Harry S. Dent Jr.'s Blog, page 140

August 19, 2015

Overrun! 9 of 11 U.S. Cities Have More Renters Than Homeowners

I’ve been to Mumbai about three times in the past decade or so. It’s the most packed city in India.

There’s no doubt it’s a magnificent, sprawling city full of wonder. Yet as far as large cities go, many think it’s more affordable than urban areas in China – a country that holds the world title for the largest housing bubble on the planet!

That might be. But what I can tell you is that I’ve talked to a number of hotel workers in Mumbai who have to travel as much as two whole hours to get to work in the city. Living in the city is completely out of the question. There’s no way they could afford to. And even the surrounding areas are pushing it.

I’ve no doubt there are countless such workers in the U.S., but even for those who can pull off renting in a big city, they haven’t got an easy time, either!

The housing bubble is now higher than ever in cities like San Francisco, Miami, Denver, Dallas and Houston.

They’re so bloated that most of the people in these cities can’t afford to own a home there. They can only rent.

But here’s the catch-22: renting hasn’t gotten easier. It’s gotten more expensive. By a lot!

Rents have been getting more and more expensive for three whole decades now. Between 1985 and 2000, renters spent an average of 24.2% of their income. Today, it’s 30.2%. That’s 24% higher!

Going into 2006, owning a home was the more attractive option.

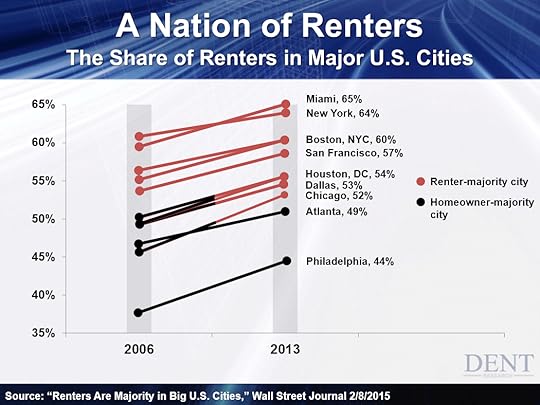

Now, in 11 of the largest U.S. cities, all have seen rising renters. And nine of them are dominated by renters:

At the top of the list is Miami, FL. That doesn’t surprise me one bit as I used to live there. The average person can’t afford to buy its real estate. Into 2006 Miami had one of the biggest bubbles, and its crash was hence as extreme. And now it’s bubbled again, this time more than ever, due largely to foreign buyers from Latin America.

The other reason is that Miami has the lowest median wages of any large city in the country. No wonder 65% of its residents are renters!

I doubt the Big Apple at No. 2 is any surprise to you either. The city’s famous for being damn-near impossible to live in, affordability-wise. Its median wages are better than Miami’s, but still not as high as you’d expect.

Next comes Boston and L.A. at 60%. San Francisco’s a little better at 57% – it at least has the highest median wages of any major U.S. city. But its housing and rent costs are still off the charts.

Last is Philly. Compared to the others, it’s more affordable and has higher than average median wages. But of these 11 cities, its percentage of renters increased the most from 2006 to 2013 – from 37% to 44%, a whopping 20% increase.

Overall, demand for rentals is rising so fast in many cities it’s starting to overwhelm supply. That’s why rental costs are rising, while ownership costs are falling.

It’s unfortunate for all of us because many of these renters are millennials who, thanks to absurdly high rent costs, can’t afford to save for a down-payment on a home even if they wanted one – which right now, they don’t.

And I can’t blame them! They’re the first generation to see home prices fall significantly, then take their sweet time trickling back up.

But that means millennials will be late to the homeowner party. And for us, it will be devastating to our housing market as boomers increasingly fall off the demographic cliff.

It’s almost ironic, since thanks to lower interest rates – much of that artificial – mortgage payments have become more affordable since 2006, dropping from 21.3% to 15.1%, or 29% lower.

But for now, millennials are stuck renting. Their rental phase doesn’t peak until age 27, which means we’ll continue to see demand for rentals increase until at least 2017.

That could be despite a deep downturn ahead. After all, it’s not like all those millennials can go back to live with mom and pop, as so many already have.

For homeowners – especially in these large cities – I continue to advise you to sell all non-essential real estate.

If you’re holding onto property because you’re renting it out for stable monthly income, that’s fine – though I’d much rather have the cash on hand to buy up investments that get slaughtered through the global downturn ahead.

But if you’re a boomer hoping to retire on the value of your home in the next five to 20 years, think again. Demographics show we’ll never see these heights again.

Harry

Follow me on Twitter @harrydentjr

U.S. Treasury Bond Yield Curve: Flatter and Flatter Still!

What I find most interesting is what the markets do in response to, or ahead of, any Fed action. The Treasury bond market is the most liquid and transparent market on the planet. That’s why it’s subject to so much volatility.

And what volatility we’ve had! As investors try to get ahead of the potential rate hike next month, it’s been crazy. Especially last week, as yields were moving down into the week, then up Monday, down again Tuesday, then closed higher Wednesday. It’s almost been silly.

The two big questions are still in the air: When will the Fed raise rates, and by how much?

They still aim to before the end of the year. They cite improving employment and a steadily growing economy. But wage growth is close to non-existent, as is inflation. Home and auto sales might have improved in this low-rate environment, but economist data is scattered.

It’s a mixed bag!

Rodney recently discussed how the Fed might have trouble raising rates at this point as it no longer has its traditional means of doing so. Another problem is, the yield curve is already starting to flatten:

This would only get worse if the Fed raised rates. Notice how long-term rates have moved lower while short-term ones have edged higher. It’s a classic example of the market pricing in the possible Fed hike, but not an improving economy. Push it further, and we’re edging closer to recession than the hallmarks of economic advancement.

I agree the economy looks better than six years ago. That’s the Fed’s whole argument for raising rates. But all this transparency and insistence about normalizing rates has backed the Fed into a corner. Damned if they do, damned if they don’t.

If nothing else, all the volatility keeps things exciting. That’s why the Treasury bond market has been a major focus, and interest, of mine since I started in this business trading commodity futures in Minneapolis some 25 years ago!

Today, the markets are even more liquid, and you don’t have to trade futures to profit from moves in interest rates. Take that and all the noise in the bond market today, and there are sure to be major profit opportunities for subscribers of Dent Digest Trader in the months ahead. Join now and I’ll show you how to bank off these movements.

Lance Gaitan

Editor, Dent Digest Trader

August 18, 2015

Young Families Today Can Hardly Afford to Make Ends Meet

I recently wrote about the cost of child care, which got me thinking of my own experience. My wife and I were in our mid-20s when we had our first child. To prep for the expenses, we sold my car. I replaced it with a 10-year old pickup painted in primer. It had an AM radio, vinyl seats, and no air conditioning. I took our son to daycare, so we commuted in the Texas summer heat with 2-by-60 air conditioning. By that, I mean rolling down both windows (by hand) and driving 60 miles per hour.

It wasn’t pleasant, but it did the trick. We all survived and kept moving up the economic ladder.

If we were young today, I’m not sure we could have pulled that off having a child at the same age.

As I noted in the earlier article, the cost of child care averages $11,600, or $972 per month. That’s like renting another apartment, or leasing a Maserati, except this payment comes with all the joys of late-night feedings, 10 to 15 different cold infections per year, and the knowledge that there’s no such thing as a cool car with a baby seat in the back. A Porsche Panamera with a baby seat is still a kid taxi, albeit a very fast one.

While the expense of early child care is high, before this ever starts the kid has to be born.

20 years ago we spent about $1,000 all-in, meaning pre-natal care, sonograms, and the delivery itself.

Today the total package costs around $8,800, and that’s if the parents have health insurance. Without coverage, the cost easily shoots past $25,000.

And all of this is in addition to daily living.

The average rent for a two-bedroom apartment is roughly $1,000 per month, and obviously much more in high-rent, urban settings.

In addition, the average student loan payment is $200, cell phone $100 for two, and house utilities $160. A car note runs $350, with insurance adding another $100. Then there’s health insurance, which for a young family runs about $335 per month after the subsidy.

All in, if they live modestly, the typical young family shells out $2,245 before they eat a thing, pay for gas, or spend any money on entertainment and travel. Adding in the new youngster would kick the basic monthly up to $3,217, not including diapers, formula, pediatric visits, etc.

Median household income is $52,000. With a 15% effective tax rate, the take-home income is $44,200, or $3,683 per month.

That leaves our young family with a whopping $466 to use toward food, entertainment, and any emergency costs.

If the couple is more fortunate and earns $70,000 per year, then with a 15% effective tax rate they bring home $59,500, or $4,958 per month.

This leaves $1,741 in the budget each month to buy food, diapers, clothes, gasoline and any extras such as a baby crib, high chair cabinet locks, electric outlet covers, and a battery-powered vacuum cleaner for sucking all the nasty stuff out of the baby’s car seat.

I made a lot of assumptions above, like the couple has only one car payment and one student loan note.

I also left out any mention of saving for the child’s college education.

These considerations would only make the picture worse. On the flip side, there are some tax consequences (such as the $3,000 child care tax credit) that could ease a bit of the pain.

But in a broad sense, the point is clear. A young couple, even a young professional couple earning more than 65% of all U.S. households, will have a difficult time making ends meet when they start a family. That appears to be the overarching reason why so many young couples have put off having children.

As we’ve noted many times, this might be good for the couple’s finances, but it slows down the economy.

Nothing requires spending like having kids. As noted above, there’s all the medical costs and child care issues, but then there’s daily living.

Parents end up buying all sorts of clothes, sports equipment, musical instruments, Halloween costumes, and toys than they ever dreamed possible. And that’s in addition to the extra daily living, entertainment, and vacation costs the family will incur.

While all of this spending puts a strain on mom and dad, it’s the sweet sound of commerce to toy companies, family restaurants, destination vacation companies, and a host of other retailers.

What they all know is that families with young children eventually become families with older children, who will eat more food, wear out more clothes, and in general require more spending right up until they leave home.

It all starts with young couples taking the leap and starting a family. Without it, the economic train never leaves the station, putting a cap on consumer spending for years to come.

Rodney

Follow me on Twitter @RJHSDent

REITs on the Rebound! Forget Stocks and Bonds

The Fed is going to raise rates next month – killing the real estate investment trust (REIT) sector.

Or so popular wisdom would have you believe. The problem is, it isn’t true. Or at the very least, it isn’t supported by history. Worse, it completely ignores two important reasons why REITs are more likely to remain strong rather than flop.

For one, it’s hard to see the Fed raising rates by more than 0.25% to 0.50% unless we see the pace of economic growth suddenly step it up a notch. The dollar is already so strong that it’s stifling export growth, and the Fed isn’t looking to make a bad situation worse. Raising rates by any significant degree would do just that. So it’s doubtful that investors will sell their income-bearing REITs for Treasury bonds that still dish out next to nothing.

But not only will this likely be a relatively mild tightening cycle compared to past rate hikes, in some cases REITs actually fair just fine – even quite well – during these periods.

The chart below tracks the price performance of the NAREIT All Equity REIT Index going back to the early 1980s (in blue). It compares the index to the Federal Reserve’s targeted Fed funds rate (in orange). Periods of extended tightening are highlighted in the blue columns.

We’ve had five periods of extended tightening since 1981. In three of them, REIT prices did indeed suffer. But in the other two – or a full 40% of the total – REIT prices did very well. In fact, the last tightening cycle in the mid-2000s coincided with one of the greatest bull markets for REITs in history.

As for today, most of the hurt in the REIT sector that comes with a rate hike has already been priced in. That’s because this is the most telegraphed Fed tightening in history. Yellen has been preparing us for this day for months. Investors who wanted to sell, for the most part already have.

So as a result, income-focused investments like REITs have had a terrible year. After topping out at $89.27 per share in late January, the Vanguard REIT ETF (NYSEARCA: VNQ) fell to as low as $74.67 by late June. That’s a decline of 16%, based almost exclusively on Fed fears.

But since then, REITs have been making a comeback, up about 6%. For the reasons I’ve explained, I expect that modest momentum to continue, with or without a Fed hike. With bond yields still very low, and the stock market looking wobbly, REITs are one of the few attractive options for investors looking for growth and income.

Charles Sizemore

Editor, Dent 401k Advisor

August 15, 2015

Pigs Solve A Major Medical Problem

Between 1991 and present day, the number of people on organ transplant lists has grown six fold, from roughly 23,000 per year to over 121,000. That’s right, enough to fill a large football stadium!

Unfortunately though, both donor and transplant operations during the same time have only doubled.

Every year this equates to roughly 8,000 people passing away while waiting for an organ transplant, which is a major problem the biotech industry has been trying to frantically solve.

Scientists and doctors are taking two primary approaches. The first has been to attempt to develop human organs leveraging 3D printing and

August 14, 2015

After This, Higher Education Will Never Be the Same Again

I’ve been a long-time financial supporter of my alma mater. Even though I philosophically disagree with some of the positions of the administration, there’s never been a doubt that I’m a Georgetown Hoya through-and-through.

My education while on campus, both in and out of class, was top-notch. It gave me a base to build on in both my professional career and my life as a citizen.

But several years ago the school reached a milestone that I could no longer stand with. It raised tuition to an astronomical amount: above $45,000 per year. Today, it stands at $48,000.

Keep in mind, that’s just tuition. Including other costs, the total bill for attending this year is $67,000.

I wrote to the dean of admissions, asking how could a single year of attending the university possibly be worth more than the

Bulls & Bears: Time to Adapt Our Investment Strategies

Let’s face it: Humans are creatures of habit.

Knowing a bit about biology (my undergrad major), I realize there are evolutionary advantages to creating and executing habitual behaviors. This M.O. allows us to be more efficient with routine tasks, even paving the way for multi-tasking. Doing things we’ve done many times before helps us operate with confidence, which is a key to success.

But there’s also a detrimental side to habits. They prevent us from adapting to change.

For decades, it worked just fine to take a comfortable approach to investing. That involved buying a mix of stocks and bonds… and holding for the long haul.

And after years of success with this simple method, I fully understand that investors find most other strategies foreign and awkward…

But, if you find yourself holding tight to old habits… you’re not adapting.

Financial markets are truly global these days. So looking only to the U.S. stock market for wealth-building strategies makes little sense… especially if buying and holding is your bread and butter.

August 13, 2015

Commodity Prices: Predicting a Substantial Stock Crash

I recently explained that it’s one thing for a central bank to artificially prop up its own stock market. It’s another thing entirely to even imagine doing something similar to falling oil prices. What’ll they do – buy oil futures? Give me a break.

Oil hit a six-year low this week. As I write this, it’s around $43, closer yet to the $42 target I forecast when oil bounced back to $63. After another tepid bounce, it will very likely fall to the $32 support level we saw in late 2008. John Kilduff, a leading oil analyst who will be speaking at our

Several Stocks Have Already Entered Their Own Bear Market

I’ve talked myself blue in the face about how we’ve been in the riskiest end of the spectrum when it comes to investing new capital into equities.

Now, more and more evidence is building to show that many stocks have already started their own bear market.

A couple weeks ago I talked about how the NASDAQ making new highs while more of its stocks actually went down than up was a sure sign of trouble for the markets. In the past 30 years, that’s happened a grand total of 10 times. And it’s always been met with a good thumbing in equities.

That means the market is much weaker than it appears on the surface. The Wall Street Journal even ran a recent graphic showing that just six stocks accounted for all the gains in the S&P 500 this year through late July.

Just six stocks out of 500 accounting for all the gains. How could that possibly be a good thing?

More interesting to me is an analysis coming out of Ned Davis Research showing that at the end of July, more than 20% of S&P 500 stocks were down 20% or more. So, right under our noses, the market is starting to fall apart!

Now is the time to be vigilant. With hundreds of leading stocks already in their own downturn, my level of concern is even higher. The bear market has begun. We just don’t realize it yet.

If you wait until leading stocks like Apple, Google, and Facebook selloff, it will be too late. The rest of your portfolio will already be in the dumps.

John Del Vecchio

Contributing Editor, Dent Research

August 12, 2015

Here’s How Much a Kid Born in 2013 Will Cost You

How much are kids worth? How much would you pay to have an extra munchkin, rug rat, tricycle motor, ankle biter or whatever else you want to call them running around?

According to the government, the answer is: a lot!

I’ve never heard anyone say that kids are cheap. The U.S. Department of Agriculture estimates that parents will spend $245,340, or a cool quarter-million bucks, to raise a child born in 2013.

That includes food, clothing, shelter, and incidentals from birth to the age of majority, but importantly does not include the cost of college. For anyone contemplating having a child, this number is terrifying.

And what do you get for your troubles? Hours of agonizing when they’re infants, worrying over every cold and allergic reaction, followed by the blood that comes from the inevitable bumps and bruises when they start walking.

Then there are endless hours of homework, sports, dance, birthday parties and countless other commitments, and that’s all before they date and learn to drive! For anyone with a toddler thinking about a college savings account, do yourself a favor and start a young-driver’s-insurance account as well. I sure wish I had.

Obviously whatever compels us to procreate outweighs all of these factors since we still have youngsters running around, but the cost/benefit analysis appears to be getting close to even. Countries around the world are struggling with falling birth rates, and one of the primary reasons is cost.

Eventually this leads to declining populations. Japan is the posterchild for this situation. Its fertility rate is about 1.4 children per woman of child-bearing age. That’s way below the 2.1 required simply to keep the population level even. Meanwhile, the German rate is about 1.6, and South Korea’s has fallen to 1.3.

Among the rich nations that make up the Organization of Economic Cooperation and Development (OECD), birth rates have trended lower for decades. Only a couple of countries remain that have fertility rates above 2.0. As you’d expect, research by the OECD names the cost of raising children as the major reason for fewer births.

Governments have tried to increase the size of families by offering financial incentives, but most of them fall flat. Tax credits can persuade those who might have waited to start a family to instead begin one earlier. On the other hand, increased paid maternity and paternity leave seem to have little effect at all.

The one approach getting high marks is access to subsidized child care. Judging by the costs in the U.S., I can see why.

Daycare in the U.S. costs between $3,800 and $18,000 per year. The average is $11,600. That’s about $972 per month.

Assuming a couple with a young child earns the average household income of $52,000 and has a 15% effective tax rate, their take-home pay is $44,200. The average cost of daycare would eat up 26% of their income.

There’s some consolation. One is that the U.S. tax code provides a child care credit of up to $3,000 on one child. That brings the family’s cost of child care down to $8,600.

This is still 19.5% of their income.

Unlike college, which many parents save for over the life of their child, the cost of daycare smacks young parents right off the bat. Once junior comes home from the hospital and maternity leave is over, young moms and dads immediately start forking over $972 per month.

To put it mildly, this is quite a drain on their resources. There aren’t many good options, either. One of the parents could stay home, but this typically means a setback in that parent’s career. I’m not judging whether a parent should or should not stay home. This is just what typically occurs.

With this sort of financial blow waiting just around the corner for young families, it’s plain to see why many would put off having children. It also explains why assistance with daycare would help ease the pain more than a tax break or a few more days off after birth. While welcome, those things are comparatively small.

If we want to give young, would-be parents the economic confidence they need to have kids, apparently we’ll have to put our tax money where it helps the most – taking care of the little tykes while mom and dad get back to work.

More importantly, that might be what it takes to get the baby train, and our economy, back to moving at a steady pace for the generations to come.

Rodney

Follow me on Twitter @RJHSDent