Harry S. Dent Jr.'s Blog, page 143

July 28, 2015

Momentum Investing Vs. Value Investing… Why Not Both?

Let’s go back in time 30 years. Remember those “Taste great / less filling” Miller Lite beer commercials from the mid-1980s? You could roughly divide the world’s beer-drinking population into two rival factions: Those that insisted that Miller Lite tasted great… and those that insisted it was less filling. I’m pretty sure people lost their lives fighting over this in bars.

Personally, I find Miller Lite neither tastes particularly great, nor is it particularly easy on my stomach. As a native Texan, my heart will always belong to Shiner Bock.

But I digress. As with Miller Lite fans, you can roughly divide the investing world into two camps: Those who favor value strategies and those that favor

July 27, 2015

Situation Critical: Everything’s Starting to Crash!

July 25, 2015

Rare Genetic Mutations Could Unlock the Secret to Managing Pain

I’m out in Hawaii working on some defense consulting and was just reading up on some of the latest DNA research…

Apparently, if you have abnormally strong bone density, or a high tolerance to pain, you may be able to cash-in big time by licensing your DNA.

Though before you jump to conclusions about your ability to withstand ungodly amounts of pain, you may want to check with your doctor to make sure you have one of these rare – and valuable – genetic mutations.

I don’t mean mutant X-men that are “walking among us.” I mean people like

July 24, 2015

We Might Already Be in a Bear Market

July 23, 2015

1.5 Million Teens Don’t Think They Can Get a Job In This Economy

One of my first paid jobs was washing dishes in the restaurant of a Holiday Inn. I was 13, and lied on the application that I was 16, the minimum age they would accept. It wasn’t a glamorous position, but it did provide a paycheck. And it came with all of the vagaries you’d expect from such a job – unpleasant working conditions, the requirement to always be on-time, shifts scheduled when I’d rather be hanging out with friends, and the proverbial bad boss.

I meandered through a number of jobs in my teen years, learning what was expected of me as an employee and how to work within corporate structures along the way.

These lessons were invaluable as I went off to college and looked for part-time work as a student, and then when I sought a full-time position as a graduate.

Investors Are Losing Faith in the Broader Bull Market

Sometimes I refer to “the market” when I’m describing how a majority of stocks are behaving. But that doesn’t mean that investors are limited to a single, binary view of the market – either bullish or bearish. Really, you should be focusing on individual sectors – particularly the ones that are outperforming.

After all, the stock market consists of nine different sectors, each with their own performance characteristics and personalities. And many of them offer far better profit opportunities than “the market.”

This is especially important to consider in times like today, when individual sectors are performing much differently than the overall market – some much better, some much worse.

So far this year, the S&P 500 is up a meager 3%.

Yet, the highest performing individual sector – health care – is up more than four times that, at 12.3%. Meanwhile, the worst performing sector – energy – is down 9.1% year-to-date.

That’s a massive spread between the top- and bottom-performing sectors.

This tells me two things. It tells me that it’s still profitable to focus your investing efforts on sectors that are outperforming, like I do in Cycle 9 Alert, as opposed to a single index.

But it tells me something else: that investors are losing confidence in the broader stock market’s bull run.

We saw something similar in late July, 2011. The S&P 500 suffered an 18% correction. That prompted investors to suddenly become more selective in the stocks and sectors they chose – most opting for less risky investments.

Simply put: investors become selective when they’re uncertain about the broader market’s trend.

That’s what happened after the 18% sell-off in 2011. And that’s what’s happening today.

Mind you, the broader stock market hasn’t sold off yet… but investors are already becoming very picky about which sectors they’ll buy.

Yesterday, I shared with Cycle 9 Alert subscribers my proprietary measure of the spread between the best- and worst-performing sectors. Currently, it’s reading its highest level in years.

And that means, not only are investors becoming picky… they’re also losing faith in the broader bull market.

But remember, investing in the broad market isn’t your only option. Instead, opt for a strategy like my

July 22, 2015

Europe’s Greatest Cover-Up Could Mean the Death of the Euro

It’s kind of like selling goods to consumers with very bad credit and then being surprised when they don’t pay.

But before I get into that, we all know Greece owes Germany, the ECB, and the IMF a lot of money.

Last week I explained that if they went the “Grexit” route, 75% of Greece’s government debt would’ve been wiped clean. That’s $90 billion to Germany alone and about $250 billion to the rest of the euro zone. It would have hurt, but there’s no avoiding pain at this point, and now it’s only going to be worse.

But there is another level of debt almost no one is talking about.

In fact, we have a harder time getting good information on it because the EU has increasingly hidden it.

However, this debt gets at the heart of why Germany and some of the strongest opponents to a Grexit were so desperate to keep Greece in the euro zone.

This not-much-talked-about debt are the TARGET2 loans Greece (and other euro zone importers) owes the rest of them.

It’s a fancy way of saying “past due accounts receivables.” Another way of saying this: “The check’s in the mail.” Or: “We’ll pay you when we can.”

Fat chance.

The idea is that when German or other euro zone companies sell goods to Greek companies, the Greek companies hand off their payment obligations to the Greece central bank. That central bank then owes Germany’s central bank, which then pays the German companies who sold the goods in the first place.

The problem is that the southern European countries – PIIGS, or Portugal, Italy, Greece, and Spain plus Ireland – import a ton. When Germany sells to Greece, Greece’s central banks collects the money, but doesn’t pay the German central banks. These are called TARGET2 loans.

They’re not really “loans” in the sense that they are involuntary. The German central bank knows that if it pushes too hard for these payments on time, exports will slow or discontinue without such credit extension. It’s either extend credit to these subprime borrowers or lose the sales!

It’s such a huge issue because these economically weaker nations aren’t competitive exporters. They can’t afford these outrageous trade deficits they’re wracking up! They have run increasing trade deficits ever since the euro was created. The currency lets them borrow at a cheaper rate. And the stronger exporting countries are willing to extend credit to keep their gravy train going.

Under this backwards arrangement, Greece owes Germany 100 billion euros, or roughly $109 billion. The broader euro zone – almost totally the PIIGS – owes it 531 billion. That’s almost $580 billion.

This is the most contentious example, but the Netherlands, Luxembourg and Finland are extending credit to these weaker central banks too – though nowhere near the extent of Germany, which holds around 75% of these TARGET2 loans.

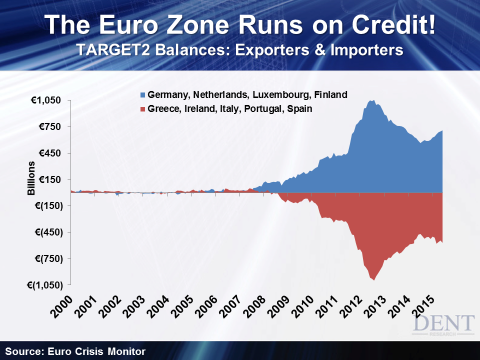

The following chart shows the TARGET2 balances across the euro zone. Blue is the extended credit from the four major net exporters. Red is what the five net importers owe them.

Before I even get into this, just take the chart at face value. Look at all that credit. It’s disgusting. We didn’t have this kind of foolishness prior to 2008. Now we live in an age where credit is king. Real value is supposed to be king. Cash is supposed to be king. Not credit. This nonsense has got to stop.

The edge of this graph shows the current balance for all TARGET2 loans: 709 billion euros ($774 billion). It actually peaked at 1.06 TRILLION euros in late 2012. Come on!

This gets at why Germany wasn’t in a hurry to let Greece leave the euro zone. And in fact, why it finally insisted they stay.

In government debt, Greece owes Germany 90 billion euros.

If Greece had exited, Germany would have had to write-off that amount overtime. The short-term affects for Germany would have been manageable.

But in addition to the government debt, Greece owes Germany another 100 billion in TARGET 2 loans. That would’ve been written off immediately. That’s much more painful and embarrassing to voters near term – which is the realm politicians live in.

That means Germany could see 190 billion euros – or $200 billion – in default if Greece exited. That’s much more than any other country by far.

To put this in more perspective, Germany’s GDP is about 2.9 trillion euros. 46% of that, or 1.3 trillion euros, is from exports. About 63% of that, or around 840 billion, goes to the euro zone. Exports are paramount to its aging economy that would otherwise already be slowing dramatically longer term!

That means the 531 billion in TARGET2 balances from the euro zone equals 63% of its exports, which means the payments are eight months late.

Any accountant worth his salt would lose his mind if account receivables were just three months late!

This is one of Europe’s dirtiest secrets.

To keep exports going to countries that can’t afford it, the central banks of the exporting nations have to extend high credit to the central banks of the weaker importing nations.

That way the stronger countries import more than they frankly should and the weaker nations live well beyond their means. This is the very imbalance that the euro has created since its inception in 1999.

Talk about denial.

Talk about not addressing the underlying problem.

Talk about kicking the can down the road!

This system won’t last. The euro won’t last. Watch out below in the months and years ahead when it finally cracks, or at best is restructured into a strong and weak version of the currency.

As bad as things will get in the U.S., there’s one bright spot: Thank god we’re not Europe. We will still be the best house in a very bad neighborhood ahead.

Harry

Follow me on Twitter @harrydentjr

Investors Run to U.S. Treasury Bonds for Safety!

Between lousy U.S. data and the lingering risks in Greece and China, bond prices have been rallying as investors turn to them for safety. And that means yields are falling.

As far as Greece goes, political pressure seems to have forced its leaders to swallow an austerity package it can’t chew. Sure, it’ll allow them to remain in the euro – not to mention keep their banks open. But ultimately this will cause its economy to sink even deeper into a hole. I guess that’s tomorrow’s problem.

And then there’s China. It seems the land of the grand illusion will go to any length to manage (or manipulate) its economy, people, currency and stock market – like injecting nearly half a trillion dollars to prop up stocks, momentarily forbidding short-selling and large investor selling, creating new margin rules, and generally halting trades on stocks in danger of going lower. I’m sure that’ll end just as well as Greece.

As a side note, I would hate to be John Del Vecchio’s counterpart in China. If you found an equally skilled short-seller there, he might be put in front of a firing squad!

Then back home in the U.S., economic data’s been a mixed bag.

Retail sales from June were dismal.

Inflation from June was as expected, but still too low to celebrate.

And housing starts came in stronger than expected, but that’s due to gains in multi-family units – i.e., rentals. Not single family houses, which spend a heck of a lot more than renters.

So, there’s really no reason to break out the champagne.

Overall, U.S. data was negative. China and Greece still represent danger to the markets. And bond prices are recovering while yields are going lower.

All of this bad news is actually good news for Dent Digest Trader subscribers. This assortment of poor economic data will undoubtedly force interest rates to move, and bond traders like them will be able to profit from the trend lower. You can join

July 21, 2015

Why Gold Hit a Five-Year Low and Will Likely Fall Lower

The problems in Greece and China threw the world markets into a tizzy over the past month. The Greeks seem schizophrenic rejecting then accepting the latest deal from their creditors, while the Chinese government layers on one new program after another to halt the rout in Chinese stocks. Every morning American investors must check the latest headlines to find out if something blew up, unraveled, or simply fell apart the night before.

It’s been a bit exhausting.

But if we step back a bit and look at the bigger picture, some corners of the market haven’t reacted to the manic-depressive swings from overseas.

One area that seems impervious to the emotional rollercoaster ride is precious metals. When it comes to gold, the market appears particularly relaxed. So relaxed that it’s at risk of falling into a coma.

After spiking to $1,300 at the start of the year, yesterday the price of gold dropped to a near-term low of $1,106, falling 2.2% in a day. It actually fell below $1,100 that morning, hitting the lowest levels in five years.

If financial chaos drives the price of gold, then the near-exit of Greece from the euro zone, coupled with a free-falling Chinese stock market, should have sent the metal soaring.

To be fair, there was a spike in mid-June to $1,200. Or maybe it was a blip. It could’ve been an accident when a trader hit the wrong key while dusting off his computer.

Whatever it was, the momentary rebound stopped almost as quickly as it occurred, driving the price of gold ever lower. For the moment, the fear-of-financial-chaos trade appears dead.

It could be that no one is worried about the global financial system, or even major parts of it, blowing up. Personally, I doubt it. I’m concerned about major disruptions in the global financial system, and every day I read research from others who share those fears. So the current slow-bleed in gold must be for a different reason, and I think I know what it is.

Recently the Chinese government reported how much gold it holds in official reserves. The last report was in 2009, when it held 1,054 metric tons.

Given that the Chinese collect a lot of foreign currency through their trade surplus, and that they’re desperate to have their currency included in the

Counting on Stocks? Time to Rethink Your Retirement

The “mini correction” of summer 2015 seems to have run its course… at least for now. But by just about any metric you want to pick, U.S. stocks are expensive and priced to deliver lousy returns.