Harry S. Dent Jr.'s Blog, page 136

September 22, 2015

Europe’s on the Brink of a Middle Eastern Crisis

REITs Rallying! Expect This Sector to Beat the Broader Market

The stock market didn’t exactly react well to the Fed’s non-decision to keep the targeted Fed funds rate unchanged last week. The S&P 500 and Dow both spent most of Thursday and Friday in freefall, and as I’m writing this, both are only modestly in the black today.

The stock market didn’t exactly react well to the Fed’s non-decision to keep the targeted Fed funds rate unchanged last week. The S&P 500 and Dow both spent most of Thursday and Friday in freefall, and as I’m writing this, both are only modestly in the black today.

But one corner of the market has held up a lot better than the rest: boring, “bond-like” real estate investment trusts, or REITs.

You see, while stock prices dropped like a rock, bond prices actually enjoyed a nice rally. And REITs, which have come to be seen as bond replacements in this era of ultra-low bond yields, have followed suit.

September 21, 2015

Here’s to Cheaper Education, Health Care, and Child Care Costs!

It’s not enough that jobs are less stable, or that the ones we’re adding are increasingly more part-time…

It’s not enough that jobs are less stable, or that the ones we’re adding are increasingly more part-time…

It’s not enough that rapidly growing student loan costs are plaguing more young echo boomers and millennials…

It’s not enough that the high costs of education are increasing the inequality gap and making upward mobility impossible…

Or that, even after the last crash, housing is still expensive and loans are harder to get…

Today, the young generation ALSO has to deal with runaway childcare costs. It’s no wonder many of them aren’t having kids!

But I believe much of this will change in the great deleveraging we see ahead. When this bubble bursts, it will bring many of our “inflated” economic realities – in this case, the ones that affect the majority of our consumer population – to center stage.

This is something important to remember. When it comes to education, health care, even child care to an extent – they’re all service industries. But these service industries rely on higher-than-average skills. They’re not hotel clerks. They’re not servers. For that reason and many others, they’re subject to heavy special interests and lobbying, and scarcer skills. And that’s one of the reasons all this stuff is so expensive!

But these trends simply cannot continue without financially killing most families.

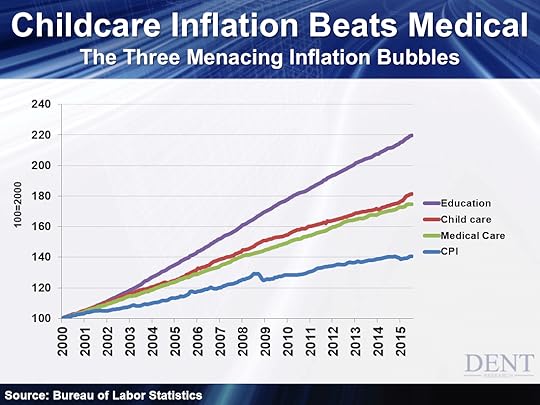

Let’s use the consumer price index (CPI) as our benchmark. It’s up 41% since the beginning of 2000, an average gain of 2.6% each year.

Medical care is up substantially higher at 75%, or 4.8% per year.

Educations costs are off their rocker – 120%, or 7.6% annually.

But more surprising to me, childcare has now surpassed medical care at 82%, or 5.2% per year. Take a look:

How are young families supposed to have kids? How are we supposed to keep our populations stable?

We need 2.1 kids per family just to be even! But inflation of this magnitude is crushing millennials and even young echo boomers before they can even get off their feet financially.

September 19, 2015

Scientists Just Discovered Vaccines That Are 1,000-Times Better

Ever wonder what is the most advanced bioreactor for creating disease antibodies in the world?

Ever wonder what is the most advanced bioreactor for creating disease antibodies in the world?

Of course you didn’t. But if you guessed the human body, give yourself a gold star.

Scientists at the Defense Advanced Research Projects Agency, better known as just DARPA, just caught on to something brilliant: they can use the human body’s ability to quickly create antibodies as a new vaccine-making method.

The problem with current vaccination production is that it just takes too long. Right now, on average, it takes at least nine months to produce vaccines in large enough quantities to treat major outbreaks.

To give you an idea of how ineffective this method is, scientists crunched the numbers for the 2009 influenza outbreak to see the effect vaccinations had.

The results were startling. Of the 60 million-plus Americans who got the flu shot in 2009, only 1.6% were truly protected.

This result was a combination of the slow production process, and limited vaccine effectiveness. The scary part is that this particular vaccine was the fastest ever produced according to Col. Daniel Wattendorf, a clinical geneticist with DARPA.

So this new method of using the human body as its own antibody factory is a god-send. Essentially, once a body overcomes the virus, it contains antibodies that can then be transferred to another patient.

In fact, this is exactly what scientists did last year during the Ebola crisis. This method essentially jump-starts the immune system by giving it the exact antibodies to replicate in order to fight specific diseases.

The problem is: how do you do this on a large enough scale to battle an outbreak?

Right now, a method is in production that will copy the best gene from recovered patients. Basically, scientists will replicate the DNA of a patient who survived the virus, then go from there.

So far this technique looks promising. Some in the industry think it will be 1,000-times more effective than the current method of production.

I am tracking this technology via my social media collective intelligence system. In the past we’ve been able to get a jumpstart on the rest of the market by targeting and tracking disruptive technology similar to this.

I’ll advise BioTech Intel Traders if we start to see an uptick in this technology’s momentum across publicly traded companies.

Ben Benoy

Editor, Biotech Intel Trader

September 18, 2015

Stock Market: This Is Not a Bottom

For the past two months, the market’s been acting like a yo-yo. Down and up. Up and down. All of this volatility has got investors freaked out. So, I thought I’d check in on the latest sentiment numbers to see how professional and individual investors feel about investing in stocks.

As I expected, sentiment numbers have fallen, and not by just a little. Ned Davis Research crowd sentiment is just 48.5% – all the way down from 72%. Anything below 55% means investors are becoming pessimistic about the market.

That’s not even the whole story. Active professionals are allocating only 25% to stocks. They were – get this – fully invested just this spring. By fully invested, I mean 100%. They’ve fled for the hills!

Some might see this as a bullish sign. When sentiment falls, it’s a contrary indicator to get back into the market. You want to get ahead of the rest of the traffic.

But, individual investors are still 65% allocated to stocks – significantly higher than the professionals. There’s a lot of horsepower there. So don’t think for a second that the market has bottomed.

It’s true that people are not as hyped up about the bull market as in the past. But sentiment needs to stay at extremes for a while before a new bull market can start.

People don’t jump out the window following a 10% decline in stock prices because they cannot stand the sight of red all over the ticker tape. We need blood in the streets before we know the market has truly bottomed. And only then can we aggressively start buying stocks with less risk.

For now, the risks remain. U.S. equities are still among the most overvalued when accounting for earnings over the last 10 years. And relative to revenue, the S&P 500 still trades at 1.8x, which is outrageously high. That’s not a level where long-term bottoms are made.

The other risk is earnings growth for the rest of 2015. The third quarter is coming to an end and earnings reports will start to come out in about a month.

Technology companies have a lot of weight on their shoulders this quarter. They’re estimated to account for nearly 25% of the S&P 500’s earnings growth.

I’m skeptical, as Forensic Investor subscribers are well aware. I just sent them a note earlier entitled “Short Big Tech,” and we just added to one of our winning positions.

So we’ll have to take those reported earnings with a grain of salt. The key will be the quality and sustainability of those earnings. That will help us understand whether the market will continue to tank, or rally higher.

John Del Vecchio

Contributing Editor, Dent Research

September 17, 2015

The Fed Isn’t Doing What It Was Meant to, and Can’t Do Much Else

After keeping the markets on edge in the days and weeks leading up to today’s decision, the Fed has decided once again to leave interest rates unchanged.

As we’ve spent this week discussing “all things Fed,” it’s worth spilling a little ink on what the quasi-government-but-really-private organization is supposed to do.

Originally, the Fed was built as a lender of last resort. In times of panic when banks needed to sell good assets for cash to meet depositor demands, someone had to be there with the ability to make good.

This is the proper role of a central bank, and is exactly what the Fed did in March 2009 when it printed $1 trillion to buy government-insured mortgage-backed bonds. Fed actions thawed the frozen market, which resuscitated the buy side and helped things return to normal, albeit at a lower level.

But over the last 100 years Congress piled other responsibilities onto the Fed, most notably full employment.

The monetary institution is supposed to use interest rates and the printing press to prod businesses into hiring more people. This part of Fed policy has failed, but you wouldn’t know it by looking at employment figures from the Bureau of Labor Statistics (BLS).

Here’s how it works.

The Fed tries to create jobs through lower interest rates. If consumers and businesses can borrow at cheaper rates, then the thinking goes they will borrow more money. With that extra cash, they’ll spend more on goods, services, equipment, etc., thereby driving up demand for such things. Businesses then will meet increased demand by hiring more people to build, sell, and maintain all the new stuff.

Only, it hasn’t happened that way.

Some industries, such as autos, benefitted from higher sales based on lower rates. Most did not.

Take housing. It is logical that with very low interest rates home buyers would rush out to purchase homes, thereby driving up new home construction. But the pace of home sales since 2008, particularly new home sales, has been anemic at best.

At the height of the market, our economy was churning out more than 1.3 million new homes a year. After falling to less than 300,000, the number recently topped a mere 500,000.

If we’re not building a lot of new homes, we don’t need more framers, roofers, plumbers, etc. The same is true of other industries – without soaring demand, why hire more people?

A key to gauging employment is the rate of new business creation. It’s not just small businesses that hire the most people, but small new businesses.

This is why the BLS tries to figure out how many net new businesses opened up each month, and therefore how many people were hired at these emerging companies. The calculation is called the “birth/death adjustment,” and it is very important to the monthly jobs report.

In August, the U.S. economy created 173,000 jobs. Within that number, the BLS estimates that 111,000 jobs were created at new businesses. In other words, a majority of the jobs are based on a guess. They’re not based on verifiable facts.

And that’s just August. The BLS estimates 658,000 jobs from new businesses year-to-date. Compare that with the roughly 1.6 million total new jobs – not just from new businesses – estimated for the year. More than one-third of the new jobs are guesses, and not very good ones at that.

Looking to other sources, it’s clear that new businesses aren’t popping up all over the place. The polling company Gallup recently published a graph showing the number of businesses failing each year compared with the number of businesses created. From the beginning of the chart in the 1970s through 2007, more companies opened each year than shut their doors.

Since 2008, the numbers have been reversed. The data only goes through 2012, but it shows that our economy consistently sheds companies, and presumably jobs.

Now we have even better data.

Just this year the Kauffman Foundation created a Startup Activity Index, which contains monthly data starting in 1997. Currently the overall index is negative. It has been below zero since 2010, dragged lower by the rate of new business creation per 100,000 people. This number bounced between 165 and 200 from the late 1990s through 2008, then dropped to 133 in 2009.

This year it sits at 130, well below the average of the 2000s.

For all the money the Fed created in its attempt to drive interest rates lower, it has not, and cannot, force economic activity. I guess there are limits to what the Fed can do… but that’s OK. The BLS is there to guess at numbers to make us feel better.

Rodney

Follow me on Twitter @RJHSDent

Stocks Have Averaged Negative Returns During This Market Phase

September 16, 2015

The Timing Was Perfect: More Evidence Shows We Hit a Major Top

More evidence is piling in to support that we did make a major top on May 20 for the Dow and S&P 500. In my view this is part of a series of key market tops we’ve seen globally between November 2014 and July 2015.

Finally, our key indicator, the S&P 500 Channel, broke its bottom trend line in late August. That is the best way to know this endless bubble is likely over!

That’s why our third annual conference couldn’t have come at a better time. And it shows – between those in attendance and those who watched from home, we had over 1,000 people tuned in. And hundreds more have reserved the on-demand recordings of the event.

Here’s what some people had to say:

“Great conference. I am confident and prepared for today’s volatile markets.”

“The Summit was great. I enjoyed all the info I picked up to help in future investments and help lower future risk.”

“I enjoyed the variety of speakers. The Summit offered a large breadth and depth of topics. Great to have all that information in one place.”

In my main presentation, I explained a convergence of my key cycles that promises a great deflationary period ahead. I also gave two workshops – one on the Great China Tsunami that will wash over the global economy, and another on the global real estate meltdown for our network members.

Rodney focused more on the political angles of this unique period in his talks – explaining how more small businesses are getting destroyed than created.

He asked: why aren’t more of our politicians in this “silly season” hammering on about that? There’s an excess of regulations making their very existence next to impossible! He also detailed the mounting problem of the student loan crisis – and it won’t just affect students. Charismatic as he is, Rodney was well received as always.

Adam O’Dell explained his unique trading service. I’ll tell you – what I like so much about Adam is that he uses different technical indicators than most traders use. And doing something differently is the only way you can have an edge in today’s more challenging markets.

Then came the shocker. Right in the middle of the conference, Adam got a major broad sell signal for Boom & Bust subscribers. This is in line with my expectations of a major crash in the making.

Adam and I are total opposites, but that’s why we have him. I focus on long-term trends and he focuses on short-term momentum. Our indicators are completely different.

But Adam’s helped me understand shorter term technical indicators to refine my forecasts. So it’s comforting to see his indicators confirm that this is the time to be defensive, as he is the expert in this arena.

The highlight for me was Dr. Lacy Hunt, who we’ve had two times before. He’s the only classical economist out there that I like and listen to. He knows his economic history, down to all the details and theories.

And unlike other economists, he understands how credit and financial-asset bubbles build throughout history and why they always end in deflation.

He startled the audience when he proclaimed that the Fed doesn’t actually create money. Banks do when they lend – and right now, they’re not! All QE’s done was push long-term rates to zero adjusted for inflation, and create greater financial-asset bubbles, especially in stocks.

Also back by popular demand from last year’s Miami IES conference, we had David Stockman appear via live stream (as his schedule wouldn’t allow a live appearance).

Few men are as dynamic, humorous and knowledgeable he is. I have learned a lot about economic, financial and political history from David Stockman and Dr. Lacy Hunt both – and you know how much I study history! To have these two together at this conference was a real treat.

And do you know how hard it is to find a competent speaker with real data from the trenches who warns you about the risks in real estate just ahead?

We finally found one, and Keith Jurow was a big hit with his colorful and very informative slides. Between Stockman, Hunt and Jurow, this had to be the most content-rich conference ever.

Our “wild card” speaker was Loral Langemeier.

I’ve spoken with Loral at several events in the U.S. and internationally. She calls herself “the millionaire maker.” And she isn’t kidding.

The audience only got a glimpse of what I’ve seen her do with people of all ages. She can draw a cash flow business strategy out of almost anyone in 10 to 20 minutes based on hobbies or unique interests they’re already doing. She holds three-day seminars where everyone walks out already making money. It’s crazy!

I have found she is especially good with kids and younger people. So I suggested that the audience get their kids or grandkids to check out Loral’s book and seminars.

What I liked most about what Loral said was that it’s all about focusing on your strengths and finding the right people to build a team. It made me appreciate the team we have built at Dent Research.

My first partner in business development was Harry Cornelius in 1995, and he’s still my partner today.

Next was Rodney Johnson in 1996 – I recognized how smart and systematic he was (you can probably surmise that I am not so systematic) and stole him from a new venture I had invested in.

Then came Shannon Sands and Erika Nolan as marketing partners through the Sovereign Society in 2013.

I have never been good at marketing. I might be the worst marketer in the world! I just give people the stats and think everyone should be on board. But they’ve allowed us to greatly expand our audience and bring down the costs of our newsletters and services. That has always been my vision, but it would not have happened without them.

Together they found Adam O’Dell who launched our first trading service – and what a track record! This conference and every conference, people come up to me and say his is one of the few trading services that they actually make money on.

Since his, we’ve launched an array of services to meet different subscribers’ investment strategies and risk tolerance.

We have Charles Sizemore focusing on asset allocations for passive 401(k) and retirement accounts, and Lance Gaitan focusing on bond strategies. Both have worked with Dent Research for many years.

We added Ben Benoy as recently as last year. Ben’s focus is the hot biotech sector. He uses a unique “crowdsourcing” approach to identify the best long and short opportunities in the field.

And finally, we added John Del Vecchio, a very experienced and accomplished short seller. He showed the audience some techniques for discovering the hidden time bombs in companies’ financial statements.

At the conference, we also invited a limited number of excellent outside investment and banking services. They range from EverBank (a global Internet bank) to AdvisorShares (ETFs like HDGE to short stocks) to RMB Group (offering a commodity trading system) to Royale Energy (an independent natural gas exploration and production company in California).

These investment companies have worked with us for years and proven to be effective for our subscribers. We only admit a select few to speak at our IES conferences.

And this year we brought a few others. Andrew Baxter from Australia (who I have spoken with many times there) introduced a simple covered call strategy for consistently making money short-term, in up or down markets.

We also brought in Erika Nolan, who through the 1291 Group advised our attendees on global-insured income solutions through life-insurance based products.

The feedback I got was music to my ears. People are getting serious about making major changes in their investment and business strategies – especially real estate. Which like I’ve said, I can’t seem to convince people out of!

If you missed this conference, make sure you reserve the on-demand recordings – we opened access back up just through tonight for those of you who didn’t get it. And make sure you make it to the next one in West Palm Beach, FL at the PGA National – October 20 to 22, 2016.

See you then!

Harry

Follow me on Twitter @harrydentjr

The Big Moment: Is the Fed Going to Do It?

The only thing on investors’ minds today is: what will the Fed decide? The reports I hear are that there may be some disagreement within the committee.

Communication from Fed chair Janet Yellen has been pretty clear. They plan to hike the federal funds rate from zero to 0.25% before the end of the year.

Although Janet Yellen has been adamant about a hike, other voting members aren’t so sure. Plus, outside forces like the IMF and the People’s Bank of China are pressuring them NOT to raise rates.

Economic data is still too poor to really justify a hike, but there have been some recent victories. Last Friday, the Bureau of Labor Statistics (BLS) released August producer prices (PPI), and prices on the wholesale level rose more than expected. That’s the third increase in prices in a row. It’s still lower than the Fed would like to see, but certainly gives them more reason to hike.

But guess what? Long-term Treasury bond yields were recently dropping! If the Fed does increase rates today, raising short-term yields while the long-term continues lower, it will flatten the yield curve even more – and maybe even invert it!

If the market responds like that, it will mean the Fed made a big mistake in hiking. Worse, we could be looking at a possible recession. If a small hike in rates slowed our economy and slowed employment, it would certainly slow inflation – again. That would be an unintended consequence of Fed action to move rates higher.

Let me just say this – I don’t think the Fed’s going to do it. The organization doesn’t have the internal consensus to get away with it. But the buildup in anxiety leading up to their decision could cause a lot of trouble either way.

Lance Gaitan

Editor, Dent Digest Trader

September 15, 2015

Rate Rise or Not, the Fed’s Not Pleasing Anyone This Week

Vancouver, British Columbia is one of the most beautiful cities in the world. It has a temperate climate, mountains in the background, and right now there is plenty of sunshine.

To make it even better, the Canadian dollar is trading at $0.75, which makes travel to Vancouver a bargain.

We just spent three days in the storied town at the 2015 Irrational Economic Summit. The event was as great as it sounds. But no matter how much we enjoyed the location, speakers, and attendees, there was a cloud hanging over the meeting.

It was the same cloud that’s been hanging over the financial markets and, to a degree, the financial world for months – the Fed.

Everyone’s grumbling about this week’s decision on raising rates. This is odd because no one knows what the decision will be. It would make sense that at least some group would be thrilled to see the Fed either raise rates or stand pat, but I can’t find anyone with that point of view.

This doesn’t mean people don’t have opinions on what the Fed should do. Everyone on television, in print, or talking at a conference can tell you why the Fed should or should not raise rates. But no one’s happy about it. And that’s the rub.

People who want the Fed to hold off point to weakness around the world and the knock-on effects of higher rates.

The Chinese economy is slowing down. If rates move higher, then the U.S. dollar will strengthen, pushing up the yuan because it is pegged to the U.S. dollar. The Chinese just devalued their currency, then spent over $100 billion trying to keep it within a narrow trading band. Anything that upsets this balancing act will require more Chinese intervention.

At the same time, a stronger dollar will entice investors to pull more capital out of emerging markets as they seek higher gains in the buck. This would make these fragile, natural-resource providers vulnerable to currency runs reminiscent of the late 1990s.

Here at home, a stronger dollar will make our exports more expensive to foreign buyers. This will drive down the earnings of multinational companies at the same time that they’re dealing with weak economies abroad.

As for our own equity markets, higher interest rates typically draw investors away from stocks. If the Fed raises rates it could exacerbate the current downtrend.

If rates remain low, then investors will keep subsidizing. As if financial institutions weren’t already favored in all of this. Currently, banks pay almost nothing for deposits while earning 3% to 4% on loans.

When the Fed pushed rates down, it hoped that borrowers would take on more loans and spend the cash, thereby re-energizing the economy. Instead, banks got a pass on paying interest while large institutions used the low-rate environment to leverage up their investing or, for public companies, to buy back their own stock.

However well-meaning the Fed’s plan, the outcome of exceptionally low rates for seven years has been corporate welfare and a bunch of profit-creation for banks and other big parties, at the expense of savers.

You’ll notice in all this, no one’s talking about the positive, because there isn’t much. Those who want to keep the status quo aren’t screaming about wonderful economic growth in the low-rate environment. They don’t make the case that things are great the way they are.

Instead, they point to the harm that could come from a change.

Those looking for higher rates aren’t asking the Fed to curb an economy at risk of growing out of control. They don’t pound the table about the need to rein in inflation, because there isn’t any (as we’ve said many times, deflation is a bigger risk). Their point revolves around the Fed’s current policy favoring one group over another.

So we have fear of a greater economic slowdown, a worry over how rising rates will affect the rest of the world, frustration with current policy as a corporate giveaway, and the distinct belief that the Fed is taking advantage of small savers. The Fed won’t win no matter what it does!

In my view, it’s about time. Finally people are realizing the negative effects of Fed intervention when it goes beyond the scope of lender of last resort.

When the Fed bought mortgage-backed securities in 2009 it was breaking open a market that had frozen shut. Everything after that has been an attempt to manage the economy, and it hasn’t worked.

What’s worse, their policies have created unintended consequences like the stock and bond booms, while driving conservative investors into riskier assets. The sooner the Fed returns short-term rates to a normal range – and excuses themselves from manipulating the long end of the yield curve – the better off we’ll all be.

Then we can get back to the task of repairing our economy and finding a way forward.

Rodney

Follow me on Twitter @RJHSDent