Harry S. Dent Jr.'s Blog, page 139

August 27, 2015

Real Estate: The Downside Risk in 20 Major U.S. Cities

I like to practice what I preach. I don’t own my home. I rent.

I’ve been renting my house in Tampa since October 2005, because I’ve seen what’s coming – the

August 26, 2015

Bear Markets: Here’s What You Need to Know!

Breakout: These Investments Were Slaughtered in a Matter of Seconds

August 25, 2015

Market Selloff: Strike While the Iron Is Hot!

I don’t usually drink on a Monday afternoon, but yesterday, I made an exception. Once the market had closed, I snuck out of the office for a cold beer (a Shiner Bock, of course). And then I ordered a second one. It had been that kind of day.

But here’s the thing: while wild market volatility is nerve wracking, these are the days when the best opportunities present themselves. I’m not exaggerating when I say that I made 30% in about 15 minutes yesterday, and I did so while taking no risk whatsoever.

I got lucky. I happened to stumble into a mispriced security, and I struck while the iron was hot.

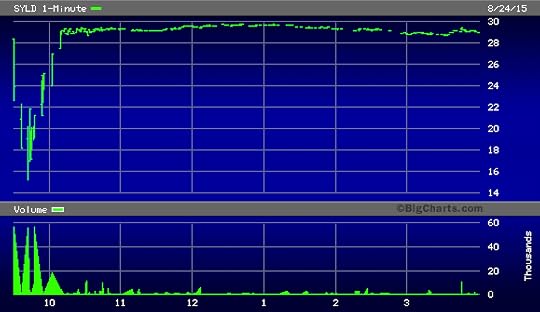

Let me give you the details. I opened my trading screen to find that an ETF I owned, the Cambria Shareholder Yield ETF (NYSEARCA: SYLD) had dropped by 50% in value. It had lost half its value from Friday’s close. This is what I saw:

Remember, ETFs are not stocks. They are exchange-traded mutual funds that, by their very construction, are supposed to follow an index. At least in theory. If they didn’t, large institutional investors could buy up a large block of ETF shares, break them apart into their portfolio holdings, and then sell the portfolio holdings in the open market for a risk-free profit.

In the case of SYLD, we had a mispricing that was theoretically impossible. The ETF’s price was down by 50%… while the actual portfolio of stocks that SYLD tracks were down maybe 4% at most.

But on a trading day like yesterday, you don’t have a normal, functioning market. You get mispricings like these. (SYLD wasn’t the only ETF whose pricing became untethered from reality. It’s just the only one I happened to be trading at the time.)

So, I did what any rational investor would do: I plowed every dollar I could find into SYLD shares before the mispricing window closed. I made about 30% in 15 minutes, sold the shares and went on about my day.

I tell this story not to toot my own horn. I’m the first to admit that I got phenomenally lucky here. But there are definitely some lessons we can learn from this:

To start, ETFs are illiquid, and have low trading volume. You can’t dump a bunch of shares without affecting its price. So when a large shareholder unloads his or her shares in a hurry, especially on a smaller ETF like SYLD that typically trades less than 30,000 shares per day, it startles the market. Thus, you get big mispricings like we saw yesterday.

But this same illiquidity can create fantastic short-term opportunities if you’re willing to take the other side of the trade and you are small and nimble enough to act. If I had been running a multi-billion-dollar hedge fund, I wouldn’t have been able to make this trade. Given the small size of the ETF, I would have moved the market, destroying the opportunity I was hoping to exploit.

I was also able to jump on this because I wasn’t fully invested. I had a little dry powder… just in case. In order to take advantage of opportunities like these, you need to keep a little cash on hand.

Keep your eyes open. We’ll have more volatility in the months to come… and plenty of good short-term opportunities.

Charles Sizemore

Editor, Dent 401k Advisor

Get With the Program: Bubbles Don’t Correct, They BURST!

I’m practically drowning in interviews. I had half a dozen yesterday and even more today. But it’s time to put the word out that the second greatest bull march in history is finally coming to an end. It’s done.

Wall Street thinks this is a correction – a 10% drop, maybe 20% at worst, followed by more gains. They think we’re just six years into a 10 if not 20 year bull market. This is just a healthy breather.

Of course they think that! It’s the same “bubble-head” logic you find at the top of any extreme market in history!

Every single time – without exception – we delude ourselves into believing there is no bubble. We think: “Life’s good, why should we argue with it?”

And every time, we’re shocked when it’s over. Only in retrospect do we realize, yes, that was clearly a bubble, and oh, how stupid we were for not seeing it.

Bubbles don’t correct. They burst. They always do. And if anyone is still doubting whether this is a bubble, they need to get with the program – now!

August 24, 2015

Run for Cover! Investors Flee to U.S. Treasury Bonds

Despite the Fed’s talk of a rate hike as soon as next month, long-term U.S. Treasury yields continue to trend lower as investors seek the safety of U.S. Treasury bonds.

This scenario was magnified Friday, and even more so today, as global equity markets sold off and the commodity bubble continued to deflate.

CRASH: There’s No Getting Out of This One

My phone’s ringing off the hook. My inbox is flooded. Some people want to know if this market rout is the big one. Others want to cheer us on for sticking to our guns for so long. But everyone has a question: How long will this selloff last?

The answer depends on why equities dropped in the first place. The problem is, there’s no single reason.

Did China kill the markets, or was it oil? Maybe it was the strong dollar. Perhaps, as Krugman claims, governments just don’t have enough debt outstanding (he really said that).

All of those claims – except Krugman’s – are true, and yet none of them are the issue.

Investors are finally waking up to the fact that we are in an economic winter. With it comes a whole assortment of problems: sluggish demand, falling commodity prices, and a race to devalue currencies to boost exports at the expense of everyone else.

Since there is no single issue to blame for the selloff, there’s no individual cure. And that’s the dilemma.

China’s Desperate Measures

China is taking new measures to stop the free fall in both its economy and stock market. Chances are, they won’t work.

The People’s Bank of China might cut the reserve rate requirement for banks. If it does this, then theoretically billions of yuan would suddenly be available for lending. This would help their economy, but only if people want to borrow, which doesn’t appear to be the case.

Then there’s the Chinese stock market. On Sunday, the Chinese government announced that the state pension fund can now allocate up to one-third of its assets to equities.

This approach has a problem similar to cutting the reserve rate requirement. It might prop up stock prices for a while, but it does exactly zero to increase economic demand.

The recent devaluation of the yuan was meant to cut the price of Chinese goods on the world markets – i.e. increase demand from other countries. Now Americans, Australians, Europeans, etc. can buy more of what China sells.

At the same time, the Chinese have to pay more for what all of us sell. This development is a problem for every nation that isn’t China, and still doesn’t address the issue.

The Problem Is Demand

When it comes to selling goods across borders, the problem isn’t exchange rates, it’s demand. American, Japanese, and European consumers control a lot of the world’s capital, but they are aging. They’re not the consumers they once were.

Meanwhile, domestic demand in China hasn’t taken off at the rate they expected. It turns out their own citizens are growing older and want to salt away more of what they earn for the future.

It’s a deflationary trend we’ve been warning about for years.

Western nations face similar problems. In Europe as well as the U.S., our central banks have burned the midnight oil to insure economic growth.

To this aim, they guaranteed bank profits through high net interest margin (long interest rates minus short interest rates), as massive amounts of capital were stripped from savers through negative interest rates.

The ammunition in this fight was newly printed currency. Trillions of dollars and euros later, here we sit, wondering when our economies will return to their previous glory.

We have other ailments. Oil production was a saving grace just a year ago, now it’s talked about as a curse. Rising production is driving down prices, which in this upside-down world of economic unreality is thought of as a bad thing.

When in history did governments wish for, and actively pursue, inflation? This stated policy goal guarantees the erosion of accumulated wealth, and yet our governments yearn for it. Crazy!

All of this comes back to the same idea. It’s not just one thing weighing on markets around the world.

It’s the multitude of issues faced in many nations. They’re dealing with aging populations, bubbles based on debt, and the misguided but unrelenting belief of policy makers, that if they only try one more monetary policy change, they can turn the economic tide.

Investors now realize this isn’t true, and there’s no way to estimate exactly how far out the tide will go.

Hopefully most investors have taken steps to avoid some of the carnage. While keeping some funds in equities as the markets marched higher these last few years, we’ve also pointed to cash and high quality fixed income as good hedges against an imminent downturn.

For those who haven’t taken such steps, this has been one heck of a wake-up call!

Rodney

Follow me on Twitter @RJHSDent

August 22, 2015

Two Google Spinoffs Making a Splash in Biotechnology

Earlier this month, Google announced it was restructuring the company by creating a parent company called Alphabet and spinning out its major divisions underneath into their own distinct companies.

This was a bold move by the founders. However, Wall Street mostly met it with praise, with the stock jumping 4% the day after the announcement on August 10.

Two of the spin-off companies that will be under Alphabet’s reign are health-focused and should be making quite a splash in the biotech space.

The first is a life sciences company that was born out of the highly innovative Google X Labs. The new company doesn’t have a name yet, but rest assured it will be catchier than their current moniker, the “life sciences group.”

Google co-founder Sergey Brin stated: “While the reporting structure will be different, their goal remains the same. They’ll continue to work with other life sciences companies to move new technologies from early R&D to clinical testing – and, hopefully – transform the way we detect, prevent, and manage disease.”

The company will still remain focused on its current initiatives, which include a nanodiagnostics platform, a cardiac activity monitor, and a baseline study.

The baseline study is focused on an effort to collect large amounts of genetic and molecular information from hundreds of people, crunch the data using Google’s massive server infrastructure, and create a picture of what a healthy human body looks like, from the DNA up!

In 2013, Google got a jump start on its plans for biotech spin-off companies by forming an independent company called Calico. Calico will join the life sciences group as a subsidiary under the Alphabet umbrella.

Calico’s main focus has been on leveraging the latest in IT and biotech breakthroughs to combat aging and its associated diseases. Bottom line, they are focused on understanding and tweaking the biology that controls lifespan, allowing people to live longer and healthier lives.

Both of these companies now have the business structure of the Alphabet brand to make their research and technologies skyrocket. I will be tracking each closely as this industry continues to bloom.

Ben Benoy

Editor, BioTech Intel Trader

August 21, 2015

It’s Finally Happening: The Crash Season Is Upon Us

It’s finally happening. The crash season is upon us.

We’ve seen the early signs this week with leading stocks getting the carpet swept out right from underneath them.

China’s stocks are right where they were when its bubble burst 35% into July. UK stocks are in a correction. The DAX is in a correction. And the S&P 500 hasn’t busted quite as much – yet – but it’s dipped below that important level of 2,000 at the bottom of the S&P 500 Channel going back to late 2011.