly

Order your copy of How to Have an Epic Retirement

Support what we do: Advertise hereAre you interested in advertising in this one premium position on our newsletter to support what I do with Epic Retirement? I have resisted up until now, but with 15,000 subscribers to the weekly newsletter and a huge 53% open rates on our emails I think it could be time to tastefully garner some commercial support for the work I do for pre-retirees and retirees. Hit the red button to contact me about advertising.

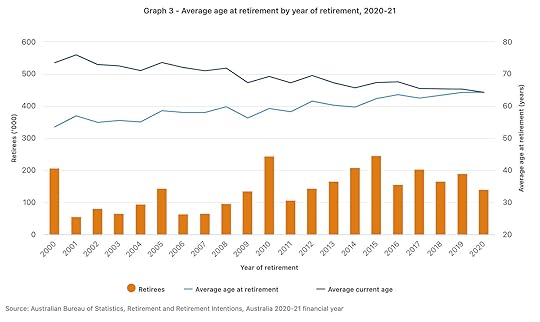

People in Australia are retiring older and still depend significantly on the age pensionLet’s talk about the retirement age and retirement intentions of Aussies first. This week the Australian Bureau of Statistics (ABS) released their latest insights into the retirement intentions of people aged 45+ in Australia. And there was some really interesting (and relatable) statistics that show that Aussies are clearly retiring older, that women are going first. It also shows that today’s retirees are still critically dependent on the age pension - which is nothing to be embarrassed about. And finally, the report showed without a doubt that the number of retirees is only going to get bigger in this country. So you certainly won’t be alone out there as you chase your epic retirement, juggling income from both the pension and superannuation.

In the 2020/21 year, we saw 300,000 new people had retired since the last census, which was held in 2018/19. And 140,000 people actually retired in the 2020/21 year. The average age of retirement in Australia in 2020/21 was 64.3 years, the same as it was in 2019 and the highest it has ever been. For men, the average age was 65.4 years and for women the average was 63.7 years.

People who have not yet retired are intending to retire at 65.5 years, with the majority of men looking to retire at 66, and women at 64.9 years. A lot of media is reporting the metric that the average retirement age has gone up Interestingly, 670,000 people intend to retire in the next 5 years, with more than 220,000 in the next 2 years, if not more according to the annual statistics.

There is now 4.1 million retirees in this country, up from 3.8 million people in 2018/19, when the last data was collected. 56% of the new retirees were women, driving our population of female retirees to 2.3 million, higher than men at 1.8 million.

When asked, there were three big reasons people retired in 2020/21. 28% retired because they had reached retirement age or become eligible for superannuation, 13% retired because of sickness, injury or disability and 7% were retrenched, dismissed or found no work was available. Retired women reported leaving their final jobs more often than men in the workforce to care for a disabled or elderly person, with 4% of women doing so, compared to 2% of men.

In financial insights, the aged pension remained the main source of income amongst retirees in Australia in 2020/21, with nearly 50% of people relying on it as a main source of income. Superannuation has grown as a source of income, with men reporting a greater increase in the use of superannuation than women. And, in not so surprising information, 34% of retired women relied on their partner’s income to meet their costs of living in retirement. We still have a big job to do in this country to equalise the balance on superannuation.

Glaringly, the largest influencing factor for people considering when to retire was ‘financial security”. No surprises there, and an important reason for us to see the superannuation guarantee rise to 12% in 2025 and for the retirement income covenant to urge superannuation funds to help people understand their superannuation better as they approach and enter retirement.

Finally, retirement has a couple of boom years ahead in Australia, with nearly 160,000 people expecting to retire in 2023, and 180,000 people in 2024, potentially. So if you’re thinking about retiring, you should be able to find others in the same boat.

The speed of inflation for retirees is slowing, up just 0.5% for the quarter, but the cost of living is still risingThis week also gave us new data on the rising cost of living for retirees. This number has been rising over the last year at a faster rate than the rest of the population, but data out this week from Association of Superannuation Funds Australia (ASFA) for the June quarter shows that finally, inflation is moderating, with the cost of living up just 0.5%. Yes, this increase means it now costs more to have a comfortable retirement. ASFA projects that retirees planning to have a comfortable retirement need to budget $70,806 per year for couples, and $50,207 for singles. These are up from $70,482 per year for couples, and $50,004 for singles in the March quarter.

This update and decrease to the speed of inflation, brings the annual inflation rate for retirees’ cost of living down from 7.7% to 6.1% for the rolling year, which is just slightly higher than the 6.0 per cent level for the general Consumer Price Index (CPI).

The biggest hits to retirees’ hip pockets in this quarter are coming from insurance where there has been an increase of 5.3% reported across house, house contents and motor vehicle insurance, and this comes on top of a 3.5% increase in the March quarter. The cost of fruit and vegetables continued to rise this quarter, up close to 4%, chiefly because of the weather effects on potato, cucumber and tomato prices. The price of bread increased more than 5 per cent and is up 14 per cent over the year too.

All in all, it was a week of interesting insights into modern retirement, the age we are actually retiring in Australia right now, and the amount of money we need to live a comfortable retirement. Do you watch these numbers? Leave a comment with your thoughts on the article here.

From Bec’s Desk this weekI just want to take a moment to say thank-you. I’ve been passionate about retirement for more than ten years now, and it feels like it’s all coming to a head, with the book really catching on, and the new podcast nearly ready to launch. I’m excited, truly excited about how the six pillars of an epic retirement can help people navigate the tricky phases of pre-retirement and early retirement where things feel so confusing. And it looks like you’ve noticed too.

How to Have an Epic Retirement has been in book stores for five weeks now, and we can now celebrate two exciting positions in the charts that I only dreamed of:

It is the #1 bestselling self improvement book by an Australian author for 4 weeks in a row! This is based on actual book sales data!

AND, possibly even more exciting, it is now #4 on Booktopia’s National Bestseller List, across all categories! They’re Australia’s largest online bookseller so we’re pretty chuffed with that.

It’s sold out again online at Book Epic Retirement">Amazon and Booktopia, awaiting the first reprint which will arrive in the warehouse in less than a week (get in first to get the next round of stock). You can still buy copies in all major bookstores and book sellers. Big W and Target have some stock in stores and Dymocks still have some available online at the time of writing. The reality is, the sooner you buy it, the sooner you’ll know what all the fuss is about, I hope.

I’ve been hard at work on our all new podcast, which I’ll launch to you with a bang very soon. Look out for the announcements. I have lots of wonderful help with this one - and it’s good! Even if I do say so myself. 😁

If I haven’t said it enough - thank-you! thank-you! thank-you for getting in there and taking all this information on board - and finding ways to make your retirement better! Make it epic!

Got a comment to leave on the stories or the newsletter - pop on over to the site and leave it for me. Don’t forget to ❤️ the post while you are there!

Bec Wilson Xx

This article appeared in the Sydney Morning Herald, The Age, Brisbane Times and WA Today on Sunday 27th August 2023, in both print and digital.

Five ways to check if your super fund is retirement-friendlyAs we explore the idea of retirement, for many, it’s the first time they have really become familiar with their superannuation fund’s services, and what they offer to help you navigate this huge step in life.

Pre-retirement is the time that many people might start to think about what they want from a super fund as they arrive at the retirement stage and start assessing whether their fund is committed to looking after their customers and helping them navigate this stage of life.

The goal of a superannuation fund in the retirement phase is to generate strong investment returns and structure its products to pay members an income they can rely on to live out their whole life. They also have an important role to play as your primary source of information about how to use that money you’ve saved for decades.

So today, let’s look at the five things I would evaluate in a superannuation fund to understand if it is really retirement-friendly.

Read the whole article on The Sydney Morning Herald here.

Order your copy now - buy the paperback, audiobook or ebook

If you haven’t ordered your copy of How to Have an Epic Retirement already, here’s how you can.

It is the ultimate guidebook for modern retirees.

How to Have an Epic Retirement guides readers through the way the systems of retirement work, and is packed with tips, insights and guidance that spans six pillars of an epic retirement. It is designed to help you learn the valuable lessons that modern retirees wish someone had shared with them before they kicked off the changes and stages of life that come after retirement.

How to Have an Epic Retirement is on the Hot Picks for Fathers’ Day list for Booktopia. You can buy it 30% off here.

You can also get it on Amazon and Audible here.

Or, you should find it wherever books are sold - see the stockists here.

Join me on Facebook & InstagramI’m about to start a stream of micro-lessons about retirement on Instagram and Facebook, so depending on which is your favourite, please, come along and be a part of the conversations.

And you should already be a member of our Epic Retirement Facebook Group. If you aren’t you can join here: facebook.com/groups/epicretire

Keen to leave a comment? Click the button to leave it on the article.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

August 25, 2023

Special Edition: Monitoring your superannuation in retirement phase - the top ten performing funds

Today I’ve got a special edition of the Epic Retirement Newsletter for you, bringing you some special release data from Chant West on how Australia’s retirement-phase superannuation funds are performing over both 10 years and 1 year. This is data that is not really available in the public at the moment, yet it’s important for those approaching and in retirement to be able to assess how funds are performing after you flip over to the retirement phase.

In this edition:

Article: Monitoring your superannuation in retirement phase: the top ten performing funds

From Bec’s Desk - an exciting little update

Article: How do you find happiness in retirement?

Buy the book or audiobook

Retirees in 2023 are grappling with a peculiar challenge – they cannot compare their super fund’s cost or performance using independent public benchmarking at all.

Superannuation funds in the retirement phase, previously referred to as the pension phase, lack government benchmarks for gauging performance and fees, unlike their counterparts in the accumulation phase who have central benchmarking on MySuper. And this gap makes it difficult for retirees to easily evaluate their retirement phase funds, which is a bit puzzling given that retirement often brings about the most substantial investment returns in one's lifetime. Today, I’m delving into what we do know about the performance of retirement phase funds this year, as well as exploring how you can take a closer look at the performance and cost of your fund if you're in the retirement phase.

We're all striving for a comfortable retirement, and there’s a couple of crucial steps we need to take about once a year, even after retirement, to monitor our superannuation. The first is to keep an eye on the performance of our fund, the second is to monitor the fees being charged by our super fund and the third is to keep checking in on the level of risk and return we want exposure to. These three things are equally important.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

But, there's a simple but significant issue at play: once we retire in Australia, it becomes quite tricky to assess how well our super funds are performing or to benchmark the fees they're charging because the only organisations that gather this information are private data companies. Strangely, there are no publicly available benchmarks for this phase. I suspect this will change over time.

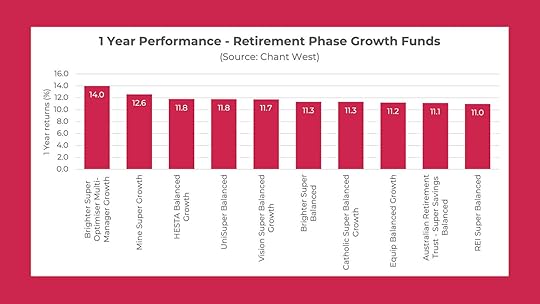

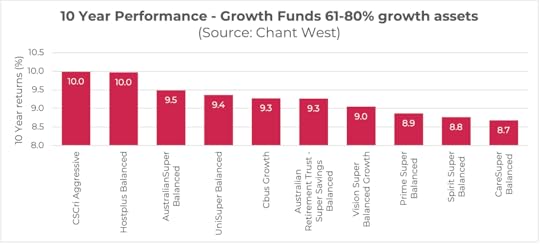

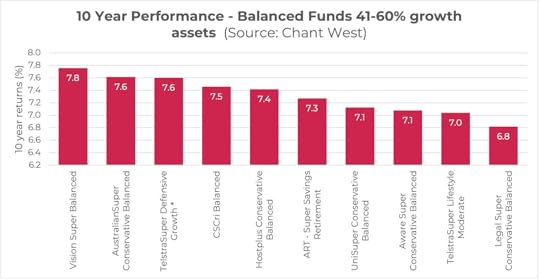

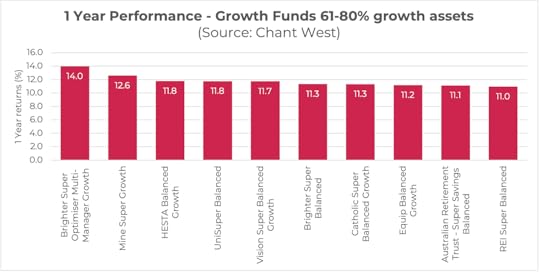

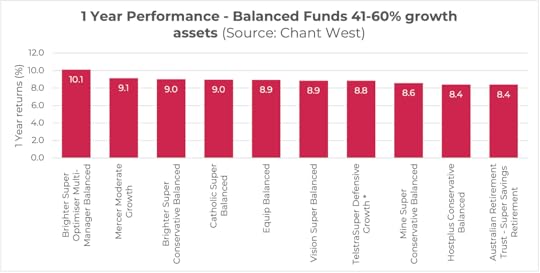

So today I have worked with Chant West to get you a snapshot of the best performing funds in the retirement phase, looking at both their one year results for 2023 and the ten year results across two different levels of risk appetite, growth and balanced, the two most common levels of risk people invest at.

Monitoring your retirement phase super performanceLet’s talk about retirement phase super fund performance. Most people don’t realise it, but most of the time funds in the retirement phase actually perform better than funds in the accumulation phase. This is for three big reasons.

First, once you enter the retirement phase, all the income generated by your fund is tax-free, which allows you to get a higher return, and if you reinvest it, will allow your super to have more rapid compounding. Second, depending on your situation, your franking credits are likely to be higher than the tax payable by the fund, again allowing for increased returns each year.

And thirdly, unless your balance is above the transfer balance cap which is currently $1.9M and still held partially in accumulation you will likely have no CGT liability on assets sold in retirement phase.

So on that basis, let’s take a look at the top performing funds in the last year, and the last 10 years in both the growth and the balanced categories.

It’s actually most important to start with the ten year returns, because superannuation is a long term investment, so we really cannot judge a fund on one good year. So below, I have listed the ten year performance of the funds that are categorised as ‘Growth Funds’ and, below it, the funds categorised as ‘Balanced Funds’.

I ran these numbers against some of the corresponding accumulation funds so you could see the difference in performance between the accumulation phase and the retirement phase performance. REST’s Diversified Accumulation fund has delivered a 7.58 per cent return in accumulation and 8.31 per cent in pension phase over 10 years.

Australian Super’s Balanced Fund had a 10-year return of 8.6 per cent in accumulation and 9.48 per cent in pension phase. For both, the retirement phase products are outperforming.

It is also important to keep an eye on which funds are performing well in the last year, which you can see below in the 1 year performance graphs for retirement phase growth funds, and, below that, the balanced funds, which have a lower exposure to growth assets. I would like to warn you against looking at one year data in isolation though because any fund can have one good year.

Consider the fees charged by your retirement phase super funds

Consider the fees charged by your retirement phase super fundsSuper funds usually report their performance and charges annually. They are required to do so for their default accumulation funds under the MySuper program, which is a benchmark across the industry. They don’t report on their retirement phase products anywhere other than their own websites, which may offer selective information.

It’s important to monitor your fund’s fees, simply because it could be costing you in the long term. A superannuation fund could be yielding high returns for retirees but could still fall short if those returns are offset by higher than average fees. So, it becomes crucial to evaluate the administration costs associated with your chosen fund. To work this out I recommend you add together all administrative fees from your fund and calculate the percentage fee relative to your account balance. By doing so, you can gauge how your fees compare to the norm.

Many funds impose fees as a fixed dollar amount, regardless of your account's size. Generally, as your account balance increases, your fee as a percentage of the total balance should decrease.

Chant West collects data on administration fees for pension phase funds in Australia. Over a decade, they have found that the average fees among the top 10 funds range from 0.1 percent to 0.35 percent based on a $250,000 balance—the current average balance for Australian super funds upon retirement.

Reviewing your risk appetiteAs you can see in the data above, I have provided two levels of risk in the benchmarks. I did this because as we get into retirement many peoples’ risk appetite changes, and they go from being keen to enjoy risk and reward, to being a little less keen to have exposure to market downside risk. So I want you to take time as you head into retirement and consider whether you want to be exposed heavily to growth assets, or you might be better with a more balanced approach. There’s no right answer, only your answer, and you might want to talk to a financial planner about it.

So what actions should you take?So what can you do if you want to take a deeper dive into your retirement phase superannuation’s performance and fees? I’m going to take you back to three essential steps:

Get out your superannuation statement and review the performance of your fund. You can start by comparing against the accumulation benchmarks at the same risk level of risk, to get a broad understanding of whether it is higher or lower. Compare against the ten year returns for balanced funds if yours sits in the balanced category (41-60% growth assets) or the growth category if yours has more growth assets(61-80% growth assets).

Calculate the fee you are being charged on your super as a percentage of your superannuation balance. Explore how this stacks up by looking at the fees charged on accumulation funds by the top ten companies with a similar account balance, and see if yours is on par, lower or much higher.

Consider whether your current risk appetite is suitable for where you are in life and your goals.

If in doubt, get some financial advice either from your super fund or an independent financial adviser.

From Bec’s DeskThe second half of this week has been rather exciting! Yep! We made it to THREE weeks as the number one bestselling self improvement book by an Australian author on Thursday! And today is only one month since the launch of the book!

We did a long show on ABC Radio National ‘Life Matters’ about Relevance Deprivation Syndrome, something I cover at length in the book. The show picked up the personal story of Jim Kilkenny who is featured in How to Have an Epic Retirement, and talks about the impact it has on the sufferers and also their families. You can listen to the show podcast here.

And I also did a really entertaining ABC Sydney and NSW Afternoons radio show with Josh Szeps on Thursday, which you can listen to here. There was so many callers and texts, it was lots of fun to chat with everyone and answer their questions.

This weekend I’ve got a deep dive article in the Sydney Morning Herald and The Age - so make sure you keep an eye out for the money section on Sunday.

And until next week, make it epic!

Bec Wilson Xx

Buy the book, audiobook or ebookIf you haven’t ordered your copy of How to Have an Epic Retirement already, here’s how you can

It is the ultimate guidebook for modern retirees.

How to Have an Epic Retirement guides readers through the way the systems of retirement work, and is packed with tips, insights and guidance that spans six pillars of an epic retirement. It is designed to help you learn the valuable lessons that modern retirees wish someone had shared with them before they kicked off the changes and stages of life that come after retirement.

How to Have an Epic Retirement is on the Hot Picks for Fathers’ Day list for Booktopia. You can buy it 30% off here.

You can also get it on Amazon and Audible here.

Or, you should find it wherever books are sold, in all major bookstores - see the stockists here.

And that’s it for my special edition. Have a lovely weekend. Don’t forget to reach out if you have interesting tales to share with me. Or join the Facebook Group at facebook.com/epicretire.

August 23, 2023

How do you find happiness in retirement?

I went to an inspiring keynote address last night from one of the world leading scientists addressing happiness, Dr Robert Waldinger, the fourth Director of the Harvard Study on Adult Development. This is a study that has been running since 1938, that has evolved over the years to offer some definitive insights into what drives happiness and fulfilment. His speech on the subject was inspiring enough to make me want to come straight home and rewrite my newsletter for you … so here goes.

In this newsletter:

Article: How do you find happiness in retirement?

Sydney Morning Herald/The Age Article: Higher interest rates are good news for retirees

From Bec’s Desk

Buy the book for Fathers’ Day (or just because)

It’s hard to believe that scientists only started to study and understand how happiness is created in the late 20th century, so the things we know about this increasingly critical and keenly sought after topic are only 20-30 years old. And yet understanding happiness is so darned important to living a purposefully fulfilling life. Those who’ve read my book know that ‘happiness and fulfilment’ is one of the key pillars of an epic retirement and I talk at length about how you can do this. But today I want to add to this some additional and helpful insights.

To give you some of the foundations again, scientific studies say there is two key ways that happiness and wellbeing manifests in our lives.

Hedonic happiness or seeking out activities and experiences that bring immediate feelings of joy, pleasure, and contentment while minimising discomfort or negative emotions. That is, enjoying life in the moment - consciously smelling the roses, eating the ice-cream, sitting with your grandchild and chatting.

Eudaimonic well-being which comes from living a life of purpose, meaning, and self-realisation. Eudaimonic well-being is based on the philosophical idea of eudaimonia, which suggests that true happiness and fulfilment come from engaging in activities that align with one's values, strengths, and passions, leading to a sense of flourishing and personal growth.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

And these things form the foundations for short-lived hedonistic happiness which you can pursue for moments, and longer lasting, meaning-driven happiness.

The discoveries grown from watching people in America age have allowed scientists to lay out a framework for what usually makes people happy. According to the Harvard Study of Adult Development, there’s seven big things you need to think about in your pursuit of happiness. And most of them boil down to pretty simple stuff.

[image error]The first important element of happiness is financial wellbeing - or enough income to be able to meet your basic living costs and keep you in comfort. The studies show that being wealthy does not necessarily make you happier, in fact, there is no correlation in the data between high wealth and increased happiness. Only a correlation with ‘having enough’ and being happy. As wealth increased in people’s lives, happiness went in a sideways to downward trend, Dr Waldinger says.

The second and potentially, the most important is cultivating meaningful connections - building and maintaining strong relationships and social connections in our lives will not only help us live both happier and longer lives, it will also help us live longer. Loneliness is toxic according to Waldinger, and more pervasive than ever with 25% of Americans reporting in 2022 that they do not have a confidant to share with, up from 14% in 2018. It results in earlier cognitive and physical decline; an increase in stress induced hypertension; and impaired sleep. The wonderful thing that the research uncovered is that relationships and connections with other people actually get into our body and protect us, and help us maintain good health for longer in life.

The third is taking care of your health - and as you can see, this is not only looking after our physical health with good diet, regular exercise and proactive and preventive healthcare. It also connects back into the second point, because our relationships offer these protective health benefits.

The fourth is setting goals and pursuing passions - The study suggests that striving toward meaningful goals can enhance our motivation and drive. Achieving goals, whether big or small, can result in a sense of accomplishment, boosting our self-esteem and contributing positively to overall well-being.

The fifth is gratitude, which is said to nurture positive relationships, aid in coping with challenges, and tends to underpin feelings of optimism and positive emotions. Gratitude is an important part of being mindful, and enjoying the present which scientists say contributes to overall emotional well-being.

The sixth is giving back to others: Engaging in acts of kindness and contributing to your community can provide a profound sense of fulfilment. And that’s why volunteer work and helping others can create such a positive impact on both your life and the lives of those around you.

And the seventh is maintaining a positive attitude: Cultivating a positive mindset by focusing on the things you can control and letting go of negativity. A positive attitude can contribute to resilience and enhance your ability to navigate life's challenges.

So how do you put that into action in your own life?Dr Waldinger spoke about, and I want to impress how important it is to be proactive and responsible about our relationships and scheduling in time for friends and family, and time for your health. In this modern world, it is very easy to let relationships wither away, and this damages our overall social fitness. He speaks of the simple steps we can all take, in our everyday lives like:

Taking a brief moment to text someone you haven’t connected with lately who means something to you and tell them you’re thinking about them. Connect! You might be surprised at how much joy this brings both you and them.

Think about applying more time and deliberate connection to family dinners. Get everyone to put the phones away and really interact, creating a dynamic that can otherwise be lost. The statistics show that if phones are on the table, the conversations will be more shallow as people are expecting interruption.

Be responsible for booking, arranging and doing things with friends. Don’t wait for someone else to make the first moves. Your healthspan, happiness and longevity will benefit from your proactivity.

Higher interest rates are good news for retireesThis article appeared in the Sydney Morning Herald, The Age, Brisbane Times and WA Today on Sunday 20th August 2023, in both print and digital.

The squeals of cost of living pain from families and first homebuyers are real, as inflation and interest rates both bite hard. But at the same time, an important shift is taking place, particularly among retirees and pre-retirees, as their purse strings loosen, and they feel more confident.

The annual results reported this week by Commonwealth Bank (CBA) chief executive, Matt Comyn showed a renewed sense of optimism and freedom among older Australians with higher interest rates fuelling significantly higher spending and saving for those over 55 in the last quarter.

Could this be the beginning of a period of optimism and newfound freedom for a whole generation approaching and in retirement?

Data in the CBA annual results report showed that among their 15.9 million customers, spending is up close to 5 per cent for the quarter among 55-64s and 6.4 per cent among 65+ in a year-on-year comparison. That’s a huge jump and a large turnaround in sentiment from the years before.

The financial shift was not just seen in spending behaviours, as those in the older bracket also managed to increase their savings significantly in the same period. This is two-pronged progress – increased spending coupled with a hefty growth in savings – and it underscores a remarkable reversal of fortune for pre-retirees and retirees driven chiefly by interest rates and investment returns.

There’s no doubt among any older retirees that this shift has been a long time coming. For nearly 13 years, historically low interest rates have caused enormous pain for a whole generation, forcing people to navigate retirement with restricted investment returns by lowering their cost of living. Interest rates even sat below CPI for several years increasing the anxiety of older consumers, particularly those dependent on superannuation income streams.

But the turnaround, driven by interest rates designed to combat high inflation appears to have a little momentum, even though inflation is expected to hang around for some time. Solid annual results from superannuation funds in 2023, alongside strong dividends from the ASX reporting season should add to the building levels of confidence in over-55s.

Read the whole article on the Sydney Morning Herald here

And keep an eye out every Sunday in Nine Newspapers for my weekly column.

From Bec’s DeskI wondered how many of you are feeling lonely (or happy) today, so I’ve opened up a poll in our Facebook group to explore it. It might be time for some community activities to start in Epic Retirement that we can come together to enjoy. I’d love to hear your honest answers. Click here to take the poll… Facebook.com.groups/epicretire

On a different note, I’m delighted to share with you that How to Have an Epic Retirement has enjoyed another week as the #1 bestselling self improvement book by an Australian author. And we’ve already gone into our first reprint. Thank you for purchasing it.

The audiobook edition was finally released last week. So you can listen to the book on audiobook or via Audible, read by me!

I’m looking forward to an appearance on Radio National’s Life Matters Program on Thursday morning (today!) at 9am, which you can listen to online at https://www.abc.net.au/radionational or watch it on your TV, on channel 26 or ask your smart speaker to "play ABC Radio National".

I’m also on ABC Afternoons in Sydney with Josh Szeps tomorrow, listen in at 2.30pm.

My favourite radio show this week was an interview on 6PR Money News with Karalee Katsambanis, which you can listen to here.

Don’t forget to email me with your ideas and feedback. Bec@epicretirement.com.au

And I’m looking for people to interview for Retirement Diaries with epic retirement stories to tell. - so reach out if you’re living an epic retirement in your own way and think others can learn from you!

Have a great week ahead! Make it Epic!

Bec Wilson Xx

Buy the book, audiobook or ebookIf you haven’t ordered your copy of How to Have an Epic Retirement already, here’s how you can

It is the ultimate guidebook for modern retirees.

How to Have an Epic Retirement guides readers through the way the systems of retirement work, and is packed with tips, insights and guidance that spans six pillars of an epic retirement. It is designed to help you learn the valuable lessons that modern retirees wish someone had shared with them before they kicked off the changes and stages of life that come after retirement.

How to Have an Epic Retirement is on the Hot Picks for Fathers’ Day list for Booktopia. You can buy it 30% off here.

You can also get it on Amazon and Audible here.

Or, you should find it wherever books are sold - see the stockists here.

Join me on Facebook & InstagramI’m about to start a stream of micro-lessons about retirement on Instagram and Facebook (and heavens forbid - Tiktok), so depending on which is your favourite, please, come along and be a part of the conversations.

Follow me on Tiktok here (yes heaven’s forbid - we’re going to be doing this!)

And you should already be a member of our Epic Retirement Facebook Group. If you aren’t you can join here: facebook.com/groups/epicretire

Keen to leave a comment? Click the button to leave it on the article.

Higher interest rates are good news for retirees

This article appeared in the Sydney Morning Herald, The Age, Brisbane Times and WA Today on Sunday 20th August 2023, in both print and digital.

The squeals of cost of living pain from families and first homebuyers are real, as inflation and interest rates both bite hard. But at the same time, an important shift is taking place, particularly among retirees and pre-retirees, as their purse strings loosen, and they feel more confident.

The annual results reported this week by Commonwealth Bank (CBA) chief executive, Matt Comyn showed a renewed sense of optimism and freedom among older Australians with higher interest rates fuelling significantly higher spending and saving for those over 55 in the last quarter.

Could this be the beginning of a period of optimism and newfound freedom for a whole generation approaching and in retirement?

Data in the CBA annual results report showed that among their 15.9 million customers, spending is up close to 5 per cent for the quarter among 55-64s and 6.4 per cent among 65+ in a year-on-year comparison. That’s a huge jump and a large turnaround in sentiment from the years before.

The financial shift was not just seen in spending behaviours, as those in the older bracket also managed to increase their savings significantly in the same period. This is two-pronged progress – increased spending coupled with a hefty growth in savings – and it underscores a remarkable reversal of fortune for pre-retirees and retirees driven chiefly by interest rates and investment returns.

There’s no doubt among any older retirees that this shift has been a long time coming. For nearly 13 years, historically low interest rates have caused enormous pain for a whole generation, forcing people to navigate retirement with restricted investment returns by lowering their cost of living. Interest rates even sat below CPI for several years increasing the anxiety of older consumers, particularly those dependent on superannuation income streams.

But the turnaround, driven by interest rates designed to combat high inflation appears to have a little momentum, even though inflation is expected to hang around for some time. Solid annual results from superannuation funds in 2023, alongside strong dividends from the ASX reporting season should add to the building levels of confidence in over-55s.

Why retirees can spend more of their super than they think

This article appeared in the Sydney Morning Herald, The Age, Brisbane Times and WA Today on Sunday 13th August 2023, in both print and digital

Retirees in 2023 are grappling with a peculiar challenge that needs solving: once in retirement, most people fear running out of money so much they only draw the minimum amount required from their super funds.

I suspect that’s because we don’t really understand that our super funds come into their own in the retirement phase – usually generating better returns than in accumulation – giving us the opportunity to consider drawing more retirement income than the minimum.

Retirement phase (formerly known as pension phase) is when superannuation performance is most important, as it is the time of life when your fund makes the largest amount of money through compound investing. In fact, for most people, between 50 and 60 per cent of your total funds in superannuation are generated during your retirement years.

So today we’re delving into the performance of retirement phase funds this year, and comparing the returns funds are making with the superannuation drawdown limits, and why you might consider drawing more than the minimum from your super fund in retirement.

August 16, 2023

Before you retire, we need to talk about your bank accounts, credit cards and home loan

Welcome back for another week of the Epic Retirement Newsletter. I have just received the book sales stats for the week ending today and How to Have an Epic Retirement is in the top spot again for the second week! #1 bestselling self improvement book by an Australian Author FOR THE SECOND WEEK and #3 bestseller on the self improvement list nationally (incorporating international authors)!

In this newsletter you’ll find …Article: We need to talk about bank accounts, credit cards and homeloans as you near retirement

‘From Bec’s Desk’ this week

Buy the book, audiobook or ebook

Article: Why retirees can spend more of their super than they think (SMH/Age)

Retirement Diaries Podcast: The #1 retirement bucket list holiday through Canada, Alaska and the USA with Suzanne Keir

Let’s dive in!

We need to talk about your bank accounts, credit cards and home loans as you near retirement

We need to talk about your bank accounts, credit cards and home loans as you near retirementI’ve written a few articles in the major newspapers in recent weeks about some of the smart steps you might want to consider with your banking, credit cards and home loans as you approach retirement, but not everyone pays for newspapers, so today we’re diving in together here. It’s a big topic and I’m not going to be shy about it. We need to talk about how the big banking sector’s attitude toward those who are 55+ and don’t have a mortgage has changed, and how that is likely to affect you as you head into this next stage of life. I want you to prepare yourselves well.

Let’s start by busting a few myths and telling a few secrets. And there’s three big ones in my firing line today:

Many people feel compelled to pay down their mortgage as they approach retirement. I’m going to explain something that might have you reconsider paying it off in full.

Many people don’t understand how difficult it can be to get or upgrade a credit card when you no longer have a paycheque, even if they have hundreds of thousands, or even millions of dollars in the bank.

And finally, many also think that the bank they have had their mortgage and savings accounts with for previous decades is likely to offer them the best rates, and ongoing benefits for their loyalty, and look after them in their older age.

I’d like to argue that in the months or years before you retire, you might want to consider reviewing the way your banking should work for you in the next stage of life. Put any loyalty you might think you should have to your bank to one side, and be a little selfish. Assess whether you really are getting a good deal and think about what you need in the next phase of life. And don’t be afraid to switch.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

Let me explain how things have changedTo give you a little perspective, let me explain how banking with the big four banks has changed over the last 10-15 years. Banks used to make money in a lot of different ways. They charged fees for holding your funds in transaction accounts and paid you very little interest, giving them a cheap deposit base. They then used this money to provide home loans to people buying houses and charged good interest on loans that generated them strong income over 25-30 years. They also used to run investment arms, which charged fees to manage money invested, but the music stopped on this four years back. And finally, they offered term deposits as another source of funds. Over some years, many of these sources of income for banks have dried up.

A big four’s bank’s primary business is now in lending money for profit and making returns for their shareholders (of which you might also be one so don’t knock it). They lend money to home buyers, most of whom have paid off their mortgages by the age of 55; and they lend money to businesses. And those loans provide the lion’s share of the bank’s margins. They have millions of shareholders relying on the dividends from their banks as income (particularly retirees) and banks don’t want to disappoint them. So that means they have to be really focussed on who they offer their services to, and at what margins they accept new business.

Why should you care?Once you stop borrowing from the bank, particularly the big four banks which are currently focussed on lending customers, you become a less desirable customer - in fact you could become their most undesirable customer type. And no business chases a less desirable customer with the highest of high interest rates, great perk-packed credit cards, loyalty benefits or offers, do they? (remember - banks have to stay focussed these days!)

In addition to this, when you shift from getting a paycheque to drawing a retirement income, most banks struggle to recognise your income at all, even if you have hundreds of thousands or even millions of dollars in super, and draw a sizeable drawdown each month. And that means you may not be able to access new credit. No new credit cards, no increases to credit limits, no new loans or lines of credit should you need access to cash flow either. And you might not have thought about the ways that can affect you until it does.

It surprises me how loyal most people feel to their banks after using them for 20-30 years. A lot of people have actually got all the way to 50 or 55 with one bank, and feel extraordinarily devoted. What they don’t realise, often until it is too late, is that their loyalty is costing them real money and might leave them with additional challenges later in life.

I know, I know, it is a giant pain in the a**e to move banks. But when your mortgage is finally paid off, if you are still getting a paycheque, it can be a lot easier to switch than at any other time in life.

Now, let’s talk about the three big areas to take it personallyOK, so now you have a little background, let’s apply this changed environment to your own banking and the things you’ll likely need as you navigate retirement.

First I want you to think about your need for access to funds and banking perks, and contemplate whether you really should pay off your home loan in fullMany people think they should work really hard to reach the huge milestone of discharging their mortgage, and getting the papers in the mail to confirm it. And, they’re not wrong. Going into retirement owning your own home is certainly the most desirable situation to be in. BUT I want you to contemplate that the day you pay it off, you wont have access to that lumpy draw facility anymore. And, on that very day, you will become a less desirable banking customer. They will no longer offer you the bonus-special-offer-credit cards, and the clever-cash-back programs designed to lure in and retain home loan customers. What’s your alternative? You might want to consider paying your loan down to the last $10, and keeping it, understanding of course, that you might have to pay an annual or monthly fee.

Second, consider your credit cards, before you stop your paychequeThe next thing to think about is your credit cards. As I mentioned before, banks find it quite difficult to consider retirement income as a real income stream. So it can be very difficult to access a new credit card or have a credit card limit increased by one of the big 4 banks after you retire.

In addition to this, if you are a second card holder on your partner’s credit card and your partner dies, this can really stop you in your tracks. As the bank will probably not extend that credit anymore. And you might find it near impossible to get a credit card in your own name, particularly if you don’t have an existing credit rating and your income comes from - you guessed it, ‘retirement income streams’.

So what can you do? Take a proper look at your credit cards before you and your partner stop your paycheques for the last time. Think about how you should ‘future proof’ your credit card setup, so that if one of you dies, the other isn’t left without credit. But also think about whether your limits are where you need them for the convenience of life, doing online shopping, booking holidays and travelling. Even if you aren’t a big credit card user, it’s an important consideration BEFORE retirement.

Third, think about your bank accounts all over againBanking is different to how it used to be. And you need to be able to spot the accounts that are right for you and chase the rates you deserve. So let me explain the way banks have shifted account offerings now.

Every person has a ‘transactional banking account’ the account through which you receive your income each month and pay your bills. Usually on the side of this you have a high interest savings account, and these differ, depending nowhere you are in life.

When you’re young and saving for a home loan the bank will offer perk-packed behavioural savings accounts, which reward you for meeting specific savings criteria (that is usually irrelevant in retirement). They pay a low base interest rate and a big incentive rate when you save money each month. And the banks use these to lure in future home buyers and promote their home loan offers. Then, once you get a home loan, every cent you have goes into your redraw, to offset your interest, the most efficient way to save. And then, when you’ve paid down your home and have a surplus of cash, you need to put it into an account that has as high an interest rate as you can. The big four banks aren’t focussed on these customers right now, so the second tier banks like ING, Bank of Queensland, AMP and Bendigo Bank are stepping up, offering very competitive high interest savings accounts without all the behavioural criteria.

—

The big four banks don’t appear to be worried at all about the smaller banks being more keen to bring you a better deal. In fact, many are so focussed on younger customers that they don’t mind if you switch. You’re not their future target market, you’re their past target market. So forget your loyalty and do what’s right for you, readying yourself to have an epic retirement.

From Bec’s Desk - a personal noteIt’s been another exciting week. The stats for this week came in minutes ago, and the book sits for the SECOND WEEK, on the official book seller charts as #1 bestselling self improvement book by an Australian author, and there’s only two books ahead on that list by international authors. It’s a huge privilege to be here after just 3 weeks in market.

Yesterday we launched the audiobook format of How to Have an Epic Retirement so if you want to hear my melodic tones for 10 hours of retirement lessons, you now can! Audiobooks are great for busy people and those who don’t like to read. I read the book aloud myself, injecting a personal touch that only an author can I think. I hope you enjoy it. It too is available where all good audiobooks are sold (Audible, Angus & Robertson, Dymocks, and Booktopia).

And last night we sold out again on Amazon and Booktopia! More stock is already on its way to their warehouses! So it will probably be back in stock within hours or days.

I am loving getting your messages, photos and feedback on the book. It really buzzes me. So thank you and please keep it up. You can email me at bec@epicretirement.com.au with your photo and story. Or just post it on social and tag me! (Insta: @epicretirement; Facebook: @becwilsonepic, Linkedin: )

I’ve had another really fun week on radio shows and recording podcasts throughout Australia. Many thanks for all the wonderful calls and texts that come in when I’m on air. I love to talk retirement.

So, for the week ahead - Make it epic and thank you for all your support and cheering on! I just want every retiring Australian to better understand how they can have an epic retirement.

Bec Wilson Xx

Buy the book, audiobook or ebookIf you haven’t ordered your copy of How to Have an Epic Retirement already, here’s how you can.

It is the ultimate guidebook for modern retirees, and if you’ve seen any of my columns in Nine’s The Sydney Morning Herald or The Age newspapers or heard any of my interviews on TV, radio and podcasts for the book, you’ll hopefully understand why.

How to Have an Epic Retirement guides readers through the way the systems of retirement work, and is packed with tips, insights and guidance that spans six pillars of an epic retirement. It is designed to help you learn the valuable lessons that modern retirees wish someone had shared with them before they kicked off the changes and stages of life that come after retirement.

How to Have an Epic Retirement is written for you, Australia’s truly epic retirees – so secure your copy today!

How to Have an Epic Retirement is on the Hot Picks for Fathers’ Day list for Booktopia. You can buy it 30% off here.

You can also get it on Amazon and Audible here.

Or, you should find it wherever books are sold - see the stockists here.

If it’s sold out, just know the sooner you order the sooner you’ll get your copy as more stock is arriving in the warehouses frequently.

Join me on Facebook & InstagramI’m about to start a stream of micro-lessons about retirement on Instagram and Facebook (and heavens forbid - Tiktok), so depending on which is your favourite, please, come along and be a part of the conversations.

Follow me on Tiktok here (yes heaven’s forbid - we’re going to be doing this!)

And you should already be a member of our Epic Retirement Facebook Group. If you aren’t you can join here: facebook.com/groups/epicretire

Why retirees can spend more of their super than they thinkThis article appeared in the Sydney Morning Herald, The Age, Brisbane Times and WA Today on Sunday 13th August 2023, in both print and digital.

Retirees in 2023 are grappling with a peculiar challenge that needs solving: once in retirement, most people fear running out of money so much they only draw the minimum amount required from their super funds.

I suspect that’s because we don’t really understand that our super funds come into their own in the retirement phase – usually generating better returns than in accumulation – giving us the opportunity to consider drawing more retirement income than the minimum.

Retirement phase (formerly known as pension phase) is when superannuation performance is most important, as it is the time of life when your fund makes the largest amount of money through compound investing. In fact, for most people, between 50 and 60 per cent of your total funds in superannuation are generated during your retirement years.

So today we’re delving into the performance of retirement phase funds this year, and comparing the returns funds are making with the superannuation drawdown limits, and why you might consider drawing more than the minimum from your super fund in retirement.

Read the full article on The Age here.

Retirement Diaries: The #1 retirement bucket list holiday through Canada, Alaska and the USA with Suzanne KeirSuzanne (and David) took a 7 week pre-retirement sabbatical to the #1 retirement destination, Canada, Alaska and they added America too. Their trip was epic, taking in all the bucket list must-dos.

Listen to the podcast here

Watch on Youtube below or here.

Post a book review, please!It’s amazing how important book reviews are when people are considering buying a new book. So, if you’ve managed to work your way through the book and found it helpful or interesting, I’d love you to leave a review. If you bought via Amazon, please leave one on their website. Otherwise, you can post a review on goodreads.com.

And thank you dearly for taking the time to do so!

Business opportunities

Business opportunitiesBooks and newsletters really are a project of passion. So, to support my passion for helping people navigate their pre- and post retirement, I am now building pre-retirement education programs for companies large and small to offer their members and customers. If you are a company looking for a solution in this space, please reach out. Likewise, if you want to partner on content, or collaborate to create high quality, bespoke content to help people navigate the second half of life, I’m building a specialist agency and consultancy that does this and I’d love to help you.

We’re also able to offer boutique advertising opportunities. We’re now up to more than 12,500 members of the Epic Retirement newsletter, so we will now consider small, aligned advertising opportunities to support what I do for companies who are helping those seeking an epic retirement. Again, please reach out for a chat. bec@epicretirement.net.

August 11, 2023

Do this before you retire (so the banks don’t turn you away)

Most people don’t realise that when they pay down their debts and say farewell to their salary, they suddenly become the country’s most unappealing customers to the big four, and will probably no longer be able to access key banking products such as loans and credit cards. They also certainly won’t be lured in with the highest-interest bank accounts and other perks and benefits offered to younger customers.

Most people think their bank will always be there to offer them credit cards, loans and good interest rates on their savings – especially if they own their home outright and have hundreds of thousands (or millions) of dollars in investments.

But that’s not always the case. The banks generally don’t care how much money you have; lending is their priority. And when they lend, the only thing they care about is whether you can service the debt using the guidelines in their systems. That is, they want you to have a pay-as-you-go income that their credit department understands.

Superannuation and investment incomes are not as stable, so the big banks don’t like them and won’t usually lend against them. And you can’t just call up your bank manager to approve a new loan or credit card – they don’t have that power. Every application for credit goes through a standardised credit approval process, and the first question is “what is your income?”.

Read the rest of the article on the Australian Financial Review here.

#1 bestseller for Epic Retirement | AFR exclusive today | new Retirement Diaries podcast

I’ve got some exciting news today that I cannot wait to share with you. On Thursday night we got the first book sales numbers in for How to Have an Epic Retirement. And drumroll please…

It is officially the #1 best selling self improvement book by an Australian author.

Many thanks to everyone who has bought their copy. If you haven’t got yours yet, Booktopia is back in stock, and they’ve listed it on the “Top Picks for Fathers’ Day” and are offering it 30% off here.

Here’s what they’re saying…

”How to Have an Epic Retirement is the ultimate guidebook for modern retirees, and if you’ve seen any of Bec’s columns in Nine’s The Sydney Morning Herald or The Age newspapers or heard any of her interviews on radio and TV for the book, you’ll understand why.”

You can buy the book on Booktopia, Amazon and in all places books are sold (unless they are sold out! Please ask your bookseller if you can’t find it on the shelves!)

Have a lovely weekend! Make it epic!

Bec Wilson Xx

Read my Australian Financial Review exclusive (In today’s Financial Review here)

Do this before you retire (so the banks don’t turn you away)With big banks having shifted their focus to the younger generation (and mortgages), the biggest losers are Baby Boomers who have paid off their homes and debts before retiring, often having worked loyally with one bank for decades.

Most people don’t realise that when they pay down their debts and say farewell to their salary, they suddenly become the country’s most unappealing customers to the big four, and will probably no longer be able to access key banking products such as loans and credit cards. They also certainly won’t be lured in with the highest-interest bank accounts and other perks and benefits offered to younger customers.

Most people think their bank will always be there to offer them credit cards, loans and good interest rates on their savings – especially if they own their home outright and have hundreds of thousands (or millions) of dollars in investments.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.

But that’s not always the case. The banks generally don’t care how much money you have; lending is their priority. And when they lend, the only thing they care about is whether you can service the debt using the guidelines in their systems. That is, they want you to have a pay-as-you-go income that their credit department understands.

Superannuation and investment incomes are not as stable, so the big banks don’t like them and won’t usually lend against them. And you can’t just call up your bank manager to approve a new loan or credit card – they don’t have that power. Every application for credit goes through a standardised credit approval process, and the first question is “what is your income?”.

Read the rest of the article on the Australian Financial Review here.

Retirement Diaries Podcast edition #7.

The #1 retirement bucket list holiday through Canada, Alaska and the USA with Suzanne KeirSuzanne (and David) took a 7 week pre-retirement sabbatical to the #1 retirement destination, Canada, Alaska and they added America too. Their trip was epic, taking in all the bucket list must-dos.

Suzanne and her husband David, both in their pre-retirement, squirrelled together all their annual and long service leave and took an epic pre-retirement sabbatical to the number #1 destination on the epic retirement bucket list - Canada and Alaska, before continuing on into America. They chose to do the trip as a 7 week sabbatical from their jobs, and they enjoyed it so much Suzanne returned and put in notice to her employer that she wanted to retire.

So today we’re talking travel, hearing about this truly epic journey, and all the highlights and experiences Suzanne and David had along the way. This will give you FOMO! We also chat with Suzanne at the end about her imminent retirement and what she hopes lies ahead.

You can watch it on Youtube below! Or, download the podcast here or wherever you get your podcasts.

NOTE: We are transitioning this to a Youtube Series, so be sure to click SUBSCRIBE on our Youtube Channel.

Thanks for reading Epic Retirement! Subscribe for free to receive new posts and support my work.