Harry S. Dent Jr.'s Blog, page 135

September 28, 2015

Time to Buy? Insider Trading Might Make You Think Otherwise

I’m not much of a market forecaster. I’m content to leave that in Harry’s capable hands (if you missed his latest update on Friday,

I’m not much of a market forecaster. I’m content to leave that in Harry’s capable hands (if you missed his latest update on Friday,

The Strong Dollar: Bad for Companies, Good for You

September 26, 2015

All’s Not as Well as It Seems

Hillary Clinton: Crashing Biotech in Just 21 Words

On Monday we saw a 21-word tweet from Hillary Clinton cost the biotech sector $40 billion in market cap in just one day.

On Monday we saw a 21-word tweet from Hillary Clinton cost the biotech sector $40 billion in market cap in just one day.

The short message distributed over social media was obviously just more presidential campaign fodder, but it still caught major attention for the way it moved the market.

Here is the tweet, clearly a pre-planned stunt to get some campaign policy out to the masses:

Shortly after the message went out the overall biotech sector, tracked by the NASDAQ Biotech ETF shown below, started to tank.

At the end of the day, the sector as a whole lost 4.5%, or roughly $40 billion in market cap.

The message was targeted at a very specific instance of price gouging, where Turing Pharmaceuticals changed the cost of a recently acquired specialty drug from $13.50 to $750 per tablet. This story was actually first covered in the New York Times, however did not receive mass attention until Clinton disseminated over social media.

Small cap biotech stocks such as Aerie Pharmaceuticals, Immunogen, and Retrophin went down more than 10%. Even industry stalwarts such as Gilead, Biogen, and Amgen were also impacted several percentage points on a day when the overall market made moderate gains.

This event is just another example of the power that key influencers can have over the market – particularly when leveraging social media to get their message out.

There is no question than institutional investors and their algorithmic trading machines are factoring social media into their trading decisions. And that’s why I track the effect that social media message have on individual stocks, and the overall market, using my social media collective intelligence system.

Ben Benoy

Editor, Biotech Intel Trader

September 25, 2015

Get Ready: The Next Wave Down in the Great Crash

I have an important update regarding how far we could see the market drop in the short days and weeks ahead…

I have an important update regarding how far we could see the market drop in the short days and weeks ahead…

I’ve been warning for months that it looks like this bubble may finally be peaking.

I’ve warned that it’s best to get out of stocks a little early rather than a bit late. That’s because, when bubbles finally break, they burst rapidly – as much as 40% in the first few months. It can make markets very volatile, up and down, hence harder to predict and adjust to. If this is indeed the end, we’ve only taken the first step down a long ladder.

In retrospect, the odds keep going up that we saw a major long-term top on May 19.

The first warning sign was that, as stocks made little progress from late December into May, we saw a series of major tops around the world. And that to me is no small matter.

Dow Transports peaked in late November and are down 20% since.

Dow Utilities peaked in late January and are down 18%.

The German DAX and British FTSE both peaked in April and are down 24% and 19%, respectively.

The Dow and S&P 500 appear to have peaked in late May. The Dow’s down 16% since then.

Then in June came China’s Shanghai Composite index – one of the leading dominoes to fall – and it’s crashed 42%. The Russell 2000 index also peaked in June and is down a little more than 12%.

And finally, our Nasdaq, which peaked in late July, is recently down 21%.

Four of those are undeniably in bear territory. The Shanghai, DAX, Nasdaq and Dow Transports have crossed that 20% threshold that literally defines a bear market. A drop like that only raises the chances that a bubble is finally over. But thus far technical indicators only show that the Shanghai and DAX have peaked for good.

And all of this is just the first warning sign…

The second sign came when stocks broke out of the narrow and very bullish four-year S&P 500 Channel on August 21. In the past, I’d told our readers that would be the first clear breaking point. Only that would begin to signal a major top and at least a 20% correction.

Finally, the third sign came on September 11. Adam O’Dell, our Chief Investment and Technical Analyst, got a broad sell signal alerting that, at least for now, the bull market is over.

As I’ve said before, Adam and I have very different indicators. He doesn’t look at the long-term. I do. But for his short-term indicators to coincide with my predictions – that says something! So while Adam is not yet clear as to whether the overall bubble is over – nor will I be 100% convinced until U.S. stocks universally cross well over that 20% line – it’s clearly time to get defensive!

For now, we are still in the classic “crash season” that lasts from mid-August to mid-October. It’s during this time that markets are most likely to make large movements down. We’ve seen this in 1973-74, 1982, 1987, 1990, 2001-02, 2008 and 2011.

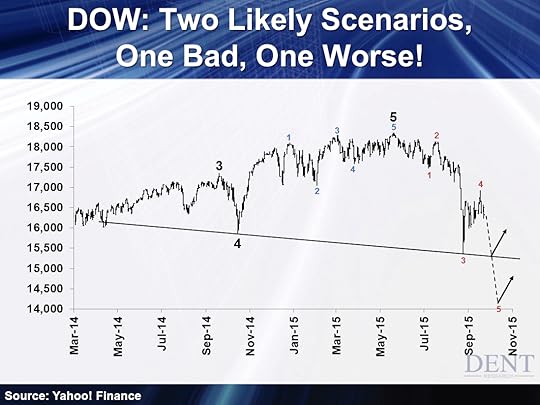

So given that we’re in the crash season, this chart shows two likely scenarios for the next leg down – one down a good bit, one down a lot more!

Based on Elliot Wave technical analysis that I won’t go into here, in my view, we are likely beginning the fifth wave down of the first broader wave. That’s what some of those markings are. And it’s likely this fifth wave will be as strong as the third one – the one that hit us in late August.

Notice the downward trend line I’ve drawn. In this scenario, at a minimum, the Dow hits a slight new low around 15,300. The Dow rebounded over 16,400 today, but that looks like another strong counter rally to the recent sharp correction. And that should be over today or by Monday at the latest. If the fifth wave likely just ahead is indeed as deep as the third as I expect, then don’t be shocked if the Dow hits 14,200.

That would be 23% off the all-time high. And that would be just another nail in the bubble’s coffin, to confirm it will not rise from the dead – although a strong bear market rally will very likely follow such a downward move into mid-October.

However far it falls in this fifth wave, I expect we’ll see this by around Friday, October 16. That’s just three weeks away.

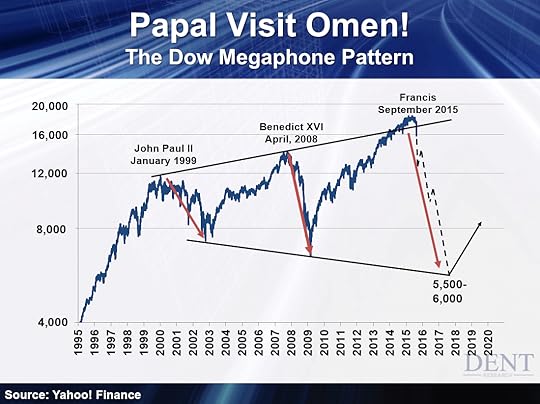

Of course, I see the Dow falling to 5,500 to 6,000 sometime by early 2017, and 3,300 or so after the dust settles, but that’s a longer story that you can watch here.

Where we are today, any number of things could kick off this next wave down.

It could be another crash in China, which frankly looks inevitable after China’s stocks have traded in a narrow range for weeks. It looks like we could see another major wave down soon to 2,400 to 2,500 – over 50% down.

It could be another sharp drop in oil to $30 to $32, like I’ve been predicting. As a wild card, it could even be a sharp spike up to $49 to $55, due to some major geopolitical event or war coming out of the Middle East now that Darth Vader Putin is involved.

That’s the point we’re at. This thing is teetering on an edge and any number of things could send Humpty Dumpty over the wall.

I’ll wrap this up on a lighter note. Enjoy it. You know I’m not one for jokes or small talk.

It just so happens, every time the Pope comes this side of the Atlantic, it lines up very closely with the bubble peaks we’ve had since 2000 on my Dow megaphone pattern, which points to 5,500 to 6,000 for the next down move. It seems he only comes at the top of good times, then things go to hell in a handbasket after. Go figure!

I call it, the “Papal Visit Omen.”

So enjoy the Pope’s visit while you can. This bubble’s days are numbered.

Harry

Follow me on Twitter @harrydentjr

The Stock Market’s Swirling in a Fed-Induced Crisis

September 24, 2015

The Real Reason Most Investors Get Slaughtered in the Stock Market

Investing in the stock market can feel at times like the cruelest of games – one that only the most self-loathing, pain-seeking types of people would choose to put up with.

Investing in the stock market can feel at times like the cruelest of games – one that only the most self-loathing, pain-seeking types of people would choose to put up with.

At the same time, it’s the only “wealth-building” solution that’s been offered to mainstream Americans – you know, average folks who work hard, save money and one day hope to retire.

To be fair to the establishment’s “buy-stocks-and-just-hold-them-forever” mantra, stocks have indeed been a powerful wealth-builder for more than a century.

Clearly, the U.S. equity market exhibits a bullish bias – namely because of earnings, inflation and, in more recent years, the simple fact that baby boomers have used it like a retirement piggy bank.

That’s why stocks have benefitted investors with average annual returns roughly between 6% and 8%. And that’s why proponents of buy-and-hold have a leg to stand on. It’s hard to argue with the stock market’s long-term track record.

That is… with one important caveat.

The buy-and-hold philosophy requires a commitment that the vast majority of the investors I’ve met simply aren’t able to make. That is, a commitment to be in stocks for the long haul.

How “long” is the “long haul,” exactly?

I’d say a decade, at bare minimum. Two to three decades is even better.

But it really doesn’t matter.

People will tell you that if you’re, say, 30 years away from retirement, then you can invest full-bore in stocks because stocks have always gone higher over a 30-year period.

It sounds good in theory. But as the late, great Yogi Berra said: “In theory there is no difference between theory and practice. In practice there is.”

In 2008, I was working as a financial advisor. And so I personally experienced the level of commitment that average investors have to stocks, in practice, when times get tough.

You see, in theory, any investor who was about 50-years-old or younger should have simply held their portfolio of stocks through the Great Financial Crisis of 2008. “Invest for the long-haul,” right!? That’s what buy-and-hold requires – your dutiful long-term commitment.

But in practice, that’s not what happened.

Long-term buy-and-hold investors always have good intentions when they’re new to saving and investing. And of course also during bull markets.

But when a bear market strikes, let alone a full-blown global financial crisis, most investors panic. And they do it only once that crisis has already been confirmed. By then, it’s too late.

That’s the really painful part of this story: most investors don’t abandon a bull market when it’s down 10%. Most investors don’t sell stocks when they’re down 20%.

Cruelly, most investors sell stocks at precisely the worst time – when they’re down 35%… or 45%… or 55%… or worse.

Simply put: investors are their own worst enemies.

I’ve witnessed this first-hand continually throughout my career. But you don’t have to take my word for it. There’s a study I like to quote, done by Dalbar, which shows the average annual return of a variety of assets, including stocks.

Get this…

Between 1992 and 2011, the S&P 500 gained 7.8% per year.

But the average investor earned just 2.1% over the same time frame.

This seems illogical – since a majority of investors invest in stocks, shouldn’t they earn closer to 7.8%?

Well, the answer is yes… they should have, if they were truly loyal to their commitment to long-term buy-and-hold.

And there in lies the problem.

For psychological reasons that are just now being researched, the vast majority of Main Street American investors simply can’t keep their paws off the panic button when stock-market calamity strikes.

We buy… we hold… and then we jump ship at the worst time possible – only after our max-pain thresholds are far exceeded and our accounts are down 50% or more.

Like I said… it’s cruel! But it’s the truth.

The good news is that there’s a very simple solution to this dilemma.

It’s a solution that allows long-term investors to fully participate in the long-term returns that stocks have produced for decades. But it also protects you from the brunt of bear markets and financial crises.

This strategy is all about capital preservation. And I’ll show you next week how you can use it to reduce the risk in your stock portfolio by more than 50%.

Adam

Chief Investment Strategist, Dent Research

Bulls and Bears Are Locked in an All-Out War Over the S&P 500

September 23, 2015

The Numbers Are In: 2013 Wasn’t So Bad After All!

Well That Was Disappointing

Were you as disappointed as I was?

Were you as disappointed as I was?

At the much-anticipated federal open market committee meeting, Federal Reserve chair Janet Yellen continued

Caterpillar, the maker of big yellow earth-moving equipment,

Caterpillar, the maker of big yellow earth-moving equipment,