Harry S. Dent Jr.'s Blog, page 144

July 20, 2015

Free Markets Are Determined to Fix This Franken-Economy!

You’ve probably seen the Jack Link’s Beef Jerky commercials where unsuspecting campers think it would be fun to mess with Sasquatch – an eight-foot tall, 400-lb. freak of nature.

I like these commercials. What kind of idiot thinks they can get away with that?

July 18, 2015

Biohackers Pave the Way for More Affordable Care

July 17, 2015

Japan: Still a Problem With No Solution

There’s a village in Japan where the dead outnumber the living, and I don’t mean the ancestors in the cemetery. The bodies are dispersed

3 Reasons Why It Would Be Stupid to Raise Rates At This Point

July 16, 2015

URGENT WARNING: 6 Signs the Great Crash Is Upon Us!

The Greek default proves that all this endless quantitative easing idiocy couldn’t live up to the promises. It has proved unable to create sustainable long-term recoveries in highly indebted developed countries with poor demographic trends.

The Greek parliament caved into totally repulsive demands, as

So Long, Farewell: The End of Futures Trading as We Know It

July 15, 2015

“How Much & When?” Fed Followers Are Focusing on the Wrong Thing!

As we look around at all the craziness in the world today, a common question is: “WWJD?” No, I’m not referring to the rubber bracelets from early 2000s. Instead, I’m talking about economics, where the appropriate question is: “What would Janet do?” That is, Federal Reserve Chair, Janet Yellen.

Greece is broke, and so is Puerto Rico. Illinois can’t pass a budget, and Chicago is bumping up against pension payments it can’t possibly make.

The U.S. economy is creating some jobs, but wages remain sluggish at best. That casts a cloud over the much-hyped-but-not-quite-here-yet boom in housing millennials will eventually lead. Right now they can hardly scrape together enough dough for a 3% down payment, much less earn enough to qualify for a conforming loan. It’ll be a long time before they rush headlong into the housing market.

So as we get closer to the Fed’s September meeting, our current situation has a lot of people wondering what in the world Janet and Company will do. Personally, I’m not too concerned.

Don’t get me wrong. It’s not that I think everything is fine. I’m just as concerned about our economic plight – or more so – than most people I know. But I think the hype around the Fed raising rates is overdone.

Eventually the Fed will announce that its target for the Fed Funds Rate – the rate at which banks lend to each other overnight – is moving up from a range of 0% to 0.25%, to simply 0.25%.

This will affect hedge funds, pension funds, insurance companies, and other institutions that use short-term leverage to increase their buying power. But aside from slightly increasing what banks pay on deposits, the move won’t mean much to everyday people. Most of us don’t live in that rarified air.

Closer to home is what happens with longer-term interest rates, like those on 5-year and 30-year Treasury bonds – and even there I think very little will happen.

That’s because interest is supposed to pay lenders (bond buyers) for the use of their money, compensate them for inflation, and provide some degree of security against the risk of non-payment.

Right now money is not in high demand. Lenders don’t get paid much to put their money to work, as any bond buyer already knows. As for inflation, I’ve written about how it’s creeping up in certain areas of the economy like health care, education, and food costs, but overall most developed nations are trying to fight deflation, not inflation. Then in regards to security, the Fed can print money to buy U.S. government bonds, so buyers have zero risk of non-payment.

In addition to all that, there are a lot of other reasons for interest rates on notes and bonds that mature in more than a year to remain quite low – tens of billions of reasons, and they are flowing from overseas!

Currently the European Central Bank (ECB) and the Bank of Japan (BoJ) are printing enough currency to buy all the new government bonds issued by all the countries of the euro zone, Japan, the U.K., and the U.S. combined.

Now, these central banks aren’t trying to buy all of those government bonds. The BoJ buys Japanese government bonds, ETFs, and other assets including foreign securities, while the ECB buys government bonds in the euro area and has just approved buying corporate bonds.

Still, the point remains that there’s a ton of capital chasing bonds and other investments, which will keep interest rates exceptionally low in developed countries.

By extension, these low interest rates on government and even corporate bonds will keep downward pressure on other interest rates. They affect mortgages, car loans, and other consumer finance products.

If things work out this way, the yield curve will flatten. Short-term interest rates will move up when the Fed raises the Fed Funds rate, but longer maturities will move only modestly, if at all. It’s even possible that long-term rates will fall, given a statement Yellen made after the last meeting.

In her press conference, she pointed out that investors were placing too much emphasis on when the Fed would start raising rates for the first time in more than eight years. Instead of focusing so much on when the Fed would start raising rates, she said that investors should pay more attention to the expected time frame over which rates would rise.

That makes me think the Fed might begin pushing up short-term rates sometime this year, but subsequent rate hikes could be few and far between after that.

All of this is good news for anyone who intends to borrow money in the months ahead, and it provides investors with a window of opportunity.

Many interest rate sensitive investments have fallen dramatically over the past six months as investors have worried about higher rates. That means now could be a very good time to go bargain hunting in that sector.

Rodney

Follow me on Twitter @RJHSDent

July 14, 2015

China Could Trigger the Next Great Crash Soon

I’ve been stressing several different triggers that could cause the next great crash and depression, after over six years of non-stop stimulus and bubble denial. They are: the faults in southern Europe starting with Greece; the faults in the U.S. fracking and Canadian tar sands industries; rising long-term government debt rates despite continued QE; and municipal defaults including Illinois and Puerto Rico.

But the ultimate trigger would be the bursting of the greatest bubble in modern history – China!

QE works to some degree but less and less overtime, like any drug. I have been looking for something to go wrong that further QE in developed countries like the U.S., Europe, and Japan could not counter. That would be the bubble bursting in China, as it is now the second largest economy in the world and has been the fastest growing by far over the last three decades.

That’s because China has urbanized too fast and overbuilt every facet of its economy 12 to 15 years out to keep the rural migrant workers employed at all cost. As a result, its real estate bubble dwarfs all others. Its debt for an emerging country is off the charts – closer to developed countries that are far more credit worthy.

But the “Big Bang” is that the Chinese save massively and invest their cash disproportionately in real estate. Its stock bubble is finally starting to burst, but the key event is when the already struggling real estate market crashes as well. That will cause an unprecedented implosion of wealth in China and a global real estate bust that reverberates around the world.

Running of the Bulls: Is the “Dumb Money” Catching On?

Investors breathed a collective sigh of relief when Greece tentatively accepted a bailout from its EU partners. And the market meltdown in China appears to have run its course… at least for now.

So with the end of the world postponed for the time being, the market’s been rallying. Yet among individual investors, bulls seem hard to come by.

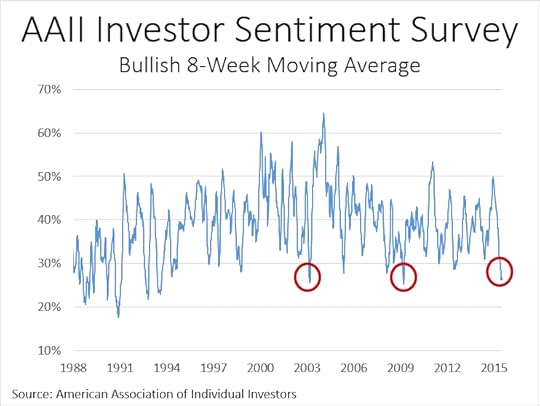

According to the latest American Association of Individual Investors (AAII) Sentiment Survey, there are fewer bulls today than at any time since the 2008 meltdown:

The AAII survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.

To smooth out the noise a little, I used an 8-week moving average. And as you can see, bullishness is currently at lows you might normally associate with panic bottoms.

July 13, 2015

Greece Needs to Exit!

Europe has extended deadline after deadline to strike a deal with Greece. It’s been a massive display of tensions across the euro zone – between Germans and Greek, the northern countries and southern ones. But now Europe is fed up.

Finally they came to a deal late Sunday night… but this is not a done deal yet!

Even though the latest agreement is tougher on Greece than the one they ironically voted against, German voters absolutely hate it. A recent TV straw poll showed that only 12% of them think Germany is being too harsh on the Greeks. There’s a great majority that thinks Greece shouldn’t get another bailout under any circumstances.

Then there’s Alexis Tsipras, who has the tough task of getting the Greek parliament, and voters, to approve this deal by Wednesday. And it’s more austere than the original that the Greeks heartily rejected by 61%!

When Greece voted Tsipras and his leftist party into power, the Greek people thought that if they screamed loud enough and threatened to leave, Germany and the euro zone would give them a debt relief that suits them. Huge miscalculation!

Instead, the euro leaders took their whining as a sign of further mistrust after they failed to comply with two bailouts totaling 220 billion euros. Now, they’ve demanded even more austere reforms and a fund of 50 billion euros in assets to make sure the Greeks put their money where their mouth is!

So the million dollar question this week is: Will Greece agree to this new plan now that they’ve basically had to barter to survive with the banks closed for two weeks? Or will they reject it and leave the euro zone altogether?

I suspect Greece will go with the new plan out of stark fear. They’ve had a look at what life outside the euro zone would look like over the past two weeks, and it looks grim.

And Germany will likely agree to the deal as well, though begrudgingly, as it has the most to lose if Greece exits the euro.

This is not what I’d prefer to see. I’d rather the markets sort this out without more and more political bantering. But here are the facts:

Greece’s government is in the gutter for 323 billion euros. 75% of that goes to foreign creditors.

If Greece decides it wants nothing to do with the latest negotiations and wants to default on that debt like Iceland did, it would be at the expense of every major European country that holds Greece debt directly or through their membership in the ECB and IMF. But it would provide massive cash flow relief to Greece’s government and its budget deficit.

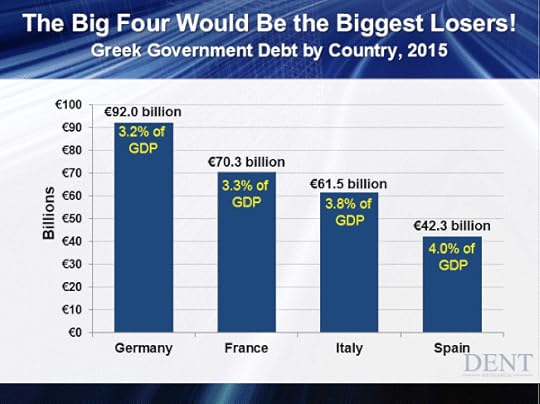

This chart shows how much Europe’s “Big Four” could be out if Greece jumps ship:

Germany holds the most Greek debt at 92 billion euros, which comes out to 3.2% of its GDP.

The others hold less, but at an even greater percentage of their GDP.

France holds 70.3 billion euros at 3.2% of GDP.

Italy 61.5 billion at 3.8% of GDP.

And Spain just 42.3 billion, but at 4% of GDP.

If Greece defaults, that money is largely or totally gone!

Potentially even worse, if Greece ejects from the euro and revitalizes the Drachma – the replacement currency – its value would only be some 30% to 50% of the euro.

Can you see someone from Greece paying 100,000 to 170,000 Drachmas to buy a BMW that costs just 50,000 euros today? Nope! So if Greece makes the switch, German and other euro zone imports would drop like a rock!

Think about how much Greece imports – 60.5 billion euros worth of goods. The largest player is Russia, which exports 8.5 billion in energy to Greece. Then Germany at 5.9 billion – 0.2% of its GDP – and Italy at 4.9 billion.

These countries stand to lose the most. Their exports would only continue to drop year over year until the Drachma gains in value again.

Of course, Greece would suffer in all this too.

With such a devalued currency, they’d face a new tax called “high inflation” to make up for higher costs due to their high ratio of imports. Again, take Iceland – its consumers saw a 20% spike in goods for a few years when the country defaulted and devalued its currency.

That means the Greek people would have to get their spending in line. And the Greek government would as well – with zero credit, it would be forced to balance its budget and increasingly enforce its taxes.

That’s what I’d prefer to see – kick Greece out of the euro for now and let the markets run their course. Politicians out to save theirs hides will only keep compromising so the next administration is the one that gets egg in its face!

If this happened, major debts would get written off and the stupid banks and governments that lent the money would take the biggest losses. And Greece’s exports would rapidly grow as its goods become more affordable with a lower-priced currency.

Greece will become the most affordable vacation haven in the Mediterranean overnight!

But it’s likely governments and politicians will continue to take the path of least resistance.

And it’s their loss. When Iceland went through some much needed restructuring, three years later it was doing better than most European countries. The free markets work if anyone would just simply let them!

Hopefully this drama will finally conclude on Thursday when euro leaders reassemble. We’ll know then whether my wish for a “Grexit” comes true.

Harry

Follow me on Twitter @harrydentjr